As filed with the Securities and Exchange Commission on July 7, 2021

Registration No. 333-255846

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-11

FOR REGISTRATION UNDER THE SECURITIES ACT OF 1933

OF SECURITIES OF CERTAIN REAL ESTATE COMPANIES

PHILLIPS EDISON & COMPANY, INC.

(Exact Name of Registrant as Specified in its Governing Instruments)

11501 Northlake Drive

Cincinnati, Ohio 45249

(513) 554-1110

(Address, Including Zip Code, and Telephone Number, including Area Code, of Registrant’s Principal Executive Offices)

Jeffrey S. Edison

Chief Executive Officer

11501 Northlake Drive

Cincinnati, Ohio 45249

(513) 554-1110

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Julian T.H. Kleindorfer Bradley A. Helms Lewis W. Kneib Latham & Watkins LLP 355 South Grand Avenue, Suite 100 Los Angeles, California 90071-1560 (213) 485-1234 | Yoel Kranz David Roberts Goodwin Procter LLP 620 Eighth Avenue New York, New York 10018 (212) 813-8800 | ||||

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ☐

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||||||||

| Non-accelerated filer | x | Smaller reporting company | ☐ | |||||||||||

| Emerging growth company | ☐ | |||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act: ☐

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Amount to be Registered(1) | Proposed Maximum Offering Price Per Share | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee(3) | ||||||||||

| Common Stock, $0.01 par value per share | 19,550,000 shares | $31.00 | $606,050,000 | $66,120.06 | ||||||||||

(1)Includes 2,550,000 shares of common stock that the underwriters have the option to purchase.

(2)Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended.

(3)$10,910 of the registration fee was paid with the initial filing of the Registration Statement on May 6, 2021.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated July 7, 2021

PROSPECTUS

17,000,000 Shares

PHILLIPS EDISON & COMPANY, INC.

Common Stock

Phillips Edison & Company, Inc. is an internally-managed real estate investment trust, or REIT, and one of the nation’s largest owners and operators of omni-channel grocery-anchored neighborhood and community shopping centers. We are offering 17,000,000 shares of our common stock as described in this prospectus. All of the shares of our common stock offered by this prospectus are being sold by us. We currently expect the public offering price to be between $28.00 and $31.00 per share. We expect that our common stock will be approved for listing, subject to notice of issuance, on the Nasdaq Global Select Market, or Nasdaq, under the ticker symbol “PECO.” Currently, our common stock is not traded on a national securities exchange, and this will be our first listed public offering.

We were formed as a Maryland corporation in October 2009 and have elected to be taxed as a REIT for U.S. federal income tax purposes beginning with our taxable year ended December 31, 2010. Shares of our common stock are subject to ownership limitations that are primarily intended to assist us in maintaining our qualification as a REIT. Our charter contains certain restrictions relating to the ownership and transfer of our common stock, including, subject to certain exceptions, a 9.8% ownership limit of common stock by value or number of shares, whichever is more restrictive. See “Description of Capital Stock—Restrictions on Ownership and Transfer” beginning on page 165 of this prospectus.

Investing in our common stock involves risk. See “Risk Factors” beginning on page 16 of this prospectus.

| Per Share | Total | |||||||||||||

| Public offering price | ||||||||||||||

Underwriting discount(1) | ||||||||||||||

| Proceeds, before expenses, to us | ||||||||||||||

(1)See the section entitled “Underwriting” for a complete description of the compensation payable to the underwriters.

We have granted the underwriters the option to purchase an additional 2,550,000 shares of our common stock on the same terms and conditions set forth above within 30 days after the date of this prospectus to cover overallotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of our common stock on or about , 2021.

| Joint Book-Running Managers | ||||||||

| Morgan Stanley | BofA Securities | J.P. Morgan | ||||||

| BMO Capital Markets | Goldman Sachs & Co. LLC | KeyBanc Capital Markets | ||||||

| Mizuho Securities | Wells Fargo Securities | |||||||

| Co-Managers | ||||||||

| BTIG | Capital One Securities | Fifth Third Securities | ||||||

| PNC Capital Markets LLC | Regions Securities LLC | |||||||

The date of this prospectus is , 2021

| TABLE OF CONTENTS | PAGE | ||||

| INDUSTRY AND MARKET DATA | |||||

You should rely only on the information contained in this prospectus or in any free writing prospectus prepared by us. We have not, and the underwriters have not, authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and in any free writing prospectus prepared by us is accurate only as of their respective dates or on the date or dates specified in these documents. Our business, financial condition, liquidity, results of operations, and prospects may have changed since those dates.

THE CONTENT OF THIS COMMUNICATION HAS NOT BEEN APPROVED BY AN AUTHORIZED PERSON WITHIN THE MEANING OF THE FINANCIAL SERVICES AND MARKETS ACT 2000. RELIANCE ON THIS COMMUNICATION FOR THE PURPOSE OF ENGAGING IN ANY INVESTMENT ACTIVITY MAY EXPOSE AN INDIVIDUAL TO A SIGNIFICANT RISK OF LOSING ALL OF THE PROPERTY OR OTHER ASSETS INVESTED.

i

MARKET, INDUSTRY, AND OTHER DATA

We use market data throughout the prospectus, generally obtained from publicly available information and industry publications. We have also obtained the information in “Industry and Market Data,” as well as certain information in “Prospectus Summary,” “Our Business and Properties,” and in other sections of this prospectus where indicated, from the market study prepared for us by Jones Lang LaSalle Americas Inc., or JLL, an independent third-party real estate advisory and consulting services firm. Such information is included herein in reliance on JLL's authority as an expert on such matters. See “Experts.” These sources generally state that the information they provide has been obtained from sources believed to be reliable, but the accuracy and completeness of the information are not guaranteed. The market data includes forecasts and projections that are based on industry surveys and the preparers’ experiences in the industry, and there is no assurance that any of the projections or forecasts will be achieved. We believe that the surveys and market research others have performed are reliable, but we have not independently verified this information.

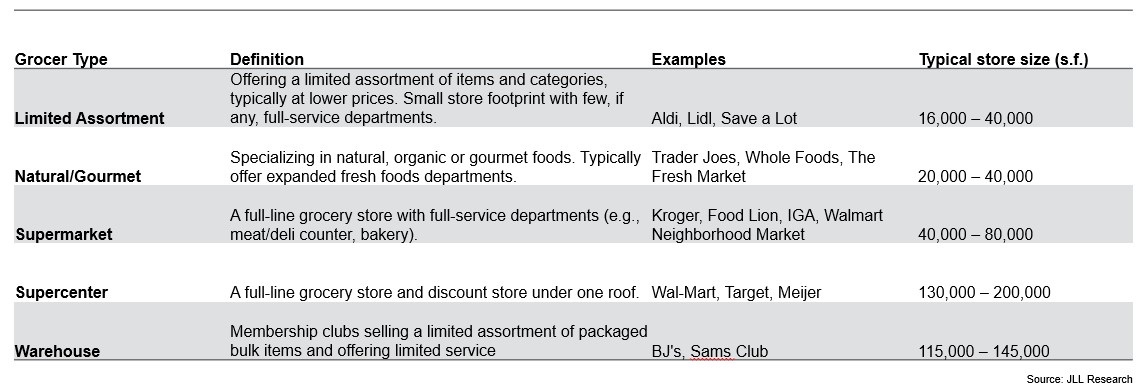

Unless otherwise indicated, references in this prospectus to a grocer’s ranking (e.g., the #1 or #2 grocer) refer to its ranking by sales within its format and trade area (i.e., the 3-mile area surrounding its stores). Store formats include conventional supermarkets, natural and gourmet food supermarkets, supercenters, limited assortment supermarkets and wholesale club stores. We categorize grocery anchors into store formats that are established by Nielsen TDLinx.

Unless otherwise indicated, references in this prospectus to information reported by our public peers or public peer group refer to metrics and data publicly reported by our public peer group, as identified by JLL. See “Certain Terms Used in this Prospectus.” Our public peers may define or calculate such metrics or data differently than we do. Accordingly, such metrics or data for our public peer group and us may not be comparable.

RECAPITALIZATION

Our stockholders approved an amendment to our charter, or Articles of Amendment, that effected a change of each share of our common stock outstanding at the time the amendment became effective into one share of a newly created class of Class B common stock, which we refer to as the “Recapitalization.” The Articles of Amendment became effective upon filing with, and acceptance by, the State Department of Assessments and Taxation of Maryland, or the SDAT, on July 2, 2021.

Our Class B common stock is identical to our common stock offered in this offering, except that (i) we do not intend to list our Class B common stock on a national securities exchange in connection with this offering, and (ii) upon the six-month anniversary of the listing of our common stock for trading on a national securities exchange (or such earlier date or dates as may be approved by our Board in certain circumstances with respect to all or any portion of the outstanding shares of our Class B common stock), each share of our Class B common stock will automatically, and without any stockholder action, convert into one share of our listed common stock.

Unless otherwise indicated, all information in this prospectus gives effect to the Recapitalization.

REVERSE STOCK SPLIT

We effected a one-for-three reverse stock split on July 2, 2021. In addition, we effected a corresponding reverse split of our Operating Partnership’s OP units. As a result of the reverse stock and OP unit splits, every three shares of our common stock and OP units were automatically combined and converted into one issued and outstanding share of common stock or OP unit, as applicable, rounded to the nearest 1/100th share or OP unit. The reverse stock and OP unit splits impacted all classes of common stock and OP units proportionately and had no impact on any stockholder’s or limited partner’s percentage ownership of all issued and outstanding common stock or OP units. Unless otherwise indicated, the information in this prospectus gives effect to the reverse stock and OP unit splits.

ii

CERTAIN DEFINED TERMS USED IN THIS PROSPECTUS

Unless the context otherwise requires, the following terms and phrases are used throughout this prospectus as described below:

“anchor space” means a space greater than or equal to 10,000 square feet of gross leasable area, or GLA;

“ABR” means monthly contractual base rent as of the end of the applicable reporting period, multiplied by 12 months;

“ABR per square foot” is calculated by dividing ABR by leased GLA;

“Board” means the board of directors of Phillips Edison & Company, Inc.;

“BOPIS” means buy-online-pickup-in-store;

“comparable lease” means a lease with consistent structure that is executed for substantially the exact same space that has been vacant less than twelve months;

“comparable rent spread” is calculated as the percentage increase or decrease in first-year ABR (excluding any free rent or escalations) on new or renewal leases (excluding options) where the lease was considered a comparable lease;

“Exchange Act” means the Securities and Exchange Act of 1934, as amended;

“fully diluted basis” means information is presented assuming all outstanding OP units have been exchanged for shares of common stock on a one-for-one basis and includes the incremental impact of (i) 17,000,000 shares of common stock to be issued in connection with this offering, (ii) an aggregate of 905,908 shares of unvested restricted stock, common stock underlying time-based restricted stock units and time-based LTIP units (including the Listing Equity Grants), and (iii) a minimum of 1,000,000 OP units to settle the earn-out we entered into in connection with the PELP Transaction (see “Prospectus Summary—The Offering”);

“GAAP” means generally accepted accounting principles as promulgated by the Financial Accounting Standards Board in the United States of America;

“GLA” means gross leasable area, or the total occupied and unoccupied square footage of a building that is available for our Neighbors or other retailers to lease;

“health ratio,” also commonly referred to as “occupancy cost percentage,” is calculated by dividing (i) the retailer’s annual rent and expense reimbursement paid to the landlord by (ii) such retailer’s annual gross sales (we believe a lower health ratio is an indication of favorable retailer economics);

“inline space” means a space containing less than 10,000 square feet of GLA;

“leased occupancy” is calculated as the percentage of total applicable GLA for which a lease has been signed, regardless of whether the lease has commenced or the Neighbor has taken possession;

“Merger” means the November 2018 merger with Phillips Edison Grocery Center REIT II, Inc., a public non-traded REIT that was advised and managed by us;

“MGCL” means the Maryland General Corporation Law;

“necessity-based goods and services” or “necessity-based retail” means goods and services that are indispensable, necessary, or common for day-to-day living or that tend to be inelastic (i.e., the demand for which does not change based on a consumer’s income level) as further discussed in “Our Business and Properties – Properties”;

“Neighbor” means one of our tenants;

“OP units” means units of limited partnership interest in the Operating Partnership, which are redeemable for cash or, at our election, shares of our common stock on a one-for-one basis;

“Operating Partnership” means Phillips Edison Grocery Center Operating Partnership I, L.P., a Delaware limited partnership, of which Phillips Edison Grocery Center OP GP I LLC, our wholly-owned subsidiary, is the sole general partner (substantially all of our business is conducted through the Operating Partnership);

“PECO,” “Phillips Edison,” “we,” “our,” “us,” and “Company” mean Phillips Edison & Company, Inc., a Maryland corporation, together with its consolidated subsidiaries, including the Operating Partnership; provided, however, that in statements relating to qualification as a REIT, such terms refer solely to Phillips Edison & Company, Inc.;

“PELP Transaction” means the October 2017 transaction pursuant to which we internalized our management structure through the acquisition of certain real estate assets and the third-party investment management business of Phillips Edison Limited Partnership, or PELP, in exchange for OP units and cash;

“portfolio retention rate” is calculated by dividing (i) the total square feet of retained Neighbors with current period lease expirations by (ii) the total square feet of leases expiring during the period (the portfolio retention rate provides insight into our ability to retain Neighbors at our shopping centers as their leases approach expiration; generally, the costs to retain an existing Neighbor are lower than costs to replace with a new Neighbor);

