UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended June 30, 2019 |

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | Date of event requiring this shell company report ___________________ |

Commission file number: 001-35022

Mission NewEnergy Limited

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Western Australia, Australia

(Jurisdiction of incorporation or organization)

Unit B9, 431 Roberts Rd,

Subiaco, Western Australia 6008, Australia

(Address of principal executive offices)

Guy Burnett

Chief Financial Officer and Company Secretary

+61 8 6313 3975; guy@missionnewenergy.com

Unit B9, 431 Roberts Rd,

Subiaco, Western Australia 6008, Australia

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | | |

| Title of each class | | Name of each exchange on which registered |

| None | | None |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

| Ordinary Shares, no par value |

(Title of Class) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of June 30, 2019: 40,870,275 Ordinary Shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| ☐ Large accelerated filer | | ☐ Accelerated filer | | ☒ Non-accelerated filer |

| | | | | ☐ Emerging growth company |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

US GAAP ☐

International Financial Reporting Standards as issued by the International Accounting Standards Board ☒

Other ☐

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☒ Yes ☐ No

TABLE OF CONTENTS

Page

| Page |

| 3 |

| 3 |

| 4 |

| PART I | 4 |

| 4 |

| 4 |

| 4 |

| 10 |

| 12 |

| 12 |

| 14 |

| 18 |

| 18 |

| 18 |

| 19 |

| 28 |

| 29 |

| PART II | 29 |

| 29 |

| 29 |

| 30 |

| 30 |

| 30 |

| 30 |

| 31 |

| 31 |

| 31 |

| 31 |

| 31 |

| 31 |

| PART III | 31 |

| 31 |

| 31 |

Item 19. Exhibit 8.1

| - |

| Item 19. Exhibit 12.1 | - |

| Item 19. Exhibit 12.2 | - |

| Item 19. Exhibit 13.1 | - |

CONVENTIONS THAT APPLY TO THIS ANNUAL REPORT

Unless otherwise indicated or the context clearly implies otherwise, references to “we,” “us,” “our,”, “Mission NewEnergy”, “Mission”, “the Group” and “the Company” are to Mission NewEnergy Limited, an Australian corporation, and its subsidiaries. In this annual report “shares” or “ordinary shares” refers to our ordinary shares.

In this annual report, references to “$,” “US$” or “U.S. dollars” are to the lawful currency of the United States and references to “Australian dollars” or “A$” are to the lawful currency of Australia.

Solely for the convenience of the reader, this annual report contains translations of certain Australian dollar amounts into U.S. dollars at specified rates. Except as otherwise stated in this annual report, all translations from Australian dollars to U.S. dollars are based on the noon buying rate of the City of New York for cable transfers of Australian dollars, as certified for customs purposes by the Federal Reserve Bank of New York on the date or year indicated. No representation is made that the Australian dollar amounts referred to in this annual report could have been or could be converted into U.S. dollars at such rates or any other rates. Any discrepancies in any table between totals and sums of the amounts listed are due to rounding.

Unless otherwise indicated, the consolidated financial statements and related notes as of and for the fiscal years ended June 30, 2017, 2018 and 2019 included elsewhere in this annual report have been prepared in accordance with Australian Accounting Standards and also comply with International Financial Reporting Standards (“IFRS”) and interpretations issued by the International Accounting Standards Board.

References to a particular “fiscal year” are to our fiscal year ended June 30 of that year. References to a year other than a “fiscal” year are to the calendar year ended December 31. References to “our refinery,” “the refinery”, “our business” and “the joint venture company” refer to a 20% shareholding held by our wholly owned subsidiary M2 Capital Sdn Bhd in a Malaysian Joint Venture Company, named FGV Green Energy Sdn Bhd, which owns a 250,000 tpa biodiesel refinery. This refinery is mothballed as the project has stalled due to an inability of the biodiesel refinery operating entity to secure ongoing offtake sales contracts and the planned retrofit of new technology is on hold. Additionally, FGV Green Energy Sdn Bhd has a loan that is now due and payable, against which the refinery is held as security. The company does not intend to inject capital into the associate company and the lenders may exercise their right to take the refinery asset owned by FGV Green Energy. The Group has impaired the carrying value of this investment in past years to NIL, and does not expect to be able to realize any value from this investment.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements that relate to our current expectations and views of future events. All statements, other than historical fact or present financial information, may be deemed to be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements relate to events that involve known and unknown risks, uncertainties and other factors, including those listed under “Item 3.D — Key Information — Risk Factors,” “Item 4 — Information on the Company” and “Item 5 — Operating and Financial Review and Prospects,” all of which are difficult to predict and many of which are beyond our control, which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements.

In some cases, these forward-looking statements can be identified by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “predict,” “forecast,” “budget,” “project,” “target,” “likely to” or other similar expressions. These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include, among other things, statements relating to:

●

our beliefs regarding the condition of the design, technology, operation and maintenance of our associates’ mothballed refinery;

●

our beliefs regarding the lack of demand for our associates’ refined product;

●

our expectations related to our ongoing restructure;

●

our expectations regarding our associates’ ability to procure customers and expand them;

●

our beliefs regarding our and our associates’ ability to successfully implement strategies;

●

our beliefs regarding our and our associates’ abilities to secure sufficient funds to meet our cash needs for our operations and capacity expansion;

●

our future business development, results of operations and financial condition

●

government regulatory and industry certification, approval and acceptance of our associates’ product and its derivatives; and

●

government policymaking and incentives relating to renewable fuels.

The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

INDUSTRY AND MARKET DATA

This annual report includes information with respect to market and industry conditions and market share from third party sources or that is based upon estimates using such sources when available. We believe that such information and estimates are reasonable and reliable. We also believe the information extracted from publications of third party sources has been accurately reproduced and, so far as we are able to ascertain from information published by the third party sources, no facts have been omitted which would render the reproduced information inaccurate or misleading. However, we have not independently verified any of the data from third party sources. Similarly, our internal research is based upon the understanding of industry conditions, and such information has not been verified by any independent sources.

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

A.

Selected Financial Data.

The following selected consolidated statements of operations and other consolidated financial data for the fiscal years 2019, 2018, and 2017 have been derived from our audited consolidated financial statements included elsewhere in this annual report. You should read the selected consolidated financial data in conjunction with our consolidated financial statements and related notes and “Item 5 — Operating and Financial Review and Prospects” included elsewhere in this annual report. Our historical results do not necessarily indicate our expected results for any future periods.

Our financial statements have been prepared in Australian dollars and in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board.

