UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| | þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | |

| | | For the fiscal year ended December 31, 2006 |

| | | OR |

| | | |

| | o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | |

| | | For the transition period from ______ to ______. |

Commission file number 001-33143

AmTrust Financial Services, Inc.

(Exact Name of Registrant as Specified in Its Charter)

Delaware | 04-3106389 |

(State or Other Jurisdiction of | (IRS Employer |

Incorporation or Organization) | Identification No.) |

| | |

59 Maiden Lane 6th Floor | 10038 |

New York, New York | (Zip Code) |

(Address of Principal Executive | |

Offices) | |

Registrant’s telephone number, including area code (212) 220-7120

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

| Common Shares, $0.01 par value per share | NASDAQ |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES o NO þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES o NO þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. YES þ NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES o NO þ

State the aggregate market value of the voting stock held by non-affiliates of the registrant. (The aggregate market value of the voting common stock held by non-affiliates of the Registrant on June 30, 2006 is not applicable as the registrant was not publicly traded as of June 30, 2006.)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer o Accelerated Filer o Non-Accelerated Filer þ

As of February 23, 2007, the number of common shares of the registrant outstanding was 59,959,000.

Documents incorporated by reference: Portions of the Proxy Statement for the 2007 Annual Meeting of Shareholders of the Registrant to be filed subsequently with the SEC are incorporated by reference into Part III of this report.

TABLE OF CONTENTS

| | | | Page |

PART I | | | |

| Item 1. | Business | | 2 |

| Item 1A. | Risk Factors | | 42 |

| Item 1B. | Unresolved Staff Comments | | 58 |

| Item 2. | Properties | | 58 |

| Item 3. | Legal Proceedings | | 59 |

| Item 4. | Submission of Matters to a Vote of Security Holders | | 59 |

| | | | |

PART II | | | |

| Item 5. | Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities | | 60 |

| Item 6. | Selected Financial Data | | 62 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 65 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | | 91 |

| Item 8. | Financial Statements and Supplementary Data | | 93 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 93 |

| Item 9A. | Controls and Procedures | | 93 |

| Item 9B. | Other Information | | 94 |

| | | | |

PART III | | | |

| Item 10. | Directors and Executive Officers of the Registrant | | 95 |

| Item 11. | Executive Compensation | | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters | | |

| Item 13. | Certain Relationships and Related Transactions | | |

| Item 14. | Principal Accountant Fees and Services | | |

| | | | |

PART IV | | | |

| Item 15. | Exhibits and Financial Statement Schedules | | |

PART I

Forward-Looking Statements: From time to time AmTrust Financial Services, Inc. has made and may continue to make written or oral forward-looking statements regarding our outlook or expectations for earnings, revenues, expenses, capital levels, asset quality or other future financial or business performance, strategies or expectations, or the impact of legal, regulatory or supervisory matters on our business operations or performance. This Annual Report on Form 10-K (the “Report” or “Form 10-K”) also includes forward-looking statements. With respect to all such forward-looking statements, you should review our Risk Factors discussion in Item 1A.

ITEM 1. BUSINESS

Overview

This Annual Report on Form 10-K, together with other statements and information publicly disseminated by AmTrust Financial Services, Inc. (“AmTrust,” the “Company,” “we,” “our,” or “us”) refer to AmTrust Financial Services, Inc. AmTrust is a multinational specialty property and casualty insurer focused on generating consistent underwriting profits. We provide insurance coverage for small businesses and products with high volumes of insureds and loss profiles which we believe are predictable. We target lines of insurance that we believe generally are underserved by larger insurance carriers. AmTrust has grown by hiring teams of underwriters with expertise in our specialty lines and through acquisitions of access to distribution networks and renewal rights to established books of specialty insurance business. Since our current majority stockholders acquired AmTrust in 1998, we have expanded our operations into three business segments:

Specialty risk and extended warranty coverage for consumer and commercial goods and custom designed coverages, such as accidental damage plans and payment protection plans offered in connection with the sale of consumer and commercial goods, in the United Kingdom, certain other European Union countries and the United States; and

Specialty middle-market property and casualty insurance. We write commercial insurance for homogeneous, narrowly defined classes of insureds, requiring an in-depth knowledge of the insured’s industry segment, through general and other wholesale agents.

Our business has grown substantially since 2002 when our annual gross premiums were $27.5 million. Our annual gross premiums written in 2006, 2005 and 2004 were $526.1 million, $286.1 million and $210.9 million, respectively. Our annual premiums written in our workers’ compensation segment have increased substantially from $21.1 million in 2002. Annual gross premiums written in this segment in 2006, 2005 and 2004 were $258.9 million, $204.6 million and $137.9 million, respectively. Our annual gross premiums written in our specialty risk and extended warranty segment increased substantially from $6.4 million in 2002. Annual gross premiums written in this segment in 2006, 2005 and 2004 were $132.8, $81.6 million and $72.9 million, respectively. Our gross premiums written in the specialty middle-market property and casualty insurance business segment, which we acquired in December 2005, was $134.3 million for the year ended December 31, 2006. Our net income from continuing operations increased from $2.2 million in 2002 to $12.0 million, $20.5 million and $48.8 million in 2004, 2005 and 2006, respectively. Given the larger scale of our current operations, our past growth rate is likely not indicative of our future growth rate.

Insurance, particularly workers’ compensation, is, generally, affected by seasonality. The first quarter generally produces greater premiums than subsequent quarters. Nevertheless, the impact of seasonality on our small business workers’ compensation and specialty middle market segments has not been significant. We believe that this is because we serve many small businesses in different geographic locations. In addition, seasonality may have been muted by our acquisition activity. We believe that seasonality is likely to be more evident over time.

One of the key financial measures that we use to evaluate our operating performance is return on average equity. We calculate return on average equity by dividing net income by the average of stockholders’ equity. Our return on average equity was 13.0% in 2004, 31.7% in 2005 and 21.3% in 2006. Our overall financial objective is to produce a return on average equity of 15.0% or more over the long term. In addition, we target a net combined ratio of 95.0% or lower over the long term, while maintaining optimal operating leverage in our insurance subsidiaries commensurate with our A.M. Best rating objectives. Our net combined ratio was 94.8% in 2004, 95.1% in 2005 and 91.9% in 2006. A key factor in achieving our targeted net combined ratio is improvement of our net expense ratio. We plan to write additional premiums without a proportional increase in expenses and further reduce the expense component of our net combined ratio over time.

Our strategy across our segments is to maintain premium rates, deploy capital judiciously, manage our expenses and focus on the sectors in which we have expertise, which we believe will provide opportunities for greater returns.

AmTrust transacts business through five insurance company subsidiaries: Technology Insurance Company, Inc. (“TIC”), Rochdale Insurance Company (“RIC”) and Wesco Insurance Company (“WIC”), which are domiciled in New Hampshire, New York and Delaware, respectively, and AmTrust International Insurance Ltd. (“AII”) and AmTrust International Underwriters Limited (“AIU”), which are domiciled in Bermuda and Ireland, respectively. Our consolidated results include the results for our holding company and our wholly-owned subsidiaries which principally include:

TIC, which underwrites workers’ compensation insurance, specialty risk insurance and extended warranty coverage, and specialty middle-market property and casualty coverages in the United States;

RIC, which underwrites workers’ compensation insurance, specialty risk and extended warranty coverage, and specialty middle-market property and casualty coverages in the United States;

WIC, which underwrites workers’ compensation insurance, specialty risk insurance and extended warranty coverage, and specialty middle-market property and casualty coverages in the United States;

AII, RIC, TIC and WIC are each rated “A-” (Excellent) by A.M. Best, which rating is the fourth highest of 16 rating levels. AIU is unrated by A.M. Best. We reinsure our insurance risks through internal reinsurance agreements and agreements with third party reinsurers.

