Cautionary Note Regarding Forward-Looking Statements

Certain statements made on this Form 20-F ("Annual Report") contain forward-looking information within the meaning of applicable United States securities laws ("forward-looking statements"). These forward-looking statements are presented for the purpose of assisting the Company's securityholders and prospective investors in understanding management's intentions and views regarding future outcomes and are inherently uncertain and should not be heavily relied upon. When used in this Annual Report, the words "may", "would", "could", "will", "intend", "plan", "anticipate", "believe", "seek", "propose", "estimate", "expect", and similar expressions, as they relate to the Company, identify such forward-looking statements. Specific forward-looking statements in this Annual Report include:

the Company's exploration and financing plans,

the ability of the Company to realize the objectives of the Company's planned exploration programs;

the results of the Company's exploration programs and the likelihood of discovering or expanding resources;

the Company's estimated mineral resources;

the future price of minerals, especially gold and other precious metals;

the Company's future capital expenditures and requirements, and sources and timing of additional financing;

the potential for resource expansion and ultimately mine development of the Company's Eau Claire Project,

permitting timelines and possible delays;

local indigenous and other communities engagement;

government regulation of mining operations;

environmental and climate-related risks;

the possible impairment of mining interests;

any objectives, expectations, intentions, plans, results, levels of activity, goals or achievements;

the liquidity of the common shares in the capital of the Company; and

other events or conditions that may occur in the future.

The forward-looking statements contained in this Annual Report represent the Company's views as of the date hereof. The assumptions related to these plans, estimates, projections, beliefs, and opinions may change without notice and in unanticipated ways. Many assumptions may prove to be incorrect, including:

the Company's budgeting plans, expected costs, assumptions regarding market conditions and other factors upon which the Company has based its expenditure and funding expectations;

the Company will be able to raise additional capital to proceed with its exploration, development and operations plans and attracting finance for precious metal exploration will be possible;

the Company's ability to obtain or renew the licenses, permits and regulatory approvals necessary for its planned exploration;

the Company's exploration plans will not be adversely impacted by declines in prices of precious metals and consequent impairment of the Company's ability to finance its operations

that operations and financial markets will not in the long term be adversely impacted by wars or pandemics;

the Company's ability to complete and successfully integrate acquisitions;

the Company's plan of operations will not be adversely impacted by climate change, extreme weather events, water scarcity, and seismic events, and the Company's strategies to deal with these issues will be effective;

the Company's expectations regarding the future demand for, and supply and price of, precious metals;

the Company's ability to recruit and retain qualified personnel to pursue its business operations;

the Company's mineral resource estimates, and the assumptions upon which they are based, are reasonably accurate;

the Company will be able to comply with current and future environmental, safety and other regulatory requirements and to obtain and maintain local community support.

Inherent in the forward-looking statements are known and unknown risks, uncertainties and other factors beyond the Company's ability to control or predict, that may cause the actual results, performance or achievements of the Company, or developments in the Company's business or in its industry, to adversely differ materially from the anticipated results, performance, achievements or developments expressed or implied by such forward-looking statements. Some of the risks and other factors (some of which are beyond the Company's control) which could cause results to differ materially from those expressed in the forward-looking statements and information contained in this Annual Report include, but are not limited to:

- fluctuations in the current and projected prices for gold, other precious and base metals and other commodities (such as natural gas, fuel oil and electricity) which are needed to explore for and ultimately produce these metals;

the Company does not earn any revenues from its business and has history of losses and negative cash flows from operations, each of which is expected to continue in the future;

the Company may not be able to secure additional financings, including equity financings, to continue the planned exploration of its mineral properties;

the Company's exploration programs are inherently risky as they involve uncertain geology and risk exploration failure and may overrun on costs and not be successful in achieving the targeted objectives or result in the discovery of new resources or the expansion of existing resources

the Company's plan of operations involves risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, potential unintended releases of contaminants, industrial accidents, unusual or unexpected geological or structural formations, pressures, cave-ins and flooding);

the speculative nature of mineral exploration and development; the estimation of mineral resources, the Company's ability to obtain funding, including the Company's ability to complete future equity financings;

environmental risks and remediation measures, including evolving environmental regulations and legislation;

changes in laws and regulations impacting exploration and mining activities;

the Company's mineral properties being subject to prior unregistered agreements, transfers or claims and other defects in title;

legal and litigation risks;

statutory and regulatory compliance;

insurance and uninsurable risks;

the continuation of our management team and our ability to secure the specialized skill and knowledge necessary to operate in the mining industry

the Company's limited business history and history of losses and negative cash, which will continue into the foreseeable future;

our inability to pay dividends, volatility in the Company's share price, the continuation of our management team and our ability to secure the specialized skill and knowledge necessary to operate in the mining industry; relations with and claims by local communities and non-governmental organizations, including relations with and claims by indigenous populations;

the effectiveness of the Company's internal control over financial reporting;

cybersecurity risks and other reputational risks;

general business, economic, competitive, political and social uncertainties;

the effects of climate change, extreme weather events, water scarcity, and seismic events, and the effectiveness of strategies to deal with these issues;

and public health crises such as the COVID-19 pandemic and other uninsurable risks.

While intended to list the primary risks were see, no list can contain an exhaustive list of the risk and other factors that may affect any of the Company's forward-looking statements. Some of these risks and other factors are discussed in more detail in the section entitled "Risk Factors". Investors and others should carefully consider these risks and other factors and not place heavy reliance on the forward-looking statements.

The Company only updates its risk factors and forward-looking statements, when and to the extent required by applicable securities laws. See Item 3.D - Risk Factors below for a more detailed discussion of the risks faced by the Company.

Emerging Growth Company ("EGC") Status

The Company ceased to qualify as an "emerging growth company", as defined in Section 3(a) of the United States Securities Exchange Act of 1934, as amended (the "Exchange Act") by the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act"), on December 31, 2022, which was the last day of the Company's fiscal year following the fifth anniversary of the date of the first sale of equity securities pursuant to an effective registration statement under the United States Securities Act of 1933, as amended ("Securities Act").

Generally, any registrant that has any class of its securities under Section 12 of the Exchange Act is required to include in its annual reports filed by it under the Exchange Act a management report on internal control over financial reporting and, subject to an exemption available to registrants that are neither an "accelerated filer" or a "larger accelerated filer" (as those terms are defined in Exchange Act Rule 12b-2), an auditor attestation report on management's assessment of internal control over financial reporting. As the Company has ceased to qualify as an "emerging growth company", the Company will be required to include in its subsequent annual reports, an auditor attestation report on management's assessment of internal control over financial reporting to the extent that it does not qualify for the exemption available to registrants that are neither an "accelerated filer" or "large accelerated filer". Based on the Company's aggregate market-value as at June 30, 2023, the Company qualifies as a "non-accelerated filer" and, as such, is not to required to include and has not included an auditors attestation report on the Company's internal control over financial reporting with this Annual Report.

Currency

In this Annual Report, unless otherwise indicated, all dollar amounts and references to "C$" or "$" are to Canadian dollars and references to "US$" are to U.S. dollars. All dollar amounts are expressed in thousands of Canadian dollars unless otherwise indicated.

Part I

Item 1 - Identity of Directors, Senior Management, and Advisers

Not applicable

Item 2 - Offer Statistics and Expected Timetable

Not applicable

Item 3 - Key Information

A. [Reserved]

B. Capitalization and indebtedness

Not Applicable

C. Reasons for the offer and use of proceeds

Not Applicable

D. Risk factors

An investment in securities of Fury Gold involves significant risks, which should be carefully considered by prospective investors before purchasing such securities. Management of Fury Gold considers the following risks to be most significant for potential investors in Fury Gold, but such risks do not necessarily comprise all those associated with an investment in Fury Gold. Additional risks and uncertainties not currently known to management of Fury Gold may also have an adverse effect on Fury Gold's business. If any of these risks actually occur, Fury Gold's business, financial condition, capital resources, results of operations and/or future operations could be materially adversely affected.

