UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the quarterly period ended June 30, 2024

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

For the transition period from to

Commission File Number 001-33708

| Philip Morris International Inc. | ||||||||||||||

(Exact name of registrant as specified in its charter)

| Virginia | 13-3435103 | ||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

| 677 Washington Blvd, Suite 1100 | Stamford | Connecticut | 06901 | ||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||

| Registrant’s telephone number, including area code | (203) | 905-2410 | ||||||

Former name, former address and former fiscal year, if changed since last report

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Stock, no par value | PM | New York Stock Exchange | ||||||||||||

| 0.625% Notes due 2024 | PM24B | New York Stock Exchange | ||||||||||||

| 3.250% Notes due 2024 | PM24A | New York Stock Exchange | ||||||||||||

| 2.750% Notes due 2025 | PM25 | New York Stock Exchange | ||||||||||||

| 3.375% Notes due 2025 | PM25A | New York Stock Exchange | ||||||||||||

| 2.750% Notes due 2026 | PM26A | New York Stock Exchange | ||||||||||||

| 2.875% Notes due 2026 | PM26 | New York Stock Exchange | ||||||||||||

| 0.125% Notes due 2026 | PM26B | New York Stock Exchange | ||||||||||||

| 3.125% Notes due 2027 | PM27 | New York Stock Exchange | ||||||||||||

| 3.125% Notes due 2028 | PM28 | New York Stock Exchange | ||||||||||||

| 2.875% Notes due 2029 | PM29 | New York Stock Exchange | ||||||||||||

| 3.375% Notes due 2029 | PM29A | New York Stock Exchange | ||||||||||||

| 3.750% Notes due 2031 | PM31B | New York Stock Exchange | ||||||||||||

| 0.800% Notes due 2031 | PM31 | New York Stock Exchange | ||||||||||||

| 3.125% Notes due 2033 | PM33 | New York Stock Exchange | ||||||||||||

| 2.000% Notes due 2036 | PM36 | New York Stock Exchange | ||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| 1.875% Notes due 2037 | PM37A | New York Stock Exchange | ||||||||||||

| 6.375% Notes due 2038 | PM38 | New York Stock Exchange | ||||||||||||

| 1.450% Notes due 2039 | PM39 | New York Stock Exchange | ||||||||||||

| 4.375% Notes due 2041 | PM41 | New York Stock Exchange | ||||||||||||

| 4.500% Notes due 2042 | PM42 | New York Stock Exchange | ||||||||||||

| 3.875% Notes due 2042 | PM42A | New York Stock Exchange | ||||||||||||

| 4.125% Notes due 2043 | PM43 | New York Stock Exchange | ||||||||||||

| 4.875% Notes due 2043 | PM43A | New York Stock Exchange | ||||||||||||

| 4.250% Notes due 2044 | PM44 | New York Stock Exchange | ||||||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ Accelerated filer ☐

Non-accelerated filer ☐ Smaller reporting company ☐

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

At July 19, 2024, there were 1,554,801,534 shares outstanding of the registrant’s common stock, no par value per share.

1

PHILIP MORRIS INTERNATIONAL INC.

TABLE OF CONTENTS

| Page No. | ||||||||

| PART I - | ||||||||

| Item 1. | ||||||||

| Condensed Consolidated Statements of Earnings for the | ||||||||

| Six Months Ended June 30, 2024 and 2023 | ||||||||

| Three Months Ended June 30, 2024 and 2023 | ||||||||

| Condensed Consolidated Statements of Comprehensive Earnings for the | ||||||||

| Six Months Ended June 30, 2024 and 2023 | ||||||||

| Three Months Ended June 30, 2024 and 2023 | ||||||||

| Condensed Consolidated Balance Sheets at | ||||||||

| June 30, 2024 and December 31, 2023 | ||||||||

| Condensed Consolidated Statements of Cash Flows for the | ||||||||

| Six Months Ended June 30, 2024 and 2023 | ||||||||

| Condensed Consolidated Statements of Stockholders’ (Deficit) Equity for the | ||||||||

| Six Months Ended June 30, 2024 and 2023 | ||||||||

| Three Months Ended June 30, 2024 and 2023 | ||||||||

| Item 2. | ||||||||

| Item 4. | ||||||||

| PART II - | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 2. | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

In this report, “PMI,” “we,” “us” and “our” refer to Philip Morris International Inc. and its subsidiaries.

Trademarks and service marks in this report are the registered property of, or licensed by, the subsidiaries of Philip Morris International Inc. and are italicized.

2

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements.

Philip Morris International Inc. and Subsidiaries

Condensed Consolidated Statements of Earnings

(in millions of dollars, except per share data)

(Unaudited)

| For the Six Months Ended June 30, | |||||||||||

| 2024 | 2023 | ||||||||||

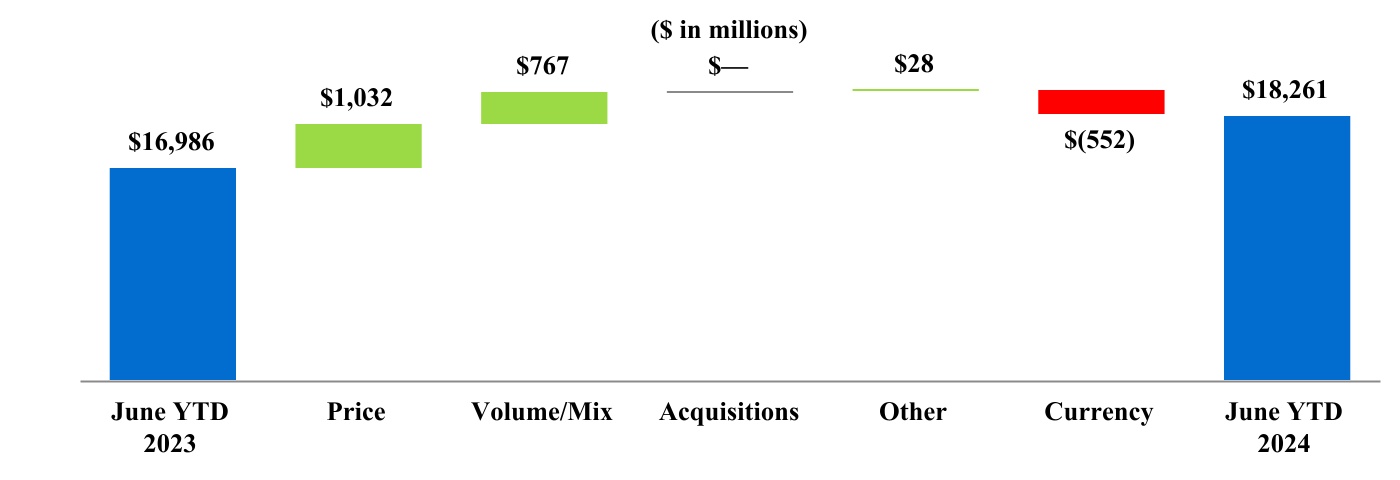

Net revenues 1 & 2 (Notes 7 & 12) | $ | 18,261 | $ | 16,986 | |||||||

| Cost of sales | 6,540 | 6,266 | |||||||||

| Gross profit | 11,721 | 10,720 | |||||||||

Marketing, administration and research costs 3 (Notes 4, 7 & 15) | 5,232 | 4,758 | |||||||||

| Impairment of goodwill (Note 4) | — | 665 | |||||||||

| Operating income | 6,489 | 5,297 | |||||||||

| Interest expense, net | 628 | 527 | |||||||||

| Pension and other employee benefit costs (Note 3) | 29 | 28 | |||||||||

| Earnings before income taxes | 5,832 | 4,742 | |||||||||

| Provision for income taxes | 1,410 | 988 | |||||||||

| Equity investments and securities (income)/loss, net | (352) | (30) | |||||||||

| Net earnings | $ | 4,774 | $ | 3,784 | |||||||

| Net earnings attributable to noncontrolling interests | 220 | 221 | |||||||||

| Net earnings attributable to PMI | $ | 4,554 | $ | 3,563 | |||||||

| Per share data (Note 6): | |||||||||||

| Basic earnings per share | $ | 2.92 | $ | 2.29 | |||||||

| Diluted earnings per share | $ | 2.92 | $ | 2.29 | |||||||

(1) Includes net revenues from related parties of $1,821 million and $1,774 million for the six months ended June 30, 2024 and 2023, respectively.

(2) Net of excise tax on products of $24,762 million and $24,048 million for the six months ended June 30, 2024 and 2023, respectively.

(3) Includes the South Korea indirect tax charge of $204 million for the six months ended June 30, 2023. For further details, see Note 7. Segment Reporting.

See notes to condensed consolidated financial statements.

3

Philip Morris International Inc. and Subsidiaries

Condensed Consolidated Statements of Earnings

(in millions of dollars, except per share data)

(Unaudited)

| For the Three Months Ended June 30, | |||||||||||

| 2024 | 2023 | ||||||||||

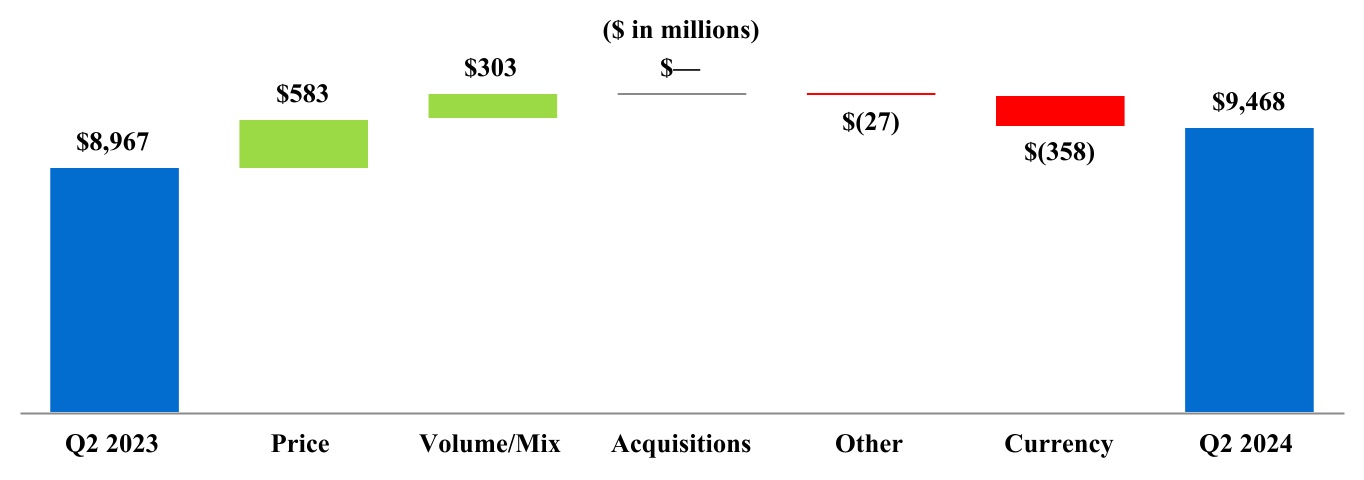

Net revenues 1 & 2 (Note 12) | $ | 9,468 | $ | 8,967 | |||||||

| Cost of sales | 3,345 | 3,228 | |||||||||

| Gross profit | 6,123 | 5,739 | |||||||||

Marketing, administration and research costs 3 (Notes 4 & 7) | 2,679 | 2,508 | |||||||||

| Impairment of goodwill (Note 4) | — | 665 | |||||||||

| Operating income | 3,444 | 2,566 | |||||||||

| Interest expense, net | 329 | 297 | |||||||||

| Pension and other employee benefit costs (Note 3) | 14 | 6 | |||||||||

| Earnings before income taxes | 3,101 | 2,263 | |||||||||

| Provision for income taxes | 734 | 560 | |||||||||

| Equity investments and securities (income)/loss, net | (161) | 21 | |||||||||

| Net earnings | 2,528 | 1,682 | |||||||||

| Net earnings attributable to noncontrolling interests | 122 | 114 | |||||||||

| Net earnings attributable to PMI | $ | 2,406 | $ | 1,568 | |||||||

Per share data (Note 6): | |||||||||||

| Basic earnings per share | $ | 1.54 | $ | 1.01 | |||||||

| Diluted earnings per share | $ | 1.54 | $ | 1.01 | |||||||

(1) Includes net revenues from related parties of $961 million and $901 million for the three months ended June 30, 2024 and 2023, respectively.

