Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | |

for the fiscal year ended December 31, 2024 |

OR

☐ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | |

for the transition period from _________ to _________ |

Commission File Number: 001-34765

Teucrium Commodity Trust |

(Exact name of registrant as specified in its charter) |

Delaware | | 61-1604335 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

Three Main Street, Suite 215

Burlington, VT 05401

(Address of principal executive offices) (Zip code)

(802) 540-0019

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each Class | Trading Symbol | Name of each exchange on which registered |

Shares of Teucrium Corn Fund | CORN | NYSE Arca, Inc. |

Shares of Teucrium Sugar Fund | CANE | NYSE Arca, Inc. |

Shares of Teucrium Soybean Fund | SOYB | NYSE Arca, Inc. |

Shares of Teucrium Wheat Fund | WEAT | NYSE Arca, Inc. |

Shares of Teucrium Agricultural Fund | TAGS | NYSE Arca, Inc. |

| | | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.1D-1(b) ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes

The aggregate market value of the units of each series of the registrant held by non-affiliates as of June 30, 2024 are included in the table below:

| | | Aggregate Market Value of Each Fund's Shares Held by Non-Affiliates as of June 30, 2024 | | | Total Number of Outstanding Shares as of March 4, 2025 | |

| | | | | | | | | |

Teucrium Corn Fund | | $ | 63,169,500 | | | | 3,175,004 | |

| | | | | | | | | |

Teucrium Sugar Fund | | | 13,725,000 | | | | 975,004 | |

| | | | | | | | | |

Teucrium Soybean Fund | | | 27,789,925 | | | | 1,225,004 | |

| | | | | | | | | |

Teucrium Wheat Fund | | | 136,865,250 | | | | 24,400,004 | |

| | | | | | | | | |

Teucrium Agricultural Fund | | | 25,909 | | | | 400,002 | |

| | | | | | | | | |

Total | | $ | 241,575,584 | | | | | |

DOCUMENTS INCORPORATED BY REFERENCE:

NONE

Statement Regarding Forward-Looking Statements

This filing includes “forward-looking statements” which generally relate to future events or future performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or the negative of these terms or other comparable terminology. All statements (other than statements of historical fact) included in this filing that address activities, events or developments that will or may occur in the future, including such matters as movements in the commodities markets and indexes that track such movements, operations of the Funds, the Sponsor’s plans and references to the future success of a Fund or the Funds and other similar matters, are forward-looking statements. These statements are only predictions. Actual events or results may differ materially. These statements are based upon certain assumptions and analyses the Sponsor has made based on its perception of historical trends, current conditions and expected future developments, as well as other factors appropriate in the circumstances. Whether or not actual results and developments will conform to the Sponsor’s expectations and predictions, however, is subject to a number of risks and uncertainties, including the special considerations discussed in this annual report, general economic, market and business conditions, changes in laws or regulations, including those concerning taxes, made by governmental authorities or regulatory bodies, and other world economic and political developments. Consequently, all the forward-looking statements made in this filing are qualified by these cautionary statements, and there can be no assurance that actual results or developments the Sponsor anticipates will be realized or, even if substantially realized, that they will result in the expected consequences to, or have the expected effects on, the operations of the Funds or the value of the Shares of the Funds.

PART I

Item 1. Business

The Trust and the Funds

Teucrium Commodity Trust (“Trust”), a Delaware statutory trust organized on September 11, 2009, is a series trust consisting of five series: Teucrium Corn Fund (“CORN”), Teucrium Sugar Fund (“CANE”), Teucrium Soybean Fund (“SOYB”), Teucrium Wheat Fund (“WEAT” and, together with CORN, CANE and SOYB, the “Agriculture Funds”) and Teucrium Agricultural Fund (“TAGS”). Hashdex Bitcoin Futures ETF (“DEFI") was a series of the Trust prior to the merger closing on January 3, 2024. As discussed elsewhere in this form 10-K, the Trust, on behalf of its series, Hashdex Bitcoin Futures Fund ("Acquired Fund"), and Tidal Commodities Trust I, on behalf of its series, Hashdex Bitcoin Futures Fund entered into an agreement and Plan of Merger and Liquidation dated as of October 30, 2023 ("Plan of Merger"). The Merger closed on January 3, 2024. Upon such closing, the Plan of Merger caused all of the Acquired Fund's shares to be canceled and the Acquired Fund to be liquidated. All of the series of the Trust are collectively referred to as the “Funds” and singularly as the “Fund.” Collectively, CORN, CANE, SOYB and WEAT are referred to as the “Agricultural Funds.” Each Fund is a commodity pool that is a series of the Trust. The Funds issue common units, called “Shares,” representing fractional undivided beneficial interests in a Fund. Effective as of April 29, 2019, the Trust and the Funds operate pursuant to the Trust's Fifth Amended and Restated Declaration of Trust and Trust Agreement (the "Trust Agreement"). The Trust Agreement may be found on the SEC’s EDGAR filing database at: https://www.sec.gov/Archives/edgar/data/1471824/000165495419004852/ex31.htm.

The Sponsor

Teucrium Trading, LLC (the “Sponsor”) is the sponsor of the Trust and each of the series of the Trust. The Sponsor is a Delaware limited liability company, formed on July 28, 2009. The principal office is located at Three Main Street, Suite 215, Burlington, Vermont 05401. The Sponsor is registered as a commodity pool operator (“CPO”) and a commodity trading adviser (“CTA”) with the Commodity Futures Trading Commission (“CFTC”) and is a member of the National Futures Association (“NFA”). Teucrium Investment Advisors, LLC, a wholly owned subsidiary of the Sponsor, is a Delaware limited liability company, which was formed on January 4, 2022. Teucrium Investment Advisors, LLC is a U.S. Securities and Exchange Commission (“SEC”) registered investment advisor. Teucrium Investment Advisors, LLC was registered with the CFTC as a CPO on May 2, 2022, a CTA on May 2, 2022, and a Swap Firm on May 9, 2022. Teucrium Investment Advisors, LLC became a member of the NFA on May 9, 2022.

The Trust and the Funds operate pursuant to the Trust Agreement. Under the Trust Agreement, the Sponsor is solely responsible for management and conducts or directs the conduct of the business of the Trust, the Funds, and any series of the Trust that may from time to time be established and designated by the Sponsor. The Sponsor is required to oversee the purchase and sale of Shares by Authorized Purchasers and to manage the Funds' investments, including to evaluate the credit risk of FCMs and swap counterparties and to review daily positions and margin/collateral requirements. The Sponsor has the power to enter into agreements as may be necessary or appropriate for the offer and sale of the Funds' Shares and the oversight of the Trust’s activities. Accordingly, the Sponsor is responsible for selecting service providers such as the Trustee, Administrator, Marketing Agent, the independent registered public accounting firm of the Trust, and any legal counsel employed by the Trust. The Sponsor is also responsible for preparing and filing periodic reports on behalf of the Trust with the SEC and will provide any required certification for such reports. No person other than the Sponsor and its principals was involved in the organization of the Trust or the Funds.

The Sponsor designed the Funds to offer liquidity, transparency, and capacity in single‐commodity investing for a variety of investors, including institutions and individuals, in an exchange‐traded product format. The Funds have also been designed to mitigate the impacts of contango and backwardation, situations that can occur in the course of commodity trading which can affect the potential returns to investors. Backwardation is defined as a market condition in which a futures price of a commodity is lower in the distant delivery months than in the near delivery months, while contango, the opposite of backwardation, is defined as a condition in which distant delivery prices for futures exceed spot prices, often due to the costs of storing and insuring the underlying commodity.

The Sponsor has a patent on certain business methods and procedures used with respect to the Funds.

The Funds

On June 7, 2010, the initial Form S-1 for CORN was declared effective by the SEC. On June 8, 2010, four Creation Baskets for CORN were issued representing 200,000 shares and $5,000,000. CORN began trading on the New York Stock Exchange (“NYSE”) Arca on June 9, 2010. The current registration statement for CORN was declared effective by the SEC on April 7, 2022. This registration statement for CORN registered an indeterminate number of shares.

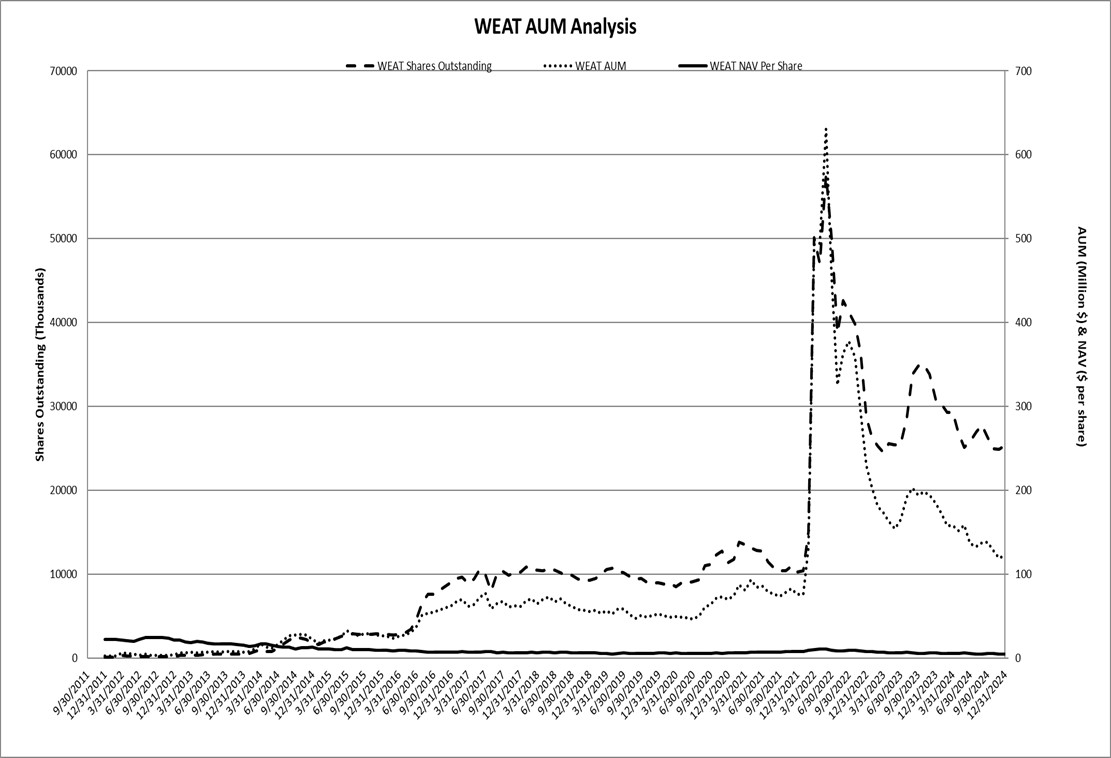

On June 13, 2011, the initial Forms S-1 for CANE, SOYB, and WEAT were declared effective by the SEC. On September 16, 2011, two Creation Baskets were issued for each Fund, representing 100,000 shares and $2,500,000, for CANE, SOYB, and WEAT. On September 19, 2011, CANE, SOYB, and WEAT started trading on the NYSE Arca. The current registration statements for CANE and SOYB were declared effective by the SEC on April 7, 2022. This registration statements for CANE and SOYB registered an indeterminate number of shares each. The current registration statement for WEAT was declared effective on March 9, 2022. This registration statement for WEAT registered an indeterminate number of shares.