In addition to the other information set forth elsewhere in this Annual Report, the following risk factors should be carefully considered when assessing risks related to Fury Gold's business.

Exploration Activities May Not Be Successful

Exploration for, and development of, mineral properties is speculative and involves significant financial risks, which even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties that are explored are ultimately developed into producing mines. Major expenditures may be required to establish reserves by drilling, to complete a feasibility study and to construct mining and processing facilities at a site for extracting gold or other metals from ore. Fury Gold cannot ensure that its future exploration programs will result in profitable commercial mining operations.

Few properties that are explored are ultimately developed into producing mines. Unusual or unexpected formations, formation pressures, fires, power outages, labour disruptions, flooding, explosions, cave-ins, landslides and the inability to obtain adequate machinery, equipment and/or labour are some of the risks involved in mineral exploration activities. The Company has relied on and may continue to rely on consultants and others for mineral exploration expertise.

The Company has implemented safety and environmental measures designed to comply with or exceed government regulations and ensure safe, reliable and efficient operations in all phases of its operations. The Company maintains liability and property insurance, where reasonably available, in such amounts as it considers prudent. The Company may become subject to liability for hazards against which it cannot insure or which it may elect not to insure against because of high premium costs or other reasons.

Also, substantial expenses may be incurred on exploration projects that are subsequently abandoned due to poor exploration results or the inability to define reserves that can be mined economically. Development projects have no operating history upon which to base estimates of future cash flow. Estimates of proven and probable mineral reserves and cash operating costs are, to a large extent, based upon detailed geological and engineering analysis. There have been no feasibility studies conducted in order to derive estimates of capital and operating costs including, among others, anticipated tonnage and grades of ore to be mined and processed, the configuration of the ore body, ground and mining conditions, expected recovery rates of the gold or copper from the ore, and anticipated environmental and regulatory compliance costs.

Substantial expenditures are required to establish mineral resources and mineral reserves through drilling and development and for mining and processing facilities and infrastructure. No assurances can be given that mineral will be discovered in sufficient quantities to justify commercial operations or that funds required for development can be obtained on a timely basis. There is also no assurance that even if commercial quantities of ore are discovered that the properties will be brought into commercial production or that the funds required to exploit any mineral reserves and resources discovered by the Company will be obtained on a timely basis or at all. Economic feasibility of a project is based on several other factors including anticipated metallurgical recoveries, environmental considerations and permitting, future metal prices and timely completion of any development plan. Most of the above factors are beyond the control of the Company. There can be no assurance that the Company's mineral exploration activities will be successful. In the event that such commercial viability is never attained, the Company may seek to transfer its property interests or otherwise realize value or may even be required to abandon its business and fail as a "going concern".

Moreover, advancing any of the Company's exploration properties into a revenue generating property, will require the construction and operation of mines, processing plants and related infrastructure, the development of which includes various risks associated with establishing new mining operations, including:

• the ability to obtain a social license from the local communities affected given many communities are opposed to mining operations of any kind;

• the timing and costs, which can be considerable, of the construction of mining and processing facilities;

• the availability and cost of skilled labour, mining equipment and principal supplies needed for operations;

• the availability and cost of appropriate smelting and refining arrangements;

• the need to maintain necessary environmental and other governmental approvals and permits;

• the availability of funds to finance construction and development activities;

• potential opposition from non-governmental organizations, environmental groups, local groups or other stakeholders which may delay or prevent development activities; and

• potential increases in construction and operating costs due to changes in the cost of labour, fuel, power, materials and supplies.

It is possible that actual costs and economic returns of future mining operations may differ materially from Fury Gold's best estimates. It is not unusual for new mining operations to experience unexpected problems during the start-up phase and to require more capital than anticipated. These additional costs could have an adverse impact on Fury Gold's future cash flows, earnings, results of operations and financial condition.

Commodity Price Fluctuations and Cycles

Resource exploration is significantly linked to the outlook for commodities. When the price of commodities being explored for declines, investor interest subsides, and capital markets become more difficult. The price of commodities varies on a daily basis and there is no reliable way to predict future prices.

Gold prices specifically are historically subject to wide fluctuation and are influenced by a number of factors including not only supply and demand for industrial its uses, but for speculation purposes, all of which factors are beyond the control or influence of the Company. Some factors that affect the price of gold include industrial and jewelry demand; central bank lending or purchase or sales of gold bullion; forward or short sales of gold by producers and speculators; future level of gold productions; and rapid short-term changes in supply and demand due to speculative or hedging activities by producers, individuals or funds. Gold prices are also affected by macroeconomic factors including: confidence in the global monetary system; expectations of the future rate of inflation; the availability and attractiveness of alternative investment vehicles; the general level of interest rates; the strength of, and confidence in the U.S. dollar, the currency in which the price of gold is generally quoted, and other major currencies; global and regional political or economic events; and costs of production of other gold producing companies.

Additional Funding Requirements and Shareholder Equity Dilution

Fury Gold's business is in the exploration stage and the Company does not carry-on mining activities. As such, it will require additional financing to continue its operations. Fury Gold's ability to secure additional financing and fund ongoing exploration will be affected by many factors, including the strength of the economy and other general economic factors. Global financial conditions continue to be subject to volatility arising from international geopolitical developments and global economic phenomenon, as well as general financial market turbulence. Access to public financing and credit can be negatively impacted by the effect of these events on Canadian and global credit markets. These instances of volatility and market turmoil could adversely impact Fury Gold's operations and the trading price of the Common Shares. There can be no assurance that Fury Gold will be able to obtain adequate financing in the future, or that the terms of such financing will be favourable for further exploration and development of its projects. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration, drilling and/or development. Further, revenues, financings and profits, if any, will depend upon various factors, including the success, if any, of exploration programs and general market conditions for natural resources.

In order to finance future operations, Fury Gold may raise funds through the issuance of additional Common Shares or the issuance of debt instruments or other securities convertible into Common Shares. Fury Gold cannot predict the size of future issuances of Common Shares or the issuance of debt instruments or other securities convertible into Common Shares or the dilutive effect, if any, that future issuances and sales of Fury Gold's securities will have on the market price of the Common Shares.

Negative Cash Flow

Fury Gold experiences negative cash flow from operations and anticipates incurring negative cash flow from operations for 2024 and beyond as a result of the fact that it does not have revenues from mining or any other activities. In addition, as a result of Fury Gold's business plans for the development of its mineral projects, Fury Gold expects cash flow from operations to continue to be negative until Fury Gold is able to establish the economic viability and the development of one of its mineral projects, of which there is no assurance. Accordingly, Fury Gold's cash flow from operations will be negative for the foreseeable future as a result of expenses to be incurred s in connection with advancement of exploration on its mineral projects.

