UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22110

AdvisorShares Trust

(Exact name of registrant as specified in charter)

4800 Montgomery Lane, Suite 150

Bethesda, Maryland 20814

(Address of principal executive offices) (Zip code)

Dan Ahrens

4800 Montgomery Lane, Suite 150

Bethesda, Maryland 20814

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-843-3831

Date of fiscal year end: June 30

Date of reporting period: June 30, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | The Report to Shareholders is attached herewith. |

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

ADVISORSHARES TRUST

4800 Montgomery Lane

Suite 150

Bethesda, Maryland 20814

www.advisorshares.com

1.877.843.3831

Annual Report

June 30, 2022

TABLE OF CONTENTS

ADVISORSHARES TRUST

Letter from the CEO of AdvisorShares Investments, LLC

It has been a volatile fiscal year. The first of half of our fiscal year occurred during the last six months of 2021 when the S&P 500 Index was moving upwards. The second half of our fiscal year, which covered the first six months of 2022, was a different story with markets declining into bear market territory. The market’s decline seemed to be driven by a choppy pandemic recovery, where COVID-related restrictions continued to hamper growth as a new variant of the coronavirus emerged. Factory lockdowns impacted the global supply change, resulting in scarcity of all types of goods and demand for those fewer goods driving prices higher. That coupled with the Russian war in Ukraine, which impacted energy prices and grain-based commodities, caused inflation numbers to begin skyrocketing.

The Federal Reserve’s plan for tackling inflations was to aggressively increase interest rates and reduce their balance sheet. These actions seemed to drive the markets lower. We are not as concerned with rising interest rates, however an increase in the cost of borrowing can negatively affect sectors or industries that have low to negative cash flows. Our biggest concern is the reduction of the Fed’s balance sheet. While necessary, the trillions of dollars added to the Fed balance sheet during the pandemic drove the U.S. markets higher while the world was shut down. We anticipate the opposite effect occurring when or if the Fed begins to remove most of the assets they had purchased during the pandemic.

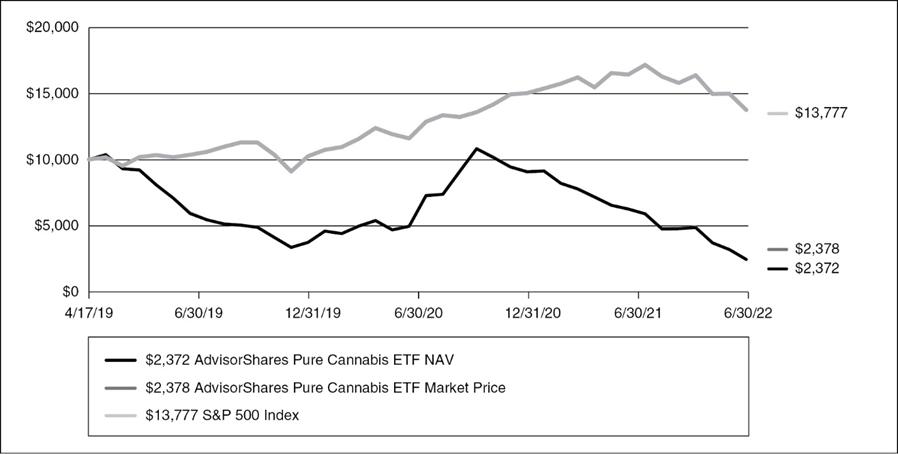

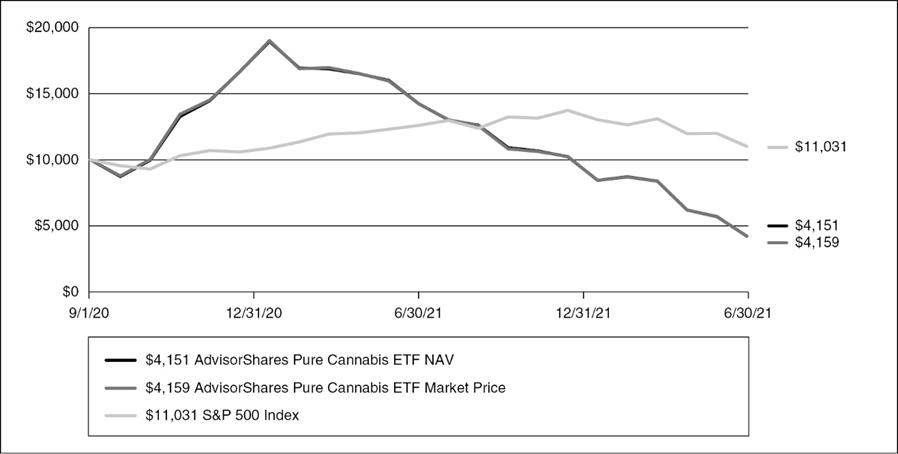

As we would expect in the first calendar half of 2022 based on struggling market conditions, we saw assets under management increase for our two short equity ETFs, the AdvisorShares Ranger Equity Bear ETF (ticker: HDGE) and the AdvisorShares Dorsey Wright Short ETF (ticker: DWSH). While our largest ETF, the AdvisorShares Pure US Cannabis ETF (ticker: MSOS) suffered the worst performance declines in our ETF fund family, surprisingly, only a few shares were redeemed, demonstrating that many of MSOS’ investors appear to be buying and holding the ETF.

The following are a list of highlights of this fiscal year:

| ● | The addition of Julio Lugo, a former BNY Mellon executive, to the AdvisorShares operations team; |

| ● | Launch of the AdvisorShares Psychedelics ETF (ticker: PSIL), the first ETF with pure exposure to the psychedelics industry; |

| ● | The AdvisorShares FolioBeyond Core Bond ETF’s (ticker: FWDB) investment strategy changed to an ESG focused bond ETF which also included changing the name and ticker to the AdvisorShares North Square McKee ESG Core Bond ETF (ticker: MENV); |

| ● | CSM Advisors, LLC taking over as subadvisor to the North Square McKee Core Reserves ETF (ticker: HOLD) and the North Square McKee ESG Core Bond ETF (ticker: MENV); |

| ● | Launch of the AdvisorShares Poseidon Dynamic Cannabis ETF (ticker: PSDN); |

| ● | Launch of the AdvisorShares Drone Technology ETF (ticker: UAV); and |

| ● | Launch of the AdvisorShares Managed Bitcoin Strategy ETF (ticker: CRYP) – the first tactically managed bitcoin ETF available, sub-advised by Morgan Creek Capital. |

While it seems the last few years have only brought new and challenging environments to the markets, we remain optimistic that “normalcy” will return. We are incredibly thankful to our shareholders and appreciate the trust and confidence you have in us. We wish you nothing but health, happiness, and prosperity.

Sincerest regards,

Noah Hamman

CEO, AdvisorShares Investments

ADVISORSHARES TRUST

Letter from the CEO of AdvisorShares Investments, LLC (Continued)

For more information on AdvisorShares ETFs, including performance and holdings, please visit www.advisorshares.com.

Investing involves risk including possible loss of principal. The Advisor’s judgment about the markets, the economy, or companies may not anticipate actual market movements, economic conditions or company performance, and these factors may affect the return on your investment. The prices of equity securities rise and fall daily. Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty. Investments in emerging or offshore markets are generally less liquid and less efficient than investments in developed markets and are subject to additional risks, such as risks of adverse governmental regulation and intervention or political developments.

There is no guarantee the Advisor’s investment strategy will be successful. When models and data prove to be incorrect or incomplete, any decisions made in reliance thereon expose the Fund to potential risks. In addition, the use of predictive models has inherent risk. Because predictive models are usually constructed based on historical data supplied by third parties, the success of relying on such models may depend heavily on the accuracy and reliability of the supplied historical data. The Fund’s particular allocations may have a significant effect on the Fund’s performance. Allocation risk is the risk that the selection of ETFs and the allocation of assets among such ETFs will cause the Fund to underperform other funds with a similar investment objective that do not allocate their assets in the same manner or the market as a whole. For a list of the asset class specific risks please see the prospectus.

The views in this report were those of the Fund’s CEO as of June 30, 2022 and may not reflect his views on the date that this report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investments and do not constitute investment advice.

ADVISORSHARES TRUST

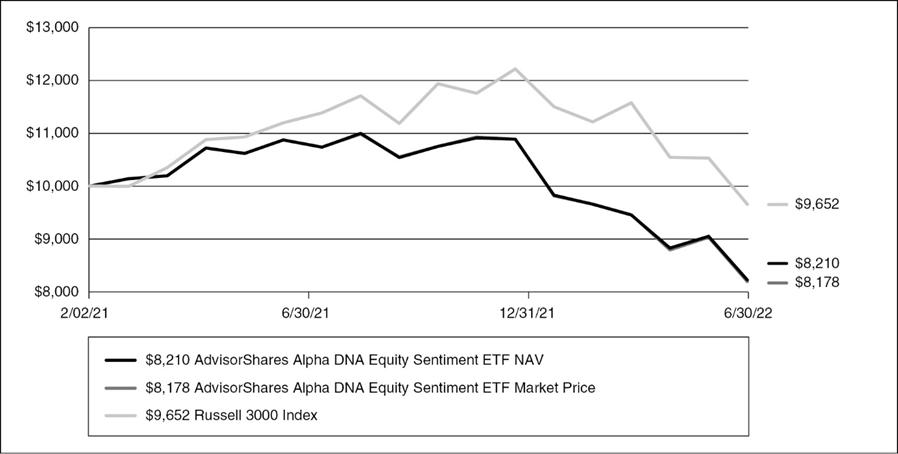

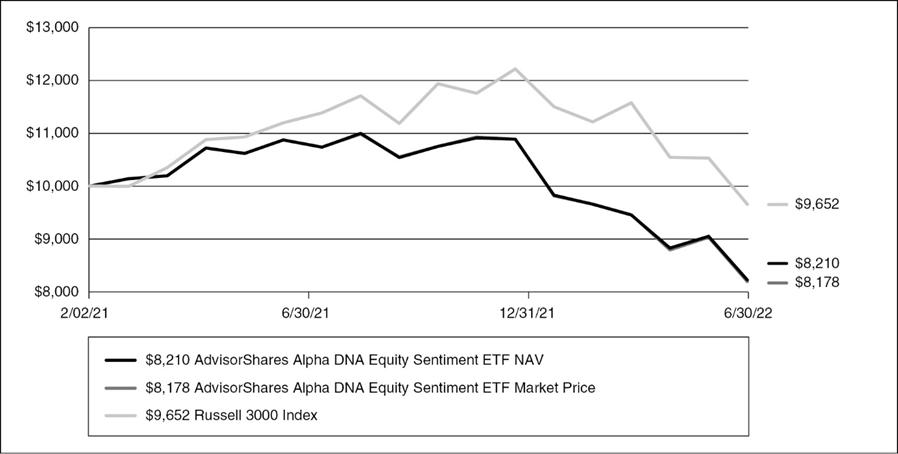

AdvisorShares Alpha DNA Equity Sentiment ETF (SENT)

The AdvisorShares Alpha DNA Equity Sentiment ETF’s (ticker: SENT) performance for the 12-month period ended June 30, 2022, while negative, was consistent with a growth-oriented U.S. equity portfolio with material exposure to mid- and small-cap equities. Mid- and small-cap growth were the laggards in U.S. equity index performance in both the last six months of 2021 and the first six months of 2022. In addition, U.S. equity large cap growth also began under-performing in the first half of 2022. Our equity exposures performed in line with their growth cohorts in each market cap over this window. Our option hedges produced profits in the down market during the first half of 2022. SENT’s hedging strategy is built to deliver more profits in fast downward moving markets. The first half of 2022 saw a slow downward trend with three different months producing -8% returns born worse in small caps (Jan, April, June).

SENT’s portfolio is designed to out-perform in upward markets that are rewarding the fastest growing companies. In other words, when growth is in favor, our portfolio will also typically be rewarded. In addition, higher uncertainty about forward earnings and demand tend to create more arbitrage opportunity for our digital signal analytics. In fact, the more that analysts struggle to assess demand in any market, the better positioned our portfolio is to outperform.

Going forward, the ambiguity of a potential recession has created an elevated level of uncertainty among the analysts generating forward looking earnings per share and revenue estimates. That provides a strong scenario to uncover hidden demand and produce more surprise earnings outcomes. As a result, we like the backdrop that this provides. However, a rising interest rate environment tends to put greater price stress on growth stocks that have higher multiples. Since growth stocks with higher multiples tend to produce higher earnings beat potential, SENT will be influenced by whether interest rate pressures continue to influence stocks prices going forward.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period February 2, 2021 to June 30, 2022

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | 1 Year | | | Since

Inception

2/2/2021* | |

| AdvisorShares Alpha DNA Equity Sentiment ETF NAV | | | -24.53 | % | | | -13.09 | % |

| AdvisorShares Alpha DNA Equity Sentiment ETF Market Price** | | | -24.84 | % | | | -13.34 | % |

| Russell 3000 Index | | | -13.87 | % | | | -2.49 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.08% and the net expense ratio is 1.08%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 1.35%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. |

| ** | The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The Russell 3000 Index measures the performance of the largest 3,000 US companies representing approximately 98% of the investable US equity market.

