1 April 2020 Investor Presentation Issuer Free Writing Prospectus Filed pursuant to Rule 433(d) Registration No. 333 - 225381 April 24, 2020

2 Disclaimer This presentation was prepared by Ecopetrol S.A. (the “Company” or “ Ecopetrol ”) with the purpose of providing interested parties certain financial and other information of the Company. This presentation is for discussion purposes and highlights basic information about Ecopetrol and this offering. Because it is a summary, it does not contain all the information that you should consider before investing. This presentation should be read in conjunction with the base pros pec tus included in the registration statement, and the related prospectus supplement (including any information incorporated by reference therein), filed by Ecopetrol with the SEC in connection with the offering of notes to which this presentation relates. You may get these documents by visiting EDGAR on the SEC website ( www.sec.gov ). This document includes forward - looking statements within the meaning of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934 and the Pri vate Securities Litigation Reform of 1995, regarding the probable development of Ecopetrol’s Business. Such projections and statem ent s include references to estimates or expectations of the Company regarding its future and operational results and other statements that are not historical facts. Est imates and expectations are uncertain because of their nature. Words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “should,” “plan,” “potential,” “p redicts,” “prognosticate,” “project,” “target,” “achieve” and “intend,” among other similar expressions, are understood as forward - looking statements. Potential investors and t he market in general should be aware that the information provided herein does not constitute any guarantee of its performance, risks or uncertainties that may occur o r m aterialize. These forward - looking statements are based on the Company’s current objectives, beliefs and expectations, and they are subject to significant risks and uncert ain ties. Real results may fluctuate and differ from those provided herein due to several factors outside of the control of the Company. Such forward - looking statements speak only as at the date in which they are made and neither Ecopetrol nor its advisors, officers, employees, directors or agents, make any representation nor shall assume any responsibility in th e event actual performance of the Company differs from what is provided herein. Moreover, Ecopetrol , its advisors, officers, employees, directors or agents shall not have any obligation whatsoever to update, correct, amend or adjust this presentation based on new information or events occurring after its disclosure. The ris ks and uncertainties regarding these forward - looking statements include, but are not limited to, those set forth under the heading “Risk Factors” in the Company’s Report on Form 20 - F for the year ended December 31, 2019 and in the Company’s other filings with Securities and Exchange Commission (the “SEC”), which are available at www.sec.gov . In making any future investment decision, you must rely on your own examination of Ecopetrol including the merits and risks involved. This presentation should not be construed as financial,The Company has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Company has filed with the SEC for more complete information about the Company and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Company or any of the underwriters can arrange to send you the prospectus if you request it by calling or writing Goldman Sachs & Co. LLC toll-free at 1-866-471-2526, J.P. Morgan Securities LLC collect at 1-212-834-4533 or Scotia Capital (USA) Inc. toll free at 1-800-372-3930 or collect at 1-212-225-5559. legal, tax, accounting, investment or other advice or a recommendation with respect to any investment . Y ou should consult your own advisors as needed to make an investment decision and determine whether it is legally permitted to make an investment under applicable le gal investment, securities or similar laws or regulations . This presentation uses Non - IFRS financial measures to present the financial performance of the Company. Non - IFRS financial meas ures should be viewed in addition to, and not as an alternative for, the Company's reported operating results or cash flow from operations or any other measure of per formance as determined in accordance with IFRS . Neither this presentation nor any of its contents may be used for any other purpose without the prior written consent of Ecopetrol. None of Goldman Sachs & Co. LLC, J.P. Morgan Securities LLC or Scotia Capital (USA) Inc. has independently verified the information contained herein or any other i nfo rmation that has or will be provided to you.

Summary Terms of the Offering 3 Issuer Ecopetrol S.A. Format SEC Registered Ranking Senior Unsecured Notes Expected Ratings Fitch: BBB - (Negative) | S&P: BBB - (Stable) | Moody’s: Baa3 (Stable) Currency USD Size Benchmark Tenor 10 year Coupon Payment Semi - annual Use of Proceeds General corporate purposes, including but not limited to financing our investment plan in the 2020 - 2021 period Minimum Demons $1,000 X $1,000 Governing Law New York Listing New York Stock Exchange Joint Lead Bookrunners Goldman Sachs, J.P. Morgan, Scotiabank

Business Overview 1 4

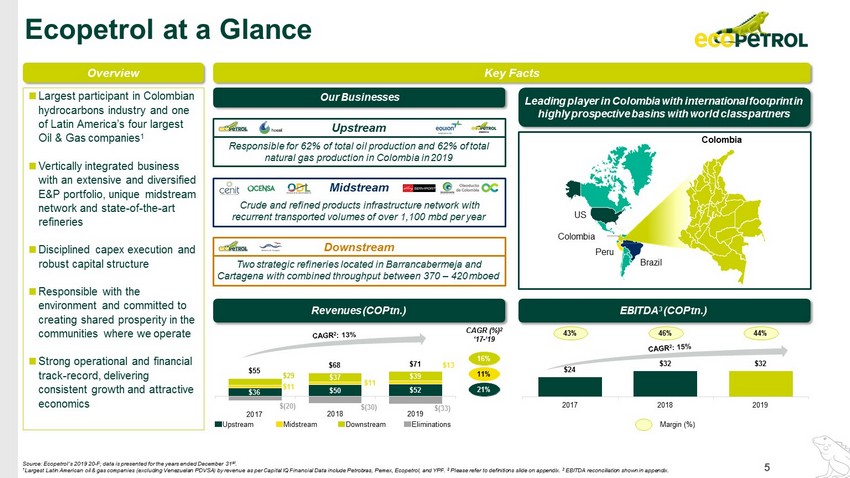

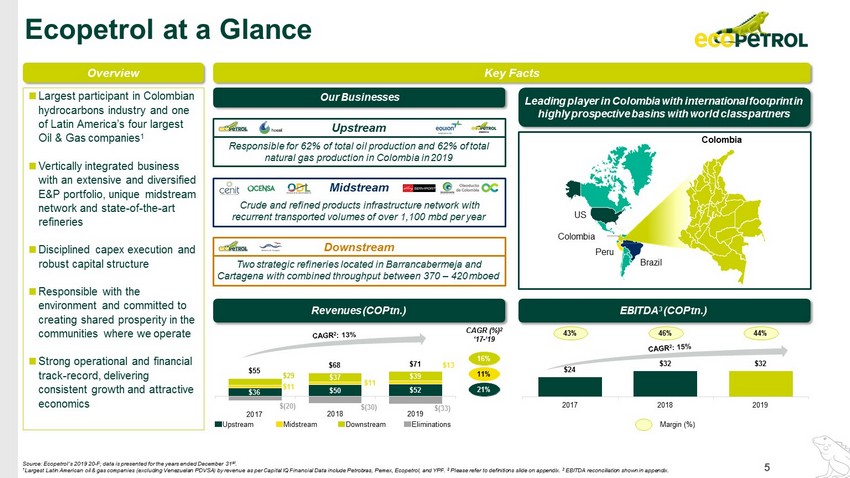

5 $24 $32 $32 2 0 17 2 0 18 2 0 19 $36 $52 $11 $11 $13 $29 $37 $50 $39 $ ( 20 ) $ ( 30 ) $ ( 33 ) $55 $68 $71 2 0 1 8 2 0 1 9 Ecopetrol at a Glance O verview Key Facts Our Businesses Leading player in Colombia with international footprint in highly prospective basins with world class partners Upstream Midstream Downstream Revenues (COP tn.) EBITDA 3 (COP tn.) Colombia US Colombia Peru Brazil CAGR (%) 2 ‘17 - ‘19 21% 11% 16% 43% 46% 44% Margin (%) 2 0 1 7 Upstream M i dstre a m Do w nstre a m Eli m i n a t i o n s Largest participant in Colombian hydrocarbons industry and one of Latin America’s four largest Oil & Gas companies 1 Vertically integrated business with an extensive and diversified E&P portfolio, unique midstream network and state - of - the - art refineries Disciplined capex execution and robust capital structure Responsible with the environment and committed to creating shared prosperity in the communities where we operate Strong operational and financial track - record, delivering consistent growth and attractive economics Responsible for 62% of total oil production and 62% of total natural gas production in Colombia in 2019 Crude and refined products infrastructure network with recurrent transported volumes of over 1,100 mbd per year Two strategic refineries located in Barrancabermeja and Cartagena with combined throughput between 370 – 420 mboed Source: Ecopetrol’s 2019 20 - F; data is presented for the years ended December 31 st . 1 Largest Latin American oil & gas companies (excluding Venezuelan PDVSA) by revenue as per Capital IQ Financial Data include Petrobras, Pemex, Ecopetrol, and YPF. 2 Please refer to definitions slide on appendix. 3 EBITDA reconciliation shown in appendix.

