UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| | |

| (Mark One) |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended | January 3, 2015 |

| | OR |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from _________________to _________________ |

Commission File Number 001-33987

HERITAGE-CRYSTAL CLEAN, INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 26-0351454 |

| State or other jurisdiction of | | (I.R.S. Employer |

| Incorporation | | Identification No.) |

2175 Point Boulevard

Suite 375

Elgin, IL 60123

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (847) 836-5670

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

|

| | |

| Title of Class | | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Securities Exchange Act of 1934:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | |

| | Large accelerated filer o | | Accelerated filer x |

| | Non-accelerated filer o | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

On June 13, 2014 (the last business day of the registrant's most recently completed second fiscal quarter), the aggregate market value of the common stock of the registrant held by non-affiliates of the registrant was approximately $162.1 million, based on the closing price of such common stock as of that date on the NASDAQ Global Select Market.

On March 10, 2015, there were outstanding 22,262,722 shares of Common Stock, $0.01 par value, of Heritage-Crystal Clean, Inc.

Table of Contents

Disclosure Regarding Forward-Looking Statements

In addition to historical information, this annual report contains forward-looking statements that are based on current management expectations and that involve substantial risks and uncertainties, which could cause actual results to differ materially from the results expressed in, or implied by, these forward-looking statements. These statements can be identified by the fact that they do not relate strictly to historical or current facts. They use words such as “aim,” “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “should,” “will be,” “will continue,” “will likely result,” “would,” and other words and terms of similar meaning in conjunction with a discussion of future or estimated operating or financial performance. You should read statements that contain these words carefully, because they discuss our future expectations, contain projections of our future results of operations or of our financial position, or state other “forward-looking” information.

The factors listed under “Risk Factors,” as well as any cautionary language in this annual report, provide examples of risks, uncertainties, and events that may cause our actual results to differ materially from the expectations or estimates we describe in our forward-looking statements. Although we believe that our expectations are based on reasonable assumptions, actual results may differ materially from those in the forward-looking statements as a result of various factors, including, but not limited to, those described under the heading “Risk Factors” and elsewhere in this annual report.

Forward-looking statements speak only as of the date of this annual report. We do not have any intention, and do not undertake, to update any forward-looking statements. As a result of these risks and uncertainties, readers are cautioned not to place undue reliance on the forward-looking statements included in this annual report or that may be made elsewhere from time to time by, or on behalf of, us. All forward-looking statements attributable to us are expressly qualified by these cautionary statements.

PART I

ITEM 1. BUSINESS

Overview

Heritage-Crystal Clean, Inc. (herein collectively referred to as “we,” “us,” “our,” “HCCI,” or “the Company”) provides full-service parts cleaning, containerized waste management, used oil collection, vacuum truck services, antifreeze recycling, and owns and operates a used oil re-refinery. We believe that we are the second largest provider of parts cleaning and hazardous and non-hazardous waste services to small and mid-sized customers in both the manufacturing and vehicle maintenance sectors in North America, and we are the second largest used oil re-refiner by capacity in North America. We operate our business through our Environmental Services and Oil Business segments.

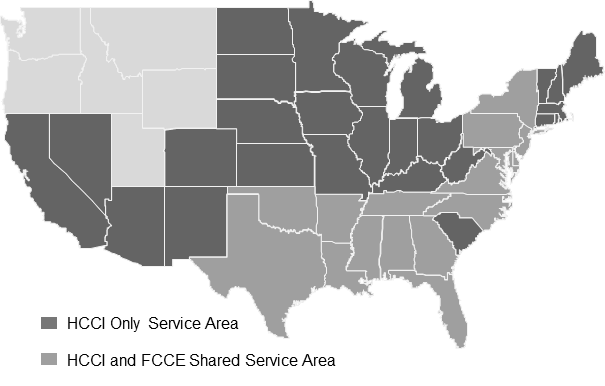

On October 16, 2014, we acquired the outstanding stock of FCC Environmental LLC and International Petroleum Corp. of Delaware (together, “FCC Environmental” or "FCCE") from Dédalo Patrimonial S.L.U. for $90.0 million in cash, subject to customary post-closing adjustments (the “Acquisition” or the “FCC Environmental Acquisition”). In 2013, FCC Environmental was a significant collector of used oil by volume in the United States. FCC Environmental offers oily water disposal and treatment, parts cleaning, vacuum services, antifreeze recycling, oil filter recycling, on-site cleaning, and waste management services in the Southern and Eastern United States. We are in the process of integrating the legacy FCC Environmental business into our operations and branch network.

Environmental Services Segment

Our Environmental Services segment consists of our parts cleaning, containerized waste management, vacuum truck services, and antifreeze recycling activities. These services allow our customers to outsource their handling and disposal of parts cleaning solvents as well as other hazardous and non-hazardous waste. Many of these substances are subject to extensive and complex regulations, and mismanagement can result in citations, penalties, and substantial direct costs both to the service provider and also to the generator. We allow our customers to focus more on their core business and devote fewer resources to industrial and hazardous waste management and its related administrative burdens.

We have adopted innovative approaches in our Environmental Services segment to minimize the regulatory burdens for our customers and have made “ease of use” of our services and products a priority. Our company has pioneered two different programs whereby our customers' used solvent may be excluded from the U.S. Environmental Protection Agency's ("EPA") definition of hazardous waste. These two programs not only simplify the management of used solvent generated by our customers, but also reduce the total volume of hazardous waste generated at many of our customers’ locations. This can allow

the customer to achieve a lower “generator status” with the EPA and thereby reduce their overall regulatory burden, including reduced reporting obligations and inspections.

Our focus on providing ease of use for our customers is also part of our containerized waste, vacuum service, antifreeze service, and field services offerings. As part of our containerized waste and vacuum service programs, we assist our customers in identifying and characterizing their regulated wastes as well as providing the proper labeling and shipping documentation for their regulated materials. Our antifreeze recycling service offers our customers a fully-compliant method to safely manage their used antifreeze while providing a high quality, environmentally friendly, remanufactured product. Similarly, our field services, some of which we now perform as a result of our acquisition of FCC Environmental, allow our customers to focus on their core business activities while we manage non-core activities such as tank cleanings and spill clean-up.

Oil Business Segment

The Oil Business segment consists of used oil collection activities, sale of recycled fuel oil, and re-refining activities. Through our re-refining process, we recycle used oil into high quality lubricant base oil and by-products, and we are a supplier to firms that produce and market finished lubricants. We operate a used oil re-refinery with an annual nameplate capacity of 65 million gallons, and we are currently in the process of expanding the capacity to 75 million gallons of used oil input per year. We are currently feeding the re-refinery with a combination of used oil collected from our customers and used oil that we purchase from third parties.

Industry

We operate within markets for industrial and hazardous waste services in the U.S. and parts of Canada. Specifically, we focus on the parts cleaning, containerized waste, used oil collection and re-refining, vacuum services, antifreeze recycling, and field services areas of the industrial and hazardous waste services markets for small to mid-sized establishments. These establishments have a need to remove grease and dirt from machine and engine parts with solvent and include businesses involved in vehicle maintenance operations, such as car dealerships, automotive repair shops, and trucking firms, as well as small manufacturers, such as metal product fabricators and printers. These businesses also generate waste materials such as used oil, waste paint, or antifreeze that generally cannot be discarded as municipal trash or poured down a standard drain.