Income statement data for the fiscal years ended June 30, 2019, 2018 and 2017 and the balance sheet data as at June 30, 2019 and 2018 have been derived from our audited financial statements that are included elsewhere in this annual report. Income statement data for the fiscal years ended June 30, 2016 and 2015 and the balance sheet data as at June 30, 2017, 2016, and 2015 have been derived from our audited financial statements that are not included in this annual report.

| | 2019 US$(1) | | | | 2016 A$

| 2015 A$

|

(in thousands, except share and per share data) |

| Income Statement data: | | | | | | |

| Total sales revenue | - | - | - | - | - | - |

| Total other income | 119 | 165 | 2 | 8 | 42 | 7,271 |

| Cost of sales | - | - | - | - | - | - |

| Employee benefits expense | - | - | - | (467) | (1091) | (1,574) |

| Other income/ (expenses) | (110) | (153) | (200) | (4,050) | (1,169) | 311 |

| Finance costs | | | (2) | - | - | (1,815) |

| Profit/(loss) from operations before income tax | 9 | 12 | (200) | (4,509) | (2,218) | 4,193 |

| Income tax (expense)/ benefit | - | - | �� - | (3) | (1) | (6) |

| Profit/(loss) from continuing operations | 9 | 12 | (200) | (4,512) | (2,219) | 4,187 |

| Share of net (loss)/profit of associate accounted for using the equity method | - | - | - | (38) | (110) | 37 |

| Profit/(loss) for the year from discontinued operations | - | - | - | - | - | 24,133 |

| Net Profit / (loss) | 9 | 12 | (200) | (4,550) | (2,329) | 28,357 |

| Profit/(loss) attributable to non-controlling interests | | | | | - | - |

| Profit/(loss) attributable to members of the parent | 9 | 12 | (200) | (4,550) | (2,329) | 28,357 |

Basic and diluted earnings / (loss) per share (2) | 0.0002 | 0.0003 | (0.005) | (0.11) | (0.06) | 0.91 |

Weighted average ordinary number of shares outstanding (3) | 40,870,275 | 40,870,275 | 40,870,275 | 40,870,275 | 40,870,275 | 31,253,837 |

| Balance Sheet data: | | | | | | |

| Total current assets | 126 | 180 | 200 | 398 | 2,522 | 8,851 |

| Total assets | 126 | 180 | 200 | 399 | 6,171 | 12,621 |

| Total current liabilities | 121 | 173 | 205 | 205 | 1,406 | 5,852 |

| Total non-current liabilities | - | - | - | - | - | - |

| Total liabilities | 121 | 173 | 205 | 205 | 1,406 | 5,852 |

| Retained earnings/ (accumulated losses) | (1,089) | (1,554) | (1,715) | (1,513) | 3,037 | 5,366 |

| Total Equity/(Deficit) | 5 | 7 | (5) | 195 | 4,765 | 6,770 |

| Other financial data: | | | | | | |

| Dividends per share | — | | - | — | — | — |

(1)

The balance sheet data has been translated into U.S. dollars from Australian dollars based upon the noon buying rate of the City of New York for cable transfers of Australian dollars, as certified for customs purposes by the Federal Reserve Bank of New York on June 30, 2019, which exchange rate was A$1.00 = US$0.7009. The income statement data has been translated into U.S. dollars from Australian dollars based upon the weighted average of the noon buying rate of the City of New York for cable transfers of Australian dollars, as certified for customs purposes by the Federal Reserve Bank of New York for the period from July 1, 2018 to June 30, 2019 which was A$1.00 = US$0.7153. These translations are merely for the convenience of the reader and should not be construed as representations that the Australian dollar amounts actually represent such U.S. dollar amounts or could be converted into U.S. dollars at the rate indicated.

(2)

Net (loss)/profit per ordinary share — basic and diluted is calculated as net loss or net profit for the period divided by adjusted weighted average number of ordinary shares outstanding for the same period.

B.

Capitalization and Indebtedness.

Not applicable.

C.

Reasons for the Offer and Use of Proceeds.

Not applicable.

Set forth below are certain risks that we believe are applicable to our business. You should carefully consider the risks described below and the other information in this annual report, including our consolidated financial statements and related notes included elsewhere in this annual report, before you decide to buy, sell or hold our ordinary shares. If any of the following risks actually occurs, our business, prospects, financial condition and results of operations could be materially harmed. Additional risks not presently known to us, or risks that do not seem significant today, may also impair our business operations in the future.

Risks Related to Our Business

We may not be able to continue as a going concern.

We incurred an operating profit for the year ended June 30, 2019 of A$0.012 million, primarily as a result of RTO proceeds received in fiscal year 2019, (2018: A$0.2 million loss), we have a history of net losses and there is a substantial doubt about our ability to continue as a going concern. Net cash used by operating activities was A$0.015 million (2018: A$0.19 million used in operating activities). At balance date, the current assets less current liabilities were a surplus of A$0.0069 million (2018: A$4.9 million deficit) and the net assets were a surplus of A$0.0069 million (2018: A$4.9 million deficit). At June 30, 2019, the Company has current liabilities of A$0.17 million (2018: A$0.2 million). Our ordinary shares have been voluntarily suspended from trading on the Australian Securities Exchange (ASX) from November 25, 2016 and we may be ultimately delisted from the ASX by November 25, 2019.

The ability of the Group to continue as a going concern is dependent on the identification and completion of a suitable alternate business opportunity.

These conditions indicate a material uncertainty that cast a significant doubt about the Group’s ability to continue as a going concern and, therefore, that it may be unable to realize its assets and discharge its liabilities in the normal course of business.

Management believe there are sufficient funds to meet the Group’s working capital requirements as at the date of this report, and that there are reasonable grounds to believe that the Group will continue as a going concern as a result of a combination of the following reasons:

●

the Group has received confirmation from its employees and Directors that they have forgone all salary entitlements since 1 December 2016 and will not call on their annual leave entitlements until the Group has a clear ability to pay;

●

and management expects the cash to be able to fund the organization until a suitable alternate business opportunity is identified and completed. The Company's Shares will have been suspended from trading on the ASX for 3 years as at 25 November 2019. ASX’s current policy is to delist a company whose shares have been suspended from trading for more than 3 years.

Should the Group not be able to continue as a going concern, it may be required to realize its assets and discharge its liabilities other than in the ordinary course of business, and at amounts that differ from those stated in the financial statements. The financial report does not include any adjustment relating to the recoverability and classification of recorded assets or liabilities that might be necessary should the entity note continue as a going concern.

If we are unable to generate sufficient earnings to offset the costs from finding a suitable alternate business opportunity, our business and financial condition will suffer a significant adverse effect.

We will continue to look for alternative business opportunities. These businesses may not exceed our expenses and therefore we may not be able to generate enough revenue to reverse our pattern of historical losses and negative cash flow, which would have a significant adverse effect on our business and financial condition.

We have not been successful in disposing of our investment, this investment has been written down to zero the investment is dormant and is not generating cash. We do not expect to be able to earn any earnings (in the form of dividends) from our investment into FGV Green Energy, a refinery joint venture company, which currently has no means of producing operating income.

If Mission does not meet the capital call of its interest in its associate (currently carried at $zero) there is a risk that we may be unable to retain our investment in our Malaysian biodiesel project.

The Malaysian biodiesel project joint venture agreement allows for capital calls from shareholders where additional funds are required by the joint venture company. The Malaysian company, in which we own 20%, biodiesel project has a loan which is now due and payable. The lender has full security over the asset. This investment may require us to inject further capital funds into the project to pay off the loan and recommence operations. If we do not meet such a capital call, our shareholding may be diluted. Given the current inability to meet any capital calls by FGVGE, we may liquidate M2 Capital, being the company which holds 20% of the shares in Felda Green energy Sdn Bhd, which owns the refinery. This, in turn, could adversely affect our operations and financial performance.

If our 20% stake in the joint venture company, carried at $zero, is unable to be sold, we may be unable to recover the cost of our investment.

We have not been successful in disposing the 20% investment stake in the joint venture company, with no interest to date. If we can’t sell the 20% stake, we will not be able to recover the cost of our investment.

We may not be able recover any funds from intercompany loans.