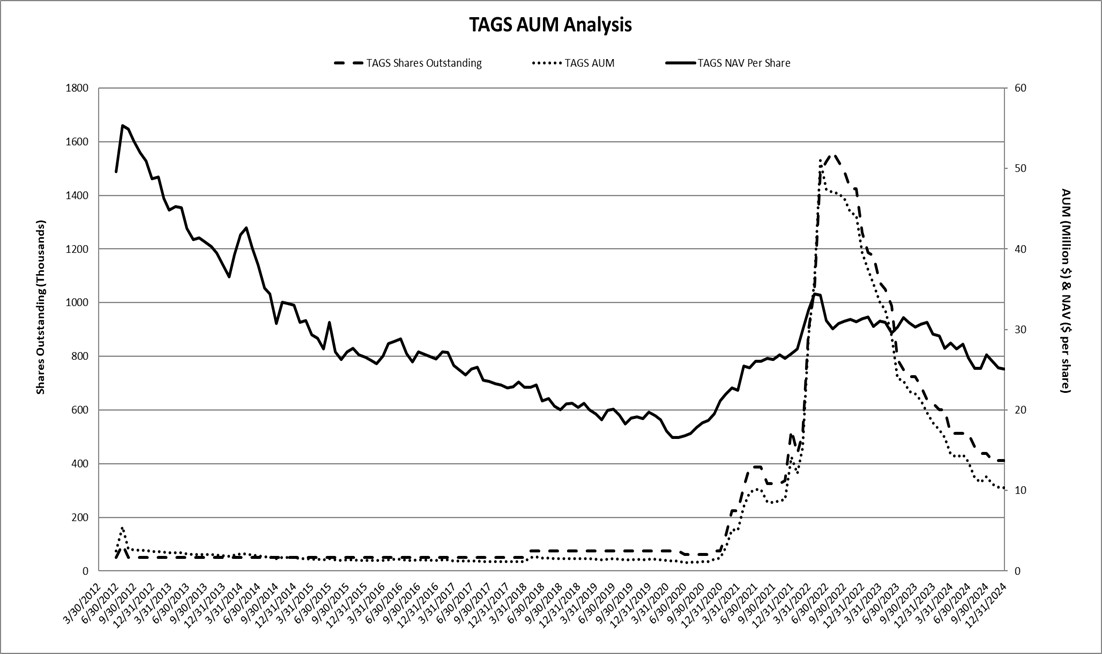

On February 10, 2012, the Form S-1 for TAGS was declared effective by the SEC. On March 27, 2012, six Creation Baskets for TAGS were issued representing 300,000 shares and $15,000,000. TAGS began trading on the NYSE Arca on March 28, 2012. The current registration statement for TAGS was declared effective by the SEC on April 7, 2022. This registration statement for TAGS registered an indeterminate number of shares.

As reported by the registrant on a Form 8-K filed with the Securities and Exchange Commission on November 7, 2023 (File No. 001-34765), Teucrium Commodity Trust (the “Teucrium Trust”), on behalf of its series, Hashdex Bitcoin Futures ETF (“Acquired Fund”), and Tidal Commodities Trust I (“Acquiring Trust”), on behalf of its series, Hashdex Bitcoin Futures ETF (“Acquiring Fund”), entered into an Agreement and Plan of Partnership Merger and Liquidation dated as of October 30, 2023 (the “Plan of Merger”). The Merger closed on January 3, 2024 (the “Closing Date”).

Pursuant to the Plan of Merger, each Acquired Fund shareholder received one share of the Acquiring Fund for every one share of the Acquired Fund held on the Closing Date based on the net asset value per share of the Acquiring Fund being equal to the net asset value per share of the Acquired Fund determined immediately prior to the Merger closing. Upon the Merger closing, the Acquiring Fund acquired all the assets of the Acquired Fund and assumed all the liabilities of the Acquired Fund via distribution. Upon the Merger closing, the Plan of Merger caused all of the Acquired Fund’s shares to be cancelled and the Acquired Fund to be liquidated.

The Sponsor of the Teucrium Trust, Teucrium Trading, LLC (“Teucrium”), has not received any compensation dependent on the consummation of the Merger.

Overview

The investment objective of the Agriculture Funds is to have the daily changes in the NAV of each Fund’s Shares reflect the daily changes in a weighted average of the closing settlement prices for certain futures contracts (“Futures Contracts”) for the commodity specified in the Fund’s name. (This weighted average is referred to herein as the Fund’s “Benchmark,” the Futures Contracts that at any given time make up a Fund’s Benchmark are referred to herein as the Fund’s “Benchmark Component Futures Contracts,” and the commodity specified in the Fund’s name is referred to herein as its “Specified Commodity.") The investment objective of TAGS is to provide daily investment results that reflect the combined daily performance of the Agricultural Funds (depending on the context, sometimes referred to as the "Underlying Funds"). Each Fund pursues its investment objective by investing in a portfolio of Futures Contracts that expire in a specific month and trade on a specific exchange in the designated commodity comprising the Benchmark, or, in the case of TAGS, Shares of the Agricultural Funds.

Consistent with applicable provisions of the Trust Agreement and Delaware law, the Funds have broad authority to make changes to a Fund’s operations. Consistent with this authority, each Fund, in its sole discretion and without shareholder approval or advance notice, may change its investment objective, Benchmark, or investment strategies. The Funds have no current intention to make any such change, and any change is subject to applicable regulatory requirements, including, but not limited to, any requirement to amend applicable listing rules of the NYSE.

The reasons for and circumstances that may trigger any such changes may vary widely and cannot be predicted. However, by way of example, the Funds may change the term structure or underlying components of the Benchmark in furtherance of a Fund’s investment objective of tracking the price of the specified commodity for future delivery (or, for TAGS, the investment objective of tracking the combined performance of the Underlying Funds) if, due to market conditions, a potential or actual imposition of position limits by the CFTC or futures exchange rules, or the imposition of risk mitigation measures by a futures commission merchant restricts the ability of the Fund (or, for TAGS, an Underlying Fund) to invest in the current Benchmark Component Futures Contracts. The Fund would file a current report on Form 8-K and a prospectus supplement to describe any such change and the effective date of the change. Shareholders may modify their holdings of the Fund’s Shares in response to any change by purchasing or selling Fund Shares through their broker-dealer.

The Investment Objectives of the Funds

The investment objective of CORN is to have the daily changes in the NAV of the Fund’s Shares reflect the daily changes in the corn market for future delivery as measured by the Benchmark. The Benchmark is a weighted average of the closing settlement prices for three futures contracts for corn (“Corn Futures Contracts”) that are traded on the Chicago Board of Trade (“CBOT”):

CORN Benchmark

CBOT Corn Futures Contract | | Weighting | |

Second to expire | | 35% | |

Third to expire | | 30% | |

December following the third to expire | | 35% | |

The investment objective of SOYB is to have the daily changes in the NAV of the Fund’s Shares reflect the daily changes in the soybean market for future delivery as measured by the Benchmark. The Benchmark is a weighted average of the closing settlement prices for three futures contracts for soybeans (“Soybean Futures Contracts”) that are traded on the CBOT:

SOYB Benchmark

CBOT Soybeans Futures Contract | | Weighting | |

Second to expire (excluding August & September) | | 35% | |

Third to expire (excluding August & September) | | 30% | |

Expiring in the November following the expiration of the third to expire contract | | 35% | |

The investment objective of CANE is to have the daily changes in the NAV of the Fund’s Shares reflect the daily changes in the sugar market for future delivery as measured by the Benchmark. The Benchmark is a weighted average of the closing settlement prices for three futures contracts for No. 11 sugar (“Sugar Futures Contracts”) that are traded on the ICE Futures US (“ICE”):

CANE Benchmark

ICE Sugar Futures Contract | | Weighting | |

Second to expire | | 35% | |

Third to expire | | 30% | |

Expiring in the March following the expiration of the third to expire contract | | 35% | |

The investment objective of WEAT is to have the daily changes in the NAV of the Fund’s Shares reflect the daily changes in the wheat market for future delivery as measured by the Benchmark. The Benchmark is a weighted average of the closing settlement prices for three futures contracts for wheat (“Wheat Futures Contracts”) that are traded on the CBOT:

WEAT Benchmark

CBOT Wheat Futures Contract | | Weighting | |

Second to expire | | 35% | |

Third to expire | | 30% | |

December following the third to expire | | 35% | |

The investment objective of TAGS is to provide daily investment results that reflect the combined daily performance of the Underlying Funds. Under normal market conditions, the Fund seeks to achieve its investment objective generally by investing equally in Shares of each Underlying Fund and, to a lesser extent, cash equivalents. The Fund’s investments in Shares of Underlying Funds are rebalanced, generally on a daily basis, in order to maintain approximately a 25% allocation of the Fund’s assets to each Underlying Fund:

TAGS Benchmark

Underlying Fund | | Weighting | |

CORN | | 25% | |

SOYB | | 25% | |

CANE | | 25% | |

WEAT | | 25% | |

As noted, the Agricultural Funds seek to achieve their investment objective by investing under normal market conditions in Benchmark Component Futures Contracts of the Fund or, in certain circumstances, in other Futures Contracts for its Specified Commodity. In addition, and to a limited extent, a Fund also may invest in exchange traded options on Futures Contracts for its Specified Commodity. Once position limits or accountability levels on Futures Contracts on a Fund’s Specified Commodity are applicable, each Fund’s intention is to invest first in contracts and instruments such as cash-settled options on Futures Contracts and forward contracts, swaps and other over the counter transactions that are based on the price of its Specified Commodity or Futures Contracts on its Specified Commodity (collectively, “Other Commodity Interests,” and together with Futures Contracts, “Commodity Interests”). By utilizing certain or all of these investments, the Sponsor will endeavor to cause each Fund’s performance to closely track that of its Benchmark.

