UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

| |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2019

or

|

| |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from______________to __________

|

| |

| Commission File Number | 001-35143 |

ANDEAVOR LOGISTICS LP

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 27-4151603 |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification No.) |

| | |

200 East Hardin Street, Findlay, OH 45840

(Address of principal executive offices) (Zip Code)

419-421-2414

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common Units Representing Limited Partnership Interests | - | NONE |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

| | Large Accelerated Filer | ☑ | | Accelerated Filer | ☐ | |

| | Non-Accelerated Filer | ☐ | | Smaller Reporting Company | ☐ | |

| | | | | Emerging Growth Company | ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

There is no public market for the registrant’s common units. All of the registrant’s common units are owned by MPLX LP.

Andeavor Logistics LP

Quarterly Report on Form 10-Q

For the Quarterly Period Ended June 30, 2019

This Quarterly Report on Form 10-Q (including documents incorporated by reference herein) contains statements with respect to our expectations or beliefs as to future events. These types of statements are “forward-looking” and subject to uncertainties. See “Important Information Regarding Forward-Looking Statements” in Management’s Discussion and Analysis of Financial Condition and Results of Operations in Part I, Item 2.

Part I - Financial Information

Item 1. Financial Statements

Andeavor Logistics LP

Condensed Statements of Consolidated Operations

(Unaudited)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2019 | | 2018 (a) | | 2019 | | 2018 (a) |

| | (In millions, except per unit amounts) |

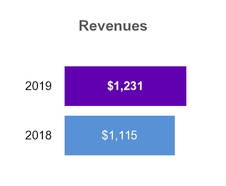

| Revenues: | | | | | | | |

| Affiliate | $ | 424 |

| | $ | 389 |

| | $ | 868 |

| | $ | 716 |

|

| Third-party | 177 |

| | 180 |

| | 363 |

| | 399 |

|

| Total Revenues | 601 |

| | 569 |

| | 1,231 |

| | 1,115 |

|

| Costs and Expenses: | | | | | | | |

| NGL expense (excluding items shown separately below) | 33 |

| | 45 |

| | 92 |

| | 93 |

|

| Operating expenses (excluding depreciation and amortization) | 237 |

| | 221 |

| | 476 |

| | 422 |

|

| Depreciation and amortization expenses | 104 |

| | 93 |

| | 205 |

| | 182 |

|

| General and administrative expenses | 18 |

| | 29 |

| | 38 |

| | 60 |

|

| Loss on asset disposals and impairments | 2 |

| | 1 |

| | 2 |

| | 1 |

|

| Operating Income | 207 |

| | 180 |

| | 418 |

| | 357 |

|

| Interest and financing costs, net | (63 | ) | | (60 | ) | | (124 | ) | | (115 | ) |

| Equity in earnings of equity method investments | 9 |

| | 10 |

| | 16 |

| | 18 |

|

| Other income, net | 7 |

| | 2 |

| | 7 |

| | 3 |

|

| Net Earnings | $ | 160 |

| | $ | 132 |

| | $ | 317 |

| | $ | 263 |

|

| | | | | | | | |

| Loss attributable to Predecessors | $ | — |

| | $ | 16 |

| | $ | — |

| | $ | 24 |

|

| Net Earnings Attributable to Partners | 160 |

| | 148 |

| | 317 |

| | 287 |

|

| Preferred unitholders’ interest in net earnings | (10 | ) | | (10 | ) | | (20 | ) | | (24 | ) |

| Limited Partners’ Interest in Net Earnings | $ | 150 |

| | $ | 138 |

| | $ | 297 |

| | $ | 263 |

|

| | | | | | | | |

| Net earnings per limited partner unit: | | | | | | | |

| Common - basic | $ | 0.65 |

| | $ | 0.63 |

| | $ | 1.29 |

| | $ | 1.23 |

|

| Common - diluted | $ | 0.65 |

| | $ | 0.63 |

| | $ | 1.29 |

| | $ | 1.23 |

|

| | | | | | | | |

| Weighted average limited partner units outstanding: | | | | | | | |

| Common units - basic | 245.6 |

| | 217.2 |

| | 245.6 |

| | 217.2 |

|

| Common units - diluted | 245.7 |

| | 217.3 |

| | 245.7 |

| | 217.3 |

|

| |

| (a) | Adjusted to include the historical results of the Predecessors. See Note 1 for further discussion. |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Andeavor Logistics LP

Condensed Consolidated Balance Sheets

(Unaudited)

|

| | | | | | | |

| | June 30,

2019 | | December 31,

2018 |

| | (In millions, except unit amounts) |

| Assets | | | |

| Current Assets | | | |

| Cash and cash equivalents | $ | 25 |

| | $ | 10 |

|

| Receivables, net of allowance for doubtful accounts | | | |

| Trade and other | 202 |

| | 195 |

|

| Affiliate | 323 |

| | 279 |

|

| Prepayments and other current assets | 65 |

| | 79 |

|

| Total Current Assets | 615 |

| | 563 |

|

| Property, Plant and Equipment, Net | | | |

| Property, plant and equipment, at cost | 8,409 |

| | 8,145 |

|

| Accumulated depreciation | (1,480 | ) | | (1,300 | ) |

| Property, Plant and Equipment, Net | 6,929 |

| | 6,845 |

|

| Acquired Intangibles, Net | 1,079 |

| | 1,104 |

|

| Goodwill | 1,051 |

| | 1,051 |

|

| Equity Method Investments | 605 |

| | 602 |

|

| Other Noncurrent Assets, Net | 271 |

| | 130 |

|

| Total Assets | $ | 10,550 |

| | $ | 10,295 |

|

| | | | |

| Liabilities and Equity | | | |

| Current Liabilities | | | |

| Accounts payable | | | |

| Trade and other | $ | 196 |

| | $ | 214 |

|

| Affiliate | 277 |

| | 252 |

|

| Accrued interest and financing costs | 41 |

| | 41 |

|

| Current maturities of debt | 503 |

| | 504 |

|

| Other current liabilities | 93 |

| | 81 |

|

| Total Current Liabilities | 1,110 |

| | 1,092 |

|

| Debt, Net of Unamortized Issuance Costs | 4,720 |

| | 4,460 |

|

| Other Noncurrent Liabilities | 186 |

| | 69 |

|

| Total Liabilities | 6,016 |

| | 5,621 |

|

| Commitments and Contingencies (Note 6) |

|

| |

|

|

| Equity | | | |

Preferred unitholders; 600,000 units issued and outstanding in 2019 and 2018 | 603 |

| | 604 |

|

Common unitholders; 245,630,444 units issued and outstanding (245,493,184 in 2018) | 3,931 |

| | 4,070 |

|

| Total Equity | 4,534 |

| | 4,674 |

|

| Total Liabilities and Equity | $ | 10,550 |

| | $ | 10,295 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

Andeavor Logistics LP

Condensed Statements of Consolidated Cash Flows

(Unaudited)

|

| | | | | | | |

| | Six Months Ended

June 30, |

| | 2019 | | 2018 (a) |

| | (In millions) |

| Cash Flows From (Used In) Operating Activities: | | | |

| Net earnings | $ | 317 |

| | $ | 263 |

|

| Adjustments to reconcile net earnings to net cash from operating activities: | | | |

| Depreciation and amortization expenses | 205 |

| | 182 |

|

| Loss on asset disposals and impairments | 2 |

| | 1 |

|

| Other operating activities | 18 |

| | 12 |

|

| Changes in current assets and liabilities | (45 | ) | | 100 |

|

| Changes in noncurrent assets and liabilities | (14 | ) | | (11 | ) |

| Net cash from operating activities | 483 |

| | 547 |

|

| Cash Flows Used In Investing Activities: | | | |

| Capital expenditures | (252 | ) | | (370 | ) |

| Acquisitions, net of cash | — |

| | (378 | ) |

| Contributions to equity method investments | (13 | ) | | — |

|

| Net cash used in investing activities | (265 | ) | | (748 | ) |

| Cash Flows From (Used In) Financing Activities: | | | |

| Borrowings under revolving credit agreements | 1,631 |

| | 520 |

|

| Repayments under revolving credit agreements | (1,376 | ) | | (278 | ) |

| Distributions to common unitholders | (480 | ) | | (411 | ) |

| Distributions to preferred unitholders | (21 | ) | | (8 | ) |

| Sponsor contributions of equity to the Predecessors | — |

| | 336 |

|

| Capital contributions by affiliate | 45 |

| | 14 |

|

| Other financing activities | (2 | ) | | (3 | ) |

| Net cash (used in) from financing activities | (203 | ) | | 170 |

|

| Increase (Decrease) in Cash and Cash Equivalents | 15 |

| | (31 | ) |

| Cash and Cash Equivalents, Beginning of Period | 10 |

| | 75 |

|

| Cash and Cash Equivalents, End of Period | $ | 25 |

| | $ | 44 |

|

(a) Adjusted to include the historical results of the Predecessors. See Note 1 for further discussion.