The parent company in our corporate structure advances funds to subsidiaries to fund working capital requirements. The company’s subsidiaries are not expected to be able to repay or service these intercompany loans, which would have an adverse effect on our business and financial condition.

We may not be able to generate sufficient cash or raise further cash through debt or equity means to fund new business strategies.

Our ability to enter into new business opportunities may be limited by our existing cash levels and/or our ability to raise further funding through debt or equity.

We have a 20% interest (currently carried at $zero) in the company that owns the refinery and we have limited control over the financial and operating policies of the joint venture company.

Our limited shareholding and representation on the Board of the joint venture company may limit our ability to influence the financial and operating procedures of the company which may limit our ability to generate a positive return for the Group.

Risks Related to Our Strategy

The proposed strategy to find an alternative business opportunity may not materialize.

The proposed strategy to find an alternative business opportunity may not materialize. In addition, the Company may not be able to dispose of its stake in the Joint. An alternative business opportunity may require Shareholders to approve the transaction, which may not be obtained.

The proposed strategy to find an alternative business opportunity will introduce new risks to the Company.

Should a new business opportunity be concluded, the Company and the group will be exposed to a number of new risks, including (but not limited to) regulatory risk, future profitability, liquidity risk, technology risk, competition, business strategy, user engagement, key personal, foreign currency risks, and other Government regulatory risk.

The Company may be delisted from the ASX.

On 25 November 2016, the Company's Securities were placed in voluntary suspension from quotation in connection with a re-compliance transaction that did not eventuate. The Company's Shares currently remain in suspension and, in accordance with ASX's policy for entities undertaking reverse takeover transactions, the Company's securities will remain suspended from trading on the ASX until the Company has recompiled with Chapters 1 and 2 of the Listing Rules in accordance with Listing Rule 11.1.3.

The Company's Shares will have been suspended from trading on the ASX for 3 years as at 25 November 2019. ASX’s current policy is to delist a company whose shares have been suspended from trading for more than 3 years.

We may be unable to sell our stake in the Joint Venture which may affect our ability to proceed with an alternative business opportunity

The Company may not be able to dispose of its stake in the Joint Venture. A failure to dispose the stake in the Joint Venture may affect the ability of the Company to conclude a new transaction. The Company has approached prospective buyers without success to date.

We currently are not generating revenue or earnings from operations and thus we may be unable to fund our operational and capital requirements and we may be unable to obtain adequate financing on favorable terms to meet these needs.

We currently expect that our cash resources will be used to fund operating losses. We cannot assure you that we will be successful in generating sufficient revenue and we will require financing to meet our needs.

Our ability to access equity and debt capital and trade financing on favorable terms may be limited by factors such as:

●

the fact that we may be delisted by the ASX on or around 25 November 2019,

●

being suspended from trading on the ASX and may be delisted;

●

general economic and market conditions;

●

credit availability from banks or other lenders for us and our industry peers;

●

our financial performance;

●

our levels of indebtedness.

Our ability to access equity capital is limited without shareholder approval and we may be unable to obtain the required shareholder approval to obtain financing in future equity offerings.

Our ability to access equity capital may be limited by a requirement to obtain shareholder approval.

Risks Related to Our Industry

A new business opportunity will introduce new industry risks to the Company.

Should the Company complete a new business opportunity, the Company and the group will be exposed to a number of new industry risks, including (but not limited to) regulatory risk, future profitability, liquidity risk, technology risk, competition, business strategy, user engagement, key personal, foreign currency risks, and other Government regulatory risk.

If Mission has not disposed of its interest in its associate (currently carried at $zero) and if the joint venture company’s biodiesel operations can be restarted, there are multiple industry related risks that the company would be exposed to.

The Companies investment in FGV Green Energy Sdn Bhd, which owns the mothballed refinery assets in Malaysia has a loan that is due and payable. If FGV Green Energy were to be able to resolve the loan matter, and raise sufficient capital to recommence operations, the entity would be faced with numerous industry related risks, including biodiesel prices are influenced by market prices for petroleum diesel, various operational risks including, gelling at lower temperatures than petroleum diesel, which can require the use of low percentage biodiesel blends in colder climates or the use of heated fuel tanks, potential water contamination that can complicate handling and long-term storage, reluctance on the part of some auto manufacturers and industry groups to endorse biodiesel and their recommendations against the use of biodiesel or high percentage biodiesel blends, potentially reduced fuel economy due to the lower energy content of biodiesel as compared with petroleum diesel, development of alternative fuels and energy sources may reduce the demand for biodiesel and potentially impaired growth due to a lack of infrastructure such as dedicated rail tanker cars and truck fleets, sufficient storage facilities, and refining and blending facilities, new standards may be introduced and existing standards may be amended or repealed from time to time.

Risks Related to Our Ordinary Shares

We may be unable to regain trading status on the Australian Securities Exchange (ASX) for our shares.

On 25 November 2016, the Company's Securities were placed in voluntary suspension from quotation in connection with a re-compliance transaction that did not eventuate. The Company's Shares currently remain in suspension and, in accordance with ASX's policy for entities undertaking reverse takeover transactions, the Company's securities will remain suspended from trading on the ASX until the Company has recompiled with Chapters 1 and 2 of the Listing Rules in accordance with Listing Rule 11.1.3.

The Company's Shares will have been suspended from trading on the ASX for 3 years as at 25 November 2019. ASX’s current policy is to delist a company whose shares have been suspended from trading for more than 3 years.

Unless an active trading market develops for our securities, you may not be able to sell your ordinary shares.

Our ordinary shares are currently traded on the OTC Markets Pink Sheets under the symbol “MNELF”. In addition, our shares were suspended from trading on the Australian Securities Exchange (“ASX”) on November 25, 2016. There is currently no active market for the shares of the Company and we can provide no assurances as to when or if there will be a market for the shares in the Company. Although we are a reporting company, currently there is only a limited trading market for our ordinary shares and a more active trading market may never develop or, if it does develop, may not be maintained. Failure to develop or maintain an active trading market will have a generally negative effect on the price of our ordinary shares, and you may be unable to sell your ordinary shares or any attempted sale of such ordinary shares may have the effect of lowering the market price, and therefore, your investment could be a partial or complete loss.

We may not be able to continue to have our shares actively traded on alternative stock markets

Our ordinary shares are currently suspended from trading on the ASX. If we are delisted from the ASX we may be unable to have our shares actively traded on an alternative platform.

As a foreign private issuer, we are expected to follow certain home country corporate governance practices which may afford less protection to holders of our ordinary shares.

As a foreign private issuer, we are permitted to follow certain home country corporate governance practices. As a company incorporated in Australia and listed (but suspended from trading) on the ASX, we expect to follow our home country practice with respect to the composition of our board of directors and nominations committee and executive sessions. The corporate governance practice and requirements in Australia do not require us as to have a majority of our board of directors to be independent, do not require us to establish a nominations committee, and do not require us to hold regular executive sessions where only independent directors shall be present. Such Australian home country practices may afford less protection to holders of our ordinary shares.

We may be classified as a passive foreign investment company, which could result in adverse U.S. federal income tax consequences to U.S. holders of our ordinary shares.

