Prospectus Supplement No. 1 (To Prospectus dated April 27, 2020)

| Filed Pursuant to Rule 424(b)(3) File No. 333-220368 |

2,133,750 Shares of Common Stock Underlying Previously Issued Warrants

This prospectus supplement No. 1 amends and supplements the Adial Pharmaceuticals, Inc. prospectus dated April 27, 2020, which was filed with the Securities and Exchange Commission on April 22, 2020, (the “Prospectus”), relating to the offering ofup to 2,133,750 shares of common stock underlying warrants previously issued by us that are issuable at an exercise price of $4.0625 per share. The warrants were issued to investors and the underwriters in our public offering that was consummated in February 2019, are exercisable at any time and will expire on the fifth anniversary of the original issuance date.

Our common stock and warrants issued in our initial public offering are listed on The NASDAQ Capital Market under the symbols “ADIL,” and “ADILW,” respectively. On May 20, 2020, the last reported sale price of our common stock on The NASDAQ Capital Market was $1.54 per share and the last reported sale price of our warrants on The NASDAQ Capital Market was $0.35 per warrant.

We are an “emerging growth company” under applicable Securities and Exchange Commission (the “SEC”) rules and are eligible for reduced public company disclosure requirements. See “Summary—Implications of Being an Emerging Growth Company” in the Prospectus.

This prospectus supplement is being filed to include the information set forth in our Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2020 filed with the Securities and Exchange Commission on May 14, 2020, which is set forth below.

This prospectus supplement should be read in conjunction with the Prospectus. This prospectus supplement updates, amends and supplements the information included in the Prospectus. If there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 7 of the Prospectus for a discussion of information that you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the Prospectus to which it relates is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement No. 1 is May 21, 2020.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period endedMarch 31, 2020

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission File Number:001-38323

ADIAL PHARMACEUTICALS, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 82-3074668 | |

State or Other Jurisdiction of Incorporation or Organization | I.R.S. Employer Identification No. | |

1180 Seminole Trail, Suite 495 Charlottesville, VA | 22901 | |

| Address of Principal Executive Offices | Zip Code |

(434) 422-9800

Registrant’s Telephone Number, Including Area Code

Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock | ADIL | NASDAQ | ||

| Warrants | ADILW | NASDAQ |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

Number of shares of common stock outstanding as of May 13, 2020 was 10,629,603.

ADIAL PHARMACEUTICALS, INC.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In particular, statements contained in this Quarterly Report on Form 10-Q, including but not limited to, statements regarding the sufficiency of our cash, our ability to finance our operations and business initiatives and obtain funding for such activities; our future results of operations and financial position, business strategy and plan prospects, or costs and objectives of management for future acquisitions, are forward looking statements. These forward-looking statements relate to our future plans, objectives, expectations and intentions and may be identified by words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “seeks,” “goals,” “estimates,” “predicts,” “potential” and “continue” or similar words. Readers are cautioned that these forward-looking statements are based on our current beliefs, expectations and assumptions and are subject to risks, uncertainties, and assumptions that are difficult to predict, including those identified below, under Part II, Item lA. “Risk Factors” and elsewhere in this Quarterly Report on Form 10-Q and those risks identified under Part I, Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2019 filed with the Securities and Exchange Commission (the “SEC”) on March 20, 2020 (“2019 Form 10-K”). Therefore, actual results may differ materially and adversely from those expressed, projected or implied in any forward-looking statements. We undertake no obligation to revise or update any forward-looking statements for any reason.

NOTE REGARDING COMPANY REFERENCES

Throughout this Quarterly Report on Form 10-Q, “Adial,” the “Company,” “we,” “us” and “our” refer to Adial Pharmaceuticals, Inc.

FORM 10-Q

TABLE OF CONTENTS

PART I - FINANCIAL INFORMATION

CONDENSED BALANCE SHEETS (UNAUDITED)

| March 31, 2020 | December 31, 2019 | |||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash and cash equivalents | $ | 4,951,631 | $ | 6,777,052 | ||||

| Prepaid research and development | 743,194 | 536,916 | ||||||

| Prepaid expenses and other current assets | 240,382 | 359,499 | ||||||

| Total Current Assets | 5,935,207 | 7,673,467 | ||||||

| Intangible assets, net | 6,029 | 6,170 | ||||||

| Total Other Assets | 6,029 | 6,170 | ||||||

| Total Assets | $ | 5,941,236 | $ | 7,679,637 | ||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable | $ | 196,382 | $ | 190,204 | ||||

| Accrued expenses | 193,447 | 348,847 | ||||||

| Total Current Liabilities | 389,829 | 539,051 | ||||||

| Commitments and contingencies | ||||||||

| Shareholders’ Equity | ||||||||

| Preferred Stock, 5,000,000 shares authorized with a par value of $0.001 per share, 0 shares outstanding at March 31, 2020 and December 31, 2019 | — | — | ||||||

| Common Stock, 50,000,000 shares authorized with a par value of $0.001 per share, 10,629,603 and 10,368,352 shares issued and outstanding at March 31, 2020 and December 31, 2019, respectively | 10,629 | 10,368 | ||||||

| Additional paid in capital | 28,444,390 | 27,757,017 | ||||||

| Accumulated deficit | (22,903,612 | ) | (20,626,799 | ) | ||||

| Total Shareholders’ Equity | 5,551,407 | 7,140,586 | ||||||

| Total Liabilities and Shareholders’ Equity | $ | 5,941,236 | $ | 7,679,637 | ||||

The accompanying notes are an integral part of these unaudited condensed financial statements.

1

CONDENSED STATEMENTS OF OPERATIONS (UNAUDITED)

| For the Three Months Ended | ||||||||

| March 31, | ||||||||

| 2020 | 2019 | |||||||

| Operating Expenses: | ||||||||

| Research and development expenses | $ | 1,059,578 | $ | 686,914 | ||||

| General and administrative expenses | 1,240,667 | 1,562,352 | ||||||

| Total Operating Expenses | 2,300,245 | 2,249,266 | ||||||

| Loss From Operations | (2,300,245 | ) | (2,249,266 | ) | ||||

| Other Income (Expense) | ||||||||

| Interest income | 23,432 | 8,378 | ||||||

| Warrant modification expense | — | (441,763 | ) | |||||

| Total other income (expense) | 23,432 | (433,385 | ) | |||||

| Loss Before Provision For Income Taxes | (2,276,813 | ) | (2,682,651 | ) | ||||

| Benefit from income taxes | — | — | ||||||

| Net Loss | $ | (2,276,813 | ) | $ | (2,682,651 | ) | ||

| Net loss per share, basic and diluted | $ | (0.22 | ) | $ | (0.33 | ) | ||

| Weighted average shares, basic and diluted | 10,497,325 | 8,250,708 | ||||||

The accompanying notes are an integral part of these unaudited condensed financial statements.