The accompanying notes are an integral part of these condensed consolidated financial statements.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) |

Note 1 - Organization and Basis of Presentation

Organization

Andeavor Logistics LP (“Andeavor Logistics”) is a fee-based, full-service, diversified Delaware limited partnership formed in December 2010 by Andeavor and its wholly-owned subsidiary, Tesoro Logistics GP, LLC (“TLGP”), to own, operate, develop and acquire logistics and related assets and businesses. TLGP served as our general partner until the closing of the MPLX Merger on July 30, 2019, as described below. Effective upon the closing of the MPLX Merger, our general partner is Andeavor Logistics GP LLC (“ALGP”), a wholly-owned subsidiary of MPLX LP (“MPLX”). Unless the context otherwise requires, references in this report to our general partner refer to TLGP for all activity through the closing of the MPLX Merger and to ALGP for all activity thereafter. Unless the context otherwise requires, references in this report to “we,” “us,” “our,” or “ours” refer to Andeavor Logistics, one or more of its consolidated subsidiaries or all of them taken as a whole. Unless the context otherwise requires, references in this report to “Andeavor” or our “Sponsor” refer collectively to Andeavor for all activity through September 30, 2018, or Andeavor LLC, successor-by-merger to Andeavor effective October 1, 2018 and a wholly owned subsidiary of Marathon Petroleum Corporation, and any of Andeavor’s or Andeavor LLC’s subsidiaries, as applicable, other than Andeavor Logistics, its subsidiaries and its general partner. References in this report to “Marathon” or “MPC” refer to Marathon Petroleum Corporation, one or more of its consolidated subsidiaries, including Andeavor LLC, or all of them taken as a whole.

MPLX LP Merger

As previously disclosed, on May 7, 2019, Andeavor Logistics, TLGP, MPLX, MPLX GP LLC, and MPLX MAX LLC, a wholly-owned subsidiary of MPLX (“Merger Sub”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) that provided for, among other things, the merger of Merger Sub with and into Andeavor Logistics (the “MPLX Merger”). On July 30, 2019, the MPLX Merger was completed, and Andeavor Logistics survived the MPLX Merger as a wholly-owned subsidiary of MPLX. At the effective time of the MPLX Merger, each common unit held by our public unitholders was converted into the right to receive 1.135 common units representing limited partner interests in MPLX (“MPLX Common Units”). Andeavor Logistics common units held by TLGP and Western Refining Southwest, Inc. (“WR Southwest”) were converted into the right to receive 1.0328 MPLX Common Units.

In connection with the completion of the MPLX Merger, we notified the New York Stock Exchange (“NYSE”) that each of our outstanding common units was converted into the right to receive MPLX Common Units in an amount determined by reference to the applicable exchange ratio. Upon our request, the NYSE filed a notification of removal from listing on Form 25 with the Securities and Exchange Commission (the “SEC”) with respect to our common units. Our common units ceased being traded prior to the opening of the market on July 30, 2019, and will no longer be listed on the NYSE. We continue to file with the SEC current and period reports that would be required by be filed with the SEC pursuant to Section 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

MPC Merger

On October 1, 2018, MPC completed its acquisition of Andeavor (the “MPC Merger”) in accordance with the Agreement and Plan of Merger, dated as of April 29, 2018, as amended. Following the MPC Merger, MPC became the beneficial owner of 156 million common units out of 245 million common units outstanding as of October 1, 2018, which represented a 64% limited partner interest. MPC also acquired 100% of the equity interests of our general partner.

Principles of Consolidation and Basis of Presentation

Principles of Consolidation

Assets acquired from our Sponsor, and the associated liabilities and results of operations, are collectively referred to as the “Predecessors.” See Note 1 of our Annual Report on Form 10-K for the year ended December 31, 2018 and Note 2 for additional information regarding the assets acquired from our Sponsor.

Transfers of businesses between entities under common control are accounted for as if the transfer occurred at the beginning of the period, and prior periods are retrospectively adjusted to furnish comparative information. On August 6, 2018, we acquired assets from our Sponsor (the “2018 Drop Down”). See Note 2 for additional information. As an entity under common control with our Sponsor, we record the assets that we acquire from our Sponsor on our condensed consolidated balance sheet at our Sponsor’s historical basis instead of fair value. Accordingly, the accompanying financial statements and related notes of Andeavor Logistics have been retrospectively adjusted to include the historical results of the assets acquired prior to the effective date of the acquisition.

The financial statements of our Predecessors have been prepared from the separate records maintained by our Sponsor and may not necessarily be indicative of the conditions that would have existed or the results of operations if our Predecessors had been operated as an unaffiliated entity. For the six months ended June 30, 2018, our condensed statement of cash flows includes net cash from operating activities of $86 million and net cash used in investing activities of $422 million from our Predecessors, offset by sponsor contributions of equity to the Predecessors in net cash from financing activities.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

The interim condensed consolidated financial statements and notes thereto have been prepared by management without audit according to the rules and regulations of the SEC and reflect all adjustments that, in the opinion of management, are necessary for a fair presentation of results for the periods presented. Such adjustments are of a normal recurring nature, unless otherwise disclosed.

Basis of Presentation

We prepare our condensed consolidated financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). However, certain information and notes normally included in financial statements prepared under U.S. GAAP have been condensed or omitted pursuant to the SEC’s rules and regulations. Management believes that the disclosures presented herein are adequate to present the information fairly. The accompanying interim condensed consolidated financial statements and notes should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2018. Certain prior year balances have been aggregated or disaggregated in order to conform to the current year presentation.

We are required under U.S. GAAP to make estimates and assumptions that affect the amounts of assets and liabilities and revenues and expenses reported as of and during the periods presented. We review our estimates on an ongoing basis using currently available information. Changes in facts and circumstances may result in revised estimates, and actual results could differ from those estimates. Our results of operations for any interim period are not necessarily indicative of results for the full year.

Cost Classifications

Natural gas liquids (“NGL”) expense results from the cost of NGL purchases under our percent of proceeds (“POP”) arrangements as well as the non-cash acquisition of replacement dry gas under our keep-whole arrangements.

Operating expenses are comprised of direct operating costs, including costs incurred for direct labor, repairs and maintenance, outside services, chemicals and catalysts, utility costs, including the purchase of electricity and natural gas used by our facilities, property taxes, environmental compliance costs related to current period operations, rent expense and other direct operating expenses incurred in the provision of services.

Depreciation and amortization expenses consist of the depreciation and amortization of property, plant and equipment, deferred charges and intangible assets related to our operating segments along with our corporate operations. General and administrative expenses represent costs that are not directly or indirectly related to or otherwise are not allocated to our operations. NGL expense, direct operating expenses, and depreciation and amortization expenses recognized by our Terminalling and Transportation, Gathering and Processing, and Wholesale segments (refer to amounts disclosed in Note 10) constitute costs of revenue as defined by U.S. GAAP.

Financial Instruments

The fair value of our senior notes is based on prices from recent trade activity and is categorized in level 2 of the fair value hierarchy. The borrowings under our amended revolving credit facility (the “Revolving Credit Facility”), our dropdown credit facility (“Dropdown Credit Facility”) and our loan agreement with MPC (the “MPC Loan Agreement”), which include a variable interest rate, approximate fair value. The carrying value and fair value of our debt were $5.3 billion and $5.4 billion as of June 30, 2019, respectively, and were $5.0 billion and $4.9 billion at December 31, 2018, respectively. These carrying and fair values of our debt exclude unamortized issuance costs, which are netted against our total debt.

We believe the carrying value of our other financial instruments, including cash and cash equivalents, receivables, accounts payable and certain accrued liabilities, approximate fair value. Our fair value assessment incorporates a variety of considerations, including the short-term duration of the instruments and the expected future insignificance of bad debt expense, which includes an evaluation of counterparty credit risk.

