UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________________________________________________________

FORM 10-K

________________________________________________________________________________________________________

(Mark One) | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number 001-37918

________________________________________________________________________________________________________

iRhythm Technologies, Inc.

(Exact name of Registrant as specified in its Charter)

________________________________________________________________________________________________________ | | | | | |

| Delaware | 20-8149544 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

699 8th Street, Suite 600 San Francisco, California (Address of principal executive offices) | 94103 (Zip Code) |

Registrant’s telephone number, including area code: (415) 632-5700

________________________________________________________________________________________________________

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, Par Value $.001 Per Share | IRTC | The Nasdaq Stock Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definition of “large accelerated filer”, “accelerated filer”, “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one): | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Small reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the Registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the Registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on The Nasdaq Stock Market LLC on June 30, 2024, was approximately $3.3 billion.

The number of shares of Registrant’s Common Stock outstanding as of February 13, 2025, was 31,409,617.

______________________________________________________________________

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the information called for by Part III of this Form 10-K is hereby incorporated by reference from the definitive Proxy Statement for our annual meeting of stockholders, which will be filed with the Securities and Exchange Commission not later than 120 days after December 31, 2024.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements contained in this Annual Report on Form 10-K other than statements of historical fact, including statements concerning our plans, objectives, and expectations for our business, operations, and financial performance and condition, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,” “potential,” “positioned,” “seek,” “should,” “target,” “will,” “would,” and other similar expressions that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology. These forward-looking statements include, but are not limited to, statements about:

•the expected impact of global business, political, and macroeconomic conditions, including inflation, interest rate volatility, cybersecurity events, potential instability in the global banking system, and volatile market conditions, and global events, including public health crises, and ongoing geopolitical conflicts, such as the war in Ukraine and conflict in the Middle East, on our business, operations, and financial results;

•the impact of supply chain disruptions on our operations and financial results;

•the impact of inflationary costs on our operations and financial results;

•plans to conduct further clinical studies, including any clinical trials initiated by third parties;

•our plans to modify our current systems and services, or identify and develop, or acquire, new products or services, to address additional indications;

•the expected growth of our business and our organization;

•our expectations regarding government and third-party payor coverage and reimbursement or other regulatory actions or decisions;

•our compliance with all applicable laws, rules, and regulations, including those of the U.S. Food and Drug Administration;

•our expectations regarding the size of our sales organization and expansion of our sales and marketing efforts, including in international geographies;

•our expectations regarding revenue, cost of revenue, cost of service per device, operating expenses, including research and development expense, sales and marketing expense, general and administrative expenses and gross margin;

•our ability to retain and recruit key personnel, including the continued development of a sales and marketing infrastructure;

•our ability to obtain and maintain intellectual property protection for our systems and services;

•our estimates of our expenses, ongoing losses, future revenue, capital requirements, and our needs for, or ability to obtain, additional financing;

•our financial performance; and

•developments and projections relating to our competitors or our industry.

We believe that it is important to communicate our future expectations to our investors. However, there may be events in the future that we are not able to accurately predict or control and that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. These forward-looking statements are based on management’s current expectations, estimates, forecasts, and projections about our business and the industry in which we operate and management’s beliefs and assumptions and are not guarantees of future performance or development and involve known and unknown risks, uncertainties, and other factors that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this Annual Report on Form 10-K may turn out to be inaccurate. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under “Risk Factors” and elsewhere in this Annual Report on Form 10-K. Potential investors are urged to consider these factors carefully in evaluating the forward-looking statements. These forward-looking statements speak only as of the date of this Annual Report on Form 10-K. We assume no obligation to update or revise these forward-looking statements for any reason after the date of this Annual Report on Form 10-K to conform these statements to actual results or to changes in our expectations, even if new information becomes available in the future.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur.

You should read this Annual Report on Form 10-K and the documents that we reference in this Annual Report on Form 10-K and have filed with the Securities and Exchange Commission (the “SEC”) as exhibits to the Annual Report on Form 10-K with the understanding that our actual future results, levels of activity, performance, and events and circumstances may be materially different from what we expect.

As used in this Annual Report on Form 10-K, the term “iRhythm,”, “the Company,” “we” or “us,” refers to iRhythm Technologies, Inc., a Delaware corporation, or iRhythm Technologies Inc. and its consolidated subsidiaries, as the context requires.

Summary of Risk Factors

Our business is subject to numerous risks and uncertainties, including those risks more fully described below. These risks include, among others, the following, which we consider our most material risks:

•Reimbursement by Medicare is highly regulated and subject to change, and our failure to comply with applicable regulations, including regulations not designed for remote diagnostic tests like our Zio Services, could prevent us from receiving reimbursement under the Medicare program and some commercial payors, subject us to penalties, and adversely affect our reputation, business, and results of operations.

•If reimbursement or other payment for our Zio Services is reduced or modified in the United States or in our international markets, including through cost containment measures or changes to policies with respect to coding, coverage, and pricing, our business could suffer.

•If we are unable to expand the number of third-party commercial payors with which we contract or expand coverage for existing third-party commercial payors, our commercial success could be impacted.

•Our revenue relies on our Zio Services, which are currently our only offerings. If our Zio Services or future service offerings fail to gain, or lose, market acceptance, our business will suffer.

•The market for remote cardiac monitoring solutions is highly competitive. If our competitors are able to develop or market monitoring devices and services that are more effective, or gain greater acceptance in the marketplace, than any services and related devices we develop, our commercial opportunities will be reduced or eliminated.

•Billing for our Zio Services is complex and highly regulated, and we must dedicate substantial time and resources to the billing process. Failure to comply with legal, regulatory, or contractual requirements applicable to our billing and collection activities could subject us to penalties, and adversely affect our reputation, business and results of operations.

•Audits or denials of our claims by government agencies or payors could expose us to recoupment, regulatory scrutiny, and penalties.

•Although our current Zio Systems are comprised of medical devices that have received FDA marketing authorization (510(k) clearance) as well as, with respect to certain devices, regulatory certifications in the EU, Japan, Switzerland and the UK, we may regularly engage in exploring and implementing product enhancements and in iterative changes to existing products, as well as seek to develop new technology or use of technology for new indications for use. These medical device developments may trigger further regulatory reviews and the results of those reviews are unpredictable.

•We are subject to extensive compliance requirements for the quality, design, safety, performance, and post-market surveillance of the medical devices we manufacture for use in our Zio Services, and for vigilance on complaint-handling, escalation, assessment, and reporting of adverse events and malfunctions. A wide range of quality, risk, regulatory, or safety matters could trigger enforcement action by regulatory authorities, the need for a recall, a hold on the distribution of the marketed product, or other corrective actions to marketed product, and such matters have the potential to escalate to judicial actions that involve the DOJ.

•Because of the patient populations for which our services are provided and the complexity of the healthcare environment in which we operate, a high degree of medical and clinical input may be necessary to evaluate complaints and adverse events, and in some cases, there may be disagreement over whether our services or the medical devices used in our services may have caused or contributed to an adverse event.

•International expansion of our business exposes us to market, regulatory, political, operational, financial, and economic risks associated with doing business outside of the United States.

•We may face risks associated with acquisitions of companies, products, and technologies and our business could be harmed if we are unable to address these risks.

•Our use of third-party service providers or company resources located outside the United States to support certain customer care, clinical, and other operations of our IDTFs may present challenges, and if we are ineffective in limiting work performed by these service providers or company resources consistent with applicable regulations or our contractual agreements with commercial payors, we may be subject to penalties or experience loss of revenue.

•If we fail to comply with medical device, healthcare, and other governmental regulations, we could face substantial penalties and our business, results of operations, and financial condition could be adversely affected.

•Changes in applicable laws or regulations or the interpretation or enforcement policies of regulators governing our IDTFs and Zio Services may constrain or require us to restructure our operations or adapt certain business strategies, which may harm our revenue and operating results.

•Our business relies on orders from licensed healthcare providers, and the continuing clinical acceptance and adoption of our Zio Services depends upon strong working relationships with healthcare providers, including physicians. These relationships, interactions, and arrangements are subject to a high degree of scrutiny by government regulators and enforcement bodies.