The Sponsor operates the Agricultural Funds with the intent to never hold a Benchmark Component Futures Contract once it becomes the next to expire contract (commonly called the “spot” contract). Accordingly, the positions of each Fund in its Specified Commodity Interests are changed or “rolled” on a regular basis in order to track the changing nature of the Benchmark. Using CORN as an example, five times a year (on the dates on which certain Corn Futures Contracts expire), a particular Corn Futures Contract will no longer be a Benchmark Component Futures Contract, and CORN's investments will have to be changed accordingly. Corn Futures Contracts traded on the CBOT expire on a specified day in the following five months: March, May, July, September, and December. Therefore, in terms of the Benchmark, in June of a given year the next to expire or “spot month” Corn Futures Contract will expire in July of that year, and the Benchmark Component Futures Contracts will be the contracts expiring in September of that year (the second to expire contract), December of that year (the third to expire contract), and December of the following year. As another example using CORN, in November of a given year the Benchmark Component Futures Contracts will be the contracts expiring in March, May and December of the following year. (CORN is designed to roll or replace its contracts five times per year but will always hold a December Corn Futures Contract as an “anchor” month.) The Sponsor will determine if the investments of a Fund will be “rolled” in one day or over a period of several days, in order that any trading does not signal unwanted market movements and to make it more difficult for third parties to profit by trading ahead based on such expected market movements. Such “roll” periods are posted to the website well in advance of the “roll” date.

The Sponsor employs a “neutral” investment strategy intended to track the changes in the Benchmark of each Fund regardless of whether the Benchmark goes up or goes down. A Fund’s “neutral” investment strategy is designed to permit investors generally to purchase and sell the Fund’s Shares for the purpose of investing indirectly in the commodity specific market in a cost-effective manner. Such investors may include participants in the specific industry and other industries seeking to hedge the risk of losses in their commodity specific related transactions, as well as investors seeking exposure to that commodity market. Accordingly, depending on the investment objective of an individual investor, the risks generally associated with investing in the commodity specific market and/or the risks involved in hedging may exist. In addition, an investment in a Fund involves the risks that the changes in the price of the Fund’s Shares will not accurately track the changes in the Benchmark, and that changes in the Benchmark will not closely correlate with changes in the price of the commodity on the spot market. The Sponsor does not intend to operate any Fund in a fashion such that its per share NAV equals, in dollar terms, the spot price of the commodity or the price of any particular commodity- specific Futures Contract.

Calculation of the Benchmarks for the Agriculture Funds

(The following section discusses the Benchmark Component Futures Contracts of the Agricultural Funds).

The notional amount of each Benchmark Component Futures Contract included in each Benchmark is intended to reflect the changes in market value of each such Benchmark Component Futures Contract within the Benchmark. The closing level of each Benchmark is calculated on each business day by U.S. Bank Global Fund Services (“Global Fund Services”) based on the closing price of the futures contracts for each of the underlying Benchmark Component Futures Contracts and the notional amounts of such Benchmark Component Futures Contracts.

Each Benchmark is rebalanced periodically to ensure that each of the Benchmark Component Futures Contracts is weighted in the same proportion as in the investment objective for each Fund. The following tables reflect the December 31, 2024 Benchmark Component Futures Contracts weights for each of the Funds. The contract held is identified by the generally accepted nomenclature of contract month and year, which may differ from the month in which the contract expires:

CORN Benchmark Component Futures Contracts

| | | NUMBER OF CONTRACTS | | | NOTIONAL AMT. | | | WEIGHT (%) | |

CBOT corn futures MAY25 | | | 974 | | | $ | 22,682,025 | | | | 35 | % |

CBOT corn futures JUL25 | | | 829 | | | $ | 19,429,688 | | | | 30 | % |

CBOT corn futures DEC25 | | | 1,019 | | | $ | 22,609,063 | | | | 35 | % |

| | | | | | | | | | | | | |

TOTAL | | | | | | $ | 64,720,776 | | | | 100 | % |

SOYB Benchmark Component Futures Contracts

| | | NUMBER OF CONTRACTS | | | NOTIONAL AMT. | | | WEIGHT (%) | |

CBOT soybean futures MAR25 | | | 175 | | | $ | 8,841,875 | | | | 35 | % |

CBOT soybean futures MAY25 | | | 148 | | | $ | 7,564,650 | | | | 30 | % |

CBOT soybean futures NOV25 | | | 172 | | | $ | 8,817,150 | | | | 35 | % |

| | | | | | | | | | | | | |

TOTAL | | | | | | $ | 25,223,675 | | | | 100 | % |

CANE Benchmark Component Futures Contracts

| | | NUMBER OF CONTRACTS | | | NOTIONAL AMT. | | | WEIGHT (%) | |

ICE sugar futures MAY25 | | | 219 | | | $ | 4,378,248 | | | | 35 | % |

ICE sugar futures JUL25 | | | 192 | | | $ | 3,763,200 | | | | 30 | % |

ICE sugar futures MAR26 | | | 222 | | | $ | 4,400,928 | | | | 35 | % |

| | | | | | | | | | | | | |

TOTAL | | | | | | $ | 12,542,376 | | | | 100.00 | % |

WEAT Benchmark Component Futures Contracts

| | | NUMBER OF CONTRACTS | | | NOTIONAL AMT. | | | WEIGHT (%) | |

CBOT wheat futures MAY25 | | | 1,518 | | | $ | 42,693,750 | | | | 35 | % |

CBOT wheat futures JUL25 | | | 1,286 | | | $ | 36,618,850 | | | | 30 | % |

CBOT wheat futures DEC25 | | | 1,430 | | | $ | 42,792,750 | | | | 35 | % |

| | | | | | | | | | | | | |

TOTAL | | | | | | $ | 122,105,350 | | | | 100.00 | % |

TAGS Benchmark Component Futures Contracts

| | | FAIR VALUE | | | WEIGHT (%) | |

Teucrium Corn Fund | | $ | 2,594,798 | | | | 25 | % |

Teucrium Soybean Fund | | $ | 2,619,232 | | | | 25 | % |

Teucrium Wheat Fund | | $ | 2,616,822 | | | | 25 | % |

Teucrium Sugar Fund | | $ | 2,513,606 | | | | 25 | % |

| | | | | | | | | |

TOTAL | | $ | 10,344,458 | | | | 100 | % |

The price relationship between the near month Futures Contract to expire and the Benchmark Component Futures Contracts will vary and may impact both the total return of each Fund over time and the degree to which such total return tracks the total return of the price indices related to the commodity of each Fund. In cases in which the near month contract’s price is lower than later expiring contracts’ prices (a situation known as “contango” in the futures markets), then absent the impact of the overall movement in commodity prices the value of the Benchmark Component Futures Contracts would tend to decline as they approach expiration. In cases in which the near month contract’s price is higher than later expiring contracts’ prices (a situation known as “backwardation” in the futures markets), then absent the impact of the overall movement in a Fund’s prices the value of the Benchmark Component Futures Contracts would tend to rise as they approach expiration, all other things being equal.

The total portfolio composition for each Fund is disclosed each business day that the NYSE Arca is open for trading on the Sponsor’s website. The website for the Agricultural Funds and the Sponsor is www.teucrium.com. The website is accessible at no charge. The website disclosure of portfolio holdings is made daily and includes, as applicable, the name and value of each Futures Contract (or Underlying Fund in the case of TAGS), other commodity interests and the amount of cash and cash equivalents held in the Fund’s portfolio.

Consistent with achieving a Fund’s investment objective of closely tracking the Benchmark, the Sponsor may for certain reasons cause a Fund to enter into or hold Futures Contracts other than the Benchmark Component Futures Contracts and/or Other Commodity Interests. Other Commodity Interests that do not have standardized terms and are not exchange traded, referred to as “over the counter” Commodity Interests, can generally be structured as the parties to the Commodity Interest contract desire. Therefore, each Fund might enter into multiple and/or over the counter Interests intended to replicate the performance of each of the Benchmark Component Futures Contracts for a Fund, or a single over the counter Commodity Interest designed to replicate the performance of the Benchmark as a whole. Assuming that there is no default by a counterparty to an over the counter Commodity Interest, the performance of the Interest will necessarily correlate with the performance of the Benchmark or the applicable Benchmark Component Futures Contract. Each Fund might also enter into or hold Interests other than Benchmark Component Futures Contracts to facilitate effective trading, consistent with the discussion of the Fund’s “roll” strategy. In addition, each Fund might enter into or hold Interests that would be expected to alleviate overall deviation between the Fund’s performance and that of the Benchmark that may result from certain market and trading inefficiencies or other reasons. By utilizing certain or all of the investments described above, the Sponsor will endeavor to cause the Fund’s performance to closely track that of the Benchmark of each Fund.

