January 2017

Cautionary Statement Regarding Forward-Looking Statements Forward Looking Statements: Certain statements are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include any statement that does not directly relate to any historical or current fact and include, but are not limited to, (1) guidance and expectations for the fourth quarter and full year 2016, including statements regarding expected net sales, comparable sales, operating income and operating margin, net income, adjusted net income, diluted earnings per share, adjusted diluted earnings per share, cash, debt, operating cash flow, free cash flow, and capital expenditures, (2) statements regarding expected store openings, store closures, and gross square footage, (3) statements regarding expected cost savings, (4) capital expenditure plans for 2017, and (5) statements regarding the Company's future plans and initiatives, including, but not limited to, those related to increasing profitability, increasing store productivity, growing e-commerce sales, expanding the outlet store base and optimizing the retail footprint, increasing brand awareness and elevating the customer experience, transforming and leveraging IT systems, investing in Associates, and results expected from such initiatives. Forward-looking statements are based on our current expectations and assumptions, which may not prove to be accurate. These statements are not guarantees and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict, and significant contingencies, many of which are beyond the Company's control. Many factors could cause actual results to differ materially and adversely from these forward-looking statements. Among these factors are (1) changes in consumer spending and general economic conditions; (2) our ability to identify and respond to new and changing fashion trends, customer preferences, and other related factors; (3) fluctuations in our sales, results of operations, and cash levels on a seasonal basis and due to a variety of other factors, including our product offerings relative to customer demand, the mix of merchandise we sell, promotions, and inventory levels; (4) competition from other retailers; (5) customer traffic at malls, shopping centers, and at our stores and online; (6) our dependence on a strong brand image; (7) our ability to develop and maintain a relevant and reliable omni-channel experience for our customers; (8) the failure or breach of information systems upon which we rely; (9) our ability to protect customer data from fraud and theft; (10) our dependence upon third parties to manufacture all of our merchandise; (11) changes in the cost of raw materials, labor, and freight; (12) supply chain disruption; (13) our dependence upon key executive management; (14) our growth strategy, including our ability to improve the productivity of our existing stores, open new stores, and grow our e-commerce business; (15) our substantial lease obligations; (16) our reliance on third parties to provide us with certain key services for our business; (17) claims made against us resulting in litigation or changes in laws and regulations applicable to our business; (18) our inability to protect our trademarks or other intellectual property rights which may preclude the use of our trademarks or other intellectual property around the world; (19) restrictions imposed on us under the terms of our asset-based loan facility; (20) impairment charges on long-lived assets; and (21) changes in tax requirements, results of tax audits, and other factors that may cause fluctuations in our effective tax rate. Additional information concerning these and other factors can be found in Express, Inc.'s filings with the Securities and Exchange Commission. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events, or otherwise, except as otherwise required by law. 2

♦ One of the largest specialty retail apparel companies with over $2 billion in annual sales ♦ Strong and enduring brand, uniquely positioned within industry ♦ Focused on improving profitability through balanced growth and cost savings ♦ Strong, tenured leadership team Sales Profile Footprint ♦ Iconic dual-gender lifestyle brand appealing to 20-30 year olds ♦ Balanced assortment of core styles and the latest fashions ♦ Address fashion needs across multiple wearing occasions ♦ Quality products at an attractive value ♦ 656 company operated stores across the U.S., Canada and Puerto Rico ♦ E-commerce and mobile platform ♦ 18 international franchise locations in Latin America 3 Express Overview 1 For the fiscal year ended January 30, 2016. 2 Excludes “other revenue” of $45 million. 3 January 28, 2017 projection.