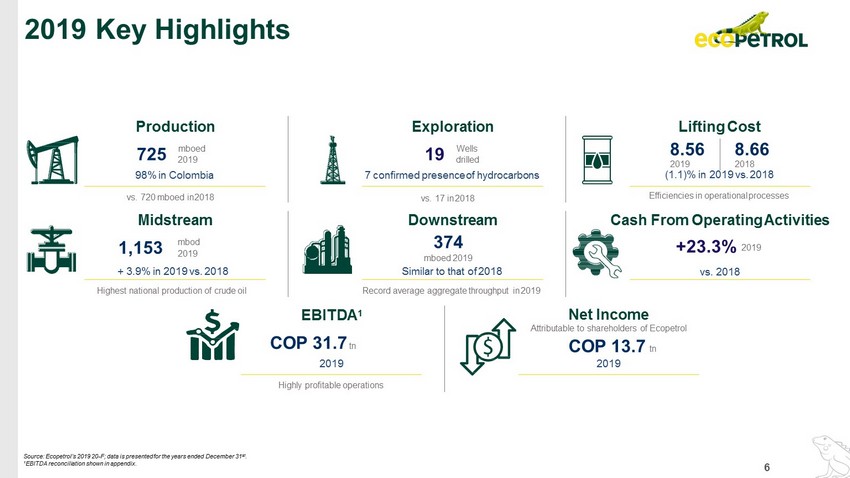

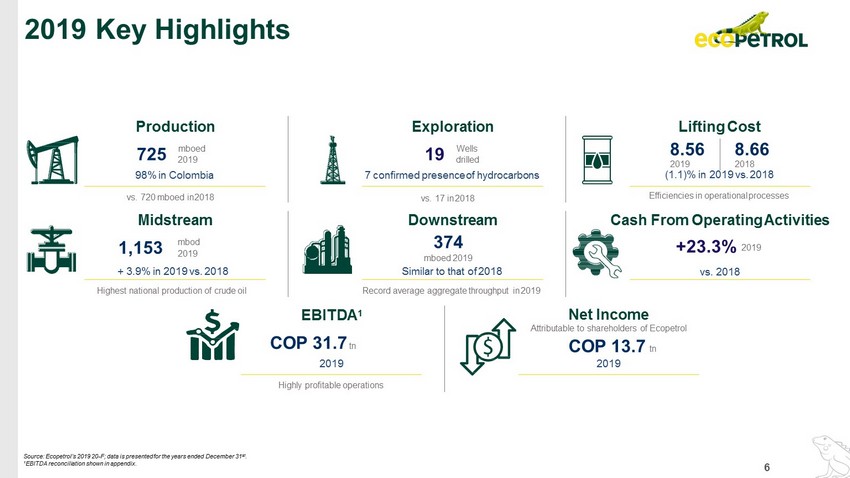

6 Net Income Attributable to shareholders of Ecopetrol COP 13.7 tn 2019 2019 Key Highlights 98% in Colombia vs. 720 mboed in 2018 72 5 Production mboed 2019 7 confirmed presence of hydrocarbons Exploration Wells d r i l l ed 19 Efficiencies in operational processes Lifting Cost 8 . 5 6 8.66 2019 2018 (1.1)% in 2019 vs. 2018 + 3.9% in 2019 vs. 2018 Highest national production of crude oil 1 , 1 5 3 M i dstream mbod 2019 Record average aggregate throughput in 2019 Downstream 374 mboed 2019 Similar to that of 2018 Highly profitable operations EBITD A 1 COP 31.7 tn 2019 vs. 17 in 2018 Source: Ecopetrol’s 2019 20 - F; data is presented for the years ended December 31 st . 1 EBITDA reconciliation shown in appendix. Cash From Operating Activities +23.3% 2019 vs. 2018

Response to COVID - 19 and Decline in Brent Oil Prices: Adjustments to 2020 Investment Plan A US$1.2 Billion Decrease in the 2020 Investment Plan New Earnings Distribution Proposal In November 2019, Ecopetrol’s Board of Directors approved between US$4.5 and US$5.5 billion for the 2020 investment plan at US$57/Bl Brent However, on March 16, 2020, Ecopetrol announced a set of actions to address the current challenging market conditions, which have resulted, among other matters, in a significant decline in the Brent crude price as compared to the end of 2019 (a 52% decline as of April 10, 2020), due to external shocks including the strong increase in the supply of oil and the spread of the novel strain of coronavirus infection (“COVID - 19”), which has reduced oil and gas demand This will enable Ecopetrol to strengthen its competitiveness, including austerity measures, through prioritization of operational and administrative activities, and greater control over operation expenses, such as travel restrictions, sponsorships and involvement in events, among others The implementation of new commercial strategies will allow Ecopetrol to maximize the value of crude and other products sold by the company The Board of Directors proposed a new payments scheme consisting of i) an initial payment of 100% of the dividend to minority shareholders and ii) a payment of 14% of the dividend to the majority shareholder, in each case, to be made on April 23, 2020 The payment for the remaining 86% of the dividend to the majority shareholders to be disbursed during the second half of 2020 The new range of the 2020 Investment Plan is US$3.3 – 4.3 Billion The measures adopted aim to intervene in investment opportunities in the early stages, seeking to preserve production and cash flow and maintain the integrity and reliability of investments, including social investment commitments already made 3 1 A COP 2 Trillion Cutback in Costs and Expenses 2 Implementation of New Commercial Strategies 4 Ecopetrol will continue to monitor market developments to determine the need to launch subsequent stages of the intervention plan, seeking to optimize the balance between decisive responses under current market conditions and preservation of long - term value proposition 7

2 Investment Highlights 8

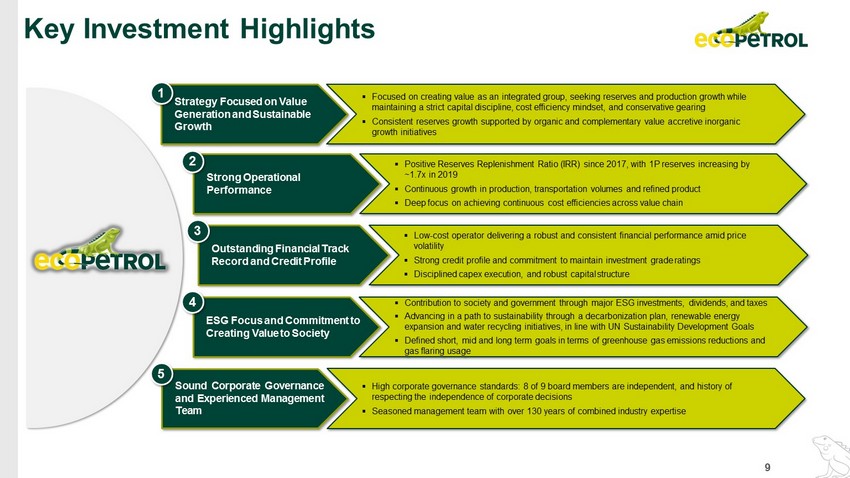

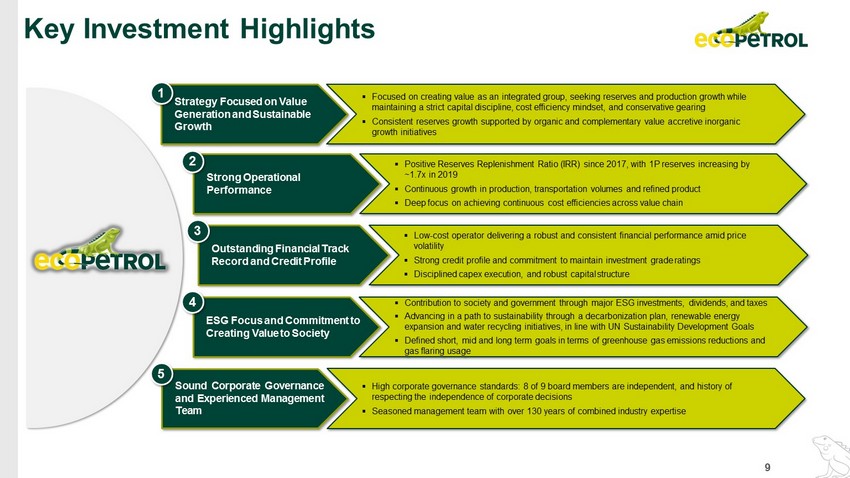

Strategy Focused on Value Generation and Sustainable Growth ESG Focus and Commitment to Creating Value to Society Strong Operational Performance Outstanding Financial Track Record and Credit Profile Sound Corporate Governance and Experienced Management Team Key Investment Highlights 1 4 2 3 5 ▪ Focused on creating value as an integrated group, seeking reserves and production growth while maintaining a strict capital discipline, cost efficiency mindset, and conservative gearing ▪ Consistent reserves growth supported by organic and complementary value accretive inorganic growth initiatives ▪ Contribution to society and government through major ESG investments, dividends, and taxes ▪ Advancing in a path to sustainability through a decarbonization plan, renewable energy expansion and water recycling initiatives, in line with UN Sustainability Development Goals ▪ Defined short, mid and long term goals in terms of greenhouse gas emissions reductions and gas flaring usage ▪ Positive Reserves Replenishment Ratio (IRR) since 2017, with 1P reserves increasing by ~1.7x in 2019 ▪ Continuous growth in production, transportation volumes and refined product ▪ Deep focus on achieving continuous cost efficiencies across value chain ▪ Low - cost operator delivering a robust and consistent financial performance amid price volatility ▪ Strong credit profile and commitment to maintain investment grade ratings ▪ Disciplined capex execution, and robust capital structure ▪ High corporate governance standards: 8 of 9 board members are independent, and history of respecting the independence of corporate decisions ▪ Seasoned management team with over 130 years of combined industry expertise 9

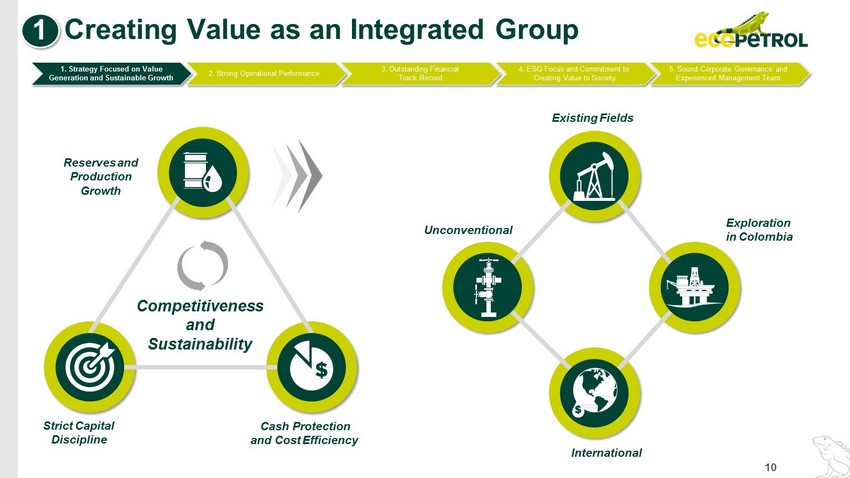

Existing Fields Unconventional Exploration in Colombia In t ernati o nal Reserves and Production Growth Cash Protection and Cost Efficiency Strict Capital Discipline Comp e tit i v en e s s and Sustainability 1. Strategy Focused on Value Generation and Sustainable Growth 2. Strong Operational Performance 3. Outstanding Financial Track Record 5. Sound Corporate Governance and Experienced Management Team 4. ESG Focus and Commitment to Creating Value to Society 1 Creating Value as an Integrated Group 10