Capital Transactions

Private Placement

On February 9, 2006, the Company sold 25,568,000 shares of Common Stock in a private placement in reliance on exemptions from registration under the Securities Act of 1933 at a price of $7.00 per share, subject to an initial purchaser’s discount and placement fee of $0.49 per share. The proceeds to the Company after expenses totaled $165.6 million.

Preferred Stock

In February 2006, all outstanding and issued shares of preferred stock were converted into 10,285,714 shares of common stock in conjunction with the private placement offering. Holders of the preferred shares were entitled to receive cumulative dividends out of any assets legally available at a rate of 8% of the liquidation value of $60,000 per share, per annum, commencing with the year ending December 31, 2003. All accrued and unpaid dividends on the preferred shares were required to be paid prior to the declaration or payment of dividends on the common stock.

Also, as a result of the conversion of the preferred stock into common stock, the preferred stockholders waived the rights to receive any further undeclared or accrued dividends.

Common Stock

On September 1, 2006 the Company issued 16,000 restricted shares of Common Stock with a market value of $120,000 to certain employees.

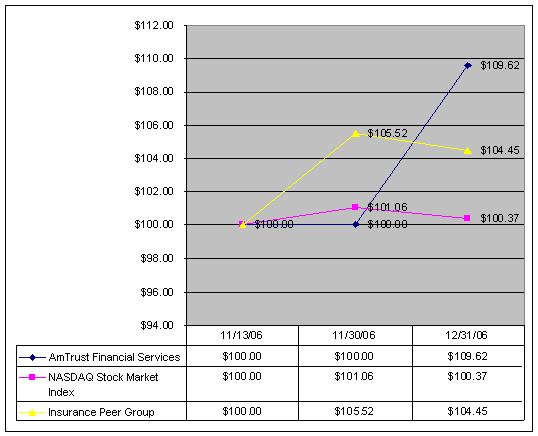

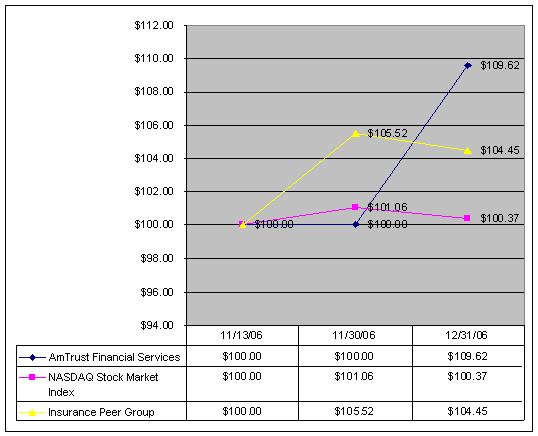

On November 9, 2006, the Securities and Exchange Commission declared effective the Company’s Registration Statement on Form S-1 (Registration Statement No. 33-134960) filed on June 12, 2006, as amended. On November 13, 2006, the Company started trading on the NASDAQ Global Markets under the symbol “AFSI” at $7.50 per share. The registration related to 25,568,000 of the private placement shares and 16,000 shares which had been issue to employees. As a part of this registration the Company received no proceeds.

Financing Activities

The Company has entered into a letter of intent to establish a special purpose trust for the purpose of issuing approximately $40 million of trust preferred securities. The offering is scheduled to close on March 22, 2007. These securities will mature in 30 years from the date of issue and require quarterly interest only payments. The interest rate will be fixed for a period of ten years and will be established at issuance and is expected to be approximately 7.9%. The Company will incur a fee of approximately $0.8 million which will be amortized over 30 years.

On June 27, 2006, we obtained a line of credit in the amount of $50.0 million from JPMorgan Chase Bank. The line of credit will permit the Company to obtain short term loans at a rate of interest of LIBOR plus 1.50%. The line of credit expires on June 30, 2007. To date, the Company has not borrowed any funds under the line of credit.

On July 25, 2006, the Company issued $30 million in principal amount of a junior subordinated debenture (the “2006 Debenture”) in connection with the issuance of trust preferred securities by a trust pursuant to an indenture with Wilmington Trust Company as trustee. The 2006 Debenture matures on September 15, 2036 and bears interest at a rate per annum of 8.83% until September 15, 2011 and, thereafter, at a floating rate per annum equal to the sum of the 3-month London Interbank Offered Rate for U.S. dollars (LIBOR) determined each quarter and 3.30%. The 2006 Debenture is redeemable at par at the Company's election after September 15, 2011.

Business Segments

The following table shows our gross premiums earned by segment for the years ended December 31, 2006, 2005 and 2004:

| | | 2006 | | 2005 | | 2004 | |

| Small Business Workers’ Compensation Insurance | | $ | 258,930 | | $ | 204,565 | | $ | 137,906 | |

| Specialty Risk and Extended Warranty | | | 132,826 | | | 81,566 | | | 72,945 | |

| Specialty Middle-Market Property and Casualty Insurance | | | 134,318 | | | — | | | — | |

| Total | | $ | 526,074 | | $ | 286,131 | | $ | 210,851 | |

Additional financial information regarding our segments is presented in note 20 of the notes to our 2006 audited financial consolidated financial statements appearing elsewhere in this Form 10-K.

Small Business Workers’ Compensation Insurance

Our small business worker’s compensation insurance segment accounted for approximately 49.2% and 71.5% of gross premiums written in the years ended December 31, 2006 and 2005, respectively. Workers’ compensation insurance provides coverage for the statutory obligations of employers to pay medical care expenses and lost wages for employees who are injured in the course of their employment. We primarily offer workers’ compensation insurance to small businesses. We believe that, historically, the loss experience of the risks inherent in small business workers’ compensation insurance is better than the loss experience presented by larger, more competitively priced risks because small-business operators are generally more familiar with the details of their businesses and provide to underwriters more accurate and complete information about their risks. Many insurance companies are unwilling to underwrite small risks because they are unable to cost-effectively write small business workers’ compensation policies, and we believe that as a result, there is less competition in the small business workers’ compensation insurance market. We believe our focus on small employers has enabled us to consistently generate loss ratios in our workers’ compensation segment below those of our peers.

We generally offer and provide guaranteed cost insurance contracts. Under guaranteed cost contracts, policyholders pay premiums based on a percentage of their payroll determined by job classification. Our premium rates for these policies vary depending upon certain factors, including the type of work to be performed by employees and the general business of the policyholder. In return for premium payments, we assume the statutorily imposed obligations of the policyholder to provide workers’ compensation benefits to its employees. There are no policy limits on our liability for workers’ compensation claims as there are for other forms of insurance.

Our policy renewal rate on voluntary business (excluding assigned risk pools) that we elected to quote for renewal was 84%, 82%, and 85% in 2006, 2005 and 2004, respectively.

Some of our commonly written small business risks include:

| | · | restaurants; |

| | | |

| | · | retail stores; |

| | | |

| | · | physician and other professional offices; |

| | | |

| | · | building management-operations by owner or contractor; |

| | | |

| | · | private schools; |

| | | |

| | · | hotels; |

| | | |

| | · | machine shops-light metalworking; |

| | | |

| | · | small grocery and specialty food stores; |

| | | |

| | · | wholesale shops; and |

| | | |

| | · | beauty shops. |

Specialty Risk and Extended Warranty

Our specialty risk and extended warranty coverage segment primarily serves manufacturers, service providers, retailers and third party warranty administrators that provide coverage for accidental damage, mechanical breakdown and related risks for consumer and commercial goods. We underwrite this coverage in Europe through AIU and in the United States through TIC, RIC and WIC. The majority of our specialty risk and extended warranty business is written in Europe ($71.5 million, $58.4 million and $57.1 million, respectively, of gross premiums written for the years ended December 31, 2006, 2005 and 2004 where we underwrite approximately 80 separate coverage plans). The remaining specialty risk and extended warranty business is written in the United States. Our specialty risk and extended warranty business primarily covers selected consumer and commercial goods and other risks, including:

| | · | consumer electronics, such as televisions and home theater components; |

| | | |

| | · | consumer appliances, such as refrigerators and washing machines; |

| | | |

| | · | automobiles in the United Kingdom (no liability coverage); |

| | | |

| | · | cellular telephones; |

| | | |

| | · | heavy equipment; |

| | | |

| | · | homeowner’s latent defects warranty in Norway; |

| | | |

| | · | hand tools; and |

| | | |

| | · | credit payment protection in the European Union. |

We believe we can profitably underwrite these risks by managing the frequency and severity of losses through: (i) carefully selecting suitable administrators and coverage plans to insure, (ii) drafting restrictive, risk-specific coverage terms, (iii) actively managing claims and (iv) if necessary, adjusting our premiums.

