UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the year ended December 31, 2023

Commission File Number: 001-33440

INTERACTIVE BROKERS GROUP, INC.

(Exact name of registrant as specified in its charter)

|

|

Delaware

(State or other jurisdiction of

incorporation or organization) | 30-0390693

(I.R.S. Employer

Identification No.) |

One Pickwick Plaza

Greenwich, Connecticut 06830

(Address of principal executive office)

(203) 618-5800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

| | Name of the exchange on which registered |

Common Stock, par value $.01 per share | IBKR | The Nasdaq Global Select Market

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the securities act. Yes x No o

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or 15(d) of the act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

Large accelerated filer x | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o | Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its

audit report. Yes x No o

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting common equity stock held by non-affiliates of the registrant was approximately $8,396,870,712 computed by reference to the $83.07 closing sale price of the common stock on the Nasdaq Global Select Market, on June 30, 2023, the last business day of the registrant’s most recently completed second fiscal quarter.

As of February 21, 2024, there were 107,062,321 shares of the issuer’s Class A common stock, par value $0.01 per share, outstanding and 100 shares of the issuer’s Class B common stock, par value $0.01 per share, outstanding.

Documents Incorporated by Reference: Portions of Registrant’s definitive proxy statement for its 2024 annual meeting of shareholders are incorporated by reference in Part III of this Form 10-K.

ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2023

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

We have included or incorporated by reference in this Annual Report on Form 10-K and from time to time our management may make statements that may constitute “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical facts, but instead represent only our beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside our control. These statements include statements other than historical information or statements of current condition and may relate to our future plans and objectives and results, among other things and may also include our belief regarding the effect of various legal proceedings, as set forth under “Legal Proceedings and Regulatory Matters” in Part I, Item 3 of this Annual Report on Form 10-K, as well as statements about the objectives and effectiveness of our liquidity policies, statements about trends in or growth opportunities for our businesses, included in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of this Annual Report on Form 10-K. By identifying these statements for you in this manner, we are alerting you to the possibility that our actual results may differ, possibly materially, from the anticipated results indicated in these forward-looking statements. Important factors that could cause actual results to differ from those in the forward-looking statements include, among others, those discussed below and under “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of this Annual Report on Form 10-K.

Factors that could cause actual results to differ materially from any future results, expressed or implied, in these forward-looking statements include, but are not limited to, the following:

general economic conditions in the markets where we operate;

increased industry competition and downward pressures on electronic brokerage commissions and on bid/offer spreads in the remaining market making business we operate;

risks inherent to the electronic brokerage and market making businesses;

implied versus actual price volatility levels of the products in which we continue to make markets;

the general level of interest rates;

failure to protect or enforce our intellectual property rights in our proprietary technology;

our ability to keep up with rapid technological change;

system failures, cyber security threats and other disruptions;

non-performance of third-party vendors;

conflicts of interest and other risks due to our ownership and holding company structure;

the loss of key executives and failure to recruit and retain qualified personnel;

the risks associated with the expansion of our business;

our possible inability to integrate any businesses we acquire;

the impact of accounting standards issued but not yet adopted;

compliance with laws and regulations, including those relating to the securities industry;

the impact of a public health emergency; and

other factors discussed under “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K or elsewhere in this Annual Report on Form 10-K.

We undertake no obligation to publicly update or revise any forward-looking statements to reflect events or circumstances that may arise after the date of this Annual Report on Form 10-K.

PART I

ITEM 1. BUSINESS

Overview

Interactive Brokers Group, Inc. (“IBG, Inc.” or the “Company”) is an automated global electronic broker. We custody and service accounts for hedge and mutual funds, exchange-traded funds (“ETFs”), registered investment advisors, proprietary trading groups, introducing brokers and individual investors. We specialize in routing orders and executing and processing trades in stocks, options, futures, foreign exchange instruments (“forex”), bonds, mutual funds, ETFs and precious metals on more than 150 electronic exchanges and market centers in 34 countries and 27 currencies seamlessly around the world. In addition, our customers can use our trading platform to trade certain cryptocurrencies through third-party cryptocurrency service providers that execute, clear and custody the cryptocurrencies. In the United States of America (“U.S.”), we conduct our business primarily from our headquarters in Greenwich, Connecticut and from Chicago, Illinois. Abroad, we conduct our business through offices located in Canada, the United Kingdom, Ireland, Switzerland, Hungary, India, China (Hong Kong and Shanghai), Japan, Singapore and Australia. As of December 31, 2023, we had 2,932 employees worldwide.

IBG, Inc. is a holding company whose primary asset is the ownership of approximately 25.4% of the membership interests of IBG LLC, the current holding company for our businesses. IBG, Inc. is the sole managing member of IBG LLC.

When we use the terms “we,” “us,” “our,” and “IBKR,” we mean IBG, Inc. and its subsidiaries (including IBG LLC). Unless otherwise indicated, the terms “common stock” and “IBKR shares” refer to the Class A common stock of IBG, Inc.

We trace our roots to the market making business founded by our Chairman, Mr. Thomas Peterffy, on the floor of the American Stock Exchange in 1977. Since our inception, we have focused on developing proprietary software to automate broker-dealer functions. We have been a pioneer in developing and applying technology as a financial intermediary to increase liquidity and transparency in the capital markets in which we operate. The proliferation of electronic exchanges and market centers has allowed us to integrate our software with an increasing number of trading venues, creating automatically functioning, computerized platforms that require minimal human intervention. Over four decades of developing our automated trading platforms and automating many middle- and back-office functions have allowed us to become one of the lowest cost providers of broker-dealer services and to significantly increase the volume of trades we handle.

Our internet address is www.interactivebrokers.com and the investor relations section of our website is located at www.interactivebrokers.com/ir. We make available free of charge, on or through the investor relations section of our website, this Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as well as proxy statements, registration statements, prospectus supplements and Section 16 filings for our directors and officers, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission (“SEC”). The SEC maintains an internet site, www.sec.gov, that contains annual, quarterly and current reports, proxy and information statements and other information that issuers file electronically with the SEC. Our electronic SEC filings are made available to the public on the SEC’s internet site. In addition, posted on our website are our Bylaws, our Amended and Restated Certificate of Incorporation, charters for the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee of our Board of Directors, our Accounting Matters Complaint Policy, our Whistle Blower Hotline, our Corporate Governance Guidelines and our Code of Business Conduct and Ethics governing our directors, officers and employees. Within the time periods required by SEC and the Nasdaq Stock Market LLC’s Global Select Market (“Nasdaq”), we will post on our website any amendment to the Code of Business Conduct and Ethics and any waiver applicable to any executive officer, director or senior financial officer. In addition, our website includes information concerning purchases and sales of our equity securities by our executive officers and directors, as well as disclosure relating to certain non-GAAP financial measures, if any, (as defined in Regulation G) promulgated under the Securities Act of 1933, as amended (the “Securities Act”) and the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that we may make public orally, telephonically, by webcast, by broadcast or by similar means from time to time.

Our Investor Relations Department can be contacted at Interactive Brokers Group, Inc., Two Pickwick Plaza, Greenwich, Connecticut 06830, Attn: Investor Relations, e-mail: investor-relations@interactivebrokers.com.