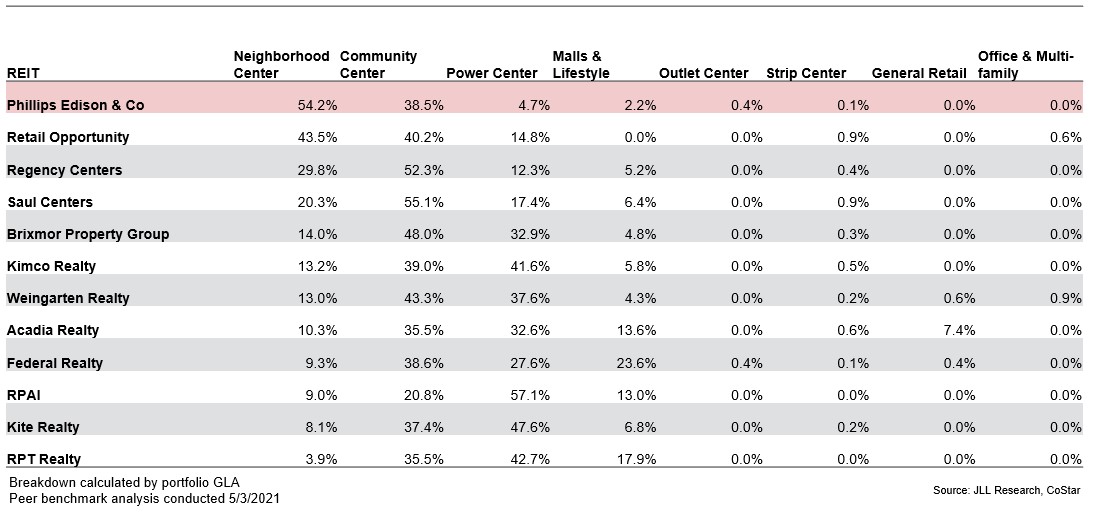

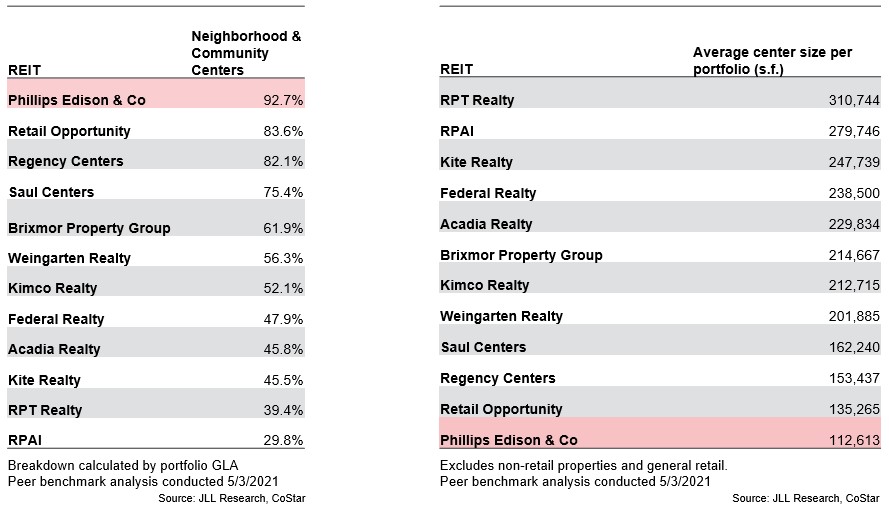

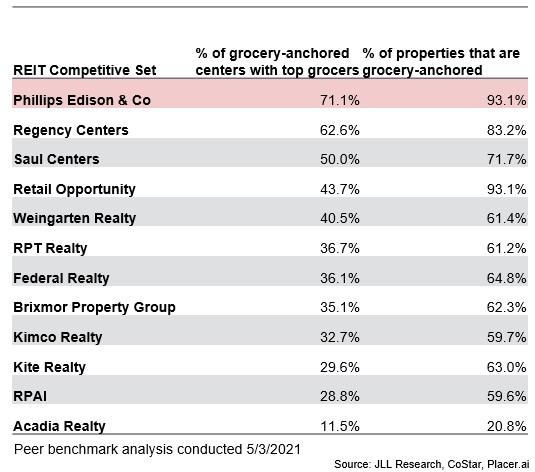

“public peers” or “public peer group” refers to a group of 11 REITs identified by JLL where at least 50% of the portfolio’s shopping centers are neighborhood or community centers and the REIT had a minimum market capitalization of at least $900 million as of the end of trading on May 21, 2021; these 11 REITs are Acadia Realty Trust, Brixmor Property Group Inc., Federal Realty Investment Trust, Kimco Realty Corporation, Kite Realty Group Trust, Regency Centers Corporation, Retail Opportunity Investments Corp., Retail Properties of America, Inc., RPT Realty, Saul Centers, Inc., and Weingarten Realty Investors;

iii

“psf” means per square foot;

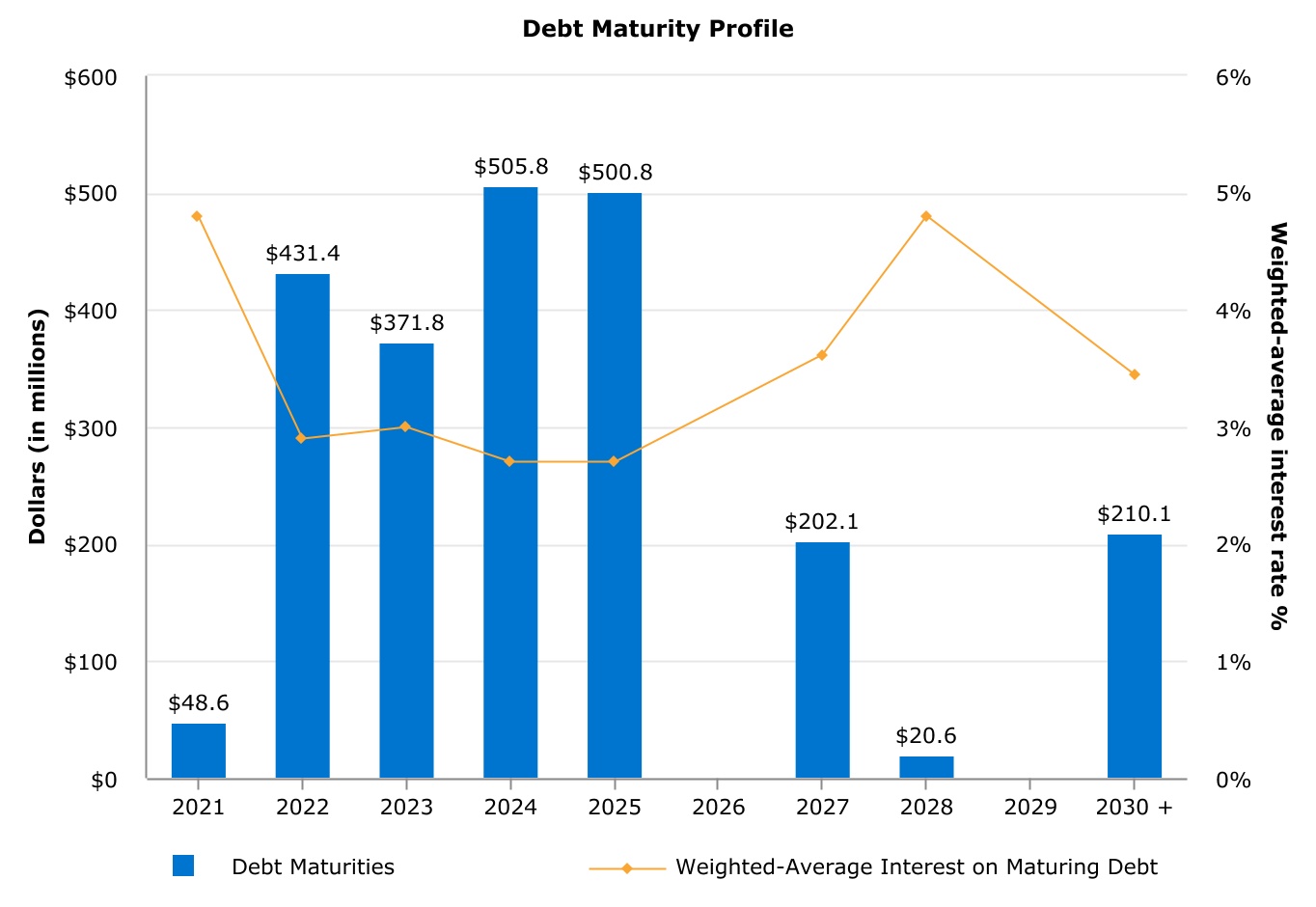

“revolving credit facility” means our $500 million senior unsecured revolving credit facility;

“Refinancing” refers to the new $980 million credit facility the Company entered into on July 2, 2021, comprised of a $500 million senior unsecured revolving credit facility and two $240 million senior unsecured term loan tranches; in connection with the Refinancing, the Company paid off the $472.5 million term loan due 2025;

“Same-Center” means a property, or portfolio of properties, that have been owned and operational for the entirety of each of the applicable reporting periods (e.g., since January 1, 2019 for the 2020 Same-Center portfolio or since January 1, 2020 for the 2021 Same-Center portfolio); for the purposes of comparing Same-Center NOI for the years ended 2019, 2018, 2017, and 2016, “Same-Center NOI” refers to “Same-Center NOI (Adjusted for Transactions)”;

“Same-Center NOI (Adjusted for Transactions)” is Same-Center NOI presented as if the PELP Transaction and the Merger had occurred on January 1 of the earliest comparable period in each presentation (see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Measures”);

“Securities Act” means the Securities Act of 1933, as amended;

“Sun Belt” means the following U.S. states: Alabama, Arizona, California, Florida, Georgia, Louisiana, Mississippi, Nevada, New Mexico, South Carolina, Tennessee, and Texas;

“top grocers” means the top three grocers in each state, as identified by JLL, based on the number of visitors that grocer received in each state in the month of March 2021, as estimated by Placer.ai;

“trade area” means the 3-mile area surrounding a shopping center;

“unconsolidated joint ventures” means the two unconsolidated third-party institutional joint ventures through which we have equity interests in 22 shopping centers; and

“wholly-owned properties,” “wholly-owned portfolio,” “wholly-owned centers” and other similar terms mean the 278 shopping centers we owned and consolidated in our financial statements as of March 31, 2021 and excludes (i) two shopping centers we disposed of subsequent to March 31, 2021 and (ii) 22 shopping centers owned by two unconsolidated joint ventures in which we had equity interests as of March 31, 2021.

iv

PROSPECTUS SUMMARY

This summary highlights some of the information in this prospectus. It does not contain all of the information that you should consider before investing in our common stock. You should read carefully the more detailed information set forth under the heading “Risk Factors” and the other information included in this prospectus. Unless otherwise indicated, the information contained in this prospectus assumes that the common stock to be sold in this offering is sold at $29.50 per share, which is the midpoint of the price range set forth on the front cover of this prospectus, and that the underwriters do not exercise their option to purchase up to an additional 2,550,000 shares of our common stock to cover overallotments, if any.

