Use these links to rapidly review the document

TABLE OF CONTENTS

Item 8. Financial Statements and Supplementary Data

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended April 2, 2011 | ||

or | ||

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to | ||

Commission file number: 001-34133

GT Solar International, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) | 03-0606749 (I.R.S. Employer Identification No.) |

243 Daniel Webster Highway

Merrimack, New Hampshire 03054

(Address of principal executive offices, including zip code)

(603) 883-5200

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| Common stock, $0.01 par value | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the registrant's common stock, $0.01 par value per share, held by non-affiliates of the registrant on October 2, 2010, the last business day of the registrant's most recently completed second fiscal quarter, was approximately $827 million (based on the closing sales price of the registrant's common stock on that date). As of May 20, 2011, 125,893,592 shares of the registrant's common stock, $0.01 par value per share, were issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The information required by Part III of this Annual Report on Form 10-K, to the extent not set forth herein, is incorporated by reference from the registrant's definitive proxy statement relating to the Annual Meeting of Shareholders to be held in 2011, which will be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Annual Report on Form 10-K relates.

GT Solar International, Inc.

Form 10-K

Year Ended April 2, 2011

TABLE OF CONTENTS

Item | | Page | ||

|---|---|---|---|---|

PART I | ||||

Item 1. | Business | 5 | ||

Item 1A. | Risk Factors | 19 | ||

Item 1B. | Unresolved Staff Comments | 44 | ||

Item 2. | Properties | 44 | ||

Item 3. | Legal Proceedings | 45 | ||

Item 4. | (Removed and Reserved) | 46 | ||

PART II | ||||

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 47 | ||

Item 6. | Selected Consolidated Financial Data | 49 | ||

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | 51 | ||

Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 78 | ||

Item 8. | Financial Statements and Supplementary Data | 80 | ||

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 123 | ||

Item 9A. | Controls and Procedures | 123 | ||

Item 9B. | Other Information | 127 | ||

PART III | ||||

Item 10. | Directors, Executive Officers and Corporate Governance | 127 | ||

Item 11. | Executive Compensation | 127 | ||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 128 | ||

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 129 | ||

Item 14. | Principal Accountant Fees and Services | 129 | ||

PART IV | ||||

Item 15. | Exhibits and Financial Statement Schedules | 129 | ||

Signatures | 130 | |||

Exhibit Index | 131 | |||

2

Cautionary Statements Concerning Forward-Looking Statements

This Annual Report on Form 10-K contains "forward-looking statements" that involve risks and uncertainties, as well as assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially from those expressed or implied by such forward-looking statements. The statements contained in this Annual Report on Form 10-K that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are identified by the use of words such as, but not limited to, "anticipate," "believe," "continue," "could," "estimate," "prospects," "forecasts," "expect," "intend," "may," "will," "plan," "target," and similar expressions or variations intended to identify forward-looking statements and include statements about our expectations of future periods with respect to, among other things, annual PV installations in 2015, expected increase in end user demand for solar energy, backlog, backlog conversions, gross margins, when our business segments will recognize revenue and the amount that will be recognized, potential increase in demand for CVD reactors, customer concentrations, demand for our products, effects of government tariffs, change in tax rates and the reasons therefore, cost of solar equipment, investments in solar energy, growth of our business and product portfolio, fluctuation of polysilicon revenue, long term prospects for the solar industry and our PV, polysilicon and sapphire segments, PV business accounting for a majority of our revenue, outcome of litigation, research and development expense, tax rates and our plans to produce and sell crystal sapphire materials and advanced sapphire crystal growth furnaces. Gross margin composition, customer relationship supporting continued growth in our PV business, growth in both the HB LED market and corresponding growth in the sapphire market, general illumination being one of the fastest growing applications for HB LEDs, increase in demand for large area sapphire material, growth in sales of upgrades, parts and services supplied by us increasing with the number of installed DSS furnaces, our relationships with leading Chinese solar companies and our expanded base of operations in China enhancing our ability to compete against the lower cost Chinese PV capital equipment companies in our markets, increase in polysilicon production capacity from 2010 to 2015, the number of sapphire equipment and sapphire material customers that we will have (and whether they are customers of our other business segments), all of our growth strategies, sales to customers in Asia will continue to be a significant portion of sales over the next several years as polysilicon and sapphire manufacturing is expected to continue to grow in that region, timeframes during which we expect to deliver our products to customers after entering into an agreement, delivery of additional ASF furnaces throughout the first half of the fiscal year ending March 31, 2012, dependence on a limited number of customers, increase in the sapphire materials business, expected increase in the use of ASF furnaces by us and our equipment customers, increased demand on suppliers and our expected growth of our business segments, results of litigation and amounts paid in connection with litigation, all information contained in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Factors Affecting the Results of Our Operations", increase in research and development spending, gross margins in fiscal 2012 including amounts attributable to ASF furnaces, timing of recognizing revenue that is included in deferred revenue, cash generated from operations together with our existing cash and customer deposits and any borrowings under the Credit Agreement, including the Revolving Facility, will be sufficient to satisfy working capital requirements, commitments for capital expenditures and other cash requirements for the foreseeable future, including at least the next twelve months, total capital expenditures in our fiscal year ending March 31, 2012 are ranging from approximately $25 million to approximately $30 million, consisting primarily of improvements to our business information systems, manufacturing equipment and expected expansion of our facilities in Asia. These statements are based on the beliefs and assumptions of our management derived from information currently available to management. Such forward-looking statements are subject to risks, uncertainties and other important factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements, and such factors include, but are not limited to, the risks discussed in Part I, Item 1A under the heading titled "Risk Factors" and elsewhere in this Annual Report on Form 10-K. Forward-looking statements speak only as of the date of this Annual Report on Form 10-K. We undertake

3

no obligation to publicly update or review any forward-looking statements to reflect events or circumstances after the date of such statements.

Information regarding markets, market size, market growth rates, forecasts and other industry data contained in this Annual Report on Form 10-K consists of estimates based on data and reports compiled by professional organizations, industry consultants and analysts, on data from other external sources, and on our knowledge and internal surveys of the photovoltaic, polysilicon and sapphire industries. Marketbuzz 2011, an annual report dated March 2011 prepared by Solarbuzz LLC, an international solar energy market research and consulting company that reports on the solar industry, and Yole Développement, an international market research and consulting company that reports on the sapphire and LED industries, were the primary sources for third party industry data and forecasts used in this Annual Report on form 10-K.

In view of the emerging nature of the photovoltaic, polysilicon and sapphire industries and the absence of publicly available information on most of the photovoltaic equipment, polysilicon and sapphire material and equipment manufacturers (including, without limitation, their existing production capacity, business plans and strategies), the estimates for the size of the photovoltaic, polysilicon and sapphire markets and their projected growth rates set out in this Annual Report on Form 10-K should be considered with caution. Certain market share information and other statements in this Annual Report on Form 10-K regarding the photovoltaic, polysilicon and sapphire industries and our position relative to our competitors is not based on published statistical data or information obtained by independent third parties. Rather, such information and statements reflect our management's best estimates based upon information obtained from trade and industry organizations and associations and other contacts within the photovoltaic, polysilicon and sapphire industries. While we believe our internal estimates to be reasonable, they have not been verified by independent sources.