In our specialty risk and extended warranty segment, we issue policies which have a term of 12 months. The policies insure the insured’s contractual liability under contracts which have terms ranging from one month to 60 months. The weighted average term is 34 months. In the event of poor results, we generally have the right to increase premium rates during the term of the policy and, in Europe, the right to cancel prior to the end of the term. We believe that the profitability of each coverage plan we underwrite is primarily dependent upon our management and review. We collect and analyze claims data to forecast future claims trends on a continuing basis. We also provide warranty administration services for a limited number of coverage plans in the United States.

Our renewal rate on specialty risk and extended warranty coverage plans that we elected to quote for renewal was over 90% in 2004, 2005 and 2006.

Specialty Middle-Market Property and Casualty Insurance

The specialty middle-market property and casualty business consists of workers’ compensation, general liability, commercial auto liability and commercial property coverage for small and middle-market businesses. In December, 2005, we expanded into this business segment through our acquisition of the renewal rights to substantially all of Alea’s specialty middle-market property and casualty business. This business was founded in 1999 by a team of experienced insurance professionals and became available to us because of capital problems associated with the reinsurance business of Alea’s parent company. Although these capital problems were unrelated to the business we purchased, they resulted in ratings downgrades for Alea’s entire insurance group which adversely affected this business.

The coverage is offered through accounts with various agents to multiple insureds, and the placing agents generally share a portion of the risk. Policyholders in this segment primarily include the following types of industries:

| | · | retail; |

| | | |

| | · | wholesale; |

| | | |

| | · | service operations; |

| | | |

| | · | artisan contracting; and |

| | | |

| | · | light and medium manufacturing. |

This business produced for Alea $250 million of gross premiums written in the nine months ended September 30, 2005 through a network of 25 general and other wholesale agents. Workers’ compensation insurance historically comprised approximately 50% of this business and primarily covers risks similar to the risks we cover in our small business workers’ compensation segment, but also covers, to a small extent, higher risk businesses. The general liability and auto liability lines historically comprised approximately 25% and 20% of this business, respectively, and generally limit exposure through coverage limits of $1.0 million per occurrence. The property line, which comprised approximately 5% of this business, generally covers relatively low value real property and improvements.

In connection with the acquisition, substantially all of Alea’s former specialty middle-market property and casualty senior management, underwriting and support team agreed to voluntarily join AmTrust. The seven-member senior management team of Alea averages of over 20 years of experience in the specialty property and casualty business.

As of December 31, 2006, we transitioned 22 coverage plans which offer workers’ compensation, general liability, or commercial automobile liability coverage through 14 wholesale agents related to the Alea acquisition. In 2006, the specialty middle-market property and casualty segment produced approximately $134.3 million in gross premiums written. Currently, claims for this segment are administered by third parties. We closely monitor the performance of third party administrators through the review and analysis of monthly claim data and periodic audits.

Certain Acquisitions

Our acquisitions principally have been limited to the purchase of distribution networks and renewal rights from other insurance companies. In these transactions, we purchase access to the seller’s distribution networks, the right to hire certain of sellers employees, non-competition covenants and the right, but not the obligation, to offer insurance coverage to a defined group of the seller’s current policyholders when the current in-force policies expire (we do not acquire any in-force policies). Our ability to renew policies is subject to our ability to negotiate mutually acceptable price and coverage terms with each insured. We typically pay the seller a combination of an initial purchase price and a percentage of the premiums we receive on business that we successfully renew. Because the cost of each transaction is ultimately based on the amount of business we renew, we believe that these transactions are generally more cost effective than traditional types of acquisitions.

Warrantech

On February 1, 2007, we participated with H.I.G. Capital in financing its acquisition of Warrantech Corporation (“Warrantech”) in a cash merger. Warrantech is an independent developer, marketer and third party administrator of service contracts and after-market warranties primarily for the motor vehicle and consumer products industries. We currently provide insurance coverage for Warrantech’s consumer product group programs. In connection with the financing, Warrantech granted to us a right of first refusal to underwrite all of its warranty programs. As the Company does not control Warrantech, the Company will account for this investment under the equity method.

WIC Acquisition

On June 1, 2006, we acquired 100% of the issued and outstanding shares of WIC from Household Insurance Group Holdings Company ("HIG"). WIC had offered credit insurance products for HIG’s affiliated banks and finance companies. WIC is licensed in 50 states and the District of Columbia. HSBC Insurance Company of Delaware (“HSBC”), an affiliate of HIG, and WIC entered into a reinsurance agreement pursuant to which HSBC reinsured all of WIC’s pre-acquisition liabilities. In addition, HIG provided WIC a guaranty, by which HIG guaranteed all of HSBC’s obligations to WIC. In connection with the acquisition, the Company paid HIG the sum of $7.5 million and WIC’s capital and statutory surplus as of the closing date, which was $15 million.

In connection with the acquisition of WIC, we agreed to write certain types of insurance for HIG that are 100% reinsured by HSBC. The premium written associated with this arrangement in 2006 was approximately $26 million.

Muirfield Acquisition

On June 1, 2006, we acquired from Muirfield Underwriters, Ltd. (“Muirfield”), access to its distribution network, the right to hire certain employees, non-competition covenants and the right, but not the obligation, to offer renewals to Muirfield’s policyholders. We paid Muirfield $2.0 million at closing and have agreed to pay a specified percentage of direct premiums written on new policies and renewal policies, quarterly, through the three year period ending May 31, 2009. Of the $2.0 million payment made at closing, $500,000 was an advance against the quarterly payments. As of December 31, 2006, we have not made any additional payments. The minimum aggregate amount payable by us under the agreement is $2.0 million. Muirfield and its affiliates have agreed not to solicit workers’ compensation business prior to June 1, 2012. We wrote approximately $14 million in premiums in 2006.

Alea Acquisition

On December 13, 2005, we acquired from Alea access to its distribution network, a non-competition covenant and the renewal rights for certain specialty middle-market property and casualty business for payments equal to a percentage of premiums written on business we renew or otherwise generate for the next five years through the agent relationships we acquired from Alea. We paid to Alea a $12.0 million nonrefundable advance against these payments at the closing of this transaction. In connection with the acquisition, we hired approximately 40 former Alea employees, including substantially all of Alea’s former specialty middle-market property and casualty segment senior management and underwriting team. See “—Business Segments—Specialty Middle-Market Property and Casualty.”

Associated Acquisition

In August 2004, we acquired from Associated access to its distribution network, the renewal rights for certain Florida workers’ compensation business and a non-competition covenant. We did not acquire any in-force business or historical liabilities associated with the policies. In addition, we were not obligated to renew any particular policies, but renewed only those policies that met our underwriting guidelines and on which we were able to charge a satisfactory premium.

We paid Associated $250,000 at closing and have agreed to pay Associated a specified percentage of direct premiums written on new or renewal policies each quarter through December 31, 2007. The minimum aggregate amount payable by us to Associated is $2.3 million. As of December 31, 2006, we made additional payments totaling $1.0 million to Associated.

Covenant Acquisition

In December 2003, we acquired from Covenant access to its distribution network, certain employees and the renewal rights for certain workers’ compensation business. We also acquired Covenant’s proprietary claims handling system and shortly after the acquisition began to use this system to internally administer our claims, which had previously been outsourced. We did not acquire any in-force business or historical liabilities associated with the policies.