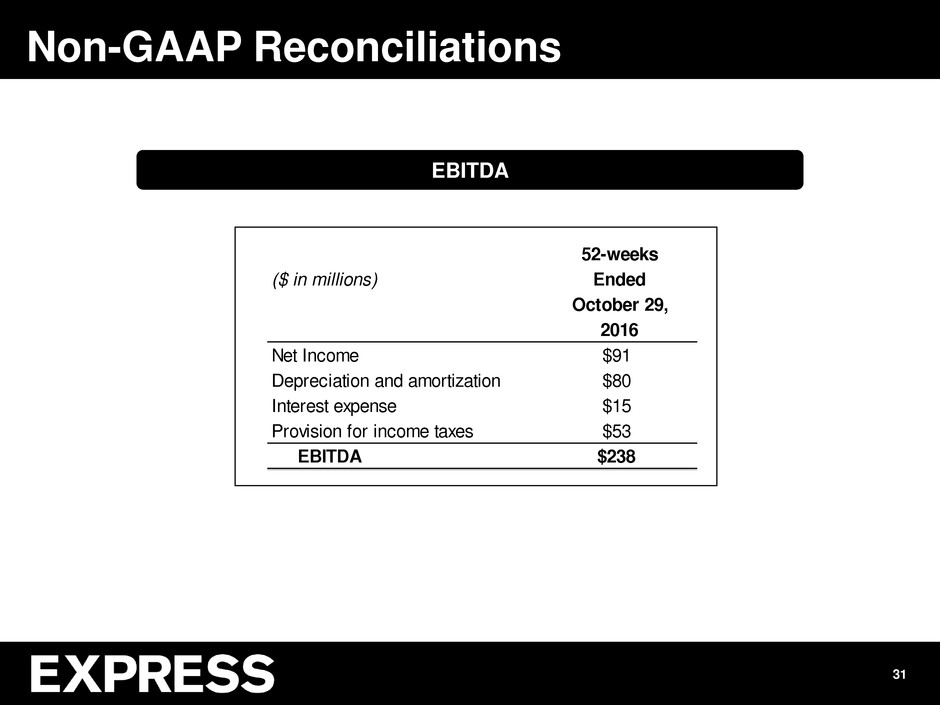

♦ Strong and Enduring Brand, Uniquely Positioned Within Industry Established lifestyle brand with over 35 years of heritage Attractive customer demographic profile – targeting both women and men between 20 and 30 years old Products that serve the lifestyle needs of our core demographic ♦ Strategy Focused on Improving Profitability Balanced approach to growth Increase brand awareness and elevate customer experience Transform and leverage IT systems Significant cost savings initiatives Invest in our Associates ♦ Solid Financial Characteristics Net sales of $2.3 billion and EBITDA of $238 million for the 52-weeks ended October 29, 2016 1 Sound balance sheet with over $100 million in cash and no debt 2 Strong operating and free cash flow generation 4 Investment Thesis 1 EBITDA is earnings before interest, taxes, depreciation and amortization. EBITDA is a Non-GAAP financial measure. Refer to pages 30-35 for information about Non-GAAP financial measures and reconciliations of GAAP to Non-GAAP financial measures. 2 As of the quarterly period ended October 29, 2016.

