UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | | | | |

| (Mark One) | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended April 30, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-00123

BROWN-FORMAN CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 61-0143150 |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

| 850 Dixie Highway | |

| Louisville, | Kentucky | 40210 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (502) 585-1100

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock (voting), $0.15 par value | BFA | New York Stock Exchange |

| Class B Common Stock (nonvoting), $0.15 par value | BFB | New York Stock Exchange |

| 1.200% Notes due 2026 | BF26 | New York Stock Exchange |

| 2.600% Notes due 2028 | BF28 | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☑ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value, as of the last business day of the most recently completed second fiscal quarter, of the voting and nonvoting equity held by nonaffiliates of the registrant was approximately $19,400,000,000.

The number of shares outstanding for each of the registrant’s classes of Common Stock on June 10, 2024, was: | | | | | |

| Class A Common Stock (voting), $0.15 par value | 169,123,305 | |

| Class B Common Stock (nonvoting), $0.15 par value | 303,536,661 | |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Registrant’s Proxy Statement for use in connection with the Annual Meeting of Stockholders to be held July 25, 2024, are incorporated by reference into Part III of this report.

| | | | | | | | |

| Table of Contents | |

| | Page |

| PART I | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| PART II | |

| Item 5. | | |

| Item 6. | | |

| | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| PART III | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| PART IV | |

| Item 15. | | |

| Item 16. | | |

| |

| |

Forward-Looking Statement Information. Certain matters discussed in this report, including the information presented in Part II under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contain statements, estimates, and projections that are “forward-looking statements” as defined under U.S. federal securities laws. Words such as “aim,” “ambition,” “anticipate,” “aspire,” “believe,” “can,” “continue,” “could,” “envision,” “estimate,” “expect,” “expectation,” “intend,” “may,” “might,” “plan,” “potential,” “project,” “pursue,” “see,” “seek,” “should,” “will,” “would,” and similar words indicate forward-looking statements, which speak only as of the date we make them. Except as required by law, we do not intend to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. By their nature, forward-looking statements involve risks, uncertainties, and other factors (many beyond our control) that could cause our actual results to differ materially from our historical experience or from our current expectations or projections. These risks and uncertainties include, but are not limited to, those described in Part I under “Item 1A. Risk Factors” and those described from time to time in our future reports filed with the Securities and Exchange Commission, including:

•Our substantial dependence upon the continued health of the Jack Daniel’s family of brands

•Route-to-consumer changes that affect the timing of our sales, temporarily disrupt the marketing or sale of our products, or result in higher fixed costs

•Disruption of our distribution network or inventory fluctuations in our products by distributors, wholesalers, or retailers

•Changes in consumer preferences, consumption, or purchase patterns – particularly away from larger producers in favor of small distilleries or local producers, or away from brown spirits, our premium products, or spirits generally, and our ability to anticipate or react to them; further legalization of marijuana; bar, restaurant, travel, or other on-premise declines; shifts in demographic or health and wellness trends; or unfavorable consumer reaction to new products, line extensions, package changes, product reformulations, or other product innovation

•Substantial competition from new entrants, consolidations by competitors and retailers, and other competitive activities, such as pricing actions (including price reductions, promotions, discounting, couponing, or free goods), marketing, category expansion, product introductions, or entry or expansion in our geographic markets or distribution networks

•Production facility, aging warehouse, or supply chain disruption

•Imprecision in supply/demand forecasting

•Higher costs, lower quality, or unavailability of energy, water, raw materials, product ingredients, or labor

•Risks associated with acquisitions, dispositions, business partnerships, or investments – such as acquisition integration, termination difficulties or costs, or impairment in recorded value

•Impact of health epidemics and pandemics, and the risk of the resulting negative economic impacts and related governmental actions

•Unfavorable global or regional economic conditions and related economic slowdowns or recessions, low consumer confidence, high unemployment, weak credit or capital markets, budget deficits, burdensome government debt, austerity measures, higher interest rates, higher taxes, political instability, higher inflation, deflation, lower returns on pension assets, or lower discount rates for pension obligations

•Product recalls or other product liability claims, product tampering, contamination, or quality issues

•Negative publicity related to our industry, company, products, brands, marketing, executive leadership, employees, Board of Directors, family stockholders, operations, business performance, or prospects, including labor strikes and work stoppages

•Failure to attract or retain key executive or employee talent

•Risks associated with being a U.S.-based company with a global business, including commercial, political, and financial risks; local labor policies and conditions, including labor strikes and work stoppages; protectionist trade policies, or economic or trade sanctions, including additional retaliatory tariffs on American whiskeys and the effectiveness of our actions to mitigate the negative impact on our margins, sales, and distributors; compliance with local trade practices and other regulations; terrorism, kidnapping, extortion, or other types of violence; and health pandemics

•Failure to comply with anti-corruption laws, trade sanctions and restrictions, or similar laws or regulations

•Fluctuations in foreign currency exchange rates, particularly a stronger U.S. dollar

•Changes in laws, regulatory measures, or governmental policies, especially those affecting production, exportation, importation, marketing and promotion, labeling, pricing, distribution, sale, or consumption of our beverage alcohol products

•Tax rate changes (including excise, corporate, sales or value-added taxes, property taxes, payroll taxes, import and export duties, and tariffs) or changes in related reserves, changes in tax rules or accounting standards, and the unpredictability and suddenness with which they can occur

•Decline in the social acceptability of beverage alcohol in significant markets

•Significant additional labeling or warning requirements or limitations on availability of our beverage alcohol products

•Counterfeiting and inadequate protection of our intellectual property rights

•Significant legal disputes and proceedings, or government investigations

•Cyber breach or failure or corruption of our key information technology systems or those of our suppliers, customers, or direct and indirect business partners, or failure to comply with personal data protection laws

•Our status as a family “controlled company” under New York Stock Exchange rules, and our dual-class share structure

Use of Non-GAAP Financial Information. Certain matters discussed in this report, including the information presented in Part II under “Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations,” include measures that are not measures of financial performance under U.S. generally accepted accounting principles (GAAP). These non-GAAP measures should not be considered in isolation or as a substitute for any measure derived in accordance with GAAP, and also may be inconsistent with similarly titled measures presented by other companies. In Part II under “Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations,” we present the reasons we use these measures under the heading “Non-GAAP Financial Measures,” and we reconcile these measures to the most closely comparable GAAP measures under the heading “Results of Operations.”

PART I

Item 1. Business

Overview

Brown-Forman Corporation (the “Company,” “Brown-Forman,” “we,” “us,” or “our” below) was incorporated under the laws of the State of Delaware in 1933, successor to a business founded in 1870 as a partnership and later incorporated under the laws of the Commonwealth of Kentucky in 1901. We primarily manufacture, distill, bottle, import, export, market, and sell a wide variety of beverage alcohol products under recognized brands. We employ approximately 5,700 people (excluding individuals who work on a part-time or temporary basis) on six continents, including approximately 2,600 people in the United States (approximately 13% of whom are represented by a union) and 1,100 people in Louisville, Kentucky, USA, home of our world headquarters. According to International Wine & Spirit Research (IWSR), we are the largest American-owned spirits and wine company with global reach. We are a “controlled company” under New York Stock Exchange rules because the Brown family owns more than 50% of our voting stock.

For a discussion of recent developments, see “Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations – Executive Summary.”