We paid Covenant $100,000 at closing and agreed to pay Covenant (i) an additional $500,000 over time until December 2008, and (ii) a specified percentage of direct premiums written on new or renewal policies each quarter for the three-year period ending December 1, 2006. We also agreed to pay a specified percentage of our annual profits on the purchased business for a three-year period ending December 1, 2006. As of December 31, 2006, an additional $1.2 million of purchase price had been incurred. Covenant and its principals have agreed not to solicit the policyholders included in the acquisition prior to December 2009.

Princeton Acquisition

In December 2002, we acquired from Princeton Insurance Company (“PIC”) all the outstanding stock of the Princeton Agency, Inc. ("Princeton"), the assets of which included access to its workers’ compensation distribution network and the right to seek to renew a block of workers’ compensation insurance policies that had been underwritten by PIC. Under the terms of the agreement, we did not acquire any in-force business or historical liabilities of any insurance carrier in connection with the policies. The acquisition enhanced our workers’ compensation marketing in the Northeast.

In connection with the acquisition, we paid PIC $500,000 and agreed to pay an additional percentage of premium on new and renewal business written through Princeton until March 31, 2008. The minimum aggregate amount payable by us is $5.5 million. As of December 31, 2006, additional payments totaling $3.8 million have been incurred. PIC has agreed not to solicit the policyholders included in the acquisition prior to December 2007.

Industry Overview

Workers’ Compensation Insurance

Workers’ compensation is a statutory system under which an employer is required to pay for its employees’ medical, disability, vocational rehabilitation and death benefit costs for work-related injuries or illnesses. While some employers elect to self-insure workers’ compensation risks, most employers purchase workers’ compensation insurance. The principal concept underlying workers’ compensation laws is that employees injured in the course and scope of their employment have only the legal remedies available under workers’ compensation laws and do not have any other recourse against their employer. An employer’s obligation to pay workers’ compensation does not depend on any negligence or wrongdoing on the part of the employer and exists even for injuries that result from the negligence or fault of another person, a co-employee or, in most instances, the injured employee. Workers’ compensation laws vary by state.

Workers’ compensation insurance policies generally provide that the insurance carrier will pay all benefits that the insured employer may become obligated to pay under applicable workers’ compensation laws. Each state has a regulatory and adjudicatory system that quantifies the level of wage replacement to be paid, determines the level of medical care required to be provided and the cost of permanent impairment and specifies the options in selecting medical providers available to the injured employee or the employer. These state laws generally require two types of benefits for injured employees: (i) medical benefits, which include expenses related to diagnosis and treatment of the injury, as well as any required rehabilitation, and (ii) indemnity payments, which consist of temporary wage replacement, permanent disability payments and death benefits to surviving family members. To fulfill these mandated financial obligations, virtually all employers purchase workers’ compensation insurance or, if permitted by state law, self-insure. Employers may purchase workers’ compensation insurance from a private insurance carrier, a state-sanctioned assigned risk pool or a self-insurance fund, which is an entity that allows employers to obtain workers’ compensation coverage on a pooled basis, typically subjecting each employer to joint and several liability for the entire fund.

We believe the challenges faced by the workers’ compensation industry over the past decade have created significant opportunity for workers’ compensation insurers to increase the amount of business that they write. Workers’ compensation insurance industry calendar year combined ratios, which had reached 122% in 2001, declined to 102% in 2005 (the most recent year for which industry data is available) as a result of premium rate increases and declines in claim severity and frequency. As a result of the opportunity arising from these trends, the workers’ compensation market recently has become more competitive and price competition is increasing.

Specialty Risk and Extended Warranty

Extended warranty and accidental damage plans offered by manufacturers, service providers, retailers and third party administrators provide coverage to purchasers of the subject consumer or commercial goods or other property against mechanical failure, accidental damage and other specified risks. These plans supplement basic manufacturer’s warranties by providing coverage for a defined time period after the expiration of the basic warranty, additional types of losses, or both. In some instances, the manufacturer, service provider or retailer offers its extended warranty or accidental damage plans directly to its customers. In others, the manufacturer, service provider or retailer partners with a third party administrator which offers the plans to users of the covered goods.

A plan may consist of a service contract setting forth the terms of the extended warranty, accidental damage or other coverage, issued by the plan provider (the manufacturer, service provider, retailer or third party administrator) or an insurance policy or insurance certificate issued by the plan provider on behalf of an insurer (often at the point of sale of the covered product). In the former case, the plan provider often seeks to mitigate its risk of loss through the purchase of contractual liability insurance. In a typical plan, the plan provider or insurer assumes the risk of mechanical failure, accidental damage or other covered losses in exchange for the payment of a fee or premium. If the plan provider is not an insurer, the plan provider typically remits part of the service contract fee to the contractual liability insurer as premium.

We believe that extended warranty and accidental damage coverage represents a growing sector of consumer services, including in the European Union and other foreign markets.

Specialty Middle-Market Property and Casualty

The specialty middle-market property and casualty market generally covers narrowly defined, homogeneous segments of primary commercial property and casualty insurance, which requires in-depth knowledge of the industry segment and underwriting expertise. Underwriting often entails customized coverage, loss control and claims services as well as risk sharing mechanisms. Competition in this segment is based primarily on client service, availability of insurance capacity, specialized policy forms, efficient claims handling and other value-based considerations, rather than price. In some instances, initial underwriting and claims functions are outsourced to specialized general agents and third party administrators.

Agents or insureds typically participate in underwriting results, through a variety of structures, such as captive insurance, risk retention groups and profit-based commissions, which are designed to provide greater stability in premium costs and control over insurance expenses for the insurance companies writing this risk.

Competition

The insurance industry, in general, is highly competitive and there is significant competition in the workers’ compensation insurance sector. Competition in the insurance business is based on many factors, including coverage availability, claims management, safety services, payment terms, premium rates, policy terms, types of insurance offered, overall financial strength, financial ratings assigned by independent rating organizations, such as A.M. Best, and reputation. Some of the insurers with which we compete have significantly greater financial, marketing and management resources and experience than we do. We may also compete with new market entrants in the future. Our competitors include other insurance companies, state insurance pools and self-insurance funds. More than 350 insurance companies participate in the workers’ compensation market. The insurance companies with which we compete vary by state and by the industries we target. We believe our competitive advantages include our underwriting and claims management practices and systems and our A.M. Best rating of “A-” (Excellent). In addition, we believe that our insurance is competitively priced and that our premium rates are typically lower than those for policyholders assigned to the state insurance pools, allowing us to provide a viable alternative for policyholders in those pools.

We believe that the specialty risk and extended warranty sector in which we do business is not as developed as most other insurance sectors (including workers’ compensation insurance). We believe that our European specialty risk and extended warranty team is recognized for its expertise in this market. Nonetheless, we face significant competition, including several internationally well-known insurers that have significantly greater financial, marketing and management resources and experience than we. We believe that our competitive advantages include the ability to provide technical assistance to warranty providers, experienced underwriting, resourceful claims management practices and good relations with the leading warranty administrators in the European Union.

Our specialty middle-market property and casualty segment employs a niche strategy that helps differentiate its offerings versus competitors. Most competing carriers pursue larger transactions and do not have the flexibility to pursue both traditional and alternative risk structures. We do not compete for high exposure or professional liability business and prefer to underwrite less volatile classes of business. The Company maintains the requisite A.M. Best rating and financial size to compete favorably for target business.

Geographic Distribution

TIC, RIC and WIC, collectively, are licensed to provide workers’ compensation insurance in 41 states and the District of Columbia, and in the year ended December 31, 2006, we wrote workers’ compensation business in 37 states and the District of Columbia. We have workers’ compensation license applications pending in two states and intend to apply for licenses in the remaining states except four which utilize monopolistic state-sponsored workers' compensation plans. The table below identifies, for the year ended 2006, the top ten producing states by percentages of our direct gross premiums written in our small business workers’ compensation insurance segment and the equivalent percentage for the years ended 2005 and 2004.

