with fuel purchases. As of December 31, 2021, we had a customer incentive asset of $12.4 million and $22.1 million, classified in “Prepaid expenses and other current assets” and “Notes receivable and other long-term assets, net,” respectively, in the accompanying consolidated balance sheets.

At-The-Market Offerings. On May 10, 2021, we entered into an equity distribution agreement with Goldman Sachs & Co. LLC, as sales agent, to sell shares of our common stock having an aggregate offering price of up to $100.0 million in an at-the-market offering program (the “May ATM Program”). As of June 3, 2021, we sold 12,362,237 shares of our common stock under the May ATM Program, which exhausted the May ATM Program. On June 7, 2021, we entered into a new equity distribution agreement with Goldman Sachs & Co. LLC, as sales agent, to sell additional shares of our common stock having an aggregate offering price of up to $100.0 million in a new at-the-market offering program (the “June ATM Program” and, together with the May ATM Program, the “ATM Programs”). On June 8, 2021, we sold 10,473,946 shares of our common stock under the June ATM Program, which exhausted the June ATM Program.

For the year ended December 31, 2021, we issued 22,836,183 shares of our common stock under the ATM Programs for gross proceeds of $200.0 million, and incurred transaction costs of $6.5 million, including $6.0 million in commissions paid to Goldman Sachs & Co. LLC.

Share Repurchase Program. On March 12, 2020, our Board of Directors approved the Repurchase Program for up to $30.0 million (exclusive of fees and commissions) of our outstanding common stock. On December 7, 2021, our Board of Directors approved an increase in the aggregate purchase amount under the Repurchase Program from $30.0 million to $50.0 million (exclusive of fees and commissions). The Repurchase Program does not have an expiration date, does not obligate us to acquire any specific number of shares, and may be suspended or discontinued at any time. As of December 31, 2021, we had utilized $17.4 million under the Repurchase Program to purchase 8,197,086 shares of our common stock for a total cost of $17.6 million.

Plains Credit Facility. On May 1, 2021, we entered into a Loan and Security Agreement (the “Plains LSA”) with PlainsCapital Bank (“Plains”) which provides us a $20.0 million revolving line of credit through May 1, 2022. The interest rate on amounts outstanding under the Plains LSA is the greater of the Prime Rate or 3.25%. As of December 31, 2021, no amounts were outstanding under the Plains LSA. On September 16, 2021, Plains issued an irrevocable standby letter of credit on behalf of the Company to the Chevron Products Company, a division of Chevron U.S.A. Inc. (“Chevron”), for $2.0 million relating to the Company’s Adopt-A-Port program with Chevron. The standby letter of credit is valid until cancelled and is collateralized by the Company’s revolving line of credit with Plains, reducing the amount available under the line of credit from $20.0 million to $18.0 million. As of December 31, 2021, no amounts have been drawn under the standby letter of credit.

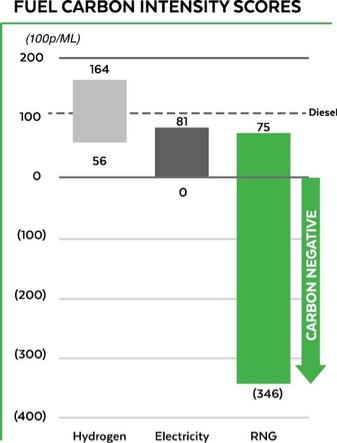

Chevron Adopt-a-Port. In June 2020, we entered into an agreement with Chevron Corp. (“Chevron”) to provide truck operators serving the ports of Los Angeles and Long Beach with cleaner, carbon negative RNG to reduce emissions. Under the agreement, Chevron will provide funding to allow truck operators to subsidize the cost of buying new RNG-powered trucks and will supply RNG to our stations near the ports.

AFTC. On December 20, 2019, the AFTC was retroactively extended beginning January 1, 2018 through December 31, 2020. As a result, AFTC revenue for vehicle fuel we sold in 2018 and 2019, which totaled $47.1 million, was recognized during the year ended December 31, 2019. AFTC revenue recognized during the year ended December 31, 2020 totaled $19.8 million. The AFTC credit for 2018, 2019 and 2020 was equal to $0.50 per GGE of CNG that we sold as vehicle fuel, and $0.50 per diesel gallon of LNG that we sold as vehicle fuel. In December 2020 AFTC was extended for vehicle fuel sales made through December 31, 2021. We expect AFTC to be reinstated during 2022 and apply retroactively to vehicle fuel sales made beginning January 1, 2022.

Zero Now Truck Financing Program. We launched the Zero Now truck financing program, which is intended to facilitate and increase the deployment of commercially available RNG heavy-duty trucks in the United States and encourage these operators to fuel their trucks at our stations. The Zero Now program is unique and complex, and has involved our entry into various arrangements in order to launch the program, including a term credit agreement for delayed draw loans of up to $100.0 million, which we could draw through January 2, 2022; a credit support agreement with THUSA, a wholly owned subsidiary of TotalEnergies, under which THUSA has guaranteed our obligations under the term