(b) In May 2006 Geovic, Ltd. issued 4,200,000 shares (as adjusted in connection with the RTO) to 34 persons for cash consideration of $4,515,000. No underwriter was involved in the placement. The shares were exempt from the registration requirements of the Securities Act under Section 4(2) and Regulation S, as the purchasers were non-U.S. persons as defined in Regulation S not present in the United States. Certificates evidencing the shares issued were restricted from transfer except in compliance with the Securities Act and carried an appropriate restrictive legend.

(c) On December 1, 2006 Geovic, Ltd. issued 27,768 shares of its common stock to Gregg Sedun, as a finder’s fee in connection the initiation of the RTO transaction. No underwriter was involved in the issuance of the shares. The shares issued were exempt from the registration requirements of the Securities Act under Regulation S, as Mr. Sedun is a non-U.S. person not present in the United States and took the shares pursuant to an appropriate investment representation.

(d) In August 2006, Geovic, Ltd. issued 865,156 shares of restricted common stock to seventeen persons in consideration of the increase in the exercise price of certain outstanding Geovic, Ltd. stock options granted in 2005 and 2006 held by such persons. No underwriters were involved in the transactions. Shares were issued in recognition that the exercise price of the options, the prices of which were increased, when issued in 2005 and 2006 were less than fair market value of Geovic, Ltd. common stock when granted, and under Section 409A of the Internal Revenue Code, would have created taxable income to the holders. One-half of the shares are subject to forfeiture until August 15, 2007 upon the occurrence of certain conditions and the balance of the shares are subject to forfeiture until August 15, 2008 upon occurrence of certain conditions. The issuance of the shares were exempt from the registration provisions of the Securities Act under Section 4(2), as each of the persons to whom the restricted shares were issued held options granted under the Geovic, Ltd. Stock Option plan, agreed in writing with the Company to hold the shares for investment purposes, and not to transfer the shares except in compliance with the Securities Act, and the Company maintains possession of certificates representing the shares while they are subject to forfeiture.

(e) Between January 1 2004, and December 15, 2005, Geovic, Ltd. issued 3,205,300 shares of its common stock and warrants to purchase 317,208 shares to 140 purchasers for total proceeds of $4,770,448. No underwriter was involved in these transactions. The issuance of the Geovic, Ltd. shares was exempt from the registration requirements under the Securities Act under Section 4(2) of the Act and Regulation D. Each of the purchasers was an Accredited Investor as defined in Regulation D, each purchaser made appropriate investment representations to the Company, and the certificates evidencing the shares issued included appropriate restrictive legends.

Geovic Finance Corp., a corporation formed in 2006 in the Cayman Islands (“FinCo”), issued the following securities that were not registered under the Securities Act.

(a) Upon organization FinCo issued 9,000,001 shares of its common stock, 6,000,000 shares of preferred stock and 3,000,000 non-transferable, non-exercisable warrants to 7 persons. The common and preferred shares were issued at $0.045 per share to 57 initial shareholders and the warrants were issued for services to be provided. The shares were exempt from the registration requirements of the Securities Act under Regulation S adopted thereunder as all shares were issued outside the United States to non-U.S. persons.

(b) On November 3, 2006, FinCo issued subscription receipts in connection with a private financing made in anticipation of the RTO. The subscription receipts entitled the purchasers, immediately before the closing of the RTO, to exchange the subscription receipts for shares of FinCo common stock and warrants to purchase additional shares of FinCo common stock. FinCo issued 6,000,000 subscription receipts entitling the subscribers to receive 6,000,000 shares of FinCo common stock and 3,000,000 warrants to purchase additional shares of common stock to twenty-four investors for Cdn$11.7 Million ($10.2 Million). Canaccord Capital Corporation served as placement agent in connection with the placement of the subscription receipts and received cash commissions equal to 6% of the purchase price of the subscription receipts sold outside the United States, plus compensation options entitling the agents to acquire up to 348,600 shares of FinCo common stock. The issuance of the subscription receipts was exempt from the registration requirements of the Securities Act under Regulations S and D adopted under the Securities Act. Four purchasers of subscription receipts were U.S. persons present in the United States. Each of such persons qualified as an Accredited Investor as defined in Regulation D and each took the subscription receipts for investment purposes. FinCo filed Form D with the Securities and Exchange Commission and in each of the states where the purchasers resided. All of the other purchasers were non-U.S. persons not present in the United States.

Our authorized capital consists of the 200,000,000 shares of common stock, $0.0001 par value, of which 100,708,908 shares are issued and outstanding as of August 31, 2007; and 50,000,000 shares of undesignated preferred stock, $0.0001 par value, of which 6,000,000 shares have been designated as Series A Preferred Stock. No shares of our preferred stock are outstanding, and all shares of Series A Preferred stock have been surrendered in exchange for, or converted into, shares of our common stock.

Except as otherwise provided by law or by the resolution or resolutions adopted by the Board of Directors of the Company designating the rights, powers and preferences of any series of preferred stock of the Company, common shares of the Company have the exclusive right to vote for the election of directors and for all other purposes. The holders of common stock have the right to notice of, to attend and to vote at meetings of our Shareholders and each share has the right to one vote per share, the right to receive dividends as and when declared on the shares by the Board of Directors, subject to the satisfaction of any preferential rights of holders of outstanding preferred stock; and the right to receive the remaining property and net assets in the event of liquidation, dissolution or winding-up, subject to the payment of any preference thereto applicable to outstanding preferred stock of the Company.

Pursuant to our Certificate of Incorporation, the Geovic Mining Board, without any vote or action by the holders of shares, may issue preferred stock from time to time in one or more series. The Board is authorized to determine the number of shares and to fix the designations, powers, preferences, and the relative, participating, optional, or other rights of any series of preferred stock. Issuances of preferred stock would be subject to the applicable rules of the TSXV, or other securities exchange or system on which our securities are then quoted or listed. Depending upon the terms of preferred stock established by the Board, any or all series of preferred stock could have preference over the common stock with respect to dividends and other distributions and upon liquidation. If any shares of preferred stock are issued with voting powers, the voting power of the outstanding common stock would be diluted. No shares of preferred stock are presently outstanding, and we have no present intention to issue any shares of preferred stock.

We have three outstanding classes of transferable Warrants: 2,999,996 Warrants issued December 1, 2006 in connection with the RTO, that expire November 3, 2011 (“November Warrants,” trading symbol: “GMC.WT”), 10,800,000 Warrants issued March 6, 2007 upon completion of our public offering that expire March 6, 2012 (March Warrants,” trading symbol: “GMC.WT.A”), and the 4,792,100 Warrants issued upon completion of our April 2007 public offering, including shares issued upon an exercise of the over-allotment option, that expire April 27, 2012 (the “April Warrants,” trading symbol: “GMC.WT.B”).

The Warrants were issued under separate warrant indentures (the “Warrant Indentures”) entered into between Geovic Mining and Pacific Corporate Trust Company (the “Trustee”). The principal transfer office of the Trustee in Vancouver is the location at which all of the Warrants may be surrendered for exercise, transfer or exchange.

77

Each whole November Warrant is exercisable to purchase one share of our common stock (a “Warrant Share”) at a price of Cdn$2.50 at any time until November 3, 2011, each whole March Warrant is exercisable to purchase one Warrant Share at a price of Cdn$3.00 at any time until March 6, 2012, and each whole April Warrant is exercisable to purchase one Warrant Share at a price of Cdn$5.00 at any time until April 27, 2012.

