UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 2

(MARK ONE)

x ANNUAL REPORT PURSUANT TO SECTION 13, 15(d), OR 37 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2007

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number 000-52313

TENNESSEE VALLEY AUTHORITY

(Exact name of registrant as specified in its charter)

| | | |

A corporate agency of the United States created by an act of Congress (State or other jurisdiction of incorporation or organization) | | 62-0474417 (IRS Employer Identification No.) |

400 W. Summit Hill Drive Knoxville, Tennessee (Address of principal executive offices) | | 37902 (Zip Code) |

(865) 632-2101

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13, Section 15(d), or Section 37 of the Securities Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13, 15(d), or 37 of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Securities Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o

Non-accelerated filer x Smaller reporting company o

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act). Yes o No x

Explanatory Note

In this Amendment No. 2 to the Annual Report on Form 10-K/A for the fiscal year ended September 30, 2007 (“Form 10-K/A No. 2”), the Tennessee Valley Authority (“TVA”) is restating the financial statements for the years ended September 30, 2007 and 2006, primarily to restate revenue associated with an accounting error in the financial statements included in the original Annual Report on Form 10-K (the “Original 10-K”). The error was discovered during TVA’s review of its unbilled revenue estimation process.

TVA is primarily a wholesale provider of power to distributor customers (“distributors”) that resell the power to end users at retail rates. Under TVA’s end-use billing arrangements with distributors, TVA relies on distributors to report their end-use sales. Because of the delay between the wholesale delivery of power to the distributor and the report of end-use sales to TVA, TVA must estimate the unbilled revenue at the end of each financial reporting period. In September 2006, TVA implemented a change in methodology for estimating unbilled revenue for electricity sales which resulted in an increase of $232 million in unbilled revenue (2.6 percent of operating revenue) for 2006.

The estimation process implemented in September 2006 utilized the distributors’ average rates and an estimate of the number of days of revenue outstanding to reflect the delay in reporting the end-use sales to TVA (“days outstanding”). The number of days outstanding was derived using a procedure similar to a cross-correlation calculation that compared the monthly retail load to the monthly wholesale load. The intent was to reflect in the unbilled estimate the end-use sales that would be reported that month by distributors plus any remaining sales that would not be reported until the following month due to the delay between wholesale delivery and end-use reporting.

TVA has determined that the process implemented in September 2006 overestimated the days outstanding and that this overestimation resulted in an error in recording unbilled revenue and unbilled receivables. The previous unbilled process also failed to consider the annual true-up of each distributor’s reported distribution losses. The annual true-up reconciles total end-use kilowatt-hour (“kWh”) sales and revenue reported by each distributor with the kWh sales recorded for each distributor at wholesale.

TVA has used a new process for estimating unbilled revenue for 2006 and 2007 in this Form 10-K/A No. 2. This process carries over only the portion of sales from the distributor’s meter read date to the month-end. Those sales, along with the current month sales, are then priced at rates based on each distributor’s customer and product mix. Additionally, the true-up component has been added to the unbilled calculation to reflect any timing differences that occur between the retail and wholesale billing cycles. Due to the new process, an adjustment was made to increase revenue in 2007 by $73 million (less than one percent of operating revenues) and to decrease revenue by $200 million (approximately 2.2 percent of operating revenues) in 2006.

The restatement of unbilled revenue also affected TVA’s fuel cost adjustment (“FCA”) calculation. The FCA is a mechanism by which TVA collects the direct cost of fuel used in its generating facilities and also the energy costs of purchased power used to serve power demand. Implementation of the FCA occurred in October 2006 as a joint effort between TVA and its customers. The goal of the FCA is timely recovery of fuel-related expenses to reduce the volatility driven by fuel and purchased power markets. Under TVA’s FCA methodology, adjustments to rates are based primarily on the difference between forecasted and actual expenses for the upcoming quarter as well as the difference between forecasted and actual revenues for the upcoming quarter. Because the FCA adjustments are forward-looking, there is typically a difference between what is collected in rates and what actual expense is realized over the course of the quarter. This difference is added to or subtracted from a deferred account on TVA’s balance sheet.

The restatement of unbilled revenue changed TVA’s forecasted revenues, and since forecasted revenues are a major component of the FCA calculation, the change in forecasted revenues required a restatement of the amounts in TVA’s deferred FCA account. In the Original 10-K, TVA reported a FCA deferred balance of $197 million at September 30, 2007, which was restated to a deferred balance of $150 million. Of the $150 million, $18 million is a deferred asset and $132 million is a current receivable.

The unbilled revenue error also affected the application of distributor prepayments. The balance in the distributors’ unbilled accounts receivable is offset by a reduction in the advance collections of those distributors who make prepayments for their power. As a result of the change in unbilled revenue, the balances in the unbilled receivable and advance collections accounts were also adjusted. The adjustment related to distributor prepayments had no effect on the account balances as of September 30, 2007 and increased the balance in the receivable and advance collections accounts by $1 million as of September 30, 2006.

In light of the need for this restatement, TVA has identified a material weakness in its internal control over financial reporting related to its unbilled revenue calculation, and has concluded that its disclosure controls and procedures were not effective as of September 30, 2007, solely because of this material weakness. To rectify the material weakness, the new method of calculating the unbilled revenue estimate described above was used for periods presented in this Form 10-K/A No. 2. See Item 9A, Controls and Procedures, for additional information regarding controls and procedures related to this material weakness.

TVA has also included in the appropriate periods in its restated consolidated financial statements other miscellaneous adjustments that were deemed to be not material by management, either individually or in the aggregate, and therefore were corrected in the period in which they were identified. These adjustments primarily include accounting for closed capital projects and related depreciation, reserves for legal proceedings, and timing of payable recognition and are described in more detail in Note 2.

The effects of these restatements and miscellaneous adjustments on TVA's consolidated financial statements as of and for the years ended September 30, 2007, and 2006, including quarterly data, are described in Note 2 and Note 17. The restatements had no impact on TVA’s cash or cash equivalents.

For the convenience of the reader, TVA is refiling its entire Annual Report on Form 10-K/A for the fiscal year ended September 30, 2007, by means of this Form 10-K/A No. 2. However, except for the information affected by the restatement, TVA has not materially updated the information contained herein for events or transactions occurring subsequent to the dates the Original 10-K and Amendment No. 1 to the Original 10-K (“10-K/A No. 1”) were filed with the SEC. TVA recommends that this Form 10- K/A No. 2 be read in conjunction with the reports and any amendments thereto TVA has filed with the SEC subsequent to the filing date of the Original 10-K and 10-K/A No. 1.

The following items have been amended principally as a result of, and to reflect, the restatement, and no other information in the Original 10-K and 10-K/A No. 1 is amended hereby as a result of the restatement:

Part I – Item 1 – Business

Part I – Item IA – Risk Factors

Part I – Item 3 – Legal Proceedings

Part II – Item 6 – Selected Financial Data

Part II – Item 7 – Management's Discussion and Analysis of Financial Condition and Results of Operations

Part II – Item 8 – Financial Statements and Supplementary Data

Part II – Item 9A – Controls and Procedures

Part III – Item 11 – Executive Compensation

Part IV – Item 15 – Exhibits and Financial Statements

TVA is also filing updated certifications by the Chief Executive Officer and Chief Financial Officer as exhibits to this Form 10-K/A No. 2.

This Form 10-K/A No. 2 is not superseding or restating financial statements contained in TVA’s quarterly reports on Form 10-Q for the quarters ended March 31, 2008, or December 31, 2007, or any current report on Form 8-K filed subsequent to September 30, 2007. However, the financial statements for the quarters ended March 31, 2008 and December 31, 2007, which are contained in the quarterly reports on Form 10-Q for the quarters then ended, have also been restated in amended quarterly reports on Form 10-Q/A, which TVA plans to file as soon as practicable after the filing of this Form 10-K/A No. 2. See Note 17. Accordingly, the information in the quarterly reports on Form 10-Q for the quarters ended March 31, 2008, and December 31, 2007, should be considered in light of the information in this Form 10-K/A No. 2.

The financial statements for the quarters ended March 31, 2008, and December 31, 2007, which are contained in the quarterly reports on Form 10-Q for the quarters then ended, are being restated in amended quarterly reports on Form 10-Q/A, which TVA plans to file as soon as practicable after the filing of this Form 10-K/A No. 2.

TVA has not separately amended its Annual Report on Form 10-K for the fiscal year ended September 30, 2006, or its Quarterly Reports on Form 10-Q for the quarterly periods for the fiscal years ended September 30, 2007 and 2006. Consequently, the financial and other information contained in such reports should be read in conjunction with the restated financial data for these fiscal periods, which is set forth in this Form 10-K/A No.2. See Note 17.