2

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(UNAUDITED)

| Common Stock | Additional Paid In | Accumulated | Total Shareholders’ | |||||||||||||||||

| Shares | Amount | Capital | Deficit | Equity | ||||||||||||||||

| Balance, December 31, 2019 | 10,368,352 | $ | 10,368 | $ | 27,757,017 | $ | (20,626,799 | ) | $ | 7,140,586 | ||||||||||

| Equity-based compensation - stock option expense | — | — | 342,007 | — | 342,007 | |||||||||||||||

| Equity-based compensation - stock issuances to consultants and employees | 261,251 | 261 | 345,366 | — | 345,627 | |||||||||||||||

| Net loss | — | — | — | (2,276,813 | ) | (2,276,813 | ) | |||||||||||||

| Balance, March 31, 2020 | 10,629,603 | $ | 10,629 | $ | 28,444,390 | $ | (22,903,612 | ) | $ | 5,551,407 | ||||||||||

| Common Stock | Additional Paid In | Accumulated | Total Shareholders’ | |||||||||||||||||

| Shares | Amount | Capital | Deficit | Equity | ||||||||||||||||

| Balance, December 31, 2018 | 6,862,499 | $ | 6,863 | $ | 16,469,818 | $ | (12,035,370 | ) | $ | 4,441,311 | ||||||||||

| Equity-based compensation - stock option expense | — | — | 129,150 | — | 129,150 | |||||||||||||||

| Equity-based compensation - stock issuances to consultants | 93,750 | 94 | 154,760 | — | 154,854 | |||||||||||||||

| Warrant modification expense | — | — | 441,763 | — | 441,763 | |||||||||||||||

| Sale of common stock & warrants | 2,845,000 | 2,845 | 9,243,404 | — | 9,246,249 | |||||||||||||||

| Offering issuance cost | — | — | (1,050,576 | ) | — | (1,050,576 | ) | |||||||||||||

| Exercise of warrants | 367,577 | 367 | 1,050,270 | — | 1,050,637 | |||||||||||||||

| Net loss | — | — | — | (2,682,651 | ) | (2,682,651 | ) | |||||||||||||

| Balance, March 31, 2019 | 10,168,826 | $ | 10,169 | $ | 26,438,589 | $ | (14,718,021 | ) | $ | 11,730,737 | ||||||||||

The accompanying notes are an integral part of these unaudited condensed financial statements.

3

CONDENSED STATEMENTS OF CASH FLOWS (UNAUDITED)

| For the Three Months Ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net loss | $ | (2,276,813 | ) | $ | (2,682,651 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Equity-based compensation | 570,633 | 284,004 | ||||||

| Non-cash warrant modification expense | — | 441,763 | ||||||

| Amortization of intangible assets | 141 | 142 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Prepaid research and development expenses | (206,278 | ) | 126,290 | |||||

| Prepaid expenses and other current assets | 119,117 | 38,125 | ||||||

| Accrued expenses | (38,399 | ) | 110,633 | |||||

| Accounts payable | 6,178 | (39,415 | ) | |||||

| Net cash used in operating activities | (1,825,421 | ) | (1,721,109 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Net proceeds from sale of common stock and warrants | — | 8,195,673 | ||||||

| Proceeds from warrant exercise | 1,050,637 | |||||||

| Net cash provided by financing activities | — | 9,246,310 | ||||||

| NET (DECREASE) INCREASE IN CASH AND CASH EQUIVALENTS | (1,825,421 | ) | 7,525,201 | |||||

| CASH AND CASH EQUIVALENTS-BEGINNING OF PERIOD | 6,777,052 | 3,869,043 | ||||||

| CASH AND CASH EQUIVALENTS-END OF PERIOD | $ | 4,951,631 | $ | 11,394,244 | ||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | ||||||||

| Interest paid | $ | — | $ | — | ||||

| Income taxes paid | $ | — | $ | — | ||||

| Reclassification of stock-based comp from accrued expenses | $ | 117,001 | $ | — | ||||

The accompanying notes are an integral part of these unaudited condensed financial statements.

4

NOTES TO CONDENSED FINANCIAL STATEMENTS

1 — DESCRIPTION OF BUSINESS

Adial Pharmaceuticals, Inc. (the “Company” or “Adial”) was converted from a limited liability company formed under the name ADial Pharmaceuticals, LLC on November 23, 2010 in the Commonwealth of Virginia to a corporation and reincorporated in Delaware on October 1, 2017. Adial is presently engaged in the development of medications for the treatment of addictions and related disorders.

The Company has commenced its first Phase 3 clinical trial of its lead compound AD04 (“AD04”) for the treatment of alcohol use disorder. Both the U.S. Food and Drug Administration (“FDA”) and the European Medicines Authority (“EMA”) have indicated they will accept heavy-drinking-based endpoints as a basis for approval for the treatment of alcohol use disorder rather than the previously required abstinence-based endpoints. Key patents have been issued in the United States, the European Union, and other jurisdictions for which the Company has exclusive license rights. The active ingredient in AD04 is ondansetron, a serotonin-3 antagonist. Due to its mechanism of action, AD04 has the potential to be used for the treatment of other addictive disorders, such as opioid use disorder, obesity, smoking, and other drug addictions.

2 — LIQUIDITY, GOING CONCERN AND OTHER UNCERTAINTIES

The unaudited condensed financial statements have been prepared in conformity with generally accepted accounting principles in the United States (“GAAP”), which contemplate continuation of the Company as a going concern. The Company is in a development stage and has not generated any revenues The Company has incurred losses each year since inception and has experienced negative cash flows from operations in each year since inception and has an accumulated deficit of approximately $22.9 million as of March 31, 2020. Based on the current development plans for AD04 in both the U.S. and international markets and other operating requirements, the Company believes that the existing cash and equivalents will not be sufficient to fund operations for at least the next twelve months following the filing of these unaudited condensed financial statements. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern.

The cash and cash equivalents as of the financial statement filing date are expected to fund operations into the fourth quarter of 2020. Due to significantly slowed trial enrollment resulting from the current COVID-19 pandemic (seeOther Uncertainties below), the Company estimates that its current liquidity will not support the funding requirements necessary for database lock in the first Phase 3 clinical trial, which is the endpoint of clinical activities for this trial. The Company has applied for grants that could be used for this Phase 3 clinical trial which, if received, would allow the Company to continue operations into the first quarter of 2021. The Company’s current estimates include the overhead costs necessary to support operations during the extended trial period and other costs increases associated with conducting trial activities impacted by the pandemic.

5

The Company’s continued operations will depend on its ability to raise additional capital through various potential sources, such as equity and/or debt financings, grant funding, strategic relationships, or out-licensing in order to complete its current and subsequent clinical trial requirements for its lead compound, AD04. Management is actively pursuing financing and other strategic plans but can provide no assurances that such financing or other strategic plans will be available on acceptable terms, or at all. Further, the extreme volatility in the financial markets due to COVID-19, may make it more difficult to raise sufficient capital when needed or execute other strategic plans or transactions. Without additional funding, the Company would be required to delay, scale back or eliminate some or all of its research and development programs, which would likely have a material adverse effect on the Company and its financial statements.

The financial statements do not include any adjustments relating to the recoverability and classification of asset carrying amounts or the amount and classification of liabilities that might result should the Company be unable to continue as a going concern.

Other Uncertainties

Generally, this industry subjects the Company to a number of other risks and uncertainties that can affect its operating results and financial condition. Such factors include, but are not limited to: the timing, costs and results of clinical trials and other development activities versus expectations; the ability to obtain regulatory approval to market product candidates; the ability to manufacture products successfully; competition from products sold or being developed by other companies; the price of, and demand for, Company products once approved; the ability to negotiate favorable licensing or other manufacturing and marketing agreements for its products.

The Company also faces the ongoing risk that the coronavirus pandemic may further slow, for an unforeseeable period, the conduct of the Company’s trial. The ongoing coronavirus pandemic may also impact the Company in other ways, through the increase of non-trial costs such as insurance premiums, by increasing the demand for and cost of capital, creation of a wider economic slow down, by the loss of work time from key personnel, and through impacts on our key clinical trial vendors and API suppliers. The full extent to which the COVID-19 pandemic impacts the clinical development of AD04, the Company’s suppliers and other commercial partners, and the value of and market for the Company’s common stock will depend on future developments that are highly uncertain and cannot be predicted with confidence at this time The global economic slowdown, the overall disruption of global healthcare systems and the other risks and uncertainties associated with the pandemic could have a material adverse effect on our business, financial condition, results of operations and growth prospects.