Our Organizational Structure and Overview of Recapitalization Transactions

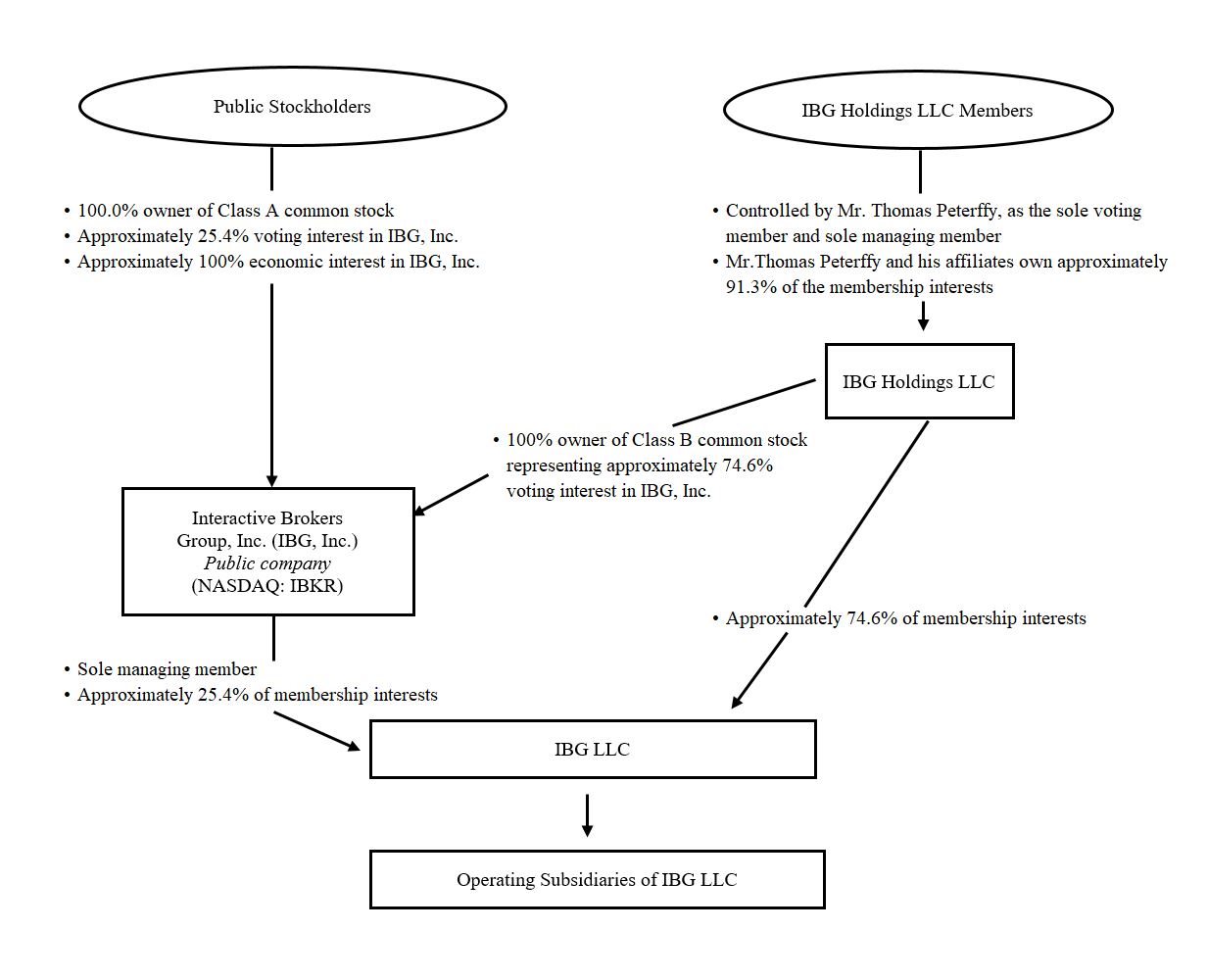

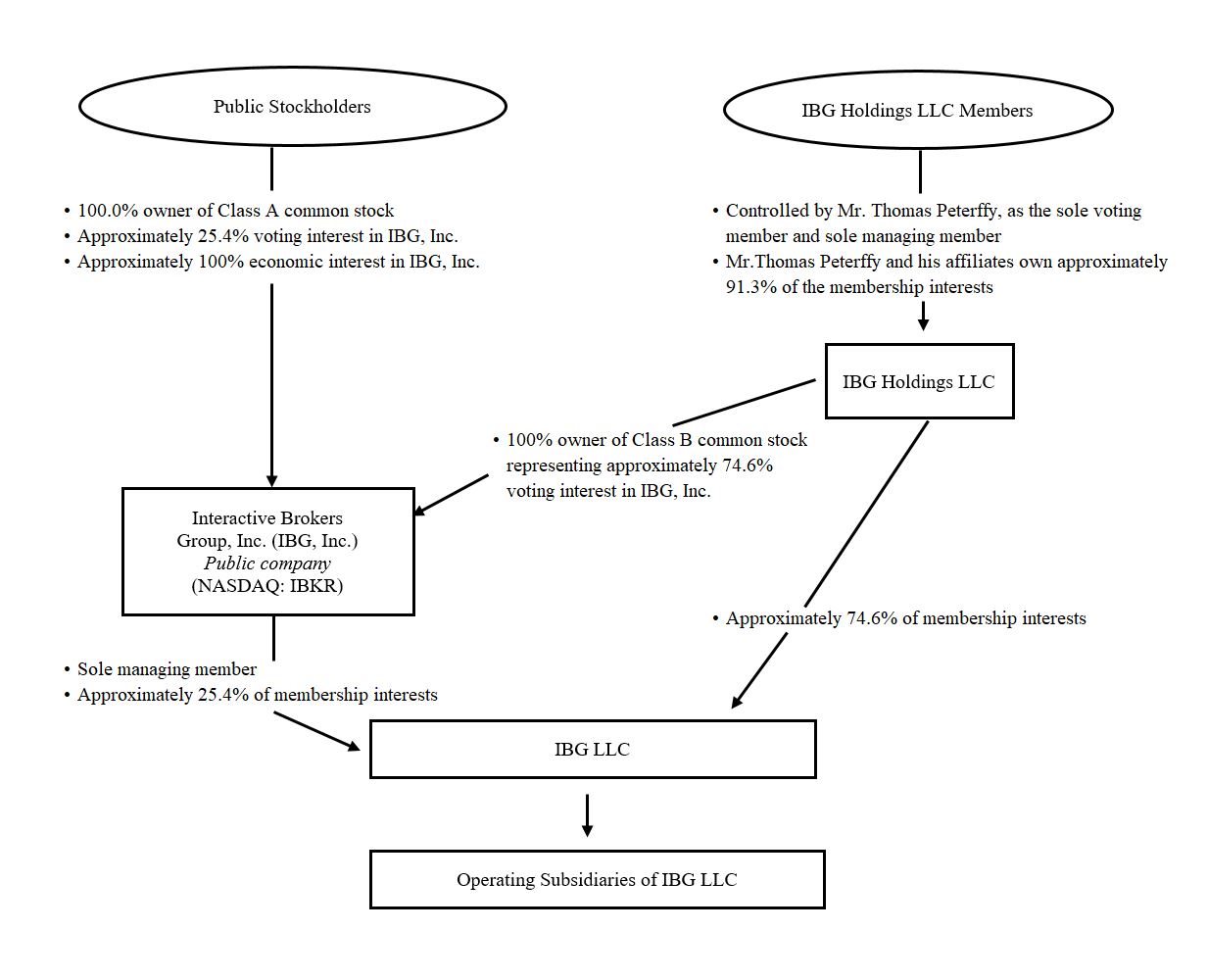

The graphic below illustrates our current ownership structure and reflects current ownership percentages. The graphic below does not display the subsidiaries of IBG LLC.

Our primary assets are our ownership of approximately 25.4% of the membership interests of IBG LLC, the current holding company for our businesses, and our controlling interest and related contractual rights as the sole managing member of IBG LLC. The remaining approximately 74.6% of IBG LLC membership interests are held by IBG Holdings LLC (“Holdings”), a holding company that is owned directly and indirectly by our founder and Chairman, Mr. Thomas Peterffy and his affiliates, management and other employees of IBG LLC, and certain other members. The IBG LLC membership interests held by Holdings will be subject to purchase by us over time in connection with offerings by us of shares of our common stock.