Indirect Economic Interest in the Homestake Ridge Project

As a result of the completion of the sale of the Homestake Ridge Project to Dolly Varden in February 2022, the Company no longer owns and controls the exploration and, if warranted, development of the Homestake Ridge Project. The Company continues to own an indirect minority economic interest in the Homestake Ridge Project through its ownership of a significant interest in Dolly Varden's common shares. Additionally, the Company has the right to nominate two directors to the Dolly Varden Board and the right to nominate a representative to the technical committee. However, the Company does not control Dolly Varden and, accordingly, will not be able to control the manner in which Dolly Varden continues the exploration and, if warranted, development of the Homestake Ridge Project. Accordingly, there is no assurance that the Company will agree with the manner in which Dolly Varden continues this exploration and, if warranted, development of the Homestake Ridge Project. In addition, the value of the Company's ownership in Dolly Varden will vary as the price of the common shares of Dolly Varden fluctuate on the TSX Venture Exchange and this value may be more or less than the accounting value ascribed to these shares. While the Company has pre-emptive rights under the Investor Rights Agreement to retain is ownership position in Dolly Varden (on a percentage ownership basis) there is no assurance that the Company will exercise these pre-emptive rights to continue to maintain its position if Dolly Varden determines to complete future equity offerings, either as a result of a determination of the Company not to invest or the inability of the Company to allocate available funds to complete a required investment. Accordingly, the Company's interest in Dolly Varden may ultimately be diluted. In addition, the Company's ability to sell its shares in Dolly Varden is restricted under the terms of the Investor Rights Agreement which may impact the ability that the Company is ultimately able to realize for its investment in Dolly Varden.

Price Volatility of Publicly Traded Securities

In recent years, the securities markets in the United States and Canada, and in particular the markets for junior resource companies, have experienced a high level of price and volume volatility, and the market prices of securities of many mining companies have experienced wide fluctuations in price which have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. There can be no assurance that continuing fluctuations in share price will not occur in connection with the Company's common shares or with its shareholding in Dolly Varden shares. These factors are ultimately beyond the control of Fury Gold and could have a material adverse effect on the Company's financial condition and results of operations. Securities class action litigation often has been brought against companies following periods of volatility in the market price of their securities. The Company may in the future be the target of similar litigation. Securities litigation could result in substantial costs and damages and divert management's attention and resources.

Mineral Resource Estimates

There is no certainty that any of the mineral resources on the Eau Claire Project, the Committee Bay Project, or any other project with mineral resources will be advanced into mineral reserves. Until a deposit is actually mined and processed, the quantity of mineral resources and grades must be considered as estimates only, and are expressions of judgment based on knowledge, mining experience, analysis of drilling results and industry best practices. Valid estimates made at any given time may vary significantly when new information becomes available. While Fury Gold believes that the Company's estimates of mineral resources are well established and reflect management's best estimates, by their nature mineral resource estimates are imprecise and depend, to a certain extent, upon statistical inferences and geological interpretations, which may ultimately prove inaccurate.

The mineral resource estimates included herein have been determined and valued based on assumed future prices, cut-off grades and operating costs. Furthermore, fluctuations in gold and base or other precious metals prices, results of drilling, metallurgical testing and production and the evaluation of studies, reports and plans subsequent to the date of any estimate may require revisions to such estimates. Any material reductions in estimates of mineral resources could have a material adverse effect on the Company's results of operations and financial condition.

To date, the Company has not established mineral reserves on any of its mineral properties.

Inflation

Consumer price inflation has risen significantly in 2023 and if it continues will mean much higher costs for Fury Gold's expenditure programs. Fury Gold's program cost estimates could rapidly become out-of-date. If this happens, the Company will need to either raise additional funds causing equity dilution or reduce its expenditures and reducing progress. Increases in inflation usually result in central bank interest rate hikes which can trigger negative capital market conditions making financing difficult. While inflation increases have often led to higher precious metals prices, there can be no assurance of that and the Company's operations and its share price could well be adversely affected by increased inflation.

Property Commitments

Fury Gold's mineral properties and/or interests may be subject to various land payments, royalties and/or work commitments. Failure by Fury Gold to meet its payment obligations or otherwise fulfill its commitments under these agreements could result in the loss of related property interests.

Environmental Regulatory, Health & Safety Risks

Fury Gold's operations are subject to environmental regulations promulgated by government agencies from time to time. Environmental legislation and regulation provide for restrictions and prohibitions on spills, releases or emissions of various substances produced in association with certain exploration industry operations, such as from tailings disposal areas, which would result in environmental pollution. A breach of such legislation may result in the imposition of fines and penalties. In addition, certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner which means stricter standards, and enforcement, fines and penalties for non-compliance are more stringent. Future legislation and regulations could cause additional expenses, capital expenditures, restrictions, liabilities and delays in exploration of any of Fury Gold's properties, the extent of which cannot be predicted. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies and directors, officers and employees. The cost of compliance with changes in governmental regulations has a potential to reduce the profitability of operations.

Although Fury Gold believes its operations are in compliance in all material respects with all relevant permits, licenses and regulations involving worker health and safety as well as the environment, there can be no assurance regarding continued compliance or ability of the Company to meet stricter environmental regulation, which may also require the expenditure of significant additional financial and managerial resources.

Moreover, mining companies are often targets of actions by non-governmental organizations and environmental groups in the jurisdictions in which they operate. Such organizations and groups may take actions in the future to disrupt Fury Gold's operations. They may also apply pressure to local, regional and national government officials to take action which may be adverse to Fury Gold's operations. Such actions could have an adverse effect on Fury Gold's ability to advance is projects and, as a result on its operations and financial performance.

Relationships with Local Communities and Indigenous Organizations

Negative relationships with Indigenous and local communities could result in opposition to the Company's projects. Such opposition could result in material delays in attaining key operating permits or make certain projects inaccessible to the Company's personnel. Fury Gold respects and engages meaningfully with Indigenous and local communities at all of its operations. Fury Gold is committed to working constructively with local communities, government agencies and Indigenous groups to ensure that exploration work is conducted in a culturally and environmentally sensitive manner.

Fury Gold believes its operations can provide valuable benefits to surrounding communities, in terms of direct employment, training and skills development and other benefits associated with ongoing community support. In addition, Fury Gold seeks to maintain its partnerships and relationships with local communities, including Indigenous peoples, and stakeholders in a variety of ways, including in-kind contributions, volunteer time, sponsorships and donations. Notwithstanding the Company's ongoing efforts, local communities and stakeholders could become dissatisfied with its activities or the level of benefits provided, which could result in civil unrest, protests, direct action or campaigns against it. Any such occurrence could materially and adversely affect the Company's business, financial condition or results of operations.

Environmental Protection

All phases of the Company's operations are subject to treaty provision and federal, provincial and local environmental laws and regulations. These provisions, laws and regulations address, among other things, the maintenance of air and water quality standards, land reclamation, the generation, transportation, storage and disposal of solid and hazardous waste, and the protection of natural resources and endangered species. Fury Gold has expanded significant financial and managerial resources to comply with environmental protection laws, regulations and permitting requirements in each jurisdiction where it operates. Fury Gold's exploration and drilling projects operate under various operating and environmental permits, licenses and approvals that contain conditions that must be met. Failure to obtain such permits, licenses and approvals and/or meet any conditions set forth therein could have a material adverse effect on Fury Gold's financial conditions or results of operations. Environmental hazards may exist on the Company's properties which are unknown to the Company at present and were caused by previous or existing owners or operators of the properties, for which the Company could be held liable.

Although Fury Gold believes its operations are in compliance, in all material respects, with all relevant permits, licenses and regulations involving worker health and safety as well as the environment, there can be no assurance regarding continued compliance or ability of Fury Gold to meet potentially stricter environmental regulation, which may also require the expenditure of significant additional financial and managerial resources.

Fury Gold cannot be certain that all environmental permits, licenses and approvals which it may require for its future operations will be obtainable on reasonable terms or that such laws and regulations would not have an adverse effect on any mining project that it might undertake. To the extent such permits, licenses and approvals are required and are not obtained, Fury Gold may be delayed or prohibited from proceeding with planned exploration or development of its projects, which would adversely affect Fury Gold's business, prospects and operations.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions including orders issued by governmental, regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed upon them for violation of applicable laws or regulations. Amendments to current provisions, laws and regulations and permits governing operations and activities of mining companies, or more stringent implementation thereof, could have a material adverse impact on Fury Gold and cause increases in capital expenditures or exploration costs, reduction in levels of exploration or abandonment or delays in the development of mining properties.