Environmental Services Segment

Parts cleaning machines and solvent are used by mechanics in industrial plants and automotive technicians in garages to clean dirty machine parts. Through use, the solvent becomes contaminated with oil and sediment and must be replaced regularly. This replacement of solvent is subject to environmental regulations prohibiting disposal with municipal trash or by pouring down the drain. Vehicle maintenance facilities as well as small to medium sized manufacturers generate other regulated materials which cannot be disposed of in the municipal trash or poured down the drain, such as used oil, waste paint, antifreeze, used oil filters, discarded fluorescent light tubes, spent batteries, etc. Because the management of these wastes is subject to changing regulatory requirements, most businesses need specialized knowledge to prepare required paperwork, maintain records, and ensure compliance with environmental laws. Large businesses, which generate substantial volumes of industrial and hazardous wastes, may find it more efficient to employ highly trained employees to manage this waste. Small and mid-sized businesses that generate lesser quantities of waste often cannot justify such personnel investments and typically prefer to outsource these services to providers that can assist them in their disposal of used solvent and other wastes subject to environmental regulations.

We believe that stable demand for our parts cleaning, containerized waste, vacuum truck, antifreeze recycling services, and field services is supported by potential growth in other services that result from new environmental regulations or new product developments. Opportunities to take advantage of trends toward outsourcing specialized waste services continue to present themselves as businesses choose to use full-service third party vendors in order to focus their resources on their core business.

Oil Business Segment

Through our used oil collection services, we compete in the used oil collection market. Automotive shops generate used oil as a result of performing oil changes on passenger cars and trucks. Industrial plants also generate used oil, often as a result of changing lubricants used in heavy machinery. Environmental regulations prohibit the disposal of used oil into sewers or landfills, so most commercial generators arrange to have their used oil picked up periodically by a used oil collector.

Since fiscal 2012, we have produced and sold lubricating base oil from our re-refinery. Most lubricating base oil is produced at refineries that process crude oil, and lubricating base oil is just one of the many products of the refining process along with gasoline, diesel fuel, jet fuel, asphalt, and other hydrocarbon products. Major refining companies such as Chevron, ExxonMobil, and Shell produce a significant share of the total U.S. base oil output. They use some of this material in producing their own branded lubricant products and also sell base oil to other firms that focus on the blending and packaging of lubricants. Historically, base oil has been sold for prices based on the market price of the crude oil feedstock plus a premium. However, the level of supply and demand for base oil can also affect the market price.

In the fourth quarter of fiscal 2014, through the acquisition of FCC Environmental, we added 18 oil processing operations. These operations remove excess water from the used oil and separate oil from oily water mixtures using thermal treatment, gravity separation, and mechanical filtration. The finished product from this process is called Recycled Fuel Oil ("RFO"). The RFO we produce is sold to industrial burners and used oil processors, such as Vacuum Gas Oil ("VGO") producers and used oil re-refiners. We also operate five wastewater treatment operations. These facilities allow us to remove oil from some of the wastewater we collect, treat the wastewater, and then discharge it according to the standards in the applicable discharge permits. Some of the oil removed in the wastewater treatment process may become RFO.

The Crystal Clean Solution

Through our network of 84 branches, as of January 3, 2015, we provided parts cleaning, used oil collection and re-refining, industrial waste removal, antifreeze recycling services, and field services to over 100,000 active customer locations.

Environmental Services Segment

During fiscal 2014, we performed more than 318,000 parts cleaning service calls. We believe our services are highly attractive to our customers, who value features such as assistance in preparing waste manifests and drum labels, regularly-scheduled service visits to check inventories and remove accumulated waste, and minimizing the number of vendors they must deal with related to the management of these materials. Our focus is to meet the service requirements of small and mid-sized clients, which we define as firms that generally spend less than $50,000 per year on industrial and hazardous waste services. Small and mid-sized clients have needs that are often highly differentiated from the needs of larger accounts. We believe that our company is structured to meet these particular needs. Revenues in our Environmental Services segment accounted for approximately 56.0% of our revenues for fiscal 2014 and are generated primarily from providing parts cleaning services, waste removal, vacuum services, and antifreeze recycling for our clients.

In the parts cleaning industry, used solvent generated by parts cleaning customers is often classified as a “hazardous waste” (a term defined in the regulations of the EPA), but our company has implemented two different programs whereby our customers' used solvent may be excluded from the definition of hazardous waste. In our non-hazardous program, we provide our customers with an alternative solvent not included in the EPA's definition of hazardous waste due to its higher flashpoint (the minimum temperature at which vapors from the solvent will ignite when tested under specified laboratory conditions), and then we recycle that solvent to be used again in our parts cleaning services. In our product reuse program, we sell used solvent as an ingredient for use in the manufacture of asphalt roofing materials. These two programs not only simplify the management of used solvent generated by our customers but also reduce the total volume of hazardous waste generated at many of our customers' locations. This can allow the client to achieve a lower “generator status” with the EPA and thereby reduce its overall regulatory burden.

In addition to the solvent-based parts cleaning programs described above, at each of our branch locations we also offer a water-based (aqueous) cleaning program. In our aqueous parts cleaning program, instead of using solvent to clean and degrease parts, our customers use water soluble cleaning chemicals mixed in a solution with water. This type of solution is typically used in parts cleaning machines designed with features such as heaters or high pressure to enhance the cleaning capabilities of the aqueous solution. After our customer is finished using the solution, we remove the used solution and almost exclusively manage it as a non-hazardous waste. Similar to the two solvent-based programs described above, our customers' used cleaning material is typically not classified as a hazardous waste, which helps reduce our customers' generation of hazardous waste and their corresponding regulatory burden.

Oil Business Segment

Through our used oil collection service, we collect the used oil generated by our customers when they replace used lubricating oil in vehicles and machinery. Most customers store the used oil that they generate in tanks, which must be emptied regularly to mitigate the risk of overflow or termination of their oil change activities. As a result, these customers have a strong

need for timely used oil service. We have designed our services to deliver regularly-scheduled pickups, and we also have the capability to respond to unscheduled requests on short notice. The used oil we collect is either transported to our used oil re-refinery or processed into RFO. When we re-refine their used oil, we are able to provide our customers with the satisfaction that their used oil is recycled into high quality lubricants using the approach cited as preferred by the EPA.

We operate our used oil re-refinery in Indianapolis, Indiana where we re-refine used oil, which we collect from our customers or purchase from other oil collection service providers, into lubricating base oil, which we sell to firms who then blend, package, and market lubricants. Our re-refinery has an annual input capacity of approximately 65 million gallons of used oil feedstock per year, which would allow it to produce about 39 million gallons of lubricating base oil per year when operating at full capacity. The nameplate capacity includes the impact of periodic shutdowns to perform routine maintenance. We are in the process of increasing our input capacity to 75 million gallons of used oil feedstock per year. As a result of our expansion, in fiscal 2014 we operated the re-refinery at a higher capacity compared to fiscal 2013. In fiscal 2014, we collected 49.9 million gallons of used oil from our customers. Revenues in our Oil Business segment accounted for 44.0% of our total revenues in fiscal 2014.

