Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the accompanying unaudited condensed consolidated financial statements and the notes thereto, included in Item 1 in this Quarterly Report on Form 10-Q, and the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and as contained in that report, the information under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” This discussion contains forward-looking information. Please see “Forward-Looking Statements” for a discussion of the uncertainties, risks and assumptions associated with these statements.

Overview

Cboe Global Markets, Inc., the world’s leading derivatives and securities exchange network, delivers cutting-edge trading, clearing and investment solutions to people around the world. Cboe provides trading solutions and products in multiple asset classes, including equities, derivatives, and FX, across North America, Europe, and Asia Pacific. Above all, the Company is committed to building a trusted, inclusive global marketplace that enables people to pursue a sustainable financial future.

Cboe’s subsidiaries include the largest options exchange and the third largest stock exchange operator in the U.S. In addition, the Company operates Cboe Europe, one of the largest stock exchanges by value traded in Europe, and owns Cboe Clear Europe, a leading pan-European equities and derivatives clearinghouse, BIDS Holdings, which owns a leading block-trading ATS by volume in the U.S., and provides block-trading services with Cboe market operators in Europe, Canada, Australia, and Japan, Cboe Australia, an operator of trading venues in Australia, Cboe Japan, an operator of trading venues in Japan, Cboe Digital Exchange, LLC, an operator of a regulated futures exchange, Cboe Clear Digital, an operator of a regulated clearinghouse, and Cboe Canada Inc., a recognized Canadian securities exchange. Cboe subsidiaries also serve collectively as a leading market globally for exchange-traded products (“ETPs”) listings and trading.

On April 25, 2024, the Company announced plans to refocus the digital asset business to leverage its core strengths in derivatives, technology, and product innovation. On May 31, 2024, the Company halted trading on Cboe Digital Exchange, LLC’s (“Cboe Digital Exchange”) spot market (“Cboe Digital spot market”), the Company’s spot digital asset trading platform, in-line with the Company’s plans to wind down the spot digital asset trading market by the third quarter of 2024. In addition, the company plans to transition its cash-settled Bitcoin and Ether futures contracts, currently available for trading on the Cboe Digital Exchange, to CFE in the first half of 2025, pending regulatory review. The Company plans to align Cboe Clear Digital with Cboe Clear Europe, under unified leadership, and expects to continue to facilitate the clearing of cash-settled Bitcoin and Ether futures contracts.

The Company is headquartered in Chicago with offices in Amsterdam, Belfast, Hong Kong, Kansas City, London, Manila, New York, San Francisco, Sarasota Springs, Singapore, Sydney, Tokyo, and Toronto.

Recent Developments

Pyth Tokens Unlocking

In October 2022, the Company, through its wholly-owned subsidiary Cboe NL entered into a Data Provider Agreement with Pyth Data Association (“Pyth”) to create a data feed and begin publishing limited derived equities market data for certain symbols from one of its four U.S. equities exchanges on the Pyth Network, a decentralized financial market data distribution platform for aggregated data. In exchange, Pyth granted Cboe NL 16,666,666 restricted PYTH tokens which unlock annually over a four-year period in equal tranches; the first 25% tranche of PYTH tokens unlocked in May 2024. The PYTH tokens, which are included within intangible assets, net in the condensed consolidated balance sheets, are carried at their historical value of $0.06 per token and are reviewed each reporting period for potential impairment. In May 2024, the Company recorded $1.0 million in market data fees revenue on the condensed consolidated statements of income, which represents the historical value of the grant of 16,666,666 restricted PYTH tokens earned for satisfying the performance obligations outlined in the Data Provider Agreement.

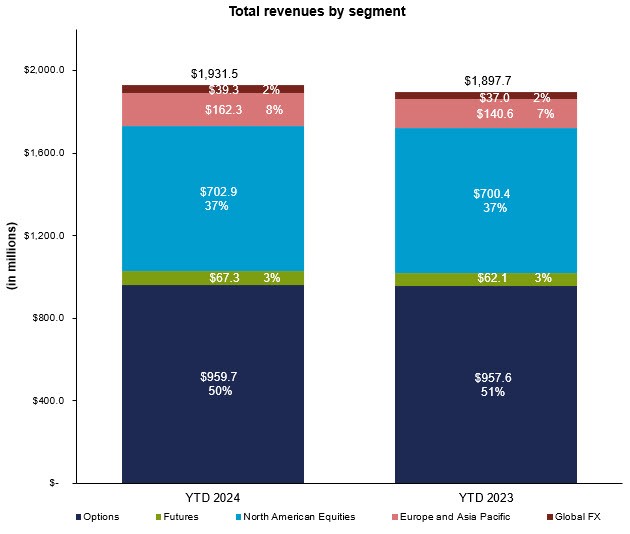

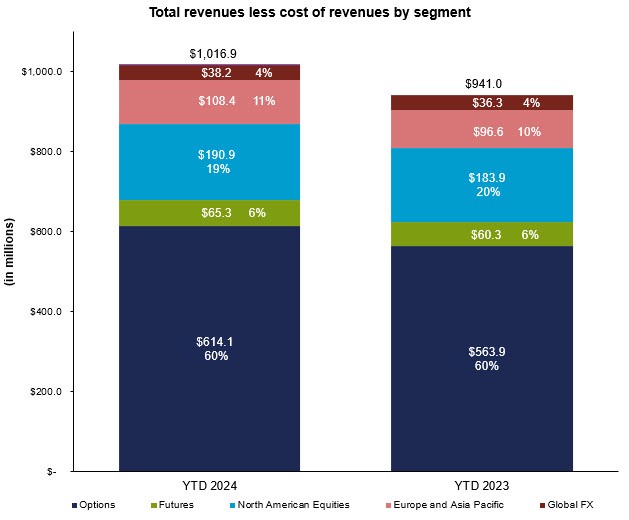

Business Segments

The Company operates six reportable business segments: Options, North American Equities, Europe and Asia Pacific, Futures, Global FX, and Digital, which is reflective of how the Company's chief operating decision-maker reviews and operates the business, as discussed in Note 1 (“Organization and Basis of Presentation”). Segment performance is primarily evaluated based on operating income (loss). The Company’s chief operating decision-maker does not use