ADVISORSHARES TRUST

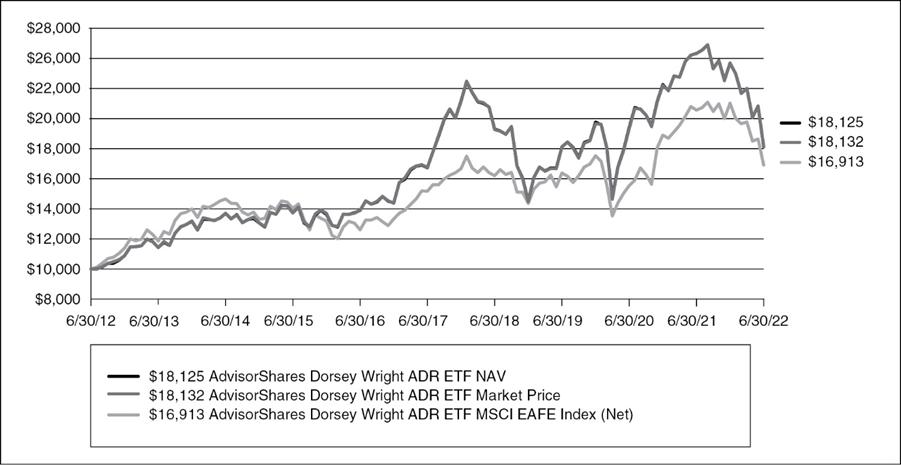

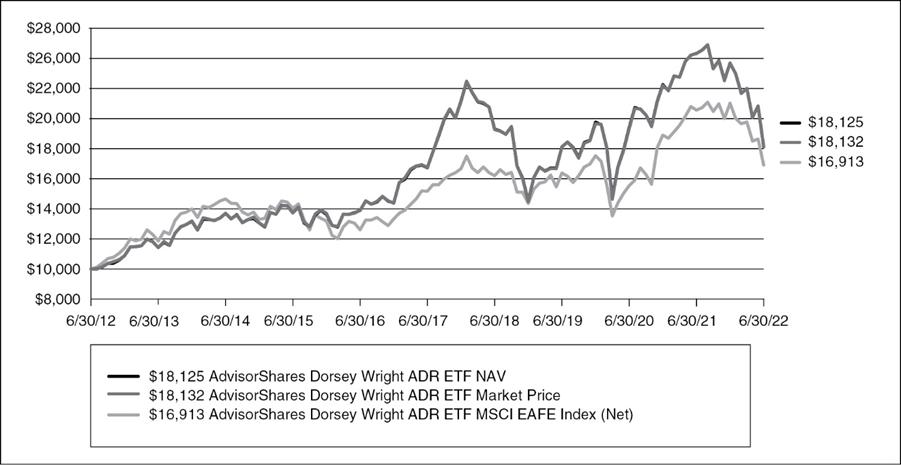

AdvisorShares Dorsey Wright ADR ETF (AADR)

The AdvisorShares Dorsey Wright ADR ETF (AADR) finished the fiscal year ended June 30th, 2022 behind its benchmark, the MSCI EAFE Index. The last year has been a tale of two markets with the end of a bull market taking us through 2021 and a bear market to start off the first half of 2022. Unsurprisingly, this caused issues for the portfolio as momentum strategies tend to struggle when market leadership changes.

The latter half of 2021 saw the portfolio perform roughly in line with the benchmark as international markets mostly treaded water despite the roaring bull market in US equities. The first half of 2022, though, saw almost all world markets decline. To make matters worse, the Russian invasion of Ukraine introduced substantial risk to some of the typically safer areas of the international universe (Europe). Some of the worst hit areas (such as the Netherlands) were areas where we were overweighted relative to the benchmark. Nevertheless, once markets begin to stabilize, we feel confident that relative strength will guide us into the new leadership, wherever that may be.

Despite the underperformance of cap-weighted international indexes versus domestic indexes, we are still looking for opportunities in high momentum names. As new market leaders emerge, the fund will continue to position itself to take advantage of its strength. The fund is well-positioned, and a shift back to international outperformance would provide a welcome tailwind.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period June 30, 2012 to June 30, 2022

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

| AdvisorShares Dorsey Wright ADR ETF NAV | | | -25.51 | % | | | 0.00 | % | | | 1.61 | % | | | 6.13 | % |

| AdvisorShares Dorsey Wright ADR ETF Market Price* | | | -25.45 | % | | | 0.04 | % | | | 1.59 | % | | | 6.13 | % |

| MSCI EAFE Index (Net) | | | -17.77 | % | | | 1.07 | % | | | 2.20 | % | | | 5.40 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.10% and the net expense ratio is 1.10%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 1.10%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the Nasdaq and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The MSCI EAFE Index is an unmanaged free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada. One cannot invest directly in an index.

ADVISORSHARES TRUST

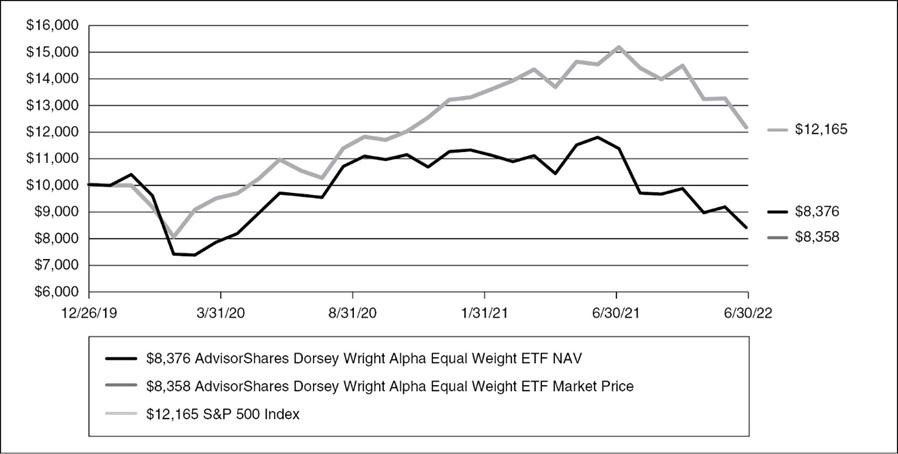

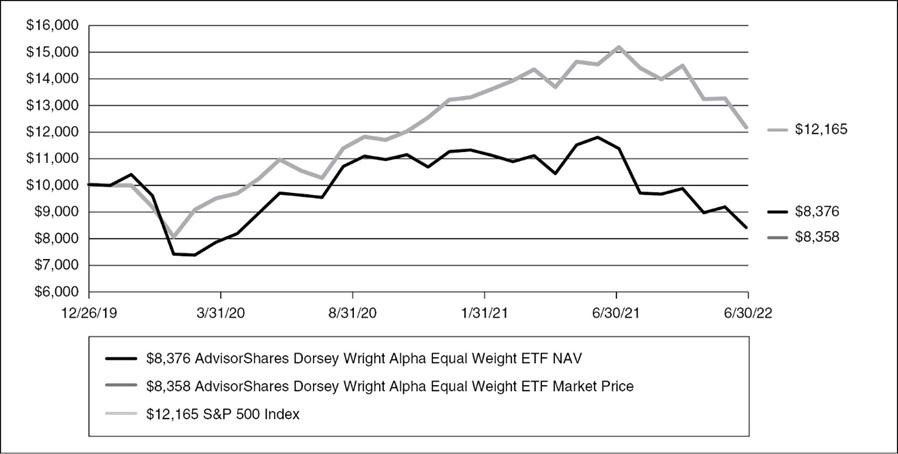

AdvisorShares Dorsey Wright Alpha Equal Weight ETF (DWEQ)

The AdvisorShares Dorsey Wright Alpha Equal Weight ETF (DWEQ) finished the fiscal year ended June 30th, 2022 behind its benchmark, the S&P 500 Total Return Index. Momentum strategies tend to underperform during periods when market leadership changes and change has been the theme of the last year with the second half of 2021 continuing a dramatic post-pandemic rally and the first half of 2022 ushering in a bear market.

In the second half of 2021 the US equity markets rallied but cracks were beginning to emerge. Former leaders such as Technology and Consumer Discretionary were starting to selloff underneath the surface and our exposure to Consumer Discretionary dragged the portfolio down. The first half of 2022, of course, started the bear market we’re currently in and the fund has struggled through this period with the rotation into new leadership. Exposure to Technology was the main performance detractor as it was one of the hardest hit areas during the decline.

Should the bear market continue, we feel the portfolio is positioned well as it has rotated into sectors that held up relatively well during the decline. It’s possible though that we’ve seen the worst of what the market will give us with consumer sentiment more negative than it has been in 50+ years (usually a bullish sign). Should we begin to recover though, it’s very possible that the more value oriented sectors we currently hold continue to outperform as many of the former leaders still have historically high valuations.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period December 26, 2019* to June 30, 2022

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | 1 Year | | | Since

Inception

12/26/2019* | |

| AdvisorShares Dorsey Wright Alpha Equal Weight ETF NAV | | | -24.56 | % | | | -6.81 | % |

| AdvisorShares Dorsey Wright Alpha Equal Weight ETF Market Price** | | | -24.85 | % | | | -6.89 | % |

| S&P 500 Index | | | -10.62 | % | | | 8.11 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.96% and the net expense ratio is 0.96%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.99%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. |

| ** | The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the Nasdaq and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

ADVISORSHARES TRUST

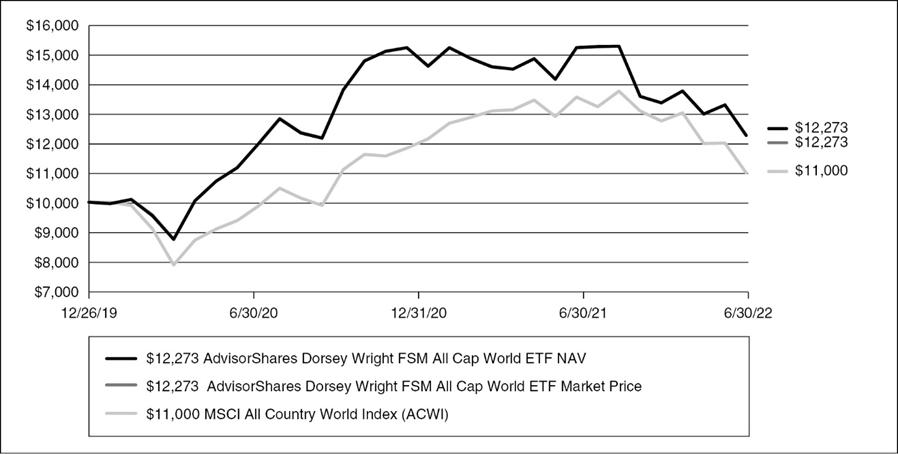

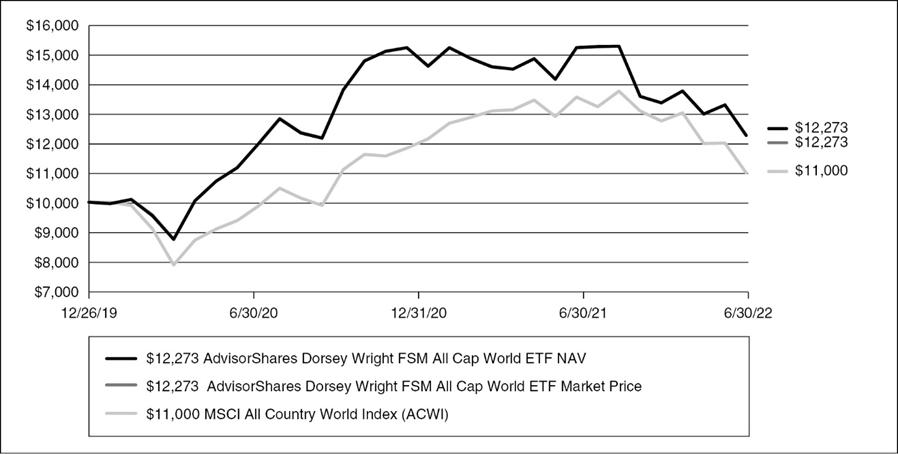

AdvisorShares Dorsey Wright FSM All Cap World ETF (DWAW)

The AdvisorShares Dorsey Wright FSM All Cap World ETF (ticker: DWAW) saw a market return of -17.47% for the 12-month period ended June 30, 2022, amid continued weakness in global equity markets. DWAW’s strategy looks to rotate among a broad inventory of U.S. and international equity representatives, seeking to hold the strongest two areas following each evaluation. The first strategy evaluation for this year came in early February, which saw the strategy rotate away from a growth-heavy allocation into equal weight positions of core large-cap and large-cap value. The next evaluation in May led the strategy to sell the core large-cap exposure in favor of large-cap low volatility, which helped buoy the portfolio during the turbulent market environment over the next several weeks. The value representative has continued to maintain positive relative strength against most other equity market representatives and is the highest scoring member of the strategy’s inventory.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period December 26, 2019* to June 30, 2022

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | 1 Year | | | Since

Inception

12/26/2019* | |

| AdvisorShares Dorsey Wright FSM All Cap World ETF NAV | | | -15.98 | % | | | 8.49 | % |

| AdvisorShares Dorsey Wright FSM All Cap World ETF Market Price** | | | -16.06 | % | | | 8.49 | % |

| MSCI All Country World Index (ACWI) | | | -15.75 | % | | | 3.87 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.14% and the net expense ratio is 1.12%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.99%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. |

| ** | The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the Nasdaq and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The MSCI All Country World Index (Net) is an unmanaged free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. One cannot invest directly in an index.