This Form 10-K/A No. 2 contains forward-looking statements relating to future events and future performance. All statements other than those that are purely historical may be forward-looking statements.

In certain cases, forward-looking statements can be identified by the use of words such as “may,” “will,” “should,” “expect,” “anticipate,” “believe,” “intend,” “project,” “plan,” “predict,” “assume,” “forecast,” “estimate,” “objective,” “possible,” “probably,” “likely,” “potential,” or other similar expressions.

Examples of forward-looking statements include, but are not limited to:

| • | Statements regarding strategic objectives; |

| • | Projections regarding potential rate actions; |

| • | Estimates of costs of certain asset retirement obligations; |

| • | Estimates regarding power and energy forecasts; |

| • | Expectations about the adequacy of TVA’s pension plans, nuclear decommissioning trust, and asset retirement trust; |

| • | Estimates regarding the reduction of bonds, notes, and other evidences of indebtedness, lease/leaseback commitments, and power prepayment obligations; |

| • | Estimates of amounts to be reclassified from other comprehensive income to earnings over the next year; |

| • | TVA’s plans to continue using short-term debt to meet current obligations; and |

| • | The anticipated cost and timetable for placing Watts Bar Unit 2 in service. |

Although the Tennessee Valley Authority (“TVA”) believes that the assumptions underlying the forward-looking statements are reasonable, TVA does not guarantee the accuracy of these statements. Numerous factors could cause actual results to differ materially from those in the forward-looking statements. These factors include, among other things:

| • | New laws, regulations, and administrative orders, especially those related to: |

| – | TVA’s protected service area, |

| – | The sole authority of the TVA Board to set power rates, |

| – | Various environmental and nuclear matters, |

| – | TVA’s management of the Tennessee River system, |

| – | TVA’s credit rating, and |

| • | Performance of TVA’s generation and transmission assets; |

| • | Availability of fuel supplies; |

| • | Purchased power price volatility; |

| • | Events at facilities not owned by TVA that affect the supply of water to TVA’s generation facilities; |

| • | Compliance with existing environmental laws and regulations; |

| • | Significant delays or cost overruns in construction of generation and transmission assets; |

| • | Significant changes in demand for electricity; |

| • | Legal and administrative proceedings; |

| • | Weather conditions including drought; |

| • | Failure of transmission facilities; |

| • | Events at any nuclear facility, even one that is not owned by or licensed to TVA; |

| • | Catastrophic events such as fires, earthquakes, floods, tornadoes, pandemics, wars, terrorist activities, and other similar events, especially if these events occur in or near TVA’s service area; |

| • | Reliability of purchased power providers, fuel suppliers, and other counterparties; |

| • | Changes in the market price of commodities such as coal, uranium, natural gas, fuel oil, electricity, and emission allowances; |

| • | Changes in the prices of equity securities, debt securities, and other investments; |

| • | Changes in interest rates; |

| • | Creditworthiness of TVA, its counterparties, or its customers; |

| • | Rising pension costs and health care expenses; |

| • | Increases in TVA’s financial liability for decommissioning its nuclear facilities and retiring other assets; |

| • | Limitations on TVA’s ability to borrow money; |

| • | Changes in the economy; |

| • | Ineffectiveness of TVA’s disclosure controls and procedures, and its internal control over financial reporting; |

| • | Changes in accounting standards; |

| • | The loss of TVA’s ability to use regulatory accounting; |

| • | Problems attracting and retaining skilled workers; |

| • | Changes in the market for TVA securities; and |

Additionally, other risks that may cause actual results to differ from the predicted results are set forth in Item 1A, Risk Factors. New factors emerge from time to time, and it is not possible for management to predict all such factors or to assess the extent to which any factor or combination of factors may impact TVA’s business or cause results to differ materially from those contained in any forward-looking statement.

TVA undertakes no obligation to update any forward-looking statement to reflect developments that occur after the statement is made.

Fiscal Year

Unless otherwise indicated, years (2007, 2006, etc.) in this Annual Report refer to TVA’s fiscal years ended September 30. References to years in the biographical information about directors and executive officers in Item 10, Directors, Executive Officers and Corporate Governance are to calendar years.

Notes

References to “Notes” are to the Notes to Financial Statements contained in Item 8, Financial Statements and Supplementary Data.

Available Information

TVA's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports are made available on TVA's website, free of charge, as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission ("SEC"). TVA's website is www.tva.gov. Information contained on TVA’s website shall not be deemed incorporated into, or to be a part of, this Annual Report. In addition, the public may read and copy any reports or other information that TVA files with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. TVA's SEC reports are also available to the public without charge from the website maintained by the SEC at www.sec.gov.

The Tennessee Valley Authority (“TVA”) is a wholly-owned corporate agency and instrumentality of the United States. TVA was created by the U.S. Congress in 1933 by virtue of the Tennessee Valley Authority Act of 1933, as amended, 16 U.S.C. §§ 831-831ee (as amended, the “TVA Act”). TVA was created to improve navigation on the Tennessee River, reduce flood damage, provide agricultural and industrial development, and provide electric power to the Tennessee Valley region. TVA manages the Tennessee River and its tributaries for multiple river-system purposes, such as navigation; flood damage reduction; power generation; environmental stewardship; shoreline use; and water supply for power plant operations, consumer use, recreation, and industry. TVA’s power system operations, however, constitute the majority of its activities and provide virtually all of its revenues.

Although TVA is similar to other power companies in many ways, there are many features that make it different. Some of these include:

| • | TVA was created by an act of the U.S. Congress and is a wholly-owned corporate agency of the United States. |

| • | Each member of TVA’s board of directors (the “TVA Board”) is appointed by the President of the United States with the advice and consent of the U.S. Senate. |

| • | TVA does not own real property; it holds real property as an agent for the United States. (Any reference in this Annual Report on Form 10-K (“Annual Report”) to TVA facilities or the ownership by TVA of facilities or real property refers to property held by TVA but owned by the United States.) |

| • | TVA is required to make payments to the U.S. Treasury as a repayment of and a return on the appropriation investment that the United States provided TVA for its power facilities (the “Power Facilities Appropriation Investment”). |

| • | TVA is not authorized to issue equity securities such as common or preferred stock. Accordingly, TVA finances its operations primarily with cash flows from operations and proceeds from issuing debt securities. |

| • | The TVA Board sets the rates TVA charges for power. In setting rates, the TVA Board must have due regard for the objective that power be sold at rates as low as are feasible. These rates are not subject to judicial review or review by any regulatory body. |

| • | TVA is exempt from paying federal income taxes and state and local taxes, but it must pay certain states and counties an amount in lieu of taxes equal to five percent of TVA’s gross revenues from the sale of power during the preceding year, excluding sales or deliveries to other federal agencies and off-system sales with other utilities, with a provision for minimum payments under certain circumstances. |

| • | TVA performs stewardship activities in connection with the Tennessee River and its tributaries and is required by federal law to fund these activities primarily with revenues from the power system and to a lesser extent with revenues from other sources. |

For a discussion of the more significant of these features, see Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations — Business Overview.

TVA is governed by the TVA Board. The Consolidated Appropriations Act, 2005, amended the TVA Act by restructuring the TVA Board from three full-time members to nine part-time members, at least seven of whom must be legal residents of the TVA service area. TVA Board members are appointed by the President of the United States with the advice and consent of the U.S. Senate. After an initial phase-in period, TVA Board members serve five-year terms, and at least one member’s term ends each year. The TVA Board, among other things, establishes broad goals, objectives, and policies for TVA; establishes long-range plans to carry out these goals, objectives, and policies; approves annual budgets; and establishes a compensation plan for employees. Information about members of the TVA Board and TVA’s executive officers is discussed in Item 10, Directors, Executive Officers and Corporate Governance.