The table below presents the amount of IBG LLC membership interests held by IBG, Inc. and Holdings as of December 31, 2023.

|

|

|

|

|

|

|

|

| IBG, Inc. |

| Holdings |

| Total |

Ownership % | 25.4% |

| 74.6% |

| 100.0% |

Membership interests | 107,049,483 |

| 313,976,354 |

| 421,025,837 |

Purchases of IBG LLC membership interests, held by Holdings, by the Company are governed by the exchange agreement among us, IBG LLC, Holdings and the historical members of IBG LLC, (the “Exchange Agreement”), a copy of which was filed as an exhibit to our Quarterly Report on Form 10-Q for the quarter ended September 30, 2009 and filed with the SEC on November 9, 2009. The Exchange Agreement, as amended June 6, 2012, provides that the Company may facilitate the redemption by Holdings of interests held by its members through the issuance of shares of common stock through a public offering or directly to Holdings in exchange for the interests in IBG LLC being sold by Holdings. The common stock received from the Company is either distributed by Holdings to certain members in redemption of their Holdings interests or sold on behalf of such members in open market transactions, with the proceeds of such sales distributed by Holdings to certain members in redemption of their Holdings interests. From 2011 through 2023, the Company issued 40,111,445 shares of common stock (with a fair value of $1.9 billion) to Holdings in exchange for an equivalent number of shares of member interests in IBG LLC.

Nature of Operations

As an electronic broker, we execute, clear and settle trades globally for both institutional and individual customers. Capitalizing on our proprietary technology, our systems provide our customers with the capability to monitor multiple markets around the world simultaneously and to execute trades electronically in these markets at a low cost in multiple products and currencies from a single unified platform. We offer our customers access to all tradable classes of primarily exchange-listed products, including stocks, options, futures, forex, bonds, mutual funds, ETFs, precious metals and cryptocurrencies traded on more than 150 electronic exchanges and market centers in 34 countries and in 27 currencies seamlessly around the world. The ever-growing complexity of multiple market centers has provided us with opportunities to build and continuously adapt our order routing software to secure excellent execution prices.

Since the launching of our electronic brokerage business in 1993, we have grown to approximately 2.6 million institutional and individual brokerage customers. We provide our customers with what we believe to be one of the most effective and efficient electronic brokerage platforms in the industry.

We are able to provide our customers with high-speed trade execution at low commission rates, in large part because of our proprietary technology. As a result of our advanced electronic brokerage platform, we are especially attractive to sophisticated and active investors.

Our customers can choose the following trading platforms to match their trading style and expertise:

IBKR Trader WorkstationSM (TWS) – The TWS is our flagship desktop trading platform, designed for seasoned, active traders who trade multiple products and require power and flexibility. The TWS Mosaic interface provides intuitive out-of-the-box usability with quick and easy access to comprehensive trading, order management, chart, watchlist and portfolio tools all in a single, customizable workspace.

IBKR Mobile – The IBKR Mobile app provides experienced traders powerful trading tools and the same market-moving information as our desktop TWS trading platform. Our mobile app provides the functionality needed to trade and manage accounts from anywhere.

IBKR Client Portal – The IBKR Client Portal is an easy-to-use web-based platform that requires no downloads. It gives customers access to every resource they need to view, trade and manage their account all with a single login.

IBKR GlobalTrader – The IBKR GlobalTrader is a streamlined mobile trading app to trade stocks, EFTs, options and cryptocurrencies worldwide. Customers can deposit in their local currency and trade stocks at 90+ exchanges and options at 30+ market centers around the world. Customers can also trade select U.S. ETFs around the clock, plus cryptocurrencies like Bitcoin, Bitcoin Cash, Ethereum and Litecoin, all from their mobile device.

IBKR APIs – For our more sophisticated customers, IBKR APIs allows them to build custom trading applications and automate any part of the trading process to their specifications. We offer APIs for every experience level from our easy-to-use Excel API to our institutional grade FIX API.

Our key product offerings include:

IBKR ProSM is the core IBKR service designed for sophisticated investors. IBKR ProSM offers the lowest cost access to stocks, options, futures, forex, bonds, mutual funds, ETFs, precious metals and cryptocurrencies from a single unified platform with no added spreads, ticket charges, account minimums or platform fees.

IBKR LiteSM provides unlimited commission-free trades on U.S. exchange-listed stocks and ETFs and low-cost access to global markets without required account minimums or platform fees to participating U.S. customers. IBKR LiteSM was designed to meet the needs of investors who are seeking a simple, commission-free way to trade U.S. exchange-listed stocks and ETFs and do not wish to consider our efforts to obtain greater price improvement through our IB SmartRoutingSM system.

IBKR Universal AccountSM – From a single point of entry in their IBKR Universal1 AccountSM, our customers are able to transact in 27 currencies, across multiple classes of tradable, primarily exchange-listed products traded on more than 150 electronic exchanges and market centers in 34 countries around the world seamlessly. Our offering features a suite of cash management services, including:

Direct Deposit and Mobile Check Deposit – Our Direct Deposit program allows customers to automatically deposit paychecks, pension distributions and other recurring payments to their (non-retirement) brokerage account with us. In addition, U.S. customers can use our Mobile Check Deposit to directly deposit checks drawn on a U.S. bank.

American Express® International Dollar Card – The American Express®2 International Dollar card allows non-U.S. residents to transact in U.S. dollars. Customers enjoy the convenience of paying their bills directly from their Interactive Brokers account. Currently available for eligible customers in Latin America and the Caribbean (excluding Puerto Rico and the U.S. Virgin Islands).

Request for Payment Service – Through this new banking service, U.S. customers can make instant deposits, 24 hours a day, from their mobile banking app or other bank portal to fund their brokerage account with us. Funds deposited via Request for Payment are immediately available for trading. The service is available to customers with accounts at several major U.S. banks and, over time, other banks will be added.

Insured Bank Deposit Sweep Program – Our Insured Bank Deposit Sweep Program provides eligible customers with up to $2,500,000 of Federal Deposit Insurance Corporation (“FDIC”) insurance on their eligible cash balances in addition to the existing $250,000 Securities Investor Protection Corporation (“SIPC”) coverage for total coverage of $2,750,000. Customers continue earning the same competitive interest rates currently applied to cash held in their brokerage accounts with us. We sweep each participating customer’s eligible cash balances daily to one or more banks, up to $246,500 per bank, allowing for the accrual of interest and keeping within the FDIC protected threshold. Cash balances above $2,750,000 remain subject to safeguarding under the SEC's Customer Protection Rule 15c3-3.

Investors’ MarketplaceSM – The Investors’ MarketplaceSM is the first electronic meeting place that brings together individual investors, financial advisors, money managers, fund managers, research analysts, technology providers, business developers and administrators, allowing them to interact to form connections and conduct business.

Mutual Fund Marketplace – The Mutual Fund Marketplace offers our customers access to more than 48,000 mutual funds worldwide, including more than 19,000 no-transaction-fee funds from more than 550 fund families.

Bond Marketplace – The Bond Marketplace allows customers to search for the best yields from a vast universe of over one million bonds from issuers in the Americas, Europe and Asia. We provide direct market access at a low cost to a wide array of corporate, government and municipal securities. Our customers obtain competitive bids and offers with low, transparent commissions and no hidden mark-ups.

Cryptocurrency – Customers, including both individuals and advisors, can trade Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) and Bitcoin Cash (BCH) through Paxos Trust Company or Zero Hash LLC, which execute, clear and custody the cryptocurrencies, alongside other asset classes on a single unified platform. In Hong Kong, customers can trade and hold BTC and ETH in their account with Interactive Brokers Hong Kong Limited (“IBHK”).

Fractional Trading – Fractional Trading allows customers to buy and sell any eligible U.S., Canadian, or European stocks (or ETFs, where available), using either a specified cash amount or fractional shares, which are stock units that amount to less than one full share. With fractional shares, there is no minimum for European shares and customers can invest in U.S. shares with as little as $1.00. This functionality allows customers to experiment with trading and investing without committing substantial sums of money and learn about building and rebalancing diversified portfolios.

1 U.S. regulations require securities and commodities activities to be conducted in separate accounts. Universal AccountSM refers to the consolidation of these accounts for display purposes only, enabling customers the ability to use a single platform to conduct trading activity and view consolidated activity and position information for all products and services offered.

2 American Express® is a trademark registered to the American Express Company, 200 Vesey Street, New York, New York 10285.

