Filed Pursuant to Rule 433 of the Securities Act of 1933

Issuer Free Writing Prospectus dated March 19, 2024

Relating to Preliminary Prospectus dated March 19, 2024

Registration Statement No. 333-278048

SUPER MICRO COMPUTER, INC.

This free writing prospectus relates to the Registration Statement on Form S-3 (File No. 333-278048), including the prospectus therein (the “Registration Statement”), that Super Micro Computer, Inc. (the “Company”) has filed with the Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended.

The article attached to this free writing prospectus as Annex A (the “Article”) was first published by the Wall Street Journal (the “Publisher”) on March 17, 2024. The Article is being filed because of the timing of its appearance and because it contains statements regarding the Company that were made in an interview between the Publisher and Charles Liang, the President, Chief Executive Officer and Chairman of the Company, that preceded the filing of the Registration Statement. The Article also includes a quote from David Weigand, the Chief Financial Officer of the Company, that he made during the Company’s earnings call in January 2024.

The Article was prepared by the Publisher, which is not affiliated with the Company. The Company made no payment and gave no consideration to the Publisher in connection with the publication of the Article. With the exception of statements and quotations attributed directly to Mr. Liang or derived from the Company’s earnings call and/or release, the Company does not affirm or assume responsibility for anything contained in the Article, including, without limitation, third-party data from FactSet. The Article represented the authors’ opinions and the opinions of others, neither of which are endorsed or adopted by the Company or any other participant of the offering to which the Registration Statement relates (the “Offering”). The statements by Mr. Liang were not intended to qualify any of the information, including the risk factors, included or incorporated by reference in the Registration Statement, and were not intended as offering material with respect to the Offering or otherwise.

You should consider the statements contained in this free writing prospectus, including those contained in the Article, only after carefully evaluating all of the information included or incorporated by reference in the Registration Statement and any prospectus relating to the Offering, including the risk factors appearing in the “Risk Factors” section in the Registration Statement and the documents incorporated by reference therein, including the Company’s Annual Report on Form 10-K filed with the SEC on August 28, 2023 and the Company’s Quarterly Reports on Form 10-Q for the quarters ended September 30, 2023 and December 31, 2023, filed with the SEC on November 3, 2023 and February 2, 2024, respectively (collectively, the “Risk Factors”).

Corrections and Clarifications

Some of the statements and quotations in the Article that are attributed to Mr. Liang contain factual omissions, inaccuracies and inconsistencies with the information contained in the Registration Statement. For purposes of correction and clarification, the Company notes the following:

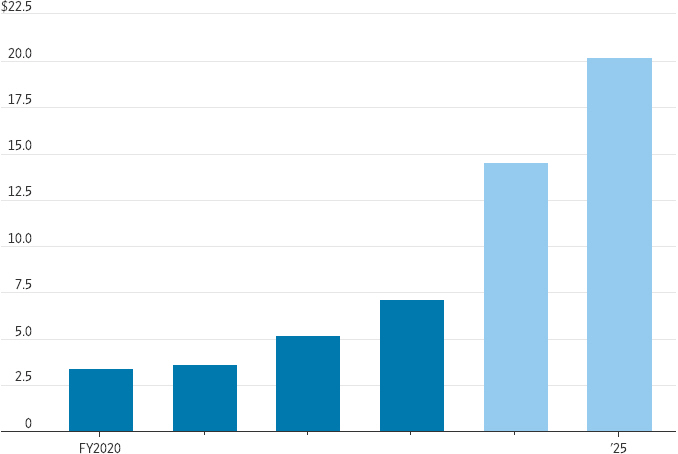

| | • | | The Article reports that “Liang said his goal was to be producing 5,000 racks of servers a month […] by the middle of this [calendar] year.” As disclosed on page 7 of the prospectus contained in the Registration Statement, as of the second quarter of fiscal year 2024, the Company had a production capacity of 4,000 racks per month and believes it has a path to significantly increasing its liquid cooling rack capacity over the next few quarters. The Company is continuing to work towards achieving Mr. Liang’s stated capacity goal in the stated timeframe, but the Company’s ability to do so is dependent on its ability to address supply chain constraints on AI platform-related components (including GPUs, CPUs, networking cards and high performance memory), its ability to raise sufficient capital to fund this growth, continued demand for its products, including its AI-compatible servers, as well as other operational, strategic and industry risks that are set forth in the Risk Factors. |

| | • | | The Article reports that “Liang has also said that the manufacturing growth is sufficient to bring the company’s potential revenue above $25 billion a year…” The correct statement should be that the manufacturing growth would provide the Company with manufacturing capacity that could allow it to achieve $25 billion in annual revenues, assuming a high level of capacity utilization and product pricing remaining at current levels or increasing. However, the Company, like other companies in its industry, faces challenges to maintaining high levels of capacity utilization due to changing product mixes, different customers and customer requirements, fluctuating rack-scale customer demand, timing of inventory deliveries and customer orders, other timing and manufacturing-related factors, as well as |