Company Overview

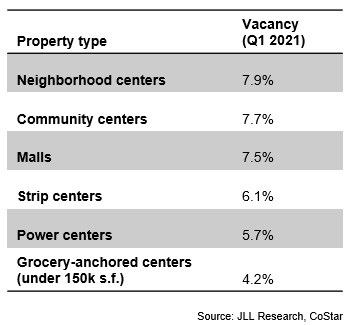

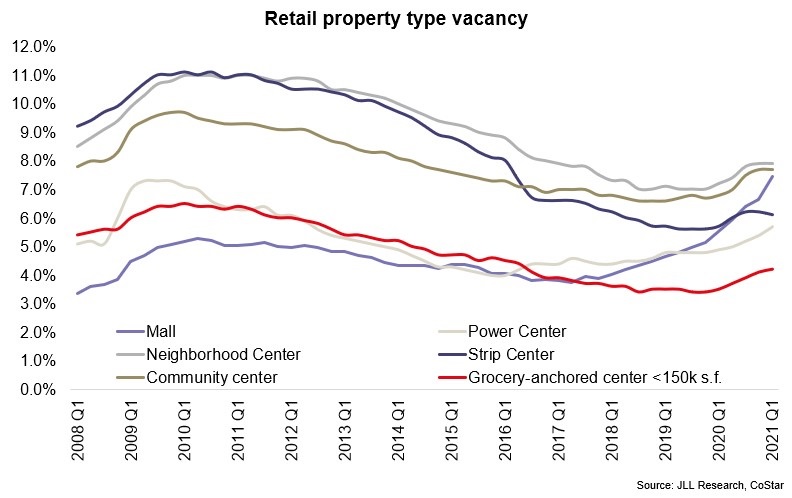

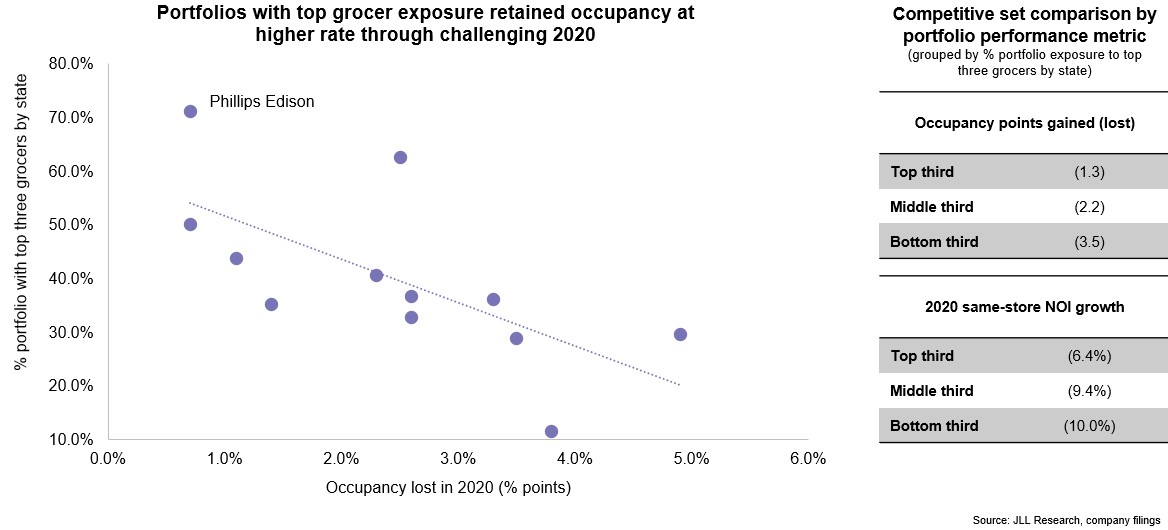

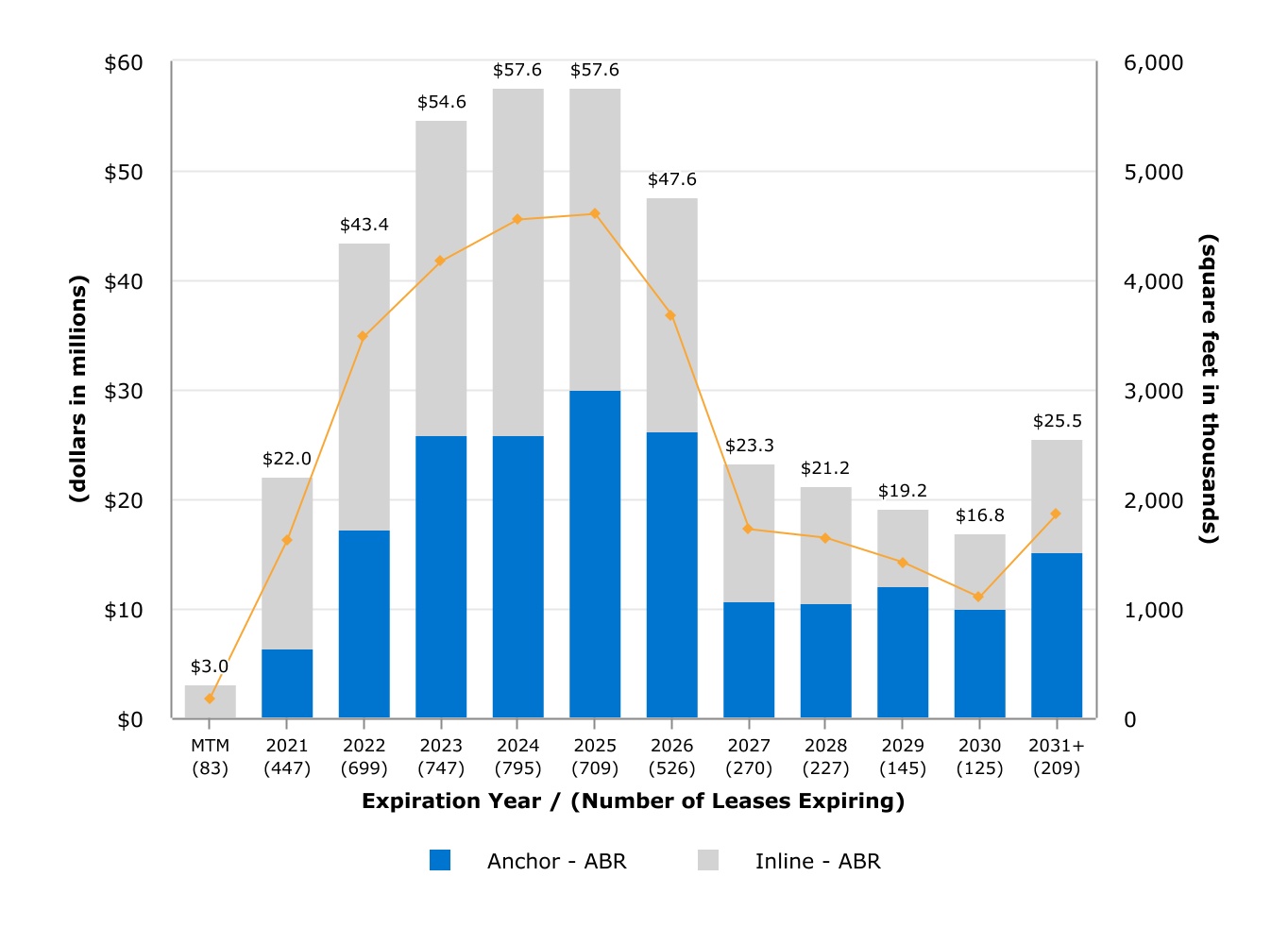

Phillips Edison is one of the nation’s largest owners and operators of omni-channel grocery-anchored shopping centers and has the highest percentage of its properties anchored by top grocers among its public peers, according to JLL. Grocery-anchored neighborhood shopping centers have been our primary focus since we started our business in 1991, and we believe this focus has generated superior growth and attractive risk-adjusted returns over time. Our portfolio primarily consists of neighborhood centers anchored by the #1 or #2 grocer tenants by sales within their respective formats by trade area. As of March 31, 2021, our portfolio was 94.8% occupied. Our tenants, who we refer to as “Neighbors,” are a mix of national, regional, and local retailers that primarily provide necessity-based goods and services.

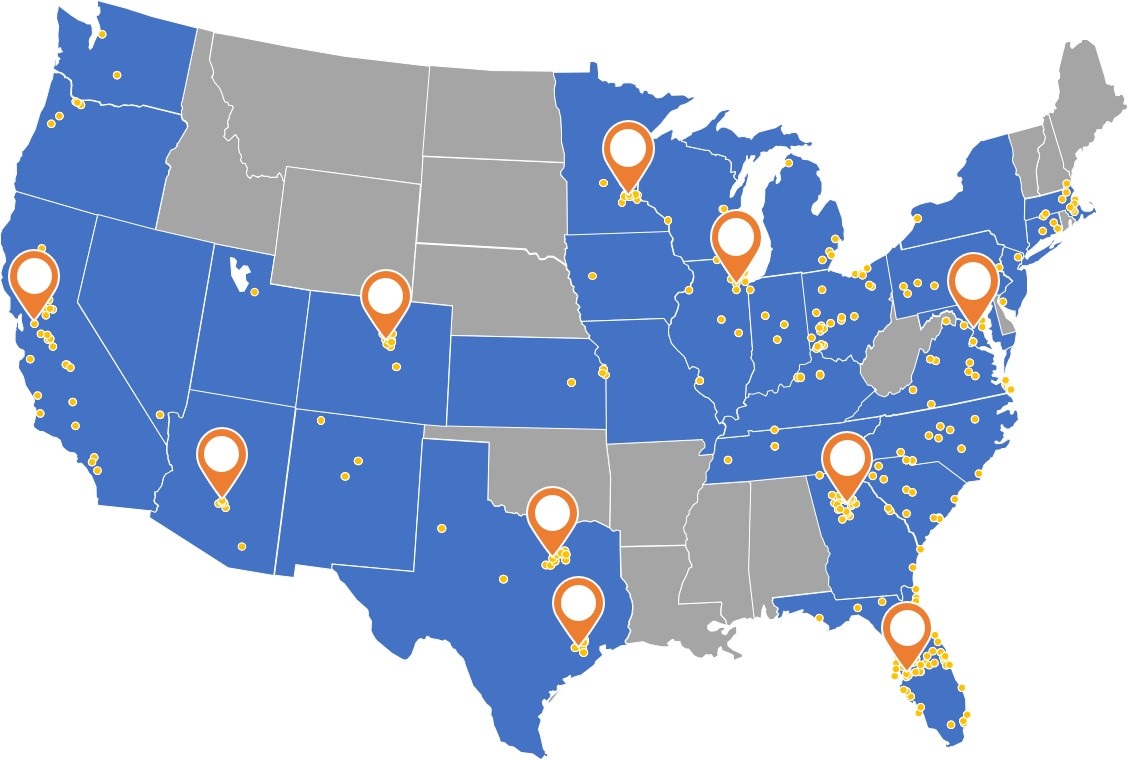

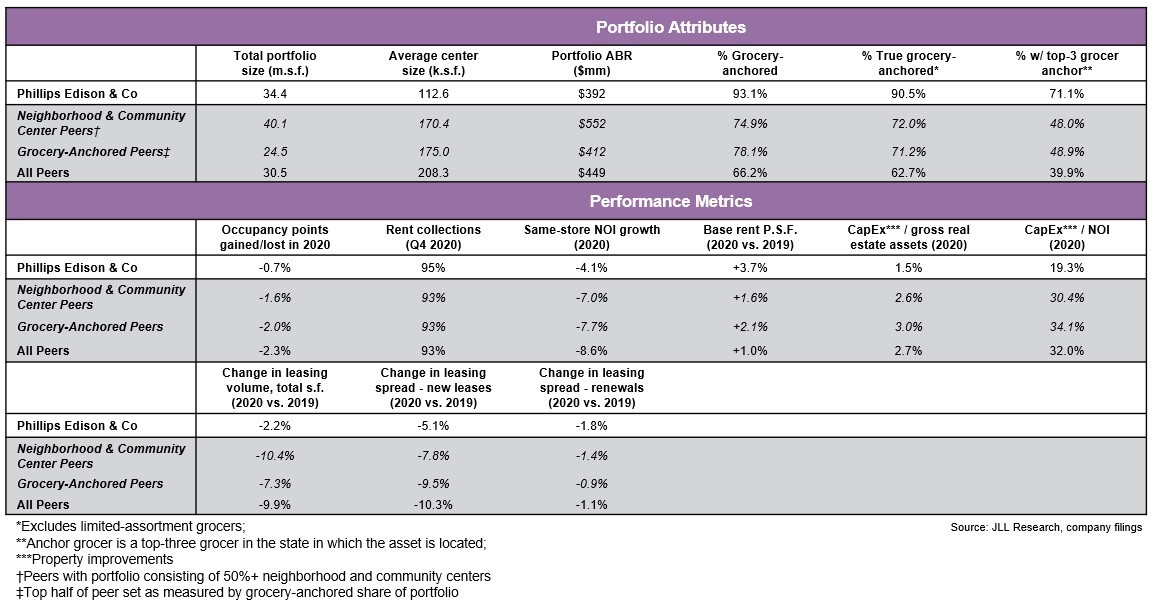

As of March 31, 2021, we owned equity interests in 300 shopping centers, including 278 wholly-owned properties which contributed more than 98% of our ABR, and 22 shopping center properties owned through two unconsolidated third-party institutional joint ventures. In total, our portfolio of wholly-owned shopping centers and our prorated portion of shopping centers owned through our unconsolidated institutional joint ventures comprises approximately 31.7 million square feet in 31 states. The following table provides the percentage of our total ABR that was generated in each of the indicated U.S. geographic regions as of March 31, 2021:

| % ABR by Region | ||||||||||||||

Sun Belt(1) | Midwest(2) | East(3) | Mountain(4) | Total | ||||||||||

| 48.8% | 25.5% | 19.0% | 6.7% | 100.0% | ||||||||||

(1)Includes Arizona, California, Florida, Georgia, Nevada, New Mexico, South Carolina, Tennessee, and Texas.

(2)Includes Illinois, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Missouri, Ohio, and Wisconsin.

(3)Includes Connecticut, Maryland, Massachusetts, New Jersey, New York, North Carolina, Pennsylvania, and Virginia.

(4)Includes Colorado, Oregon, Utah, and Washington.

As of March 31, 2021, 96.4% of our ABR was generated from omni-channel grocery-anchored shopping centers and 82.2% of our ABR was generated from shopping centers with the #1 or #2 grocer by sales within their respective format. Phillips Edison has the highest share of its centers anchored by top grocers among its public peers, according to JLL.

As of March 31, 2021, our top five Neighbors were grocers:

•Kroger, which includes such banners as Ralphs, Harris Teeter, King Soopers, and Smith’s, anchors 54 locations and generates 6.6% of our ABR — we are Kroger’s largest landlord by number of stores;

•Publix, which anchors 47 locations and generates 5.5% of our ABR — we are Publix’s second largest landlord by number of stores;

•Ahold Delhaize, which includes such banners as Stop & Shop and Giant, anchors 23 locations and generates 4.5% of our ABR;

•Albertsons-Safeway, which includes such banners as Safeway and Jewel-Osco, anchors 28 locations and generates 4.3% of our ABR; and

•Walmart, which anchors 13 locations and generates 2.3% of our ABR.