4

Our Company

GT Solar International, Inc., through its subsidiaries (referred to collectively herein as "we," "us" and "our"), is a global provider of polysilicon production technology and multicrystalline ingot growth systems and related photovoltaic manufacturing services for the solar industry, and sapphire growth systems and material for the LED and other specialty markets. Our customers include several of the world's largest solar companies as well as companies in the chemical industry.

Our principal products are:

- •

- Chemical vapor deposition (CVD) reactors and related equipment used to produce polysilicon, the key raw material used in silicon-based solar wafers and cells;

- •

- Directional solidification (DSS) furnaces and related equipment used to cast multicrystalline silicon ingots by melting and cooling polysilicon in a precisely controlled process. These ingots are used to make photovoltaic (PV) wafers which are, in turn, used to make solar cells;

- •

- Advanced sapphire furnaces (ASF) used to crystallize sapphire boules by melting and cooling aluminum oxide in a precisely controlled process. These sapphire boules are used to make sapphire wafers, the preferred substrate for manufacturing light emitting diode (LED) devices, and for use in other specialty markets; and

- •

- Sapphire material is produced in our sapphire production facility and sold directly to customers. These materials are primarily used to make a variety of products such as epitaxial-ready wafers for the LED industry and other specialty markets.

GT Solar International, Inc. (the "Company") was originally incorporated in Delaware in September 2006. On September 27, 2006, we completed an internal reorganization through which GT Solar International, Inc. became the parent company of GT Solar Incorporated, our principal operating subsidiary.

In July 2008, we completed an initial public offering of 30,300,000 shares of common stock by GT Solar Holdings, LLC. In March 2010, we completed a secondary public offering of 28,750,000 shares of common stock by GT Solar Holdings, LLC.

On July 29, 2010, we acquired privately-held Crystal Systems, Inc., which we refer to as Crystal Systems, a crystal growth technology company that produces sapphire material used for LED applications, as well as other specialty markets, such as medical, research, aerospace industries and defense.

In September 2010, we completed a secondary offering of 11,000,000 shares of common stock by GT Solar Holdings, LLC. At the same time we completed an additional secondary offering of 14,000,000 shares of common stock by GT Solar Holdings, LLC, such sale was made to UBS AG and UBS Securities LLC in connection with an offering by UBS AG of its Mandatorily Exchangeable Notes due 2013.

On November 12, 2010, GT Solar International, Inc. repurchased 26,500,000 shares of our common stock from GT Solar Holdings, LLC, such repurchase was funded with our available cash.

We did not receive any proceeds in connection with any of the foregoing offerings by GT Solar Holdings, LLC. As of April 2, 2011, we believe that GT Solar Holdings, LLC held less than 10% of the outstanding shares of our common stock.

5

PV Industry Overview

Today, the majority of the world's electricity supply is generated by fossil fuels such as oil, coal and natural gas. Volatile global energy prices, increasing demand for electricity, particularly in developing economies, growing environmental awareness of the consequences of fossil fuel-based energy sources and the desire for energy security are, we believe, driving the demand for renewable energy sources such as solar photovoltaic (PV) systems. PV systems are used in industrial, commercial and residential applications to convert sunlight directly into electricity. Today, electricity costs generated from PV energy are higher than electricity generated by traditional energy sources, although the difference has decreased substantially in recent years. To offset the higher costs associated with solar energy and to encourage the adoption of alternative energy supplies, certain countries have implemented various tax credits and other incentives in connection with the use of renewable energy.

A solar industry research firm reported that the 2010 world PV market, as measured by total customer installations, increased to 18.2 gigawatts (or GW) from 7.9GW in 2009, a 139% growth increase year over year. The global PV market grew at a compound annual growth rate of 67% between 2005 and 2010. PV industry revenues in 2010 were approximately $82.1 billion. The industry research firm, in its "Green World" scenario, also estimates that in 2015 the annual PV installations at end-user sites may reach approximately 36.4GW with global PV industry revenues of approximately $96.2 billion for 2015.

The PV industry growth has been historically driven by incentive programs such as feed-in-tariffs (or FITs), most notably in Germany. FITs have been set at a level that allowed for cost efficient PV manufacturers, and end-market investors alike, to earn a sufficient return on their solar project investments. Of the 18.2GW of total installed demand in 2010, 71% or 12.9GW was attributable to just three countries in Europe: Germany, Italy and the Czech Republic. In 2011, the governmental support regarding continued support for financial incentive programs remains uncertain.

However, recent decisions by certain governments to reduce or eliminate FITs may result in reduced demand for PV equipment.

PV Manufacturing Trends

Manufacturers across the various segments comprising the PV manufacturing process are lowering their manufacturing costs and improving cell efficiency in an effort to make solar generated electricity more price competitive with electricity generated from traditional sources. According to Solarbuzz, a solar industry research firm, solar module prices have fallen from an average of $3.30 per watt in the fourth quarter of 2008 to an estimated $2.17 per watt in the fourth quarter of 2010.

In 2010, China continued to be one of the fastest growing global regions for PV manufacturing. According to Solarbuzz, at the end of 2010, 68% of the world's PV silicon wafer production capacity was located in China (including Taiwan), up from 65% in 2009. Economic incentives offered by the Chinese government and the availability of low cost labor have, we believe, accelerated the expansion of PV manufacturing capacity within the country. In the fiscal year ended April 2, 2011, 93% of our revenue was from existing or new customers in Asia, with 71% generated of that amount from customers in China.

We also believe that the desire to reduce overall cost drove the growth of PV manufacturing in China in recent years and is creating a trend towards vertical integration among PV manufacturers. Larger, better capitalized manufacturers improve their competitive position by controlling a greater range of the PV manufacturing process. The expanded scale of their operations enhances their ability to control costs, preserve margins, and manage through the volatility in raw material prices. We have supplied equipment to three of the eight largest PV manufacturers in China based on wafer manufacturing capacity, according to Solarbuzz data.

6

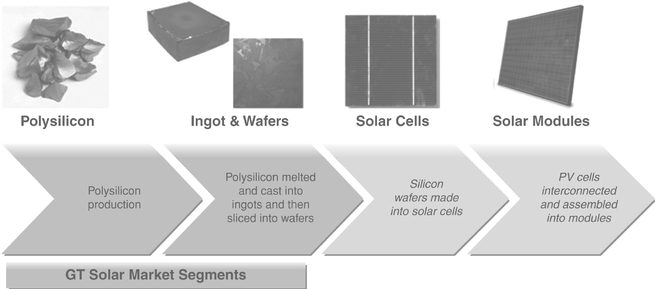

The production of multicrystalline-based solar modules includes a number of manufacturing steps. The first step involves the production of raw polysilicon using one of several production techniques. Raw polysilicon is then cast into a multicrystalline ingot in a DSS furnace. The ingot then moves into the wafering operation where it is sawed into bricks and the bricks are then sawed into thin wafers. Next the wafers are processed into solar cells through a series of etching, doping, coating and electrical contact processes. The next step involves interconnecting and assembling solar cells into solar modules. Finally, solar modules along with other system components such as batteries and inverters are installed as solar power systems.