ADVISORSHARES TRUST

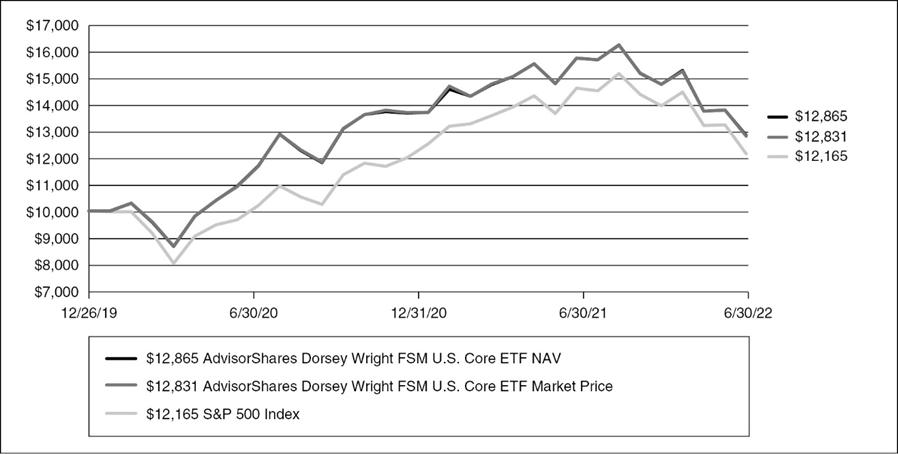

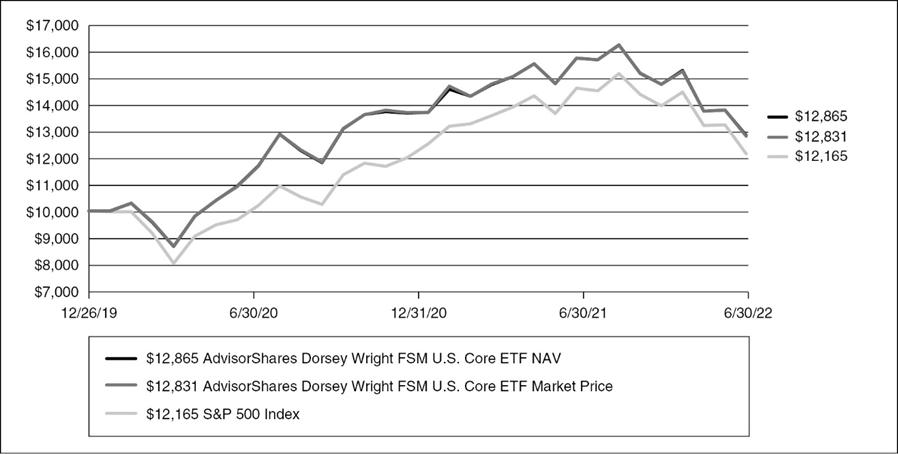

AdvisorShares Dorsey Wright FSM US Core ETF (DWUS)

The AdvisorShares Dorsey Wright FSM All Cap World ETF (ticker: DWUS) saw a market return of -13.79% for the 12-month period ended June 30, 2022. The underlying strategy behind DWUS looks to rotate among an inventory of core U.S. equity fund representatives, targeting exposure toward the strongest two areas after each model evaluation. The portfolio entered the year with high exposure toward growth equities with an overweight position in technology. The only change for DWUS’s strategy this year came in May, when the portfolio sold out of the growth-centric representative in favor of low volatility representation, which joins the core equity position as the two portfolio members. This portfolio is overweight large-cap blend and has high exposure toward utilities, industrials, and consumer staples.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period December 26, 2019* to June 30, 2022

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | 1 Year | | | Since

Inception

12/26/2019* | |

| AdvisorShares Dorsey Wright FSM US Core ETF NAV | | | -12.97 | % | | | 10.55 | % |

| AdvisorShares Dorsey Wright FSM US Core ETF Market Price** | | | -13.36 | % | | | 10.43 | % |

| S&P 500 Index | | | -10.62 | % | | | 8.11 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.10% and the net expense ratio is 1.07%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.99%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. |

| ** | The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the Nasdaq and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

ADVISORSHARES TRUST

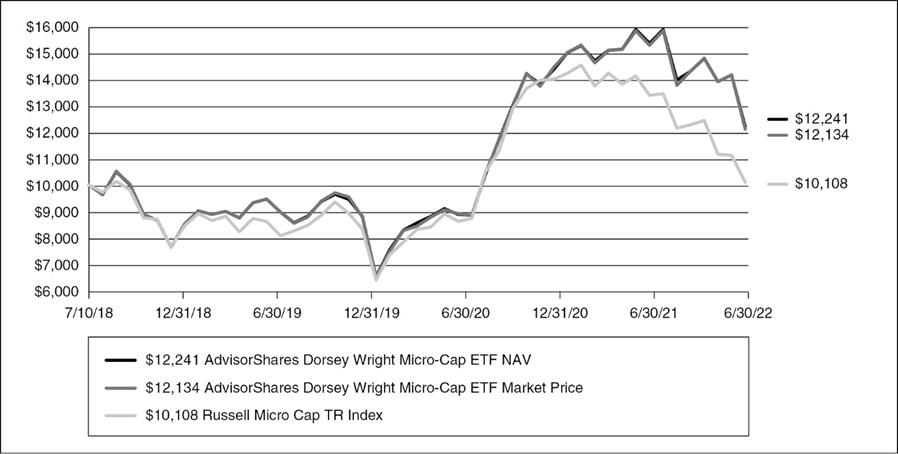

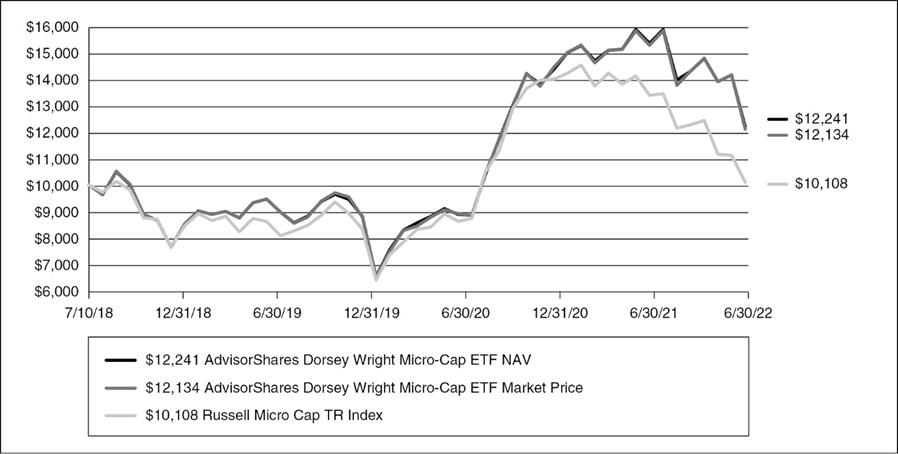

AdvisorShares Dorsey Wright Micro-Cap ETF (DWMC)

The AdvisorShares Dorsey Wright Micro-Cap ETF (DWMC) finished the fiscal year ended June 30th, 2022 ahead of its benchmark, the Russell Microcap Index. It was a rough year for the microcap space as US equities entered a bear market. Small/Micro cap stocks were some of the worst hit areas during the decline, but relative strength was able to guide us toward names that outperformed.

The second half of 2021 was great for US equities as a whole, but cracks were emerging in the Small/Micro cap space as the Russell Microcap index was down -7.5%. The fund performed well in this environment though, posting a 3.5% gain. Once the bear market began in 2022 though, almost no market/sector (aside from Energy) was left unscathed. Nevertheless, the fund was still able to outperform.

DWMC’s strategy is designed to unemotionally follow trends, which we think will benefit the portfolio in the coming months that are expected to be filled with uncertainty. Given stretched consumer sentiment, we feel the prospects for micro-cap stocks continue to be strong despite the bear market. Valuations for smaller stocks continue to be attractive relative to large caps, with a large valuation gap between the smallest and largest companies. This can persist for long periods but doesn’t last forever. We believe the fund is well-positioned to capitalize on a narrowing valuation gap when it comes.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period July 10, 2018* to June 30, 2022

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | 1 Year | | | 3 Year | | | Since

Inception

7/10/2018* | |

| AdvisorShares Dorsey Wright Micro-Cap ETF NAV | | | -20.17 | % | | | 9.51 | % | | | 5.22 | % |

| AdvisorShares Dorsey Wright Micro-Cap ETF Market Price** | | | -20.99 | % | | | 9.21 | % | | | 4.99 | % |

| Russell Micro-Cap Index | | | -30.73 | % | | | 5.05 | % | | | 0.27 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 3.19% and the net expense ratio is 1.27%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 1.25%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. |

| ** | The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the Nasdaq and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The Russell Micro-Cap Index measures the performance of the micro cap segment of the U.S. equity market. It includes 1,000 of the smallest securities in the Russell 2000 Index based on a combination of their market cap and current index membership and it also includes up to the next 1,000 stocks.

ADVISORSHARES TRUST

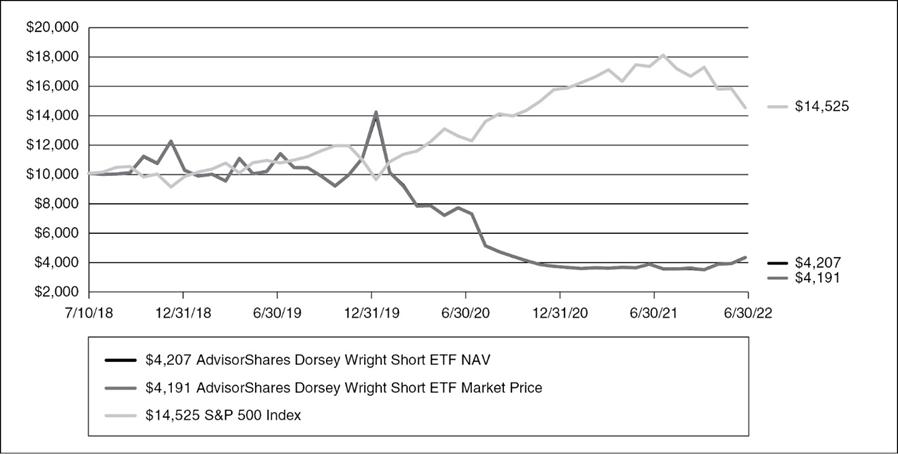

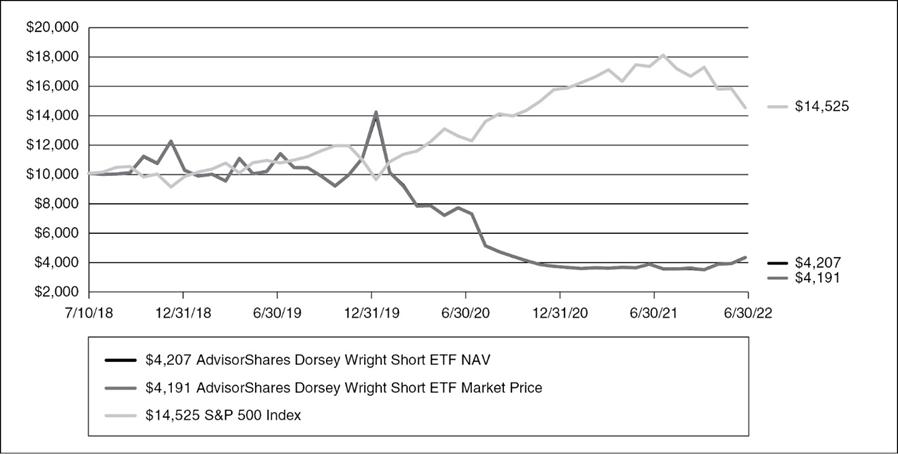

AdvisorShares Dorsey Wright Short ETF (DWSH)

The AdvisorShares Dorsey Wright Short ETF (DWSH) finished the fiscal year ended June 30, 2022 ahead of its benchmark, the inverse of the S&P 500 Total Return Index. The bear market that unfolded in the first half of 2022 undeniably helped the portfolio, but on a relative basis more ground was gained in the second half of 2021 as areas of the market began to diverge from each other.

In the second half of 2021, the US Equity markets performed very well, but cracks were beginning to emerge with many technology stocks producing notable selloffs. The fund was able to capitalize on this environment as it shorted pockets of the market showing relative weakness while the S&P 500 index barreled upward and it’s inverse barreled downward. The first half of 2022, of course, produced the bear market we’re currently in, and the fund produced a positive return in this environment as well as one would expect.

With recession risks mounting, we feel that using the fund as a hedge continues to remain attractive. The fund’s strategy of rotating into the weakest sectors should bode well for any further legs down in the market.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period July 10, 2018* to June 30, 2022

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | 1 Year | | | 3 Year | | | Since

Inception

7/10/2018* | |

| AdvisorShares Dorsey Wright Short ETF NAV | | | 22.15 | % | | | -25.00 | % | | | -19.58 | % |

| AdvisorShares Dorsey Wright Short ETF Market Price** | | | 22.08 | % | | | -25.13 | % | | | -19.66 | % |

| S&P 500 Index | | | -10.62 | % | | | 10.60 | % | | | 9.85 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 3.75% and the net expense ratio is 3.68%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 1.25%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. |

| ** | The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the Nasdaq and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

ADVISORSHARES TRUST

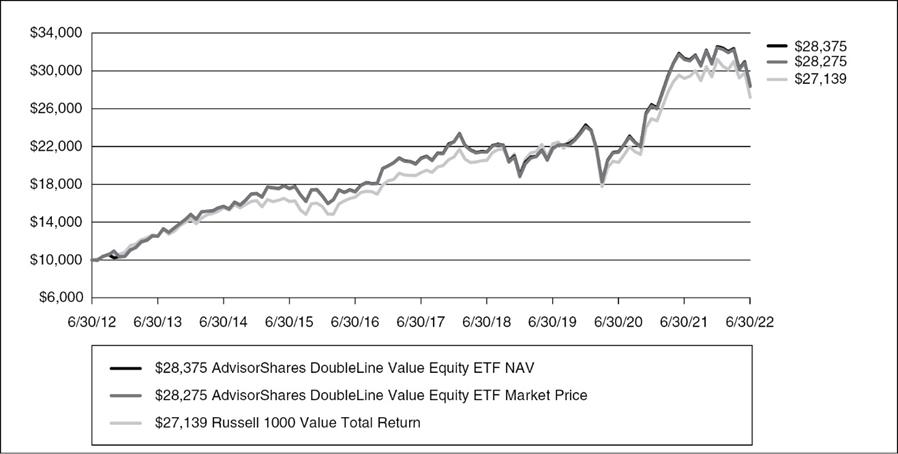

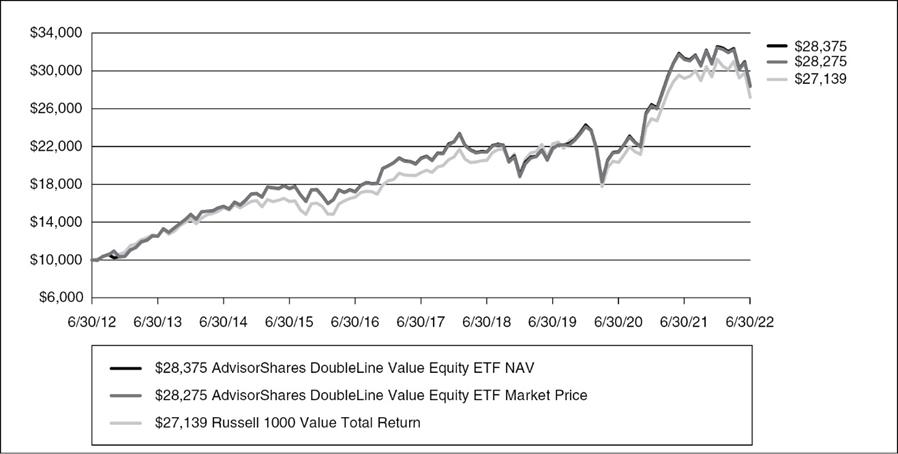

AdvisorShares DoubleLine Value Equity ETF (DBLV)

For the fiscal year ended June 30, 2022, the AdvisorShares Doubleline Value Equity ETF (ticker: DBLV) returned -9.12%, based on NAV, while the Russell 1000 Value Index benchmark posted a return of -6.82%. Unfavorable sector weights drove most of the underperformance. Our overweight in communication services, consumer discretionary and financials and our underweight in utilities hurt performance, while our underweight in technology helped. The fund benefitted from positive stock selection in consumer discretionary, industrials, and technology, which was offset by negative stock selection in communication services, materials, financials, healthcare, and real estate.