(2) Net of excise taxes of $12,923 million and $12,749 million for the three months ended June 30, 2024 and 2023, respectively.

(3) Includes the South Korea indirect tax charge of $204 million for the three months ended June 30, 2023. For further details, see Note 7. Segment Reporting.

See notes to condensed consolidated financial statements.

4

Philip Morris International Inc. and Subsidiaries

Condensed Consolidated Statements of Comprehensive Earnings

(in millions of dollars)

(Unaudited)

| For the Six Months Ended June 30, | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| Net earnings | $ | 4,774 | $ | 3,784 | ||||||||||

| Other comprehensive earnings (losses), net of income taxes: | ||||||||||||||

| Change in currency translation adjustments: | ||||||||||||||

| Unrealized gains (losses), net of income taxes of $(130) in 2024 and $83 in 2023 | 365 | (827) | ||||||||||||

| (Gains)/losses transferred to earnings, net of income taxes of $0 in 2024 and 2023 (Notes 11, 15 & 18) | 155 | 2 | ||||||||||||

Change in net loss and prior service cost: | ||||||||||||||

| Net gains (losses) and prior service costs, net of income taxes of $0 in 2024 and $0 in 2023 | — | — | ||||||||||||

| Amortization of net losses, prior service costs and net transition costs, net of income taxes of $(18) in 2024 and $(14) in 2023 | 67 | 41 | ||||||||||||

Change in fair value of derivatives accounted for as hedges: | ||||||||||||||

| Gains (losses) recognized, net of income taxes of $(55) in 2024 and $(48) in 2023 | 286 | 246 | ||||||||||||

| (Gains) losses transferred to earnings, net of income taxes of $23 in 2024 and $22 in 2023 | (94) | (104) | ||||||||||||

| Total other comprehensive earnings (losses) | 779 | (642) | ||||||||||||

| Total comprehensive earnings | 5,553 | 3,142 | ||||||||||||

| Less comprehensive earnings (losses) attributable to: | ||||||||||||||

| Noncontrolling interests | 114 | 65 | ||||||||||||

| Comprehensive earnings attributable to PMI | $ | 5,439 | $ | 3,077 | ||||||||||

See notes to condensed consolidated financial statements.

5

Philip Morris International Inc. and Subsidiaries

Condensed Consolidated Statements of Comprehensive Earnings

(in millions of dollars)

(Unaudited)

| For the Three Months Ended June 30, | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| Net earnings | $ | 2,528 | $ | 1,682 | ||||||||||

| Other comprehensive earnings (losses), net of income taxes: | ||||||||||||||

| Change in currency translation adjustments: | ||||||||||||||

| Unrealized gains (losses), net of income taxes of $(28) in 2024 and $31 in 2023 | (123) | (572) | ||||||||||||

| (Gains)/losses transferred to earnings, net of income taxes of $0 in 2024 and 2023 (Note 18) | 113 | 2 | ||||||||||||

Change in net loss and prior service cost: | ||||||||||||||

| Net gains (losses) and prior service costs, net of income taxes of $0 in 2024 and $1 in 2023 | — | (2) | ||||||||||||

| Amortization of net losses, prior service costs and net transition costs, net of income taxes of $(9) in 2024 and $(7) in 2023 | 33 | 16 | ||||||||||||

Change in fair value of derivatives accounted for as hedges: | ||||||||||||||

| Gains (losses) recognized, net of income taxes of $(16) in 2024 and $(32) in 2023 | 108 | 187 | ||||||||||||

| (Gains) losses transferred to earnings, net of income taxes of $7 in 2024 and $16 in 2023 | (48) | (75) | ||||||||||||

| Total other comprehensive earnings (losses) | 83 | (444) | ||||||||||||

| Total comprehensive earnings | 2,611 | 1,238 | ||||||||||||

| Less comprehensive earnings (losses) attributable to: | ||||||||||||||

| Noncontrolling interests | 70 | 101 | ||||||||||||

| Comprehensive earnings attributable to PMI | $ | 2,541 | $ | 1,137 | ||||||||||

See notes to condensed consolidated financial statements.

6

Philip Morris International Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(in millions of dollars)

(Unaudited)

| June 30, 2024 | December 31, 2023 | ||||||||||

| ASSETS | |||||||||||

| Cash and cash equivalents | $ | 4,807 | $ | 3,060 | |||||||

Trade receivables (less allowances of $54 in 2024 and $79 in 2023) (1) | 4,240 | 3,461 | |||||||||

| Other receivables (less allowances of $21 in 2024 and $35 in 2023) | 877 | 930 | |||||||||

Inventories: | |||||||||||

| Leaf tobacco | 1,920 | 1,942 | |||||||||

| Other raw materials | 2,359 | 2,293 | |||||||||

| Finished product | 5,103 | 6,539 | |||||||||

| 9,382 | 10,774 | ||||||||||

| Other current assets | 1,722 | 1,530 | |||||||||

Total current assets | 21,028 | 19,755 | |||||||||

Property, plant and equipment, at cost | 16,736 | 17,080 | |||||||||

| Less: accumulated depreciation | 9,472 | 9,564 | |||||||||

| 7,264 | 7,516 | ||||||||||

| Goodwill (Note 4) | 16,819 | 16,779 | |||||||||

| Other intangible assets, net (Note 4) | 12,171 | 9,864 | |||||||||

| Equity investments (Note 12) | 4,961 | 4,929 | |||||||||

| Deferred income taxes | 918 | 814 | |||||||||

| Other assets (less allowances of $24 in 2024 and $25 in 2023) (Note 18) | 2,621 | 5,647 | |||||||||

| TOTAL ASSETS | $ | 65,782 | $ | 65,304 | |||||||

(1) Includes trade receivables from related parties of $834 million and $710 million as of June 30, 2024, and December 31, 2023, respectively. For further details, see Note 12. Related Parties - Equity Investments and Other.

See notes to condensed consolidated financial statements.

Continued

7

Philip Morris International Inc. and Subsidiaries

Condensed Consolidated Balance Sheets (Continued)

(in millions of dollars, except share data)

(Unaudited)

| June 30, 2024 | December 31, 2023 | ||||||||||

| LIABILITIES | |||||||||||

| Short-term borrowings (Note 10) | $ | 139 | $ | 1,968 | |||||||

| Current portion of long-term debt (Note 10) | 4,353 | 4,698 | |||||||||

| Accounts payable | 3,591 | 4,143 | |||||||||

| Accrued liabilities: | |||||||||||

| Marketing and selling | 961 | 862 | |||||||||

| Taxes, except income taxes | 6,826 | 7,514 | |||||||||

| Employment costs | 1,052 | 1,262 | |||||||||

| Dividends payable | 2,040 | 2,041 | |||||||||

| Other | 2,453 | 2,737 | |||||||||

| Income taxes | 1,001 | 1,158 | |||||||||

| Total current liabilities | 22,416 | 26,383 | |||||||||

Long-term debt (Note 10) | 44,647 | 41,243 | |||||||||

| Deferred income taxes | 2,651 | 2,335 | |||||||||

| Employment costs | 2,823 | 3,046 | |||||||||

| Income taxes and other liabilities | 1,187 | 1,743 | |||||||||

| Total liabilities | 73,724 | 74,750 | |||||||||

Contingencies (Note 8) | |||||||||||

STOCKHOLDERS’ (DEFICIT) EQUITY | |||||||||||

Common stock, no par value (2,109,316,331 shares issued in 2024 and 2023) | — | — | |||||||||

| Additional paid-in capital | 2,249 | 2,285 | |||||||||

| Earnings reinvested in the business | 34,582 | 34,090 | |||||||||

| Accumulated other comprehensive losses (Note 11) | (10,930) | (11,815) | |||||||||

| 25,901 | 24,560 | ||||||||||

Less: cost of repurchased stock (554,559,782 and 556,891,800 shares in 2024 and 2023, respectively) | 35,645 | 35,785 | |||||||||

| Total PMI stockholders’ deficit | (9,744) | (11,225) | |||||||||

| Noncontrolling interests | 1,802 | 1,779 | |||||||||

| Total stockholders’ deficit | (7,942) | (9,446) | |||||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ (DEFICIT) EQUITY | $ | 65,782 | $ | 65,304 | |||||||

See notes to condensed consolidated financial statements.

8

Philip Morris International Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(in millions of dollars)

(Unaudited)

| For the Six Months Ended June 30, | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES | ||||||||||||||

| Net earnings | $ | 4,774 | $ | 3,784 | ||||||||||

| Adjustments to reconcile net earnings to operating cash flows: | ||||||||||||||

| Depreciation and amortization expense | 812 | 600 | ||||||||||||

| Impairment of goodwill and other intangibles (Note 4) | 27 | 680 | ||||||||||||

| Deferred income tax (benefit) provision | 59 | (211) | ||||||||||||

| Asset impairment and exit costs, net of cash paid (Note 15) | 136 | 85 | ||||||||||||

| Cash effects of changes, net of the effects from acquired companies: | ||||||||||||||