Moreover, mining companies are often targets of actions by non-governmental organizations and environmental groups in the jurisdictions in which they operate. Such organizations and groups may take actions in the future to disrupt Fury Gold's operations. They may also apply pressure to local, regional and national government officials to take actions which may be adverse to Fury Gold's operations. Such actions could have an adverse effect on Fury Gold' ability to advance its projects and, as a result, on its financial position and results.

Climate Change

Fury Gold recognizes climate change as an international and community concern. The effects of climate change or extreme weather events may cause prolonged disruption to the delivery of essential commodities which could negatively affect production efficiency. Furthermore, increased regulation of greenhouse gas emissions (including in the form of carbon taxes or other charges) may adversely affect the Company's operations and that related legislation is becoming more stringent.

Fury Gold is focused on operating in a manner that minimizes environmental impacts of its activities; however, environmental impacts from exploration and drilling activities are inevitable. The physical risks of climate change that may impact the Company's operations are highly uncertain and may be particular to the unique geographic circumstances associated with each of its operations. Such physical risks include, but are not limited to, extreme weather events, wildfires, resource shortages, changes in rainfall and storm patterns and intensities, water shortages, changing sea levels and changing temperatures. The Company's operations in Nunavut and northern British Columbia are particularly vulnerable to extreme weather due to their remoteness. There may also be supply chain implications in getting supplies to the Company's operations, including transportation issues. Fury Gold makes efforts to mitigate climate risks by ensuring that extreme weather conditions are included in its emergency response plans. However, there is no assurance that the response will be effective, and the physical risks of climate change will not have an adverse effect on the Company's operations and profitability.

Moreover, governments are introducing climate change legislation and treaties at the international, national and local levels. Regulations relating to emission levels and energy efficiency are becoming more stringent, which may result in increased costs of compliance. Some of the costs associated with reducing emissions can be offset by increased energy efficiency and technological innovation. However, if current regulatory trends continue, this may result in increased costs at some or all of the Company's operations. There is no assurance that such regulations will not have an adverse effect on the Company's results of operations and financial condition.

Changes in Government Regulation

In addition to climate change, other changes in government regulations or the application thereof and the presence of unknown environmental hazards on any of Fury Gold's mineral properties may result in significant unanticipated compliance and reclamation costs. Government regulations and treaty provisions relating to mineral rights tenure, permission to disturb areas and the right to operate can adversely affect Fury Gold.

Fury Gold may not be able to obtain all necessary licenses and permits that may be required to carry out exploration on any of its projects. Obtaining the necessary governmental permits is a complex, time consuming and costly process. The duration and success of efforts to obtain permits are contingent upon many variables not within our control. Obtaining environmental permits may increase costs and cause delays depending on the nature of the activity to be permitted and the interpretation of applicable requirements implemented by the permitting authority. There can be no assurance that all necessary approvals and permits will be obtained and, if obtained, that the costs involved will not exceed those that we previously estimated. It is possible that the costs and delays associated with the compliance with such standards and regulations could become such that we would not proceed with the development or operation.

Competitive Conditions

Fury Gold's activities are directed towards exploration, evaluation and development of mineral deposits. The mineral exploration industry is competitive and Fury Gold will be required to compete for the acquisition of mineral permits, claims, leases and other mineral interests for operations, exploration and development projects. As a result of this competition Fury Gold may not be able to acquire or retain prospective development projects, technical experts that can find, develop and mine such mineral properties and interests, workers to operate its mineral properties, and capital to finance exploration, development and future operations. The Company competes with other mining companies, some of which have greater financial resources and technical facilities, for the acquisition of mineral property interests, the recruitment and retention of qualified employees; and for investment capital with which to fund its projects. If Fury Gold is unable to successfully compete in its industry it could have a material adverse effect on the Company's results of operations and financial condition.

Local Community Uncertainties

Fury Gold's operations at the Committee Bay Project are located in Nunavut, and, as such, its operations are exposed to various levels of political, economic and other risks and uncertainties inherent in operating in such jurisdictions. Risks and uncertainties of operating in Nunavut may vary from time to time, but are not limited to a limited local workforce, poor infrastructure, a complex regulatory regime and harsh weather. Moreover, Fury Gold's operations at the Eau Claire Project are located within the Eeyou Istchee James Bay region, which is subject to a modern treaty with the Cree Nation. The treaty identifies land use categories across the region and communities of interest within the Cree Nations which will be consulted with during development of mineral projects in the Eau Claire Project area.

Acquisitions May Not Be Successfully Integrated

Fury Gold undertakes evaluations from time to time of opportunities to acquire additional mining assets and businesses. Any such acquisitions may be significant in size, may change the scale of the Company's business, may require additional capital, and/or may expose the Company to new geographic, political, operating, financial and geological risks.

Fury Gold's success in its acquisition activities depends on its ability to identify suitable acquisition candidates, acquire them on acceptable terms, and integrate their operations successfully. Any acquisitions would be accompanied by risks such as: (i) a significant decline in the relevant metal price after Fury Gold commits to complete an acquisition on certain terms; (ii) the quality of the mineral deposit acquired proving to be lower than expected; the difficulty of assimilating the operations and personnel of any acquired companies; (iii) the potential disruption of Fury Gold's ongoing business; (iv) the inability of management to realize anticipated synergies and maximize the financial and strategic position of Fury Gold; (v) the failure to maintain uniform standards, controls, procedures and policies; (vi) the impairment of relationships with employees, customers and contractors as a result of any integration of new management personnel; and (vii) the potential unknown liabilities associated with acquired assets and businesses.

Changes in the Market Price of Common Shares

The Common Shares are listed on the TSX and the NYSE American. The price of Common Shares is likely to be significantly affected by short-term changes in the gold price or in its financial condition or results of operations as reflected in its quarterly earnings reports. Other factors unrelated to Fury Gold's performance that may have an effect on the price of Common Shares and may adversely affect an investor's ability to liquidate an investment and consequently an investor's interest in acquiring a significant stake in Fury Gold include: a reduction in analyst coverage by investment banks with research capabilities, a drop in trading volume and general market interest in Fury Gold's securities, a failure to meet the reporting and other obligations under relevant securities laws or imposed by applicable stock exchanges could result in a delisting of the Common Shares and a substantial decline in the price of the Common Shares that persists for a significant period of time.

Properties May Be Subject to Defects in Title

Fury Gold has investigated its rights to explore and exploit its projects and, to the best of its knowledge, its rights are in good standing. However, no assurance can be given that such rights will not be revoked, or significantly altered, to Fury Gold's detriment. There can also be no assurance that Fury Gold's rights will not be challenged or impugned by third parties.

Some of Fury Gold's mineral claims may overlap with other mineral claims owned by third parties which may be considered senior in title to the Fury Gold mineral claims. The junior claim is only invalid in the areas where it overlaps a senior claim. Fury Gold has not determined which, if any, of the Fury Gold mineral claims is junior to a mineral claim held by a third party. Although Fury Gold is not aware of any existing title uncertainties with respect to any of its projects, there is no assurance that such uncertainties will not result in future losses or additional expenditures, which could have an adverse impact on Fury Gold's future cash flows, earnings, results of operations and financial condition.

