Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2013

Commission file number: 001-35671

LifeLock, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 56-2508977 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

60 East Rio Salado Parkway, Suite 400

Tempe, Arizona 85281

(Address of principal executive offices and zip code)

(480) 682-5100

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of July 26, 2013, there were outstanding 88,735,186 shares of the registrant’s common stock, $0.001 par value.

Table of Contents

LIFELOCK, INC.

QUARTERLY REPORT ON FORM 10-Q

FOR THE QUARTER ENDED JUNE 30, 2013

i

Table of Contents

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited).

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

(unaudited)

| June 30, 2013 | December 31, 2012 | |||||||

Assets | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | $ | 169,444 | $ | 134,197 | ||||

Trade and other receivables, net | 10,953 | 7,560 | ||||||

Prepaid expenses and other current assets | 6,435 | 5,753 | ||||||

|

|

|

| |||||

Total current assets | 186,832 | 147,510 | ||||||

Property and equipment, net | 11,155 | 9,701 | ||||||

Goodwill | 129,428 | 129,428 | ||||||

Intangible assets, net | 47,310 | 51,242 | ||||||

Other non-current assets | 1,707 | 1,707 | ||||||

|

|

|

| |||||

Total assets | $ | 376,432 | $ | 339,588 | ||||

|

|

|

| |||||

Liabilities and stockholders’ equity | ||||||||

Current liabilities: | ||||||||

Accounts payable | $ | 1,251 | $ | 1,151 | ||||

Accrued expenses and other liabilities | 29,680 | 27,329 | ||||||

Deferred revenue | 115,965 | 90,877 | ||||||

|

|

|

| |||||

Total current liabilities | 146,896 | 119,357 | ||||||

Other non-current liabilities | 2,673 | 265 | ||||||

|

|

|

| |||||

Total liabilities | 149,569 | 119,622 | ||||||

Commitments and contingencies | ||||||||

Stockholders’ equity: | ||||||||

Common stock, $0.001 par value, 300,000,000 shares authorized at June 30, 2013 and December 31, 2012 and 88,580,177 and 86,561,320 shares issued and outstanding at June 30, 2013 and December 31, 2012, respectively | 89 | 87 | ||||||

Preferred stock, $0.001 par value, 10,000,000 authorized and no shares issued and outstanding at June 30, 2013 and December 31, 2012 | — | — | ||||||

Additional paid-in capital | 452,959 | 439,883 | ||||||

Accumulated deficit | (226,185 | ) | (220,004 | ) | ||||

|

|

|

| |||||

Total stockholders’ equity | 226,863 | 219,966 | ||||||

|

|

|

| |||||

Total liabilities and stockholders’ equity | $ | 376,432 | $ | 339,588 | ||||

|

|

|

| |||||

See accompanying notes to condensed consolidated financial statements.

1

Table of Contents

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(unaudited)

| For the Three Months Ended June 30, | For the Six Months Ended June 30, | |||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

Revenue: | ||||||||||||||||

Consumer revenue | $ | 82,574 | $ | 61,616 | $ | 157,667 | $ | 118,324 | ||||||||

Enterprise revenue | 6,946 | 6,267 | 13,947 | 7,171 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total revenue | 89,520 | 67,883 | 171,614 | 125,495 | ||||||||||||

Cost of services | 25,227 | 19,125 | 49,031 | 37,965 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Gross profit | 64,293 | 48,758 | 122,583 | 87,530 | ||||||||||||

Costs and expenses: | ||||||||||||||||

Sales and marketing | 43,248 | 31,167 | 85,041 | 61,505 | ||||||||||||

Technology and development | 10,370 | 7,644 | 19,394 | 12,993 | ||||||||||||

General and administrative | 10,900 | 6,602 | 20,323 | 9,537 | ||||||||||||

Amortization of acquired intangible assets | 1,966 | 1,966 | 3,932 | 2,325 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total costs and expenses | 66,484 | 47,379 | 128,690 | 86,360 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Income (loss) from operations | (2,191 | ) | 1,379 | (6,107 | ) | 1,170 | ||||||||||

Other income (expense): | ||||||||||||||||

Interest expense | (79 | ) | (935 | ) | (146 | ) | (1,285 | ) | ||||||||

Interest income | 26 | 1 | 46 | 2 | ||||||||||||

Change in fair value of warrant liabilities | — | (7,836 | ) | — | (2,941 | ) | ||||||||||

Change in fair value of embedded derivative | — | 714 | — | 714 | ||||||||||||

Other | — | — | (4 | ) | (2 | ) | ||||||||||

|

|

|

|

|

|

|

| |||||||||

Total other income (expense) | (53 | ) | (8,056 | ) | (104 | ) | (3,512 | ) | ||||||||

|

|

|

|

|

|

|

| |||||||||

Loss before provision for income taxes | (2,244 | ) | (6,677 | ) | (6,211 | ) | (2,342 | ) | ||||||||

Income tax expense (benefit) | (179 | ) | 221 | (29 | ) | (13,897 | ) | |||||||||

|

|

|

|

|

|

|

| |||||||||

Net income (loss) | (2,065 | ) | (6,898 | ) | (6,182 | ) | 11,555 | |||||||||

Accretion of convertible redeemable preferred stock | — | (4,018 | ) | — | (4,752 | ) | ||||||||||

Net income allocable to convertible redeemable preferred stockholders | — | — | — | (4,517 | ) | |||||||||||

|

|

|

|

|

|

|

| |||||||||

Net income available (loss attributable) to common stockholders | $ | (2,065 | ) | $ | (10,916 | ) | $ | (6,182 | ) | $ | 2,286 | |||||

|

|

|

|

|

|

|

| |||||||||

Net income available (loss attributable) per share to common stockholders: | ||||||||||||||||

Basic | $ | (0.02 | ) | $ | (0.56 | ) | $ | (0.07 | ) | $ | 0.12 | |||||

Diluted | $ | (0.02 | ) | $ | (0.59 | ) | $ | (0.07 | ) | $ | 0.10 | |||||

Weighted-average common shares outstanding: | ||||||||||||||||

Basic | 87,533 | 19,476 | 87,089 | 19,453 | ||||||||||||

Diluted | 87,533 | 19,476 | 87,089 | 52,212 | ||||||||||||

See accompanying notes to condensed consolidated financial statements.

2

Table of Contents

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| For the Six Months | ||||||||

| Ended June 30, | ||||||||

| 2013 | 2012 | |||||||

Operating activities | ||||||||

Net income (loss) | $ | (6,182 | ) | $ | 11,555 | |||

Adjustment to reconcile net income (loss) to net cash provided by operating activities: | ||||||||

Depreciation and amortization | 6,360 | 4,403 | ||||||

Share-based compensation | 6,261 | 2,363 | ||||||

Provision for (recovery of ) doubtful accounts | 95 | (10 | ) | |||||

Change in fair value of warrant liabilities | — | 2,941 | ||||||

Change in fair value of embedded derivative | — | (714 | ) | |||||

Deferred income tax benefit | (212 | ) | (14,310 | ) | ||||

Other | 4 | 2 | ||||||

Change in operating assets and liabilities: | ||||||||

Trade and other receivables | (3,244 | ) | (3,293 | ) | ||||

Prepaid expenses and other current assets | (470 | ) | 1,735 | |||||

Other non-current assets | 432 | (1,154 | ) | |||||

Accounts payable | (134 | ) | 2,373 | |||||

Accrued expenses and other liabilities | 3,179 | (1,245 | ) | |||||

Deferred revenue | 25,089 | 18,965 | ||||||

Other non-current liabilities | 2,408 | (512 | ) | |||||

|

|

|

| |||||

Net cash provided by operating activities | 33,586 | 23,099 | ||||||

Investing activities | ||||||||

Acquisition of ID Analytics, net of cash acquired | — | (157,430 | ) | |||||

Acquisition of property and equipment | (3,652 | ) | (2,080 | ) | ||||

|

|

|

| |||||

Net cash used in investing activities | (3,652 | ) | (159,510 | ) | ||||

Financing activities | ||||||||

Proceeds from: | ||||||||

Long-term debt | — | 68,000 | ||||||

Issuance of warrants | — | 4,373 | ||||||

Issuance of convertible redeemable preferred stock, net of offering costs | — | 102,167 | ||||||