•Our communications with healthcare stakeholders – physicians and other healthcare professionals, payors, and similar entities, as well as patients and lay caregivers – are subject to a high degree of scrutiny for compliance with a wide range of laws and regulations. Continuing or increasing our sales and marketing and other external communication efforts may expose us to additional risk of being alleged or deemed to be non-compliant by regulators, enforcement authorities, or competitors.

•In the future we may identify additional material weaknesses or otherwise fail to maintain an effective system of internal controls, which may result in material misstatements of our consolidated financial statements or cause us to fail to meet our periodic reporting obligations.

•Our financial results may fluctuate significantly from quarter-to-quarter and may not fully reflect the underlying performance of our business.

•We are subject to legal proceedings and government investigations that could adversely affect our business, financial condition, and results of operations.

•We are subject to complex and evolving U.S. and foreign laws and regulations and other requirements regarding privacy, data protection, security, and other matters. Many of these laws and regulations are subject to change and uncertain interpretation, and could result in claims, changes to our business practices, monetary penalties, increased cost of operations, or declines in customer growth or engagement, or otherwise harm our business.

•If securities or industry analysts do not publish research or reports about our business, or if they issue an adverse or misleading opinion regarding our stock, our stock price and trading volume could decline.

•Our stock price is highly volatile and investing in our stock involves a high degree of risk, which could result in substantial losses for investors.

PART I

ITEM 1: BUSINESS

Company Background

iRhythm Technologies Inc.1 is a leading digital healthcare company that creates trusted solutions that detect, predict, and prevent disease. Our principal business is the design, development, and commercialization of device-based technology to provide ambulatory cardiac monitoring services that we believe allow clinicians to diagnose certain arrhythmias quicker and with greater efficiency than other services that rely on traditional technology.

Since first receiving clearance from the U.S. Food and Drug Administration (“FDA”) for our technology in 2009, we have supported physician and patient use of our technology and provided ambulatory cardiac monitoring services from our Medicare-enrolled independent diagnostic testing facilities (“IDTFs”) and with our qualified technicians. We have provided our Zio ambulatory cardiac monitoring services, including long-term continuous monitoring, short-term continuous monitoring, and mobile cardiac telemetry (“MCT”) monitoring services (collectively, the “Zio Services”), using our Zio Systems (as defined below).

Each Zio System combines an FDA-cleared and CE-marked, wire-free, patch-based, 14-day wearable biosensor that continuously records electrocardiogram (“ECG”) data with a proprietary, FDA-cleared, CE-marked cloud-based data analytic software to help physicians monitor patients and diagnose arrhythmias. Since receiving FDA clearance, we have provided the Zio Services to over eight million patients and have collected over 2 billion hours of curated heartbeat data.

The Company was incorporated in the state of Delaware in September 2006. Our principal executive offices are located at 699 8th Street, Suite 600, San Francisco, California 94103, and our telephone number is (415) 632-5700. Our common stock is listed on The Nasdaq Global Select Market under the symbol “IRTC”, and we employ approximately 2,000 regular full-time employees as of December 31, 2024.

Our website address is https://www.irhythmtech.com, and our investor relations website is located at https://investors.irhythmtech.com. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Exchange Act are available free of charge on our investor relations website as soon as reasonably practicable after we file such material with the SEC.

iRhythm investors and others should note that we announce material information to the public about our company, products, and services, and other issues through a variety of means – including via our website, our investor relations website, press releases, SEC filings, and public conference calls – to achieve broad, non-exclusionary distribution of information to the public and to comply with our disclosure obligations under Regulation FD. We encourage our investors and others to review the information we make public in these locations as such information could be deemed material. Please note that this information may be updated from time to time.

Cardiac Arrhythmias and the Ambulatory Cardiac Monitoring Market

Cardiac Arrhythmias

Every year, millions of patients experience symptoms potentially associated with cardiac arrhythmias, a condition in which the electrical impulses that coordinate heartbeats do not occur properly, causing the heart to beat too quickly, too slowly, or irregularly. There are many different types of arrhythmias which are typically categorized based on where in the heart they originate - in either the atria or ventricles - and their speed - tachycardia for fast rhythms, bradycardia for slow rhythms. The causes of arrhythmias are diverse, and they can be triggered by conditions such as heart disease, high blood pressure, electrolyte imbalances, drug use, or stress. Some arrhythmias may not show symptoms, while others may lead to dizziness, shortness of breath, fainting, or chest pain.

The most common sustained type of arrhythmia is atrial fibrillation (“Afib”), a condition which causes the upper chambers of the heart to beat irregularly and blood not to flow properly to the lower chambers of the heart. It is estimated that more than 50 million patients worldwide have Afib with at least one-third of these patients presenting as asymptomatic at the time of their diagnosis, and the condition contributes to an estimated 350,000 deaths globally each year. The prevalence of Afib in the United States is estimated to increase from approximately 5.2 million in 2010 to 12.1 million in 2030, and more than 450,000 hospitalizations occur each year in the United States because of Afib. Since Afib is more common among people over the age of 60, these numbers are expected to increase as the U.S. population ages. In Europe, the prevalence of arrhythmias is also expected to continue to rise with atrial fibrillation affecting an estimated 7.6 million people over 65 in the EU in 2016 and projections indicating a surge to 9.5% of individuals over 65 by 2060.

1 As used throughout the text of Items 1 to 7, on Form 10-K, the term “iRhythm,”, “the Company,” “we” or “us,” refers to iRhythm Technologies, Inc., a Delaware corporation, or iRhythm Technologies Inc. and its consolidated subsidiaries, as the context requires.

Atrial Fibrillation and Stroke

Early detection of heart rhythm disorders, such as Afib and other clinically relevant arrhythmias, supports appropriate medical intervention and can help avoid more serious downstream medical events, including stroke. In 2021, it was estimated that the age-adjusted US stroke death rate as an underlying cause of death was approximately 41.1 per 100,000, and there were approximately 7.4 million deaths attributable to stroke worldwide. Afib is the leading risk factor for stroke because Afib can cause blood to collect in the heart and potentially form a clot, which can then travel to the brain possibly resulting in an ischemic stroke. While individuals with Afib are approximately five times more likely to suffer a stroke, the American Stroke Association (“ASA”) estimated in 2022 that up to 80% of second clot-related strokes may be preventable. According to the AHA, stroke costs the United States an estimated $34.5 billion each year in healthcare costs and lost productivity and is a leading cause of serious long-term disability. Between 15% and 20% of people who have strokes also have Afib.

We believe early detection of Afib is critical to optimizing patient care, delivering earlier treatment to help avoid further adverse clinical events, managing symptoms caused by Afib, and reducing the total public health burden of treating stroke. The AHA and ASA have published treatment guidelines for patients diagnosed with Afib to manage heart rhythm and rate and to support stroke prevention. These early treatments include medications such as oral anticoagulants, treatment with anti-arrhythmic drugs, and interventions such as cardiac ablation therapy to help control heart rhythm and rate.

Afib burden, or the amount of time a patient spends in Afib during the period of time the patient is wearing a heart monitor, has been identified in the clinical community as a clinically relevant measure for helping to determine appropriate and effective therapeutic interventions to manage patients with Afib and for assessing stroke risk. We believe the calculated Afib burden is only as good as the data available for analysis during the monitoring period. Since the most common type of Afib occurs intermittently, we believe that long-term continuous monitoring with patch-based technology, such as with the Zio patch technology that is part of our Zio Systems, can more accurately measure Afib burden as it captures the patient’s heartbeat data is captured continuously through the wear period.

Ambulatory Cardiac Monitoring Overview

The ambulatory cardiac monitoring (“ACM”) market is well-established in the United States with an estimated 6.5 million diagnostic tests performed annually with meaningful expansion anticipated in the coming years due to an aging population, a rising number of heart-related disorders globally, and broader acceptance of innovative medical technologies. Traditional ambulatory cardiac monitoring devices used by physicians for diagnosing patients with suspected arrhythmias – such as traditional, 24-to-48-hour Holter and cardiac event monitors – are constrained by short-term monitoring times, non-continuous data collection and reporting, cumbersome equipment, and/or lower patient compliance. For example, patients often remove traditional monitors when sleeping, showering, or exercising, which can lead to a failure to capture critical data and result in incomplete diagnoses and repeat testing, which in turn can result in suboptimal patient care and higher costs to the health system.