We design and sell capital equipment and related services used in both the polysilicon production and ingot production segments of the PV manufacturing process.

Sapphire Industry Overview

On July 29, 2010, we acquired privately-held Crystal Systems, Inc., a company that specializes in the manufactured of high-quality sapphire material used in the LED industry and other specialty industries such as medical and aerospace. Our sapphire material and equipment business focuses on two core strategies—producing high quality sapphire material for the LED and other specialty markets and selling our advanced sapphire furnace (ASF) to companies that intend to grow their own sapphire material.

Sapphire is one of the hardest materials on earth and is recognized for its durability, chemical resistivity and optical transmission qualities. These characteristics make sapphire an effective material for a variety of applications that require demanding optical and mechanical performance in industries such as aerospace and defense, oil and gas, and medical devices. Sapphire is a preferred substrate material for high brightness (HB) white, blue and green LED devices, currently representing over 80% of all substrate material used in LED applications. Therefore, as the HB LED market grows, we believe the sapphire substrate market will grow as well.

Common applications for LEDs include: color displays for mobile phones and other portable electronics such as GPS systems, MP3 players and digital camera flashes; backlighting units for large displays to replace conventional fluorescent back-lighting units, or BLUs, in LCD flat panel televisions, notebook computers and desktop monitors; car and truck headlights, turning and tail light functions as well as interior lighting; as the light sources on large signs, and outdoor displays such as jumbo screens

7

used in sporting arenas and electronic billboards; general illumination for replacement lamps, architectural lighting, retail displays commercial and industrial lights, residential lighting, street lights and off grid lighting for developing countries. General illumination is expected to be one of the fastest growing applications for HB LEDs.

Optical and Mechanical applications

Sapphire material is also used in a number of optical and mechanical applications including semiconductor wafer carriers, nozzles, bearings, blades, tubes, jewel bearings, high powered lasers and windows. Other applications such as liquid chromatography require well-annealed and low stressed material, which can be produced in our ASF crystallization furnaces.

Sapphire Manufacturing Trends

Historical methods of sapphire crystal growth have relied on several different technologies.

The value chain for producing epitaxial-ready LED substrates consists of the following key steps: crystal growth, coring, slicing, lapping and polishing. The crystal growth process represents approximately 48% of the total LED material substrate costs. The industry measures output quality in flatness, desired crystal planar orientation and crystalline structure uniformity. LED device manufacturers are seeking larger diameter sapphire wafers to allow them to achieve economies of scale. As downstream processing technologies such as MOCVD tools, which are used to grow compound semiconductor materials at the atomic scale, increase the capability to process larger wafers diameters such as 4-inch and 6-inch substrates, the demand for large area sapphire material is expected to grow.

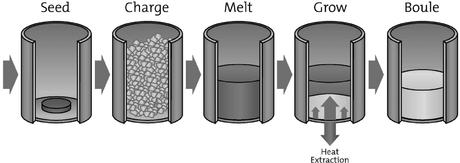

The design of our ASF sapphire furnace has benefited from over 40 years of sapphire material process developments at Crystal Systems. We have leveraged this experience to create a furnace design that is, we believe, easy to operate, scalable and is capable of producing quality sapphire boules. The ASF production process includes a seeding, charging, melting, growing, and cooling cycle to create the sapphire boule. Each boule is inspected by using our optical homogeneity technique which is designed to ensure that no sub-optimized material enters the downstream processing steps.

The simplicity and reliability of our furnace design will, we believe, allow customers to operate high volume production environments to produce sapphire material with a lower capital investment compared to other competing crystallization technologies.

Our Business Segments

We report revenue from three business segments; our polysilicon business, our PV business, and our sapphire business. For financial information regarding revenues, profit or loss and total assets for each segment for each of the last three years, please refer to Note 17 in our Consolidated Financial Statements included elsewhere in this Annual Report on Form 10-K. None of the businesses in which our segments operate are seasonal.

Polysilicon Business

Polysilicon is a purified form of silicon that is a key raw material used to produce photovoltaic and microelectronic wafers. Our polysilicon business offers the technologies and equipment to the produce polysilicon. Our polysilicon business offers CVD reactors and related equipment engineering services such as trichlorosilane (TCS) and silane engineering services to existing polysilicon producers and new market entrants. Our CVD reactors utilize the Siemens process, a polysilicon production process which has been in existence for nearly fifty years. In July 2006, our polysilicon business received its first order for CVD reactors from OCI Company, Ltd. (formerly DC Chemical Co., Ltd.,) a leading Korean chemical company. From July 31, 2007 through April 2, 2011 we shipped over 200 CVD reactors.

8

CVD reactors—We sell CVD reactors that produce polysilicon. We market our CVD reactors under the names SDR™200, SDR™300 and SDR™400. We began offering these products commercially in April 2006. Our SDR200 CVD reactors are producing at levels greater than 200 MT of polysilicon annually and our SDR300 CVD reactors are producing in excess of 300 MT annually of polysilicon. Our most recent SDR reactor, the SDR400, is producing polysilicon in excess of 400 MT annually.

Polysilicon services, parts and other—In addition to CVD reactors for polysilicon manufacturing, we also provide technology and engineering services for the commissioning, start-up and optimization of our equipment and technology. We provide the basic engineering packages, process licenses and key equipment for the production and purification of trichlorosilane and silane. In 2009, our polysilicon business began offering equipment and engineering services to assist companies with the production of TCS, an essential raw material in both the semiconductor and solar industries. In 2010, we began offering hydrochlorination technology which is designed to lower the capital costs and power consumption of polysilicon production. Hydrochlorination technology eliminates the need for silicon tetrachloride converters which are required when using certain other technology.

We also provide ancillary equipment and technologies for producing starting seed rods used in our CVD reactors and for handling and processing the polysilicon into a finished product.

Our polysilicon segment focuses on product design, quality control, engineering services, project management providing technical know-how and process development related to the commissioning and production of polysilicon. One of our major goals is to lower the cost of producing high quality polysilicon for our customers by providing improved plant designs and increasing the throughput and efficiency of each new generation of our CVD reactors.

PV Business

The primary focus of our PV business includes the manufacture and sales of DSS™ crystallization furnaces and ancillary equipment required in the operation of DSS crystallization furnaces to cast multicrystalline silicon ingots. We believe we have established a leading position in the market for specialized furnace technology for the production of multicrystalline solar wafers. From April 1, 2005 through April 2, 2011, we shipped approximately 2,900 DSS crystallization furnaces.

DSS crystallization furnaces—Our DSS furnace is a specialized furnace used to melt polysilicon and cast multicrystalline ingots. Polysilicon is placed into a quartz crucible and the crucible is then loaded into the chamber of the DSS furnace where it is cast into multicrystalline ingots under precise heating and cooling conditions. Multicrystalline ingots are used to produce solar wafers, which ultimately become solar cells. Solar cells made from multicrystalline wafers represented approximately 55.5% of all solar cells produced in 2010 according to a sole-industry research firm. Our DSS crystallization furnaces are capable of applying precise incremental temperature changes, which is critical to forming quality ingots required for high efficiency solar cells. We have developed proprietary control software systems to automate the operation of the furnace during all stages of the crystal growth process. Our DSS furnaces share a common architecture, which are designed to allow customers to efficiently upgrade systems to generate greater throughput with an existing furnace. We market our DSS crystallization furnaces under the names DSS240, DSS450, DSS450HP, and DSS650.

