UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

Form 10-K

| (Mark One) | ||||||||

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||

For the fiscal year ended December 31, 2021

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||

For the transition period from _____ to _____

Commission File Number: 001-34112

| Energy Recovery, Inc. | ||||||||

| (Exact Name of Registrant as Specified in its Charter) | ||||||||

| Delaware | 01-0616867 | ||||||||||||||||||||||||||||

| (State or Other Jurisdiction of Incorporation) | (I.R.S. Employer Identification No.) | ||||||||||||||||||||||||||||

1717 Doolittle Drive

San Leandro, California 94577

(Address of Principal Executive Offices) (Zip Code)

(510) 483-7370

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

| Common Stock, $0.001 par value | ERII | The Nasdaq Stock Market LLC | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer ☑ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

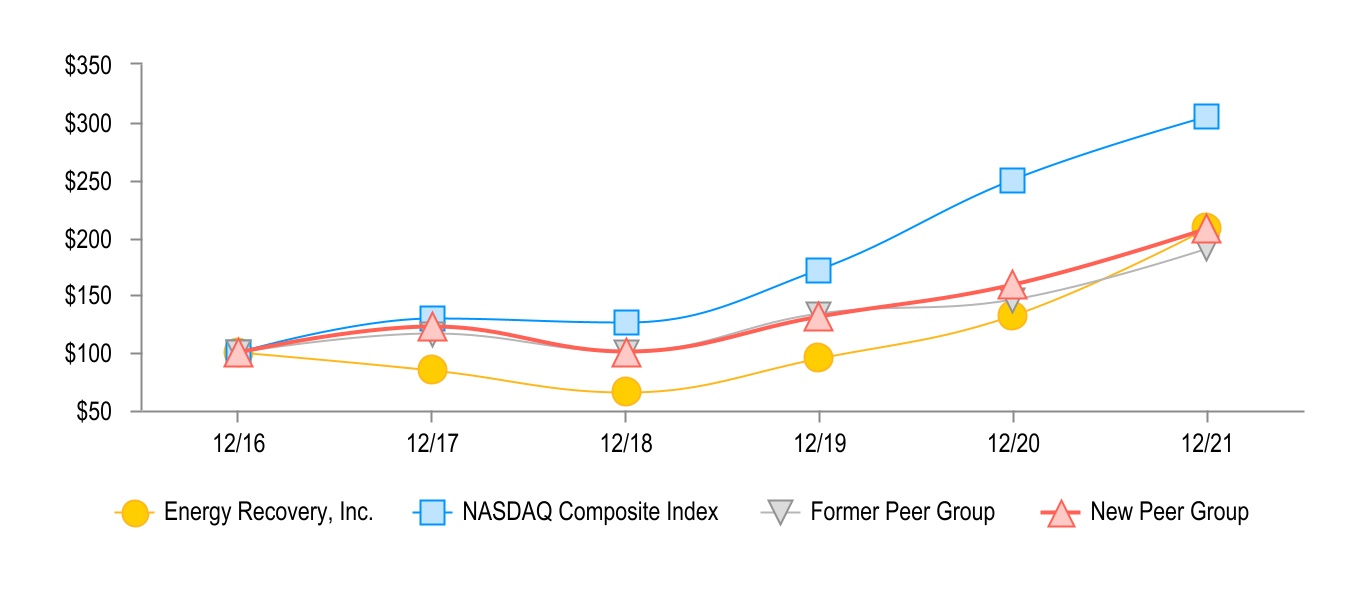

The aggregate market value of the voting stock held by non-affiliates amounted to approximately $1.12 billion on June 30, 2021.

The number of shares of the registrant’s common stock outstanding as of February 17, 2022 was 56,810,449 shares.

DOCUMENTS INCORPORATED BY REFERENCE

As noted herein, the information called for by Part III is incorporated by reference to specified portions of the registrant’s definitive proxy statement to be filed in conjunction with the registrant’s 2022 Annual Meeting of Stockholders, which is expected to be filed not later than 120 days after the registrant’s fiscal year ended December 31, 2021.

TABLE OF CONTENTS

| Page | ||||||||

Energy Recovery, Inc. | 2021 Form 10-K Annual Report

Forward-Looking Information

This Annual Report on Form 10-K for the year ended December 31, 2021, including Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (the “MD&A”) and certain information incorporated by reference, contain forward-looking statements within the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this report include, but are not limited to, statements about our expectations, objectives, anticipations, plans, hopes, beliefs, intentions or strategies regarding the future.

Forward-looking statements represent our current expectations about future events, are based on assumptions, and involve risks and uncertainties. If the risks or uncertainties occur or the assumptions prove incorrect, then our results may differ materially from those set forth or implied by the forward-looking statements. Our forward-looking statements are not guarantees of future performance or events.

Words such as “expects,” “anticipates,” “aims,” “projects,” “intends,” “plans,” “believes,” “estimates,” “seeks,” “continue,” “could,” “may,” “potential,” “should,” “will,” “would,” variations of such words and similar expressions are also intended to identify such forward-looking statements. These forward-looking statements are subject to risks, uncertainties and assumptions that are difficult to predict; therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. Readers are directed to risks and uncertainties identified under Part I, Item 1A, “Risk Factors,” and elsewhere in this report for factors that may cause actual results to be different from those expressed in these forward-looking statements. Except as required by law, we undertake no obligation to revise or update publicly any forward-looking statements for any reason.

Forward-looking statements in this report include, without limitation, statements about the following:

•our belief that the pressure exchanger is the industry standard for energy recovery in the seawater reverse osmosis desalination (“SWRO”) industry;

•our belief that the scalability and versatility of our platform can help us achieve success in emerging markets similar to SWRO;

•our belief that the Ultra PX™ addresses key challenges associated with treating industrial wastewater in a range of reverse osmosis (“RO”) applications;

•our belief that the Ultra PX can accelerate adoption of RO in the growing zero liquid discharge (“ZLD”) and minimal liquid discharge (“MLD”) markets;

•our belief that the Ultra PX can help make RO the preferred treatment option to achieve ZLD and MLD requirements by enhancing RO’s affordability and efficiency compared to thermal treatment options.

•our estimate that our life-to-date installed energy recovery devices (“ERDs”) have saved water desalination customers approximately $2.6 billion in energy costs and helped our customers avoid over 26 terawatt-hours of energy usage, which represents approximately a 4% reduction in the global energy consumption for potable water utilities;

•our belief that pressure exchanger technology can provide benefits to our customers, including the reduction of capital expenditures and energy use;

•our belief that our pressure exchanger technology can address inefficiencies and waste within industrial systems and processes that involve high-pressure and low-pressure fluid flows;

��our belief that our PX® Pressure Exchanger® (“PX”) has helped make SWRO an economically viable and more sustainable option in the production of potable water;

•our belief that our hydraulic turbochargers (“Turbochargers”) deliver substantial savings and ease of integration into desalination systems;

•our anticipation that markets not traditionally associated with desalination, such as the United States of America (the “U.S.”) and China will inevitably develop and provide further revenue growth opportunities;

•our belief that countries around the world will continue to mandate ZLD or MLD requirements for specific industries;

•our belief that leveraging the Ultra PX with RO will significantly lower thermal demand;

•our belief that, as the existing thermal technology is replaced with RO technology, demand for our products will be created;

•our belief that ongoing operating costs rather than capital expenditures is the key factor in the selection of an ERD solution for megaproject (“MPD”) customers;

•our belief that our PX offers market-leading value with the highest technological and economic benefit;

•our estimate that MPD customer projects represent revenue opportunities from approximately $1 million to $21 million;

•our estimate that the total capital investments by MPD customers in these large-scale infrastructure projects may range between $50 million to over $1 billion;

•our belief that initial capital expenditure rather than future ongoing operating costs is the key factor in the selection of an ERD solution for original equipment manufacturer (“OEM”) projects;

•our estimate that OEM customer projects represent revenue opportunities up to $1 million;

•our estimate that the total capital investments by OEM customers in these projects are typically up to $50 million;

•our belief that our solutions offer a competitive advantage compared to our competitors’ solutions because our ERDs provide the lowest life-cycle cost and are, therefore, the most cost-effective ERD solutions for RO desalination applications;

•our belief that our PX has a competitive advantage, as compared to the Flowserve Corporation’s DWEER product, because our devices are made with highly durable and corrosion-resistant aluminum oxide (“alumina”) ceramic parts that are designed for a life of more than 25 years, are warrantied for high efficiencies, and cause minimal unplanned downtime, resulting in lower lifecycle costs;

•our belief that our PX has a distinct competitive advantage over Fluid Equipment Development Company’s (“FEDCO”) turbochargers and Danfoss Group’s iSave ERDs because our devices provide up to 98% efficiency, have lower lifecycle maintenance costs, and are made of highly durable and corrosion-resistant alumina ceramic parts;

•our belief that our Turbochargers compete favorably with FEDCO’s turbochargers based on efficiency, price, and because our Turbochargers have design advantages that enhance efficiency, operational flexibility and serviceability;

•our belief that our pump solutions are competitive with our competitors because our pumps are developed specifically for RO desalination, are highly efficient, feature product-lubricated bearings, and are often purchased with our ERDs in small to medium-sized plants;

•our belief that leveraging our pressure exchanger technology will unlock new commercial opportunities in the future;