Services

Across our full range of services, we focus on reducing our customers' burdens associated with their generation of hard-to-handle wastes. Many of these wastes are subject to extensive and complex regulations, and mismanagement can result in citations, penalties, and substantial direct costs, both to the service provider and the generator. Many customers are familiar with “Superfund liability” and the possibility that they will be required to pay for future cleanups if their waste is mismanaged in a way that leads to environmental damage. Our services allow customers to focus more on their core business and devote fewer resources to industrial and hazardous waste management. A majority of our customers use our parts cleaning, waste management, and/or used oil collection services, and these services are offered at almost of our branches.

Environmental Services Segment

In our full-service parts cleaning business, we provide customers with parts cleaning equipment and chemicals to remove oil, grease, and other contaminants from engine parts and machine parts. Most commonly, we provide a parts cleaning machine that contains a petroleum-based solvent in a reservoir. The customer activates a pump that circulates the solvent through a nozzle where it is used to clean parts. The solvent can be reused for a period of time, after which it becomes too dirty and requires replacement. We typically visit our customers every 4 to 12 weeks to remove the used solvent and replace it with clean solvent, while at the same time cleaning and inspecting the customers' parts cleaning equipment to ensure that it is functioning properly and assisting our customers with relevant regulatory paperwork. We believe that many of the parts cleaning services performed in the U.S. are structured as hazardous waste services, meaning that when the solvent has been used, it is managed as a regulated hazardous waste subject to numerous laws and regulatory filings. We reduce this burden for our customers by offering three alternative parts cleaning programs (our non-hazardous and reuse programs for solvent parts cleaning and our aqueous parts cleaning program) that do not subject the customer to the same hazardous waste regulations. These low-burden approaches help our customers achieve regulatory compliance while minimizing the paperwork and bureaucracy associated with hazardous waste management - ultimately saving them time and money. For example, these programs currently enable many of our customers to reduce their generation of hazardous wastes below the 220 pounds per month maximum threshold for retaining the EPA generator status of Conditionally Exempt Small Quantity Generator ("CESQG"). For our customers, maintaining a CESQG status provides significant savings associated with not having to maintain an EPA identification number; prepare, track, and file transportation manifests; or produce other reports related to the use, storage, and disposal of used solvents. We offer more than a dozen different models of parts cleaning machines from which our customers may choose the machine that best fits their specific parts cleaning needs. While the majority of our customers are provided or sold machines directly from us, we also offer parts cleaning services for customers who purchase their parts cleaning machines from other sources. We offer a variety of petroleum solvents and aqueous chemicals for use in parts cleaning machines. We also have a wide range of service schedules from weekly service visits to triannual service visits.

In our containerized waste services, we collect drums, pails, boxes, and other containers of hazardous and non-hazardous waste materials from our customers. Typical wastes from vehicle maintenance include used antifreeze, used oil filters, waste paint, and used absorbent material. Typical wastes from manufacturing operations include waste paint and solvents, oily water wastes, used absorbents, and discarded fluorescent lighting tubes. We endeavor to find the lowest burden regulatory approach for managing each of these materials for our clients. In some cases, we can develop lower burden alternatives based on recycling materials for component recovery, such as with oil filters, or by following the less onerous universal waste regulations, such as with fluorescent tubes and waste paint. In other cases, the hazardous waste regulations may apply, in which case we assist customers with the complete hazardous waste disposal process, including performing analysis to

characterize their waste, preparing manifests and drum labels, and selecting the appropriate destination facility. As part of our full-service approach, we visit our customers periodically to check their inventory of used or waste materials and remove full containers as appropriate. Because there are statutory limits on the amount of time that customers can store these waste materials, these service visits are valuable to help customers stay in compliance. To the extent that we can coordinate these service visits together with a regularly scheduled parts cleaning service, we are able to perform both tasks during the same visit, with the same truck and service employee.

In selected branch locations, we provide vacuum truck services for the removal of mixtures of oil, water, and sediment from wastewater pretreatment devices and other sources. Many shops and plants have floor drain systems that lead to pits, sumps, or separators that are designed to separate and retain oil and dirt, but allow clear water to flow out to a municipal sewer. Periodically, these drains and collection points accumulate excess oil or sediment that needs to be removed. Because some of the material is very thick, a specialized vacuum truck is utilized for efficient removal of the material. Our vacuum truck service includes the removal of the oil, water, and sediment so that the customer's equipment operates as intended. We also offer bulk oily water removal. These services are scheduled on a regular basis. Because our efforts to expand vacuum truck services have started more recently than some of our other offerings in the Environmental Services segment, these services are currently offered at 56 of our branches, and we generate fewer sales from these services. In the fourth quarter of fiscal 2014, as part of our acquisition of FCC Environmental, we acquired five waste water treatment facilities. These facilities allow us to remove oil from some of the wastewater we collect, treat the wastewater, and discharge it according to the standards in the applicable discharge permits.

Through our antifreeze recycling service, we offer customers a fully-compliant method to safely manage their used antifreeze while providing a high quality, environmentally friendly, remanufactured product. We offer responsive, on-time scheduled or on-demand collection and transportation of used automotive antifreeze to our three antifreeze recycling facilities, where it is recycled into high quality clean antifreeze. We then sell a variety of formulations of this antifreeze to our vehicle maintenance customers.

As a result of our acquisition of FCC Environmental in the fourth quarter of fiscal 2014, we offer a variety of Field Services to assist customers with on-site equipment cleaning and the removal and proper management of fluid waste. Typical projects include the cleaning of above ground storage tanks, sumps, separators, ship-to-shore fluid transfers, and other environmental remediation services. We typically serve as contractor and engage contract labor or outsourced labor to provide our field services.

Oil Business Segment

In 78 of our branch locations, we provide bulk used oil collection services. Although we manage some used oil through our containerized waste program, most customers who generate used oil (typically from vehicle engine oil changes) produce large quantities that are stored in bulk tanks, and these volumes are handled more efficiently via bulk tank trucks such as those that we utilize. We pump the customer's material into our tank truck for proper management. We transfer a majority of the used oil we collect to our re-refinery to be recycled into lubricating base oil. We recycle the remaining used oil into RFO, some of which is sold to industrial burners, such as asphalt plants that use the RFO as a less expensive substitute for other fuels, and some of which is sold to used oil processors such as VGO producers and used oil re-refiners. As with our other services, we offer to visit customers on a regularly scheduled basis to arrange for the removal of their accumulated oil.

Competitive Strengths

We believe that we are the second largest provider of full-service parts cleaning services in the U.S. and a leading provider of containerized waste services and used oil collection services targeting small and mid-sized customers. From our base of 84 branch locations, we implement an organized and disciplined approach to increasing our market share, taking advantage of the following competitive strengths:

Excellent Customer Service. Since our founding, we have instilled a standardized, sales-oriented approach to our customers across our branch network. Our branch personnel are focused on local sales and service delivery, and a significant portion of their compensation is linked to sales growth and new business development. In order to achieve this sales growth, our personnel understand that they must retain existing business, which is best achieved by providing a very high level of customer service which can lead to cross-selling opportunities and referrals to new prospects. During fiscal 2014, approximately 89.4% of our revenues were generated from customers that we also served during fiscal 2013.