All of the components and assemblies for our DSS furnaces are manufactured by third parties using our designs. Our manufacturing personnel focus on final assembly, integration and testing of the DSS furnace. We also provide engineering and product design, quality control, process engineering and engineering services related to the operation of our DSS furnaces.

Ancillary equipment—Our largest capacity DSS furnace, the DSS650, is capable of producing ingots that weigh up to 625 kilograms. Our ancillary equipment provides operators with material handling assistance during the preparation of the crucible before it is loaded with silicon and during the loading

9

and unloading of the crucible into the DSS furnace chamber at the start of the growth process and out of the DSS furnace chamber at the conclusion of the ingot growth process. Our ancillary equipment includes crucible coating stations, crucible manipulators, extraction tools and other material handling systems required to safely transport material during the ingot growth process. We report ancillary equipment revenue as other PV equipment.

Photovoltaic parts and services—The use of our products requires substantial technical know-how and many of our customers rely on us to design and optimize their production processes as well as train their employees in the use of our equipment. We sell replacement parts and consumables used in our DSS furnaces and other PV equipment. We also offer a range of services in connection with the sale of equipment, including facility design, equipment installation and integration, technical training and manufacturing process optimization. We typically charge for these services separately from the price of our equipment. As the number of our installed DSS crystallization furnaces continued to expand, we believe that sales of upgrades, parts and services will grow as well. We report revenue from PV parts and services as PV services, parts and other.

Sapphire Business

Our sapphire segment is focused in two areas: (i) the production of high quality sapphire material for the LED and other specialty markets, and (ii) the marketing and sales of our advanced sapphire furnaces to customers to enable them to produce their own sapphire material.

Sapphire Materials—We produce high quality sapphire material in our facility in Salem, Massachusetts. We sell this material to customers in the LED and other specialty markets, such as the aerospace, defense and medical device.

We manufacture and sell two principal types of sapphire materials.

Sapphire Material: Using the material derived from the sapphire boule generated with our advanced sapphire furnaces, we are able to cut the sapphire material in a number of different dimensions, including as cores, rods, blanks, windows and tubes. In addition, due to the growth processes that we utilize, we are able to deliver to our customers high yields of material. In many cases, we are able to improve the performance of the material by fabricating such material using our sophisticated machining and tooling machinery. It is, however, frequently the case that additional finishing and polishing needs to be performed on the material before it can be utilized by an end-user in a commercial or research product. Customers for our sapphire material cover a broad range of industries, from aerospace to medical devices to research.

Titanium-doped Sapphire (Ti:Sapphire) Material: Utilizing a similar production technique, we generate sapphire boules that are doped with titanium. Titanium-doped sapphire has optical qualities which makes it useful in applications such as tunable lasers and photonics products. Unlike our standard sapphire material, we provide finishing and polishing for our Ti:Sapphire material. Customers for our Ti:Sapphire material principally consist of research institutions, including those working on proton cancer therapy and high energy physics.

ASF Crystallization Furnaces—Our advanced sapphire furnaces (ASF) crystallize sapphire material into sapphire boules. Our ASF technology is based on the heat exchanger method (HEM), a directional solidification technique which crystallizes the sapphire meltstock material during the growth process. We began entering into contracts to sell our ASF furnaces in the fall of 2010 and have been taking orders from new market entrants and existing PV customers who are interested in growing their own sapphire material for sale, we believe, primarily to the LED market. The design of our ASF crystallization furnace has benefited from the 40 years of sapphire crystal growing experience at Crystal Systems, Inc. We believe the similarities between our crystal growing operation and our ASF

10

equipment business gives us a competitive advantage in the market place. We market and sell our ASF furnaces under the names ASF85 and ASF100.

Advanced Sapphire Crystalline Growth Process

All of the components and assemblies for our ASF furnaces are manufactured by third parties using our designs. Our manufacturing personnel focus on final assembly, integration and testing of the ASF furnace prior to shipping the product to the customer. We also provide engineering and product design, quality control, process engineering and engineering services related to the operation of our ASF furnaces.

Target customers for our ASF furnaces include manufacturers from the solar and LED industries, as well as other diversified manufacturers.

We are in the process of commercializing our ASF furnaces and delivered the first furnaces to customers in May 2011 and expect to deliver additional furnaces throughout the first half of the fiscal year ending March 31, 2012. We have no experience installing and operating the ASF furnaces in customer facilities. If the ASF furnace does not operate properly in our customers' facilities, we will not be able to recognize revenue from the sale of furnaces in a timely manner, or at all. In addition, our sapphire business, and our overall business, would be materially and adversely impacted.

Turnkey Integration Services

We had offered complete turnkey integration services to our PV customers, using third party wafer, cell and module production equipment designed to produce a specified level of output. These services were sold to new market entrants in connection with the construction of new PV manufacturing facilities. Most of our turnkey revenues were from sales of wafer production lines, which provided additional sales opportunities for our DSS crystallization furnaces. During the three months ended July 3, 2010, we completed a review of our PV turnkey services and decided to no longer offer these services. This decision was based on our assessment of reduced market opportunities, as well as low gross margins compared to our other product lines. Our decision did not impact the recoverability of any tangible or intangible assets, and we did not incur any significant costs to eliminate this product offering. We have re-directed certain of the resources formerly engaged in our turnkey business into our sapphire business, including in assisting our effort to expand our materials business and to operate our sapphire equipment business.

Our Competitive Strengths

We believe that our competitive strengths include:

- •

- Key equipment supplier to many of the world's leading polysilicon and solar companies—We have been providing manufacturing equipment to the solar industry for over a decade and have supplied equipment to many of the world's leading polysilicon, solar wafer, cell and module manufacturers, including OCI Company, Ltd, (formerly DC Chemical Co., Ltd.), LDK

11

- •

- Large and growing presence in China, a major growth market for solar manufacturing—Today, many of the world's leading solar manufacturing companies are based in China (including Taiwan), which according to Solarbuzz, accounted for approximately 68% of the world's solar wafer manufacturing capacity in 2010. We have supplied equipment to three of the top eight leading PV manufacturers in China based on wafer manufacturing capacity, according to Solarbuzz data.

Solar Co., Ltd., (LDK), Nexolon Co., Ltd., Green Energy Technology, Baoding Tianwei Yingli New Energy Resources Co., Ltd. (Yingli), Changzhou Trina Solar Energy Co., Ltd. (Trina) AG, and GCL—Poly Energy Holdings Limited.

- •

- Leading market position in crystal growth equipment for the multicrystalline solar industry—We believe our DSS crystallization furnaces are the most widely used furnaces for casting multicrystalline ingots in the solar industry. Since the introduction of our DSS240 in 2005, we have shipped approximately 2,900 furnaces to customers worldwide, the majority of which were to manufacturers in China. Our DSS furnaces produce high quality crystalline ingots with reliability and low cost of ownership. We believe our installed base of DSS units and other PV equipment promotes higher sales of parts and service in the future as our customers' equipment ages.