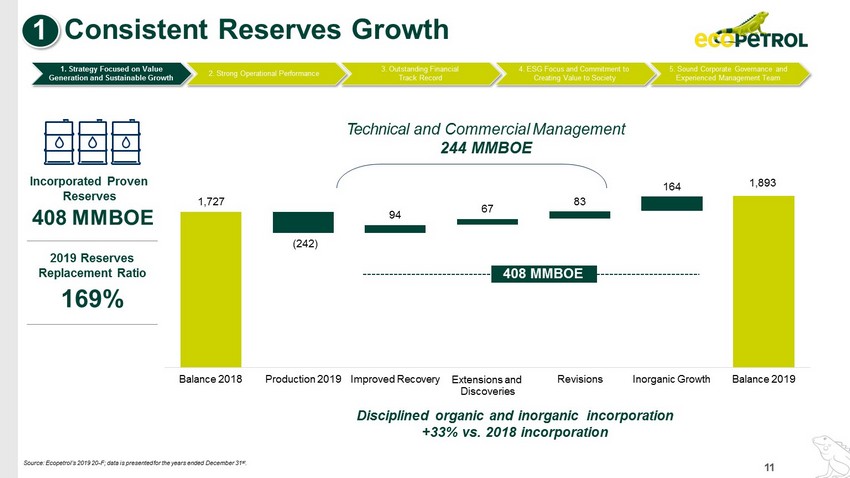

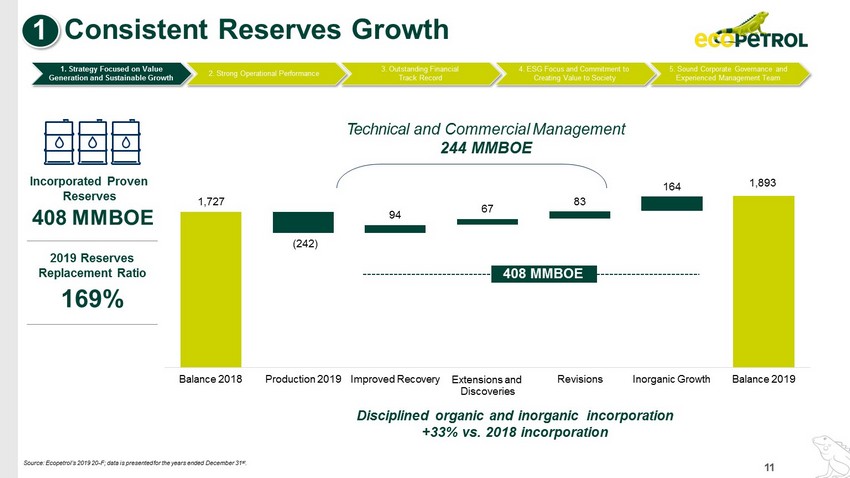

11 1,727 (2 4 2) 94 67 83 164 1,893 Balance 2018 Production 2019 Improved Recovery Extensions and Discoveries Revisions Inorganic Growth Balance 2019 Technical and Commercial Management 244 MMBOE Disciplined organic and inorganic incorporation +33% vs. 2018 incorporation 408 MMBOE 2019 Reserves Replacement Ratio 169% Incorporated Proven Reserves 408 MMBOE 1. Strategy Focused on Value Generation and Sustainable Growth 2. Strong Operational Performance 3. Outstanding Financial Track Record 5. Sound Corporate Governance and Experienced Management Team 4. ESG Focus and Commitment to Creating Value to Society 1 Consistent Reserves Growth Source: Ecopetrol’s 2019 20 - F; data is presented for the years ended December 31 st .

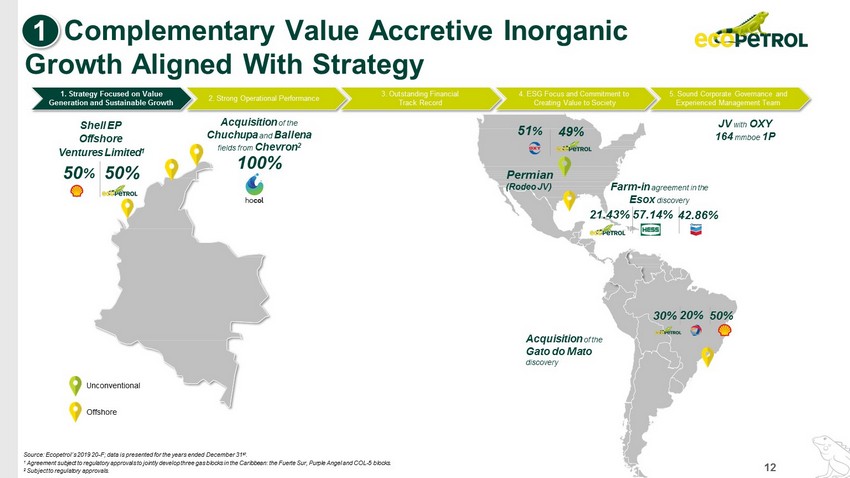

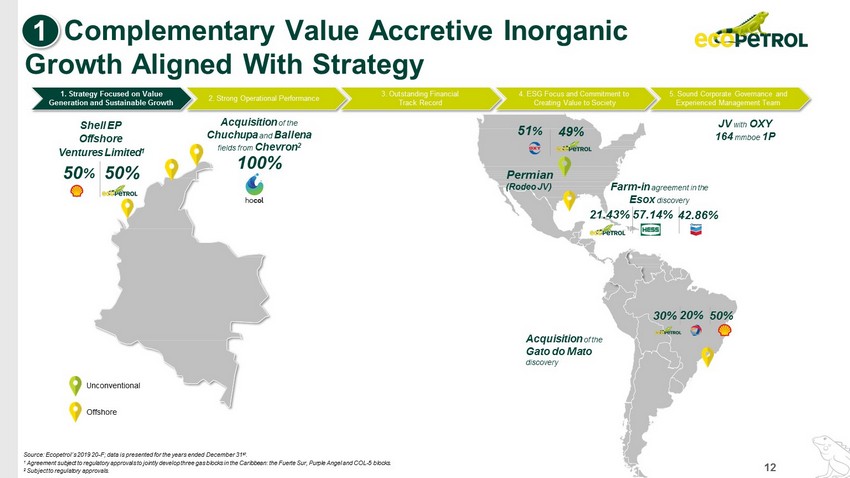

12 JV with OXY 164 mmboe 1P Farm - in agreement in the Esox discovery Shell EP O f fs ho r e Ventures Limited 1 50 % 50% Acquisition of the Chuchupa and Ballena fields from Chevron 2 100% 51 % 49% 30% 20% 50% Acquisition of the Gato do Mato discovery Permian (Rodeo JV) 21.43% 57.14% 42.86% Unconventional Offshore Source: Ecopetrol’s 2019 20 - F; data is presented for the years ended December 31 st . 1 Agreement subject to regulatory approvals to jointly develop three gas blocks in the Caribbean: the Fuerte Sur, Purple Angel and COL - 5 blocks. 2 Subject to regulatory approvals. 1. Strategy Focused on Value Generation and Sustainable Growth 2. Strong Operational Performance 3. Outstanding Financial Track Record 5. Sound Corporate Governance and Experienced Management Team 4. ESG Focus and Commitment to Creating Value to Society 1 Complementary Value Accretive Inorganic Growth Aligned With Strategy

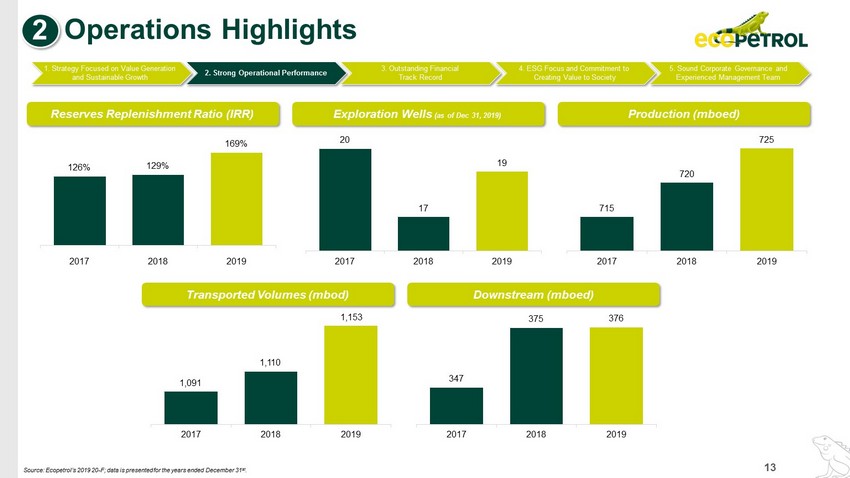

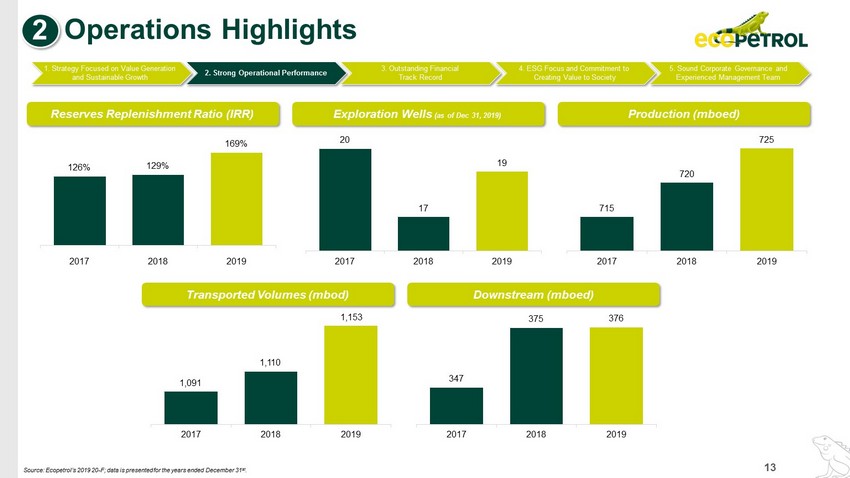

13 Reserves Replenishment Ratio (IRR) Exploration Wells (as of Dec 31, 2019) Production (mboed) Downstream (mboed) 20 17 19 2 0 17 2 0 18 2 0 19 715 720 725 2 0 17 2 0 18 2 0 19 1 , 0 91 1 , 1 10 Transported Volumes (mbod) 1,1 5 3 2 0 17 2 0 18 2 0 19 347 375 376 2 0 17 2 0 18 2 0 19 126% 129% 169% 2 0 17 2 0 18 2 0 19 1. Strategy Focused on Value Generation and Sustainable Growth 2. Strong Operational Performance 3. Outstanding Financial Track Record 5. Sound Corporate Governance and Experienced Management Team 4. ESG Focus and Commitment to Creating Value to Society 2 Operations Highlights Source: Ecopetrol’s 2019 20 - F; data is presented for the years ended December 31 st .