Stock option exercises | 5,753 | 158 | ||||||

Payments for: | ||||||||

Term loan | — | (2,790 | ) | |||||

Debt issuance costs related to credit facilities | (440 | ) | (1,511 | ) | ||||

|

|

|

| |||||

Net cash provided by financing activities | 5,313 | 170,397 | ||||||

|

|

|

| |||||

Net increase in cash and cash equivalents | 35,247 | 33,986 | ||||||

Cash and cash equivalents at beginning of period | 134,197 | 28,850 | ||||||

|

|

|

| |||||

Cash and cash equivalents at end of period | $ | 169,444 | $ | 62,836 | ||||

|

|

|

| |||||

Supplemental information for non-cash financing activities: | ||||||||

Convertible redeemable preferred stock issued as part of purchase price for ID Analytics | — | 11,542 | ||||||

Preferred stock embedded derivative issued as part of purchase price for ID Analytics | — | 7,934 | ||||||

See accompanying notes to condensed consolidated financial statements.

3

Table of Contents

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(in thousands, except share and per share data)

(unaudited)

1. Description of Business and Basis of Presentation

We provide proactive identity theft protection services to our consumer subscribers, who we refer to as our “members”, on an annual or monthly subscription basis. We also provide identity risk assessment and fraud protection services to our enterprise customers.

We were incorporated in Delaware on April 12, 2005 and are headquartered in Tempe, Arizona. On March 14, 2012, we acquired ID Analytics, Inc. and its wholly owned subsidiary IDA Inc. (collectively, “ID Analytics”), each of which is incorporated in Delaware.

We completed our initial public offering (“IPO”) in October 2012 and our common stock is listed on the New York Stock Exchange under the symbol “LOCK.”

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States (“GAAP”) and applicable rules and regulations of the Securities and Exchange Commission (“SEC”) regarding interim financial reporting. Certain information and note disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations. Therefore, these condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2012.

The condensed consolidated balance sheet as of December 31, 2012 included herein was derived from the audited financial statements as of that date, but does not include all disclosures including notes required by GAAP.

The accompanying unaudited condensed consolidated financial statements reflect all normal recurring adjustments necessary to present fairly the financial position, results of operations, and cash flows for the interim periods, but are not necessarily indicative of the result of operations to be anticipated for the entire year ending December 31, 2013 or any future period.

Basis of Consolidation

The condensed consolidated financial statements include our accounts and those of our wholly-owned subsidiary, ID Analytics. All intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of the condensed consolidated financial statements in conformity with GAAP requires us to make certain estimates and assumptions that affect the amounts reported in the condensed consolidated financial statements and accompanying notes. We base our estimates on historical experience, current business factors, and various other assumptions that we believe are necessary to consider in forming a basis for making judgments about the carrying values of assets and liabilities, the recorded amounts of revenue and expenses, and the disclosure of contingent assets and liabilities. Actual results could differ from our estimates.

2. Summary of Significant Accounting Policies

Significant Accounting Policies

There have been no material changes to our significant accounting policies as compared to the significant accounting policies described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2012.

Recently Issued Accounting Standards

In February 2013, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2013-02, which supersedes and replaces the presentation requirements for reclassifications out of accumulated other comprehensive income in ASUs 2011-05 and 2011-12. The amendment requires that an entity must report the effect of significant reclassifications out of accumulated other comprehensive income on the respective line items in net income if the amount being reclassified is required under GAAP. For other amounts that are not required under GAAP to be reclassified in their entirety to net income in the same reporting period, an entity is required to cross-reference other disclosures required under GAAP that provide additional detail about those amounts. ASU 2013-02 was effective for fiscal years, and interim periods within those years, beginning on or after December 15, 2012. We adopted the amended standards beginning January 1, 2013. As there was no other comprehensive income during the periods ended June 30, 2013 or 2012 or the years ended December 31, 2012 or 2011, or any amounts reclassified out of accumulated other comprehensive income, there was no impact on our financial position, results of operations, or cash flows.

4

Table of Contents

In March 2013, the FASB issued ASU 2013-04, which provides guidance on the recognition, measurement, and disclosure of obligations resulting from joint and several liability arrangements for which the total amount of the obligation is fixed at the reporting date. The update requires an entity to measure obligations resulting from joint and several liability obligations for which the total amount of the obligation within the scope of the update is fixed at the reporting date, as the sum of the amount the reporting entity agreed to pay on the basis of its arrangements among its co-obligors and any additional amount the reporting entity expects to pay on behalf of its co-obligors. The update also requires an entity to disclose the nature and amount of the obligation as well as other information about those obligations. The amendments in ASU 2013-04 are effective for fiscal years, and interim periods within those years, beginning on or after December 15, 2013 and must be applied retrospectively. We do not expect the adoption of ASU 2013-04 in the first quarter of 2014 to have an impact on our financial position, results of operations, or cash flows.

3. Acquisition of ID Analytics

In the first quarter of 2012, we acquired ID Analytics, a provider of enterprise identity risk assessment and fraud protection services and a strategic technology partner of ours since 2009. The aggregate purchase price consisted of approximately $166,474 of cash paid at the closing (cash paid net of cash acquired was $157,430) and 1,586,778 shares of Series E-1 convertible redeemable preferred stock with a fair value of approximately $19,476 as of the acquisition date. We accounted for the acquisition using the acquisition method. Accordingly, we allocated the total purchase price to the tangible and identifiable intangible assets acquired and the net liabilities assumed based on their respective fair values on the acquisition date. As a result of the acquisition, we recorded goodwill in the amount of $129,428, identifiable definite-lived intangible assets of $57,500, which was comprised of $4,000 related to trade name and trademarks, $33,000 related to technology, and $20,500 related to customer relationships, and net liabilities assumed of $978. The overall weighted-average life of the identifiable definite-lived intangible assets acquired was 7.6 years, which will be amortized on a straight-line basis over their respective useful lives. The condensed consolidated financial statements for the six-month period ended June 30, 2012 include the results of operations of ID Analytics from the date of acquisition.

4. Financing Arrangements

Credit Agreement

On January 9, 2013, we refinanced our existing credit agreement and entered into a new credit agreement (the “Credit Agreement”) with Bank of America, N.A. as administrative agent, swing line lender and L/C issuer, Silicon Valley Bank as syndication agent, Merrill Lynch, Pierce, Fenner & Smith Incorporated as sole lead arranger and sole book manager, and the lenders from time to time party thereto. We refer to the Credit Agreement and related documents as the “Senior Credit Facility.” The Senior Credit Facility provides for an $85,000 revolving line of credit, which we can increase to $110,000 subject to the conditions set forth in the Credit Agreement. The revolving line of credit also includes a letter of credit subfacility of $10,000 and a swing line loan subfacility of $5,000. The Senior Credit Facility has a maturity date of January 9, 2018. As of June 30, 2013, we had no outstanding debt under our Senior Credit Facility. We paid unused commitment fees of $53 and $99 for the three- and six-month periods ended June 30, 2013, respectively, which is included in interest expense in the condensed consolidated statements of operations.