Percentage of Aggregate Workers’ Compensation Direct Gross Premiums Written By State(1)

| | | Year Ended December 31, | |

State | | 2006 | | 2005 | | 2004 | |

| Florida | | | 22.4 | % | | 29.1 | % | | 6.1 | % |

| New Jersey | | | 15.3 | | | 12.1 | | | 15.6 | |

| New York | | | 11.7 | | | 12.0 | | | 13.9 | |

| Georgia | | | 9.7 | | | 9.7 | | | 16.0 | |

| Pennsylvania | | | 9.2 | | | 10.5 | | | 12.9 | |

| Illinois | | | 9.1 | | | 6.5 | | | 9.7 | |

| Texas | | | 2.9 | | | 5.6 | | | 5.4 | |

| South Carolina | | | 2.6 | | | 2.2 | | | 3.2 | |

| Missouri | | | 1.7 | | | 0.7 | | | 1.7 | |

| Tennessee | | | 1.6 | | | 1.6 | | | 2.6 | |

| All Other States and the District of Columbia | | | 13.8 | | | 10.0 | | | 12.9 | |

| | |

| (1) | Direct premiums consist of gross premiums written other than those premiums assumed or written that are attributable to assigned risk pools. |

We are licensed to provide specialty risk and extended warranty coverage in 48 states and the District of Columbia, and in Ireland, and pursuant to European Union law, certain other European Union member states. Through fronting arrangements with State National Insurance Company (“State National”), we are able to underwrite specialty risk insurance and extended warranty coverage in all 50 states. Pursuant to these arrangements, State National insures risks we underwrite on policy forms that we supply. We administer the business, settle all claims and reinsure 100% of the risks. We pay State National a fee for its services, but it does not share in the profits or losses of the business it writes for us.

Based on coverage plans written or renewed in 2006 and 2005, the European Union accounts for approximately 54% and 72%, respectively, of our specialty risk and extended warranty business, and the United Kingdom accounts for approximately 49% of our European specialty risk and extended warranty business. Norway makes up approximately 33% of our European specialty risk and extended warranty business in 2006. The table below shows the geographic distribution of our annualized gross premiums written in our specialty risk and extended warranty segment with respect to coverage plans in effect at December 31, 2006.

Percentage of Specialty Risk and Extended Warranty Gross Premiums Written by Country

| | | Year Ended December 31, | |

Country | | 2006 | | 2005 | |

| United States | | | 46 | % | | 21 | % |

| United Kingdom | | | 26 | | | 42 | |

| Norway | | | 18 | | | 7 | |

| Sweden | | | 7 | | | 15 | |

| Czech Republic | | | 2 | | | 6 | |

| Slovakia | | | 1 | | | 2 | |

| Other | | | — | | | 7 | |

| Total | | | 100 | | | 100 | |

Percentage of Specialty Middle-Market Property and Casualty Direct Premiums Written By State.

State | | Year Ended December 31, 2006 | |

| New York | | | 45 | % |

| New Jersey | | | 12 | % |

| Pennsylvania | | | 8 | % |

| California | | | 3 | % |

| Missouri | | | 3 | % |

| Illinois | | | 2 | % |

| Texas | | | 2 | % |

| North Carolina | | | 2 | % |

| Vermont | | | 2 | % |

| Delaware | | | 2 | % |

| Michigan | | | 2 | % |

| All other States and the District of Columbia | | | 17 | % |

Distribution

We market our small business workers’ compensation insurance products and specialty risk and extended warranty products through unaffiliated third parties that charge us a commission or, as is often the case in our specialty risk and extended warranty segment, charge an administrative fee to the manufacturer or retailer providing the extended warranty or accidental damage coverage plan. Accordingly, the success of our business is dependent upon our ability to motivate these third parties to sell our products and support them in their sales efforts. The special middle-market property and casualty business is distributed through a limited number of qualified general and wholesale agents. The agent network is restricted to experienced, professional agents that have the requisite licensing to conduct business with AmTrust.

Small Business Workers’ Compensation

Currently, we have a network of approximately 8,800 independent wholesale and retail agents, located in 41 states and the District of Columbia. We plan to maintain our specialized small business workers’ compensation market focus and grow our policyholder base through development of additional agent relationships and expansion of current agent relationships. Our efforts to maintain and broaden our market include the continued development and enhancement of software that enables and promotes responsive interaction with our agents, including our proprietary web-based indicative rate quotation system. Our current system permits agents and brokers to determine whether a risk is within our eligible classes in real-time and enables the underwriters, in most cases, to make an underwriting determination within two business days of receiving a request.

We also enhanced our marketing and customer liaison capabilities for small-business workers’ compensation insurance by acquiring distribution networks and renewal rights from Princeton in 2002, Covenant in 2003, Associated in 2004 and Muirfield in 2006. These entities had long-standing relationships with agents and the expertise and infrastructure to support placing and servicing the smaller workers’ compensation insurance accounts that make up the core of our workers’ compensation business. These acquisitions have expanded our geographic reach.

Specialty Risk and Extended Warranty

We market our specialty risk insurance and extended warranty coverage primarily through brokers and third party warranty administrators.

Specialty Middle-Market Property and Casualty

The specialty middle-market property and casualty segment currently is distributed through a network of 14 general and other wholesale agents in the United States. This coverage is offered through these wholesale agents to multiple retail agents and insureds. These wholesale agents typically have a substantial role in underwriting and claims administration as well. These agents or the ultimate insureds generally share a portion of the risk. We pay these agents commission based on the services they provide. In addition, generally, a substantial portion of the commission is based on the profitability over time of business written in a given year.

Underwriting and Pricing

Small Business Workers’ Compensation

We use proprietary web-based tools and computer applications to assist in the underwriting process for our small business workers’ compensation insurance. To begin the underwriting process, an agent logs on to our web-page and enters general information about the risk and automatically receives an indicative price quotation. If the prospective policyholder and agent elect to continue, the agent enters detailed information and submits an underwriting request. The underwriting request is electronically delivered to one of our underwriters who reviews the submission. If the underwriter approves the submission, the underwriter provides a quote to the agent. The complete submission record is indexed to the quote, and the policy is bound as soon as the customer pays the requisite down-payment. We issue our policies via the internet to agents who are responsible to deliver them to the insureds. Our system will not allow business to be placed if it does not fit within our guidelines. Due to our adherence to our underwriting guidelines and filed rates, we offer quotes on only about 40% of the coverage requests we receive and issue policies on approximately half of the quotes we provide. Our system handles most clerical duties, so that our underwriters can focus on making decisions on risk submissions. As of December 31, 2006, we employed 32 underwriters in the small business workers’ compensation segment.

Specialty Risk and Extended Warranty

We underwrite our specialty risk coverage on a coverage plan-level basis, which involves substantial data collection and actuarial analysis as well as analysis of applicable laws governing policy coverage language and exclusions. We prefer to apply a historical rating approach in which we analyze historical loss experience of the covered product or similar products rather than an approach that attempts to estimate our total exposure without such historical data. In addition, we believe that the warranty administrator is very important to the profitability of each coverage we underwrite because the warranty administrator typically handles marketing and claims administration. Accordingly, each underwriting includes a critical evaluation of the prospective warranty administrator. The results of our underwriting analysis are used to determine the premium we charge and to draft the coverage language and exclusions. The underwriting process in our specialty risk and extended warranty segment generally takes three months or more to complete. We ultimately underwrite approximately 20% of the specialty risk and extended warranty business we are offered. Our specialty risk and extended warranty business is underwritten primarily in London, where we employ three underwriters. We also employ one underwriter in the United States and two in Sweden.