3 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying unaudited condensed financial statements have been prepared in accordance with GAAP for interim financial information and with the instructions for Form 10-Q and Article 8 of Regulation S-X. In the opinion of management, the accompanying unaudited condensed financial statements reflect all adjustments, consisting of normal recurring adjustments, considered necessary for a fair presentation of such interim results. The interim operating results are not necessarily indicative of results that may be expected for any subsequent period. These unaudited condensed financial statements should be read in conjunction with the audited financial statements for the year ended December 31, 2019, included in the Annual Report on Form 10-K filed on March 20, 2020.

Reclassification

Certain prior year amounts have been reclassified for consistency with the current year presentation. These reclassifications had no effect on the reported results of operations.

Use of Estimates

The preparation of unaudited condensed financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Significant items subject to such estimates and assumptions include the valuation of stock-based compensation, accruals associated with third party providers supporting clinical trials, and income tax asset realization. In particular, the recognition of clinical trial costs are dependent on the our own judgement, as well as the judgment of our contractors and subcontractors in their reporting of information to us.

6

Basic and Diluted Earnings (Loss) per Share

Basic and diluted earnings (loss) per share are computed based on the weighted-average outstanding shares of common stock, which are all voting shares. Diluted net loss per share is computed giving effect to all proportional shares of common stock, including stock options and warrants to the extent dilutive. Basic net loss per share was the same as diluted net loss per share for the three months ended March 31, 2020 and 2019 as the inclusion of all potential common shares outstanding would have an anti-dilutive effect.

The total number of potentially dilutive common shares that were excluded at March 31, 2020 and 2019 was as follows:

| Potentially Dilutive Common Shares Outstanding March 31, | ||||||||

| 2020 | 2019 | |||||||

| Warrants to purchase Common Shares | 6,595,631 | 6,728,113 | ||||||

| Common Shares issuable on exercise of options | 2,620,877 | 1,400,967 | ||||||

| Total potentially dilutive Common Shares excluded | 9,216,508 | 8,129,080 | ||||||

Research and Development

Research and development costs are charged to expense as incurred and include direct trial expenses such as fees due to contract research organizations, consultants which support the Company’s research and development endeavors, the acquisition of technology rights without an alternative use, and compensation and benefits of clinical research and development personnel. Certain research and development costs, in particular fees to contract research organizations (“CROs”), are structured with milestone payments due on the occurrence of certain key events. Where such milestone payments are greater than those earned through the provision of such services, the Company recognizes a prepaid asset which is recorded as expense as services are incurred.

Stock-Based Compensation

The Company measures the cost of option awards based on the grant date fair value of the awards. That cost is recognized on a straight-line basis over the period during which the awardee was required to provide service in exchange for the entire award. The fair value of options is calculated using the Black-Scholes option pricing model, based on key assumptions such as the expected volatility of the Company’s common stock, the risk-free rate of return, and expected term of the options. The Company’s estimates of these assumptions are primarily based on historical data, peer company data, government data, and the judgment of management regarding future trends.

Common shares issued are valued based on the fair value of the Company’s common shares as determined by the market closing price of a share of our common stock on the date of the Commitment to make the issuance.

Income Taxes

The Company accounts for income taxes using the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis and tax carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

7

A valuation allowance is established to reduce net deferred tax assets to the amount expected to be realized. The Company recognizes the effect of income tax positions only if those positions are more likely than not of being sustained. Recognized income tax positions are measured at the largest amount that is greater than 50% likely of being recognized. Changes in recognition and measurement are reflected in the period in which the change in judgment occurs. Interest and penalties related to unrecognized tax benefits are included in income tax expense. The Company has generally recorded a full valuation allowance for its tax carryforwards, reflecting the judgment of Company management that they are more likely than not to expire unused.

Adoption of Recent Accounting Pronouncements

Fair Value— In August 2018, the FASB issued ASU No. 2018-13, Fair Value Measurement (Topic 820) Disclosure Framework—Changes to the Disclosure Requirements for Fair Value Measurement (“ASU 2018-13”). ASU 2018-13 amends guidance concerning disclosure of transfers between the Levels 1, 2, and 3 for the fair value hierarchy used to disclose the fair value of financial instruments. ASU 2018-13 also adds additional requirements that reporting entities disclose unrealized gains or losses in the value of financial instruments as a result of changes to recurring fair Level 3 fair value measurements and the range and weighted averages of significant unobservable inputs used to develop fair value measurements. The amendments in ASU 2018-13 are effective for all entities required under existing GAAP to disclose fair value measurements, and is effective for annual periods, and interim periods within those annual periods, beginning after December 15, 2019. ASU 2018-13 was adopted effective January 1, 2020. There was no material effect on the financial statements as a result of the adoption of ASU 2018-13.

4 — ACCRUED EXPENSES

Accrued liabilities consist of the following:

| March 31, 2020 | December 31, 2019 | |||||||

| Accrued employee compensation | $ | 111,769 | $ | 263,914 | ||||

| Legal and consulting services | 25,350 | 68,056 | ||||||

| Clinical research organization services and expenses | 46,328 | 16,877 | ||||||

| Minimum license royalties | 10,000 | – | ||||||

| Total accrued liabilities | $ | 193,447 | $ | 348,847 | ||||

5 — RELATED PARTY TRANSACTIONS

In January 2011, the Company entered into an exclusive, worldwide license agreement with The University of Virginia Patent Foundation d/b/a the University of Virginia Licensing and Ventures Group (the “UVA LVG”) for rights to make, use or sell licensed products in the United States based upon patents and patent applications made and held by UVA LVG (the “UVA LVG License”). The Company is required to pay compensation to the UVA LVG, as described Note 7. A certain percentage of these payments by the Company to the UVA LVG may then be distributed to the Company’s former Chairman of the Board who currently serves as the Company’s Chief Medical Officer in his capacity as inventor of the patents by the UVA LVG in accordance with their policies at the time.

See Note 7 for related party vendor, consulting, and lease agreements.

6 — SHAREHOLDERS’ EQUITY

Common Stock Issuances

On January 22, 2019, the Company issued 250,000 unregistered shares of common stock upon the exercise of the warrant to purchase 300,000 shares of common stock at an exercise price of $3.75 per share for a cash payment of $468,750 and the cashless exercise of the remaining warrant.

On January 31, 2019, the Company issued 22,311 unregistered shares of common stock upon the full cashless exercise of a warrant to purchase 65,130 shares of common stock at an exercise price of $4.99 per share.

8

On February 22, 2019, the Company concluded a follow-on offering of 2,475,000 shares of common stock and warrants to purchase 1,856,250 shares of common stock at an exercise price of $4.0625 per share. The shares of common stock and accompanying warrants were sold to the public at a price of $3.25 per share and warrant. The underwriters were granted an over-allotment option to purchase up to 371,250 shares of common stock and warrants to purchase 278,437 shares of common stock at a price of $3.25 per share of common stock and warrant. The underwriters partially exercised their over-allotment option by purchasing 370,000 shares of common stock and warrants to purchase 277,500 shares common stock. Gross proceeds of the offering, totaled $9,246,249, which after offering expenses, resulted in net proceeds of $8,195,673.

On March 3, 2020, the Compensation Committee of Board of Directors of the Company awarded the Company’s executive officers, William B. Stilley, Chief Executive Officer, and Joseph Truluck, Chief Financial Officer, performance bonuses for 2019, partially paid in common stock of the Company to preserve cash, of $42,000 and $21,000 in cash, respectively, and 54,167 and 27,084 shares of the Company’s common stock, respectively, which shares are subject to a six-month contractual restriction on sale. Of the $180,002 total cost of these bonuses, $150,000 were recognized in the year ended December 31, 2019 as expected under these executives’ contracts, and the remaining $30,002 in bonus was recognized as time of issue as Board discretionary. The cost of the equity component of these issuances was recorded as contributed equity of $117,001.