U.S. equities struggled in 2022 amid worsening inflationary pressures, protracted supply chain disruptions, sharply rising interest rates, hawkish central bankers, growing recessionary fears and continued geopolitical concerns around the war in Ukraine, as well as continual COVID lockdowns in China and elsewhere. The rapid rise in stagflationary fears led to relative outperformance of the energy sector, driven by higher commodity prices, as well as highly defensive sectors like consumer staples, utilities, and health care. Meanwhile, less defensive sectors with high valuation multiples, such as technology and consumer discretionary underperformed, as did cyclically sensitive value-priced names in areas like financials and industrials.

Even with the meaningful outperformance of value stocks relative to growth stocks during the year, we continue to see attractive opportunities in value names. Value continues to trade at valuation discount to growth more than the historical average, providing a runway of opportunity for further normalization of that discount. In terms of positioning, we increasingly prefer high-quality, late-cycle value stocks that are better poised to benefit even amidst the moderating economic growth and rising input costs, alongside those names with more defensive characteristics. We seek to balance investments offering attractive long-term expected risk-adjusted returns with those that should serve as more defensive ballasts in uncertain times. Note that the differentiated fundamental value strategy behind DBLV is well suited to allowing one to navigate through these evolving risks and opportunities.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period June 30, 2012 to June 30, 2022

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

| AdvisorShares DoubleLine Value Equity ETF NAV | | | -9.12 | % | | | 9.23 | % | | | 6.46 | % | | | 10.99 | % |

| AdvisorShares DoubleLine Value Equity ETF Market Price* | | | -9.12 | % | | | 9.22 | % | | | 6.46 | % | | | 10.95 | % |

| Russell 1000 Value Total Return | | | -6.82 | % | | | 6.87 | % | | | 7.17 | % | | | 10.50 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.06% and net expense ratio is 0.91%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.90%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The Russell 1000 Value Total Return Index measures the performance of the large-cap value segment of the U.S. equity market. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected and historical growth rates.

ADVISORSHARES TRUST

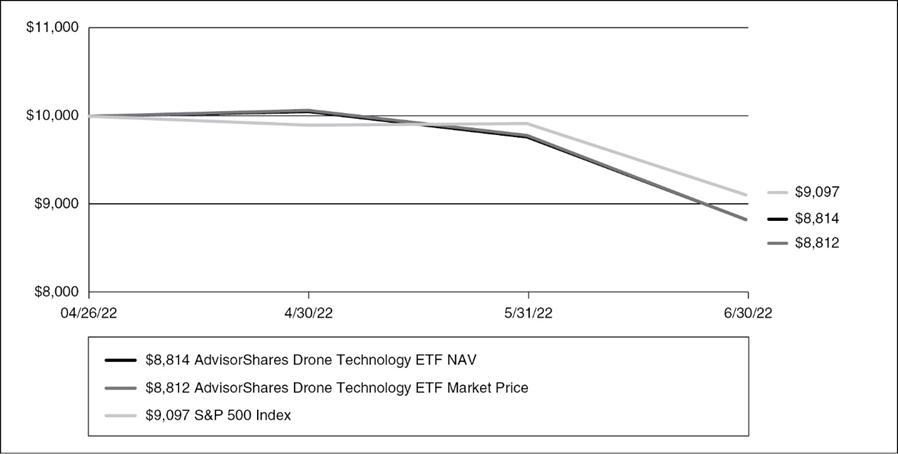

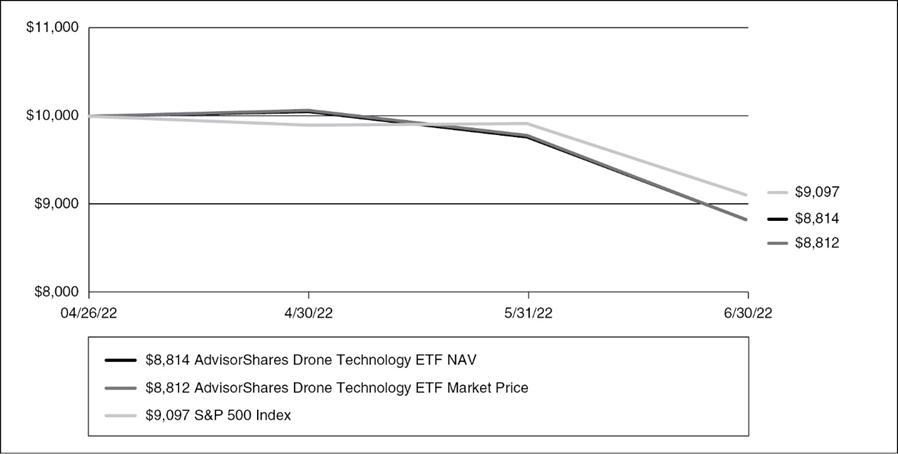

AdvisorShares Drone Technology ETF (UAV)

The AdvisorShares Drone Technology ETF (ticker: UAV) was just launched with an inception date of April 27, 2022 and has less than 3 months of performance. As the Drone Technology ETF invests in a limited universe of companies, the Fund can be volatile as compared to the overall market. We believe that drone technology presents great investment opportunities for long term investors as autonomous vehicle development, adoption and use increases worldwide.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period April 27, 2022* to June 30, 2022

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | Since

Inception

4/27/2022* | |

| AdvisorShares Drone Technology ETF NAV | | | -11.86 | % |

| AdvisorShares Drone Technology ETF Market Price** | | | -11.88 | % |

| S&P 500 Index | | | -9.03 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.22% and the net expense ratio is 0.99%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.99%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. |

| ** | The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

ADVISORSHARES TRUST

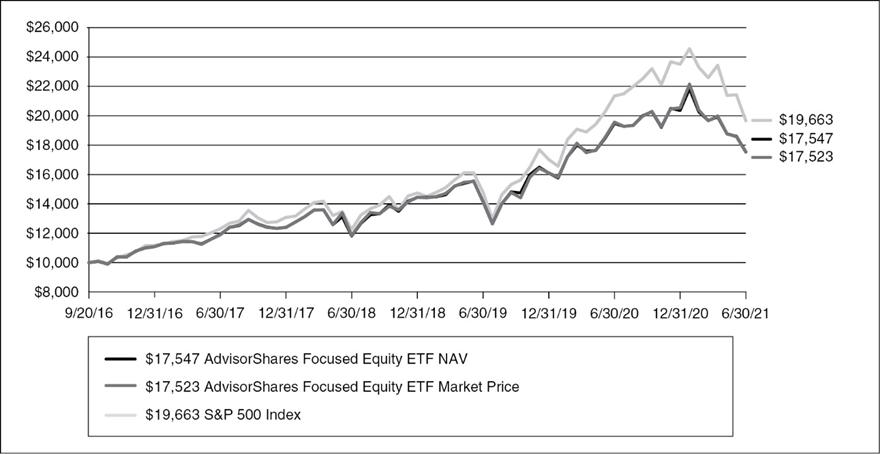

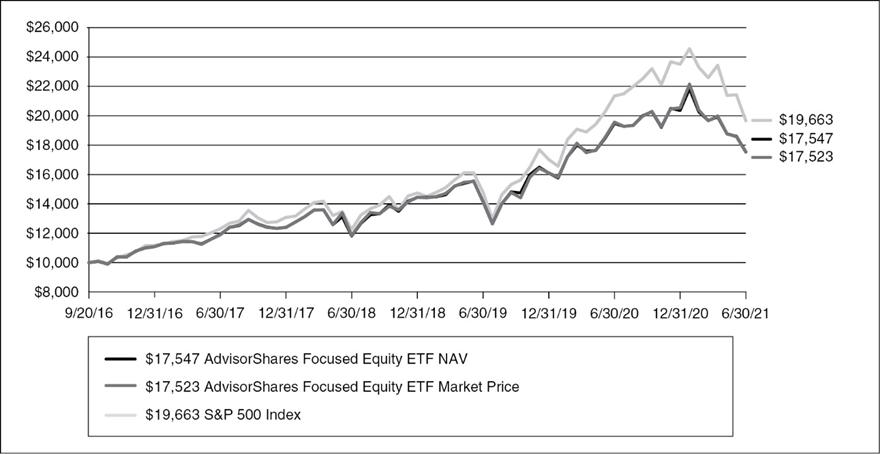

AdvisorShares Focused Equity ETF (CWS)

For the 12 months ended June 30, 2022, the NAV of the AdvisorShares Focused Equity ETF (ticker: CWS) lost 9.28%, and the traded shares lost 9.44%. Despite the loss, CWS performed well versus the overall market. For example, the S&P 500 Total Return Index lost over 10.6% over the same time span, and the small-cap Russell 2000 Total Return Index lost over 25%.

This was an unusually challenging period for investors. The economy faced the highest inflation in over 40 years. Companies were impacted by supply-chain issues and the Federal Reserve raised interest rates, including its first 0.75% rate hikes in over 25 years.

Due to CWS’s conservative nature and long-term focus, the anxious mood worked to our benefit. When the market started to fall in January, shares of CWS didn’t fall as much as the rest of the market. Meanwhile, many of the stocks that had rallied so strongly in 2021 were punished severely. The stocks in CWS tend to be of a higher quality than the rest of the market. Additionally, since we make portfolio changes only once a year, we aren’t subject to the perils of poor market-timing. In fact, our set-and-forget strategy can be ideal for turbulent markets such as we had in early 2022.

We continue to expect CWS’s performance to lead the overall stock market. The economy and financial markets still face significant challenges including a slowing economy, rising inflation, more interest-rate hikes plus several troubling geo-political risks. During uncertain times, investors gravitate towards high-quality stocks. In our opinion, this makes for an excellent environment for the AdvisorShares Focused Equity ETF.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period September 20, 2016* to June 30, 2022

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | 1 Year | | | 3 Year | | | 5 Year | | | Since

Inception

9/20/2016* | |

| AdvisorShares Focused Equity ETF NAV | | | -9.28 | % | | | 7.37 | % | | | 8.93 | % | | | 10.23 | % |

| AdvisorShares Focused Equity ETF Market Price** | | | -9.44 | % | | | 7.44 | % | | | 8.90 | % | | | 10.20 | % |

| S&P 500 Index | | | -10.62 | % | | | 10.60 | % | | | 11.31 | % | | | 12.42 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.19% and the net expense ratio is 0.66%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding the range from 0.65% to 0.85%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. |

| ** | The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

ADVISORSHARES TRUST

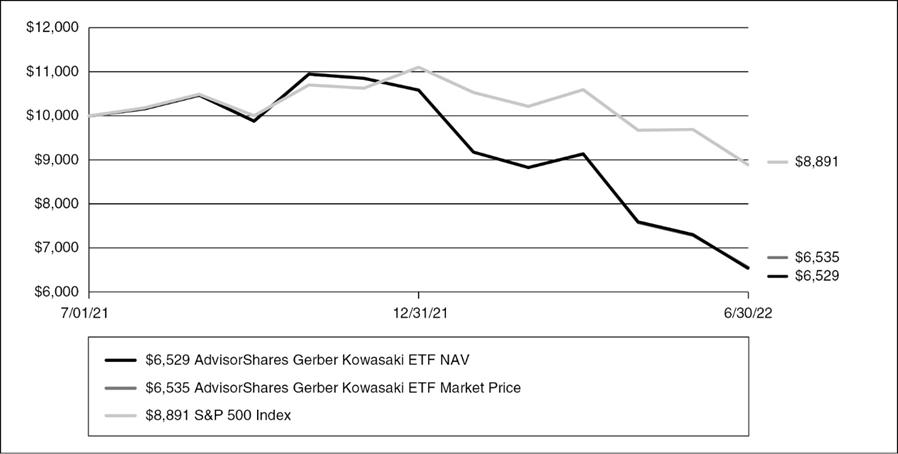

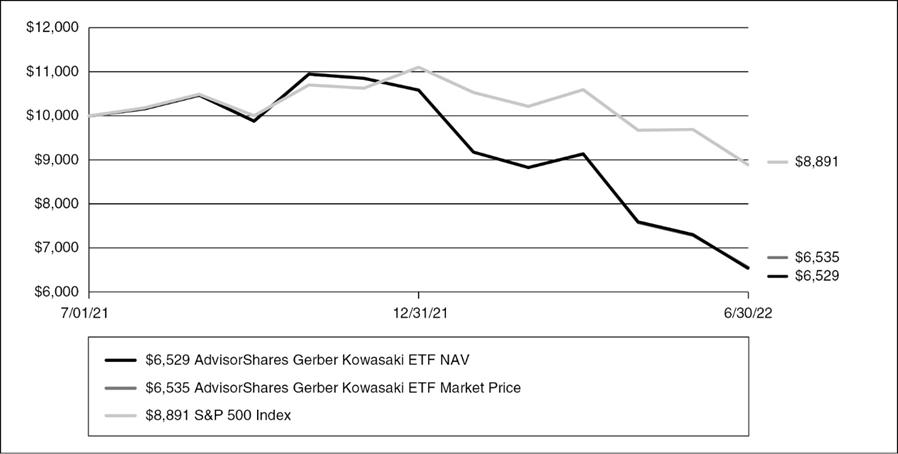

AdvisorShares Gerber Kawasaki (GK)

The AdvisorShares Gerber Kawasaki ETF (ticker: GK) launched one year ago during the end of the bull market of 2021. The fund had a stellar first five months beating the benchmarks and providing positive total return. In December 2021, the market began to turn with the next six months turning out to be the most difficult time for stocks in the last 50 years. Unfortunately, this was a very difficult period for the fund as well. The bear market lasted from mid-November 2021 to mid-June 2022. Due to the fact we are a concentrated fund, focused on technology, consumer discretionary, clean energy and transportation areas, we were hit particularly hard relative to the indexes. High inflation and supply chain issues caused many of our investments to temporarily decline in value. For the twelve months ended June 30, 2022, GK’s performance was negative, underperforming the S&P 500 Index.