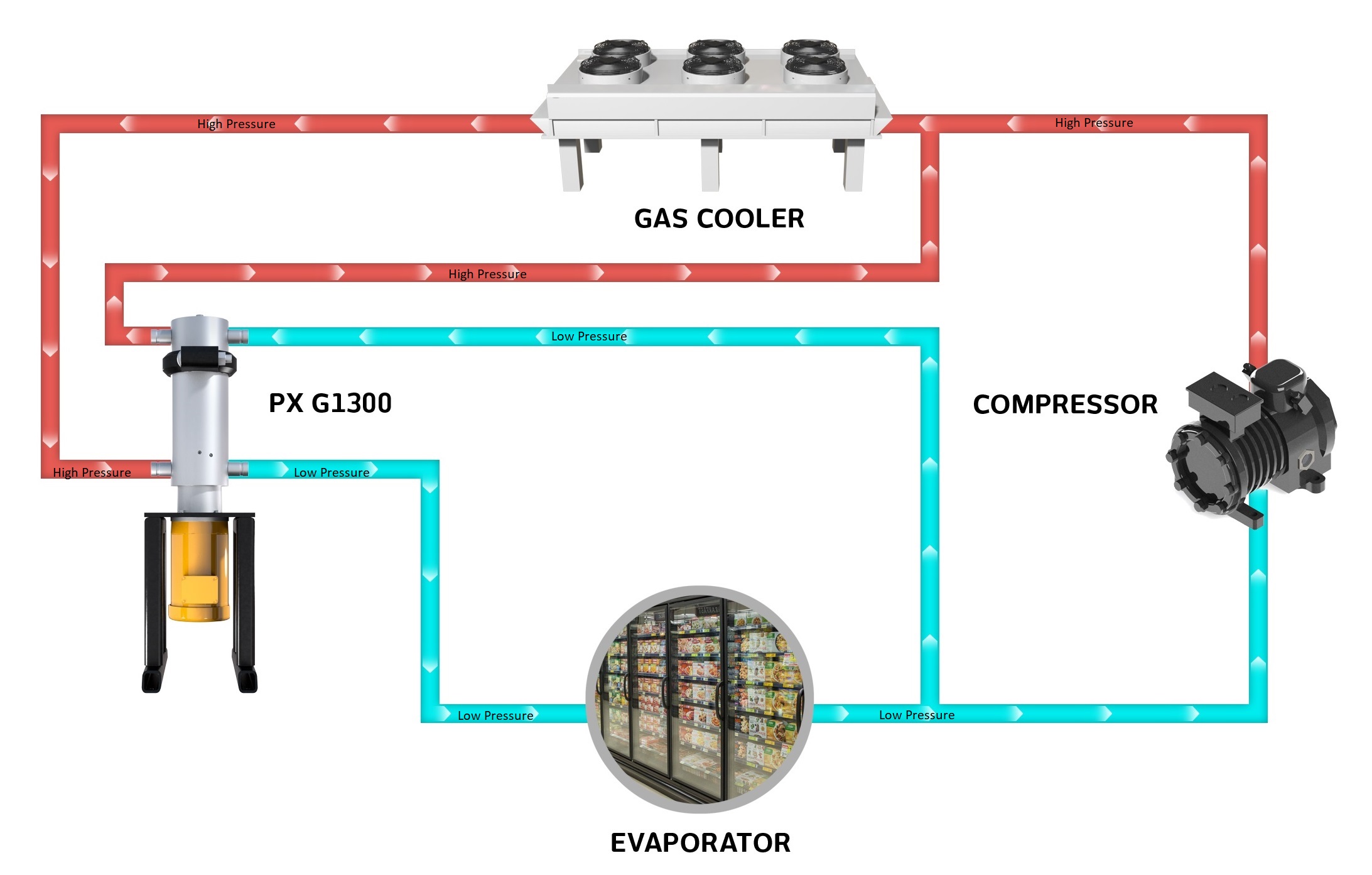

•our belief that sales of carbon dioxide (“CO2”) refrigeration systems will increase in response to regulations and supermarkets’ search for safe natural refrigerants;

•our belief that our pressure exchanger technology can significantly help reduce the operating costs of CO2 refrigeration systems by recycling the pressure energy of CO2 gas thereby significantly reducing the energy needed to operate these systems;

•our belief that the PX G1300 could eventually alter the standard refrigeration system architecture by reducing costs for retail end users such as grocery stores;

•our belief that we will be able to achieve efficiencies across a wider range of temperatures that exceed incumbent CO2 refrigeration technologies;

•our belief that the Ultra PX™ can address the key challenges associated with treating industrial wastewater in ultra high-pressure reverse osmosis (“UHPRO”) applications;

•our belief that the Ultra PX can help make UHPRO the preferred treatment option to achieve ZLD and MLD requirements by enhancing UHPRO’s affordability and efficiency compared to thermal treatment options;

•our belief that our Ultra PX enables customers to optimize their wastewater treatment process for ZLD and MLD;

•our belief that we can successfully find a suitable collaboration partner to commercialize the VorTeq™;

•our objective of finding new applications for our technology and developing new products for use outside of desalination;

•our belief that our current facilities will be adequate for the foreseeable future;

•our belief that by investing in research and development, we will be well positioned to continue to execute on our product strategy;

•our expectation that sales outside of the U.S. will remain a significant portion of our revenue;

•the timing of our receipt of payment for products or services from our customers;

•our belief that the integration of Environmental, Social and Governance (“ESG”) principles into our corporate and risk management strategies can strengthen our existing business as well as our efforts to develop new applications of pressure exchanger technology for high-pressure fluid-flow environments;

•our belief that our enhanced safety measures will allow us to help contain the spread of the novel coronavirus (“COVID-19”);

•the development of major public health concerns, including the COVID-19 outbreak or other pandemics arising globally, and the future impact of such major public health concerns, and specifically in the short-term the COVID-19 pandemic, on our business and operations;

•our belief that our existing cash and cash equivalents, our short and/or long-term investments, and the ongoing cash generated from our operations, will be sufficient to meet our anticipated liquidity needs for the foreseeable future, with the exception of a decision to enter into an acquisition and/or fund investments in our latest technology arising from rapid market adoption that could require us to seek additional equity or debt financing;

•our expectation that, as we expand our international sales, a portion of our revenue could be denominated in foreign currencies and the impact of changes in exchange rates on our cash and operating results;

•our expectation of increased sales and marketing expenditures for 2022 and 2023;

•our expectation that we will be able to enforce our intellectual property (“IP”) rights;

•our expectation that the adoption of new accounting standards will not have a material impact on our financial position or results of operations;

•our share repurchase program will result in repurchases of our common stock or enhance long term stockholder value;

•the outcome of proceedings, lawsuits, disputes and claims;

•the impact of losses due to indemnification obligations;

•the impact of changes in internal control over financial reporting; and

•other factors disclosed under Part I, Item 1, “Business,” Item 1A, “Risk Factors,” and Item 2, “Properties,” and Part II, Item 7, MD&A, and Item 7A, “Quantitative and Qualitative Disclosures about Market Risk,” and elsewhere in this Form 10‑K.

You should not place undue reliance on these forward-looking statements, which reflect management’s opinions only as of the date of the filing of this Annual Report on Form 10-K. All forward-looking statements included in this document are subject to additional risks and uncertainties further discussed under Part I, Item 1A, “Risk Factors,” and are based on information available to us as of February 24, 2022. We assume no obligation to update any such forward-looking statements, certain risks and uncertainties which could cause actual results to differ materially from those projected in the forward-looking statements, as disclosed from time to time in our Annual Reports on Form 10‑K, Quarterly Reports on Form 10‑Q and Current Reports on Form 8‑K filed with or furnished to the Securities and Exchange Commission (the “SEC”), as well as in Part I, Item 1A, “Risk Factors,” within this Annual Report on Form 10-K. It is important to note that our actual results could differ materially from the results set forth or implied by our forward-looking statements. The factors that could cause our actual results to differ from those included in such forward-looking statements are set forth under the heading Item 1A, “Risk Factors,” in our Quarterly Reports on Form 10-Q, and in our Annual Reports on Form 10-K, and from time-to-time, in our results disclosed on our Current Reports on Form 8-K.

We provide our Annual Reports on Form 10‑K, Quarterly Reports on Form 10‑Q, Current Reports on Form 8‑K, Proxy Statements, Forms 3, 4 and 5 filed by or on behalf of directors, executive officers and certain large shareholders, and any amendments to those documents filed or furnished pursuant to the Securities Exchange Act of 1934, free of charge on the Investor Relations section of our website, www.energyrecovery.com. These filings will become available as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. From time to time, we may use our website as a channel of distribution of material company information.

We also make available in the Investor Relations section of our website our corporate governance documents including our code of business conduct and ethics and the charters of the audit, compensation and nominating and governance committees. These documents, as well as the information on the website, are not intended to be part of this Annual Report on Form 10-K. We use the Investor Relations section of our website as a means of complying with our disclosure obligations under Regulation FD. Accordingly, you should monitor the Investor Relations section of our website in addition to following our press releases, SEC filings and public conference calls and webcasts.

PART I

Item 1 — Business

Overview

Energy Recovery, Inc. (the “Company”, “Energy Recovery”, “we”, “our” and “us”) designs and manufactures solutions that make industrial processes more efficient and sustainable. Leveraging our pressure exchanger technology, which generates little to no emissions when operating, our solutions lower costs, save energy, reduce waste and minimize emissions for companies across a variety of industrial processes. As the world coalesces around the urgent need to address climate change and its impacts, we are at the forefront on helping companies reduce their energy consumption in their industrial processes, which in turn, reduces their carbon footprint. We believe that our customers do not have to sacrifice quality and cost savings for sustainability and are committed to developing solutions that drive long-term value – both financial and environmental.

The original product application of our technology, the PX® Pressure Exchanger® (“PX”) energy recovery device (“ERD”), was a major contributor to the advancement of seawater reverse osmosis desalination (“SWRO”), significantly lowering the energy intensity and cost of water production globally from SWRO. The PX, which we believe is the industry standard for energy recovery in the SWRO industry, is up to 98% efficient, operates with minimal maintenance, and outlasts most other components of the system in which it is incorporated. We have since introduced our technology to the fast growing industrial wastewater (“IWW”) market, such as battery manufacturers, mining operations, and manufacturing plants that discharge wastewater with significant levels of metals and pollutants, as well as the commercial and industrial refrigeration market.

Engineering, and research and development (“R&D”), have been, and remain, an essential part of our history, culture and corporate strategy. Since our formation, we have developed leading technology and engineering expertise through the continual evolution of our pressure exchanger technology, which can enhance environmental sustainability and improve productivity by reducing waste and energy consumption in high-pressure industrial fluid-flow systems. This versatile technology works as a platform to build product applications and is at the heart of many of our products. In addition, we have engineered and developed ancillary devices, such as our hydraulic turbochargers (“Turbochargers”) and boosters, that complement our ERDs.