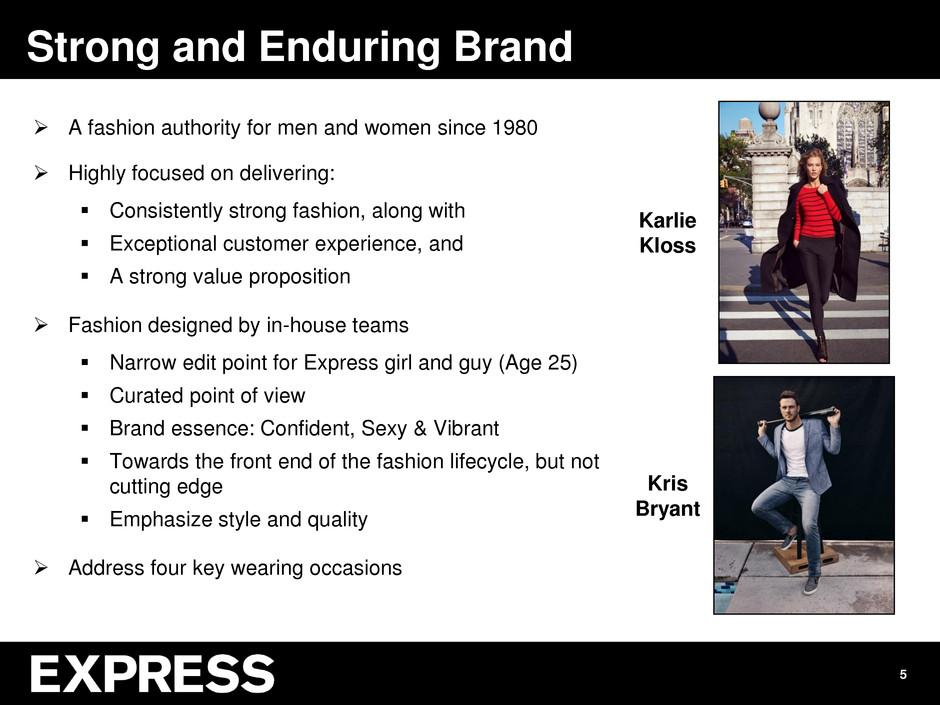

A fashion authority for men and women since 1980 Highly focused on delivering: Consistently strong fashion, along with Exceptional customer experience, and A strong value proposition Fashion designed by in-house teams Narrow edit point for Express girl and guy (Age 25) Curated point of view Brand essence: Confident, Sexy & Vibrant Towards the front end of the fashion lifecycle, but not cutting edge Emphasize style and quality Address four key wearing occasions Karlie Kloss Kris Bryant 5 Strong and Enduring Brand

Work Casual Jeanswear Going Out Teens 20-30s Mid - Late 30's Online: Amazon ASOS 6 Serving Four Wearing Occasions

Our Strategy

♦ Strong and Enduring Brand, Uniquely Positioned Within Industry Established lifestyle brand with over 35 years of heritage Attractive customer demographic profile – targeting both women and men between 20 and 30 years old Products that serve the lifestyle needs of our core demographic ♦ Strategy Focused on Improving Profitability Balanced approach to growth Increase brand awareness and elevate customer experience Transform and leverage IT systems Significant cost savings initiatives Invest in our Associates ♦ Solid Financial Characteristics Net sales of $2.3 billion and EBITDA of $238 million for the 52-weeks ended October 29, 2016 1 Sound balance sheet with over $100 million in cash and no debt 2 Strong operating and free cash flow generation 8 Investment Thesis 1 EBITDA is earnings before interest, taxes, depreciation and amortization. EBITDA is a Non-GAAP financial measure. Refer to pages 30-35 for information about Non-GAAP financial measures and reconciliations of GAAP to Non-GAAP financial measures. 2 As of the quarterly period ended October 29, 2016.

Why Invest in Express?EXPRESS Increase Existing Store Productivity e-Commerce Growth Optimize Retail & Expand Outlet Real Estate Balanced Approach To Growth 9

Deliver compelling product with high emotional content Introduce increased newness & new categories to drive growth Product launches: Petites, Karlie Kloss collection, and others Disciplined testing and tightly controlled inventory to reduce risk More effective marketing to drive traffic and brand awareness Relaunching NEXT loyalty program Optimize customer engagement across all touch points Leverage IT systems – we have modernized 95% of our portfolio of systems over the past four years 10 Increase Store Productivity Objective: Consistent positive comparable sales and margin expansion

E-Commerce Sales Launched in 2008 E-commerce sales continue to grow and outpace store growth +11% in 2015 +3% through Q3 2016 (+15% in Q3-16) Mobile growing as a percentage of sales Driving sales through: A focus on fashion and story telling A mobile first approach to development Improved search and checkout capabilities More targeted customer outreach and segmentation using analytics Exclusive product, color and size offerings $ in millions % of Total Sales 11 Grow E-Commerce Sales

Total store count and net square footage growth up slightly in recent years Expansion of outlet store base Contraction of retail store footprint ~13% decrease since FY13 International opportunity remains significant 18 international franchise stores in Latin America Store Count1 12 Total Stores Net Sq Ft Growth 3% 3% 3% 1% 2% 0% 1% # of Stores 1 Chart excludes international franchise stores. 2 January 28, 2017 projection. 2

552 Express retail stores First store opened in 1980 535 in the U.S. and 17 in Canada Profitable store base with diverse location mix High-traffic malls, lifestyle centers and street locations Continue to optimize footprint Rationalization plan: close ~ 50 stores as leases expire 43 closures achieved to date Remaining to be closed in 2017 Increase flexibility with lease renewals Regularly assess overall store profitability Retail Stores 13 Optimize Retail Footprint 1 January 28, 2017 projection. 1 1