Borrowings under the Senior Credit Facility bear interest at a per annum rate equal to, at our option, either (a) a base rate equal to the highest of (i) the Federal Funds Rate plus 0.50%, (ii) the rate of interest in effect for such day as publicly announced from time to time by Bank of America as its “prime rate,” and (iii) the eurodollar rate for base rate loans plus 1.00%, plus an applicable rate ranging from 0.50% to 1.25%, or (b) the eurodollar rate for eurodollar rate loans plus an applicable rate ranging from 1.50% to 2.25%. The initial applicable rate is 0.50% for base rate loans and 1.50% for eurodollar rate loans, subject to adjustment from time to time based upon our achievement of a specified consolidated leverage ratio.

In addition to paying interest on the outstanding principal under the Senior Credit Facility, we are also required to pay a commitment fee to the administrative agent at a rate per annum equal to the product of (a) an applicable rate ranging from 0.25% to 0.50% multiplied by (b) the actual daily amount by which the aggregate revolving commitments exceed the sum of (1) the outstanding amount of revolving borrowings, and (2) the outstanding amount of letter of credit obligations. The initial applicable rate is 0.25%, subject to adjustment from time to time based upon our achievement of a specified consolidated leverage ratio.

We also will pay a letter of credit fee to the administrative agent for the account of each lender in accordance with its applicable percentage of a letter of credit for each letter of credit, which fee will be equal to the applicable rate then in effect, multiplied by the daily maximum amount available to be drawn under the letter of credit. The initial applicable rate for the letter of credit is 1.50%, subject to adjustment from time to time based upon our achievement of a specified consolidated leverage ratio.

5. Operating Leases

On May 17, 2013, we entered into a Second Amendment to Office Lease (the “Second Amendment”) with PKY Fund II Phoenix II, LLC, as successor-in-interest to Hayden Ferry Lakeside, LLC (“Lessor”), which amended that certain Office Lease dated May 18, 2007 and that certain First Amendment to Office Lease dated March 7, 2008 (together with the Second Amendment, the “Lease”). Pursuant to the Second Amendment, the term of the Lease was extended through December 31, 2024 and we leased additional space in the building in which our principal executive offices are located. In the event that Lessor is unable to deliver certain portions of the additional space to be leased

5

Table of Contents

under the Second Amendment by November 1, 2013, we may choose to terminate the Lease in its entirety and elect to hold over in the then-occupied Premises (as defined in the Lease) for an additional 12 to 24 months following such election.

The Lease contains rent abatements that provide rent-free monthly rent and rent escalations that increase monthly rent payments over the term of the Lease. We record rental expense on a straight-line basis over the base, non-cancelable term of the Lease. We recognize any difference between the calculated expense and amount actually paid as deferred rent. We reflect deferred rent as a current or non-current liability, depending on its expected date of reversal.

Associated with the Lease, we have received tenant improvement allowances from the Lessor. We record the value of these improvements as fixed assets and amortize the assets over the shorter of the estimated useful life of the asset or the lease term. We record an offsetting obligation as deferred rent and amortize it as a reduction to rent expense on a straight-line basis over the lease term.

The following summarizes the future minimum lease payments for all outstanding lease agreements as of June 30, 2013:

2013 | $ | 785 | ||

2014 | 2,219 | |||

2015 | 2,739 | |||

2016 | 2,696 | |||

2017 | 2,767 | |||

2018 | 2,843 | |||

Thereafter | 11,499 | |||

|

| |||

| $ | 25,548 | |||

|

|

6. Stockholders’ Equity

Share-Based Compensation

We issue stock-based awards to our employees in the form of stock options and restricted stock units. We also have an employee stock purchase plan. The following table summarizes the components of share-based compensation expense included in our condensed consolidated statements of operations for the three- and six-month periods ended June 30:

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

Cost of services | $ | 206 | $ | 182 | $ | 412 | $ | 251 | ||||||||

Sales and marketing | 386 | 283 | 719 | 413 | ||||||||||||

Technology and development | 824 | 490 | 1,339 | 710 | ||||||||||||

General and administrative | 2,121 | 604 | 3,791 | 989 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total cost related to share-based compensation expense | $ | 3,537 | $ | 1,559 | $ | 6,261 | $ | 2,363 | ||||||||

|

|

|

|

|

|

|

| |||||||||

Unrecognized share-based compensation expenses totaled $40,464 as of June 30, 2013, which we expect to recognize over a weighted-average time period of 3.3 years.

Stock Warrants

As of June 30, 2013, we had the following warrants to purchase common stock outstanding:

| Exercise | ||||||||

Expiration Date | Shares | Price | ||||||

October 3, 2014 | 2,334,044 | $ | 0.70 | |||||

December 19, 2014 | 166,666 | 4.50 | ||||||

6

Table of Contents

7. Fair Value Measurements

As of June 30, 2013 and December 31, 2012, the fair value of our financial assets and liabilities was as follows:

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

June 30, 2013 | ||||||||||||||||

Assets | ||||||||||||||||

Commercial paper | $ | — | $ | 45,063 | $ | — | $ | 45,063 | ||||||||

|

|

|

|

|

|

|

| |||||||||

Total assets | $ | — | $ | 45,063 | $ | — | $ | 45,063 | ||||||||

|

|

|

|

|

|

|

| |||||||||

December 31, 2012 | ||||||||||||||||

Assets | ||||||||||||||||

Commercial paper | $ | — | $ | 35,023 | $ | — | $ | 35,023 | ||||||||

|

|

|

|

|

|

|

| |||||||||

Total assets | $ | — | $ | 35,023 | $ | — | $ | 35,023 | ||||||||

|

|

|

|

|

|

|

| |||||||||

Commercial paper, classified as cash and cash equivalents, represent investments in open commercial paper.

8. Net Income (Loss) Per Share

The following table sets forth the computation of basic and diluted net income available (loss attributable) per share to common stockholders for the three- and six-month periods ended June 30:

| Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

Net income (loss) | $ | (2,065 | ) | $ | (6,898 | ) | $ | (6,182 | ) | $ | 11,555 | |||||

Less: | ||||||||||||||||

Accretion of convertible redeemable preferred stock redemption premium | — | (4,018 | ) | — | (4,752 | ) | ||||||||||

Net income allocable to convertible redeemable preferred stockholders | — | — | — | (4,517 | ) | |||||||||||

|

|

|

|

|

|

|

| |||||||||

Net income available (loss attributable) to common stockholders | (2,065 | ) | (10,916 | ) | (6,182 | ) | 2,286 | |||||||||

Less: | ||||||||||||||||

Accretion of convertible redeemable preferred stock redemption premium for shares assumed issued in exercise of warrants | — | (630 | ) | — | (749 | ) | ||||||||||

Add back: | ||||||||||||||||

Net income allocable to convertible redeemable preferred stockholders | — | — | — | 3,443 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Diluted net income available (loss attributable) to common stockholders | $ | (2,065 | ) | $ | (11,546 | ) | $ | (6,182 | ) | $ | 4,980 | |||||

|

|

|

|

|

|

|

| |||||||||

Denominator (basic): | ||||||||||||||||

Weighted average common shares outstanding | 87,532,810 | 19,476,042 | 87,088,642 | 19,453,077 | ||||||||||||

Denominator (diluted): | ||||||||||||||||

Weighted average common shares outstanding | 87,532,810 | 19,476,042 | 87,088,642 | 19,453,077 | ||||||||||||

Dilutive stock options and awards outstanding | — | — | — | 3,350,442 | ||||||||||||

Weighted average common shares from preferred stock | — | — | — | 29,239,607 | ||||||||||||

Weighted average common shares from warrants | — | — | — | 169,165 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Net weighted average common shares outstanding | 87,532,810 | 19,476,042 | 87,088,642 | 52,212,291 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Net income available (loss attributable) per share to common stockholders: | ||||||||||||||||

