Take Action – The Brookfield Offer is open until 5 p.m. MT on September 3rd, 2021 Brookfield’s Offer is recommended by IPL’s Board of Directors Brookfield has taken-up 65.6% of the IPL shares not beneficially owned by Brookfield IPL shareholders who tendered by the August 20th expiry do not need to take any further action, and should expect payment by August 25th This will be the final extension – tender today to receive the chosen form of consideration shortly after take-up Brookfield Infrastructure August 20, 2021 Filed by: Brookfield Infrastructure Corporation (Commission File No. 001-39250) and Brookfield Infrastructure Partners L.P. (Commission File No. 001-33632) Pursuant to Rule 425 under the Securities Act of 1933 Subject Company: Inter Pipeline Ltd.

Disclaimer This presentation is for informational purposes only and does not constitute an offer to buy or sell, or a solicitation of an offer to sell or buy, any securities. Any reference to Brookfield Infrastructure Partners L.P. and its institutional partners’ (“Brookfield Infrastructure”) offer to acquire common shares of Inter Pipeline Ltd. (“IPL”) is for information only and is qualified in its entirety by the full terms and conditions of such offer as set forth in the Offer to Purchase and Circular dated February 22, 2021, as varied by the Notice of Variation, Change and Extension dated June 4, 2021, the Notices of Variation and Extension dated June 21, 2021 and July 13, 2021, Notice of Variation and Change dated July 19, 2021, the Notice of Variation and Extension dated August 6, 2021 and the Notice of Extension dated August 20, 2021. This presentation is not intended to form the basis of any investment activity or decision nor should this presentation be considered as a recommendation by Brookfield Infrastructure (nor any person who controls it nor any director, officer, employee nor agent of its or affiliate of any such person), that any recipient should acquire any securities of Brookfield Infrastructure Corporation or other form of interest in Brookfield Infrastructure or any related entity or in any assets of any of the foregoing. This presentation does not constitute or form, nor should it be construed as constituting or forming, any part of any offer, solicitation of any offer or invitation to sell or issue or purchase or subscribe for any securities nor shall it or any part of it, or the fact of its distribution, form the basis of, or be relied on in connection with, any contract or commitment whatsoever with Brookfield Infrastructure. This presentation does not constitute or form, nor should it be construed as an offering circular or memorandum for the purposes of applicable securities law. This presentation is not an offering or solicitation for the sale of securities. This presentation should not be relied upon in making any investment decisions. Under no circumstances shall this presentation constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. Forward-Looking Statements and Information This presentation contains certain forward-looking statements within the meaning of applicable Canadian securities laws (“forward-looking statements” or “forward-looking information”) that involve various risks and uncertainties and should be read in conjunction with Brookfield Infrastructure Corporation’s 2020 audited consolidated financial statements and Brookfield Infrastructure Partners L.P.’s 2020 audited consolidated financial statements. Statements other than statements of historical fact contained in this presentation may be forward-looking statements, including, without limitation, management’s expectations, intentions and beliefs concerning anticipated future events, results, circumstances, economic performance or expectations with respect to BIP, including BIP’s business operations, business strategy and financial condition. When used herein, the words “anticipates”, “believes”, “budgets”, “could”, “estimates”, “expects”, “forecasts”, “goal”, “intends”, “may”, “might”, “outlook”, “plans”, “projects”, “schedule”, “should”, “strive”, “target”, “will”, “would” and similar expressions are often intended to identify forward-looking information, although not all forward-looking information contains these identifying words. The forward-looking statements in this presentation include statements relating to the Offer and the expected timing thereof, and statements relating to a subsequent transaction; statements regarding growth plans and opportunities for Brookfield Infrastructure; and Brookfield Infrastructure’s intentions with respect to the business of IPL. These forward-looking statements may reflect the internal projections, expectations, future growth, results of operations, performance, business prospects and opportunities and are based on information currently available to Brookfield Infrastructure and/or assumptions that Brookfield Infrastructure believes are reasonable. Many factors could cause actual results to differ materially from the results and developments discussed in the forward- looking information. In developing these forward-looking statements, certain material assumptions were made. These forward-looking statements are subject to certain risks. These risks include, but are not limited to: actual future market conditions being different than anticipated by management; competition and changes in the industry in which IPL and Brookfield Infrastructure operate; changes in the regulatory regime that applies to IPL’s and Brookfield Infrastructure’s business; and the failure to realize on anticipated growth. Material factors or assumptions that were applied to drawing a conclusion or making an estimate set out in forward-looking statements include: IPL’s public disclosure is accurate and that IPL has not failed to publicly disclose any material information respecting IPL, its business, operations, assets, material agreements, or otherwise; there will be no material changes to government and environmental regulations adversely affecting the Brookfield Infrastructure’s or IPL’s operations; management’s views regarding current and anticipated market conditions; industry trends and the regulatory regime remaining unchanged; and assumptions regarding interest rates, foreign exchange rates and commodity prices. Readers are cautioned that the preceding list of material factors or assumptions is not exhaustive. Although forward-looking statements contained in this presentation are based upon what management believes are reasonable assumptions, there can be no assurance that actual results will be consistent with these forward-looking statements. Accordingly, readers should not place undue reliance on such forward-looking statements and assumptions as management cannot provide assurance that actual results or developments will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, Brookfield Infrastructure. All forward-looking information in this presentation is made as of the date of this presentation. These forward-looking statements are subject to change as a result of new information, future events or other circumstances, in which case they will only be updated by Brookfield Infrastructure where required by law.