During the three months ended March 31, 2020, the Company issued 180,000 shares of common stock to consultants for services rendered at a total cost of $210,300.

2017 Equity Incentive Plan

On October 9, 2017, the Company adopted the Adial Pharmaceuticals, Inc. 2017 Equity Incentive Plan (the “2017 equity incentive plan”); which became effective on July 31, 2018. Initially, the aggregate number of shares of our common stock that may be issued pursuant to stock awards under the 2017 equity incentive plan was 1,750,000 shares. On August 16, by a vote of the shareholders, the number of shares issuable under the plan was increased to 3,500,000. At March 31, 2020, we had issued 614,438 shares and had outstanding 2,481,191 options to purchase shares of our common stock under the 2017 equity incentive plan.

Stock Options

The following table provides the stock option activity for the three months ended March 31, 2020:

| Total Options Outstanding | Weighted Average Remaining Term (Years) | Weighted Average Exercise Price | Weighted Average Fair Value at Issue | |||||||||||||

| Outstanding December 31, 2019 | 1,661,466 | 9.14 | 3.38 | 2.38 | ||||||||||||

| Issued | 1,100,000 | 1.44 | 1.13 | |||||||||||||

| Cancelled | (140,589 | ) | 3.30 | 2.54 | ||||||||||||

| Outstanding March 31, 2020 | 2,620,877 | 8.49 | 2.57 | 1.84 | ||||||||||||

| Outstanding March 31, 2020, vested and exercisable | 697,960 | 7.12 | $ | 3.50 | $ | 2.57 | ||||||||||

At March 31, 2020, the intrinsic value totals of the outstanding options were $0.

9

The Company used the Black Scholes valuation model to determine the fair value of the options issued, using the following key assumptions for the three months ended March 31, 2020 and 2019:

| March 31, 2020 | ||||

| Fair Value per Share | $ | 1.44 | ||

| Expected Term | 5.75 years | |||

| Expected Dividend | $ | 0 | ||

| Expected Volatility | 102.4 | % | ||

| Risk free rate | 0.72 | % | ||

Compensation expense associated with issuance of options was recognized using the straight-line method over the requisite service period. During the three months ended March 31, 2020, 1,100,000 options to purchase shares of common stock were issued at a cost of $1.13 per option, for a total cost of $1,243,000 to be amortized over a service a weighted average period of three years. As of March 31, 2020, $3,305,359 in further compensation expense resulting from issued options remained to be recognized over a weighted average remaining service period of 2.57 years.

The components of stock-based compensation expense included in the Company’s Statements of Operations for the three months ended March 31, 2020 and 2019 are as follows:

| Three months ended March 31 | ||||||||

| 2020 | 2019 | |||||||

| Research and development options expense | 86,439 | 43,174 | ||||||

| Total research and development expenses | 86,439 | 43,174 | ||||||

| General and administrative options expense | 255,568 | 85,976 | ||||||

| Stock issued to consultants and employees | 228,626 | 154,854 | ||||||

| Total general and administrative expenses | 484,194 | 240,830 | ||||||

| Total stock-based compensation expense | $ | 570,633 | $ | 284,004 | ||||

Stock Warrants

The following table provides the activity in warrants for the respective periods.

Total Warrants | Weighted Average Remaining Term (Years) | Weighted Average Exercise Price | Average Intrinsic Value | |||||||||||||

| Outstanding December 31, 2019 | 6,669,274 | 4.23 | $ | 5.38 | 0.03 | |||||||||||

| Issued | – | NA | NA | NA | ||||||||||||

| Exercised | – | NA | NA | NA | ||||||||||||

| Outstanding March 31, 2020 | 6,669,274 | 3.98 | $ | 5.38 | 0.01 | |||||||||||

During the three months ended March 31, 2020, no warrants to purchase shares of common stock were either issued or exercised.

10

7 — COMMITMENTS AND CONTINGENCIES

License with University of Virginia Patent Foundation

In January 2011, the Company entered into an exclusive, worldwide license agreement with (the “UVA LVG”) for rights to make, use or sell licensed products in the United States based upon the ten separate patents and patent applications made and held by UVA LVG.

As consideration for the rights granted in the UVA LVG License, the Company is obligated to pay UVA LVG yearly license fees and milestone payments, as well as a royalty based on net sales of products covered by the patent-related rights. More specifically, the Company paid UVA LVG a license issue fee and is obligated to pay UVA LVG (i) annual minimum royalties of $40,000 commencing in 2017; (ii) a $20,000 milestone payments upon dosing the first patient under a Phase 3 human clinical trial of a licensed product, $155,000 upon the earlier of the completion of a Phase 3 trial of a licensed product, partnering of a licensed product, or sale of the Company, $275,000 upon acceptance of an NDA by the FDA, and $1,000,000 upon approval for sale of AD04 in the U.S., Europe or Japan; as well as (iii) royalties equal to a 2% and 1% of net sales of licensed products in countries in which a valid patent exists or does not exist, respectively, with royalties paid quarterly. In the event of a sublicense to a third party, the Company is obligated to pay royalties to UVA LVG equal to a percentage of what the Company would have been required to pay to UVA LVG had it sold the products under sublicense ourselves. In addition, the Company is required to pay to UVA LVG 15% of any sublicensing income.

The license agreement may be terminated by UVA LVG upon sixty (60) days written notice if the Company breaches its obligations thereunder, including failing to make any milestone, failure to make required payments, or the failure to exercise diligence to bring licensed products to market. In the event of a termination, the Company will be obligated to pay all amounts that accrued prior to such termination.

The term of the license continues until the expiration, abandonment or invalidation of all licensed patents and patent applications, and following any such expiration, abandonment or invalidation will continue in perpetuity on a royalty-free, fully paid basis.

The Company executed an amendment, dated December 14, 2017, which changed the dates by which the Company, using commercially reasonable efforts, was to achieve the goals of submitting a New Drug Application to the FDA for a licensed product to December 31, 2024 (from December 31, 2023) and commencing commercialization of an FDA approved product by December 31, 2025 (from December 31, 2024). If the Company were to fail to use commercially reasonable effort and fail to meet either goal, the licensor would have the right to terminate the license.

The Company executed a further amendment to the license agreement, dated December 18, 2018, changing the date at which the Company must have initiated a Phase 3 trial to December 31, 2019.

On December 31, 2019, the Company executed a further amendment to the license agreement which, among other things, removed in its entirety the diligence milestone to initiate a Phase 3 clinical trial by December 31, 2019. Furthermore, the Company agreed to pay upon execution of the Amendment the diligence milestone payment of $20,000 that had been due upon initiation of a Phase 3 clinical trial. In addition, the Company agreed to use and will continue to use best efforts to dose a first patient with a Licensed Product (as defined in the License Agreement) in a Phase 3 clinical trial on or before March 31, 2020. In March of 2020, the first patient was dosed with AD04 after having joined the Company’s trial, satisfying this term of the license agreement.

During the three months ended March 31, 2020, the Company recognized a $10,000 minimum license royalty expense under this agreement.

Clinical Research Organization (CRO)

On October 31, 2018, the Company entered into a master services agreement (“MSA”) with Crown CRO Oy (“Crown”) for contract clinical research and consulting services. The MSA has a term of five years, automatically renewed for two-year periods, unless either party gives written notice of a decision not to renew the agreement three months prior to automatic renewal. The agreement can be terminated by the Company if, in the Company’s reasonable opinion, clinical or non-clinical data support termination of the clinical research for safety reasons.