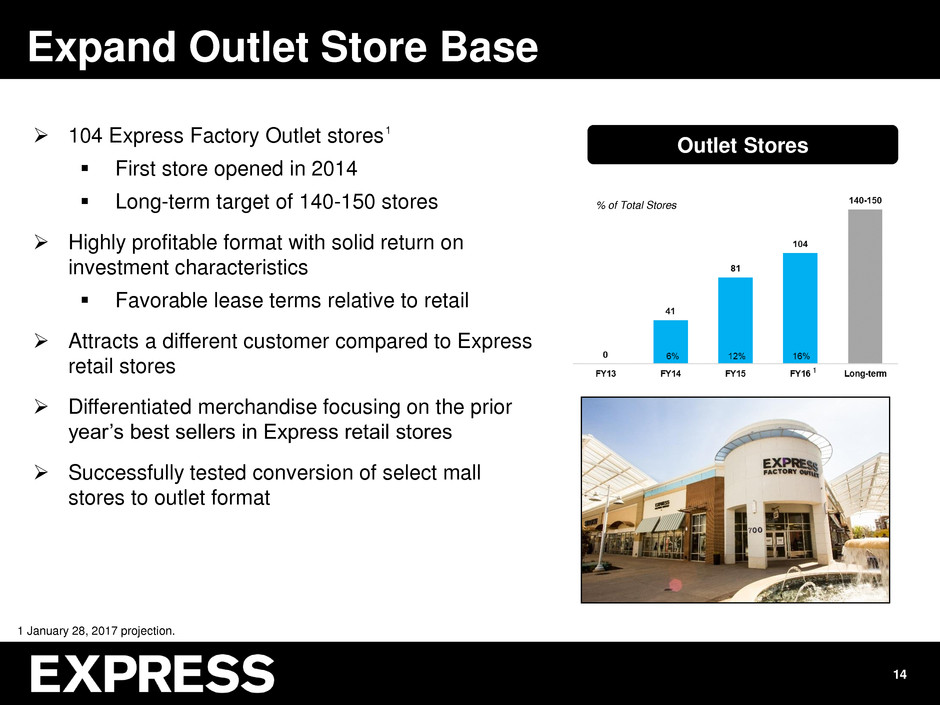

104 Express Factory Outlet stores First store opened in 2014 Long-term target of 140-150 stores Highly profitable format with solid return on investment characteristics Favorable lease terms relative to retail Attracts a different customer compared to Express retail stores Differentiated merchandise focusing on the prior year’s best sellers in Express retail stores Successfully tested conversion of select mall stores to outlet format Outlet Stores 14 Expand Outlet Store Base % of Total Stores 1 January 28, 2017 projection. 1 1

Leverage marketing spend to increase awareness and purchase intent for both women’s and men’s offering Direct marketing, social media, broadcast TV advertising, ambassadors, influencers and bloggers Improve customer experience and increase conversion rates Express NEXT loyalty re-launch Omni-channel initiatives 15 Elevate Brand Awareness And Experience

Transitioned to a new call center and fulfillment center during Q2-16 New order management system in Q2-16 New retail management system in Q3-16 New enterprise planning system in Q3-16 16 Transform and Leverage IT Systems Transform IT Systems Leverage IT Systems We have modernized 95% of our portfolio of systems over the past four years Foundation to pursue omni-channel capabilities Possess greater insight into customers’ shopping preferences Quicker decision making and increased speed to market Ability to conduct planning and allocation to a more precise level across channels Maximize inventory productivity and reduce markdowns

On track to deliver $44 to $54 million in cost savings opportunities across various areas of the business Merchandise margin savings Expansion of factory sourcing base Buying & occupancy cost savings Sustainability efforts within stores (e.g. lighting, HVAC) SG&A expense savings Enhanced focus on overall productivity Also manage to a zero-based budgeting approach 17 Significant Cost Savings Initiatives Savings By Category Expected Savings Timeline $ in millions

Commitment to ensuring Express remains a great place to work, develop and grow professionally, and that we continue to attract outstanding talent to the brand Offer a variety of unique associate development programs that have received national recognition by leading industry publications Express Values We are… Collaborative Authentic Resilient 18 Invest In Our Associates

Financial Discussion

♦ Strong and Enduring Brand, Uniquely Positioned Within Industry Established lifestyle brand with over 35 years of heritage Attractive customer demographic profile – targeting both women and men between 20 and 30 years old Products that serve the lifestyle needs of our core demographic ♦ Strategy Focused on Improving Profitability Balanced approach to growth Increase brand awareness and elevate customer experience Transform and leverage IT systems Significant cost savings initiatives Invest in our Associates ♦ Solid Financial Characteristics Net sales of $2.3 billion and EBITDA of $238 million for the 52-weeks ended October 29, 2016 1 Sound balance sheet with over $100 million in cash and no debt 2 Strong operating and free cash flow generation 20 Investment Thesis 1 EBITDA is earnings before interest, taxes, depreciation and amortization. EBITDA is a Non-GAAP financial measure. Refer to pages 30-35 for information about Non-GAAP financial measures and reconciliations of GAAP to Non-GAAP financial measures. 2 As of the quarterly period ended October 29, 2016.

