UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

or

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

Commission file number: 001-36822

InfraREIT, Inc.

(Exact name of Registrant as specified in its charter)

Maryland | | 75-2952822 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification Number) |

| | |

1900 North Akard Street Dallas, Texas | | 75201 |

(Address of Principal Executive Offices) | | (Zip Code) |

(214) 855-6700

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Class | | Name of Each Exchange on Which Registered |

Common Stock, $0.01 par value per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | | ☐ | | Accelerated filer | | ☒ |

| | | | | | |

Non-accelerated filer | | ☐ (Do not check if a smaller reporting company) | | Smaller reporting company | | ☐ |

| | | | | | |

| | | | Emerging growth company | | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of June 30, 2017, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of Common Stock held by non-affiliates of the registrant was $638.8 million based on the last sales price on June 30, 2017 on the New York Stock Exchange of $19.15 for the registrant’s Common Stock.

As of February 23, 2018, 43,796,915 shares of common stock were issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement for the registrant’s 2018 Annual Meeting of Stockholders to be held May 16, 2018 are incorporated in Part III of this Annual Report on Form 10-K.

InfraREIT, Inc.

INDEX

2

GLOSSARY OF TERMS

This glossary highlights some of the industry terms that we use in this Annual Report on Form 10-K and is not a complete list of all the defined terms used herein.

Abbreviation | | Term |

| | |

AFUDC | | allowance for funds used during construction |

| | |

CREZ | | competitive renewable energy zones, as defined by a 2005 Texas law establishing the Texas renewable energy program |

| | |

CWIP | | construction work in progress |

| | |

DC Tie | | high-voltage direct current interconnection necessary to provide for electricity flow between asynchronous electric grids in North America |

| | |

distribution | | that portion of a power delivery network consisting of an interconnected group of electric distribution lines, towers, poles, substations, transformers and associated assets over which electric power is distributed from points within the transmission network to end use consumers |

| | |

distribution service territory | | a designated area in which a utility is required or has the right to supply electric service to ultimate customers under a regulated utility structure |

| | |

electric utilities | | a person or river authority that owns or operates equipment or facilities to produce, generate, transmit, distribute, sell or furnish electricity for compensation |

| | |

ERCOT | | Electric Reliability Council of Texas |

| | |

ERCOT 4CP | | the average of ERCOT coincident peak demand for the months of June, July, August and September, excluding the portion of coincident peak demand attributable to wholesale storage load (during 2017, ERCOT 4CP was approximately 67,273 megawatts) |

| | |

FERC | | Federal Energy Regulatory Commission |

| | |

Footprint Projects | | transmission or, if applicable, distribution projects that (1) are primarily situated within our current or previous distribution service territory, as applicable; (2) physically hang from our existing transmission assets, such as the addition of another circuit to our existing transmission lines, or that are physically located within one of our substations; or (3) connect or are otherwise added to transmission lines or other property that comprise a part of the transmission assets acquired in the Asset Exchange Transaction (as defined below). Footprint Projects do not include the addition of a new substation on our existing transmission lines or generation interconnects to our existing transmission lines, unless the addition or interconnection occurred within our current or prior distribution service territories |

| | |

PUCT | | Public Utility Commission of Texas |

| | |

rate base | | calculated as our gross electric plant in service under U.S. GAAP (as defined below), which is the aggregate amount of our total cash expenditures used to construct such assets plus AFUDC, less accumulated depreciation and adjusted for accumulated deferred income taxes, regulatory liabilities and regulatory assets |

| | |

revenue requirement | | a utility’s revenue requirement is equal to its targeted total costs, including operating and maintenance costs, return on rate base and taxes |

| | |

ROFO Projects | | identified projects developed by Hunt Consolidated, Inc. and its affiliates with respect to which we have a right of first offer |

| | |

regulated assets | | rate-regulated electric transmission and distribution assets, as applicable, such as power lines, substations, transmission towers, distribution poles, transformers and related property and assets |

| | |

TCOS filing | | an interim transmission cost of service filing with the PUCT that updates a utility’s transmission cost of service, and therefore its transmission tariff, to reflect recent capital expenditures, among other matters; an interim TCOS filing establishes transmission cost of service until the next rate case or interim TCOS filing |

| | |

transmission | | that portion of a power delivery network consisting of an interconnected group of electric transmission lines, towers, poles, switchyards, substations, transformers and associated assets over which electric power is transmitted between points of supply or generation and distribution |

| | |

U.S. GAAP | | accounting principles generally accepted in the United States of America |

3

FORWARD-LOOKING STATEMENTS

Some of the information in this Annual Report on Form 10-K may contain forward-looking statements. Forward-looking statements give InfraREIT, Inc.’s (InfraREIT, we or Company) current expectations and include projections of results of operations or financial condition or forecasts of future events. Words such as “could,” “will,” “may,” “assume,” “forecast,” “position,” “predict,” “strategy,” “expect,” “intend,” “plan,” “estimate,” “anticipate,” “believe,” “project,” “budget,” “potential” or “continue” and similar expressions are used to identify forward-looking statements. Without limiting the generality of the foregoing, forward-looking statements contained in this document include our expectations regarding our strategies, objectives, growth and anticipated financial and operational performance, including guidance regarding our capital expenditures, infrastructure programs and estimated distributions to our stockholders.

A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement. We believe that we have chosen these assumptions or bases in good faith and that they are reasonable. However, the assumptions and estimates underlying the forward-looking statements included in this document are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in this document. Accordingly, when considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in this document, and you are cautioned not to place undue reliance on any forward-looking statements. You should also understand that it is not possible to predict or identify all such factors, and you should not consider the following list to be a complete statement of all potential risks and uncertainties. Factors that could cause our actual results to differ materially from the results contemplated by such forward-looking statements include:

| • | decisions by regulators or changes in governmental policies or regulations with respect to our organizational structure, lease arrangements, capitalization, acquisitions and dispositions of assets, recovery of investments, authorized rate of return and other regulatory parameters; |

| • | the impact of the Tax Cuts and Jobs Act on the relative advantages of our business model and the effects of any decision to terminate our real estate investment trust (REIT) status; |

| • | the implications of our relationships with Hunt Consolidated, Inc. (HCI) and its affiliates on any transaction or alternative arrangement that may be proposed by HCI or a third party; |

| • | our current reliance on our tenant for all our lease revenues and, as a result, our dependency on our tenant’s solvency and financial and operating performance; |

| • | the amount of available investment to grow our rate base; |

| • | our ability to negotiate future rent payments or to renew leases with our tenant; |

| • | insufficient cash available to meet distribution requirements; |

| • | cyber breaches and weather conditions or other natural phenomena; |

| • | the price and availability of debt and equity financing; |

| • | our level of indebtedness or debt service obligations; |

| • | the effects of existing and future tax and other laws and governmental regulations; |

| • | our failure to qualify or maintain our status as a REIT or changes in the tax laws applicable to REITs; |

| • | the termination of our management agreement or the loss of the services of Hunt Utility Services, LLC or other qualified personnel; |

| • | adverse economic developments in the electric power industry or in business conditions generally; and |

| • | certain other factors discussed elsewhere in this Annual Report on Form 10-K. |

For the above reasons, there can be no assurance that any forward-looking statements included herein will prove to be indicative of our future performance or that actual results will not differ materially from those presented. In no event should the inclusion of forward-looking information in this document be regarded as a representation by any person that the results contained in such forward-looking information will be achieved.