Arrhythmia symptoms are generally monitored either in a physician’s office or healthcare facility, or with the ambulatory cardiac monitoring services. Typically, physicians will administer a resting ECG test in their offices to record and analyze the electrical impulses of patients’ hearts. If physicians determine that patients require monitoring for a longer wear period to generate a diagnosis, they have historically prescribed an ambulatory cardiac monitoring device such as a traditional Holter monitor, which is a non-invasive, battery powered device that typically records data continuously for 24 to 48 hours. For longer term (i.e., up to 30 days) event driven monitoring, physicians may prescribe ambulatory cardiac event monitoring services, including MCT services, which record ECG data upon auto-detection (i.e., asymptomatic events) and/or patient activation (i.e., symptomatic events) and may transmit such data wirelessly to a monitoring center like an IDTF. Physicians may also prescribe implantable loop recorders, which are implanted underneath the patient’s skin in a minimally invasive, hospital-based procedure and record ECG data similar to cardiac event monitors but are intended for monitoring up to 3 years.

If the diagnosis is not definitive following the first monitoring period, physicians may prescribe a repeat traditional, 24-to-48-hour Holter monitoring test or, alternatively, event monitoring services, MCT, or implantable loop recorders. Physicians use frequency and acuity of symptoms to determine which monitoring device to prescribe. Some physicians own their own ambulatory cardiac monitoring devices and provide ambulatory monitoring services directly to their patients, while others outsource these services to third-party providers, including IDTFs.

Our Products and Services

Zio Systems and Zio Services

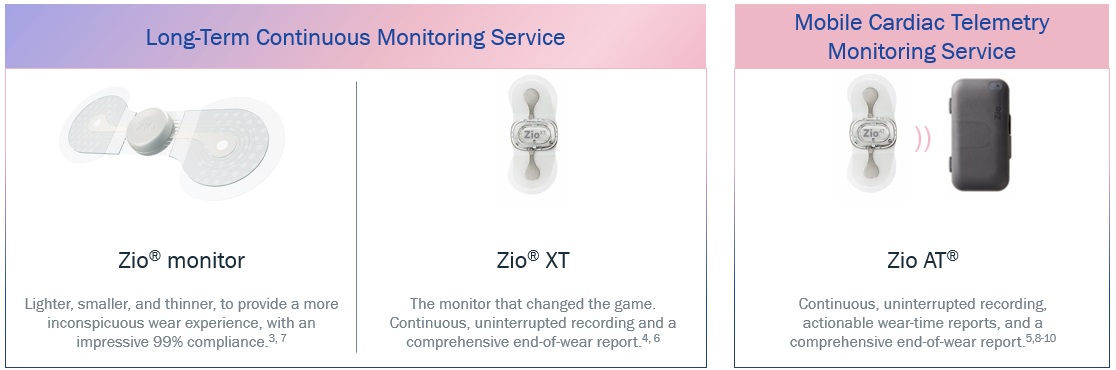

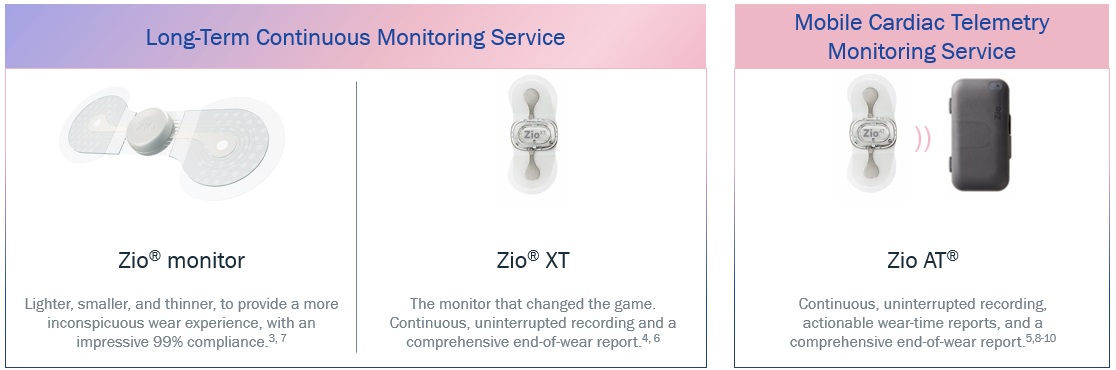

The Zio Systems and Zio Services deliver a patient-friendly design that enables between 98%-99% patient compliance with minimal ECG data noise or artifact, thereby potentially delivering superior clinical accuracy to physicians diagnosing arrhythmias and reducing the cost of care for healthcare systems by avoiding costly downstream adverse events. We have developed a proprietary system that combines an FDA-cleared and CE-marked wire-free, patch-based, 14-day wearable biosensor that continuously records ECG data, with a proprietary FDA-cleared and CE-marked cloud-based data analytic platform to help physicians monitor patients and diagnose arrhythmias (collectively, the “Zio System”). We currently offer three Zio System options — the Zio Monitor System, the Zio XT System, and the Zio AT System.

Zio ECG monitors are designed to provide high-quality, accurate data with patient compliance for up to 14 days of wear time.1-6

1. Data on file. iRhythm Technologies; 2022-2023. 2. Data on file. iRhythm Technologies; 2019. 3. Data on file. iRhythm Technologies; 2022. 4. Zio XT Clinical Reference Manual, iRhythm Technologies; 2019. 5. Zio AT Clinical Reference Manual. iRhythm Technologies; 2022. 6. Zio Monitor Instructions for Use. iRhythm Technologies, 2023. 7. Data on file. iRhythm Technologies; 2023. 8. Continuous, uninterrupted refers to the recording of ECG data. Zio AT Gateway transmissions may be impacted by a variety of factors. See Product Labeling for more information. 9. Zio AT is contraindicated for critical care patients. 10. Do not use Zio AT for patients with symptomatic episodes where variations in cardiac performance could result in immediate danger to the patient or when real-time or in-patient monitoring should be prescribed. Refer to the Zio AT labeling and Clinical Reference Manual for full contraindications.

The Zio Service Monitoring Solutions

The Zio Monitor System is a prescription-only, remote ECG monitoring system that consists of a patch ECG monitor (the “Zio Monitor patch”) that records the electric signal from the heart continuously for up to 14 days and the Zio ECG Utilization Software (“ZEUS”) System, which supports the capture and analysis of ECG data recorded by the Zio Monitor patch at the end of the wear period, including specific arrhythmia events detected by the ZEUS System. The Zio XT System is the previous generation of the Zio Monitor System and is a prescription-only, remote ECG monitoring system that consists of a patch ECG monitor (the “Zio XT patch”) that records the electric signal from the heart continuously for up to 14 days and the ZEUS System, which supports the capture and analysis of ECG data recorded by the Zio XT patch at the end of the wear period, including specific arrhythmia events detected by the ZEUS System.

The Zio Monitor patch is 72% smaller, 62% lighter, and 23% thinner than our Zio XT patch, attributes which have contributed to a positive impact on patient experience, including improved patient satisfaction, and associated improvement in device wear times. Furthermore, the Zio Monitor patch incorporates a breathable adhesive construct, which enhances the patient experience by removing moisture otherwise captured next to the patient’s skin, as well as Bluetooth communication capabilities and improved processing efficiency.

Zio Monitor Patch and Zio XT Patch

The Zio AT System is a prescription-only, remote ECG monitoring system that similarly consists of a patch ECG monitor (the “Zio AT patch”) that records the electric signal from the heart continuously for up to 14 days and the ZEUS System, but which also incorporates the Zio AT wireless gateway that provides connectivity between the Zio AT patch and the ZEUS System during the patient wear period. The wireless gateway, slightly larger than a smart phone, is provided to the patient at the time of Zio AT patch application and collects and transmits data from the Zio AT patch to the cloud via a long-term evolution (“LTE”) cellular protocol.