Brands

Beginning in 1870 with Old Forester Kentucky Straight Bourbon Whisky – our founding brand – and spanning the generations since, we have built a portfolio of more than 40 spirit, ready-to-drink (RTD) cocktail, and wine brands that includes some of the best-known and most loved trademarks in our industry. The most important and iconic brand in our portfolio is Jack Daniel’s Tennessee Whiskey, the #1 selling American whiskey in the world.1 Jack Daniel’s Tennessee Whiskey was recently named the most valuable spirits brand in the world in the 2023 Interbrand “Best Global Brands” rankings, and the newly released Glenglassaugh Sandend was named the “2023 Whisky of the Year” by Whisky Advocate. Our premium bourbons, Woodford Reserve and Old Forester, were once again selected for the Impact “Hot Brands”2 list, marking eleven and six consecutive years on the list, respectively, as were Jack Daniel's RTDs.

| | | | | | | | |

| Principal Brands |

| Jack Daniel's Tennessee Whiskey | | el Jimador Tequilas5 |

Jack Daniel's RTD3 | | el Jimador New Mix RTD |

| Jack Daniel's Tennessee Honey | | Herradura Tequilas9 |

| Gentleman Jack Rare Tennessee Whiskey | | Korbel California Champagnes6 |

| Jack Daniel's Tennessee Apple | | Korbel California Brandy6 |

| Jack Daniel's Tennessee Fire | | Sonoma-Cutrer California Wines7 |

Jack Daniel's Single Barrel Collection4 | | Old Forester Whiskey Row Series |

| Jack Daniel's Bonded Tennessee Whiskey | | Old Forester Kentucky Straight Bourbon Whisky |

| Jack Daniel's Sinatra Select | | Old Forester Kentucky Straight Rye Whisky |

| Jack Daniel’s Winter Jack | | Finlandia Vodkas8 |

| Jack Daniel's Tennessee Rye | | The Glendronach Single Malt Scotch Whiskies9 |

| Jack Daniel's Triple Mash Blended Straight Whiskey | | Glenglassaugh Single Malt Scotch Whiskies9 |

| Jack Daniel's Bottled-in-Bond | | Benriach Single Malt Scotch Whiskies9 |

| Jack Daniel's American Single Malt | | Diplomático Rums9 |

| Jack Daniel’s 12 Year Old | | Chambord Liqueur |

| Jack Daniel’s 10 Year Old | | Gin Mare9 |

| Woodford Reserve Kentucky Bourbon | | Fords Gin |

| Woodford Reserve Double Oaked | | Slane Irish Whiskey |

| Woodford Reserve Batch Proof | | Coopers' Craft Kentucky Bourbon |

| Woodford Reserve Kentucky Rye Whiskey | | |

| Woodford Reserve Baccarat Edition | | |

| | | | | |

| |

1IWSR 2023 Data. |

2Impact Databank, March 2024. |

3Jack Daniel's RTD includes Jack Daniel's & Cola, Jack Daniel’s & Coca-Cola RTD, Jack Daniel's Country Cocktails, Jack Daniel's Double Jack, and other malt- and spirit-based Jack Daniel’s RTDs. |

4The Jack Daniel's Single Barrel Collection includes Jack Daniel's Single Barrel Select, Jack Daniel's Single Barrel Barrel Proof, Jack Daniel's Single Barrel Rye Barrel Proof, and other Jack Daniel’s Single Barrel special-release expressions. |

5el Jimador Tequilas comprise all full-strength expressions of el Jimador. |

6Korbel is not an owned brand. We sell Korbel products under contract in the United States and other select markets. |

7Sonoma-Cutrer California Wines was divested on April 30, 2024. | |

8Finlandia Vodka was divested on November 1, 2023. | |

9Comprises all expressions of this brand. |

See “Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations – Results of Operations – Fiscal 2024 Brand Highlights” for brand performance details.

Our vision in marketing is to be the best brand-builder in the industry. We build our brands by investing in platforms that we believe create enduring connections with our consumers. These platforms cover a wide spectrum of activities, including media advertising (TV, radio, print, outdoor, digital, and social), consumer and trade promotions, sponsorships, and visitors' center programs at our distilleries. We aim to grow our sales and profits by consistently delivering creative, responsible marketing programs that drive brand recognition, brand trial, brand loyalty, and, ultimately, consumer demand around the world.

Markets

We sell our products in over 170 countries. The United States, our most important market, accounted for 45% of our net sales in fiscal 2024 and the other 55% were outside of the United States. The table below shows the percentage of total reported net sales for our top markets in our three most recent fiscal years:

| | | | | | | | | | | | | |

| Percentage of Total Reported Net Sales by Geographic Area |

| | | Year ended April 30 |

| | 2022 | 2023 | 2024 |

| United States | | | 49 | % | 47 | % | 45 | % |

| Mexico | | | 5 | % | 6 | % | 7 | % |

| Germany | | | 6 | % | 6 | % | 6 | % |

| Australia | | | 6 | % | 5 | % | 5 | % |

| United Kingdom | | | 6 | % | 5 | % | 4 | % |

| Other | | | 28 | % | 31 | % | 32 | % |

| | | | | |

| TOTAL | | | 100 | % | 100 | % | 100 | % |

Note: Totals may differ due to rounding

| | | | | |

For details about net sales in our top markets, see “Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations – Results of Operations – Fiscal 2024 Market Highlights.” For details about our reportable segment and for additional geographic information about net sales and long-lived assets, see Note 19 to the Consolidated Financial Statements in “Item 8. Financial Statements and Supplementary Data.” For details on risks related to our global operations, see “Item 1A. Risk Factors.”

Distribution Network and Customers

Our distribution network, or our “route to consumer” (RTC), varies depending on (a) the laws and regulatory framework for trade in beverage alcohol by market, (b) our assessment of a market's long-term attractiveness and competitive dynamics, (c) the relative profitability of distribution options available to us, (d) the structure of the retail and wholesale trade in a market, and (e) our portfolio's development stage in a market. As these factors change, we evaluate our RTC strategy and, from time to time, adapt our model.

In the United States, which generally prohibits spirits and wine manufacturers from selling their products directly to consumers, we sell our brands either to distributors or to state governments (in states that directly control alcohol sales) that then sell to retail customers and consumers.

Outside the United States, we use a variety of RTC models, which can be grouped into three categories: owned distribution, partner, and government-controlled markets. We own and operate distribution companies for Australia, Belgium and Luxembourg, Brazil, Czechia, France, Germany, Japan, Mexico, Poland, Slovakia, South Korea, Spain, Taiwan, Thailand, Türkiye, and the United Kingdom. In these owned-distribution markets, and in a large portion of the Travel Retail channel, we sell our products directly to retailers or wholesalers. In many other markets, we rely on third parties to distribute our brands, generally under fixed-term distribution contracts. In Canada, we sell our products to provincial governments.

We believe that our customer relationships are good and that our exposure to concentrations of credit risk is limited due to the diverse geographic areas covered by our operations and our thorough evaluation of each customer. In fiscal 2024, our two largest customers accounted for approximately 13% and 11% of consolidated net sales, respectively. No other customer accounted for 10% or more of our consolidated net sales in fiscal 2024.

Seasonality

Holiday buying makes the fourth calendar quarter the peak season for our business. Approximately 29%, 27%, and 28% of our reported net sales for fiscal 2022, fiscal 2023, and fiscal 2024, respectively, were in the fourth calendar quarter.

Competition

Trade information indicates that we are one of the largest global suppliers of premium spirits. According to IWSR, for calendar year 2023, the ten largest global spirits companies controlled over 20% of the total spirits volume sold around the world. While we believe that the overall market environment offers considerable growth opportunities for us, our industry is, and will remain, highly competitive. We compete against many global, regional, and local brands in a variety of categories of beverage alcohol, but our brands compete primarily in the industry's premium-and-above price points. Our competitors include major global spirits and wine companies, such as Bacardi Limited, Becle S.A.B. de C.V., Davide Campari-Milano N.V., Diageo PLC, LVMH Moët Hennessy Louis Vuitton SE, Pernod Ricard SA, Rémy Cointreau, and Suntory Global Spirits. In addition, particularly in the United States, we compete with national companies and craft spirit brands, many of which entered the market in the last few years.

Brand recognition, brand provenance, quality of product and packaging, availability, flavor profile, and price affect consumers' choices among competing brands in our industry. Other factors also influence consumers, including advertising, promotions, merchandising at the point of sale, expert or celebrity endorsement, social media and word of mouth, and the timing and relevance of new product introductions. Although some competitors have substantially greater resources than we do, we believe that our competitive position is strong, particularly as it relates to brand awareness, quality, availability, and relevance of new product introductions.