Reliance on Contractors and Experts

In various aspects of its operations, Fury Gold relies on the services, expertise and recommendations of its service providers and their employees and contractors, whom often are engaged at significant expense to the Company. For example, the decision as to whether a property contains a commercial mineral deposit and should be brought into production depends in large part upon the results of exploration programs and/or feasibility studies, and the recommendations of duly qualified third party engineers and/or geologists. In addition, while Fury Gold emphasizes the importance of conducting operations in a safe and sustainable manner, it cannot exert absolute control over the actions of these third parties when providing services to Fury Gold or otherwise operating on Fury Gold's properties. Any material error, omission, act of negligence or act resulting in environmental pollution, accidents or spills, industrial and transportation accidents, work stoppages or other actions could adversely affect the Company's operations and financial condition.

Qualified and Experienced Employees, Management, and Board Members

Fury Gold's future success is based on successfully attracting, training and developing employees at all levels of the company from Site Staff to Executive Management. This is especially true for Geologists with the required skillset being available in the geographic areas that we operate in. The markets for highly skilled workers, as well as talented professionals and leaders in the mining and exploration industry are extremely competitive. The inability to meet our needs for skilled workers and talented professionals and leaders, whether through recruitment or internal training and development activities, could impact our ability to effectively implement our strategy. In addition to this, retaining qualified board members with diversified experience also brings valuable oversight and knowledge to the business.

Legal and Litigation Risks

All industries, including the exploration industry, are subject to legal claims, with and without merit. Defense and settlement costs of legal claims can be substantial, even with respect to claims that have no merit. Due to the inherent uncertainty of the litigation process, the resolution of any particular legal proceeding to which Fury Gold may become subject could have a material adverse effect on Fury Gold's business, prospects, financial condition, and operating results. Defense and settlement of costs of legal claims can be substantial.

Risks Relating to Statutory and Regulatory Compliance

Fury Gold's current and future operations, from exploration through development activities and commercial production, if any, are and will be governed by applicable laws, regulations and treaty obligations governing mineral claims acquisition, prospecting, development, mining, production, exports, taxes, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies engaged in exploration activities and in the development and operation of mines and related facilities, generally experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations, treaty obligations and permits. Fury Gold has received all necessary permits for the exploration work it is presently conducting; however, there can be no assurance that all permits which Fury Gold may require for future exploration, construction of mining facilities and conduct of mining operations, if any, will be obtainable on reasonable terms or on a timely basis or at all, or that such laws and regulations would not have an adverse effect on any project which Fury Gold may undertake.

Failure to comply with applicable laws, regulations, treaty obligations and permits may result in enforcement actions thereunder, including the forfeiture of claims, orders issued by regulatory or judicial authorities requiring operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or costly remedial actions. Fury Gold may be required to compensate those suffering loss or damage by reason of its mineral exploration activities and may have civil or criminal fines or penalties imposed for violations of such laws, regulations, treaty obligations and permits. Fury Gold is not currently covered by any form of environmental liability insurance. See " Insurance Risk", below.

Existing and possible future laws, regulations and permits governing operations and activities of exploration companies, or more stringent implementation thereof, could have a material adverse impact on Fury Gold and cause increases in capital expenditures or require abandonment or delays in exploration.

Insurance and Uninsurable Risks

Fury Gold is subject to a number of operational risks and may not be adequately insured for certain risks, including: accidents or spills, industrial and transportation accidents, which may involve hazardous materials, labour disputes, catastrophic accidents, fires, blockades or other acts of social activism, changes in the regulatory environment, impact of non-compliance with laws and regulations, natural phenomena such as inclement weather conditions, floods, earthquakes, ground movements, cave-ins, and encountering unusual or unexpected geological conditions and technological failure of exploration methods.

Limited Business History and No History of Earnings

Fury Gold has no history of operating earnings. The likelihood of success of Fury Gold must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with the establishment of its business. Fury Gold has limited financial resources and there is no assurance that additional funding will be available to it for further operations or to fulfill its obligations under applicable agreements. There is no assurance that Fury Gold will ultimately generate revenues, operate profitably, or provide a return on investment, or that it will successfully implement its plans.

Claims by Investors Outside of Canada

Fury Gold is incorporated under the laws of British Columbia. All of Fury Gold's directors and officers, with the exception of Mr. Tim Clark, CEO of the Company who is a US resident, and some of the experts named herein, are residents of Canada or otherwise reside outside of the United States, and all or a substantial portion of their assets, and a substantial portion of Fury Gold's assets, are located outside of the United States. As a result, it may be difficult for investors in the United States or outside of Canada to bring an action against directors, officers or experts who are not resident in the United States. It may also be difficult for an investor to enforce a judgment obtained in a United States court or a court of another jurisdiction of residence predicated upon the civil liability provisions of United States federal securities laws or other laws of the United States or any state thereof or the equivalent laws of other jurisdictions outside of Canada against those persons or Fury Gold.

No-Dividends Policy

No dividends on the Common Shares have been paid by Fury Gold to date. Payment of any future dividends, if any, will be at the discretion of the Board after taking into account many factors, including Fury Gold's operating results, financial conditions, development and growth, and current and anticipated cash needs.

Disclosure and Internal Controls

Internal controls over financial reporting are procedures designed to provide reasonable assurance that transactions are properly authorized, assets are safeguarded against unauthorized or improper use, and transactions are properly recorded and reported. Disclosure controls and procedures are designed to ensure that information required to be disclosed by a company in reports filed with securities regulatory agencies is recorded, processed, summarized and reported on a timely basis and is accumulated and communicated to Fury Gold's management, including its Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance with respect to the reliability of reporting, including financial reporting and financial statement preparation.

The Company documented and tested its internal controls over financial reporting during its most recent fiscal year in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act ("SOX"). SOX requires an annual assessment by management and an independent assessment by the Company's independent auditors of the effectiveness of the Company's internal controls over financial reporting. As the Company is presently a "non-accelerated filer", the Company's independent auditors are not required to attest to the effectiveness of the Company's internal control over financial reporting. While the Company's management has assessed and made a statement to internal controls over financial reporting, and the Company will be required to detail changes to our internal controls on a quarterly basis, the Company cannot provide assurance that the independent registered public accounting firm's review process in assessing the effectiveness of our internal controls over financial reporting, if obtained, would not find one or more material weaknesses or significant deficiencies in the Company's internal control over financial reporting.

The Company may fail to achieve and maintain the adequacy of its internal controls over financial reporting as such standards are modified, supplemented, or amended from time to time, and the Company may not be able to ensure that it can conclude on an ongoing basis that its internal controls over financial reporting are effective. The Company's failure to maintain effective internal controls over financial reporting could result in the loss of investor confidence in the reliability of its financial statements, which in turn could harm the Company's business and negatively impact the trading price of its common shares. In addition, any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm the Company's operating results or cause it to fail to meet its reporting obligations. There can be no assurance that the Company will be able to remediate material weaknesses, if any, identified in future periods, or maintain all the controls necessary for continued compliance, and there can be no assurance that the Company will be able to retain sufficient skilled finance and accounting personnel, especially in light of the increased demand for such personnel among publicly traded companies. Future acquisitions of companies, if any, may provide the Company with challenges in implementing the required processes, procedures and controls in its acquired operations. Acquired companies may not have disclosure controls and procedures or internal control over financial reporting that are as thorough or effective as those required by the securities laws currently applicable to the Company.

No evaluation can provide complete assurance that the Company's internal control over financial reporting will detect or uncover all failures of persons within the Company to disclose material information otherwise required to be reported. The effectiveness of the Company's controls and procedures could also be limited by simple errors or faulty judgment. The challenges involved in implementing appropriate internal controls over financial reporting will likely increase with the Company's plans for ongoing development of its business and this will require that the Company continues to improve its internal controls over financial reporting. Although the Company intends to devote substantial time and incur costs, as necessary, to ensure ongoing compliance, the Company cannot be certain that it will be successful in complying with SOX.