An “exchange for related position” (“EFRP”) can be used by each Agricultural Fund as a technique to facilitate the exchanging of a futures hedge position against a creation or redemption order, and thus each Fund may use an EFRP transaction in connection with the creation and redemption of Shares. The market specialist/market maker that is the ultimate purchaser or seller of Shares in connection with the creation or redemption basket, respectively, agrees to sell or purchase a corresponding offsetting futures position which is then settled on the same business day as a cleared futures transaction by the FCMs. The Fund will become subject to the credit risk of the market specialist/market maker until the EFRP is settled within the business day, which is typically 7 hours or less. Each Fund reports all activity related to EFRP transactions under the procedures and guidelines of the CFTC and the exchanges on which the futures are traded.

The Funds seek to earn interest and other income (“interest income”) from cash equivalents that it purchases and, on the cash they hold through the Custodian or other financial institutions. The Sponsor anticipates that the interest income will increase the NAV of each Fund. The Funds apply the interest income to the acquisition of additional investments or use it to pay their expenses. If the Fund reinvests the earned interest income, it makes investments that are consistent with its investment objectives as disclosed. Any cash equivalent invested by a Fund will have original maturity dates of three months or less at inception. Any cash equivalent invested by a Fund will be deemed by the Sponsor to be of investment grade quality. As of December 31, 2024, available cash balances in each of the Funds were invested in the U. S. Bank Demand Deposit Account, in the Goldman Sachs Financial Square Government Fund – Institutional Class, in demand deposits at Capital One, and in commercial paper with maturities of ninety days or less. Additionally, the CORN, SOYB, CANE and WEAT Funds may invest a portion of the amount of funds required to be deposited with the FCM as initial margin in U.S. Treasury obligations with time to maturity of 90 days or less. The obligations are purchased and held in the respective Fund accounts through the FCM.

In managing the assets of the Funds, the Sponsor does not use a technical trading system that automatically issues buy and sell orders. Instead, the Sponsor will purchase or sell the specific underlying Commodity or Cryptocurrency Interests with an aggregate market value that approximates the amount of cash received or paid upon the purchase or redemption of Shares.

The Sponsor anticipates managing each Fund in a way that tracks the stated Benchmark. The Agricultural Funds’ Benchmarks do not hold spot futures and therefore do not anticipate letting the commodity Futures Contracts of any Fund expire, thus avoiding delivery of the underlying commodity. Instead, the Sponsor will close out existing positions, for instance, in response to ordinary scheduled changes in the Benchmark or, if at the Sponsor’s sole discretion, it otherwise determines it would be appropriate to do so, will reinvest the proceeds in new Commodity Interests. Positions may also be closed out to meet redemption orders, in which case the proceeds from closing the positions are not reinvested.

Market Outlook

General

Commodities in general are primarily priced and traded in US dollars. As such global trade can be influenced by relative currency valuations, which are largely dependent on a nation’s fiscal strength, monetary policy, and general economic health. Furthermore, US fiscal and monetary policy is of particular importance given that commodities are largely priced in US dollars. Interest rates, money supply, fiscal spending (including deficit spending), and tax policy can all have an impact on the relative value of the US dollar.

In addition to measuring US dollar strength relative to international currencies, market participants also pay close attention to US dollar strength relative to consumer goods. The Consumer Price Index (CPI), and the Personal Consumption Expenditures Index (PCE), are two popular indexes measuring the changes in costs of consumer goods priced in US dollars. Higher CPI and PCE levels signal inflation, whereas lower CPI and PCE levels suggest deflation. Higher inflation expectations may result in increased investor demand for commodities.

The Corn Market

Corn is currently the most widely produced livestock feed grain in the United States. The two largest demands of the United States’ corn crop are used in livestock feed and ethanol production. Corn is also processed into food and industrial products, including starch, sweeteners, corn oil, beverages and industrial alcohol. The United States Department of Agriculture (“USDA”) publishes weekly, monthly, quarterly and annual updates for U.S. domestic and worldwide corn production and consumption, and for other grains such as soybeans and wheat which can be used in some cases as a substitute for corn. These reports are available on the USDA’s website, www.usda.gov, at no charge. The outlook provided below is from the January 10, 2025 USDA report.

As a general matter, the occurrence of a severe weather event, natural disaster, terrorist attack, geopolitical events, outbreak, or public health emergency as declared by the World Health Organization, the continuation or expansion of war or other hostilities, or a prolonged government shutdown may have significant adverse effects on the Fund and its investments and alter current assumptions and expectations. For example, in late February 2022, Russia invaded Ukraine, significantly amplifying existing geopolitical tensions among Russia and other countries in the region and in the west. The responses of countries and political bodies to Russia’s actions, Ukraine’s military response and the potential for wider conflict may increase financial market volatility. Generally, these adverse effects may cause continued volatility in the price of corn, corn futures, and the share price of the Fund.

The price per bushel of corn in the United States is primarily a function of both U.S. and global production and demand. Long term impacts from sanctions, shipping disruptions, collateral war damage, and a potential expansion of the conflict between Russia and Ukraine could further disrupt the availability of corn supplies. These impacts remain important to track as both countries have played important roles in supplying grain to other parts of the world. As such, volatility, trading volumes, and prices in global corn markets have risen dramatically and are expected to continue indefinitely at extreme elevated levels. Given all of the above factors, the Sponsor has no ability to discern when current high levels of volatility will subside.

Recent geopolitical, economic and inflationary events may have impacted the level of “backwardation” that the Fund's holdings experienced and potentially placed upward pressure on the prices of a wide variety of commodities. As a result, near to expire contracts can trade at a higher price than longer to expire contracts, a situation referred to as “backwardation.” Putting aside the impact of the overall movement in prices of corn and corn futures, the Benchmark Component Futures Contracts (the corn futures contracts that the Fund invests in to achieve its investment objective) would tend to rise as they approach expiration. This backwardation may benefit the Fund because it will sell more expensive contracts and buy less expensive contracts on an ongoing basis.

Conversely, in the event of a corn futures market where near to expire contracts trade at a lower price than longer to expire contracts, a situation referred to as “contango,” then absent the impact of the overall movement in corn prices the value of the Benchmark Component Futures Contracts would tend to decline as they approach expiration. If the price of corn and corn futures were to decline, for example, because of a resolution of the Russia-Ukraine conflict, the Fund would experience the negative impact of contango.

The United States is the world’s leading producer and exporter of corn. For the Crop Year 2024-25, the United States Department of Agriculture (“USDA”) estimates that the U.S. will produce approximately 31% of all the corn globally, of which about 16% will be exported. For 2024-25, based on the January 10, 2025 USDA reports, global consumption of 1,238 Million Metric Tons (MMT) is expected to be slightly higher than global production of 1,214 MMT. If the global demand for corn is not equal to global supply, this may have an impact on the price of corn. Besides the United States, other principal world corn exporters include Argentina, Brazil, Russia, South Africa, and Ukraine. Major import nations include Mexico, Japan, the European Union (EU), South Korea, Egypt, and parts of Southeast Asia. China’s production at 295 MMT is approximately 6% less than its domestic usage.