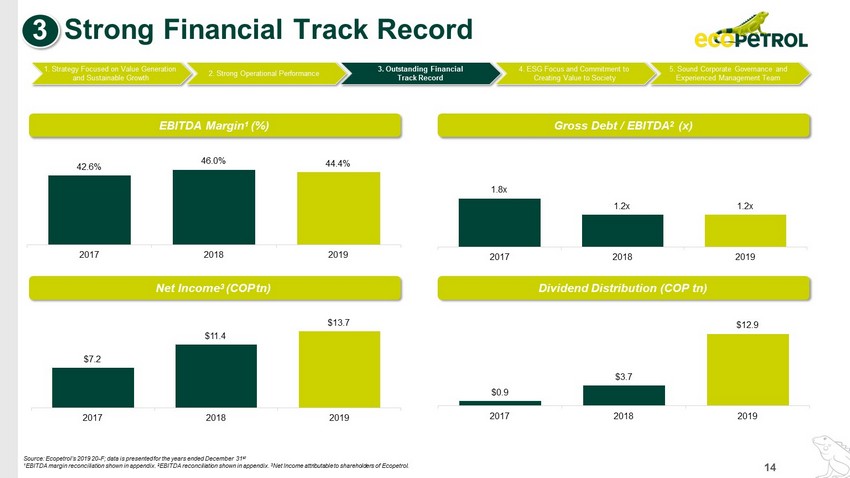

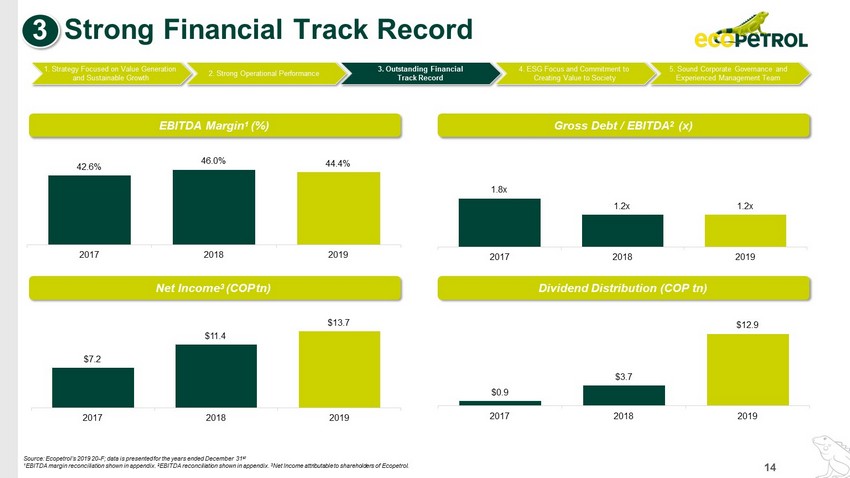

14 EBITDA Margin 1 (%) Net Income 3 (COP tn) Gross Debt / EBITDA 2 (x) Dividend Distribution (COP tn) $7 .2 $ 1 1 .4 $13 .7 2 0 17 2 0 18 2 0 19 1 . 8 x 1 . 2 x 1 . 2 x 2 0 17 2 0 18 2 0 19 $0 .9 $3 .7 $12 .9 2 0 17 2 0 18 2 0 19 42 . 6 % 46 . 0 % 44 . 4 % 2 0 17 2 0 18 2 0 19 Source: Ecopetrol’s 2019 20 - F; data is presented for the years ended December 31 st 1 EBITDA margin reconciliation shown in appendix. 2 EBITDA reconciliation shown in appendix. 3 Net Income attributable to shareholders of Ecopetrol. 1. Strategy Focused on Value Generation and Sustainable Growth 2. Strong Operational Performance 3. Outstanding Financial Track Record 5. Sound Corporate Governance and Experienced Management Team 4. ESG Focus and Commitment to Creating Value to Society 3 Strong Financial Track Record

$ 4 .6 $ 7 .2 $ 1 2.0 $0.6 $ 0 .7 $0.8 $ 0 .6 $1.5 $ 0 .5 $ 6 .1 $ 8 .5 $ 1 4.0 2019 2017 Exploration and Production 2018 Refining and Petrochemicals Transport and Logistics 1. Strategy Focused on Value Generation and Sustainable Growth 2. Strong Operational Performance 3. Outstanding Financial Track Record 5. Sound Corporate Governance and Experienced Management Team 4. ESG Focus and Commitment to Creating Value to Society 2020 New 2020 Old US$4.5 - $5.5 US$3.3 - US$4.3 3 Capex Overview Ecopetrol has reduced projected levels of capex to maximize cash flow generation and mitigate financial impact of COVID - 19 Capex Evolution (COP tn) 2020 Capex Guidance (US$ bn.) 15 Source: Ecopetrol’s 2019 20 - F; data is presented for the years ended December 31st

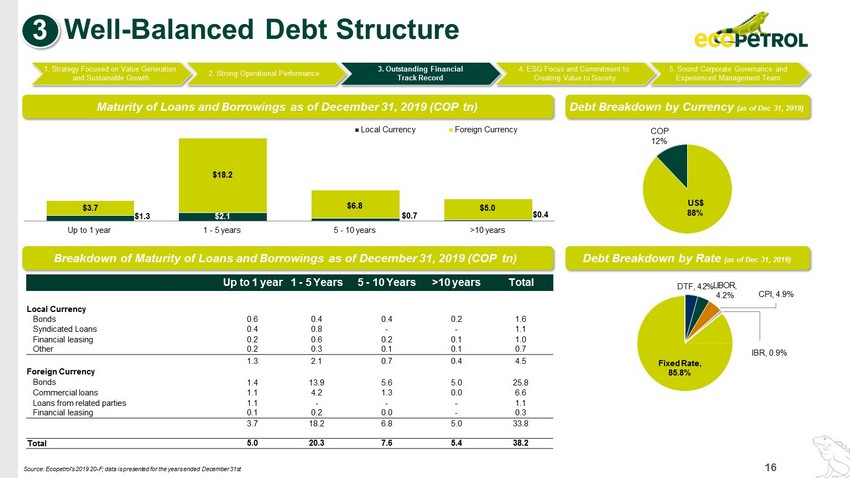

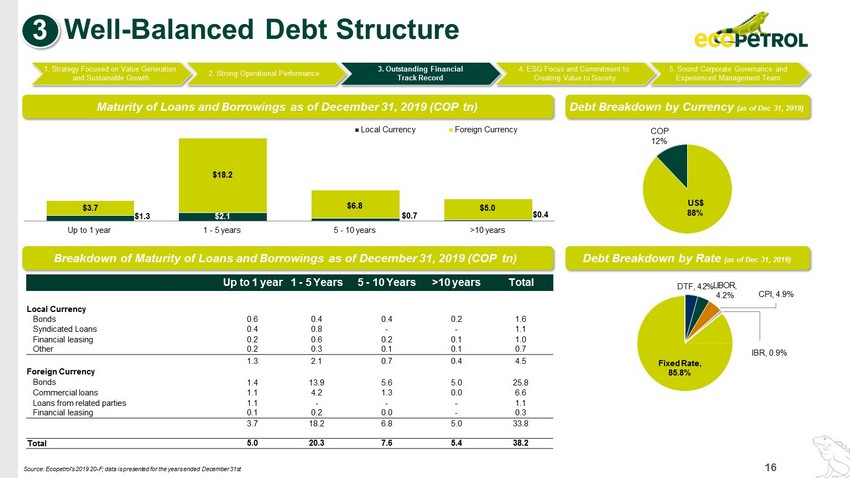

Debt Breakdown by Currency (as of Dec 31, 2019) Debt Breakdown by Rate (as of Dec 31, 2019) 1. Strategy Focused on Value Generation and Sustainable Growth 2. Strong Operational Performance 3. Outstanding Financial Track Record 5. Sound Corporate Governance and Experienced Management Team 4. ESG Focus and Commitment to Creating Value to Society 3 Well - Balanced Debt Structure Up to 1 year 1 - 5 Years 5 - 10 Years >10 years Total Local Currency Bonds 0.6 0.4 0.4 0.2 1.6 Syndicated Loans 0.4 0.8 - - 1.1 Financial leasing 0.2 0.6 0.2 0.1 1.0 Other 0.2 0.3 0.1 0.1 0.7 1.3 2.1 0.7 0.4 4.5 Foreign Currency Bonds 1.4 13.9 5.6 5.0 25.8 Commercial loans 1.1 4.2 1.3 0.0 6.6 Loans from related parties 1.1 - - - 1.1 Financial leasing 0.1 0.2 0.0 - 0.3 3.7 18.2 6.8 5.0 33.8 Total 5.0 20.3 7.6 5.4 38.2 U S $ 88% C OP 12% DTF, 4.2% LIBOR, 4.2% CPI, 4.9% IBR, 0.9% Fixed Rate, 85.8% Breakdown of Maturity of Loans and Borrowings as of December 31, 2019 (COP tn) $ 1 .3 $2.1 $ 0 .7 $ 0 .4 $3.7 $ 1 8.2 $ 6 .8 $5.0 Up to 1 year 1 - 5 years 5 - 10 years >10 years Maturity of Loans and Borrowings as of December 31, 2019 (COP tn) Local Currency Foreign Currency 16 Source: Ecopetrol’s 2019 20 - F; data is presented for the years ended December 31st