We may be a passive foreign investment company, or PFIC, for U.S. federal income tax purposes for our current fiscal year ending June 30, 2019. A non-U.S. corporation will be considered a PFIC for any fiscal year if either (1) at least 75% of its gross income is passive income or (2) at least 50% of the value of its assets (based on an average of the quarterly values of the assets during the fiscal year) is attributable to assets that produce or are held for the production of passive income. If we are a PFIC for any fiscal year during which a U.S. holder (as defined in “Item 10.E - Additional Information Taxation — U.S. Federal Income Tax Considerations”) holds an ordinary share, certain adverse U.S. federal income tax consequences could apply to such U.S. holder. See “Item 10.E - Additional Information Taxation — U.S. Federal Income Tax Considerations — Passive Foreign Investment Company Considerations.”

Investors may be unable to enforce your legal rights against us.

We are incorporated in Australia. Substantially all of our assets are located outside of the United States. It may be difficult for investors to enforce, outside of the United States, judgments against us that are obtained in the United States in any such actions, including actions predicated on civil liability provisions of securities laws of the United States. In addition, all of our directors and officers are nationals or residents of countries outside of the United States, and all, or a substantial portion of, their assets are outside of the United States. As a result, it may be difficult for investors to serve process on these persons in the United States or to enforce judgments against them obtained in United States courts, including judgments predicated on civil liability provisions of the securities laws of the United States.

Currency fluctuations may adversely affect the price of our ordinary shares.

Our ordinary shares are quoted in Australian dollars on the ASX (currently suspended from trading) and in U.S. dollars on the OTC Markets Pink Sheets. Movements in the Australian dollar/U.S. dollar exchange rate may adversely affect the U.S. dollar price of our ordinary shares. In the past year the Australian dollar has generally remained depreciated against the U.S. dollar. Any continuation of this trend may affect the U.S. dollar price of our ordinary shares, even if the price of our ordinary shares in Australian dollars increases or remains unchanged. However, this trend may not continue and may be reversed.

Risks Relating to Takeovers

Australian takeovers laws may discourage takeover offers being made for us or may discourage the acquisition of large numbers of our ordinary shares.

We are incorporated in Australia and are subject to the takeovers laws of Australia. Among other things, we are subject to the Australian Corporations Act 2001, or the Corporations Act. Subject to a range of exceptions, the Corporations Act prohibits the acquisition of a direct or indirect interest in our issued voting shares if the acquisition of that interest will lead to a person’s voting power in us increasing from 20% or below to more than 20%, or increasing from a starting point that is above 20% and below 90%. Australian takeovers laws may discourage takeover offers being made for us or may discourage the acquisition of large numbers of our ordinary shares. This may have the ancillary effect of entrenching our board of directors and may deprive or limit our shareholders’ strategic opportunities to sell their ordinary shares and may restrict the ability of our shareholders to obtain a premium from such transactions.

Our Constitution and other Australian laws and regulations applicable to us may adversely affect our ability to take actions that could be beneficial to our shareholders.

As an Australian company, we are subject to different corporate requirements than a corporation organized under the laws of the United States. Our Constitution, as well as the Corporations Act, set forth various rights and obligations that are unique to us as an Australian company. These requirements operate differently than from many U.S. companies and may limit or otherwise adversely affect our ability to take actions that could be beneficial to our shareholders. For more information, you should carefully review the summary of these matters set forth under the section entitled, “Item 10.B — Additional Information — Memorandum and Articles of Association” as well as our Constitution.

Item 4. Information on the Company

●

History and Development of the Company.

Our legal and commercial name is Mission NewEnergy Limited, which was incorporated in Western Australia under the laws of Australia (specifically, the Australian Corporations Act) in November 2005. We are an Australian public company, limited by shares.

On November 25, 2016, the Company announced its securities traded on the Australian Securities Exchange (ASX) would be placed into voluntary suspension, at the request of the Company, pending receipt of an announcement regarding its proposed change of activities. The Companies securities will stay suspended on the ASX until the Company has either provided information regarding its proposed change of activities until the Company has complied with Chapters 1 and 2 of the ASX Listing rules in accordance with Listing Rule 11.1.3.

On December 5, 2016, the Company announced that it has entered into a heads of agreement to acquire 100% of the business operations of Aus Group.

On January 19, 2018, the Company announced that the option to acquire Aus Group as announced on 5 December 2016 has been terminated because Aus Group had not been able to meet its required conditions precedent.

On June 25, 2019 the Company announced that it had been notified by its associate entity, Felda Green Energy Sdn Bhd, of a default in a loan. MBT owns 100% of M2 Capital Sdn Bhd, a Malaysian subsidiary, which owns a 20% stake in FGVGE, which owns a mothballed biodiesel refinery situated in east Malaysia. FGVGE borrowed money from FGV Capital Sdn Bhd in 2015 as part proceeds to acquire the refinery. FGV Capital Sdn Bhd have terminated the loan facility on 24 June 2019, which is now immediately due and payable. The Board of FGVGE have met and declared an inability to repay this loan. Under the terms of the loan agreement, FGV Capital have full security over the refinery asset in the event of a default. MBT and its subsidiaries have no obligation, financial or otherwise, to meet any capital shortfall requirements of FGVGE.

Capital Spend of the Company

We have incurred the following capital expenditures over the last three fiscal years:

| | 2019 A$’000 | 2018 A$’000 | 2017 A$’000 |

| Biodiesel refinery | - | - | - |

| Land & buildings | - | - | - |

| IT systems & office equipment | - | - | - |

| Vehicles & sundry equipment | - | - | - |

Our principal office is located at Unit B9, 431 Roberts Rd, Subiaco, Western Australia 6008 Australia. Our telephone number is +61 8 6313 3975. Our website address is www.missionnewenergy.com. Information on our website and websites linked to it do not constitute part of this annual report.

Recent Developments

In July 2019 the Company announced that it has entered into a heads of agreement to acquire 100% of the business operations of Pilbara Metals Group Pty Ltd (PMG), an Australian Private Limited Company. This transaction was terminated on 31 October 2019.

The Malaysian company, Felda Green Energy Sdn Bhd (FGVGE) in which we own 20%, biodiesel project has a loan which is now due and payable. The lender has full security over the asset. This investment may require us to inject further capital funds into the project to pay off the loan and recommence operations. In addition, the lender has the option to take the asset as compensation for the loan default if we do not meet such a capital call. Given the current inability to meet any capital calls by FGVGE, we may liquidate the M2 Capital, being the company which holds the shares in the refinery.

Overview

Mission’s only asset is its 20% share in a joint venture company. In December 2016 the Company started actively seeking buyers for its stake in the biodiesel plant, no buyers have been found and Mission impaired its held for sale investment to $zero.

The joint venture company, in which Mission owns a 20% share, owns a mothballed 250,000 tpa refinery which has a loan currently due and payable and the lender has full security over the refinery asset.

Mission have been actively seeking to dispose of this 20% interest since December 2016 and to date no offers for this business have been received and the asset is recorded at $zero. The Malaysian company, Felda Green Energy Sdn Bhd (FGVGE) in which we own 20%, biodiesel project has a loan which is now due and payable. The lender has full security over the asset. This investment may require us to inject further capital funds into the project to pay off the loan and recommence operations. In addition, the lender has the option to take the asset as compensation for the loan default if we do not meet such a capital call. Given the current inability to meet any capital calls by FGVGE, we may liquidate the M2 Capital, being the company which holds the shares in the refinery.

Our Competitive Strengths

Nil

Our Strategies

The Company is focused on maximizing shareholder value through a positive return from looking for new business opportunities.

