On December 28, 2021, the CAC published the Cybersecurity Review Measures, pursuant to which, among others, (i) critical information infrastructure operators purchasing network products and services that affect or may affect national security, (ii) internet platform operators engaging in data processing activities that affect or may affect national security, and (iii) any internet platform operator possessing personal information of more than one million users and applying for listing on a foreign exchange, shall be subject to the cybersecurity review by the CAC. We believe the Company, its subsidiaries and the VIE would not be subject to the cybersecurity review by the CAC, given that the Company, its subsidiaries and the VIE do not possess a large amount of personal information in our business operations, and data processed in our business does not have a bearing on national security and thus may not be classified as core or important data by the authorities. However, there remains uncertainty as to how the Cybersecurity Review Measures will be interpreted or implemented and whether the PRC regulatory agencies, including the CAC, may adopt new laws, regulations, rules, or detailed implementation and interpretation related to the Cybersecurity Review Measures. If the relevant laws, regulations or interpretations change in the future and the Company, its subsidiaries and the VIE are subject to mandatory cybersecurity review and other specific actions required by the CAC, we will face uncertainty as to whether any clearance or other required actions can be timely completed, or at all. If not, the Company, its subsidiaries and the VIE may be required to suspend relevant business, shut down relevant website, or face other penalties, which could materially and adversely affect our business, financial condition, and results of operations, and/or the value of our ADSs, or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless. As of the date of this annual report, the Company, its subsidiaries and the VIE have not received any notice from regulatory authorities requiring us to go through the cybersecurity review by the CAC.

On February 24, 2023, the CSRC and other PRC governmental authorities issued the Confidentiality Provisions, which came into effect on March 31, 2023. Pursuant to the Confidentiality Provisions, both “direct issuance of securities overseas by a Chinese domestic company” and “indirect issuance of securities overseas by a Chinese domestic company” (i.e., issuance of securities by relevant overseas holding company) shall be subject to the Confidentiality Provisions. Domestic enterprises that provide, publicly disclose files and documents that contain state secrets and work secrets of the authorities to relevant securities companies, securities service agencies, foreign regulatory agencies and other institutions and individuals or do so through its overseas listing entities, shall obtain the approval of the competent authorities, and file with the competent confidentiality administrative authorities. As the Confidentiality Provisions were recently issued, their interpretation and implementation remain substantially uncertain. However, we tend to believe the Company, its subsidiaries and the VIE would not be subject to clearance under the Confidentiality Provisions as the Company, its subsidiaries and the VIE do not possess any document or file that involves state secrets or work secrets of the authorities. As of the date of this annual report, the Company, its subsidiaries and the VIE have not received any notice from regulatory authorities requiring them to obtain the foregoing approval or complete any of the foregoing procedures. However, if the relevant laws, regulations or interpretations change in the future and the Company, its subsidiaries and the VIE are subject to such clearance, we will face uncertainty as to whether any required approval can be timely obtained and any actions can be timely completed, or at all. If not, the Company, its subsidiaries and the VIE may be subject to investigation, fines and other penalties; and if any related behavior is suspected as a crime, may be subject to criminal penalties, which could materially and adversely affect our business, financial condition, and results of operations, and/or the value of our ADSs.

We have been closely monitoring regulatory developments in China regarding any necessary approvals from the CSRC, the CAC or other PRC regulatory authorities required for overseas listings. As of the date of this annual report, we have not received any inquiries, notices, warnings, sanctions, denials, or regulatory objections from the CSRC, CAC, nor any other PRC regulatory authority related to any approval requirement of overseas listings.

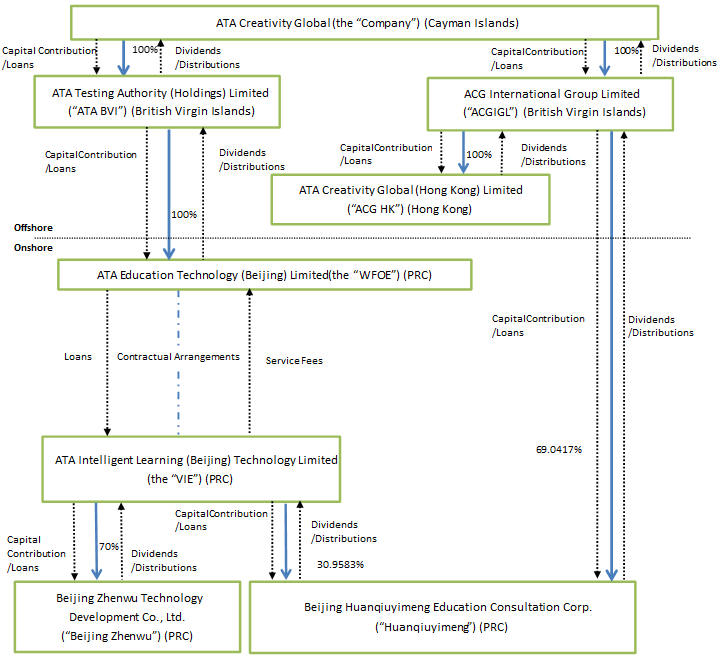

Because we may rely on dividends and other distributions on equity paid by our current and future PRC subsidiaries for our cash requirements, restrictions under PRC law on their ability to make such payments could materially and adversely affect our ability to grow, make investments or acquisitions that could benefit our business, pay dividends to you, and otherwise fund and conduct our businesses.

We adopt a holding company structure, and our holding companies rely on dividends and other distributions on equity paid by our current and future PRC subsidiaries for their cash requirements, including the funds necessary to service any debt we may incur or financing we may need for operations other than through our PRC subsidiaries. Chinese legal restrictions permit payments of dividends by our PRC subsidiaries only out of their accumulated after-tax profits, if any, determined in accordance with PRC GAAP. Our PRC subsidiaries are also required under PRC laws and regulations to allocate at least 10% of their after-tax profits determined in accordance with PRC GAAP to statutory reserves until such reserves reach 50% of the company’s registered capital. Allocations to these statutory reserves and funds can only be used for specific purposes and are not transferable to us in the form of loans, advances or cash dividends. As of December 31, 2022, our PRC subsidiaries have allocated RMB25.7 million ($3.7 million) to the general reserve fund, which is restricted for distribution to the Company. We are in full compliance with PRC laws and regulations relating to such allocations. Any limitations on the ability of our PRC subsidiaries to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

In addition, see “Item 3. Key Information — Restrictions on Foreign Exchange and Our Ability to Transfer Cash Between Entities, Across Borders, and to U.S. Investors, and Restrictions and Limitations on Our Ability to Distribute Earnings from Our Businesses” for more detailed analysis on the restrictions on our ability to transfer cash between entities.

38