New Accounting Standards and Disclosures

Leases

We adopted Accounting Standards Update (“ASU”) 2016-02, “Leases (Topic 842)” (“ASC 842”), as of January 1, 2019, using the optional transition method. The optional transition method permits entities to adopt the provisions of ASC 842 prospectively without adjusting comparative periods, which we have elected. As part of the adoption of ASC 842, we elected the package of practical expedients permitted under the transition guidance within the new standard, which among other things, allowed us to grandfather the historical accounting conclusions until a reassessment event is present. We have also elected the practical expedient to not recognize short-term leases on the balance sheet, and the practical expedient related to right of way permits and land easements, allowing us to carry forward our accounting treatment for those existing agreements. Further, we have elected the practical expedient to not separate lease and non-lease components for the majority of our underlying classes of assets except for our third-party contractor service and equipment agreements in which we are the lessee. We did not elect the practical expedient to combine lease and non-lease components for arrangements in which we are the lessor. In instances where the practical expedient was not elected, lease and non-lease consideration is allocated based on relative standalone selling price.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) |

Right of use assets represent our right to use an underlying asset in which we obtain substantially all of the economic benefits and convey the right to control during the lease term and lease liabilities represent our obligation to make lease payments arising from the lease. Operating lease right of use assets and lease liabilities are recognized at commencement date based on the present value of lease payments over the lease term. Payments that are not fixed at the commencement date are considered variable and are excluded from the right of use asset and lease liability calculated. We recognized right of use assets and lease liabilities on the balance sheet for leases with a lease term of greater than one year. In the measurement of our right of use assets and lease liabilities, the fixed minimum lease payments in the agreement are discounted using a secured incremental borrowing rate provided by our financial service providers, as most of our leases do not provide an implicit rate, for a term similar to the duration of the lease. Operating lease expense is recognized on a straight-line basis over the lease term.

Adoption of the new standard resulted in the recording of additional right of use lease assets and lease liabilities of $131 million and $133 million, respectively, as of January 1, 2019, as further described in Note 4. The standard did not materially impact our condensed statements of consolidated operations or condensed statements of consolidated cash flows.

As a lessor under ASC 842, we may be required to re-classify existing contracts or operating leases to sales-type leases upon modification and reassessment of the contract. If such a modification were to occur, it may result in the de-recognition of existing assets, recognition of a receivable in the amount of the present value of fixed payments expected to be received by us under the contract, and recognition of a corresponding gain or loss in the period of change. We will evaluate the impact of a reassessment as modifications occur.

Stock Compensation

In June 2018, the Financial Accounting Standards Board (“FASB”) issued ASU 2018-07, “Improvements to Nonemployee Share-Based Payment Accounting”, which expanded the scope of Topic 718 to include share-based payment awards to nonemployees and eliminated the classification differences for employee and nonemployee share-based payment awards. This guidance was effective for interim and annual periods beginning after December 15, 2018. The adoption of this standard did not have a material impact on our condensed consolidated financial statements.

Credit Losses

In June 2016, the FASB issued ASU 2016-13, “Measurement of Credit Losses on Financial Instruments” (“ASU 2016-13”), which amends guidance on the impairment of financial instruments. The ASU requires the estimation of credit losses based on expected losses and provides for a simplified accounting model for purchased financial assets with credit deterioration. In November 2018, the FASB issued ASU 2018-19, “Codification Improvements to Topic 326, Financial Instruments - Credit Losses” that clarifies the scope of ASU 2016-13. In May 2019, the FASB issued ASU 2019-05, “Financial Instruments - Credit Losses (Topic 326) Targeted Transition Relief” to allow companies to irrevocably elect the fair value option on financial instruments that were previously recorded at amortized cost for eligible instruments. These ASUs are effective for annual reporting periods beginning after December 15, 2019, and interim reporting periods within those annual reporting periods. Early adoption is permitted for annual reporting periods beginning after December 15, 2018. While we are still evaluating the impact of ASU 2016-13, we do not expect to early adopt ASU 2016-13 nor expect the adoption of this standard to have a material impact on our consolidated financial statements.

Note 2 - Acquisitions

2018 Drop Down

On August 6, 2018, we completed the 2018 Drop Down for total consideration of $1.55 billion. These assets include gathering, storage and transportation assets in the Permian Basin; legacy Western Refining, Inc. assets and associated crude terminals; the majority of Andeavor’s remaining refining terminalling, transportation and storage assets; and equity method investments in Andeavor Logistics Rio Pipeline LLC (“ALRP”), Minnesota Pipe Line Company, LLC, and PNAC, LLC (“PNAC”). In addition, the Conan Crude Oil Gathering System and the Los Angeles Refinery Interconnect Pipeline (“LARIP”) were transferred at cost plus incurred interest.

SLC Core Pipeline System

On May 1, 2018, we completed our acquisition of the SLC Core Pipeline System from Plains All American Pipeline, L.P. for total consideration of $180 million. The system consists of pipelines that transport crude oil to another third-party pipeline system that supplies Salt Lake City area refineries, including Marathon’s Salt Lake City refinery. We financed the acquisition using our Revolving Credit Facility. This acquisition is not material to our condensed consolidated financial statements and its operating results are reported in our Terminalling and Transportation segment.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

Combined Consolidated Financial Information

As discussed further in Note 1, we refer to the historical results of the assets acquired from our Sponsor in the 2018 Drop Down (prior to August 6, 2018) as our “Predecessors.” The following table presents our results of operations disaggregated to present results relating to us and the Predecessors for the assets acquired from our Sponsor and the total amounts included in our combined financial statements for the three and six months ended June 30, 2018.

Reconciliation of Combined Financial Statements (in millions)

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2018 | | Six Months Ended June 30, 2018 |

| | Combined | | Andeavor Logistics | | Predecessors | | Combined | | Andeavor Logistics | | Predecessors |

| Revenues | | | | | | | | | | | |

| Affiliate | $ | 389 |

| | $ | 381 |

| | $ | 8 |

| | $ | 716 |

| | $ | 699 |

| | $ | 17 |

|

| Third-party | 180 |

| | 176 |

| | 4 |

| | 399 |

| | 393 |

| | 6 |

|

| Total Revenues | 569 |

| | 557 |

| | 12 |

| | 1,115 |

| | 1,092 |

| | 23 |

|

| Costs and Expenses | | | | | | | | | | | |

| NGL expense (exclusive of items shown separately below) | 45 |

| | 45 |

| | — |

| | 93 |

| | 93 |

| | — |

|

| Operating expenses (exclusive of depreciation and amortization) | 221 |

| | 201 |

| | 20 |

| | 422 |

| | 391 |

| | 31 |

|

| Depreciation and amortization expenses | 93 |

| | 83 |

| | 10 |

| | 182 |

| | 163 |

| | 19 |

|

| General and administrative expenses | 29 |

| | 25 |

| | 4 |

| | 60 |

| | 52 |

| | 8 |

|

| Loss on asset disposals and impairments | 1 |

| | 1 |

| | — |

| | 1 |

| | 1 |

| | — |

|

| Operating Income (Loss) | 180 |

| | 202 |

| | (22 | ) | | 357 |

| | 392 |

| | (35 | ) |

| Interest and financing costs, net | (60 | ) | | (58 | ) | | (2 | ) | | (115 | ) | | (112 | ) | | (3 | ) |

| Equity in earnings of equity method investments | 10 |

| | 3 |

| | 7 |

| | 18 |

| | 5 |

| | 13 |

|

| Other income, net | 2 |

| | 1 |

| | 1 |

| | 3 |

| | 2 |

| | 1 |

|

| Net Earnings (Loss) | $ | 132 |

| | $ | 148 |

| | $ | (16 | ) | | $ | 263 |

| | $ | 287 |

| | $ | (24 | ) |

| | | | | | | | | | | | |

| Loss attributable to Predecessors | $ | 16 |

| | $ | — |

| | $ | 16 |

| | $ | 24 |

| | $ | — |

| | $ | 24 |

|

| Net Earnings Attributable to Partners | 148 |

| | 148 |

| | — |

| | 287 |

| | 287 |

| | — |

|

| Preferred unitholders’ interest in net earnings | (10 | ) | | (10 | ) | | — |

| | (24 | ) | | (24 | ) | | — |

|

| Limited Partners’ Interest in Net Earnings | $ | 138 |

| | $ | 138 |

| | $ | — |

| | $ | 263 |

| | $ | 263 |

| | $ | — |

|

Note 3 - Related-Party Transactions

Affiliate Agreements

We have various long-term, fee-based commercial agreements with our Sponsor, under which we provide terminal distribution, storage services, pipeline transportation, crude oil, natural gas and produced water gathering and processing, wholesale, and trucking services to Marathon, and Marathon commits to provide us with minimum monthly throughput volumes of crude oil, refined products and other products. If, in any calendar month, Marathon fails to meet its minimum volume commitments under these agreements, it will be required to pay us a shortfall payment. For the NGLs that we handle under keep-whole agreements, we transfer the commodity price risk exposure associated with these keep-whole agreements to Marathon pursuant to the Keep-Whole Commodity Fee Agreement, as amended (the “Keep-Whole Commodity Agreement”). Under the Keep-Whole Commodity Agreement, Marathon pays us a processing fee for NGLs related to the keep-whole agreements and delivers replacement dry gas to the producers on our behalf. We then pay Marathon a marketing fee in exchange for assuming the commodity price risk. The terms and pricing of this agreement are subject to revision each year.