Ingredients and Other Supplies

The principal raw materials used in manufacturing and packaging our distilled spirits, liqueurs, RTD products, and wines1 are shown in the table below. | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Principal Raw Materials |

| Distilled Spirits | | Liqueurs | | RTD Products | | Wines1 | | Packaging |

| Agave | | Flavorings | | Carbon dioxide | | Grapes | | Aluminum cans |

| Barley | | Neutral spirits | | Flavorings | | Wood | | Cartons |

| Corn | | Sugar | | Malt | | | | Closures |

| Malted barley | | Water | | Neutral spirits | | | | Glass bottles |

| Molasses | | Whiskey | | Sugar | | | | Labels |

| Rye | | Wine | | Tequila | | | | PET2 bottles |

| Sugar | | | | Water | | | | |

| Water | | | | Whiskey | | | | |

| Wood | | | | | | | | |

| | | | | |

| |

1Sonoma-Cutrer California Wines was divested on April 30, 2024. | |

2Polyethylene terephthalate (PET) is a polymer used in non-glass containers. |

None of these raw materials are in short supply, but shortages could occur in the future. From time to time, our agricultural ingredients (agave, barley, corn, grapes1, malted barley, molasses, rye, sugar, and wood) could be adversely affected by weather and other forces out of our control that might constrain supply or reduce our inventory below desired levels for optimum production.

Whiskeys, certain tequilas, rums, and some other distilled spirits must be aged. Because we must produce these distilled spirits years in advance to meet projected future demand, our inventories of these products may be larger in relation to sales and total assets than in many other businesses.

For details on risks related to the unavailability of raw materials and the inherent uncertainty in forecasting supply and demand, see “Item 1A. Risk Factors.”

Intellectual Property

Our intellectual property includes trademarks, copyrights, proprietary packaging and trade dress, proprietary manufacturing technologies, know-how, and patents. Our intellectual property, especially our trademarks, is essential to our business. We register our trademarks broadly around the world, focusing primarily on where we sell or expect to sell our products. We protect our intellectual property rights vigorously but fairly. We have licensed some of our trademarks to third parties for use with services or on products other than alcoholic beverages, which we believe enhances the awareness and protection of our brands. Depending on the jurisdiction, trademarks are valid as long as they are in use and/or their registrations are properly maintained. We also have various licenses and distribution agreements for the production, sale, and marketing of our products, and for the sale and marketing of products of others. These licenses and distribution agreements have varying terms and durations.

For details on risks related to the protection of our intellectual property, see “Item 1A. Risk Factors.” For details on our most important brands, see “Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations – Results of Operations – Fiscal 2024 Brand Highlights.”

Regulatory Environment

Federal, state, local, and foreign authorities regulate how we produce, store, transport, distribute, market, and sell our products. Some countries and local jurisdictions prohibit or restrict the marketing or sale of distilled spirits in whole or in part.

In the United States, at the federal level, the Alcohol and Tobacco Tax and Trade Bureau of the U.S. Department of the Treasury regulates the spirits and wine industry with respect to the production, blending, bottling, labeling, advertising, sales, and transportation of beverage alcohol. Similar regulatory regimes exist at the state level and in most non-U.S. jurisdictions where we sell our products. In addition, beverage alcohol products are subject to customs duties, excise taxes, and/or sales taxes in many countries, including taxation at the federal, state, and local level in the United States.

Many countries set their own distilling and maturation requirements. For example, under U.S. federal and state regulations, bourbon and Tennessee whiskeys must be aged in new, charred oak barrels; we typically age our whiskeys at least three years. Mexican authorities regulate the production and bottling of tequilas; they mandate minimum aging periods for extra añejo (three years), añejo (one year), and reposado (two months). Irish whiskey must be matured at least three years in a wood cask, such as oak, on the island of Ireland. Scotch whisky must be matured in oak casks for at least three years in Scotland. We comply with all of the applicable laws and regulations.

Our operations are also subject to various environmental protection statutes and regulations, and our policy is to comply with them. Complying with these statutes and regulations has not materially impacted our capital expenditures, earnings, or competitive position, and is not expected to have a material impact during fiscal 2025.

Integrated Strategy and Performance

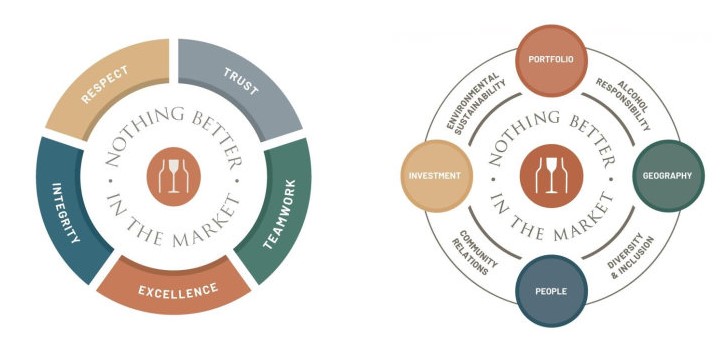

For more than 150 years, Brown-Forman and the Brown family have been committed to driving sustainable growth and preserving Brown-Forman as a thriving, family-controlled, independent company. The image on the left illustrates our highest ambition, “Nothing Better in the Market,” surrounded by the values that have guided us for decades: integrity, respect, trust, teamwork, and excellence. In addition to these guiding principles, our success depends on several strategic priorities, as illustrated in the image on the right: the quality of our brands within our portfolio, our geographic reach, the talent and diversity of our people, and the return on our investments. Moreover, taking an integrated approach means that many aspects of our company contribute to this value creation and are fundamental to our strategy, including our commitment to environmental sustainability, alcohol and marketing responsibility, diversity and inclusion, and to building communities in which we live and work. We call these efforts Living a Spirit of Commitment.

Over the past four fiscal years, we faced a challenging, volatile environment, including supply chain disruptions and a global pandemic. Our employees' unique mix of agility, resilience, energy, and collaboration enabled us to succeed despite these challenges. Our values drive our decisions, and our core purpose and our highest ambition continue to guide us as we move forward to a reimagined future with renewed enthusiasm for the opportunities that lie ahead. We believe we are well positioned to navigate the ever-changing landscape. We will make bold moves with a commitment to improve continuously as we work together to deliver sustained long-term growth.

This Integrated Annual Report on Form 10-K for the fiscal year ended April 30, 2024, presents not only our financial performance but also our environmental, social, and governance strategies, commitments, and results. It provides a more holistic view of Brown-Forman, our culture, our strategic approach to our business, and how we achieve results.

Portfolio and Responsibility

We seek to build brands and create stockholder value responsibly by delivering strong, sustainable growth, solid margins, and high returns on invested capital. We focus on building brands that can be meaningful for our company and our legal drinking age consumers (consumers) over the longer term. We aim to grow our premium spirits portfolio both organically and through innovation. Opportunistically and thoughtfully, we also consider acquisitions and partnerships that will enhance our capacity to deliver meaningful growth, improve margins, and increase stockholder returns.

We strive to grow our brands and enhance consumers' experience with them. Even as we do so, we remain committed to marketing our brands responsibly and promoting responsible drinking. Regulation of our industry is not new, and external interest from the World Health Organization and other health bodies has grown over time. We uphold high standards of self-regulation by adhering to industry guidelines on responsible marketing and advertising. We promote alcohol responsibility both independently and with industry organizations such as the International Alliance for Responsible Drinking, the Foundation for Advancing Alcohol Responsibility (responsibility.org) in the United States, the Portman Group in the United Kingdom, DrinkWise in Australia, and FISAC in Mexico.

The Jack Daniel's family of brands, led by Jack Daniel's Tennessee Whiskey (JDTW), is our most valuable asset – the engine of our overall financial performance and the foundation of our leadership position in the American whiskey category.1 We strive to strengthen the brand's leadership position continually, and will work steadfastly to keep JDTW relevant to consumers worldwide. We will also pursue opportunities to grow the Jack Daniel's family of brands across markets, premium-and-above price points, channels, and consumer groups. Product innovation continues to contribute meaningfully to our performance. Different Jack Daniel's expressions have brought new consumers to the franchise, including Jack Daniel's Tennessee Honey (2011), Jack Daniel's Tennessee Fire (2015), Jack Daniel's Tennessee Apple (2019), Jack Daniel's Bonded Tennessee Whiskey and Triple Mash Blended Straight Whiskey (2022), and our most recent launches, Jack Daniel’s Bonded Tennessee Rye Whiskey and Jack Daniel’s American Single Malt (2023), which individually and collectively add great value to the company and to our consumers the world over.