U.S. Spot Gold – Customers can trade U.S. Spot Gold alongside other asset classes from a single unified platform. In addition, our customers have access to efficient pricing in quantities as small as one ounce and can request physical delivery of their U.S. Spot Gold position.

No Transaction Fee Program for Exchange-Traded Funds – We offer a no transaction fee program for ETFs that reimburses IBKR ProSM customers and eligible non-U.S. customers for commissions paid on ETF shares held for at least 30 days.

Event Contracts – IBKR EventTraderSM is our web-based platform for trading event contracts on select CME futures markets. IBKR EventTraderSM allows customers to trade their opinion about a specific question with a “yes” or “no” outcome.

Overnight Trading Hours – Customers can trade over 10,000 U.S. stocks and ETFs nearly 24 hours a day, five days a week, enabling them to react immediately to market-moving news and conveniently trade at almost any time. It also provides customers in Asia with access to the U.S. Equity markets during their trading day.

For all customers, our platform offers:

Low Costs – We provide our customers with among the industry’s lowest overall transaction costs in two ways. First, we offer among the lowest execution, commission and financing costs in the industry. Second, our IBKR ProSM customers benefit from our advanced routing of orders designed to achieve the best available trade price. In addition, customers earn interest on their uninvested cash balances above $10,000 (or the equivalent in foreign currency).

IB SmartRoutingSM – IB SmartRoutingSM retains control of the customer’s order, continuously searches for the best available price and, unlike most other routers, dynamically routes and re-routes all or parts of a customer’s order to achieve optimal execution and among the lowest execution and commission costs in the industry. We offer Transaction Cost Analysis reporting to allow customers to track execution performance using multiple criteria. Our IBKR ProSM customers benefit from our advanced order routing technology for all trades, while our IBKR LiteSM customers benefit from this technology for their trades in products not eligible for IBKR LiteSM.

Automated Risk Controls – Throughout the trading day, we calculate margin requirements for each of our customers on a real-time basis across all product classes and across all currencies. Our customers are alerted to approaching margin violations and if a customer’s equity falls below what is required to support that customer’s margin, we attempt to automatically liquidate positions to bring the customer’s account into margin compliance. This is done to protect us, as well as the customer, from excessive losses.

Flexible and Customizable System – Our platform is designed to provide an efficient customer experience, beginning with a highly automated account opening process and continuing through fast trade execution and reporting. Our sophisticated interface provides interactive real-time views of account balances, positions, profits or losses, buying power and “what-if” scenarios to enable our customers to more easily make informed investment decisions and trade effectively. Our system is configured to remember the user’s preferences and is specifically designed for multi-screen systems. When away from their main workstations, customers can conveniently access their accounts through our IBKR Mobile platforms.

Securities Financing Services – We offer a suite of automated Stock Borrow and Lending tools, including our depth of availability, transparent rates, global reach and dedicated service representatives. In addition, our Stock Yield Enhancement Program allows our customers to lend their fully-paid stock shares to us in exchange for cash or U.S. Treasury securities collateral. In turn, we lend these stocks in exchange for collateral and earn stock lending fees. We pay our customers interest on the collateral value generally equal to 50% of a market-based rate for lending the shares. This allows customers holding fully-paid long stock positions to enhance their returns.

Block Trade Desk – We offer broker-assisted trading through our Corporate Bond and Stock and Option block order desks. The desks help traders execute large or complex orders and monitor trades when customers are unable to do so. The desks source liquidity, bring SPX color from the pit, offer price discovery services, and help customers calibrate and execute complex algo trading strategies.

IBKR Campus – IBKR Campus helps customers learn about the markets, products, and tools available through our platforms. IBKR Campus offers self-directed courses at the Traders’ Academy; live and recorded webinars; our Traders’ Insight market commentary blog; IBKR Podcasts, a podcast series featuring interviews with financial industry thought leaders; the IBKR Quant Blog; IBKR-API, the source for all IBKR API documentation; and the Student Trading Lab, which allows educators to bring real-world trading experiences to their classroom. In addition, we provide content to Coursera, an online provider of learning content, for a certificate program called Practical Guide to Trading.

Promotional offerings include:

IBKR Refer a Friend Program – Under the Refer a Friend program, we encourage existing customers to refer friends and family to IBKR. The referring customer can earn a flat fee payment of $200 while the new customer can receive up to $1,000 in IBKR stock. The specific program details and eligibility requirements are described on our website.

Analytical offerings on our platform include:

IBKR GlobalAnalystSM – Our IBKR GlobalAnalystSM tool, designed for investors who are interested in international portfolio diversification, helps find new opportunities to diversify an investor’s portfolio and discover undervalued companies that may have greater growth potential. The relative value of global stocks by region, country, industry or individually can be compared, and metrics displayed in one of 31 currencies. IBKR GlobalAnalystSM can search across business sectors and allows for filtering by region, country and market capitalization.

PortfolioAnalyst® – Our PortfolioAnalyst® reporting tool allows customers to consolidate, track and analyze their portfolios, offering multi-custody solutions, advanced reporting, global support, benchmarks, risk metrics, GIPS® verified returns and powerful on-the-go analytics. PortfolioAnalyst® can consolidate data from a customer’s investment, checking, savings and annuity accounts, as well as incentive plans, credit card accounts, mortgages and student loans.

IB Risk NavigatorSM – We offer to all customers our real-time market risk management platform that unifies exposure across multiple asset classes around the globe. The system is capable of identifying overexposure to risk by starting at the portfolio level and drilling down into successively greater detail within multiple report views. Report data is updated every ten seconds or upon changes to portfolio composition. Predefined reports allow the summarization of a portfolio from different risk perspectives, providing views of Exposure, Value at Risk (“VaR”), Delta, Gamma, Vega and Theta, profit and loss, and position quantity measures. The system also offers customers the ability to modify positions through “what-if” scenarios that show hypothetical changes to the risk profile.

Portfolio Builder – Portfolio Builder supports our customers in setting up an investment strategy based on research and rankings from top buy-side providers and fundamental data; use filters to define the universe of equities that will comprise their strategy and back-test their strategy using up to three years of historical performance; work in hypothetical mode to adjust the strategy until the historical performance meets their standards; and with the click of a button let the system create the orders to invest in a strategy and track its performance in their portfolio.

Securities Lending Dashboard – The Securities Lending Dashboard is designed to help customers assess the short-selling activity for specific securities and inform trading decisions. The dashboard allows sophisticated individual and institutional investors, including hedge funds, to view an expanded universe of securities lending data across key metrics. The Securities Lending Dashboard complements IBKR’s Securities Loan and Borrow system, which is a fully electronic and actionable self-service utility that lets customers search for availability of shortable securities from within IBKR trading platforms at no cost.

Interactive AnalyticsSM and IB Option AnalyticsSM – We offer our customers state-of-the-art tools, which include a customizable trading platform, advanced analytic tools and over 100 sophisticated order types and algorithms. We also provide a real-time option analytics window that displays values reflecting the rate of change of an option’s price with respect to a unit change in each of several risk dimensions.

Probability Lab® – The Probability Lab® provides customers with an intuitive, visual method to analyze market participants’ future stock price forecasts based on current option prices. This tool compares a customer’s stock price forecast versus that of the market and scans the entire option universe for the highest Sharpe ratio multi-leg option strategies that take advantage of the customer’s forecast.

Goal Tracker – Interactive Advisors’ Goal Tracker projects the hypothetical performance of a portfolio and monitors how likely it is the portfolio might achieve the goal. Customers can adjust inputs, such as monthly contribution amount, goal target date, or the cost or outflow associated with the goal, to estimate the likelihood of achieving a goal.

Sustainable Investing Tools

IMPACT by Interactive BrokersSM – IMPACT by Interactive BrokersSM (“IMPACT App”) is a unique, simple and intuitive mobile app that helps customers easily align their investment portfolio with their values. The IMPACT App allows customers to select their personal investment criteria from thirteen impact values and principles, and also allow customers to exclude investments based on business practices they would like to avoid.