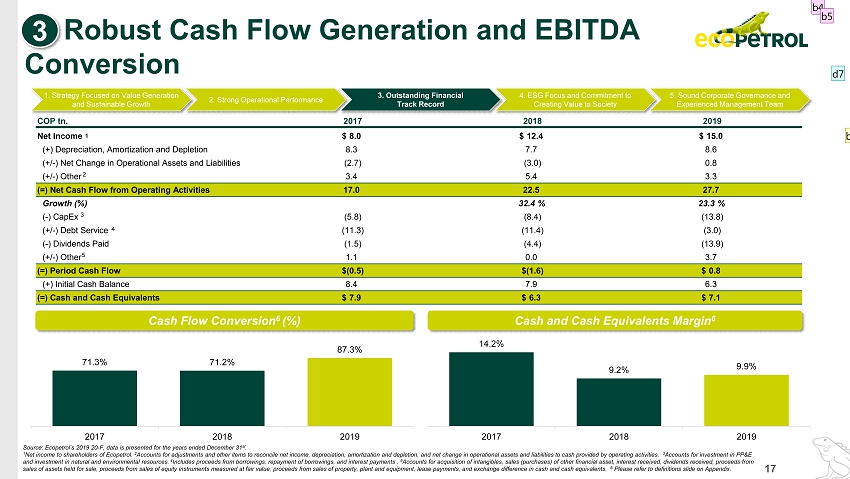

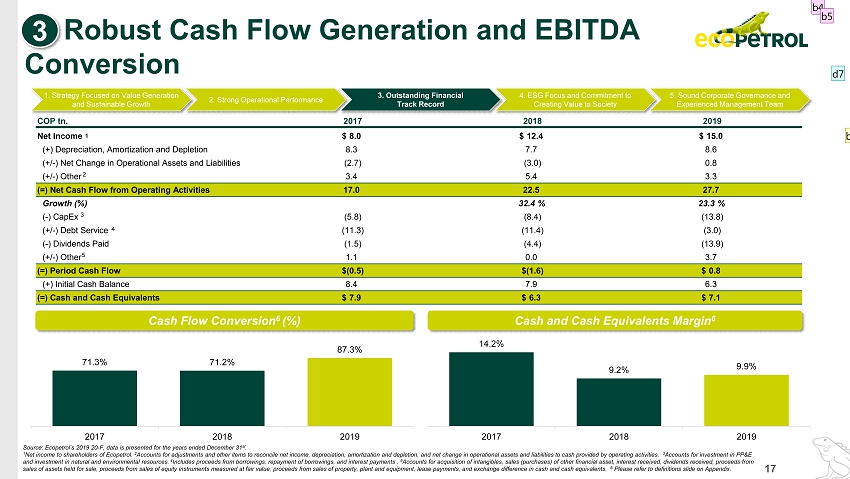

17 71 . 3 % 7 1 .2% 87 . 3 % 1. Strategy Focused on Value Generation and Sustainable Growth 2. Strong Operational Performance 3. Outstanding Financial Track Record 5. Sound Corporate Governance and Experienced Management Team 4. ESG Focus and Commitment to Creating Value to Society 3 Robust Cash Flow Generation and EBITDA Conversion Cash Flow Conversion 6 (%) Cash and Cash Equivalents Margin 6 14 . 2 % 9 . 2 % 9 . 9 % 2 0 17 2 0 18 2 0 19 2 0 17 2 0 18 2 0 19 Source: Ecopetrol’s 2019 20 - F, data is presented for the years ended December 31 st . 1 Net income to shareholders of Ecopetrol . 2 Accounts for adjustments and other items to reconcile net income, depreciation, amortization and depletion, and net change in operational assets and liabilities to cash provided by operating activities . 3 Accounts for investment in PP&E and investment in natural and environmental resources . 4 Includes proceeds from borrowings, repayment of borrowings, and interest payments . 5 Accounts for acquisition of intangibles, sales (purchases) of other financial asset, interest received, dividends received, proceeds from sales of assets held for sale, proceeds from sales of equity instruments measured at fair value, proceeds from sales of property, plant and equipment, lease payments, and exchange difference in cash and cash equivalents . 6 Please refer to definitions slide on Appendix . COP tn. 2017 2018 2019 Net Income 1 $ 8.0 $ 12.4 $ 15.0 (+) Depreciation, Amortization and Depletion 8.3 7.7 8.6 (+/ - ) Net Change in Operational Assets and Liabilities (2.7) (3.0) 0.8 (+/ - ) Other 2 3.4 5.4 3.3 (=) Net Cash Flow from Operating Activities 17.0 22.5 27.7 Growth (%) 32.4 % 23.3 % ( - ) CapEx 3 (5.8) (8.4) (13. 8 ) (+/ - ) Debt Service 4 (11.3) (11.4) (3.0) ( - ) Dividends Paid (1.5) (4.4) (13. 9 ) (+/ - ) Other 5 1.1 0.0 3.7 (=) Period Cash Flow $(0.5) $(1.6) $ 0.8 (+) Initial Cash Balance 8.4 7.9 6.3 (=) Cash and Cash Equivalents $ 7.9 $ 6.3 $ 7.1

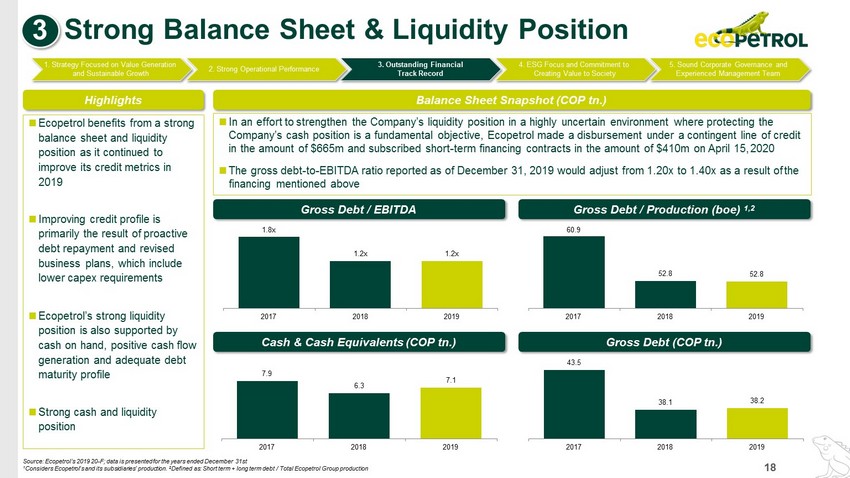

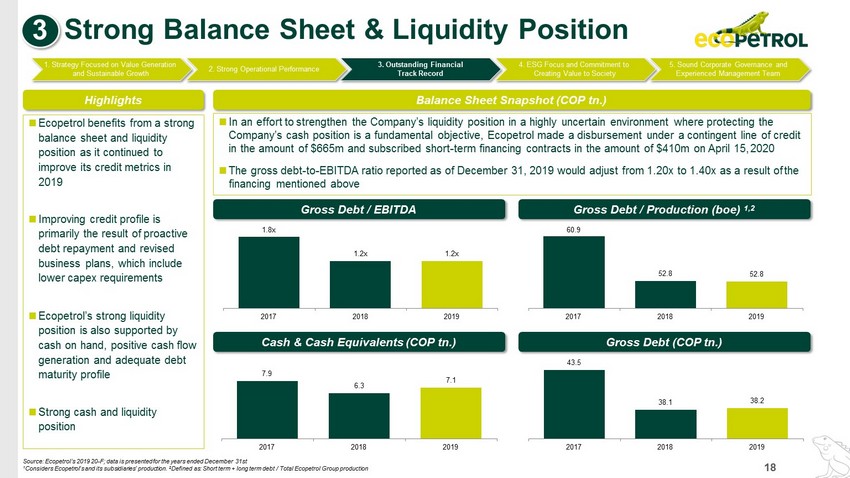

18 Hig h lig h ts Balance Sheet Snapshot (COP tn.) Gross Debt (COP tn.) Ecopetrol benefits from a strong balance sheet and liquidity position as it continued to improve its credit metrics in 2019 Improving credit profile is primarily the result of proactive debt repayment and revised business plans, which include lower capex requirements Ecopetrol’s strong liquidity position is also supported by cash on hand, positive cash flow generation and adequate debt maturity profile Strong cash and liquidity position Source: Ecopetrol’s 2019 20 - F; data is presented for the years ended December 31st 1 Considers Ecopetrol’s and its subsidiaries’ production. 2 Defined as: Short term + long term debt / Total Ecopetrol Group production 1. Strategy Focused on Value Generation and Sustainable Growth 2. Strong Operational Performance 3. Outstanding Financial Track Record 5. Sound Corporate Governance and Experienced Management Team 4. ESG Focus and Commitment to Creating Value to Society 3 Strong Balance Sheet & Liquidity Position In an effort to strengthen the Company’s liquidity position in a highly uncertain environment where protecting the Company’s cash position is a fundamental objective, Ecopetrol made a disbursement under a contingent line of credit in the amount of $665m and subscribed short - term financing contracts in the amount of $410m on April 15, 2020 The gross debt - to - EBITDA ratio reported as of December 31, 2019 would adjust from 1.20x to 1.40x as a result of the financing mentioned above Gross Debt / EBITDA 43.5 38.1 38.2 2 0 17 2 0 18 2 0 19 7.9 6.3 7.1 2 0 17 2 0 18 2 0 19 Gross Debt / Production (boe) 1,2 60.9 52.8 52.8 2 0 17 2 0 18 2 0 19 1.8x 1.2x 1.2x 2 0 17 2 0 18 2 0 19 Cash & Cash Equivalents (COP tn.)