Basic | $ | (0.02 | ) | $ | (0.56 | ) | $ | (0.07 | ) | $ | 0.12 | |||||

Diluted | $ | (0.02 | ) | $ | (0.59 | ) | $ | (0.07 | ) | $ | 0.10 | |||||

For the three- and six-month periods ended June 30, 2013 and 2012, potentially dilutive securities are not included in the calculation of diluted net income available (loss attributable) per share as their impact would be anti-dilutive. The following weighted-average

7

Table of Contents

number of outstanding stock options, warrants to purchase common and preferred stock, and convertible redeemable preferred stock were excluded from the computation of diluted net income available (loss attributable) per share for the three- and six-month periods ended June 30:

| Three Months Ended | Six Months Ended | |||||||||||||||

| June 30, | June 30, | |||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

Common equivalent shares from convertible preferred stock | — | 44,598,344 | — | 15,358,737 | ||||||||||||

Common equivalent shares from stock options | 5,078,661 | 3,506,603 | 5,341,368 | — | ||||||||||||

Common equivalent shares from stock warrants | 2,262,543 | 6,170,693 | 2,292,039 | 5,848,213 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

| 7,341,204 | 54,275,640 | 7,633,407 | 21,206,950 | |||||||||||||

|

|

|

|

|

|

|

| |||||||||

9. Segment Reporting

Following our acquisition of ID Analytics on March 14, 2012, we began operating our business and reviewing and assessing our operating performance using two reportable segments: our consumer segment and our enterprise segment. In our consumer segment, we offer proactive identity theft protection services to our members on an annual or monthly subscription basis. In our enterprise segment, we offer identity risk assessment and fraud protection services to our enterprise customers.

Financial information about our segments during the three-month period ended June 30, 2013 and as of June 30, 2013 was as follows:

| Consumer | Enterprise | Eliminations | Total | |||||||||||||

Revenue | ||||||||||||||||

External customers | $ | 82,574 | $ | 6,946 | $ | — | $ | 89,520 | ||||||||

Intersegment revenue | — | 1,307 | (1,307 | ) | — | |||||||||||

Income (loss) from operations | 762 | (2,953 | ) | — | (2,191 | ) | ||||||||||

Goodwill | 69,891 | 59,537 | — | 129,428 | ||||||||||||

Total assets | 252,387 | 124,486 | (441 | ) | 376,432 | |||||||||||

Loss from operations in our enterprise segment for the three-month period ended June 30, 2013 includes amortization of acquired intangibles of $1,966.

Financial information about our segments during the six-month period ended June 30, 2013 was as follows:

| Consumer | Enterprise | Eliminations | Total | |||||||||||||

Revenue | ||||||||||||||||

External customers | $ | 157,667 | $ | 13,947 | $ | — | $ | 171,614 | ||||||||

Intersegment revenue | — | 2,544 | (2,544 | ) | — | |||||||||||

Income (loss) from operations | 129 | (6,236 | ) | — | (6,107 | ) | ||||||||||

Loss from operations in our enterprise segment for the six-month period ended June 30, 2013 includes amortization of acquired intangibles of $3,932.

Financial information about our segments during the three-month period ended June 30, 2012 and as of December 31, 2012 was as follows:

| Consumer | Enterprise | Eliminations | Total | |||||||||||||

Revenue | ||||||||||||||||

External customers | $ | 61,616 | $ | 6,267 | $ | — | $ | 67,883 | ||||||||

Intersegment revenue | — | 1,010 | (1,010 | ) | — | |||||||||||

Income (loss) from operations | 3,226 | (1,847 | ) | — | 1,379 | |||||||||||

Goodwill | 69,891 | 59,537 | — | 129,428 | ||||||||||||

Total assets | 213,564 | 129,245 | (3,221 | ) | 339,588 | |||||||||||

Loss from operations in our enterprise segment for the three-month period ended June 30, 2012 includes amortization of acquired intangibles of $1,966.

8

Table of Contents

Financial information about our segments during the six-month period ended June 30, 2012 was as follows:

| Consumer | Enterprise | Eliminations | Total | |||||||||||||

Revenue | ||||||||||||||||

External customers | $ | 118,324 | $ | 7,171 | $ | — | $ | 125,495 | ||||||||

Intersegment revenue | — | 1,205 | (1,205 | ) | — | |||||||||||

Income (loss) from operations | 3,596 | (2,426 | ) | — | 1,170 | |||||||||||

Loss from operations in our enterprise segment for the six-month period ended June 30, 2012 includes amortization of acquired intangibles of $2,325.

All of our revenue is derived from sales in the United States and all our long-lived assets are located in the United States.

10. Income Taxes

Income taxes for the interim periods presented have been included in the accompanying condensed consolidated financial statements on the basis of an estimated annual effective tax rate. Based on an estimated annual effective tax rate and discrete items, the estimated income tax benefit from operations for the three- and six-month periods ended June 30, 2013 was $179 and $29, respectively. We recognized an income tax benefit of $13,897 for the six-month period ended June 30, 2012, primarily due to a benefit of $14,310 resulting from the release of our valuation allowance on the acquisition of ID Analytics.

11. Contingencies

As part of our consumer services, we offer 24x7x365 member service support. If a member’s identity has been compromised, our member service team and remediation specialists will assist the member until the issue has been resolved. This includes our $1 million service guarantee, which is backed by an identity theft insurance policy, under which we will cover certain third-party costs and expenses incurred in connection with the remediation, such as legal and investigatory fees. This insurance also covers certain out-of-pocket expenses, such as loss of income, replacement of fraudulent withdrawals, child and elderly care, travel expenses, and replacement of documents. While we have reimbursed members for claims under this guarantee, the amounts in aggregate for the three- and six-month periods ended June 30, 2013 and 2012 were not material.

In January 2010, Neal Duncan, one of our stockholders, filed a breach of contract claim against us in the Superior Court of Maricopa County, Arizona. In his complaint, Mr. Duncan alleged that we breached a purported contract with him and sought an ownership interest in our company equal to 7.5%. The parties participated in a private mediation on December 21, 2011, but the dispute was not resolved. We filed motions for summary judgment on November 2, 2011 and January 12, 2012. Oral argument was heard on our motions for summary judgment on April 4, 2012. Immediately following oral argument, the presiding judge ruled from the bench in our favor and granted both motions for summary judgment. We filed an application for an award of fees and costs on April 20, 2012. On June 5, 2012, the judge once again ruled in our favor and awarded fees and costs in excess of $250. On July 2, 2012, Mr. Duncan filed a notice of appeal. On September 30, 2012, we received Mr. Duncan’s opening brief. We filed our response brief on November 13, 2012. Mr. Duncan filed his reply brief on December 10, 2012. The Arizona Court of Appeals issued a Memorandum Decision on July 2, 2013, in our favor, affirming the Superior Court’s grant of summary judgment and its award of attorneys’ fees and costs. Mr. Duncan had the option of filing a motion for reconsideration or submitting a Petition for Review to the Arizona Supreme Court. His deadline for filing a motion for reconsideration was July 17, 2013. That deadline passed. However, Mr. Duncan filed a Petition for Review on July 31, 2013. The Company is not required to respond to Mr. Duncan’s Petition until and unless the Arizona Supreme Court issues an order requesting a response.

Because Mr. Duncan did not post the required supersedeas bond at the start of his appeal, we brought garnishment proceedings in Maricopa County Superior Court to recover stock previously issued to him. On July 23, 2013, the Superior Court Commissioner signed the formal written Judgment on the Writ of Garnishment and Order of Sale allowing us to recover all shares of stock presently held in Mr. Duncan’s name.