Cost-Efficient Branch Rollout Model. Our branch model allows us to consolidate operational and administrative functions not critical to sales and service at either a regional hub or at our headquarters. This model has been the foundation for our new branch rollout as we have expanded from 14 branches in 1999, and we expect to extend this model to new locations. Furthermore, as we grow within each branch, we improve our route density, which is an important contribution to profitability in our business.

Large Branch Network. We have spent over fifteen years building up and developing a large network of branches that has enabled us to rapidly grow our environmental services and used oil collection services efficiently and cost effectively. Our investments in this network help us to rapidly open new branches and cross sell products and services through existing branches.

Large and Highly Diverse Customer Base. Our focus on small and mid-sized businesses has enabled us to attract a variety of customers engaged in a range of businesses spread across the spectrum of the manufacturing, vehicle service, and transportation industries which helps insulate us from disruption caused by the possible loss of a single large account. Our customer base consists of over 100,000 active customer locations. In fiscal 2014, our largest single customer in our Environmental Services segment represented 0.7% of our consolidated revenues, and our largest ten customers represented approximately 3.0% of our consolidated revenues. In the Oil Business segment, revenues from one customer accounted for 5.0% of our consolidated revenues for fiscal 2014, and our largest ten customers represented 27.5% of our consolidated revenues for fiscal 2014.

Experience in Re-Refining Technology. Our management team has substantial experience in the development and operation of used oil re-refineries, as several members of our management team were significant contributors to the development of approximately 64% of the used oil re-refining capacity in North America. Our team is able to design and construct re-refining capacity for a comparatively low capital cost. In 2012 we began operating our re-refinery which had an original nameplate capacity of 50 million gallons of used oil. We were able to construct the original re-refining capacity for approximately $54 million, or approximately $1 per gallon of capacity. As of January 3, 2015, we had increased our annual nameplate capacity to 65 million gallons of used oil feedstock, and we plan to expand the annual nameplate capacity of the re-refinery to 75 million gallons. We expect to complete the full expansion from 50 million to 75 million gallons of annual capacity for approximately $1 of capital cost per gallon of annual capacity. We believe that recent re-refineries built in the United States have cost substantially more than $1 per gallon of capacity.

Innovative Services that Reduce Customers' Regulatory Burdens. We have designed our service programs to meet the needs of our target customers. In particular, these customers desire to minimize their regulatory compliance burdens, and we have developed innovative methods to help our customers achieve this objective. For example, we have created parts-cleaning service programs which each exempt our customers from certain hazardous waste regulations and filing requirements:

| |

| • | Non-hazardous Program for Parts Cleaning. In our non-hazardous program for parts cleaning, we provide our customers with an alternative solvent that is not included in the EPA's definition of hazardous waste due to its increased flashpoint, and we educate each participating customer to prevent harmful contaminants from being added to the solvent during use. Because of the reduced solvent flammability, as long as the customer does not add toxic or flammable contaminants during use, neither the clean solvent that we supply nor the resulting used solvent generated by customers participating in the program is classified as hazardous waste by the EPA and as a result can be managed as non-hazardous waste. To participate in this program, our customers must provide certification that no hazardous wastes have been added to the parts cleaning solvent. After we collect the used solvent from customers participating in our non-hazardous program for parts cleaning, we recycle it via distillation for re-delivery to our parts cleaning customers. The recycling process removes oil, water, and other impurities, resulting in solvent suitable to be re-used by our customers for parts cleaning. At the same time, this process minimizes the burdensome hazardous waste regulations faced by our customers and allows us to minimize our virgin solvent purchases. Our solvent recycling system located in Indianapolis is capable of recycling up to six million gallons per year of used solvent generated by customers participating in our non-hazardous program. This provides significant capacity in excess of our current requirements. |

| |

| • | Product Reuse Program for Parts Cleaning. Rather than managing used solvent as a waste, we have developed a program that uses the solvent as an ingredient in the manufacture of asphalt roofing materials. Used solvent generated by customers participating in our product reuse program for parts cleaning is sold as a direct substitute for virgin solvent that is otherwise used in the asphalt manufacturing process. Because the used solvent is destined for reuse, it is not deemed a waste, and therefore it is not subject to hazardous waste regulations. To enhance the marketing of |

these programs, in the past 20 years we and our predecessor Heritage Environmental Services have voluntarily obtained concurrence letters from more than 30 state environmental agencies to validate this approach.

| |

| • | Aqueous Program. In addition to our petroleum-based solvent, we offer a full suite of proprietary aqueous-based parts cleaning solutions, including our patented aqueous parts cleaning equipment and patented filtration technology for water-based fluids, which we believe is the most comprehensive aqueous-based solutions offering in the industry. After our customer is finished using the solution, we remove the used solution and almost exclusively manage it as non-hazardous waste. Similar to the two solvent-based programs described above, our customers’ used cleaning material will not be included in the EPA’s definition of a hazardous waste, which helps reduce our customers’ regulatory burdens. In addition, our patented Aqua Filtration Unit provides our customers with an innovative method to remove contaminants from their water-based fluids. |

Experienced Management Team. Our management team has substantial experience in the industry and possesses particular expertise in the small to mid-sized customer segment. Our senior managers have on average more than 30 years of industry experience and our middle managers have on average more than 20 years of industry experience. Many of our managers held key positions with Safety-Kleen between 1986 and 1998, during which time Safety-Kleen grew from $255 million to over $1.0 billion in annual revenue.

Growth Strategies

We intend to grow by providing environmental solutions that meet the needs of our customers. We have several different strategies to accomplish this and they include:

Same-Branch Sales Growth. We seek to generate year-over-year growth in existing markets by obtaining new customers and by cross-selling multiple services to existing customers, including customers newly acquired through our acquisition of FCC Environmental. Our sales and marketing strategy includes providing significant incentives to our field sales and service personnel to find and secure new business. These incentives include commission compensation for individuals and managers as well as prize awards and contests at the individual and team level. Our company culture is designed to consistently emphasize the importance of sales and service excellence and to build and maintain enthusiasm that supports continued sales success. Additionally, we intend to drive profitability by leveraging fixed costs against incremental sales growth at our existing branches. Consolidation of legacy Heritage-Crystal Clean and legacy FCC Environmental branches should allow us to further leverage the fixed costs of our combined branch operations. In addition, implementing our integrated sales and service approach with legacy FCC Environmental service representatives will increase the number of personnel involved in sales.

Expanded Service Offerings. Of our 84 branches, 83 currently offer parts cleaning and containerized waste management services, 78 offer used oil collection services, and 56 offer vacuum truck services. As our business grows and we achieve sufficient market penetration, we have the opportunity to expand our vacuum truck services to each branch location. We also have other new business programs in various stages of development which have the potential to be offered through our branch locations in the future.

Geographic Expansion. We currently operate from 84 branch locations that offer all or portions of our service menu to customers in 43 states, the District of Columbia, and parts of Ontario, Canada. We have historically been able to install new branches at a relatively low cost, although installation of branches in the Western U.S. is relatively more costly. Within the contiguous United States, we believe that there are opportunities to open more branches and provide convenient local service to additional markets.