Receivables, net (1) | (978) | (292) | ||||||||||||

| Inventories | 1,047 | (74) | ||||||||||||

| Accounts payable | (145) | (414) | ||||||||||||

| Accrued liabilities and other current assets | (341) | (1,603) | ||||||||||||

| Income taxes | (329) | (509) | ||||||||||||

| Pension plan contributions (Note 3) | (55) | (72) | ||||||||||||

| Other | (134) | 513 | ||||||||||||

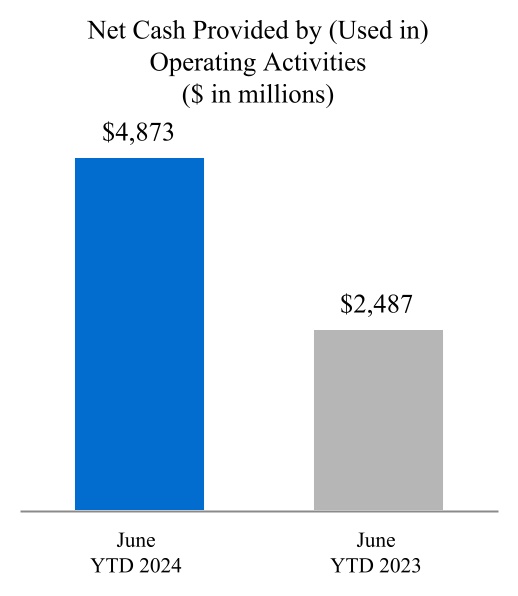

| Net cash provided by (used in) operating activities | 4,873 | 2,487 | ||||||||||||

| CASH PROVIDED BY (USED IN) INVESTING ACTIVITIES | ||||||||||||||

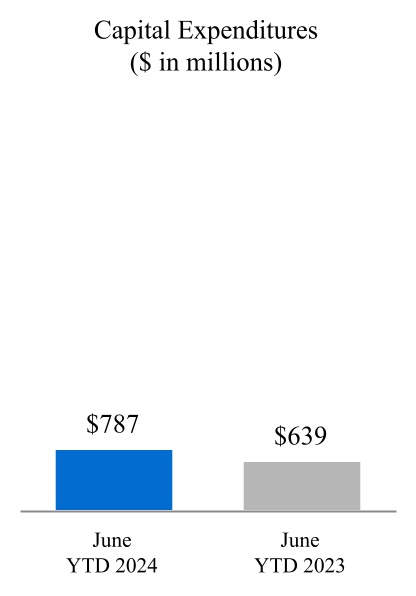

| Capital expenditures | (787) | (639) | ||||||||||||

| Acquisitions, net of acquired cash (Note 18) | 44 | — | ||||||||||||

| Equity investments | (113) | (91) | ||||||||||||

| Collateral posted/settlements for derivatives, (paid)/returned (Note 5) | 439 | (342) | ||||||||||||

| Other | (113) | (2) | ||||||||||||

| Net cash provided by (used in) investing activities | (530) | (1,074) | ||||||||||||

(1) Includes amounts from related parties of $(142) million and $(134) million for June 30, 2024 and 2023, respectively

See notes to condensed consolidated financial statements.

Continued

9

Philip Morris International Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows (Continued)

(in millions of dollars)

(Unaudited)

| For the Six Months Ended June 30, | |||||||||||

| 2024 | 2023 | ||||||||||

| CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES | |||||||||||

| Short-term borrowing activity by original maturity: | |||||||||||

| Net issuances (repayments) - maturities of 90 days or less | $ | (1,463) | $ | 2,356 | |||||||

| Issuances - maturities longer than 90 days | 100 | 712 | |||||||||

| Repayments - maturities longer than 90 days | (433) | (180) | |||||||||

| Repayments under credit facilities related to Swedish Match AB acquisition | — | (4,430) | |||||||||

| Long-term debt proceeds | 5,194 | 7,652 | |||||||||

| Long-term debt repaid | (1,812) | (2,034) | |||||||||

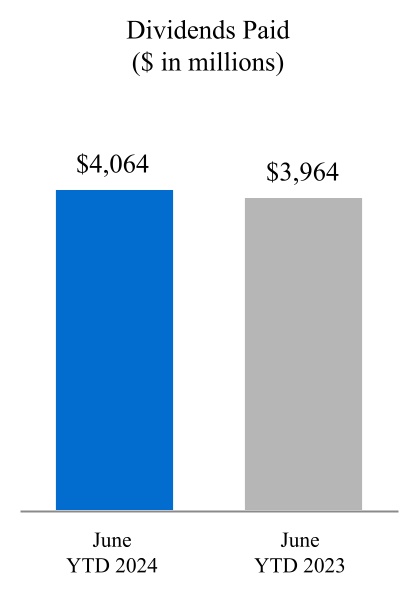

| Dividends paid | (4,064) | (3,964) | |||||||||

| Collateral received/settlements for derivatives, received/(returned) | 350 | (5) | |||||||||

| Payments to acquire Swedish Match AB noncontrolling interests | — | (883) | |||||||||

| Noncontrolling interests activity and Other (Note 18) | (269) | (144) | |||||||||

| Net cash provided by (used in) financing activities | (2,397) | (920) | |||||||||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (216) | (198) | |||||||||

Cash, cash equivalents and restricted cash (1): | |||||||||||

| Increase (Decrease) | 1,730 | 295 | |||||||||

| Balance at beginning of period | 3,146 | 3,217 | |||||||||

| Balance at end of period | $ | 4,876 | $ | 3,512 | |||||||

(1) The amounts for cash, cash equivalents and restricted cash shown above include restricted cash of $69 million and $20 million as of June 30, 2024 and 2023, respectively, and $86 million and $10 million as of December 31, 2023 and 2022, respectively, which were included in other current assets in the condensed consolidated balance sheets.

See notes to condensed consolidated financial statements.

10

Philip Morris International Inc. and Subsidiaries

Condensed Consolidated Statements of Stockholders’ (Deficit) Equity

For the Six Months Ended June 30, 2024 and 2023

(in millions of dollars, except per share amounts)

(Unaudited)

| PMI Stockholders’ (Deficit) Equity | |||||||||||||||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-in Capital | Earnings Reinvested in the Business | Accumulated Other Comprehensive Losses | Cost of Repurchased Stock | Noncontrolling Interests | Total | |||||||||||||||||||||||||||||||||||||||||

| Balances, January 1, 2023 | $ | — | $ | 2,230 | $ | 34,289 | $ | (9,559) | $ | (35,917) | $ | 2,646 | $ | (6,311) | |||||||||||||||||||||||||||||||||

| Net earnings | 3,563 | 221 | 3,784 | ||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive earnings (losses), net of income taxes | (665) | 23 | (642) | ||||||||||||||||||||||||||||||||||||||||||||

| Issuance of stock awards | (11) | 126 | 115 | ||||||||||||||||||||||||||||||||||||||||||||

| Dividends declared ($2.54 per share) | (3,959) | (3,959) | |||||||||||||||||||||||||||||||||||||||||||||

| Dividends paid to noncontrolling interests | (318) | (318) | |||||||||||||||||||||||||||||||||||||||||||||

| Sale (purchase) of subsidiary shares to/(from) noncontrolling interests (Note 18) | 21 | 179 | (829) | (629) | |||||||||||||||||||||||||||||||||||||||||||

| Balances, June 30, 2023 | $ | — | $ | 2,240 | $ | 33,893 | $ | (10,045) | $ | (35,791) | $ | 1,743 | $ | (7,960) | |||||||||||||||||||||||||||||||||

| Balances, January 1, 2024 | $ | — | $ | 2,285 | $ | 34,090 | $ | (11,815) | $ | (35,785) | $ | 1,779 | $ | (9,446) | |||||||||||||||||||||||||||||||||

| Net earnings | 4,554 | 220 | 4,774 | ||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive earnings (losses), net of income taxes | 885 | (106) | 779 | ||||||||||||||||||||||||||||||||||||||||||||

| Issuance of stock awards | (36) | 140 | 104 | ||||||||||||||||||||||||||||||||||||||||||||

| Dividends declared ($2.60 per share) | (4,062) | (4,062) | |||||||||||||||||||||||||||||||||||||||||||||

| Dividends paid to noncontrolling interests | (262) | (262) | |||||||||||||||||||||||||||||||||||||||||||||

| Acquisitions (Note 18) | 159 | 159 | |||||||||||||||||||||||||||||||||||||||||||||

| Sale (purchase) of subsidiary shares to/(from) noncontrolling interests | 12 | 12 | |||||||||||||||||||||||||||||||||||||||||||||

| Balances, June 30, 2024 | $ | — | $ | 2,249 | $ | 34,582 | $ | (10,930) | $ | (35,645) | $ | 1,802 | $ | (7,942) | |||||||||||||||||||||||||||||||||

See notes to condensed consolidated financial statements.

11

Philip Morris International Inc. and Subsidiaries

Condensed Consolidated Statements of Stockholders’ (Deficit) Equity

For the Three Months Ended June 30, 2024 and 2023

(in millions of dollars, except per share amounts)

(Unaudited)

| PMI Stockholders’ (Deficit) Equity | |||||||||||||||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-in Capital | Earnings Reinvested in the Business | Accumulated Other Comprehensive Losses | Cost of Repurchased Stock | Noncontrolling Interests | Total | |||||||||||||||||||||||||||||||||||||||||

| Balances, April 1, 2023 | $ | — | $ | 2,188 | $ | 34,303 | $ | (9,614) | $ | (35,801) | $ | 1,871 | $ | (7,053) | |||||||||||||||||||||||||||||||||

| Net earnings | 1,568 | 114 | 1,682 | ||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive earnings (losses), net of income taxes | (431) | (13) | (444) | ||||||||||||||||||||||||||||||||||||||||||||

| Issuance of stock awards | 52 | 10 | 62 | ||||||||||||||||||||||||||||||||||||||||||||

| Dividends declared ($1.27 per share) | (1,978) | (1,978) | |||||||||||||||||||||||||||||||||||||||||||||

| Dividends paid to noncontrolling interests | (225) | (225) | |||||||||||||||||||||||||||||||||||||||||||||

| Sale (purchase) of subsidiary shares to/(from) noncontrolling interests | (4) | (4) | |||||||||||||||||||||||||||||||||||||||||||||

| Balances, June 30, 2023 | $ | — | $ | 2,240 | $ | 33,893 | $ | (10,045) | $ | (35,791) | $ | 1,743 | $ | (7,960) | |||||||||||||||||||||||||||||||||

| Balances, April 1, 2024 | $ | — | $ | 2,205 | $ | 34,208 | $ | (11,065) | $ | (35,657) | $ | 1,746 | $ | (8,563) | |||||||||||||||||||||||||||||||||

| Net earnings | 2,406 | 122 | 2,528 | ||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive earnings (losses), net of income taxes | 135 | (52) | 83 | ||||||||||||||||||||||||||||||||||||||||||||

| Issuance of stock awards | 44 | 12 | 56 | ||||||||||||||||||||||||||||||||||||||||||||

| Dividends declared ($1.30 per share) | (2,032) | (2,032) | |||||||||||||||||||||||||||||||||||||||||||||

| Dividends paid to noncontrolling interests | (186) | (186) | |||||||||||||||||||||||||||||||||||||||||||||

| Acquisitions (Note 18) | 159 | 159 | |||||||||||||||||||||||||||||||||||||||||||||

| Sale (purchase) of subsidiary shares to/(from) noncontrolling interests | 13 | 13 | |||||||||||||||||||||||||||||||||||||||||||||

| Balances, June 30, 2024 | $ | — | $ | 2,249 | $ | 34,582 | $ | (10,930) | $ | (35,645) | $ | 1,802 | $ | (7,942) | |||||||||||||||||||||||||||||||||

See notes to condensed consolidated financial statements.

12

Philip Morris International Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Note 1. Background and Basis of Presentation:

Background

Philip Morris International Inc. is a holding company incorporated in Virginia, U.S.A. (also referred to herein as the U.S., the United States or the United States of America), whose subsidiaries and affiliates and their licensees are primarily engaged in the manufacture and sale of cigarettes and smoke-free products. Throughout these financial statements, the term "PMI" refers to Philip Morris International Inc. and its subsidiaries.

Smoke-Free Business ("SFB”) is the term PMI uses to refer to all of its smoke-free products. SFB also includes wellness and healthcare products, as well as consumer accessories, such as lighters and matches.

Smoke-free products (also referred to herein as "SFPs") is the term PMI uses to refer to all of its products that provide nicotine without combusting tobacco, such as heat-not-burn, e-vapor, and oral smokeless, and that therefore generate far lower levels of harmful chemicals. As such, these products have the potential to present less risk of harm versus continued smoking.