On September 25, 2012, Denise Richardson filed a complaint against our company and Todd Davis, our Chairman and Chief Executive Officer, in the United States District Court for the Southern District of Florida. Ms. Richardson performed services for us as an independent contractor under a series of Independent Contractor Services Agreements, the most recent of which expired on December 31, 2011. The gravamen of Ms. Richardson’s claims is that (1) Ms. Richardson was improperly classified as an independent contractor instead of an employee and (2) we breached the terms of an alleged employment agreement and were obligated to Ms. Richardson under that agreement until June 30, 2013. Ms. Richardson asserts claims against us in the complaint for alleged violation of ERISA fiduciary duties, unlawful interference with attainment of ERISA benefits, ERISA retaliation, unlawful misclassification and denial of ERISA benefits, retroactive benefits under ERISA plans, failure to pay overtime in violation of the Fair Labor Standards Act (“FLSA”), breach of employment contract, unjust enrichment, fraud and punitive damages, and intentional infliction of emotional distress. In the complaint, Ms. Richardson alleges entitlement to equitable relief, compensatory damages, liquidated damages, statutory penalties, punitive damages, interest, costs, and attorneys’ fees. On October 15, 2012, Ms. Richardson filed an amended

9

Table of Contents

complaint that did not include any substantive changes to her claims. On November 1, 2012, we filed a motion to dismiss Ms. Richardson’s amended complaint or, in the alternative, to transfer venue — challenging on a variety of grounds all of the claims asserted against us in the amended complaint. In addition, on January 16, 2013, Todd Davis filed a motion to dismiss Ms. Richardson’s amended complaint or, in the alternative, to transfer venue, directed to the single count of the amended complaint asserted against Mr. Davis and that joined our motion in several applicable respects and made additional arguments regarding Ms. Richardson’s claim against Mr. Davis. Ms. Richardson responded to that motion on January 30, 2013 and Mr. Davis filed a reply brief on February 11, 2013. On January 23, 2013, pursuant to an order of the court, Ms. Richardson filed a statement of her alleged FLSA claim in which she summarized the FLSA damages to which she claims to be entitled and asserted that those damages amount to at least $179. On April 9, 2013, the Florida district court entered an order transferring Ms. Richardson’s case, in its entirety, to the United States District Court for the District of Arizona, as we and Mr. Davis sought. To date, no substantive proceedings have occurred in the matter following the transfer. On May 20, 2013, both we and Mr. Davis filed a renewed motion to dismiss that, following the transfer of the case, brought before the Arizona district court the issues raised in our and Mr. Davis’ motions to dismiss. Ms. Richardson responded to that motion on June 25, 2013 and we and Mr. Davis filed a reply brief on July 12, 2013. That motion now is fully briefed and the parties are awaiting the court’s decision.

We are subject to other legal proceedings and claims that have arisen in the ordinary course of business. Although there can be no assurance as to the ultimate disposition of these matters and the proceedings disclosed above, we believe, based upon the information available at this time, that a material adverse outcome related to the matters is neither probable nor estimable.

12. Subsequent Events

Subsequent to June 30, 2013, a letter of credit in the amount of $1,200 was released by the counterparty in connection with the execution of the Second Amendment to the Office Lease as described in Note 5.

10

Table of Contents

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

You should read the following discussion of our financial condition and results of operations in conjunction with the condensed consolidated financial statements and the notes thereto included elsewhere in this Quarterly Report on Form 10-Q and with our audited consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2012. This Quarterly Report on Form 10-Q contains “forward-looking statements” that involve substantial risks and uncertainties. The statements contained in this Quarterly Report on Form 10-Q that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including, but not limited to, statements regarding our expectations, beliefs, intentions, strategies, future operations, future financial position, future revenue, projected expenses, and plans and objectives of management. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “project,” “will,” “would,” “should,” “could,” “can,” “predict,” “potential,” “continue,” “objective,” or the negative of these terms, and similar expressions intended to identify forward-looking statements. However, not all forward-looking statements contain these identifying words. These forward-looking statements reflect our current views about future events and involve known risks, uncertainties, and other factors that may cause our actual results, levels of activity, performance, or achievement to be materially different from those expressed or implied by the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those identified below, and those discussed in the section titled “Risk Factors” included in this Quarterly Report on Form 10-Q and our Annual Report on Form 10-K for the fiscal year ended December 31, 2012. Furthermore, such forward-looking statements speak only as of the date of this report. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements.

Overview

We are a leading provider of proactive identity theft protection services for consumers and identity risk assessment and fraud protection services for enterprises. We protect our members by constantly monitoring identity-related events, such as new account openings and credit-related applications. If we detect that a member’s personally identifiable information is being used, we offer notifications and alerts, including proactive, near real-time, actionable alerts, that provide our members peace of mind that we are monitoring use of their identity and allow our members to confirm valid or unauthorized identity use. If a member confirms that the use of his or her identity is unauthorized, we can proactively take actions designed to protect the member’s identity. We also provide remediation services to our members in the event that an identity theft actually occurs. We protect our enterprise customers by delivering on-demand identity risk and authentication information about consumers. Our enterprise customers utilize this information in real time to make decisions about opening or modifying accounts and providing products, services, or credit to consumers to reduce financial losses from identity fraud.

The foundation of our differentiated services is the LifeLock ecosystem. This ecosystem combines large data repositories of personally identifiable information and consumer transactions, proprietary predictive analytics, and a highly scalable technology platform. Our members and enterprise customers enhance our ecosystem by continually contributing to the identity and transaction data in our repositories. We apply predictive analytics to the data in our repositories to provide our members and enterprise customers actionable intelligence that helps protect against identity theft and identity fraud. As a result of our combination of scale, reach, and technology, we believe that we have the most proactive and comprehensive identity theft protection services available, as well as the most recognized brand in the identity theft protection services industry.

On March 14, 2012, we acquired ID Analytics, a provider of enterprise identity risk assessment and fraud protection services and a strategic technology partner of ours since 2009, for a total purchase price of $186.0 million. Our acquisition of ID Analytics marked our entry into the enterprise market and enhanced the LifeLock ecosystem by expanding our data repositories and providing direct ownership of certain intellectual property related to our services. We began recognizing revenue from our enterprise customers immediately following the closing of our acquisition of ID Analytics on March 14, 2012.

We derive the substantial majority of our revenue from member subscription fees. We also derive revenue from transaction fees from our enterprise customers.

We offer our consumer identity theft protection services on a monthly or annual, automatically renewing subscription basis. As of June 30, 2013, approximately 60% of our members subscribed to our consumer services on an annual basis. We currently offer our consumer services under our basic LifeLock, LifeLock Command Center, and premium LifeLock Ultimate services, with retail list prices of $10, $15, and $25 per month and $110, $165, and $275 per year, respectively. We recently released our LifeLock Junior service, which monitors personal information with proactive protection features designed specifically for children, with a retail list price of $6 per month and $65 per year. Our average revenue per member is lower than our retail list prices due to wholesale or bulk pricing that we offer to strategic partners in our embedded product, employee benefits, and breach distribution channels to drive our membership growth. In our embedded product channel, our strategic partners embed our consumer services into their products and services and pay us on behalf of their customers; in our employee benefit channel, our strategic partners offer our consumer services as a voluntary benefit as part of their employee benefit enrollment process; and in our breach channel, enterprises that have experienced a data breach pay us a fee to provide

11

Table of Contents

our services to the victims of the data breach. We also offer special discounts and promotions from time to time to incentivize prospective members to enroll in one of our consumer services. Our members pay us the full subscription fee at the beginning of each subscription period, in most cases by authorizing us to directly charge their credit or debit cards. We initially record the subscription fee as deferred revenue and then recognize it ratably on a daily basis over the subscription period. The prepaid subscription fees enhance our visibility of revenue and allow us to collect cash prior to paying our fulfillment partners.