Forward-looking statements speak only as of the date on which they are made. While we may update these statements from time to time, we are not required to do so other than pursuant to applicable laws. For a further discussion of these and other factors that could impact our future results and performance, see Part I, Item 1A., Risk Factors.

4

PART I

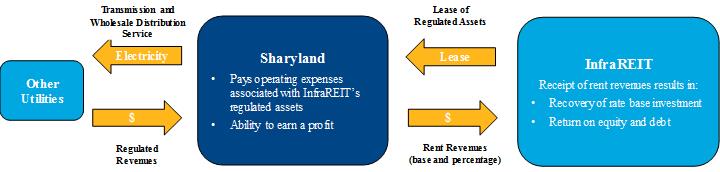

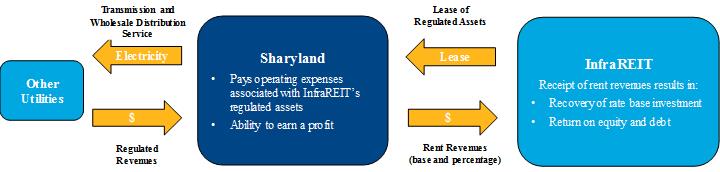

Company Overview

We are a Maryland corporation engaged in owning and leasing rate-regulated assets in Texas and headquartered in Dallas, Texas. We are structured as a REIT and lease our regulated assets to Sharyland Utilities, L.P. (Sharyland), a Texas-based regulated electric utility, pursuant to leases between Sharyland and our subsidiary, Sharyland Distribution & Transmission Services, L.L.C. (SDTS), a Texas-based regulated electric utility. Sharyland delivers electric service to other utilities and collects revenues through PUCT-approved rates.

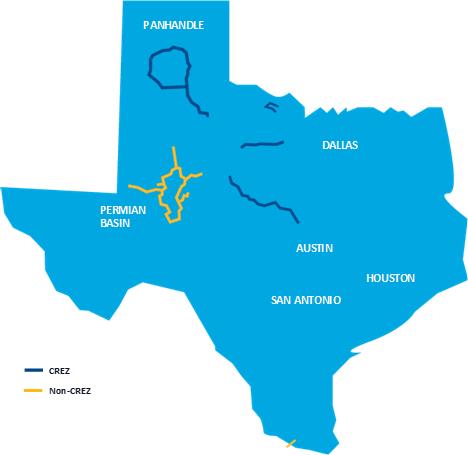

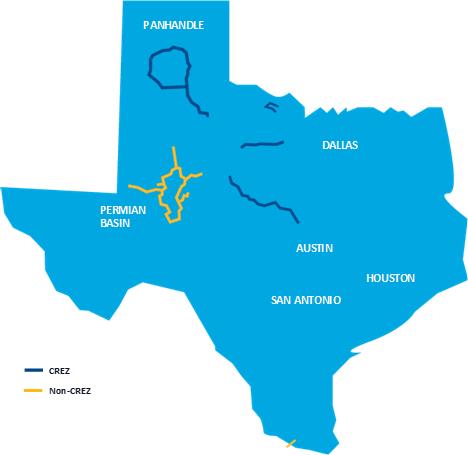

Our assets are located in the Texas Panhandle; near Wichita Falls, Abilene and Brownwood; in the Permian Basin; and in South Texas. We have grown rapidly since our formation, with our rate base increasing from approximately $60 million as of December 31, 2009 to approximately $1.5 billion as of December 31, 2017.

Our business originated in the late 1990s when members of the Hunt family founded Sharyland, the first investor owned utility created in the United States since the 1960s. In 2007, we obtained a private letter ruling from the Internal Revenue Service (IRS) confirming that our transmission and distribution assets could constitute real estate assets under applicable REIT rules. In 2008, the PUCT approved a restructuring that allowed us to utilize our REIT structure (2008 Restructuring Order). In 2010, InfraREIT, L.L.C. was formed as a REIT, holding all its assets through InfraREIT Partners, LP (Operating Partnership). We completed our initial public offering (IPO) and a series of reorganization transactions in 2015. Hunt Utility Services, LLC (Hunt Manager) manages our day-to-day business, subject to oversight from our board of directors.

In July 2017, SDTS and Sharyland signed a definitive agreement (Definitive Agreement) with Oncor Electric Delivery Company LLC (Oncor) to exchange SDTS’s retail distribution assets and certain transmission assets for a group of Oncor’s transmission assets located in Northwest and Central Texas (Asset Exchange Transaction). The Asset Exchange Transaction closed in November 2017 and, among other things, resulted in SDTS receiving $383 million of transmission assets owned by Oncor and $20 million of net cash in exchange for $403 million of SDTS’s net assets. See Note 2, Asset Exchange Transaction in the Notes to the Consolidated Financial Statements beginning on page F-1 for additional information.

InfraREIT, Inc. was formed as a Delaware corporation in 2001 and converted into a Maryland corporation in 2014. We conduct our business through a traditional umbrella partnership REIT (UPREIT) in which our properties are owned by our Operating Partnership or direct and indirect subsidiaries of our Operating Partnership. All our assets are held by and all our business activities are conducted through the Operating Partnership, either directly or through its subsidiaries. InfraREIT is the sole general partner of our Operating Partnership and owns approximately 72.1% of the limited partnership units (OP Units) as of February 23, 2018. The remaining OP Units are held by the Operating Partnership’s limited partners, including HCI affiliates. Subject to the terms of the partnership agreement, OP Units held by the limited partners may be redeemed for cash or, at our option, exchanged for shares of our common stock on a one-for-one basis.

As previously disclosed, in light of the enactment of the Tax Cuts and Jobs Act (TCJA), we are reviewing our REIT election and the existing lessor-lessee relationship with Sharyland, which includes consideration of whether we should terminate our REIT status (De-REIT transaction). See Company Structure Review below for additional information.

5

Our Regulated Assets

Our regulated assets consist of approximately 1,373 circuit miles of transmission lines, substations, a 300-megawatt high-voltage DC Tie between Texas and Mexico (Railroad DC Tie) and a transmission operations center. Approximately 67% of our net assets as of December 31, 2017 constitute transmission lines that were constructed as part of the CREZ initiative, which was originated by the Texas Legislature in 2005 and carried out by the PUCT, to meet the state’s goals regarding renewable energy capacity by delivering renewable energy to end use consumers in the most cost-effective manner.

The following map shows the location of our assets as of December 31, 2017:

Expected Capital Expenditures

We expect to fund capital expenditures for Footprint Projects during the calendar years 2018 through 2020 in the range of $70 million to $180 million. For additional information related to our estimated Footprint Projects capital expenditures, see Capital Expenditures under the caption Liquidity and Capital Resources in Part II, Item 7., Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Our Revenue Model

We lease our regulated assets to Sharyland, which makes lease payments to us consisting of base and percentage rent. To support its lease payments to us, Sharyland delivers electric service to other utilities and collects revenues through PUCT-approved rates. Under the terms of our leases, Sharyland is responsible for the maintenance and operation of our assets, payment of all property related expenses associated with our assets, including repairs, maintenance, insurance and taxes (other than income taxes and REIT excise taxes) and construction of Footprint Projects. Sharyland is also primarily responsible for regulatory compliance and reporting requirements related to our assets.

6

Leases

We currently lease all our assets pursuant to five separate leases. The following table provides a summary description of the regulated assets in each of our leases as of December 31, 2017.