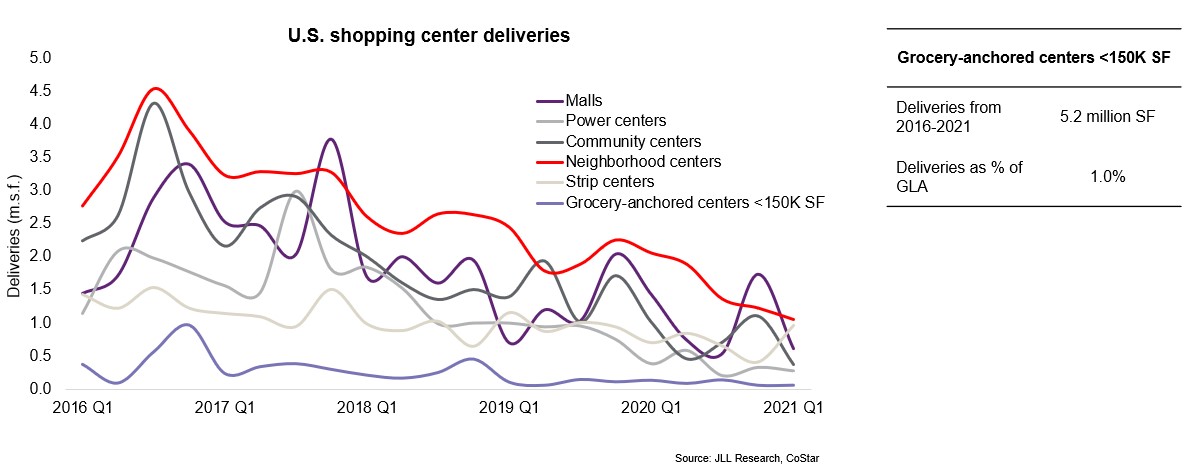

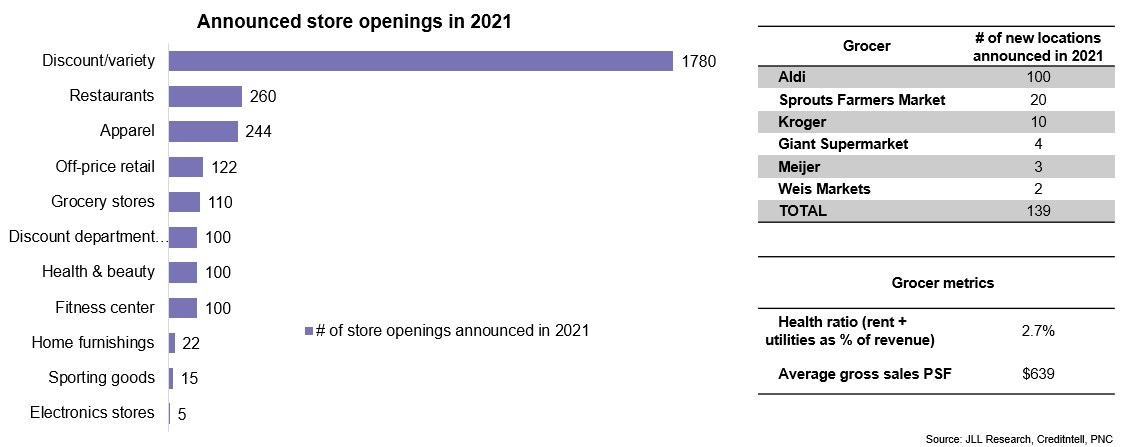

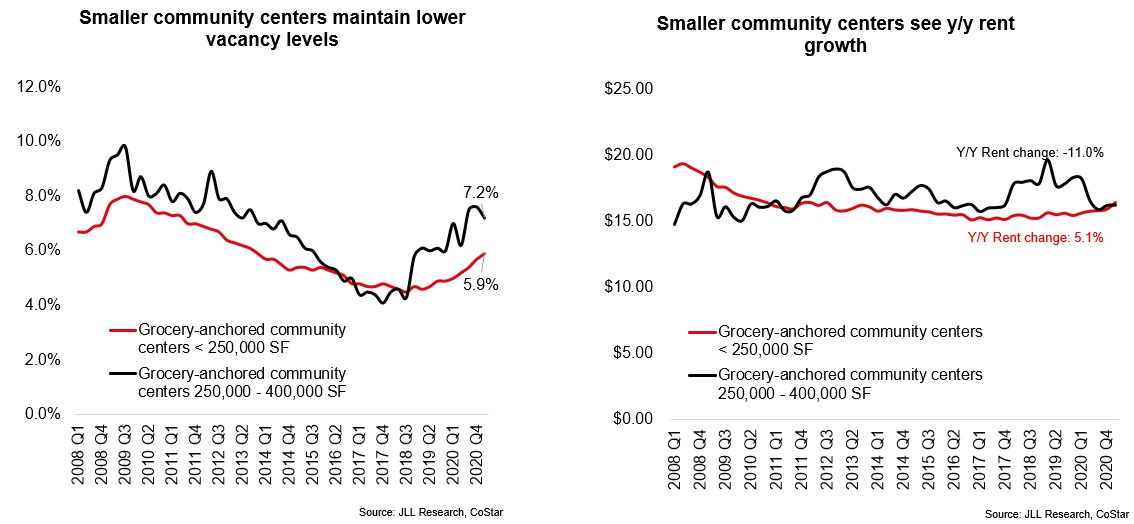

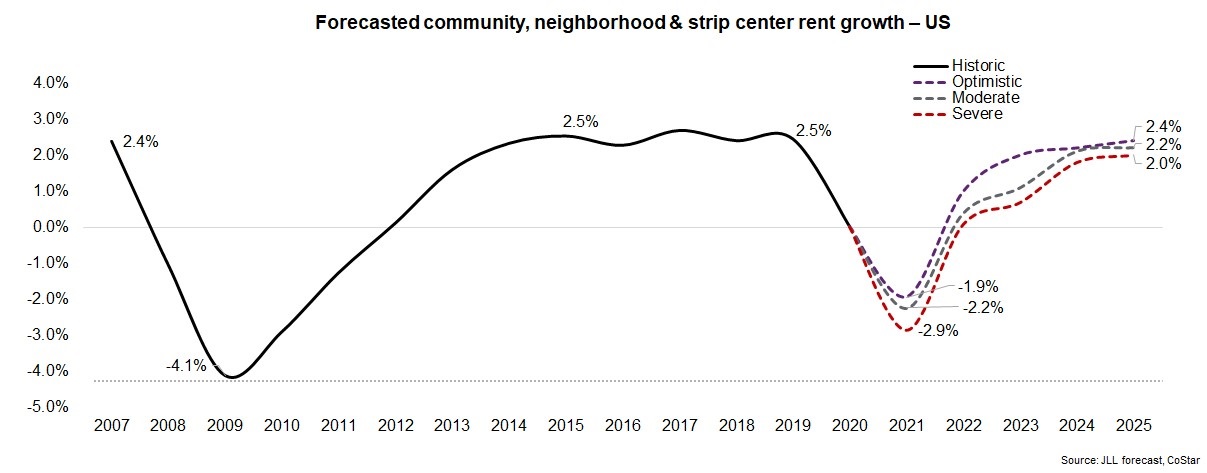

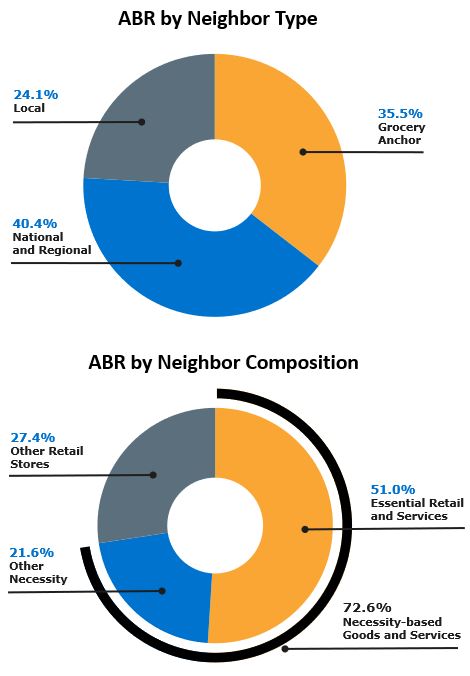

Our business model is founded on owning and operating omni-channel grocery-anchored neighborhood shopping centers that provide necessity-based goods and services to the average American household. As of March 31, 2021, for our wholly-owned shopping centers and our prorated portion of shopping centers owned through our unconsolidated joint ventures, approximately 72.6% of our ABR comes from necessity-based goods and services retailers. As of March 31, 2021, our wholly-owned centers averaged approximately 113,000 square feet in size, and our average inline Neighbor occupied 2,100 square feet. Our average center, at 113,000 square feet in size, is smaller than those of our public peers, at 217,000 square feet, according to JLL. We believe that smaller shopping centers and smaller Neighbor spaces create a positive leasing dynamic as spaces are sized to meet demand from the large variety of retailers that are growing and opening new stores, which we believe creates pricing power. In 2019, 65% of leasing activity in strip shopping centers was in spaces of less than 2,500 square feet.

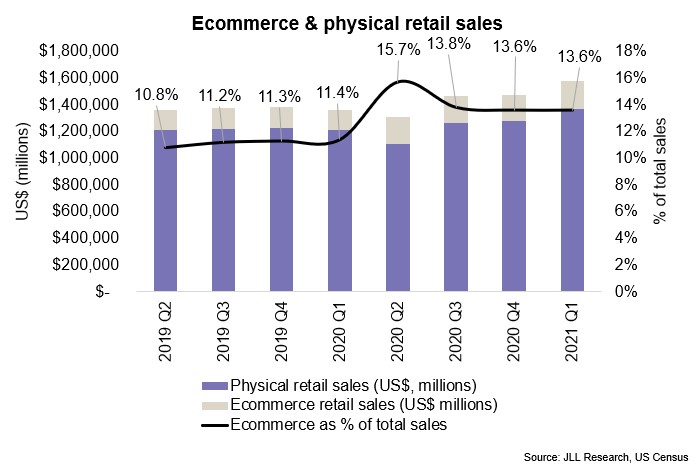

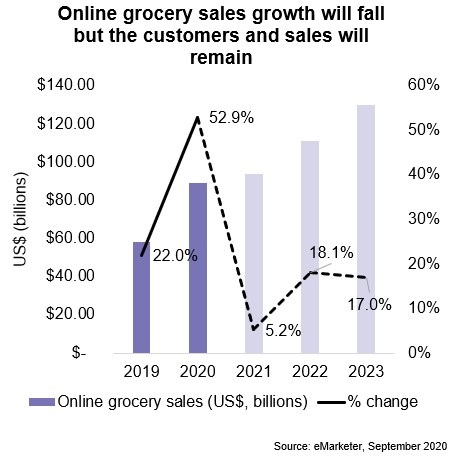

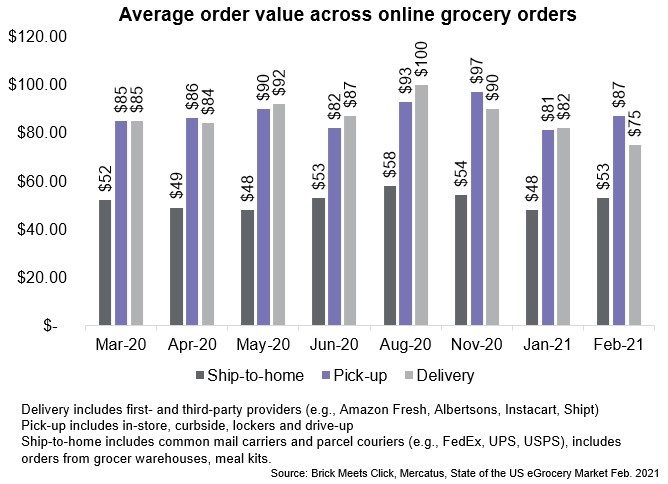

We believe our grocery focus is ecommerce resilient and adaptive, with many customers visiting our Neighbors to collect online purchases. We believe that grocery sales are ecommerce resilient because the economics of delivery typically remain unattractive to grocers. We believe grocery margins are typically 2-4% and the additional costs associated with delivery produce an overall loss for the grocer unless the customer is willing to pay for the cost of delivery. We believe delivery fees are a major deterrent for customers in our markets and that customers have demonstrated a preference for buy-online-pickup-in-store, or BOPIS, over delivery and therefore the store remains the delivery point.

We believe that our centers are a critical component of our Neighbors’ omni-channel strategies and that, as ecommerce continues to grow, our centers provide omni-channel retailers with a solution for critical last mile delivery and BOPIS options. As of March 31, 2021, we estimate that 87% of our grocers offer BOPIS options to customers. In 2020, we established Front

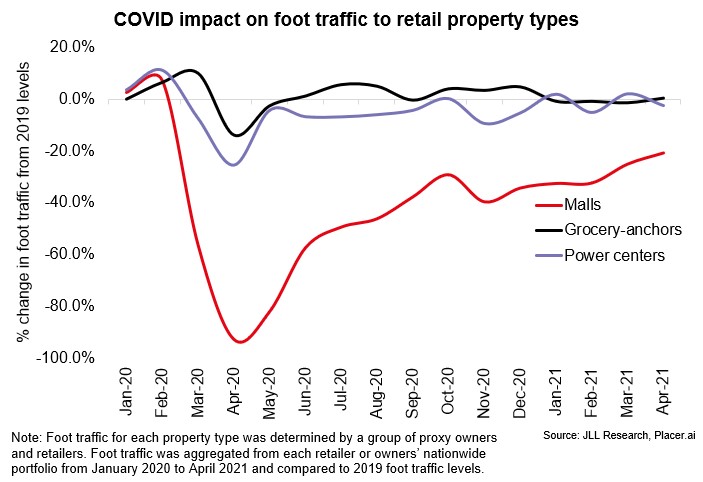

1

Row To Go®, a program that provides convenient curbside pick-up and clearly marked parking spaces to facilitate customer pickup from all Neighbors. Approximately 91% of our portfolio now provides Front Row To Go®. We believe this program complements our grocers’ expansion of BOPIS and brings consistently high levels of foot traffic to our centers. Our centers now record foot traffic that exceeds levels prior to the onset of the COVID-19 pandemic. During March 2021, foot traffic at our centers was 104% of average monthly levels during 2019 according to data provided to us by Placer.ai, a company that analyzes location and foot traffic for retailers, commercial real estate owners and municipalities by collecting geolocation and proximity data.

Our Shopping Centers

The map below presents the geographic distribution of our portfolio, inclusive of shopping center properties owned through our unconsolidated institutional joint ventures, as of March 31, 2021. Our portfolio consists of 300 properties located in 31 states (excluding six dispositions that occurred subsequent to March 31, 2021):

2

The following table provides summary information regarding our wholly-owned portfolio (unless otherwise noted) as of March 31, 2021 (dollars and square feet in thousands, excluding per square foot data):

| March 31, 2021 | |||||

| Number of shopping centers | 278 | ||||

| Number of states | 31 | ||||

| Total GLA | 31,306 | ||||

| Average shopping center GLA | 113 | ||||

| Total ABR | $ | 386,971 | |||

Total ABR from necessity-based goods and services(1) | 72.6 | % | |||

| Grocery-related: | |||||

| Percent of ABR from omni-channel grocery-anchored shopping centers | 96.4 | % | |||

| Percent of ABR from grocery anchors | 35.4 | % | |||

| Percent of ABR from nongrocery anchors | 13.6 | % | |||

| Percent of ABR from inline spaces | 51.0 | % | |||

| Percent of GLA leased to grocery Neighbors | 48.7 | % | |||

Grocer health ratio(2) | 2.1 | % | |||

| Percent of ABR from centers with grocery anchors that are #1 or #2 by sales | 82.2 | % | |||

| Average annual sales per square foot of reporting grocers | $ | 609 | |||

| Leased occupancy as a percentage of rentable square feet: | |||||

| Total portfolio | 94.8 | % | |||

| Anchor spaces | 97.3 | % | |||

| Inline spaces | 89.8 | % | |||

Average remaining lease term (in years):(3) | |||||

| Total portfolio | 4.6 | ||||

| Grocery anchor spaces | 4.7 | ||||

| Nongrocery anchor spaces | 5.0 | ||||

| Inline spaces | 4.1 | ||||

Portfolio retention rate:(4) | |||||

| Total portfolio | 88.8 | % | |||

| Anchor spaces | 92.9 | % | |||

| Inline spaces | 80.3 | % | |||

| Average ABR per square foot: | |||||

| Total portfolio | $ | 13.05 | |||

| Anchor spaces | $ | 9.34 | |||

| Inline spaces | $ | 20.82 | |||

(1)Inclusive of our prorated portion of shopping centers owned through our unconsolidated joint ventures.