Our enterprise customers pay us based on their monthly volume of transactions with us, with approximately half of them committed to monthly transaction minimums. We recognize revenue at the end of each month based on transaction volume for that month and bill our enterprise customers at the conclusion of each month.

We have historically invested aggressively in new member acquisition and expect to continue to do so for the foreseeable future. Our largest operating expense is advertising for member acquisition, which we record as a sales and marketing expense. This is comprised of radio, television, and print advertisements; direct mail campaigns; online display advertising; paid search and search-engine optimization; third-party endorsements; and education programs. We also pay internal and external sale commissions, which we record as a sales and marketing expense.

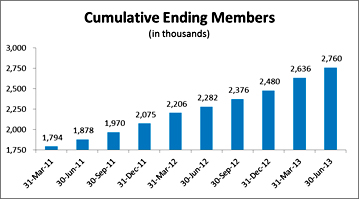

Since our founding in April 2005, we have experienced 33 consecutive quarters of sequential growth in both total revenue and cumulative ending members primarily due to the success of our marketing efforts, the introduction of premium services, and our strong member retention rate. In general, increases in revenue and cumulative ending members occur during and after periods of significant and effective direct retail marketing efforts.

For the three-month period ended June 30, 2013, we recorded revenue of $89.5 million, an increase of 32% from the three-month period ended June 30, 2012. Revenue in our consumer segment was $82.6 million for the three-month period ended June 30, 2013, a 34% increase from $61.6 million for the three-month period ended June 30, 2012. We generated a net loss from operations of $2.2 million and a net loss of $2.1 million for the three-month period ended June 30, 2013. For the six-month period ended June 30, 2013, we recorded revenue of $171.6 million, an increase of 37% from the six-month period ended June 30, 2012, which only included enterprise revenue subsequent to our acquisition of ID Analytics. Revenue in our consumer segment was $157.7 million for the six-month period ended June 30, 2013, a 33% increase from $118.3 million for the six-month period ended June 30, 2012. We generated a net loss from operations of $6.1 million and a net loss of $6.2 million for the six-month period ended June 30, 2013.

Our Business Model

In our consumer business, we evaluate the lifetime value of a member relationship over its anticipated lifecycle. While we generally incur member acquisition costs in advance of or at the time of the acquisition of the member, we recognize revenue ratably over the subscription period. As a result, a member relationship is not profitable at the beginning of the subscription period even though it is likely to have value to us over the lifetime of the member relationship.

When a member’s subscription automatically renews in each successive period, the relative value of that member increases because we do not incur significant incremental acquisition costs. We also benefit from decreasing fulfillment and member support costs related to that member, as well as economies of scale in our capital and operating and other support expenditures.

In our enterprise business, the majority of our costs relate to personnel primarily responsible for data analytics, data management, software development, sales and operations, and various support functions. We incur minimal third-party data expenses, as our enterprise customers typically provide us with their customer transaction data as part of our service. New customer acquisition is often a lengthy process requiring significant investment in the sales team, including costs related to detailed retrospective data analysis to demonstrate the return on investment to prospective customers had our services been deployed over a specific period of time. Since most of the expenses in our enterprise business are fixed in nature, as we add new enterprise customers, there are typically modest incremental costs resulting in additional economies of scale.

Key Metrics

We regularly review a number of operating and financial metrics to evaluate our business, determine the allocation of our resources, measure the effectiveness of our sales and marketing efforts, make corporate strategy decisions, and assess operational efficiencies.

12

Table of Contents

Key Operating Metrics

The following table summarizes our key operating metrics for the three- and six-month periods ended June 30:

| Three Months | Six Months | |||||||||||||||

| Ended June 30, | Ended June 30, | |||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| (in thousands, except percentages and per member data) | ||||||||||||||||

| (Unaudited) | ||||||||||||||||

Cumulative ending members | 2,760 | 2,282 | 2,760 | 2,282 | ||||||||||||

Gross new members | 230 | 169 | 480 | 377 | ||||||||||||

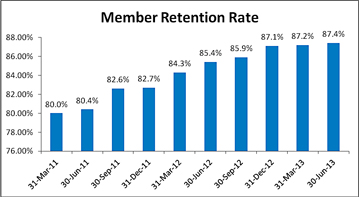

Member retention rate | 87.4 | % | 85.4 | % | 87.4 | % | 85.4 | % | ||||||||

Average cost of acquisition per member | $ | 175 | $ | 172 | $ | 165 | $ | 157 | ||||||||

Monthly average revenue per member | $ | 10.18 | $ | 9.14 | $ | 10.00 | $ | 9.00 | ||||||||

Enterprise transactions | 48,325 | 55,710 | 106,808 | 105,479 | ||||||||||||

Cumulative ending members.We calculate cumulative ending members as the total number of members at the end of the relevant period. Most of our members are paying subscribers who have enrolled in our consumer services directly with us on a monthly or annual basis. A small percentage of our members receive our consumer services through third-party enterprises that pay us directly, often as a result of a breach within the enterprise or by embedding our service within a broader third-party offering. We monitor cumulative ending members because it provides an indication of the revenue and expenses that we expect to recognize in the future.

As of June 30, 2013, we had approximately 2.8 million cumulative ending members, an increase of 21% from June 30, 2012. This increase was driven by several factors, including the success of our marketing campaigns, increased awareness of breaches, media coverage of identity theft, and our continued retention improvements.

Gross new members.We calculate gross new members as the total number of new members who enroll in one of our consumer services during the relevant period. Many factors may affect the volume of gross new members in each period, including the effectiveness of our marketing campaigns, the timing of our marketing programs, the effectiveness of our strategic partnerships, and the general level of identity theft coverage in the media. We monitor gross new members because it provides an indication of the revenue and expenses that we expect to recognize in the future. For the three-month period ended June 30, 2013, we enrolled 230,000 gross new members, up from 169,000 for the three-month period ended June 30, 2012. For the six-month period ended June 30, 2013, we enrolled 480,000 gross new members, up from 377,000 for the six-month period ended June 30, 2012. This increase was driven by the success of our marketing campaigns, the continued success of our LifeLock Ultimate service, which accounted for more than 40% our gross new members during the three- and six-month periods ended June 30, 2013, and increased awareness of breaches and identity theft.

Member retention rate.We define member retention rate as the percentage of members on the last day of the prior year who remain members on the last day of the current year, or for quarterly presentations, the percentage of members on the last day of the comparable quarterly period in the prior year who remain members on the last day of the current quarterly period. A number of factors may increase our member retention rate, including increases in the number of members enrolled on an annual subscription, increases in the number of alerts a member receives, increases in the number of members enrolled in our premium services, and increases in the number of members enrolled through strategic partners with which the member has a strong association. Conversely, factors reducing our member retention rate may include increases in the number of members enrolled on a monthly subscription, increases in the number of members enrolled in our basic LifeLock service, and the end of programs in our embedded product and breach channels. We monitor our member retention rate because it provides a measure of member satisfaction and the revenue that we expect to recognize in the future.

13

Table of Contents

As of June 30, 2013, our member retention rate was 87.4%, an increase of 2.0% points from June 30, 2012. This continued improvement was due to a variety of factors, including consumer awareness, media coverage of identity theft, and our focus on customer service and operational efficiencies.