Zio AT Patch and Wireless Gateway

We support physician and patient use of our Zio Systems through our Medicare-enrolled IDTF and qualified technicians, who perform the technical monitoring services associated with a physician’s order for long-term continuous monitoring or MCT monitoring services. Long-term continuous monitoring services (the “Zio LTCM Service”) and MCT services (the “Zio MCT Service”) are diagnostic medical procedures typically ordered by physicians for patients not suspected of having life-threatening arrhythmias, but who are suspected of having infrequent, difficult-to-detect, or asymptomatic arrhythmias. When physicians order long-term continuous monitoring services with our Zio System, our biosensor technology collects an uninterrupted, long-term continuous recording of ECG data for up to 14 days and delivers a comprehensive end-of-wear report, which includes specific arrhythmia events detected by the ZEUS algorithm upon return of the Zio Monitor patch or Zio XT patch (and with the Zio AT patch, each, a “Zio patch”) and analysis of the stored data by qualified technicians. A Zio patch typically collects approximately 1.5 million heartbeats of data for each patient during a single wear period of up to 14 consecutive days.

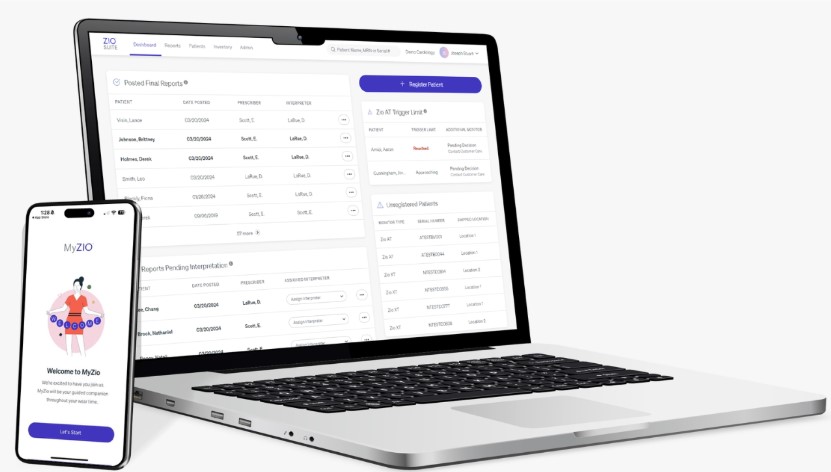

After we receive the Zio patch at our IDTF, the ECG data is uploaded to our secure cloud and preliminary findings are generated by our proprietary FDA-cleared deep learning algorithms. Each report is then validated by qualified technicians and sent to the patient’s prescribing physician who may access the Zio report on our proprietary, web-based portal, referred to as ZioSuite, and also through our Electronic Health Record (“EHR”) connections or ZioSuite mobile apps. Our technicians also notify physicians of potential urgent arrhythmias according to the ordering physician’s specified notification criteria.

ZioSuite web portal via desktop or mobile application

For the Zio MCT Services, the Zio AT patch and wireless gateway also offer the additional capability of providing actionable transmissions during the wear period to assist physicians in diagnosing and treating patients in situations where their physician has determined that there is a medical need to receive more timely, clinically actionable information. For the MCT services, physicians will receive daily reports, routine reports, and notifications from qualified technicians if there are significant events that meet predetermined and physician-specified notification criteria.

While wearing a Zio patch, patients can mark when symptoms occur by pressing a trigger button on the device and separately recording contextual data like activities and circumstances in a written symptom diary or digitally via the myZio application. This allows physicians to match symptoms and activity with ECG-based findings. The Zio patches are not available for sale outside of use with our Zio Services. The Zio patches include the following features:

•patented clear, flexible, lightweight, wire-free design;

•unobtrusive and inconspicuous profile;

•proprietary adhesive backing designed to keep the Zio patch securely in place for the duration of the prescribed wear period;

•water-resistant functionality, allowing patients to shower, sleep, and perform normal daily activities, including moderate exercise;

•hydrogel electrodes and a compliant mechanical design to deliver a clear ECG with minimal artifact from movement;

•large symptom button, or patient trigger, that is easy to find and press;

•indicated single application wear period of up to 14 days (for longer prescribed wear periods for MCT services, additional Zio AT patches and gateways can be provided); and

•sufficient battery power for the entire wear period, without the need to recharge or replace batteries.

The Zio Platform for Clinical-grade Wearables

We believe a clinical need and an opportunity exists to expand our Zio platform into clinical-grade wearables to detect and characterize arrhythmias while integrating with clinicians’ workflows. As part of this expansion strategy, we partnered with Verily Life Sciences LLC, an Alphabet Company (“VLS”) and Verity Ireland Limited (“VIL,” and together with VLS, “Verily”) to develop their Verily Study Watch wearable device into a clinical platform. We developed the Zio® Watch (Study Watch with Irregular Pulse Monitor) with our clinically integrated ZEUS System, a solution that is intended to be integrated into clinical care delivery and to assist healthcare providers in identifying and monitoring Afib.

We have what we believe to be the world’s largest repository of labelled ECG data, which we leveraged to develop our proprietary photoplethysmography (“PPG”) algorithms utilized in both the Zio Watch and the ZEUS System. In July 2022, we received FDA clearance on the clinically integrated ZEUS System, the AI algorithm and solution component of the Zio Watch. The Zio Watch has not been commercially launched. We are evaluating potential opportunities to leverage our PPG algorithms and ZEUS System with other PPG-based wearables, and we intend to further pursue development opportunities on a wearable platform in the future.

The iRhythm Difference

We believe there are strong benefits offered by our 14-day wear time, by the diagnostic yield possibly achieved through our technology, and by the clinical accuracy of our Zio report as enabled by our proprietary deep-learned artificial intelligence that can help to reduce inaccuracies in computerized ECG interpretations and improve the efficiency of expert human ECG interpretation. This is supported by more than 125 original scientific research manuscripts and a robust, growing body of clinical evidence by third-party researchers.

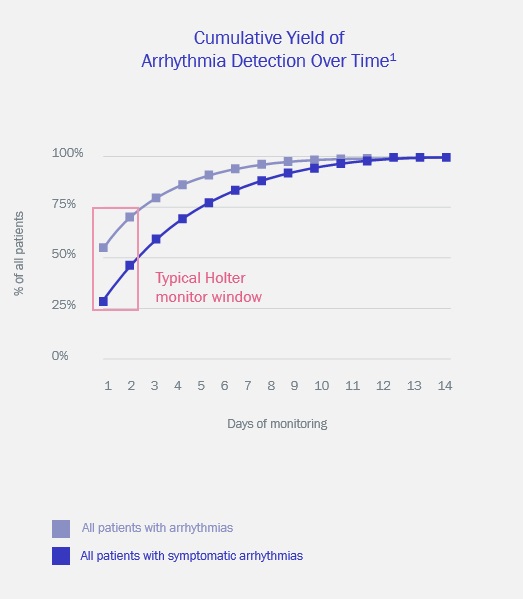

Among this compendium of clinical evidence are multiple studies which demonstrate significant increases in arrhythmia detection through a 14-day monitoring time such as with Zio LTCM Services, as compared to shorter-term 24- to 48-hour monitoring, such as performed as with standard Holter devices. Longer monitoring times with a consistent ECG signal of consistent quality permit detection of infrequent arrhythmias. Other publications illustrate high patient compliance with a 14-day prescribed wear time and low ECG signal artifact, with wear times routinely above 13 days and percent analyzable time above 95%. Additionally, data from the Zio LTCM Service has been used in development of proprietary artificial intelligence, including a deep-learned neural network model which has been shown to meet or exceed the performance of cardiologists in detection of 12 arrhythmia types. In clinical settings, we believe that this approach could reduce the number of misdiagnosed computerized ECG interpretations and improve the efficiency of expert human ECG interpretation by accurately triaging or prioritizing the most urgent conditions.

Long-term, continuous monitoring maximizes diagnostic yield1

1, Turakhia et al. Diagnostic Utility of a Novel Leadless Arrhythmia Monitoring Device. The American Journal of Cardiology, 2013.