(2)Based on the most recently reported sales data available.

(3)The average remaining lease term in years is as of March 31, 2021. Including future options to extend the term of the lease, the average remaining lease term in years for our total portfolio, grocery anchors, nongrocery anchors and inline spaces is 20.9, 31.4, 16.0, and 7.9, respectively.

(4)For the three months ended March 31, 2021.

Recent Developments – Operational Update on Leasing

For our wholly-owned properties, as of June 30, 2021, our portfolio’s leased occupancy as a percentage of rentable square feet was 94.7%, compared to 94.8% as of March 31, 2021. Leased occupancy for our anchor spaces was 96.8% as of June 30, 2021, compared to 97.3% as of March 31, 2021, and inline leased occupancy was 90.6% at June 30, 2021 as compared to 89.8% at March 31, 2021. Additionally, average ABR per square foot was $13.21 for our wholly-owned portfolio as of June 30, 2021, including $9.41 in ABR per square foot for our anchor spaces and $21.10 in ABR per square foot for our inline spaces. This compares to $13.05 per square foot for the total portfolio, $9.34 per square foot for anchor spaces, and $20.82 per square foot for inline spaces, all as of March 31, 2021.

3

Below is a summary of leasing activity for our wholly-owned shopping centers for the three months ended June 30, 2021 and the three months ended March 31, 2021:

Total Deals(1) | Inline Deals(1) | |||||||||||||||||||||||||

| Q2 2021 | Q1 2021 | Q2 2021 | Q1 2021 | |||||||||||||||||||||||

| New leases: | ||||||||||||||||||||||||||

| Number of leases | 124 | 153 | 121 | 147 | ||||||||||||||||||||||

| Square footage (in thousands) | 341 | 467 | 278 | 341 | ||||||||||||||||||||||

| ABR (in thousands) | $ | 6,338 | $ | 8,120 | $ | 5,816 | $ | 6,605 | ||||||||||||||||||

| ABR per square foot | $ | 18.57 | $ | 17.39 | $ | 20.94 | $ | 19.34 | ||||||||||||||||||

| Cost per square foot of executing new leases | $ | 28.97 | $ | 29.00 | $ | 26.80 | $ | 29.65 | ||||||||||||||||||

| Number of comparable leases | 57 | 70 | 55 | 70 | ||||||||||||||||||||||

| Comparable rent spread | 18.5 | % | 12.4 | % | 19.0 | % | 12.4 | % | ||||||||||||||||||

| Weighted-average lease term (in years) | 7.2 | 8.0 | 6.8 | 6.2 | ||||||||||||||||||||||

| Renewals and options: | ||||||||||||||||||||||||||

| Number of leases | 174 | 163 | 159 | 147 | ||||||||||||||||||||||

| Square footage (in thousands) | 1,049 | 978 | 333 | 312 | ||||||||||||||||||||||

| ABR (in thousands) | $ | 12,895 | $ | 11,472 | $ | 7,306 | $ | 7,069 | ||||||||||||||||||

| ABR per square foot | $ | 12.30 | $ | 11.73 | $ | 21.95 | $ | 22.67 | ||||||||||||||||||

| ABR per square foot prior to renewals | $ | 11.55 | $ | 10.97 | $ | 20.08 | $ | 21.02 | ||||||||||||||||||

| Percentage increase in ABR per square foot | 6.5 | % | 6.9 | % | 9.3 | % | 7.8 | % | ||||||||||||||||||

| Cost per square foot of executing renewals and options | $ | 2.48 | $ | 2.20 | $ | 3.58 | $ | 4.85 | ||||||||||||||||||

Number of comparable leases(2) | 155 | 136 | 148 | 133 | ||||||||||||||||||||||

Comparable rent spread(2) | 8.0 | % | 8.0 | % | 9.4 | % | 7.9 | % | ||||||||||||||||||

| Weighted-average lease term (in years) | 5.4 | 3.9 | 4.0 | 4.0 | ||||||||||||||||||||||

| Portfolio retention rate | 85.5 | % | 88.8 | % | 79.5 | % | 80.3 | % | ||||||||||||||||||

(1)Per square foot amounts may not recalculate exactly based on other amounts presented within the table due to rounding.

(2)Excludes exercise of options.

Competitive Strengths

We believe our position as a leading omni-channel grocery-anchored neighborhood shopping center owner and operator is founded on the following competitive strengths:

Exclusive Focus on Omni-Channel Grocery-Anchored Shopping Centers

Since starting our business in 1991, our core strategy has focused exclusively on owning and operating grocery-anchored shopping centers. We believe that our centers are anchored by leading grocery banners that drive customers to our centers. We categorize our grocery anchors into store formats that are established by Nielsen TDLinx. The grocery store formats in our wholly-owned centers today are set forth below, including Neighbor detail as of March 31, 2021:

•Conventional, which includes full-line, self-service grocery. Our top two conventional grocery Neighbors are:

◦Kroger, which anchors 54 locations and generates 6.6% of our ABR. We are Kroger’s largest landlord by number of stores.

◦Publix, which anchors 47 locations and generates 5.5% of our ABR. We are Publix’s second largest landlord by number of stores.

•Natural and Gourmet, which includes self-service grocery stores primarily offering natural, organic or gourmet foods. Our top two natural grocery Neighbors are:

◦Sprouts, which anchors eleven locations and generates 1.3% of our ABR. We are Sprouts’ largest landlord by number of stores.

◦Trader Joe’s, which anchors six locations and generates 0.4% of our ABR.

•Supercenter, which includes a full-line supermarket with a full-line discount merchandiser under one roof. We have one supercenter grocery Neighbor:

◦Walmart, which anchors 13 locations and generates 2.3% of our ABR.

•Limited Assortment, which includes supermarkets with a limited selection of items in a reduced number of categories. Our top two limited assortment grocery Neighbors are:

◦Aldi, which anchors four locations and generates 0.2% of our ABR.

4

◦Save A Lot, which anchors two locations and generates 0.1% of our ABR.

•Wholesale Club, which includes membership club stores distributing packaged and bulk foods and general merchandise. We have one wholesale club grocery Neighbor:

◦BJ’s Wholesale Club, which anchors two locations and generates 0.4% of our ABR.

We believe omni-channel grocery-anchored shopping centers are a critical element of a community’s infrastructure providing essential goods and services, and as such, we believe our centers have superior durability and higher return potential relative to other forms of retail real estate. As of March 31, 2021, 96.4% of our ABR was generated by omni-channel grocery-anchored shopping centers, and 35.4% of our ABR was generated by our grocery Neighbors across our wholly-owned portfolio. In addition, as of March 31, 2021, only 13.6% of our ABR was generated by anchors that are not grocers. Our non-grocery anchors are well-diversified. Our largest non-grocery anchor is TJX Companies, which includes the T.J. Maxx brand, and which generated 1.3% of our ABR as of March 31, 2021. Our next largest non-grocery anchor, Dollar Tree, generated approximately 1.0% of our ABR as of March 31, 2021.

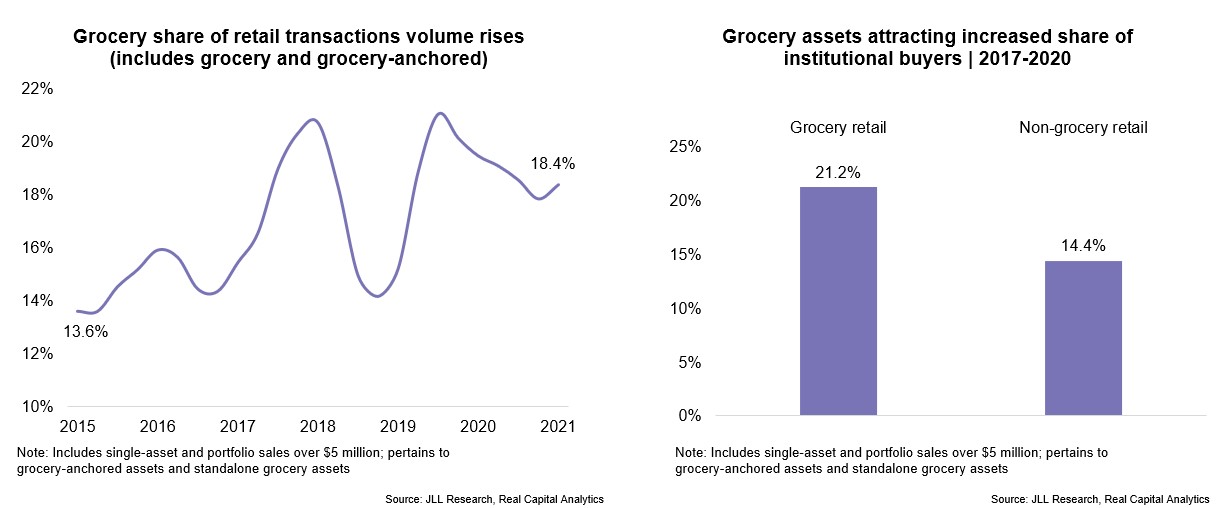

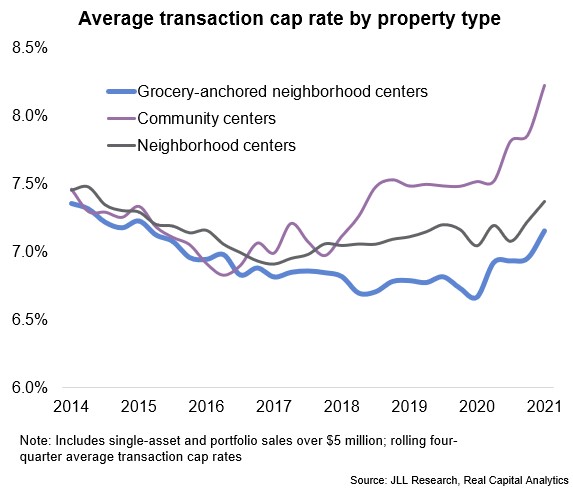

We believe omni-channel grocery-anchored shopping center property values are resilient through economic cycles. According to Jones Lang LaSalle Americas, Inc., or JLL, asset prices for grocery-anchored retail properties have increased by 21.5% since 2015, which compares favorably to the price performance of non-grocery-anchored retail properties, which have declined in value by 21.8% over the same period.

We maintain strong relationships with our grocery Neighbors. Our portfolio consists of 34 grocer companies across more than 55 unique banners. For the three months ended March 31, 2021, our grocery Neighbor retention rate was 92.2%, and for the year ended December 31, 2020, this rate was 97.1%. In addition, we actively monitor the performance of our grocery Neighbors to balance rent growth and their ability to generate profitability. On average, our grocery Neighbors who report sales to us exhibit a 2.1% health ratio as of March 31, 2021, which represents the amount of annual rent and expense recoveries paid by the Neighbor as a percentage of its annual gross sales. This health ratio compares favorably to the average grocer health ratio of 2.7%, according to JLL. Low grocer health ratios provide us with the knowledge to manage our rents effectively while seeking to ensure the financial stability of our grocery anchors.

We believe our grocery anchors and our necessity-based inline Neighbors are essential businesses with greater stability and resiliency than other types of retail, as demonstrated by our strong absolute and relative performance throughout the COVID-19 pandemic. During the year ended December 31, 2020, our average annual sales per square foot of reporting grocers was $609, an increase of 14.1% over the prior year for grocers who reported in both periods, which compares favorably to the 11% increase for all grocery sales in 2020, according to the U.S. Census Bureau.

We believe that we and our inline Neighbors have benefited from strong recurring foot traffic generated by our grocery anchors. We believe our omni-channel grocery-anchored shopping centers have benefited from a multitude of factors, including increasing demand for last-mile delivery, BOPIS, work-from-home, shop local, and changing consumer preferences away from regional malls and into local retail options, including open-air shopping centers. On average, U.S. consumers visited grocery stores 1.6 times per week during 2019, according to The Food Marketing Institute. During 2020, our shopping centers averaged over 19,000 customer visits per week, according to Placer.ai. We believe that frequent foot traffic generated by our grocery anchors supports our inline spaces with consistent sales volume and enhances the ability of our inline Neighbors to pay rent. During the three months ended March 31, 2021 and year ended December 31, 2020, our comparable rent spreads for new inline leases were 12.4% and 10.9%, respectively.

