UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

or

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number 1-35529

PetroLogistics LP

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 45-2532754 (I.R.S. Employer Identification No.) | |

600 Travis Street, Suite 3250, Houston, Texas (Address of principal executive offices) | 77002 (Zip Code) |

(713) 255-5990

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Units | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yeso No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer x | |

Non-accelerated filer o | Smaller reporting company o | |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yeso Nox

The aggregate market value of the voting common units held by non-affiliates of the registrant as of June 28, 2013, on the last business day of the registrant’s most recently completed second fiscal quarter, was $465,507,000 (based on the closing price of the common units).

There were 139,212,737 common units outstanding as of March 1, 2014.

DOCUMENTS INCORPORATED BY REFERENCE

None

| PART I | ||

| Item 1. | 1 | |

| Item 1A. | 9 | |

| Item 1B. | 23 | |

| Item 2. | 23 | |

| Item 3. | 23 | |

| Item 4. | 23 | |

| PART II | ||

| Item 5. | 24 | |

| Item 6. | 26 | |

| Item 7. | 28 | |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 41 |

| Item 8. | 42 | |

| Item 9. | 70 | |

| Item 9A. | 70 | |

| Item 9B. | 70 | |

| PART III | ||

| Item 10. | 71 | |

| Item 11. | 76 | |

| Item 12. | 83 | |

| Item 13. | 84 | |

| Item 14. | 86 | |

| PART IV | ||

| Item 15. | 87 | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K for the year ended December 31, 2013 contains forward-looking statements. Statements that are predictive in nature, that depend upon or refer to future events or conditions or that include the words “will,” “believe,” “expect,” “anticipate,” “intend,” “estimate” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. Our forward-looking statements include statements about our business strategy, our industry, our future profitability, our expected capital expenditures and the impact of such expenditures on our performance. These statements involve known and unknown risks, uncertainties and other factors, including the factors described under Item 1A under the caption “Risk Factors,” that may cause our actual results and performance to be materially different from any future results or performance expressed or implied by these forward-looking statements.

You should not place undue reliance on our forward-looking statements. Although forward-looking statements reflect our good faith beliefs, forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements to differ materially from anticipated future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking statements made herein are made only as of the date of this report. We undertake no obligation to publicly update or revise any forward-looking statement after the date they are made, whether as a result of new information, future events, changed circumstances or otherwise, unless required by law.

PART I

Unless the context otherwise requires, references in this report to “PetroLogistics LP,” “the Partnership,” “we,” “our,” “us” or like terms used for periods after the closing of our initial public offering (the “IPO”) on May 9, 2012, refer to PetroLogistics LP. References in this report to the “predecessor,” “we,” “our,” “us” or like terms, when used for periods prior to the closing of our IPO, refer to PL Propylene LLC, our predecessor for accounting purposes. References in this report to “our sponsors” refer to Lindsay Goldberg LLC (or “Lindsay Goldberg”) and York Capital Management (or “York Capital”), which collectively and indirectly own 84% of PetroLogistics GP (our “General Partner”) and own approximately 63% of our common units.

Organizational Structure

The following chart provides a simplified overview of our organizational structure.

1

Our Business

We currently own and operate the only U.S. propane dehydrogenation (or “PDH”) facility (or “our facility”) producing propylene from propane. Propylene is one of the basic building blocks for petrochemicals and is utilized in the production of a variety of end uses including paints, coatings, building materials, clothing, automotive parts, packaging and a range of other consumer and industrial products. We are the only independent, dedicated “on-purpose” propylene producer in North America. We are strategically located in the vicinity of the Houston Ship Channel which is situated within the largest propylene consumption region in North America. We also have access to the leading global fractionation and storage hub for propane located at Mt. Belvieu, Texas. Our location provides us with excellent access and connectivity to both customers and feedstock suppliers.