The factors that most affected GK’s performance during the fiscal year was exposure to the areas of the market that was dramatically affected by inflation and the subsequent rapid rise in interest rates. Unfortunately, the technology sector tends to perform poorly during a rising interest rate environment and that held true. Also, the fund’s thematic investment strategy led to GK being heavily invested in consumer discretionary stocks. These positions were also hit particularly hard as high gas prices, caused by the war in Ukraine, took away some of consumers’ spending power. This combination of factors along with a concentrated portfolio caused the fund to underperform for the year. Also, GK’s heavy investments in electric vehicles and clean energy were negatively affected by the Biden Administration’s inability to get the Climate Bill approved earlier in the year. While it was a difficult year for GK, it has not changed our belief in the fund’s strategy and the future of its investments.

As we enter the new fiscal year, we’ve seen the end of the recent bear market, what appears to be the peak in inflation as the Federal Reserve’s actions appear to be working, and the passage of a U.S. Climate Bill placing greater focus on alternative energy. These factors are favorable for the fund, and we believe GK should begin to outperform. As the world struggles with an over-dependence on oil and gas in the wake of the Ukraine-Russia war, we are quite bullish on the future of renewable energy. Although we expect some additional bumps as the Fed finishes its rate hiking cycle, once the Fed is done, we anticipate markets will react well and GK will be in a prime position to benefit from the transformative trends that will continue in out thematic investment approach.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period July 2, 2021* to June 30, 2022

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | Since

Inception

7/2/2021* | |

| AdvisorShares Gerber Kawasaki ETF NAV | | | -34.71 | % |

| AdvisorShares Gerber Kawasaki ETF Market Price** | | | -34.65 | % |

| S&P 500 Index | | | -11.09 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.87% and the net expense ratio is 0.81%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.75%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. |

| ** | The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

ADVISORSHARES TRUST

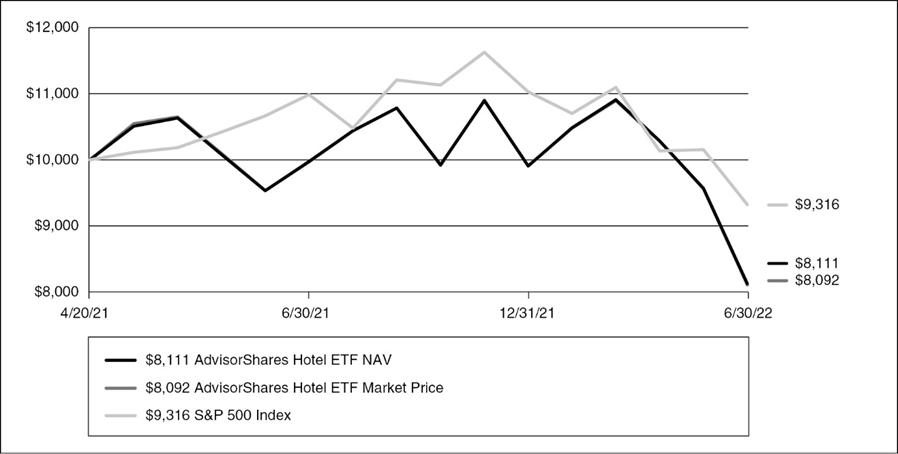

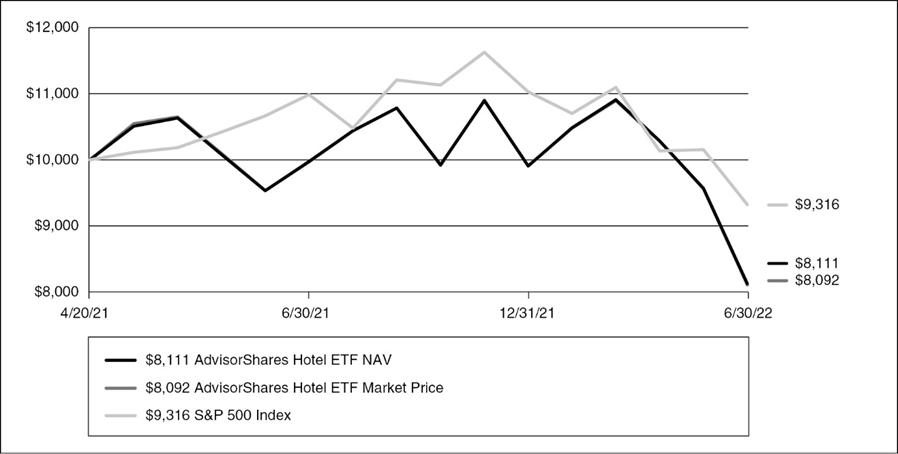

AdvisorShares Hotel ETF (BEDZ)

The AdvisorShares Hotel ETF (ticker: BEDZ) launched in the Spring of 2021 and just completed its first full fiscal year. The Fund somewhat underperformed the overall market as measured by the S&P 500 Index. The Fund’s overall performance is very much aligned with the success of the hotel industry. While much of the travel industry has bounced back from COVID-19, hotels have faced employment shortages, supply chain limitations, and an overall negative impact of inflation.

Investors in a focused, industry-related fund should have a very long-term focus. We remain bullish about future hotel and travel growth as the world continues to slowly return to a more normal business travel environment. While we are bullish on the overall hotel industry, the Fund attempts relative outperformance with individual security selection among hotels and related areas plus good trading techniques.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period April 20, 2021* to June 30, 2022

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | 1 Year | | | Since

Inception

4/20/2021* | |

| AdvisorShares Hotel ETF NAV | | | -19.54 | % | | | -16.08 | % |

| AdvisorShares Hotel ETF Market Price** | | | -19.87 | % | | | -16.24 | % |

| S&P 500 Index | | | -10.62 | % | | | -5.76 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.99% and the net expense ratio is 0.99%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.99%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. |

| ** | The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

ADVISORSHARES TRUST

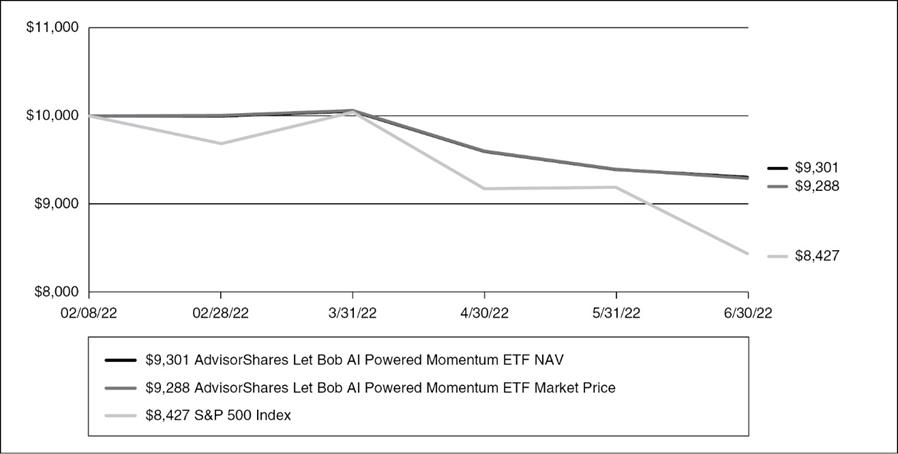

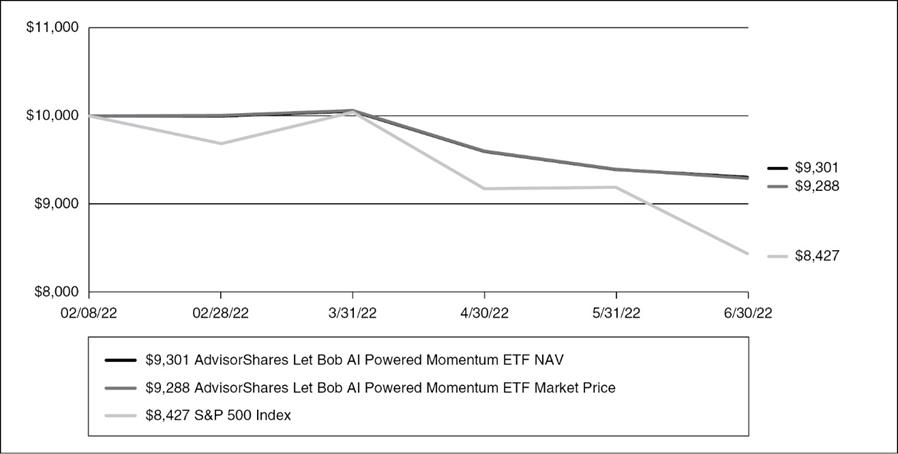

AdvisorShares Let Bob AI Powered Momentum ETF (LETB)

The AdvisorShares Let Bob AI Powered Momentum ETF (ticker: LETB) launched with an inception date of February 8, 2022. Through fiscal year ended June 30, 2022, the Fund has less than 5 months of investment performance. During 2022’s volatile and negative markets, LETB’s artificial intelligence-powered investment strategy has caused the Fund to hold comparatively large percentages of its assets in a defensive cash investment position. While the Fund has lost value since its inception, it has lost much less than the overall market as measured by the S&P 500 Index. As the overall market returns to more a normal situation, the Fund is expected to be more fully invested per its investment strategy and security selection process.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period February 9, 2022* to June 30, 2022

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | Since

Inception

2/9/2022* | |

| AdvisorShares Let Bob AI Powered Momentum ETF NAV | | | -6.99 | % |

| AdvisorShares Let Bob AI Powered Momentum ETF Market Price** | | | -7.12 | % |

| S&P 500 Index | | | -15.73 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.87% and the net expense ratio is 0.87%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.99%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. |

| ** | The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The S&P 500 Index is a broad-based, unmanaged measurement of changes in stock market conditions based on the average of 500 widely held common stocks. One cannot invest directly in an index.

ADVISORSHARES TRUST

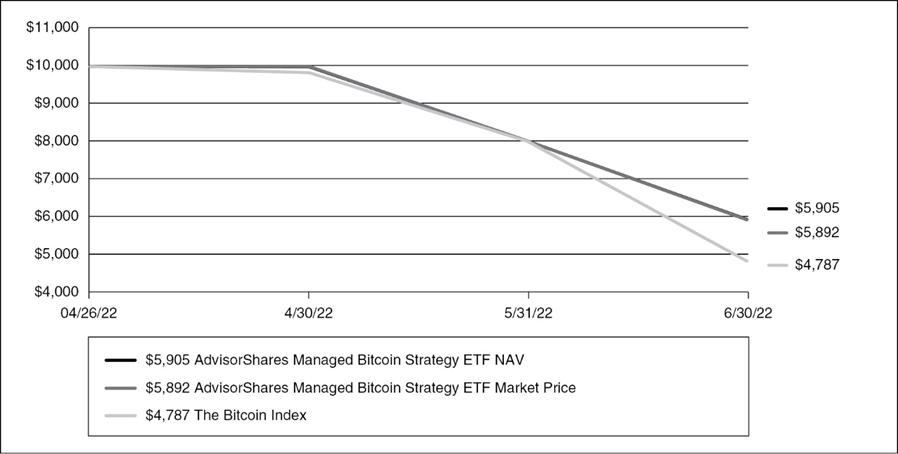

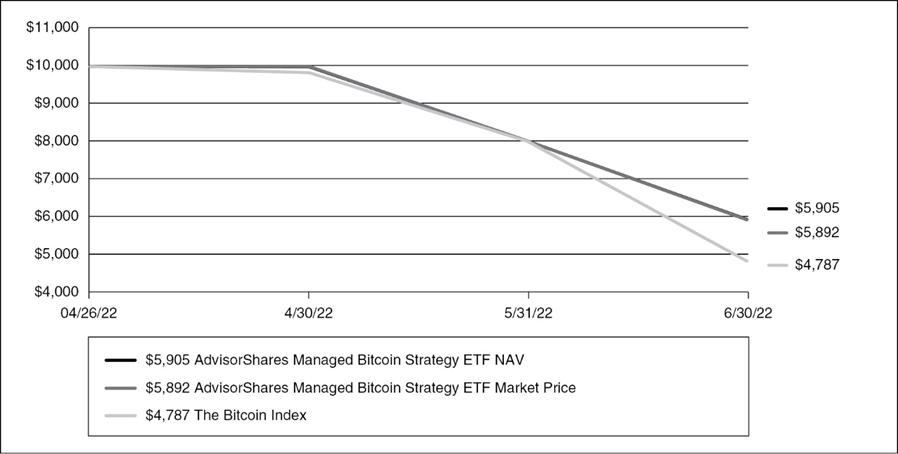

AdvisorShares Managed Bitcoin Strategy ETF (CRYP)

The AdvisorShares Managed Bitcoin Strategy ETF (CRYP) was launched during the second half of the fiscal year ended June 30, 2022 and finished the fiscal year ahead of its benchmark – the price of Bitcoin in USD (BTCUSD). The outperformance during the period was driven primarily by the active management of the strategy which enabled the Fund to mitigate losses in a very challenging investment environment.

Toward the end of 2021, global capital markets shifted dramatically toward a risk-off posture as global central banks began to withdraw liquidity from the global financial system by raising interest rates. A rising interest environment is challenging for all assets as rising discount rates compress equity market valuations (Price to Earnings ratios) and directly reduce the value of fixed income investments. In the first half of 2022, global capital markets experienced very significant losses across the board, and sectors with the highest growth rates and those that had performed very well in 2020 and 2021, dramatically decreased in value. The withdrawal of liquidity by the Fed and other central banks triggered a wave of deleveraging that prompted rapid outflows from capital markets for the first time in many years. Digital assets such as Bitcoin experienced significant price pressure, and investors reacted by reducing exposures, which put further downward pressure on the asset class.