Strategy

On May 31, 2007, the TVA Board approved the 2007 Strategic Plan (“Strategic Plan”). The Strategic Plan focuses on TVA’s performance in the following five broad areas and establishes general guidelines for each area:

| • | CUSTOMERS: Maintain power reliability, provide competitive rates, and build trust with TVA’s customers; |

| • | PEOPLE: Build pride in TVA’s performance and reputation; |

| • | FINANCIAL: Adhere to a set of sound financial guiding principles to improve TVA’s fiscal performance; |

| • | ASSETS: Use TVA’s assets to meet market demand and deliver public value; and |

| • | OPERATIONS: Improve performance to be recognized as an industry leader. |

Performance Indicators

On September 27, 2007, the TVA Board adopted performance indicators for 2008 that are aligned with TVA’s Strategic Plan. These performance indicators are as follows:

2008 TVA Scorecard

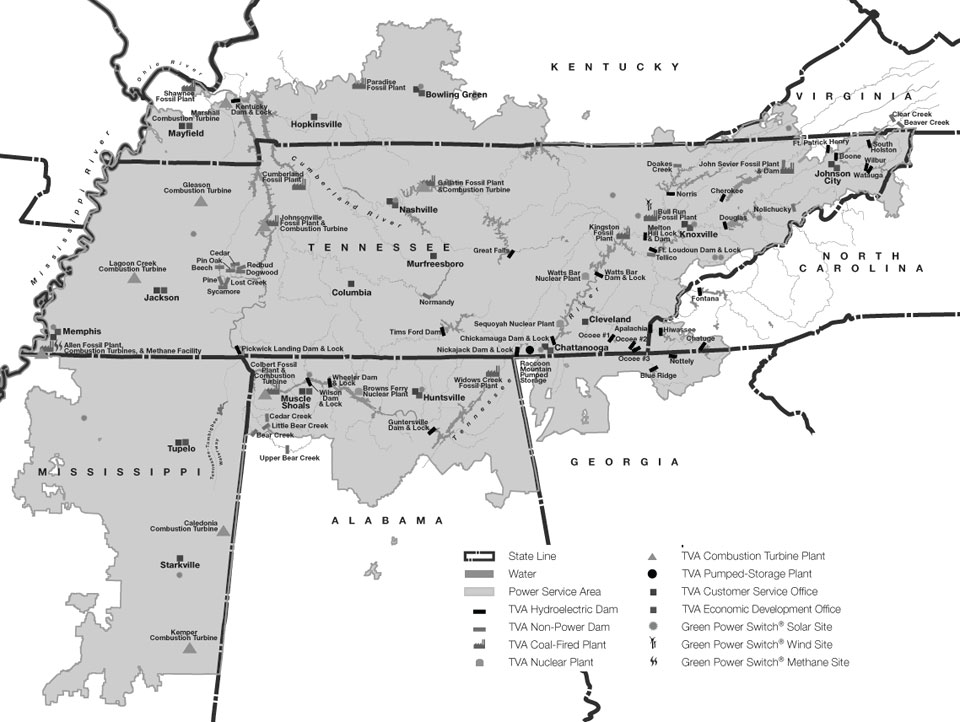

TVA operates the nation’s largest public power system. TVA supplies power in most of Tennessee, northern Alabama, northeastern Mississippi, and southwestern Kentucky and in portions of northern Georgia, western North Carolina, and southwestern Virginia to a population of approximately 8.7 million people.

Subject to certain minor exceptions, TVA may not, without specific authorization from the U.S. Congress, enter into contracts which would have the effect of making it, or the distributor customers of its power, a source of power supply outside the area for which TVA or its distributor customers were the primary source of power supply on July 1, 1957. This statutory provision is referred to as the “fence” because it bounds TVA’s sales activities, essentially limiting TVA to power sales within a defined service area.

Correspondingly, the Federal Power Act (“FPA”), primarily through its anti-cherrypicking provision, prevents the Federal Energy Regulatory Commission (“FERC”) from ordering TVA to provide access to its transmission lines to others for the purpose of delivering power to customers within substantially all of its defined service area. The anti-cherrypicking provision reduces TVA’s exposure to loss of revenue.

Sales of electricity accounted for substantially all of TVA’s operating revenues in 2007, 2006, and 2005, amounting to $9.2 billion (restated), $8.8 billion (restated), and $7.7 billion, respectively. TVA’s revenues by state for the last three years are detailed in the table below.

Electricity Sales Revenues by State

For the years ended September 30

(in millions)

| | | | | | | | |

| | | 2007 | | | 2006* | | | 2005* | |

| | | As Restated | | As Restated | | | | |

| Alabama | | $ | 1,264 | | $ | 1,239 | | $ | 1,051 | |

| Georgia | | | 206 | | | 226 | | | 186 | |

| Kentucky | | | 1,084 | | | 902 | | | 830 | |

| Mississippi | | | 804 | | | 798 | | | 671 | |

| North Carolina | | | 58 | | | 36 | | | 38 | |

| Tennessee | | | 5,740 | | | 5,621 | | | 4,806 | |

| Virginia | | | 7 | | | 5 | | | 4 | |

| Subtotal | | | 9,163 | | | 8,827 | | | 7,586 | |

| Sale for resale | | | 17 | | | 13 | | | 95 | |

| Subtotal | | | 9,180 | | | 8,840 | | | 7,681 | |

| Other revenues | | | 146 | | | 143 | | | 111 | |

| Operating revenues | | $ | 9,326 | | $ | 8,983 | | $ | 7,792 | |

* See Note 1 — Reclassifications.

TVA SERVICE AREA

TVA is primarily a wholesaler of power. TVA sells power at wholesale to distributor customers, consisting of municipalities and cooperatives that resell the power to their customers at a retail rate. TVA also sells power to (1) directly served customers, consisting primarily of federal agencies and customers with large or unusual loads, and (2) exchange power customers (electric systems that border TVA’s service area) with which TVA has entered into exchange power arrangements.

Operating revenues by customer type for each of the last three years are set forth in the table below. In this table, sales to industries directly served are included in Industries directly served, and sales to federal agencies directly served and to exchange power customers are included in Federal agencies and other.

Operating Revenues by Customer Type For the years ended September 30 | |

| (in millions) | |

| | | | | | | | |

| | | 2007 | | | 2006* | | | 2005* | |

| | | As Restated | | As Restated | | | | |

| Municipalities and cooperatives | | $ | 7,847 | | $ | 7,659 | | $ | 6,539 | |

| Industries directly served | | | 1,221 | | | 1,065 | | | 961 | |

| Federal agencies and other | | | | | | | | | | |

| Federal agencies directly served | | | 95 | | | 103 | | | 86 | |

| Off-system sales | | | 17 | | | 13 | | | 95 | |

| Subtotal | | | 9,180 | | | 8,840 | | | 7,681 | |

| Other revenues | | | 146 | | | 143 | | | 111 | |

| Operating revenues | | $ | 9,326 | | $ | 8,983 | | $ | 7,792 | |

* See Note 1 — Reclassifications.

Municipalities and Cooperatives

Revenues from distributor customers accounted for 84.1 percent of TVA’s total operating revenues in 2007. At September 30, 2007, TVA had wholesale power contracts with 158 municipalities and cooperatives. All of these contracts require distributor customers to purchase all of their electric power and energy requirements from TVA.

All distributor customers purchase power under one of three basic termination notice arrangements:

| • | Contracts that require five years’ notice to terminate; |

| • | Contracts that require 10 years’ notice to terminate; and |

| • | Contracts that require 15 years’ notice to terminate. |

The number of distributor customers with the contract arrangements described above, the revenues derived from such arrangements in 2007, and the percentage of TVA’s 2007 total operating revenues represented by these revenues are summarized in the table below.

TVA Distributor Customer Contracts As of September 30, 2007 | |

Contract Arrangement | | Number of Distributor Customers | | | Sales to Distributor Customers in 2007 | | | Percentage of Total Operating Revenues in 2007 | |

| | | | | | (in millions) | | | | |

| | | | | | As Restated | | | As Restated | |

| 15-Year termination notice | | | 5 | | | $ | 87 | | | | 0.9 | % |

| 10-Year termination notice | | | 48 | | | | 2,597 | | | | 27.8 | % |

| 5-Year termination notice * | | | 102 | | | | 5,112 | | | | 54.8 | % |

| Notice given - less than 5 years remaining * | | | 3 | | | | 51 | | | | 0.6 | % |

| Total | | | 158 | | | $ | 7,847 | | | | 84.1 | % |

| * | Ordinarily the distributor customer and TVA have the same termination notice period; however, in contracts with six of the distributor customers with five-year termination notices, TVA has a 10-year termination notice (which becomes a five-year termination notice if TVA loses its discretionary wholesale rate-setting authority). |

TVA’s two largest distributor customers — Memphis Light, Gas and Water Division (“MLGW”) and Nashville Electric Service (“NES”) — have contracts with five-year and 10-year termination notice periods, respectively. Although no single customer accounted for 10 percent or more of TVA’s total operating revenues in 2007, sales to MLGW and NES accounted for 8.6 percent and 7.9 percent, respectively. In 2004, TVA and MLGW entered into a prepayment agreement under which MLGW prepaid TVA $1.5 billion for the future costs for a portion of the electricity to be delivered by TVA to MLGW over a period of 180 months. See Note 1 — Energy Prepayment Obligations for more information about this prepayment arrangement.

On September 26, 2006, the city of Bristol, Virginia, announced that it had selected TVA as the new power provider for its municipal electric system, Bristol Virginia Utilities (“BVU”), beginning in January 2008. TVA had provided wholesale power to BVU from 1945 to 1997. The contract has a minimum 15-year term, and a five-year termination notice may not be given until January 2018. The rates under this contract are intended to recover the cost of reintegrating BVU into TVA’s power-supply plan and serving its customer load.