We have agreements for the provision of various general and administrative services by our Sponsor. Under our partnership agreement, we are required to reimburse our general partner and its affiliates for all costs and expenses they incur on our behalf for managing and controlling our business and operations.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) |

On January 30, 2019, TLGP and certain of its indirect subsidiaries entered into a secondment agreement between us and certain of our subsidiaries and Marathon Petroleum Logistics Services LLC (“MPLS”) and a secondment agreement between us and certain of our subsidiaries and Marathon Refining Logistics Services LLC (“MRLS”) (collectively, the “2019 Secondment Agreements”). Under the 2019 Secondment Agreements, MPLS and MRLS second certain employees to occupy positions within our business and organization and to conduct business on our behalf.

While seconded by MPLS and MRLS to us, seconded employees remain on the payroll of MPLS or MRLS, as the case may be, and are eligible to participate in all MPLS or MRLS benefit plans that they would be eligible to participate in absent the secondment, but work for and are under our general direction, supervision and control. We reimburse MPLS or MRLS, as the case may be, for the payroll costs of the seconded employees, including base pay, bonuses and other incentive compensation plus a burden rate associated with benefits and other payroll costs for the portion of the employee’s time that is allocated to us. The 2019 Secondment Agreements are for a term of 10 years, but may be sooner terminated by us, MPLS or MRLS upon 60 days written notice. In connection with the entry into the 2019 Secondment Agreements, on January 30, 2019, our Sponsor entered into an agreement (the “Termination Agreement”) that terminated the Andeavor Secondment Agreement. The Termination Agreement had an effective date of January 1, 2019.

Except to the extent specified under our amended omnibus agreement (the “Amended Omnibus Agreement”) or the 2019 Secondment Agreements, TLGP determines the amount of these expenses. Under the terms of the Amended Omnibus Agreement in effect as of June 30, 2019, we are required to pay our Sponsor an annual corporate services fee of $17 million for the provision of various centralized corporate services, including executive management, legal, accounting, treasury, human resources, health, safety and environmental, information technology, certain insurance coverage, administration and other corporate services.

Pursuant to the applicable secondment agreements in effect, our Sponsor charged us $24 million and $4 million during the three months ended June 30, 2019 and 2018, respectively, and $47 million and $10 million during the six months ended June 30, 2019 and 2018, respectively, reflecting increased services provided in conjunction with the assets acquired in the 2018 Drop Down. Additionally, pursuant to the Amended Omnibus Agreement and 2019 Secondment Agreements, we reimburse our Sponsor for any direct costs incurred by our Sponsor in providing other operational services with respect to certain of our other assets and operations.

Summary of Affiliate Transactions

Summary of Revenue and Expense Transactions with our Sponsor (in millions)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2019 | | 2018 (a) | | 2019 | | 2018 (a) |

| Revenues (b) | $ | 424 |

| | $ | 389 |

| | $ | 868 |

| | $ | 716 |

|

| Operating expenses (c) | 113 |

| | 72 |

| | 217 |

| | 134 |

|

| General and administrative expenses | 15 |

| | 22 |

| | 29 |

| | 46 |

|

| |

| (a) | Adjusted to include the historical results of the Predecessors. See Note 1 for further discussion. |

| |

| (b) | Represents 71% and 68% of our total revenues for the three months ended June 30, 2019 and 2018, respectively, and 71% and 64% of our total revenues for the six months ended June 30, 2019 and 2018, respectively. |

| |

| (c) | Excludes reimbursements from our Sponsor pursuant to the Amended Omnibus Agreement, the Carson Assets Indemnity Agreement and other affiliate agreements of $7 million and $3 million for the three months ended June 30, 2019 and 2018, respectively, and $10 million for both the six months ended June 30, 2019 and 2018. |

Distributions

During the six months ended June 30, 2019, we paid quarterly cash distributions of $294 million to our Sponsor. See Note 7 for further information regarding distributions.

Note 4 - Leases

For further information regarding the adoption of ASC 842, including the method of adoption and practical expedients elected,

see Note 1.

Lessee

We lease a wide variety of facilities and equipment under operating leases, including land and building space, office and field equipment, storage facilities and transportation equipment with remaining lease terms ranging from less than 1 year to 25 years. Some of our long-term leases include renewal options. Renewal options and termination options were not included in the

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

measurement of right of use assets and lease liabilities since it was determined they were not reasonably certain to be exercised. The decision to renew or terminate the lease is at our sole discretion. Our lease agreements do not include any material residual value guarantees or restrictive covenants.

Maturities of lease liabilities for operating lease obligations and finance lease obligations having initial or remaining noncancellable lease terms in excess of one year as of June 30, 2019 as well as the components of lease expense under ASC 842 are as follows:

Lease Liabilities Maturities (in millions)

|

| | | | | | | |

| | Lease Obligations |

| | Operating | | Finance |

| 2019 | $ | 6 |

| | $ | 2 |

|

| 2020 | 18 |

| | 3 |

|

| 2021 | 15 |

| | 2 |

|

| 2022 | 12 |

| | 2 |

|

| 2023 | 12 |

| | 2 |

|

| 2024 and thereafter | 102 |

| | 4 |

|

| Gross lease payments | 165 |

| | 15 |

|

| Less: imputed interest | (45 | ) | | (2 | ) |

| Total Lease Payments | $ | 120 |

| | $ | 13 |

|

Components of Lease Expense (in millions)

|

| | | | | | | |

| | Three Months Ended June 30, 2019 | | Six Months Ended June 30, 2019 |

| Operating lease cost | $ | 5 |

| | $ | 8 |

|

| | | | |

| Finance lease cost: | | | |

| Amortization of right-of-use assets | 1 |

| | 2 |

|

| Interest on lease liabilities | 1 |

| | 1 |

|

| Total finance lease cost | 2 |

| | 3 |

|

| | | | |

| Variable lease cost | 2 |

| | 3 |

|

| Short-term lease cost | 9 |

| | 15 |

|

| Total Lease Cost | $ | 18 |

| | $ | 29 |

|

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) |

Supplemental Balance Sheet Data (in millions, except lease term and discount rates)

|

| | | |

| | June 30, 2019 |

| Operating Leases | |

| Right of use assets included in other noncurrent assets, net | $ | 121 |

|

| | |

| Operating lease liabilities included in other current liabilities | $ | 12 |

|

| Long-term operating lease liabilities included in other noncurrent liabilities | 108 |

|

| Total Operating Lease Liabilities | $ | 120 |

|

| | |

| Weighted average remaining lease term | 13 years |

|

| Weighted average discount rate | 4.83 | % |

| | |

| Finance Leases | |

| Property, plant and equipment, gross | $ | 25 |

|

| Accumulated depreciation | (14 | ) |

| Property, Plant and Equipment, Net | $ | 11 |

|

| | |

| Debt due within one year | $ | 3 |

|

| Long-term debt | 10 |

|

| Total Finance Lease Liabilities | $ | 13 |

|

| | |

| Weighted average remaining lease term | 5 years |

|

| Weighted average discount rate | 5.88 | % |

Lessor

We provide storage at several of our terminals as well as certain other services to our Sponsor in which we are considered to be the lessor in accordance with U.S. GAAP. We charge fixed fees based on the total storage capacity of our tanks under those agreements. During the three and six months ended June 30, 2019, we did not receive any material contingent lease payments. The term of the majority of the storage agreements is a primary term of ten years with two renewal option periods of five years, with the primary term scheduled to expire from 2021 to 2028. Our revenue from implicit lease arrangements, excluding executory costs, totaled $132 million and $91 million for the three months ended June 30, 2019 and 2018, respectively, and $268 million and $178 million for the six months ended June 30, 2019 and 2018, respectively.

Based on the changes presented in ASC 842, we, as a lessor, may be required to reclassify contracts or existing operating leases to sales-type leases upon modification and related reassessment of the contract. If such a modification were to occur, it may result in the derecognition of existing assets, recognition of a receivable in the amount of the present value of fixed payments expected to be received by us under the contract, and recognition of a corresponding gain or loss in the period of change. We will evaluate the impact of a reassessment as modifications occur.