As discussed further under the Research, Development and Technology section under Part I, Item 1 of this report, today, we are applying our core technology in new and important ways, building new products to accelerate environmental sustainability across more industries.

We have been incorporated in the state of Delaware since 2001. Our headquarters and principal R&D and manufacturing facility is located in San Leandro, California. In addition, we have manufacturing and warehouse space in Tracy, California and manufacturing, testing and warehouse space in Katy, Texas. We are a global team with sales and worldwide on-site technical support. We maintain international direct sales offices and technical support centers to service customers in Europe, Latin America, the Middle East and Asia.

Energy Recovery, Inc. | 2021 Form 10-K Annual Report | 1

Environmental, Social and Governance Program

We released our second annual Environmental, Social and Governance (“ESG”) report, which details our efforts to accelerate the environmental sustainability of our customers’ operations and enhance the management of ESG issues in our own operations. The report provides examples and data illustrating our products’ positive environmental impacts across the industries where we operate. We understand the importance of being a responsible corporate citizen and believe our ESG program provides us with a strategic roadmap to become a more sustainable and resilient business. Our ESG report outlines our ESG goals and aligns to leading sustainability frameworks and reporting standards, including the Sustainability Accounting Standards Board as well as select disclosures from the Global Reporting Initiative and the United Nations Sustainable Development Goals. Our ESG efforts resulted in an increase in our MSCI, Inc. (“MSCI”) rating position from BBB to a rating of A in February 2021, leading to our inclusion in the MSCI USA Small Cap Leaders Index.

Our ESG goals were set following a materiality assessment and focus on four key ESG topics – Employees, Environmental & Climate Change Risks, Innovation & Opportunity and Products – that both we and key stakeholders identified as highly influential to our business success. Our top-line ESG goals are as follows:

Employees

•Develop workforce to deliver sustainable, diversified growth; and

•Protect the lives and livelihoods of our employees by providing a safe and healthy work environment,

Environmental & Climate Change Risks

•Report climate-related risk strategy and management aligned with the Task Force on Climate-related Financial Disclosures (“TCFD”) recommendations by the end of fiscal year 2024; and

•Certification to the International Organization for Standardization (“ISO”) 14001 environmental management standard by the end of 2022,

Innovation & Opportunity

•Double emissions reductions from our products by end the of fiscal year 2025 versus fiscal year 2019 baseline,

Products

•Deliver products and solutions customers can trust.

Our top-line ESG goals are paired with quantitative targets and key performance indicators to promote transparency and equip our stakeholders to hold us accountable for our ESG performance. With regards to our TCFD recommendations goal, the TCFD recommendations provide a structured approach to evaluating and communicating the potential impact climate change may have on our operations and financial results. We believe alignment with this framework represents the best path for our company to evolve our climate change risk management strategy over the next few years.

Furthermore, as part of our efforts to transparently communicate our ESG performance to our stakeholders, in September 2021, we hosted an ESG-focused webinar, “Charting Sustainable Growth with ESG Principles,” in which we discussed the highlights of our ESG program and how ESG is linked to driving long-term, sustainable growth for us and our stakeholders.

The on-demand webinar and our complete 2020 ESG report can be found on our website at: https://energyrecovery.com/about-us/environmental-social-governance/.

Markets

We offer a suite of products for the SWRO and IWW treatment industries, including ERDs, and high-pressure feed and recirculation pumps. We are also focused on applying our pressure exchanger technology to industries outside of desalination and IWW. We have introduced a solution to reduce energy consumption in natural gas processing and in refrigeration systems that use carbon dioxide (“CO2”), an environmentally sustainable alternative to traditional hydrofluorocarbon (“HFC”)-based systems.

Energy Recovery, Inc. | 2021 Form 10-K Annual Report | 2

The PX Technology

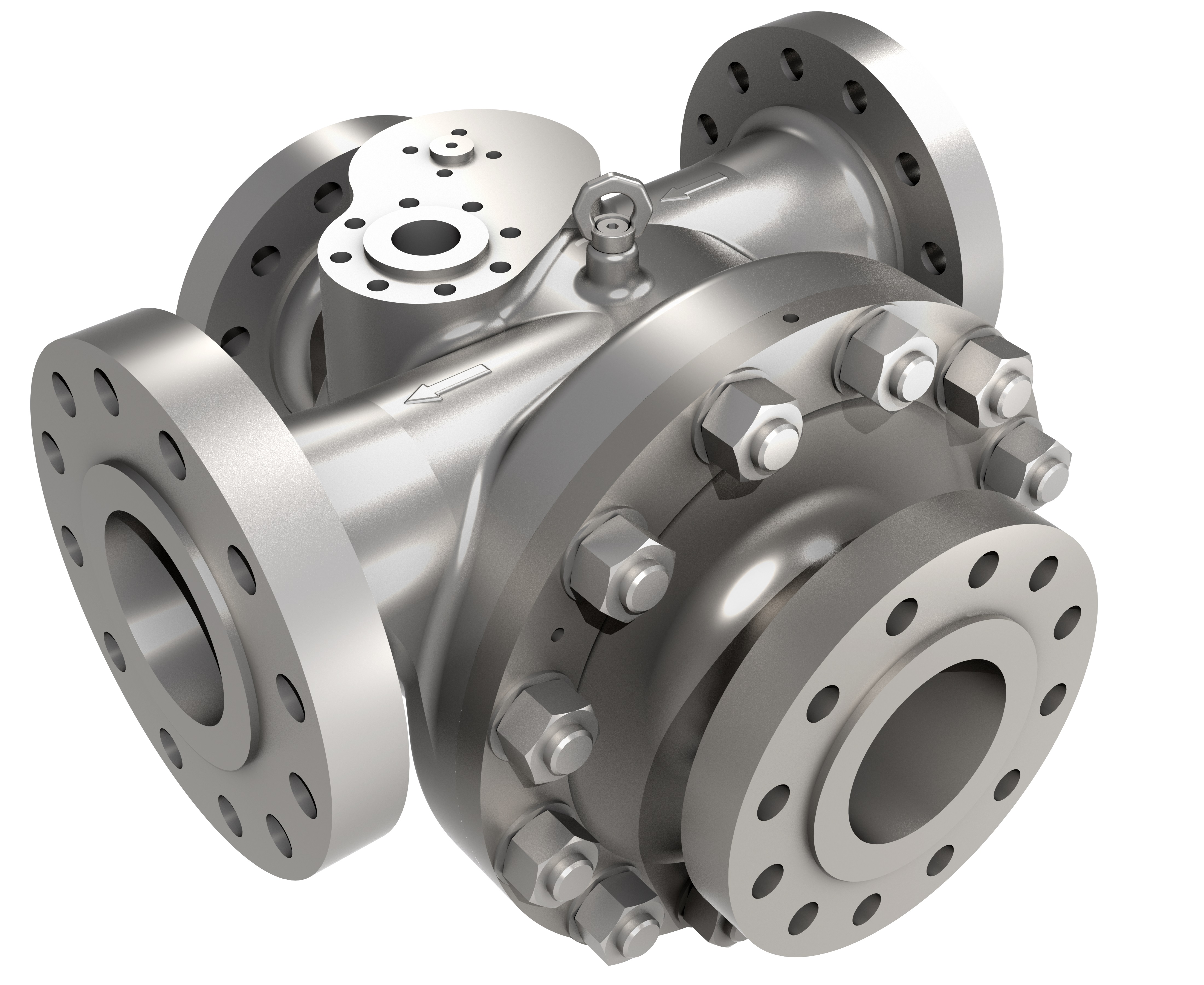

Our success has been built on the strength of our PX using our proprietary pressure exchanger technology platform. Our highly-developed pressure exchanger technology is capable of allowing our PX to recycle pressure energy by transferring this energy from one high pressure column of fluid (liquid or gas) to a low-pressure column of fluid. This technology platform is applicable to a wide-range of industries where high pressure fluids exist.

Our pressure exchanger technology is at the heart of many of the products we have developed and is the core solution to the industries in which we serve. Our pressure exchanger technology is what we center and structure our product applications, solutions, and services around. The pressure exchanger technology, which generates little to no emissions when operating, recycles otherwise wasted pressure energy within a variety of industrial systems, lowering costs, saving energy, reducing waste, while concurrently minimizing emissions and unplanned downtime.