11

On November 16, 2018, the Company and Crown entered into Service Agreement 1 under the MSA for a 24 week, multi-centered, randomized, double-blind, placebo-controlled, parallel-group, Phase 3 clinical study of the Company’s lead compound, AD04. The MSA or a service agreement under it may be terminated by the Company, without penalty, on fourteen days written notice. On June 28, 2019, the Company and Crown Executed a change order to Service Agreement 1 increasing Crown’s fee from $3,262,411 (€2,958,835 converted to dollars at the Euro/US Dollar exchange rate of 1.1026 as of March 31, 2020) to $3,494,024 (€3,168,895) and rescheduling future milestone payments as shown below.

On November 21, 2018, the Company made the initial prepayment under the agreement of $505,960, after exchange to US dollars at the rate then prevailing. The fees are to be paid as milestones are reached on the following schedule. On September 30, 2019, the Company received an invoice for the 10% milestone payment associated with the first submission of a trial application to a national regulatory authority and recorded a prepaid expense of $294,124. On February 1, 2020, the first site initiation visit (“SIV”) of a study site had been completed and the second milestone of €269,938, was recognized as a prepaid expense of $299,496. On February 27, 2020, the first potential patient for the study had been screened and the third milestone payment of €269,938 was recognized as a prepaid expense of $297,013.

At March 31, 2020, the remaining future milestone payments are shown in the table below, converted to dollars from euros at the exchange rate then prevailing.

Milestone Event | Percent Milestone Fees | Amount | ||||||

| 30% patients randomized | 10 | % | $ | 297,634 | ||||

| 50% sites initiated | 10 | % | $ | 297,634 | ||||

| 60% patients randomized | 10 | % | $ | 297,634 | ||||

| 100% sites initiated | 10 | % | $ | 297,634 | ||||

| 100% of patients randomized | 10 | % | $ | 297,634 | ||||

| 90% of case report form pages monitored | 5 | % | $ | 148,817 | ||||

| PE analysis | 5 | % | $ | 148,817 | ||||

| Database is locked | 10 | % | $ | 297,634 | ||||

Service Agreement 1 also estimated approximately $2.4 million (€ 2,172,000) in pass-through costs, mostly fees to clinical investigators and sites, which will be billed as incurred and the total contingent upon individual site rate and enrollment rates. In the event that the MSA or Service Order are terminated, Crown’s actual costs up the date of termination will be payable by the Company, but any unrealized milestones shall not be. During the three months ended March 31, 2020, the Company recognized $34,120 in costs associated with fees to investigators and sites.

During the three months ended March 31, 2020, the Company recognized $337,503 in direct expenses associated with the Service Agreement 1, classified as R&D expense, leaving a $473,639 prepaid expense asset.

Lease Commitments – Related Party

On March 1, 2020, the Company entered into a sublease with Purnovate, LLC, a private company in which the Company’s CEO has a 35% financial interest for the lease of three offices at 1180 Seminole Trail, Suite 495, Charlottesville, VA 22901. The lease has a term of two years, and the monthly rent is $1,400. In the three months ended March 31, 2020, the rent expense associated with this lease was $1,400.

Consulting Agreements – Related Party

On March 24, 2019, the Company entered into a consulting agreement (the “Consulting Agreement”) with Dr. Bankole A. Johnson, who at the time of the agreement was serving as the Chairman of the Board of Directors, for his service as Chief Medical Officer of the Company. The Consulting Agreement has a term of three years, unless terminated by mutual consent or by the Company for cause. Dr. Johnson resigned as Chairman of the Board of Directors at the time of execution of the consulting agreement. Under the terms of the Consulting Agreement, Dr. Johnson’s annual fee of $375,000 per year is paid twice per month. On execution, Dr. Johnson received a signing bonus of $250,000 and option to purchase 250,000 shares of common stock. Dr. Johnson’s participation in the Grant Incentive Plan (see below) continues unaffected. The total expense to the Company under this agreement was $93,750 in the three months ended March 31, 2020.

12

On July 5, 2019, the Company entered into a Master Services Agreement (the “MSA”) and attached statement of work with Psychological Education Publishing Company (“PEPCO”) to administer a behavioral therapy program during the Company’s upcoming Phase 3 clinical trial. PEPCO is owned by a related party, Dr. Bankole Johnson, the Company’s Chief Medical Officer, and currently the largest stockholder in the Company. It is anticipated that the compensation to be paid to PEPCO for services under the MSA will total approximately $300,000, of which shares of the Company’s common stock having a value equal to twenty percent (20%) of this total can be issued to Dr. Johnson in lieu of cash payment.

On December 12, 2019, the Company entered into an Amendment (the “Amendment”) to the statement of work (“SOW”). The Company had paid PEPCO $39,064 under the SOW for services rendered to date, leaving as estimated balance of $274,779 to be paid under the SOW. The Amendment provided the Company with a 20% discount on the remaining services and to fix the price of any remaining services at a total of $219,823 for all services required for the use of Brief Behavioral Compliance Enhancement Treatment (BBCET) in support of the Trial. In addition, Dr. Johnson executed a guaranty, dated December 12, 2019, of PEPCO’s performance under the MSA and SOW (the “Guaranty”), together with a pledge and security agreement, dated December 12, 2019 (the “Pledge and Security Agreement”), to secure the Guaranty with 600,000 shares of the Company’s common stock beneficially owned by him and a lock-up agreement, dated December 12, 2019 (the “Lock-Up”), pursuant to which he agreed not to transfer or dispose of, directly or indirectly, any shares of the Company’s common stock, as currently owned by him, until after January 1, 2021. As of March 31, 2020, the Company had recognized $91,972 in expenses, of which $52,908 were charged against cash advanced under the terms of the Amendment, leaving a net prepaid expense asset of $167,095 associated with this vendor agreement.

Litigation

The Company is subject, from time to time, to claims by third parties under various legal disputes. The defense of such claims, or any adverse outcome relating to any such claims, could have a material adverse effect on the Company’s liquidity, financial condition and cash flows. At March 31, 2020, the Company did not have any pending legal actions.

13

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis is intended as a review of significant factors affecting our financial condition and results of operations for the periods indicated. The discussion should be read in conjunction with our unaudited financial statements and the notes presented herein included in this Form 10-Q and the audited financial statements and the other information set forth in the 2019 Form 10-K. ln addition to historical information, the following Management’s Discussion and Analysis of Financial Condition and Results of Operations contains forward-looking statements that involve risks and uncertainties including, but not limited to, those set forth below under “Risk Factors” and elsewhere herein, and those identified under Part I, Item 1A of our 2019 Form 10-K. Our actual results could differ significantly from those anticipated in these forward-looking statements as a result of certain factors discussed herein and any other periodic reports filed and to be filed with the Securities and Exchange Commission.

Overview

We are a clinical-stage biopharmaceutical company currently focused on the development of a therapeutic agent for the treatment of alcohol use disorder (“AUD”) using our lead investigational new drug product, AD04, a selective serotonin-3 antagonist (i.e., a “5-HT3 antagonist”). The active ingredient in AD04 is ondansetron, which is also the active ingredient in Zofran®, an approved drug for treating nausea and emesis. AUD is characterized by an urge to consume alcohol and an inability to control the levels of consumption. We have commenced a Phase 3 clinical trial using AD04 for the potential treatment of AUD in subjects with certain target genotypes. We believe our approach is unique in that it targets the serotonin system and individualizes the treatment of AUD, through the use of genetic screening (i.e., a companion diagnostic genetic biomarker). We have created an investigational companion diagnostic biomarker test for the genetic screening of patients with certain biomarkers that, as reported in theAmerican Journal of Psychiatry (Johnson, et. al. 2011 & 2013), we believe will benefit from treatment with AD04. Our strategy is to integrate the pre-treatment genetic screening into AD04’s label to create a patient-specific treatment in one integrated therapeutic offering. Our goal is to develop a genetically targeted, effective and safe product candidate to treat AUD by reducing or eliminating the patients’ consumption of alcohol. We are also exploring expanding or portfolio in the field of addiction.