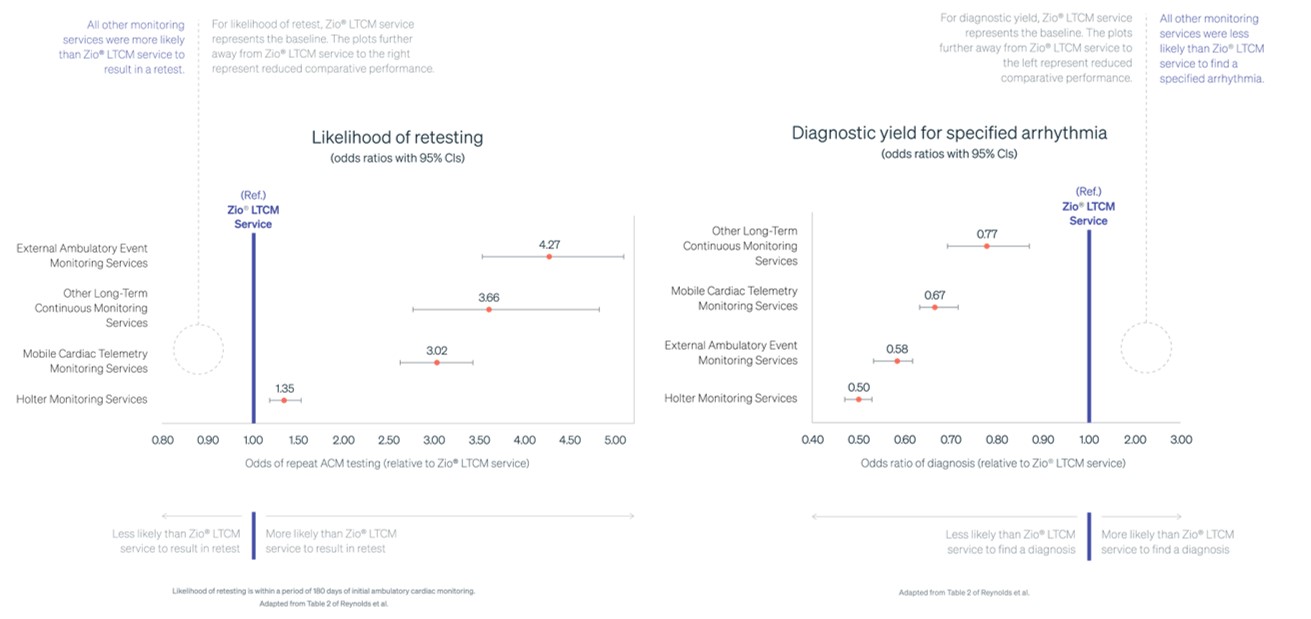

Taken together, we believe that these elements are differentiators for the Zio Systems in the diagnosis and treatment of cardiac arrhythmias and can lead to improved clinical outcomes, enhanced patient experience, high physician and healthcare staff satisfaction, and reduced cost of care to healthcare systems. This was demonstrated by the results from the Cardiac Ambulatory Monitor EvaLuation of Outcomes and Time to Events (“CAMELOT”) study that were published in the American Heart Journal in December 2023. The largest ever real-world evidence study of ambulatory cardiac monitoring, it revealed that the Zio LTCM Service using the Zio XT System was independently associated with the highest yield of clinical arrhythmia encounter diagnosis, lowest likelihood of retest, and the lowest incremental healthcare resource utilization of all strategies examined.

Results of the CAMELOT study1-4

1, Reynolds et al. Comparative effectiveness and healthcare utilization for ambulatory cardiac monitoring strategies in Medicare beneficiaries. Am Heart J. 2024;269:25–34. 2. A specified arrhythmia refers to an arrhythmia encounter diagnosis as per Hierarchical Condition Categories (HCC) 96. 3. Based on previous generation Zio XT device data. Zio Monitor utilizes the same operating principles and ECG algorithm. Additional data on file. 4. Zio LTCM service refers to Zio XT and Zio Monitor service.

Opportunities in Monitoring for Undiagnosed Arrhythmias

Currently, the Zio Services are generally ordered by physicians for patients that are experiencing symptoms, with limited provision of these services for the estimated one-third of the U.S. population that may be experiencing undiagnosed arrhythmias, including Afib. Because Afib is associated with increased risk of clinical outcomes such as stroke and heart failure, we see a future opportunity in supporting physicians in the proactive assessment of the approximately 12 million patients who are at high risk of undiagnosed Afib or other clinically actionable arrhythmias to identify those with the illness, enabling initiation of appropriate therapies which may reduce risks. To that end, iRhythm established the “Know Your Rhythm” program with the goal of enabling population health management strategies to identify undiagnosed arrhythmias in a defined patient population by using data-driven risk stratification, early disease identification, and targeted interventions.

What was initially conceived as our ‘Know Your Rhythm’ program for payor channels has been instead organically adopted by innovative, value-based care organizations to encapsulate proactive monitoring strategies. Early success of the Zio Services within this paradigm has been the culmination of several factors iRhythm has been driving over the past few years. The known increases in health care utilization and costs have been met with a focus on serving patients in lower cost settings of care. The ease of use for physicians and patients alike of our Zio Monitor System, together with iRhythm’s clinical evidence demonstrate the Zio Services' ability to identify undiagnosed arrhythmias and the cost-effectiveness of a proactive arrhythmia monitoring approach. To this end, we intend to utilize a precision artificial intelligence approach to better apply risk factor-based monitoring for atrial fibrillation and other arrhythmias in targeted patient populations — many that would not be identified with conventional criteria.

In 2024, the European Society for Cardiology updated their practice guidelines for management of Afib to include recommended screening in all patients 75 years and older and for those 65 and older with additional risk factors. We have participated in multiple clinical studies, including SCREEN-AF, GUARD-AF, and mHealth Screening to Prevent Strokes ("mSToPS") which have demonstrated significant increases in Afib detection using Zio LTCM Services versus routine clinical care. During a three-year follow-up period in the mSToPS study, Afib screening with the Zio LTCM Service was associated with a reduction in the rate of the combined endpoint of stroke, death, systemic emboli, and myocardial infarction as compared to an observational cohort that did not participate in active screening.

In patients who have suffered an ischemic stroke, identification of the underlying cause is important in prevention of recurring strokes and to improve patient outcomes. The 2024 American College of Cardiology expert consensus decision statement on arrhythmia monitoring after stroke now recommends ambulatory cardiac monitoring of 14 or more days as the primary modality for use in detection of Afib in cases of stroke of unknown origin. The Zio LTCM Service was shown to be superior to Holter monitoring for detection of Afib in post-stroke patients as part of the Early Prolonged Ambulatory Cardiac Monitoring in StrokeTrial.

Utility of Zio Long-term Continuous Monitoring in Ventricular Rhythms

Recently published literature has also demonstrated the value of 14-day long-term continuous monitoring in assessment of ventricular rhythms, including ventricular tachycardia and premature ventricular contractions (“PVC”). Hypertrophic cardiomyopathy (“HCM”) is among the most common genetic heart diseases and patients are at increased risk for ventricular tachycardia and sudden cardiac death. A 2024 study conducted by Rowin et al. assessed the incidence of ventricular tachycardia in 236 HCM patients and concluded that 14-day continuous monitoring with Zio LTCM Services identified three times as many patients with high-risk episodes as compared to Holter monitoring over 48 hours, the standard duration for Holter monitoring. Additionally, a 2024 study conducted by Krumerman et al. assessed 106,705 patients with elevated PVC burden and demonstrated reduced error in determining the burden of PVC with 14-day continuous monitoring as compared to short-term monitoring durations. This enabled improved classification of patients with respect to burden level, which is associated with increased risk for reduced ejection fraction and heart failure.

We believe that these studies together illustrate that 14-day continuous monitoring with the Zio Services may improve sensitivity for risk identification in ventricular rhythms and provides additional data valuable in clinical decision-making, such as determining the need for the implantable cardioverter defibrillator implant to reduce risk of sudden cardiac death in HCM patients, or the use of ablation procedures to reduce heart failure risks in patients with elevated PVC burden.