In addition to the leadership of our Jack Daniel's family of brands, we expect strong worldwide growth from our other whiskey brands, particularly Woodford Reserve and Old Forester. Woodford Reserve is the leading super-premium American whiskey globally,1 growing volumes at a strong double-digit compound annual growth rate since the brand was introduced over 25 years ago. Woodford Reserve sold over 1.7 million nine-liter cases for the fiscal year ended April 30, 2024. We believe the brand is poised for continued growth as the bourbon category continues to grow around the world. Old Forester has continued its return to prominence in the United States and in select international markets. Innovation has played an important role in the premiumization of both of these brands, including the success of high-end expressions such as Woodford Reserve Double Oaked and the Old Forester Whiskey Row Series.

Outside of our American whiskey brands, we believe our portfolio remains well positioned in other high-growth categories, with meaningful premium brands and a focus on accelerating our super-premium portfolio. Our tequila portfolio is led by two brands steeped in Mexican heritage, Herradura and el Jimador. Despite the cyclical cost pressures of agave, we remain committed to the growth of our tequila business in the United States and the long-term growth prospects of this business globally. We believe that our Scotch whiskies The Glendronach, Benriach, and Glenglassaugh, and our Irish whiskey, Slane, are well-positioned in their respective categories. We expect them all to contribute meaningfully over the longer term. In addition, the acquisitions of Gin Mare (2022) and Diplomático (2023) provide us with leadership positions in the super-premium-and-above gin and rum categories, respectively, and we look to grow these brands globally.

Our RTD portfolio continues to evolve globally. In June 2022, we jointly announced a global relationship with The Coca-Cola Company to introduce the iconic Jack & Coke cocktail as a branded, ready-to-drink, pre-mixed cocktail. Since the announcement, we have launched the product in over 25 markets, including the top RTD markets such as the United States, Japan, the United Kingdom, Mexico, and Germany. Jack Daniel's Country Cocktails in the United States are produced, sold, and distributed under our relationship with the Pabst Brewing Company.

We appreciate the power of our brands to enrich the experience of life, and we believe it is our duty to ensure that our products are marketed with deep respect for our consumers. Our mission for alcohol responsibility is to empower mindful choices around beverage alcohol. We launched the Pause campaign in 2019. Pause is Brown-Forman’s driving effort to encourage mindful choices. In 2022, we launched our 2030 Alcohol Responsibility strategy to prioritize strategic programs and partnerships, in-market tools and resources, and to continue empowering our employees and business partners. We execute our 2030 Alcohol Responsibility strategy through the lens of our Pause campaign to showcase the importance of alcohol responsibility and inspire action among our consumers, colleagues, and business partners.

Geography

The United States remains our largest market, and growth there is important to our long-term success. We expect to foster this growth by emphasizing fast-growing spirits categories, continuing product and packaging innovation, and building brands within growing consumer segments. This includes increasing emphasis on inclusive, digital, and integrated marketing and the growth of our e-commerce capabilities to better connect and engage with consumers where they are.

Outside the United States, our improved routes to consumers continue to increase our competitiveness. In fiscal 2024, we established our owned-distribution organizations in Japan and Slovakia; and announced plans to distribute our own brands in Italy, effective May 1, 2025. More direct connection with customers and consumers enabled through owned distribution is an important part of our strategic growth.

1 IWSR 2023 Data

People, Diversity & Inclusion, and Ethics & Compliance

As we work to increase our brands' relevance and appeal to diverse consumer groups around the world, we believe a diversity of experiences, perspectives, and mindsets within our own workforce is essential. Our vision is to create an environment where leveraging diversity and fostering inclusion occurs naturally, giving us a sustainable marketplace advantage. By 2030, we aspire to have 50% women in professional- and leader-level roles globally, 40% women in senior leadership positions globally, 25% people of color in our United States workforce, and 6% self-identified LGBTQ+ employees in our United States workforce. Also by 2030, we aspire for 16% of our supplier spend to be with businesses that are woman- or minority-owned in locations such as the United States, the United Kingdom, and Australia. For more than a decade, we have earned a perfect score in the Corporate Equality Index, a national benchmarking survey and report on corporate policies and practices related to LGBTQ+ workplace equality administered by the Human Rights Campaign Foundation. We also extended our diversity and inclusion commitment more deeply in our communities, especially our hometown of Louisville, Kentucky.

One of the main drivers of our inclusive culture is the continued growth and leadership of our ten Employee Resource Groups (ERGs). We believe ERGs are instrumental in enriching our company's culture and our employees experience by:

•supporting development and engagement of our diverse workforce;

•driving cultural awareness and competency across the organization;

•enabling authentic engagement with our consumers; and

•creating spaces for our employees and their allies to connect with, support, and advocate for one another.

Our core values of integrity, respect, trust, teamwork, and excellence form the foundation of our ethics and compliance program. “Values Drive Decisions” is the key theme of this program, and we use it to teach our employees to rely on our values when faced with a difficult decision and to “speak up” if they believe they, a colleague, or a business partner may have violated the law, our Code of Conduct, or company policy. In 46 countries, we offer a third-party service to employees and others who choose to “speak up” anonymously. As we train our managers, we reinforce our commitment to non-retaliation and maintaining a “speak up” culture.

We convey our compliance expectations to employees via our Code of Conduct, and our employees certify annually that they will comply with it and report potential violations. The Code of Conduct details expectations for 20 different risks; links to Q&A, policies, and training; and gives contact details for subject-matter experts. We refresh our Code of Conduct and certification annually and make them available in 12 languages.