"Platform 1" is the term PMI uses to refer to PMI’s smoke-free products that use a precisely controlled heating device into which a specially designed and proprietary tobacco unit is inserted and heated to generate an aerosol.

Basis of Presentation

The interim condensed consolidated financial statements of PMI are unaudited. These interim condensed consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America ("U.S. GAAP") and such principles are applied on a consistent basis. Certain information and footnote disclosures normally included in annual financial statements prepared in accordance with U.S.GAAP have been omitted. It is the opinion of PMI’s management that all adjustments necessary for a fair statement of the interim results presented have been reflected therein. All such adjustments were of a normal recurring nature. Net revenues and net earnings attributable to PMI for any interim period are not necessarily indicative of results that may be expected for the entire year.

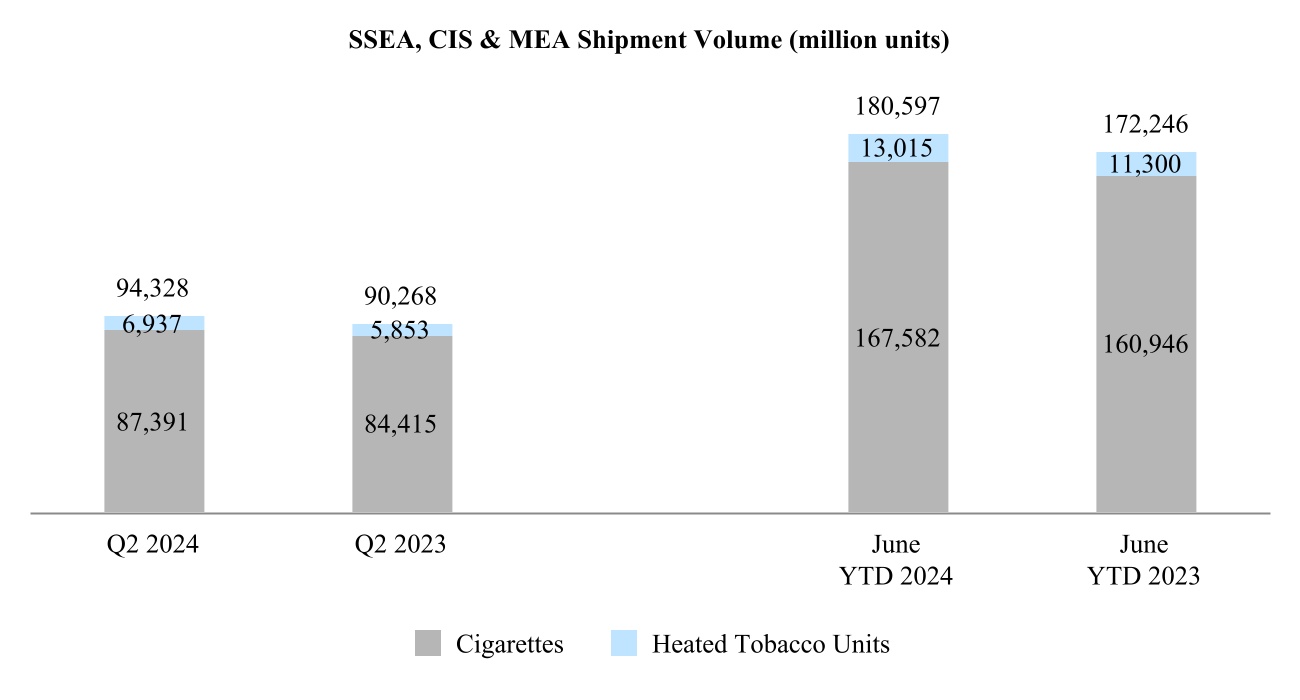

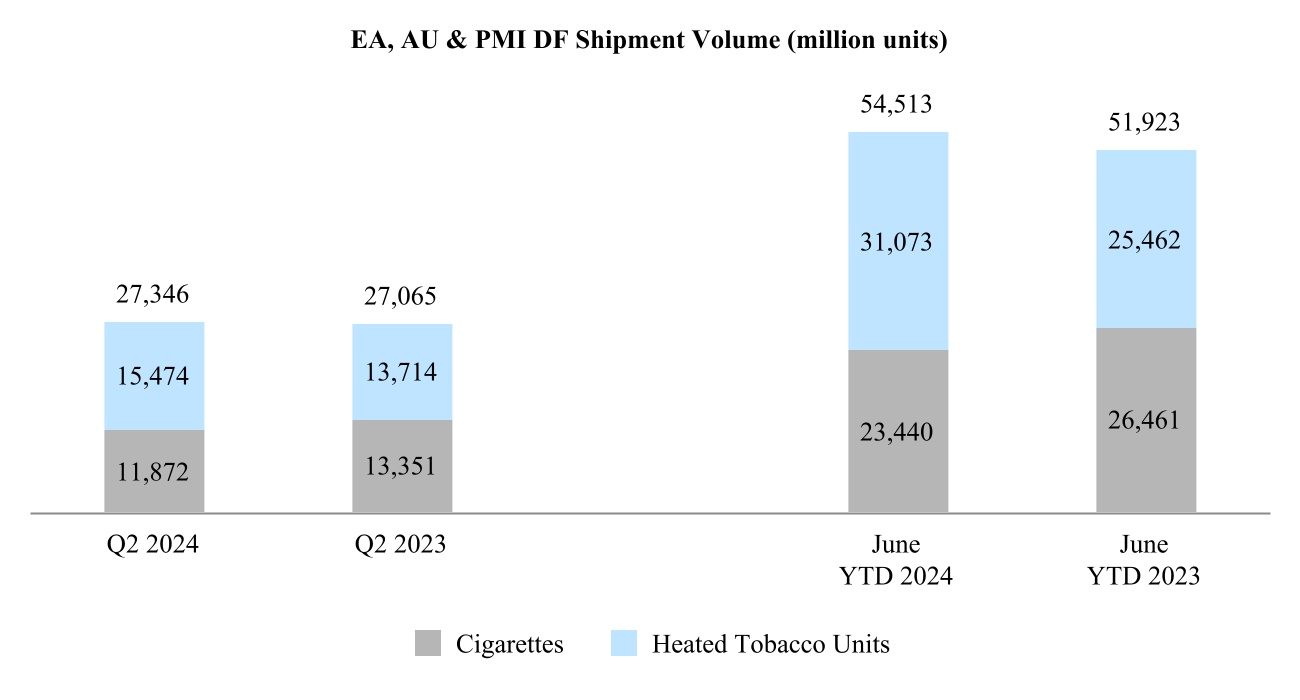

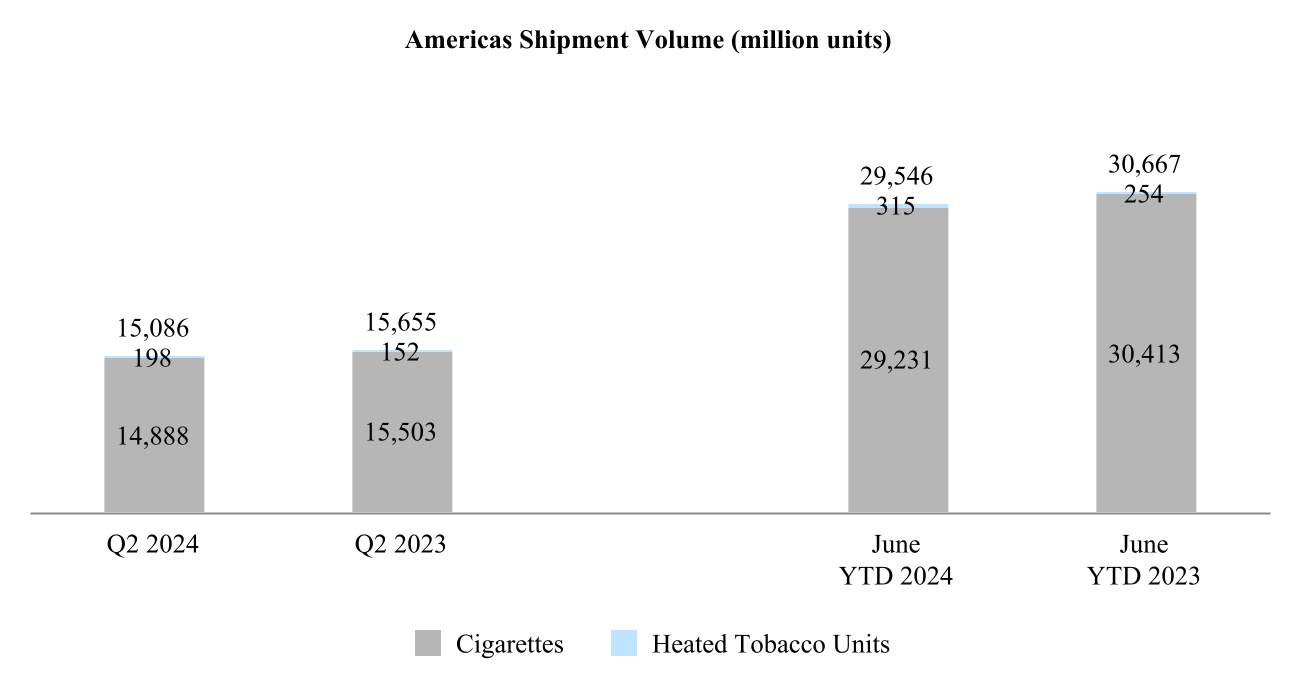

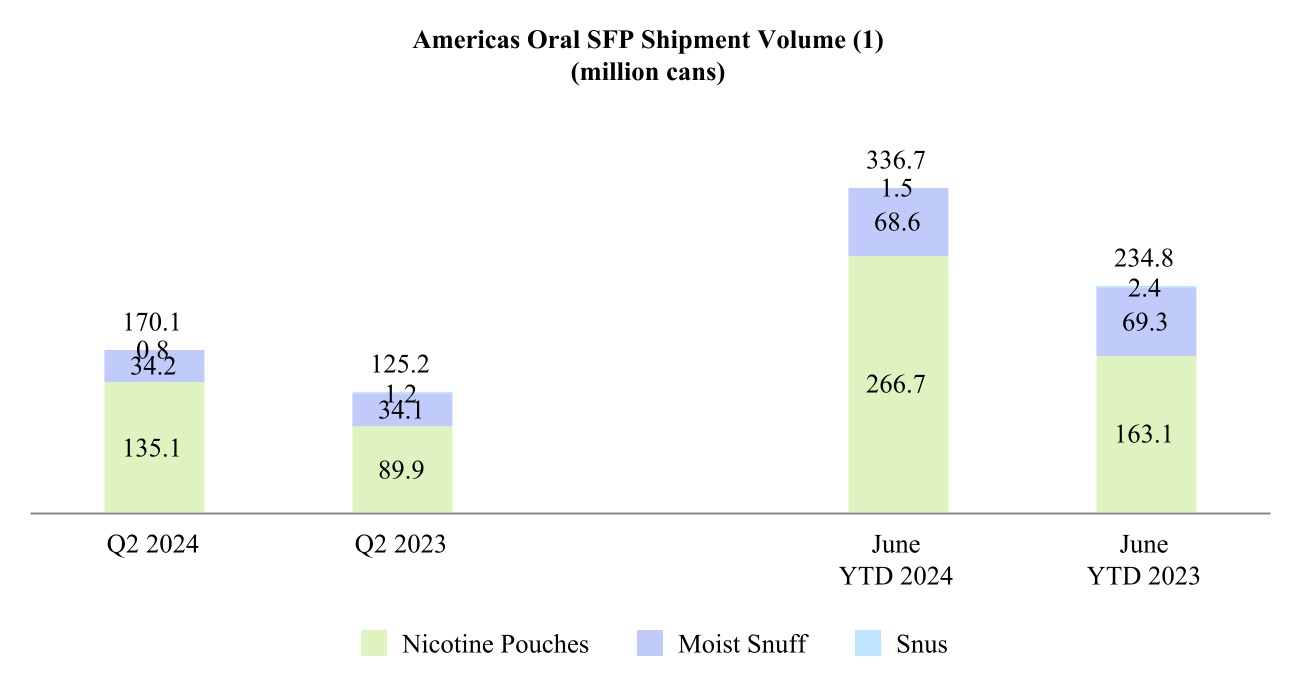

Following the combination and the progress in 2023 toward the integration of the Swedish Match business into PMI's existing regional structure, PMI updated in January 2024 its segment reporting by including the former Swedish Match segment results into the four existing geographical segments. The four existing geographical segments are as follows: Europe Region; South and Southeast Asia, Commonwealth of Independent States, Middle East and Africa Region ("SSEA, CIS & MEA"); East Asia, Australia, and PMI Duty Free Region ("EA, AU & PMI DF"); and Americas Region. The Wellness and Healthcare ("W&H") segment remained unchanged.