Lease | | Location of Assets | | Description of Assets | | Lease Expiration Date |

McAllen Lease | | Primarily South Texas | | Railroad DC Tie, transmission operations center and 138 kV transmission lines | | 12/31/2019 |

Permian Lease (1) | | In and around Midland, Texas | | 138 kV transmission lines and connected substations | | 12/31/2020 |

CREZ Lease | | Texas Panhandle and near Wichita Falls, Abilene and Brownwood | | 345 kV transmission lines and designated collection stations | | 12/31/2020 |

Stanton Transmission Loop Lease | | Near Stanton, Texas | | 138 kV transmission lines and connected substations | | 12/31/2021 |

ERCOT Transmission Lease | | Texas Panhandle | | Substations | | 12/31/2022 |

(1) | Formerly the Stanton/Brady/Celeste Lease (S/B/C Lease) |

2017 Rent Revenue

The table below provides a summary of lease revenue and certain other information with respect to our leases (dollar amounts in thousands):

Lease | | Lease Expiration Date | | Net Effective Rent (1) | | | Percentage of Total Net Effective Rent (2) | | | Electric Plant, net (3) | | | Percentage of Total Electric Plant, net (4) | |

McAllen Lease (5) | | 12/31/2019 | | $ | 13,754 | | | | 7.2 | % | | $ | 107,579 | | | | 6.5 | % |

Permian Lease (6) | | 12/31/2020 | | | 86,024 | | | | 45.2 | % | | | 402,823 | | | | 24.3 | % |

CREZ Lease (7) | | 12/31/2020 | | | 80,688 | | | | 42.4 | % | | | 1,065,877 | | | | 64.2 | % |

Stanton Transmission Loop Lease | | 12/31/2021 | | | 4,422 | | | | 2.3 | % | | | 30,928 | | | | 1.9 | % |

ERCOT Transmission Lease | | 12/31/2022 | | | 5,453 | | | | 2.9 | % | | | 51,379 | | | | 3.1 | % |

| | | | $ | 190,341 | | | | 100.0 | % | | $ | 1,658,586 | | | | 100.0 | % |

(1) | Consists of lease revenue under the lease for the year ended December 31, 2017, determined on a straight-line basis under U.S. GAAP. See Revenue Recognition under the caption Summary of Significant Accounting Policies and Estimates in Item II, Item 7., Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

(2) | Calculated as lease revenue for the applicable lease for the year ended December 31, 2017 divided by the total lease revenue for all leases. |

(3) | Consists of plant in service, net for the applicable lease as of December 31, 2017. |

(4) | Calculated as the electric plant, net for the applicable lease divided by the total electric plant, net for all leases as of December 31, 2017. |

(5) | Certain assets that were previously included in the McAllen Lease were transferred to Oncor effective as of the November 9, 2017 closing date as part of the Asset Exchange Transaction. |

7

(6) | Net Effective Rent relates to the S/B/C Lease prior to its termination on December 31, 2017. Certain assets that were previously included in the S/B/C Lease were transferred to Oncor effective as of the November 9, 2017 closing date as part of the Asset Exchange Transaction. Electric Plant, net relates to the Permian Lease as of December 31, 2017. |

(7) | All of the transmission assets acquired from Oncor in the Asset Exchange Transaction were added to the CREZ Lease effective as of the November 9, 2017 closing date. |

Provisions of Our Leases

The following summarizes the material terms of our leases.

Rental Rates

All of our current revenue is comprised of rental payments from Sharyland under leases and lease supplements that were negotiated at various times between 2010 and 2017. Lease supplements are exhibits to our leases that include the economics of the lease obligations that Sharyland owes us. We and Sharyland have negotiated rent payments intended to provide us with approximately 97% of the projected regulated return on rate base investment attributable to our assets that we and Sharyland would receive if we were a fully-integrated utility. See the caption Lease Revenues under Factors Expected to Affect Our Operating Results and Financial Condition included in Part II, Item 7., Management’s Discussion and Analysis of Financial Condition and Results of Operations. We and Sharyland have negotiated these rental rates based on the premise that we, as the owner of regulated assets, should receive most of the regulated return on our invested capital, while leaving Sharyland with a portion of the return that gives it the opportunity to operate prudently and earn a profit or suffer a loss on its operation of assets. Our leases require us to negotiate rent payments in a manner consistent with this practice.

Actual revenue and expenses incurred by Sharyland will be different from those expected at the time of negotiation. As a result, we and Sharyland may earn more or less than originally projected. Our leases prohibit adjustments to lease payments for the effect of differences between Sharyland’s actual and projected results.

Our lease revenue primarily consists of base rent, but certain lease supplements contain percentage rent as well. The lease supplements for the Permian Lease, Stanton Transmission Loop Lease and assets in the CREZ Lease that were acquired from Oncor in the Asset Exchange Transaction provide only for base rent. Rent for the McAllen Lease, ERCOT Lease and assets in the CREZ Lease not acquired in the Asset Exchange Transaction is comprised primarily of base rent but also includes percentage rent. Prior to its termination, the S/B/C Lease also included a percentage rent component. Percentage rent under our leases is based on a percentage of Sharyland’s annual gross revenues, as defined in the applicable lease, in excess of annual specified breakpoints, which are at least equal to the base rent under each lease. Because a utility’s rate base decreases over time as our regulated assets depreciate, revenue under our leases will decrease over time unless we add to our existing rate base by making additional capital expenditures to offset the decreases in the rent resulting from depreciation. The weighted average annual depreciation rate of our assets as of December 31, 2017 was 2.50%.

Our leases provide that, as the completion of Footprint Projects increases our rate base, we and Sharyland will negotiate amended and restated lease supplements that will update the scheduled rent payments to include additional rent payments related to this incremental rate base. The negotiation of amended and restated lease supplements relates only to the revenue we expect to be generated from the incremental rate base subject to the negotiation and does not impact the portion of the scheduled lease payments previously negotiated with respect to assets that are already in service. However, various factors, such as a change in regulatory conditions or assumptions, could cause Sharyland’s expected lease payments on incremental rate base to be different than its lease payments to us on our existing rate base. Also, our leases provide that either party can negotiate for economics in the amended and restated lease supplements that differ from our existing leases based on factors that we determine to be appropriate at the time of the negotiation.

Additionally, the amended and restated lease supplement process allows us to address and update a number of other matters under our leases, such as updating the amount of revenue attributable to Sharyland’s capital expenditures and related matters. Because we frequently prepare amended and restated supplements based on our and Sharyland’s expectations regarding various matters, including expected capital expenditures, our leases contain a mechanism, which we refer to as a validation, that we use to amend previously negotiated supplements in order to reflect the difference between the expected capital expenditures and the actual capital expenditures that were placed in service, placed in service dates, TCOS filing and effective dates and related matters. In no event may we use the validation process to account for differences between the expected and actual return on capital expenditures. If we and Sharyland are unable to agree on a rent supplement or a validation, the leases obligate us to submit the dispute to binding arbitration.

8

Operation of Our Regulated Assets

The leases require that Sharyland operate the regulated assets in a reasonable and prudent manner in accordance with PUCT guidelines and applicable law. Sharyland must obtain and maintain any licenses, permits or other approvals required by applicable law to operate the regulated assets under the leases.

Expenditures

Sharyland is required to provide a capital expenditure budget on a rolling three year basis that sets forth anticipated capital expenditures related to Footprint Projects. Our capitalization policies, consistent with standard utility practices under U.S. GAAP, determine whether a particular expenditure is characterized as a Footprint Project, which we are required to fund, or a repair, which Sharyland is required to fund. Footprint Projects expenditures are capitalized and increase our net electric plant, while expenditures relating to repairs of our existing regulated assets are expensed.