Comparable Sales Growth 1 Based on our 2016 guidance as of January 10, 2017. Net Sales 21 Financial Performance $ in millions 1 1 After a solid year in 2015, sales have been under pressure in 2016 Fiscal 2016 net sales estimated to be approximately $2.2 billion

Diluted EPSOperating Margin 1 Operating Margin is calculated based on adjusted operating income which excludes the impact of non-core items. Adjusted Operating Income is a Non-GAAP financial measure. Refer to pages 30-35 for information about Non-GAAP financial measures and reconciliations of GAAP to Non-GAAP financial measures. 2 Based on the mid-point of our 2016 guidance as of January 10, 2017. 3 Diluted EPS is adjusted to exclude the impact of non-core items. Adjusted Diluted EPS is a Non-GAAP financial measure. Refer to pages 30-35 for information about Non- GAAP financial measures and reconciliations of GAAP to Non-GAAP financial measures. 4 Based on our 2016 guidance as of January 10, 2017. Diluted EPS is adjusted to exclude the impact of non-core items. Adjusted Diluted EPS is a Non-GAAP financial measure. Refer to pages 30-35 for information about Non-GAAP financial measures and reconciliations of GAAP to Non-GAAP financial measures. 22 Financial Performance 2016 operating margin and diluted EPS negatively impacted by net sales decrease 1 1 2 3 3 3 4 ~ -410 bps

23 Financial Guidance Based on our holiday results, we reaffirmed our EPS guidance for Q4 and 2016 Q4 comparable sales are expected to be negative 13% Q4 net income expected to range from $20 to $23 million Diluted EPS expected to range from $0.26 to $0.30 Guidance as of January 10, 2017 Q4 2016 FY 2016 Comparable Sales: -13% -9% N t Inc me $20 to $23 million $55 to $58 million Adjusted Net Income: N/A $62 to $65 million (1,2) Diluted EPS $0.26 to $0.30 $0.70 to $0.74 Adjusted Diluted EPS: N/A $0.78 to $0.82 (2) 78.8 million 79.1 million Weighted Average Diluted Shares: (1) Adjusted net income excludes approximately $11.4 million, or $6.9 million net of tax benefit, of non-core operating items related to an amendment to the Times Square Flagship store lease. (2) Adjusted Net Income and Adjusted Diluted EPS are non-GAAP financial measures. Refer to pages 30-35 for information about Non-GAAP financial measures and reconciliations of GAAP to Non-GAAP financial measures. This guidance does not take into account any additional non-core items that may occur.

Operating Cash FlowCash and Debt 24 Balance Sheet and Cash Flow $ in millions $ in millions 2 2 ≥ $150 ~$150 Sound balance sheet with cash of $102 million at the end of Q3 1 We expect over $150 million in cash and no debt at the end of 2016 2 Fiscal 2016 operating cash flow estimated to be approximately $150 million 1 As of the quarterly period ended October 29, 2016. 2 Estimate based on our 2016 guidance as of January 10, 2017.

Free Cash Flow2Capital Expenditures 25 Capital Spend and Free Cash Flow $ in millions $ in millions 1 2016 guidance as of January 10, 2017. 2 Free cash flow is a Non-GAAP financial measure. Free cash flow represents cash flow from operations less capital expenditures. Refer to pages 30-35 for information about Non-GAAP financial measures and reconciliations of GAAP to Non-GAAP financial measures. 3 Estimate based on our 2016 guidance as of January 10, 2017. 1 1 3 Elevated due to significant IT investments Priorities of cash use include: Reinvesting back into the business (e.g. new outlet stores and retail remodels) Plan to lower capital spend in 2017 by ~25% Fiscal 2016 free cash flow estimated to be approximately $45-50 million ~$45-50