Notice to Shareholders in the United States In connection with the Offer, BIP and BIPC have filed with the U.S. Securities and Exchange Commission (the “SEC”) a Registration Statement on Form F-4 and Amendment No. 1 Amendment No. 2, Amendment No. 3, Amendment No. 4 and Amendment No. 5 thereto, which contains a prospectus relating to the Offer. SHAREHOLDERS AND OTHER INTERESTED PARTIES ARE URGED TO READ SUCH REGISTRATION STATEMENT AND ANY AND ALL OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE OFFER, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO ANY SUCH DOCUMENTS, AS EACH BECOMES AVAILABLE, BECAUSE EACH CONTAINS AND WILL CONTAIN IMPORTANT INFORMATION ABOUT BISON ACQUISITION CORP., BIPC, BIP, IPL AND THE OFFER. Materials filed with the SEC will be available electronically without charge at the SEC’s website at www.sec.gov and the materials will be posted on BIP’s website at www.brookfield.com/infrastructure. BIPC is a foreign private issuer and BIP is permitted to prepare the offering documents in accordance with Canadian disclosure requirements, which are different from those of the United States. The financial statements included in the offering documents have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, and thus may not be comparable to financial statements of U.S. companies. Shareholders in the United States should be aware that the disposition of their shares and the acquisition of BIPC shares by them as described herein may have tax consequences both in the United States and in Canada. Shareholders should be aware that owning BIPC shares may subject them to tax consequences both in the United States and in Canada. Such consequences for shareholders who are resident in, or citizens of, the United States may not be described fully herein and such shareholders are encouraged to consult their tax advisors. See Section 18 of the Offer to Purchase and Circular dated February 22, 2021, “Certain Canadian Federal Income Tax Considerations” and Section 19 of such Offer to Purchase and Circular, “Certain United States Federal Income Tax Considerations” and Section 9 of the Notice of Variation, Change and Extension dated June 4, 2021, “Tax Considerations to Shareholders – Certain Canadian Federal Income Tax Considerations”. The enforcement by shareholders of civil liabilities under U.S. federal securities laws may be affected adversely by the fact that each of Bison Acquisition Corp., BIP, BIPC and IPL is formed under the laws of a non-U.S. jurisdiction, that some or all of their respective officers and directors may reside outside of the United States, that some or all of the experts named herein may reside outside of the United States and that all or a substantial portion of the assets of Bison Acquisition Corp., BIP, BIPC, IPL and such persons may be located outside the United States. Shareholders in the United States may not be able to sue Bison Acquisition Corp., BIP, BIPC or IPL or their respective officers or directors in a non-U.S. court for violation of United States federal securities laws. It may be difficult to compel such parties to subject themselves to the jurisdiction of a court in the United States or to enforce a judgment obtained from a court of the United States. In accordance with applicable law, rules and regulations of the United States, Canada or its provinces or territories, including Rule 14e-5 under the United States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”), Bison Acquisition Corp. or its affiliates and any advisor, broker or other person acting as the agent for, or on behalf of, or in concert with Bison Acquisition Corp. or its affiliates, directly or indirectly, may bid for, make purchases of or make arrangements to purchase common shares or certain related securities outside the Offer, including purchases in the open market at prevailing prices or in private transactions at negotiated prices. Such bids, purchases or arrangements to purchase may be made during the period of the Offer and through the expiration of the Offer. Any such purchases will be made in compliance with applicable laws, rules and regulations. To the extent information about such purchases or arrangements to purchase is made public in Canada, such information will be disclosed by means of a press release or other means reasonably calculated to inform shareholders in the United States of such information. The Offer is being made for the securities of a Canadian company that does not have securities registered under Section 12 of the U.S. Exchange Act. Accordingly, the Offer is not subject to Section 14(d) of the U.S. Exchange Act, or Regulation 14D promulgated by the SEC thereunder, except for any requirements thereunder applicable to exchange offers commenced before the effectiveness of the related registration statement. The Offer is being conducted in accordance with Section 14(e) of the U.S. Exchange Act and Regulation 14E promulgated thereunder.