Specialty Middle-Market Property and Casualty

In the specialty middle-market property and casualty segment, independent wholesale agents handle underwriting, subject to underwriting standards we provide, and the agents or the ultimate insureds generally bear a portion of the risk. Our specialty middle-market property and casualty underwriting team establishes these standards through actuarial analysis using historical and industry data. Prior to entering into a relationship with an agency, we do extensive diligence on the agent including underwriting, claims and financial control areas. Diligence and approval for a new relationship or program generally takes three to nine months. Our team carefully monitors the loss experience of business written through our wholesale agents. We conduct annual underwriting audits of the agent. With respect to coverage plans which are on our underwriting system, which includes more than half of the business in this segment, we receive real time information on accounts bound. We are in the process of transitioning all of our general agents to our underwriting system.

Claims Administration

Small Business Workers’ Compensation

We have internally administered the majority of our workers’ compensation claims since April, 2004. Previously, we had utilized national third party administrators to handle claims. We have structured our claims operation to provide immediate and personal management of claims to guide injured employees through medical treatment, rehabilitation and recovery with the primary goal of returning the injured employee to work as promptly as practicable. We seek to limit the number of claim disputes with injured employees through early intervention in the claims process. We use a proprietary system of internet-based tools and applications that enable our claims staff to concentrate on investigating submitted claims, to seek subrogation opportunities and to determine the compensability of each claim. This system allows the claims process to begin as soon as a claim is submitted. Our adjusters handle an average workers’ compensation indemnity caseload of approximately 125 claims.

In 2006 approximately 77% of our small business workers’ compensation claims seek only medical expenses as opposed to an additional claim for lost wages. Based on industry data, we believe this rate exceeds the workers’ compensation industry average. We believe that we have such a high percentage of medical-only claims because of the nature of small businesses. We have entered into a consulting agreement with three consulting physicians pursuant to which they review certain serious claims. As of December 31, 2006 with respect to our small business workers’ compensation segment, approximately 0.5% of the 383 claims reported for accident year 2001 were open, 0.9% of the 1,214 claims reported for accident year 2002 were open, 3.7% of the 2,512 claims reported for accident year 2003 were open, 5.2% of the 5,282 claims reported for accident year 2004 were open, 8.3% of the 7,537 claims reported for accident year 2005 were open and 32.1% of the 10,035 claims reported for accident year 2006 were open.

Our small business workers’ compensation adjusters have an average of 15 years of experience. Supervision of the adjusters is performed by our internal claims manager in each region. Increases in reserves over the authority of the claims adjuster must be approved by supervisors. Senior claims managers provide direct oversight on all claims with an incurred value of $50,000 or more.

We have small business workers’ compensation claims offices in Atlanta, Georgia, Princeton, New Jersey, Lexington, Kentucky, Dallas, Texas, Missoula, Montana, Iowa, Wisconsin and Chicago, Illinois.

Specialty Risk and Extended Warranty

In our specialty risk and extended warranty segment, third party administrators generally handle claims on our policies and provide monthly loss reports. We review the monthly reports and if the losses are unexpectedly high, we generally have the right under our policies to adjust our pricing or cease underwriting new business under the coverage plan. We routinely audit the claims paid by the administrators. We generally settle our specialty risk claims in-kind — by repair or replacement — rather than in cash. When possible, we negotiate volume fixed-fee repair or replacement agreements with third parties to reduce our loss exposure. We hire third party experts to validate certain types of claims. For example, we engage engineering consultants to validate claims made on coverage we provide on heavy machinery.

Specialty Middle-Market Property and Casualty

In the specialty middle-market property and casualty segment third party administrators generally handle claims and provide periodic loss reports. Approximately 18 such providers administered this business as of December 31, 2006. We closely monitor the loss experience of each coverage we provide and audit claims paid by the administrators at least twice each twelve-month period. We intend to integrate claims administration into our systems over time.

Reinsurance

Our insurance subsidiaries cede portions of their insurance risk to reinsurance companies through reinsurance agreements. Such agreements serve to limit our maximum loss as a result of a single occurrence. The cost and limits of the reinsurance coverage we purchase vary from year to year based upon the availability of quality reinsurance at an acceptable price and our desired level of retention. Retention refers to the amount of risk that we retain for our own account. We have obtained excess of loss reinsurance for our small business workers’ compensation coverage and the workers’ compensation portion of our specialty middle-market property and casualty business segment. We have obtained variable quota share reinsurance for our European Union specialty risk and extended warranty insurance exposures. We have obtained reinsurance to cover the property portion of this business, which we have not yet written. We do not plan to reinsure the general liability and auto liability portions of this business. We do not purchase finite reinsurance.

We believe reinsurance is critical to our business. Our reinsurance strategy is to protect against unforeseen or catastrophic loss activity that would adversely impact our income and capital base. We periodically evaluate the financial condition of our third party reinsurers in order to minimize our exposure to significant losses from reinsurer insolvencies. Reinsurance does not discharge or diminish our obligation to pay claims covered under insurance policies we issue; however, it does permit us to recover losses on such risks from our reinsurers. We would be obligated to pay claims in the event these reinsurers were unable to meet their obligations. We have only selected financially strong reinsurers with an A.M. Best rating of “A-” (Excellent) or better at the time we entered into our reinsurance agreements.

The following table summarizes the four reinsurers that account for approximately 90% of our reinsurance recoverables on paid and unpaid losses and loss adjustment expenses as of December 31, 2006.

Reinsurer | | A.M. Best Rating | | Amount Recoverable as of December 31, 2006 | |

| | | | | ($ in thousands) | |

| National Workers' Compensation Reinsurance Pool (1) | | | | | $ | 10,549 | |

| HSBC Insurance Company of Delaware (2) | | | A+ | | | 9,980 | |

| Midwest Employers Casualty Company | | | A | | | 8,249 | |

| Munich Reinsurance Company | | | A+ | | | 7,910 | |

| General Reinsurance Corporation | | | A++ | | | 2,889 | |

| (1) | As per the NWCRP Articles of Agreement reinsurance is provided through a 100% quota share reinsurance agreement entered into among the Servicing Carrier (Technology Insurance Company) and the participating companies (all carriers writing in the state) pursuant to the Articles of Agreement. |

| | |

| (2) | In connection with the acquisition of WIC, HSBC reinsures 100% of WIC's pre-acquisition business. In addition, we agreed to write certain types of insurance for HIG that is 100% reinsured by HSBC. HIG provided WIC a guaranty, by which HIG guarantees all of HSBC's obligations to WIC. |

Intercompany Reinsurance

TIC/RIC/WIC/AII Intercompany Reinsurance. Our subsidiaries, AII, TIC, RIC and WIC are parties to an Intercompany Reinsurance Agreement, effective June 1, 2006, which provides reinsurance for insurance risks of TIC, RIC and WIC net of any applicable third party reinsurance. Although this reinsurance agreement is worded broadly enough to cover all insurance written by TIC, RIC and WIC in any line of business, not all specialty risk and extended warranty business is ceded under the agreement. Pursuant to the Intercompany Reinsurance Agreement, TIC and RIC act as both ceding companies and reinsurers, WIC acts only as a ceding company and AII acts only as a reinsurer. Under the original terms of the agreement, which apply to policies with effective dates prior to January 1, 2003, TIC ceded 57.5% of its risks covered by the agreement to RIC and AII (15% to RIC, 42.5% to AII) and reinsured 42.5% of the risks ceded by RIC. RIC ceded 85% of its risks covered by the agreement to TIC and AII (42.5% to TIC, 42.5% to AII) and reinsured 15% of the risks ceded by TIC. AII reinsured 42.5% of the risks ceded by both TIC and RIC. WIC was not a party to the agreement until June 1, 2006.