Certain prior years' amounts have been reclassified to conform with the current year's presentation as a result of the new segment structure discussed above. See Note 4. Goodwill and Other Intangible Assets, net, Note 7. Segment Reporting and Note 15. Asset Impairment and Exit Costs for further details. These reclassifications did not impact PMI’s consolidated financial position, results of operations or cash flows in any of the periods presented.

These statements should be read in conjunction with the audited consolidated financial statements and related notes, which appear in PMI’s Annual Report on Form 10-K for the year ended December 31, 2023.

Note 2. Stock Plans:

In May 2022, PMI’s shareholders approved the Philip Morris International Inc. 2022 Performance Incentive Plan (the “2022 Plan”). Under the 2022 Plan, PMI may grant to eligible employees restricted shares and restricted share units, performance-based cash incentive awards and performance-based equity awards. Up to 25 million shares of PMI’s common stock may be issued under the 2022 Plan. At June 30, 2024, shares available for grant under the 2022 Plan were 19,161,366.

In May 2017, PMI’s shareholders approved the Philip Morris International Inc. 2017 Stock Compensation Plan for Non-Employee Directors (the “2017 Non-Employee Directors Plan”). A non-employee director is defined as a member of the PMI Board of Directors who is not a full-time employee of PMI or of any corporation in which PMI owns, directly or indirectly, stock possessing at least 50% of the total combined voting power of all classes of stock entitled to vote in the election of

13

Philip Morris International Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

directors in such corporation. Up to 1 million shares of PMI common stock may be awarded under the 2017 Non-Employee Directors Plan. At June 30, 2024, shares available for grant under the plan were 855,920.

Restricted share unit (RSU) awards

During the six months ended June 30, 2024 and 2023, shares granted to eligible employees and the weighted-average grant date fair value per share related to RSU awards were as follows:

| Number of Shares Granted | Weighted-Average Grant Date Fair Value Per RSU Award Granted | ||||||||||||||||

| 2024 | 1,976,920 | $ 89.05 | |||||||||||||||

| 2023 | 1,752,050 | $ 101.98 | |||||||||||||||

Compensation expense related to RSU awards was as follows:

| Compensation Expense Related to RSU Awards | ||||||||

| (in millions) | For the Six Months Ended June 30, | For the Three Months Ended June 30, | ||||||

| 2024 | $ 84 | $ 37 | ||||||

| 2023 | $ 86 | $ 36 | ||||||

As of June 30, 2024, PMI had $228 million of total unrecognized compensation cost related to non-vested RSU awards. The cost is recognized over the original restriction period of the awards, which is typically three years after the date of the award, or upon death, disability or reaching the age of 58.

During the six months ended June 30, 2024, 1,741,966 RSU awards vested. The grant date fair value of all the vested awards was approximately $148 million. The total fair value of RSU awards that vested during the six months ended June 30, 2024 was approximately $159 million.

Performance share unit (PSU) awards

During the six months ended June 30, 2024 and 2023, PMI granted PSU awards to certain executives. The PSU awards require the achievement of certain performance metrics, which are predetermined at the time of grant, typically over a three-year performance cycle.

The performance metrics for such PSU's granted during the six months ended June 30, 2023 consisted of PMI's Total Shareholder Return ("TSR") relative to a predetermined peer group and on an absolute basis (40% weight), PMI’s currency-neutral compound annual adjusted diluted earnings per share growth rate (30% weight), and a Sustainability Index, which consists of two drivers:

•Product Sustainability (20% weight) measuring progress primarily on PMI's efforts to maximize the benefits of smoke-free products, purposefully phase out cigarettes, and reduce post-consumer waste; and

•Operational Sustainability (10% weight) measuring progress on PMI's efforts to tackle climate change, preserve nature, improve the quality of life of people in its supply chain, and foster an empowered, and inclusive workplace.

The performance metrics, targets and relative weights for the PSU’s granted during the six months ended June 30, 2024 were the same as the PSU’s granted during the six months ended June 30, 2023, with the exception of adjustments made to certain components of the Sustainability Index intended to address PMI's developing sustainability strategy and reporting.

The PSU performance metrics may be adjusted if appropriate to reflect the impact of unusual or infrequently occurring events, including, to the extent significant, corporate transactions, accounting or tax law changes, asset write-downs, litigation or claim adjustments, foreign exchange gains and losses, unbudgeted capital expenditures and other such events.

14

Philip Morris International Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

The aggregate of the weighted performance factors for the three metrics in each such PSU award determines the percentage of PSUs that will vest at the end of the three-year performance cycle. The minimum percentage of such PSUs that can vest is zero, with a target percentage of 100 and a maximum percentage of 200. Each such vested PSU entitles the participant to one share of common stock. An aggregate weighted PSU performance factor of 100 will result in the targeted number of PSUs being vested. At the end of the performance cycle, participants are entitled to an amount equivalent to the accumulated dividends paid on common stock during the performance cycle for the number of shares earned.

During the six months ended June 30, 2024 and 2023, shares granted to eligible employees and the grant date fair value per share related to PSU awards were as follows:

| Number of Shares Granted | Weighted- Average PSU Grant Date Fair Value Subject to Other Performance Factors | Weighted- Average PSU Grant Date Fair Value Subject to TSR Performance Factors | ||||||||||||

| (Per Share) | (Per Share) | |||||||||||||

| 2024 | 543,560 | $ 89.01 | $ 85.72 | |||||||||||

| 2023 | 482,360 | $ 102.02 | $ 133.54 | |||||||||||

The grant date fair value of the PSU awards subject to the other performance factors was determined by using the market price of PMI’s stock on the date of the grant. The grant date fair value of the PSU market-based awards subject to the TSR performance factor was determined by using the Monte Carlo simulation model. The following assumptions were used to determine the grant date fair value of the PSU awards subject to the TSR performance factor:

| 2024 | 2023 | |||||||||||||

Average risk-free interest rate (a) | 4.2 | % | 4.1 | % | ||||||||||

Average expected volatility (b) | 19.9 | % | 24.3 | % | ||||||||||

(a) Based on the U.S. Treasury yield curve.

(b) Determined using the observed historical volatility.

| Compensation Expense Related to PSU Awards | ||||||||

| (in millions) | For the Six Months Ended June 30, | For the Three Months Ended June 30, | ||||||

| 2024 | $ 49 | $ 18 | ||||||

| 2023 | $ 45 | $ 18 | ||||||

As of June 30, 2024, PMI had $55 million of total unrecognized compensation cost related to non-vested PSU awards. The cost is recognized over the performance cycle of the awards, or upon death, disability or reaching the age of 58.

During the six months ended June 30, 2024, 916,452 PSU awards vested. The grant date fair value of all the vested awards was approximately $86 million. The total fair value of PSU awards that vested during the six months ended June 30, 2024 was approximately $83 million.

Note 3. Benefit Plans:

Pension coverage for employees of PMI’s subsidiaries is provided, to the extent deemed appropriate, through separate plans, many of which are governed by local statutory requirements. In addition, PMI provides health care and other benefits to certain U.S. retired employees and certain non-U.S. retired employees. In general, health care benefits for non-U.S. retired employees are covered through local government plans.

15

Philip Morris International Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Pension and other employee benefit costs per the condensed consolidated statements of earnings consisted of the following:

| For the Six Months Ended June 30, | For the Three Months Ended June 30, | ||||||||||||||||||||||

| (in millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Net pension costs (income) | $ | (39) | $ | (37) | $ | (20) | $ | (25) | |||||||||||||||

| Net postemployment costs | 62 | 59 | 31 | 29 | |||||||||||||||||||

| Net postretirement costs | 6 | 6 | 3 | 2 | |||||||||||||||||||

| Total pension and other employee benefit costs | $ | 29 | $ | 28 | $ | 14 | $ | 6 | |||||||||||||||

Pension Plans

Components of Net Periodic Benefit Cost

Net periodic pension cost consisted of the following:

Pension (1) | |||||||||||||||||||||||

| For the Six Months Ended June 30, | For the Three Months Ended June 30, | ||||||||||||||||||||||

| (in millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Service cost | $ | 109 | $ | 85 | $ | 54 | $ | 42 | |||||||||||||||

| Interest cost | 116 | 129 | 57 | 63 | |||||||||||||||||||

| Expected return on plan assets | (200) | (181) | (99) | (91) | |||||||||||||||||||

| Amortization: | |||||||||||||||||||||||

| Net loss | 46 | 16 | 23 | 4 | |||||||||||||||||||

| Prior service cost (credit) | (1) | (1) | (1) | (1) | |||||||||||||||||||

| Net periodic pension cost | $ | 70 | $ | 48 | $ | 34 | $ | 17 | |||||||||||||||

(1) Primarily non-U.S. based defined benefit retirement plans.

Employer Contributions

PMI makes, and plans to make, contributions, to the extent that they are tax deductible and meet specific funding requirements of its funded pension plans. Employer contributions of $55 million were made to the pension plans during the six months ended June 30, 2024. Currently, PMI anticipates making additional contributions during the remainder of 2024 of approximately $66 million to its pension plans, based on current tax and benefit laws. However, this estimate is subject to change as a result of changes in tax and other benefit laws, as well as asset performance significantly above or below the assumed long-term rate of return on pension assets, or changes in interest and currency rates.