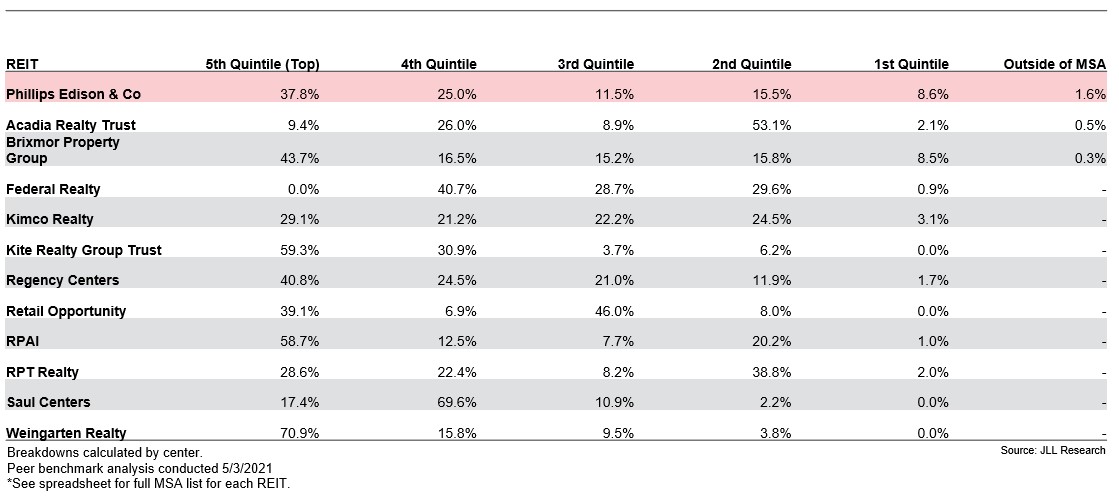

Differentiated National and Scaled Portfolio Anchored by Market Leading Grocers in Suburban Communities

As of March 31, 2021, we own equity interests in 300 shopping centers, including 278 wholly-owned shopping centers and 22 shopping centers through two unconsolidated third-party institutional joint ventures. Our centers are located in 31 states. Our investment thesis is focused on owning neighborhood centers that are anchored by the #1 or #2 grocer in a trade area that are right sized and that have our targeted trade area demographic profile. As of March 31, 2021, 82.2% of our ABR was generated from shopping centers with a grocery Neighbor ranked #1 or #2 by sales. We believe that the format of a shopping center matters, and our strategy is focused on owning and operating smaller neighborhood and community centers. Approximately 93% of our portfolio is composed of neighborhood and community centers, which is a higher percentage than any of our public peers, according to JLL. Our average center size is 113,000 square feet, which is much smaller than the average center size of our public peers at 217,000 square feet, according to JLL. We believe that smaller centers provide higher growth potential because they enjoy a positive leasing dynamic as (i) there is less space to lease, (ii) we believe retailer demand is higher as smaller spaces are the ones preferred by retailers today, (iii) there is less exposure to big box retailers, which we believe have higher risk because there is less demand from big box retailers currently and they are costly to backfill, and (iv) smaller centers typically have lower capital expenditures.

We target investments with attractive going-in yields and growth potential in markets with demographic profiles that support necessity-based retail concepts. According to Costar, there are approximately 15,000 grocery-anchored shopping centers within the United States. We believe, based upon our market research, that there are approximately 5,800 properties that are anchored by a grocer ranked #1 or #2 by sales with our targeted demographic profile that we view as potential acquisition candidates for us. Our portfolio median household income in the 3-mile trade area is approximately $68,100, which compares favorably to the U.S. median household income of $68,700 in 2019 according to US Census Bureau data. The average population in the 3-mile trade area in our portfolio is approximately 61,000 people. We believe our demographic metrics line up well with those of our top two grocer Neighbors, Kroger and Publix. According to Synergos Technologies, Inc., Kroger stores average 55,000 people in the three-mile trade area with median household incomes of $63,000, and Publix stores average 63,000 people in the three mile trade area with median household incomes of $68,000. Our performance and experience have proven these demographics support our grocer and inline Neighbors as we have maintained high occupancy levels and successfully grown rents. We have realized sector-leading renewal spreads among our public peers for the three year period 2017-2019 and in the first quarter of 2021.

5

Consistent Track Record of Delivering Strong Performance

We believe that our business model and targeted market approach have generated strong growth over time. For the years ended December 31, 2020, 2019, 2018, and 2017, our net income (loss) was $5.5 million, $(72.8) million, $47.0 million, and $(41.7) million, respectively. For the three year period of 2017, 2018, and 2019, prior to the COVID-19 pandemic, our Same-Center NOI growth averaged 3.6% and our core funds from operations, or Core FFO, per share growth averaged 4.8%. The COVID-19 pandemic impacted our operating results, with our Same-Center NOI declining 4.1% and Core FFO per share declining 6.2% in the year ended December 31, 2020. The impact of the COVID-19 pandemic on our operating results decreased in the three months ended March 31, 2021. Our net income for the three months ended March 31, 2021 was $0.1 million, with our Same-Center NOI having declined 0.9% compared to the three months ended March 31, 2020 and our Core FFO per share having increased by 9.3% compared to the three months ended March 31, 2020. Our comparable renewal lease spreads averaged 9.5% for the three years ended December 31, 2019, 6.7% for the year ended December 31, 2020, and 8.0% for the three months ended March 31, 2021. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Non-GAAP Measures” included elsewhere in this prospectus for a reconciliation of the non-GAAP measures to Net Income (Loss).

We believe our returns are enhanced due to our focus on omni-channel grocery-anchored neighborhood shopping centers, which require a lower level of capital expenditures to maintain net operating income, or NOI. Our level of capital expenditures as a percentage of NOI is significantly lower than our public peers. For the three year period 2018-2020, our capital expenditures as a percentage of NOI averaged approximately 19.8%, which is significantly lower than the average capital expenditure as a percentage of NOI of our public peer group of approximately 31%. We believe that our centers require lower capital expenditures as a percentage of NOI for a number of reasons, including our high tenant retention rates, a favorable supply demand dynamic for space in our centers, reduced exposures to tenant categories we believe are more ecommerce-vulnerable such as office supplies, entertainment and electronics, and the smaller average tenant size in our centers.

Our results in the following table demonstrate our consistent record (dollars in thousands):

Three Months Ended March 31, 2021(1) | Year Ended December 31, 2020(1) | Three Years Ended December 31, 2019(2) | ||||||||||||||||||

| Net income (loss) | $ | 117 | $ | 5,462 | $ | (67,569) | ||||||||||||||

Same-Center NOI (decline) growth(3)(4) | (0.9) | % | (4.1) | % | 3.6 | % | ||||||||||||||

| Comparable renewal lease spreads average | 8.0 | % | 6.7 | % | 9.5 | % | ||||||||||||||

| Leased occupancy | 94.8 | % | 94.7 | % | 94.2 | % | ||||||||||||||

Core FFO per share growth (decline)(3) | 9.3 | % | (6.2) | % | 4.8 | % | ||||||||||||||

(1)Growth or decline is calculated based on the comparable prior year period.

(2)Growth or decline as well as occupancy are calculated as an average over the three year period.

(3)For the three years ended December 31, 2019, represents Same-Center NOI (Adjusted for Transactions). See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Measures.”

(4)Our Same-Center NOI, Same-Center NOI (Adjusted for Transactions), NOI, and Core FFO referenced above are non-GAAP financial measures. For definitions of Same-Center NOI, Same-Center NOI (Adjusted for Transactions), NOI, and Core FFO, reconciliations of these metrics to net income (loss), the most directly comparable GAAP financial measure, and a statement of why our management believes the presentation of these metrics provides useful information to investors and any additional purposes for which management uses these metrics, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Measures.”

Stable, Resilient and Increasing Rents from Adaptive and Diversified Neighbors

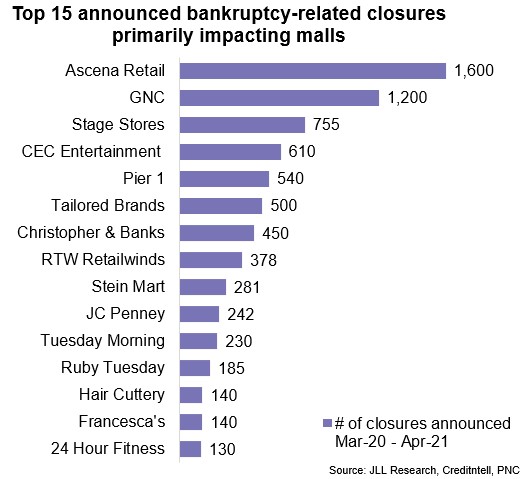

Our portfolio demonstrated strong resilience throughout the difficult economic conditions caused by the COVID-19 pandemic. As of March 31, 2021, our portfolio leased occupancy was 94.8%, and 100% of our occupied spaces were open for business. For the month ended March 31, 2021, our foot traffic was 104% of the average monthly levels during the year ended December 31, 2019 according to data provided by Placer.ai. We believe that our portfolio has minimal exposure to distressed retailers as evidenced by the fact that less than 1% of our ABR came from the 15 largest retailers that declared bankruptcy in 2020.

We collected a high percentage of rents and recovery billings from our Neighbors throughout 2020 and had better collection results than any of our public peers, according to JLL. For the three months ended June 30, 2020, for our wholly-owned portfolio and the prorated portion owned through our unconsolidated joint ventures, we initially collected 86% of rents and recovery billings and we have since collected 93% of such amounts for that period. We continue to collect amounts owed for past billing periods. As of June 15, 2021, we have collected 96% of all rent and recovery billings for April 2020 through March 2021. Additionally, as of June 15, 2021, we have collected 98% and 97% in rent and recoveries billed during April and May 2021, respectively. Despite the challenging economic conditions that certain Neighbors experienced throughout 2020 as a result of the COVID-19 pandemic, we granted limited requests for rent deferrals and abatements. As of March 31, 2021, from the beginning of the COVID-19 pandemic in March 2020, we had executed rent abatements totaling less than 2% of portfolio ABR.

We believe that our necessity-based retail strategy, coupled with the successful execution of our capital recycling program in recent years positioned our portfolio to successfully weather the economic downturn in 2020. We began a disciplined capital recycling program in 2017 to improve the overall quality of our portfolio, delever our balance sheet and prepare the Company for an initial public offering. Since 2017, we have sold 45 assets for $442.1 million.

As of December 31, 2020, portfolio leased occupancy declined by only 0.9% to 94.7%, and inline leased occupancy declined by 1.2% to 88.9%, compared to March 31, 2020. Between December 31, 2020 and March 31, 2021, portfolio leased occupancy increased by 0.1% to 94.8% and inline leased occupancy increased by 0.9% to 89.8%. We believe, based upon

6

current leasing activity, that we can increase inline occupancy and total occupancy above current levels. As higher occupancy levels are achieved, we believe that we will be able to accelerate rent growth given a more favorable supply/demand dynamic.

We achieve cash flow stability through geographic, property and Neighbor diversification, as well as lease structure. As of March 31, 2021, our centers are located in 31 states. As of March 31, 2021, no single property contributed more than 1.2% to our ABR, and no single MSA contributed more than 7.2% to our ABR. Our wholly-owned shopping centers and those owned through our institutional joint ventures contained approximately 5,400 occupied spaces as of March 31, 2021. We believe that our necessity-based retail strategy combined with strong geographical and Neighbor diversification limited the effects of state and local stay-at-home and lock down orders during the COVID-19 pandemic. In addition, our management team has successfully operated our business for 30 years through many other difficult economic environments, including the 2001 recession and the 2007-09 financial crisis, gaining experience and significant insight that allow us to effectively manage difficult economic conditions.

We believe the innovative and adaptive nature of our grocery Neighbors allows them to successfully respond to evolving market demands and enhances our portfolio. Our top five Neighbors by ABR are five of the largest grocers in the U.S. by sales volume and their combined total sales represent approximately 60% of the total U.S. grocery market sales of $1.01 trillion in 2020, according to FoodIndustry.com. As a large landlord for a number of our grocery Neighbors, we work closely with them on their adaptive strategies. These Neighbors are well-capitalized and complement their in-store strategy with ecommerce concepts such as home delivery and curbside pickup. We believe our Neighbors’ ability to adapt to changing demand patterns contributed to our resilient foot traffic trends.

Balance Sheet Positioned for External Growth and Investment Grade Rating

Upon completion of this offering, we believe we will be well positioned to grow our portfolio by opportunistically pursuing acquisitions in a disciplined manner, while maintaining an attractive leverage profile and flexible balance sheet.

As of March 31, 2021, we had total debt of approximately $2.0 billion (as adjusted for this offering, inclusive of our prorated portion of debt of shopping centers owned through our unconsolidated joint ventures) and our net loss for the trailing 12-months then ended was $5.6 million. As of March 31, 2021, as adjusted for this offering, our net debt to trailing 12-month Adjusted EBITDAre was 6.0x (5.7x assuming exercise of the underwriters’ overallotment option in full). In addition, as of March 31, 2021 and as adjusted for this offering and the Refinancing, we estimate that we will have $600.9 million of total liquidity comprised of $490.3 million of undrawn capacity under our $500 million revolving credit facility and $110.6 million of cash and cash equivalents. We believe our conservative leverage profile and significant liquidity will compare favorably to our public shopping center REIT peers and will position us to pursue attractive external growth opportunities. We believe that becoming a publicly traded REIT will allow us to access multiple forms of equity and debt capital currently not available to us, further enhancing our financial flexibility and external growth. Approximately 73% of our in-place NOI for the three months ended March 31, 2021 was unencumbered, which we believe provides us with flexibility to refinance our existing debt, either with our existing relationship banks or by accessing the private or public debt capital markets that we anticipate will be available to us as a publicly traded company at attractive levels. We believe that our balance sheet profile provides us with the financial capacity to pursue external growth initiatives in an accretive and prudently capitalized manner. Our net debt, our Adjusted EBITDAre, and our ratio of net debt to EBITDAre referenced above are non-GAAP financial measures. For definitions of net debt and Adjusted EBITDAre, reconciliations of these metrics to total debt and net income (loss), respectively, the most directly comparable GAAP financial measures, and a statement of why our management believes the presentation of these metrics provides useful information to investors and any additional purposes for which management uses these metrics, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Measures” and “—Liquidity and Capital Resources—Financial Leverage Ratios.”

We intend to maintain a strong balance sheet in order to pursue an investment grade credit rating.