Pursuant to an endorsement to the Intercompany Reinsurance Agreement, which applied to policies with an effective date of January 1, 2003 or later, TIC ceded 80% of its risks covered by this agreement to RIC and AII (10% to RIC, 70% to AII) and reinsured 20% of the risks ceded by RIC. RIC ceded 90% of its risks covered by the agreement to TIC and AII (20% to TIC, 70% to AII) and reinsured 10% of the risks ceded by TIC. AII reinsured 70% of the risks ceded by both TIC and RIC. Pursuant to a second endorsement to the agreement, effective January 1, 2003, TIC and RIC ceded and AII reinsured 100% of TIC’s and RIC’s risks from any assigned risk or similar plans. An assigned risk is one underwritten by special insurance facilities established under state laws to provide certain types of coverage for those who cannot purchase it in the open market.

In connection with our acquisition of WIC, the Intercompany Reinsurance Agreement was amended to include WIC effective June 1, 2006. Pursuant to the current Intercompany Reinsurance Agreement WIC cedes 70% of its risks covered by the agreement to AII and 20% to TIC and AII would reinsure 70% of the risks ceded by WIC and TIC would reinsure 20% of such risks. WIC does not cede any part of its business to RIC and does not reinsure any business written by the other companies. The cession and reinsurance of risks among TIC, RIC and AII will otherwise remain the same.

The table below outlines the risks ceded and assumed net of third party reinsurance under the current terms of the Intercompany Reinsurance Agreement:

Subsidiary Company | | Retains | | Cedes | | Assumes | |

TIC | | | 20% of own risk 0% of assigned risk | | | 10%of risk to RIC 70% of risk to AII* | | | 20% of RIC Risk 20% of WIC Risk | |

| RIC | | | 10% of own risk 0% of assigned risk | | | 20% of risk to TIC 70% of risk to AII* | | | 10% of TIC Risk | |

| WIC | | | 10% of own risk 0% of assigned risk | | | 20% to TIC 70% to AII* | | | N/A | |

| AII | | | N/A | | | N/A | | | 70% of RIC risk* 70% of TIC risk 70% of WIC risk | |

| * | TIC, RIC and WIC cede 100% of all assigned risks to AII. |

AIU/AII Intercompany Reinsurance. AIU has entered into a 60% quota share reinsurance arrangement with AII for the portion of AIU’s risks under its specialty risk and extended warranty business that is not ceded to third party reinsurers. Although this intercompany reinsurance arrangement is broad enough to cover all of AIU’s specialty risk and extended warranty risks to the extent that they are not reinsured with third party reinsurers, AIU has elected not to cede certain of these risks to AII.

Third Party Workers’ Compensation Reinsurance

We purchase excess of loss reinsurance for our workers’ compensation business, which includes workers’ compensation that is attributable to both the small business workers’ compensation segment as well as the specialty middle market segment, from third party reinsurers. Under excess of loss reinsurance, covered losses in excess of the retention level up to the limit of the reinsurance coverage are paid by the reinsurer. Our excess of loss reinsurance is written in layers, in which our reinsurers accept a band of coverage up to a specified amount. In return for this coverage, we pay our reinsurers a percentage of our net or gross earned insurance premiums subject to certain minimum reinsurance premium requirements. Different layers in our excess of loss reinsurance program are scheduled to renew at different times during the year. Effective January 1, 2006, our retention for workers’ compensation claims other than those arising out of acts of terrorism is $1.0 million per occurrence.

The following description of our third party reinsurance protection covers the period from January 1, 2006 through December 31, 2008 and certain periods prior to January 1, 2006. Some layers of this reinsurance include so-called “sunset clauses” which limit reinsurance coverage to claims reported within eight years of the inception of a 12-month contract period and may also include commutation clauses which permit reinsurers to terminate their obligations by making a final payment to us based on an estimate of their remaining liabilities, which may ultimately prove to be inadequate. In addition to insuring employers for their statutory workers’ compensation liabilities, our workers’ compensation policies provide insurance for the employers’ tort liability (if any) for bodily injury or disease sustained by employees in the course of their employment. Certain layers of our workers’ compensation reinsurance exclude coverage for such employers’ liability insurance or provide coverage for such insurance at lower limits than the applicable limits for workers’ compensation insurance.

January 1, 2006 to January 1, 2008. From January 1, 2006 to January 1, 2008, we retain the first $1 million per occurrence on workers’ compensation claims other than those arising out of acts of terrorism. We cede losses greater than $1.0 million for such claims. Our reinsurance for such claims totals $129.0 million, structured as a five layer tower. The first three layers of this reinsurance exclude coverage for our participation in assigned risk pools. Coverage in the last three layers of this reinsurance will expire in May 2007 and we currently are in the process of soliciting renewals.

| | · | The first layer of this reinsurance, provides $9.0 million of coverage per occurrence in excess of our $1.0 million retention. It has an annual aggregate deductible of $1.25 million and reinsures losses in excess of $1.0 million up to $10.0 million. Pursuant to these deductible provisions, we must pay a total amount of $1.25 million in workers’ compensation losses incurred in 2006 in excess of our $1.0 million retention before we are entitled to any reinsurance recovery. |

| | | |

| | · | The second layer provides $10.0 million of coverage per occurrence in excess of $10.0 million. This layer reinsures losses in excess of $10.0 million up to $20.0 million. |

| | | |

| | · | The third layer provides $30.0 million of coverage per occurrence for claims in excess of $20.0 million. This layer provides coverage for losses in excess of $20.0 million up to $50.0 million. It has limits of $10.0 million per individual. This means that if an individual is involved in a compensable claim, the maximum coverage provided under this layer would not exceed $10.0 million for that individual. It has an aggregate limit of $60.0 million for the entire 12-month contract period. |

| | | |

| | · | The fourth layer provides $30.0 million of coverage per occurrence for claims in excess of $50.0 million. It reinsures losses in excess of $50.0 million up to $80.0 million. It has limits of $10.0 million per individual and an aggregate limit of $60.0 million for the entire 12-month contract period. |

| | | |

| | · | The fifth layer provides $50.0 million of coverage per occurrence for claims in excess of $80.0 million. It reinsures losses greater than $80.0 million up to $130.0 million. It has limits of $10.0 million ($5.0 million for losses occurring before May 1, 2005) per individual and an aggregate limit of $100.0 million for the entire 12-month contract period. |

January 1, 2005 to January 1, 2006. From January 1, 2005 to January 1, 2006, we retain the first $0.6 million per occurrence on workers’ compensation claims. We cede losses greater than $0.6 million for such claims. Our reinsurance for such claims totals $129.4 million, structured as a six layer tower. The first three layers of this reinsurance exclude coverage for our participation in assigned risk pools.

| | · | The first layer of this reinsurance provides $4.4 million of coverage per occurrence excess of our $0.6 million retention. It has an annual aggregate deductible of $1.25 million and reinsures losses in excess of $0.6 million up to $5.0 million. Pursuant to these deductible provisions, we must pay a total amount of $1.25 million in workers’ compensation losses incurred in 2005 in excess of our $0.6 million retention before we are entitled to any reinsurance recovery. |

| | | |

| | · | The second layer provides $5.0 million of coverage per occurrence excess of $5.0 million. This layer reinsures losses in excess of $5.0 million up to $10.0 million. |

| | | |

| | · | The third layer provides $10.0 million of coverage per occurrence excess of $10.0 million. It reinsures losses in excess of $10.0 million up to $20.0 million. It has an aggregate limit of $20.0 million per 12-month contract period. This means that regardless of the number of occurrences in any 12-month contract period with insured losses in excess of $10.0 million, the aggregate amount paid under this layer would not exceed $20.0 million. |

| | | |

| | · | The fourth layer provides $30.0 million of coverage per occurrence for claims excess of $20.0 million. This layer provides coverage for losses in excess of $20.0 million up to $50.0 million. It has limits of $10.0 million per individual. This means that if an individual is involved in a compensable claim, the maximum coverage provided under this layer would not exceed $10.0 million for that individual. It has an aggregate limit of $60.0 million for the entire 12-month contract period. |

| | | |

| | · | The fifth layer provides $30.0 million of coverage per occurrence for claims excess of $50.0 million. It reinsures losses in excess of $50.0 million up to $80.0 million. It has limits of $10.0 million per individual and an aggregate limit of $60.0 million for the entire 12-month contract period. |

| | | |

| | · | The sixth layer provides $50.0 million of coverage per occurrence for claims excess of $80.0 million. It reinsures losses greater than $80.0 million up to $130.0 million. It has limits of $10.0 million ($5.0 million for losses occurring before May 1, 2005) per individual and an aggregate limit of $100.0 million for the entire 12-month contract period. |