The design of the AdvisorShares Managed Bitcoin Strategy ETF is well suited to this type of market volatility and enabled the Fund to achieve the goal of mitigating downside risk during significant drawdowns. We believe that the Fund is well positioned to continue to provide investors with an alternative to direct ownership of Bitcoin by mitigating many of the risks associated with owning and managing digital assets and helping advisors integrate this important, but highly volatile, asset into client portfolios. Markowitz portfolio theory has shown that including volatile assets with low correlation to traditional assets into a portfolio can increase the efficiency and return profile of the portfolio, and we believe CRYP can play an important role in diversified portfolios.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period April 27, 2022* to June 30, 2022

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | Since

Inception

4/27/2022* | |

| AdvisorShares Managed Bitcoin Strategy ETF NAV | | | -40.95 | % |

| AdvisorShares Managed Bitcoin Strategy ETF Market Price** | | | -41.08 | % |

| The Bitcoin Index | | | -52.13 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.61% and the net expense ratio is 0.61%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 1.49%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. |

| ** | The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The NYSE Bitcoin Index aims to represent the value of (1) bitcoin in U.S. Dollars (USD) as of 4 PM U.K. time each weekday. The Index is calculated sourcing data from qualified exchanges, currently GDAX and itBit. Only bitcoin transactions conducted in USD are eligible to be input into the Index. One cannot invest directly in an index.

ADVISORSHARES TRUST

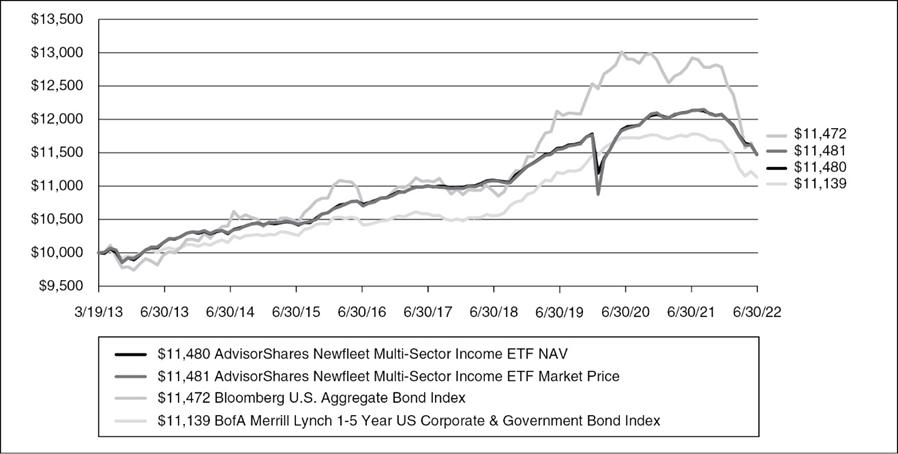

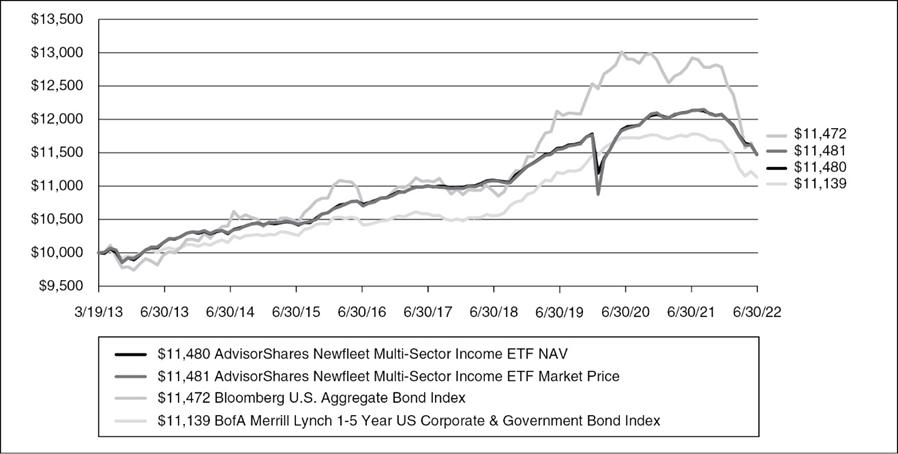

AdvisorShares Newfleet Multi-Sector Income ETF (MINC)

The AdvisorShares Newfleet Multi-Sector Income ETF (ticker: MINC) posted a return of -5.24%, based on NAV and -5.19%, based on Market Price as compared to -10.29% for the Bloomberg U.S. Aggregate Bond Index or -5.19% for the BofA Merrill lynch 1-5 Year U.S. Corporate & Government Bond Index for the 1-year period ended June 30, 2022.

Global central banks intensified their fight with inflation during the period, signaling they will remain vigilant until inflation objectives are met. This backdrop clouded the outlook for global and regional economic growth, resulting in negative total returns for most assets. The pandemic remains a global issue, with China’s zero-COVID policy continuing to delay the normalization of supply chains. Meanwhile, the war between Russia and Ukraine is an ongoing economic shock to food and energy prices. These unresolved issues make economic forecasting and modeling a challenge and will likely contribute to a volatile investing environment for the next several quarters.

During the most recent one-year period, MINC’s allocation to asset backed securities and non-agency residential mortgage-backed securities had a positive impact on the Fund. We are still constructive on both short duration credit backed by the U.S. consumer, and mortgage credit. The underweight to investment grade corporates also positively contributed to performance. The focus on higher quality loans in the Fund benefited performance as BB risk continued to outperform lower-quality cohorts. The Fund’s underweight to U.S. Treasuries was the primary detractor from performance. Allocation to the corporate high yield sector also had a negative impact on performance. Factors that have plagued the high yield market for the last few months persist: the war in Ukraine rages on, supply chain disruptions continue, and U.S. Treasury yields rose as the market tried to handicap the levers the FOMC will pull to quell inflation.

We believe some of the best total return and yield opportunities can be found in spread sectors. However, given the increased risk of a recession, we have reduced some exposure to spread sectors that would typically be more negatively impacted, such as corporate high yield and bank loans. Credit selection and positioning remain key. Specific sectors that demonstrate the best relative value for us include out-of-index/off-the-run ABS, non-agency RMBS, and BBB-rated corporate investment grade.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period March 19, 2013* to June 30, 2022

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | 1 Year | | | 3 Year | | | 5 Year | | | Since

Inception

3/19/2013* | |

| AdvisorShares Newfleet Multi-Sector Income ETF NAV | | | -5.24 | % | | | 0.00 | % | | | 1.02 | % | | | 1.50 | % |

| AdvisorShares Newfleet Multi-Sector Income ETF Market Price** | | | -5.19 | % | | | 0.05 | % | | | 1.02 | % | | | 1.50 | % |

| Bloomberg U.S. Aggregate Bond Index | | | -10.29 | % | | | -0.93 | % | | | 0.88 | % | | | 1.49 | % |

| BofA Merrill Lynch 1-5 Year U.S. Corporate & Government Bond Index | | | -5.19 | % | | | 0.14 | % | | | 1.11 | % | | | 1.17 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.79% and net expense ratio is 0.76%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.75%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. |

| ** | The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The Bloomberg U.S. Aggregate Bond Index measures the performance of the U.S. investment grade bond market. One cannot invest directly in an index.

The BofA Merrill Lynch 1-5 Year U.S. Corporate & Government Bond Index tracks the performance of US dollar denominated investment grade debt publicly issued in the US domestic market, including US Treasury, US agency, foreign government, supranational and corporate securities, with a remaining term to final maturity less than 5 years, calculated on a total return basis. One cannot invest directly in an index.

ADVISORSHARES TRUST

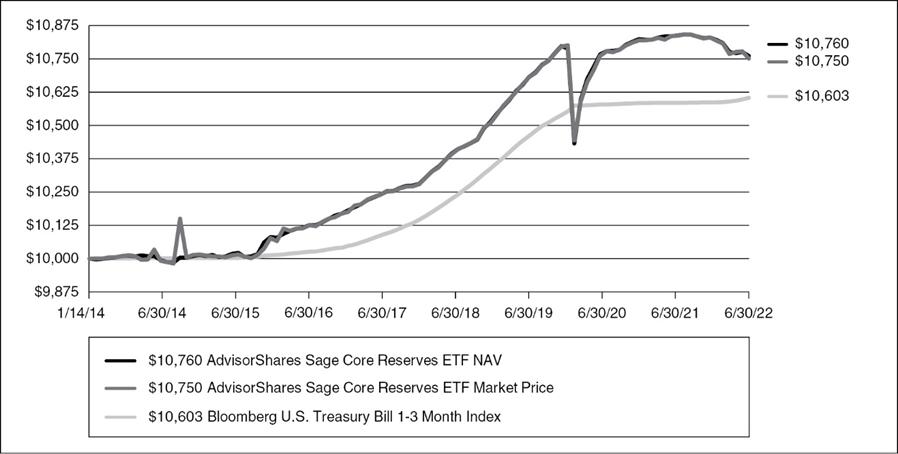

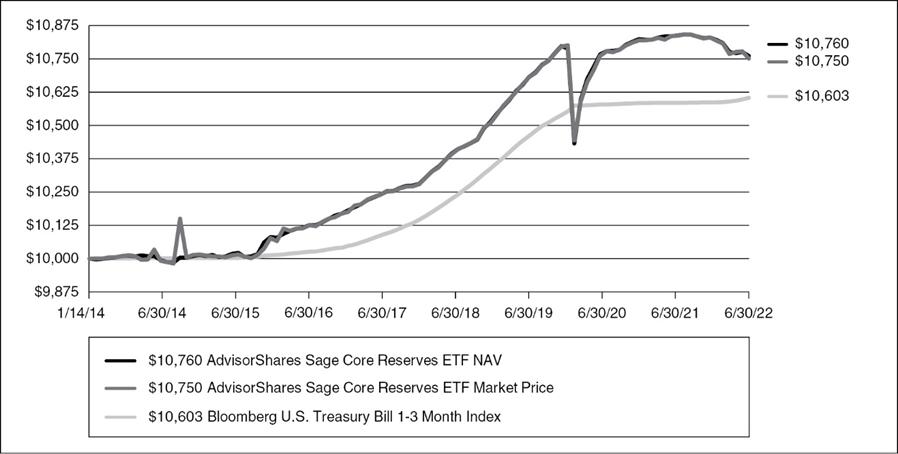

AdvisorShares North Square McKee Core Reserves ETF (HOLD)

C.S. McKee assumed the role of subadvisor for the AdvisorShares North Square McKee Core Reserves ETF (ticker: HOLD) November 1, 2021, continuing to manage it as a short-term maturity, investment grade fixed income portfolio. With market interest rates rising quickly in response to the Federal Reserve’s belated response to rising inflation and balancing the need for income with principal preservation, portfolio duration was managed to the low end of the fund’s stated 0.50 years to 1.25 years target range. Performance for the eight-month period ended June 30, 2022 was -0.76%.

Fund holdings include securitized (asset backed and commercial mortgage backed), corporate, agency, and Treasury bonds. Growing concerns for a mild recession lead us to maintain average quality of AA-, on par with the Fund’s long-term target. Asset backed securities, a consistent and significant allocation in the Fund, underperformed Treasuries in the first half of 2022, but have stabilized in third quarter.

We expect to see a further tightening in financial conditions in the second half of 2022 as the battle to contain inflation continues. We believe the Fed Funds rate should peak in the 3.75% to 4% range by early next year, an environment in which portfolio duration will likely be increased to approximately one year with a corresponding increase in yield.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period January 14, 2014* to June 30, 2022

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | 1 Year | | | 3 Year | | | 5 Year | | | Since

Inception

1/14/2014* | |

| AdvisorShares North Square McKee Core Reserves ETF NAV | | | -0.68 | % | | | 0.41 | % | | | 1.06 | % | | | 0.87 | % |

| AdvisorShares North Square McKee Core Reserves ETF Market Price** | | | -0.76 | % | | | 0.39 | % | | | 1.04 | % | | | 0.86 | % |

| Bloomberg U.S. Treasury Bill 1-3 Month Index | | | 0.18 | % | | | 0.57 | % | | | 1.05 | % | | | 0.69 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 0.57% and the net expense ratio is 0.35%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.35%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | Commencement of operations. |

| ** | The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

The Bloomberg U.S. Treasury Bill 1-3 Month Index includes all publicly issued zero-coupon U.S. Treasury Bills that have a remaining maturity of less than 3 months and more than 1 month, are rated investment grade, and have $250 million or more of outstanding face value. The Bloomberg U.S. 1-3 Month Treasury Bill Index is an unmanaged index considered representative of the performance of the U.S. Treasury Bill issued by the U.S. Government. One cannot invest directly in an index.