Malaysian Asset

The Company is trying to sell its investment in the joint venture company.

Corporate Opportunities

The Company will continue to look at other related opportunities and projects on a continued basis to enhance shareholder value.

Production Safety and Environmental Matters

Safety

We had no material safety issues and none were reported to us last year by the joint venture company.

Environment

We had no material environmental issues and none were reported to us last year by the joint venture company.

●

Organizational Structure.

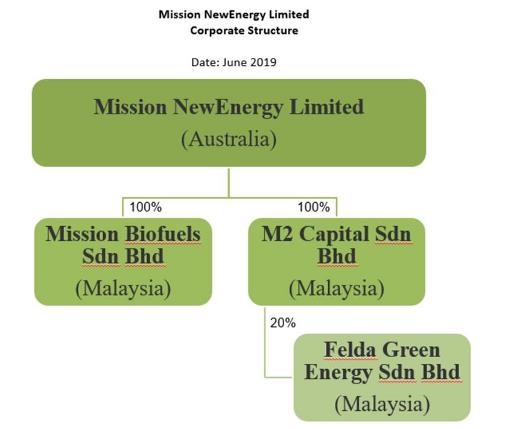

Our principal subsidiaries at 30 June 2019 are set out below. Unless otherwise stated, they have share capital consisting solely of ordinary shares that are held directly by the Group, and the proportion of ownership interests held equals the voting rights held by the Group. The country of incorporation or registration is also their principal place of business.

Set forth below is the organizational structure of Mission NewEnergy Limited:

The Company owns 100% of M2 Capital Sdn Bhd, a Malaysian registered Company, which in turn owns 20% of FGV Green Energy Sdn, a Malaysian registered Company formed to own the 250,000 tpa refinery sold by the Group during that financial period. This biodiesel refinery is mothballed. Mission Biofuels Sdn Bhd is 100% owned and is now the Malaysian administrative entity and is in the process of being shut down.

For a list of our wholly-owned and indirectly owned subsidiaries, see Exhibit 8.1 filed hereto.

We own a 20% stake in a joint venture company that owns a biodiesel production facility (with a lease for the underlying land) that is located at Port Kuantan, Malaysia. This 20% stake is up for sale and carried at $zero. The refinery is mothballed. The Malaysian company, Felda Green Energy Sdn Bhd (FGVGE) in which we own 20%, biodiesel project has a loan which is now due and payable. The lender has full security over the asset. This investment may require us to inject further capital funds into the project to pay off the loan and recommence operations. In addition, the lender has the option to take the asset as compensation for the loan default if we do not meet such a capital call. Given the current inability to meet any capital calls by FGVGE, we may liquidate the M2 Capital, being the company which holds the shares in the refinery.

The following is further information about the biodiesel facility:

| | Total Planned Capacity (1) (million gallonsper year) | Capacity Utilization (2)(percentage) | Commissioning Date |

250,000 tpa refinery owned by FGV Green Energy Sdn Bhd | 6.0 | 75 | 0% | Project has stalled |

(1) | Nominal operating capacity. |

(2) | The total tonnage produced during this period was NIL. |

Our registered administrative offices are located on premises comprising approximately 60 square meters in an office building in Perth, Australia.

We also lease properties for purposes of office quarters in Malaysia.

Item 4A. Unresolved Staff Comments

None.

Item 5. Operating and Financial Review and Prospects

You should read the following discussion and analysis of our financial condition and results of operations in conjunction with “Item 3.A — Selected Financial Data” and our consolidated financial statements and related notes included elsewhere in this annual report. This discussion may contain forward-looking statements that involve risks and uncertainties. Our actual results and the timing of selected events could differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to, those set forth under “Item 3.D — Risk Factors” and elsewhere in this annual report.

Overview

We historically were a producer of biodiesel that integrated sustainable biodiesel feedstock cultivation, biodiesel production and wholesale biodiesel distribution, focused on the government mandated markets of the United States and Europe and Malaysia. We currently own a 20% share in a joint venture company that owns a biodiesel refinery that is mothballed.

The Companies 20% stake in the joint venture company is currently being actively marketed for sale, no buyers have been found and the asset has been written down to $zero.

During fiscal 2019, we made a net profit of A$0.012 million (2018: A$0.2 million loss). We recognized revenues of A$0.17 million (A$0.002 million in fiscal 2018). The income in fiscal 2019 is mostly generated from the proceeds of RTO activities and 2018 was predominately comprised of interest income. As of the date of this report, we have no non-current liabilities. If a new venture does not generate sufficient revenue to fund the ongoing operating costs of the business, and if we are unable to achieve our business strategies and objectives, we may need to raise further equity or loan capital for the business (See item 4 for further detail).

Biodiesel refining

The Group owns 100% of M2 Capital Sdn Bhd, a Malaysian subsidiary, which owns a 20% stake in FGV Green Energy Sdn Bhd (FGVGE), a refinery joint venture company, which is carried at NIL. FGVGE has a loan that is due and payable and the lender has full security over the refinery asset. Given the current inability to meet any capital calls by FGVGE, we may liquidate M2 Capital, being the company which holds the shares in FGVGE which owns the refinery.

Critical Accounting Policies

Our discussion and analysis of our operating and financial performance and prospects are based upon our consolidated financial statements. The preparation of these consolidated financial statements requires us to make estimates and judgments that affect the reported amounts of revenue, assets, liabilities and expenses. We re-evaluate our estimates on an on-going basis. Our estimates are based on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual results may differ from these estimates under different assumptions or conditions.

Our significant accounting policies are more fully described in the notes to our audited consolidated financial statements included elsewhere in this annual report. However, critical accounting policies that affect our more significant judgments and estimates used in the preparation of our financial statements are set forth below.

Principles of Consolidation

The consolidated financial statements comprise the financial statements of Mission NewEnergy Limited and its subsidiaries, as defined in Accounting Standard AASB 127 ‘Separate Financial Statements’. These include Mission Biofuels Sdn Bhd and M2 Capital Sdn Bhd. All controlled entities have a 30 June financial year-end. The Associate company has a 31 December year end.

All inter-company balances and transactions between entities in the Consolidated Group, including any unrealized profits or losses, have been eliminated on consolidation. Accounting policies of subsidiaries have been changed where necessary to ensure consistency with the policies applied by the parent entity.

Where controlled entities have entered or left the Consolidated Group during the year, their operating results have been included/excluded from the date control was obtained or until the date control ceased.

Non-controlling interests in the equity and results of the entities that are controlled are shown as a separate item in the consolidated financial report.

Investments in associates/Non-Current Assets held for sale

The Group owns 100% of M2 Capital Sdn Bhd, a Malaysian subsidiary, which owns a 20% stake in FGV Green Energy Sdn Bhd (FGVGE), a refinery joint venture company. Investments in associates held by the parent entity, Mission NewEnergy Limited, are reviewed for impairment if there is any indication that the carrying amount may not be recoverable. The carrying value of this investment is NIL.

During the current financial year the Group announced an intention to undertake a new Reverse Take Over (refer to the Director’ Report for further details). Under the RTO arrangement the Group is required to dispose of the shares held in 100% owned subsidiaries and the Associate Joint Venture Company. The accounting standards require assets held for sale to be separately disclosed on the statement of financial position with the value of the investment into the joint venture company to be accounted for at the lower of carrying value or fair value less costs to sell.