FCC Environmental Acquisition Integration. Through our recent acquisition of FCC Environmental, we have been able to accelerate a number of our growth strategies. We expect the FCC Environmental customer base to provide additional sales penetration opportunities in existing markets from Texas through the southeastern U.S. and northward up the East coast of the United States. The geographic overlap of the legacy Heritage-Crystal Clean and legacy FCC Environmental service territories provides us with the opportunity to increase route density in all of our existing businesses. We expect that facility consolidation and route density improvements resulting from the Acquisition will enable us to better leverage the fixed costs of our business.

Selectively Pursue Acquisition Opportunities. Our management team has significant experience in identifying and integrating acquisition targets. Given the number of small competitors in our business, there are generally multiple acquisition opportunities available to us at any given time. In fiscal 2013, we made various strategic acquisitions to help grow our used oil collection business and to enter the antifreeze recycling business, and in fiscal 2014, we acquired Sav-Tech in order to enter into business in Canada. In October 2014, we acquired FCC Environmental, a significant collector of used oil and provider of environmental services in the United States, for total consideration of $90.0 million, our largest acquisition to date. Our growth plan is not dependent on acquisitions, but we will continue to pursue acquisitions that leverage our established infrastructure.

Sales and Marketing

Our mission and culture emphasize sales and service excellence and entrepreneurship, and our sales philosophy starts with the principle of “sales through service.” We assign a territory to each of our Sales & Service Representatives ("SSRs"), and require and encourage them to grow their business on their routes by delivering excellent service to existing customers. This helps our SSRs retain business, sell more services to satisfied customers, and obtain valued referrals to potential new customers. In addition to the efforts of our SSRs, we employ a branch manager at each of our branches, and we also employ branch sales managers, all of whom have dedicated sales territories and responsibilities.

Suppliers and Recycling/Disposal Facilities

We purchase goods such as parts cleaning machines, solvent (petroleum naphtha mineral spirits), cleaning chemicals, bulk used oil, bulk antifreeze (ethylene glycol), and absorbent from a limited group of suppliers. We also have arrangements with various firms that can recycle, burn, or dispose of the waste materials we collect from customers. These suppliers and disposal facilities are important to our business, and we have identified backup suppliers in the event that our current suppliers and disposal facilities cannot satisfy our supply or disposal needs. Heritage Environmental Services, an affiliate of The Heritage Group which beneficially owned 22.5% of our common stock as of January 3, 2015, operates one of the largest privately-owned hazardous waste treatment businesses in the U.S. We have used their hazardous waste services in the past, and it is likely that we will continue some level of use in the future.

In fiscal 2013 we purchased substantially all of the operating assets of Mirachem Corporation, a supplier of the cleaning chemistry used in our aqueous parts cleaning service. In a separate transaction, we acquired from a third party additional aqueous technologies in exchange for a 20% interest in Mirachem, LLC. We completed these transactions in order to secure the supply of our aqueous parts cleaning chemistry which, together with our patented aqueous parts cleaning equipment, should provide us with a strong platform from which to compete in the aqueous parts cleaning market. Mirachem, LLC is consolidated into our financial statements as part of the Environmental Services segment.

In the fourth quarter of fiscal 2014, as part of our acquisition of FCC Environmental, we acquired five waste water treatment facilities. These facilities allow us to remove oil from some of the waste water we collect, treat the waste water, and then discharge it according to the standards in the applicable discharge permits. The acquisition of these facilities allows us the flexibility to dispose of our oily water and vacuum services waste water collected from certain branches internally,

Competition

The markets for parts cleaning, containerized waste management, used oil collection, vacuum truck services, antifreeze recycling, and field services in which we participate are intensely competitive. While numerous small companies provide these services, our largest competitor, Safety-Kleen (a wholly-owned subsidiary of Clean Harbors, Inc.), has held substantial market share in the full-service parts cleaning industry for the last four decades and has developed significant market share in used oil collection and containerized waste management. Safety-Kleen operates throughout the continental U.S., Puerto Rico, and Canada through a large branch network. We believe that Safety-Kleen and some of our other competitors have substantially greater financial and other resources and greater name recognition than us. We estimate that in the full-service portion of the parts cleaning market, Safety-Kleen is significantly larger than us, and that we are substantially larger than the next largest competitor.

Many of our smaller competitors tend to be regional firms or parts cleaning companies that operate in a single city. Although many of these smaller competitors lack the resources to offer clients a full menu of services, they generally offer parts cleaning services ancillary to a primary line of business, such as used oil collection, in order to present a more complete menu to customers. In addition, companies involved in the waste management industry, including waste hauling, separation, recovery, and recycling, may have the expertise, access to customers, and financial resources that would encourage them to develop and market services and products competitive with those offered by us. We also face competition from alternative services that provide similar benefits to our customers as those provided by us.

Price, service quality and timeliness, breadth of service offering, reputation, financial strength, and compliance history are the principal competitive factors in the markets in which we compete. While we feel that most market competitors compete primarily on price, we believe that our competitive strength comes from our focus on customer service and our broad menu of services. Although we employ a pricing structure that controls discounts, we are able to deliver a sound value proposition through the reduced regulatory burden achieved through our programs. We could lose a significant number of customers if Safety-Kleen or other competitors materially lower their prices, improve service quality, develop more competitive product and service offerings, or offer a non-hazardous or reuse program for parts cleaning more appealing to customers than ours.

We have the second largest used oil re-refinery, by capacity, in North America. Our largest competitor, Safety-Kleen, currently controls approximately 52% of the used oil re-refining capacity in North America. Over the past several years, many of our competitors have announced their intentions to enter into the used oil re-refining or base oil business or expand their capacities.

Seasonality

Our operations may be affected by seasonal fluctuations due to weather cycles influencing the timing of customers' need for products and services. Typically during the first quarter and the end of the fourth quarter of each year there is less demand for our products and services due to the lower levels of activities by our customers as a result of the cold weather, particularly in the Northern and Midwestern regions of the United States. This lower level of activity also results in lower volumes of used oil generated for collection by us in the first quarter. In the winter months there is less construction activity, which reduces demand for certain re-refinery by-products. In addition, factory closings for the year-end holidays reduce the volume of industrial waste generated, which results in lower volumes of waste handled by us during the first quarter of the following year.

Information Technology

We believe that automation and technology can enhance customer convenience, lower labor costs, improve cash management, and increase overall profitability. We are constantly evaluating opportunities to develop technologies that can improve our sales and service processes. Our commitment to the application of technology has resulted in the creation of a custom web-based application for scheduling, tracking, and management of customer services, billing, and collections. This system has been used as an integral part of our business operations for more than eight years. We believe that our standardized processes and controls enhance our ability to successfully add new branches and expand our operations into new markets. Mobile devices are used by our employees in the field to access customer service information. In the used oil collection portion of our Oil Business segment, these devices are also used to capture service transactions and inventory movements. Statistics are gathered and reported on a daily and weekly basis through sales personnel and document processing. These capabilities provide timely, automated data measurement and control for service activities to accelerate response to market and operational change.

Employees

As of January 3, 2015, we employed 1,377 full time and 64 part time employees. None of our employees are represented by a labor union or covered by a collective bargaining agreement. We believe that our employee relations are good.