Investment and Sustainability

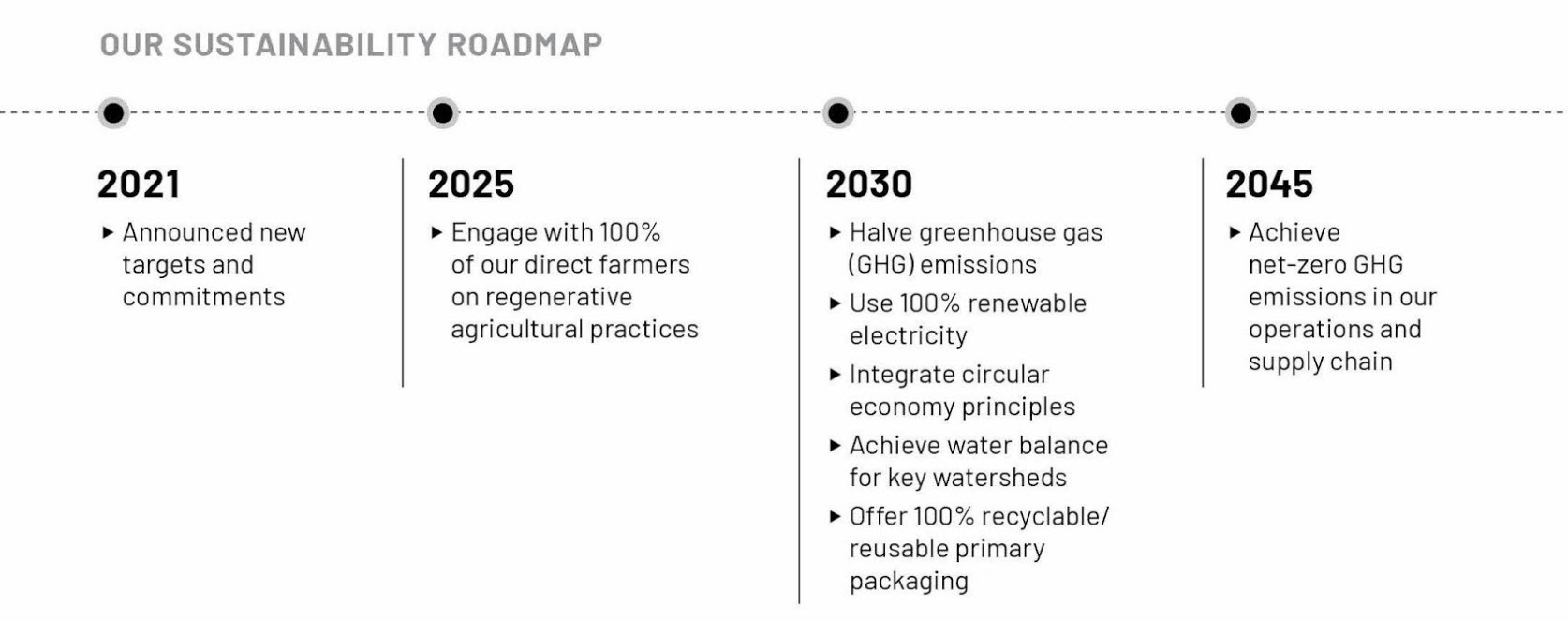

For over a century and a half, we have learned that long-term success requires investment and a mindset of sustainability. We understand the need to invest in our brands, global supply chain facilities, homeplace and visitor centers, and aging inventory. For example, in May 2023, we announced a $200 million capital investment to expand our Casa Herradura tequila distillery to meet anticipated consumer demand. Additionally, during fiscal 2022, we announced a £30 million expansion of our The Glendronach distillery to meet strong demand. We also understand the importance of investing in our people, communities, and the environment. We recognize that climate change is a business issue with risks and opportunities. As such, we are committed to actions that will ensure the long-term health of the planet and our business. In fiscal 2021, we established a new 2030 Sustainability Strategy to align our efforts with industry best practices and the most current climate science. Our goals broaden our focus beyond business operations to include our supply chain, where the majority of our environmental footprint resides. With this evolving strategy, we have a roadmap for continued progress over the next quarter-century.

Our continued investments in renewable energy and resource stewardship underscore our long-term focus:

•Renewable Electricity: In fiscal 2024, we installed a rooftop solar system at our Newbridge bottling plant in Edinburgh, Scotland, in partnership with YLEM Energy, and our Slane Distillery signed a Corporate Power Purchase Agreement with Flogas Enterprise for renewable electricity from a wind farm in Ireland.

•Byproducts to Energy: In fiscal 2024, construction continued on the anaerobic digester at the Jack Daniel Distillery that will convert a portion of the distillery byproducts to renewable energy and fertilizer. The project is expected to become operational in fiscal 2025.

•Water Stewardship: In fiscal 2024, we continued our work with Waterplan to improve the measurement of water- related risk at eight of our facilities and to identify opportunities for water efficiency improvements and water reuse at our Casa Herradura facility. We will expand this collaboration in fiscal 2025 to begin measuring water risk in our supply chain and further enhance our water stewardship program.

•Sustainable Agriculture: In June 2023, our Woodford Reserve Distillery announced a five-year commitment to purchase the rye grown by Kentucky farmers as part of the Rye in Kentucky research being led by the University of Kentucky. In fiscal 2024, we met our target to engage with 100% of our direct farmers on regenerative agriculture practices, and will continue engaging with direct farmers in fiscal 2025.

•Sustainable Forestry: In June 2023, the Jack Daniel Seed Orchard and our continued relationship with the University of Tennessee celebrated its 25th anniversary. In December 2023, the Tennessee Forestry Association, supported by Jack Daniel’s, announced that it received a grant from the National Fish and Wildlife Federation to engage with family forest landowners on sustainable management practices to improve Tennessee’s shortleaf pine and white oak forests.

Community

We believe we are a responsible and caring corporate citizen and invest in the communities where employees live and work. We encourage employees to participate in philanthropic outreach efforts by giving their time and talents to support those non-profit organizations most meaningful to them. This civic engagement, as well as our philanthropic contributions, further promotes Brown-Forman’s caring culture and commitment to the community.

We continue to expand our civic engagement in Brown-Forman global office locations, allowing those employees closest to the needs of their communities to decide how to invest their charitable-giving resources. We leverage our key community relations partners to stay informed of collaborative opportunities where we work and live and to shape our charitable-giving strategy to meet the essential needs of the communities that sustain us. We created the Brown-Forman Foundation (the Foundation) in fiscal year 2018 to help fund our ongoing philanthropic endeavors, with an emphasis on the communities surrounding Brown-Forman’s headquarters in Louisville, KY. The Foundation's resources provide a consistent source of support for charitable giving independent of our annual earnings. We work to partner with organizations that support our key focus areas: empowering responsible and sustainable living, ensuring essential living standards, and enhancing arts and cultural living. As part of our commitment to be better and do better as neighbors and as corporate citizens, the Brown-Forman Foundation made a 10-year, $50 million commitment to five organizations in west Louisville in fiscal year 2022, which is the

largest investment in its history. Our partner organizations include AMPED, the Louisville Central Community Center, the Louisville Urban League, Simmons College of Kentucky, and the West End School. Together, these organizations will advance educational opportunities from early childhood through adult learning.

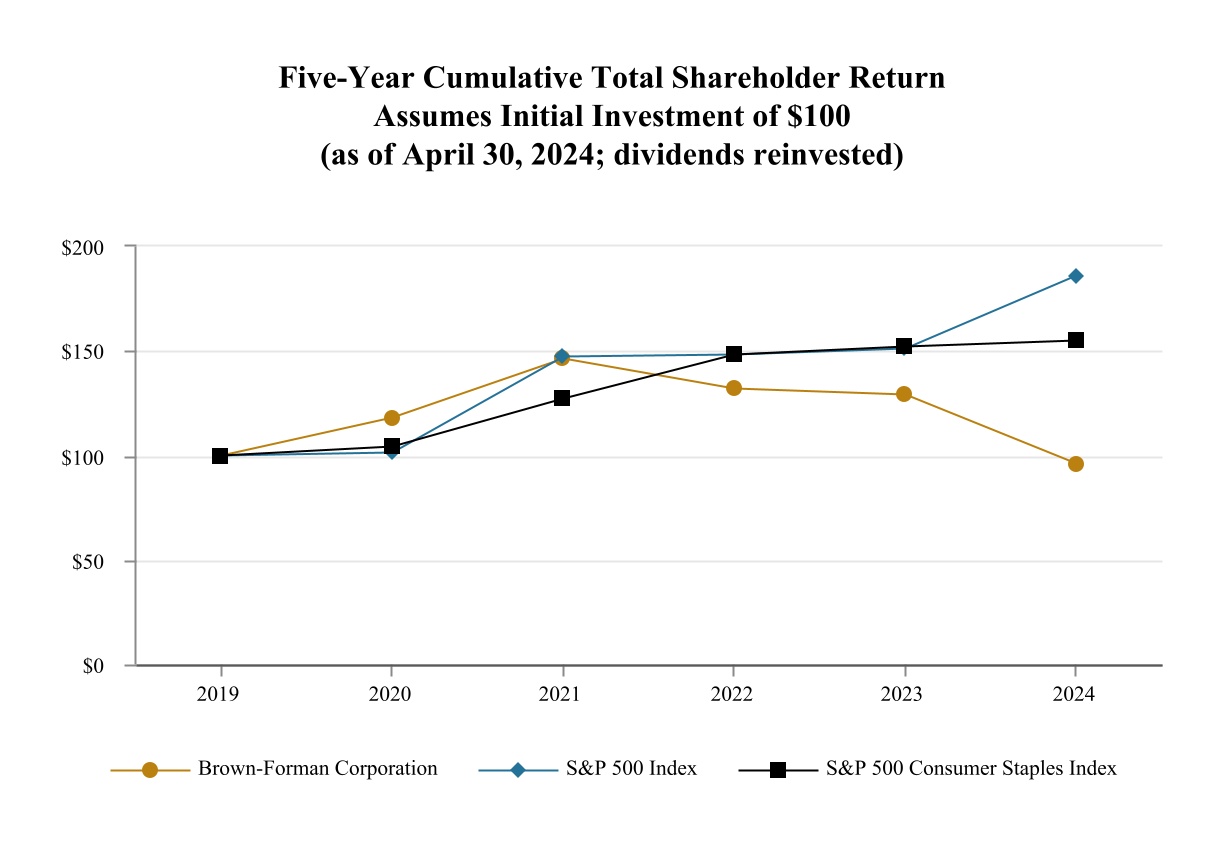

We believe that having a long-term-focused, committed, and engaged stockholder base, anchored by the Brown family, gives us a distinct strategic advantage, particularly in a business with multi-generational brands and products that must be aged. We are committed to continually improving our environmental, social, and governance performance and acting upon our deeply held values. Recognizing the strong cash-generating capacity and the capital efficiency of our business, we will continue to pursue top-tier stockholder return through stockholder-friendly capital allocation and socially and environmentally conscious investments to fuel long-term growth.