All of the power contracts between TVA and the distributor customers provide for purchase of power by the distributor customers at the rates established by the TVA Board, which, beginning with 2007, are adjusted quarterly to reflect changing fuel and purchased power costs. See Item 1, Business — Rate Actions. In addition, most of the power contracts between TVA and the distributor customers specify the resale rates that distributor customers charge their power customers. These resale rates are divided into the classifications of residential, general power, and manufacturing. The general power and manufacturing classifications are further divided into subclassifications according to their load size. These rates are revised from time to time to reflect changes in costs, including changes in the wholesale cost of power, and are designed to conform to the TVA Act’s objective of providing an adequate supply of power at the lowest feasible rates.

Termination Notices

At September 30, 2006, six of TVA’s distributor customers had notices in effect terminating their power contracts with TVA. In November 2006, TVA made an offer, which ended January 10, 2007, to allow these six power distributors a grace period to return to TVA without being subject to reintegration fees. Any distributor choosing to rescind its contract termination notice after January 10, 2007, would be required to pay the additional costs to resume planning for its future power supply needs.

Subsequently, Warren Rural Electric Cooperative Corporation (“Warren”), Duck River Electric Membership Corporation, and Glasgow Electric Plant Board rescinded their termination notices in response to this offer. Monticello Electric Plant Board, Princeton Electric Plant Board, and Paducah Power System did not accept the offer to rescind. The contracts of the remaining three distributors will all terminate by January 2010. Sales in 2007 to the three remaining distributor customers amounted to $51 million, or 0.6 percent of TVA’s operating revenues in 2007.

The table below lists the names and locations of the three distributor customers whose termination notices were still in effect as of September 30, 2007, their contract termination dates, the amount of revenues that TVA generated by selling power to these distributor customers in 2007, and the percentage of TVA’s total 2007 operating revenues represented by these revenues.

Distributor Customers with Termination Notices in Effect

As of September 30, 2007

(in millions)

Distributor Customer | Location | Date of Termination of Power Contract | | TVA Sales to Distributor Customer in 2007 | | | Percentage of TVA Operating Revenues in 2007 | |

| | | | | As Restated | | | As Restated | |

| Monticello Electric Plant Board | Kentucky | November 2008 | | $ | 6 | | | | 0.1 | % |

| Paducah Power System | Kentucky | December 2009 | | | 39 | | | | 0.4 | % |

| Princeton Electric Plant Board | Kentucky | January 2010 | | | 6 | | | | 0.1 | % |

| Total | | | | $ | 51 | | | | 0.6 | % |

Other Customers

Revenues from industrial customers directly served accounted for 13.1 percent of TVA’s total operating revenues in 2007. In 2007, contracts for customers directly served were generally for terms from five to 10 years. These contracts are subject to termination by TVA or the customer upon a minimum notice period that varies according to the customer’s contract demand and the period of time service has been provided.

The United States Enrichment Corporation (“USEC”) is TVA’s largest industrial customer directly served. Sales to USEC for its Paducah, Kentucky, facility represented 5.5 percent of TVA’s total operating revenues in 2007. TVA’s current contract with USEC expires on May 31, 2012. USEC is currently rated 'CCC' by Standard & Poor's and 'Caa2' by Moody's Investors Service. As a result of USEC’s credit ratings, it has provided credit assurance to TVA, per the terms of its power contract. In January 2004, USEC announced its decision to construct a new commercial centrifuge facility in Piketon, Ohio, which is outside TVA’s service area. Once this new facility is opened, it is unclear how much electricity USEC will acquire from TVA for its Paducah, Kentucky, facility. However, the electric power requirements of USEC, or of its successor at that site, are expected to be substantially less than their current level.

TVA is self-regulated with respect to rates and the TVA Act gives the TVA Board sole responsibility for establishing the rates TVA charges for power. These rates are not subject to judicial review or to review or approval by any state or federal regulatory body.

According to the TVA Act, TVA is required to charge rates for power which will produce gross revenues sufficient to provide funds for:

| • | Operation, maintenance, and administration of its power system; |

| • | Payments to states and counties in lieu of taxes; |

| • | Debt service on outstanding indebtedness; |

| • | Payments to the U.S. Treasury in repayment of and as a return on the Power Facilities Appropriation Investment; and |

| • | Such additional margin as the TVA Board may consider desirable for investment in power system assets, retirement of outstanding bonds, notes, or other evidences of indebtedness (“Bonds”) in advance of maturity, additional reduction of the Power Facilities Appropriation Investment, and other purposes connected with TVA’s power business. |

In setting TVA’s rates, the TVA Board is charged by the TVA Act to have due regard for the primary objectives of the TVA Act, including the objective that power shall be sold at rates as low as are feasible. See Note 1 — General.

Revenue Requirements

In setting rates to cover the costs set out in the TVA Act, TVA uses a debt-service coverage (“DSC”) methodology to derive annual revenue requirements in a manner similar to that used by other public power entities that also use the DSC rate methodology. The DSC method is essentially a measure of an organization’s ability to cover its operating costs and to satisfy its obligations to pay principal and interest on debt. TVA believes this method is appropriate because of TVA’s debt-intensive capital structure. This ratemaking approach is particularly suitable for use by highly leveraged enterprises (i.e., financed primarily, if not entirely, by debt capital).

The revenue requirements (or projected costs) are calculated under the DSC method as the sum of the following components:

| • | Fuel and purchased power costs; |

| • | Operating and maintenance costs; |

Once the revenue requirements (or projected costs) are determined, this amount is compared to the projected revenues for the year in question, at existing rates, to arrive at the shortfall or surplus of revenues as compared to the projected costs. Subject to TVA Board approval, power rates would be adjusted to a level sufficient to produce revenues approximately equal to projected costs. This methodology reflects the cause-and-effect relationship between a regulated entity’s costs and the corresponding rates the entity charges for its regulated products and services.

Fuel Cost Adjustment

On July 28, 2006, the TVA Board implemented a fuel cost adjustment (“FCA”) to be used quarterly to adjust TVA’s rates to reflect changing fuel and purchased power costs beginning in 2007. The FCA was initially set to zero and had its first impact on rates effective January 1, 2007. The FCA rate adjustment on January 1, 2007, was 0.01 cents per kilowatt-hour, the rate adjustment on April 1, 2007, was 0.084 cents per kilowatt-hour, and the rate adjustment on July 1, 2007, was 0.087 cents per kilowatt-hour. These 2007 rate adjustments produced an estimated $82 million in revenue. As of September 30, 2007, TVA had recognized a regulatory asset of $150 million representing deferred power costs to be recovered through the FCA adjustments in future periods. The FCA rate adjustment on October 1, 2007, was 0.432 cents per kilowatt-hour. Based upon the FCA calculation methodology in use as of October 1, 2007, the FCA was expected to produce an estimated $159 million in revenue during the first quarter of 2008.

Under TVA’s FCA methodology, adjustments to rates are based on the difference between forecasted and baseline (budgeted) costs for the upcoming quarter. Because the FCA adjustments are forward-looking, there is typically a difference between what is collected in rates and what actual expense is realized over the course of the quarter. This difference is added to or deducted from a deferred account on TVA’s balance sheet. Each quarterly adjustment includes a core FCA adjustment plus one half of the deferred balance. The higher or lower costs added to or taken away from the deferred balance sheet account are then amortized to expense in the periods in which they are to be collected in revenues. This allows better matching of the revenues with associated expenses.

TVA’s cash flow can be negatively impacted by the FCA process, however. Under the methodology, some of the FCA portion of higher fuel and purchased power expense realized during the quarter is placed in the deferred account to be collected in rates in later periods. The timing of the collection of revenues related to the FCA does not coincide with the cash expended for fuel and purchased power consumed. See Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations — Executive Summary — Challenges During 2007.

Reserve for Future Generation

Also included in the 2007 rate base was a reserve for future generation to fund additional generating capacity. The reserve for generation was calculated as 1.05 percent of TVA’s billed firm power sales since it was based on firm demand and energy. Firm sales are those that TVA has no contractual right to interrupt. TVA collected $76 million during 2007 which it applied to the purchase of two combustion turbine facilities. See Note 1 — Reserve for Future Generation. The reserve for generation was not extended beyond 2007.

Environmental Rate Adjustment

In 2003, the TVA Board approved a wholesale rate increase of 6.1 percent designed to cover TVA investment in equipment associated with its clean air program. This rate adjustment is scheduled to terminate in 2013.