We have a worldwide, exclusive license from the University of Virginia Patent Foundation (d.b.a the Licensing & Venture Group) (“UVA LVG”), which is the licensing arm of the University of Virginia, to commercialize our investigational drug candidate, AD04, subject to Food and Drug Administration (“FDA”) approval of the product, based upon three separate patent application families, with patents issued in over 40 jurisdictions, including three issued patents in the U.S. Our investigational agent has been used in several investigator-sponsored trials and we possess or have rights to use toxicology, pharmacokinetic and other preclinical and clinical data that supports our Phase 3 clinical trial. Our therapeutic agent was the product candidate used in a University of Virginia investigator sponsored Phase 2b clinical trial of 283 patients. In this Phase 2b clinical trial, ultra-low dose ondansetron, the active pharmaceutical agent in AD04, showed a statistically significant difference between ondansetron and placebo for both the primary endpoint and secondary endpoint, which were reduction in severity of drinking measured in drinks per drinking day (1.71 drinks/drinking day; p=0.0042), and reduction in frequency of drinking measured in days of abstinence/no drinking (11.56%; p=0.0352), respectively. Additionally, and importantly, the Phase 2b results showed a significant decrease in the percentage of heavy drinking days (11.08%; p=0.0445) with a “heavy drinking day” defined as a day with four (4) or more alcoholic drinks for women or five (5) or more alcoholic drinks for men consumed in the same day.

The active pharmaceutical agent in AD04, our lead investigational new drug product, is ondansetron (the active ingredient in Zofran®), which was granted FDA approval in 1991 for nausea and vomiting post-operatively and after chemotherapy or radiation treatment and is now commercially available in generic form. In studies of Zofran®, conducted as part of its FDA review process, ondansetron was given acutely at dosages up to almost 100 times the dosage expected to be formulated in AD04 with the highest doses of Zofran® given intravenously (“i.v.”), which results in approximately 160% of the exposure level as oral dosing. Even at high doses given i.v. the studies found that ondansetron is well-tolerated and results in few adverse side effects at the currently marketed doses, which reach more than 80 times the AD04 dose and are given i.v. The formulation dosage of ondansetron used in our drug candidate (and expected to be used by us in our Phase 3 clinical trials) has the potential advantage that it contains a much lower concentration of ondansetron than the generic formulation/dosage that has been used in prior clinical trials, is dosed orally, and is available with use of a companion diagnostic genetic biomarker. Our development plan for AD04 is designed to demonstrate both the efficacy of AD04 in the genetically targeted population and the safety of ondansetron when administered chronically at the AD04 dosage. However, to the best of our knowledge, no comprehensive clinical study has been performed to date that has evaluated the safety profile of ondansetron at any dosage for long-term use as anticipated in our Phase 3 clinical trial.

14

According to the National Institute of Alcohol Abuse and Alcoholism (the “NIAAA”) and the Journal of the American Medical Association (“JAMA”), in the United States alone, approximately 35 million people each year have AUD (such number is based upon the 2012 data provided in Grant et. al. the JAMA 2015 publication and has been adjusted to reflect a compound annual growth rate of 1.13%, which is the growth rate reported by U.S. Census Bureau for the general adult population from 2012-2017), resulting in significant health, social and financial costs with excessive alcohol use being the third leading cause of preventable death and is responsible for 31% of driving fatalities in the United States (NIAAA Alcohol Facts & Statistics). AUD contributes to over 200 different diseases and 10% of children live with a person that has an alcohol problem. According to the American Society of Clinical Oncologists, 5-6% of new cancers and cancer deaths globally are directly attributable to alcohol. And,The Lancetpublished that alcohol is the leading cause of death in people ages 15-49 globally. The Centers for Disease Control (the “CDC”) has reported that AUD costs the U.S. economy about $250 billion annually, with heavy drinking accounting for greater than 75% of the social and health related costs. Despite this, according to the article in the JAMA 2015 publication, only 7.7% of patients (i.e., approximately 2.7 million people) with AUD are estimated to have been treated in any way and only 3.6% by a physician (i.e., approximately 1.3 million people). In addition, according to the JAMA 2017 publication, the problem in the United States appears to be growing with almost a 50% increase in AUD prevalence between 2002 and 2013.

AUD is characterized by an urge to consume alcohol and an inability to control the levels of consumption. Until the publication of the fifth revision of theDiagnostic and Statistical Manual of Mental Disorders in 2013 (the “DSM-5”), AUD was broken into “alcohol dependence” and “alcohol abuse”. More broadly, overdrinking due to the inability to moderate drinking is called alcohol addiction and is often called “alcoholism”, sometimes pejoratively.

Since ondansetron is already manufactured for generic sale, the active ingredient for AD04 is readily available from several manufacturers, and we have contracted with a U.S. manufacturer to acquire ondansetron at a cost expected to be under $0.01 per dose. Clinical trial material (“CTM”) has already been manufactured for the initial Phase 3 trial. The CTM has demonstrated good stability after four years with the stability studies to date.

We have also developed the manufacturing process at a third-party vendor to produce tablets at what we expect will serve for commercial scale production, also at a cost expected to be less than $0.01 per dose. A proprietary packaging process has been developed, which appears to extend the stability of the drug product. Packaging costs are expected to be less than $0.05 per dose. We do not have a written commitment for supply of either the tablets or the packaging and believe that alternative suppliers are available to whom we can transfer the processes that have been developed.

Methods for the companion diagnostic genetic test have been developed as a blood test, and we established the test with a U.S. third-party vendor capable of supporting a Phase 3 clinical trial. Additionally, we have built validation and possible approval of the companion diagnostic into the Phase 3 program, including that we plan to store blood samples for all patients in the event additional genetic testing is required by regulatory authorities. Methods are intended to be transferred to third-party vendors in Europe for conduct of the ongoing initial Phase 3 trial.

Ultimately, we plan to explore the development of AD04 in other addiction-related indications (e.g., opioid use disorder, other drug addictions, obesity, smoking cessation, eating disorders and anxiety) and to build out our product portfolio with the intent that product portfolio expansions will be focused on promising addiction therapies. Our vision is to create the world’s leading addiction related pharmaceutical company.

We have devoted substantially all of our resources to development efforts relating to AD04, including preparation for conducting clinical trials, providing general and administrative support for these operations and protecting our intellectual property. We currently do not have any products approved for sale and we have not generated any significant revenue since our inception. From our inception through the date of this Quarterly Report on Form 10-Q, we have funded our operations primarily through the private placement of debt and equity securities and most recently, our initial public offering and follow-on offering.

We have incurred net losses in each year since our inception, including net losses of approximately $8.6 million and $11.6 million for the years ended December 31, 2019 and 2018, respectively and net losses of $2.3 million and $2.7 million in the three months ended March 31, 2020 and 2019, respectively. We had an accumulated deficit of approximately $22.9 million and $20.6 million as of March 31, 2020 and December 31, 2019, respectively. Substantially all our operating losses in these periods resulted from costs incurred in connection with our research and development programs and from general and administrative costs associated with our operations.

