Filed Pursuant to Rule 424(b)(2)

Registration No. 333-238621

Prospectus Supplement

(to Prospectus dated December 11, 2020)

$40,000,000

First Eagle Alternative Capital BDC, Inc.

5.00% Notes due 2026

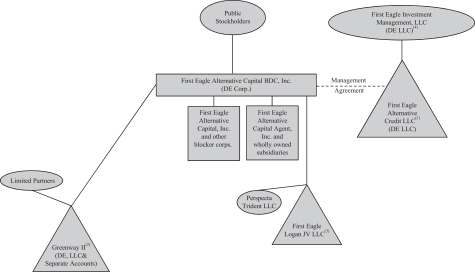

We are an externally managed, non-diversified closed-end management investment company that has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended. We are managed by our investment adviser, First Eagle Alternative Credit, LLC, (formerly, THL Credit Advisors LLC), or FEAC, which also provides the administrative services necessary for us to operate. Effective January 31, 2020, FEAC is a subsidiary of First Eagle Investment Management, LLC (“First Eagle”). Prior to August 3, 2020, we were named “THL Credit, Inc.”

Our investment objective is to generate both current income and capital appreciation, primarily through investments in privately negotiated debt and equity securities of middle market companies. We are a direct lender to middle market companies and invest primarily in directly originated first lien senior secured loans, including unitranche investments. In certain instances, we also make second lien secured loans and subordinated, or mezzanine, debt investments, which may include an associated equity component such as warrants, preferred stock or similar securities, and direct equity investments. Our first lien senior secured loans may be structured as traditional first lien senior secured loans or as unitranche loans. Unitranche structures may combine characteristics of traditional first lien senior secured as well as second lien and subordinated loans and our unitranche loans will expose us to the risks associated with second lien and/or subordinated loans to the extent we invest in the “last-out” tranche or subordinated tranche (or piece) of the unitranche loan. We also may provide advisory services to managed funds.

Substantially all of the debt securities in which we invest are below investment grade debt securities and are often referred to as “high yield” or “junk” securities. Exposure to below investment grade securities involves certain risk, and those securities are viewed as having predominately speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. A material amount of our debt investments contain interest reset provisions that may make it more difficult for the borrowers to make debt repayments. Further, our debt investments generally will not pay down principal during their term which could result in a substantial loss to us if the portfolio company is unable to refinance or repay the debt at maturity.

We are offering $40,000,000 in aggregate principal amount of 5.00% notes due 2026, or the “Notes.” The Notes will mature on May 25, 2026. We will pay interest on the Notes on March 30, June 30, September 30 and December 30 of each year. The Notes offered hereby are a further issuance of the $69,000,000 aggregate principal amount of 5.00% notes due 2026 previously issued by us on May 25, 2021 and June 4, 2021 (the “Existing Notes”). The Notes offered hereby will be treated as a single series with, and will have the same terms (except the issue date and offering price) as the Existing Notes. The Notes offered hereby will have the same CUSIP number and will be fungible and rank equally with the Existing Notes. Upon the issuance of the Notes offered hereby, the outstanding aggregate principal amount of our 5.00% notes due 2026 will be $109,000,000 (assuming the underwriters’ overallotment option is not exercised). Unless the context otherwise requires, references herein to the “Notes” include the Notes offered hereby and the Existing Notes.

We may redeem the Notes in whole or in part at any time or from time to time on or after May 25, 2023, at the redemption price set forth under “Specific Terms of the Notes and the Offering-Optional redemption” in this prospectus supplement. The Notes will be issued in minimum denominations of $25 and integral multiples of $25 in excess thereof.

The Notes are our direct unsecured obligations and rank pari passu, or equally in right of payment, with all outstanding and future unsecured unsubordinated indebtedness issued by First Eagle Alternative Capital BDC, Inc.

The Existing Notes are listed on the New York Stock Exchange (“NYSE”), under the trading symbol “FCRX.” On November 15, 2021, the last reported price of the Existing Notes on the NYSE was $26.05. We intend to list the Notes offered hereby on the NYSE under the same trading symbol. The Notes are expected to trade “flat,” which means that purchasers will not pay, and sellers will not receive, any accrued and unpaid interest on the Notes that is not reflected in the trading price.

This prospectus supplement and the accompanying prospectus contain important information about us that a prospective investor should know before investing in the Notes. Please read this prospectus supplement and the accompanying prospectus, and the documents incorporated by reference herein and therein, before investing and keep it for future reference. We file annual, quarterly and current reports, proxy statements and other information about us with the Securities and Exchange Commission. You may obtain this information free of charge or make stockholder inquiries by contacting us at First Eagle Alternative Capital BDC, Inc., 500 Boylston Street, Suite 1200, Boston, MA 02116, or by calling us at (800) 450-4424 or on our website at www.feacbdc.com. The Securities and Exchange Commission maintains a website at www.sec.gov where such information is available without charge. Information contained on or accessed through our website is not incorporated by reference into this prospectus supplement and the accompanying prospectus, and you should not consider information contained on or accessed through our website to be part of this prospectus supplement and the accompanying prospectus.

An investment in the Notes involves risks that are described in the “Supplementary Risks” section beginning on page S-20 in this prospectus supplement, the “Risks” section beginning on page 10 of the accompanying prospectus or otherwise included in or incorporated by reference herein or in the accompanying prospectus and in any free writing prospectus.

THE NOTES ARE NOT DEPOSITS OR OTHER OBLIGATIONS OF A BANK AND ARE NOT INSURED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION OR ANY OTHER GOVERNMENT AGENCY.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement and the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | | | | | |

| | | Per Note | | | Total | |

Public Offering Price(1) | | $ | 25.41 | | | $ | 40,656,000 | |

Sales Load (Underwriting Discounts and Commissions) | | $ | 0.75 | | | $ | 1,200,000 | |

Proceeds to First Eagle Alternative Capital BDC, Inc. (before expenses)(2) | | $ | 24.66 | | | $ | 39,456,000 | |

| (1) | Includes accrued interest from, and including, September 30, 2021 of $0.1806 per Note. |

| (2) | Before deducting expenses payable by us related to this offering, estimated at $0.3 million. See “Underwriting” in the prospectus supplement. |

The underwriters have an option to purchase up to an additional $6,000,000 aggregate principal amount of Notes from us at the public offering price, less the underwriting discounts and commissions, within 30 days from the date of this prospectus supplement to cover overallotments, if any. If the underwriters exercise this option in full, the total public offering price will be $46,754,400, the total underwriting discount and commissions (sales load) paid by us will be $1,380,000, and total proceeds, before expenses, will be $45,374,400.

Delivery of the Notes in book-entry form only through The Depository Trust Company will be made on or about November 22, 2021.

Joint Book-Running Managers

| | | | |

Keefe, Bruyette & Woods A Stifel Company | | Goldman Sachs & Co. LLC | | Oppenheimer & Co. |

The date of this prospectus supplement is November 17, 2021