Sharyland’s Events of Default

Under our leases, a default will be deemed to occur upon certain events, including, subject in certain instances to applicable cure periods, (1) the failure of Sharyland to pay rent, (2) certain events of bankruptcy or insolvency with respect to Sharyland, (3) Sharyland’s material breach of a representation or warranty in a lease, (4) Sharyland’s material breach of a covenant in a lease or (5) a final judgment for the payment of cash in excess of $1,000,000 rendered against Sharyland that is not bonded, stayed pending appeal or discharged within 60 days.

Remedies Upon a Default

Upon a default under a lease, we may, at our option, exercise the following remedies, subject to any necessary approvals of the PUCT or other applicable governmental authority: (1) terminate the applicable lease agreement upon notice to Sharyland and recover any damages to which we are entitled under applicable law, (2) terminate Sharyland’s right to use our regulated assets and recover any damages to which we are entitled under applicable law or (3) take reasonable action to cure Sharyland’s default at Sharyland’s expense.

Financial Covenants

Sharyland is subject to certain covenants under our leases that prohibit Sharyland from incurring indebtedness in excess of certain thresholds and that otherwise obligate Sharyland to comply with certain covenants under our debt agreements.

Assignment and Subletting

Sharyland may not assign or sublet any of our regulated assets under the leases without our prior written consent and the approval of the PUCT or other applicable governmental authority.

Indemnification

Sharyland is required to defend, indemnify and hold us harmless from and against any and all claims, obligations, liabilities, damages and costs and expenses arising from any act or omission of Sharyland with respect to (1) the operation of the regulated assets, (2) damage to the regulated assets, (3) physical injuries or death (including in connection with the operation of the regulated assets), (4) any breach of any representation or warranty or covenant or (5) any negligence, recklessness or intentional misconduct of Sharyland.

Lease Renewals or Expiration

Our leases provide that, if we and Sharyland desire to renew a lease, we will negotiate lease terms based on our historical negotiations and the return that utilities in Texas are generally earning at the time of negotiation. If either we or Sharyland do not wish to renew a lease, we expect that our negotiations with a new third-party tenant would be based on the rate base of the assets covered by the expired lease and the rate of return expected at the time a new lease is negotiated, among other factors. In any event, because our regulated assets are rate-regulated and necessary for the transmission of electricity, we expect that they will continue to generate tariff revenue.

9

Regulatory Environment

In the United States, regulated electric assets are subject to regulation by various federal, state and local agencies. State regulatory commissions generally establish utility rates based on a traditional cost-of-service basis, providing for the timely recovery of prudently incurred costs and the opportunity to earn a reasonable rate of return on invested capital, subject to review and approval through periodic regulatory proceedings.

Our regulated assets are located in ERCOT within Texas and, as a result, we are not subject to general regulation as a “public utility” under the Federal Power Act and therefore not subject to FERC jurisdiction. Instead, we are regulated by the PUCT, which has original jurisdiction over transmission and distribution rates and services in unincorporated areas and in those municipalities that have ceded original jurisdiction to the PUCT and has exclusive appellate jurisdiction to review the rate and service orders and ordinances of municipalities that have not ceded original jurisdiction. Rates are established through rate case proceedings, which occur periodically and are typically initiated by the utility or the PUCT, on its own motion or on complaint by an affected stakeholder, to ensure that rates remain just and reasonable. In addition, the Texas Public Utility Regulatory Act (PURA) requires owners and operators of transmission facilities to provide open-access wholesale transmission services to third parties at rates and terms that are nondiscriminatory and comparable to the rates and terms of the utility’s own use of its system, and the PUCT has adopted rules implementing the state open-access requirements for all utilities that are subject to the PUCT’s jurisdiction over transmission services.

Historical Regulation of Our Structure

We have separated, between Sharyland and us, the functionality that is typically combined under one commonly owned group in an integrated utility. We are generally responsible for financing and funding asset additions while Sharyland is responsible for construction management, operation and maintenance of our regulated assets. Accordingly, our 2008 Restructuring Order required Sharyland and SDTS to be regulated on a combined basis, and Sharyland, as the holder of the certificates of convenience and necessity (CCN) required to operate our regulated assets, has historically made all regulatory filings related to our assets with the PUCT. As part of our rate case in Docket No. 45414 (2016 Rate Case), the PUCT raised certain questions indicating that this regulatory construct might change in the future, including the potential regulation of the leases between Sharyland and SDTS as tariffs. See Our regulated assets and Sharyland’s operations are subject to governmental regulation and oversight that could adversely impact our expected returns and operating results. in Item 1A., Risk Factors. In addition, as part of its order approving the Asset Exchange Transaction, the PUCT granted SDTS a separate CCN to continue to own and lease its assets to Sharyland.

Rate Setting

Rates are determined by an electric utility’s cost of rendering service to the public during a historical test year, adjusted for known and measurable changes, in addition to a reasonable return on invested capital. When we refer to a “rate case” or a “rate proceeding,” we are referring to formal proceedings before the PUCT, and not to TCOS filings, which are described below.

Currently, transmission rates can be updated up to two times per year through TCOS filings. In a TCOS filing, the revenue requirement is updated to reflect changes regarding assets placed in service, the effect of depreciation, updates to the ERCOT 4CP and changes in property taxes, among other matters. A utility is not permitted in these filings to update the revenue requirement to reflect any changes in operations and maintenance charges, which can be updated only through a full rate proceeding with the PUCT. If an application is materially sufficient and there are no intervenors that challenge the update, the transmission rates will generally be updated within 60 days of the date of the TCOS filing. The updates of the rates pursuant to a TCOS filing will be subject to review in the next rate case filing.

Sharyland’s Rates

In January 2014, the PUCT approved a rate case (2013 Rate Case) filed by Sharyland applicable to our regulated assets providing for a capital structure consisting of 55% debt and 45% equity, a cost of debt of 6.73%, a return on equity of 9.70% and a return on invested capital of 8.06% in calculating rates. The new rates became effective May 1, 2014. Under the order approving the 2013 Rate Case, Sharyland was required to file its next rate case in 2016. The 2016 Rate Case was dismissed in November 2017 (Rate Case Dismissal), which resulted in the 2013 Rate Case regulatory parameters remaining in place. SDTS and Sharyland are required to file a new rate case in the calendar year 2020 with a test year ending December 31, 2019.

10

Tax Cuts and Jobs Act

In December 2017, the TCJA was signed into law. The TCJA reduced the corporate federal income tax rate from 35% to 21% effective for taxable years beginning on or after January 1, 2018. Sharyland’s rates have historically incorporated an income tax allowance at a 35% corporate federal income tax rate; however, in light of the TCJA, Sharyland has agreed to reduce its wholesale transmission service rate (WTS rate) to reflect an income tax allowance at the reduced 21% corporate federal income tax rate. For additional information regarding the TCJA, see the caption TCJA Impacts and Company Structure Review under Factors Expected to Affect Our Operating Results and Financial Condition included in Part II, Item 7., Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Our Relationship with Sharyland

A REIT is required to generate a substantial portion of its income from REIT-qualified assets and through qualified income streams, which include lease payments from third-party tenants. As a result, we have structured ownership of our regulated assets through a lessor/lessee structure, with Sharyland acting as the tenant under each of our leases. Sharyland has been a regulated utility since 1999 and, as our lessee, has control of and is responsible for operating and maintaining our regulated assets.