ADVISORSHARES TRUST

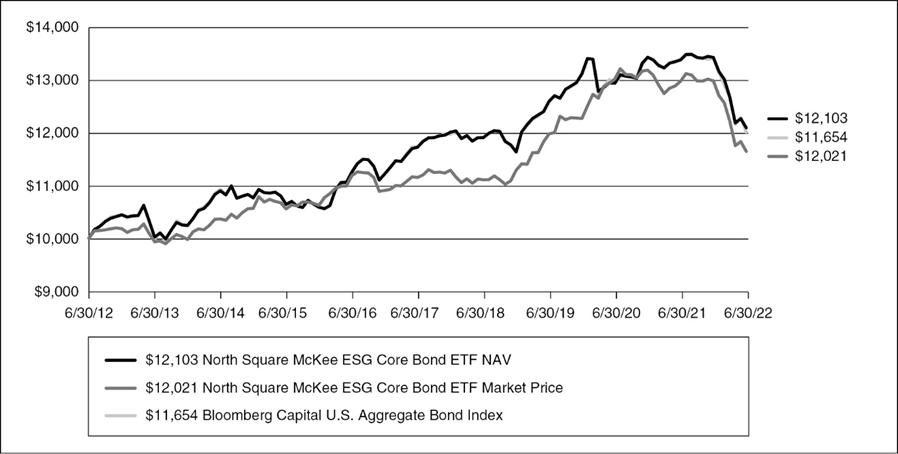

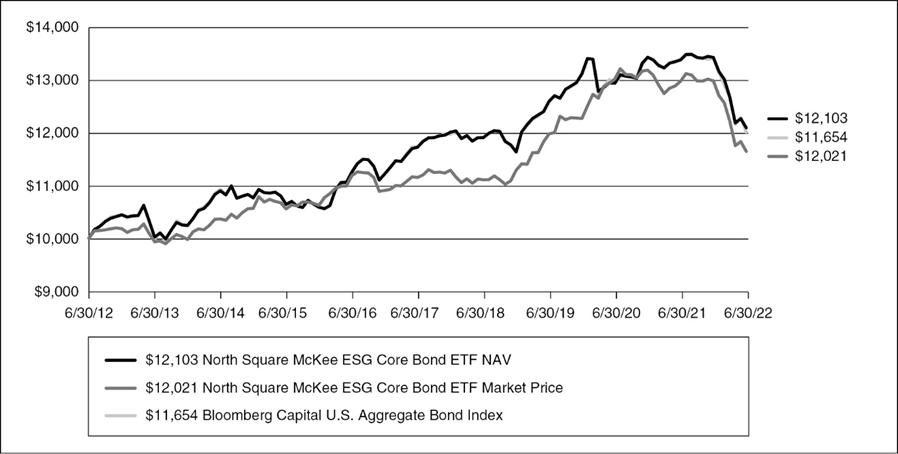

AdvisorShares North Square McKee ESG Core Bond ETF (MENV)

C.S. McKee assumed the role of subadvisor for AdvisorShares North Square McKee ESG Core Bond ETF (ticker: MENV) November 1, 2021, converting it to a core fixed income ESG* managed product employing our proprietary model. Fund performance for the period ended June 30, 2022 was largely driven by the significant rise in market interest rates and the corresponding increase in measured volatility. As inflation proved itself to be anything but transitory, the Federal Reserve belatedly took action to slow economic growth. The Fed Funds rate is expected to rise more than 3% from the previous low, tightening financial conditions.

The Fund’s overweight to the corporate and agency sectors adversely impacted returns as yield spreads versus Treasuries widened over this period. Investors generally reduced their allocation to fixed income or took less risk in the space, pressuring prices lower. The market began to find some balance in mid-June, with market interest rates peaking and investor demand for all areas of the bond market improving.

We expect to see a further tightening in financial conditions in the second half of 2022 as the battle to contain inflation continues. We believe the Fed Funds rate should peak in the 3.75% to 4% range by early next year, an environment in which market volatility should also top out. The portfolio’s significant overweight to callable securities (mortgage passthroughs and agency debentures) are expected to perform well in this scenario, boosting performance without assuming added credit risk.

| * | Environmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. Environmental criteria consider how a company performs as a steward of nature. Social criteria examine how it manages relationships with employees, suppliers, customers, and the communities where it operates. Governance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights. |

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period June 30, 2012 to June 30, 2022

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

| AdvisorShares North Square McKee ESG Core Bond ETF NAV | | | -9.67 | % | | | -1.36 | % | | | 0.62 | % | | | 1.93 | % |

| AdvisorShares North Square McKee ESG Core Bond ETF Market Price** | | | -10.29 | % | | | -1.57 | % | | | 0.47 | % | | | 1.86 | % |

| Bloomberg U.S. Aggregate Bond Index | | | -10.29 | % | | | -0.93 | % | | | 0.88 | % | | | 1.54 | % |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Fund NAV returns are calculated using the Fund’s daily 4:00 p.m. NAV. Returns shown include the reinvestment of all dividends and other distributions. Index returns do not include expenses. As stated in the current prospectus, the Fund’s annual operating expense ratio (gross) is 1.89% and the net expense ratio is 0.47%. (Actual expenses can be referenced in the Financial Highlights section later in this report.) The Fund’s advisor has agreed to waive a portion of its fees and/or reimburse expenses to the extent necessary to keep the Fund’s expenses from exceeding 0.47%. Returns less than one year are not annualized. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. For the Fund’s most recent month end performance, please call 1-877-843-3831.

| * | The price used to calculate market return (“Market Price’’) is determined by using the closing price listed on the NYSE Arca and does not represent returns an investor would receive if shares were traded at other times. Total returns are calculated using the daily 4:00pm midpoint between the bid and offer. Shares are bought and sold at market price, not NAV and are not individually redeemed from the Fund. |

Bloomberg U.S. Aggregate Bond Index measures the performance of the U.S. investment grade bond market. One cannot invest directly in an index.

ADVISORSHARES TRUST

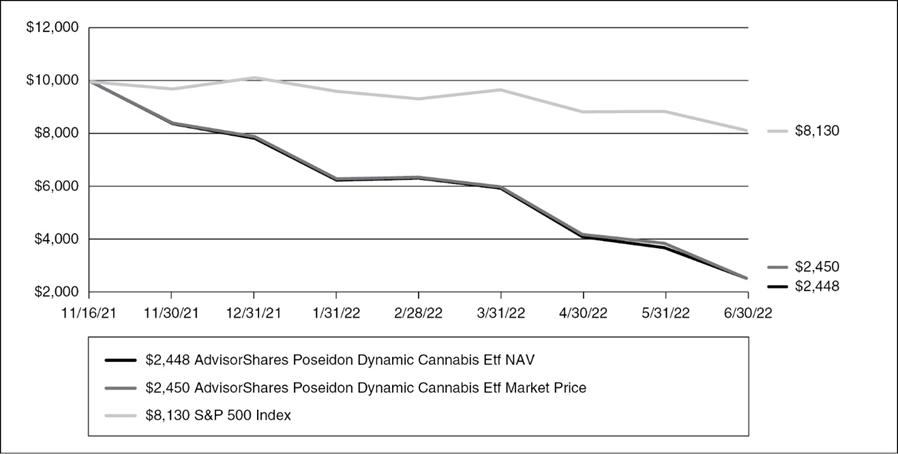

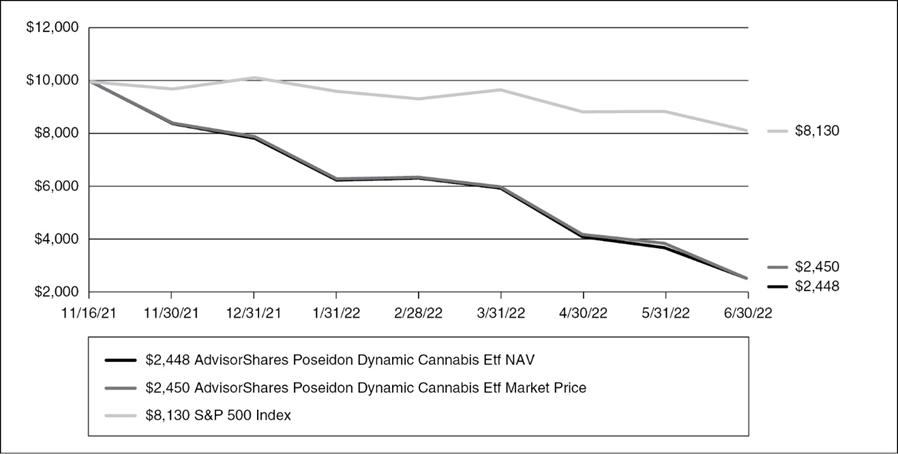

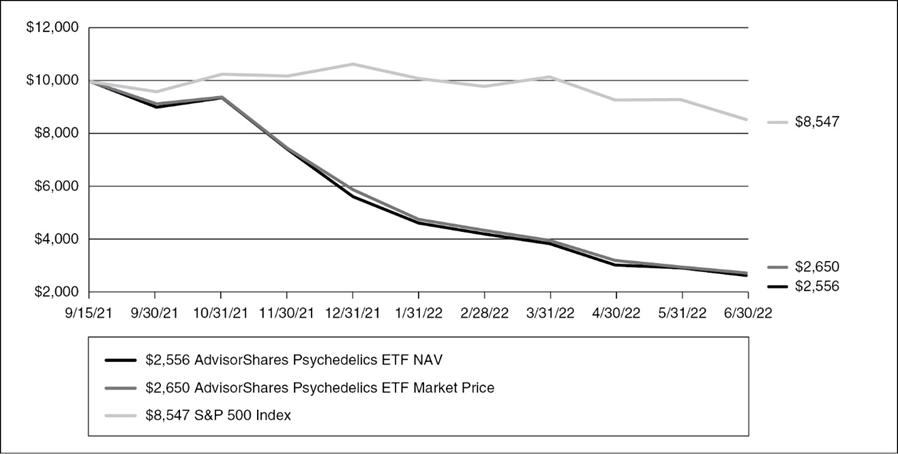

AdvisorShares Poseidon Dynamic Cannabis ETF (PSDN)

The AdvisorShares Poseidon Dynamic Cannabis ETF (ticker: PSDN) launched in November of 2021. Since its launch through the end of the second quarter of 2022, while its performance has been negative, PSDN has experienced new share creations totaling approximately $13.3 million of inflows. These inflows were despite incredibly challenging times in cannabis and broader markets. PSDN can actively use moderate levels of leverage, at portfolio management’s discretion, and had an average leverage position of 122% from its inception.

The cannabis sector largely peaked in February 2021 and has been negative for 18 consecutive months through the end of the second quarter of 2022. It is our belief that most of the decline is attributable to what now is proving to be previously overly optimistic expectations from the industry and the analysts. Predicting state-level or international regulatory progress on cannabis has been an extremely challenging exercise, as well as a big contributor to missed expectations and lowering guidance in 2021 through 2023.

As we enter the second half of 2022, growth in the cannabis sector is starting to reaccelerate with decelerating to stabilizing pricing trends in key markets along with new adult use access opening in many new markets, including New Jersey. Growth with low valuations creates a very compelling backdrop for the cannabis sector’s equity performance to potentially perform positively on an absolute basis and a relative basis compared to other equity sectors over the subsequent quarters and years ahead.