Minimum Future Lease Revenue on Non-Cancellable Operating Leases (in millions)

|

| | | |

| | June 30, 2019 (a) |

| 2019 | $ | 268 |

|

| 2020 | 535 |

|

| 2021 | 533 |

|

| 2022 | 533 |

|

| 2023 | 532 |

|

| 2024 and thereafter | 6,292 |

|

| Total Minimum Lease Revenue | $ | 8,693 |

|

| |

| (a) | Includes minimum future lease revenue assuming all renewal option periods for each agreement are exercised. |

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

Investment in Assets Held for Operating Leases (in millions)

|

| | | | | | | |

| | June 30,

2019 | | December 31, 2018 |

| Terminals and related assets | $ | 847 |

| | $ | 778 |

|

| Pipelines | 110 |

| | 110 |

|

| Land and leasehold improvements | 29 |

| | 28 |

|

| Construction in progress | 21 |

| | 15 |

|

| Property, plant and equipment, at cost | 1,007 |

| | 931 |

|

| Accumulated depreciation | (262 | ) | | (238 | ) |

| Property, Plant and Equipment, Net | $ | 745 |

| | $ | 693 |

|

Note 5 - Debt

Debt Balance, Net of Unamortized Issuance Costs (in millions)

|

| | | | | | | |

| | June 30,

2019 | | December 31,

2018 |

| Total debt | $ | 5,263 |

| | $ | 5,010 |

|

| Unamortized issuance costs | (40 | ) | | (46 | ) |

| Current maturities | (503 | ) | | (504 | ) |

| Debt, Net of Current Maturities and Unamortized Issuance Costs | $ | 4,720 |

| | $ | 4,460 |

|

Our debt is non-recourse to Marathon, except for TLGP and, with respect to borrowings under our Dropdown Credit Facility, WR Southwest.

Available Capacity Under Credit Facilities (in millions) (a)

|

| | | | | | | | | | | | | | | | | | | | |

| | Total Capacity | | Amount Borrowed as of June 30, 2019 | | Outstanding Letters of Credit | | Available Capacity as of June 30, 2019 | | Weighted Average Interest Rate | | Expiration |

| Revolving Credit Facility | $ | 1,100 |

| | $ | 1,070 |

| | $ | — |

| | $ | 30 |

| | 3.90 | % | | January 29, 2021 |

| Dropdown Credit Facility | 1,000 |

| | 430 |

| | — |

| | 570 |

| | 3.92 | % | | January 29, 2021 |

| MPC Loan Agreement | 500 |

| | — |

| | — |

| | 500 |

| | — | % | | December 21, 2023 |

| Total Credit Facilities | $ | 2,600 |

| | $ | 1,500 |

| | $ | — |

| | $ | 1,100 |

| | | | |

| |

| (a) | In conjunction with the MPLX Merger, on July 30, 2019, all outstanding borrowings and unpaid fees on our credit facilities were repaid and the agreements were terminated, including the MPC Loan Agreement. |

Note 6 - Commitments and Contingencies

In the ordinary course of business, we may become party to lawsuits, disputes, administrative proceedings and governmental investigations, including environmental, regulatory and other matters. The outcome of these matters cannot always be predicted accurately, but we will accrue liabilities for these matters if the amount is probable and can be reasonably estimated. While it is not possible to predict the outcome of such proceedings, if one or more of them were decided against us, we believe there would be no material impact on our condensed consolidated financial statements.

Note 7 - Equity and Net Earnings per Unit

We had 89,457,316 common public units and 600,000 6.875% Series A Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units (the “Preferred Units”) outstanding as of June 30, 2019. Additionally, Marathon owned 156,173,128 of our common units, constituting 64% ownership interest in us. Marathon also held 80,000 TexNew Mex units and all of the outstanding non-economic general partner units as of June 30, 2019. See Note 1 for further discussion of the treatment of our common units in connection with the MPLX Merger. In addition, in connection with the MPLX Merger, our Preferred Units were exchanged for Series B Preferred Units of MPLX and our TexNew Mex units were converted into a new class of units of MPLX with substantially equivalent rights, powers, duties and obligations as our TexNew Mex Units.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) |

Changes to Equity (in millions)

|

| | | | | | | | | | | |

| | Three and Six Months Ended June 30, 2019 |

| | Common | | Preferred | | Total |

| Balance at December 31, 2018 | $ | 4,070 |

| | $ | 604 |

| | $ | 4,674 |

|

| Distributions to common and preferred unitholders (a) | (240 | ) | | (21 | ) | | (261 | ) |

| Net earnings attributable to partners | 147 |

| | 10 |

| | 157 |

|

| Contributions (b) | 19 |

| | — |

| | 19 |

|

| Other | 1 |

| | — |

| | 1 |

|

| Balance at March 31, 2019 | 3,997 |

| | 593 |

| | 4,590 |

|

| Distributions to common unitholders (a) | (241 | ) | | — |

| | (241 | ) |

| Net earnings attributable to partners | 150 |

| | 10 |

| | 160 |

|

| Contributions (b) | 25 |

| | — |

| | 25 |

|

| Balance at June 30, 2019 | $ | 3,931 |

| | $ | 603 |

| | $ | 4,534 |

|

|

| | | | | | | | | | | | | | | |

| | Three and Six Months Ended June 30, 2018 |

| | Equity of Predecessors (c) | | Andeavor Logistics | | Total |

| | | Common | | Preferred | |

| Balance at December 31, 2017 | $ | 1,292 |

| | $ | 2,925 |

| | $ | 589 |

| | $ | 4,806 |

|

| Sponsor contributions of assets to the Predecessors | 197 |

| | — |

| | — |

| | 197 |

|

| Loss attributable to the Predecessors | (8 | ) | | — |

| | — |

| | (8 | ) |

| Distributions to common and preferred unitholders (a) | — |

| | (205 | ) | | (8 | ) | | (213 | ) |

| Net earnings attributable to partners | — |

| | 125 |

| | 14 |

| | 139 |

|

| Contributions (b) | — |

| | 16 |

| | — |

| | 16 |

|

| Cumulative effect of accounting standard adoption | — |

| | (22 | ) | | — |

| | (22 | ) |

| Other | — |

| | — |

| | (1 | ) | | (1 | ) |

| Balance at March 31, 2018 | 1,481 |

| | 2,839 |

| | 594 |

| | 4,914 |

|

| Sponsor contributions of assets to the Predecessors | 139 |

| | — |

| | — |

| | 139 |

|

| Loss attributable to the Predecessors | (16 | ) | | — |

| | — |

| | (16 | ) |

| Distributions to common unitholders (a) | — |

| | (206 | ) | | — |

| | (206 | ) |

| Net earnings attributable to partners | — |

| | 138 |

| | 10 |

| | 148 |

|

| Contributions (b) | — |

| | 7 |

| | — |

| | 7 |

|

| Other | — |

| | 1 |

| | — |

| | 1 |

|

| Balance at June 30, 2018 | $ | 1,604 |

| | $ | 2,779 |

| | $ | 604 |

| | $ | 4,987 |

|

| |

| (a) | Represents cash distributions declared and paid during the period. |

| |

| (b) | Includes Marathon and TLGP contributions to us primarily related to reimbursements for capital spending pursuant predominantly to the Amended Omnibus Agreement and the Carson Assets Indemnity Agreement. |

| |

| (c) | Adjusted to include the historical results of the Predecessors. See Note 1 for further discussion. |

Cash Distributions

Our partnership agreement, as amended, sets forth the calculation to be used to determine the amount and priority of cash distributions that the limited partner unitholders will receive.

Quarterly Distributions on Common Units

|

| | | | | | | | | | | |

| Quarter Ended | Quarterly Distribution Per Common Unit | | Total Cash Distribution (in millions) | | Date of Distribution | | Unitholders Record Date |

| December 31, 2018 (a) | $ | 1.03 |

| | $ | 238 |

| | February 14, 2019 | | February 5, 2019 |

| March 31, 2019 (a) | 1.03 |

| | 240 |

| | May 15, 2019 | | May 9, 2019 |

| |

| (a) | This distribution is net of $12.5 million waived with respect to units held by our Sponsor and its affiliates for the three months ended March 31, 2019 and $15 million for the three months ended December 31, 2018. These distribution waivers were instituted in 2017 under the terms of our partnership agreement. |

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

During the period from the execution of the MPLX Merger Agreement to the date that the MPLX Merger was consummated, we coordinated the record dates of our quarterly distributions with MPLX so that no holder of our common units received distributions from both us and MPLX or failed to receive one distribution. As a result of the record date of the MPLX distribution occurring after the MPLX Merger, we did not declare a distribution for the second quarter of 2019.

During the six months ended June 30, 2019 and 2018, we paid distributions of $21 million and $8 million, respectively, to holders of our Preferred Units. Distributions on the Preferred Units are payable semi-annually in arrears on the 15th day of February and August of each year. Due to the timing of the MPLX Merger, exchange of Preferred Units and the record dates discussed above, we did not declare a distribution associated with the Preferred Units for the first half of 2019.

Net Earnings per Unit

We use the two-class method when calculating the net earnings per unit applicable to limited partners, because we have more than one participating security. At June 30, 2019, our participating securities consisted of common units, Preferred Units and TexNew Mex units. Net earnings is allocated between the partners in accordance with our partnership agreement. We base our calculation of net earnings per unit on the weighted average number of common limited partner units outstanding during the period.

Diluted net earnings per unit include the effects of potentially dilutive units on our common units, which consist of unvested phantom units. Distributions less than or greater than earnings are allocated in accordance with our partnership agreement.