Sharyland is the managing member of SDTS and has operational control over our regulated assets pursuant to the leases. However, to the extent that day-to-day operations of SDTS involve matters primarily related to passive ownership of the assets, such as capital sourcing, financing, cash management and investor relations, Sharyland has delegated those responsibilities and authorities to InfraREIT pursuant to a delegation agreement. We also have negative control rights over SDTS, such as the right to approve renewals of the leases or any new leases, sales or dispositions of assets, debt issuances and annual budgets, subject to some exceptions.

Our Relationship with Hunt

We have various agreements with HCI and its subsidiaries (Hunt), Hunt Transmission Services, L.L.C. (Hunt Developer), Hunt Manager and Sharyland. The following chart illustrates our key relationships with each of these entities as of February 23, 2018.

(1) | Parties to the management agreement |

(2) | Parties to the development agreement |

(3) | Sharyland is the managing member of SDTS; however, Sharyland’s economic interest in SDTS is de minimis, and Sharyland has delegated to us some of its managing member authority and obligations pursuant to a delegation agreement. |

11

Lock-Up Agreement

Hunt owns a substantial portion of our equity, and we have a lock-up agreement with Hunt, pursuant to which Hunt has agreed not to transfer or sell an aggregate of 8,419,987 of the shares of our common stock and OP Units that it currently owns. These transfer restrictions will expire on February 4, 2020. As of February 23, 2018, Hunt is the record holder of 6,334 shares of our common stock and 15,624,544 OP Units. Hunt’s lock-up agreement with us will terminate upon the termination or non-renewal of the management agreement and development agreement, both of which are discussed below. In addition, Hunt has informed us that it currently intends to hold a substantial portion of its equity in us for the foreseeable future. See Hunt’s Schedule 13D below for additional information related to Hunt’s intentions regarding its investment in us.

Management Agreement

We are party to a management agreement with Hunt Manager pursuant to which Hunt Manager manages our day-to-day business, subject to oversight from our board of directors.

Compensation

The following table summarizes the fees and expense reimbursements that we pay to Hunt Manager pursuant to the management agreement:

Compensation | | Description |

Base Fee | | The base fee for each twelve month period beginning on April 1 will equal 1.5% of our total equity (including noncontrolling interest) as of the end of the immediately preceding year. Effective April 1, 2018, the annual base fee will decrease from $14.2 million to $13.5 million through March 31, 2019. |

Incentive Payment | | We pay Hunt Manager an incentive payment, payable quarterly, equal to 20% of the quarterly distributions per OP Unit (inclusive of the incentive payment) in excess of $0.27 per OP Unit per quarter. |

Reimbursement of Expenses | | We reimburse Hunt Manager for all third-party expenses incurred on our behalf or otherwise in connection with the operation of our business, other than certain specified expenses, such as compensation expenses related to Hunt Manager's personnel that are identified in the management agreement as the exclusive responsibility of Hunt Manager. |

Termination Fee | | If we exercise our right not to renew the management agreement at the end of the then current term, we will be required to pay Hunt Manager a termination fee, in cash or equity, at our election, in an amount equal to three times the most recent annualized base management fee and incentive payment amount. |

Term

The term of the management agreement expires December 31, 2019, and will automatically renew for successive five year terms unless a majority of our independent directors decides to terminate the agreement. If a majority of our independent directors decides to terminate the agreement, we must give Hunt Manager notice of the termination at least one year in advance of the scheduled termination date and pay Hunt Manager the termination fee described above. We also have the right to terminate the management agreement at any time for cause (as defined in the management agreement), and Hunt Manager may terminate the agreement at any time upon 365 days’ prior notice to us, provided that Hunt Manager may not terminate the agreement effective before December 31, 2019. If we terminate for cause or Hunt Manager terminates, the termination fee would not be owed to Hunt Manager.

Hunt’s Development Projects

Development Agreement

The development agreement with Hunt Developer and Sharyland gives us the exclusive right to continue to fund the development and construction of Footprint Projects and Hunt Developer the exclusive right to fund the development and construction of ROFO Projects. The development agreement also provides us with a right of first offer to acquire ROFO Projects.

12

Under the terms of the development agreement, Hunt has the obligation to offer ROFO Projects to us prior to the project being energized. Hunt’s offer of a ROFO Project will commence a 75-day negotiation period; however, in certain circumstances, the parties may agree to extend the negotiation period past 75 days. Following this period, if we are unable to reach an agreement on the terms of such purchase, Hunt may, during the following 18 months, transfer the ROFO Project to a third party, but only on terms and conditions generally no more favorable than those offered to us. If the ROFO Project is not transferred to a third party during that time period, Hunt would once again be required to offer the project to us and begin another negotiation period with us before transferring the project to a third party.

Additionally, under the terms of the development agreement, we are required to give Sharyland a right of first offer to lease any assets we acquire or develop, subject to exceptions. If we and Sharyland are unable to agree on lease terms and an exception does not apply, we will only be able to lease the assets to other tenants on terms that are more favorable to us than Sharyland’s best offer.

The term of the development agreement expires December 31, 2019, and will automatically renew for successive five year terms. However, our rights under the development agreement will expire effective upon any termination of the management agreement.

Hunt Projects

The following ROFO Projects relate to assets placed in service which are owned and operated by Sharyland. We expect these projects to be offered to us again in the future.

Project | | State | | Net Electric Plant |

Golden Spread Project | | TX | | Approximately $90 million |

Cross Valley Project | | TX | | Approximately $167 million |

The following are additional development projects Hunt is pursuing. Although not all of the development projects listed below are ROFO Projects under the development agreement, Hunt has informed us that it intends for us to be the primary owner of its regulated development projects, including those not listed as ROFO projects under the development agreement.

Project | | State | | Status |

Generation interconnections | | TX | | Development |

South Plains / Lubbock Power & Light integration | | TX | | Development |

Nogales - DC Tie | | AZ | | Development |

Southline | | AZ - NM | | Development |

Acquisitions by Us

The Conflicts Committee of our board of directors will evaluate any potential acquisition of a project from Hunt or Sharyland and determine if the project is in our best interest based on the negotiated terms. The purchase price for any project will be negotiated based on a number of factors, such as the cash flow and rate base for the assets, market conditions, potential for incremental Footprint Projects, the terms of any related lease and the regulatory return we expect the assets will earn.

Hunt’s Schedule 13D

On January 16, 2018, HCI filed an amendment to its Schedule 13D with the U.S. Securities and Exchange Commission (SEC) stating that, in connection with its ongoing evaluation of various alternative arrangements described below, HCI is currently focusing on evaluating and developing a “going private” transaction as a result of which we would no longer be a publicly traded entity. Some of the other alternatives under consideration by HCI, as described in the Schedule 13D, are:

| • | a De-REIT transaction in which InfraREIT would elect to no longer be treated as a REIT for federal income tax purposes; |

| • | a sale by InfraREIT of all or certain of its assets or operations to a third party; |

| • | a business combination between InfraREIT and a third party; |

| • | a business combination between InfraREIT or SDTS and Sharyland; or |

| • | other transactions that would significantly alter the organizational structure, business or ownership of InfraREIT. |

13

HCI has stated that it will continue to develop and evaluate scenarios and consider the various alternatives identified above; however, based on HCI’s evaluation to date, HCI has indicated that it currently does not have a high level of interest in pursuing an alternative that would involve a disposition of HCI’s entire interest in us or our Operating Partnership. Instead, at the present time, HCI is focusing on an alternative that would enable it to maintain a substantial equity stake in us or our Operating Partnership (or any successor business entities) and continue to actively participate in, and exercise a substantial degree of influence over, the business and affairs of these entities.