The Warrant Indentures provide for adjustment in the number of Warrant Shares issuable upon the exercise of the Warrants and/or the exercise price per Warrant Share upon the occurrence of certain events, including:

| (i) | the issuance of common shares or securities exchangeable for or convertible into common shares to all or substantially all of the holders of the common shares by way of a stock dividend or other distribution; |

| |

| (ii) | the subdivision, redivision or change of the common shares into a greater number of shares; |

| |

| (iii) | the consolidation, reduction or combination of the common shares into a lesser number of shares; |

| |

| (iv) | the issuance to all or substantially all of the holders of the common shares of rights, options or warrants under which such holders are entitled, during a period expiring not more than 45 days after the date of such issuance, to subscribe for or purchase common shares, or securities exchangeable for or convertible into common shares, at a price per share to the holder (or at an exchange or conversion price per share) of less than 95% of the “current market price”, as defined in the Warrant Indenture for each class of Warrants, for the common shares on the record date; and |

| |

| (v) | the issuance or distribution to all or substantially all of the holders of the common shares of (a) shares of any class other than common shares, (b) rights, options or warrants to acquire shares of any class or securities exchangeable or convertible into any such shares (other than those contemplated in (iv)), (c) evidences of indebtedness, or (d) any property or other assets (other than cash dividends paid in the ordinary course). |

The Warrant Indentures also provide for adjustment in the class and/or number of securities issuable upon the exercise of the Warrants and/or exercise price per security in the event of the following additional events:

| (i) | reclassification of the common shares; |

| |

| (ii) | consolidation, amalgamation or merger of the Company with or into any other corporation or other entity (other than consolidations, amalgamations or mergers which do not result in any reclassification of the outstanding common shares or a change of the common shares into other shares); or |

| |

78

| (iii) | the transfer of the undertaking or assets of the Company as an entirety or substantially as an entirety to another corporation or other entity. |

No adjustment in the exercise price or the number of Warrant shares issuable upon the exercise of the Warrants will be required to be made unless the cumulative effect of such adjustment or adjustments would result in a change of at least 1% in the exercise price or the number of Warrant shares issuable upon exercise of the Warrants by at least one one-hundredth of a Warrant Share.

We have agreed in the Warrant Indentures that, during the period in which the Warrants are exercisable, Geovic Mining will give notice to Warrantholders of certain stated events, including events that would result in an adjustment to the exercise price for the Warrants or the number of Warrant shares issuable upon exercise of the Warrants, at least 14 days prior to the record date or effective date, as the case may be, of such event.

No fractional Warrant shares will be issuable upon the exercise of any Warrants. Warrantholders will not have any voting or any other rights which a holder of common shares would have until the Warrants are properly exercised and Warrant shares issuable upon the exercise of the Warrants are issued.

The Warrant Indentures provide that, from time to time, Geovic Mining and the Trustee, without the consent of the Warrantholders, may amend or supplement the Warrant Indentures for certain purposes, including curing defects or inconsistencies or making any change that does not prejudice the rights of Warrantholders. Any amendment or supplement to the Warrant Indentures that would prejudice the interests of the Warrantholders may only be made by “special resolution”, which is defined in the Warrant Indentures as a resolution either (1) passed at a meeting of the Warrantholders at which there are Warrantholders present in person or represented by proxy representing at least 20% of the aggregate number of the then outstanding Warrants (unless such meeting is adjourned to a prescribed later date due to a lack of quorum, at which adjourned meeting the Warrantholders present in person or by proxy shall form a quorum) and passed by the affirmative vote of Warrantholders representing not less than 66 2/3% of the aggregate number of all the then outstanding Warrants represented at the meeting and voted on the poll upon such resolution, or (2) adopted by an instrument in writing signed by the by the Warrantholders representing not less than 66 2/3% of the aggregate number of all the then outstanding Warrants.

| Voluntary Pooling (Re-Sale) Restrictions |

Certain shares of Geovic Mining common stock held by most persons who were security holders of Geovic or FinCo before completion of the RTO may not be transferred or resold by the holders until expiration of various holding periods described below. Geovic Mining, Geovic, FinCo and Buckovic agreed to the re-sale restrictions in the Arrangement Agreement in connection with the RTO, subject to any early release provisions that the Board of Directors of the Company may decide upon. On June 9, 2007, at the request of the Board of Directors, stockholders of Geovic Mining approved a proposal to shorten the required holding periods under this arrangement. Subsequently, the TSXV authorized the revision of the restrictions. As revised, the required holding periods will expire as described below:

79

| (a) | For all of the Common shares issued upon completion of the RTO, including upon due exercise of Geovic options with an exercise price of less than $1.08, issued to directors, officers or insiders of the Company, to all other FinCo common shareholders, and to FinCo preferred shareholders the required holding periods prohibits the holder from selling or transferring the shares, except as follows: |

| |

| (i) | 15% of a holder’s Common shares are transferable on or after September 1, 2007; |

| |

| (ii) | 15% of a holder’s Common shares are transferable on or after December 1, 2007; |

| |

| (iii) | 15% of a holder’s Common shares are transferable on or after March 1, 2008; |

| |

| (iv) | 15% of a holder’s Common shares are transferable on or after June 1, 2008; |

| |

| (v) | 30% a holder’s Common shares are transferable on or after September 1, 2008; and |

| |

| (vi) | the balance of each holder’s Common shares are transferable on or after December 1, 2008 |

| |

| (b) | all other Common shares issued upon the completion of the RTO or the due exercise of Geovic options with an exercise price of less than $1.08 are subject to a such a pooling arrangement whereby: |

| |

| (i) | up to 5,000 Common shares held by a holder were not subject to the pooling |

| |

| |

| (ii) | the greater of 25% of a holder’s Common shares or 5,000 Common shares became transferable on June 1, 2007; |

| |

| (iii) | the greater of 25% of a holder’s Common shares or 5,000 Common shares are transferable on or after September 1, 2007; |

| |

| (iv) | the greater of 25% of a holder’s Common shares or 25,000 Common shares are transferable on or after December 1, 2007; and |

| |

| (v) | (the balance of each holder’s Common shares will be transferable on or after March 1, 2008. |

The Common shares issued in connection with the RTO to each of the following groups or individuals are not subject to the above re-sale restrictions:

80

| (i) | Certain former Geovic shareholders holding a total of 500,000 Common shares andwho are not directors, officers or insiders of Geovic Mining, |

| |

| (ii) | Subscribers to the FinCo Subscription Receipt Financing, |

| |

| (iii) | Geovic optionholders who held Geovic options with an exercise price of $1.08 or greater, upon the due exercise of such Geovic options, |

| |

| (iv) | Geovic warrantholders, upon the due exercise of such Geovic warrants, |

| |

| (v) | holders of FinCo performance warrants, |

| |

| (vi) | holders of compensation options issued in connection with the Subscription Receipt Financing, |

| |

| (vii) | a Geovic officer pursuant to the executive employment contract providing for a special bonus of options to purchase 10,000 Geovic shares by the officer upon the completion and approval of an environmental study and plan on GeoCam’s cobalt nickel mining project prior to February 1, 2007 and |

| |

| (viii) | Buckovic pursuant to the exclusive option agreement dated April 24, 2006 between Geovic and Buckovic whereby Buckovic granted to Geovic the exclusive and irrevocable option to purchase all GeoCam shares owned by Buckovic. |

As of September 1, 2007, approximately 30,364,763 of our outstanding shares remain subject to these pooling restrictions. An additional 13,010,611 shares will be released December 1, 2007, and 10,637,840 shares will be released March 1, 2008. The balance of 15,716,312 shares subject to the restrictions will be released over six months beginning June 1, 2008.

The Board of Geovic Mining may take appropriate action to permit one or more additional early releases of some or all shares from the pooling restrictions, one result of which would be to permit the holders to sell shares subject to the pooling restrictions earlier than would otherwise be permitted. Such action would require approval from the TSXV.

Anti-Takeover Effects of Provisions of the Certificate of Incorporation, Bylaws and Delaware General Corporation Law

Our Certificate of Incorporation, Bylaws, and the Delaware General Corporation Law (“DGCL”) contain certain provisions, as set forth below, that could delay or make more difficult an acquisition of control of Geovic Mining not approved by the Geovic Mining Board, whether by means of a tender offer, open market purchases, a proxy contest, or otherwise. These provisions could have the effect of discouraging third parties from making proposals involving an acquisition or change of control of Geovic Mining even if such a proposal, if made, might be considered desirable by a majority of Geovic Mining Shareholders. These provisions may also have the effect of making it more difficult for third parties to cause the replacement of the current management or Geovic Mining Board without the concurrence of Geovic Mining’s Board of Directors.

81

The DGCL provides that stockholders are denied the right to cumulate votes in the election of directors unless the corporation’s certificate of incorporation provides otherwise. Geovic Mining’s Certificate of Incorporation does not provide for cumulative voting.

Advance Notice Requirements for Stockholder Proposals

Geovic Mining’s Bylaws establish an advance notice procedure for stockholder proposals to be brought before an annual meeting of stockholders. Stockholders at an annual meeting may only consider proposals or nominations specified in the notice of meeting or brought before the meeting by or at the direction of the board of directors or by a stockholder of record on the record date for the meeting who is entitled to vote at the meeting and who has delivered timely written notice in proper form to Geovic Mining’s Secretary of the stockholder’s intention to bring such business before the meeting. These provisions could have the effect of delaying until the next stockholders’ meeting stockholder actions that are favored by the holders of a majority of Geovic Mining’s outstanding voting securities.