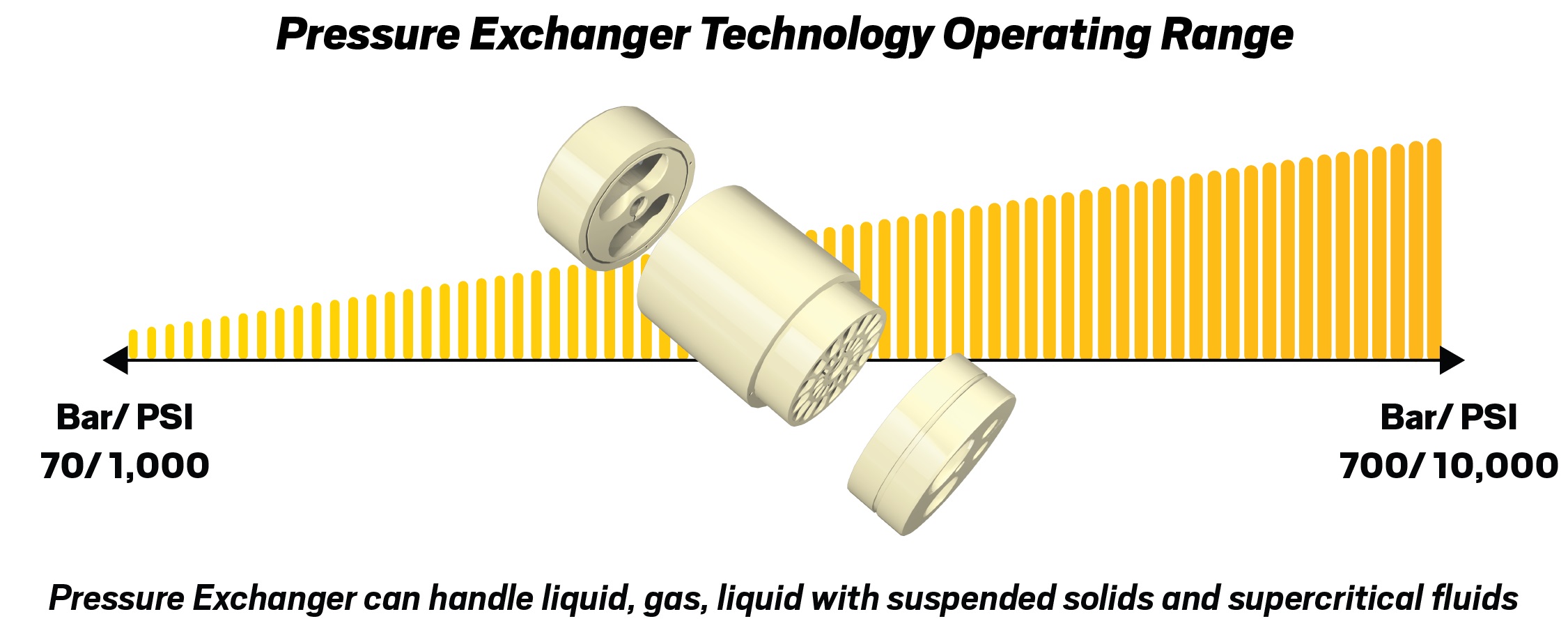

The pressure exchanger technology is highly versatile and acts like a fluid piston, transferring liquid or gas energy ranging from operating pressures between 1,000 pounds per square inch (“psi”), or 70 bar, and as high as 10,000 psi, or 700 bar, through continuous batch process of pressure exchanges, with efficiencies up to 98%.

Our patented PX family of products leverages our pressure exchanger technology and includes a variety of sizes defined by the flow of the plant ranging as low as 20 gallons per minute and up to 300 gallons per minute per device; however, our customers can design their ERD systems to achieve unlimited capacities by installing our PX in parallel and in multiple arrays. Our technology has been deployed into the largest industrial and municipal water treatment plants in the world and we believe the scalability and versatility of our platform can achieve similar success in the emerging markets we are targeting.

Energy Recovery, Inc. | 2021 Form 10-K Annual Report | 3

Solutions

PX, high efficiency isobaric ERDs. Our PX is made of a ceramic rotor supported by a highly efficient hydrodynamic and hydrostatic bearing system. Products in this family are designed for use a variety of reverse osmosis (“RO”) processes within the water treatment industry, including SWRO and higher salinity within brackish water reverse osmosis desalination (“BWRO”), and as well as IWW. |  | ||||

| Ultra PX™. In 2020, we introduced the Ultra PX ERD, which we believe addresses key challenges, such as energy intensity and environmental impacts, associated with treating industrial wastewater in a variety of RO applications. Designed with the pressure exchanger technology that powers our PX, the Ultra PX functions similarly to our PX but can withstand higher pressures and may recover up to 60 percent of wasted energy when applied to higher pressure RO processes, reducing energy use and operating costs. | ||||

| While RO adoption in industrial wastewater treatment is in its early stages, we believe our Ultra PX can help accelerate adoption of RO in the growing zero liquid discharge (“ZLD”) and minimal liquid discharge (“MLD”) market. Furthermore, we believe the Ultra PX can help make RO the preferred treatment option to achieve ZLD and MLD requirements by enhancing RO’s affordability and efficiency compared to thermal treatment options, similar to the impact of our PX in the seawater desalination market. | |||||

Turbochargers, high efficiency centrifugal ERD. Our AT and LPT Turbochargers are used in low-pressure brackish and high-pressure seawater desalination systems, as well as various other water treatment applications, such as those in IWW. Our Turbochargers product lines are highly efficient with state-of-the-art engineering in a compact configuration. We believe our Turbochargers deliver substantial savings, operational benefits, and ease of integration into systems. With custom-designed hydraulics that allow for optimum performance over a wide range of operating conditions, our turbocharger technology offers solutions to capital cost constrained single-stage RO applications, inter-stage boost applications typically found in brackish water desalination and some IWW systems, as well as in the processing of natural gas. |  | ||||

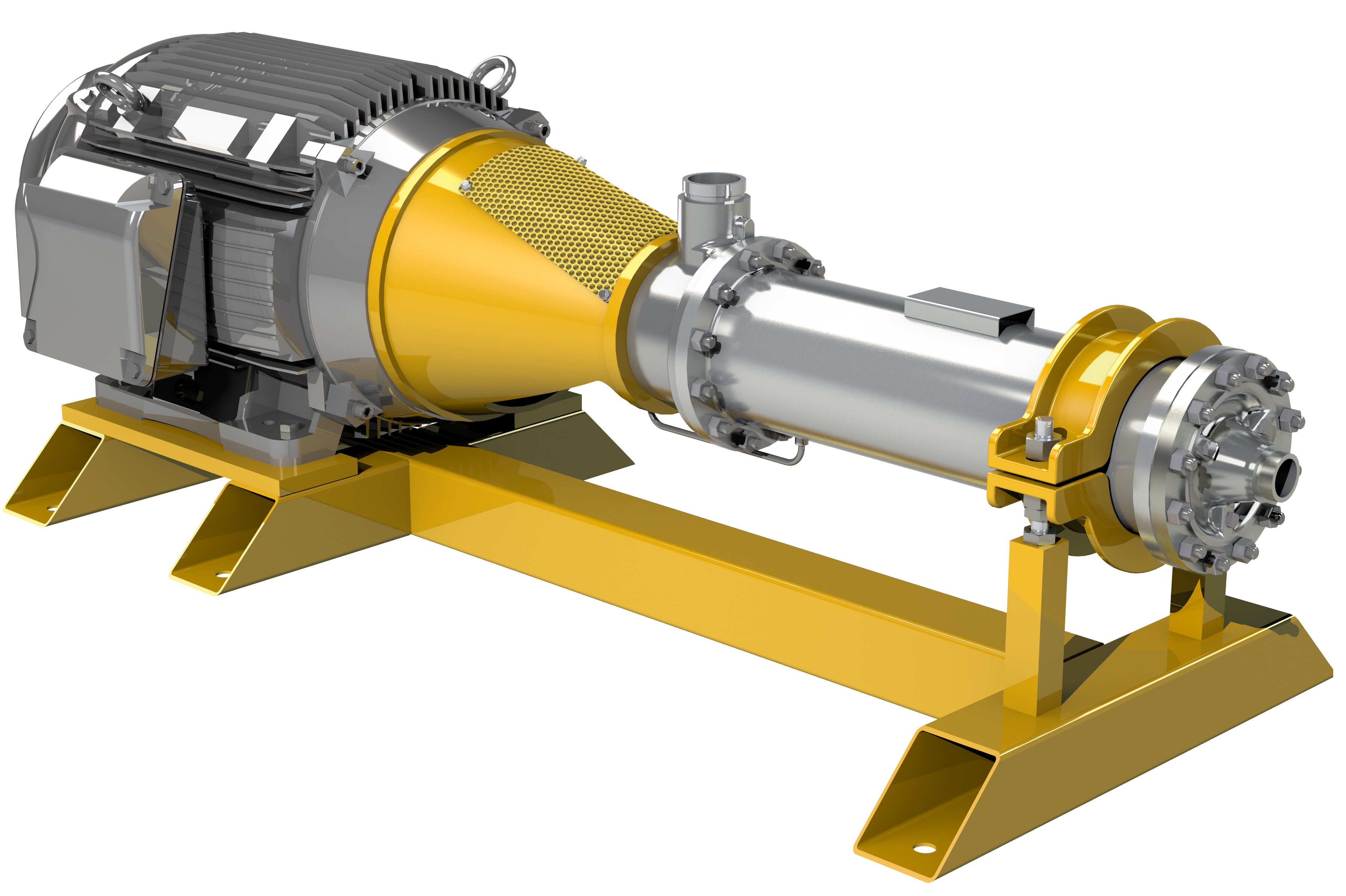

| Pumps. SWRO requires specialized high-pressure membrane feed and, in pressure exchanger applications, high-pressure circulation pumps. We manufacture and/or supply specialized high-pressure feed and circulation pumps for only a portion of the markets served by our ERD solutions. Our high-pressure feed pumps are designed to pressurize the membrane feed flow and overcome the osmotic pressure requirements of the feed water resulting in the production of desalinated water. Our high-pressure circulation pumps are designed to circulate and control the high-pressure flow through our PX and to compensate for small pressure losses across the membranes, PX and associated process piping. | ||||

Energy Recovery, Inc. | 2021 Form 10-K Annual Report | 4

Water Treatment

The world’s need for clean water is intensifying, driven by population growth, industrialization, rapid urbanization, and climate change. According to the United Nations’ estimates, the world will only have 60% of the potable water it needs by 2030, and global demand will surge 30% by 2050, further outstripping supply. Apart from seasonal variations, the supply of fresh water generally remains fixed and is already decreasing in some geographic areas. These trends make the markets we serve, such as desalinating or filtering sea and brackish water, and the treatment and re-use of IWW, increasingly vital to quench global thirst.

Desalination

As reported in our 2020 ESG report, we estimated that in 2020, our life-to-date installed ERDs have saved water desalination customers approximately $2.6 billion in energy costs and helped our customers avoid over 26 terawatt-hours of energy usage, which represents approximately a 4% reduction in the global energy consumption for potable water utilities. Worldwide, SWRO plants using our ERDs produce over 24.0 million cubic meters of water per day (“m3/day”), enough to provide for more than 10% of the United States of America (the “U.S.”) population’s daily water needs. As water scarcity grows in communities across the globe, we are proud of our impact in enabling more affordable, sustainable access to this vital resource.