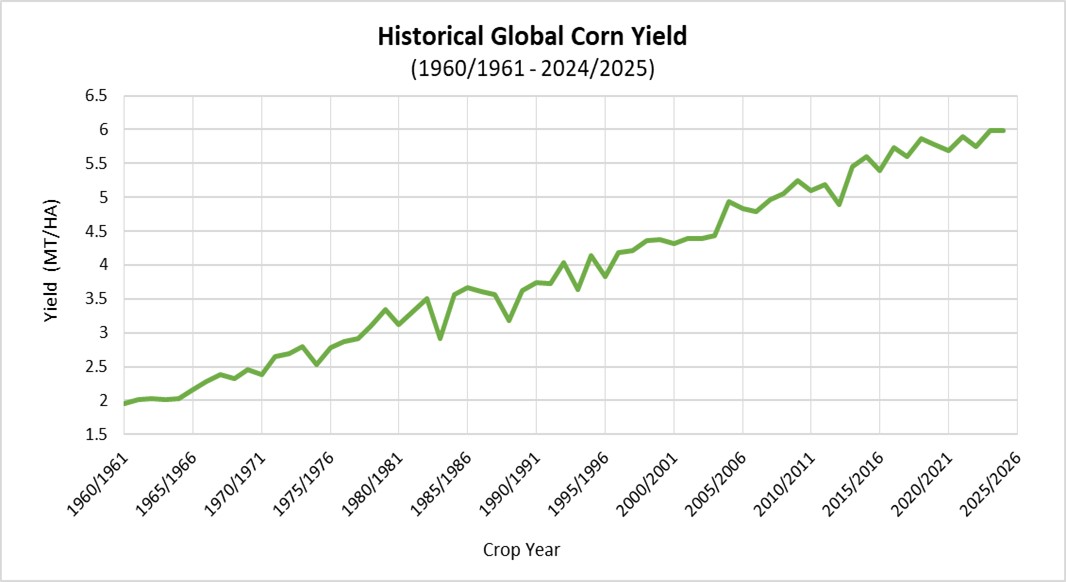

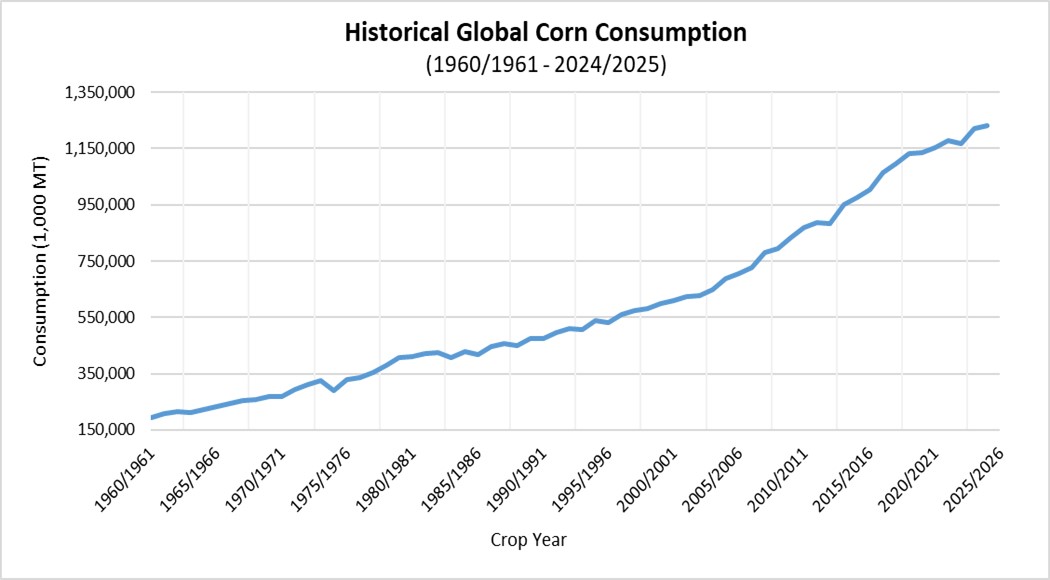

According to the USDA, global corn consumption has increased 633% from crop year 1960/1961 to 2024/2025 as demonstrated by the graph below and is projected to continue to grow in coming years. Consumption growth is the result of a combination of many factors including: 1) global population growth, which, according to the U.S. Census Department, is estimated to reach 9.7 billion by 2050; 2) a growing global middle class which is increasing the demand for protein and meat-based products globally and most significantly in developing countries; and 3) increased use of biofuels, including ethanol in the United States.

Global corn consumption may fluctuate year over year due to any number of reasons which may include, but is not limited to, economic conditions, global health concerns, international trade policy. Corn is a staple commodity used pervasively across the globe so that any contractions in consumption may only be temporary as has historically been the case.

While global consumption of corn has increased over the 1960/1961-2024/2025 period, so has production, driven by increases in acres planted and yield per acre. However, according to the USDA and United Nations, future growth in planted acres and yield may be inhibited by lower productive land, and lack of infrastructure and transportation. In addition, agricultural crops such as corn are highly weather dependent for yield and therefore susceptible to changing weather patterns. In addition, given the current production/consumption patterns, nearly 100% of all corn produced globally is consumed which leaves minimal excess inventory if production issues arise.

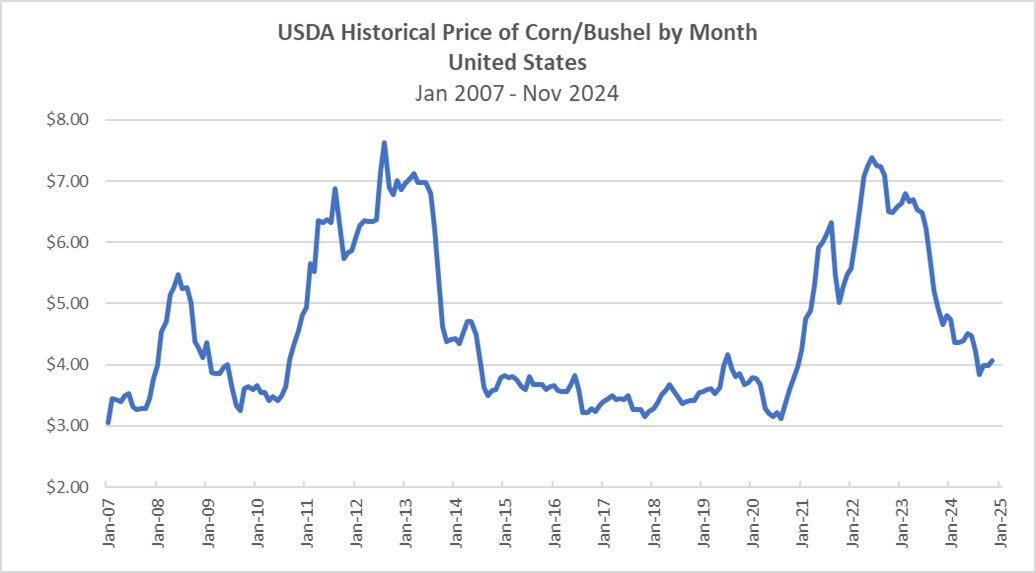

The price per bushel of corn in the United States is primarily a function of both U.S. and global production, as well as U.S. and global demand. The graph below shows the USDA published price per bushel by month for the period January 2007 to November 2024.

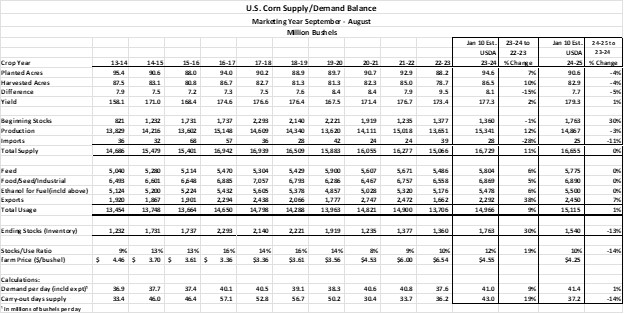

On January 10, 2025, the USDA released its monthly World Agricultural Supply and Demand Estimates (WASDE) for the Crop Year 2024-25. The exhibit below provides a summary of historical and current information for United States corn production.

Standard Corn Futures Contracts trade on the CBOT in units of 5,000 bushels. Three grades of corn are deliverable under CBOT Corn Futures Contracts: Number 1 yellow, which may be delivered at 1.5 cents over the contract price; Number 2 yellow, which may be delivered at the contract price; and Number 3 yellow, between a 2 and 4 cents per bushel under contract price depending on broken corn and foreign material and damage grade factors. There are five months each year in which CBOT Corn Futures Contracts expire: March, May, July, September, and December.

If the futures market is in a state of backwardation (i.e., when the price of corn in the future is expected to be less than the current price), the Fund will buy later to expire contracts for a lower price than the sooner to expire contracts that it sells. Hypothetically, and assuming no changes to either prevailing corn prices or the price relationship between immediate delivery, soon to expire contracts and later to expire contracts, the value of a contract will rise as it approaches expiration. Over time, if backwardation remained constant, the differences would continue to increase. If the futures market is in contango, the Fund will buy later to expire contracts for a higher price than the sooner to expire contracts that it sells. Hypothetically, and assuming no other changes to either prevailing corn prices or the price relationship between the spot price, soon to expire contracts and later to expire contracts, the value of a contract will fall as it approaches expiration. Over time, if contango remained constant, the difference would continue to increase. Historically, the corn futures markets have experienced periods of both contango and backwardation. Frequently, whether contango or backwardation exists is a function, among other factors, of the seasonality of the corn market and the corn harvest cycle. All other things being equal, a situation involving prolonged periods of contango may adversely impact the returns of the Fund; conversely a situation involving prolonged periods of backwardation may positively impact the returns of the Fund.

Futures contracts may be either bought or sold, long or short. The CFTC weekly releases the “Commitment of Traders” (COT) report, which depicts the open interest as well as long and short positions in the market. Market participants may use this report to gauge market sentiment.

The Soybean Market

Global soybean production is concentrated in the U.S., Brazil, Argentina and China. The United States Department of Agriculture (“USDA”) has estimated that, for the Crop Year 2024-25, the United States will produce approximately 119 MMT of soybeans or approximately 28% of estimated world production, with Brazil production at 169 MMT. Argentina is projected to produce about 52 MMT. For 2024-25, based on the January 10, 2025 USDA report, global consumption of 406 MMT is estimated slightly lower than global production of 424 MMT. If the global demand for soybeans is not equal to global supply, this may have an impact on the price of soybeans. Global soybean consumption may fluctuate year over year due to any number of reasons which may include, but is not limited to, economic conditions, global health concerns, and international trade policy. Soybeans are a staple commodity used pervasively across the globe so that any contractions in consumption may only be temporary as has historically been the case. The USDA publishes weekly, monthly, quarterly and annual updates for U.S. domestic and worldwide soybean production and consumption. These reports are available on the USDA’s website, www.usda.gov, at no charge. The outlook provided below is from the January 10, 2025 USDA report.

As a general matter, the occurrence of a severe weather event, natural disaster, terrorist attack, geopolitical events, outbreak, or public health emergency as declared by the World Health Organization, the continuation or expansion of war or other hostilities, or a prolonged government shutdown may have significant adverse effects on the Fund and its investments and alter current assumptions and expectations. For example, in late February 2022, Russia invaded Ukraine, significantly amplifying existing geopolitical tensions among Russia and other countries in the region and in the west. Global response to Russia’s actions, the larger overarching tensions, and Ukraine’s military response may increase financial market volatility generally, have severe adverse effects on global economic markets, and cause volatility in the price of agricultural products, including agricultural futures, and the share price of the Fund.

The price per bushel of soybeans in the United States is primarily a function of both U.S. and global production and demand. The price per bushel of soybeans can be affected by the price of corn; because corn and soybeans are planted on the same acres, farmers must choose which crop to plant each year. If corn prices rise enough to incentivize the planting of corn over soybeans, the supply and price of soybeans could be affected. Long term impacts from sanctions, shipping disruptions, collateral war damage, and a potential expansion of the conflict between Russia and Ukraine could further disrupt the availability of agricultural products and supplies. China remains the largest importer of soybeans in the world. Volatility, trading volumes, and prices in global corn and soybean markets have risen dramatically and are expected to continue indefinitely at elevated levels. Given all of the above factors, the Sponsor has no ability to discern when current high levels of volatility will subside.