Limitations on Liability; Indemnification of Officers and Directors

The DGCL authorizes corporations to limit or eliminate the personal liability of directors to corporations and their stockholders for monetary damages for breaches of directors’ fiduciary duties as directors. Geovic Mining’s Certificate of Incorporation and By-laws include provisions that indemnify, to the fullest extent allowable under the DGCL, the personal liability of directors or officers for monetary damages for actions taken as a director or officer of Geovic Mining, or for serving at the request of Geovic Mining as a director or officer or another position at another corporation or enterprise, as the case may be. Geovic Mining’s Certificate of Incorporation and By-laws also provide that Geovic Mining must indemnify and advance reasonable expenses to its directors and officers, subject to its receipt of an undertaking from the indemnitee as may be required under the DGCL.

The limitation of liability and indemnification provisions in Geovic Mining’s Certificate of Incorporation may discourage stockholders from bringing a lawsuit against directors for breach of their fiduciary duty. These provisions may also have the effect of reducing the likelihood of derivative litigation against directors and officers, even though such an action, if successful, might otherwise benefit Geovic Mining and its stockholders.

| Authorized but Unissued shares |

Geovic Mining’s authorized but unissued shares of common stock and preferred stock will be available for future issuance without stockholder approval. Geovic Mining may use additional shares for a variety of corporate purposes, including future public offerings to raise additional capital, corporate acquisitions and employee benefit plans. The existence of authorized but unissued shares of common stock and preferred stock could render more difficult or discourage an attempt to obtain control of Geovic Mining by means of a proxy contest, tender offer, merger or otherwise.

82

| Delaware Statutory Provisions |

Under Section 203 of the DGCL, no Delaware corporation shall engage in a “business combination” with an “interested stockholder” for a period of three years following the date that the stockholder became an interested stockholder. “Business combination” includes a merger, consolidation, asset sale, or other transaction resulting in financial benefit to the interested stockholder. “Interested stockholder” is a person who, together with affiliates and associates, owns, or within three years, did own 15% or more of the corporation’s voting stock. This prohibition does not apply if: (i) prior to the time that the stockholder became an interested stockholder, the board of directors of the corporation approved either the business combination or the transaction resulting in the stockholder’s becoming an interested stockholder, (ii) upon consummation of the transaction resulting in the stockholder’s becoming an interested stockholder, the stockholder owns at least 85% of the outstanding voting stock of the corporation, excluding voting stock owned by directors who are also officers and certain employee stock plans, or (iii) at or subsequent to the time that the stockholder became an interested stockholder, the business combination is approved by the board and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least two-thirds of the outstanding voting stock that the interested stockholder does not own. Under a provision of our Certificate of Incorporation, Geovic Mining has elected not to be subject to Section 203.

Certain United States Federal Income Tax Consequences of the Ownership and Disposition of Geovic Mining shares for Persons Other Than U.S. Holders*

NOTICE PURSUANT TO IRS CIRCULAR 230: NOTHING CONTAINED IN THIS SUMMARY CONCERNING ANY U.S. FEDERAL TAX ISSUE IS INTENDED OR WRITTEN TO BE USED, AND IT CANNOT BE USED, BY A U.S. HOLDER (AS DEFINED BELOW), FOR THE PURPOSE OF AVOIDING U.S. FEDERAL TAX PENALTIES UNDER THE CODE (AS DEFINED BELOW). THIS SUMMARY WAS WRITTEN TO SUPPORT THE PROMOTION OR MARKETING OF THE TRANSACTIONS OR MATTERS ADDRESSED BY THIS CIRCULAR. EACH U.S. HOLDER SHOULD SEEK U.S. FEDERAL TAX ADVICE, BASED ON SUCH U.S. HOLDER’S PARTICULAR CIRCUMSTANCES, FROM AN INDEPENDENT TAX ADVISOR.

The following discussion of certain of the anticipated material U.S. federal income tax considerations arising from and relating to the ownership and disposition of Geovic Mining shares is for general information only, and does not purport to be a complete analysis or listing of all U.S. federal income tax consequences that may apply to a Non-U.S. Holder of Geovic Mining shares.

| * | U.S. Holders are encouraged to consult their independent tax advisors if they have any tax questions in regard to their Geovic Mining shares. Based on the individual circumstances of each such Holder, tax rules of general application to holders of shares in publicly-traded U.S. corporations will apply to them. |

83

This summary is based upon the U.S. Internal Revenue Code of 1986, as amended (the “Code”); Treasury Regulations, proposed, temporary and final, issued under the Code; and judicial and administrative interpretations of the Code and Treasury Regulations, in each case as in effect and available as of the date of this Registration Statement on Form 10. The Code, Treasury Regulations and judicial and administrative interpretations thereof, however, may change at any time, and any change could be retroactive to the date of this Registration Statement. The Code, Treasury Regulations and judicial and administrative interpretations thereof are also subject to various interpretations, and the U.S. Internal Revenue Service (the “IRS”) or the U.S. courts could later disagree with the explanations or conclusions contained in this summary.

A “Non-U.S. Holder” is a beneficial owner of Geovic Mining shares other than a U.S. Holder. For purposes of this summary, a “U.S. Holder” is a beneficial owner of Geovic Mining shares that, for U.S. federal income tax purposes, is: a citizen or resident of the U.S., including some former citizens or residents of the U.S.; a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the U.S. or any state thereof, including the District of Columbia; an estate if its income is subject to U.S. federal income taxation regardless of its source; or a trust if it has validly elected to be treated as a U.S. person for U.S. federal income tax purposes or if a U.S. court can exercise primary supervision over its administration, and one or more U.S. persons have the authority to control all of its substantial decisions. If a partnership, or other entity taxed as a partnership for U.S. federal income tax purposes, holds the Geovic Mining shares, the U.S. federal income tax treatment of a partner in the partnership will depend on the status of the partner and the activities of the partnership. Partnerships that hold the Geovic Mining shares, and partners in such partnerships, are urged to consult their own tax advisors regarding the U.S. federal income tax consequences of holding the Geovic Mining shares.

Scope of this Disclosure

Transactions Addressed |

The following discussion is a summary of the anticipated material U.S. federal income tax consequences arising from and relating to the ownership and disposition of Geovic Mining shares that are generally applicable to Non-U.S. Holders of Geovic Mining shares.

The following discussion of the anticipated material U.S. federal income tax considerations arising from and relating to the disposition of Geovic Mining shares is for general information only, and does not purport to be a complete analysis or listing of all U.S. federal income tax consequences that may apply to a Non-U.S. Holder of Geovic Mining shares. Non-U.S. Holders of Geovic Mining shares are strongly urged to consult their own tax advisors to determine the particular tax consequences to them of the disposition of Geovic Mining shares and any other U.S tax matters that may be relevant in regard to their Geovic Mining shares, including the application and effect of U.S. federal, state, local, and other tax laws.

84

The U.S. federal income tax consequences to the following persons (including persons who are Non-U.S. Holders) are not addressed in this summary, and the following persons are accordingly urged to consult with their own tax advisors regarding the U.S. federal income tax consequences to them of a disposition of Geovic Mining shares: (a) Geovic Mining, (b) persons who are subject to special U.S. federal income tax treatment such as financial institutions, real estate investment trusts, tax-exempt organizations, qualified retirement plans, individual retirement accounts, regulated investment companies, insurance companies, dealers in securities or currencies, or traders in securities that elect to apply a mark-to-market accounting method, (c) persons who acquired Geovic Mining shares pursuant to an exercise of employee stock options or rights or otherwise as compensation for services, (d) persons who hold Geovic Mining shares as part of a position in a straddle or as part of a hedging or conversion transaction and (e) persons who own their Geovic Mining shares other than as a capital asset as defined in the Code.

U.S. Tax Consequences to Non-U.S. Holders of Disposition of Geovic Mining shares Generally

The U.S. does not tax non-resident aliens on their U.S. capital gains from stock unless they are in the U.S. for more than 183 days in the tax year in which the gain is realized and recognized or the gains are effectively connected with a U.S. trade or business. If the non-resident alien is within the U.S. for more than 183 days in the tax year in which the gain is realized and recognized and the gains are not effectively connected with a U.S. trade or business, the gains are subject to withholding at a 30% or lower treaty rate. If the gains are effectively connected with a U.S. trade or business, they are taxed at graduated individual or corporate rates.