Average cost of acquisition per member.We calculate average cost of acquisition per member as our sales and marketing expense for our consumer segment during the relevant period divided by our gross new members for the period. A number of factors may influence this metric, including shifts in the mix of our media spend. For example, when we engage in marketing efforts to build our brand, our cost of acquisition per member increases in the short term with the expectation that it will decrease over the long term. In addition, when we introduce new partnerships in our embedded product channel, such as when we launched our partnership with AOL in the fourth quarter of 2011, our average cost of acquisition per member decreases due to the volume of members that enroll in our consumer services in a relatively short period of time. We monitor average cost of acquisition per member to evaluate the efficiency of our marketing programs in acquiring new members. For the three-month period ended June 30, 2013, our average cost of acquisition per member was $175, up from $172 for the three-month period ended June 30, 2012. For the six-month period ended June 30, 2013, our average cost of acquisition per member was $165, up from $157 for the six-month period ended June 30, 2012. Although our average cost of acquisition per member increased period-over-period, the continued improvements in our member retention rate and the increasing monthly average revenue per member, primarily from the continued penetration of our LifeLock Ultimate service, results in a higher lifetime value of a member relationship which enables us to absorb a higher average cost of acquisition per member.

Monthly average revenue per member.We calculate monthly average revenue per member as our consumer revenue during the relevant period divided by the average number of cumulative ending members during the relevant period (determined by taking the average of the cumulative ending members at the beginning of the relevant period and the cumulative ending members at the end of each month in the relevant period), divided by the number of months in the relevant period. A number of factors may influence this metric, including whether a member enrolls in one of our premium services; whether we offer the member any promotional discounts upon enrollment; the distribution channel through which we acquire the member, as we offer wholesale pricing in our embedded product, employee benefit, and breach channels; and whether a new member subscribes on a monthly or annual basis, as members enrolling on an annual subscription receive a discount for paying for a year in advance. While our retail list prices have historically remained unchanged, our average revenue per member increased approximately 11% in the three- and six-month periods ended June 30, 2013 from the three- and six-month periods ended June 30, 2012. We monitor monthly average revenue per member because it is a strong indicator of revenue in our consumer business and of the performance of our premium services. The increase in our monthly average revenue per member resulted primarily from the continued success of our LifeLock Ultimate service, which accounted for more than 40% of our gross new members for the three- and six-month periods ended June 30, 2013.

Our monthly average revenue per member for the three-month period ended June 30, 2013 was $10.18, an increase of 11% from the three-month period ended June 30, 2012. Our monthly average revenue per member for the six-month period ended June 30, 2013 was $10.00, an increase of 11% from the six-month period ended June 30, 2012.

14

Table of Contents

Enterprise transactions.We calculate enterprise transactions as the total number of enterprise transactions processed for either an identity risk or credit risk score during the relevant period. Our enterprise transactions are processed by ID Analytics, which we acquired on March 14, 2012. Accordingly, the enterprise transactions data for 2012 includes transactions processed by ID Analytics before the acquisition. Enterprise transactions have historically been higher in the fourth quarter as the level of credit applications and general consumer spending increases. We monitor the volume of enterprise transactions because it is a strong indicator of revenue in our enterprise business.

We processed 48.3 million enterprise transactions for the three-month period ended June 30, 2013, a decrease of 13% from the three-month period ended June 30, 2012. The decrease was primarily driven by a large telecommunications customer who had previously obtained scores for all their incoming subscribers through all channels such as wireless, landline, and bundled internet services. After process and technical modifications were made, the customer made the decision to stop obtaining scores for in-home service customers due to the fraud risk associated with these segments being lower than the wireless segment. Going forward, this customer will now only be obtaining scores for customers coming in from the mobile portion of their business where the fraud risk is much higher. Due to the low per transaction price for this customer, this change had an immaterial impact to our enterprise revenue for the quarter. We do not expect to experience a similar decrease with other existing telecommunication customers. In addition, we have seen a reduction in enterprise transactions as we gave notice of non-renewal to several customers in our consumer segment and we have allowed such contracts to lapse as a result. We expect the transaction volume to decrease as these enterprise customers churn over time. We do not expect this to have a material impact on our total revenue. We processed 106.8 million enterprise transactions for the six-month period ended June 30, 2013, an increase of 1% from the six-month period ended June 30, 2012.

Key Financial Metrics

The following table summarizes our key financial metrics for the three- and six-month periods ended June 30:

| Three Months | Six Months | |||||||||||||||

| Ended June 30, | Ended June 30, | |||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| (in thousands) | ||||||||||||||||

Consumer revenue | $ | 82,574 | $ | 61,616 | $ | 157,667 | $ | 118,324 | ||||||||

Enterprise revenue | 6,946 | 6,267 | 13,947 | 7,171 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total revenue | $ | 89,520 | $ | 67,883 | $ | 171,614 | $ | 125,495 | ||||||||

Adjusted net income | $ | 3,438 | $ | 3,749 | $ | 4,011 | $ | 4,160 | ||||||||

Adjusted EBITDA | $ | 4,635 | $ | 6,067 | $ | 6,514 | $ | 7,936 | ||||||||

Free cash flow | $ | 18,424 | $ | 11,552 | $ | 29,934 | $ | 21,019 | ||||||||

Adjusted Net Income

Adjusted net income is a non-GAAP financial measure that we calculate as net income (loss) excluding amortization of acquired intangible assets, change in fair value of warrant liabilities, change in fair value of embedded derivatives, share-based compensation, and income tax benefits resulting from the acquisition of ID Analytics. We have included adjusted net income in this Quarterly Report on Form 10-Q because it is a key measure used by us to understand and evaluate our core operating performance and trends. In particular, the exclusion of certain expenses in calculating adjusted net income can provide a useful measure for period-to-period comparisons of our core business.

Accordingly, we believe that adjusted net income provides useful information to investors and others in understanding and evaluating our operating results in the same manner as we do. We believe that it is useful to exclude amortization of acquired intangible assets, change in fair value of warrant liabilities, change in fair value of embedded derivatives, share-based compensation, and income tax benefits from our acquisition of ID Analytics from net income (loss) because (i) the amount of such non-cash expenses in any specific period may not directly correlate to the underlying operational performance of our business, and (ii) such expenses can vary significantly between periods as a result of new acquisitions and full amortization of previously acquired intangible assets.

Our use of adjusted net income has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our operating results as reported under GAAP. Some of these limitations include the following:

| • | although amortization of intangible assets is a non-cash charge, additional intangible assets may be acquired in the future and adjusted net income does not reflect cash capital expenditure requirements for new acquisitions; |

| • | adjusted net income does not reflect changes in, or cash requirements for, our working capital needs; |

| • | adjusted net income does not consider the potentially dilutive impact of share-based compensation; |

| • | adjusted net income does not reflect the income tax benefit from the release of the valuation allowance due to increased deferred tax liabilities resulting from our acquisition of ID Analytics; and |

15

Table of Contents

| • | other companies, including companies in our industry, may calculate adjusted net income or similarly titled measures differently, limiting their usefulness as a comparative measure. |

Because of these limitations, you should consider adjusted net income alongside other financial performance measures, including various cash flow metrics, net income (loss), and our other GAAP results. The following table presents a reconciliation of adjusted net income to net income (loss) for each of the periods indicated:

| Three Months | Six Months | |||||||||||||||

| Ended June 30, | Ended June 30, | |||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| (in thousands) | ||||||||||||||||

Reconciliation of Net Income (Loss) to Adjusted Net Income: | ||||||||||||||||

Net income (loss) | $ | (2,065 | ) | $ | (6,898 | ) | $ | (6,182 | ) | $ | 11,555 | |||||

Amortization of acquired intangible assets | 1,966 | 1,966 | 3,932 | 2,325 | ||||||||||||

Change in fair value of warrant liabilities | — | 7,836 | — | 2,941 | ||||||||||||

Change in fair value of embedded derivative | — | (714 | ) | — | (714 | ) | ||||||||||

Share-based compensation | 3,537 | 1,559 | 6,261 | 2,363 | ||||||||||||

Tax benefit from acquisition | — | — | — | (14,310 | ) | |||||||||||

|

|

|

|

|

|

|

| |||||||||

Adjusted net income | $ | 3,438 | $ | 3,749 | $ | 4,011 | $ | 4,160 | ||||||||

|

|

|

|

|

|

|

| |||||||||

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP financial measure that we calculate as net income (loss) excluding depreciation and amortization, interest expense, interest income, change in fair value of warrant liabilities, change in fair value of embedded derivatives, other income (expense) (which consists primarily of gains and losses on disposal of fixed assets), income taxes, and share-based compensation. We have included adjusted EBITDA in this Quarterly Report on Form 10-Q because it is a key measure used by us to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget, and to develop short- and long-term operational plans. In particular, the exclusion of certain expenses in calculating adjusted EBITDA can provide a useful measure for period-to-period comparisons of our core business. Additionally, adjusted EBITDA is a key financial measure used in determining management’s incentive compensation.