Recent geopolitical, economic and inflationary events may have impacted the level of “backwardation” that the Fund's holdings experienced and potentially placed upward pressure on the prices of a wide variety of commodities. As a result, near to expire contracts trade at a higher price than longer to expire contracts, a situation referred to as “backwardation.” Putting aside the impact of the overall movement in prices of soybeans and soybean futures, the Benchmark Component Futures Contracts (the soybean futures contracts that the Fund invests in to achieve its investment objective) would tend to rise as they approach expiration. This backwardation may benefit the Fund because it will sell more expensive contracts and buy less expensive contracts on an ongoing basis.

Conversely, in the event of a soybean futures market where near to expire contracts trade at a lower price than longer to expire contracts, a situation referred to as “contango,” then absent the impact of the overall movement in soybean prices the value of the Benchmark Component Futures Contracts would tend to decline as they approach expiration. If the prices of soybean and soybean futures were to decline, for example the Fund would experience the negative impact of contango.

The soybean processing industry converts soybeans into soybean meal, soybean hulls, and soybean oil. Soybean meal and soybean hulls are processed into soy flour or soy protein, which are used, along with other commodities, by livestock producers and the fish farming industry as feed. Soybean oil is sold in multiple grades and is used by the food, petroleum and chemical industries. The food industry uses soybean oil in cooking and salad dressings, baking and frying fats, and butter substitutes, among other uses. In addition, the soybean industry continues to introduce soy-based products as substitutes to various petroleum-based products including lubricants, plastics, inks, crayons and candles. Soybean oil is also converted to biodiesel and renewable diesel for use as fuel.

Standard Soybean Futures Contracts trade on the CBOT in units of 5,000 bushels, although 1,000 bushel “mini-sized” Soybean Futures Contracts also trade. Three grades of soybeans are deliverable under CBOT Soybean Futures Contracts: Number 1 yellow, which may be delivered at 6 cents per bushel over the contract price; Number 2 yellow, which may be delivered at the contract price; and Number 3 yellow, which may be delivered at 6 cents per bushel under the contract price. There are seven months each year in which CBOT Soybean Futures Contracts expire: January, March, May, July, August, September and November.

If the futures market is in a state of backwardation (i.e., when the price of soybeans in the future is expected to be less than the current price), the Fund will buy later to expire contracts for a lower price than the sooner to expire contracts that it sells. Hypothetically, and assuming no changes to either prevailing soybean prices or the price relationship between immediate delivery, soon to expire contracts and later to expire contracts, the value of a contract will rise as it approaches expiration. If the futures market is in contango, the Fund will buy later to expire contracts for a higher price than the sooner to expire contracts that it sells. Hypothetically, and assuming no other changes to either prevailing soybean prices or the price relationship between the spot price, soon to expire contracts and later to expire contracts, the value of a contract will fall as it approaches expiration. Historically, the soybeans futures markets have experienced periods of both contango and backwardation. Frequently, whether contango or backwardation exists is a function, among other factors, of the seasonality of the soybean market and the soybean harvest cycle. All other things being equal, a situation involving prolonged periods of contango may adversely impact the returns of the Fund; conversely a situation involving prolonged periods of backwardation may positively impact the returns of the Fund.

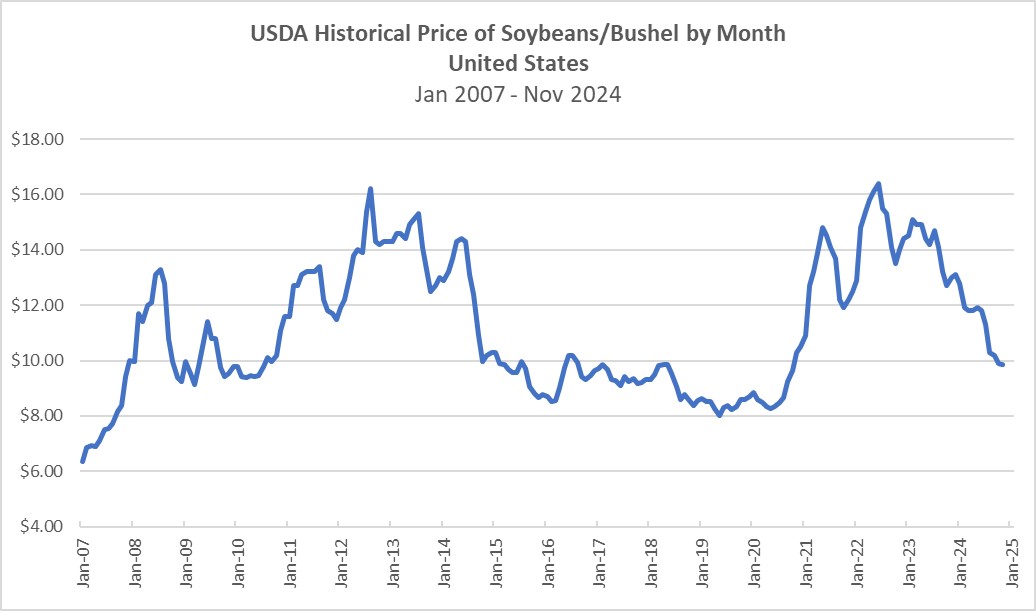

The price per bushel of soybeans in the United States is primarily a function of both U.S. and global production, as well as U.S. and global demand. The graph below shows the USDA published price per bushel by month for the period January 2007 to November 2024.

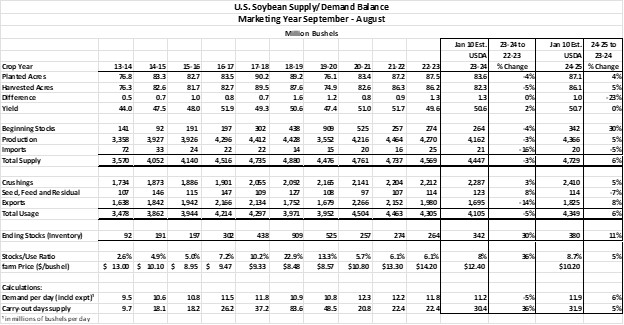

On January 10, 2025, the USDA released its monthly World Agricultural Supply and Demand Estimates (WASDE) for the Crop Year 2024-25. The exhibit below provides a summary of historical and current information for United States soybean production.

The Sugar Market

Sugarcane accounts for nearly 79% of the world’s sugar production, while sugar beets account for the remainder of the world’s sugar production. Sugar manufacturers use sugar beets and sugarcane as the raw material from which refined sugar (sucrose) for industrial and consumer use is produced. Sugar is produced in various forms, including granulated, powdered, liquid, brown, and molasses. The food industry (in particular, producers of baked goods, beverages, cereal, confections, and dairy products) uses sugar and sugarcane molasses to make sugar-containing food products. Sugar beet pulp and molasses products are used as animal feed ingredients. Ethanol is an important by-product of sugarcane processing. Additionally, the material that is left over after sugarcane is processed is used to manufacture paper, cardboard, and “environmentally friendly” eating utensils.

As a general matter, the occurrence of a severe weather event, natural disaster, terrorist attack, geopolitical events, outbreak, or public health emergency as declared by the World Health Organization, the continuation or expansion of war or other hostilities, or a prolonged government shutdown may have significant adverse effects on the Fund and its investments and alter current assumptions and expectations. For example, in late February 2022, Russia invaded Ukraine, significantly amplifying existing geopolitical tensions among Russia and other countries in the region and in the west. The responses of countries and political bodies to Russia’s actions, the larger overarching tensions, and Ukraine’s military response and the potential for wider conflict may increase financial market volatility generally, have severe adverse effects on global economic markets, and cause volatility in the price of agricultural products, including agricultural futures, and the share price of the Fund.

The price per pound of sugar in the United States is primarily a function of both U.S. and global production and demand as well as expansive protectionist policies implemented by the US Government. Long term impacts from sanctions, shipping disruptions, collateral war damage, and a potential expansion of the conflict between Russia and Ukraine could further disrupt the availability of agricultural products and supplies. Russian production of sugar comes primarily from sugar beets. Ukraine’s sugar production is small and relatively inconsequential to global sugar markets. Now at question is the ability of farmers in both countries to plant this season’s sugar beet crop. Volatility, trading volumes, and prices in global sugar markets have risen dramatically and are expected to continue indefinitely at extreme elevated levels. Given all of the above factors, the Sponsor has no ability to discern when current high levels of volatility will subside.

Recent geopolitical, economic and inflationary events may have impacted the level of “backwardation” that the Fund's holdings experienced and potentially placed upward pressure on the prices of a wide variety of commodities. As a result, near to expire contracts trade at a higher price than longer to expire contracts, a situation referred to as “backwardation.” Putting aside the impact of the overall movement in prices of sugar and sugar futures, the Benchmark Component Futures Contracts (the sugar futures contracts that the Fund invests in to achieve its investment objective) would tend to rise as they approach expiration. This backwardation may benefit the Fund because it will sell more expensive contracts and buy less expensive contracts on an ongoing basis.

Conversely, in the event of a sugar futures market where near to expire contracts trade at a lower price than longer to expire contracts, a situation referred to as “contango,” then absent the impact of the overall movement in sugar prices the value of the Benchmark Component Futures Contracts would tend to decline as they approach expiration. If the prices of sugar and sugar futures were to decline, for example, because of a resolution of the Russia-Ukraine conflict, the Fund would experience the negative impact of contango.

The Sugar No. 11 Futures Contract is the world benchmark contract for raw sugar trading. This contract prices the physical delivery of raw cane sugar, delivered to the receiver’s vessel at a specified port within the country of origin of the sugar. Sugar No. 11 Futures Contracts trade on ICE Futures US and the NYMEX in units of 112,000 pounds.