Summary

♦ Strong and Enduring Brand, Uniquely Positioned Within Industry Established lifestyle brand with over 35 years of heritage Attractive customer demographic profile – targeting both women and men between 20 and 30 years old Products that serve the lifestyle needs of our core demographic ♦ Strategy Focused on Improving Profitability Balanced approach to growth Increase brand awareness and elevate customer experience Transform and leverage IT systems Significant cost savings initiatives Invest in our Associates ♦ Solid Financial Characteristics Net sales of $2.3 billion and EBITDA of $238 million for the 52-weeks ended October 29, 2016 1 Sound balance sheet with over $100 million in cash and no debt 2 Strong operating and free cash flow generation 27 Investment Thesis 1 EBITDA is earnings before interest, taxes, depreciation and amortization. EBITDA is a Non-GAAP financial measure. Refer to pages 30-35 for information about Non-GAAP financial measures and reconciliations of GAAP to Non-GAAP financial measures. 2 As of the quarterly period ended October 29, 2016.

Non-GAAP Reconciliations

Cautionary Statement Regarding Non GAAP Financial Measures Non-GAAP Financial Measures This presentation contains references to Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA), Adjusted Operating Margin, Adjusted Operating Income, Adjusted Net Income, Adjusted Diluted Earnings Per Share (EPS), and Free Cash Flow which are Non-GAAP financial measures. These measures should be considered supplemental to and not a substitute for financial information prepared in accordance with generally accepted accounting principles (GAAP) included in Express, Inc.’s filings with the Securities and Exchange Commission and may differ from similarly titled measures used by others. Please refer to slides 31-35 in this presentation for additional information and reconciliations of these measures to the most directly comparable financial measures calculated in accordance with GAAP. Management believes that EBITDA, Adjusted Operating Margin, Adjusted Operating Income, Adjusted Net Income, and Adjusted Diluted EPS provide useful information because they exclude items that may not be indicative of or are unrelated to our underlying business results, and provide a better baseline for analyzing trends in our underlying business. Management believes that Free Cash Flow provides useful information regarding liquidity as it shows our operating cash flow generation less cash reinvested back into the business (capital expenditures). 30

31 EBITDA Non-GAAP Reconciliations 52-weeks ($ in millions) Ended October 29, 2016 Net Income $91 Depreciation and amortization $80 Interest expense $15 Provision for income taxes $53 EBITDA $238

32 Non-GAAP Reconciliations 2015 and 2016 Adjusted Net Income and Adjusted EPS Fifty-Two Weeks Ended January 28, 2017 (in thousands, except per share amounts) Projected Net Income Projected Diluted Earnings per Share Projected Weighted Average Diluted Shares Outstanding Projected GAAP Measure * $ 56,500 $ 0.71 79,068 Interest Expense (a) 11,354 0.14 Income Tax Benefit (b) (4,428 ) (0.06 ) Projected Adjusted Non-GAAP Measure * $ 63,426 $ 0.80 (a) Represents non-core items related to the amendment of the Times Square Flagship store lease. (b) Represents the tax impact of the interest expense adjustment at our statutory rate of approximately 39% for the fifty-two weeks ended January 28, 2017. * Represents mid-point of guidance range. Fifty-Two Weeks Ended January 30, 2016 (in thousands, except per share amounts) Net Income Earnings per Diluted Share Weighted Average Diluted Shares Outstanding Reported GAAP Measure $ 116,513 $ 1.38 84,591 Interest Expense (a) 9,657 0.11 Income Tax Benefit (b) (3,741 ) (0.04 ) Adjusted Non-GAAP Measure $ 122,429 $ 1.45 (a) Includes the redemption premium paid, the write-off of unamortized debt issuance costs, and the write-off of the unamortized debt discount related to the redemption of all $200.9 million of our Senior Notes. (b) Represents the tax impact of the interest expense adjustment at our statutory rate of approximately 39% for the fifty-two weeks ended January 30, 2016.

33 Non-GAAP Reconciliations 2011 Adjusted Operating Income, Adjusted Net Income and Adjusted EPS Fifty-Two Weeks Ended January 28, 2012 (in thousands, except per share amounts) Operating Income Net Income Earnings per Diluted Share Weighted Average Diluted Shares Outstanding GAAP measure $ 270,946 $ 140,697 $ 1.58 88,896 Transaction costs (a) 1,011 1,011 0.01 Interest expense (b) — 9,583 0.11 Income tax benefit (c) — --- (4,165 ) (0.05 ) Adjusted non-GAAP measure $ 271,957 $ 147,126 $ 1.66 (a) Includes transaction costs related to the secondary offerings completed in April 2011 and December 2011. (b) Includes premium paid and accelerated amortization of debt issuance costs and debt discount related debt reductions and amendments. (c) Represents the tax impact at our statutory rate of approximately 39% for the fifty -two weeks ended January 28, 2012.