Cybersecurity Risks

Information systems and other technologies, including those related to the Company's financial and operational management, and its technical and environmental date, are an integral part of the Company's business activities. Network and information systems related events, such as computer hacking, cyber-attacks, computer viruses, works or other destructive or disruptive software, process breakdowns, denial of service attaches, or other malicious activities or any combination of the foregoing, or power outages, natural disasters, terrorist attacks or other similar events could result in damage to the Company's property, equipment and date. These events also could result in significant expenditures to repair or replace damage property or information systems and/or to protect them from similar events in the future. Furthermore, any security breaches such as misappropriation, misuse, leakage, falsification, accidental release or loss of information contained in the Company's information technology seems including personal and other data that could damage is reputation and require the Company to expend significant capital and other resources to remedy any such security breach. Insurance held by the Company may mitigate losses; however, in any such events or security breaches may not be sufficient to cover any consequent losses or otherwise adequately compensate the Company for disruptions to its business that may result and the occurrence of any such events or security breaches could have a material adverse effect on the Company's operations and financial results. There can be no assurances that these events and/or security breaches will not occur in the future or not have an adverse effect on the Company's operations and financial results.

Social Media Risks

As a result of social media and other web-based applications, companies today are at much greater risk of losing control over how they are perceived. Damage to Fury Gold's reputation can be the result of the actual or perceived occurrence of any number of events, and could include any negative publicity, whether true or not. Although the Company places a great emphasis on protecting its image and reputation, it does not ultimately have direct control over how it is perceived by others. Reputation loss may lead to increased challenges in developing and maintaining community relations, decreased investor confidence and act as an impediment to the Company's overall ability to advance its projects, thereby having a material adverse impact on the Company's business, financial condition or results of operations.

Liabilities relating to Past Issuances of Flow-Through Shares

The Company has issued Flow-Through Shares which requires that it expend the proceeds on exploration in Canada pursuant to the requirements of Canadian tax legislation which incentivized investors to purchase these shares (which aside form the tax aspects are in all respects ordinary common shares). Although the Company believes it will be able to incur the necessary amount of exploration expenditures as required by the Flow-Through Share subscription agreements, there is a risk that expenditures incurred by the Company may not be expended within the time limits, or that they will qualify as "Canadian exploration expenditures" ("CEE") , as such term is defined in the Income Tax Act (Canada) (the "Tax Act"), or that any such resource expenses incurred will be reduced by other events including failure to comply with the provisions of the Flow-Through Share subscription agreements or of applicable income tax legislation.

If the Company does not renounce to Flow-Through Share subscribers CEE within 2023, or if there is a reduction in such amount renounced pursuant to the provisions of the Tax Act, the Company may need to indemnify such subscribers, on the terms included in the Flow-Through Share subscription agreements, for an amount equal to the amount of any tax payable or that may become payable under the Tax Act. There were $0.6 million remaining expenditures as of December 31, 2023, in connection with the requirement to incur CEE in 2024.

On March 23, 2023, the Company issued 6,076,500 FTS of the Company for gross proceeds of $8.75 million. The Company is required to deploy the remaining $0.6 million of CEE on or before December 31, 2024 in respect of this financing and the balance in 2025 and failure to do so will result in material financial penalties.

The Company is a foreign private issuer which exempts us from complying with certain Exchange Act reporting requirements.

The Company is considered a "foreign private issuer" and will report under the Exchange Act as a non-U.S. company with foreign private issuer status. This means that, as long as the Company qualifies as a foreign private issuer under the Exchange Act, it will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act;

the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time;

- the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specified information, or current reports on Form 8-K, upon the occurrence of specified significant events.

The Company intends to take advantage of these exemptions (or voluntarily comply with the requirements applicable to U.S. domestic public companies) until such time as it is no longer a foreign private issuer. The Company would cease to be a foreign private issuer at such time as more than 50% of the Company's outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (i) the majority of the Company's executive officers or directors are U.S. citizens or residents; (ii) more than 50% of the Company's assets are located in the USA; or (iii) the Company's business is administered principally in the USA.

If the Company fails to maintain its foreign private issuer status and decides, or is required, to register as a U.S. domestic issuer, the regulatory and compliance costs to the Company will be significantly more than the costs incurred as a foreign private issuer. In such event, the Company would not be eligible to use foreign issuer forms and would be required to file periodic and current reports and registration statements on U.S. domestic issuer forms with the SEC, which are generally more detailed and extensive than the forms available to a foreign private issuer.

It may be difficult to enforce judgments or bring actions outside the United States against the Company and certain of its directors.

The Company is a British Columbia, Canada corporation and certain of its officers and directors are neither citizens nor residents of the USA. A substantial part of the assets of several of these persons are located outside the USA. As a result, it may be difficult or impossible for an investor:

to enforce in courts outside the U.S. judgments obtained in U.S. courts based upon the civil liability provisions of U.S. federal securities laws against these persons and the Company; or

to bring in courts outside the U.S. an original action to enforce liabilities based upon U.S. federal securities laws against these persons and the Company.

We may be a "passive foreign investment company" ("PFIC"), which may have adverse U.S. federal income tax consequences for U.S. investors.

We believe that we were classified as a PFIC for our most recently completed tax year, and based on current business plans and financial expectations, we expect that we may be a PFIC for our current tax year and subsequent tax years. If we are a PFIC for any year during a U.S. taxpayer's holding period of Common Shares, then such U.S. taxpayer generally will be required to treat any gain realized upon a disposition of the Common Shares or any so-called "excess distribution" received on its Common Shares as ordinary income, and to pay an interest charge on a portion of such gain or distribution. In certain circumstances, the sum of the tax and the interest charge may exceed the total amount of proceeds realized on the disposition, or the amount of excess distribution received, by the U.S. taxpayer. Subject to certain limitations, these tax consequences may be mitigated if a U.S. taxpayer makes a timely and effective QEF Election (as defined below) or a Mark-to-Market Election (as defined below). A U.S. taxpayer who makes a timely and effective QEF Election generally must report on a current basis its share of our net capital gain and ordinary earnings for any year in which we are a PFIC, whether or not we distribute any amounts to our shareholders. However, U.S. taxpayers should be aware that there can be no assurance that we will satisfy the record keeping requirements that apply to a qualified electing fund, or that we will supply U.S. taxpayers with information that such U.S. taxpayers require to report under the QEF Election rules, in the event that we are a PFIC and a U.S. taxpayer wishes to make a QEF Election. Thus, U.S. taxpayers may not be able to make a QEF Election with respect to their Common Shares. A U.S. taxpayer who makes the Mark-to-Market Election generally must include as ordinary income each year the excess of the fair market value of the Common Shares over the taxpayer's basis therein. This paragraph is qualified in its entirety by the discussion below under the heading "Certain United States Federal Income Tax Considerations - Passive Foreign Investment Company Rules." Each potential investor who is a U.S. taxpayer should consult its own tax advisor regarding the tax consequences of the PFIC rules and the acquisition, ownership, and disposition of the Common Shares.

Item 4 - Information on the Company

A. History and development of the company

Name, Address and Incorporation

The Company was incorporated under the Business Corporations Act (British Columbia) (the "BCBCA") on June 9, 2008, under the name Georgetown Capital Corp. The Company was a Capital Pool Company under the policies of the TSX Venture Exchange (the "TSXV") and, accordingly, on February 23, 2011, the Company completed a qualifying transaction (the "Qualifying Transaction") with Full Metal Minerals USA Inc., a wholly owned subsidiary of Full Metals Minerals Ltd. Pursuant to the Qualifying Transaction, the Common Shares began trading on the TSXV. On October 15, 2013, the Company changed its name to Auryn Resources Inc. On November 1, 2016, the Company completed its graduation to the TSX and the Common Shares began trading on the TSX. In connection with the Company's graduation to the TSX, the Common Shares were voluntarily delisted from the TSXV. On July 17, 2017, the Common Shares also commenced trading on the NYSE American.