16

Philip Morris International Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Note 4. Goodwill and Other Intangible Assets, net:

2024 Annual impairment review of goodwill and non-amortizable intangible assets

During the second quarter of 2024, PMI completed its annual review of goodwill and non-amortizable intangible assets for potential impairment using a quantitative assessment for all of its reporting units and non-amortizable intangible assets. As a result of this review, no impairment charges were required. Each of PMI's reporting units had fair values substantially in excess of their carrying values with the exception of the Wellness & Healthcare reporting unit, which had less than 20% excess of fair value over its carrying value. PMI will continue to monitor this reporting unit as any changes in assumptions and estimates, unfavorable clinical trial results, failure to obtain regulatory approvals or other market factors could result in additional future goodwill and other intangible asset impairments. In addition, there are still risks related to PMI’s Russian reporting unit’s assets as the fair value of these assets is difficult to predict due to the current economic, political, regulatory and social conditions as well as the volatility in foreign currency and commodity markets. As of June 30, 2024, our Russian operations had approximately $2.8 billion in total assets, excluding intercompany balances, of which approximately $0.7 billion consisted of cash and cash equivalents held mostly in local currency (Russian rubles). Additionally, we hold a 23% equity interest in Megapolis Distribution B.V., the holding company of JSC TK Megapolis, PMI's distributor in Russia. For further details, see Note 8. Contingencies and Note 12. Related Parties – Equity Investments and Other.

Goodwill

The movements in goodwill were as follows:

| (in millions) | Europe | SSEA, CIS & MEA | EA, AU & PMI DF | Americas | Wellness & Healthcare | Total | |||||||||||||||||

| Balances at December 31, 2023 | $ | 4,173 | $ | 2,877 | $ | 492 | $ | 8,847 | $ | 390 | $ | 16,779 | |||||||||||

| Changes due to: | |||||||||||||||||||||||

| Acquisitions | — | 510 | — | — | — | 510 | |||||||||||||||||

| Currency | (228) | (159) | (27) | (49) | (7) | (470) | |||||||||||||||||

| Balances, June 30, 2024 | $ | 3,945 | $ | 3,228 | $ | 465 | $ | 8,798 | $ | 383 | $ | 16,819 | |||||||||||

As discussed in Note 1. Background and Basis of Presentation, PMI updated in January 2024 its segment reporting by including the former Swedish Match segment results into its geographical segments. As a result, the December 31, 2023 goodwill balance in the table above included the reclassification of the former Swedish Match segment to the Europe and Americas segments.

The increase in goodwill was due to the preliminary purchase price allocation of PMI's acquisition in Egypt of United Tobacco Company in the second quarter of 2024, partially offset by currency movements. For further details on the acquisition in Egypt, see Note 18. Acquisitions.

At June 30, 2024, goodwill primarily reflects PMI’s acquisitions of Swedish Match AB, Fertin Pharma A/S and Vectura Group plc., as well as acquisitions in Egypt, Greece, Indonesia, Mexico, the Philippines and Serbia.

17

Philip Morris International Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Other Intangible Assets

Details of other intangible assets were as follows:

| June 30, 2024 | December 31, 2023 | |||||||||||||||||||||||||

| (in millions) | Weighted-Average Remaining Useful Life | Gross Carrying Amount | Accumulated Amortization | Net | Gross Carrying Amount | Accumulated Amortization | Net | |||||||||||||||||||

| Non-amortizable intangible assets | $ | 4,541 | $ | 4,541 | $ | 4,543 | $ | 4,543 | ||||||||||||||||||

| Amortizable intangible assets: | ||||||||||||||||||||||||||

| Trademarks | 16 years | 2,179 | $ | 812 | 1,367 | 2,267 | $ | 784 | 1,483 | |||||||||||||||||

Reacquired commercialization rights for IQOS in the U.S. | 5 years | 2,777 | 93 | 2,684 | — | — | — | |||||||||||||||||||

| Developed technology, including patents | 6 years | 750 | 349 | 401 | 774 | 329 | 445 | |||||||||||||||||||

| Customer relationships and other | 11 years | 3,757 | 579 | 3,178 | 3,843 | 450 | 3,393 | |||||||||||||||||||

| Total other intangible assets | $ | 14,004 | $ | 1,833 | $ | 12,171 | $ | 11,427 | $ | 1,563 | $ | 9,864 | ||||||||||||||

Non-amortizable intangible assets substantially consist of the ZYN trademarks and other trademarks related to acquisitions in Indonesia and Mexico, as well as the tobacco manufacturing license associated with the preliminary purchase price allocation of PMI's acquisition in Egypt in the second quarter of 2024 (see Note 18. Acquisitions for further details). The decrease since December 31, 2023 was mainly due to currency movements of $181 million and a pre-tax impairment charge in the first quarter of 2024 of $27 million primarily for an in-process research and development project in the Wellness and Healthcare segment, partially offset by the recognition of the Egyptian tobacco manufacturing license. The pre-tax impairment charge of $27 million was recorded in marketing, administration and research costs on PMI's condensed consolidated statements of earnings during the six months ended June 30, 2024.

The increase in the gross carrying amount of amortizable intangible assets from December 31, 2023, was primarily due to the classification of the IQOS commercialization rights in the U.S. on the acquisition date (May 1, 2024) as Other intangible assets, net (see Note 18. Acquisitions), partially offset by currency movements of $203 million.

The change in the accumulated amortization from December 31, 2023, was mainly due to the 2024 amortization of $332 million, partially offset by currency movements of $62 million. The amortization of intangibles for the six months ended June 30, 2024 was recorded in cost of sales ($32 million) and in marketing, administration and research costs ($300 million) on PMI's condensed consolidated statements of earnings.

Amortization expense for each of the next five years is estimated to be approximately $1,031 million or less, assuming no additional transactions occur that require the amortization of intangible assets. This amount includes amortization of IQOS commercialization rights in the U.S. (see Note 18, Acquisitions).

18

Philip Morris International Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

2023 Annual impairment review of goodwill and non-amortizable intangible assets

During the second quarter of 2023, as a result of the completion of PMI's annual review of goodwill and non-amortizable intangible assets for potential impairment, it was determined that the estimated fair value of the Wellness and Healthcare reporting unit was lower than its carrying value. Consequently, PMI recorded a goodwill impairment charge of $665 million in the consolidated statements of earnings for the six months and three months ended June 30, 2023, reflecting the impact of reduced estimated future cash flows, which were primarily attributable to unfavorable clinical trial results that became available in June 2023 for an inhalable aspirin product being developed by the Wellness and Healthcare business. Additionally, as a result of the impairment test of non-amortizable intangible assets, PMI recorded a pre-tax impairment charge of $15 million for an in-process research and development project related to one of PMI's 2021 acquisitions. This pre-tax impairment charge of $15 million was recorded within marketing, administration and research costs in the consolidated statements of earnings for the six months and three months ended June 30, 2023.

Note 5. Financial Instruments:

Overview

PMI operates globally with manufacturing and sales facilities in various locations around the world and is exposed to risks such as changes in foreign currency exchange rates and interest rates. As a result, PMI uses deliverable and non-deliverable forward foreign exchange contracts, foreign currency swaps and foreign currency options, (collectively referred to as "foreign exchange contracts"), and interest rate contracts to mitigate its exposure to changes in foreign currency exchange and interest rates related to net investments in foreign operations, third-party and intercompany actual and forecasted transactions. The primary currencies to which PMI is exposed include the Euro, Egyptian pound, Indonesian rupiah, Japanese yen, Mexican peso, Philippine peso, Russian ruble and Swiss franc.

Additionally, certain materials that PMI uses in the manufacturing of its products are exposed to market price risks. PMI uses commodity derivative contracts (“commodity contracts") to manage its exposure to the market price volatility of certain commodity components of these materials.

These foreign exchange contracts, interest rate contracts and commodity contracts are collectively referred to as "derivative contracts". PMI is not a party to leveraged derivatives and, by policy, does not use derivative financial instruments for speculative purposes. Substantially all of PMI's derivative financial instruments are subject to master netting arrangements, whereby the right to offset occurs in the event of default by a participating party. While these contracts contain the enforceable right to offset through close-out netting rights, PMI elects to present them on a gross basis in the condensed consolidated balance sheets. Collateral associated with these arrangements is in the form of cash and is unrestricted. Changes in collateral posted are included in cash flows from investing activities and changes in collateral received are included in cash flows from financing activities. Financial instruments qualifying for hedge accounting must maintain a specified level of effectiveness between the hedging instrument and the item being hedged, both at inception and throughout the hedged period. PMI formally documents the nature and relationships between the hedging instruments and hedged items, as well as its risk-management objectives, strategies for undertaking the various hedge transactions and method of assessing hedge effectiveness. Additionally, for hedges of forecasted transactions, the significant characteristics and expected terms of the forecasted transaction must be specifically identified, and it must be probable that each forecasted transaction will occur. If it were deemed probable that the forecasted transaction would not occur, the gain or loss would be recognized in earnings.

19

Philip Morris International Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

The gross notional amounts for outstanding derivatives at the end of each period were as follows:

| (in millions) | At June 30, 2024 | At December 31, 2023 | ||||||

| Derivative contracts designated as hedging instruments: | ||||||||

| Foreign exchange contracts | $ | 22,826 | $ | 21,987 | ||||

| Interest rate contracts | 1,000 | 3,600 | ||||||

| Commodity contracts | 13 | 20 | ||||||

| Derivative contracts not designated as hedging instruments: | ||||||||

| Foreign exchange contracts | 17,540 | 17,658 | ||||||

| Total | $ | 41,379 | $ | 43,265 | ||||

20

Philip Morris International Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

The fair value of PMI’s derivative contracts included in the condensed consolidated balance sheets as of June 30, 2024 and December 31, 2023, were as follows:

| Derivative Assets | Derivative Liabilities | ||||||||||||||||||||||||||||||||||

| Fair Value | Fair Value | ||||||||||||||||||||||||||||||||||

| At | At | At | At | ||||||||||||||||||||||||||||||||

| (in millions) | Balance Sheet Classification | June 30, 2024 | December 31, 2023 | Balance Sheet Classification | June 30, 2024 | December 31, 2023 | |||||||||||||||||||||||||||||

| Derivative contracts designated as hedging instruments: | |||||||||||||||||||||||||||||||||||

| Foreign exchange contracts | Other current assets | $ | 590 | $ | 345 | Other accrued liabilities | $ | 50 | $ | 249 | |||||||||||||||||||||||||

| Other assets | 292 | 153 | Income taxes and other liabilities | 167 | 449 | ||||||||||||||||||||||||||||||

| Interest rate contracts | Other current assets | — | 1 | Other accrued liabilities | 41 | 78 | |||||||||||||||||||||||||||||

| Other assets | — | — | Income taxes and other liabilities | 16 | 18 | ||||||||||||||||||||||||||||||

| Commodity contracts | Other current assets | — | — | Other accrued liabilities | 3 | 5 | |||||||||||||||||||||||||||||

| Other assets | — | — | Income taxes and other liabilities | — | 1 | ||||||||||||||||||||||||||||||

| Derivative contracts not designated as hedging instruments: | |||||||||||||||||||||||||||||||||||

| Foreign exchange contracts | Other current assets | 144 | 85 | Other accrued liabilities | 61 | 425 | |||||||||||||||||||||||||||||

| Other assets | 2 | — | Income taxes and other liabilities | 99 | 143 | ||||||||||||||||||||||||||||||

| Total gross amount derivatives contracts presented in the condensed consolidated balance sheets | $ | 1,028 | $ | 584 | $ | 437 | $ | 1,368 | |||||||||||||||||||||||||||

| Gross amounts not offset in the condensed consolidated balance sheets | |||||||||||||||||||||||||||||||||||

| Financial instruments | (352) | (374) | (352) | (374) | |||||||||||||||||||||||||||||||

| Cash collateral received/pledged | (483) | (109) | (48) | (551) | |||||||||||||||||||||||||||||||

| Net amount | $ | 193 | $ | 101 | $ | 37 | $ | 443 | |||||||||||||||||||||||||||

PMI assesses the fair value of its derivative contracts using standard valuation models that use, as their basis, readily observable market inputs. The fair value of PMI’s foreign exchange forward contracts, foreign currency swaps and interest rate contracts is determined by using the prevailing foreign exchange spot rates and interest rate differentials, and the respective maturity dates of the instruments. The fair value of PMI’s currency options is determined by using a Black-Scholes methodology based on foreign exchange spot rates and interest rate differentials, currency volatilities and maturity dates. The fair value of PMI’s commodity contracts is determined by using the prevailing market spot and futures prices and the respective maturity dates of the instruments. PMI’s derivative contracts have been classified within Level 2 at June 30, 2024 and December 31, 2023.