Human Capital Resources

Overview

We put our values at the forefront of all our decisions and actions in an effort to make our employees feel respected, safe, and supported so they can make, market, and sell our products with the finest craftsmanship, quality, and care. What enables our success are the approximately 5,700 people (excluding individuals that work on a part-time or temporary basis) we employ in over 45 countries around the world. This includes approximately 3,600 salaried employees and 2,100 hourly employees, with the largest percentage of our employees residing within the United States, Mexico, and the United Kingdom. We believe our employee relations are good and our turnover rate is low.

Total Rewards

We strive to pay our employees fairly and competitively. Each fiscal year, we review the compensation for all salaried roles both internally and externally, ensuring that every employee is paid fairly compared to each other and competitively against the market. All roles are priced based on compensation survey data for the market where the employee resides. We will continue to refresh our data and monitor pay equity annually.

Talent Development

We continually seek opportunities to develop our employees to ensure that we have the capabilities to grow our business. We do this through a combination of succession planning, planned learning, short-term assignments, international opportunities, and thoughtful talent management. Given our low turnover, we are intentional about moving employees through new roles, ensuring that they have the opportunity to learn new skills. We track all internal movement and are comfortable that we are providing an appropriate level of growth and development for our employees.

Diversity & Inclusion

We are continuing to pursue our 2030 Diversity & Inclusion ambitions, as outlined in our Many Spirits, One Brown-Forman strategy. We remain focused on ensuring our workforce mirrors the consumers and communities we serve. We regularly monitor our progress with women in senior leadership globally, and people of color and LGBTQ+ salaried employees in the United States. We track promotion and lateral movement by gender (globally) and ethnicity (in the United States) and, based on that data, we can confirm that our growth opportunities for women and people of color are proportional to our salaried employee population.

To support our culture of inclusion, we have continued to build awareness of the foundations of inclusive leadership and inclusive behaviors. We also have ten ERGs that help foster an inclusive environment across the organization.

Workforce Stability

We have historically enjoyed low turnover among our salaried population and continue to track our departures, given the acceleration in the job market in recent years. We analyze our quantitative and qualitative attrition data each quarter, and our voluntary turnover among salaried employees remains consistent with our historical levels. We will continue to monitor our data carefully.

Executive Officers

Information about Our Executive Officers

The following persons served as executive officers as of June 14, 2024:

| | | | | | | | |

| Name | Age | Principal Occupation and Business Experience |

| Lawson E. Whiting | 55 | President and Chief Executive Officer since January 2019. Executive Vice President and Chief Operating Officer from October 2017 to December 2018. Executive Vice President and Chief Brands and Strategy Officer from February 2015 to September 2017. Senior Vice President and Chief Brands Officer from January 2013 to January 2015. |

| Matias Bentel | 49 | Executive Vice President and Chief Brands Officer since March 2023. Senior Vice President and Chief Brands Officer from January 2020 to March 2023. Senior Vice President and Managing Director of Jack Daniel’s Family of Brands from August 2018 to January 2020. Vice President and General Manager of Mexico from January 2016 to August 2018. Vice President Latin America Marketing and Chief of Staff from October 2009 to January 2016. |

Michael E. Carr, Jr.

| 44 | Executive Vice President, General Counsel and Secretary since May 2024. Vice President, Associate General Counsel - Regional and Corporate Development from October 2022 to April 2024. Vice President, Associate General Counsel - Europe from May 2018 to October 2022. Vice President, Managing Attorney and Assistant Corporate Secretary from September 2013 to May 2018. |

| Leanne D. Cunningham | 54 | Executive Vice President and Chief Financial Officer since March 2023. Senior Vice President and Chief Financial Officer from July 2021 to March 2023. Senior Vice President, Shareholder Relations Officer, Global Commercial Finance, and Financial Planning and Analysis from August 2020 to July 2021. Senior Vice President, Shareholder Relations Officer from August 2019 to July 2020. Senior Vice President, and General Manager - Brown-Forman Brands from May 2015 to July 2019. Vice President, Director of Finance Global Production from October 2013 to April 2015. |

| Marshall B. Farrer | 53 | Executive Vice President, Chief Strategic Growth Officer since March 2024. Executive Vice President, Chief Strategic Growth Officer and President Europe from January 2023 to March 2024. Senior Vice President, President Europe from August 2020 to January 2023. Senior Vice President, Managing Director, Global Travel Retail and Developed APAC Region from August 2018 to July 2020. Senior Vice President, Managing Director, Global Travel Retail from May 2015 to July 2018. Vice President, Managing Director, Jack Daniel’s Tennessee Honey from January 2014 to April 2015.

|

| Kirsten M. Hawley | 54 | Executive Vice President, Chief People, Places, and Communications Officer since March 2023. Senior Vice President, Chief People, Places, and Communications Officer from May 2021 to March 2023. Senior Vice President, Chief Human Resources and Corporate Communications Officer from March 2019 to April 2021. Senior Vice President and Chief Human Resources Officer from February 2015 to February 2019. Senior Vice President and Director of Human Resources Business Partnerships from August 2013 to January 2015. |

| Thomas W. Hinrichs | 62 | Executive Vice President, President Emerging International since March 2023. Senior Vice President, President Emerging International from August 2020 to March 2023. Senior Vice President, President, International Division from June 2018 to July 2020. Senior Vice President and President for Europe, North Asia, and ANZSEA from February 2015 to June 2018. Senior Vice President and Managing Director for Europe from January 2013 to January 2015. |

| Timothy M. Nall | 53 | Executive Vice President, Chief Global Supply Chain and Technology Officer since March 2023. Senior Vice President, Chief Global Supply Chain and Technology Officer from March 2022 to March 2023. Senior Vice President, Chief Information and Advanced Analytics Officer from January 2015 to February 2022. Vice President Director Technical Services from May 2013 to December 2014. |

Yiannis Pafilis

| 53 | Executive Vice President and President, Europe since March 2024. Senior Vice President, Managing Director of Germany, Czechia, Poland and Europe Commercial Strategy from September 2023 to February 2024. Vice President, Managing Director of Germany, Czechia, Poland and Europe Strategy from October 2022 to August 2023. Vice President, Managing Director of Germany, Czechia and Europe Commercial Strategy from August 2020 to September 2022. Vice President, General Manager of Germany and Czechia from September 2017 to July 2020. General Manager of Russia from July 2014 to August 2017. |

| Crystal L. Peterson | 53 | Executive Vice President, Chief Inclusion and Global Community Relations Officer since March 2023. Senior Vice President, Chief Inclusion and Global Community Relations Officer from June 2022 to March 2023. Vice President and Chief Diversity Officer from February 2022 to June 2022. Vice President and Human Resources Director - Global Production, Diversity and Inclusion from March 2021 to January 2022. Vice President and Human Resources Director - Global Production from August 2017 to February 2021. Vice President and Human Resources Director - North America Region from May 2015 to July 2017. Human Resources Director - North America Region and Latin America Region from May 2013 to April 2015. |

| | | | | | | | |

| Name | Age | Principal Occupation and Business Experience |

| Jeremy J. Shepherd | 49 | Executive Vice President, President USA & Canada since March 2023. Senior Vice President, President USA & Canada from July 2022 to March 2023. Vice President, General Manager for the United Kingdom & Ireland from January 2018 to July 2022. Vice President Director Midwest Division from May 2015 to December 2017. Portfolio Integration Director from September 2014 to May 2015. |

| Kelli N. Brown | 54 | Senior Vice President and Chief Accounting Officer since August 2018. Vice President and Director Finance (North America Region) from May 2015 to August 2018. Director NAR Division Finance (North America Region) from November 2013 to April 2015. |

| | |

Available Information

Our website address is www.brown-forman.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to these reports are available free of charge on our website as soon as reasonably practicable after we electronically file those reports with the Securities and Exchange Commission (SEC). The information provided on our website, and any other website referenced herein, is not part of this report, and is therefore not incorporated by reference into this report or any other filing we make with the SEC, unless that information is otherwise specifically incorporated by reference.