U.S. Real Property Holding Corporation Status of Geovic Mining

Geovic Mining is likely to be a United States Real Property Holding Corporation (“USRPHC”) as defined in Section 897(c)(2) of the Code. A USRPHC is treated as a U.S. real property interest (“USRPI>”) and gain or loss from the disposition of a USRPI is generally treated as gain which is effectively connected with a U.S. trade or business. However, Section 897(c)(3) of the Code provides that shares of a class of stock that is regularly traded on an established securities market shall be treated as a USRPI only in the case of a person who holds (or held within 5 years previously) more than 5% of such class of stock. Attribution rules apply in determining whether the 5% threshold has been passed, but it appears likely that the Geovic Mining shares will be regularly traded on an established securities market immediately after the Distribution and that few, if any, Non-U.S. Holders will own as much as 5% of the Geovic Mining shares. Consequently, it is unlikely that the Geovic Mining shares will be treated as a USRPI in the hands of most Non-U.S. Holders unless additional Geovic Mining shares are acquired by the Non-U.S. Holder or some event occurs which would cause Geovic Mining shares to cease to be regularly traded on an established securities market.

85

U.S. Tax Consequences to Non-U.S. Holders of Geovic Mining Shares of Dividends and Other Distributions

Distributions by Geovic Mining to its stockholders with respect to stock are treated first as dividends to the extent that Geovic Mining has current or accumulated earnings and profits, then by the stockholder as return of capital to the extent of the stockholder’s adjusted basis for its Geovic Mining shares and thereafter as gain from sale or exchange of the stockholder’s Geovic Mining shares (See “U.S. Tax Consequences to Non-U.S. Holders of Disposition of Geovic Mining shares Generally” and “U.S. Real Property Holding Corporation Status of Geovic Mining”). The dividend component of any such distribution is treated as United States source gross income for Non-U.S. Holders of Geovic Mining shares, and they will be subject to withholding under Section 1441 of the Code with respect to so much of the distribution as is treated as a dividend. The withholding rate is generally 30%, but may be reduced pursuant to a treaty. The Canada/U.S. Tax Treaty currently provides for a withholding rate of 15% on dividends generally. In the unlikely event the Geovic Mining shares are a USRPI (See “U.S. Real Property Holding Corporation Status of Geovic Mining”), a 10% withholding tax may be imposed on any such distribution that is not out of earnings and profits.

Non-U.S. Holders may be required to provide specific documentation to claim a treaty exemption or other relief or to avoid withholding with respect to the entire distribution.

U.S. Estate and Gift Tax Consequences of Transfers of Geovic Mining Shares

Shares of stock of a company incorporated in the United Sates such as Geovic Mining are considered U.S. situs property for U.S. estate tax purposes and will be subject to U.S. estate tax if they are owned by an individual Non-U.S. Holder at the death of the Non-U.S. Holder. The U.S. has estate tax treaties with many countries, including Canada, which may effect the situs, and the U.S. taxability of the Geovic Mining shares, for U.S. estate tax purposes. It should be noted that the U.S.-Canada estate tax treaty provides that shares of stock of a company have a situs where the company is incorporated and does not alter the statutory result. However, since estate and gift tax rules are extremely complex and results may vary depending on how the shares are owned, the origin of ownership, the mode of ownership and other interests of the decedent as well as other circumstances, each Non-U.S Holder of Geovic Mining shares should consult an independent tax advisor with respect to U.S. estate and gift tax consequences applicable to ownership of Geovic Mining shares in his or her circumstances. U.S. estate tax is imposed using a progressive rate schedule with the highest marginal rate currently being 46%. Although the effect of the tax may be largely mitigated or eliminated by double taxation credit relief in the decedent’s home country, many taxpayers do not find this relief satisfactory and seek to avoid the tax by holding their shares in U.S. corporations through non-U.S. corporations which will not result in U.S. estate tax on the beneficial stockholder’s death.

86

SINCE THE U.S. ESTATE TAX CONSEQUENCES ARISING FROM THE DEATH OF A GEOVIC MINING SHAREHOLDER MAY BE SEVERE EACH NON-U.S. HOLDER SHOULD ADDRESS THIS AS PART OF T HE SHAREHOLDER’S ESTATE PLAN AND OBTAIN THE ADVICE OF A COMPETENT INDEPENDENT TAX ADVISOR.

Non-U.S. Holders of Geovic Mining shares who are individuals are generally not subject to the federal gift tax on transfers of intangible personal property such as the Geovic Mining shares.

THIS SUMMARY IS OF A GENERAL NATURE ONLY AND IS NOT INTENDED TO BE, AND SHOULD NOT BE CONSTRUED TO BE, LEGAL, BUSINESS OR TAX ADVICE TO ANY PARTICULAR SECURITY HOLDER. EACH NON-U.S. HOLDER SHOULD SEEK U.S. FEDERAL TAX ADVICE, BASED ON SUCH NON-U.S. HOLDER’S PARTICULAR CIRCUMSTANCES, FROM AN INDEPENDENT TAX ADVISOR.

ITEM 12. INDEMNIFICATION OF DIRECTORS AND OFFICERS

Geovic Mining’s Certificate of Incorporation provides that we shall indemnify any director or officer of Geovic Mining or any person who was serving at our request as a director or officer of another corporation, partnership, joint venture, trust, employee benefit plan or other enterprise to the fullest extent permitted under and in accordance with the laws of the State of Delaware. Our Certificate of Incorporation also eliminates in certain circumstances the liability of directors of Geovic Mining for monetary damages for breach of their fiduciary duty as directors. This provision does not eliminate the liability of a director (i) for breach of the director’s duty of loyalty to Geovic Mining or our stockholders; (ii) for acts or omissions by the director not in good faith or which involve intentional misconduct or a knowing violation of law; (iii) for willful or negligent declaration of an unlawful dividend, stock purchase or redemption; or (iv) for transactions from which the director derived an improper personal benefit. Such limitation of liability does not affect the availability of equitable remedies such as injunctive relief or rescission.

Geovic Mining’s By-laws require us to indemnify any director or officer of Geovic Mining, or any person who is or was serving at our request as a director or officer of any other corporation, partnership, joint venture, trust or other enterprise, to the fullest extent permitted by law.

Subsection (a) of Section 145 of the Delaware General Corporation Law empowers a corporation to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the corporation) by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by the person in connection with such action, suit or proceeding if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe the person’s conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction, or upon a plea of nolo contendere or its equivalent, shall not, of itself, create a presumption that the person did not act in good faith and in a manner which the person reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any criminal action or proceeding, had reasonable cause to believe that the person’s conduct was unlawful.

87

Subsection (b) of Section 145 empowers a corporation to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor by reason of the fact that the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against expenses (including attorneys’ fees) actually and reasonably incurred by the person in connection with the defense or settlement of such action or suit if the person acted in good faith and in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation and except that no indemnification shall be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the corporation unless and only to the extent that the Delaware Court of Chancery or the court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the Court of Chancery or such other court shall deem proper.

Section 145 further provides that to the extent a director, officer or former director or officer, of a corporation has been successful in the defense of any action, suit or proceeding referred to in subsection (a) and (b) or in the defense of any claim, issue or matter therein, such person shall be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by him or her in connection therewith. Section 145 also provides that expenses (including attorneys’ fees) incurred by an officer or director in defending any civil, criminal, administrative or investigative action, suit or proceeding may be paid by the corporation, upon such terms and conditions, if any, as the corporation deems appropriate, in advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of such director or officer to repay such amount if it shall ultimately be determined that such person is not entitled to be indemnified by the corporation as authorized in Section 145.

Section 145 additionally provides that the indemnification provided by Section 145 shall not be deemed exclusive of any other rights to which the indemnified party may be entitled; and that the scope of indemnification extends to directors, officers, employees, or agents of a constituent corporation absorbed in a consolidation or merger and persons serving in that capacity at the request of the constituent corporation for another.

Section 145 also empowers a corporation to purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the corporation or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against any liability asserted against such person and incurred by such person in any such capacity or arising out of such person’s status as such whether or not the corporation would have the power to indemnify such person against such liabilities under Section 145.