21

Philip Morris International Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

For the six months ended June 30, 2024 and 2023, PMI's derivative contracts impacted the condensed consolidated statements of earnings and comprehensive earnings as follows:

| (pre-tax, in millions) | For the Six Months Ended June 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amount of Gain/(Loss) Recognized in Other Comprehensive Earnings/(Losses) on Derivatives | Statement of Earnings Classification of Gain/(Loss) on Derivatives | Amount of Gain/(Loss) Reclassified from Other Comprehensive Earnings/(Losses) into Earnings | Amount of Gain/(Loss) Recognized in Earnings | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Derivative contracts designated as hedging instruments: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash flow hedges: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign exchange contracts | $ | 288 | $ | 223 | Net revenues | $ | 90 | $ | 39 | ||||||||||||||||||||||||||||||||||||||||||||

| Cost of sales | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Marketing, administration and research costs | 7 | 71 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense, net | (5) | (6) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest rate contracts | 54 | 72 | Interest expense, net | 25 | 22 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Commodity contracts | (1) | (1) | Cost of sales | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Fair value hedges: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest rate contracts | Interest expense, net (a) | $ | (17) | $ | (14) | ||||||||||||||||||||||||||||||||||||||||||||||||

Net investment hedges (b): | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign exchange contracts | 578 | (439) | Interest expense, net (c) | 147 | 127 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Derivative contracts not designated as hedging instruments: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign exchange contracts | Interest expense, net | 99 | 152 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Marketing, administration and research costs (d) | 432 | (104) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 919 | $ | (145) | $ | 117 | $ | 126 | $ | 661 | $ | 161 | |||||||||||||||||||||||||||||||||||||||||

(a) The gains (losses) from these contracts are offset by the changes in the fair value of the hedged item

(b) Amount of gains (losses) on hedges of net investments principally related to changes in foreign currency exchange and interest rates between the Euro and U.S. dollar

(c) Represent the gains for amounts excluded from the effectiveness testing

(d) The gains (losses) from these contracts attributable to changes in foreign currency exchange rates are partially offset by the (losses) and gains generated by the underlying intercompany and third-party loans being hedged

22

Philip Morris International Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

For the three months ended June 30, 2024 and 2023, PMI's derivative contracts impacted the condensed consolidated statements of earnings and comprehensive earnings as follows:

| (pre-tax, in millions) | For the Three Months Ended June 30, | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amount of Gain/(Loss) Recognized in Other Comprehensive Earnings/(Losses) on Derivatives | Statement of Earnings Classification of Gain/(Loss) on Derivatives | Amount of Gain/(Loss) Reclassified from Other Comprehensive Earnings/(Losses) into Earnings | Amount of Gain/(Loss) Recognized in Earnings | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Derivative contracts designated as hedging instruments: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash flow hedges: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign exchange contracts | $ | 122 | $ | 213 | Net revenues | $ | 61 | $ | 27 | ||||||||||||||||||||||||||||||||||||||||||||

| Cost of sales | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Marketing, administration and research costs | (17) | 55 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest expense, net | (2) | (3) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest rate contracts | — | 7 | Interest expense, net | 13 | 12 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Commodity contracts | 2 | (1) | Cost of sales | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Fair value hedges: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest rate contracts | Interest expense, net (a) | $ | (6) | $ | (17) | ||||||||||||||||||||||||||||||||||||||||||||||||

Net investment hedges (b): | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign exchange contracts | 125 | (181) | Interest expense, net (c) | 75 | 64 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Derivative contracts not designated as hedging instruments: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign exchange contracts | Interest expense, net | 55 | 62 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Marketing, administration and research costs (d) | (80) | (88) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 249 | $ | 38 | $ | 55 | $ | 91 | $ | 44 | $ | 21 | |||||||||||||||||||||||||||||||||||||||||

(a) The gains (losses) from these contracts are offset by the changes in the fair value of the hedged item

(b) Amount of gains (losses) on hedges of net investments principally related to changes in foreign currency exchange and interest rates between the Euro and U.S. dollar

(c) Represent the gains for amounts excluded from the effectiveness testing

(d) The gains (losses) from these contracts attributable to changes in foreign currency exchange rates are partially offset by the (losses) and gains generated by the underlying intercompany and third-party loans being hedged

Cash Flow Hedges

PMI has entered into derivative contracts to hedge the foreign currency exchange, interest rate and commodity price risks related to certain forecasted transactions. Gains and losses associated with qualifying cash flow hedge contracts are deferred as components of accumulated other comprehensive losses until the underlying hedged transactions are reported in PMI’s condensed consolidated statements of earnings. As of June 30, 2024, PMI has hedged forecasted transactions with derivative contracts expiring at various dates through May 2028. Premiums paid for, and settlements of, the derivative contracts designated as cash flow hedges are included primarily in cash flows from operating activities on PMI’s condensed consolidated statements of cash flows.

23

Philip Morris International Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Fair Value Hedges

PMI has entered into fixed-to-floating interest rate contracts, designated as fair value hedges to minimize exposure to changes in the fair value of fixed rate U.S. dollar-denominated debt that results from fluctuations in benchmark interest rates. For derivative contracts that are designated and qualify as fair value hedges, the gain or loss on the derivative, as well as the offsetting gain or loss on the hedged items attributable to the hedged risk, is recognized in current earnings. The carrying amount of the debt hedged, which includes the cumulative adjustment for fair value gains/losses, as of June 30, 2024 was $941 million, of which $336 million was recorded in current portion of long-term debt and $605 million was recorded in long-term debt in the condensed consolidated balance sheets. The cumulative amount of fair value gains/(losses) included in the carrying amount of the debt hedged was $57 million as of June 30, 2024.

Hedges of Net Investments in Foreign Operations

PMI designates derivative contracts and certain foreign currency denominated debt and other financial instruments as net investment hedges, primarily of its Euro net assets. For the six months ended June 30, 2024 and 2023, the amount of pre-tax gain/(loss) related to the non-derivative financial instruments, that was reported as a component of accumulated other comprehensive losses within currency translation adjustments, was $5 million and $24 million, respectively. For the three months ended June 30, 2024 and 2023, the amount of pre-tax gain/(loss) related to the non-derivative financial instruments, that was reported as a component of accumulated other comprehensive losses within currency translation adjustments, was nil and $23 million, respectively. Settlements of the derivative contracts designated as net investment hedges are included in cash flows from investing activities on PMI’s condensed consolidated statements of cash flows.

Other Derivatives

PMI has entered into derivative contracts to hedge the foreign currency exchange and interest rate risks related to intercompany loans between certain subsidiaries and third-party loans. While effective as economic hedges, no hedge accounting is applied for these contracts; therefore, the gains (losses) relating to these contracts are reported in PMI’s condensed consolidated statements of earnings. Settlements of other derivative contracts are included primarily in cash flows from investing activities on PMI's condensed consolidated statements of cash flows.

Qualifying Hedging Activities Reported in Accumulated Other Comprehensive Losses

Derivative gains or losses reported in accumulated other comprehensive losses are a result of qualifying hedging activity. Transfers of these gains or losses to earnings are offset by the corresponding gains or losses on the underlying hedged item. Hedging activity affected accumulated other comprehensive losses, net of income taxes, as follows:

| (in millions) | For the Six Months Ended June 30, | For the Three Months Ended June 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||

| Gain/(loss) as of beginning of period, | $ | 241 | $ | 266 | $ | 373 | $ | 296 | |||||||||

| Derivative (gains)/losses transferred to earnings | (94) | (104) | (48) | (75) | |||||||||||||

| Change in fair value | 286 | 246 | 108 | 187 | |||||||||||||

| Gain/(loss) as of June 30, | $ | 433 | $ | 408 | $ | 433 | $ | 408 | |||||||||

At June 30, 2024, PMI expects $197 million of derivative gains that are included in accumulated other comprehensive losses to be reclassified to the condensed consolidated statement of earnings within the next 12 months. These gains are expected to be substantially offset by the statement of earnings impact of the respective hedged transactions.

Contingent Features

PMI’s derivative instruments do not contain contingent features.

24

Philip Morris International Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Credit Exposure and Credit Risk

PMI is exposed to credit loss in the event of non-performance by counterparties. While PMI does not anticipate non-performance, its risk is limited to the fair value of the financial instruments less any cash collateral received or pledged. PMI actively monitors its exposure to credit risk through the use of credit approvals and credit limits and by selecting and continuously monitoring a diverse group of major international banks and financial institutions as counterparties.

Other Investments

A certain PMI investment, which is comprised primarily of money market funds, has been classified within Level 1 and had a fair value of $144 million at June 30, 2024. For the six months and three months ended June 30, 2024, the unrealized pre-tax gains (losses) on these investments were immaterial.

Note 6. Earnings Per Share:

Basic and diluted earnings per share (“EPS”) were calculated using the following:

| (in millions) | For the Six Months Ended June 30, | For the Three Months Ended June 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||

| Net earnings attributable to PMI | $ | 4,554 | $ | 3,563 | $ | 2,406 | $ | 1,568 | |||||||||

| Less distributed and undistributed earnings attributable to share-based payment awards | 14 | 11 | 7 | 5 | |||||||||||||

| Net earnings for basic and diluted EPS | $ | 4,540 | $ | 3,552 | $ | 2,399 | $ | 1,563 | |||||||||

| Weighted-average shares for basic EPS | 1,554 | 1,552 | 1,555 | 1,552 | |||||||||||||

Plus contingently issuable performance stock units (PSUs)(1) | 2 | 1 | 1 | 1 | |||||||||||||

| Weighted-average shares for diluted EPS | 1,556 | 1,553 | 1,556 | 1,553 | |||||||||||||

(1) Including rounding adjustment

Unvested share-based payment awards that contain non-forfeitable rights to dividends or dividend equivalents are participating securities and therefore are included in PMI’s earnings per share calculation pursuant to the two-class method.

For the 2024 and 2023 computations, there were no antidilutive stock awards.