Reverse Osmosis. RO is the preferred technology in the vast majority of desalination applications, and growing in importance in IWW applications. As the industry leader in ERDs, we deliver efficient, scalable solutions for recovering otherwise wasted energy in the RO process, thereby allowing our customers to reduce their capital expenditures, as well as lower operating costs and reduce carbon emissions associated with the production of clean potable water. We also offer high-pressure multi- and single-stage centrifugal pumps designed to complement our ERDs for a wide range of RO plant capacities and applications.

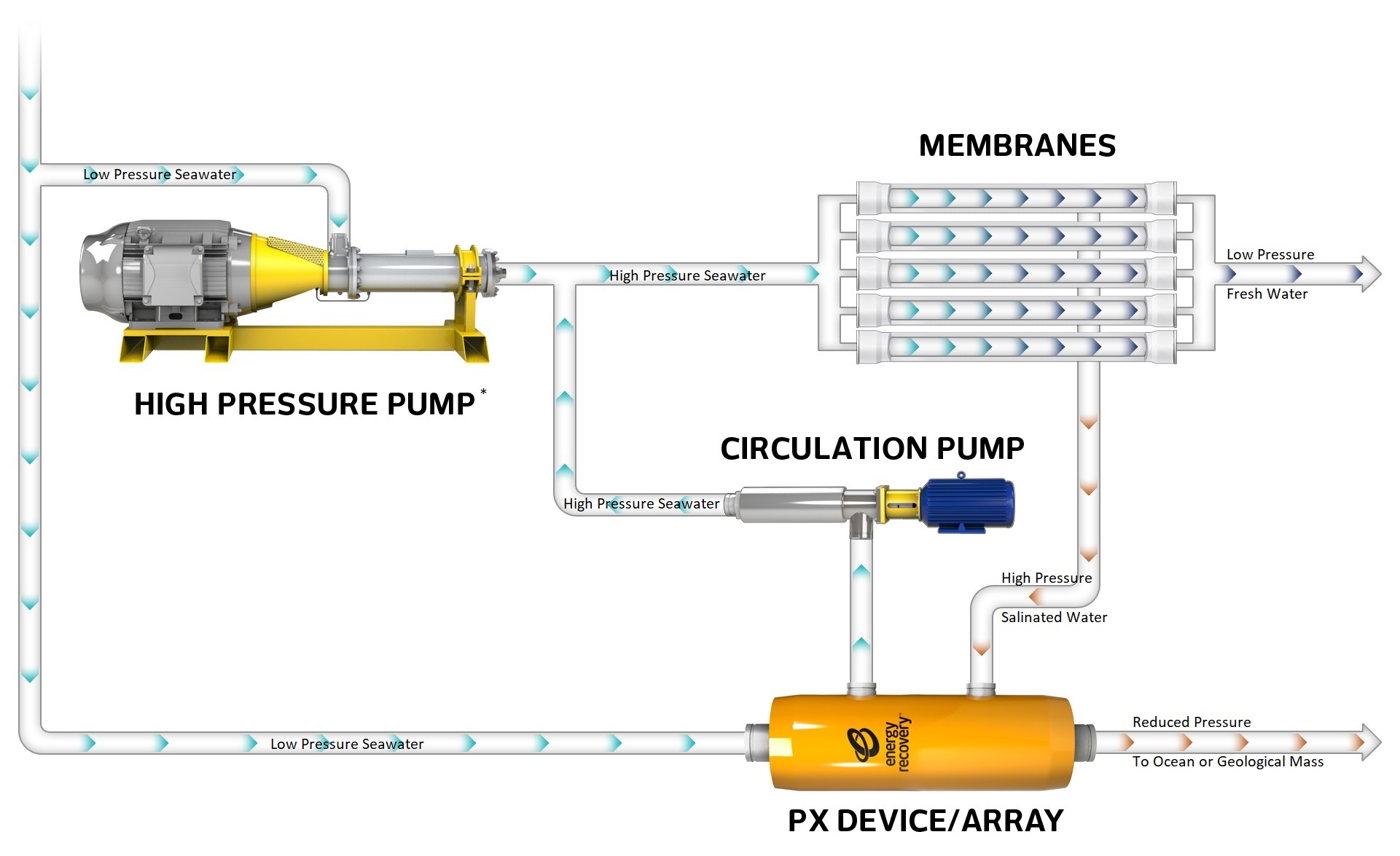

Desalination and Industrial Wastewater Process Flow

* Incoming seawater is simultaneously routed to a high-pressure pump and the PX, allowing the customer to reduce the main high pressure pump size by 60%. Desalination and industrial wastewater process flow diagram incorporating our PX is for illustration purposes only. Actual configuration may vary.

Energy Recovery, Inc. | 2021 Form 10-K Annual Report | 5

Seawater Reverse Osmosis Desalination. Energy intensive pumps are used to pressurize feed waters with varying concentrations of salts, minerals and contaminants, which is then forced through a semi-permeable membrane to achieve the desired water quantity and quality. The SWRO process results in fresh water, suitable for potable, agricultural and industrial use and a highly concentrated and pressurized concentrate or brine stream. Rather than dissipating or “wasting” the pressure energy from the discharge brine, our PX, the most widely used energy recovery solution, can transfer the pressure energy from the high-pressure discharge stream directly to a portion of the low-pressure filtered feed water, thereby reducing the amount of flow required by the main high-pressure processes’ pumps. Our highly efficient technology can recycle this pressure energy at efficiencies up to 98%. This results in a more efficient process as the size of the high-pressure pumps are greatly reduced, no longer need to be sized for full membrane feed flow, and are now re-sized for the permeate flow, thus reducing the energy usage by up to 60%. As a result, our PXs have helped make SWRO an economically viable and more sustainable option in the production of potable water.

Brackish Water Reverse Osmosis Desalination. The BWRO process is similar to the SWRO process. Brackish water typically has lower salt, mineral and contaminant content than seawater, therefore, fewer solids need to be removed and less energy is expended on pressurizing the feed water. Due to the lower cost and available pressure energy involved, our Turbochargers generally have characteristics more applicable to the BWRO process. The amount of salts in the feed water will ultimately determine the system design and operating conditions which, in turn, will drive decisions related to the specification or type of ERD to be employed, if any.

SWRO and BWRO have been our primary markets for revenue generation. The market ranges from small, decentralized desalination plants, such as those used in cruise ships and resorts, to large-scale (“mega”) project desalination plants, defined as those which produce over 50.0 thousand m3/day. Because of the geographical location of many significant water desalination projects, geopolitical and economic events can influence the timing of expected projects. We anticipate that markets traditionally not associated with desalination, such as the U.S. and China, will inevitably develop and provide further revenue growth opportunities.

Both the SWRO and BWRO markets are represented by newly constructed water treatment plant (“greenfield”) projects, and existing water treatment plant (“brownfield”) projects, such as retrofits, upgrades and plant expansions, that utilize legacy ERD technologies, alternative technologies or no ERDs at all. The greenfield market has been the key market for our water business and represents large scale projects that are typically public in nature and involve a formal tendering process; while smaller projects, which are not as common and which may be private in nature, may or may not involve a formal tendering process. Typical brownfield facilities face higher energy consumption and reduced plant availability due to legacy technologies and include improvements to existing operations, equipment upgrades and potential expansions of existing capacity.

We work directly with the project bidders, generally large engineering, procurement and construction firms (“EPC”), end-users and industry consultants, to specify our products prior to the project being awarded, where possible. Once the project is awarded to an EPC, our normal sales process ensues. The greenfield market is highly competitive, and the tendering process pays close attention to the cost to desalinate water (i.e., dollars per cubic meter of water produced). Retrofit opportunities may or may not have a formal tendering process. We typically approach the plant operators, owners and/or end-users of these facilities to present our leading life-cycle cost value-proposition

Industrial Wastewater

The IWW market covers a wide range of industries and geographies. As governments across the globe increase their focus on water conservation, reuse and limiting the amount of pollution, they are establishing more stringent requirements for wastewater treatment and discharge. China and India are two countries that have begun to mandate ZLD or MLD requirements for specific industries, and we expect this trend to expand throughout the world in response to the growing gap between water availability and water demand while focusing on decreasing and/or eliminating pollution from heavy industries.

Many companies are also under pressure from investors and other stakeholders to adopt more sustainable water reuse practices and to reduce their reliance on existing water resources. Sectors such as automotive and electric vehicles, chemicals, pulp and paper, textiles, semiconductors, and other heavy industries are often large polluters and/or water consumers. Their water usage can compete with municipal and agricultural water resources, further straining potable water supply in areas already struggling with water scarcity.

Energy Recovery, Inc. | 2021 Form 10-K Annual Report | 6

A variety of RO technologies may be utilized in the IWW filtration process where our energy recovery solutions may be utilized. Such processes are typically multi-staged, with each stage increasing in pressure as the wastewater is filtered until it reaches a desired stage of purity. Our ERDs can be applied to each of these stages, including our Turbochargers at lower pressures, our flagship desalination PX, and our Ultra PX at the highest pressures, to recover clean water from a wastewater stream and concentrate pollutants to a level where they can be economically utilized or safely disposed, rather than discharged into waterways. Typical operating pressures can range from a few hundred psi to 1,800 psi. We have a full suite of products to serve the various process stages in IWW treatment. Some IWW treatment plants seek to concentrate the dissolved pollutants to an extent that they produce very little or no discharge of pollutants. These treatment facilities are often associated with the mineral extraction, mining, textile, pulp and paper, power generation, and chemical manufacturing industries.

Technology Conversion

The thermal desalination process was the dominant seawater desalination technology employed throughout the 1990’s. In this process, thermal energy is used to evaporate water from heated seawater and subsequently condenses the vapor to produce pure water. Starting in the early 1990’s, due to many factors including the introduction and greater usage of ERDs, the process of choice for the desalination industry shifted from thermal- to membrane-based RO desalination.

Over the past two decades RO desalination technology has become the predominant technology, supplanting thermal desalination technology as today’s desalination technology of choice. As water desalination plants that use the thermal desalination technology age, the industry expects the majority of these plant owners to replace their existing thermal technology with RO desalination technology. These conversions are driving new demand for RO desalination process equipment, which creates demand for our products.