On our website, we have posted our Code of Conduct that applies to all our directors and employees, and our Code of Ethics that applies specifically to our senior financial officers. If we amend or waive any of the provisions of our Code of Conduct or our Code of Ethics applicable to our principal executive officer, principal financial officer, or principal accounting officer that relates to any element of the definition of “code of ethics” enumerated in Item 406(b) of Regulation S-K under the Securities Exchange Act of 1934 Act, as amended, we intend to disclose these actions on our website. We have also posted on our website our Corporate Governance Guidelines and the charters of our Audit Committee, Compensation Committee, Corporate Governance and Nominating Committee, and Executive Committee of our Board of Directors. Copies of these materials are available free of charge by writing to our Secretary at 850 Dixie Highway, Louisville, Kentucky 40210 or emailing Secretary@b-f.com.

Item 1A. Risk Factors

We believe the following discussion identifies the material risks and uncertainties that could adversely affect our business. If any of the following risks were actually to occur, our business, results of operations, cash flows, or financial condition could be materially and adversely affected. Additional risks not currently known to us, or that we currently deem to be immaterial, could also materially and adversely affect our business, results of operations, cash flows, or financial condition.

Risks Related to Our Business and Operations

Our business performance depends substantially on the continued health of the Jack Daniel's family of brands.

The Jack Daniel's family of brands is the primary driver of our revenue and Jack Daniel's is an iconic global trademark with a loyal consumer fan base. We invest much effort and many resources to protect and preserve the brand's reputation for authenticity, craftsmanship, and quality. A brand's reputational value is based in large part on consumer perceptions, and even an isolated incident that causes harm – particularly one resulting in widespread negative publicity – could adversely influence these perceptions and erode consumer trust and confidence in the brand. Significant damage to the brand equity of the Jack Daniel's family of brands would adversely affect our business. Given the importance of Jack Daniel's to our overall success, a significant or sustained decline in volume or selling price of our Jack Daniel's products, as a result of negative publicity or otherwise, would have a negative effect on our financial results. Additionally, if we are not successful in our efforts to maintain or increase the relevance of the Jack Daniel's brand to current and future consumers, our business and operating results could suffer. For details on the importance of the Jack Daniel's family of brands to our business, see “Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations - Results of Operations - Fiscal 2024 Brand Highlights.”

Changes to our route-to-consumer models and consolidation among beverage alcohol producers, distributors, wholesalers, suppliers, and retailers, could hinder the marketing, sale, or distribution of our products.

We use various business models to market and distribute our products in different countries around the world. In the United States, we sell our products either to distributors for resale to retail outlets or e-commerce retailers or, in those states that control alcohol sales, to state governments who then sell them to retail customers and consumers. In our non-U.S. markets, we use a variety of route-to-consumer models – including, in many markets, reliance on third parties to distribute, market, and sell our products. We own and operate distribution companies for 16 international markets. Transitioning from a third-party

distribution model to an owned-distribution model involves a significant undertaking, and subjects us to risks associated with that geographic region. If we are unsuccessful in our route-to-consumer strategies, including any transition to owned distribution, the sale and marketing of our products could be disrupted.

Changes to any of our route-to-consumer models or distribution partners in important markets could result in temporary or longer-term sales disruption, higher costs, and harm to other business relationships we might have with that partner. Disruption of our distribution network or fluctuations in our product inventory levels at distributors, wholesalers, or retailers could negatively affect our results for a particular period. Moreover, other suppliers, as well as wholesalers and retailers of our brands, offer products that compete directly with ours for shelf space, promotional displays, and consumer purchases. Pricing (including price promotions, discounting, couponing, and free goods), marketing, new product introductions, entry into our distribution networks, and other competitive behavior by other suppliers, and by wholesalers and traditional and e-commerce retailers, could adversely affect our growth, business, and financial results. While we seek to take advantage of the efficiencies and opportunities that large retail customers can offer, they often seek lower pricing and increased purchase volume flexibility, offer competing private label products, and represent a large number of other competing products. If the buying power of these large retail customers continues to increase, it could negatively affect our financial results. Further, while we believe we have sufficient scale to succeed relative to our major competitors, we nevertheless face a risk that continuing consolidation of large beverage alcohol companies could put us at a competitive disadvantage.

Consolidation, whether domestically or internationally, among spirits producers, distributors, wholesalers, suppliers, or retailers and the increased growth of the e-commerce environment across the consumer product goods market has created and could continue to create a more challenging competitive landscape for our products. Consolidation at any level could hinder the distribution and sale of our products as a result of reduced attention and resources allocated to our brands both during and after transition periods, because our brands might represent a smaller portion of the new business portfolio. Furthermore, consolidation of distributors may lead to the erosion of margins. Changes in distributors' strategies, including a reduction in the number of brands they carry, the allocation of shelf space for our competitors' brands, or private label products, may adversely affect our growth, business, financial results, and market share. Our competitors may respond to industry and economic conditions and shifts in consumer behaviors more rapidly or effectively than we do. To remain competitive, we must be agile and efficient in adopting digital technologies and building analytical capabilities, which our competitors may be able to achieve with more agility and resources.

Changes in consumer preferences and purchases, any decline in the social acceptability of our products, or governmental adoption of policies disadvantageous to beverage alcohol could negatively affect our business results.

We are a branded consumer products company in a highly competitive market, and our success depends substantially on our continued ability to offer consumers appealing, high-quality products. Consumer preferences and purchases may shift, often in unpredictable ways, as a result of a variety of factors, including health and wellness trends; changes in economic conditions, demographic, and social trends; public health policies and initiatives; changes in government regulation of beverage alcohol products; concerns or regulations related to product safety; legalization of cannabis and its use on a more widespread basis in the markets where we operate; and changes in trends related to travel, leisure, dining, gifting, entertaining, and beverage consumption. As a result, consumers may begin to shift their consumption and purchases from our premium and super-premium products, or away from alcoholic beverages entirely. This shift includes consumption at home as a result of various factors, including shifts in social trends, and shifts in the channels for the purchases of our products. These shifts in consumption and purchasing channels could adversely impact our profitability. Consumers also may begin to prefer the products of competitors or may generally reduce their demand for brands produced by larger companies. Over the past several decades, the number of small, local distilleries in the United States has grown significantly. This growth is being driven by a trend of consumers showing increasing interest in locally produced, regionally sourced products. As more brands enter the market, increased competition could negatively affect demand for our premium and super-premium American whiskey brands, including Jack Daniel’s. In addition, we could experience unfavorable business results if we fail to attract consumers from diverse backgrounds and ethnicities in all markets where we sell our products.

Expansion into new product categories by other suppliers, or innovation by new entrants into the market, could increase competition in our product categories. For example, we have observed an increase in diversification by various consumer goods companies such as the entrance of both traditional beer and soft drink companies into the ready-to-drink market and the entrance of both beer and spirits companies into the cannabis market – expanding the potential for competition in the spirits market from various sectors of the consumer goods industry. Increased competition may, among other things, negatively impact our ability to maintain or gain market share; increase pricing pressure, which inhibits our ability to adequately respond to inflationary changes in commodities used in making our products; require increases in marketing and promotional activities; and negatively impact the market for our premium and super-premium products. To continue to succeed, we must anticipate or react effectively to shifts in demographics, our competition, consumer behavior, consumer preferences, drinking tastes, and drinking occasions.

Our long-term plans call for the continued growth of the Jack Daniel's family of brands. If these plans do not succeed, or if we otherwise fail to develop or implement effective business, portfolio, and brand strategies, our growth, business, or financial results could suffer. More broadly, if consumers shift away from spirits (particularly brown spirits such as American whiskey and bourbon), our premium-priced brands, or our ready-to-drink products, our financial results could be adversely affected.