- •

- Established supplier of technology to new entrants to the polysilicon industry—Our polysilicon production technology is recognized for its ability to produce quality polysilicon at a low cost per kilogram. Our first commissioned new polysilicon production facility was for OCI Company, Ltd, a large South Korean chemical company. In its "Green World" scenario, Solarbuzz estimates that approximately 146,000 metric tons (MT) of polysilicon production capacity will be added from 2010 to 2015. As one of a small number of companies providing CVD reactors commercially, we believe we are well positioned to successfully compete for these opportunities.

- •

- Rapid commercialization of technology to enable the growth of new markets—We have been successful in commercializing crystal growth technology that enables new entrants capitalize on expected market growth opportunities. We established a leading multicrystalline growth technology in the PV industry with our DSS furnace in 2005. In the fall of 2010, we began entering into contracts to sell our ASF sapphire crystallization furnace for commercial sale to companies interested in producing sapphire. The operational experience we have gained in successfully building and managing a high quality, global supply chain to support the growth of our DSS furnaces has allowed us to quickly ramp our ASF equipment business.

- •

- Supplier of quality sapphire material for the LED and other specialty markets—Through our acquisition of Crystal Systems in July, 2010, we produce high quality sapphire material. Crystal Systems, utilizing learning from 40 years of sapphire crystal growing experience has made ongoing improvement in sapphire production and today is recognized for its ability to produce material that meets stringent technical requirements for applications such as high power lasers, windows for the aerospace and defense industry, and other industries such as medical device and oil and gas.

We have been doing business in China since 2002 and have continued to expand our base of operations to better serve the increased number of our China-based customers. In September 2009, we opened our Shanghai production facility to provide spare parts inventory, certain limited manufacturing furnaces, a demonstration and training center and other customer service capabilities for our Asia-based customers. In October 2010, we transitioned our global operations center to Hong Kong. We believe that our relationships with leading Chinese solar companies and our expanded base of operations in China will enhance our ability to compete against the lower cost Chinese PV capital equipment companies in our markets.

12

- •

- Outsourced manufacturing model—Our manufacturing model is different from many capital equipment manufacturers in that we outsource most of the components used in our PV and sapphire equipment and the manufacturing of our polysilicon equipment. All of the components of our polysilicon products are shipped directly from our qualified vendors to the customer installation site. Components for our DSS crystallization furnaces are shipped to our facilities in Merrimack, New Hampshire and Shanghai and Hong Kong, China, where they are crated prior to shipping to our Hong Kong consolidation warehouse, for ultimate shipment to the customer. Our Merrimack, New Hampshire facility is also being expanded to accommodate the integration and final assembly of our ASF furnaces prior to shipping to the customer.

- •

- Strong balance sheet—Our strong financial position allows us to use our cash balances and cash flows from operations, subject to certain restrictions in our credit agreement, on strategic initiatives such as investments in new products or services or other growth opportunities. Additionally, we believe that our liquid working capital position is important due to the volatility that has occurred and may occur in the future in the solar industry.

This model results in a highly flexible cost structure, modest working capital and physical plant requirements and a relatively small number of manufacturing employees. This model also improves our competitive position by keeping our cost of operations low.

Our Growth Strategies

Our growth strategies include:

- •

- maintaining technology leadership in our core product areas through innovation and new product development;

- •

- better serving our customers and lowering our costs by further expanding our operations in Asia;

- •

- protecting our customers' investments in capital equipment by providing technical improvements for existing products that enhance their productivity and efficiency;

- •

- leveraging our sapphire materials capabilities to become a supplier of crystal growth equipment to the sapphire industry; and

- •

- developing or acquiring complementary technologies or businesses.

Competition

We compete on the basis of reputation, technology, delivery, service (both installation and aftermarket) and price. We principally compete with equipment manufacturers in the PV market for CVD reactors for the production of polysilicon and DSS furnaces for the production of multicrystalline ingots. Our sapphire materials and equipment business competes with a number of well established sapphire material producers and several sapphire furnace manufacturers.

Polysilicon business—Our CVD reactor products and other related services face direct competition from a small number of entities to the polysilicon production market. These competitors include MSA Apparatus Construction for Chemical Equipment Ltd, Centrotherm Elektrische Anlagen GmbH & Co., Morimatsu Industry Co. Ltd. and Poly Plant Project, Inc. We also face indirect competition from large, well-established companies that produce polysilicon primarily for the semiconductor industry. These companies have developed polysilicon production technology for their own use which they do not market to third parties. These indirect competitors include Hemlock Semiconductor Corporation, Wacker Chemie AG, Tokuyama Corporation, MEMC Electronic Materials, Inc. and Renewable Energy Corporation ASA.

13

PV business—Over the past several years, we have seen the emergence of low-cost competitors to our DSS crystallization furnaces. These competitors include ALD Vacuum Technologies AG, JYT Corporation, Ferrotec Corporation, PVA TePla AG, Centrotherm Elektrische Anlagen GmbH & Co., Jing Gong Technology, Zhejiang Jingsheng Mechanical & Electrical Co., Ltd., as well as a number of other furnace manufacturers. Several of these competitors, such as Centrotherm and Ferrotec are large integrated manufacturers with significant resources capable of competing for business globally.

Sapphire business—We face competition for the sale of our sapphire material from a number of well established companies. These competitors include Rubicon Technology, Inc., Sapphire Technology Co. Ltd. (Korea), Kyocera International Inc., Namiki Precision Jewel Co. Ltd., and Monocrystal as well as a number of other sapphire material suppliers. We also face competition for the sale of our advanced sapphire furnace from companies offering alternative technologies including Thermal Technology LLC and Advanced RenewableEnergy Company, LLC.

In addition, all three of our business segments experience competition from new entrants to the respective industries, many of these new entrants have significant resources and advanced technology, as well as competition from certain companies who formerly purchased materials from our equipment customers and have decided to manufacture their own polysilicon, silicon ingot and sapphire material by means of creating and building their own equipment.

Customers

We sell our products and services globally to polysilicon producers, solar wafer manufacturers, and sapphire producers. We also sell sapphire material to customers in the LED and other specialty markets. Our customers include, or are suppliers to, some of the world's leading solar wafer and cell manufacturers and LED manufacturers.

In any one year, we typically have a small number of customers in our polysilicon and PV segments, with any one customer representing a significant percentage of our total revenue. However, our customers and/or their contribution to our revenue typically change from year to year, as different customers replace equipment and undertake projects to add manufacturing capacity. We are new to the sapphire business, but expect that we will have a limited number of customers for our sapphire equipment, some of whom are customers of our PV and polysilicon segment, and a significantly greater number of customers for our sapphire materials. The following customers comprised 10% or more of our total net revenues for the fiscal years ended April 2, 2011, April 3, 2010, and March 28, 2009:

| | Fiscal Year Ended | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | April 2, 2011 | April 3, 2010 | March 28, 2009 | ||||||||||||||

| | Revenue | % of Total | Revenue | % of Total | Revenue | % of Total | |||||||||||

| | (dollars in thousands) | ||||||||||||||||

Jiangsu GCL Silicon Material Technology Development Co. Ltd. | $172,627 | 19 | % | * | * | % | * | * | % | ||||||||

LDK Solar Co., Ltd | * | * | % | $ | 185,249 | 34 | % | $108,781 | 20 | % | |||||||

OCI Company Ltd (formerly DC Chemical Co. Ltd) | * | * | % | * | * | % | 92,544 | 17 | % | ||||||||

Baoding Tianwei, Yingli New Energy Resources Co., Ltd | * | * | % | * | * | % | 74,533 | 14 | % | ||||||||

Glory Silicon Energy Co., Ltd | * | * | % | * | * | % | 57,896 | 11 | % | ||||||||

- *

- Revenue from these customers was either zero or less than 10% of the total net revenue during the period.