Regulation

Substantially all of our services and products involve the collection, transportation, storage, recycling and/or disposal of industrial and hazardous waste or hazardous materials, including solvents used in parts cleaners; containerized waste including waste paint, inks, adhesives, used antifreeze, used oil, and used oil filters; and bulk waste including used oil, oily water, and antifreeze. Our services are highly regulated by various governmental agencies at the federal, state, and local levels, as described in more detail below. Regulations govern matters such as the disposal of residual chemical wastes, operating procedures, storm water and wastewater discharges, fire protection, worker and community right-to-know, and emergency response plans.

Our services and products require us to comply with these laws and regulations and to obtain federal, state, and local environmental permits or approvals for some of our operations. Some of these permits must be renewed periodically, and governmental authorities have the ability to revoke, deny, or modify these permits. Zoning and land use restrictions also apply to all of our facilities. Siting and other state-operating approvals also apply in some states.

We are subject to federal and state regulations governing hazardous and solid wastes. The Resource Conservation and Recovery Act ("RCRA") is the principal federal statute governing hazardous waste generation, treatment, transportation, storage, and disposal. Under RCRA, the EPA has established comprehensive “cradle-to-grave” regulations for the management of a wide range of materials identified as hazardous or solid waste. The regulations impose technical and operating requirements that must be met by facilities that generate, store, treat, transport, and dispose of these wastes. A number of states have regulatory programs governing the operations and permitting of hazardous and solid waste facilities. In addition, some states classify as hazardous some wastes that are not regulated under RCRA. Accordingly, we must comply with the state requirements for handling state regulated wastes.

In 2013, the EPA issued preliminary regulations regarding its plans to replace paper manifests with an electronic manifesting system and electronic database that will be developed and maintained by the EPA. Users of the system will pay transaction fees to the EPA for maintaining the system. Congress established a statutory deadline of October 2015 for the EPA to have a functioning "e-manifest" system. However, the EPA estimates that the availability of a functioning system has been delayed for approximately 18 to 24 months. We intend to develop systems that will allow us to utilize the EPA's "e-manifest" system for shipments of hazardous wastes and other waste materials and that will be linked to the EPA's data management system once the designs, requirements, and schedules are finalized.

Our operations are governed by 10-day transfer requirements and do not typically require a hazardous waste facility permit. The majority of our branches in the U.S. are 10-day transfer sites. Under RCRA, states are delegated to implement the regulatory programs through state regulations, which can be more stringent than those of the federal EPA. We have obtained a facility waste permit for our locations in Maryland and Connecticut and are currently pursuing a waste permit in New Hampshire because these states have more stringent programs that do not allow the typical 10-day transfer option. In 2014, we obtained authorization from New Jersey to provide solid and hazardous waste services within the state.

The Comprehensive Environmental Response Compensation and Liability Act of 1980, as amended ("CERCLA") governs the cleanup of inactive hazardous waste sites and imposes liability for the cleanup on “responsible parties” generating or transporting waste to a site. CERCLA further provides for immediate response and removal actions coordinated by the EPA to releases of hazardous substances into the environment and authorizes the government to respond to the release or threatened release of hazardous substances or to order responsible persons to perform any necessary cleanup. CERCLA imposes strict liability on current or former owners and operators of facilities that release hazardous substances into the environment as well as on businesses that generate those substances or transport them to the facilities. Responsible parties may be liable for substantial investigation and cleanup costs even if they operated their businesses properly and complied with applicable federal and state laws and regulations. Liability under CERCLA may be joint and several. Certain of our customers' and third-party contractors' facilities have been in operation for many years and, over time, the operators of these facilities may have generated, used, handled, and disposed of hazardous and other regulated wastes or other hazardous substances. Environmental liabilities could therefore exist under CERCLA, including cleanup obligations at these facilities or off-site locations where materials from our operations were disposed. In the past, we have been involved as a potentially responsible party (“PRP”) at CERCLA cleanup sites, and it is possible that we may be involved at similar cleanup sites in the future.

In addition to regulations under RCRA and CERCLA, the EPA has adopted regulations under the Clean Air Act ("CAA") and the Clean Water Act ("CWA"). The CAA regulates emissions of pollutants into the air from mobile and stationary sources. CAA permits limit the emissions from parts cleaning units. One of our distribution hubs, our used oil re-refinery, and several of our oily water treatment operations are subject to facility based permits under the CAA. The used oil re-refinery was constructed and is operating under CAA New Source Performance Standards and an associated permit. This air permit was modified to accommodate the ongoing expansion of the re-refinery. Our transportation fleet of trucks is regulated for emissions as mobile sources. Regulations under the CWA govern the discharge of pollutants into surface waters and sewers and require discharge permits and sampling and monitoring requirements. The CWA also requires specific spill plans governing the storage of waste and product hydrocarbons. A more detailed spill plan is also required at the used oil re-refinery because of the large volume of certain storage tanks. Two of our legacy facilities and the majority of our newly acquired FCC Environmental facilities currently hold CWA National Pollution Discharge Elimination System ("NPDES") permits for stormwater runoff and water pollution prevention. Our operations are also regulated pursuant to state statutes and implementing regulations, including those addressing clean water and clean air.

Our transportation fleet, truck drivers, and the transportation of hazardous materials are regulated by the U.S. Department of Transportation ("DOT") Motor Carrier and the Federal Railroad Administration ("FRA"), as well as by the regulatory agencies of each state in which we operate or through which our vehicles pass. Governmental regulations apply to the vehicles used by us to transport the chemicals we distribute to customers and the waste and other residuals collected from customers. These vehicle requirements include the licensing requirements for the vehicles and the drivers, vehicle safety requirements, vehicle weight limitations, shipping papers, and vehicle placarding requirements.

The Department of Labor Occupational Safety & Health Administration ("OSHA") safety standards are applicable to all of our operations. The used oil re-refinery and mineral spirits distillation facility are also subject to OSHA Process Safety Management standards that govern the operation of the facilities.

In August 1997, the South Coast Air Quality Management District in California (the “SCAQMD”), enacted Rule 1171, which prohibits the use of certain types of solvents that we currently sell for parts cleaning operations. In the areas of California affected by this or similar regulations (including Los Angeles, San Francisco, and Sacramento), aqueous parts cleaning is the primary substitute. We currently have one branch located in Los Angeles, California. Although other states have not passed regulations similar to Rule 1171, we cannot predict if or when other state and/or local governments will promulgate similar regulations which may restrict or prevent the use of solvent for parts cleaning. Pending air regulation laws in the northeastern United States may restrict, or possibly eliminate, the use of our typical parts washer solvent in cold parts cleaners. Due to the size of the states in the northeastern U.S. and the transport of pollutants over state boundaries, the Ozone Transport Commission ("OTC") develops overarching air pollution programs for member states to adopt. While there has been some delay in implementation of the regulations throughout the northeastern OTC states, additional regulations limiting the use of certain solvents and other ozone forming chemicals are expected to begin going into effect within the next five years. The OTC states include twelve states in the far northeastern U.S. as well as the District of Columbia. Among the OTC states, Maryland and Delaware have initiated development of rules to limit the use of ozone pollution forming compounds.