Tender Instructions Brookfield Infrastructure has exceeded the modified statutory minimum condition and upon payment will own 68.9% of IPL’s common shares, providing a clear path to pursue a privatization of Inter Pipeline Ltd. following the mandatory extension period The Brookfield Offer is open until 5 p.m. MT on September 3rd, 2021 (the “Expiry Time”) This will be the final extension of the Brookfield Offer IPL shareholders who do not tender their shares during the mandatory extension period may not have another opportunity to sell their shares to Brookfield Infrastructure unless and until completion of any subsequent acquisition transaction IPL shareholders who have already tendered do not need to take any further action Beneficial IPL Shareholders (IPL shares are held through a broker or other intermediary) Contact your intermediary and provide them with your tender instructions. As intermediaries may have an earlier deadline to receive your instructions, IPL shareholders are encouraged to take-action well in advance of the September 3rd expiry Registered IPL Shareholders (IPL shares are held directly and not through an intermediary) Complete the applicable Letter of Transmittal or Supplemental Letter of Transmittal and return it to Laurel Hill Advisory Group at assistance@laurelhill.com or the coordinates listed on the Sixth Notice of Extension

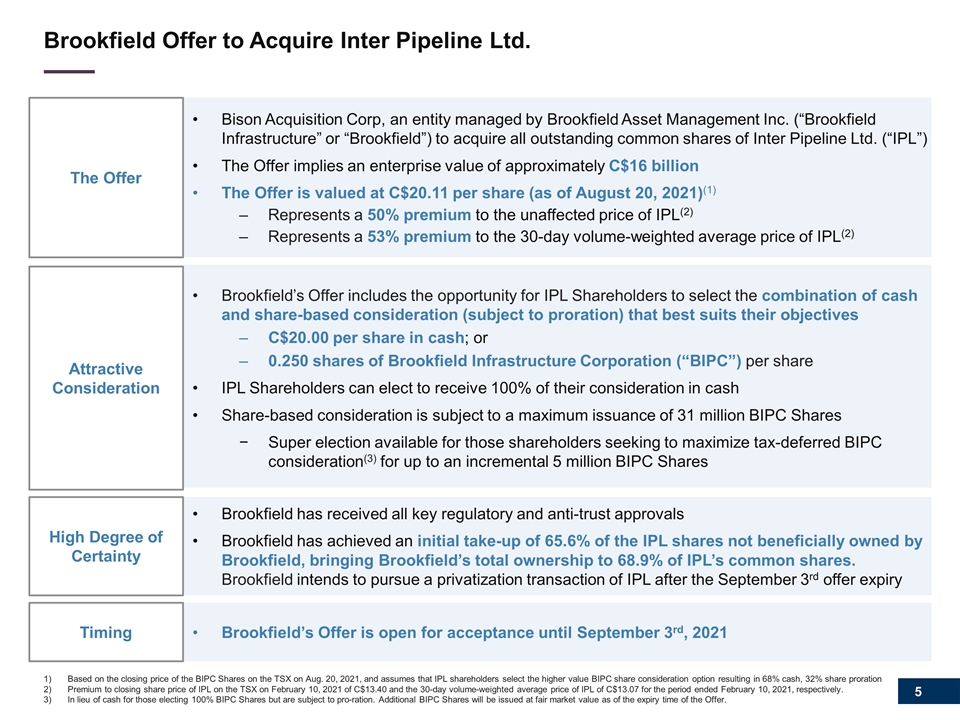

Brookfield Offer to Acquire Inter Pipeline Ltd. Based on the closing price of the BIPC Shares on the TSX on Aug. 20, 2021, and assumes that IPL shareholders select the higher value BIPC share consideration option resulting in 68% cash, 32% share proration Premium to closing share price of IPL on the TSX on February 10, 2021 of C$13.40 and the 30-day volume-weighted average price of IPL of C$13.07 for the period ended February 10, 2021, respectively. In lieu of cash for those electing 100% BIPC Shares but are subject to pro-ration. Additional BIPC Shares will be issued at fair market value as of the expiry time of the Offer. High Degree of Certainty Brookfield has received all key regulatory and anti-trust approvals Brookfield has achieved an initial take-up of 65.6% of the IPL shares not beneficially owned by Brookfield, bringing Brookfield’s total ownership to 68.9% of IPL’s common shares. Brookfield intends to pursue a privatization transaction of IPL after the September 3rd offer expiry The Offer Bison Acquisition Corp, an entity managed by Brookfield Asset Management