January 1, 2004 to January 1, 2005. From January 1, 2004 to January 1, 2005, we retain the first $0.5 million per occurrence on workers’ compensation claims. We cede losses greater than $0.5 million for such claims. From January 1, 2004 to May 1, 2004, our reinsurance for such claims totals $79.5 million, structured as a five layer tower. From May 1, 2004 to January 1, 2005, our reinsurance for such claims totals $129.5 million, structured as a six layer tower. The first four layers of this reinsurance exclude coverage for our participation in assigned risk pools.

| | · | The first layer of this reinsurance provides $4.5 million of coverage per occurrence excess of our $0.5 million retention. It has an annual aggregate deductible of $1.0 million and reinsures losses in excess of $0.5 million up to $5.0 million. |

| | | |

| | · | The second layer provides $5.0 million of coverage per occurrence excess of $5.0 million. This layer reinsures losses in excess of $5.0 million up to $10.0 million. |

| | | |

| | · | The third layer provides $10.0 million of coverage per occurrence excess of $10.0 million. It reinsures losses in excess of $10.0 million up to $20.0 million. It has an aggregate limit of $20.0 million per 12-month contract period. |

| | | |

| | · | The fourth layer provides $30.0 million of coverage per occurrence for claims excess of $20.0 million. This layer provides coverage for losses in excess of $20.0 million up to $50.0 million. It has limits of $10.0 million ($5.0 million for losses occurring prior to April 1, 2004) per individual and an aggregate limit of $60.0 million for the entire 12-month contract period. |

| | | |

| | · | The fifth layer provides $30.0 million of coverage per occurrence for claims excess of $50.0 million. It reinsures losses in excess of $50.0 million up to $80.0 million. It has limits of $10.0 million ($5.0 million for losses occurring before May 1, 2004) per individual and an aggregate limit of $60.0 million per 12-month contract period. |

| | · | The sixth layer only applies to losses occurring on or after May 1, 2004. It provides $50.0 million of coverage per occurrence for claims excess of $80.0 million. It reinsures losses greater than $80.0 million up to $130.0 million. It has limits of $10.0 million per one individual and an aggregate limit of $100.0 million for the entire 12-month contract period. |

All told, for the period January 1, 2004 to May 1, 2004, we have $79.5 million per occurrence of reinsurance for workers’ compensation claims. For the period May 1, 2004 to January 1, 2005, we have $129.5 million per occurrence of reinsurance for such claims.

Certain layers of our reinsurance provide coverage for losses caused by terrorism. For terrorism losses in excess of $20.0 million per occurrence, we have three layers of reinsurance, none of which provides coverage for nuclear, biological or chemical terrorism. This additional reinsurance is provided net of any recovery that we receive from the federal government pursuant to the Terrorism Risk Insurance Act of 2002, as modified by the Terrorism Risk Insurance Extension Act of 2005 (“TRIA”). As discussed above, these three layers expire in May 2007 and we are in the process of soliciting renewals.

| | · | The first layer of this additional reinsurance provides $30.0 million of coverage per occurrence for claims in excess of $20.0 million. It reinsures terrorism losses in excess of $20.0 million up to $50.0 million and has an aggregate limit of $30.0 million for the entire 12-month contract period. |

| | | |

| | · | The second layer of this additional reinsurance provides $30.0 million of coverage per occurrence for claims in excess of $50.0 million. This layer provides coverage for losses in excess of $50.0 million up to $80.0 million and has an aggregate limit of $30.0 million for the entire 12-month contract period. |

| | | |

| | · | The third layer of this additional reinsurance provides $50.0 million of coverage per occurrence for claims in excess of $80.0 million. It reinsures losses in excess of $80.0 million up to $130.0 million and has an aggregate limit of $50.0 million for the entire 12-month contract period. |

TRIA, as extended and amended, requires that commercial property and casualty insurance companies offer coverage (with certain exceptions, such as with respect to commercial auto insurance) for certain acts of terrorism and has established a federal assistance program through the end of 2007 to help such insurers cover claims for terrorism-related losses. TRIA covers certified acts of terrorism, and the U.S. Secretary of the Treasury must declare the act to be a “certified act of terrorism” for it to be covered under this federal program. In addition, no certified act of terrorism will be covered by the TRIA program unless the aggregate insurance industry losses from the act exceed certain substantial threshold amounts ($100 million for acts of terrorism occurring in 2007). Under the TRIA program, the federal government covers 85% of the losses from covered certified acts of terrorism on commercial risks in the United States only, in excess of a deductible amount. This deductible is calculated as a percentage of an affiliated insurance group’s prior year premiums on commercial lines policies (with certain exceptions, such as commercial auto insurance policies) covering risks in the United States. This deductible amount is 20% of such premiums for losses occurring in 2007.

TRIA, will expire at the end of 2007 and We cannot assure you that it will be renewed or that any such renewal will not be on materially less favorable terms.

Third Party Specialty Risk and Extended Warranty Reinsurance

Variable Quota Share Reinsurance. Since January 1, 2003, we have had variable quota share reinsurance with Munich Reinsurance Company (“Munich Re”) for our specialty risk and extended warranty insurance. The scope of this reinsurance arrangement is broad enough to cover all of our specialty risk and extended warranty insurance worldwide. However, we do not cede to Munich Re the majority of our U.S. specialty risks and extended warranty business, although we may cede more of this U.S. business to Munich Re in the future.

Under quota share reinsurance arrangements, the ceding company cedes a percentage of each risk within the covered class or classes of business to the reinsurer and recovers the same percentage of the ceded loss and loss adjustment expenses. The ceding company pays the reinsurer the same percentage of the insurance premium on the ceded business, less a ceding commission. The ceding commission rate for our reinsurance with Munich Re is based upon a certain net loss ratio for the ceded business.

Under the variable quota share reinsurance arrangements with Munich Re, we may elect to cede from 35% to 85% (as of December 31, 2006; effective January 1, 2007 the range is 15% to 50%) of each covered risk, but Munich Re shall not reinsure more than £850,000 for each ceded risk which we at acceptance regard as one individual risk. This means that regardless of the amount of insured losses generated by any ceded risk, the maximum coverage for that ceded risk under this reinsurance arrangement is £850,000. For the majority of the business ceded under this reinsurance arrangement, we cede 35% of the risk to Munich Re, but for some newer or larger risks, we cede a larger share to Munich Re. This reinsurance is subject to a limit of £2.5 million per occurrence of certain natural perils such as windstorms, earthquakes, floods and storm surge. Coverage for losses arising out of acts of terrorism is excluded from the scope of this reinsurance.

Loss Reserves

Workers’ Compensation Business

We record reserves for estimated losses under insurance policies that we write and for loss adjustment expenses related to the investigation and settlement of policy claims. Our reserves for loss and loss adjustment expenses represent the estimated cost of all reported and unreported loss and loss adjustment expenses incurred and unpaid at a given point in time. In establishing our reserves, we do not use loss discounting, which involves recognizing the time value of money and offsetting estimates of future payments by future expected investment income. Our process and methodology for estimating reserves applies to both our voluntary and assigned risk business and does not include our reserves for mandatory pooling arrangements. We record reserves for mandatory pooling arrangements as those reserves are reported to us by the pool administrators. We use a consulting actuary to assist in the evaluation of the adequacy of our reserves for loss and loss adjustment expenses.