19 Emission reduction and water management Creating Value to Society Social and Environmental Investment • In line with Ecopetrol’s objective of reducing the carbon emissions associated with its operations, the 2020 Investment Plan allocates: • Investment in project that helps reduce carbon emissions • Reduce 200 - 400 kilotons of carbon dioxide equivalents (KtCO2e) , in order to reach an annual reduction of between 1.8 – 2.0m tons of carbon dioxide equivalents (MtCO2e) in 2022 1. Strategy Focused on Value Generation and Sustainable Growth 2. Strong Operational Performance 3. Outstanding Financial Track Record 5. Sound Corporate Governance and Experienced Management Team 4. ESG Focus and Commitment to Creating Value to Society 4 ESG Strategies and Initiatives Emission reduction • In order to enhance integrated water management, wastewater reuse, water security and water governance, the 2020 Investment Plan allocates: • Investment in wastewater treatment plant and final water disposal wells • Provide potable water and sanitation to 900,000 people in 32 prioritized municipalities Water Management • Ecopetrol’s 2020 Investment Plan also expects to allocate funds to its socio - environmental program , designed to help close socioeconomic gaps in Colombia and boost sustainable community development and wellbeing • The priority areas for the socio - environmental investment program are: • Public and community infrastructure • Public services • Education • Sports & Health • Rural development • Business entrepreneurship • The plan emphasizes our commitment to a safe and sustainable operation, while protecting the environment and the communities in the areas where we operate Republic of Colombia D ivi d e nd s Taxes Royalties Community Social & E n vir on me n tal Investment Shareholders Dividends Employees Salaries Variable Compensation Benefits Training Suppliers Local Pr o c u reme n t Source: Ecopetrol’s 2019 20 - F; data is presented for the years ended December 31st

Sergio Restrepo Isaza Independent Board Member » Former Vice President of Capital Markets and Corporate Development at Bancolombia Group » Former board member of Cementos Argos, Compañía Nacional de Chocolates, Conavi, SUAM, among others » B.A. in Management from EAFIT Unversity of Medellín, with an MBA from Stanford University Luis Perdomo Maldonado Independent Board Member » +30 years of senior management experience in the Colombian banking industry, including President of Banco Colpatria and Scotiabank Group » Founding member of the Colombian Institute of Corporate Governance » B.A. in Management from the CESA School of Advanced Studies in Administration Carlos Gustavo Cano Sanz Independent Board Member » Former President of the Colombian Agriculture Association (SAC), Founder and Director of Corporación Colombia Internacional (CCI), President of the Agrarian Fund, and President of the newspaper El Espectador » Former Minister of Agriculture and Co - Director of Banco de la República » Member of the Group on Earth Observations Global Water Sustainability (GEOGLOWS) in the United States Hernando Ramírez Plazas Independent Board Member » Former Dean of the Faculty of Engineering at Universidad Surcolombiana, Principal, and Professor. » Has acted as a trainer in gas issues for production personnel at Canacol Energy Inc. » BSc in Chemical Engineer and MSc in Public Health from Universidad Nacional de Colombia, and specialization in Gas Engineering from Universidad de Zulia (Venezuela) Esteban Piedrahita Uribe Independent Board Member » Former General Director of the National Planning Department, Advisor for the President, Senior Specialist for the Inter - American Development Bank, among others » President of the Cali Chamber of Commerce and board member of Cementos Argos, among other corporates » BSc in Economics from Harvard University and MSc in Philosophy and History of Science from LSE Luis G. Echeverri Vélez Independent Board Member » +20 years of experience in international business, public policy, and public & private project finance » For m er E x e c ut iv e D i re c tor o f th e Inte r - A m erican Development Bank » Chairman of the Bogota Chamber of Commerce, and board member of Teléfónica and Pragma » B.A. in Law from University of Medellin and MSc in Agricultural Economics from Cornell Orlando Ayala Lopez Independent Board Member » +40 years of experience in the global technology industry » For m er M i c r o s o f t ’ s W o r l d P res i d e nt f or e m erg i ng markets, and VP of Sales, Marketing & Support » Independent director of the Executive Council of Centene Corp. » BSc in Information Systems Administration at Jorge Tadeo Lozano University in Bogota German Quintero Rojas Board Member » General Secretary of the Ministry of Finance and Public Credit » Former Managing Director of Fogafin and President of the National Hydrocarbons Agency » Board member at Fiduciaria La Previsora S.A., Central de Inversiones S.A. and Gecelca S.A. E.S.P » B.A. in Law from Sergio Arboleda University and PhD candidate from San Pablo CEU University of Madrid Juan E. Posada Echeverri Independent Board Member » Former Chairman of Avianca, Alianza Summa (Avianca - Aces - Sam) and Aces S.A. » Currently serves as Executive Chairman of Táximo Ltd., President of Direktio S.A.S., and board member of Grupo Odinsa S.A., among other corporates and non - profits » B.A. in Management from EAFIT University in Medellín, with an MBA from Pace University in New York Board Fully Committed to Best Corporate Governance Practices 1. Strategy Focused on Value Generation and Sustainable Growth 2. Strong Operational Performance 3. Outstanding Financial Track Record 5. Sound Corporate Governance and Experienced Management Team 4. ESG Focus and Commitment to Creating Value to Society 5 Our Governance Claims x Best corporate governance practices — Commitment to transparency — Multiple venues to look for guidance or whistleblowing — Robust AML standards to prevent money laundering and terrorism financing — Increased independent directors: from 4 in 2008 to 8 in 2019 — Minority governance ensured through an elected board member — No director with ministerial rank following OECD recommendations x New corporate governance model underpins the execution of the business plan — Clear and timely information to shareholders — Innovation and transformation to digital leadership 20

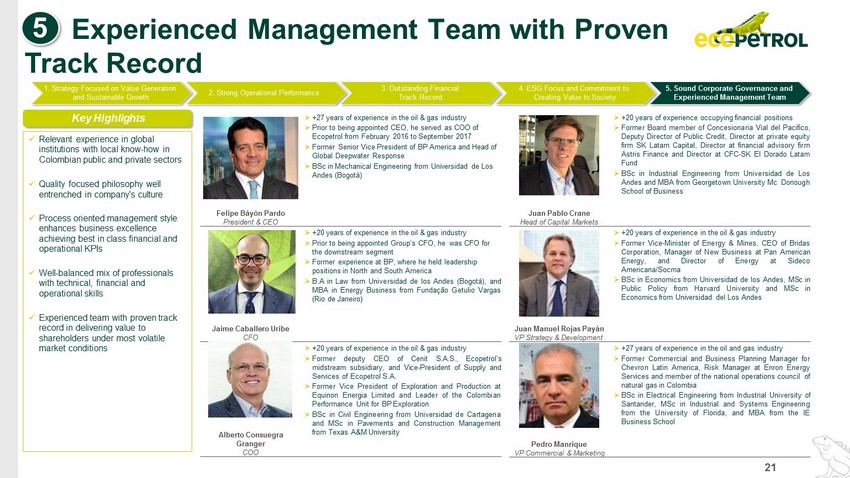

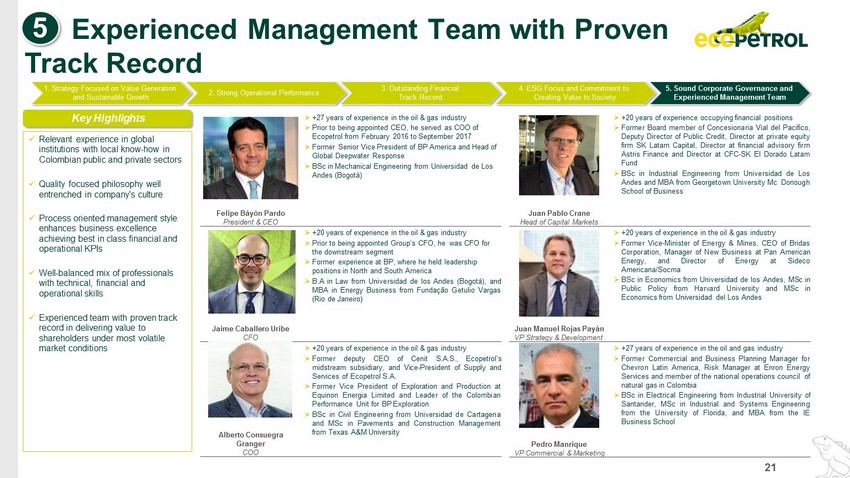

Juan Pablo Crane Head of Capital Markets » +20 years of experience occupying financial positions » Former Board member of Concesionaria Vial del Pacifico, Deputy Director of Public Credit, Director at private equity firm SK Latam Capital, Director at financial advisory firm Astris Finance and Director at CFC - SK El Dorado Latam Fund » BSc in Industrial Engineering from Universidad de Los Andes and MBA from Georgetown University Mc Donough School of Business Juan Manuel Rojas Payán VP Strategy & Development » +20 years of experience in the oil & gas industry » Former Vice - Minister of Energy & Mines, CEO of Bridas Corporation, Manager of New Business at Pan American Energy, and Director of Energy at Sideco Americana/Socma » BSc in Economics from Universidad de los Andes, MSc in Public Policy from Harvard University and MSc in Economics from Universidad del Los Andes Pedro Manrique VP Commercial & Marketing » +27 years of experience in the oil and gas industry » Former Commercial and Business Planning Manager for Chevron Latin America, Risk Manager at Enron Energy Services and member of the national operations council of natural gas in Colombia » BSc in Electrical Engineering from Industrial University of Santander, MSc in Industrial and Systems Engineering from the University of Florida, and MBA from the IE Business School Felipe Báyón Pardo President & CEO » +27 years of experience in the oil & gas industry » Prior to being appointed CEO, he served as COO of Ecopetrol from February 2016 to September 2017 » Former Senior Vice President of BP America and Head of Global Deepwater Response » BSc in Mechanical Engineering from Universidad de Los Andes (Bogotá) Jaime Caballero Uribe CFO » +20 years of experience in the oil & gas industry » Prior to being appointed Group’s CFO, he was CFO for the downstream segment » Former experience at BP, where he held leadership positions in North and South America » B . A in Law from Universidad de los Andes (Bogotá), and MBA in Energy Business from Fundação Getulio Vargas (Rio de Janeiro) Alberto Consuegra Granger COO » +20 years of experience in the oil & gas industry » Former deputy CEO of Cenit S . A . S . , Ecopetrol’s midstream subsidiary, and Vice - President of Supply and Services of Ecopetrol S . A . » Former Vice President of Exploration and Production at Equinon Energia Limited and Leader of the Colombian Performance Unit for BP Exploration » BSc in Civil Engineering from Universidad de Cartagena and MSc in Pavements and Construction Management from Texas A&M University Experienced Management Team with Proven Track Record 1. Strategy Focused on Value Generation and Sustainable Growth 2. Strong Operational Performance 3. Outstanding Financial Track Record 5. Sound Corporate Governance and Experienced Management Team 4. ESG Focus and Commitment to Creating Value to Society 5 Key Highlights x Relevant experience in global institutions with local know - how in Colombian public and private sectors x Quality focused philosophy well entrenched in company's culture x Process oriented management style enhances business excellence achieving best in class financial and operational KPIs x Well - balanced mix of professionals with technical, financial and operational skills x Experienced team with proven track record in delivering value to shareholders under most volatile market conditions 21