TVA produces forecasts of future load and energy requirements using multiple models driven by historical TVA loads and regional economic forecasts of employment, population, and electricity and gas prices. The best models are then chosen with the result being a range of load forecasts. Numerous factors, such as weather conditions and the health of the regional economy, could cause actual results to differ materially from TVA’s forecasts. See Forward-Looking Information. As outlined in the Strategic Plan, TVA believes that new generation sources will be needed to meet load growth under most likely scenarios. See Item 1, Business — Governance — Strategy.

General

TVA’s power generating facilities in operation at September 30, 2007, included 29 conventional hydroelectric sites, one pumped storage hydroelectric site, 11 coal-fired sites, three nuclear sites, eight combustion turbine sites, two diesel generator sites, one wind energy site, one digester gas site, and 16 solar energy sites. In addition, TVA acquires power under power purchase agreements of varying duration as well as short-term contracts of less than 24-hour duration (spot market).

TVA-Owned Generation Facilities

The following table summarizes TVA’s net generation in millions of kilowatt-hours by generating source and the percentage of all electric power generated by TVA for the years indicated:

Power Supply from TVA-Owned Generation Facilities

For the years ended September 30

(millions of kWh)

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | | | | | | | | | | | | | | |

| Coal-fired | | | 100,169 | | | 64 | % | | | 99,598 | | | 64 | % | | | 98,361 | | | 62 | % | | | 94,618 | | | 61 | % | | | 90,958 | | | 60 | % |

| Nuclear | | | 46,441 | | | 30 | % | | | 45,313 | | | 29 | % | | | 45,156 | | | 28 | % | | | 46,003 | | | 30 | % | | | 43,167 | | | 29 | % |

| Hydroelectric | | | 9,047 | | | 6 | % | | | 9,961 | | | 6 | % | | | 15,723 | | | 10 | % | | | 13,916 | | | 9 | % | | | 16,103 | | | 11 | % |

| CCombustion turbine and diesel generators | | | 705 | | <1 | % | | | 613 | | <1 | % | | | 595 | | <1 | % | | | 278 | | <1 | % | | | 817 | | <1 | % |

| Renewable resources * | | | 27 | | <1 | % | | | 36 | | <1 | % | | | 47 | | <1 | % | | | 35 | | <1 | % | | | 21 | | <1 | % |

| Total | | | 156,389 | | | 100 | % | | | 155,521 | | | 100 | % | | | 159,882 | | | 100 | % | | | 154,850 | | | 100 | % | | | 151,066 | | | 100 | % |

Note:

| | * | Renewable resources for years 2003 through 2006 have been adjusted to remove renewable resources amounts that were acquired under purchased power agreements and included in this table in TVA’s 2006 Annual Reports on Forms 10-K and 10-K/A. These adjustments resulted in reductions in the amount of renewable resources by 11 million kWh for 2003, 13 million kWh for 2004, 14 million kWh for 2005, and 15 million kWh for 2006. Also, for years 2003 through 2006 the following amounts related to TVA’s digester gas cofiring site have been reclassified from Coal-fired to Renewable resources: 17 million kWh for 2003, 30 million kWh for 2004, 43 million kWh for 2005, and 32 million kWh for 2006. Renewable resource facilities include a digester gas cofiring site, a wind energy site, and solar energy sites. |

The following table indicates TVA’s average fuel expense by generation-type for the years indicated:

Fuel Expense Per kWh

For the years ended September 30

(cents/kWh)

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | | | | | | | | | | | | | | |

| Coal | | | 2.13 | | | | 2.02 | | | | 1.65 | | | | 1.48 | | | | 1.43 | |

| Natural gas and fuel oil | | | 7.00 | | | | 10.65 | | | | 11.44 | | | | 9.01 | | | | 7.61 | |

| Nuclear | | | 0.41 | | | | 0.38 | | | | 0.39 | | | | 0.39 | | | | 0.39 | |

| Average fuel cost per kWh net thermal generation from all sources | | | 1.61 | | | | 1.54 | | | | 1.30 | | | | 1.14 | | | | 1.14 | |

Coal-Fired. TVA has 11 coal-fired power sites consisting of 59 units. At September 30, 2007, these facilities accounted for 15,052 megawatts of winter net dependable capacity. Net dependable capacity is defined as the ability of an electric system, generating unit, or other system component to carry or generate power for a specified time period excluding any fluctuations in capacity that may occur due to planned outages, unplanned outages, and deratings. TVA’s coal-fired units were placed in service between 1951 and 1973. See Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations — Executive Summary — Challenges During 2007.

Nuclear. TVA has three nuclear sites consisting of six units in operation. At September 30, 2007, these facilities accounted for 6,898 megawatts of winter net dependable capacity. For a detailed discussion of TVA’s nuclear power program, see Item 1, Business — Nuclear. For a discussion of challenges faced by TVA’s nuclear power program during 2007, see Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations — Executive Summary — Challenges During 2007.

Hydroelectric. TVA has 29 conventional hydroelectric sites consisting of 109 units. In addition, TVA has one pumped storage facility consisting of four units. At September 30, 2007, these facilities accounted for 5,186 megawatts of winter net dependable capacity. The amount of electricity that TVA is able to generate from its hydroelectric plants depends on a number of factors outside TVA’s control, including the amount of precipitation, runoff, initial water levels, the need for water for competing water management objectives, and the availability of its hydroelectric generation plants. When these factors are unfavorable, TVA must increase its reliance on more expensive generation plants and purchased power. See Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations — Executive Summary — Challenges During 2007 — Weather Conditions.

Combustion Turbines and Future Combined Cycle Facility. As of September 30, 2007, TVA had eight combustion turbine generating facilities consisting of 83 combustion turbine units providing a maximum of 6,258 megawatts of winter net dependable capacity. All of the units are quick-start peaking facilities used during periods of high demand, and all but three of the units are fueled by both natural gas and fuel oil. As of September 30, 2007, 24 of the combustion turbine units were leased to private entities and leased back to TVA under long-term leases. See Note 13 — Other Financing Obligations.

In 2007, TVA acquired and re-commissioned combustion turbine facilities in Marshall County, Kentucky, and Gleason, Tennessee. Together, these facilities include 11 units and provide 1,296 megawatts of winter net dependable capacity (included in the total above). In addition, in September 2007, the TVA Board approved the acquisition and the construction of a combined cycle facility at a former combustion turbine site of approximately 80 acres located in southwest Tennessee. Now known as Lagoon Creek 3, the unfinished site contains turbine foundations and substantial ancillary equipment. With an anticipated commercial operation date of June 2010, the facility is expected to have a planned winter net dependable capacity of approximately 600 megawatts. TVA completed acquisition of the site in October 2007.

Diesel Generators. TVA has two diesel generator plants consisting of nine units. At September 30, 2007, these facilities provided 13 megawatts of winter net dependable capacity.

Renewable Resources. TVA has one wind energy site with three wind turbines, one digester gas cofiring site, and 16 solar energy sites. At September 30, 2007, the digester gas cofiring site provided TVA with about three megawatts of renewable capacity. In addition, the wind energy site and the solar energy sites provided two megawatts of capacity, but because of the nature of this capacity, it is not considered to be winter net dependable capacity.

Purchased Power and Other Agreements

TVA acquires power from a variety of power producers through long-term and short-term power purchase agreements as well as through spot market purchases. During 2007, TVA acquired 32 percent of the power that it purchased on the spot market, 41 percent through short-term power purchase agreements, and 27 percent through long-term power purchase agreements that expire more than one year after September 30, 2007.

At September 30, 2007, TVA’s long-term power purchase agreements provided TVA with 3,504 megawatts of winter net dependable capacity. Counterparties to contracts for 1,308 megawatts of this capacity were in bankruptcy, but the counterparties have continued to perform under their power purchase agreements with TVA throughout their bankruptcy proceedings. See Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations — Risk Management Activities — Credit Risk.