Note 7. Segment Reporting:

PMI’s subsidiaries and affiliates are primarily engaged in the manufacture and sale of cigarettes and smoke-free products, including heat-not-burn, e-vapor and oral nicotine products. Excluding the Wellness and Healthcare segment, PMI's segments are generally organized by geographic region and managed by segment managers who are responsible for the operating and financial results of the regions inclusive of combustible tobacco and smoke-free product categories sold in the region. As discussed in Note 1. Background and Basis of Presentation, PMI updated in January 2024 its segment reporting by including the former Swedish Match segment results into the four existing geographical segments. The four existing geographical segments are as follows: Europe Region; South and Southeast Asia, Commonwealth of Independent States, Middle East and Africa Region ("SSEA, CIS & MEA"); East Asia, Australia, and PMI Duty Free Region ("EA, AU & PMI DF"); and Americas Region. The Wellness and Healthcare segment remained unchanged.

PMI’s chief operating decision maker evaluates geographical segment performance and allocates resources based on regional operating income, which includes results from all product categories sold in each region, excluding Wellness and Healthcare products. Business operations in the Wellness and Healthcare segment are evaluated separately.

PMI disaggregates its net revenues from contracts with customers by product category for each of PMI's four geographical segments. For the Wellness and Healthcare business, Vectura Fertin Pharma, net revenues from contracts with customers are included in the Wellness and Healthcare segment. PMI believes this best depicts how the nature, amount, timing and uncertainty of its revenue and cash flows are affected by economic factors.

25

Philip Morris International Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Segment data were as follows:

| (in millions) | For the Six Months Ended June 30, | For the Three Months Ended June 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||

| Net revenues: | |||||||||||||||||

| Europe | $ | 7,180 | $ | 6,642 | $ | 3,815 | $ | 3,574 | |||||||||

| SSEA, CIS & MEA | 5,429 | 5,145 | 2,771 | 2,668 | |||||||||||||

| EA, AU & PMI DF | 3,357 | 3,200 | 1,673 | 1,680 | |||||||||||||

| Americas | 2,125 | 1,837 | 1,129 | 969 | |||||||||||||

| Wellness and Healthcare | 170 | 162 | 80 | 76 | |||||||||||||

| Net revenues | $ | 18,261 | $ | 16,986 | $ | 9,468 | $ | 8,967 | |||||||||

| Operating income (loss): | |||||||||||||||||

| Europe | $ | 3,116 | $ | 2,834 | $ | 1,660 | $ | 1,619 | |||||||||

| SSEA, CIS & MEA | 1,663 | 1,614 | 891 | 880 | |||||||||||||

| EA, AU & PMI DF | 1,516 | 1,194 | 753 | 557 | |||||||||||||

| Americas | 282 | 426 | 183 | 243 | |||||||||||||

| Wellness and Healthcare | (88) | (771) | (43) | (733) | |||||||||||||

| Operating income | $ | 6,489 | $ | 5,297 | $ | 3,444 | $ | 2,566 | |||||||||

PMI's net revenues by product category were as follows:

| (in millions) | For the Six Months Ended June 30, | For the Three Months Ended June 30, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||

| Net revenues: | |||||||||||||||||

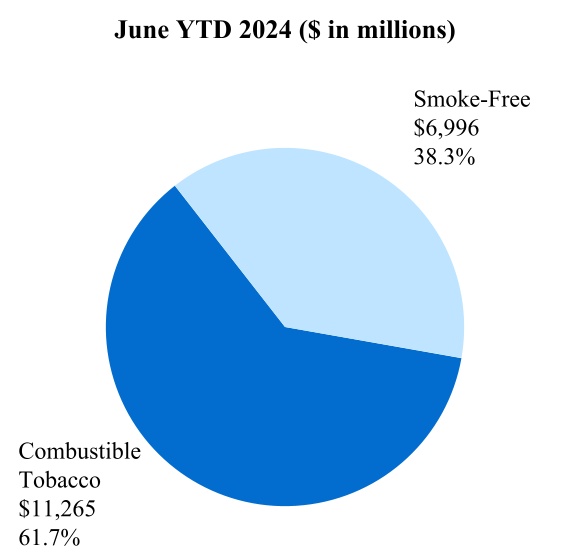

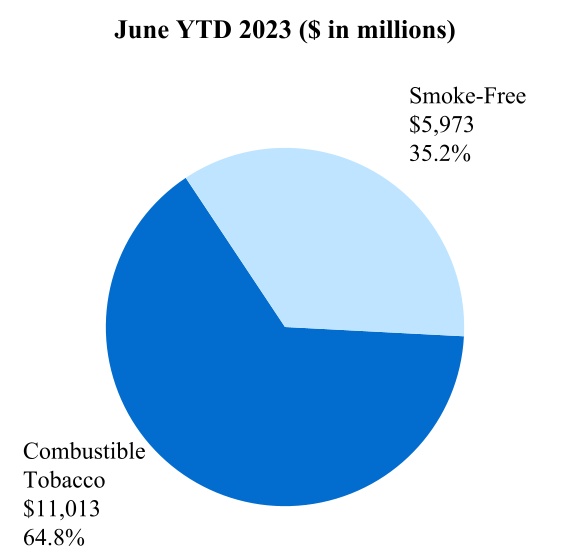

| Combustible tobacco: | |||||||||||||||||

| Europe | $ | 4,145 | $ | 3,924 | $ | 2,214 | $ | 2,108 | |||||||||

| SSEA, CIS & MEA | 4,778 | 4,504 | 2,432 | 2,350 | |||||||||||||

| EA, AU & PMI DF | 1,217 | 1,412 | 620 | 724 | |||||||||||||

| Americas | 1,126 | 1,173 | 592 | 608 | |||||||||||||

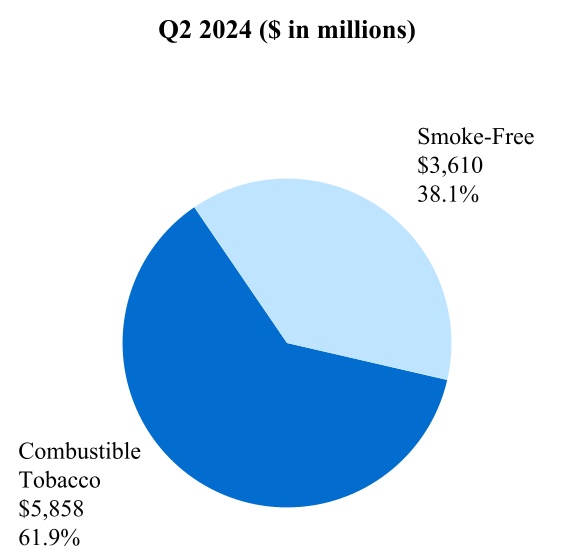

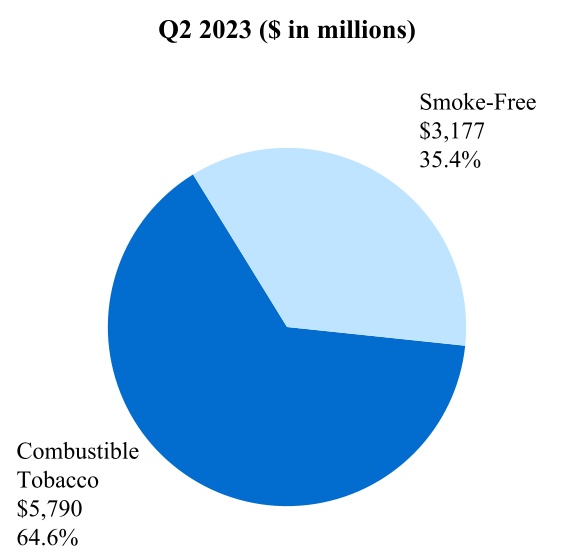

| Total combustible tobacco | 11,265 | 11,013 | 5,858 | 5,790 | |||||||||||||

| Smoke-free: | |||||||||||||||||

| Smoke-free excluding Wellness and Healthcare: | |||||||||||||||||

| Europe | 3,035 | 2,718 | 1,601 | 1,466 | |||||||||||||

| SSEA, CIS & MEA | 651 | 641 | 339 | 318 | |||||||||||||

| EA, AU & PMI DF | 2,140 | 1,788 | 1,053 | 956 | |||||||||||||

| Americas | 999 | 664 | 537 | 361 | |||||||||||||

| Total Smoke-free excluding Wellness and Healthcare | 6,826 | 5,811 | 3,530 | 3,101 | |||||||||||||

| Wellness and Healthcare | 170 | 162 | 80 | 76 | |||||||||||||

| Total Smoke-free | 6,996 | 5,973 | 3,610 | 3,177 | |||||||||||||

| Total PMI net revenues | $ | 18,261 | $ | 16,986 | $ | 9,468 | $ | 8,967 | |||||||||

Note: Sum of product categories or Regions might not foot to total PMI due to roundings.

26

Philip Morris International Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(Unaudited)

Items affecting the comparability of results from operations were as follows:

•Asset impairment and exit costs – See Note 15. Asset Impairment and Exit Costs for a breakdown of these costs by segment for the six months ended June 30, 2024 and 2023.

•Termination of distribution arrangement in the Middle East – In the first quarter of 2023, PMI recorded a pre-tax charge of $80 million following the termination of a distribution arrangement in the Middle East. This pre-tax charge was recorded as a reduction of net revenues in the condensed consolidated statements of earnings, and was included in the SSEA, CIS & MEA segment results for the six months ended June 30, 2023.

•Swedish Match AB acquisition accounting related items – In the first quarter of 2023, PMI recorded $18 million pre-tax purchase accounting adjustments related to the sale of acquired inventories stepped up to fair value included in the Americas segment.

•Impairment of goodwill and other intangibles – For the six months and three months ended June 30, 2023, PMI recorded $680 million of goodwill and non-amortizable intangible assets impairment charges that was included in the Wellness and Healthcare segment. For further details, see Note 4. Goodwill and Other Intangible Assets, net.

•South Korea indirect tax charge – On July 13, 2023, PMI's South Korean subsidiary, PM Korea, received an adverse ruling from the Supreme Court of South Korea related to cases alleging underpayment of excise taxes in connection with a 2015 excise tax increase and subsequent audit by the South Korean Board of Audit and Inspection. The Supreme Court ruling reversed previous decisions that were in PM Korea’s favor at the trial and appellate levels. As a result of the ruling, we concluded that an adverse outcome was probable. Consequently, we recorded a non-cash pre-tax charge of $204 million in marketing, administration and research costs in the condensed consolidated statements of earning, reflecting the full amount previously paid by PM Korea, which was included in the EA, AU & PMI DF segment for the six months and three months ended June 30, 2023.

Net revenues related to combustible tobacco refer to the operating revenues generated from the sale of these products, including shipping and handling charges billed to customers, net of sales and promotion incentives, and excise taxes. These net revenue amounts consist of the sale of PMI's cigarettes and other tobacco products that are combusted. Other tobacco products primarily include roll-your-own and make-your-own cigarettes, pipe tobacco, cigars and cigarillos, and do not include smoke-free products.

Net revenues related to smoke-free, excluding wellness and healthcare, refer to the operating revenues generated from the sale of these products, including shipping and handling charges billed to customers, net of sales and promotion incentives, and excise taxes, if applicable. These net revenue amounts consist of the sale of PMI's products that are not combustible tobacco products, such as heat-not-burn, e-vapor, and oral products, as well as consumer accessories.

Net revenues related to wellness and healthcare consist of operating revenues generated from the sale of products primarily associated with inhaled therapeutics, and oral and intra-oral delivery systems that are included in the operating results of PMI's Wellness and Healthcare business, Vectura Fertin Pharma.

Note 8. Contingencies:

Tobacco and/or Nicotine-Related Litigation