Net Earnings per Unit (in millions, except per unit amounts)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2019 | | 2018 (a) | | 2019 | | 2018 (a) |

| Net earnings | $ | 160 |

| | $ | 132 |

| | $ | 317 |

| | $ | 263 |

|

| Distributions on Preferred Units (b) | — |

| | (10 | ) | | — |

| | (20 | ) |

| Net earnings attributable to common units | 160 |

| | 122 |

| | 317 |

| | 243 |

|

| Limited partners’ distributions on common units (c) | — |

| | (209 | ) | | (240 | ) | | (414 | ) |

| Distributions on common units less (greater) than earnings | $ | 160 |

| | $ | (87 | ) | | $ | 77 |

| | $ | (171 | ) |

| General partner’s earnings: | | | | | | | |

| Allocation of distributions greater than earnings (d) | $ | — |

| | $ | (16 | ) | | $ | — |

| | $ | (24 | ) |

| Total general partner’s loss | $ | — |

| | $ | (16 | ) | | $ | — |

| | $ | (24 | ) |

| Limited partners’ earnings on common units: | | | | | | | |

| Distributions (c)(e) | $ | — |

| | $ | 209 |

| | $ | 240 |

| | $ | 414 |

|

| Allocation of distributions less (greater) than earnings | 160 |

| | (71 | ) | | 77 |

| | (147 | ) |

| Total limited partners’ earnings on common units | $ | 160 |

| | $ | 138 |

| | $ | 317 |

| | $ | 267 |

|

| | | | | | | | |

| Weighted average limited partner units outstanding: | | | | | | | |

| Common units - basic | 245.6 |

| | 217.2 |

| | 245.6 |

| | 217.2 |

|

| Common units - diluted (f) | 245.7 |

| | 217.3 |

| | 245.7 |

| | 217.3 |

|

| Net earnings per limited partner unit: (g) | | | | | | | |

| Common - basic | $ | 0.65 |

| | $ | 0.63 |

| | $ | 1.29 |

| | $ | 1.23 |

|

| Common - diluted | $ | 0.65 |

| | $ | 0.63 |

| | $ | 1.29 |

| | $ | 1.23 |

|

| |

| (a) | Adjusted to include the historical results of the Predecessors. See Note 1 for further discussion. |

| |

| (b) | The Preferred Units entitle unitholders to receive preferred distributions on a semi-annual basis. Due to the MPLX Merger, we did not declare a distribution for the first half of 2019. |

| |

| (c) | We did not declare a distribution for the second quarter of 2019 due to the MPLX Merger. |

| |

| (d) | We have revised the historical allocation of general partner earnings to include the Predecessors’ losses of $16 million and $24 million for the three and six months ended June 30, 2018, respectively. |

| |

| (e) | Distributions of earnings for limited partners’ common units for the three months ended June 30, 2018 is net of a $15 million waiver and the six months ended June 30, 2019 and 2018 are net of a $12.5 million and $30 million waiver, respectively, from our Sponsor. There was no waiver for the three months ended June 30, 2019 because we did not declare a distribution for the second quarter of 2019 due to the MPLX Merger. |

| |

| (f) | Diluted net earnings per unit include the effects of potentially dilutive units on our common units, which consist of unvested phantom units. |

| |

| (g) | Amounts may not recalculate due to rounding of dollar and unit information. |

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) |

Note 8 - Supplemental Cash Flow Information

Supplemental Disclosures of Cash Activities (in millions)

|

| | | | | | | |

| | Six Months Ended

June 30, |

| | 2019 | | 2018 (a) |

| Net cash from operating activities: | | | |

| Interest paid (net of amounts capitalized) | $ | 117 |

| | $ | 78 |

|

| Cash paid for amounts included in the measurement of lease liabilities: | | | |

| Payments on operating leases | 8 |

| | — |

|

| Net cash used in investing activities: | | | |

| Capital expenditures included in accounts payable | 113 |

| | 87 |

|

| Net cash used in financing activities: | | | |

| Receivable from affiliate for capital expenditures | 8 |

| | 2 |

|

| Principal payments under finance lease obligations | 2 |

| | — |

|

| Right of use assets obtained in exchange for new operating lease obligations | 2 |

| | — |

|

| Right of use assets obtained in exchange for new financing lease obligations | 1 |

| | — |

|

| |

| (a) | Adjusted to include the historical results of the Predecessors. See Note 1 for further discussion. |

Note 9 - Revenues

We recognize revenue upon transfer of control of promised products or services to customers in an amount that reflects the consideration to which we expect to be entitled in exchange for those products or services. Revenue is recognized net of amounts collected from customers for taxes assessed by governmental authorities on, and concurrent with, specific revenue-producing transactions.

Revenues (in millions)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2019 | | 2018 (a) | | 2019 | | 2018 (a) |

| Revenues from contracts with customers | $ | 469 |

| | $ | 478 |

| | $ | 963 |

| | $ | 937 |

|

| Lease revenues | 132 |

| | 91 |

| | 268 |

| | 178 |

|

| |

| (a) | Adjusted to include the historical results of the Predecessors. See Note 1 for further discussion. |

Service Revenue

We generate service revenue for gathering and transporting crude oil, natural gas and water; processing and fractionating natural gas and NGLs; and terminalling, transporting, and storing crude oil and refined products. We perform these services under various contractual arrangements with our customers. We recognize service revenue over time, as customers simultaneously receive and consume the related benefits of the services that we stand ready to provide. Where contracts contain provisions for minimum volume commitments, we assess the likelihood of insufficient volumes and recognize probable deficiency revenue ratably over the commitment or clawback period.

Product Revenue

We generate product revenue from the sale of NGLs and related products along with the sale of gasoline and diesel fuel within our wholesale business. We sell NGLs, shrink gas and condensate using natural gas we acquire from producers under our POP arrangements. We have certain fuel purchase and sale arrangements under which we receive certain minimum guaranteed margins with upside potential on a certain portion of our branded and unbranded fuel sales. Marathon retains control of fuel and is the principal in these affiliate arrangements. Therefore, we net the purchase and sale of fuel in our condensed consolidated statements of operations. Product revenues are recognized at a point-in-time, which generally occurs upon delivery and transfer of title to the customer.

Other Arrangements

Based on the terms of certain storage and other agreements in which the counterparty is primarily our Sponsor, we are considered to be the lessor under these implicit operating lease arrangements, as discussed in Note 4.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

Customer Contract Assets

Our receivables are primarily associated with customer contracts. Our payment terms vary by product or service type, and the period between invoicing and payment is not significant. Included in our receivables are balances associated with commodity sales on behalf of our producer customers, for which we remit the net sales price back to the producer customers upon completion of each sale. These balances are commingled in our receivables, net of allowance for doubtful accounts in our consolidated balance sheets. Our contract assets include amounts recognized for deficiency payments associated with minimum volume commitments which have not been billed to customers. These contract assets are included in prepayments and other current assets in our consolidated balance sheets and are shown in the "Summary of Customer Contract Assets and Liabilities" table below.

Customer Contract Liabilities

For certain products or services, we receive payment in advance of when performance obligations are satisfied. These liabilities from contracts with customers consist primarily of certain deficiency payments for minimum volume commitments and customer reimbursements of costs for capital projects. Customer advances for capital projects are generally recognized over the contract term. Payments for minimum volume commitments and other customer advances are included in deferred income within other current liabilities and other noncurrent liabilities based on timing of expected recognition, which may extend up to 15 years. During the three months ended June 30, 2019 and 2018, we recognized $7 million and $6 million, respectively, and $18 million and $20 million during the six months ended June 30, 2019 and 2018, respectively, in revenue from contract liabilities existing as of December 31, 2018 and January 1, 2018, respectively, after cumulative adjustments for the adoption of ASC 606.

Summary of Customer Contract Assets and Liabilities (in millions)

|

| | | | | | | |

| | June 30,

2019 | | December 31, 2018 |

| Other contract assets | $ | 22 |

| | $ | 32 |

|

| Deferred income, current | 25 |

| | 24 |

|

| Deferred income, noncurrent | 68 |

| | 57 |

|

Remaining Performance Obligations

We do not disclose the value of unsatisfied performance obligations for contracts with original expected terms of one year or less or the value of variable consideration related to unsatisfied performance obligations, when such values are not required to be estimated for purposes of allocation and recognition. Revenues associated with remaining obligations under contracts with terms in excess of one year related primarily to arrangements for which the customer has agreed to fixed consideration based on minimum throughput volume commitments or capacity utilization. As of June 30, 2019, we had $3.8 billion of expected revenues from remaining performance obligations.

The future revenues from our service arrangements with fixed fees or minimum throughput volume commitments will be recognized over the period of performance to which the fixed fee or commitment relates, which ranges from 1 year to 15 years. We expect approximately 85% of our total remaining obligations to be recognized within 5 years.