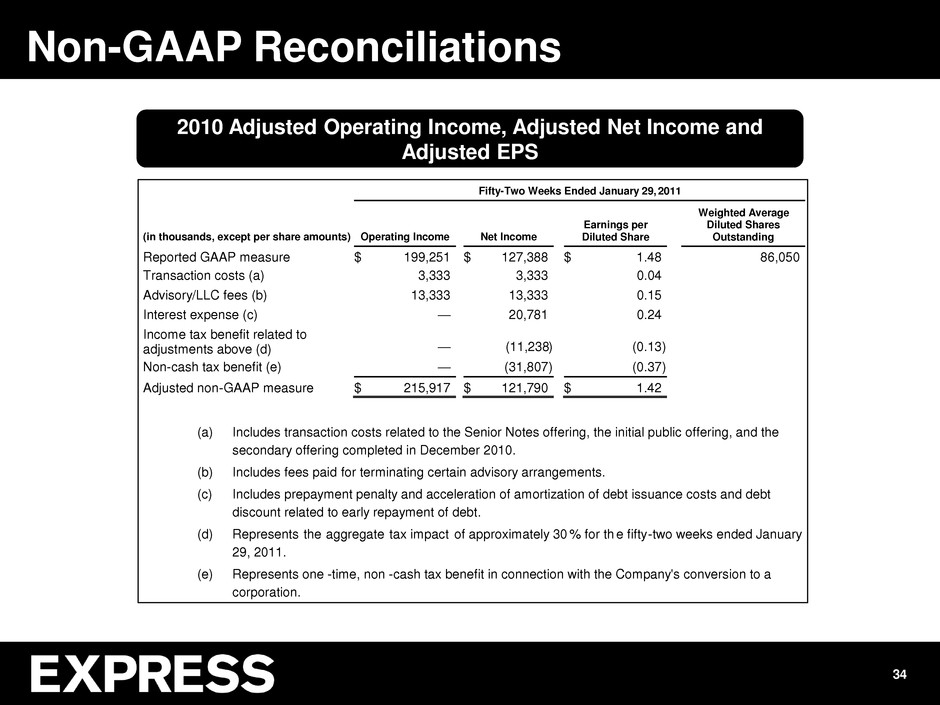

34 Non-GAAP Reconciliations 2010 Adjusted Operating Income, Adjusted Net Income and Adjusted EPS Fifty-Two Weeks Ended January 29, 2011 (in thousands, except per share amounts) Operating Income Net Income Earnings per Diluted Share Weighted Average Diluted Shares Outstanding Reported GAAP measure $ 199,251 $ 127,388 $ 1.48 86,050 Transaction costs (a) 3,333 3,333 0.04 Advisory/LLC fees (b) 13,333 13,333 0.15 Interest expense (c) — 20,781 0.24 Income tax benefit related to adjustments above (d) — (11,238 ) (0.13 ) Non-cash tax benefit (e) — (31,807 ) (0.37 ) Adjusted non-GAAP measure $ 215,917 $ 121,790 $ 1.42 (a) Includes transaction costs related to the Senior Notes offering, the initial public offering, and the secondary offering completed in December 2010. (b) Includes fees paid for terminating certain advisory arrangements. (c) Includes prepayment penalty and acceleration of amortization of debt issuance costs and debt discount related to early repayment of debt. (d) Represents the aggregate tax impact of approximately 30 % for th e fifty-two weeks ended January 29, 2011. (e) Represents one -time, non -cash tax benefit in connection with the Company's conversion to a corporation.

35 FY 2010 – FY 2016 Free Cash Flow Non-GAAP Reconciliations Projected 52-weeks 52-weeks 53-weeks 52-weeks 52-weeks 52-weeks 52-weeks ($ in millions) Ended Ended Ended Ended Ended Ended Ended January 29, January 28, February 2, February 1, January 31, January 30, January 28, 2011 2012 2013 2014 2015 2016 2017 Cash flow from operations $220 $213 $269 $195 $157 $230 ~$150 Less: Capital expenditures $55 $77 $100 $105 $115 $115 $100-105 Free Cash Flow $165 $135 $170 $90 $41 $114 ~$45-50 1 Estimate based on our 2016 guidance as of January 10, 2017. 1