Any transaction proposed by HCI would be expected to require approvals from our board of directors or the Conflicts Committee and/or from our stockholders. Our Conflicts Committee intends to consider any alternatives that may be proposed by Hunt.

Company Structure Review

The TCJA reduced the corporate federal income tax rate from 35% to 21%. Sharyland’s rates have historically incorporated an income tax allowance at a 35% corporate federal income tax rate, and our lease supplements with Sharyland reflect this assumption. However, due to the enactment of the TCJA and at the request of the PUCT, Sharyland has agreed to reduce its WTS rate to reflect an income tax allowance at the 21% corporate federal income tax rate. This reduction will impact our percentage rent revenues, which are calculated based on a percentage of Sharyland’s gross revenue. The impact of the TCJA will also be incorporated into new lease supplements for future assets placed in service or upon the renewal of our leases, resulting in a reduction, relative to the existing lease terms, in the amount of lease revenue we receive per dollar of rate base. It is also possible that, in the future, Sharyland could request a reduction in rent for existing assets already under lease to reflect the impacts of the TCJA; if such request is made, we are not obligated under the leases to agree to the requested change. Sharyland has indicated that it currently does not intend to make such a request with respect to the 2018 lease payments.

We continue to evaluate these and other potential impacts of the TCJA. In consideration of the significant impact of the change in the corporate federal income tax rate, as well as the other potential impacts of the TCJA, we believe that the TCJA will, over time, decrease the relative economic benefits of owning utility assets in a REIT structure as compared to a traditional C-corporation structure and, accordingly, we are reviewing our REIT election and the existing lessor-lessee relationship with Sharyland. This review includes consideration of a De-REIT transaction which, in addition to revoking our REIT status with the IRS, also may involve one or more of the following:

| • | combining Sharyland with SDTS; |

| • | terminating the leases between SDTS and Sharyland; |

| • | terminating our Operating Partnership; and/or |

| • | other negotiations with Hunt, including terminating or renegotiating our management agreement, terminating or renegotiating the development agreement, and engaging in related negotiations. |

We have not set a specific timeline for completing this review.

Competition

Improvements in existing technologies to produce, transmit or deliver electricity, including advancements related to self-generation and distributed generation or the creation of new technologies or services, could result in a reduction of demand for Sharyland’s regulated asset services, but these have not been significant factors to date.

Additionally, the market for acquiring and developing electric infrastructure assets is highly competitive and fragmented, and we have seen an increase in both the amount of and different types of investors in these assets over the last several years. Many fully integrated utility companies, public and private funds and foreign investors pursue the types of investments that we compete for in the U.S. electric infrastructure sector. Some of these competitors may be substantially larger than us and have greater financial resources or lower costs of capital than we do.

Customers

We lease all our regulated assets to Sharyland, which supports its lease payments to us by collecting revenues from other utilities through PUCT-approved rates. Prior to the Asset Exchange Transaction, Sharyland also collected revenue through PUCT-approved rates directly from retail electric providers who sell electricity to Texas customers.

14

Environmental Matters

Our tenant’s day-to-day operations are subject to a wide range of environmental laws and regulations across a large number of jurisdictions, including laws and regulations that impose limitations on the discharge of pollutants into the environment, establish standards for the management, treatment, storage, transportation and disposal of hazardous materials and solid and hazardous wastes, and impose obligations to investigate and remediate contamination in certain circumstances. We rely on our tenant for the compliance of our regulated assets with such laws and regulations. Under the terms of our leases, our tenant is required to indemnify us if we incur damages as a result of its failure to comply with any such law or regulation.

These laws and regulations also generally require that governmental permits and approvals be obtained both before construction and during operation of regulated assets. As construction manager of our regulated asset projects, we also rely on our tenant for compliance with such permits and approvals, and our tenant is required to indemnify us if they fail to obtain or comply with any permit or approval in accordance with the terms of our leases.

We do not believe that we currently have any material environmental liabilities.

Insurance

Our leases require our tenant to carry liability and casualty insurance on our properties covering certain hazards with specific policy limits set forth in the lease agreements. However, there may not be adequate insurance to cover the associated costs of repair or reconstruction, or insurance may not be available at commercially reasonable rates or, for some events, at all. For instance, Sharyland has not been able to obtain property insurance coverage on commercially reasonable terms for the full value of our regulated assets. As a result, we have amended or waived the requirements under our leases that Sharyland obtain such insurance. In this respect, we and Sharyland are self-insured for a substantial portion of the amount that it would cost to repair or replace our regulated assets. In the event remediating any damage or loss is considered a repair under the applicable lease, our tenant is responsible for the cost of repairing or replacing such damage or loss whether or not covered by insurance. On the other hand, in the event remediating any damage or loss is considered a Footprint Project under the lease, we will be responsible for payment of any insurance deductible, as well as for any such damage or loss not covered by insurance. We believe that our regulated assets are covered by adequate insurance, including those regulated assets for which we and our tenant are self-insured.

Seasonality

Sharyland’s transmission revenue is not subject to seasonality, although the revenue from Sharyland’s wholesale distribution assets is subject to seasonality. However, due to our lease revenue structure, no material portion of our business is affected by seasonality. See Summary of Critical Accounting Policies and Estimates in Item 7., Management’s Discussion and Analysis of Financial Condition and Results of Operations.

JOBS Act

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (JOBS Act). An emerging growth company may take advantage of reduced reporting requirements that are otherwise applicable to public companies. We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of our IPO, which will occur in 2020, or such earlier time that we are no longer considered an emerging growth company under the JOBS Act. We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenues as of the end of a fiscal year, if we are deemed to be a large accelerated filer under the rules of the SEC, or if we issue more than $1.0 billion of non-convertible debt over a three year period.

We have elected to “opt out” of certain exemptions that we are permitted to take advantage of as an emerging growth company, including a provision that would exempt us from obligations to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (Sarbanes-Oxley Act), and a provision that would permit us to take advantage of an extended transition period for complying with new or revised accounting standards. As a result, we have complied with the auditor attestation requirements of the Sarbanes-Oxley Act beginning as of December 31, 2016, and we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for public companies that are not emerging growth companies.

To the extent that we utilize certain provisions available to us as an emerging growth company, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

15

Employees

We have no employees. We are externally managed by Hunt Manager. All our officers are employees of Hunt Manager. Pursuant to the terms of our management agreement, Hunt Manager provides for our day-to-day management, subject to oversight by our board of directors. In exchange for these management services, we pay a management fee to Hunt Manager. In the event Hunt Manager is unable to provide these services to us, we would be required to provide such services ourselves or obtain such services from other sources.

Financial Information About Industry Segments

We internally evaluate all our rate-regulated assets as one industry segment, and, accordingly, we do not report segment information.

Available Information

Our Internet address is www.InfraREITInc.com. The information contained on our website or that can be accessed through our website does not constitute part of this Annual Report on Form 10-K. A printed copy of this Annual Report on Form 10-K will be provided without charge upon written request to Investor Relations at InfraREIT, Inc., 1900 North Akard Street, Dallas, Texas, 75201. A direct link to our filings with the SEC is available on our website under the Investor Relations tab. Our common stock is traded on the New York Stock Exchange (NYSE) under the trading symbol “HIFR.”

Risks Related to Our Business

Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may materially and adversely affect our business, financial condition, results of operations, cash flows and ability to pay dividends. You should carefully consider these risks together with all the other information included in this Annual Report on Form 10-K, including the financial statements and related notes, when deciding to invest in us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business operations. If any of the following risks were to actually occur, our business, financial condition or results of operations could be materially and adversely affected.