Disaggregation

Revenue is disaggregated by nature of revenue stream as presented in Note 10 because these categories depict how the nature, amount, timing and uncertainty of revenues and cash flows are affected by economic factors.

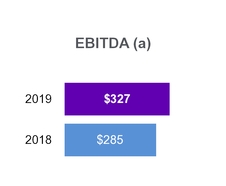

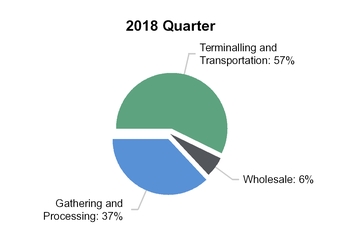

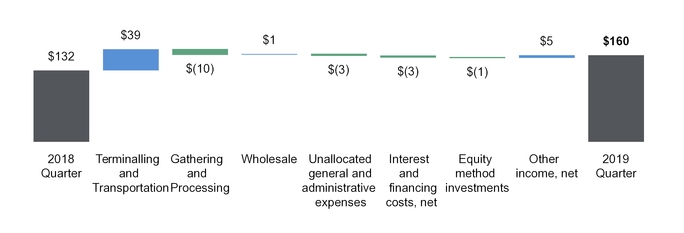

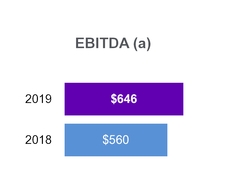

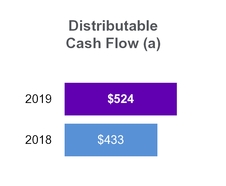

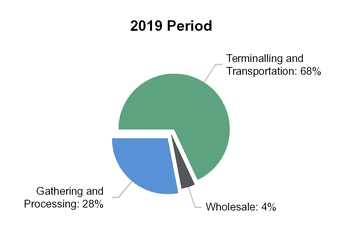

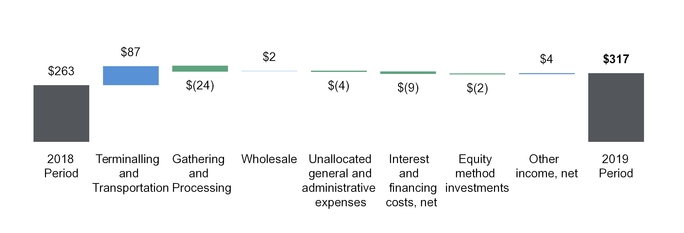

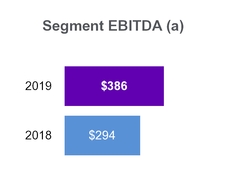

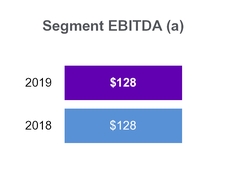

Note 10 - Operating Segments

Our revenues are derived from three operating segments: Terminalling and Transportation, Gathering and Processing, and Wholesale. We evaluate the performance of our segments based primarily on segment operating income and net earnings before interest, income taxes, depreciation and amortization expenses (“EBITDA”). For the purposes of our operating segment disclosure, we present operating income as it is the most comparable measure to the amounts presented in our condensed statements of consolidated operations. Segment operating income includes those revenues and expenses that are directly attributable to management of the respective segment. Certain general and administrative expenses and interest and financing costs are excluded from segment operating income as they are not directly attributable to a specific operating segment.

Our Terminalling and Transportation segment consists of pipeline systems, including regulated common carrier refined products pipeline systems and other pipelines, which transport products and crude oil primarily from Marathon’s refineries to nearby facilities, as well as crude oil and refined products terminals and storage facilities, marine terminals, stand-alone asphalt terminals as well as a 50% interest in PNAC, rail-car unloading facilities, an asphalt trucking operation and a petroleum coke handling and storage facility.

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) |

Our Gathering and Processing segment consists of crude oil, natural gas, NGLs and produced water gathering systems in the Bakken Shale/Williston Basin area of North Dakota and Montana, the Green River Basin, Uinta Basin, and Vermillion Basin in the states of Utah, Colorado and Wyoming, the Delaware Basin in the Permian Basin area of West Texas and Southern New Mexico, and in the San Juan Basin in the Four Corners area of Northwestern New Mexico. It also consists of the Great Northern Midstream and Fryburg pipelines, crude trucking operations and gas processing and fractionation complexes.

Our Wholesale segment includes the operations of several bulk petroleum distribution plants and a fleet of refined product delivery trucks that distribute commercial wholesale petroleum products primarily in Arizona, Colorado, Nevada, New Mexico and Texas. The refined product trucking business delivers a significant portion of the volumes sold by our Wholesale segment.

Segment Information (in millions)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2019 | | 2018 (a) | | 2019 | | 2018 (a) |

| Revenues | | | | | | | |

| Terminalling and Transportation: | | | | | | | |

| Terminalling | $ | 248 |

| | $ | 209 |

| | $ | 493 |

| | $ | 408 |

|

| Pipeline transportation | 47 |

| | 40 |

| | 93 |

| | 71 |

|

| Other revenues | 2 |

| | 1 |

| | 4 |

| | 3 |

|

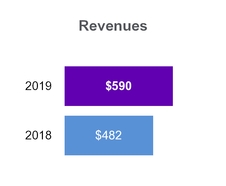

| Total Terminalling and Transportation | 297 |

| | 250 |

| | 590 |

| | 482 |

|

| Gathering and Processing: | | | | | | | |

| NGL sales | 94 |

| | 95 |

| | 216 |

| | 199 |

|

| Gas gathering and processing | 75 |

| | 82 |

| | 145 |

| | 167 |

|

| Crude oil and water gathering | 79 |

| | 80 |

| | 176 |

| | 155 |

|

| Pass-thru and other | 36 |

| | 44 |

| | 68 |

| | 79 |

|

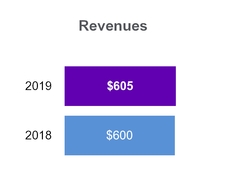

| Total Gathering and Processing | 284 |

| | 301 |

| | 605 |

| | 600 |

|

| Wholesale: | | | | | | | |

| Fuel sales | 17 |

| | 15 |

| | 29 |

| | 24 |

|

| Other wholesale | 6 |

| | 10 |

| | 16 |

| | 18 |

|

| Total Wholesale | 23 |

| | 25 |

| | 45 |

| | 42 |

|

| Intersegment wholesale revenues | (3 | ) | | (7 | ) | | (9 | ) | | (9 | ) |

| Total Revenues | $ | 601 |

| | $ | 569 |

| | $ | 1,231 |

| | $ | 1,115 |

|

| | | | | | | | |

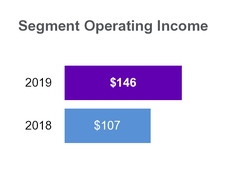

| Segment Operating Income | | | | | | | |

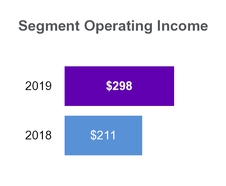

| Terminalling and Transportation | $ | 146 |

| | $ | 107 |

| | $ | 298 |

| | $ | 211 |

|

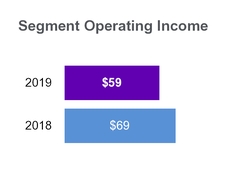

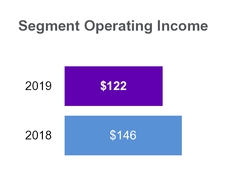

| Gathering and Processing | 59 |

| | 69 |

| | 122 |

| | 146 |

|

| Wholesale | 12 |

| | 11 |

| | 17 |

| | 15 |

|

| Total Segment Operating Income | 217 |

| | 187 |

| | 437 |

| | 372 |

|

| Unallocated general and administrative expenses | (10 | ) | | (7 | ) | | (19 | ) | | (15 | ) |

| Operating Income | 207 |

| | 180 |

| | 418 |

| | 357 |

|

| Interest and financing costs, net | (63 | ) | | (60 | ) | | (124 | ) | | (115 | ) |

| Equity in earnings of equity method investments | 9 |

| | 10 |

| | 16 |

| | 18 |

|

| Other income, net | 7 |

| | 2 |

| | 7 |

| | 3 |

|

| Net Earnings | $ | 160 |

| | $ | 132 |

| | $ | 317 |

| | $ | 263 |

|

| |

| (a) | Adjusted to include the historical results of the Predecessors. See Note 1 for further discussion. |

|

| | |

| Notes to Condensed Consolidated Financial Statements (Unaudited) | |

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| | 2019 | | 2018 (a) | | 2019 | | 2018 (a) |