Inc. (“Brookfield Infrastructure” or “Brookfield”) to acquire all outstanding common shares of Inter Pipeline Ltd. (“IPL”) The Offer implies an enterprise value of approximately C$16 billion The Offer is valued at C$20.11 per share (as of August 20, 2021)(1) Represents a 50% premium to the unaffected price of IPL(2) Represents a 53% premium to the 30-day volume-weighted average price of IPL(2) Attractive Consideration Brookfield’s Offer includes the opportunity for IPL Shareholders to select the combination of cash and share-based consideration (subject to proration) that best suits their objectives C$20.00 per share in cash; or 0.250 shares of Brookfield Infrastructure Corporation (“BIPC”) per share IPL Shareholders can elect to receive 100% of their consideration in cash Share-based consideration is subject to a maximum issuance of 31 million BIPC Shares Super election available for those shareholders seeking to maximize tax-deferred BIPC consideration(3) for up to an incremental 5 million BIPC Shares Timing Brookfield’s Offer is open for acceptance until September 3rd, 2021

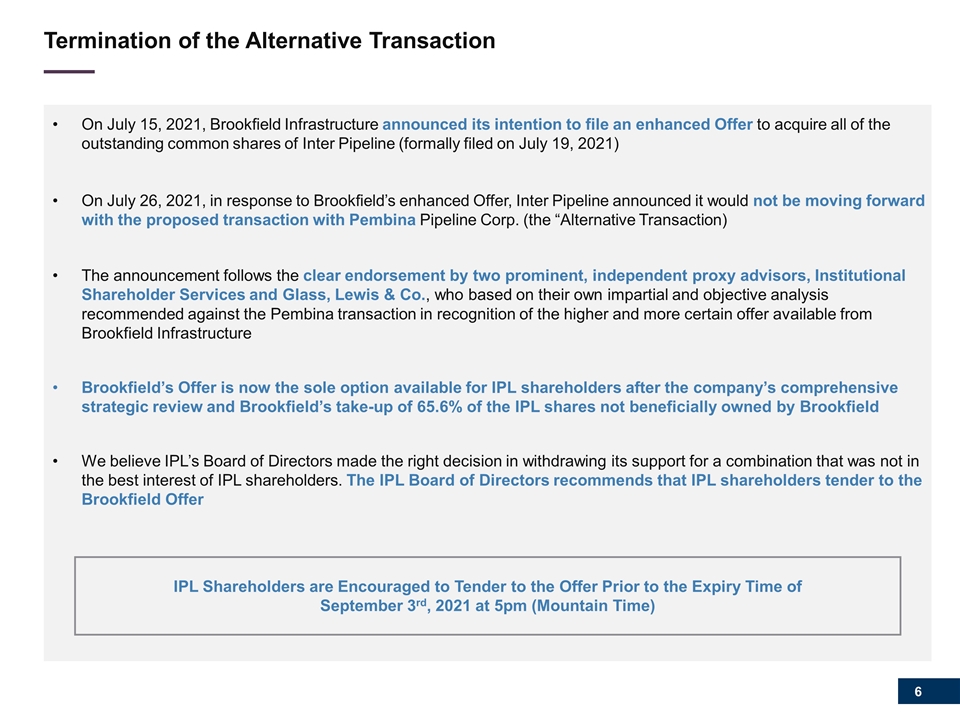

Termination of the Alternative Transaction On July 15, 2021, Brookfield Infrastructure announced its intention to file an enhanced Offer to acquire all of the outstanding common shares of Inter Pipeline (formally filed on July 19, 2021) On July 26, 2021, in response to Brookfield’s enhanced Offer, Inter Pipeline announced it would not be moving forward with the proposed transaction with Pembina Pipeline Corp. (the “Alternative Transaction) The announcement follows the clear endorsement by two prominent, independent proxy advisors, Institutional Shareholder Services and Glass, Lewis & Co., who based on their own impartial and objective analysis recommended against the Pembina transaction in recognition of the higher and more certain offer available from Brookfield Infrastructure Brookfield’s Offer is now the sole option available for IPL shareholders after the company’s comprehensive strategic review and Brookfield’s take-up of 65.6% of the IPL shares not beneficially owned by Brookfield We believe IPL’s Board of Directors made the right decision in withdrawing its support for a combination that was not in the best interest of IPL shareholders. The IPL Board of Directors recommends that IPL shareholders tender to the Brookfield Offer IPL Shareholders are Encouraged to Tender to the Offer Prior to the Expiry Time of September 3rd, 2021 at 5pm (Mountain Time)