A portion of TVA’s capacity provided by power purchase agreements is provided under long-term contracts that expire between 2010 and 2032, and the most significant of these contracts are discussed below.

| • | Caledonia Combined Cycle Facility. During the third quarter of 2007, TVA entered into an operating lease agreement and various related contracts for the Caledonia combined cycle facility located near Columbus, Mississippi, with a commencement date of July 1, 2007. The lease agreement has a 15-year term expiring on February 28, 2022. The Caledonia facility consists of three combined cycle units with a winter net dependable capacity of 892 megawatts. A conversion services agreement providing for power purchases from the Caledonia facility was terminated as of July 1, 2007, the lease commencement date, and dispatch control was shifted to TVA on July 3, 2007. Under the lease, TVA will assume plant operations no later than January 1, 2008. The lease agreement further provides for an end-of-term purchase option. |

| • | Choctaw Generation, L.P. TVA has contracted with Choctaw Generation L.P. (“Choctaw”) for 440 megawatts of winter net dependable capacity from a lignite-fired generating plant in Chester, Mississippi. TVA’s contract with Choctaw expires on March 31, 2032. On October 9, 2007, Moody's Investors Service downgraded Choctaw to 'Ba1.' Choctaw has continued to perform under the contract and has provided credit assurance to TVA, per the terms of the contract. |

| • | Alcoa Power Generating, Inc. Four hydroelectric plants owned by Alcoa Power Generating, Inc. (“APGI”), formerly known as Tapoco, Inc, are operated in coordination with the TVA system. Under contractual arrangements with APGI which terminate on June 20, 2010, TVA dispatches the electric power generated at these facilities and uses it to partially supply Alcoa’s energy needs. TVA’s arrangement with APGI provides 348 megawatts of winter net dependable capacity. |

| • | Invenergy TN LLC. TVA has contracted with Invenergy TN LLC for 27 megawatts of wind energy generation from 15 wind turbine generators located on Buffalo Mountain near Oak Ridge, Tennessee. Because of the nature of wind conditions in the TVA service area, these generators provide energy benefits but are not included in TVA’s net dependable capacity total. TVA's contract with Invenergy TN LLC expires on December 31, 2024. |

| | • | Southeastern Power Administration. TVA, along with others, contracted with the Southeastern Power Administration (“SEPA”) to obtain power from eight U.S. Army Corps of Engineers hydroelectric facilities on the Cumberland River system. The agreement with SEPA can be terminated upon three years’ notice, but this notice of termination may not become effective prior to June 30, 2017. The contract originally required SEPA to provide TVA an annual minimum of 1,500 hours of power for each megawatt of TVA’s 405 megawatt allocation, and all surplus power from the Cumberland River system. Because hydroelectric production has been reduced at two of the hydroelectric facilities on the Cumberland River system (Wolf Creek and Center Hill Dams) and because of reductions in the summer stream flow on the Cumberland River, SEPA declared “force majeure” on February 25, 2007. SEPA then instituted an emergency operating plan that: |

| | – | Eliminates its obligation to provide any affected customer (including TVA) with a minimum amount of power; |

| | – | Provides for all affected customers (except TVA) to receive a pro rata share of a portion of the gross hourly generation from the eight Cumberland River hydroelectric facilities; |

| | – | Provides for TVA to receive all of the remaining hourly generation (minus station service for those facilities); |

| | – | Eliminates the payment of demand charges by customers (including TVA) since there is significantly reduced dependable capacity on the Cumberland River system; and |

| | – | Increases the rate charged per kilowatt-hour of energy received by SEPA’s customers (including TVA), because SEPA is legally required to charge rates that cover its costs. |

It is unclear how long the emergency operating plan will remain in effect.

Under the Public Utility Regulatory Policies Act of 1978, as amended by the Energy Policy Act of 1992 and the Energy Policy Act of 2005, TVA is required to purchase energy from qualifying facilities, cogenerators and small power producers at TVA's avoided cost of self-generating or purchasing this energy from another source.

During the past five years, TVA supplemented its power generation through power purchases as follows:

Purchased Power *

For the years ended September 30

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| Millions of kWh | | | 22,141 | | | | 19,019 | | | | 14,892 | | | | 14,025 | | | | 15,181 | |

| Percent of TVA’s Total Power Supply | | | 12.4 | | | | 10.9 | | | | 8.5 | | | | 8.3 | | | | 9.1 | |

Note

| | * | Purchased power amounts for years 2004, 2005, and 2006 have been adjusted to remove APGI purchases and include them as a credit to Industries directly served. |

For more information regarding TVA’s power purchase obligations, see Note 15 — Commitments — Power Purchase Obligations.

Purchasing power from others will likely remain a part of how TVA meets the power needs of its service area. The Strategic Plan establishes a goal of balancing production capabilities with power supply requirements within five percent. Achieving this goal will require TVA to reduce its reliance on purchased power. In 2007, TVA took several actions which will help reduce its dependence on purchased power.

| | • | TVA purchased two additional combustion turbine facilities in December 2006 that together provide approximately 1,296 megawatts of winter net dependable capacity. See Item 1, Business — Power Supply — Combustion Turbines and Future Combined Cycle Facility. |

| | • | Browns Ferry Nuclear Plant Unit 1 (“Browns Ferry Unit 1”) began commercial operation on August 1, 2007. Browns Ferry Unit 1 is initially providing additional generating capacity of approximately 1,150 megawatts and is expected eventually to provide approximately 1,280 megawatts of capacity. See Item 1, Business — Nuclear. |

| | • | On August 1, 2007, the TVA Board approved the completion of Watts Bar Nuclear Plant Unit 2 (“Watts Bar Unit 2”) upon which construction was halted in 1985. Completing Watts Bar Unit 2 is expected to take 60 months and cost approximately $2.5 billion, excluding allowance for funds used during construction and initial nuclear fuel core costs. When completed, the nuclear unit is expected to provide 1,180 megawatts of capacity. See Item 1, Business — Nuclear. |

| | • | In September 2007, the TVA Board approved proceeding with the construction of a combined cycle facility at a former combustion turbine site of approximately 80 acres located in southwest Tennessee. See Item 1, Business — Power Supply — Combustion Turbines and Future Combined Cycle Facility. |

Net Dependable Capacity

The following table summarizes the winter and summer net dependable capacity in megawatts TVA had available as of September 30, 2007:

NET DEPENDABLE CAPACITY

As of September 30, 2007

Source of Capacity | Location | | Number of Units | | | Winter Net Dependable Capacity 1 (MW) | | | Summer Net Dependable Capacity 1 (MW) | | Date First Unit Placed in Service | Date Last Unit Placed in Service |

| | | | | | | | | | | | | |

| TVA-OWNED GENERATING FACILITIES | | | | | | | | | | | |

| Coal-Fired | | | | | | | | | | | | |

| Allen | Tennessee | | | 3 | | | | 744 | | | | 735 | | 1959 | 1959 |

| Bull Run | Tennessee | | | 1 | | | | 889 | | | | 889 | | 1967 | 1967 |

| Colbert | Alabama | | | 5 | | | | 1,197 | | | | 1,180 | | 1955 | 1965 |

| Cumberland | Tennessee | | | 2 | | | | 2,532 | | | | 2,478 | | 1973 | 1973 |

| Gallatin | Tennessee | | | 4 | | | | 976 | | | | 964 | | 1956 | 1959 |

| John Sevier | Tennessee | | | 4 | | | | 712 | | | | 704 | | 1955 | 1957 |

| Johnsonville | Tennessee | | | 10 | | | | 1,248 | | | | 1,200 | | 1951 | 1959 |

| Kingston | Tennessee | | | 9 | | | | 1,433 | | | | 1,411 | | 1954 | 1955 |

| Paradise | Kentucky | | | 3 | | | | 2,324 | | | | 2,201 | | 1963 | 1970 |

| Shawnee | Kentucky | | | 10 | | | | 1,369 | | | | 1,329 | | 1953 | 1956 |

| Widows Creek | Alabama | | | 8 | | | | 1,628 | | | | 1,604 | | 1952 | 1965 |

| Total Coal-Fired | | | | 59 | | | | 15,052 | | | | 14,695 | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Nuclear | | | | | | | | | | | | | | | |

| Browns Ferry | Alabama | | | 3 | | | | 3,383 | | | | 3,280 | | 1974 | 1977 |

| Sequoyah | Tennessee | | | 2 | | | | 2,333 | | | | 2,282 | | 1981 | 1982 |

| Watts Bar | Tennessee | | | 1 | | | | 1,182 | | | | 1,109 | | 1996 | 1996 |

| Total Nuclear | | | | 6 | | | | 6,898 | | | | 6,671 | | | |

| | | | | | | | | | | | | | | | |

| Hydroelectric | | | | | | | | | | | | | | | |

| Conventional Plants | Alabama | | | 36 | | | | 1,146 | | | | 1,188 | | 1925 | 1962 |

| | Georgia | | | 2 | | | | 32 | | | | 35 | | 1931 | 1956 |

| | Kentucky | | | 5 | | | | 165 | | | | 218 | | 1944 | 1948 |

| | North Carolina | | | 6 | | | | 455 | | | | 489 | | 1940 | 1956 |

| | Tennessee | | | 60 | | | | 1,735 | | | | 1,918 | | 1912 | 1972 |

| Pumped Storage | Tennessee | | | 4 | | | | 1,653 | | | | 1,653 | | 1978 | 1979 |