Fury Gold is a reporting issuer in all of the provinces and territories of Canada. In addition, the Common Shares are registered under Section 12(b) of the U.S. Exchange Act by virtue of being listed on the NYSE American. The Company's registered and records office is at 1500-1055 West Georgia Street, Vancouver, BC, V6E 4N7, and its head office is located at 1630-1177 West Hastings Street, Vancouver, BC, V6E 2K3.

2020 Merger and Reorganization

On October 9, 2020, the Company acquired all of the then-issued and outstanding shares of Eastmain Resources Inc. ("Eastmain") in accordance with the terms and conditions of the arrangement agreement dated August 10, 2020 (the "Arrangement Agreement"). On October 5, 2020, the Eastmain Transaction and the Spinco Transactions (as defined herein) received the approval of both the Company's and Eastmain's shareholders, and on October 7, 2020, the British Columbia Supreme Court and the Ontario Superior Court of Justice approved the Reorganization Arrangement and the Eastmain Arrangement, respectively, and both courts issued final orders approving the Eastmain Transaction and the Spinco Transactions. In accordance with the terms of the Arrangement Agreement, the Company changed its name to "Fury Gold Mines Limited" pursuant to a certificate of change of name dated October 8, 2020.

Immediately following the closing of the Transaction, the Company's ticker symbol for the Common Shares was changed to "FURY" effective October 12, 2020 on the NYSE American and October 13, 2020 on the TSX. Eastmain's shares were delisted from the TSX and removed from the OTCQB after the end of trading on October 9, 2020. Immediately following the closing of the Eastmain Arrangement, Eastmain became a wholly-owned subsidiary of Fury Gold.

2022 Sale of mineral interests to Dolly Varden Silver Corporation for Dolly Varden Shares

On February 25, 2022, the Company announced the completion of the sale of the Homestake Ridge project to Dolly Varden Silver Corporation ("Dolly Varden"), a publicly traded corporation listed on the TSX Venture Exchange. Pursuant to the Homestake Purchase Agreement entered into on December 6, 2021, Dolly Varden acquired 100% of Homestake Resource Corporation from Fury in exchange for a $5 million cash payment and the issuance of 76,504,590 common shares of Dolly Varden. On October 13, 2022, the Company reduced its holdings to 59,504,590 by selling 17 million common shares, representing 22.2% of the Company's interest in Dolly Varden, for gross proceeds of $6.8 million, and resulting in the Company's interest in Dolly Varden being reduced to 25.8%. Following further dilutive equity financings completed by Dolly Varden on December 22, 2022 and November 2, 2023, Fury Gold held 59,504,590 common shares, representing a 22.03% interest in Dolly Varden as at December 31, 2023. The Company's interest in Dolly Varden was further reduced by 5,450,000 shares in a March 2024 private sale.

2022 Acquisition of 25% interest in Universal Mineral Services Ltd ("UMS")

On April 1, 2022, the Company purchased a 25% share interest in UMS, a private shared-services provider for nominal consideration. The remaining 75% of UMS is owned equally by three other junior resource issuers, namely Tier One Silver Inc, Coppernico Metals Inc, and Torq Resources Inc. who share a head office location in Vancouver, BC. Previously, UMS had been privately owned by a director in common, Mr. Ivan Bebek, then subsequently from January 1, 2022, by Mr. Steve Cook, another director in common, until March 31, 2022.

UMS is the private company through which its shareholders, including Fury Gold, share geological, financial, and transactional advisory services as well as administrative services on a full, cost recovery basis. Having these services available through UMS, on an as needed basis, allows the Company to maintain a more efficient and cost-effective corporate overhead structure by hiring fewer full-time employees and engaging outside professional advisory firms less frequently. The agreement has an indefinite term and can be terminated by either party upon providing 180 days' notice. Many of the Company's key personnel are now, or will be, directly employed by UMS and seconded to the Company and other members of the group.

2022 to 2024 Acquisition of additional interest in the Eleonore South Gold Project

On September 12, 2022, the Company and its joint venture partner Newmont Corporation ("Newmont"), through their respective subsidiaries, completed the acquisition of the remaining approximately 23.77% participating interest of Azimut Exploration Inc. in the ESJV, on a pro-rata basis. Following the completion of the transaction, the 100% ESJV participating interests were then held 50.022% by the Company and 49.978% by Newmont with Fury remaining operator under an amended and restated joint operating agreement.

On February 29, 2024, the Company completed the purchaser of Newmont's 49.978% interest in the Eleonore South Gold Project in Quebec ("Eleonore South") for $3,000,000. As a result of the consolidation, Fury Gold is the sole owner of Eleonore South. The Company acquired Newmont's 30,392,372 common shares or 10.98% of Sirios Resources Inc. ("Sirios") as part of the transaction for an additional $1,300,000. Sirios shares have been acquired for investment purposes, and Fury will evaluate its investment in Sirios on an ongoing basis with respect to any possible additional purchases or dispositions. In March 2024, the Company sold 1,514,000 common shares, resulting in the Company's interest in Sirios being reduced to 10.4%.

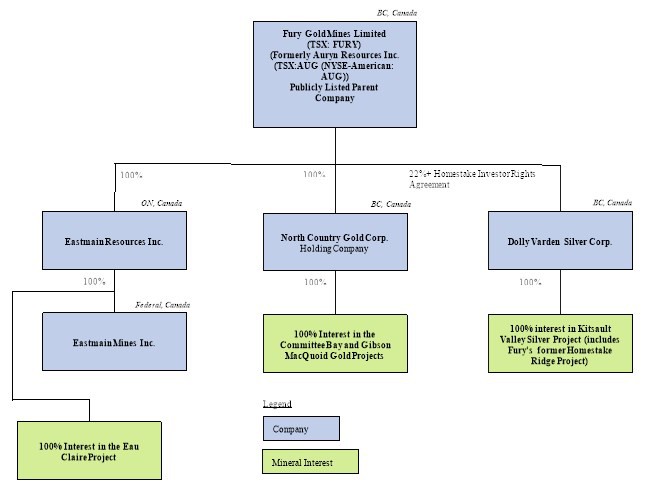

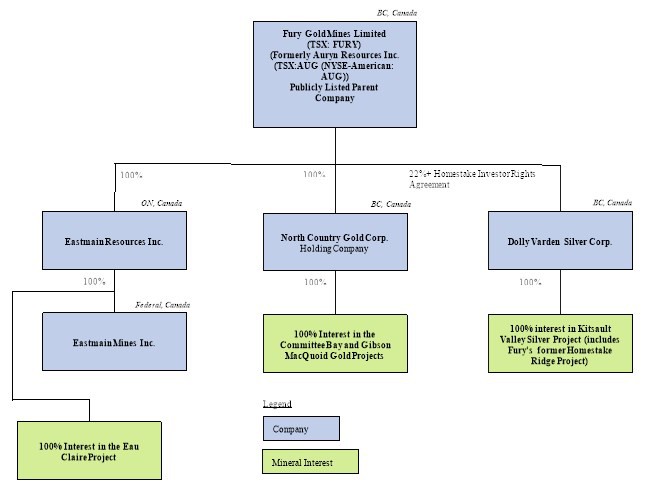

Inter-corporate Relationships

Fury Gold conducts its business through a number of wholly-owned subsidiaries depicted in a diagram under the Organizational structure section. It owns 25% of a shared service provider company (with three other junior resource explores each owning 25%) which is further discussed under "Related party Transactions" below.