14

We believe that our sales to customers in Asia will continue to be a significant portion of sales over the next several years as polysilicon and sapphire manufacturing is expected to continue to grow in that region. For more information about our revenue and long-lived assets by geographic region and our revenue, gross profit and assets by segment, please refer to Note 17 in our Consolidated Financial Statements included elsewhere in this Annual Report on Form 10-K.

Sales, Marketing and Customer Support

We market our products principally through a direct sales force, and our equipment products through regional indirect sales representatives who solicit orders and identify potential sales opportunities in markets where our business is less established. All sales are made directly by us to the customer and our indirect sales representatives are not authorized to enter into sales contracts on our behalf.

Sales terms

We have established standard terms and conditions of sale for our products; however, sales contracts and prices can vary and are generally negotiated on a case-by-case basis. In the case of our polysilicon, PV and sapphire equipment sales, customers are generally required to make a cash deposit when the order is placed. Customers occasionally require us to provide a standby letter of credit to secure the cash deposit. In addition to cash deposits, customers are also generally required to either post a letter of credit or make advance payments of typically 90% of the value of the equipment prior to shipment. The balance, typically 10%, is paid upon customer acceptance of the equipment sold, which typically occurs within a two to twelve month period after shipping based upon contract terms. Because of the longer production times associated with our CVD reactors, customers are also required to make a series of installment payments as production milestones are achieved in addition to the initial cash deposit. In the event market conditions deteriorate, our existing terms and conditions in connection with equipment sales may not be sustainable.

The majority of sales for sapphire and Ti:sapphire material products are based on customer purchase orders. Payment for these materials is generally due in full within thirty days following shipment. Customers without a credit history are generally required to make an advance payment at least equal to the amount of the next current shipment(s). We have, in very limited circumstances, entered into longer term supply arrangements for sapphire material, which require, among other things, advance payments and other terms and conditions that are not included in a purchase order.

Product warranty

Our polysilicon products are generally sold with a standard warranty typically for a period not exceeding twenty-four months from delivery. Our PV and sapphire equipment are generally sold with a standard warranty for technical defects for a period equal to the shorter of: (i) twelve months from the date of acceptance by the customer; or (ii) fifteen months from the date of shipment. The warranty is typically provided on a repair or replacement basis and includes both products we manufacture and products that we supply our customers from other manufacturers. The Company's sapphire material products are generally sold with a standard warranty for a period not greater than 30 days, but in certain circumstances this warranty period has been extended to greater than 30 days. Our total warranty accruals for new warranties issued, was $11.0 million for the fiscal year ended April 2, 2011, $1.1 million for the fiscal year ended April 3, 2010, and $2.3 million for the fiscal year ended March 28, 2009.

15

Customer support

Our polysilicon production equipment and crystallization furnaces are critical to the operation of our customers' manufacturing operations. Prior to an order being placed, a customer service representative advises the customer with respect to its facilities requirements and undertakes modeling of expected operating costs. Following delivery, our engineers assist with installation and integration of equipment at the customer's facility. After the sale is complete we often provide support services for a fee. As the number of our product installations increases, we will continue to offer our service and support.

Manufacturing and Suppliers

Our manufacturing model is different from many capital equipment manufacturers in that we outsource most of the components used in our PV and sapphire equipment. Our factory focuses on assembly operations and the production of proprietary components. Nearly all of the components of our polysilicon products are shipped directly from our qualified vendors to the customer installation site. Components for our DSS crystallization furnaces and our ASF sapphire furnaces are shipped to our facilities in Merrimack, New Hampshire and Shanghai and Hong Kong, China, where they are crated prior to shipping to our Hong Kong consolidation warehouse, for ultimate shipment to the customer. This model results in a flexible cost structure, modest working capital and physical plant requirements and a relatively small number of manufacturing employees.

Our DSS and ASF manufacturing operation uses a "forecast manufacturing" methodology to project our raw material needs sufficiently in advance of manufacturing lead times, in an attempt to diminish the threat of spot price volatility and generally minimizing the effect of supply shortages and disruptions. We believe this approach reduces product delivery times and increases scalability and factory utilization. Our polysilicon operations procure materials when customer orders are received.

We purchase a range of materials and components for use in our products from other manufacturers. Many component parts purchased by us are made to our specifications and under appropriate confidentiality arrangements. Purchased components represented approximately 82%, 87%, and 85% of cost of goods sold in the fiscal year ended April 2, 2011, April 3, 2010, and March 28, 2009, respectively. We attempt to secure multiple suppliers of our components to reduce our concentration risk and ensure adequate supply, but, in some cases, components and parts are obtained from a single vendor. In addition, we do not use any single supplier to produce all of the components for any single product in order to reduce the risk that a supplier could replicate our products. In many cases, but not all, we believe that these materials and components are available from multiple sources and that we are not dependent on any single supplier. We have well-established relationships with various domestic and foreign suppliers of the components used in our products. We generally are required to make a series of pre-payments to these vendors, which we fund from our working capital.

Research, Development and Engineering

Our research and development activities are focused on advancing, developing and improving technologies for the markets we serve. We also have cooperative research and development agreements with certain universities, customers and suppliers. Our research and development expense was $23.8 million in the fiscal year ended April 2, 2011; $21.4 million in the fiscal year ended April 3, 2010; and $18.3 million in the fiscal year ended March 28, 2009.

Intellectual Property

We believe that our competitive position depends, in part, on our ability to protect our intellectual property resulting from our research, development, engineering, manufacturing, marketing, and technical and customer service activities. Under our intellectual property strategy we protect our

16

proprietary technology through a combination of patents, trademarks, copyrights, know-how and trade secrets, as well as employee and third party confidentiality and assignment of rights agreements. We focus on developing, identifying and protecting our technology and resulting intellectual property in a manner that supports our overall business and technology objectives. Although we rely on intellectual property that is primarily developed in-house for our solar, polysilicon and sapphire equipment and related products, we also enter into patent and/or technology licenses with other parties when we believe such licenses would advance or complement our products and technology or would otherwise be in our best interest.

One of the principal means of protecting our proprietary technology, including technical processes and equipment designs, is through trade secret protection and confidentiality agreements. Our personnel, including our research and development personnel, enter into confidentiality agreements and non-competition agreements with us. These agreements further address intellectual property protection issues and require our employees to assign to us, among other things, all of the inventions, designs and technologies they develop during the course of their employment with us. We also generally require our customers and business partners to enter into confidentiality agreements before we disclose any sensitive aspects of our technology or business plans. Confidentiality agreements, however, may be difficult to enforce in certain jurisdictions and, therefore, may be of limited value in protecting our intellectual property.