15

Clinical Trials — Research and Development Schedule

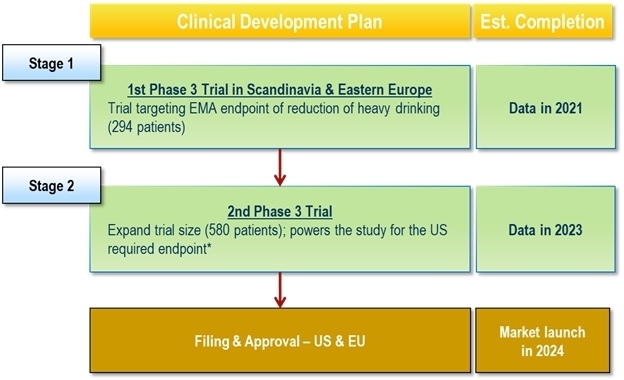

We currently anticipate that we, working in collaboration with our vendors, upon execution of collaborative research and development agreements with them, will be able to execute the following timeline:

AD04 — Two-Stage Clinical Development Strategy — Conduct the Phase 3 clinical trials sequentially

| * | Even if the 1st Phase 3 trial is not accepted by the FDA due to the study not being well-powered for the FDA’s currently stated end point, we still expect that the EMA will require only one additional trial. In this case, however, a 3rd trial might be required by the FDA (i.e., three Phase 3 trials in total). If two additional trials are required for FDA approval after an initial Phase 3 trial conducted in the EMA, we would expect to run the 2nd and 3rdtrials in parallel (i.e., at the same time) so as not to increase the expected time to approval. The 2nd Phase 3 trial is expected to require $20 million in direct expenses, and up to $10 million in additional other development expenses is expected to be required. A possible 3rd Phase 3 trial would be expected to require an additional $20 million in clinical trial related expenditures. |

In March 2020, the World Health Organization declared SARS-CoV-2 (Severe Acute Respiratory Syndrome-Coronavirus 2), the virus that causes COVID-19 a global pandemic. This contagious disease outbreak, which has continued to spread, and its related adverse public health developments, has adversely affected workforces, economies, and financial markets globally, potentially leading to an economic downturn. It has also disrupted the normal operations of many businesses. With the global spread of the ongoing coronavirus pandemic in the first quarter of 2020, we have implemented business continuity plans designed to address and mitigate the impact of the coronavirus pandemic on its business. We anticipate that the coronavirus pandemic will continue to have an impact on the clinical development timeline of AD04. The extent to which the coronavirus pandemic impacts our business, the clinical development of AD04, the business of our suppliers and other commercial partners, our corporate development objectives and the value of and market for our common stock, will depend on future developments that are highly uncertain and cannot be predicted with confidence at this time, such as the ultimate duration of the pandemic, travel restrictions, quarantines, social distancing, and business closure requirements in the United States, Europe, and other countries, and the effectiveness of actions taken globally to contain and treat the disease. The global economic slowdown, the overall disruption of global healthcare systems and the other risks and uncertainties associated with the pandemic could have a material adverse effect on our business, financial condition, results of operations and growth prospects. In addition, to the extent the ongoing coronavirus pandemic adversely affects our business and results of operations, it may also have the effect of heightening many of the other risks and uncertainties which we face.

16

We estimate the total cost to complete our initial Phase 3 clinical trial of AD04 for the treatment of AUD to be approximately $9.0 million, of which approximately $2.6 million has already been incurred or been pre-paid, leaving approximately $6.4 million in direct trial expenses that we will be required to pay in the future. We have applied for a number of grants, one of which could be used to defray a portion of the expense of our trial and for which we believe we are well qualified. However, due to slowed enrollment in our trial as a result of the ongoing coronavirus pandemic, which is expected to continue, we will not be able to reach database lock for our initial Phase 3 clinical trial of AD04 for the treatment of AUD even if the grant funding for which we have applied is received. Therefore, although we are currently experiencing limited financial impact resulting from the coronavirus pandemic, due to the impact on our clinical trial timelines, whether the grant funding for which we have applied is received or not, additional funds will need to be raised in order for us to reach database lock. There is no assurance that the funds necessary to fund our direct trial costs, plus company overhead, could be raised by on acceptable terms before we exhaust our funds. Given the global economic slowdown, the overall disruption of global healthcare systems and the other risks and uncertainties associated with the pandemic, our business, financial condition, results of operations and growth prospects could be materially adversely affected. Moreover, if our trial activities are further slowed due to the coronavirus pandemic, our cash runway would be required to last a longer period of time than anticipated in order to support our administrative activities during extended trial period, which could result in us requiring significant additional funding that was not anticipated, which we would need to satisfy with additional funding, either through other grants or through potentially dilutive means. This estimate is subject to many factors, some of which are beyond our control. These factors include, but are not limited to, the following:

| ● | the progress and cost of our research and development activities; |

| ● | the number and scope of our research and development programs; |

| ● | the progress and cost of our preclinical and clinical development activities; |

| ● | our ability to maintain current research and development licensing arrangements and to establish new research and development and licensing arrangements; |

| ● | our ability to achieve our milestones under licensing arrangements; |

| ● | the costs involved in prosecuting and enforcing patent claims and other intellectual property rights; |

| ● | the costs and timing of regulatory approvals; and |

| ● | changes in the value of the Euro relative to the US Dollar. |

Additional funds are expected to be raised through grants, partnerships with other pharmaceutical companies or through additional debt or equity financings. We expect the second Phase 3 Trial to cost approximately $20 million, such estimate subject to the factors stated above.

As we advance our clinical programs, we are in close contact with our CROs and clinical sites and are assessing the impact of COVID-19 on our studies and current timelines and costs.

Recent Developments

In January 2020, we announced that we had received favorable opinions from theFinnish Medicines Agency (FIMEA) and National Committee on Medical Research Ethics (TUKIJA) to commence our Phase 3 clinical trial to investigate AD04 as a genetically targeted therapeutic agent for the treatment of AUD.

In February 2020, we were informed by our CRO that the first site initiation visit had taken place and that subsequently the first potential trial participant had been screened.

17

Results of operations for the three months ended March 31, 2020 and 2019(rounded to nearest thousand)

The following table sets forth the components of our statements of operations in dollars for the periods presented:

| For the Three Months Ended March 31, | Change | |||||||||||

| 2019 | 2018 | (Decrease) | ||||||||||

| Research and development expenses | $ | 1,060,000 | $ | 687,000 | $ | 373,000 | ||||||

| General and administrative expenses | 1,241,000 | 1,562,000 | (321,000 | ) | ||||||||

| Total Operating Expenses | 2,301,000 | 2,249,000 | (52,000 | ) | ||||||||

| Loss From Operations | (2,301,000 | ) | (2,249,000 | ) | 52,000 | |||||||

| Interest Income | 23,000 | 8,000 | 15,000 | |||||||||

| Warrant modification expense | - | (442,000 | ) | 442,000 | ||||||||

| Total other income (expenses) | 23,000 | (434,000 | ) | 457,000 | ||||||||

| Net Loss | $ | (2,278,000 | ) | $ | (2,683,000 | ) | $ | 405,000 | ||||

Research and development (“R&D”) expenses

R&D expenses increased by approximately $373,000 (54%) during the three months ended March 31, 2020 as compared to the three months ended March 31, 2019. This increase was due to the significant increase in R&D activities in the first quarter of 2020 as we commenced our Phase 3 clinical trial for AD04. The increase in R&D costs in the first quarter of 2020, as compared to the first quarter of 2019 included increase in CRO fees and subcontractor costs of $426,000, increase of regulatory consulting of $79,000, increase in CMC consulting and manufacturing expenses of $64,000, offset by decreases in total R&D-devoted employee salaries, bonuses, and option expense of $185,000, and license expenses of $13,000.

General and administrative expenses (“G&A”) expenses

G&A expenses decreased by approximately $321,000 (21%) in the three months ended March 31, 2020 as compared to the three months ended March 31, 2019. This decrease was due to substantial one time G&A expenses associated with discretionary bonuses granted officers in the first quarter of 2019, as well as non-capitalized legal, accounting, and consulting services associated with the follow-on offering.