| Depreciation and Amortization Expenses | | | | | | | |

| Terminalling and Transportation | $ | 38 |

| | $ | 37 |

| | $ | 74 |

| | $ | 70 |

|

| Gathering and Processing | 64 |

| | 54 |

| | 126 |

| | 107 |

|

| Wholesale | 2 |

| | 2 |

| | 5 |

| | 5 |

|

| Total Depreciation and Amortization Expenses | $ | 104 |

| | $ | 93 |

| | $ | 205 |

| | $ | 182 |

|

| | | | | | | | |

| Capital Expenditures | | | | | | | |

| Terminalling and Transportation | $ | 26 |

| | $ | 33 |

| | $ | 51 |

| | $ | 79 |

|

| Gathering and Processing | 110 |

| | 148 |

| | 207 |

| | 258 |

|

| Wholesale | — |

| | — |

| | — |

| | 1 |

|

| Total Capital Expenditures | $ | 136 |

| | $ | 181 |

| | $ | 258 |

| | $ | 338 |

|

| |

| (a) | Adjusted to include the historical results of the Predecessors. See Note 1 for further discussion. |

|

| | |

| Management’s Discussion and Analysis |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Unless the context otherwise requires, references in this report to “Andeavor Logistics,” “we,” “us,” “our,” or “ours” refer to Andeavor Logistics LP, one or more of its consolidated subsidiaries, or all of them taken as a whole. Unless the context otherwise requires, references in this report to our general partner refer to TLGP for all activity through the closing of the MPLX Merger and to ALGP for all activity thereafter. Unless the context otherwise requires, references in this report to “Sponsor” refer collectively to Andeavor and any of Andeavor’s subsidiaries for all activity through September 30, 2018, or Marathon or any of Marathon’s subsidiaries including Andeavor LLC, successor-by-merger to Andeavor effective October 1, 2018 and a wholly owned subsidiary of Marathon, as applicable, other than Andeavor Logistics, its subsidiaries and its general partner. References in this report to “Marathon” or “MPC” refer to Marathon Petroleum Corporation, one or more of its consolidated subsidiaries, including Andeavor LLC, or all of them taken as a whole. Unless the context otherwise requires, references in this report to “Predecessors” refer collectively to the acquired businesses from our Sponsor, and its assets, liabilities and results of operations.

Those statements in this section that are not historical in nature should be deemed forward-looking statements that are inherently uncertain. See “Important Information Regarding Forward-Looking Statements” section for a discussion of the factors that could cause actual results to differ materially from those projected in these statements.

This section should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2018.

Recent Developments

As previously disclosed, on May 7, 2019, Andeavor Logistics, TLGP, MPLX, MPLX GP LLC, and Merger Sub, entered into the Merger Agreement, which provided for, among other things, the MPLX Merger. On July 30, 2019, the MPLX Merger was completed, and Andeavor Logistics survived the MPLX Merger as a wholly-owned subsidiary of MPLX. At the effective time of the MPLX Merger, each common unit held by our public unitholders was converted into the right to receive 1.135 MPLX Common Units. Each Andeavor Logistics common unit held by TLGP and WR Southwest was converted into the right to receive 1.0328 MPLX Common Units.

The transaction combines MPLX and us into a single listed entity to create a leading, large-scale, diversified midstream company anchored by fee-based cash flows. The combined entity has an expanded geographic footprint that is expected to enhance its long-term growth opportunities and the sustainable cash flow profile of the business.

In connection with the completion of the MPLX Merger, we notified the NYSE that each of our outstanding common units was converted into the right to receive MPLX Common Units in an amount determined by reference to the applicable exchange ratio. Upon our request, the NYSE filed a notification of removal from listing on Form 25 with the SEC with respect to our common units. Our common units ceased being traded prior to the opening of the market on July 30, 2019, and will no longer be listed on the NYSE. We continue to file with the SEC current and period reports that would be required by be filed with the SEC pursuant to Section 15(d) of the Exchange Act.

Business Overview

Overview

Prior to the MPLX Merger, we were a fee-based, full-service, diversified Delaware limited partnership operating primarily in the western and inland regions of the United States. We own and operate networks of crude oil, refined products and natural gas pipelines, terminals with crude oil and refined product storage capacity, rail loading and offloading facilities, marine terminals, bulk petroleum distribution facilities, a trucking fleet and natural gas processing and fractionation complexes.

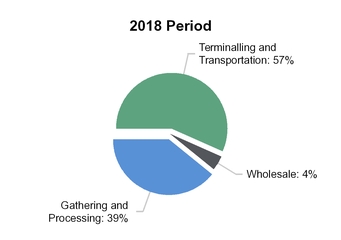

Our revenues were derived from three operating segments: Terminalling and Transportation, Gathering and Processing, and Wholesale. 71% of our total revenues for both the three and six months ended June 30, 2019 were derived from Marathon under various long-term, fee-based commercial agreements, the majority of which include minimum volume commitments.

On October 1, 2018, MPC completed its acquisition of Andeavor. Following the MPC Merger, MPC became the beneficial owner of 156 million common units out of 245 million common units outstanding as of October 1, 2018 which represented a 64% limited partner interest. MPC also acquired 100% of the equity interests of our general partner.

We generate revenues by charging fees for terminalling, transporting and storing crude oil, refined products and asphalt, gathering crude oil and produced water, gathering and processing natural gas and selling fuel through wholesale commercial contracts. We do not engage in the trading of crude oil, natural gas, NGLs or refined products; therefore, we have minimal direct exposure to risks associated with commodity price fluctuations as part of our normal operations. However, we have certain natural gas gathering and processing contracts structured as POP arrangements. Under these POP arrangements, we gather and process the producers’ natural gas, market the natural gas and return the majority of the proceeds to the producer. Under these arrangements, we have exposure to fluctuations in commodity prices; however, this exposure is not expected to be material to our results of operations. Also, we have a wholesale fuel business that has exposure to commodity prices while the refined product is being transported but are mitigated by fixed margin contracts.

|

| | |

| Management’s Discussion and Analysis | |

Results of Operations

A discussion and analysis of the factors contributing to our results of operations presented below includes the financial results of our Predecessors and the consolidated financial results of Andeavor Logistics. The financial statements of our Predecessors were prepared from the separate records maintained by our Sponsor and may not necessarily be indicative of the conditions that would have existed or the results of operations if our Predecessors had been operated as an unaffiliated entity. The financial statements, together with the following information, are intended to provide investors with a reasonable basis for assessing our historical operations, but should not serve as the only criteria for predicting future performance.

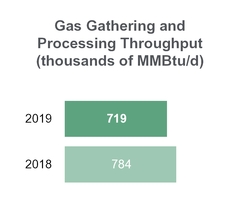

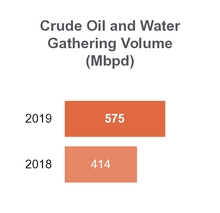

Operating Metrics

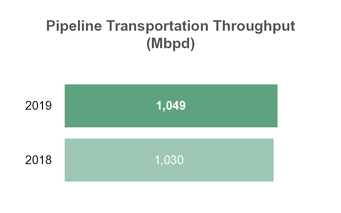

Management utilizes the following operating metrics to evaluate performance and compare profitability to other companies in the industry (amounts may not recalculate due to rounding of dollar and volume information):

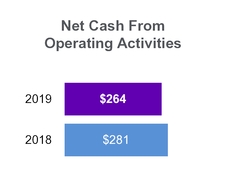

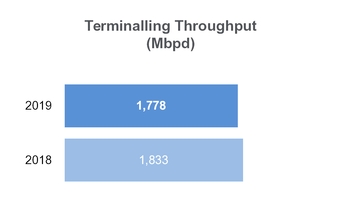

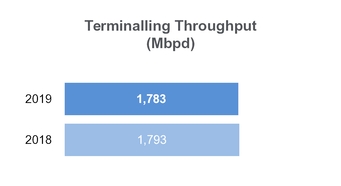

| |

| • | Average terminalling revenue per barrel - calculated as total terminalling revenue divided by terminalling throughput presented in thousands of barrels per day (“Mbpd”) multiplied by 1,000 and multiplied by the number of days in the period (91 days for both the three months ended June 30, 2019 (the “2019 Quarter”) and 2018 (the “2018 Quarter”) and 181 days for both the six months ended June 30, 2019 (the “2019 Period”) and 2018 (the “2018 Period”)); |

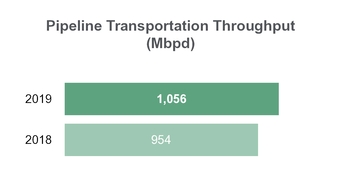

| |

| • | Average pipeline transportation revenue per barrel - calculated as total pipeline transportation revenue divided by pipeline transportation throughput presented in Mbpd multiplied by 1,000 and multiplied by the number of days in the period as outlined above; |

| |