88

We obtained officers’ and directors’ liability insurance for members of our Board of Directors and executive officers of Geovic Mining which became effective following completion of the RTO in December 2006. In addition to the indemnification provided in the Certificate of Incorporation and Bylaws, we also have agreed to indemnify our directors and officers. These agreements generally act as a supplement to the indemnification provisions set forth in our Certificate of Incorporation and Bylaws and Section 145, as in effect from time to time. Generally, these agreements require Geovic Mining to indemnify our directors and executive officers for any reasonable expenses they incur in connection with any action, suit or other proceeding brought against them as a result of their status as a director or executive officer of Geovic Mining or a subsidiary entity. This indemnification will be required only where an individual director or executive officer has acted in good faith and in a manner which he or she reasonably believes was in, or not adverse to, the best interests of Geovic Mining. These indemnification agreements will also require Geovic Mining to advance the expenses of an individual director or executive officer prior to the final disposition of any action, suit or other proceeding, following receipt by Geovic Mining of a statement requesting the advance and providing reasonable detail of expenses incurred. We believe that these indemnification agreements and the provisions of our Certificate of Incorporation and By-laws described in the preceding paragraphs, are necessary and advisable in order to attract and retain highly qualified persons to serve on our Board of Directors and as executive officers.

ITEM 13. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

ITEM 14. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

Neither Geovic Mining, nor Geovic, Ltd. has had any disagreements with, or changes of our independent auditors during the last three years. Prior to completion of the RTO, Resource Equity, Ltd. was audited by Deloitte & Touche.

89

ITEM 15. FINANCIAL STATEMENTS SCHEDULES AND EXHIBITS

Documents Filed as Part of Report

Financial Statements |

| The following Consolidated Financial Statements of the Corporation are filed as part of this report: | | |

| |

| 1. | | Report of Independent Accountants dated April 27, 2007 | | F-1 |

| 2. | | Consolidated Balance Sheets—at December 31, 2006 and 2005 | | F-2 |

| 3. | | Consolidated Statements of Operations—Years ended December 31, 2006, 2005, and 2004 | | F-3 |

| 4. | | Consolidated Statements of Cash Flows—Years ended December 31, 2006, 2005 and 2004 | | F-4 |

| 5. | | Consolidated Statements of Equity (Deficiency)—Years ended December 31, 2006, 2005 and 2004 | | F-5 |

| 6. | | Notes to Consolidated Financial Statements | | F-6 |

| 7. | | Unaudited Consolidated Balance Sheets—at December 31, 2006 and March 31, 2007 | | F-26 |

| 8. | | Unaudited Statements of Operations—For the quarters ended March 31, 2007 and 2006 | | F-27 |

| 9. | | Unaudited Statements of Cash Flows—For the quarters ended March 31, 2007 and 2006 | | F-28 |

| 10. | | Notes to Unaudited Consolidated Quarterly Financial Statements | | F-29 |

| Financial Statement Schedules |

No financial statement schedules are filed as part of this report because such schedules are not applicable or the required information is shown in the Consolidated Financial Statements or notes thereto.

The following exhibits are filed as part of this Registration Statement:

Exhibit

Number Description |

| 2.1 | Arrangement Agreement as Amended dated October 31, 2006. |

| |

| 2.2 | Arrangement Agreement Amending Agreement. |

| |

| 3.1 | Certificate of Domestication of the Registrant, dated November 21, 2006. |

| |

| 3.2 | Certificate of Incorporation of the Registrant, dated November 21, 2006. |

| |

| 3.3 | Bylaws of Registrant. |

| |

| 4.1 | Certificate of Designation of Series A Convertible Preferred Stock. |

| |

| 4.2 | Warrant Indenture dated December 1, 2006 between Geovic Mining Corp and Pacific Corporate Trust Company. |

| |

90

Exhibit

Number Description |

| 4.3 | Warrant Indenture dated March 1, 2007 between Geovic Mining Corp and Pacific Corporate Trust Company. |

| |

| 4.4 | Warrant Indenture dated April 20, 2007 between Geovic Mining Corp and Pacific Corporate Trust Company. |

| |

| 4.5 | Geovic Mining Corp. Audit Committee Charter Adopted April 30, 2007. |

| |

| 4.6 | Underwriting Agreement by and among Geovic Mining Corp., Canaccord Adams Limited, Canaccord Capital Corporation and Orion Securities Inc. dated April 11, 2007. |

| |

| 10.1 | Letter Agreement between Registrant, Frank Guistra and William A. Buckovic, Dated February 26, 2007. |

| |

| 10.2 | Finders Fee Agreement Between Geovic, Ltd. (Geovic) and Gregg J. Sedun (Sedun) Effective December 1, 2005. |

| |

| 10.3 | Service Agreement between Geovic, Ltd. and Mineral Services, LLC, effective June 6, 2004. |

| |

| 10.4 | Republic of Cameroon Mining Permit Decree, Dated April 11, 2003. |

| |

| 10.5 | Mining Convention Between The Republic of Cameroon and Geovic Cameroon, S.A., dated July 31, 2002. |

| |

| 10.6 | Geovic Cameroon Plc Shareholders Agreement, dated April 9, 2007. |

| |

| 10.7 | Exclusive Option Agreement between Geovic, Ltd. and William A. Buckovic dated April 24, 2006. |

| |

| 10.8 | Form of Director Compensation Letter, dated December 1, 2006. |

| |

| 10.9 | Extended Employment Agreement of William A. Buckovic, dated April 20, 2006. |

| |

| 10.10 | Extended Employment Agreement of David C. Beling, dated April 20, 2006. |

| |

| 10.11 | Extended Employment Agreement of John Sherborne Jr., dated April 20, 2006. |

| |

| 10.12 | Executive Employment Contract of Gary R. Morris, dated May 1, 2006. |

| |

| 10.13 | Geovic Mining Corp. Stock Option Plan dated September 29, 2006. |

| |

| 10.14 | Agreement for Consulting and Professional Services Between Geovic, Ltd. and Washington Group International, Inc. effective as of June 30.2006. |

| |

| 10.15 | [Exhibit removed] |

| |

| 10.16 | Patent License Agreement Inco Limited, dated November 8, 2006. |

| |

| 10.17 | Investor Relations Agreement with Vanguard Shareholder Solutions Inc. , dated as of December 1, 2006. |

91

Exhibit

Number Description

| 10.18 | Compensation Option to Purchase Common Shares of Geovic Mining Corp. |

| |

| 10.19 | Loan and Debt Repayment Security Agreement between Geovic, Ltd. and Geovic Cameroon Plc., effective January 1, 2006. |

| |

| 10.20 | Contract for Professional and Technical Services between Geovic Cameroon Plc and Geovic, Ltd., effective January 1, 2007. |

| |

| 21 | Subsidiaries of the Corporation. |

| |

| 23.1 | Consent of Pincock Allen & Holt, Inc. |

| |

| 99.1 | [Exhibit removed] |

| |

| 99.2 | Annual Information Form, for year ended December 31, 2006. |

| |

| 99.3 | Information Circular for Annual Meeting of Stockholders. |

________________

All Exhibits previously filed.

92

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused this amendment no. 4 to registration statement on Form 10 to be signed on its behalf by the undersigned, thereunto duly authorized.

| | GEOVIC MINING CORP.

Registrant

By: /s/ John E. Sherborne

Name: John E. Sherborne

Title: Chief Executive Officer |

| Dated: September 26, 2007 |

93

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Stockholders of

Geovic Mining Corporation

(an exploration stage company) |

We have audited the accompanying consolidated balance sheets of Geovic Mining Corporation (an exploration stage company) as of December 31, 2006 and 2005 and the related consolidated statements of operations, stockholders’ equity (deficiency) and cash flows for the each of the years in the three-year period ended December 31, 2006. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the Company’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated financial position of Geovic Mining Corporation (an exploration stage company) at December 31, 2006 and 2005, and the consolidated results of its operations and its cash flows for each of the years in the three-year period ended December 31, 2006, in conformity with United States generally accepted accounting principles.