Significant Events and Highlights

2021

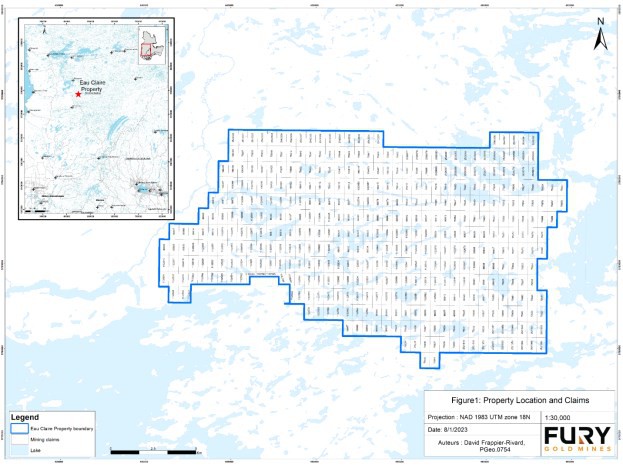

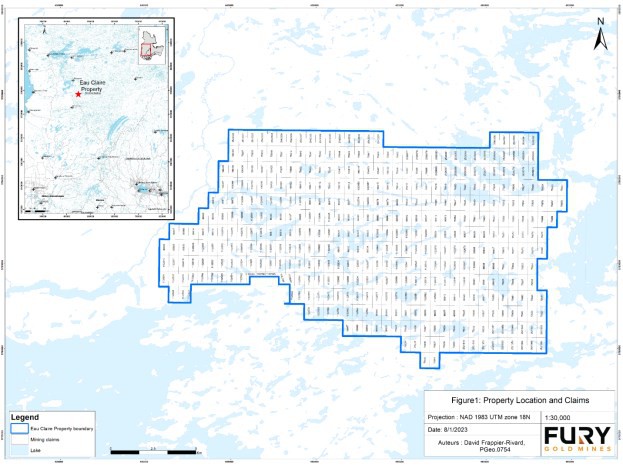

Eau Claire Exploration Program

In November 2020, Fury Gold commenced an ongoing initial 50,000m drill program at the Eau Claire project. The drill program consists of i) an infill phase focused on upgrading and expanding the current resource ("Infill Program") and ii) an exploration phase designed to test targets along the 4.5km long deposit trend ("Expansion Program"). To date a total of 35,297 metres, or approximately 70% of the total program, have been drilled at Eau Claire. The Company temporarily paused drilling at Eau Claire in the fourth quarter of 2021 to allow the receipt of pending drillhole assay results. The remainder of the program is planned to be completed in 2022.

During the third quarter of 2021, the Company completed biogeochemical surveys on three grids targeting six priority regional exploration targets ("Regional Exploration Program").

The Expansion Drill Program, Exploration Drill Program and the Regional Exploration Program are discussed below under "Eau Claire Project - Eau Claire Exploration Program ".

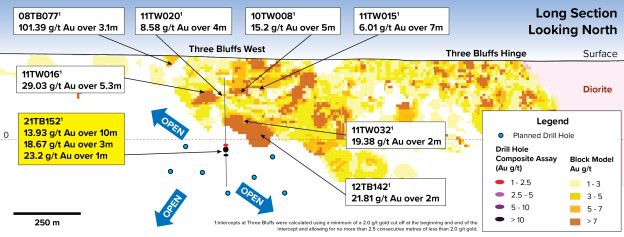

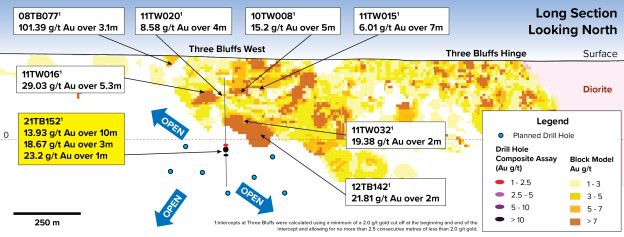

Committee Bay Project Drill and Exploration Program

The Company completed 2,587m of diamond drilling during a six-week field program in the third quarter of 2021. As summarized below under "Committee Bay Project - 2021 Committee Bay Exploration Program". The drilling was focused on expanding the defined high-grade mineralization at the Raven prospect and testing the potential mineralization below the current resource at the Three Bluffs deposit.

Changes to Management and the Board

On March 16, 2021, the Company announced that Tim Clark has been appointed a director of the Company, replacing Mr. Blair Schultz, an Eastmain nominee, who had resigned as a director. The Company also announced the appointment of Jeffrey Mason as lead director.

On August 18, 2021, the Company appointed Tim Clark to the position of Chief Executive Officer, replacing Mr. Timmins, who resigned to pursue other opportunities. Mr. Clark has 23 years of global capital markets experience with numerous major US, European and Canadian banks. Over the years, he has developed strong working relationships with Tier 1 institutional investors throughout the United States and Canada, providing corporate strategy, and peer and financial analysis and insights on corporates within the materials, commodities and mining sectors.

Financing

On October 13, 2021, the Company announced completion of a non-brokered private placement of 7,461,450 Units and raised gross proceeds of CAD$5,596,088. Each Unit consisted of one Common Share and one common share purchase warrant, (each, a "Warrant") entitling the holder to purchase one Common Share ("Warrant Share") at a price of CAD$1.20 for a period of three years. The expiry date of the Warrants can be accelerated to 30 days with notice from the Company should the Common Shares trade after the expiry of the four-month hold period at a price equal to or greater than CAD$1.50 for 20 consecutive trading days.

Corporate developments

On April 30, 2021, the Company announced the filing of a preliminary short form base shelf prospectus (the "Shelf Prospectus") with the securities commissions or similar regulatory authorities in all of the provinces and territories of Canada and has filed a corresponding registration statement on Form F-10 with the United States Securities and Exchange Commission. The final Shelf Prospectus was filed on May 10, 2021, and the Form F-10 registration statements was declared effective by the SEC on May 11, 2021. As a result of the completion of these filings, the Company is permitted to publicly offer up to $200 million of common shares, subscription receipts, warrants, and units or any combination thereof to investors in Canada and the United States during the 25-month period from May 10, 2021, that the Shelf Prospectus is effective.

On September 13, 2021, the Company announced that it had entered into a Royalty Purchase Agreement for the purchase of a 2% net smelter return royalty on certain claims at its Homestake Ridge project in British Columbia. The purchase price paid was $400,000, payable 25% in cash and 75% in shares. The purchase completed on September 27, 2021, and the Company issued 328,767 common shares on closing.

On December 6, 2021, the Company entered into a definitive agreement with Dolly Varden Silver Corp. pursuant to which the Company completed the sale of a 100% interest in Homestake Resources Corporation, the owner of a 100% interest in the Homestake Ridge Project, to Dolly Varden which completed on February 25, 2022, after Dolly Varden shareholder approval was obtained.

2022

Eau Claire Exploration Program

In October 2022, the Company completed the initial drilling program at Eau Claire and the Percival prospect, completing a total of approximately 52,700m from 2020-2022, with the final 17,700m completed in 2022. Additionally, the company completed a B-horizon soil sampling program at Lac Clarkie, a property adjacent to the Eau Claire project.

The Expansion Drill Program, Exploration Drill Program and the Regional Exploration Program are discussed below under "Eau Claire Project - 2022 Eau Claire Exploration Program".

Changes to Management and the Board

On March 9, 2022, the Company announced the appointment of Bryan Atkinson, P.Geo, to Senior Vice President (SVP), Exploration and Michael Henrichsen, P.Geo, to Chief Geological Officer, effective immediately. The Company also announced that Salisha Ilyas, Vice President of Investor Relations, has resigned to pursue other opportunities.