Our Strategy

Our mission is to boldly innovate to create trusted solutions that detect, predict, and prevent disease. The key elements of our strategy include:

•Further penetrating and expanding the U.S. ambulatory cardiac monitoring market. Our goal is to be the leading provider of ambulatory cardiac monitoring for patients at risk for arrhythmias. We intend to expand our market penetration by targeting the large existing ambulatory cardiac monitoring market in the United States and driving broader awareness of its advantages. We plan to leverage our portfolio of products, including the Zio Monitor System and Zio AT System, and position Zio Services as providing certainty in a single test due to high patient compliance and superior quality of uninterrupted data. The Zio Monitor System, which provides continuous long-term ECG monitoring, is designed to be appropriate for the majority of patients that require ambulatory cardiac monitoring while the Zio AT System, which includes near real-time monitoring, is intended for more acute patients that require timely notification. We estimate our current market penetration in the United States to be over 30%.

Marketing and education throughout the medical community are key to bringing awareness and communicating the strong clinical evidence backing Zio Services. In addition, we expect to continue developing and publishing clinical evidence to demonstrate the potential advantages of Zio Services relative to legacy and competitive monitoring technologies. Within existing accounts, we expect to continue to introduce our Zio Services beyond cardiology and electrophysiology into other departments, including primary care, neurology, and emergency room. To enable this broader adoption within a hospital system, we have successfully interfaced the Zio ordering and report posting processes into a number of large health systems’ electronic health record (“EHR”) systems. This seamless integration of Zio workflow processes has proven to be a key factor in spurring growth within existing and new accounts and is an important part of our ongoing market penetration strategy.

Furthermore, we believe there is potential to increase the core symptomatic total addressable market by moving further upstream in the care pathway to the primary care physician call point. We estimate that 15 million patients in the United States visit a primary care physician annually with palpitations due to suspected cardiac disease. In addition to approaching primary care physicians directly, we also are able to leverage virtual cardiology providers as key partners to deliver clinical decisions. By educating primary care physicians on the benefits of Zio Services for this patient population, we believe we can expand the market and reach more patients that are candidates for ambulatory cardiac monitoring.

•Pursuing international expansion opportunities. While our initial commercial focus is the U.S. market, we have initiated efforts that will allow for future expansion into international geographies. We have a presence in the UK with efforts underway to pursue national reimbursement. In September 2020, we were named a winner of the Artificial Intelligence in Health and Care Award run by the Accelerated Access Collaborate as part of the National Health Service (“NHS”) AI Lab. This funding brought Zio Services to selected NHS sites over a three-year program measuring clinical, pathway, and economic outcomes. We also received positive guidance from the National Institute for Health and Care Excellence (“NICE”) in December 2020 for the adoption of the Zio XT Service which may facilitate future support of Zio Services through the MedTech Funding Mandate.

We are also conducting diligence and prioritizing other geographies based on market size, regulatory pathway, and reimbursement opportunity. We initiated commercial launch of the Zio Monitor System and Zio Services in Austria, the Netherlands, Spain, and Switzerland in the third quarter of 2024 and were granted regulatory approval in Japan in September 2024. We estimate the total addressable market in our initial selected countries of the UK, Japan, and prioritized European countries to be at least 5 million existing ambulatory monitoring tests annually.

•Exploring adjacent market opportunities. We intend to continue assessing the potential pathways for expanding indications and clinical use cases for our Zio Services and developing new systems for patient populations with unmet needs. Leading with clinical and economical evidence, we are pursuing commercialization opportunities for proactive monitoring strategies that are focused on patients at risk for undiagnosed arrhythmias. With at least 12 million individuals in the United States estimated to be at risk for undiagnosed cardiac arrhythmias, we believe this could be a significant market opportunity for which we believe Zio Services are uniquely positioned to succeed. Initial efforts to proactively monitor this population with the Zio Monitor System were initiated in 2024 and will be continued into 2025.

In addition, we are actively exploring opportunities in adjacent markets beyond ambulatory cardiac monitoring. We have research and development efforts focused on exploring the use of our Zio Services or other new systems and services for the following patient populations:

•Obstructive sleep apnea patients, with an estimated prevalence of approximately 30 million in the United States. Approximately 50% to 80% of patients with Afib may also have sleep apnea compared with 30% to 60% in control groups, and there is a large prevalence of patients with undiagnosed sleep apnea.

•Heart failure patients, with an estimated prevalence of over 8 million in the United States by the year 2030. Atrial fibrillation and heart failure share many antecedent risk factors, and approximately 40% of people with either Afib or heart failure will develop the other condition. Total cost for heart failure in the U.S. are expected to reach $70 billion by 2030.

•Patients with hypertension, with an estimated prevalence of over 120 million in the United States. Up to 90% of patients with Afib may also have hypertension.

•Advancing our system portfolio and core technology offering. We continue to invest in building a unique, innovative system portfolio and digital platform that addresses unmet needs in the ACM market and adjacent markets. We will continue to invest in research and development efforts to further differentiate our biosensor, data analytics and reporting, our information system, and our digital platform. We intend to make improvements in Zio MCT Services during 2025, and we also intend to continue evaluating potential opportunities to leverage our PPG algorithms and ZEUS System with a PPG-based wearable platform in the future. Additionally, in 2024 we entered into an exclusive license agreement with BioIntelliSense, Inc., a continuous health monitoring and clinical intelligence company, to develop and commercialize their patented pulse oximetry, accelerometry and trending non-invasive blood pressure technologies for use within the ACM market. By incorporating medical grade, connected, multi-sensor capabilities, we believe iRhythm will be well positioned to deliver broad clinical insights within ACM that improve patient outcomes, enhance clinical and operational efficiency, and reduce costs to the healthcare system.

Sales and Marketing

We directly market our Zio Services in the United States to healthcare professional through our internal organization comprised of sales representatives, field billing specialists, and customer experience representatives. Our sales team focuses on initial introduction of the Zio Services to those participants that are instrumental to the decision-making process for ambulatory cardiac monitoring, which include physician practices and healthcare systems. We also focus on continuing efforts to ensure healthcare professionals are knowledgeable about the clinical benefits and economic value of the Zio Services. We continue to invest in our sales force and focus on ensuring we optimize the structure of our U.S. sales organization to expand the current customer account base and support adoption of the Zio Services.

We market our Zio Services to a variety of physician specialties including general cardiologists, electrophysiologists, primary care physicians, neurologists, and other physician specialists who diagnose and manage care for patients with arrhythmias. We have found success focusing on integrated delivery networks (“IDNs”), in which large networks of facilities and providers work together to offer a continuum of care to a specific geographic area or market, as well as with risk-bearing entities as our Zio Systems become a key tool in population health management. Focusing on sales to these customer programs gives us the opportunity to conduct a holistic sale for health systems interested in making value-based purchasing decisions.

In January 2021, we established a small direct sales and clinical infrastructure in Bagshot, Surrey in England to service the UK market. We have since focused efforts on the introduction of the Zio Services using the Zio XT System into new accounts and market access efforts, in particular through orders made by NHS Trusts and Hospitals. Additionally, we have built a small sales force covering Switzerland, Austria, and the Netherlands. In Japan and Spain, we intend to utilize distributor services.

We typically experience reduced revenue during the third quarter, as well as during the year-end holiday season. We believe this is the result of physicians and patients taking vacations and patients electing to delay our monitoring services during the summer months or holidays.

Competition

The market for remote cardiac monitoring is competitive, characterized by rapid change resulting from technological advances, scientific discoveries, and other market activities of industry participants.

In providing our Zio Services, we compete with BioTelemetry, Inc. (acquired by Royal Philips), Preventice Solutions, Inc. (acquired by Boston Scientific, Inc.), and Bardy Diagnostics, Inc. (acquired by Baxter International, Inc.) to offer remote cardiac monitoring technology and also function as diagnostic service providers. We also compete with companies that sell traditional, 24-to-48-hour Holter monitors, including GE Healthcare, Philips Healthcare, and Spacelabs Healthcare Inc., as well as Mortara Instrument, Inc. and Welch Allyn Holdings, Inc. (both acquired by Hill-Rom Holdings, Inc. now part of Baxter International, Inc.).