Fully-Integrated National Operating Platform Drives Strong Operating Performance

We believe in fully controlling all aspects of owning and operating our shopping centers with PECO employees, who we refer to as associates. We do not employ outside leasing brokers or property managers. Our fully-integrated and internally-managed operating platform had approximately 300 associates located in 20 states across the United States as of March 31, 2021. We believe our strong operating results are due to our locally smart™ operational platform, which allows our associates to gather market intelligence from thousands of Neighbors and other market participants. In addition, due to our extensive operations across the United States, and supporting platform of associates, we believe we have the ability to acquire and integrate shopping centers quickly and deploy capital effectively as opportunities arise. Our diversified merchandising mix of Neighbors and geography provide us with proprietary insights into which retail segments are performing well and which emerging brands are realizing financial success. Our portfolio management team uses these insights to optimize merchandising mix and maximize lease agreement terms. We have twelve associates on our portfolio management team with an average tenure of eleven years with our Company and average industry experience of 17 years.

We believe our leasing team structure is unique, optimizes our relationship with Neighbors, and allows us to create meaningful value across our portfolio. Our in-house leasing team of 30 associates consists of a new lease execution team, a dedicated renewals team, and a national accounts team that is focused exclusively on emerging brands. For the three months ended March 31, 2021, we executed 153 new leases compared to 87 in the prior year period and we achieved comparable leasing spreads of 12.4% for new leases. For the same period, we also renewed 163 leases comprising one million square feet of GLA, at comparable leasing spreads of 8.0%. Our portfolio retention rate with all Neighbors for the three months ended March 31, 2021 was 88.8%, and for the five years ended December 31, 2020, it averaged 86.9%. We believe our strong leasing performance and high retention rates are a result of our strong focus on creating the right merchandising mix for each center and our new lease execution team, dedicated renewals team, and national accounts team.

We have a proven track record of successfully managing institutional capital. Our first institutional fund was raised in 2005. Our three most recent institutional funds include unconsolidated joint ventures with Northwestern Mutual, TPG Real Estate, and CBRE Investors. Our Northwestern Mutual joint venture is a $411 million omni-channel grocery-anchored shopping center venture formed in November 2018 named Grocery Retail Partners I, or GRP I. We currently own 14% of this joint venture. We

7

formed a $250 million equity joint venture with TPG Real Estate in March 2016 named Necessity Retail Partners, or NRP, to invest in omni-channel grocery-anchored shopping centers. We hold a 20% interest in this joint venture. Further, in September 2011, we entered into a $100 million equity joint venture with a group of international institutional investors advised by CBRE Investors. We served as general partner and held a 54% interest in this joint venture, which has since been realized. We generated a 16.1% internal rate of return in the CBRE joint venture. Our Northwestern Mutual and TPG Real Estate ventures are still active and have not been fully realized. We currently expect them to meet their targeted returns.

We have made meaningful investments in technology to enhance our operating capabilities and investment decisions. Our technology initiatives have been recognized through numerous industry awards including awards from ComSpark, MRI Software and Realcomm. Some of the tools that we employ include advanced machine learning, robotic process automation, and a Neighbor service portal. In machine learning, we are developing algorithms using internal proprietary data and third-party data sources. The four areas we are currently focused on are Neighbor credit, rent prediction, grocer health and optimal merchandising mix. We use Robotic Process Automation to perform repetitive tasks and to reduce labor costs. Our Neighbor service platform, which we refer to as DashComm®, is a proprietary Neighbor platform to improve how we deliver Neighbor-facing customer service. Over the last five years, we have invested over $43.3 million in technology initiatives. Our investments in technology enabled us to seamlessly transition our workforce to a remote work environment during the pandemic.

We believe our technology investments have enhanced our investment and asset management processes. We have developed the PECO Power ScoreTM, a proprietary asset evaluation algorithm created to analyze thousands of data points to better understand which variables correlate with, and contribute to, strong center performance. The PECO Power ScoreTM is comprised of 45 variables, including grocer sales per square foot, percentage of trade area population with a bachelor’s degree, center age, percent of GLA in multi-Neighbor units, grocer credit rating, and three-mile population growth. We believe the PECO Power ScoreTM provides a data-based score of the strength and quality of a grocery-anchored shopping center. As such, we believe the PECO Power ScoreTM is a critical metric for our transaction team in assessing the quality of potential shopping center acquisitions and to our portfolio management team in measuring the performance of our assets. We believe this disciplined data driven approach to evaluating assets contributes to sector leading operating performance and cash flow growth.

We have also created a qualitative model to assess the stability of a grocery anchor. The Grocery Occupancy Longevity Dynamics score, or GOLD ScoreTM, was created to better assess the health and stability of our grocery anchors. Utilizing our 30 year track record with grocery partners, we assess hundreds of variables to determine which variables have the highest impact on the longevity of a grocery Neighbor at a particular shopping center. The GOLD ScoreTM is back-tested and adjusted annually.

Experienced and Aligned Management Team

We believe our executive management team has strong insight and operating acumen developed from over 30 years of successfully operating grocery-anchored centers and creating value through prudent balance sheet management. Our Chief Executive Officer, Jeffrey S. Edison, co-founded Phillips Edison Limited Partnership in 1991, starting with a single grocery-anchored shopping center that we still own today. Since that time, Mr. Edison has overseen the acquisition of assets having an aggregate value of approximately $6.8 billion, of which the majority were grocery-anchored shopping centers. In addition, our five member executive management team has extensive real estate experience with an average of 27 years in real estate related roles and an average tenure of 14 years with the Company. In addition to our executive management team, our next most senior executives are our Senior Vice Presidents who are responsible for running each business unit, such as Accounting, Leasing, Property Management, and Portfolio Management. As of March 31, 2021 we had eleven Senior Vice Presidents with an average of 19 years of real estate industry experience and an average tenure of nine years with our Company. We benefit from the significant experience of our management team and its ability to effectively navigate changing market conditions in order to achieve sustained growth. In addition, we believe the interests of our executive management team are strongly aligned with our stockholders. As of the completion of this offering, we expect our executive management team to collectively own approximately 7.5% of our outstanding common stock and OP units on a fully diluted basis, which represents $276.1 million of value at the midpoint of the price range set forth on the front cover of this prospectus.

Business Objectives and Growth Strategies

Our primary objective is to provide attractive risk-adjusted returns for our stockholders by executing on internal and external business and growth initiatives, which include:

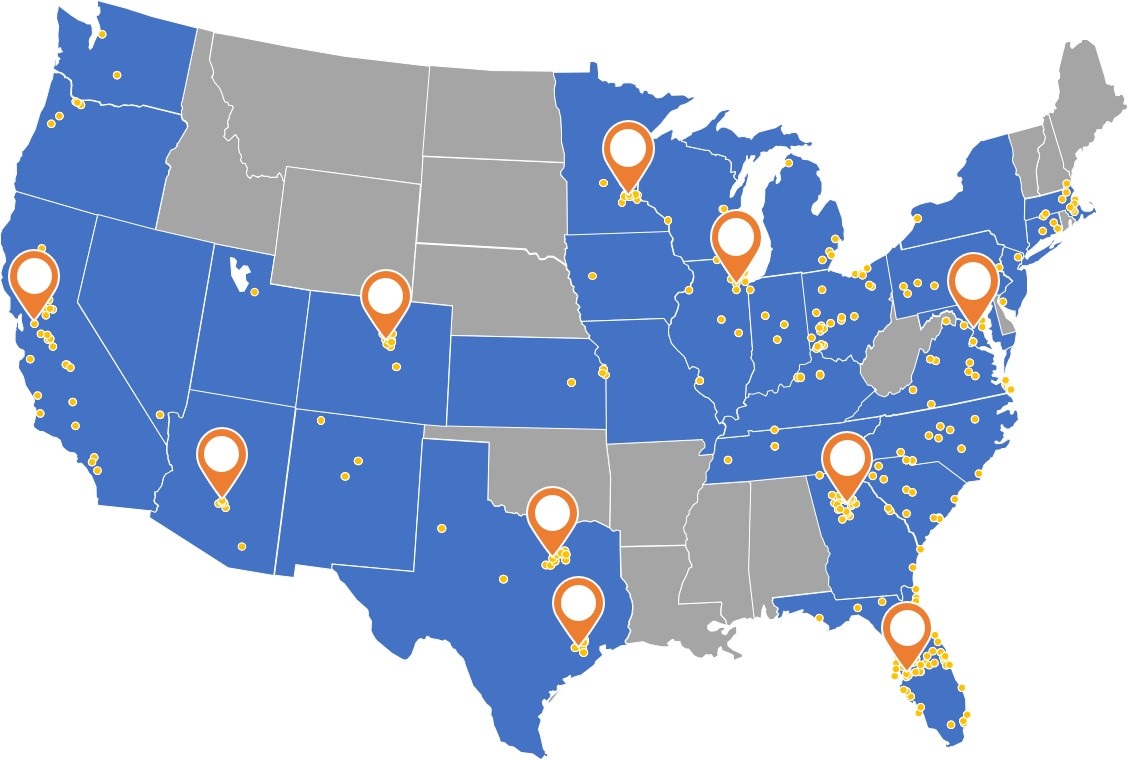

Driving NOI Growth from Re-Leasing Below Market Rents

We seek to increase NOI at our centers by maximizing rental rates and attracting high quality retailers while improving the merchandising mix and credit profile of our rental revenue. As of March 31, 2021, for our wholly-owned portfolio, we have a total of 416 leases expiring in 2021, representing 1.6 million square feet of GLA. While we cannot predict what rental rates we will achieve in 2021 as we renew or replace these expiring leases, the comparable rent spread of new leases signed during 2020 was 8.2%, and the comparable rent spread for lease renewals and options was 6.7% for the year ended December 31, 2020. The comparable rent spread of new leases signed was 12.4% and the comparable rent spread for lease renewals and options was 8.0% for the three months ended March 31, 2021.

Recent leasing activity has been strong. During the three months ended March 31, 2021, we executed 316 new and renewal leases totaling 1.4 million square feet. This compares to our average quarterly leasing results for the three-year period ended December 31, 2019, the last period prior to the onset of the COVID-19 pandemic, of 195 executed leases per quarter, representing 0.9 million square feet per quarter.

8

Lease-up Vacant Space to Drive Occupancy and NOI

We intend to increase the percentage of leased space at our centers to drive additional cash flow and NOI. Our national footprint of experienced leasing professionals is dedicated to (i) increasing occupancy, (ii) creating the optimal merchandising mix, (iii) maximizing rental income, and (iv) executing leases with annual contractual rent increases. As of March 31, 2021, our anchor space is 97.3% leased and our inline space is 89.8% leased, as compared to 98.0% and 90.2%, respectively, in the period ended December 31, 2019, the last period prior to the onset of the COVID-19 pandemic. We believe, based upon current leasing activity, that we can increase inline occupancy and total occupancy above current levels. As higher occupancy levels are achieved, we believe that we will be able to accelerate rent growth given a more favorable supply/demand dynamic. Demand for our well-located omni-channel grocery-anchored retail space increased during the third and fourth quarters of 2020 and was approaching 2019 leasing levels. For the three months ended March 31, 2021, we leased 1.4 million square feet, which represented a 29% increase over the prior year period and a 43% increase compared to the three months ended March 31, 2019. Our leased occupancy levels prior to the onset of the COVID-19 pandemic coupled with our current leasing demand and pipeline position us well to further increase our occupancy rate.

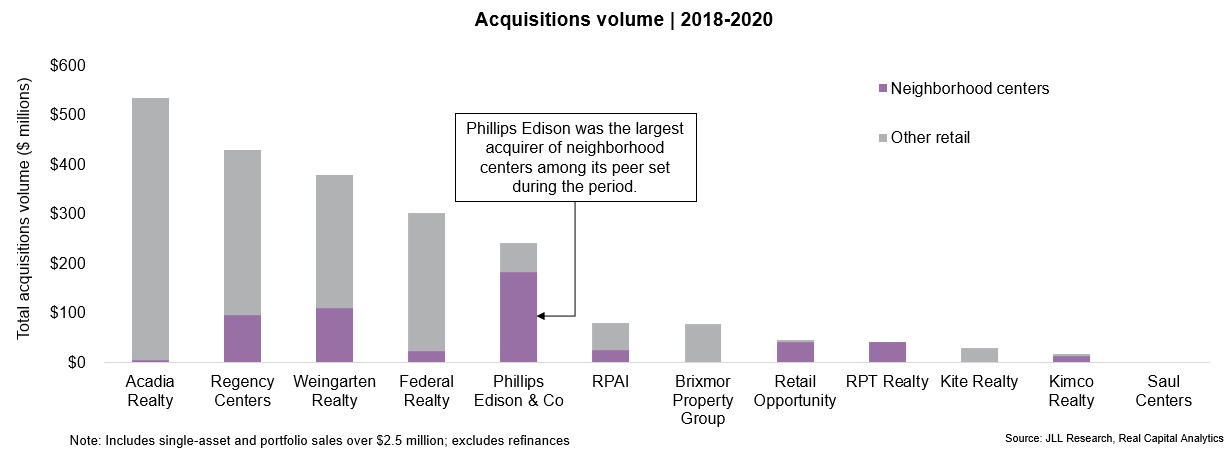

Selectively Acquire Omni-Channel Grocery-Anchored Shopping Centers

We intend to selectively acquire omni-channel grocery-anchored shopping centers with attractive yields in markets that support our necessity-based retail strategy. We focus on acquisitions in our targeted markets that have capitalization rates that we believe are generally 50-100 bps higher than those observed in primary markets. We have a dedicated transactions team of six professionals with an average of 12 years of real estate transaction experience and a 10-year average tenure at our Company that is responsible for executing all of our acquisitions and dispositions. In considering and evaluating potential acquisition opportunities, and to augment our seasoned acquisition team, we employ our proprietary underwriting methodology, which includes the use of the PECO Power ScoreTM, to assess shopping center attributes and projected returns. We believe that we maintain a competitive advantage in acquiring centers given the scale of our business and the experience of our team. We maintain a network of thousands of retailers, real estate brokers, and other market participants which gives us unique insight into new and highly desirable acquisition opportunities. We are often sought out as a preferred buyer of shopping centers due to our track record and reputation in our markets. For the 7-year period 2012-2018, we acquired 280 assets for a total of $4.7 billion, an average of 40 assets for $670 million per year. For the three year period 2018-2020, we were the largest acquiror of grocery-anchored neighborhood centers among our public peers, according to JLL. We believe that there is a large acquisition opportunity set for us and that there are approximately 5,800 shopping centers anchored by the #1 or #2 grocer by sales with our target demographic profile that we view as potential acquisition candidates for us.