Carbon Offsets – Using the IMPACT App, U.S. customers can offset their carbon emissions by purchasing carbon offsets and can use the Carbon Offsets tool to select from either greenhouse-gas emitting activities related to household, transportation and food, or enter a specific amount of carbon to offset. We source and retire the carbon credits at the appropriate registries enabling customers to fully or partially offset their carbon footprints.

Charitable Giving – IBKR GIVESM supports U.S. customers in making charitable donations directly from the IMPACT App. Using a comprehensive directory of U.S. charities and non-profit organizations from GuideStarTM by Candid, IBKR GIVESM lets customers easily donate to a charity matching their values, or search for a non-profit organization of their choice.

Impact Dashboard – The Impact Dashboard helps customers to evaluate and invest in companies that align with their values. Customers can select the values they care about from a list ranging from clean air to consumer safety and racial equality, and measure how both individual securities and their overall portfolio measure up against their criteria.

ESG Scores – ESG Scores from Refinitiv give customers a new set of tools for making investment decisions based on more than just financial factors. Companies are scored along several dimensions, such as reducing emissions and supporting human rights, and customers can easily see how companies rank both overall and on each dimension.

We cater to various customer groups with specific service needs.

For advisors, we offer:

Model Portfolios – Model Portfolios offer advisors an efficient and time-saving approach to investing customer assets. They allow advisors to create groupings of financial instruments based on specific investment themes, and then invest customer funds into these models.

IBKR Allocation Order Tool – The IBKR Allocation Order Tool streamlines the creation, execution and allocation of group orders. The tool provides advisors with a single screen to enter trade allocations quickly across many customer accounts, advisors or strategies; allocate total quantity or cash quantity for user-specified values proportionally or equally; and modify orders or allocations on the fly. In addition, customers can use the Allocation Order Tool to project, preview and allocate trades to take advantage of potential capital losses for all or some of an advisor’s invested customers.

ESG Impact Profile – The ESG Impact Profile helps advisors understand customer preferences for socially responsible and impact investing. Advisors’ customers can select personal investment criteria from thirteen impact values and principles and exclude investments based on ten categories.

IBKR Client Risk Profile – IBKR Client Risk Profile is designed to help advisors determine the most suitable investments for their customers, based on each customer’s risk tolerance. This information is collected through a custom-designed questionnaire. Advisors can view the scores through the Advisor Portal and create custom pre-trade allocation groups and profiles in Trader WorkstationSM to place orders and allocate trades for customers with similar risk profiles.

Custom Indexing – Custom Indexing allows advisors to create custom portfolios for their customers that directly hold the underlying securities of an index, rather than purchasing a traditional index fund. This gives advisors the ability to customize portfolios to align with specific investment objectives.

Employee Plan Administrator SIMPLE IRA – The Employee Plan Administrator account allows U.S. advisors to offer self-employed individuals and companies of less than 100 employees a Savings Investment Match Plan for Employees Individual Retirement Account (“SIMPLE IRA”).

Tax Loss Harvesting – IBKR’s Tax Loss Harvest tool helps advisors to potentially reduce their customers’ tax liabilities by harvesting losses across multiple assets for multiple customers at the same time.

For introducing brokers and advisors, we offer:

White Branding – Our large financial advisor and broker-dealer customers may “white brand” our trading interface, account management and reports with their firm’s identity. Broker-dealer customers can also select from among our modular functionalities, such as order routing, trade reporting or clearing, on specific products or exchanges where they may not have up-to-date technology to offer to their customers a complete global range of services and products.

Streamlined Client Service Program – The Streamlined Client Service Program offers a new level of service for brokers and advisors who want to handle tasks for their customers, with a simplified process for approving funding requests and signing agreements. The full list of available tasks includes authorization to update or change account information, account settings, trading permissions, tax forms, banking and transfer instructions; authorization to vote shares and make elections regarding positions; authorization for special programs and alternative investments; and request to send electronic notices, confirmations, account statements and certain communications only to the broker or advisor.

For customers looking for online advisory services, we offer:

Interactive Advisors – Interactive Advisors recruits registered financial advisors, vets them, analyzes their investment track records, and groups them by their risk profile. Investors who are interested in having their individual accounts robo-traded are grouped by their risk and return preferences. Investors can assign their accounts to be traded by one or more advisors. Interactive Advisors also offers our customers Smart Beta Portfolios which combine the benefits of actively managed fund stock selection techniques with passive ETFs low-cost automation to provide broad market exposure and potentially higher returns, as well as Socially Responsible Investing.

Technology

Our proprietary technology is the key to our success. We believe that integrating our system with electronic exchanges and market centers worldwide results in transparency, liquidity and efficiencies of scale. Together with the IB SmartRoutingSM system and our low execution costs, this approach reduces overall transaction costs to our IBKR ProSM customers and, in turn, increases our transaction volume and profits (customers who elect to use our IBKR LiteSM offering do not take advantage of our IB SmartRoutingSM technology). Over the past four decades, we have developed an integrated trading system and communications network and have positioned our company as an efficient conduit for the global flow of risk capital across asset and product classes on electronic marketplaces around the world, permitting us to have one of the lowest cost structures in the industry. We believe that developing, maintaining and continuing to enhance our proprietary technology provides us and our customers with the competitive advantage of being able to adapt quickly to the changing environment of our industry and to take advantage of opportunities presented by new exchanges, products, pricing mechanisms or regulatory changes before our competitors.

Our proprietary technology infrastructure enables us to provide our customers with the ability to execute trades at among the lowest execution costs in the industry for comparable services. Customer trades are both automatically captured and reported in real time in our system. Our customers can trade on more than 150 electronic exchanges and market centers in 34 countries around the world. These exchanges and market centers are all partially or fully electronic, meaning that customers can buy or sell a product traded on that exchange via an electronic link from their computer or mobile device through our system to the exchange. We offer our products and services through a global communications network that is designed to provide secure, reliable and timely access to the most current market information. We provide our customers with a variety of means to connect to our brokerage systems, including cross connects, dedicated point-to-point data circuits, extranets, virtual private networks and the Internet.

Specifically, our customers receive electronic access worldwide via our Trader WorkstationSM (real-time Java-based trading platform), our proprietary Application Programming Interface (“API”), our IBKR Mobile app, our Client Portal-based Quick Trade feature or industry standard Financial Information Exchange (“FIX”) connectivity. Customers who want a professional quality trading application with a sophisticated user interface utilize our Trader WorkstationSM, which can be accessed through a desktop or variety of mobile devices. Customers interested in developing programmatic trading utilize our API, which supports multiple programming languages. Large institutions with FIX infrastructure prefer to use our FIX solution for seamless integration of their existing order gathering and reporting applications.

While many brokerages, including some online brokerages, rely on employees performing manual procedures to execute many day-to-day functions, we employ proprietary technology to automate, or otherwise facilitate, many of the following functions:

account opening and funding;

smart order routing resulting in industry-leading execution quality;

seamless trading across all types of securities, futures and currencies around the world from one account;

diverse order types and analytical tools offered to customers;

securities lending and short stock availability;

delivery of customer information, such as confirmations, customizable real-time account statements, audit trails and regulatory trade reporting;

compliance;

customer service; and

risk management through automated real-time credit management of all new orders and margin monitoring.

Research and Development

One of our core strengths is our expertise in the rapid development and deployment of automated technology for the financial markets. Our core software technology is developed internally, and we do not generally rely on outside vendors for software development or maintenance. To achieve optimal performance from our systems and in response to changing market conditions, we continuously rewrite and upgrade our software. Use of the best available technology not only improves our performance but also helps us attract and retain talented developers. Our software development costs are relatively low because the employees who oversee the development of the software are often the same employees who design the application, evaluate its performance, and participate along with our quality assurance professionals in our robust quality assurance testing procedures. The involvement of our developers in each of these processes enables us to add features and further refine our software rapidly.