We seek patent protection in various countries when it is consistent with our strategy and the protection afforded justifies the required disclosure costs associated with the filing. We own, or have applied for, various patents and patent applications in the United States and other countries relating to our products, product uses and manufacturing processes. The patents and patent applications vary in scope and duration. As of May 1, 2011, we own twenty issued patents in the PV and semiconductor and sapphire fields in the United States, which will expire at various times between 2012 and 2028. We also held, as of May 1, 2011, eight patents in other jurisdictions which expire at various times between 2018 and 2020. Although the products made, sold or used under our patents or technology licenses are important to us, we believe at this time that our business as a whole is not materially dependent on any particular patent or technology license, or on the licensing of our patents or technology to third parties, other than our customers.

We have not been subject to any material claims for infringement, misappropriation or other violation of intellectual property rights, claims for compensation by employee inventors or claims disputing ownership of our proprietary technologies. We have instituted claims and actions against others for what we believe are infringement of our intellectual property rights.

Order Backlog

Our order backlog consists of signed purchase orders or other written contractual commitments. The table below sets forth our order backlog as of April 2, 2011 and April 3, 2010 by business segment:

| | April 2, 2011 | April 3, 2010 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Product Category | Amount | % of Backlog | Amount | % of Backlog | |||||||||

| | (dollars in millions) | ||||||||||||

Photovoltaic business | $ | 468 | 39 | % | $ | 441 | 49 | % | |||||

Polysilicon business | 537 | 45 | % | 465 | 51 | % | |||||||

Sapphire business | 184 | 16 | % | — | — | ||||||||

Total | $ | 1,189 | 100 | % | $ | 906 | 100 | % | |||||

Our order backlog as of April 2, 2011, included deferred revenue of $154.6 million related to our PV business and $290.9 million related to our polysilicon business. There were no amounts in deferred

17

revenue as of April 2, 2011 related to the sapphire business. Deferred revenue represents equipment that had been shipped to customers but not yet recognized as revenue. Cash received in deposits related to our order backlog were $144.4 million as of April 2, 2011, and substantially all of the contracts in our order backlog require the customer to either post a standby letter of credit in our favor or make advance payment prior to shipment of equipment. From the date of a written commitment, we generally would expect to deliver PV products over a period ranging from three to nine months and polysilicon products over a period ranging from twelve to eighteen months, although portions of the related revenue are expected to be recognized over longer periods in many cases.

As of April 2, 2011, our order backlog for our sapphire business was comprised primarily of contracts related to our sapphire crystal growth furnaces that were received during the year ended April 2, 2011. In addition, our backlog includes short-term contracts or sales orders for sapphire materials. From the date of a written commitment, we generally would expect to deliver sapphire material products over a period ranging from three to nine months. We are in the process of commercializing our sapphire crystal growth furnaces and delivered the first two furnaces in May 2011 and expect to deliver additional furnaces throughout the first half of the fiscal year ending March 31, 2012. From the date of a written commitment, we would generally expect to deliver ASF furnaces over a period ranging from approximately 12 to 18 months. However, we have only shipped two ASF furnaces and our expectation of delivery time frames may not be accurate and it may actually take us a longer period of time as we develop this business.

Disregarding the effect of any contract terminations or modifications, we would expect to convert approximately 72% of our April 2, 2011 order backlog into revenue during fiscal year 2012, and approximately 28% during fiscal 2013 and 2014. Although, most of our orders require substantial non-refundable deposits, our order backlog as of any particular date should not be relied upon as indicative of our revenues for any future period. We began tracking our backlog as a performance measure on a consistent basis during 2007.

If a customer fails to perform on a timely basis, and such failure continues after notice of breach and a cure period, we may terminate the contract. Our contracts do not contain cancellation provisions and in the event of a customer breach, the customer may be liable for contractual damages. During the fiscal year ended April 2, 2011, we terminated or modified contracts resulting in a $10.7 million reduction in our order backlog (82% of the reduction was from 3 contracts) as compared to the fiscal year ended April 3, 2010, where we terminated or modified contracts resulting in a $105.0 million reduction in our order backlog (95% of the reduction was from 9 contracts). During the fiscal year ended April 2, 2011 and April 3, 2010 we recorded revenues of $44.4 million and $21.1 million, respectively, from terminated contracts.

As of April 2, 2011, our order backlog consisted of contracts with 35 PV customers, 18 of which have orders of $3 million or greater; and contracts with 10 polysilicon customers, all of which have orders of $3 million or greater. As of April 2, 2011, our sapphire business backlog consisted of several customers, five of which had orders of greater than $3 million. Our April 2, 2011 backlog for the sapphire segment included new orders totaling $184.2 million, of which $174.2 million was related to sapphire equipment and $10.0 million was related to sapphire material contracts.

Our order backlog as of April 2, 2011, included $346.6 million attributed to one customer representing 10% or more our order backlog.

Employees

As of April 2, 2011, we employed 622 full-time employee equivalents and contract personnel, consisting of 124 engineering and research and development employees; 85 customer service representatives; 8 executives; 44 sales and marketing employees; 147 finance, general and administrative employees; 201 manufacturing staff; and 13 information technology employees. As of April 2, 2011,

18

300 employees were located at our Merrimack and Nashua, New Hampshire facilities, 74 employees were located at our Salem, Massachusetts facility, 59 employees were located at our Montana facility and 189 employees were located at our Asia facilities. None of our employees are currently represented by labor unions or covered by a collective bargaining agreement. We believe that relations with our employees are satisfactory.

Environmental Matters

Our Merrimack, New Hampshire and Salem, Massachusetts facilities are subject to an industrial user discharge permit governing the discharge of wastewater to the Merrimack and Salem sewer systems. Our Salem, Massachusetts facility is subject to permit related to the installation and storage of diesel sub-based fuel tanks and generators. There are no further environmental related permits required by us that are material to our business. We are not aware of any environmental issues that would have a material adverse effect on our operations generally.

Available Information

Our internet website address is http://www.gtsolar.com. Through our website, we make available, free of charge, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports, as soon as reasonably practicable after such materials are electronically filed, or furnished to, the Securities and Exchange Commission, or the SEC. These SEC reports can be accessed through the investor relations section of our website. The information found on our website is not part of this or any other report we file with or furnish to the SEC.

The charters of our Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee, as well as our Code of Conduct and Code of Ethics for Senior Financial Officers, and Corporate Governance Guidelines are available on our website at www.gtsolar.com under "Corporate Governance". These items are also available in print to any stockholder who requests them by calling (603) 883-5200. This information is also available by writing to us, attention: Corporate Secretary, at the address on the cover of this Annual Report on Form 10-K.

Our business, operating results and cash flows can be impacted by a number of factors, any one of which could cause our actual results to vary materially from recent results or from our anticipated future results. You should carefully consider the risks described below and the other information in this report before deciding to invest in shares of our common stock. These are the risks and uncertainties we believe are most important for you to consider. Additional risks and uncertainties not presently known to us, which we currently deem immaterial or which are similar to those faced by other companies in our industry or business in general, may also impair our business operations. If any of the following risks or uncertainties actually occurs, our business, financial condition and operating results would likely suffer. In that event, the market price of our common stock could decline and an investor in our common stock could lose all or part of their investment.