| Total Hydroelectric | | | | 113 | | | | 5,186 | | | | 5,501 | | | |

| | | | | | | | | | | | | | | | |

Combustion Turbine 2 | | | | | | | | | | | | | | | |

| Allen | Tennessee | | | 20 | | | | 597 | | | | 478 | | 1971 | 1972 |

| Colbert | Alabama | | | 8 | | | | 480 | | | | 384 | | 1972 | 1972 |

| Gallatin | Tennessee | | | 8 | | | | 790 | | | | 636 | | 1975 | 2000 |

Gleason 3 | Tennessee | | | 3 | | | | 540 | | | | 519 | | 2007 | 2007 |

| Johnsonville | Tennessee | | | 20 | | | | 1,509 | | | | 1,218 | | 1975 | 2000 |

| Kemper | Mississippi | | | 4 | | | | 390 | | | | 329 | | 2001 | 2001 |

| Lagoon Creek | Tennessee | | | 12 | | | | 1,196 | | | | 1,009 | | 2002 | 2002 |

| Marshall County | Kentucky | | | 8 | | | | 756 | | | | 659 | | 2007 | 2007 |

| Total Combustion Turbine | | | | 83 | | | | 6,258 | | | | 5,232 | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Diesel Generator | | | | | | | | | | | | | | | |

| Meridian | Mississippi | | | 5 | | | | 9 | | | | 9 | | 1998 | 1998 |

| Albertville | Alabama | | | 4 | | | | 4 | | | | 4 | | 2000 | 2000 |

| Total Diesel Generators | | | | 9 | | | | 13 | | | | 13 | | | |

| | | | | | | | | | | | | | | | |

| Renewable Resources | | | | | | | | 3 | | | | 3 | | | |

| | | | | | | | | | | | | | | | |

| Total TVA-Owned Generation Facilities | | | | | | | | 33,410 | | | | 32,115 | | | |

| | | | | | | | | | | | | | | | |

| POWER PURCHASE AND OTHER AGREEMENTS | | | | | | | | | | | | | | |

| APGI | | | | | | | | 348 | | | | 347 | | | |

| Caledonia | | | | | | | | 892 | | | | 768 | | | |

| Choctaw | | | | | | | | 440 | | | | 440 | | | |

| Other Power Purchase Agreements | | | | | | | | 1,824 | | | | 1,872 | | | |

| Total Power Purchase Agreements | | | | | | | | 3,504 | | | | 3,427 | | | |

| Total Net Dependable Capacity | | | | | | | | 36,914 | | | | 35,542 | | | |

| | (1) | Net dependable capacity is defined as the ability of an electric system, generating unit, or other system component to carry or generate power for a specified time period excluding any fluctuations in capacity that may occur due to planned outages, unplanned outages, and deratings. |

| | (2) | As of September 30, 2007, 24 of TVA’s combustion turbine units were leased to private entities and leased back to TVA under long-term leases. |

| | (3) | Plant does not have firm gas transportation or the ability to burn oil as a back-up fuel; however, TVA forecasts available gas supply for Gleason throughout the fiscal year. |

Overview

TVA has six operating nuclear units and has resumed construction of one nuclear unit that is scheduled to be placed in service in 2013. Selected statistics of each of these units are included in the table below.

TVA Nuclear Power

As of September 30, 2007

Nuclear Unit | Status | | Installed Capacity (MW) | | | Net Capacity Factor for 2007 | | | Date of Expiration of Operating License | | | Date of Expiration of Construction License | |

| | | | | | | | | | | | | | |

| Sequoyah Unit 1 | Operating | | | 1,221 | | | | 98.5 | | | 2020 | | | – | |

| Sequoyah Unit 2 | Operating | | | 1,221 | | | | 89.5 | | | 2021 | | | – | |

| Browns Ferry Unit 1 | Operating | | | 1,150 | | | | 85.6 | (1) | | 2033 | | | – | |

| Browns Ferry Unit 2 | Operating | | | 1,190 | | | | 74.0 | | | 2034 | | | – | |

| Browns Ferry Unit 3 | Operating | | | 1,190 | | | | 94.1 | | | 2036 | | | – | |

| Watts Bar Unit 1 | Operating | | | 1,230 | | | | 82.3 | | | 2035 | | | – | |

Watts Bar Unit 2 (2) | Construction to resume in December 2007 | | | – | | | | – | | | – | | | 2010 | |

| | | | | | | | | | | | | | | | |

(1) Browns Ferry Unit 1 capacity factor is derived for a period of commercial operation from August 1, 2007, through September 30, 2007.

(2) Completion of construction of Watts Bar Unit 2 was approved by the TVA Board on August 1, 2007.

TVA began a significant nuclear plant construction program in 1966 to meet projected system load growth. At the height of its construction program, TVA had 17 units either under construction or in commercial operation at seven plant sites. In 1982, TVA canceled construction of four units because of lower than expected load growth, and TVA canceled four more units in 1984 for similar reasons.

By August 1985, TVA had delayed construction of two units each at Watts Bar and Bellefonte Nuclear Plants and had shut down its three-unit Browns Ferry Nuclear Plant and two-unit Sequoyah Nuclear Plant because of an increasing number of technical and operational problems. The Nuclear Regulatory Commission (“NRC”) required TVA to address program and management deficiencies and to provide its corrective actions to the NRC before restarting any of its licensed nuclear units or requesting a license for Watts Bar Unit 1. After implementing a comprehensive recovery plan, TVA restarted Sequoyah Unit 2 in May 1988 and Sequoyah Unit 1 in November 1988. TVA restarted Browns Ferry Unit 2 in May 1991 and Browns Ferry Unit 3 in November 1995. Construction of Watts Bar Unit 1 was successfully completed, and the unit commenced full power commercial operation in May 1996.

In May 2002, the TVA Board initiated activities to return Browns Ferry Unit 1 to service, and on August 1, 2007, Browns Ferry Unit 1 returned to commercial operation. The total amount invested in the Unit 1 restart project through the commercial operation date was $1.84 billion excluding allowance for funds used during construction (“AFUDC”) of $269 million. TVA completed Browns Ferry Unit 1 during 2007 with a total project cost overrun of $90 million or five percent of the original projected cost. The cost overruns were due in part to the scope of work associated with extended power uprate being greater than planned. Browns Ferry Unit 1 provides additional generating capacity of approximately 1,150 megawatts and is expected to eventually provide 1,280 megawatts of capacity.

In November 2005, TVA canceled the construction of Units 1 and 2 at Bellefonte Nuclear Plant. Two months prior to the cancellation of these units, the Bellefonte site was selected by NuStart Development LLC (“NuStart”) as one of two sites for the development of a combined license application for two new reactors using the Westinghouse Advanced Passive 1000 (“AP1000”) reactor design. NuStart is an industry consortium composed of 10 utilities and two reactor vendors whose purpose is to satisfactorily demonstrate the new NRC licensing process for advanced design nuclear plants. TVA submitted its combined license application to the NRC for Bellefonte Units 3 and 4 in October 2007. If approved, the license to build and operate the plant would be issued to TVA. Obtaining the necessary license will give TVA more certainty about the cost and schedule of a nuclear option for future decisions. The TVA Board has not made a decision to construct a new plant at the Bellefonte site.

On August 1, 2007, the TVA Board approved completing the construction of Watts Bar Unit 2. Prior to the approval, TVA conducted a detailed scoping, estimating, and planning study to estimate the project’s cost, schedule, and risks. Separately, TVA prepared a report evaluating potential environmental impacts as required by the National Environmental Policy Act. TVA has an NRC construction permit for Watts Bar Unit 2 that expires in 2010 and will need to seek an extension of the permit in order to complete construction activities. TVA will seek an operating license under NRC regulations, and this process will include an opportunity for a public hearing. Completing Watts Bar Unit 2 is expected to take approximately 60 months and cost approximately $2.5 billion, excluding AFUDC. Preliminary project activities began in October 2007. In accordance with NRC policy, TVA notified the NRC that it may resume unrestricted construction activities as early as December 3, 2007. Current plans are to begin construction related activities by the end of December 2007. When completed, Watts Bar Unit 2 is expected to provide 1,180 megawatts of capacity.

Spent Nuclear Fuel

Under the Nuclear Waste Policy Act of 1982, TVA (and other domestic nuclear utility licensees) entered into a contract with the U.S. Department of Energy (“DOE”) for the disposal of spent nuclear fuel. Payments to DOE are based upon TVA’s nuclear generation and charged to nuclear fuel expense. Although the contracts called for DOE to begin accepting spent nuclear fuel from the utilities by January 31, 1998, DOE announced that it would not begin receiving spent nuclear fuel from any domestic nuclear utility until 2010 at the earliest. TVA, like other nuclear utilities, stores spent nuclear fuel in pools of borated water at its nuclear sites. TVA would have had sufficient space to continue to store spent nuclear fuel in those storage pools at its Sequoyah and Browns Ferry Nuclear Plants indefinitely had DOE begun accepting spent nuclear fuel. DOE’s failure to do so in a timely manner required TVA to construct dry cask storage facilities at its Sequoyah and Browns Ferry Nuclear Plants and to purchase special storage containers for the spent nuclear fuel. The Sequoyah and Browns Ferry dry cask storage facilities have been constructed and approved by the NRC and have been in use since 2004 and 2005, respectively, providing storage capacity through 2030 at Sequoyah and 2019 at Browns Ferry. Watts Bar has sufficient storage capacity in its spent fuel pool to last until approximately 2015.