Reasons to Tender to the Brookfield Offer Significant Premium and Flexible Consideration High Degree of Transaction Certainty Opportunity to Participate in Brookfield Infrastructure’s Global Infrastructure Platform

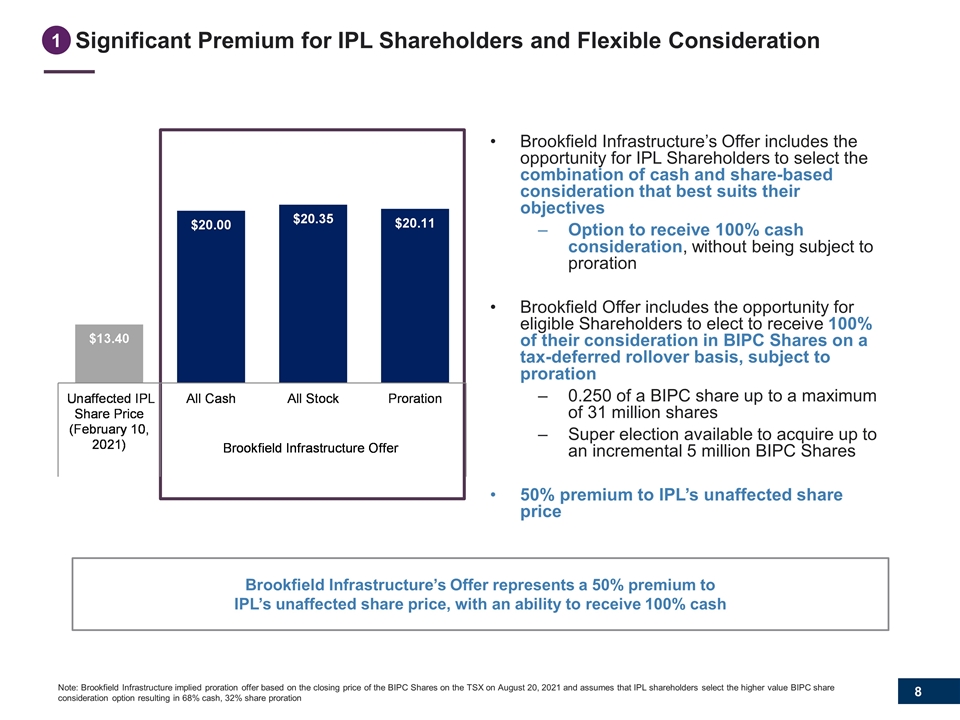

Significant Premium for IPL Shareholders and Flexible Consideration Brookfield Infrastructure’s Offer includes the opportunity for IPL Shareholders to select the combination of cash and share-based consideration that best suits their objectives Option to receive 100% cash consideration, without being subject to proration Brookfield Offer includes the opportunity for eligible Shareholders to elect to receive 100% of their consideration in BIPC Shares on a tax-deferred rollover basis, subject to proration 0.250 of a BIPC share up to a maximum of 31 million shares Super election available to acquire up to an incremental 5 million BIPC Shares 50% premium to IPL’s unaffected share price Brookfield Infrastructure’s Offer represents a 50% premium to IPL’s unaffected share price, with an ability to receive 100% cash Note: Brookfield Infrastructure implied proration offer based on the closing price of the BIPC Shares on the TSX on August 20, 2021 and assumes that IPL shareholders select the higher value BIPC share consideration option resulting in 68% cash, 32% share proration 1

