PROSPECTUS SUMMARY

This prospectus summary highlights certain information contained elsewhere in this prospectus. This is only a summary and it may not contain all of the information that is important to you. Before deciding to invest in this offering, you should carefully read this entire prospectus, including the “Risk Factors” section.

Q: What is Pacific Oak Strategic Opportunity REIT, Inc.?

A: We are a Maryland corporation that invests in and manage a diverse portfolio of opportunistic real estate, real estate-related loans, real estate-related securities and other real estate-related investments. In particular, we are currently focused on acquiring properties with significant possibilities for short-term capital appreciation, such as those requiring development, redevelopment or repositioning or those located in markets with higher volatility, lower barriers to entry and high growth potential. We may acquire office, industrial, retail, hospitality, multi-family, single family home and other real properties, including existing or newly constructed properties or properties under development or construction. We also may invest in real estate-related loans, including but not limited to mortgage, bridge or mezzanine loans. Further, we may invest in real estate-related securities, including securities issued by other real estate companies, either for investment or in change of control transactions completed on a negotiated basis or otherwise. We may make our investments through the acquisition or origination of individual assets, through joint ventures, or by acquiring portfolios of assets or other companies. We anticipate that the majority of our investments will be made in the United States, although we may also invest outside the United States to the extent that opportunities exist that may help us meet our investment objectives.

We were incorporated in the State of Maryland on October 8, 2008, and we elected to be taxed as a REIT beginning with the taxable year ended December 31, 2010 and intend to continue to operate in such a manner. We conduct our business primarily through our Operating Partnership, of which we are the sole general partner. We commenced a “best efforts” initial public offering on November 20, 2009 for up to 140,000,000 unclassified shares of common stock, 100,000,000 shares of which were registered in our primary offering and 40,000,000 shares were registered under our dividend reinvestment plan. We ceased offering shares of common stock in the primary portion of our initial public offering on November 14, 2012. We sold 56,584,976 unclassified shares of common stock in the primary offering for gross offering proceeds of $561.7 million.

Prior to the commencement of this offering, we intend to rename our unclassified shares of common stock as “Class I” shares and classify three new classes of common stock: Class T, S and D shares. We also will begin reporting a monthly NAV for each class of our shares. We intend to operate as a perpetual-life REIT, which means that we intend to offer our shares continuously through ongoing primary offerings. We also offer our shares through our dividend reinvestment plan. As of September 30, 2019, we had 66,124,718 shares outstanding, held by 12,923 stockholders.

As of September 30, 2019, our portfolio was composed of seven office properties, one office portfolio consisting of four office buildings and 14 acres of undeveloped land, one apartment property and three investments in undeveloped land with approximately 1,000 developable acres and owned five investments in unconsolidated joint ventures and four investments in real estate equity securities.

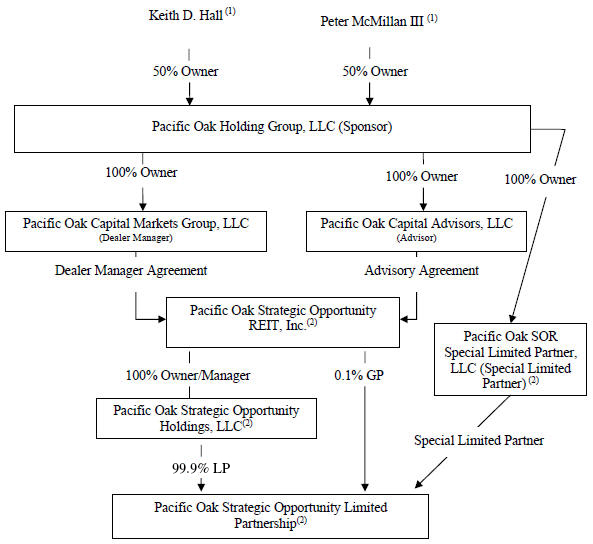

Our external advisor, Pacific Oak Capital Advisors, LLC (“Pacific Oak Capital Advisors”), a registered investment adviser with the SEC, conducts our operations and manages our portfolio of real estate investments. We have no paid employees.

Our office is located at 11150 Santa Monica Blvd., Suite 400, Los Angeles, CA 90025. Our telephone number is (424)208-8100. Our fax number is310-432-2119, and our web site address iswww.sorinvinfo.com.

Q: What are your investment objectives and strategies?

A: Our primary investment objectives are to invest in assets that will enable us to:

| | · | | to provide our stockholders with attractive and stable returns; and |

| | · | | to preserve and return our stockholders’ capital contributions. |

We seek to achieve these objectives by investing in and managing a portfolio of opportunistic real estate, real estate-related loans, real estate-related securities and other real estate-related investments. In particular, we are currently focused on acquiring properties with significant possibilities for short-term capital appreciation, such as those requiring development, redevelopment or repositioning or those located in markets with higher volatility, lower barriers to entry and high growth potential. We may acquire office, industrial, retail, hospitality, multi-family, single family home and other real properties, including existing or newly constructed