19

Risks Related to Our Business Generally

General economic conditions may have an adverse impact on demand for our products.

Demand for products requiring significant capital expenditures, such as our DSS units, CVD reactors and ASF furnaces, is affected by general economic conditions. A downturn in the global construction market reduces demand for solar panels in new residential and commercial buildings, which in turn reduces demand for our products that are used in the manufacture of PV wafers, cells and modules and polysilicon for the solar power industry. In addition, a downturn in the sapphire material market, and the sapphire-based LED market in particular (or if these markets do not experience any growth) would likely result in reduced demand for our sapphire material and our advanced sapphire furnaces. Uncertainties about economic conditions, negative financial news, tighter credit markets and declines in asset values have caused our customers to postpone making purchases of capital equipment and materials. Increasing budgetary pressures could reduce or eliminate government subsidies and economic incentives for on-grid solar electricity applications. A prolonged downturn in the global economy could have a material adverse effect on our business in a number of ways, including decreased demand for our products, which would result in lower sales and reduced backlog.

Uncertainty about future economic conditions makes it challenging for us to forecast our operating results, make business decisions and identify the risks that may affect our business. If we are not able to timely and appropriately adapt to changes resulting from the difficult macroeconomic environment, our business, results of operations and financial condition may be materially and adversely affected.

Current or future credit and financial market conditions could materially and adversely affect our business and results of operations in several ways.

Financial markets in the United States, Europe and Asia experienced extreme disruption in recent years, including, among other things, extreme volatility in security prices, tightened liquidity and credit availability, rating downgrades of certain investments and declining valuations of others. There can be no assurance that there will not be further tightening in credit markets, deterioration in the financial markets and reduced confidence in economic conditions. These economic developments adversely affect businesses such as ours in a number of ways. The tightening of credit in financial markets has resulted in reduced funding worldwide and a higher level of uncertainty for solar module and sapphire equipment manufacturers. As a result, some of our customers have been delayed in securing, or prevented from securing, funding adequate to honor their existing contracts with us or to enter into new contracts to purchase our products. We believe a reduction in the availability of funding for new manufacturing facilities and facility expansions in the solar and sapphire industries, or reduction demand for solar equipment panels or sapphire material, could cause a decrease in orders for certain of our products. We currently require most of our equipment customers to prepay a portion of the purchase price of their orders. We use these customer deposits to prepay our suppliers to reduce the need to borrow to cover our cash needs for working capital. This practice may not be sustainable if the recent market conditions continue. Some of our customers who have become financially distressed have failed to provide letters of credit or make payments in accordance with the terms of their existing contracts. If customers fail to post letters of credit or make payments, and we do not agree to revised terms, it could have a significant impact on our business, results of operations and financial condition.

During the fiscal years ended April 2, 2011 and April 3, 2010, some of our PV and polysilicon customers failed to make deposits when due under their contracts, and we terminated some of those contracts. In addition, certain of these customers requested extensions of delivery dates and other modifications. The resulting contract modifications included lower pricing and reductions in the number of units deliverable under the contracts, thereby reducing our order backlog. As a result of these terminations and other contract modifications, our PV and polysilicon order backlog was reduced by $10.7 million during the fiscal year ended April 2, 2011 and by $105.0 million during the fiscal year ended April 3, 2010.

20

As a result of PV and polysilicon customer delays or contract terminations, we reschedule or cancel, from time to time, purchase orders with our vendors to procure materials and reimburse the vendor for costs incurred to the date of termination plus predetermined profits. In addition, in the past, certain of the vendors from whom we purchased materials were unable to deliver their components because economic conditions had an adverse impact on their ability to operate their businesses and, in some cases, we were unable to recover advances paid to those vendors for components that were not delivered. For example, during the fiscal year ended March 28, 2009, we rescheduled and/or cancelled commitments to our vendors as a result of customer delays, contract modifications and terminations and we recorded losses of $11.3 million relating to expected forfeitures of vendor advances and reserves against advances on inventory purchases with vendors that had become financially distressed. In cases where we are not able to cancel or modify purchase orders impacted by customer delays or terminations, our purchase commitments may exceed our order backlog requirements and we may be unable to redeploy the undelivered equipment. In addition, we may be required to pay advances to vendors in the future without being able to recover that advance if the vendor is placed in bankruptcy, becomes insolvent or otherwise experiences financial distress.

We are new to the sapphire material and equipment industry and have only delivered our first two ASF furnaces to customers (and have not operated these furnaces in the customers' facilities), but expect that the adverse impact of changes in the credit and financial markets on our sapphire business segment would be similar to that in our PV and polysilicon business segments. Delays in deliveries for products of all of our segments could cause us to have inventories in excess of our short-term needs and may delay our ability to recognize revenue on contracts in our order backlog. Contract breaches or cancellation of orders would prevent us from recognizing revenue on contracts in our order backlog and may require us to reschedule and/or cancel additional commitments to vendors in the future.

Credit and financial market conditions may similarly affect our suppliers. We may lose advances we make to our suppliers in the event they become insolvent because our advances are not secured or backed by letters of credit. The inability of our suppliers to obtain credit to finance development or manufacture our products could result in delivery delays or prevent us from delivering our products to our customers.

We are unable to predict the likely duration and severity of the disruption in financial markets and adverse worldwide economic conditions and any resulting effects or changes, including those described above, may have a material and adverse effect on our business, results of operations and financial condition.

Amounts included in our order backlog may not result in actual revenue or translate into profits.

Although our order backlog is based on signed purchase orders or other written contractual commitments, we cannot guarantee that our order backlog will result in actual revenue in the originally anticipated period or at all. In addition, the contracts included in our order backlog may not generate margins equal to our historical operating results. We began to track our order backlog on a consistent basis as a performance measure in 2007, and as a result, we do not have significant experience in determining the level of realization that we will actually achieve on our backlog. Our customers may experience project delays or defaults on the terms of their contracts with us as a result of external market factors and economic or other factors beyond our control. If a customer fails to perform its contractual obligations and we do not reasonably expect such customer to perform its obligations, we may terminate the contract. In addition, our backlog is at risk to varying degrees to the extent customers request that we extend the delivery schedules and make other modifications under their contracts in our order backlog. Any contract modifications that we negotiate could likely include an extension of delivery dates, and could result in lower pricing or in a reduction in the number of units deliverable under the contract, thereby reducing our order backlog. Our order backlog includes contracts with customers to whom we have sent notices of breach for failure to provide letters of credit

21

or to make payments when due. If we cannot come to an agreement with these customers, it could result in a further reduction of our order backlog. Other customers with contracts in our order backlog that are not currently under negotiation may approach us with requests for delays in the future, or may fail to make payments when due, which could further reduce our order backlog. As a result of terminations and other contract revisions, our order backlog was reduced by $10.7 million during the fiscal year ended April 2, 2011 and by $105.0 million during the fiscal year ended April 3, 2010. If our order backlog fails to result in revenue in a timely manner, or at all, we could experience a reduction in revenue, profitability and liquidity.

We currently depend on a small number of customers in any given fiscal year for a substantial part of our sales and revenue.