Many of our competitors have substantially greater financial, manufacturing, marketing, and technical resources than we do. Furthermore, many of our competitors have well-established brands, widespread distribution channels, broader product offerings, and an established customer base.

These competitors have also developed patch-based cardiac monitors that have received FDA and foreign regulatory clearances. We are also aware of small start-up companies entering the patch-based cardiac monitoring market. Large medical device companies may continue to acquire or form alliances with these smaller companies to diversify their product offering and participate in the digital health space. These competitors and potential competitors may introduce new products and services that more directly compete with our Zio Services and Zio Systems.

Future competition may also come from manufacturers of wearable fitness products or large information technology companies focused on general health and wellness. For example, in 2021 and 2022, Apple Inc. and Fitbit each respectively added capabilities on their watch platform to measure non-continuous ECG and to alert users to the potential presence of irregular heartbeats suggestive of asymptomatic Afib.

We believe the principal competitive factors in our market include:

•ease of use, comfort, and unobtrusiveness of the device for the patient;

•quality and clinical validation of the deep-learned algorithms used to detect arrhythmias;

•concise and comprehensive reports supporting efficient physician interpretation;

•ease of use of service workflow for physicians and supporting clinicians;

•digital tools for data management, including the myZio mobile app, website tools, and EHR integration;

•contracted rates with third-party payors;

•government reimbursement rates associated with our Zio Services and supporting Zio Systems;

•quality of clinical data and publications in peer-reviewed journals;

•size, experience, knowledge, and training of sales and marketing teams;

•availability and reliability of sales representatives and customer support services;

•workflow protocols for solution implementation in existing care pathways;

•reputation of existing device manufacturers and diagnostic service providers; and

•relationships with physicians, hospitals, administrators, and other third-party payors.

Manufacturing and Quality Assurance

We currently manufacture our Zio Systems, including the Zio Monitor System and Zio AT System, in our leased facility in Cypress, California. This manufacturing facility is approximately 34,000 square feet and provides space for our manufacturing and production operations, including inspection, assembly, testing, packaging, labeling, storage, and shipping. We believe this manufacturing facility has the capacity to meet our manufacturing needs for at least the next five years.

Outside suppliers are the source for components and sub-assemblies in the production of the Zio Systems. Any significant supplier of a critical component, such as the circuit boards for the Zio Systems provided by contract electronic manufacturers, is managed through our manufacturing team that is focused on reducing supply chain risk. These suppliers are evaluated, approved, and monitored by our quality team to ensure conformity with the specifications, policies, and procedures applicable to our devices.

Our manufacturing operations are subject to regulatory requirements of FDA’s Quality System Regulation (“QSR”), the Medical Devices Regulation 2017/745 of the European Parliament and of the Council (“EU MDR”), the UK Medical Device Regulations 2002 (“UK MDR”), and the Japanese medical device Quality Management System ("QMS"). We are also subject to applicable requirements relating to the environment, waste management, and health and safety matters, including measures relating to the release, use, storage, treatment, transportation, discharge, disposal, sale, labeling, collection, recycling, treatment, and remediation of hazardous substances.

We purchase certain components and materials used in manufacturing from single sources due to quality considerations, costs, or constraints resulting from regulatory or other requirements. As of December 31, 2024, those single sources include suppliers of application-specific integrated circuits used in our transmitters, seals used for the applicators, and certain polymers used to synthesize polymeric membranes for our sensors.

Our manufacturing facilities are also ISO certified (EN ISO 13485:2016). We have registered our device establishments with FDA and with the UK’s Medicines & Healthcare products Regulatory Agency (“MHRA”). Additional EU registrations may be sought in 2025 in EU member states by our EU authorized representative as appropriate.

Third-Party Reimbursement

We receive revenue for the Zio Services primarily from third-party payors, which include commercial payors and government agencies, such as the Centers for Medicare & Medicaid Services (“CMS”). Third-party payors require us to identify the service for which we are seeking reimbursement by using a Current Procedural Terminology (“CPT”) code set maintained by the American Medical Association (“AMA”). These CPT codes are subject to periodic change and update, which will impact the reimbursement rates for our Zio Services.

For the year ended December 31, 2024, we received approximately 84% of our revenue through third-party payors, which includes approximately 24% of our total revenue from the Medicare program. As we continue to contract with more commercial payors and the patient population ages into eligibility for the Medicare Advantage program, we believe more of our revenue will convert to commercial payor billing.

Our clinical centers are enrolled in the Medicare program as IDTFs, which allows us to bill CMS directly for our Zio Services. To maintain enrollment, we must meet the CMS IDTF supplier standards, including having an independent medical director for oversight and qualified technicians who support the analysis of ECG data captured by the Zio patches as part of our Zio Services.

For additional information on third-party reimbursement, please see our Risk Factor titled “If reimbursement or other payment for our Zio Services is reduced or modified in the United States, including through cost containment measures or changes to policies with respect to coding, coverage, and pricing, our business could suffer.”

Research and Development

We focus our research and development efforts on improvement of our Zio System and Zio Services in alignment with our strategy. We employ engineering and research and development staff to focus on delivering future innovations and sustaining improvements. Our research and development activities are focused on:

•Continuous improvement and extensions to existing products and services. We are continuously working to improve the Zio Services to increase patient comfort, product quality, operational scalability, and security.

•International expansion. We are working on building our infrastructure and ensuring global compliance as we identify appropriate opportunities for international growth.

•Advancing our technology offering. Our product portfolio includes patch-based solutions (utilized in the Zio Monitor System, Zio AT System, and Zio XT System) and the FDA-cleared Zio Watch (not yet commercially available) that combine continuous monitoring for extended periods with accelerated notification of significant events through mobile transmission capabilities.

•Customer workflow optimization. We have initiatives that aim to increase customer productivity by optimizing workflow through easier patient enrollment, report access, and interpretation, in addition to integrating the reports from our Zio Services directly into EHRs.

•Data analytics. We are focused on improving and enhancing our back-end, deep-learning analytic platform, building on our core competency in data analytics.

•Developing clinical evidence. We frequently provide support to third parties conducting clinical studies that further support the benefits of the Zio System, including clinical research in areas such as obstructive sleep apnea, hypertension, predictive features, and patient wearables.

•Continuing to solidify our footprint in digital healthcare. Using our repository of ambulatory ECG patient data, we will continue to look for ways to create value-driving opportunities in digital healthcare, such as expansion of indications for the Zio System, new therapeutic discoveries, development of an analytical engine for ambulatory consumers, other medical data and payor and provider decision support, and the potential for more complete system integration with large health systems.

We have supported clinical studies conducted by leading physicians and clinicians to explore and develop new techniques and applications for our Zio Systems, the clinically-integrated version of ZEUS for the Zio Watch, and other clinical and research activities, including healthcare economic outcomes research.

Our research and development activities consist of software development, algorithm and product development, regulatory affairs, and clinical research. Our research and development expenses (excluding in-process research and development) were $71.5 million, $60.2 million, and $46.6 million for the years ended December 31, 2024, 2023, and 2022, respectively.

Technology License Agreement with BioIntelliSense, Inc.

On August 30, 2024, we entered into a Technology License Agreement (the “License Agreement”) with BioIntelliSense, Inc. (“BioIS”), pursuant to which (i) we will receive a perpetual fully paid up license to certain of BioIS’ intellectual property, technology and products for research, development and commercialization of potential next generation products and services in certain fields of use, including an exclusive license to develop and commercialize pulse oximetry, accelerometry, and trending non-invasive blood pressure technologies for use within our ambulatory cardiac monitoring products and services, and (ii) each party agreed to negotiate in good faith a supply agreement for pulse oximetry hardware.