In assessing the carrying value of the investment, the following factors were considered by the Directors:

o

Mission does not hold a refining asset, however it holds a 20% share in the refining JV,

o

This refining JV is not a listed publicly traded entity with a readily determinable share price, nor is there a ready market to sell the 20% holding,

o

Mission does not have the voting or management rights to force any actions on the JV company, (be that to commence refurbishment, sell the asset as a going concern or for sell for scrap value),

o

Should the JV company require further equity funding to undertake the refurbishment the group has insufficient current cash proceeds to protect its equity position and hence our shareholding position would likely be diluted.

o

The Malaysian company, Felda Green Energy Sdn Bhd (FGVGE) in which we own 20%, biodiesel project has a loan which is now due and payable. The lender has full security over the asset. This investment may require us to inject further capital funds into the project to pay off the loan and recommence operations. In addition, the lender has the option to take the asset as compensation for the loan default if we do not meet such a capital call. Given the current inability to meet any capital calls by FGVGE, we may liquidate the M2 Capital, being the company which holds the shares in the refinery.

Management has been unsuccessful to date in disposing of the investment, however continues to seek buyers. The Directors impaired the carrying value of the investment to NIL during the prior financial year. Should the Group sell the refinery an impairment reversal is expected to be recognized in the financial records of the Group, to the extent of any consideration received, if any.

Since that date Mission has been actively looking to dispose of its 20 % stake, no such buyers were identified.

| | | |

| | | |

Impairment of investment in associate | - | - |

| |

|

|

Impairment of assets

We assess impairment of assets by evaluating conditions that may lead to impairment of particular assets. Where an impairment trigger exists, the recoverable amount of the asset is determined.

Recently issued accounting pronouncements

There are no recently issued accounting pronouncements that have had any material impact to the financial reported position of the Company.

The changes in Accounting policies and impact on the financial statements were:

●

IFRS 9 was adopted without restating comparative. Adoption had no impact on the Groups financial statements.

●

IFRS 15 had no impact because the Group had no revenue.

Any new, revised or amending Accounting Standards or Interpretations that are not yet mandatory have not been early adopted.

Comparison of Results of Operations

Fiscal 2019 compared with fiscal 2018

Other income. Other income increased by A$163,628 (ten times increase) from A$1,524 in fiscal 2018 to A$165,152 in fiscal 2019, primarily as a result of RTO proceeds.

Expenses. Total expenses decreased by A$50,258 (25% decrease) from A$203,503 in fiscal 2018 to A$153,245 in fiscal 2019 principally due to a general reduction in operating costs. Employee benefits expenses remained at $0.0 in fiscal 2019 as a result of the Directors agreeing to not take a salary until the Company has sufficient funds. Foreign currency losses increased by A$3,238 from a loss in fiscal 2018 of A$4,095 to a loss in fiscal 2019 of A$7,333.

Other expense decreased by A$129,293 from A$173,143 in fiscal 2018 to A$43,850 in fiscal 2019 primarily due to a general reduction in costs

Finance cost

Finance costs of A$0 were incurred in fiscal 2019 and $2,450 incurred in fiscal 2018.

Income tax. Income tax expense was $0.0 in fiscal 2019 and $135 in fiscal 2018.

Profit for the year. As a result of the foregoing, fiscal 2019 registered a profit for the year of A$11,907, an increase of A$214,021 from a A$202,114 loss in fiscal 2018.

Fiscal 2018 compared with fiscal 2017

Revenue. Interest revenue decreased by A$6,253 (80% reduction) from A$7,777 in fiscal 2017 to A$1,524 in fiscal 2018.

Expenses. Total expenses decreased by A$4.3 million (95% decrease) from A$4.5million in fiscal 2017 to A$0.2 million in fiscal 2018 principally due to impairment of investment in associate company in fiscal 2017. Employee benefits expenses decreased A$0.4 million from A$0.4 million in fiscal 2017 to A$0.0 million in fiscal 2018 primarily as a result of the continued Group restructure, cost management and in particular the Directors agreeing to not take a salary until the Company has sufficient funds. Foreign currency losses decreased by A$0.006 million from a loss in fiscal 2017 of A$0.01 million to a loss in fiscal 2018 of A$0.004 million. Other expense decreased by A$0.1 million from A$0.3 million in fiscal 2017 to A$0.2 million in fiscal 2018 primarily due to a reduction in legal costs and due diligence costs incurred in 2017 fiscal year.

Finance cost

Finance costs of A$2,450 were incurred in fiscal 2018. No finance cost incurred in fiscal 2017.

Income tax. Income tax expense decreased by A$3,117 from A$3,252 in fiscal 2017 to an expense of A$135 in fiscal 2018.

Discontinued operations. There were no discontinued operations in fiscal 2017 and fiscal 2018.

Loss for the year. As a result of the foregoing, fiscal 2018 registered a loss for the year of A$0.2 million, a decrease of A$4.4 million from A$4.6 million loss in fiscal 2017.

Impact of Inflation

We do not believe that inflation has had a material effect on our business.

Effects of Currency Fluctuations

Our presentation currency is the Australian dollar. In accordance with IFRS, costs not denominated in Australian dollars are re-measured in Australian dollars, when recorded, at the prevailing exchange rates for the purposes of our financial statements. Consequently, fluctuations in the rates of exchange between the Australian dollar, Malaysian Ringgit, Indian Rupee and the U.S. dollar affect the presentation of our results of operations. An increase in the value of a particular currency relative to the Australian dollar will reduce the Australian dollar reporting value for transactions in that particular currency, and a decrease in the value of that currency relative to the Australian dollar will increase the Australian dollar reporting value for those transactions.

The effect of foreign currency translation is reflected in our financial statements in the statements of changes in shareholders’ equity and is reported as accumulated foreign currency translation reserve. We have not entered into any hedging arrangements to mitigate the effects of currency fluctuations.

B.

Liquidity and Capital Resources.

Overview

Our operations have historically been financed primarily from the issuance of convertible notes and equity securities to investors.

The following table sets forth our consolidated cash flows since fiscal 2017.

| | 2019 A$’000 | 2018 A$’000 | 2017 A$’000 |

| Net cash (used in) operating activities | (15) | (190) | (979) |

| Net cash provided by investingactivities | - | - | - |

| Net cash (used in) financingactivities | - | - | - |

| Effect of exchange rate changes on cash held in foreign currency | (8) | (2) | (34) |

| Net movement in cash and cash equivalents | (23) | (192) | (1,013) |

Cash and cash equivalents at the beginning of the year | 196 | 388 | 1,401 |

| Cash and cash equivalents at the end of the year | 173 | 196 | 388 |

Fiscal 2019 compared with fiscal 2018

Net cash used in operating activities is as a result of ongoing operating costs with no group operating revenue.

There were NIL investing or financing activities in fiscal year 2019.

Fiscal 2018 compared with fiscal 2017

Net cash used in operating activities is as a result of ongoing operating costs with no group operating revenue.

There were NIL investing or financing activities in fiscal year 2018.

Bank facility

We do not currently have any bank credit facilities.

Secured loans

We do not currently have any secured loans.

Other material commitments

We do not have any material commitments.

Warrants

There are no outstanding warrants.

C.

Research and Development, Patents and Licenses, etc.

Our expenditure on research and development was Nil in fiscal years 2019, 2018 and 2017.