More specifically to our traditional parts cleaning services, federal and state laws and regulations dictate and restrict to varying degrees what types of cleaning solvents may be used, how a solvent may be stored, and the manner in which contaminated or used solvents may be handled, transported, disposed of, or recycled. These legal and regulatory mandates have been instrumental in shaping the parts cleaning industry. We have developed methods of managing solvent as non-hazardous so as to significantly reduce the regulatory burden on us and on our customers. Any changes to, relaxation of, or repeal of federal or state laws and regulations affecting the parts cleaning industry may significantly affect the demand for our products as well as our competitive position in the market.

The EPA has promulgated regulations that govern the management of used oils. Although used oil is not classified as a hazardous waste under federal law, certain states do regulate used oil as state-regulated waste. Our used oil collection services require compliance with both federal and state regulations. As with our parts cleaning services, we make use of various programs to reduce the administrative burden associated with our customers' compliance with used oils regulations. Any used oil contaminated with polychlorinated biphenyls ("PCBs") is regulated under the Toxic Substances Control Act ("TSCA"). The rules set minimum requirements for storage, treatment, and disposal of PCB wastes. Used oil contaminated with a certain level of PCBs may require incineration or special TSCA authorization or permits. The EPA has recently proposed CAA regulations requiring more stringent air permits governing the burning of certain recyclable materials, including non-specification used oil. We do not anticipate any negative impacts to the Company from this pending court ordered regulation.

One of the by-products of the re-refinery process is Vacuum Tower Asphalt Extender ("VTAE"). VTAE is sold for use as an ingredient in asphalt used in the construction of roadways. State Departments of Transportation may regulate the characteristics of materials that are used as ingredients in roadway asphalt. A small number of states have banned the use of VTAE as an ingredient in asphalt used on roadways. We believe, when used in the proper proportion, the VTAE produced at our re-refinery can be used in a paving asphalt formulation that meets all relevant performance standards. Regulatory restrictions on the use of VTAE could potentially negatively impact the marketability of this product and the profitability of our oil business. To our knowledge, current restrictions on the use of VTAE in asphalt have not had a significant negative impact on our business.

Governmental authorities have the power to enforce compliance with these and other regulations, and violators are subject to civil and criminal penalties. Private individuals may also have the right to sue to enforce compliance with certain of the governmental requirements.

Available Information

We maintain a website at the following Internet address: http://www.crystal-clean.com. Through a link on this website to the SEC website, http://www.sec.gov, we provide free access to our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after electronic filing with the SEC. The public can obtain copies of these materials by visiting the SEC's Public Reference Room at 100 F Street, NE, Washington DC 20549 or by accessing the SEC's website at http://www.sec.gov. The public may obtain information on the operation of the SEC's Public Reference Room by calling 1-800-SEC-0330. Our guidelines on corporate governance, the charters for our Board Committees, and our code of ethics are also available on our website, and we will post on our website any waivers of, or amendments to, such code of ethics. Our website and the information contained therein or connected thereto are not incorporated by reference into this annual report.

Executive Officers of Registrant

The following table sets forth the names, ages and titles, as well as a brief account of the business experience of each person who is an executive officer of Heritage-Crystal Clean.

|

| | | | | |

| Name | Age | Position |

| |

| Joseph Chalhoub | | 68 |

| | Founder, President, Chief Executive Officer, and Director |

| | | | | |

| Gregory Ray | | 54 |

| | Chief Operating Officer and Secretary |

| | | | | |

| John Lucks | | 61 |

| | Senior Vice President of Sales and Marketing |

| | | | | |

| Mark DeVita | | 46 |

| | Chief Financial Officer |

| | | | | |

| Ellie Bruce | | 51 |

| | Vice President Oil, Vice President of Sales |

| | | | | |

| Tom Hillstrom | | 54 |

| | Vice President of Operations |

Joseph Chalhoub

Founder, President, Chief Executive Officer, and Director

Mr. Chalhoub, founder of Heritage-Crystal Clean, LLC, has served as our President, Chief Executive Officer, and director since the formation of the Company in 1999. He started his career with Shell Canada as a process engineer, and he then worked for several years at SNC, an engineering firm. In 1977 he founded Breslube Enterprises and built this into the largest used oil re-refiner in North America before selling a controlling interest to Safety-Kleen in 1987. Mr. Chalhoub then served as an executive of Safety-Kleen from 1987 to 1998, and he was President of Safety-Kleen from 1997 to 1998. Mr. Chalhoub holds a Chemical Engineering degree with high distinction from École Polytechnique, Montréal. Mr. Chalhoub has over 35 years of experience in the industrial and hazardous waste services industry.

Gregory Ray

Chief Operating Officer

In 2012, Mr. Ray became Chief Operating Officer. Before that, Mr. Ray served as Chief Financial Officer since June 2007, and as Vice President, Business Management since 1999. In addition, Mr. Ray has served as our Secretary since 2004. From 1994 to 1999, Mr. Ray served in various roles at Safety-Kleen, including Vice President, Business Management, where he was in charge of and oversaw a $700 million revenue business unit. While at Safety-Kleen, Mr. Ray was responsible for managing and expanding the used oil collection service and establishing the first nationwide used oil program, and he led the development of that firm's vacuum services business. From 1983 to 1993, Mr. Ray helped establish the used oil recycling business of Evergreen Oil. Mr. Ray has over 30 years of experience in the industrial and hazardous waste services industry, and he holds an A.B. in economics and an M.S. in industrial engineering from Stanford University.

John Lucks

Senior Vice President of Sales and Marketing

In 2012, Mr. Lucks became Senior Vice President of Sales and Marketing. Before that, Mr. Lucks served as our Vice President of Sales and Marketing since 2010 and prior to that as our Vice President of Sales since 2000. From 1988 to 1997, Mr. Lucks served as the Vice President of Industrial Marketing and Business Management of Safety-Kleen, where he was in charge of and oversaw a $300 million revenue business unit. Mr. Lucks also led the development of several lines of business, in particular the industrial parts cleaning and drum waste business which became the largest segment of Safety-Kleen. Mr. Lucks has over 30 years of experience in the industrial and hazardous waste services industry.

Mark DeVita

Chief Financial Officer

Mr. DeVita became Chief Financial Officer in 2012. He served as Vice President, Business Management in 2011. Mr. DeVita has been with the Company since 2000 and has served in a variety of roles related to business management, finance, and acquisitions. He took the lead in developing multi-million dollar lines of business for the Company. Mr. DeVita has 20 years of experience in the industrial and hazardous waste services industry. Mr. DeVita earned his Bachelor of Science in Accountancy with honors from the University of Illinois and his MBA from Northern Illinois University. Mr. DeVita earned his CPA and worked in public accounting for four years.

Ellie Bruce

Vice President Oil and Vice President of Sales

Ms. Bruce became Vice President of Sales in 2012. She has also served as Vice President Oil since 2010. She served as Chief Accounting Officer from June of 2007 to 2012. Ms. Bruce has been with the Company since March 2006. She began her career in the used oil collection and re-refining business in 1988 when she joined Safety-Kleen, working at the oil re-refinery in Breslau Canada and served in a number of positions, including Controller of Safety-Kleen Canada Inc., responsible for the accounting and business management for all of the branch lines of business.