Our regulated assets and Sharyland’s operations are subject to governmental regulation and oversight that could adversely impact our expected returns and operating results.

Both Sharyland and SDTS, our subsidiary, are regulated by the PUCT, and decisions by the PUCT, including in some circumstances in which we are not involved directly as a party, can directly impact our business. Rate regulation is premised on the timely recovery of prudently incurred costs and the opportunity to earn a reasonable rate of return on invested capital, although, over time, the PUCT may change its position regarding a reasonable rate of return on invested capital through changes to our allowed return on equity and capital structure, the timelines of adding capital invested to our rate base and any other adjustments to our rate base. Additionally, there is no assurance that the PUCT will determine that all of our rate base can be recovered through rates, or that the PUCT will not otherwise make regulatory determinations that adversely affect our regulated assets or Sharyland’s operations. The PUCT could, among other things, determine that certain of our capital expenditures should not be included in rates, or the PUCT could challenge other regulatory judgments, such as those related to affiliate charges, operations and maintenance expenses, tax elections, rate case expenses, regulatory assets and other matters. Also, if the PUCT makes a determination that adversely affects the amount of our rate base, we may need to take accounting charges that impair our assets, which could further adversely affect our results of operations and financial condition. Further, any transfer of our assets or change of control involving us would be subject to the approval of the PUCT.

A number of fundamental legal and policy issues were raised as part of our 2016 Rate Case, including questions regarding whether our leases with Sharyland are tariffs under PURA that are subject to regulation by the PUCT and challenges to the recovery of an income tax allowance by a utility organized in a REIT structure. The Rate Case Dismissal preserved the right of the parties to the 2016 Rate Case to address in a future proceeding all issues not mooted by the Rate Case Dismissal. Therefore, it is possible that in a future proceeding parties may again argue that our leases, including the rent rates that SDTS charges Sharyland for its lease of the regulated assets owned by SDTS, should be directly regulated by the PUCT as tariffs under PURA, question our ability to recover an income tax allowance or raise various other issues that were in dispute in our 2016 Rate Case.

16

Under the terms of the Rate Case Dismissal, Sharyland and SDTS are required to file a new rate case in the calendar year 2020, based on a test year ending December 31, 2019, and the PUCT has the authority to require us to file a new rate case earlier. Although we cannot predict what issues will be raised in that rate case or what the outcome of any particular issue will be, it is possible that the consideration and resolution of any of the issues that were previously raised in our 2016 Rate Case or other regulatory determinations could result in regulatory requirements or outcomes that adversely affect the amount of rent we receive from Sharyland or Sharyland’s ability to meet its obligations to pay us rent pursuant to the leases, or that otherwise materially and adversely affect our operating results and financial condition, limit our ability to timely recover our capital investments, challenge our ability to continue to operate as a REIT under applicable tax laws or otherwise materially and adversely affect our business.

In addition, our regulated assets and Sharyland’s operations are subject to a variety of other U.S. federal, state and local laws and regulations, including laws and regulations related to regulatory matters; environmental health and safety matters; and human health and safety matters. We generally rely on Sharyland to ensure compliance with these laws and rules, and, in most circumstances, Sharyland is required under our leases to remedy the effect of any non-compliance during the term of the applicable lease. Compliance with the requirements under these various regulatory regimes may cause us or Sharyland to incur significant additional costs, and failure to comply with these requirements could result in the shutdown of the non-complying assets and the imposition of liens, fines and/or civil or criminal liability. Utility operations may also be affected by legislative and regulatory changes, as well as changes to market design, market rules, tariffs and cost allocation by regulatory authorities. We cannot predict what effect any such changes in the regulatory environment will have on us or Sharyland’s operations.

The enactment of the TCJA will, over time, have the effect of decreasing the relative advantages of our business model and, if we determine to terminate our REIT status, the effects of this change in tax status could have adverse implications on our financial results or otherwise have a negative effect on us or our stockholders.

The TCJA includes a reduction in the corporate federal income tax rate from 35% to 21%, effective for taxable years beginning on or after January 1, 2018. In accordance with Accounting Standards Codification Topic 980, Regulated Operations, Section 405, Liabilities, we have recorded a regulatory liability for the amount of excess accumulated deferred federal income tax (ADFIT) associated with the lower corporate federal income tax rate. See the caption Tax Cuts and Jobs Act Regulatory Adjustment under Significant Components of Our Results of Operations included in Part II, Item 7., Management’s Discussion and Analysis of Financial Condition and Results of Operations. Additionally, our lease supplements currently assume Sharyland’s recovery in rates of an income tax allowance of the 35% corporate federal income tax rate; however, at the request of the PUCT, Sharyland has agreed to reduce its WTS rate to reflect an income tax allowance at the reduced corporate federal income tax rate. This reduction will impact our percentage rent revenues, which are calculated based on a percentage of Sharyland’s gross revenue. Additionally, lease payments for future assets placed in service or upon the renewal of our leases will reflect a reduction in Sharyland’s rates and the impact of the regulatory liability, which will result in a reduction, relative to the existing lease terms, in the amount of lease revenue we receive per dollar of rate base. Further, in the future Sharyland could request a reduction in the existing lease payments to reflect these changes. In light of the foregoing as well as the other potential impacts of the TCJA, the TCJA will, over time, have the effect of decreasing the relative economic benefits of owning utility assets in a REIT structure, as compared to a traditional C-corporation structure. See Company Structure Review under Item 1., Business.

Our charter provides our board of directors with the power, under certain circumstances, to revoke or otherwise terminate our REIT election and cause us to be taxed as a corporation, without the vote of our stockholders. The ultimate impact of any decision to terminate our REIT status on us or on our financial position would be subject to a number of variables, both positive and negative, the net effect of which we cannot predict at this time. In addition, if we determine to terminate our REIT status, we would no longer be required to pay any dividends to our stockholders, and the amount of any dividend that we determine to pay may be reduced. Although our board of directors could cause us to terminate our REIT status only if it determined in good faith that it is in our best interest, it is possible that a change that the board of directors determines to be in our best interest may not be in the best interest of any particular stockholder.

17

Conflicts of interest may arise in the event that we receive a going private offer from Hunt, and our relationships with Hunt and its affiliates could have a negative effect on other transactions that might be in the best interests of our stockholders.

On January 16, 2018, HCI filed an amendment to its Schedule 13D with the SEC confirming that it has been engaged in developing and evaluating various alternative arrangements to the existing business structures in place between us and Hunt, including a De-REIT transaction in which we would elect to no longer be treated as a REIT for federal income tax purposes, a sale by us of all or certain of our assets or operations to a third party, a business combination between us and a third party, a business combination between us or SDTS and Sharyland or other transactions that would significantly alter our organizational structure, business or ownership. HCI also stated in its Schedule 13D that, although Hunt will continue to develop and evaluate scenarios and consider other alternative arrangements, it does not have a high level of interest in pursuing an alternative that would involve a disposition of HCI’s entire interest in us or our Operating Partnership. HCI further stated that Hunt intends to focus on evaluating and developing a “going private” transaction in which we would no longer be a publicly traded entity. See the caption Hunt’s Schedule 13D under Our Relationship with Hunt included in Item 1., Business. Due to Hunt’s ownership and control of Hunt Manager and its relationships with our management team and with three members of our board of directors, conflicts of interest will likely arise in the event that we were to receive a going private offer from Hunt or in the event we were to pursue one of the other alternative arrangements. See the caption Risks Related to Related Party Transactions and Conflicts of Interest below.