Other than as disclosed elsewhere in this annual report, we are not aware of any trends, uncertainties, demands, commitments or events that are reasonably likely to have a material effect on our revenue, income, profitability, liquidity or capital resources or that would cause reported financial information not necessarily to be indicative of future operating results or financial condition.

E.

Off-Balance Sheet Arrangements.

We do not have any material off-balance sheet commitments or arrangements.

F.

Tabular Disclosure of Contractual Obligations.

We do not have any contractual commitments at June 30, 2019.

Item 6. Directors, Senior Management and Employees

A.

Directors and Senior Management.

The following table sets forth information of our directors and executive officers as of the date of this annual report. The directors have served in their respective capacities since their election or appointment and will serve until the next annual general shareholders meeting or until a successor is duly elected.

| Name | | Position |

| Dato’ Nathan Mahalingam | 62 | Executive Chairman, Chief Executive Officer and Director |

| Guy Burnett | 51 | Chief Financial Officer, Director and Company Secretary |

| James Garton | 43 | Director and Head of Corporate Finance/Mergers and Acquisitions |

Dato’ Nathan Mahalingam. Dato’ Nathan has been Chief Executive Officer (formerly having the title of Managing Director) and a Director of Mission NewEnergy since 2005. He has over 25 years of management experience in banking and finance, heavy industries and infrastructure development. He has successfully implemented numerous start up manufacturing operations in Malaysia during his tenure of service with a large Malaysian conglomerate. Between 1995 and 2000, he served as project director in the Westport Group, developers of one of Malaysia’s largest privatized port and transhipment facility. Dato’ Nathan has gained extensive project advisory, corporate finance, mergers and acquisitions experience while running his own boutique corporate advisory practice between 2000 and 2004. Dato’ Nathan took over the role of Executive Chairman in June 2017 upon the retirement of the past Chairman.

Guy Burnett. Mr. Burnett has been Chief Financial Officer (formerly having the title of Finance Director) since 2008, a Director since 2009 and Company Secretary of Mission NewEnergy since September 2010. He is a Chartered Accountant and has worked as a financial professional in several large corporations. Prior to joining Mission NewEnergy, Mr. Burnett was Manager, Corporate Accounting & Tax with Western Power (an electricity networks corporation owned by the Western Australian government) from 2006 to 2008 and, before that, worked as a financial accountant for Water Corporation from 2004 to 2005 and served as a Manager with KPMG from 2005 to 2006 where he assisted clients with implementing International Financial Reporting Standards.

James Garton. Mr. Garton Mr. Garton has over 15 years’ experience in corporate finance, working in investment banking. Prior to his current role, James was has been Head of Corporate Finance and Mergers and

Acquisitions for Mission since 2008. Mr. Garton joined Mission NewEnergy from U.S. investment bank, FBR Capital Markets, where he was Vice President, Investment Banking. Prior to FBR Capital Markets, he worked in corporate finance and equity capital markets with Australian firm BBY Limited. Before BBY, Mr. Garton worked in private equity with the Australian advisory firm Investment Capital Limited.

Family Relationships

There are no family relationships between any directors or executive officers of Mission NewEnergy.

Arrangements

There are no known arrangements or understandings with any major shareholders, customers, suppliers or others pursuant to which any of our officers or directors was selected as an officer or director of Mission NewEnergy.

In fiscal year 2019, the aggregate remuneration we paid and that accrued to our directors and senior management was A$0.0 million. During the year the company settled $30,000 of accrued leave liabilities.

| 2019 | | | | | Post-employment Super Contribution | |

| Dato’ Nathan Mahalingam | - | - | - | - | - | - |

| Mr. Guy Burnett | - | - | - | - | - | - |

| Mr. James Garton | - | - | - | - | - | - |

| TOTAL KEY MANAGEMENT PERSONNEL | - | - | - | - | - | - |

During the financial year, each director was paid out $10,000 of annual leave owed.

| 2018 | | | | | Post-employment Super Contribution | |

| Dato’ Nathan Mahalingam | - | - | - | - | - | - |

| Mr. Guy Burnett | - | - | - | - | - | - |

| Mr. James Garton | - | - | - | - | - | - |

| TOTAL KEY MANAGEMENT PERSONNEL | - | - | - | - | - | - |

Share Based Compensation Plans

At the date of this report, the Group has no Share Based Compensation Plans.

Performance Rights

At the date of this annual report, the Group has no Performance Right Plans and there were no performance rights issued in fiscal years 2017, 2018 and 2019.

Options

At the date of this annual report, the Group has no Option Plans and there were no options issued in fiscal years 2017, 2018 and 2019.

Retirement Benefits

All employees employed by Mission NewEnergy and its subsidiaries belong to appropriate retirement schemes for each jurisdiction in which it operates. All such employee retirement schemes are defined contribution schemes and thus no amounts are required to be set aside by us to meet any future retirement benefit obligations.

Role of the Board of Directors

The Board of Mission is responsible for setting the Company’s strategic direction and providing effective governance over Mission’s affairs in conjunction with the overall supervision of the Company’s business with the view of maximising shareholder value. The Board’s key responsibilities are to:

●

chart the direction, strategies and financial objectives for Mission and monitor the implementation of those policies, strategies and financial objectives;

●

keep updated about the Group’s business and financial status;

●

provide oversight and monitor compliance with regulatory requirements, ethical standards, risk management, internal compliance and control, code of conduct, legal compliance and external commitments;

●

appoint, evaluate the performance of, determine the remuneration of, plan for the succession of and, where appropriate, remove the Managing Director/Group Chief Executive Officer, the Company Secretary and the Finance Director/Chief Financial Officer;

●

exercise due care and diligence and sound business judgment in the performance of those functions and responsibilities; and

●

ensure that the Board continues to have the mix of skills and experience necessary to conduct Mission’s activities, and that appropriate directors are selected and appointed as required.

The Group has a formal process to educate new directors about the nature of the business, current issues, the corporate strategy, the culture and values of the Group, and the expectations of the Group concerning performance of the directors. In addition directors are also educated regarding meeting arrangements and director interaction with each other, senior executives and other stakeholders. Directors also have the opportunity to visit Group facilities and meet with management to gain a better understanding of business operations. Directors are given access to continuing education opportunities to update and enhance their skill and knowledge.

The Board has adopted a Board Charter, which sets out in more detail the responsibilities of the Board. The Board Charter sets out the division of responsibility between the Board and management to assist those affected by decisions to better understand the respective accountabilities and contribution to Board and management.

In accordance with Mission’s Constitution, the Board delegates responsibility for the day–to–day management of Mission to the Executive Chairman/Managing Director/Group Chief Executive Officer (subject to any limits of such delegated authority as determined by the Board from time to time). Management as a whole is charged with reporting to the Board on the performance of the Company.

Board structure and composition

The Board currently is comprised of three directors, all of which are non-independent executive directors. Details of each director’s skills, expertise and background are contained within the directors’ report included with the company’s annual financial statements lodged with the Australian Securities Exchange. The Board considers the mix of skills and the diversity of Board members when assessing the composition of the Board. The Board assesses existing and the potential director’s skill to ensure they have appropriate industry expertise in the Group’s operating segments. In addition, the Board has considered the current Board composition based on the existing level of operations within the group.

Independence, in this context, is defined to mean a non–executive director who is free from any interest and any business or other relationship that could, or could reasonably be perceived to, materially interfere with the directors ability to act in the best interests of Mission. The definition of independence in ASX Recommendation 2.1 is taken into account for this purpose.