Under the terms of the License Agreement, we paid BioIS an upfront fee of $15.0 million in cash consideration in acceptance of the initial transfer of certain licensed technologies and data following the execution of the License Agreement. In connection with the License Agreement, we also purchased an aggregate of $40.0 million of convertible promissory notes from BioIS (the “Convertible Notes”), of which $20.0 million (“Milestone Notes”) were designated for satisfaction of our regulatory milestone payment obligations. The Milestone Notes, plus accrued and unpaid interest, if any, shall be cancelled, if outstanding, upon the achievement of the regulatory milestones up through December 31, 2026. Additionally, BioIS is eligible to receive low single digit royalty payments on annual net sales of certain products that include licensed rights in the home sleep testing field of use, subject to certain adjustments specified in the License Agreement.

Intellectual Property

To establish and protect our proprietary and other intellectual property rights, we rely on a combination of trademark, copyright, patent, trade secret, and other intellectual property laws, and employment, non-disclosure and invention assignment agreements, and other protective contractual provisions with our employees, contractors, consultants, suppliers, partners, outside scientific collaborators, and advisors, and other third parties. In addition, we have entered into licenses in the ordinary course of business relating to a wide array of technologies or other intellectual property rights or assets.

We hold patents and pending patent applications in the United States and other parts of the world which, in aggregate, we believe to be of importance in the operation of our business. As of December 31, 2024, we owned, or retained an exclusive license to, 46 issued patents from the U.S. Patent Office (“USPTO”), 13 issued patents from the Japanese Patent Office, 4 issued patents from the Australian Patent Office, 5 issued patents from the Canadian Patent Office, 7 issued patents from the European Patent Offices, 6 issued patents from the Korean Patent Office, two issued patents from the Chinese Patent Office, and 1 issued patent from the Indian Patent Office. Our U.S. issued patents as of December 31, 2024 are set to expire over a range of years, from November 2028 to August 2041, subject to any extensions. As of December 31, 2024, we had 50 pending patent applications globally, including 14 non-provisional applications and 2 design applications in the United States, 7 in the European Patent Office, 8 in Japan, 1 Patent Cooperation Treaty ("PCT") international application, 5 in Korea, 4 each in Australia and China, 3 in India, and 2 in Canada.

Our patents and patent applications seek to protect aspects of our core technologies and our product concepts for ambulatory cardiac monitoring. We believe that our patent position provides us with sufficient rights to protect our current and proposed commercial products and services. However, our patent applications may not result in issued patents, and any patents that have been issued or might be issued may not protect our intellectual property rights. We also rely on trade secrets, technical know-how, and continuing innovation to develop and maintain our competitive position.

As of December 31, 2024, our trademark portfolio contained U.S. trademark registrations for the marks MyZIO, ZIO, ZIO SUITE, ZIO AT, and IRHYTHM and pending U.S. trademark applications for the marks KNOW YOUR RHYTHM BY ZIO, KNOW YOUR RHYTHM, and ZIO MCT. It also contained registered trademarks for the mark IRHYTHM in Australia, the EU, Austria, Canada, China, Denmark, Finland, France, Germany, Japan, Italy, Norway, Sweden, Switzerland, and the UK. It further contained trademark registrations for the mark ZIO in Australia, Canada, China, the EU, Japan, Norway, Switzerland, and the UK. It also contained trademark registrations for the mark MYZIO in Canada, the UK, and the EU, trademark registrations for the mark ZIO MCT in the UK and the EU, and trademark registrations for the mark ZIOSUITE in the UK and the EU.

Regulation

Based on the nature of the services we provide, the medical devices used to deliver our services, and the ways in which payment is available for our services, we are subject to a complex spectrum of intersecting laws and regulatory frameworks.

Our facilities in Illinois, California, and Texas are enrolled in the Medicare program as IDTFs, defined by CMS as entities independent of a hospital or physician’s office in which diagnostic tests are performed by licensed or certified non-physician personnel under appropriate physician supervision. CMS has set certain performance standards that every IDTF must meet in order to obtain or maintain its billing privileges.

We are also regulated as a medical device manufacturer because of our role in the design, development, and manufacturing of the Zio Systems used in our Zio Services.

The United States has historically been the primary focus of the delivery of our services, but based on our operations we are subject to a range of laws and regulations outside the United States, and we expect the complexity of the global regulatory landscape to which we are subject to continue to increase.

U.S. Fraud and Abuse Laws and Other Healthcare Compliance Requirements

Medicare is a federal healthcare program administered by CMS that is available to individuals age 65 or over, and certain other individuals. The Medicare program provides, among other things, healthcare benefits that cover most medically necessary care for such individuals, subject to certain deductibles and co-payments. CMS has established guidelines for the coverage and reimbursement of certain products, supplies, and services, including ambulatory cardiac monitoring services. In general, Medicare will only reimburse ambulatory cardiac monitoring services, such as our Zio Services, that are reasonable and necessary for the diagnosis or treatment of patients. CMS also administers the Medicaid program, a cooperative federal/state program that provides medical assistance benefits to qualifying low income and medically needy persons. State participation in Medicaid is optional, and each state is given discretion in developing and administering its own Medicaid program, subject to certain federal requirements. All CMS programs are subject to statutory and regulatory changes, retroactive and prospective rate adjustments, administrative rulings, interpretations of policy, intermediary determinations, and government funding restrictions, all of which may materially increase or decrease the rate of program payments to healthcare facilities and other healthcare providers, including those paid for our Zio Services.

Because of the significant federal funding involved, the government actively enforces a number of laws and regulations to eliminate fraud and abuse in federal healthcare programs. Our business is subject to compliance with these laws. The most significant of these laws for our business include the federal Anti-Kickback Statute (the “AKS”) and the federal False Claims Act (the “FCA”).

Anti-Kickback Laws

Under the AKS, it is a criminal offense to knowingly and willfully offer, pay, solicit, or receive any remuneration to induce, or in return for purchasing, ordering, or recommending, or arranging for, the purchase or order of items or services (or referrals of the same) reimbursable by a federal healthcare program. The AKS imposes criminal liability for both the party that provides or offers such remuneration and the party that receives or solicits such remuneration. Courts and enforcement agencies interpret the AKS broadly, such that it may be implicated whenever anything of value is provided to a party in a position to generate federal healthcare program business where any one purpose of an arrangement involving remuneration is to induce referrals. Penalties for violations include criminal penalties and civil sanctions such as fines, imprisonment, and possible exclusion from Medicare, Medicaid, and other federal healthcare programs. Many states have adopted laws similar to the AKS. Some of these state prohibitions apply to referral of recipients for healthcare products or services reimbursed by any source, not only CMS programs. The Physician Payments Sunshine Act requires transparency around certain transfers of value and ownership interests that may raise parallel scrutiny of the appropriateness of financial relationships. Notably, some kickback allegations are also interpreted as violations of the FCA.

False Claims Act

The FCA prohibits: (i) knowingly presenting, or causing to be presented, a false or fraudulent claim for payment or approval and (ii) knowingly making, using, or causing to be made or used a false record or statement material to a false or fraudulent claim. Importantly, the FCA provides for “whistleblower” or qui tam actions, which allow a private individual to bring actions on behalf of the federal government alleging that the defendant has violated the FCA and to share in any monetary recovery. The federal government has used the FCA to assert liability on the basis of inadequate care, kickbacks, and other improper referrals, and improper use of CMS billing numbers, as well as allegations of off-label promotion of products, and activities relating to the reporting of discount and rebate information. The FCA is the federal government’s preferred enforcement vehicle for addressing a variety of alleged misconduct and provides for treble damages and civil money penalties ranging from $13,508 to approximately $27,018 per claim, as well as exclusion from participation in federal healthcare programs and potential criminal penalties, including imprisonment and criminal fines. Additionally, as part of any settlement, the government will often require the entity to enter into a corporate integrity agreement, which imposes certain ongoing compliance, certification, and reporting obligations. In addition, various states have enacted false claims laws analogous to the FCA, and many of these state laws apply where a claim is submitted to any third-party payor and not only a federal healthcare program.

Healthcare Reform

Changes in healthcare policy could increase our costs and subject us to additional regulatory requirements that may interrupt commercialization of our current and future solutions. The Affordable Care Act (“ACA”) substantially changed the way healthcare is financed by both governmental and private insurers, and significantly impacts our industry. Any changes to, or repeal of, the ACA may have a material adverse effect on our results of operations.