To recover the cost of providing long-term, on-site storage for spent nuclear fuel, TVA filed a breach of contract suit against the United States in the Court of Federal Claims in 2001. In August 2006, the United States paid TVA almost $35 million in damages awarded by the Court of Federal Claims, which partially offset the construction costs of the dry cask storage facilities that TVA incurred through 2004. TVA is pursuing additional claims against DOE to recover costs that TVA has incurred after 2004.

Low-Level Radioactive Waste

Low-level radioactive waste (“radwaste”) results from the normal operation of nuclear units and includes such materials as disposable protective clothing, mops, and filters. TVA has contracted to dispose of radwaste at a Barnwell, South Carolina, disposal facility through June 2008. As allowed by the Low-Level Radioactive Waste Policy Act, on July 1, 2008, the Barnwell, South Carolina, facility will close to radwaste generators located in states that are not members of the Atlantic Interstate Low-Level Radioactive Waste Management Compact ("Atlantic Compact"). Connecticut, New Jersey, and South Carolina are members of the Atlantic Compact. Accordingly, after June 2008, TVA will no longer be able to use this disposal facility and will have to consider other options, which may include storing some radwaste at its own facilities. TVA is capable of doing so for an extended period of time, and has done so in the past.

Nuclear Decommissioning Trust

TVA maintains a nuclear decommissioning trust to provide funding for the ultimate decommissioning of its nuclear power plants. The trust is invested in securities generally designed to achieve a return in line with overall equity market performance. The assets of the trust as of September 30, 2007, totaled $1.1 billion, which is greater than the present value of TVA’s estimated future nuclear decommissioning costs as computed under the NRC funding requirements but less than the present value of these costs as computed under Statement of Financial Accounting Standards No. 143, “Accounting for Asset Retirement Obligations.” See Note 15 — Contingencies — Decommissioning Costs.

Nuclear Insurance

The Price-Anderson Act provides a layered framework of protection to compensate for losses arising from a nuclear event. For the first layer, all NRC nuclear plant licensees, including TVA, purchase $300 million of nuclear liability insurance from American Nuclear Insurers for each plant with an operating license. Funds for the second layer, the Secondary Financial Program, would come from an assessment of up to $101 million from the licensees of each of the 104 NRC licensed reactors in the United States. The assessment for any nuclear accident would be limited to $15 million per year per unit. American Nuclear Insurers, under a contract with the NRC, administers the Secondary Financial Program. With its six licensed units, TVA could be required to pay a maximum of $604 million per nuclear incident, but it would have to pay no more than $90 million per incident in any one year. When the contributions of the nuclear plant licensees are added to the insurance proceeds of $300 million, over $10.7 billion would be available. Under the Price-Anderson Act, if the first two layers are exhausted, Congress is required to take action to provide additional funds to cover the additional losses.

TVA carries property, decommissioning, and decontamination insurance of $4.6 billion for its licensed nuclear plants, with up to $2.1 billion available for a loss at any one site, to cover the cost of stabilizing or shutting down a reactor after an accident. Some of this insurance, which is purchased from Nuclear Electric Insurance Limited (“NEIL”), may require the payment of retrospective premiums up to a maximum of approximately $66 million. On October 1, 2007, TVA endorsed the existing property policies for the Watts Bar Nuclear Plant site to add Builders Risk coverage for the construction of Unit 2. The addition of this coverage places the new maximum retrospective assessment at $70.5 million.

TVA purchases accidental outage (business interruption) insurance for TVA’s nuclear sites from NEIL. In the event that an accident covered by this policy takes a nuclear unit offline or keeps a nuclear unit offline, NEIL will pay TVA, after a waiting period, an indemnity (a set dollar amount per week) up to a maximum indemnity of $490 million per unit. This insurance policy may require the payment of retrospective premiums up to a maximum of approximately $24 million. See Note 15 — Contingencies — Nuclear Insurance.

Tritium-Related Services

TVA and DOE are engaged in a long-term interagency agreement under which TVA will, at DOE’s request, irradiate tritium producing burnable absorber rods to assist DOE in producing tritium. Tritium is used in nuclear weapons. This agreement, which ends in 2035, requires DOE to reimburse TVA for the costs that TVA incurs in connection with providing irradiation services and to pay TVA an irradiation services fee at a specified rate per tritium-producing rod over the entire operating cycle in which the tritium-producing rods are irradiated.

In September 2002, the NRC issued amendments to the operating licenses for the Watts Bar and Sequoyah Nuclear Plants, allowing TVA to provide irradiation services for DOE at these plants. The Watts Bar license amendment currently permits TVA to install up to 240 tritium-producing rods in Watts Bar Unit 1. Planned future license amendments would allow TVA to irradiate up to approximately 2,000 tritium-producing rods in the Watts Bar and Sequoyah reactors.

In general, tritium-producing rods are irradiated for a full cycle, which lasts about 18 months. At the end of the cycle, TVA removes the irradiated rods and loads them into a shipping cask. DOE then ships them to its tritium-extraction facility. TVA loads a fresh set of tritium-producing rods into the reactor during each refueling outage. Irradiating the tritium-producing rods does not affect TVA’s ability to operate the reactors to produce electricity.

TVA began irradiating tritium-producing rods at Watts Bar Unit 1 in the fall of 2003. TVA removed these rods from the reactor in the spring of 2005. DOE subsequently successfully shipped them to its tritium-extraction facility. At this time, no tritium-related services are being performed at the Sequoyah Nuclear Plant.

General

TVA’s consumption of various types of fuel depends largely on the demand for electricity by TVA’s customers, the availability of various generating units, and the availability and cost of fuel. The following table indicates TVA’s costs for various fuels for the years indicated:

Fuel Purchases for TVA-Owned Facilities

For the years ended September 30

(in millions)

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| | | | | | | | | | | | | | | | |

| Coal | | $ | 1,922 | | | $ | 1,835 | | | $ | 1,495 | | | $ | 1,254 | | | $ | 1,242 | |

| Natural gas | | | 62 | | | | 60 | | | | 63 | | | | 22 | | | | 42 | |

| Fuel oil | | | 22 | | | | 46 | | | | 28 | | | | 17 | | | | 40 | |

| Uranium | | | 121 | | | | 71 | | | | 44 | | | | 16 | | | | 42 | |

| Total | | $ | 2,127 | | | $ | 2,012 | | | $ | 1,630 | | | $ | 1,309 | | | $ | 1,366 | |

TVA also has tolling agreements under which it buys power production from outside suppliers. Under these tolling agreements, TVA supplies the fuel to the outside supplier, and the outsider supplier converts the fuel into electricity. The following table indicates the cost of fuel supplied by TVA under these agreements and also the average fuel expense per kilowatt-hour for the years indicated:

Natural Gas Purchases and Average Fuel Expense for Tolling Plants

For the years ended September 30

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

| | | | | | | | | | | | |

| Cost of Fuel (in millions) | | $ | 430 | | $ | 288 | | $ | 159 | | $ | 10 | | $ | <1 | |

| Average Fuel Expense (cents/kWh) | | | 5.51 | | | 6.07 | | | 6.21 | | | 4.71 | | | 0.00 | |

Beginning with the implementation of the FCA mechanism on October 1, 2006, TVA’s rates are adjusted on a quarterly basis to reflect changing fuel and purchased power costs. See Item 1, Business — Rate Actions.

Coal

Coal consumption at TVA’s coal-fired generating facilities during 2007 was 46.5 million tons. As of September 30, 2007 and 2006, TVA had 23 days and 20 days of system-wide coal supply at full burn, respectively, with a net book value of coal inventory of $264 million and $214 million, respectively.

TVA utilizes both short-term and long-term coal contracts. Long-term coal contracts generally last longer than one year, while short-term contracts are usually for one year or less. During 2007, long-term contracts made up 89 percent of coal purchases and short-term contracts accounted for the remaining 11 percent. TVA plans to continue signing contracts of various lengths, terms, and coal quality to meet its expected burn and inventory requirements. During 2007, TVA purchased coal by basin as follows:

| • | 37 percent from the Illinois Basin; |

| • | 24 percent from the Powder River Basin in Wyoming; |