We currently rely on Hunt or its affiliates to perform a variety of functions for us, and our relationships with Hunt Manager, Hunt Developer and Sharyland are interrelated and subject to certain contractual limitations. Specifically, there are restrictions on our ability to terminate the leases with Sharyland. Additionally, we are only allowed to terminate the management agreement with Hunt Manager on or before December 31, 2018, to be effective December 31, 2019, and we are required to pay a termination fee equal to three times the most recent annualized base management and incentive payment, in each case except in the event of a termination “for cause.” There are also restrictions on our ability to terminate the development agreement with Hunt Developer. However, the development agreement with Hunt Developer expires automatically upon termination of the management agreement, regardless of whether the management agreement is terminated by us or by Hunt Manager (unless we terminate for cause), meaning that the termination of our relationship with Hunt Manager as our external manager would terminate our right of first offer with respect to ROFO Projects. Accordingly, the terms and limitations governing our arrangements with Hunt and Sharyland, and Hunt’s stated intention to maintain a substantial equity stake in us that enables it to continue to actively participate in, and exercise a substantial degree of influence over, our business and affairs, may inhibit a competing acquisition proposal for us by any third party or lower the price we would receive in a competing transaction.

Because all of our lease revenues are currently generated by lease payments from Sharyland, our business, financial condition, results of operations and cash flows are dependent on Sharyland’s financial and operating performance.

Sharyland’s ability to make lease payments to us under our leases is subject to its ability to generate cash flows or raise additional capital sufficient to support its obligations. Sharyland has incurred both U.S. GAAP and management reported losses in the past. If Sharyland were to operate at a loss in future years, and if it is unable to obtain debt or equity capital to fund its cash needs, its financial condition and liquidity may suffer. Sharyland’s liquidity and operating results will be negatively impacted by the decrease in its revenues that will result from its agreement to reduce its WTS rate to give effect to the TCJA, and may also be negatively impacted if its expenses increase rapidly, including for reasons outside of its control, before it is able to file and complete a full rate proceeding with the PUCT in order to recover the higher operation and maintenance expenses in its rates.

If Sharyland experiences declines in its financial and operating performance or liquidity constraints, it may request that we defer or waive its obligations under the leases, including its obligation to make lease payments to us or to cover certain emergency or other costs for which it is responsible under the leases, or, alternatively, it may seek to terminate its leases with us. In extraordinary circumstances, Sharyland may become insolvent or seek bankruptcy relief. Depending upon the sufficiency of assets available to pay claims, a rejection of the leases in bankruptcy or an insolvency of Sharyland could ultimately preclude full collection of sums due to us under our lease agreements and could place the financial burden for any of Sharyland’s accrued obligations under the leases, such as costs for repairs, maintenance, and ad valorem or property taxes, on us without any corresponding ability on our part to either transfer the obligation for these costs to a new tenant, recoup these costs from third parties or otherwise avoid paying these costs. To the extent any such events occur, our financial condition and results of operations would be adversely affected.

18

We will not be able to materially increase our lease revenue unless the rate base of our regulated assets grows.

There are two ways for us to increase our rate base and, as a result, our lease revenues, namely funding capital expenditures under our leases or acquiring additional regulated assets from Hunt or third parties. In recent years, our primary method for increasing our rate base has been funding Footprint Projects under our leases. There are a number of factors that could impact the amount of available investment in Footprint Projects, including the number of and capital needs associated with requests by electricity generators to connect to our transmission facilities as well as population, economic and load growth in and around the Permian Basin, where growth may be adversely affected by the impact of lower oil and gas prices on economic activity in the region. Further, as a result of the Asset Exchange Transaction, we now are focused on a transmission-based strategy, and we will forgo future retail distribution capital expenditures. Transmission projects, as compared to distribution projects, are typically larger projects that require lengthy regulatory approval processes and longer construction times. As a result, we may experience significant variability in our capital expenditures and our ability to grow our rate base and lease revenue is uncertain. Additionally, although historically the PUCT has generally favored the expansion and updating of the transmission infrastructure within its jurisdiction, if the PUCT were to change its view on transmission needs in Texas, or if those needs do not continue or develop as projected, our strategy of investing in transmission could be impacted.

Under the development agreement, we are prohibited from funding projects that qualify as ROFO Projects, even, in some circumstances, certain projects that connect to our transmission assets. Consequently, our ability to grow our rate base and revenues also depends in part on Hunt’s ability to develop and construct ROFO Projects and our ability to acquire ROFO Projects or other regulated assets on acceptable terms. Accordingly, if Hunt is unable to develop ROFO Projects or we do not identify regulated assets that are attractive to us, or if we are unable to acquire ROFO Projects or other regulated assets on terms that are acceptable to us, we will not experience the rate base and lease revenue growth that we would otherwise expect, which could affect our financial condition, results of operations and our ability to make distributions to our stockholders.

The results of our negotiations of future rent payments under our leases and our ability to renew our leases upon their expiration, or to identify new tenants under our leases, will affect our operating results and financial condition.

We generally do not negotiate lease payments with respect to the capital expenditures that we fund until shortly before the beginning of the year in which we expect the related assets to be placed in service. As a result, we have not yet negotiated lease payments under our existing leases with respect to capital expenditures that we expect to fund and place in service subsequent to 2018. Although our existing leases provide that our historical agreements with Sharyland will serve as the basis for new rent payments, we expect that, as a result of the TCJA, the amount of revenue we receive per dollar of rate base will be lower with respect to future assets placed in service or upon renewal of our leases, as compared to our existing lease terms. Further, even after the impacts of the TCJA are reflected in our lease payments, there is no assurance that future negotiations of new or amended lease supplements will result in a certain level of lease payments or lease revenues.

Furthermore, the leases relating to approximately 90% of our current net assets expire on December 31, 2020, and our other existing leases expire at various times between December 31, 2019 and December 31, 2022. Although we and Sharyland have been able to negotiate several new leases and lease extensions in the last several years, there is no assurance that we and Sharyland will be able to renew or extend our leases on acceptable terms upon their expiration. We also have the right to terminate our leases upon Sharyland’s breach, subject in some circumstances to applicable cure periods. However, terminating the leases, or entering into new leases with a different tenant following expiration of our leases with Sharyland, would require the approval of the PUCT and any other applicable regulatory bodies, which could be complex and costly and which we may not be able to obtain. Because other utilities in the state of Texas are structured as integrated utilities that own the assets they operate, we may not be able to identify a new tenant that is willing to operate assets that they do not own. Further, any new tenant would need to be a qualified and reputable operator of regulated assets with the wherewithal and capability of acting as our tenant and, if leasing a significant portion of our assets, would need to agree to timely provide us with their financial statements for us to include in the periodic reports we file under the Securities Exchange Act of 1934, as amended (Exchange Act). There is no assurance that we would be able to identify a tenant that meets these criteria efficiently or at all, or, if we are able to identify such tenant, that we would receive lease terms from such new tenant that are as favorable as our lease terms with Sharyland.

There may be significant lag time between the time we make capital expenditures and when we begin receiving rent with respect to such expenditures and, because of the lessor/lessee structure, if Sharyland’s revenue increases in the future, our lease revenue will not increase as quickly as it would if we were operating as an integrated utility.

All our lease revenues currently come from lease payments from Sharyland. Under our lease agreements, we and Sharyland negotiate lease payments for our capital expenditures before the applicable assets are placed in service. As a result, if, during the term of a lease, market conditions change in a manner that allows Sharyland to realize a greater rate of return than what was originally anticipated, we would not be able to force a renegotiation of our leases to reflect the higher rate of return.

19