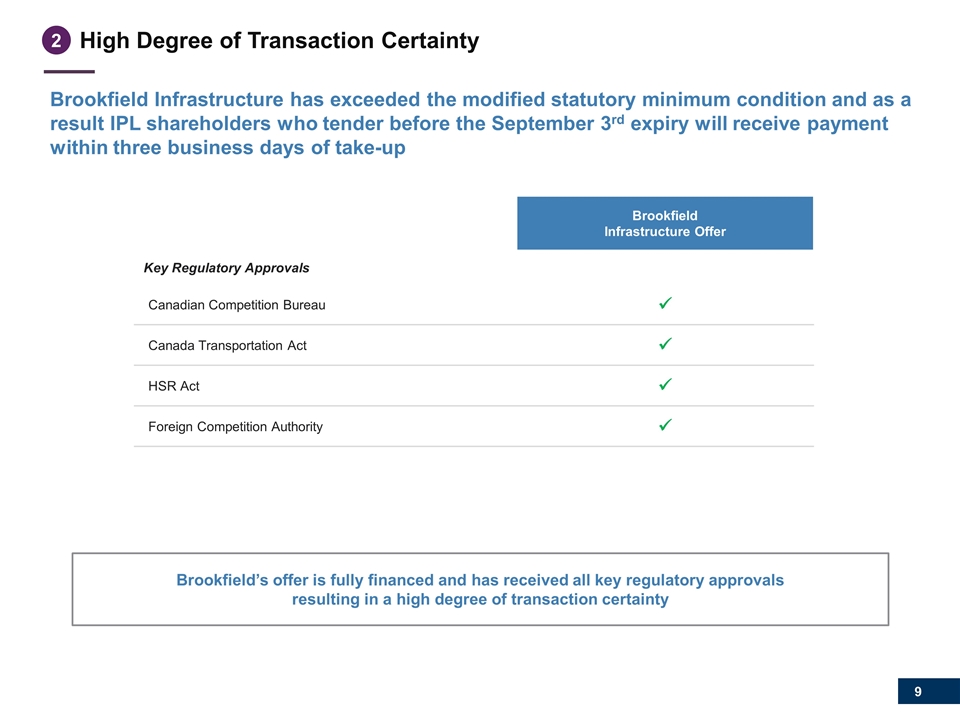

High Degree of Transaction Certainty 2 Brookfield’s offer is fully financed and has received all key regulatory approvals resulting in a high degree of transaction certainty Brookfield Infrastructure Offer Key Regulatory Approvals Canadian Competition Bureau ü Canada Transportation Act ü HSR Act ü Foreign Competition Authority ü Brookfield Infrastructure has exceeded the modified statutory minimum condition and as a result IPL shareholders who tender before the September 3rd expiry will receive payment within three business days of take-up

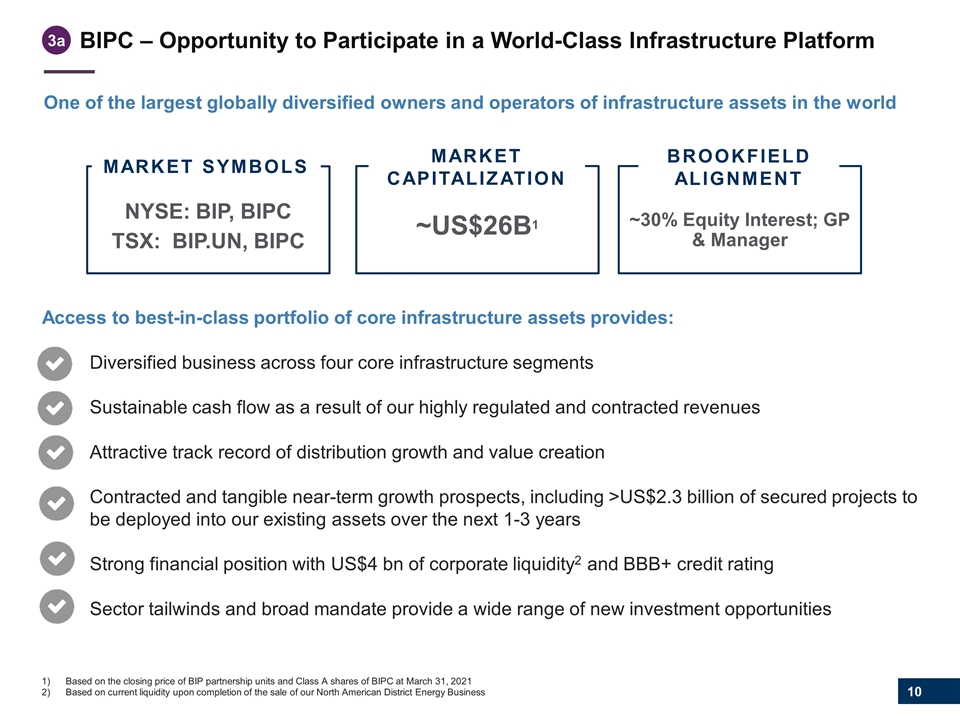

One of the largest globally diversified owners and operators of infrastructure assets in the world NYSE: BIP, BIPC TSX: BIP.UN, BIPC MARKET SYMBOLs ~US$26B1 MARKET CAPITALIZATION ~30% Equity Interest; GP & Manager BROOKFIELD Alignment Based on the closing price of BIP partnership units and Class A shares of BIPC at March 31, 2021 Based on current liquidity upon completion of the sale of our North American District Energy Business Access to best-in-class portfolio of core infrastructure assets provides: Diversified business across four core infrastructure segments Sustainable cash flow as a result of our highly regulated and contracted revenues Attractive track record of distribution growth and value creation Contracted and tangible near-term growth prospects, including >US$2.3 billion of secured projects to be deployed into our existing assets over the next 1-3 years Strong financial position with US$4 bn of corporate liquidity2 and BBB+ credit rating Sector tailwinds and broad mandate provide a wide range of new investment opportunities BIPC – Opportunity to Participate in a World-Class Infrastructure Platform 3a