Supplemental Information 3 22

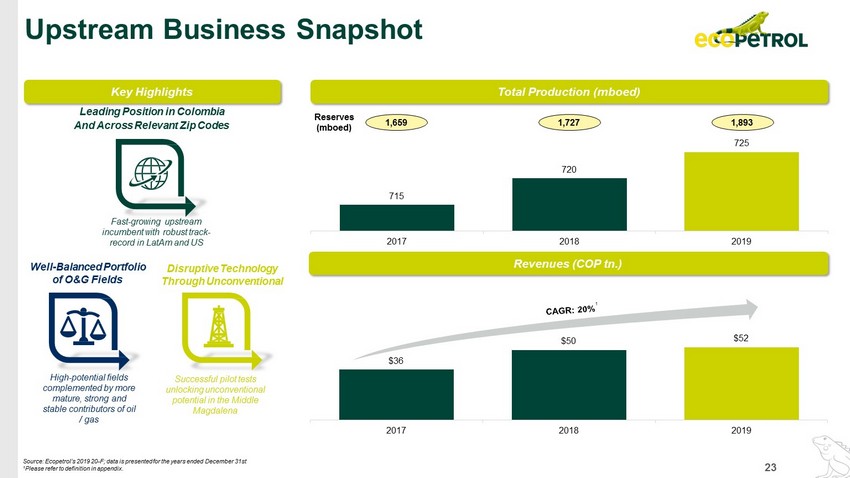

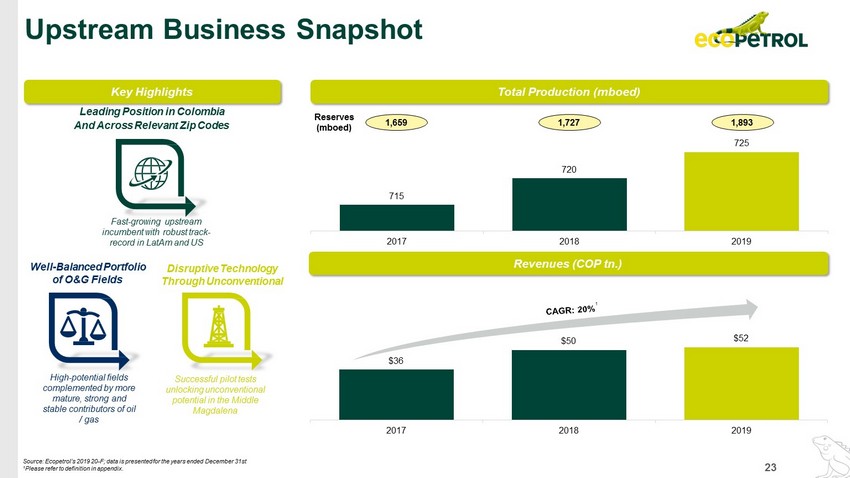

715 720 725 2 0 17 2 0 18 2 0 19 Revenues (COP tn.) Upstream Business Snapshot Total Production (mboed) Key Highlights Leading Position in Colombia And Across Relevant Zip Codes Fast - growing upstream incumbent with robust track - record in LatAm and US Well - Balanced Portfolio of O&G Fields High - potential fields complemented by more mature, strong and stable contributors of oil / gas Disruptive Technology Through Unconventional Successful pilot tests unlocking unconventional potential in the Middle Magdalena 1 1, 6 59 1, 7 27 1, 8 93 Re s er v es (mboed) $36 $50 $52 2 0 17 2 0 18 2 0 19 Source: Ecopetrol’s 2019 20 - F; data is presented for the years ended December 31st 1 Please refer to definition in appendix. 23

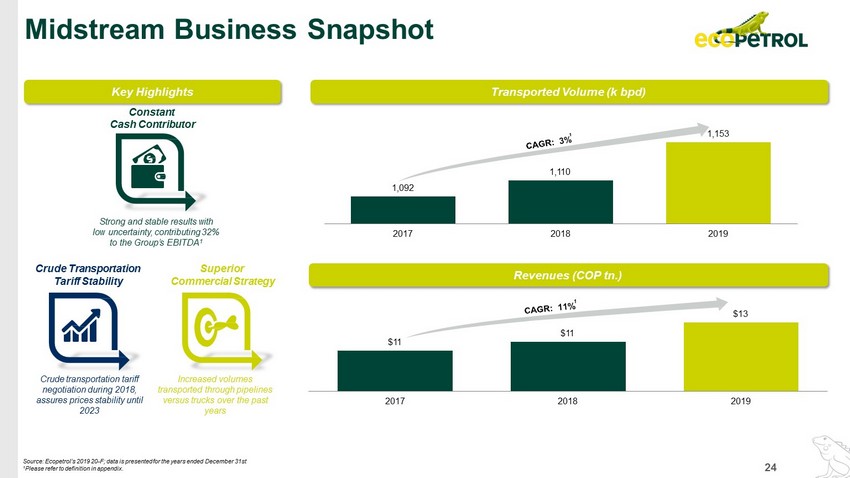

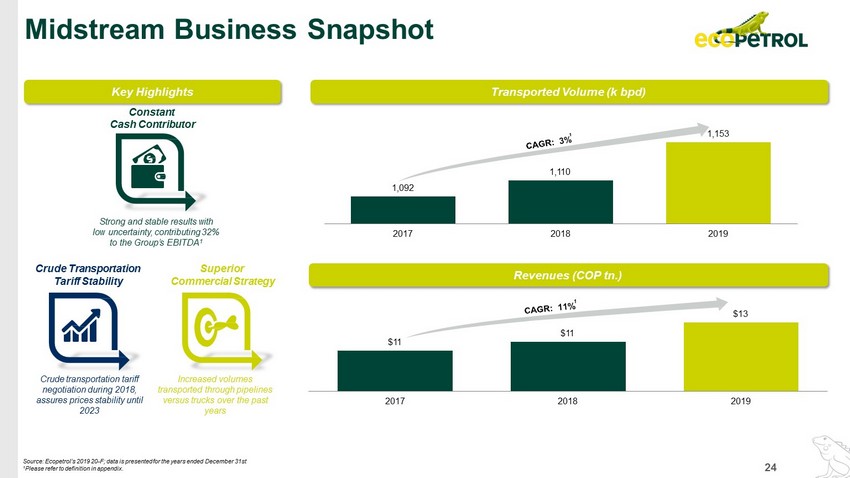

Revenues (COP tn.) Midstream Business Snapshot Transported Volume (k bpd) Key Highlights Constant Cash Contributor Strong and stable results with low uncertainty, contributing 32% to the Group’s EBITDA 1 Crude Transportation Tariff Stability Crude transportation tariff negotiation during 2018, assures prices stability until 2023 Superior Commercial Strategy Increased volumes transported through pipelines versus trucks over the past years 1 1 ,0 92 1, 1 10 1 ,1 53 2 0 17 2 0 18 2 0 19 $ 1 1 $ 1 1 $13 2 0 17 2 0 18 2 0 19 Source: Ecopetrol’s 2019 20 - F; data is presented for the years ended December 31st 1 Please refer to definition in appendix. 24