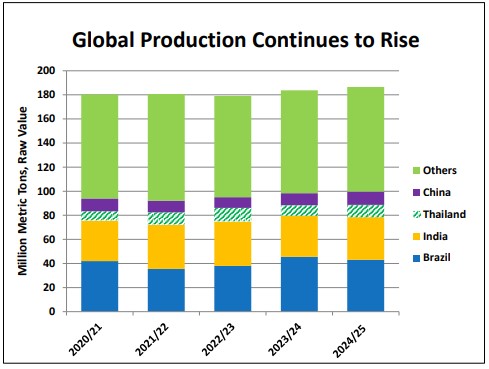

The United States Department of Agriculture (“USDA”) publishes two major reports annually on U.S. domestic and worldwide sugar production and consumption. These are usually released in November and May. In addition, the USDA publishes periodic, but not as comprehensive, reports on sugar monthly. These reports are available on the USDA’s website, www.usda.gov, at no charge. The USDA’s November 2024 report for the 2024-25 Marketing year estimated global production of 186.6 MMT with higher production in China, India and Thailand expected to more than offset declines in Brazil. Consumption is expected to rise due to growth in markets such as India. Stocks are forecast lower as reduced stocks in Thailand are projected to offset a rise in stocks in India. Sugar is a staple commodity used pervasively across the globe so that any contractions in consumption may only be temporary as has historically been the case.

Source: https://apps.fas.usda.gov/psdonline/circulars/sugar.pdf

If the futures market is in a state of backwardation (i.e., when the price of sugar in the future is expected to be less than the current price), the Fund will buy later to expire contracts for a lower price than the sooner to expire contracts that it sells. Hypothetically, and assuming no changes to either prevailing sugar prices or the price relationship between immediate delivery, soon to expire contracts and later to expire contracts, the value of a contract will rise as it approaches expiration. If the futures market is in contango, the Fund will buy later to expire contracts for a higher price than the sooner to expire contracts that it sells. Hypothetically, and assuming no other changes to either prevailing sugar prices or the price relationship between the spot price, soon to expire contracts and later to expire contracts, the value of a contract will fall as it approaches expiration. Historically, the sugar futures markets have experienced periods of both contango and backwardation. Frequently, whether contango or backwardation exists is a function, among other factors, of the seasonality of the sugar market and the sugar harvest cycle. All other things being equal, a situation involving prolonged periods of contango may adversely impact the returns of the Funds; conversely a situation involving prolonged periods of backwardation may positively impact the returns of the Funds.

Futures contracts may be either bought or sold long or short. The CFTC weekly releases the “Commitment of Traders” (COT) report, which depicts the open interest as well as long and short positions in the market. Market participants may use this report to gauge market sentiment.

The Wheat Market

Wheat is used to produce flour, the key ingredient for breads, pasta, crackers, and many other food products, as well as several industrial products such as starches and adhesives. Wheat by-products are used in livestock feeds. Wheat is the principal food grain produced in the United States, and the United States’ output of wheat is typically exceeded only by that of China, the European Union, Russia, and India. The United States Department of Agriculture (“USDA”) estimates that for 2024-25, the principal global producers of wheat will be the EU, Russia, Ukraine, China, India, the United States, Australia, and Canada. The U.S. generates approximately 7% of global production, with approximately 43% of that being exported. For 2024-25, based on the January 10, 2025 USDA report, global consumption of 802 MMT is estimated to be slightly higher than production of 793 MMT. If the global demand for wheat is not equal to global supply, this may have an impact on the price of wheat. Global wheat consumption may fluctuate year over year due to any number of reasons which may include, but is not limited to, economic conditions, global health concerns, international trade policy. Wheat is a staple commodity used pervasively across the globe so that any contractions in consumption may only be temporary as has historically been the case. The USDA publishes weekly, monthly, quarterly, and annual updates for U.S. domestic and worldwide wheat production and consumption. These reports are available on the USDA’s website, www.usda.gov, at no charge. The outlook provided herein is from the January 10, 2025 USDA report.

As a general matter, the occurrence of a severe weather event, natural disaster, terrorist attack, geopolitical events, outbreak, or public health emergency as declared by the World Health Organization, the continuation or expansion of war or other hostilities, or a prolonged government shutdown may have significant adverse effects on the Fund and its investments and alter current assumptions and expectations. For example, in late February 2022, Russia invaded Ukraine, significantly amplifying already existing geopolitical tensions among Russia and other countries in the region and in the west. The responses of countries and political bodies to Russia’s actions, the larger overarching tensions, and Ukraine’s military response and the potential for wider conflict may increase financial market volatility generally, have severe adverse effects on regional and global economic markets, and cause volatility in the price of wheat, wheat futures and the share price of the Fund.

The price per bushel of wheat in the United States is primarily a function of both U.S. and global wheat production and demand. Russia and Ukraine, historically, have constituted the top export supply of wheat by volume (approximately 30 percent of total global wheat exports) to the world. The escalating conflict between the two countries, including but not limited to, sanctions, shipping disruptions, and collateral war damage could further disrupt the availability of wheat supplies. The conflict has greatly impacted exports of the wheat crop that was harvested last season and is currently in storage. In addition, the ability of farmers in both countries to plant fall crops could be greatly impacted. As such, volatility, trading volumes, and prices in global wheat markets have risen dramatically and are expected to continue indefinitely at extreme elevated levels. Given all of the above factors, the Sponsor has no ability to discern when current high levels of volatility will subside.

Recent geopolitical, economic and inflationary events may have impacted the level of “backwardation” that the Fund's holdings experienced and potentially placed upward pressure on the prices of a wide variety of commodities. As a result, near to expire contracts trade at a higher price than longer to expire contracts, a situation referred to as “backwardation.” Putting aside the impact of the overall movement in prices of wheat and wheat futures, the Benchmark Component Futures Contracts (the wheat futures contracts that the Fund invests in to achieve its investment objective) would tend to rise as they approach expiration. This backwardation may benefit the Fund because it will sell more expensive contracts and buy less expensive contracts on an ongoing basis.

Conversely, in the event of a wheat futures market where near to expire contracts trade at a lower price than longer to expire contracts, a situation referred to as “contango,” then absent the impact of the overall movement in wheat prices the value of the Benchmark Component Futures Contracts would tend to decline as they approach expiration. If the prices of wheat and wheat futures were to decline, for example, because of a resolution of the Russia-Ukraine conflict, the Fund would experience the negative impact of contango.

There are several types of wheat grown in the U.S., which are classified in terms of color, hardness, and growing season. CBOT Wheat Futures Contracts call for delivery of #2 soft red winter wheat, which is generally grown in the eastern third of the United States, but other types and grades of wheat may also be delivered (Grade #1 soft red winter wheat, Hard Red Winter, Dark Northern Spring and Northern Spring wheat may be delivered at 3 cents premium per bushel over the contract price and #2 soft red winter wheat, Hard Red Winter, Dark Northern Spring and Northern Spring wheat may be delivered at the contract price.) Winter wheat is planted in the fall and is harvested in the late spring or early summer of the following year, while spring wheat is planted in the spring and harvested in late summer or fall of the same year. Standard Wheat Futures Contracts trade on the CBOT in units of 5,000 bushels. There are five months each year in which CBOT Wheat Futures Contracts expire: March, May, July, September, and December.

If the futures market is in a state of backwardation (i.e., when the price of wheat in the future is expected to be less than the current price), the Fund will buy later to expire contracts for a lower price than the sooner to expire contracts that it sells. Hypothetically, and assuming no changes to either prevailing wheat prices or the price relationship between immediate delivery, soon to expire contracts and later to expire contracts, the value of a contract will rise as it approaches expiration. If the futures market is in contango, the Fund will buy later to expire contracts for a higher price than the sooner to expire contracts that it sells. Hypothetically, and assuming no other changes to either prevailing wheat prices or the price relationship between the spot price, soon to expire contracts and later to expire contracts, the value of a contract will fall as it approaches expiration. Historically, the wheat futures markets have experienced periods of both contango and backwardation. Frequently, whether contango or backwardation exists is a function, among other factors, of the seasonality of the wheat market and the wheat harvest cycle. All other things being equal, a situation involving prolonged periods of contango may adversely impact the returns of the Fund; conversely a situation involving prolonged periods of backwardation may positively impact the returns of the Fund.

Futures contracts may be either bought or sold long or short. The CFTC weekly releases the “Commitment of Traders” (COT) report, which depicts the open interest as well as long and short positions in the market. Market participants may use this report to gauge market sentiment.

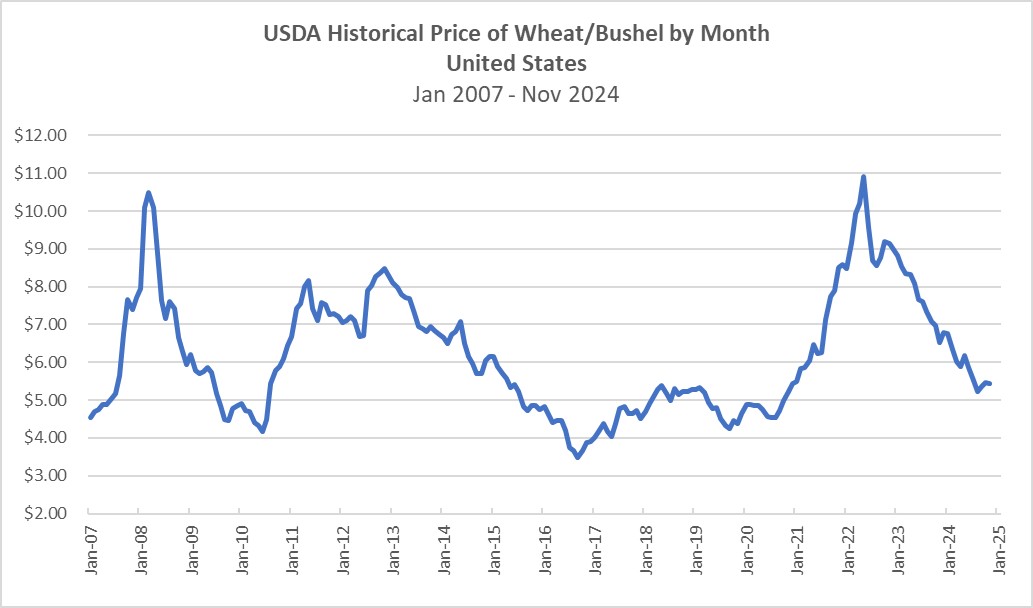

The price per bushel of wheat in the United States is primarily a function of both U.S. and global production, as well as U.S. and global demand. The graph below shows the USDA published price per bushel by month for the period January 2007 to November 2024.