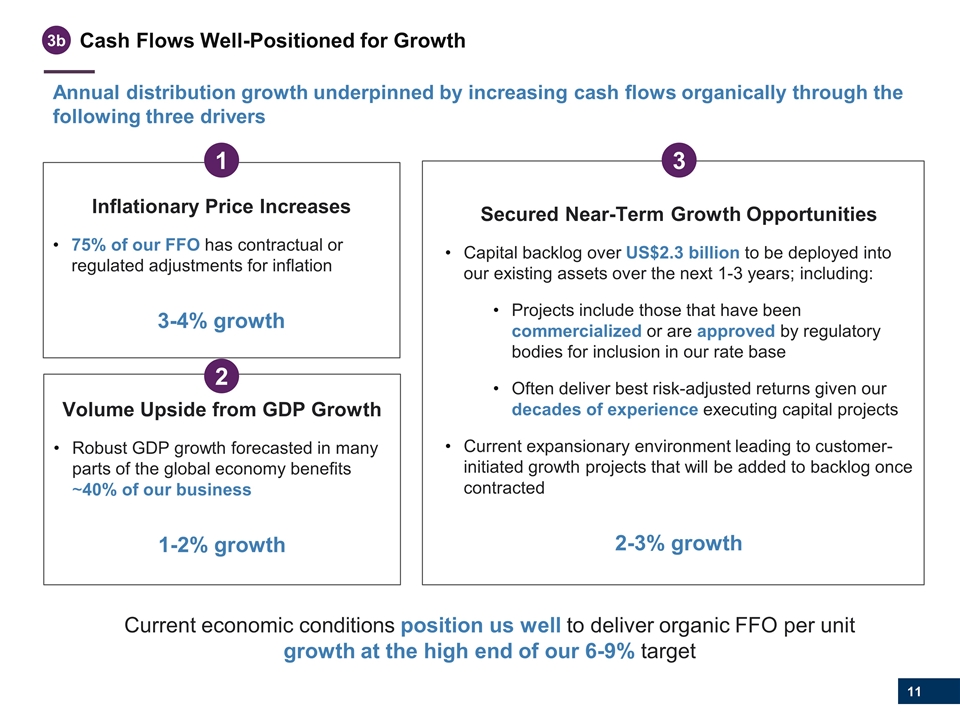

Cash Flows Well-Positioned for Growth 3b Annual distribution growth underpinned by increasing cash flows organically through the following three drivers Inflationary Price Increases 75% of our FFO has contractual or regulated adjustments for inflation 3-4% growth Volume Upside from GDP Growth Robust GDP growth forecasted in many parts of the global economy benefits ~40% of our business 1-2% growth Secured Near-Term Growth Opportunities Capital backlog over US$2.3 billion to be deployed into our existing assets over the next 1-3 years; including: Projects include those that have been commercialized or are approved by regulatory bodies for inclusion in our rate base Often deliver best risk-adjusted returns given our decades of experience executing capital projects Current expansionary environment leading to customer-initiated growth projects that will be added to backlog once contracted 2-3% growth Current economic conditions position us well to deliver organic FFO per unit growth at the high end of our 6-9% target 1 2 3