Tom Hillstrom

Vice President of Operations

Mr. Hillstrom has served in various capacities since joining Heritage-Crystal Clean, LLC in 2002. He is currently our Vice President of Operations. From 1983 to 2000, Mr. Hillstrom served in various functions at Safety-Kleen. He was a member of the planning and design team for the construction of Safety-Kleen's used oil re-refinery in East Chicago, Indiana and held the position of Facility Manager during the re-refinery's start-up and through its first years of operation. From 1996 to 1998, he was Director of Planning and Evaluation, where he was responsible for strategic planning and acquisitions. Mr. Hillstrom holds a Bachelor's degree in Chemical Engineering from the University of Notre Dame. Mr. Hillstrom has over 25 years of experience in the industrial and hazardous waste services industry.

ITEM 1A. RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully consider the following factors, as well as other information contained or incorporated by reference in this report, before deciding to invest in shares of our common stock. The risks and uncertainties described below are not the only risks and uncertainties we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations. If any of those risks actually occurs, our business, financial condition and results of operations would suffer. In that event, the

trading price of our common stock could decline, and you may lose all or part of your investment. The risks discussed below also include forward-looking statements and our actual results may differ substantially from those discussed in these forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements” included elsewhere in this document.

Risks Relating to Our Business

Our operating margins and profitability may be negatively impacted by the volatility in crude oil, solvent, fuel, energy, and commodity prices.

The price at which we sell oil-based products from our re-refinery is affected by changes in certain oil indices. If the relevant oil indices rise, we can typically expect to increase prices for our re-refined lubricating base oil. If the relevant oil indices decline, we would typically reduce prices for our re-refined lubricating base oil. The cost to collect used oil, including the amounts we must pay to obtain used oil and the fuel costs of our oil collection fleet, generally also increases or decreases when the relevant index increases or decreases. Even though the prices we can charge for our re-refined oil and the costs to collect and re-refine used oil generally correlate, they do not always increase or decrease by the same magnitude, and we cannot assure you that any increased costs we experience can be passed through to the prices we charge for our re-refined oil or that the costs to collect and re-refine used oil will decline when re-refined oil prices decline. If the prices we charge for our re-refined oil and the costs to collect and re-refine used oil do not move together or in similar magnitudes, our profitability may be materially and negatively impacted. Any increases in our costs to collect used oil could adversely affect the profitability of our used oil re-refinery. In fiscal 2014, base oil prices decreased compared to prices in fiscal 2013, and our margins were adversely impacted.

Increased costs of crude oil can significantly increase our operating costs in our Environmental Services segment. Because solvent is a product of crude oil, we are also susceptible to increases in solvent costs when crude oil costs increase. During a period of rising crude oil costs, we experience increases in the cost of solvent, fuel, and other petroleum-based products. We have in the past been able to mitigate increased solvent and fuel costs through the imposition of price increases and energy surcharges to customers. However, because of the competitive nature of the industry, there can be no assurance that we will be able to pass on future price increases. Due to political instability in oil-producing countries, oil prices could increase significantly in the future. A significant or sudden increase in solvent or fuel costs could lower our operating margins and negatively impact our profitability. We currently do not use financial instruments to hedge against fluctuations in oil, solvent, or energy prices. If this volatility continues, our operating results could be volatile and adversely affected.

In addition, a significant portion of our inventory consists of new and used solvents and oil products. Volatility in the price of crude oil has impacted in the past and can significantly impact in the future the value of this inventory and our operating margins. Further, because we apply a first-in first-out accounting method, volatility in oil prices and solvent can significantly impact our operating margins.

During the fourth quarter of 2014, the price of crude oil and related commodities fell sharply. Consequently, during the fourth quarter of fiscal 2014, we recorded a non-cash inventory impairment charge of $6.1 million on that portion of our oil inventory that was held for sale, reflecting the lower market value of such inventory. We recorded additional expense to reflect the lower value of the solvent inventory held for use in our service programs. If volatility in the price of crude oil continues, our operating results will be difficult to predict and could be adversely affected. If we do not decrease how much we pay to generators to acquire their used oil as quickly as the price for our oil products declines, the profitability of our Oil Business segment could be negatively impacted.

Many small automotive repair shops and manufacturing companies burn used oil as a source of heat as an alternative to using natural gas. If the price of natural gas were to increase significantly, these potential customers may choose to retain their used oil for fuel purposes rather than sell to us. This could make it difficult to supply our re-refinery with internally collected feedstock at competitive prices. In addition, increases in the cost of natural gas may increase the cost to operate our used oil re-refinery.

We may not be able to realize the anticipated benefits from our acquisition of FCC Environmental.

We may not be able to realize the anticipated benefits from our acquisition of FCC Environmental within the expected time period, or at all. Achieving those benefits depends on the timely, efficient, and successful execution of a number of post-acquisition events, including integrating FCC Environmental’s operations into the Company's. Factors that could affect our ability to achieve these benefits include:

• the failure of FCC Environmental’s businesses to perform in accordance with our expectations;

• difficulties in integrating and managing personnel, financial reporting, and other systems used by FCC Environmental’s businesses;

• any future goodwill impairment charges that we may incur with respect to the assets of FCC Environmental;

• failure to achieve anticipated synergies between our business units and the business units of FCC Environmental;

• the loss of FCC Environmental’s customers or our customers; and

• the loss of any of the key employees of FCC Environmental or the Company.

If FCC Environmental’s businesses do not operate as we anticipate, it could materially harm our business, financial condition, and results of operations. In addition, as a result of the Acquisition, we have assumed all of FCC Environmental’s liabilities, except as provided through indemnifications and remedies in the Stock Purchase Agreement. We may learn additional information about FCC Environmental’s business that adversely affects us, such as unknown or contingent liabilities, issues relating to internal controls over financial reporting, and issues relating to compliance with the Sarbanes-Oxley Act of 2002 or other applicable laws. As a result, there can be no assurance that the Acquisition will be successful or will not, in fact, harm our business. Among other things, if FCC Environmental’s liabilities are greater than projected, or if there are obligations of FCC Environmental of which we are not aware at the time of completion of the Acquisition, our business could be materially adversely affected.

Additionally, in both 2013 and fiscal 2014 up to and following the Acquisition, FCC Environmental had a net operating loss. If we are not able to integrate FCC Environmental and realize the expected synergies and benefits from the Acquisition as contemplated, then FCC Environmental’s operating results may not improve and our business and combined financial results would be materially adversely affected.

The successful integration of FCC Environmental’s businesses into the Company following the Acquisition may present significant challenges.

We anticipate that the FCC Environmental Acquisition may place significant demands on our administrative, operational and financial resources, and we cannot assure you that we will be able to successfully integrate FCC Environmental’s businesses into the Company. Our failure to successfully integrate FCC Environmental with the Company, and to manage the challenges presented by the integration process successfully, may prevent us from achieving the anticipated benefits of the acquisition and could have a material adverse effect on our business.

We incurred significant indebtedness in connection with our acquisition of FCC Environmental, which could harm our operating flexibility and competitive position as well as adversely affect our financial condition and ability to fulfill our obligations, and expose us to interest rate risk.