Total Other income (expenses)

Other income increased by $457,000 (105%) in the three months ended March 31, 2020, from an expense of $434,000 to other income of $23,000, when compared to the three months ended March 31, 2019. This increase is due to the occurrence in the first quarter of 2019 of a one time warrant modification expense, as well as increased interest income resulting from our increased cash holdings after the follow on offering in the first quarter of 2019. Interest income has decreased in the periods since the follow on offering, as cash has been used for operations and our interest bearing account balances have reduced.

Liquidity and capital resources at March 31, 2020

Overview

Our principal liquidity needs have historically been working capital, R&D, patent costs, and personnel costs. We expect these needs to continue as we develop and eventually commercialize our compound. Over the next several years, we expect to increase our R&D expenses as we undergo clinical trials to demonstrate the safety and efficacy of the product. To date, we have funded our operations primarily with equity financings and the issuance of notes. In February 2019, we closed a follow-on underwritten offering for aggregate net proceeds of approximately $8.2 million, net of offering expenses.

At March 31, 2020, we had approximately $5.0 million in cash and cash equivalents and approximately $5.5 million of working capital, compared to approximately $6.8 million in cash and cash equivalents and $7.1 million of working capital as of December 31, 2019. As of March 31, 2020, we had no liabilities outstanding other than accounts payable and accrued expenses.

18

Our current cash and cash equivalents of approximately $5.0 million at March 31, 2020, are not expected to be sufficient to fund operations for the twelve months from the date of this form 10-Q, based our current projections. We have applied for grants with the a number of federal agencies totaling approximately $5.5 million of which $2.5 million would be usable to partially fund our Phase 3 trial and of which we expect to defray $2.0 of currently planned trial expenses, and, although not yet received or guaranteed, we expect, assuming we receive the anticipated grant funding, to exhaust our funds in the first quarter of 2021. However, due to a significant slowing of the conduct of our trial resulting from the ongoing coronavirus pandemic, even with the receipt of grant funding, we will be unable to complete our phase three trial (to the point of reaching database lock) prior to exhausting our funds, and will need to seek additional funding, either through other grants or though potentially dilutive means. Should the anticipated grant funding not be received, we would exhaust our cash by fourth quarter of 2020 if no changes are made to our anticipated cash expenditures, by which time it would be necessary to raise additional funds in order to reach database lock, including through potentially dilutive means. There is no assurance that such funds could be raised by that time on acceptable terms. While we are experiencing limited direct financial impacts at this time resulting from the coronavirus pandemic, other than the slowing of the trial, given the global economic slowdown, the overall disruption of global healthcare systems and the other risks and uncertainties associated with the pandemic, our business, financial condition, results of operations and growth prospects could be materially adversely affected. Moreover, if our trial activities suffer additional, significant slowing over that already anticipated due to the coronavirus pandemic, our cash runway would be required to last a longer period of time than anticipated in order to support our administrative activities during the longer trial period, which could result in us requiring significant additional funding that was not anticipated. There is no certainty that funding in the amounts needed will be available in the amounts needed on acceptable terms.

We will also require additional financing as we continue to execute our overall business strategy, including an estimated $20 million for a second phase three trial. Our liquidity may be negatively impacted as a result of research and development cost increases in addition to general economic and industry factors. We anticipate that, our future liquidity requirements will be funded through the incurrence of indebtedness, additional equity financings or a combination. In addition, we may raise additional funds through grants and/or corporate collaboration and licensing arrangements. If we raise additional funds by issuing equity securities or convertible debt, our shareholders will experience dilution. Debt financing, if available, would result in increased fixed payment obligations and may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. If we raise additional funds through collaboration and licensing arrangements with third parties, it may be necessary to relinquish valuable rights to our products, future revenue streams or product candidates or to grant licenses on terms that may not be favorable to us. We cannot be certain that additional funding will be available on acceptable terms, or at all. Any failure to raise capital in the future could have a negative impact on our financial condition and our ability to pursue our business strategies.

Cash flows

| (rounded to nearest thousand) | For the Three Months Ended March 31, | |||||||

| 2019 | 2018 | |||||||

| Provided by (used in) | ||||||||

| Operating activities | $ | (1,825,000 | ) | (1,721,000 | ) | |||

| Investing activities | – | – | ||||||

| Financing activities | – | 9,246,000 | ||||||

| Net (decrease) increase in cash and cash equivalents | $ | 1,825,000 | 7,525,000 | |||||

19

Net cash used in operating activities

Net cash used by operating activities for the three months ended March 31, 2020 consists primarily of net loss adjusted for certain non-cash items (including amortization and share-based compensation), and the effect of changes in working capital and other activities. The modest increase in cash used in operating activities ($104,000) for the three months ended March 31, 2020 as compared to the three months ended March 31, 2019, despite the decrease in net loss between the same periods, is due to the larger proportion of costs in the three months ended March 31, 2019 being non-cash costs, such as equity compensation expense, compared to the three months ended March 31, 2020. Non-cash assets, such as pre-paid research and development, also increased substantially in the three months ended March 31, 2020, compared to the three months ended March 31, 2019.

Net cash provided by financing activities

Net cash provided by financing activities decreased $9,246,000 during the three months ended March 31, 2020, this decrease was attributable to the net proceeds of $8,195,000 from the follow-on public offering and warrant exercises of $1,051,000 during the three months ended March 31, 2019, while no financing activity took place in the three months ended March 31, 2020.

Off-balance sheet arrangements

We do not have any off-balance sheet arrangements.

Item 3. Quantitative and Qualitative Disclosures about Market Risk.

Not applicable.

Item 4. Controls and Procedures.

Disclosure Controls and Procedures

We have adopted and maintain disclosure controls and procedures that are designed to provide reasonable assurance that information required to be disclosed in the reports filed under the Exchange Act, such as this Quarterly Report on Form 10-Q, is collected, recorded, processed, summarized and reported within the time periods specified in the rules of the SEC. Our disclosure controls and procedures are also designed to ensure that such information is accumulated and communicated to management to allow timely decisions regarding required disclosure. Based upon the most recent evaluation of internal controls over financial reporting, our Chief Executive Officer (our principal executive officer) and our Chief Financial Officer (our principal financial officer) identified material weaknesses in our internal control over financial reporting. The material weaknesses identified to date include (i) policies and procedures which are not yet adequately documented, (ii) lack of proper approval processes and review processes and documentation for such reviews, (iii) insufficient GAAP experience regarding complex transactions and reporting, and (iv) insufficient number of staff to maintain optimal segregation of duties and levels of oversight. As of March 31, 2020, based on evaluation of our disclosure controls and procedures, management concluded that our disclosure controls and procedures were not effective.

Notwithstanding the material weaknesses described above, our management, including the Chief Executive Officer and Chief Financial Officer, has concluded that financial statements, and other financial information included in this quarterly report, fairly present in all material respects our financial condition, results of operations, and cash flows as of and for the periods presented in this quarterly report.

Changes in Internal Control

There has been no change in our internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) of the Exchange Act) that occurred during our fiscal quarter ended March 31, 2020 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

20

From time to time we may become involved in legal proceedings or be subject to claims arising in the ordinary course of our business. We are not presently a party to any legal proceedings that, if determined adversely to us, would individually or taken together have a material adverse effect on our business, operating results, financial condition or cash flows. Regardless of the outcome, litigation can have an adverse impact on us because of defense and settlement costs, diversion of management resources and other factors.

The following information updates, and should be read in conjunction with, the information disclosed in Part I, Item 1A, “Risk Factors,” contained in our 2019 Form 10-K. Except as disclosed below, there have been no material changes from the risk factors disclosed in our 2019 Form 10-K.

Risks Relating to our Company

We have incurred net losses every year and quarter since our inception and anticipate that we will continue to incur net losses in the future.