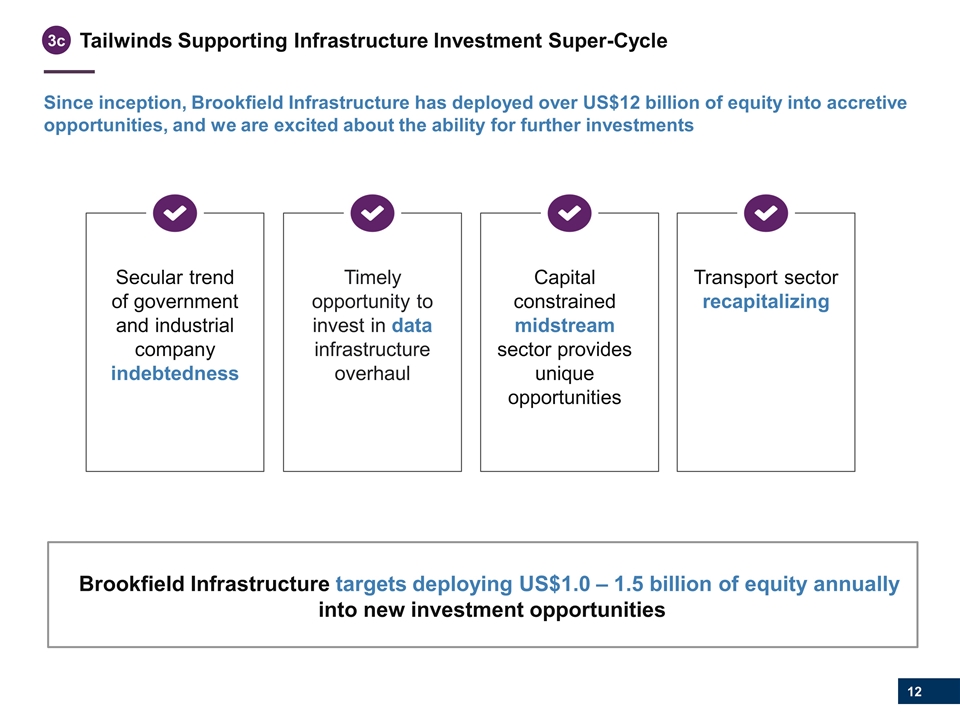

Tailwinds Supporting Infrastructure Investment Super-Cycle 3c Since inception, Brookfield Infrastructure has deployed over US$12 billion of equity into accretive opportunities, and we are excited about the ability for further investments Secular trend of government and industrial company indebtedness Timely opportunity to invest in data infrastructure overhaul Capital constrained midstream sector provides unique opportunities Transport sector recapitalizing Brookfield Infrastructure targets deploying US$1.0 – 1.5 billion of equity annually into new investment opportunities

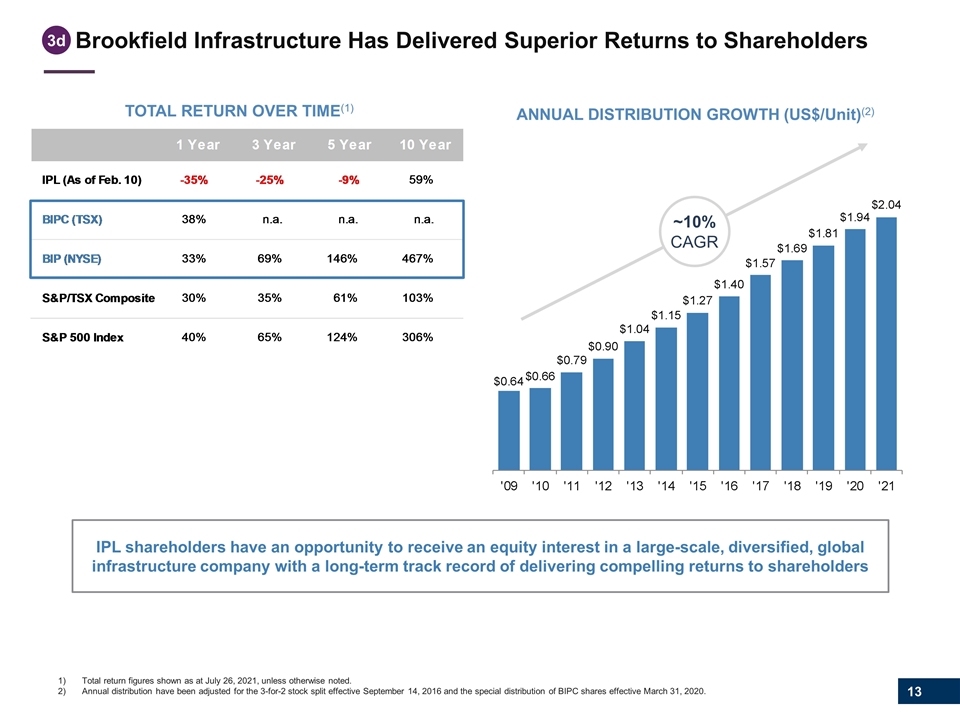

Brookfield Infrastructure Has Delivered Superior Returns to Shareholders 3d ANNUAL DISTRIBUTION GROWTH (US$/Unit)(2) ~10% CAGR IPL shareholders have an opportunity to receive an equity interest in a large-scale, diversified, global infrastructure company with a long-term track record of delivering compelling returns to shareholders TOTAL RETURN OVER TIME(1) Total return figures shown as at July 26, 2021, unless otherwise noted. Annual distribution have been adjusted for the 3-for-2 stock split effective September 14, 2016 and the special distribution of BIPC shares effective March 31, 2020.