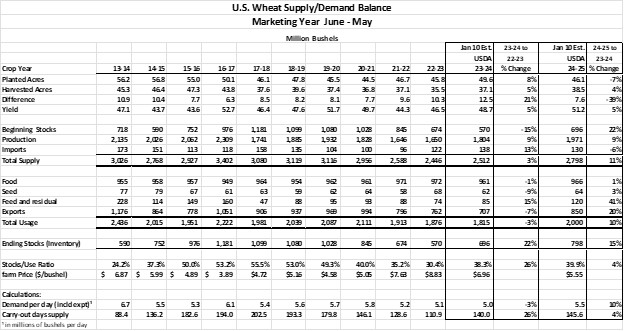

On January 10, 2025, the USDA released its monthly World Agricultural Supply and Demand Estimates (WASDE) for the Crop Year 2024-25. The exhibit below provides a summary of historical and current information for United States wheat production.

The Sponsor’s Operations

The Sponsor established the Trust and caused the Trust to establish the first series, the Corn Fund, which commenced offering its Shares to the public on June 9, 2010. Three additional series, namely the Sugar Fund, the Soybean Fund and the Wheat Fund, commenced offering of Shares in September 2011 and the Teucrium Agricultural Fund commenced operation on March 28, 2012. The Hashdex Bitcoin Futures ETF commenced operations on September 16, 2022. In addition to establishing these series, operating those series that have commenced offering their Shares, and obtaining capital from a small number of outside investors in order to engage in these activities, the Sponsor also offers Commodity Trading Advisory services to U.S. ETFs.

Teucrium Investment Advisors, LLC, a wholly owned subsidiary of the Sponsor, which was formed on January 4, 2022.

The Trust and the Funds do not have any employees or officers. Any persons acting as agents of the Trust, or the Funds do so as employees or officers of the Sponsor.

Under the Trust Agreement, the Sponsor is solely responsible for the management, and conducts or directs the conduct of the business of the Trust, the Funds, and any series of the Trust that may from time to time be established and designated by the Sponsor. The Sponsor is required to oversee the purchase and sale of Shares by Authorized Purchasers and to manage the Fund’s investments, including to evaluate the credit risk of futures commission merchants (FCMs) and swap counterparties and to review daily positions and margin/collateral requirements. The Sponsor has the power to enter into agreements as may be necessary or appropriate for the offer and sale of the Fund’s Shares and the oversight of the Trust’s activities. Accordingly, the Sponsor is responsible for selecting service providers for the Trust, such as the Trustee, Administrator, Marketing Agent, the independent registered public accounting firm of the Trust, and any legal counsel employed by the Trust. The Sponsor is also responsible for preparing and filing periodic reports on behalf of the Trust with the SEC and will provide any required certification for such reports. The Sponsor also maintains a website on behalf of each of the Agricultural Funds. No person other than the Sponsor and its principals was involved in the organization of the Trust or the Funds.

A portion of the aggregate common expenses of the Funds is related to the Sponsor or related parties of principals of the Sponsor; these are necessary services to the Trust and the Funds, which are primarily the cost of performing accounting and financial reporting, regulatory compliance, and trading activities that are directly attributable to the Trust and the Funds. For the period ended December 31, such expenses, which are primarily included as distribution and marketing fees, totaled $2,629,898 in 2024, $2,656,282 in 2023, and $2,721,842 in 2022; of these amounts, $68,233 in 2024, $70,069 in 2023, and $518,599 in 2022 were waived by the Sponsor.

All asset-based fees and expenses for the Funds are calculated on the prior day’s net assets.

The Sponsor has an information security program and policy aligned with the NIST Cybersecurity Framework, ensuring compliance with SEC and FINRA regulations. The Sponsor engages Align to provide fully outsourced IT services, including 24x7x365 support, cybersecurity monitoring, and disaster recovery. Align’s services encompass Office365 security features such as anti-phishing, encryption, and advanced threat protection, alongside endpoint security via Microsoft Entra ID and Intune, enforcing policies like MFA, BitLocker encryption, and geo-blocking.

Key service providers’ cybersecurity measures are integral to the Sponsor’s disaster recovery and business continuity planning. Employees receive regular cybersecurity training, with real-time updates as needed. The information security plan is reviewed and updated at least annually to address evolving threats and regulatory requirements.

Ownership or “membership” interests in the Sponsor are owned by persons referred to as “members.” The Sponsor currently has three voting or “Class A” members - Mr. Sal Gilbertie, Van Eck Associates Corporation and Mr. Carl N. Miller III - and a small number of non-voting or “Class B” members who have provided working capital to the Sponsor. Mr. Gilbertie currently owns 46%, Van Eck Associates Corporation currently own 49%, and Mr. Miller owns 5% of the Sponsor’s Class A membership interests.

Management of the Sponsor

In general, under the Sponsor’s Amended and Restated Limited Liability Company Operating Agreement, as amended from time to time, the Sponsor (and as a result the Trust and each Fund) is managed by the officers of the Sponsor. The Chief Executive Officer of the Sponsor is responsible for the overall strategic direction of the Sponsor and has general control of its business. The Chief Investment Officer and President of the Sponsor is primarily responsible for new investment product development with respect to the Funds. The Chief Operating Officer has primary responsibility for trade operations, trade execution, and portfolio activities with respect to the Fund. The Chief Financial Officer, Chief Accounting Officer and Chief Compliance Officer acts as the Sponsor’s principal financial and accounting officers. Furthermore, certain fundamental actions regarding the Sponsor, such as the removal of officers, the addition or substitution of members, or the incurrence of liabilities other than those incurred in the ordinary course of business and de minimis liabilities, may not be taken without the affirmative vote of a majority of the Class A members (which is generally defined as the affirmative vote of Mr. Gilbertie and Van Eck Associates Corporation). The Sponsor has no board of directors, and the Trust has no board of directors or officers. The three Class A members of the Sponsor are Sal Gilbertie, Van Eck Associates Corporation and Carl N. Miller III. A discussion concerning the officers of the Sponsor is incorporated herein under Item 10 of this report.

The Custodian and Administrator

In its capacity as the Fund’s custodian, the Custodian, currently U.S. Bank, N.A., holds the Funds’ securities, cash and/or cash equivalents pursuant to a custodial agreement. U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services ("Global Fund Services"), an entity affiliated with U.S. Bank, N.A., is the registrar and transfer agent for the Funds. In addition, Global Fund Services also serves as Administrator for the Fund, performing certain administrative, accounting services, and preparing certain SEC and CFTC reports on behalf of the Fund. For these services, the Funds pays fees to the Custodian and Global Fund Services set forth in the table entitled “Contractual Fees and Compensation Arrangements with the Sponsor and Third-Party Service Providers.”

The Custodian is located at 5065 Wooster Rd, Cincinnati Ohio 45226 and is regulated by the Office of the Comptroller of the Currency. The Custodian is a national banking association organized and existing under the laws of the United States of America with its principal place of business at Minneapolis, Minnesota.

The Marketing Agent

The Sponsor employs PINE Distributors, LLC (“PINE” or the “Marketing Agent”) as the Marketing Agent for the Funds. The Distribution Services Agreement among the Marketing Agent and the Sponsor calls for the Marketing Agent to work with the Custodian in connection with the receipt and processing of orders for Creation Baskets and Redemption Baskets and the review and approval of all Fund sales literature and advertising materials. The Marketing Agent and the Sponsor have also entered into a Registered Representative Service Agreement (the “RRSA”) under which certain employees and officers of the Sponsor are licensed as registered representatives or registered principals of the Marketing Agent, under Financial Industry Regulatory Authority (“FINRA”) rules.

The Marketing Agent’s principal business address is 501 S. Cherry Street, Suite 610, Denver, CO 80264. The Marketing Agent is a broker-dealer registered with the SEC and a member of FINRA.

The Trustee

The sole Trustee of the Trust is Wilmington Trust Company, a Delaware banking corporation. The Trustee’s principal offices are located at 1100 North Market Street, Wilmington, Delaware 19890-0001. The Trustee is unaffiliated with the Sponsor. The Trustee’s duties and liabilities with respect to the offering of Shares and the management of the Trust and the Fund are limited to its express obligations under the Trust Agreement.

The Trustee will accept service of legal process on the Trust in the State of Delaware and will make certain filings under the Delaware Statutory Trust Act. The Trustee does not owe any other duties to the Trust, the Sponsor or the Shareholders. The Trustee is permitted to resign upon at least sixty (60) days’ notice to the Sponsor. If no successor trustee has been appointed by the Sponsor within such sixty-day period, the Trustee may, at the expense of the Trust, petition a court to appoint a successor. The Trust Agreement provides that the Trustee is entitled to reasonable compensation for its services from the Sponsor or an affiliate of the Sponsor (including the Trust), and is indemnified by the Sponsor against any expenses it incurs relating to or arising out of the formation, operation or termination of the Trust, or any action or inaction of the Trustee under the Trust Agreement, except to the extent that such expenses result from the gross negligence or willful misconduct of the Trustee. The Sponsor has the discretion to replace the Trustee.

Under the Trust Agreement, the duty and authority to manage the business affairs of the Trust, and of all of the funds that are a series of the Trust, including control of the Fund and the Underlying Funds, is vested solely with the Sponsor, which the Sponsor may delegate as provided for in the Trust Agreement. The Trustee has no duty or liability to supervise or monitor the performance of the Sponsor, nor does the Trustee have any liability for the acts or omissions of the Sponsor. As the Trustee has no authority over the operation of the Trust, the Trustee itself is not registered in any capacity with the CFTC.

The Clearing Brokers

Effective as of December 1, 2022, E D & F Man Capital Markets, Inc., one the Fund’s clearing brokers, changed its name to “Marex Capital Markets Inc."