We also see a similar technology conversion in the IWW market. Thermal technologies have been the technology of choice for RO systems seeking to maximize the removal of water in the process, such as in ZLD and MLD processes. Similar to seawater desalination, thermal technologies are an energy- and cost-intensive method for cleaning water in traditional ZLD and MLD configurations, with up to fifty percent of costs typically stemming from thermal treatments. Even in treatment facilities that adopt RO, ZLD and MLD will still require a small amount of thermal treatment to achieve ZLD and MLD objectives. However, leveraging the Ultra PX with RO will significantly lower thermal demand, saving energy and reducing emissions.

Project Channels

We separate our sales into three distinct channels due to financial and other commercial and technical aspects of the projects. We identify these sales channels as megaproject (“MPD”), original equipment manufacturers (“OEM”) and aftermarket (“AM”).

Megaproject. MPD customers are major firms that develop, design, build, own and/or operate large-scale desalination plants with capacities greater than 50.0 thousand m3/day. A majority of our water treatment revenue comes from these customers. Our MPD customers have the required desalination expertise to engineer, undertake procurement for, construct, and sometimes own and operate, large-scale desalination plants or megaprojects. Due to the project structures and capacities of these megaprojects, ongoing operating costs and life cycle costs, rather than the initial capital expenditures is the key factor in the MPD customers’ selection of an ERD solution. As such, MPD customers most often select our PX, which we believe offers market-leading value with the highest technological and economic benefit. We work with our MPD customers to specify and optimize our PX solutions for their plant designs. The average time between project tender and shipment ranges from 16 to 36 months, or more. Each megaproject represents revenue opportunities ranging from approximately $1 million to $21 million. We estimate that the total capital investments by MPD customers in these large-scale infrastructure projects may range between $50 million to over $1 billion.

Original Equipment Manufacturer. OEM customers are companies that supply equipment, packaged systems, and various operating and maintenance solutions for small to medium-sized desalination plants, utilized by commercial and industrial entities, as well as national, state and local municipalities worldwide. We sell to our OEM customers a broad set of our products, including our PX, Turbochargers, high-pressure pumps and circulation “booster” pumps, and associated services. OEM projects comprise desalination plants processing up to 50.0 thousand m3/day, such as desalination plants located in local municipalities, hotels and resorts, power plants, cruise ships, and agricultural sectors, among others. In addition, these OEM customers purchase our solutions for mobile, decentralized “quick water” or emergency water solutions. Unlike megaprojects, OEM projects are smaller in scope and, as such, the initial capital expenditure, rather than future ongoing operating costs, is often more of a factor in selection of an ERD solution. Accordingly, we sell not only our PX, but also our Turbochargers, which offer a lower cost alternative to our PX. The typical OEM project timeline from project tender to shipment ranges from one to 16 months. Each OEM project typically represents revenue opportunities up to $1 million. We estimate that the total capital investments by OEM customers in these projects are typically up to $50 million.

Energy Recovery, Inc. | 2021 Form 10-K Annual Report | 7

Aftermarket. AM customers are desalination plant owners and/or operators who can utilize our technology to upgrade or keep their plant running, and usually have our solutions installed and in operation. We provide spare parts and repair services, field services and various commissioning activities. We leverage our industry expertise in supporting our existing installed base to ensure that our ERD solutions are being operated effectively and efficiently in order to maximize plant availability and overall profitability of the facility operations, as required by our industry partners and customers.

Sales and Marketing

Our strategically located direct sales force offers our products through capital sale to our customers around the world. We maintain a sales and service footprint in strategic territories, allowing rapid response to our customers’ needs, such as in the U.S., China, India, Latin America, Spain, Saudi Arabia and the United Arab Emirates. Our team is comprised of individuals with many years of desalination and water treatment industry expertise. Aligning to the geographic breadth of our current and potential future customers, our product marketing approach includes a strategic presence at water industry events across various regions. In addition, we leverage our industry and market intelligence to develop new solutions and services that can be adopted by our growing customer base.

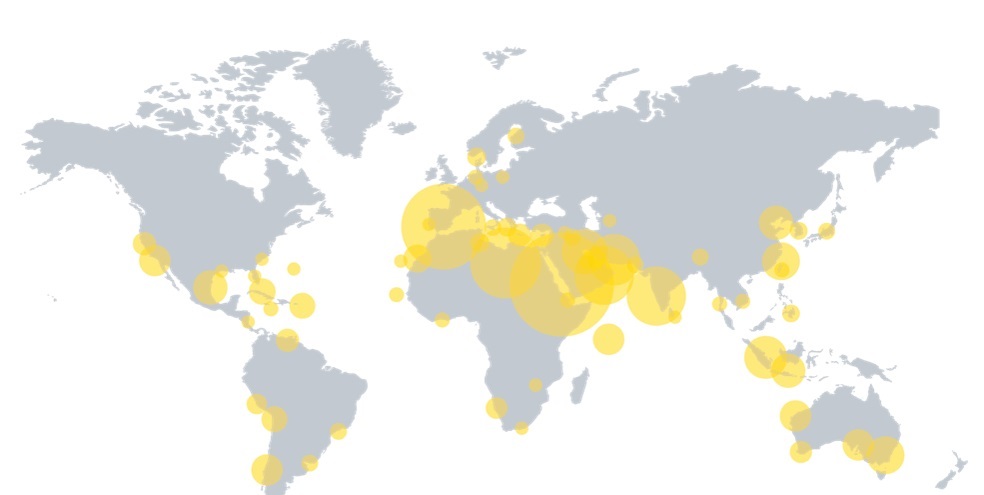

Global Installations of Energy Recovery’s ERDs

A significant portion of our revenue is from outside of the U.S. Additional segment and geographical information regarding our product revenue is included in Note 2, “Revenue,” Note 11, “Segment Reporting,” and Note 12, “Concentrations,” of the Notes to Consolidated Financial Statements in Part II, Item 8, “Financial Statements and Supplementary Data,” of this Annual Report on Form 10-K (the “Notes”).

Energy Recovery, Inc. | 2021 Form 10-K Annual Report | 8

Competition

The market for ERDs, high-pressure pumps, and circulation “booster” pumps, is competitive. As the demand for fresh water increases and the market expands, we expect competition to persist and intensify. We have three main competitors for our ERDs: Flowserve Corporation (“Flowserve”); Fluid Equipment Development Company (“FEDCO”); and Danfoss Group (“Danfoss”). We believe our solutions offer a competitive advantage compared to our competitors’ solutions because our ERDs provide the lowest life-cycle cost and are, therefore, the most cost-effective ERD solutions for the RO desalination application.

In the market for large megaprojects, our PX competes primarily with Flowserve’s DWEER product. We believe our PX has a competitive advantage, as compared to the DWEER product, because our devices are made with highly durable and corrosion-resistant aluminum oxide (“alumina”) ceramic parts that are designed for a life of more than 25 years, are warrantied for high efficiencies, and cause minimal unplanned downtime, resulting in lower lifecycle costs. Additionally, our PX offers optimum scalability with a quick startup, as well as no scheduled maintenance.

In the market for small- to medium-sized desalination plants, as well as IWW, our ERD solutions compete with FEDCO’s turbochargers and Danfoss’ iSave. We believe that our PX has a distinct competitive advantage over these solutions because our devices provide significantly higher energy savings, have lower lifecycle maintenance costs, and are made of highly durable and corrosion-resistant alumina ceramic parts. We also believe that our Turbochargers compete favorably with FEDCO’s turbochargers based on efficiency, price, and because our Turbochargers have design advantages that enhance efficiency, operational flexibility and serviceability.

In the applicable market and flow ranges that we serve for high-pressure pumps and circulation pumps, our solutions compete with pumps manufactured by FEDCO, Flowserve, KSB Aktiengesellschaft, Torishima Pump Mfg. Co., Ltd., Sulzer Pumps, Ltd., and other companies. We believe that our pump solutions are competitive with these solutions because our pumps are developed specifically for RO desalination, are highly efficient, feature product-lubricated bearings, and are often purchased with our ERDs in small- to medium-sized plants.

Seasonality

There is no specific seasonality to highlight that occurs throughout a calendar year. We often experience substantial fluctuations in product revenue from quarter-to-quarter and from year-to-year primarily due to the timing and execution of our MPD shipments, which vary from year to year.

Emerging Technologies

Today, we are leveraging our pressure exchanger technology platform to develop novel new product applications and diversify into new industries. We continue to push the limits of what our core pressure exchanger technology can do, which we believe will unlock new commercial opportunities in the future.

Refrigeration

The global refrigeration industry is a leading contributor to greenhouse gas emissions and HFC refrigerants are the leading contributor. This industry is the fastest growing source of greenhouse gas emissions, growing at a rate of approximately 10% to 15%. Worldwide, more than 120 countries have signed on to the Kigali Amendment which establishes a timeline for the mandated phase down of HFC in both developed and developing countries. In May 2021, the U.S. Environmental Protection Agency (the “EPA”) announced its intention to phase down the production and import of HFC emissions by 85% by 2036, in accordance with the Kigali Amendment. In addition, certain states in the U.S., such as the states of California and Washington, are also adding regulations requiring supermarkets to change their refrigeration systems and the European Union is similarly moving to limit HFCs with supplemental regulations such as the F-Gas phase down.

All of these regulations are driving the refrigeration industry, as well as several supermarket chains looking for a safer source of refrigerants, to shift to CO2, which is one of the most sustainable and safe natural refrigerants due to its low toxicity and flammability, as compared to alternative refrigerants, such as ammonia and propane. As the markets catch up to comply, we anticipate the sales of CO2 refrigeration systems to increase.