Execute Redevelopment Opportunities

Our team of seasoned professionals identifies opportunities to unlock additional value at our centers through investments in our redevelopment program. Our strategies primarily consist of outparcel development, footprint reconfiguration, anchor repositioning, and anchor expansion. Our capital expenditures were prioritized in 2020 to support new leasing activity due to the impact from the COVID-19 pandemic. In more normal operating environments, we look for redevelopment opportunities to increase the overall yield and value of our centers, which we believe will allow us to generate higher returns for our stockholders while creating exceptional omni-channel grocery-anchored shopping center experiences. Our underwritten incremental unlevered yields on redevelopment projects are expected to range between 9% - 11%. Our current in process projects represent an estimated total investment of $35.1 million, and the total underwritten incremental unlevered yield range on this estimated investment is expected to be between 9.5% - 10.5%. Actual incremental yields may vary from our underwritten incremental yield range based on the actual total cost to complete a project and its actual incremental annual NOI at stabilization. Our average net investment per redevelopment project is between $2 and $3 million. We believe the small average size of our redevelopment projects is a positive, as our risk in this activity is well-diversified.

Capitalize on Favorable Macroeconomic Trends

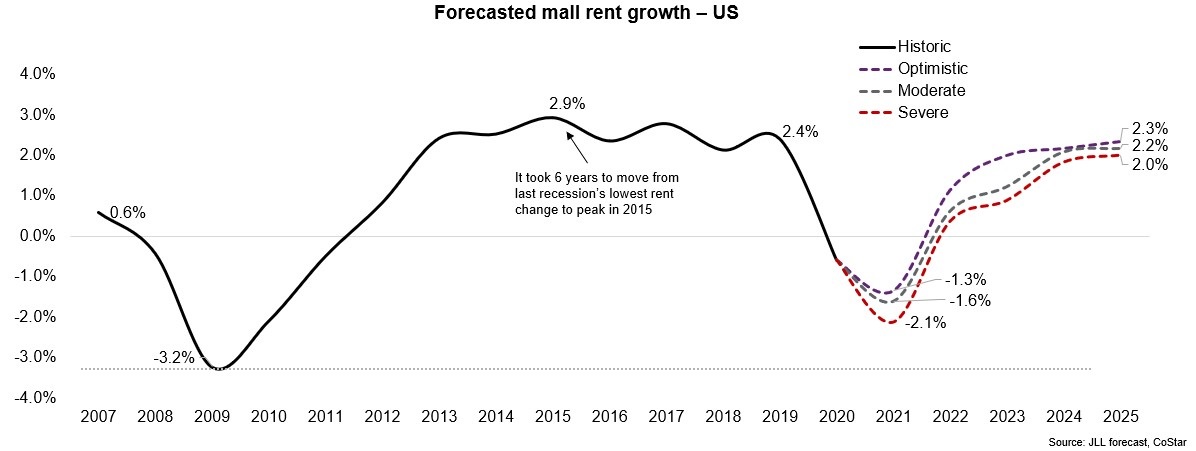

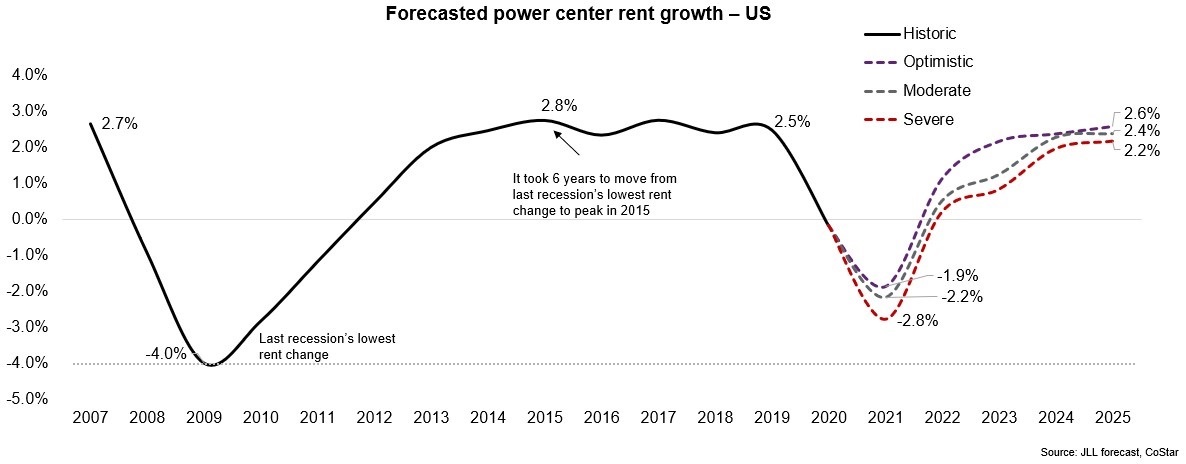

We believe there are a number of macroeconomic trends that are positive for the growth potential of our shopping centers including the population trends in Sun Belt states, the population shift from urban to non-urban communities, the increase in work from home initiatives, the importance of last mile delivery, the increase in “shop local” trends, and Neighbors relocating from malls to open air shopping centers.

The Sun Belt region has experienced significant growth in population. Between 2000 and 2020, Sun Belt states increased their collective population by 28 million people, which represented 56% of all U.S. population growth, according to the U.S. Census Bureau. Sun Belt states represent 40% of the U.S. population as of 2020, an increase from 37% in 2000. Approximately 49% of our portfolio ABR is located in Sun Belt states. We believe we benefit from increased demand resulting from the Sun Belt’s increased percentage of the total population.

The net population flow out of U.S. urban neighborhoods and into non-urban neighborhoods doubled in the period between March and September 2020 as compared to the average for the same months in 2017 through 2019, according to the Federal Reserve Bank of Cleveland. We believe our suburban focus is well-positioned to capture additional growth from such trends.

We believe the increase in work from home initiatives across the United States will increase the growth potential of our shopping centers. We believe customers spending more time at home are more likely to visit our suburban stores.

We believe consumers increasingly prefer to “shop local” rather than purchase products from large retailers. We believe local stores create vibrant communities with unique businesses and strong neighborhood social bonds. We believe our inline Neighbors are representative of many of the “shop local” qualities that our customers demand.

We believe the COVID-19 pandemic has generated and, in some cases, accelerated the migration of retailers from malls to open air shopping centers. Retailers cite a number of reasons for this trend, including changing lifestyles, a customer preference for open air environments due to the pandemic, cost savings and getting closer to the customer. We have executed leases with retailers, including Lenscrafters, Panda Express, Pearle Vision, and Shoe Sensation, which we believe are following this trend.

9

Corporate Governance Profile

We have structured our corporate governance in a manner we believe closely aligns our interests with those of our stockholders. Notable features of our corporate governance structure that we expect to be in effect upon the completion of this offering include the following:

•our Board will not be classified and each of our directors will be subject to election annually, and our charter will provide that we may not elect to be subject to the provision of the MGCL that would permit us to classify our Board, unless we receive prior approval from stockholders;

•we have fully independent audit, compensation and nominating and corporate governance committees;

•at least one of our directors qualifies as an “audit committee financial expert” by applicable SEC regulations and all members of the Audit Committee are financially literate in accordance with the Nasdaq listing standards;

•we have opted out of the business combination and control share acquisition statutes in the MGCL;

•we will not have a stockholder rights plan, and we will not adopt a stockholder rights plan in the future without (i) the approval of our stockholders or (ii) seeking ratification from our stockholders within 12 months of adoption of the plan if the Board determines, in the exercise of its duties under applicable law, that it is in our best interest to adopt a rights plan without the delay of seeking prior stockholder approval;

•none of our directors or stockholders (or their respective designees) will have the right to be nominated to the Board;

•we will have adopted a stock ownership policy that requires each non-employee director, the chief executive officer and each other named executive officer to own a certain amount of specified equity interests in the Company;

•the Circuit Court for Baltimore City, Maryland, or, if that court does not have jurisdiction, the United States District Court for the District of Maryland, Baltimore Division, will be the sole and exclusive forum for certain claims;

•our bylaws will provide that our stockholders may alter or repeal any provision of our bylaws and adopt new bylaws if any such alteration, repeal or adoption is approved by the affirmative vote of a majority of the votes entitled to be cast on the matter; and

•while holders of OP units have certain approval rights, including with respect to a change of control transaction, we are required to vote the full number of OP units that we own in any such vote in the same proportion as votes cast by our stockholders at a stockholders meeting relating to such transaction. After giving effect to this offering, we would have directly or indirectly controlled 89.2% of the OP units as of June 30, 2021.

Recapitalization and Structure of Our Company

Recapitalization

Our stockholders approved an amendment to our charter, or Articles of Amendment, that effected a change of each share of our common stock outstanding at the time the amendment became effective into one share of a newly created class of Class B common stock, which we refer to as the “Recapitalization.” The Articles of Amendment became effective upon filing with, and acceptance by, the SDAT on July 2, 2021. Upon the six-month anniversary of the listing of our common stock for trading on a national securities exchange or such earlier date or dates as approved by our Board with respect to all or any portion of the outstanding shares of our Class B common stock, each share of our Class B common stock will automatically, and without any stockholder action, convert into one share of our listed common stock. In all other respects, our Class B common stock has identical preferences, rights, voting powers, restrictions, limitations as to dividends and other distributions, qualifications, and terms and conditions of redemption as our common stock offered in this offering.

See “Recapitalization” for more information.

Reverse Stock Split

We effected a one-for-three reverse stock split effective on July 2, 2021. In addition, we effected a corresponding reverse split of the OP units. As a result of the reverse stock and OP unit split, every three shares of our common stock and OP units were automatically combined and converted into one issued and outstanding share of common stock or OP unit, as applicable, rounded to the nearest 1/100th share or OP unit. The reverse stock and OP unit splits impacted all common stock and OP units proportionately and had no impact on any stockholder’s or limited partner’s percentage ownership of all issued and outstanding common stock or OP units. Unless otherwise indicated, the information in this prospectus gives effect to the reverse stock and OP unit splits.

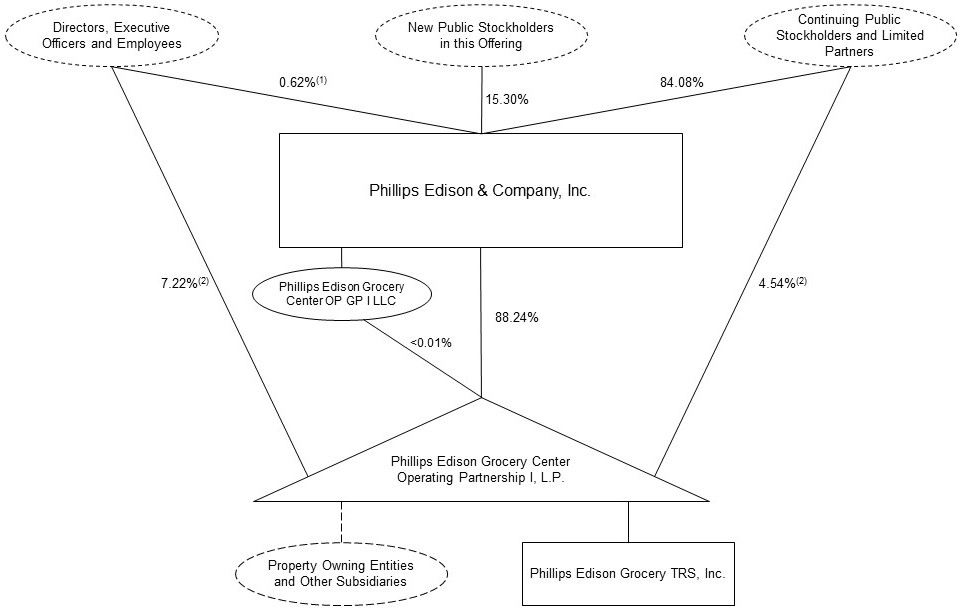

Our Operating Partnership

Substantially all of our business is conducted through the Operating Partnership. We will contribute the net proceeds received by us from this offering to the Operating Partnership in exchange for OP units. Our interest in the Operating Partnership generally entitles us to share in cash distributions from, and in the profits and losses of, the Operating Partnership in proportion to our percentage ownership. Through our wholly-owned subsidiary, Phillips Edison Grocery Center OP GP I LLC, the sole general partner of the Operating Partnership, we generally have the exclusive power under the partnership agreement to manage and conduct the business and affairs of the Operating Partnership, subject to certain limited approval and voting rights of the limited partners. After giving effect to this offering, we would have directly or indirectly controlled 89.2% of the OP units as of June 30, 2021.

Beginning on and after the date that is one year after the issuance of OP units to a limited partner, such limited partner has the right to require the Operating Partnership to redeem part or all of such OP units for cash, based upon the value of an equivalent number of shares of our common stock at the time of the redemption, or, at our election, shares of our common stock on a one-for-one basis, subject to certain adjustments and the restrictions on ownership and transfer of our stock set forth in our charter and described under the section entitled “Description of Capital Stock—Restrictions on Ownership and

10

Transfer.” Each redemption of OP units will increase our percentage ownership interest in the Operating Partnership and our share of its cash distributions and profits and losses. See “The Operating Partnership and the Partnership Agreement” for more information.

Our Structure

The following chart sets forth information about our Company, the Operating Partnership, and certain related parties upon completion of the Recapitalization and this offering. Ownership percentages below assume that the underwriters’ option to purchase additional shares of our common stock to cover overallotments, if any, is not exercised and include the Listing Equity Grants, as defined below.

__________