HYPOTHETICAL GROWTH OF $10,000 INVESTMENT

For the period November 17, 2021* to June 30, 2022

HISTORICAL PERFORMANCE

Total Return as of June 30, 2022

| | | Since

Inception

11/17/2021* | |

| AdvisorShares Poseidon Dynamic Cannabis ETF NAV | | | -75.52 | % |

| AdvisorShares Poseidon Dynamic Cannabis ETF Market Price** | | | -75.50 | % |

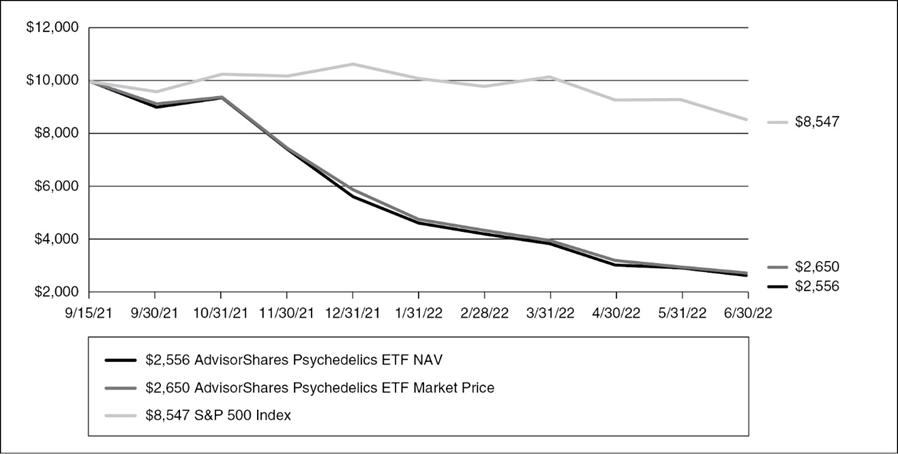

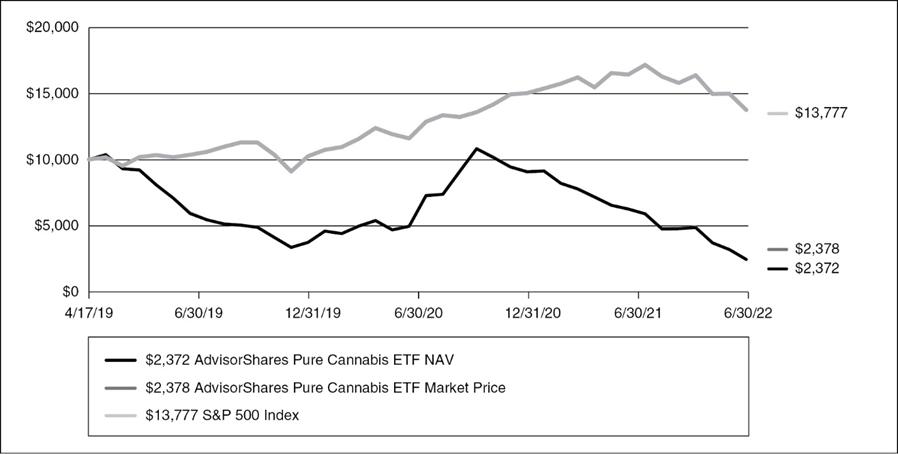

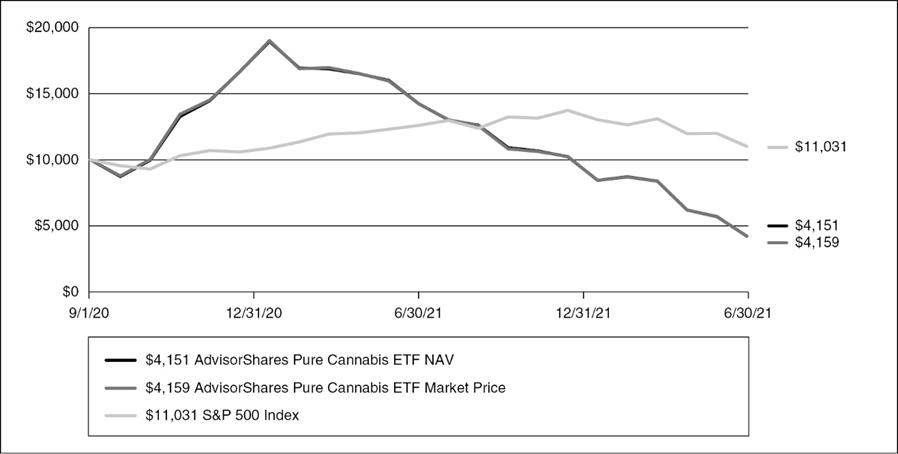

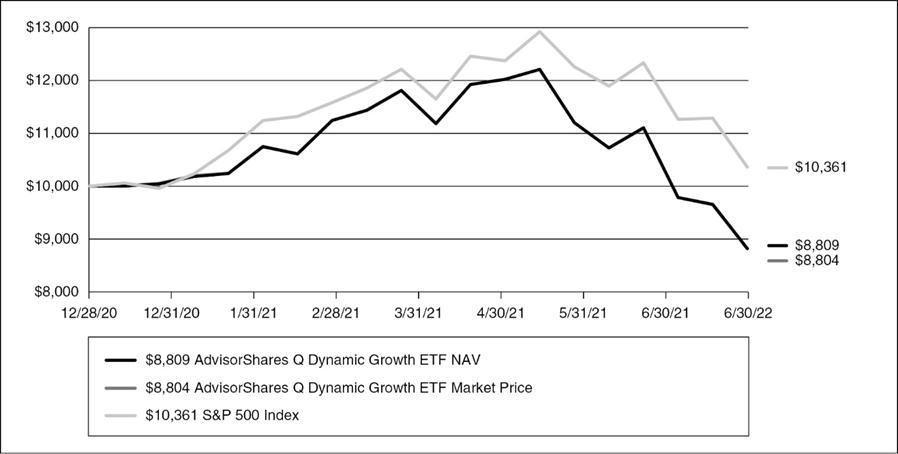

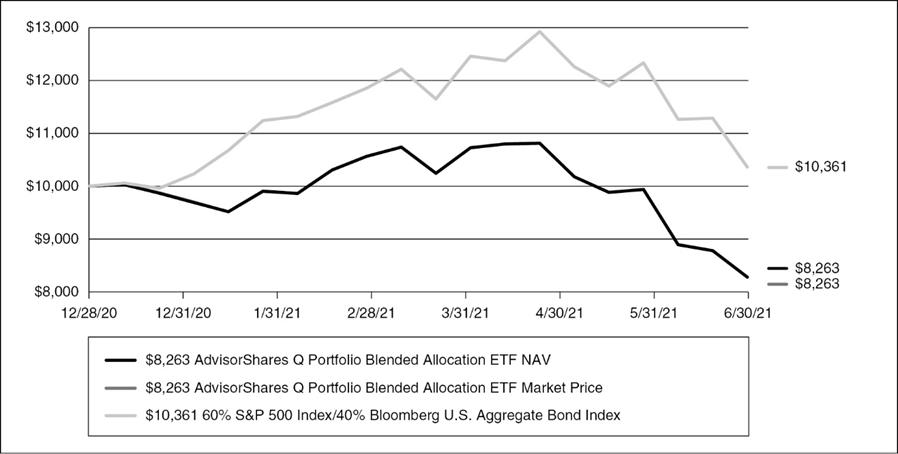

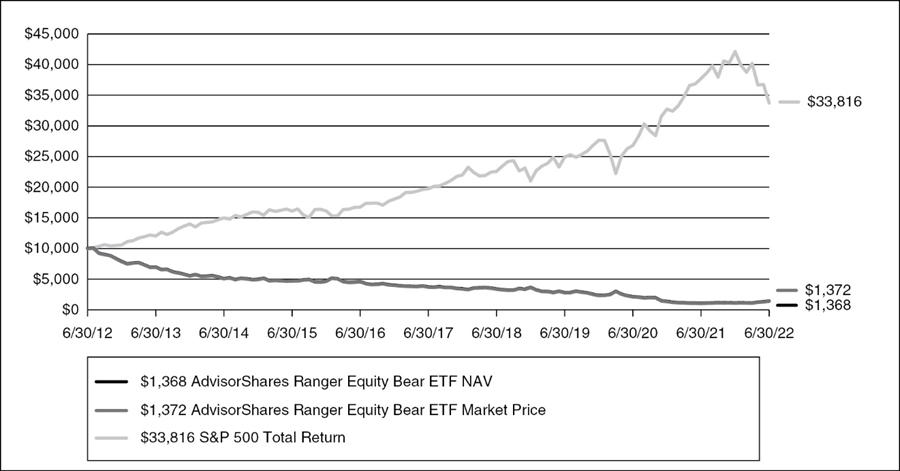

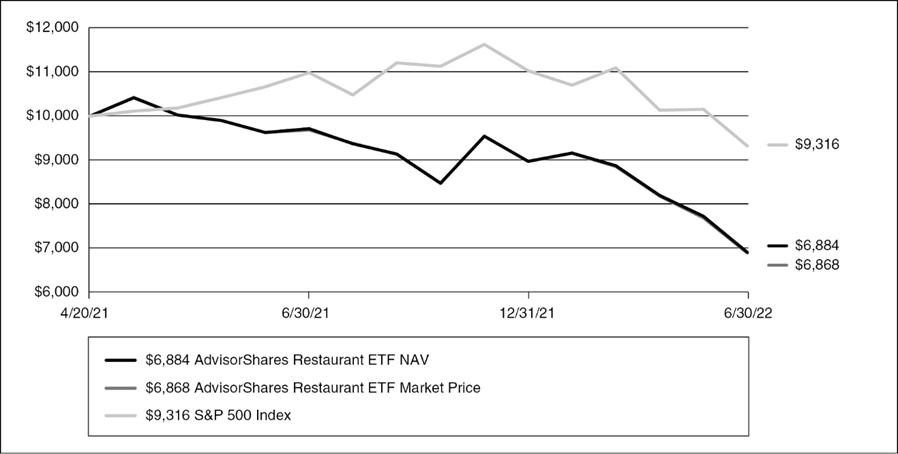

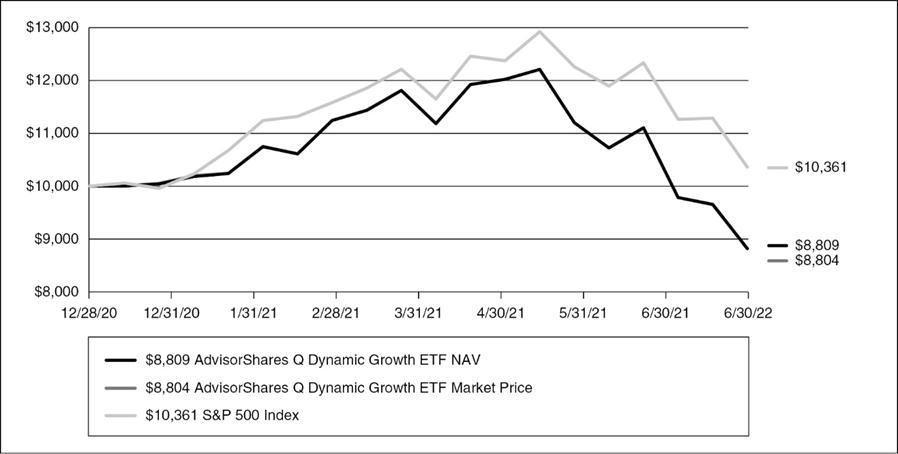

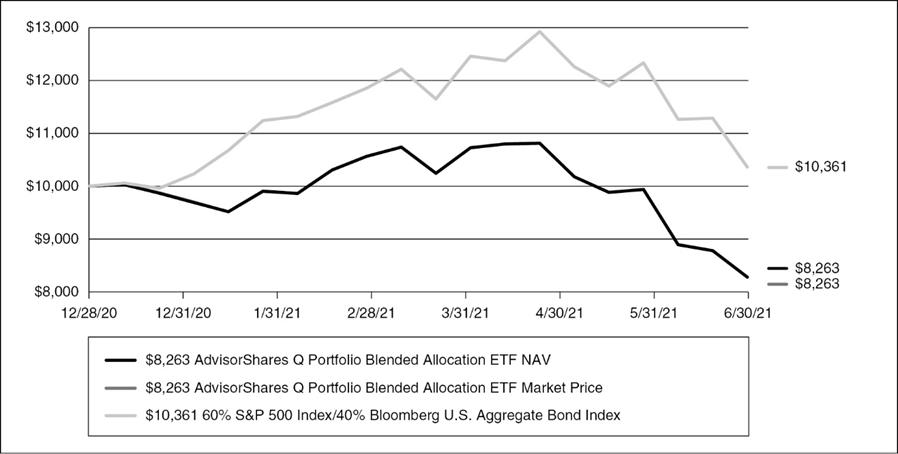

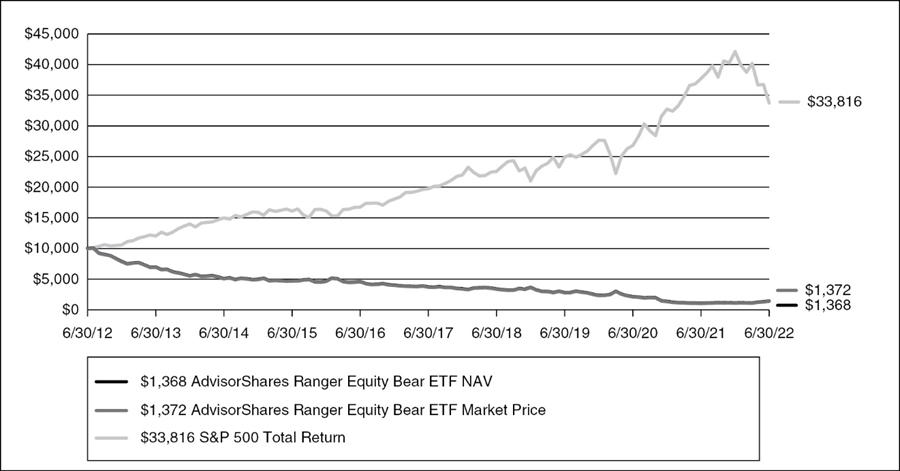

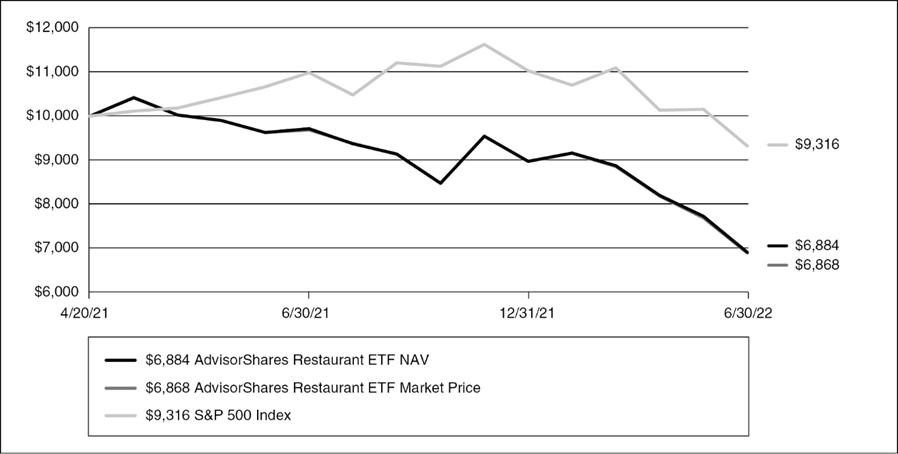

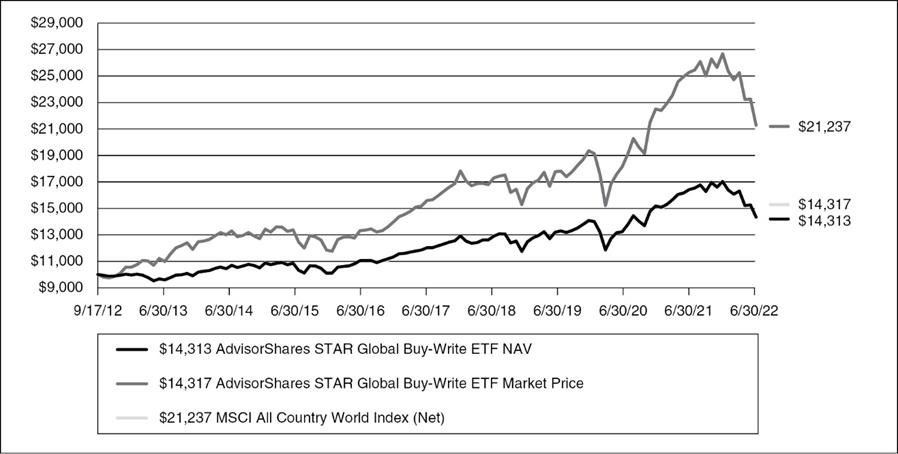

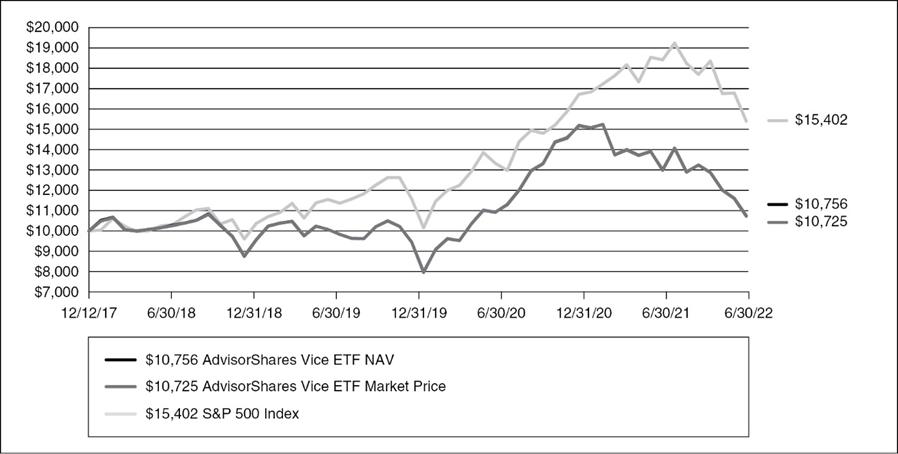

| S&P 500 Index | | | -18.70 | % |