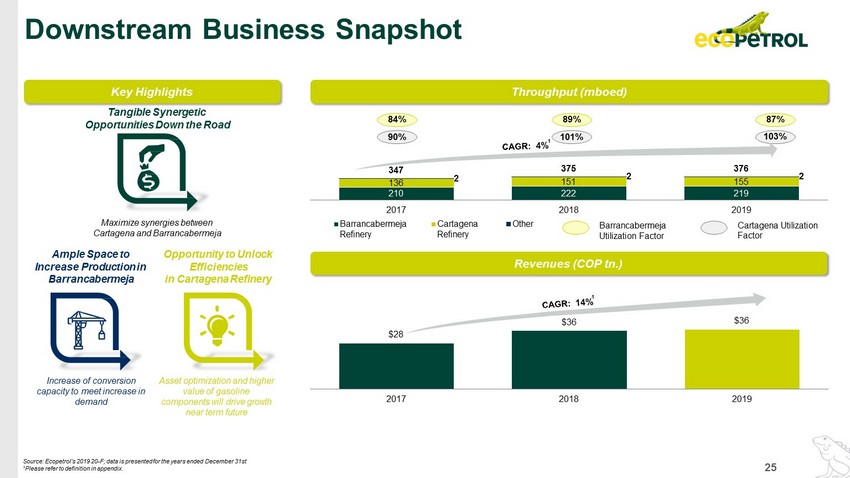

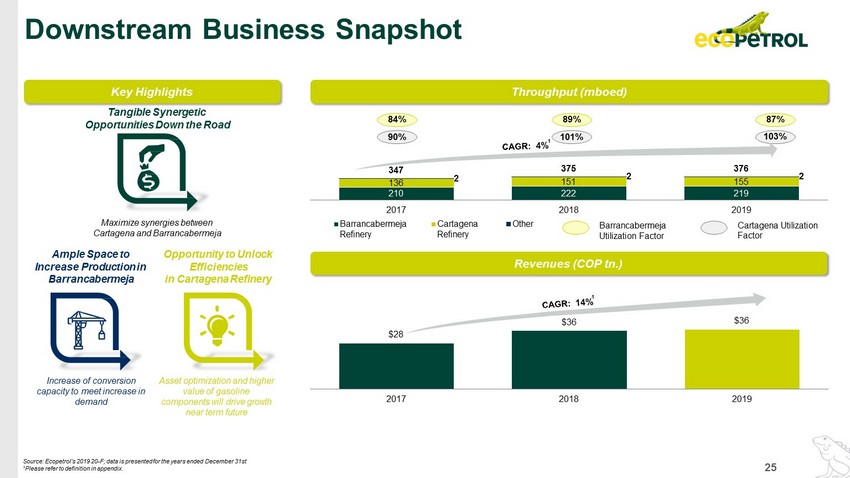

$28 $36 $36 2 0 17 2 0 18 2 0 19 Downstream Business Snapshot Throughput (mboed) Revenues (COP tn.) Key Highlights Ample Space to Increase Production in Barrancabermeja Increase of conversion capacity to meet increase in demand Tangible Synergetic Opportunities Down the Road Maximize synergies between Cartagena and Barrancabermeja Opportunity to Unlock Efficiencies in Cartagena Refinery Asset optimization and higher value of gasoline components will drive growth near term future 1 1 210 222 219 136 151 155 2 2 2 347 375 376 2 0 18 2017 B a r ra n ca b e rm e ja Refinery Carta g e n a Refinery Ot h e r 84% 89% B a r r an ca be rm eja Utilization Factor 2019 Cartagena Utilization Factor 90% 101% 87% 103% Source: Ecopetrol’s 2019 20 - F; data is presented for the years ended December 31st 1 Please refer to definition in appendix. 25

26 Appendix

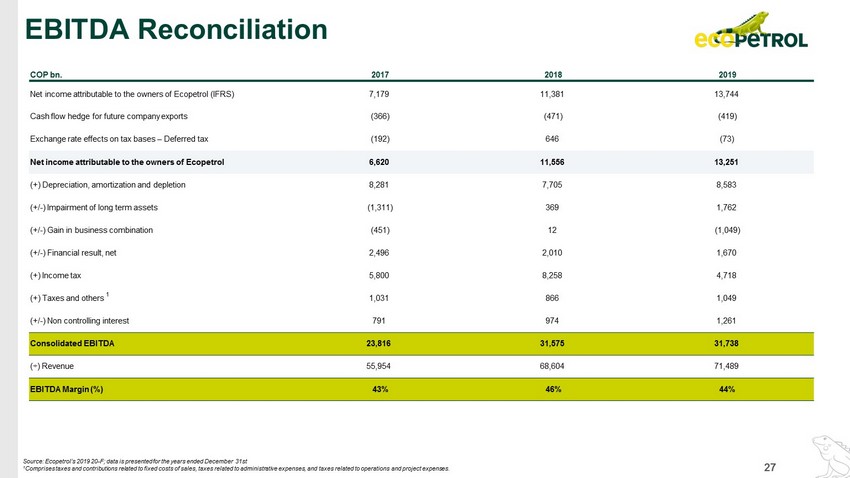

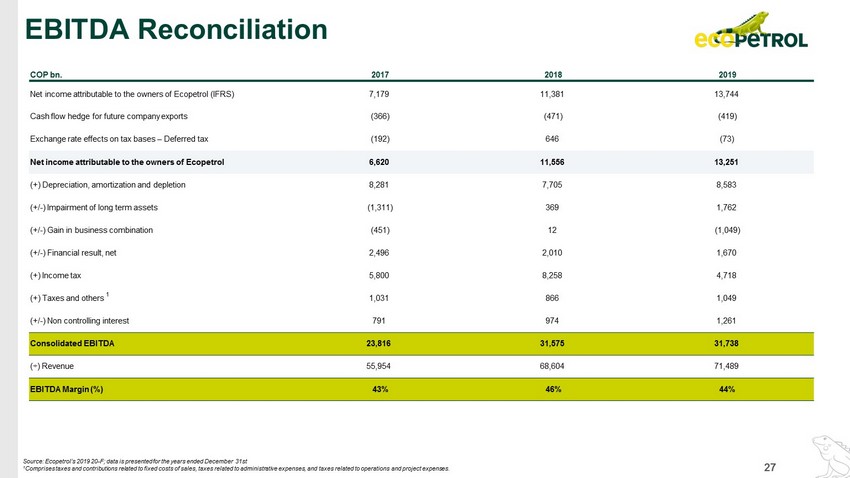

27 EBITDA Reconciliation Source: Ecopetrol’s 2019 20 - F; data is presented for the years ended December 31st 1 Comprises taxes and contributions related to fixed costs of sales, taxes related to administrative expenses, and taxes related to operations and project expenses. COP bn. 2017 2018 2019 Net income attributable to the owners of Ecopetrol (IFRS) 7,179 11,381 13, 7 44 Cash flow hedge for future company exports (366) (471) (419) Exchange rate effects on tax bases – Deferred tax (192) 646 (73) Net income attributable to the owners of Ecopetrol 6,620 11,556 13, 2 51 (+) Depreciation, amortization and depletion 8,281 7,705 8, 5 83 (+/ - ) Impairment of long term assets (1,311) 369 1, 7 62 (+/ - ) Gain in business combination (451) 12 (1, 0 49) (+/ - ) Financial result, net 2,496 2,010 1, 6 70 (+) Income tax 5,800 8,258 4, 7 18 (+) Taxes and others 1 1,031 866 1, 0 49 (+/ - ) Non controlling interest 791 974 1, 2 61 Consolidated EBITDA 23,816 31,575 31, 7 38 ( · ) Revenue 55,954 68,604 71, 4 89 EBITDA Margin (%) 43% 46% 44%

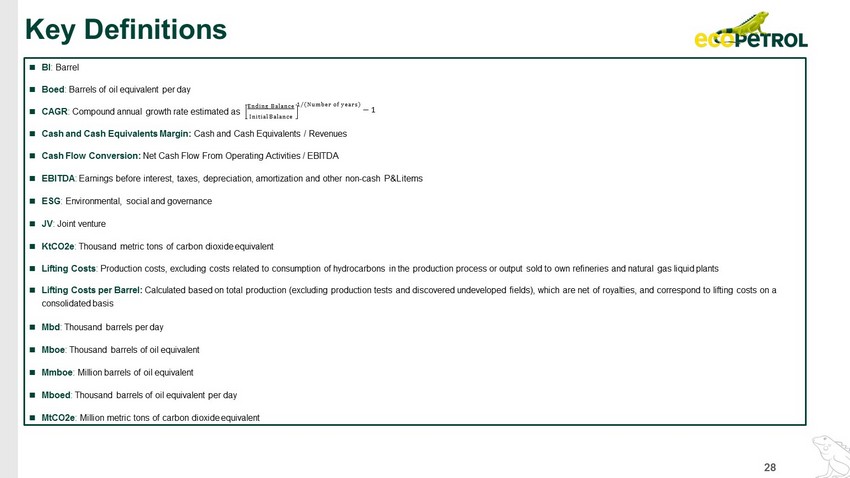

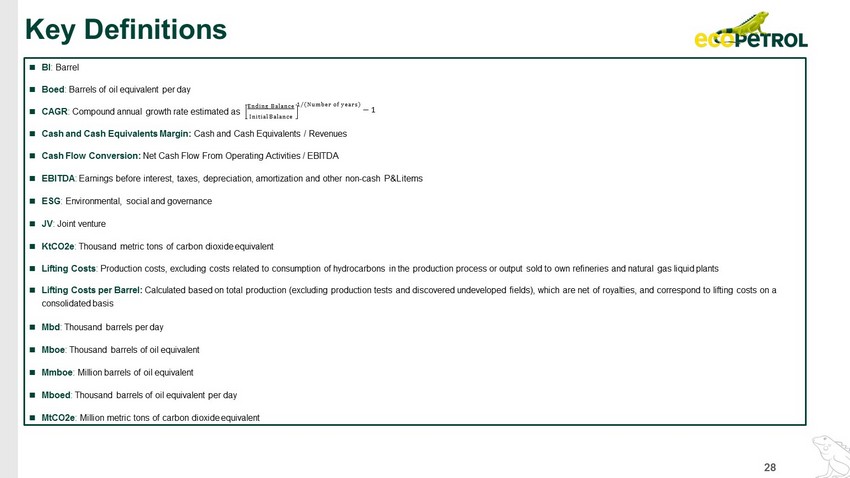

28 Key Definitions Bl : Barrel Boed : Barrels of oil equivalent per day CAGR : Compound annual growth rate estimated as Initial Balance Ending Balance 1/(Number of years) − 1 Cash and Cash Equivalents Margin: Cash and Cash Equivalents / Revenues Cash Flow Conversion: Net Cash Flow From Operating Activities / EBITDA EBITDA : Earnings before interest, taxes, depreciation, amortization and other non - cash P&L items ESG : Environmental, social and governance JV : Joint venture KtCO2e : Thousand metric tons of carbon dioxide equivalent Lifting Costs : Production costs, excluding costs related to consumption of hydrocarbons in the production process or output sold to own refineries and natural gas liquid plants Lifting Costs per Barrel: Calculated based on total production (excluding production tests and discovered undeveloped fields), which are net of royalties, and correspond to lifting costs on a consolidated basis Mbd : Thousand barrels per day Mboe : Thousand barrels of oil equivalent Mmboe : Million barrels of oil equivalent Mboed : Thousand barrels of oil equivalent per day MtCO2e : Million metric tons of carbon dioxide equivalent