Apart from the Group CEO, Mission’s directors may not hold office for a continuous period in excess of three years or past the third annual general meeting following their appointment, whichever is longer, without submitting for re–election. Directors are elected or re–elected, as the case may be, by shareholders in a general meeting. Directors may offer themselves for re–election. A Director appointed by the directors (e.g., to fill a casual vacancy) will hold office only until the conclusion of the next annual general meeting of Mission but is eligible for re–election at that meeting.

Under Mission’s Constitution, voting requires a simple majority of the Board. The Chairman does not hold a casting vote.

Board Diversity

The Board has a formal diversity policy which states that Mission NewEnergy Limited is committed to embedding a corporate culture that embraces diversity through:

●

Recruitment on the basis of competence and performance and selection of candidates from a diverse pool of qualified candidates,

●

Maintaining selection criteria that does not indirectly disadvantage people from certain groups,

●

Providing equal employment opportunities through performance and flexible working practices,

●

Maintaining a safe working environment and supportive culture by taking action against inappropriate workplace and business behavior that is deemed as unlawful (discrimination, harassment, bullying, vilification and victimization),

●

Promoting diversity across all levels of the business,

●

Undertaking diversity initiatives and measuring their success,

●

Regularly surveying our work climate, and

●

Establishing measurable objectives in achieving gender diversity.

Since the Company’s incorporation, given its cross-jurisdictional operations in Australia and Malaysia, a diversity practice is naturally in place.

Board and management effectiveness

Responsibility for the overall direction and management of Mission, its corporate governance and the internal workings of Mission rests with the Board, notwithstanding the delegation of certain functions to the Managing Director/Group Chief Executive Officer and management generally (such delegation effected at all times in accordance with Mission’s Constitution and its corporate governance policies). The Board has access, at the company’s expense, to take independent professional advice after consultation with the Chairman.

An evaluation procedure in relation to the Board, individual directors and Company executives was not completed during the 2018 financial year due to the limited operating status of the Company. Traditionally, the evaluations of the Board as a whole were facilitated through the use of a questionnaire required to be completed by each Board member, the results of which were summarised, discussed with the Chairman of the Board and tabled for discussion at a Board Meeting. Similarly each individual director was required to self assess his performance and discuss the results with the Chairman. Individual directors’ performance was evaluated by reference to the Director’s contribution to monitoring and assessing management performance in achieving strategies and budgets approved by the Board (among other things). A similar process for review of committees was has not been undertaken during the current year due to the limited extent of operations.

Internal control, risk management and financial reporting

The Board has overall responsibility for Mission’s systems of internal control. These systems are designed to ensure effective and efficient operations, including financial reporting and compliance with laws and regulations, with a view to managing the risk of failure to achieve business objectives. It must be recognized, however, that internal control systems can provide only reasonable and not absolute assurance against the risk of material loss.

The Board reviews the effectiveness of the internal control systems and risk management on an ongoing basis, and monitors risk through the Audit and Risk Management Committee (see the Audit and Risk Management Committee). The Board regularly receives information about the financial position and performance of Mission. For annual and half-yearly accounts released publicly, the Managing Director/Group Chief Executive Officer and the Finance Director/Chief Financial Officer sign-off to the Board:

●

the accuracy of the accounts and that they represent a true and fair view, in all material respects, of Missions financial condition and operational results, and have been prepared in accordance with applicable accounting standards; and

●

that the representations are based on a system of risk management and internal compliance and control relating to financial reporting which implements the policies adopted by the Board, and that those systems are operating efficiently and effectively in all material respects.

In addition, management has reported to the Board on the effectiveness of the Company’s management of its material business risks.

Internal audit

The Group does not have an Internal Auditor due to the restructure and significant downsizing of the Group since fiscal year 2012.

Our risk management policy is included in the Corporate Governance section of the Company’s website.

Committees of the Board of Directors

The Board has established two permanent Board committees to assist the Board in the performance of its functions:

●

the Audit and Risk Management Committee; and

●

the Remuneration and Nomination Committee.

Each committee has a charter that sets out its purpose and responsibilities. The committees are described further below.

The names of the members of the two committees are set out in the directors’ report contained within the Company’s annual financial statements.

Audit and Risk Management Committee

The purpose of the Audit and Risk Management Committee is to provide assistance to the Board in its review of:

●

Mission’s financial reporting, internal control structure and risk management systems’;

●

the internal and external audit functions; and

●

Mission’s compliance with legal and regulatory requirements in relation to the above.

The Audit and Risk Management committee has specific responsibilities in relation to Missions’ financial reporting process; the assessment of accounting, financial and internal controls; the appointment of the external auditor; the assessment of the external audit; the independence of the external auditor; and setting the scope of the external audit.

During prior fiscal years, the Audit and Risk Management Committee comprised two independent non–executive directors and one non-independent non–executive director that have diverse and complementary backgrounds. Since the retirement of the non-executive Directors, the three executive Directors form the members of the Audit and Risk Committee.

Remuneration and Nomination Committee

The purpose of the Remuneration and Nomination Committee is to discharge the Board’s responsibilities relating to the nomination and selection of directors and the compensation of the Company’s executives and directors.

The key responsibilities of the Remuneration and Nomination Committee are to:

●

ensure the establishment and maintenance of a formal and transparent procedure for the selection and appointment of new directors to the Board; and

●

establish transparent and coherent remuneration policies and practices, which will enable Mission to attract, retain and motivate executives and Directors who will create value for shareholders and to fairly and responsibly reward executives.

During prior fiscal years, the Remuneration and Nomination Committee comprised two independent non–executive directors and one non-independent non–executive director. Since the retirement of the non-executive Directors, the three executive Directors form the members of the Nomination and Remuneration Committee.

We have a remuneration policy that sets out the terms and conditions for the Managing Director and other senior executives.

Disclosure policy

Mission is committed to promoting investor confidence and ensuring that shareholders and the market have equal access to information and are provided with timely and balanced disclosure of all material matters concerning the Company. Additionally, Mission recognizes its continuous disclosure obligations under the ASX Listing Rules and the Corporations Act. To assist with these matters, the Board has adopted a Continuous Disclosure and Shareholder Communication Policy.

The Continuous Disclosure and Shareholder Communication Policy allocates roles to the Board and management in respect of identifying material information and coordinating disclosure of that information where required by the ASX Listing Rules.

The Policy also identifies authorized company spokespersons and the processes Mission has adopted to communicate effectively with its shareholders. In addition to periodic reporting, Mission will ensure that all relevant information concerning the Company is placed on its website.

Code of Conduct

The Board has created a framework for managing the Company including internal controls, business risk management processes and appropriate ethical standards.

The Board has adopted practices for maintaining confidence in the Company’s integrity including promoting integrity, trust, fairness and honesty in the way employees and directors’ conduct themselves and Mission’s business, avoiding conflicts of interest and not misusing company resources. A formal Code of Conduct has been adopted for all employees and directors of Mission.

Securities Trading Policy

A Securities Trading Policy has been adopted by the Board to set a standard of conduct, which demonstrates Mission’s commitment to ensuring awareness of the insider trading laws, and that employees and directors’ comply with those laws. The Securities Trading Policy imposes additional share trading restrictions on Directors, the Company Secretary, executives and employees involved in monthly financial accounting processes (“specified persons”).