Energy Recovery, Inc. | 2021 Form 10-K Annual Report | 9

The challenge today is to make CO2 systems less costly and more efficient in order to bolster the economic case for transitioning to environmentally-friendly CO2 refrigeration, especially in warmer climates where energy consumption in a CO2 refrigeration system is much higher compared to a HFC system. We believe our pressure exchanger technology can solve this challenge by reducing energy consumption and lowering the costs of CO2 systems, similar to what we have achieved in desalination and IWW applications. Our refrigeration-focused product, the PX G1300 (“PX G”), leverages our existing ceramics, material science, and manufacturing expertise, and could eventually alter the standard refrigeration system architecture by reducing costs for retail end users such as grocery stores. The PX G reduces the energy consumption and operating costs of CO2 refrigeration systems in a broad range of operating conditions. We see this as a significant accelerator for adoption of CO2 refrigeration and announced our first commercial contract in the fourth quarter of fiscal year 2021. |  | ||||

The commercial refrigeration market ecosystem has multiple players who integrate the components to build a system. These multiple players include supermarkets, which are the end users of the systems; contractors that assist with the installation and maintenance of the systems; refrigeration system manufacturers; and design consultants that assist in designing and specifying the systems for the supermarkets and the component specifications to the OEMs.

Refrigeration System Gas Process Flow Incorporating Our PX G1300

* Low pressure CO2 is simultaneously routed to a compressor and the PX G1300 which allows the customer to reduce the compressor size. Refrigeration system gas process flow diagram incorporating our PX G1300 is for illustration purposes only. Actual configuration may vary.

Energy Recovery, Inc. | 2021 Form 10-K Annual Report | 10

Natural Gas Processing

| Combustion of natural gas emits about half as much CO2 as coal and 30 percent less than oil, as well as far fewer pollutants, per unit of energy delivered. Natural gas is typically processed by removing acid gases, such as CO2 and hydrogen sulfide before it is ready for distribution and use. A common acid gas removal process uses an amine solvent to absorb acid gases in a high-pressure contactor column. Having absorbed the CO2 and hydrogen sulfide, the pressurized (rich) amine is then depressurized and processed into regenerated (lean) amine for reuse. Our technology has enabled gas processing plant owners and operators, our targeted customers, to achieve immediate and long-term energy savings with little or no operational disruption. Our IsoBoost™ product, an ERD solution based on our turbocharger technology, can recover the energy wasted during the depressurization of the amine. This recovery of amine pressure energy allows the use of fewer high-pressure pumps which reduces energy consumption and thereby the carbon footprint of the plant, capital expenditures, and energy and maintenance costs. In addition, reduced downtime and maintenance can positively impact plant availability. Within the gas processing, the IsoBoost technology enables the recovery of pressure energy in the fluid flows either through the exchange of pressure within the application or by converting it to electricity. | ||||

Several companies manufacture hydraulic turbochargers, which could eventually develop into competitive technology to our IsoBoost. However, none of the companies that currently manufacture turbochargers have significant experience within gas processing. In order to utilize a turbocharger in gas processing, expertise is required to validate the component as well as system level design and integration within a gas processing application.

Manufacturing

Our products, including our PX, Turbochargers, high-pressure pumps, and circulation “booster” pumps, are designed, produced, assembled and tested in our facilities located in California. Our facilities include advanced ceramics manufacturing and testing laboratories, multiple hydraulic performance testing loops, computer numerical control (also referred to as “CNC”) machines, assembly stations and warehouse.

Alumina ceramic components for our PX are manufactured in-house from high-purity alumina to the final product. As part of our waste management strategies, during the machining phase, when the solid components are shaped, excess high-purity alumina powder is collected, processed, and then reused. Components for our other products also undergo final precision machining to protect the proprietary nature of our manufacturing methods and product designs and to maintain premium quality standards. In addition, the availability of multiple test loops allows us to test every water product we manufacture to its full operating conditions. These test loops, which are a major driver of our water usage, have been modified to allow us to recycle most of the water used in these testing cycles.

We obtain raw, processed and certain pre-machined materials from various suppliers to support our manufacturing operations. A limited number of these suppliers are single source to maintain material consistency and support new product development. A qualified redundant source exists in a majority of cases. Through our vertically integrated ceramics precision manufacturing process, we ensure that all components meet our high standards for quality, durability, and reliability.

Our Texas facility is focused on the machining, assembly and testing of tungsten carbide components, which we source from global manufacturers. This facility can also be used to augment alumina ceramics manufacturing as, and if, needed.

We are committed to reducing the environmental impact of our operations. We recognize that as we pursue our strategy of diversified and disciplined growth, our operations and our impact on the environment, may increase. Some of the ways we currently seek to minimize our environmental impact are by reducing consumption of resources through waste management strategies, optimizing the use of renewable energy, and monitoring key environmental indicators. Our efforts to measure and manage our impact will continue to evolve as our business grows. As a commitment to the sustainability of our operations, we are pursuing certification to ISO14001, the international standard for environmental management systems, with a goal to complete certification by the end of fiscal year 2022.

Our production facilities operate under the principles of Lean Manufacturing, and we continuously seek ways to improve product and process performance. Our quality management system is certified to ISO9001:2015 and our safety management system to the ISO45001 standard.

Energy Recovery, Inc. | 2021 Form 10-K Annual Report | 11

Research, Development and Technology

Today our investments into R&D are focused on (1) advancing our solutions to better service historical markets, such as desalination; (2) applying our pressure exchanger technology to new markets, such as our recent entries into the industrial wastewater and refrigeration markets; and (3) fundamental research into new applications of our pressure exchanger technology in existing and new verticals.

At the onset of any technology project, we set stringent financial and commercial parameters, such as profitability and market size, to benchmark our success, including these time-based restrictions: (1) our R&D team must prove any new technologies are viable within 12 months; (2) we must commercialize new products within 24 months of project inception; and (3) we must achieve a breakeven run rate within 36 months of inception. In addition, we consider broader implications of a new product’s impact on environmental and social issues as part of business case development.

We recognize the importance of carefully stewarding resources to support our ongoing R&D program. We maintain advanced analytical and testing capabilities to evaluate our solutions at all company sites. We have developed complex analytical tools which allow us to be less reliant on full-scale testing that is costly and often uses considerable amounts of water and consumable energy. Our advanced numerical modeling and analytical tools allows for 3-dimensional (“3D”), multi-phase, multi-physics, and multi-scale, computational fluid dynamics, fluid structure interactions, thermodynamics and system analysis. Leading-edge modeling and analytical techniques coupled with extensive state of the art experimental capabilities allow us to further refine our existing water, refrigeration and oil & gas technologies, as well as developing new derivatives of our pressure exchanger technology for complex systems and applications.

Our world-class engineers specialize in a range of technical fields critical to support our current product lines and advance our incubation initiatives, including core engineering competencies of fluid mechanics and aerodynamics, solid mechanics with expertise in computational fluid dynamics and finite element analysis, bearings design (roller-element, hydrostatic, and hydrodynamic), multi-phase flow, dynamics and controls, acoustics and vibrations, tribology, material science and coatings, pumps and turbines, turbo-machinery, and rotating equipment.

Information Technology

We rely on our information technology (“IT”) and data systems in connection with many of our business activities. As the role of technology in our business expands, so too does the importance of cybersecurity. We take protecting our brand, systems, data, intellectual property, and customer and employee information, seriously. We actively monitor and manage our IT for security risks (e.g., cybersecurity risks), and look to mitigate these risks through enterprise-wide programs, annual employee training and vulnerability assessments. We have made, and continue to make, investments in a skilled IT workforce and critical technologies.

Our enterprise-wide programs include endpoint security and encryption, network intrusion prevention and detection, a system for managing and installing security patches, updates for third-party applications, and security information and event management (“SIEM”) systems that monitor our infrastructure and alert our security operations center of potential cybersecurity issues. We strictly regulate and limit all access to servers and networks at our facilities. Local network access is restricted by domain authentication, using stringent access control lists and virtual local area networks (“VLAN”). We have built additional layers of security for remote-work access to applications and services, such as software-defined perimeters (“SDP”), zero trust network access, and multi-factor authentication (“MFA”). Our IT department regularly performs penetration testing and we engage a third-party penetration testing company to conduct penetration tests to identify and remediate any issues.

Under our enterprise-wide approach to risk management, cybersecurity is “high-level” risk that is reported to, and overseen by, our Audit Committee of the Board of Directors, which consists of four non-employee independent directors, of which one of these directors has information systems experience. In addition to the enterprise-wide initiatives, we purchase cybersecurity insurance to protect against a wide range of costs that could be incurred in connection with cybersecurity-related incidents. We continually strengthen and enhance our programs and controls around people, process and technology, and apply risk-based strategies to enhance prevention, detection, and response efforts.

Intellectual Property

We seek patent protection for new technologies, inventions, and improvements that are likely to be incorporated into our solutions. We rely on patents, trade secret laws, and contractual safeguards to protect the proprietary tooling, processing techniques, and other know-how used in the production of our solutions. We have a robust intellectual property (“IP”) portfolio consisting of U.S. and international issued patents as well as pending patent applications.

Energy Recovery, Inc. | 2021 Form 10-K Annual Report | 12

We have registered the following trademarks with the United States Patent and Trademark office: “ERI,” “PX,” “PX Pressure Exchanger,” “Pressure Exchanger,” “Ultra PX,” “PX PowerTrain,” “IsoBoost,” the Energy Recovery logo, and “Making Desalination Affordable.” Application is pending for “PX G1300,” “PX G,” and “VorTeq.” We have also applied for and received registrations in international trademark offices.

Human Capital Resources

Our employees are key to our company’s success. Our unparalleled PX ingenuity, increasing sales and related production growth are all enabled by our employees. Our company is built around innovation and driven by diversity of thought and background. We need employees to challenge the status quo, actively partner to resolve challenges, and seek to continuously improve themselves as well as our operations. We strive for an exciting, safe, and collaborative work environment. We are proud of this culture and believe it creates a vital competitive advantage.

As of December 31, 2021, we had 222 full-time employees, which include both permanent and leased employees, primarily as sales and service agents worldwide, and IT support. Our employees are not unionized and we consider our relations with our employees to be good.