We believe that new products, line extensions, label and bottle changes, product reformulations, and similar product innovations by both our competitors and us will increase competition in our industry. Product innovation, particularly for our core brands, is a significant element of our growth strategy; however, there can be no assurance that we will continue to develop and implement successful line extensions, packaging, formulation or flavor changes, or new products.

Unsuccessful implementation or short-lived popularity of our product innovations could result in inventory write-offs and other costs, could reduce profits from one year to the next, and could also damage consumers' perception of our brands. Our inability to attract consumers to our product innovations relative to our competitors' products – especially over time – could negatively affect our growth, business, and financial results.

Production facility disruption could adversely affect our business.

Some of our largest brands, including Jack Daniel's and our tequilas, are distilled at single locations. A catastrophic event causing physical damage, disruption, or failure at any one of our major distillation or bottling facilities, including facilities that support the production of our premium brands such as Woodford Reserve and Old Forester, could adversely affect our business. Further, because whiskeys, rums, and some tequilas are aged for various periods, we maintain a substantial inventory of aged and maturing products in warehouses at a number of different sites. The loss of a substantial amount of aged inventory – through fire, other natural or man-made disaster, contamination, or otherwise – could significantly reduce the supply of the affected product or products. These and other supply (or supply chain) disruptions could prevent us from meeting consumer demand for the affected products in the short and medium term. In addition to catastrophic events identified above, supply disruptions could include the temporary inability to make our products at normal levels or at all. We could also experience disruptions if our suppliers are unable to deliver supplies. Our business continuity plans may not prevent business disruption, and reconstruction of any damaged facilities could require a significant amount of time and resources.

The inherent uncertainty in supply/demand forecasting could adversely affect our business, particularly with respect to our aged products.

There is an inherent risk of forecasting imprecision in determining the quantity of aged and maturing products to produce and hold in inventory in a given year for future sale. The forecasting strategies we use to balance product supply with fluctuations in consumer demand may not be effective for particular years or products. For example, in addition to our American and Irish whiskeys, rums, and some tequilas, which are aged for various periods, our Scotch whisky brands require long-term maturation – an average of 12 years with limited releases of 30 years or more – making forecasts of demand for such products in future periods subject to significant uncertainty. Our tequila supply also depends on the growth cycle of agave plants, which take approximately six to seven years to reach full maturity, requiring us to make forecasts of demand for our tequilas over a long-time horizon to determine in advance how much agave to plant or otherwise source. Factors that affect our ability to forecast accurately include changes in business strategy, market demand, consumer preferences, macroeconomic conditions, introductions of competing products, and other changes in market conditions. Additionally, our supply of aged products can deviate from expectations due to changes in forecasted maturation loss. Such forecasting errors could lead to our inability to meet the objectives of our business strategy, failure to meet future demand, or a future surplus of inventory and consequent write-down in value of such inventory. A failure to accurately forecast demand for our products or efficiently manage inventory could have a material adverse effect on our business and financial results. Further, we cannot be certain that we will be successful in using various levers, such as pricing changes, to create the desired balance of available supply and consumer demand for particular years or products. As a consequence, we may be unable to meet consumer demand for the affected products for a period of time. Furthermore, not having our products in the market consistently may adversely affect our brand equity and future sales.

Higher costs or unavailability of water, raw materials, product ingredients, or labor could adversely affect our financial results.

Our products use materials and ingredients that we purchase from suppliers. Our ability to make and sell our products depends on the availability of the raw materials, product ingredients, finished products, wood, glass and PET bottles, cans, bottle closures, packaging, and other materials used to produce and package them. Without sufficient quantities of one or more key materials, our business and financial results could suffer. For instance, only a few glass producers make bottles on a scale sufficient for our requirements, and a single producer supplies most of our glass requirements. During the recent global supply chain challenges, our primary glass provider could not produce sufficient quantities to meet our needs, which increased our cost

to produce, constrained supply of some of our products, and adversely affected our financial results. In response to these events, we took action to diversify suppliers of our raw materials, including glass. Our glass supply, as well as global supply chains, have stabilized. However, similar supply chain challenges may occur in the future, making it difficult and more expensive to produce and deliver our products. For example, a disruption in the supply of American white oak logs, staves, heading, or steel it could constrain our ability to produce or procure the new charred oak barrels in which we age our whiskeys. If any of our key suppliers were no longer able to meet our timing, quality, or capacity requirements, ceased doing business with us, or significantly raised prices, and we could not promptly develop alternative cost-effective sources of supply or production, our operations and financial results could suffer.

Higher costs or insufficient availability of suitable grain, agave, water, molasses, wood, glass, closures, and other input materials, or higher associated labor costs or insufficient availability of labor, may adversely affect our financial results. Similarly, when energy costs rise, our transportation, freight, and other operating costs, such as distilling and bottling expenses, also may increase. Our freight cost and the timely delivery of our products could be adversely affected by a number of factors, including driver or equipment shortages, higher fuel costs, weather conditions, traffic congestion, ocean freight lane disruptions, shipment container availability, rail shutdowns, increased government regulation, and other matters that could reduce the profitability of our operations. Our financial results may be adversely affected if we cannot pass along energy, freight, or other input cost increases through higher prices to our customers without reducing demand or sales. For example, during the COVID-19 pandemic and subsequent economic recovery, we experienced supply chain disruptions in connection with the availability of timely modes of transportation to ship our products globally, which resulted in higher costs and delays in supplying some of our products.

International or domestic geopolitical or other events, including the imposition of any tariffs or quotas by governmental authorities on any raw materials that we use in the production of our products, could adversely affect the supply and cost of these raw materials to us. While we do not currently expect our production operations to be directly impacted by conflicts around the world, changes in global grain and commodity pricing and availability may impact the markets where we operate. If we cannot offset higher raw material costs with higher selling prices, increased sales volume, or reductions in other costs, our profitability could be adversely affected.

Weather, acute or chronic climate change impacts, fires, diseases, and other agricultural uncertainties that affect the health, yield, quality, or price of the various raw materials used in our products also present risks for our business, including in some cases potential impairment in the recorded value of our inventory. Increasing average temperatures could also affect the maturation and yield of our aged inventory over time. Changes in weather patterns or intensity can disrupt our supply chain as well, which may affect production operations, insurance costs and coverage, and the timely delivery of our products.

Water is an essential component of our products, so the quality and quantity of available water is critical to our ability to operate our business. If extended droughts become more common or severe, or if our water supply is interrupted for other reasons, high-quality water could become scarce in some key production regions for our products,which in turn could adversely affect our business and financial results.

We might not succeed in our strategies for investments, acquisitions, dispositions, and other strategic transactions.

From time to time, we acquire or invest in additional brands or businesses. We expect to continue to seek acquisition and investment opportunities that we believe will increase long-term stockholder value, but we may not be able to find investment opportunities, or purchase brands or businesses, at acceptable prices and terms. Acquisitions and investments involve risks and uncertainties, including paying more than a brand or business is ultimately determined to be worth; potential difficulties integrating acquired brands and personnel; the possible loss of key customers or employees most knowledgeable about the acquired business; implementing and maintaining consistent U.S. public company standards, controls, procedures, policies, and information systems; exposure to unknown liabilities; business disruption; and management distraction or departure. We have in the past, and could in the future, incur restructuring charges or record impairment losses on the value of goodwill or other intangible assets resulting from previous acquisitions, or the risk of potential losses on equity investments which may also negatively affect our financial results.

From time to time, we also consider disposing of assets or businesses that may no longer meet our financial or strategic objectives. In selling assets or businesses, we may not get prices or terms as favorable as we anticipated. We could also encounter difficulty in finding buyers on acceptable terms in a timely manner, which could delay accomplishment of our strategic objectives. Expected cost savings from reduced overhead, relating to the sold assets, may not materialize. The overhead reductions could temporarily disrupt our other business operations. Any of these outcomes could negatively affect our financial results.

Our business faces various risks related to health epidemics and pandemics that could materially and adversely affect our business, our operations, our cash flows, and our financial results.