Accordingly, we believe that adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as we do. We believe that it is useful to exclude non-cash charges for depreciation and amortization, change in fair value of warrant liabilities, change in fair value of embedded derivatives, and share-based compensation from net income (loss) because (i) the amount of such non-cash expenses in any specific period may not directly correlate to the underlying operational performance of our business, and (ii) such expenses can vary significantly between periods as a result of new acquisitions and full amortization of previously acquired intangible assets.

Our use of adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our operating results as reported under GAAP. Some of these limitations include the following:

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; |

| • | adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; |

| • | adjusted EBITDA does not consider the potentially dilutive impact of share-based compensation; |

| • | adjusted EBITDA does not reflect cash interest income or expense; |

| • | adjusted EBITDA does not reflect tax payments that may represent a reduction in cash available to us; and |

| • | other companies, including companies in our industry, may calculate adjusted EBITDA or similarly titled measures differently, limiting their usefulness as a comparative measure. |

16

Table of Contents

Because of these limitations, you should consider adjusted EBITDA alongside other financial performance measures, including various cash flow metrics, net income (loss), and our other GAAP results. The following table presents a reconciliation of adjusted EBITDA to net income (loss) for each of the periods indicated:

| Three Months | Six Months | |||||||||||||||

| Ended June 30, | Ended June 30, | |||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| (in thousands) | ||||||||||||||||

Reconciliation of Net Income (Loss) to Adjusted EBITDA: | ||||||||||||||||

Net income (loss) | $ | (2,065 | ) | $ | (6,898 | ) | $ | (6,182 | ) | $ | 11,555 | |||||

Depreciation and amortization | 3,289 | 3,129 | 6,360 | 4,403 | ||||||||||||

Interest expense | 79 | 935 | 146 | 1,285 | ||||||||||||

Interest income | (26 | ) | (1 | ) | (46 | ) | (2 | ) | ||||||||

Change in fair value of warrant liabilities | — | 7,836 | — | 2,941 | ||||||||||||

Change in fair value of embedded derivative | — | (714 | ) | — | (714 | ) | ||||||||||

Other | — | — | 4 | 2 | ||||||||||||

Income tax expense (benefit) | (179 | ) | 221 | (29 | ) | (13,897 | ) | |||||||||

Share-based compensation | 3,537 | 1,559 | 6,261 | 2,363 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Adjusted EBITDA | $ | 4,635 | $ | 6,067 | $ | 6,514 | $ | 7,936 | ||||||||

|

|

|

|

|

|

|

| |||||||||

Free Cash Flow

Free cash flow is a non-GAAP financial measure that we calculate as net cash provided by operating activities less net cash used in investing activities for acquisitions of property and equipment. We use free cash flow as a measure of our operating performance; for planning purposes, including the preparation of our annual operating budget; to allocate resources to enhance the financial performance of our business; to evaluate the effectiveness of our business strategies; to provide consistency and comparability with past financial performance; to determine capital requirements; to facilitate a comparison of our results with those of other companies; and in communications with our board of directors concerning our financial performance.

We use free cash flow to evaluate our business because, although it is similar to net cash provided by operating activities, we believe it typically presents a more conservative measure of cash flow as purchases of property and equipment are necessary components of ongoing operations. We believe that this non-GAAP financial measure is useful in evaluating our business because free cash flow reflects the cash surplus available to fund the expansion of our business after payment of capital expenditures relating to the necessary components of ongoing operations. We also believe that the use of free cash flow provides consistency and comparability with our past financial performance, facilitates period-to-period comparisons of operations, and also facilitates comparisons with other companies, many of which use similar non-GAAP financial measures to supplement their GAAP results.

Although free cash flow is frequently used by investors in their evaluations of companies, free cash flow has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our operating results as reported under GAAP. Some of these limitations including the following:

| • | free cash flow does not reflect our future requirements for contractual commitments to third-party providers; |

| • | free cash flow does not reflect the non-cash component of employee compensation or depreciation and amortization of property and equipment; and |

| • | other companies, including companies in our industry, may calculate free cash flow or similarly titled measures differently, limiting their usefulness as comparative measures. |

Because of these limitations, you should consider free cash flow alongside other financial performance measures, including net cash provided by operating activities, net income (loss), and our other GAAP results. The following table presents a reconciliation of free cash flow to net cash provided by operating activities for each of the periods indicated:

| Three Months | Six Months | |||||||||||||||

| Ended June 30, | Ended June 30, | |||||||||||||||

| 2013 | 2012 | 2013 | 2012 | |||||||||||||

| (in thousands) | ||||||||||||||||

Reconciliation of Net Cash Provided By Operating Activities to Free Cash Flow: | ||||||||||||||||

Net cash provided by operating activities | $ | 20,791 | $ | 13,295 | $ | 33,586 | $ | 23,099 | ||||||||

Acquisitions of property and equipment | (2,367 | ) | (1,743 | ) | (3,652 | ) | (2,080 | ) | ||||||||

|

|

|

|

|

|

|

| |||||||||

Free cash flow | $ | 18,424 | $ | 11,552 | $ | 29,934 | $ | 21,019 | ||||||||

|

|

|

|

|

|

|

| |||||||||

Factors Affecting Our Performance

Customer acquisition costs.We expect to continue to make significant expenditures to grow our member and enterprise customer bases. Our average cost of acquisition per member and the number of new members we generate depends on a number of factors, including the

17

Table of Contents

effectiveness of our marketing campaigns, changes in cost of media, the competitive environment in our markets, the prevalence of identity theft issues in the media, publicity about our company, and the level of differentiation of our services. Shifts in the mix of our media spend also influence our member acquisition costs. For example, when we engage in marketing efforts to build our brand, our member acquisition costs increase in the short term with the expectation that they will decrease over the long term. We also continually test new media outlets, marketing campaigns, and call center scripting, each of which impacts our average cost of acquisition per member. In addition, given the continued success of our LifeLock Ultimate service since its launch in the fourth quarter of 2011, we expect to be able to absorb a higher average cost of acquisition per member and still recognize value over the lifetime of our member relationships.

Mix of members by services, billing cycle, and distribution channel.Our performance is affected by the mix of members subscribing to our various consumer services, by billing cycle (annual versus monthly), and by the distribution channel through which we acquire the member. Our adjusted EBITDA, adjusted net income, free cash flow, and average cost of acquisition per member are all affected by this mix. We have seen a recent shift to more monthly members, in large part due to the increase in the number of members enrolling through our embedded product channel in which our members enroll on a monthly basis. We also have seen an increase in the number of LifeLock Ultimate members as a percentage of our gross new members.

Customer retention.We have continued to improve the retention of our members and, as a result, the anticipated lifetime value of our members. Our member retention rate improved to 87.4% as of June 30, 2013 from 85.4% as of June 30, 2012. Our ability to continue to improve our member retention rate may be affected by a number of factors, including the effectiveness of our services, the performance of our member services organization, external media coverage of identity theft, the continued evolution of our service offerings, the competitive environment, the effectiveness of our media spend, and other developments.