Our internally-developed, fully integrated trading and risk management systems are unique and transact across all product classes. These systems have the flexibility to assimilate new trading venues and new product classes without compromising transaction speed or fault tolerance. Fault tolerance, or the ability to maintain system performance despite trading venue malfunctions or hardware failures, is crucial to ensuring best possible executions for our customers. Our systems are designed to detect trading venue malfunctions and quickly take corrective actions by re-routing pending orders when possible.

Our company is technology-focused, and our management team is hands-on and technology-savvy. Most members of the management team participate in algorithm design and supervise the creation of detailed specifications for new applications. The development queue is prioritized and highly disciplined. Progress on programming initiatives is generally tracked on a bi-weekly basis by the Steering Committee and other committees consisting of senior executives. This enables us to prioritize key initiatives and achieve rapid results. All new business involves a software development project. We generally do not engage in any business that we cannot automate and incorporate into our platform prior to entering the business.

We achieve a rapid software development and deployment cycle by leveraging a highly integrated, object-oriented development environment. The software code is modular, with each object providing a specific function and being reusable in multiple applications. New software releases are tracked and tested with proprietary automated testing tools. We are not hindered by disparate and often limiting legacy systems assembled through acquisitions. Virtually all our software has been developed and maintained with a unified purpose.

For over four decades, we have built and continuously refined our automated and integrated, real-time systems for world-wide trading, risk management, clearing and cash management, among others. We have also assembled a proprietary connectivity network between us and exchanges and market centers around the world. Efficiency and speed in performing prescribed functions are always crucial requirements for our systems. As a result, our systems can assimilate market data, disseminate market prices to customers and update risk management information in real time, across tradable products in all available product classes and across multiple geographies.

Risk Management Activities

Our risk management policies are developed and implemented by our Steering Committee, which is chaired by our Chief Executive Officer and comprised of senior executives of our various operating subsidiaries. The core of our risk management philosophy is the utilization of our fully integrated computer systems to perform critical risk-management activities on a real-time basis. Our integrated risk management seeks to ensure that each customer’s positions are continuously credit checked and brought into compliance if equity falls short of margin requirements, curtailing bad debt losses.

We calculate margin requirements for each of our customers on a real-time basis across all product classes (stocks, options, futures, forex, bonds, mutual funds, ETFs and other financial instruments) and across all currencies. Recognizing that our customers generally are experienced investors, we expect our customers to manage their positions proactively, and we provide tools to facilitate our customers’ position management. However, if a customer’s equity falls below what is required to support that customer’s margin, we will automatically liquidate positions on a real-time basis to bring the customer’s account into margin compliance. We do this to protect ourselves, as well as the customer, from excessive losses. These systems further contribute to our low-cost structure. The entire credit management process is automated.

As a safeguard, all liquidations are displayed on custom built liquidation monitoring screens that are part of the toolset our risk management professionals use to minimize market exposure. In addition, our risk management staff uses these displays to monitor the performance of our risk systems at all times across all open markets around the world. Should our systems absorb erroneous market data from exchanges that prompt liquidations, our risk specialists have the capability to temporarily halt liquidations that meet specific criteria. The liquidation halt function is highly restricted.

Our customer interfaces include color coding on the account screen and pop-up warning messages to notify customers that they are approaching their margin limits. This feature allows customers to take action, such as entering margin reducing trades, to avoid having their positions liquidated under our automated liquidation algorithm. These tools and real-time margining aid our customers in understanding their trading risk at any moment of the day and help us maintain low commissions.

We actively manage our global currency exposure on a continuous basis by maintaining our equity in a basket of currencies we call the GLOBAL. We define the GLOBAL as consisting of fractions of a U.S. dollar, Euro, Japanese yen, British pound, Swiss franc, Chinese renminbi, Indian rupee, Canadian dollar, Australian dollar and Hong Kong dollar. The currencies comprising the GLOBAL and their relative proportions can change over time. Additional information regarding our currency diversification strategy is set forth in “Quantitative and Qualitative Disclosures about Market Risk” in Part II, Item 7A of this Annual Report on Form 10-K.

With respect to our remaining market making activities, we employ certain hedging and risk management techniques to protect us from a severe market dislocation. Our automated system evaluates and monitors the risks inherent in our portfolio, assimilates market data and reevaluates the outstanding quotes in our portfolio many times per second. Our model automatically rebalances our positions throughout each trading day to manage risk exposures. Under risk management policies implemented and monitored primarily through our computer systems, reports to management, including risk profiles, profit and loss analysis and trading performance, are prepared on real-time and periodical bases. Although our remaining market making activities are completely automated, the trading process and risk exposures are monitored by a team of individuals who, in real-time, observe various risk parameters of our consolidated positions.

Operational Risk and Controls

We manage the operational risk inherent in our business and limit potential exposure to operational incidents by maintaining robust and comprehensive controls. Our control environment is designed to ensure that services and controls are resilient during periods of operational stress (e.g., extreme market volatility) and business disruptions. These controls are periodically assessed for both design appropriateness and operating effectiveness by our Enterprise Risk Management and Internal Audit functions. In addition, an Independent Service Auditor annually examines our brokerage operations system and the suitability of the design and operating effectiveness of the related controls (System and Organizational Controls 1 Report).

We have automated the full cycle of controls surrounding our businesses. Key automated controls include the following:

Our technical operations team continuously monitors our network and the proper functioning of each of our nodes (exchanges and market centers, internet service providers (“ISPs”), leased customer lines and our own data centers) around the world.

Our real-time credit manager software provides pre- and post-execution controls by:

testing every customer order to ensure that the customer’s account holds enough equity to support the execution of the order, rejecting the order if equity is insufficient or directing the order to an execution destination without delay if equity is sufficient; and

continuously updating a customer account’s equity and margin requirements and, if the account’s equity falls below its minimum margin requirements, automatically issuing liquidating orders in a smart sequence designed to minimize the impact on the account’s equity.

Our clearing system captures trades in real-time and performs automated reconciliation of trades and positions, corporate action processing, customer account transfer, options exercise, securities lending and inventory management, allowing us to effectively manage operational risk.

Our accounting system operates with automated data feeds from clearing and banking systems, allowing us to produce financial statements for all parts of our business every day by mid-day on the day following trade date.

Our market making system continuously evaluates securities and futures products in which we provide bid and offer quotes and changes our bids and offers in such a way as to maintain an overall hedge and a low-risk profile. The speed of communicating with exchanges and market centers is maximized through continuous software and network engineering maintenance, thereby allowing us to achieve real-time controls over market exposure.

Transaction Processing

Our transaction processing is automated over the full life cycle of a trade. Our fully automated IB SmartRoutingSM system searches for the best possible combination of prices available at the time a customer order is placed and immediately seeks to execute that order electronically or send it where the order has the highest possibility of execution at the best price. Our market making software generates and disseminates to the exchanges and market centers, in which we still operate, continuous bid and offer quotes on tradable, exchange-listed products.

When an order is executed, our systems capture and deliver this information back to the source, either to the customer via the brokerage system or to the market making system, generally within a fraction of a second. Simultaneously, the trade record is written into our clearing system, where it flows through a chain of control accounts that allow us to reconcile trades, positions and money until the final settlement occurs. Our integrated software tracks other important activities, such as dividends, corporate actions, options exercises, securities lending, margining, risk management and funds receipt and disbursement.

IB SmartRoutingSM

IB SmartRoutingSM searches for the best destination price in view of the displayed prices, sizes and accumulated statistical information about the behavior of market centers at the time an order is placed, then immediately seeks to execute that order electronically. Unlike other smart routers, IB SmartRoutingSM never relinquishes control of the order, and constantly searches for the best price. It continuously evaluates fast-changing market conditions and dynamically re-routes all or parts of the order seeking to achieve optimal execution. For example, for U.S. options, IB SmartRoutingSM can represent each leg of a spread order independently, if needed, and in that event enters each leg at the best possible venue. IB SmartRouting AutorecoverySM re-routes a customer’s U.S. options order in the case of an exchange malfunction, and we absorb the risk of double executions. In addition, IB SmartRoutingSM checks each new order to see if it could be executed against any of its pending orders in our automated trading system (“ATS”). As the system continues to gain more users, IB SmartRoutingSM and the IBKR ATS facilities become more important for customers in a world of multiple exchanges, market centers and penny-priced orders because it increases the possibility of best possible executions for our customers ahead of customers of other brokers. As a result of this feature, our customers have a greater chance of executing limit orders and can do so sooner than those who use less sophisticated routers.