/s/ Ernst & Young LLP

Chartered Accountants |

Vancouver, Canada,

April 27, 2007 |

F-1

| Geovic Mining Corp. | | | | | | |

| (an exploration stage company) | | | | | | |

| |

CONSOLIDATED BALANCE SHEETS

(United States Dollars) | | | | | | |

| |

| As at December 31 | | | | | | |

| | | 2006 | | | 2005 | |

| | | $ | | | $ | |

| ASSETS | | | | | | |

| Current | | | | | | |

| Cash and cash equivalents | | 9,373,870 | | | 935,338 | |

| Accounts receivable | | 7,654 | | | 31,972 | |

| Prepaid expenses | | 83,271 | | | 60,000 | |

| Total current assets | | 9,464,795 | | | 1,027,310 | |

| Property, plant and equipment (note 5) | | 201,869 | | | 139,913 | |

| Deposits | | 65,163 | | | 4,190 | |

| Total assets | | 9,731,827 | | | 1,171,413 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | |

| Current | | | | | | |

| Accrued liabilities and other payables | | 913,138 | | | 280,460 | |

| Income tax payable (note 9) | | 859,697 | | | — | |

| Total current liabilities | | 1,772,835 | | | 280,460 | |

| Contingent liability (note 8(a)) | | 240,863 | | | 240,863 | |

| Total liabilities | | 2,013,698 | | | 521,323 | |

| Commitments and contingencies (note 8) | | | | | | |

| Stockholders’ equity | | | | | | |

| Preferred shares, par value of $.0001, 50,000,000 shares | | | | | | |

| authorized and 6,000,000 shares issued and outstanding | | 600 | | | — | |

| Common shares, par value of $.0001 | | | | | | |

| 200,000,000 shares authorized and 62,142,943 (2005 - | | | | | | |

| 39,371,408) shares issued and outstanding | | 6,214 | | | 3,937 | |

| Share purchase warrants (note 7) | | 3,074,845 | | | — | |

| Additional paid in capital | | 37,281,909 | | | 26,449,706 | |

| Deficit accumulated during the exploration stage | | (32,645,439 | ) | | (25,803,553 | ) |

| Total stockholders’ equity | | 7,718,129 | | | 650,090 | |

| Total liabilities and stockholders’ equity | | 9,731,827 | | | 1,171,413 | |

F-2

| Geovic Mining Corp. | | | | | | | | | | | | |

| (an exploration stage company) | | | | | | | | | | | | |

| |

CONSOLIDATED STATEMENTS OF OPERATIONS

(United States Dollars) |

| |

| Years ended December 31 | | | | | | | | | | | | |

| | | | | | | | | | | | Unaudited | |

| | | | | | | | | | | | Period From | |

| | | | | | | | | November 16, 1994 | |

| | | | | | | | | | | | (inception) to | |

| | | | | | | | | | | | December 31, | |

| | | 2006 | | | 2005 | | | 2004 | | | 2006 | |

| | | $ | | | $ | | | $ | | | $ | |

| Operating expenses | | | | | | | | | | | | |

| Exploration costs (note 4) | | 3,465,331 | | | 871,727 | | | 1,272,912 | | | 14,241,480 | |

| Head office and management | | 1,592,627 | | | 908,999 | | | 636,584 | | | 5,599,553 | |

| Stock based compensation (note 6) | | 1,051,924 | | | 958,750 | | | 1,655,364 | | | 11,523,254 | |

| Interest and bank charges | | 8,832 | | | 2,468 | | | 2,171 | | | 27,513 | |

| Depreciation | | 39,336 | | | 77,703 | | | 149,093 | | | 704,419 | |

| |

| Total operating expenses | | 6,158,050 | | | 2,819,647 | | | 3,716,124 | | | 32,096,219 | |

| Interest income | | 175,861 | | | 890 | | | 24,657 | | | 310,477 | |

| |

| Net loss before income taxes | | (5,982,189 | ) | | (2,818,757 | ) | | (3,691,467 | ) | | (31,785,742 | ) |

| Income tax expense | | 859,697 | | | — | | | — | | | 859,697 | |

| |

| Net loss for the year | | (6,841,886 | ) | | (2,818,757 | ) | | (3,691,467 | ) | | (32,645,439 | ) |

| |

| Basic and diluted loss per share | | (0.16 | ) | | (0.07 | ) | | (0.10 | ) | | — | |

| |

| Basic and diluted weighted | | | | | | | | | | | | |

| average number of common shares | | 44,008,591 | | | 38,241,826 | | | 36,759,678 | | | — | |

F-3

| Geovic Mining Corp. | | | | | | | | | | | | |

| (an exploration stage company) | | | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (United States Dollars) |

| |

| |

| Years ended December 31 | | | | | | | | | | | | |

| |

| | | | | | | | | | | | Unaudited | |

| | | | | | | | | | | | Period From | |

| | | | | | | | | | | | November 16, 1994 | |

| | | | | | | | | | | | (inception) to | |

| | | 2006 | | | 2005 | | | 2004 | | | December 31, 2006 | |

| | | $ | | | $ | | | $ | | | $ | |

| OPERATING ACTIVITIES | | | | | | | | | | | | |

| Net loss | | (6,841,886 | ) | | (2,818,757 | ) | | (3,691,467 | ) | | (32,645,439 | ) |

| Adjustments to reconcile net loss to net cash | | | | | | | | | | | | |

| used in operating activities: | | | | | | | | | | | | |

| Depreciation expense | | 39,336 | | | 77,703 | | | 149,093 | | | 704,419 | |

| Stock based compensation expense | | 1,051,924 | | | 958,750 | | | 1,655,364 | | | 11,523,254 | |

| Changes in non-cash operating working capital: | | | | | | | | | | | | |

| (Increase) decrease in accounts receivable | | 24,318 | | | (14,956 | ) | | 33,961 | | | (7,654 | ) |

| Increase in prepaid expenses | | (23,271 | ) | | (60,000 | ) | | — | | | (83,271 | ) |

| (Increase) decrease in deposits | | (60,973 | ) | | 17,500 | | | (341 | ) | | (65,163 | ) |

| Increase (decrease) in accrued liabilities and | | | | | | | | | | | | |

| other payables | | 632,678 | | | (345,450 | ) | | (682,487 | ) | | 913,138 | |

| Increase in income tax payable | | 859,697 | | | — | | | — | | | 859,697 | |

| Increase in contingent liability | | — | | | — | | | 94,798 | | | 240,863 | |

| |

| Cash used in operating activities | | (4,318,177 | ) | | (2,185,210 | ) | | (2,441,079 | ) | | (18,560,156 | ) |

| INVESTING ACTIVITIES | | | | | | | | | | | | |

| Purchases of property, plant and equipment | | (101,293 | ) | | (2,957 | ) | | (49,979 | ) | | (906,289 | ) |

| Cash used in investing activities | | (101,293 | ) | | (2,957 | ) | | (49,979 | ) | | (906,289 | ) |

| |

| FINANCING ACTIVITIES | | | | | | | | | | | | |

| Decrease in bank overdraft | | — | | | (2,715 | ) | | — | | | — | |

| Cash paid to rescind exercise of stock options | | (15,000 | ) | | — | | | — | | | (15,000 | ) |

| Proceeds from issuance of common shares and preferred shares | | 12,523,323 | | | 3,089,832 | | | 1,677,176 | | | 28,431,641 | |

| Proceeds from issuance of share purchase warrants | | 3,074,845 | | | — | | | — | | | 3,074,845 | |

| Proceeds from exercise of stock options | | 18,430 | | | 150 | | | 32,810 | | | 92,425 | |

| Share issue costs | | (2,743,596 | ) | | — | | | — | | | (2,743,596 | ) |

| |

| Cash provided by the financing activities | | 12,858,002 | | | 3,087,267 | | | 1,709,986 | | | 28,840,315 | |

| Net increase in cash | | 8,438,532 | | | 899,100 | | | (781,072 | ) | | 9,373,870 | |

| Cash and cash equivalents, beginning of year | | 935,338 | | | 36,238 | | | 817,310 | | | — | |

| Cash and cash equivalents, end of year | | 9,373,870 | | | 935,338 | | | 36,238 | | | 9,373,870 | |

See accompanying notes

F-4

| Geovic Mining Corp. | | | | | | | | | | | | | | | | | | | | | |

| (an exploration stage company) | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF |

STOCKHOLDERS’ EQUITY (DEFICIENCY)