Our Code of Business Conduct (our “Code”) serves as a critical tool to help all of us recognize and report unethical conduct, while preserving and nurturing our culture. Our Code is reflected in our employee manual and training programs, including our policies against harassment and bullying, and the elimination of bias in the workplace, which we provide to all of our employees.

Our focus is to create an engaged employee experience, throughout the process of attracting, onboarding, developing, and retaining employees. We are committed to supporting employee development as well as providing competitive benefits and a safe workplace. Our employee engagement efforts include newsletters and all-employee town hall meetings, as well as small group informational settings, through which we aim to keep our employees well-informed and to increase transparency and open communication. In addition, we provide periodic employee training and development through which we strive to educate and enhance our employee’s financial, mental, and physical wellness.

In addition to managing the COVID-19 pandemic and all the ways it has impacted our employees’ lives, we took the virtual meeting opportunity to connect and engage our company’s leaders and technical project influencers, from across the globe, by facilitating numerous leadership development sessions. These sessions empower our company’s leaders to improve their communication and recognize diversity of thought as a true benefit to teamwork.

Our compensation and benefit programs are designed to recognize our employees’ contributions to value ingenuity and business results, including variable pay, which rewards each employee for company and individual performance. In addition, all full-time employees and equivalents are included in share-based equity award grants, health and welfare benefits, including mental wellness, time-off, development programs and training, and opportunities to give back to our communities through donations of time and money.

Employee safety remains our top priority. To accomplish our safety goals, we developed and maintain company-wide policies to ensure the safety of each employee, as well as compliance with Occupational Safety and Health Administration (“OSHA”), and the internationally recognized ISO45001 standards. In our continued response to the COVID-19 pandemic, we implemented safety protocols and procedures to protect our employees, and subcontractors and customers who work at, or visit, our facilities. These protocols, which are reviewed on a periodic basis in accordance with the Centers for Disease Control and Prevention (“CDCP”) and other federal, state and local government agencies public health guidelines, include complying with social distancing and other prescribed health and safety standards. In addition, we modified the way we conduct many aspects of our business to reduce the number of in-person interactions, such as significantly expanding the use of virtual interactions in all aspects of our business, including customer facing activities. In addition, we implemented additional safety measures over and above legally mandated protocols such as weekly COVID-19 testing of employees and visitors, which provides an added layer of trust and comfort for our employees. These safety protocols are reviewed on a periodic basis and will be adjusted as the pandemic progresses.

Energy Recovery, Inc. | 2021 Form 10-K Annual Report | 13

Additional Information

Our website is www.energyrecovery.com. We also maintain an Investor Relations website as a routine channel for distribution of important information, including news releases, presentations, and financial statements (https://ir.energyrecovery.com). We intend to use our Investor Relations website as a means of complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor our Investor Relations website in addition to press releases, Securities and Exchange Commission (“SEC”) filings, and public conference calls and webcasts. Our Annual Report on Form 10‑K, Quarterly Reports on Form 10‑Q, Current Reports on Form 8‑K, all amendments to those reports, and the Proxy Statement for our Annual Meeting of Stockholders are made available, free of charge, in the Investor Relations section of our website, as soon as reasonably practicable after the reports have been filed with, or furnished to, the SEC. The information contained on our website or any other website is not part of this report nor is it considered to be incorporated by reference herein or with any other filing we make with the SEC. Our headquarters and primary manufacturing center is located at 1717 Doolittle Drive, San Leandro, California 94577, and our main telephone number is (510) 483-7370. The SEC maintains an internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC and the address of that site (http://www.sec.gov).

Item 1A — Risk Factors

The following discussion sets forth what management currently believes could be the most significant risks and uncertainties that could impact our businesses, results of operations, and financial condition. Other risks and uncertainties, including those not currently known to us or our management, could also negatively impact our businesses, results of operations, and financial conditions. Accordingly, the following should not be considered a complete discussion of all of the risks and uncertainties we may face. We may amend or supplement these risk factors from time to time in other reports we file with the SEC.

Risks Related to our Water Segment

Our Water segment revenues depend on the construction of new desalination plants, and the retrofit of existing plants, and as a result, our operating results have experienced, and may continue to experience, significant variability due to volatility in capital spending, availability of project financing, and other factors affecting the water desalination industry.

We currently derive the majority of our Water segment revenues from sales of products and services used in desalination plants for municipalities, hotels, mobile containerized desalination solutions, resorts, and agricultural operations in dry or drought-ridden regions of the world. The demand for our products used in the Water segment may decrease if the construction of desalination plants or the retrofit of existing plants, declines for political, economic, or other factors, especially in dry or drought-ridden regions. In addition, the desalination industry has been experiencing a technology shift from thermal desalination plants to SWRO production. If this technology shift does not continue or we are unable to capture a portion of the market created by this shift, our Water segment sales and revenue can be negatively impacted.

Other factors that could affect the number and capacity of desalination plants built or the timing of their completion, include the availability of required engineering and design resources; a weak global economy; shortage in the supply of credit and other forms of financing; changes in government regulation, permitting requirements, or priorities; and reduced capital spending for desalination. Each of these factors could result in reduced or uneven demand for our products. Pronounced variability or delays in the construction of desalination plants or reductions in spending for desalination, could negatively impact our Water segment sales and revenue, which in turn could have an adverse effect on our entire business, financial condition, or results of operations and make it difficult for us to accurately forecast our future sales and revenue.

Energy Recovery, Inc. | 2021 Form 10-K Annual Report | 14

Our Water segment faces competition from a number of companies that offer competing energy recovery and pump solutions. If any one of these companies produces superior technology or offers more cost-effective products, our competitive position in the market could be harmed and our profits may decline.

The market for ERD and pumps for desalination plants is competitive and evolving. We expect competition to persist and intensify as the desalination market continues to grow. We expect new competitors to enter the market and existing competitors to introduce improvements to their existing products and new products that are directly competitive to our energy recovery and pump solutions. These improved and new products may be superior to our products and/or could be offered at prices that are considerably less than the cost of our products. The performance and pricing pressure of such new products could cause us to adjust the prices of certain products to stay competitive, or we may not be able to continue to win large contracts, which could adversely affect our market share, competitive position and margins. Some of our current and potential competitors may have significantly greater financial, technical, marketing, and other resources; longer operating histories; or greater name recognition. They may also have more extensive products and product lines that would enable them to offer multi-product or packaged solutions as well as competing products at lower prices or with other more favorable terms and conditions. As a result, our ability to sustain our market share may be adversely impacted, which would affect our business, product margins, operating results, and financial condition. In addition, if one of our competitors were to merge or partner with another company, the change in the competitive landscape could adversely affect our continuing ability to compete effectively.

A sustained downturn in the economy or prolonged lower oil prices, could impact future desalination plants and the retrofit of existing plants, which could result in decreased demand for our water products and services.

The demand for our water products and services depends primarily on the continued construction of new large scale desalination plants and the retrofit of existing plants, particularly in the countries that make up the Gulf Cooperation Council (“GCC”). The recent economic decline caused by the spread of COVID-19 or a prolonged decrease in oil prices, may have a negative economic impact on these and other countries, which may impact the availability of project financing for new desalination and retrofit projects, such as the ability to secure credit for these projects, which would result in the postponement or cancellation, and/or change government priorities or otherwise reduce spending for desalination projects, each of which could result in decreased demand for our products and services, which could have an adverse effect on our entire business, financial condition or results of operations.

We are subject to risks related to product defects, which could lead to warranty claims in excess of our warranty provision or result in a significant or a large number of warranty or other claims in any given year.

We provide a warranty for certain products for a period of 18 to 30 months and provide up to a five-year warranty for the ceramic components of our PX-branded products. We test our products in our manufacturing facilities through a variety of means; however, there can be no assurance that our testing will reveal latent defects in our products, which may not become apparent until after the products have been sold into the market. The testing may not replicate the harsh, corrosive, and varied conditions of the desalination and other plants in which they are installed. It is also possible that components purchased from our suppliers could break down under those conditions. Certain components of our Turbochargers and pumps are custom-made and may not scale or perform as required in production environments. Accordingly, there is a risk that we may have significant warranty claims or breach supply agreements due to product defects. We may incur additional cost of revenue if our warranty provisions are not sufficient to cover the actual cost of resolving issues related to defects in our products. If these additional expenses are significant, they could adversely affect our business, financial condition, and results of operations.

Energy Recovery, Inc. | 2021 Form 10-K Annual Report | 15

Risks Related to our Emerging Technologies

Our diversification into new fluid flow markets, such as commercial refrigeration and IWW, may not be successful.

We have made a substantial investment in R&D and sales to execute on our diversification strategy into fluid flow markets such as commercial refrigeration and IWW. While we see diversification as core to our growth strategy, there is no guarantee that we will be successful in our efforts. Our model for growth is based in part on our ability to initiate and embrace disruptive technology trends, to enter new markets, both in terms of geographies and product areas, and to drive broad adoption of the products and services that we develop and market. Our competitive position and future growth depend upon a number of factors, including our ability to successfully: (i) innovate, develop and maintain competitive products, and services to address emerging trends and meet customers’ needs, (ii) defend our market share against an ever-expanding number of competitors, (iii) enhance our product and service offerings by adding innovative features or disruptive technologies that differentiate them from those of our competitors and prevent commoditization, (iv) develop, manufacture and bring compelling new products and services to market quickly and cost-effectively, (v) attract, develop and retain individuals with the requisite innovation and technical expertise and understanding of customers’ needs to develop new technologies, products and services, (vi) continue to invest in manufacturing, research and development, engineering, sales and marketing, and customer support. Any inability to execute this model for growth could damage our reputation, limit our growth, and negatively affect our operation results. In addition, profitability, if any, in new industrial verticals may be lower than in our Water segment, and we may not be sufficiently successful in our diversification efforts to recoup investments. The failure of our technologies, products or services to maintain and gain market acceptance due to more attractive offerings, or customers’ slower-than-expected adoption of and investment in our new and innovative technologies could significantly reduce our revenues or market share and adversely affect our competitive position.

We may not be able to successfully complete development, launch or commercialize our CO2 refrigeration technology.