Clearing and Margining

Our activities in the U.S. are entirely self-cleared. We are a clearing member of OCC (formerly known as the Options Clearing Corporation), The Depository Trust and Clearing Corporation, the Chicago Mercantile Exchange Clearing House, and ICE Clear U.S. In addition, we are fully or partially self-cleared in Canada, the United Kingdom, Switzerland, France, Germany, Belgium, Austria, the Netherlands, Spain, Norway, Sweden, India, Hong Kong, Japan and Australia.

Customers

Our customers primarily fall into two groups based on services provided, both of which take advantage of our low commissions as well as our best price execution. Cleared customers, the large majority of our customers, use our trade execution and clearing services, low financing rates, high interest paid (when available) and, under our IBKR LiteSM offering, commission-free trades. Non-cleared customers use our trade execution services while choosing to clear with another prime broker or a custodian bank.

We currently service approximately 2.56 million cleared customer accounts and have customers residing in over 200 countries and territories around the world. Our target customer is one who requires the latest in trading technology and worldwide access, and who expects low overall transaction and financing costs and market rate interest on idle cash balances. Our customers are mainly comprised of individuals, trading desk professionals, electronic retail brokers, hedge funds, mutual funds, financial advisors, proprietary trading firms, and introducing brokers and banks that require global access. No single customer represented more than 1% of our commissions in 2023.

Human Capital

As of December 31, 2023, we had 2,932 employees across 27 locations globally. We aim to attract, develop and retain employees to drive our business forward. To help our employees thrive at work and at home, we offer industry-leading benefits programs, including paid leave time for all parents, adoption and fertility support, childcare support, mental health services, and healthcare travel reimbursement. In the U.S., we fund healthcare premiums at no cost to employees.

Social Initiatives

We believe that communication and connectivity are critical to creating a culture of inclusion, and in 2023 we implemented a new digital platform with over 60 employee-led communities that employees use to engage in shared interests ranging from philanthropy and sports to innovative technologies.

In response to the results of our 2023 Employee Engagement Survey, we rolled out new programs to support the well-being of our employees. We implemented a global mental health program operated by an external specialist, which includes peer-to-peer, interactive group sessions and one-on-one sessions to facilitate awareness and education on mental health topics. We also launched a global Steps Challenge to motivate our employees to build fitness into their work routine. We continued to expand our global mentorship program, with more than 120 mentors providing peer-to-peer career support.

We believe philanthropic giving is a personal and powerful tool to connect to local communities and causes that matter most to our employees. To facilitate employee giving, we partner with a workplace giving platform in a program that features matching contributions from the Company.

Employee and Leadership Development

We support career and skill development for our employees through online and in-person training. Our IBKR Training Portal offers over 900 courses encompassing market and industry knowledge building, technical skills, and soft-skills training that supports managers and employees in developing in their roles.

We believe managers have an outsized impact on employee experience and careers, so we have invested in supporting managers with content and training focused on coaching, giving and receiving feedback, managing unconscious bias, performance management, and interview skills. We launched the New Manager Development Program to help first-time managers transition and learn from each other. Over 175 leaders completed one of our programs in 2023. In addition, all employees must complete compliance training in many role-relevant areas, meeting or exceeding all regulatory requirements. Topics include Anti-Money Laundering, Anti-Bribery and Corruption, Sanctions, Cybersecurity and Data Privacy.

Diversity, Equity and Inclusion

We believe a diverse workforce enriches our employees’ and customers’ experience. We are dedicated to promoting a culture of inclusion and attracting and developing a diverse global workforce. To broaden the pool of applicants who apply to our jobs and internships, we partner with organizations like 100 Women in Finance and Girls Who Code.

We continue to support our employee resource groups to promote personal growth and professional development for women, minorities and others at the Company. These include our Women’s Resource Group, Military Veterans and Families Group, and Pride Network. We continue to support these communities by running networking events and skills workshops, such as:

Panels with our Non-Executive Board and female members of our Board of Directors;

International Women’s Day events;

Learning sessions on Neurodiversity and other topics;

Pride Month awareness and events; and

Employee wellness events.

Sustainability

Our Board’s ESG Committee provides ongoing leadership governance for related strategies and initiatives throughout the Company. In 2023, we produced our first Sustainability Report which summarizes the three primary areas of our sustainability strategy: (1) Leadership and Governance, (2) Our People, and (3) Environmental Stewardship. Our Sustainability Report can be found on our website located at www.interactivebrokers.com. The contents of our Sustainability Report are not incorporated by reference into this Annual Report on Form 10-K or in any other report or document we file with the SEC.

In 2023, we also completed our baseline Greenhouse Gas (“GHG”) assessment to help us inventory and analyze our Scope 1 and Scope 2 emissions. We continue to implement sustainable practices that help protect the environment. All of our offices have completed an environmental review to assess current and best practices for energy, water and waste management, and in 2023, we developed our Environmental Standards, a framework for managing our GHG, waste, water and recycling. We also procured renewable power sources for all of our offices through the purchase of renewable energy certificates representing over 95% of our operational footprint. We use third-party providers for data centers. Worldwide, 90% of these data centers use renewable power provided directly through the landlord or via renewable energy certificates.

Competition

The market for electronic brokerage services is rapidly evolving and highly competitive, and we expect it to remain so. The environment in which we operate has a broad array of competitors ranging from large integrated banks to online brokers to early-stage private companies. Our primary competitors, both in the U.S. and abroad, are other companies that provide electronic brokerage, prime brokerage, and financial advisor and introducing broker products and services. We compete based on numerous factors, including quality of transaction execution, customer experience, products and services, technological excellence and innovation, reputation, global access, and price. Since our inception, we have been transforming the electronic brokerage business through automation and innovation, with software development, product improvement, expansion of products and geographies, and management focus dedicated to this mission. We believe these are significant differentiators that set us apart from our competitors.

We experience competition in hiring and retaining qualified employees. The market for qualified personnel in our business is highly competitive and, at various times, the demand in the market for different functions and roles can become especially high, which may oblige us to pay more to attract and retain talent. We also compete on non-monetary forms of compensation, providing what we believe to be a robust set of benefits to our employees.

Regulation

Our securities and derivatives businesses are extensively regulated by U.S. federal and state regulators, foreign regulatory agencies, and numerous exchanges and self-regulatory organizations of which our subsidiaries are members. In the current era of heightened regulation of financial institutions, we expect to incur increasing compliance costs, along with the industry as a whole. Our approach has been to build many of our regulatory and compliance functions into our integrated order routing, custodial, customer onboarding and transaction processing systems, and augment these systems with experienced staff members.

Overview

As registered U.S. broker-dealers, Interactive Brokers LLC (“IB LLC”), IBKR Securities Services LLC (“IBKRSS”) and Interactive Brokers Corp. are subject to the rules and regulations of the Exchange Act, and as members of various exchanges, we are also subject to such exchanges’ rules and requirements. Additionally, IB LLC is subject to the Commodity Exchange Act and rules promulgated by the Commodity Futures Trading Commission (“CFTC”) and the various commodity exchanges of which it is a member. We are also subject to the requirements of various self-regulatory organizations such as the Financial Industry Regulatory Authority (“FINRA”), the Chicago Mercantile Exchange (“CME”) and the National Futures Association (“NFA”). Our foreign subsidiaries are similarly regulated under the laws and institutional frameworks of the countries in which they operate.

U.S. broker-dealers and futures commission merchants are subject to laws, rules and regulations that cover all aspects of the securities and derivatives business, including:

sales methods;

“know your customer” requirements;

anti-money laundering requirements;

trade practices;

use and safekeeping of customers’ funds and securities;

capital structure;

risk management;

record-keeping;

financing of customers’ purchases; and

conduct of directors, officers and employees.