(United States Dollars)

|

| | | | Preferred Stock | | Common Stock | | | Stock Purchase | | Additional | | | | | | | |

| | | | Shares | | Amount | | Shares | | Amount | | | Warrants | | paid-in capital | | | Deficit | | | Total | |

| | | | # | | $ | | # | | $ | | | $ | | $ | | | $ | | | $ | |

| Balance, December 31, 2003 | | | — | | — | | 36,166,108 | | 3,617 | | | — | | 19,065,464 | | | (19,293,329 | ) | | (224,248 | ) |

| |

| Issuance of common shares | | | — | | — | | 832,232 | | 83 | | | — | | 1,677,093 | | | — | | | 1,677,176 | |

| Stock options granted | | | — | | — | | — | | — | | | — | | 1,655,364 | | | — | | | 1,655,364 | |

| Exercise of stock options | | | — | | — | | 39,360 | | 4 | | | — | | 3,286 | | | — | | | 3,290 | |

| Net loss for the year | | | — | | — | | — | | — | | | — | | — | | | (3,691,467 | ) | | (3,691,467 | ) |

| Balance, December 31, 2004 | | | — | | — | | 37,037,700 | | 3,704 | | | — | | 22,401,207 | | | (22,984,796 | ) | | (579,885 | ) |

| | | | | | | | | | | | | — | | | | | | | | | |

| Issuance of common shares | | | — | | — | | 2,331,708 | | 233 | | | — | | 3,089,599 | | | — | | | 3,089,832 | |

| Stock options granted | | | — | | — | | — | | — | | | — | | 958,750 | | | — | | | 958,750 | |

| Exercise of stock options | | | — | | — | | 2,000 | | — | | | — | | 150 | | | — | | | 150 | |

| Net loss for the year | | | — | | — | | — | | — | | | — | | — | | | (2,818,757 | ) | | (2,818,757 | ) |

| Balance, December 31, 2005 | | | — | | — | | 39,371,408 | | 3,937 | | | — | | 26,449,706 | | | (25,803,553 | ) | | 650,090 | |

| |

| Issuance of common shares | | | — | | — | | 389,768 | | 39 | | | — | | 228,908 | | | — | | | 228,947 | |

| FG Group financing (note 3(a)) | | | — | | — | | 4,200,000 | | 420 | | | — | | 4,514,580 | | | — | | | 4,515,000 | |

| Restricted Stock Grants (note 7) | | | — | | — | | 865,156 | | 87 | | | — | | 642,522 | | | — | | | 642,609 | |

| Stock options granted (note 6(a)) | | | — | | — | | — | | — | | | — | | 283,233 | | | — | | | 283,233 | |

| Stock options exercised (note 6) | | | — | | — | | 66,600 | | 7 | | | — | | 3,424 | | | — | | | 3,431 | |

| Subtotal Geovic shares outstanding pre RTO | | | — | | — | | 44,892,932 | | 4,489 | | | — | | 32,122,374 | | | (25,803,553 | ) | | 6,323,310 | |

| Subscription Receipt Financing | | | | | | | | | | | | | | | | | | | | | |

| (note 3(c)) | | | — | | — | | 6,000,000 | | 600 | | | — | | 5,865,674 | | | — | | | 5,866,274 | |

| Stock Purchase Warrants Issued | | | | | | | | | | | | | | | | | | | | | |

| (note 3(c)) | | | — | | — | | — | | — | | | 3,074,845 | | — | | | — | | | 3,074,845 | |

| Shares issued to William Buckovic | | | | | | | | | | | | | | | | | | | | | |

| (note 3(j)) | | | — | | — | | 1,250,010 | | 125 | | | — | | 1,233,875 | | | — | | | 1,234,000 | |

| Finco Preferred Share Conversion | | | | | | | | | | | | | | | | | | | | | |

| (note 3(j)) | | | 6,000,000 | | 600 | | — | | — | | | — | | — | | | — | | | 600 | |

| Finco Common Share Conversion | | | | | | | | | | | | | | | | | | | | | |

| (note 3(j)) | | | — | | — | | 9,000,001 | | 900 | | | — | | 674,675 | | | — | | | 675,575 | |

| Shares outstanding in Resource Equity | | | | | | | | | | | | | | | | | | | | | |

| Ltd. before RTO (note 3(d)) | | | — | | — | | 1,000,000 | | 100 | | | — | | 32,677 | | | — | | | 32,777 | |

| RTO share issue costs (note 3(k)) | | | — | | — | | — | | — | | | — | | (2,976,575 | ) | | — | | | (2,976,575 | ) |

| Post RTO Stock options (note 6(c)) | | | — | | — | | — | | — | | | — | | 329,209 | | | — | | | 329,209 | |

| Net loss for the year | | | — | | — | | — | | — | | | — | | — | | | (6,841,886 | ) | | (6,841,886 | ) |

| Balance, December 31, 2006 | | | 6,000,000 | | 600 | | 62,142,943 | | 6,214 | | | 3,074,845 | | 37,281,909 | | | (32,645,439) | | | 7,718,129 | |

See accompanying notes

F-5

Geovic Mining Corp.

(an exploration stage company) |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(United States Dollars)

1. NATURE OF BUSINESS AND CONTINUANCE OF OPERATIONS

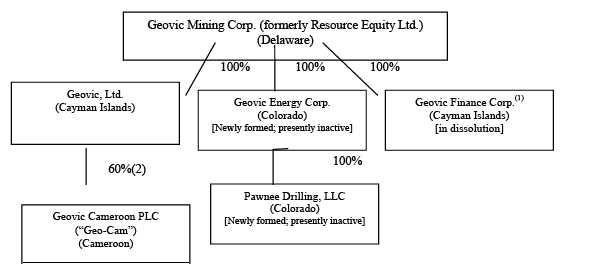

Geovic Mining Corp. (the “Company”) is the successor corporation to Resource Equity Ltd. (“Target Co”). The Company is incorporated under the laws of the state of Delaware. The Company owns 100% of the shares of Geovic, Ltd (“Geovic”), a company that has been in the mining exploratory stage since its inception. As described in note 3, the Company acquired all of the shares of Geovic and other entities December 1, 2006, pursuant to an agreement (the “Arrangement Agreement”) dated as of September 20, 2006, as amended October 31, 2006, entered into among the Company, Geovic, Geovic Finance Corp. (“FinCo”), Target Co and William A. Buckovic (“Buckovic”) with respect to a reverse acquisition of Target Co (the “RTO”) by Geovic. For financial reporting purposes, Geovic is treated as the acquiring entity in the RTO. The historical statements of operations and stockholders’ equity (deficiency) presented include only those of Geovic (the accounting acquirer) and only the deficit of the accounting acquirer carries over consistent with the requirements of reverse acquisition accounting. See note 3 for further details.

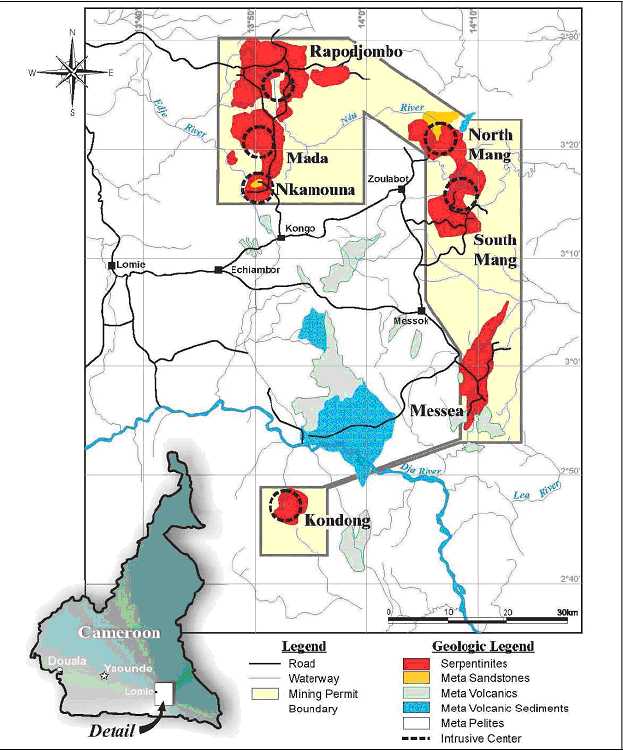

Geovic is engaged in the business of exploring for nickel, cobalt, and related minerals through its majority-owned (60%) subsidiary, Geovic Cameroon, PLC (“GeoCam”), a financially dependent public limited company duly organized and incorporated under the laws of the Republic of Cameroon. The Company is an exploration stage company in the process of planning to develop its mineral properties through its subsidiaries.

The recoverability of any amounts shown for mineral property interests in the Company’s balance sheet are dependent upon the existence of economically recoverable reserves, the ability of the Company to arrange appropriate financing to complete the development of its properties, the receipt of necessary permitting and upon achieving future profitable production or receiving proceeds from the disposition of the properties. The timing of such events occurring, if at all, is not yet determinable. The Company is considered to be an exploration stage enterprise.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The significant accounting principles and policies used in these United States generally accepted accounting principles (“US GAAP”) consolidated financial statements are as follows:

This summary of significant accounting policies is presented to assist in understanding the Company’s financial statements. The consolidated financial statements and notes are representations of the Company’s management, which is responsible for their integrity and objectivity. These accounting policies conform to US GAAP and have been consistently applied in the preparation of the financial statements.

F-6

Geovic Mining Corp.

(an exploration stage company) |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(United States Dollars)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont’d.)

| Principles of consolidation |

The consolidated financial statements include the accounts of the Company, Geovic, GeoCam and FinCo. All significant intercompany transactions and balances have been eliminated in consolidation.

The process of preparing financial statements in conformity with US GAAP requires the use of estimates and assumptions regarding certain types of assets, liabilities, revenue, and expenses. Such estimates relate primarily to unsettled transactions and events as of the date of the consolidated financial statements. Accordingly, upon settlement, actual results may differ from estimated amounts.

| Exploration and development costs |

As the Company has not adopted a final mining plan, exploration costs are expensed as incurred. The Company engaged an independent consulting firm to conduct an extensive analysis and final feasibility study of the Nkamouna project to prepare a detailed mine plan. When a final mining plan has been adopted, costs subsequently incurred to develop the mine on the property prior to the start of the mining operations will be capitalized. Capitalized amounts may be written down if future undiscounted cash flows, including potential sales proceeds, related to a mineral property are estimated to be less than the carrying value of the property.

| Mineral property acquisition costs |

Mineral property acquisition costs are capitalized until the viability of the mineral interest is determined. Capitalized acquisition costs are expensed in the period in which it is determined that the mineral property has no future economic value.

Capitalized amounts may be written down if future cash flows, including potential sales proceeds, related to the property are estimated to be less than the carrying value of the property. Management of the Company reviews the carrying value of each mineral property interest periodically, and whenever events or changes in circumstances indicate that the carrying value may not be recoverable. Reductions in the carrying value of each property would be recorded to the extent the carrying value of the investment exceeds the estimated future net cash flows.

F-7

Geovic Mining Corp.

(an exploration stage company) |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(United States Dollars)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont’d.)

The Company accounts for its stock options in accordance with FAS 123(R) – Share Based Payment, and related interpretations in accounting for stock-based compensation awards to employees, directors and non-employees. In accordance with FAS 123(R) – Share Based Payment, the Company recognizes stock-based compensation expense based on the fair value of the stock option on the date of grant. The fair value of the stock options at the date of grant is amortized over the vesting period, with the offsetting credit to additional paid in capital. If the stock options are exercised, the proceeds are credited to share capital.

| Cash and cash equivalents |

Cash and cash equivalents include highly liquid investments with a maturity of 3 months or less.

| Property, plant and equipment |

Property, plant and equipment are stated at cost less depreciation. Depreciation is computed on the straight-line method using the following terms:

Machinery and equipment | 5 to 7 years |

| Vehicles | 5 years |

| Furniture and equipment | 5 years |

| Accrued site closure costs |

The Company records the fair value of an asset retirement obligation as a liability in the period in which it incurs a legal obligation associated with the retirement of tangible long-lived assets that results from the acquisition, construction, development or normal use of the assets with a corresponding increase in the carrying amount of the related long-lived asset. This amount is then depreciated over the estimated useful life of the asset. Over time, the liability is increased to reflect an interest element (accretion expense) considered in its initial measurement at fair value. The amount of the liability will be subject to re-measurement at each reporting period. Currently, the Company has no asset retirement obligations.

F-8

Geovic Mining Corp.

(an exploration stage company) |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(United States Dollars)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont’d.)

Income taxes are accounted for using the liability method of tax allocation. Under this method deferred income tax assets and liabilities are recognized for the tax consequences of temporary differences by applying enacted statutory tax rates applicable to future years to differences between the financial statement carrying amounts and the tax bases of existing assets and liabilities.

The effect on deferred taxes for a change in tax rates is recognized in income in the period that includes the enactment. In addition, deferred tax assets are recognized to the extent their realization is more likely than not.

| Foreign currency translation |

The Company and its subsidiaries, all of which are considered to be integrated, use the United States Dollar as their functional currency. The Company accounts for foreign currency transactions in accordance with SFAS No. 52, “Foreign Currency Translation.” Current assets and liabilities, as well as long-term monetary assets and liabilities denominated in foreign currencies are translated into the currency of measurement at the rates of exchange prevailing on the balance sheet date. Other consolidated balance sheet items are translated into the currency of measurement at the rate prevailing on the respective transaction dates. Transaction amounts denominated in foreign currencies are translated into U.S. dollars at exchange rates prevailing at the transaction dates. The resulting foreign exchange gains and losses are included in operations. As of December 31, 2006, the Company had no foreign currency transactions requiring remeasurement as defined in SFAS 52 paragraphs 10 and 15.

Loss per common share is determined based on the weighted average number of common shares outstanding during the year. Diluted loss per share is calculated by the treasury stock method. Under the treasury stock method, the weighted average number of common shares outstanding for the calculation of diluted earnings per share assumes that the proceeds to be received on the exercise of dilutive stock options and warrants are applied to repurchase common shares at the average market price for the period. Stock options and warrants are dilutive when the Company has income from continuing operations and when the average market price of the common shares during the period exceeds the exercise price of the options and warrants.

F-9

Geovic Mining Corp.

(an exploration stage company) |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(United States Dollars)

On May 1, 2006 (as subsequently amended on August 17, 2006, August 29, 2006, October 31, 2006 and March 6, 2007 (see note 12(a)), Geovic signed an agreement with Frank Giustra on behalf of a group of investors (the “FG Group”) and Buckovic, the founder of Geovic and President of the Company, with respect to a reverse acquisition of Target Co, a TSX Venture Exchange (“TSX-V”) listed company (the “RTO”). For accounting purposes, this transaction has been treated as a reverse acquisition of Target Co by Geovic. The historical statements of operations and stockholders equity (deficiency) presented herein include only those of Geovic (the accounting acquirer) and only the deficit of the accounting acquirer carries over consistent with the requirements of reverse acquisition accounting. As the former shareholders of Target Co held approximately 1% of the Company following the transaction, the transaction constituted an RTO. Prior to December 1, 2006, Target Co was a public company based in Toronto and listed on the TSX Venture Exchange, the shares of which were suspended from trading between August 6, 2006 and December 1, 2006 and Geovic was a private mining exploration company based in Colorado.

Prior to the RTO, Target Co was a non-operating public enterprise with nominal net non-monetary assets and therefore did not meet the definition of a business according to the SEC Staff Accounting Bulletins Topic 2A and Staff publications. Accordingly, the RTO was treated as a capital transaction rather than a business combination and no goodwill has been recorded. The net monetary assets of Target Co at the transaction date were $32,777.

On December 1, 2006, the RTO was completed and the Company acquired: (a) all of the issued and outstanding securities of Geovic from the Geovic security holders, (b) all of the issued and outstanding securities of FinCo from the FinCo security holders; and (c) 45 shares, or 4.5% of the issued and outstanding shares of GeoCam from Buckovic. The other key provisions of the FG Group agreement included:

| (a) | The purchase by the FG Group of 4.2 million shares of Geovic at a price of $1.075 per share for gross proceeds of $4.515 million on May 24, 2006; |

| |

| (b) | The incorporation of Geovic Finance Corp. (“FinCo”), a private Cayman Islands exempt company, with an initial capitalization of 15,000,001 shares (9,000,001 common shares and 6,000,000 preferred shares) and 3,000,000 common share purchase warrants (the “FinCo Performance Warrants”) and identification of Target Co as a party to the RTO; |

| |

| (c) | As a condition to the Arrangement Agreement, the arrangement by FinCo and Geovic of equity financing of 6,000,000 subscription receipts at a price of Cdn$1.95 ($1.71) per subscription receipt for gross proceeds of Cdn$11.7 million ($10.2 million) (the “Initial Financing”) which was completed on November 3, 2006, in escrow, with the escrowed funds released upon the RTO taking effect on December 1, 2006 (the “Effective Date”). Immediately prior to the Effective Date, each subscription receipt was exercisable, without the payment of any further consideration, into one FinCo common share and one-half of a transferable FinCo warrant, with each full warrant entitling the holder to purchase one FinCo common share at an exercise price of Cdn$2.75 per share at any time for five years following the completion of the Initial Financing; |

| |