In addition, the businesses that we may conduct are limited by our arrangements with and our oversight by regulators. Participation in new business lines, including trading of new products or participation on new exchanges or in new countries often requires governmental and/or exchange approvals, which may take significant time and resources. As a result, we may be prevented from entering new businesses that may be profitable in a timely manner, or at all.

As certain of our subsidiaries are members of FINRA, we are subject to certain regulations regarding changes in control of our ownership. FINRA Rule 1017 generally provides that FINRA approval must be obtained in connection with any transaction resulting in a change in control of a member firm. FINRA defines control as ownership of 25% or more of the firm’s equity by a single entity or person and would include a change in control of a parent company. As a result of these regulations, our future efforts to sell shares or raise additional capital may be delayed or prohibited by FINRA.

Net Capital Rule

The SEC, FINRA, CFTC and various other regulatory agencies within the U.S. have stringent rules and regulations with respect to the maintenance of specific levels of net capital by regulated entities. Generally, a broker-dealer’s capital is its net worth plus qualified subordinated debt less deductions for certain types of assets. The Net Capital Rule requires that at least a minimum part of a broker-dealer’s assets be maintained in a relatively liquid form.

If these net capital rules are changed or expanded, or if there is an unusually large charge against our net capital, our operations that require the intensive use of capital would be limited. A large operating loss or charge against our net capital could adversely affect our ability to expand or even maintain these current levels of business, which could have a material adverse effect on our business and financial condition.

The U.S. regulators impose rules that require notification when net capital falls below certain predefined criteria. These rules also dictate the ratio of debt-to-equity in the regulatory capital composition of a broker-dealer and constrain the ability of a broker-dealer to expand its business under certain circumstances. If a firm fails to maintain the required net capital, it may be subject to suspension or revocation of registration by the applicable regulatory agency, and suspension or expulsion by these regulators could ultimately lead to the firm’s liquidation. Additionally, the Net Capital Rule and certain FINRA rules impose requirements that may have the effect of prohibiting a broker-dealer from distributing or withdrawing capital and requiring prior notice to U.S. regulators and approval from FINRA for certain capital withdrawals.

Our foreign subsidiaries are similarly regulated with regard to capital requirements in support of their brokerage activities.

As of December 31, 2023, aggregate excess regulatory capital for all of the operating subsidiaries was $10.2 billion.

IB LLC is subject to the Uniform Net Capital Rule (Rule 15c3-1) under the Exchange Act and to the CFTC’s minimum financial requirements (Regulation 1.17) under the Commodities Exchange Act. Additionally, Interactive Brokers Canada Inc. (“IBC”) is subject to the Canadian Investment Regulatory Organization (“CIRO”) risk adjusted capital requirement; Interactive Brokers (U.K.)

Limited (“IBUK”) is subject to the United Kingdom’s (“U.K.”) Financial Conduct Authority (“FCA”) financial resources requirement; Interactive Brokers Ireland Limited (“IBIE”) is subject to the Central Bank of Ireland (“CBI”) financial resources requirement; IBKR Financial Services AG (“IBKRFS”) is subject to the Swiss Financial Market Supervisory Authority (“FINMA”) eligible equity requirement; Interactive Brokers Central Europe Zrt. (“IBCE”) is subject to the Hungarian National Bank (“MNB”) financial resource requirement; Interactive Brokers (India) Private Limited (“IBI”) is subject to the National Stock Exchange of India net capital requirements; Interactive Brokers Hong Kong Limited (“IBHK”) is subject to the Hong Kong Securities and Futures Commission (“SFC”) financial resource requirement; Interactive Brokers Securities Japan, Inc. (“IBSJ”) is subject to the Japanese Financial Services Agency (“FSA”) capital requirements; Interactive Brokers Singapore Pte. Ltd. (“IBSG”) is subject to the Monetary Authority of Singapore (“MAS”) capital requirements; and Interactive Brokers Australia Pty Limited (“IBA”) is subject to the Australian Securities Exchange (“ASX”) liquid capital requirement.

The table below summarizes capital, capital requirements and excess regulatory capital as of December 31, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Capital/ |

|

|

|

|

|

|

|

| Eligible Equity |

| Requirement |

| Excess |

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

|

|

|

|

|

|

|

|

|

|

IB LLC |

| $ | 7,319 |

| $ | 823 |

| $ | 6,496 |

IBHK |

|

| 1,265 |

|

| 223 |

|

| 1,042 |

IBIE |

|

| 685 |

|

| 189 |

|

| 496 |

Other regulated operating subsidiaries |

|

| 2,333 |

|

| 142 |

|

| 2,191 |

|

| $ | 11,602 |

| $ | 1,377 |

| $ | 10,225 |

As of December 31, 2023, all of the operating subsidiaries were in compliance with their respective regulatory capital requirements. For additional information regarding our net capital requirements see Note 16 – “Regulatory Requirements” to the audited consolidated financial statements in Part II, Item 8 of this Annual Report on Form 10-K.

Protection of Customer Assets

To conduct customer activities, IB LLC is obligated under rules mandated by its primary regulators, the SEC and the CFTC, to segregate cash or qualified securities belonging to customers. In accordance with the Securities Exchange Act of 1934, IB LLC is required to maintain separate bank accounts for the exclusive benefit of customers. In accordance with the Commodity Exchange Act, IB LLC is required to segregate all monies, securities and property received from commodities customers in specially designated accounts. IBC, IBUK, IBIE, IBCE, IBI, IBHK, IBSJ, IBSG and IBA are subject to similar requirements within their respective jurisdictions.

To further enhance the protection of our customers’ assets, IB LLC performs daily (i.e., instead of the required weekly) customer reserve computations along with daily adjustments of the money set aside in safekeeping for our customers.

Supervision and Compliance

Our Compliance department supports and seeks to ensure proper operations of our business in accordance with applicable regulatory requirements. The philosophy of the Compliance department, and the Company as a whole, is to build automated systems to try to minimize manual steps in the compliance process and then to augment these systems with experienced staff members who apply their judgment where needed. We have built automated systems to handle wide-ranging compliance issues such as trade and audit trail reporting, financial operations reporting, enforcement of short sale rules, enforcement of margin rules and pattern day trading restrictions, recording and review of employee correspondence, archival of required records, execution quality and order routing reports, approval and documentation of new customer accounts, surveillance of customer trading for market manipulation or abuse or violations of exchange rules, and anti-money laundering and anti-fraud surveillance in line with our anti-money laundering policies. Our automated operations and automated compliance systems provide substantial efficiencies to our Compliance department. As part of this continuing effort, we have implemented a robust case management and surveillance system and increased our Compliance staffing over the past several years to meet the growing regulatory burdens faced by all industry participants.

Our electronic brokerage subsidiaries have Chief Compliance Officers who report to the Chief Executive Officer or business head for their subsidiary, and to the Global Chief Regulatory Officer (or regional Compliance Head). In the U.S., the Chief Compliance Officer and certain other senior staff members are FINRA and NFA registered principals with supervisory responsibility over the compliance aspects of our businesses. Similar roles are undertaken by staff in certain non-U.S. locations as well. Staff members in the Compliance department and in other departments are also registered with FINRA, NFA or other regulatory organizations.

Patriot Act and Increased Anti-Money Laundering (“AML”) and “Know Your Customer” Obligations

Registered broker-dealers traditionally have been subject to a variety of rules that require that they “know their customers” and monitor their customers’ transactions for suspicious activities. Under the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (the “USA Patriot Act”), broker-dealers are subject to even more stringent requirements. Likewise, the SEC, CFTC, foreign regulators, and the various exchanges and self-regulatory organizations, of which our operating subsidiaries are members, have passed numerous AML and customer due diligence rules. Significant criminal and civil penalties can be imposed for violations of the USA Patriot Act, and significant fines and regulatory penalties can also be imposed for violations of other governmental and self-regulatory organization AML rules.