We currently have multi-year contracts for the sale of our propylene with The Dow Chemical Company (“Dow”), Total Petrochemicals & Refining USA, Inc. (“Total”), BASF Corporation (“BASF”) and INEOS Olefins and Polymers USA (“INEOS”) that expire between 2016 and 2018 and a one-year contract with LyondellBasell Industries N.V. (“LyondellBasell”) that ends in December 2014. Our customer contracts provide for minimum and maximum offtake volumes, with the minimum customer-contracted volumes representing approximately 75% of our current facility capacity and the maximum reflecting approximately 96% of our current facility capacity. Each of our customer contracts contain pricing terms based upon market rates. In addition to our contracted sales, we have made and will continue to make additional propylene sales on a spot basis. Also, if necessary, we may purchase propylene in order to meet short-term customer obligations.

Propylene comprised 98% and 97% of our sales in 2013 and 2012, respectively. In addition to propylene, we also produce commercial quantities of hydrogen and C4 mix/C5+ streams.

Our Products and Customers

We derive our sales from three different sources: propylene, hydrogen, and C4 mix/C5+ streams. In general, we deliver our propylene to our customers by pipeline on a continuous basis and ratably throughout the month. We may elect to store product to help ensure that a constant supply of propylene is available to our customers in the event of a temporary outage. For more information relating to the sales, assets, profits and losses of our business, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” as well as “Item 8. Financial Statements and Supplementary Data.”

Contracted Propylene Sales

Since commencing operations, we have been party to long-term propylene sales contracts with Dow, Total and INEOS. After optimizing our facility, with a resulting increase in stated capacity, we added LyondellBasell and BASF as contract customers. Each contract details both minimum and maximum offtake volumes as well as pricing terms. As is customary in the propylene industry, our customer contracts are based on market prices. Consistent with industry practice for such contracts, our pricing terms with these customers reflect a specified discount to the monthly benchmark propylene price published by IHS Inc. (or “IHS”), formerly Chemical Market Associates, Inc. For the year ended December 31, 2013, Dow, Total, INEOS, BASF and LyondellBasell accounted for 44%, 21%, 18%, 9% and 6% of our total sales, respectively.

We deliver propylene to these customers through our integrated pipeline system, which directly connects our facility to the Dow and Total plants and through interconnected third-party pipelines, which connect our facility to INEOS, BASF, LyondellBasell and to other potential propylene customers.

The following table illustrates certain information regarding our propylene contracts with Dow, Total, INEOS, BASF and LyondellBasell (in millions of pounds):

| Company | Connections | Max | Min | Contract Term Ends | |||||||

| Contracts: | |||||||||||

| Dow | Direct | 690 | 510 | 12/31/2018 | |||||||

| Total | Direct | 300 | 240 | 12/31/2017 | |||||||

| INEOS | Shell | 288 | 228 | 12/31/2016 | |||||||

| BASF | Shell | 60 | 48 | 12/31/2016 | |||||||

| LyondellBasell | Direct | 60 | 60 | 12/31/2014 | |||||||

| Total | 1,398 | 1,086 | |||||||||

| % of our capacity | 96 | % | 75 | % | |||||||

Spot-Market Propylene Sales

Through our integrated pipeline system, we are also able to access other consumers of propylene which we are able to supply on a spot basis with any excess production. We are connected to major propylene consumers with the necessary logistics already in place. In 2013, we limited our spot sales activity in order to build inventory in anticipation of our first triennial maintenance project, or turnaround, which commenced on September 28, 2013, and was completed on October 30, 2013.

Hydrogen Gas Sales

As part of the PDH process, we produce commercially saleable quantities of hydrogen. Hydrogen is primarily consumed in numerous refinery processes, including fuel desulphurization. We are party to a ten-year contract for the sale of our hydrogen production. Any volumes we do not sell are consumed in our fuel system, reducing our requirement to purchase natural gas.

An additional benefit of our hydrogen production is that it provides a natural hedge against natural gas prices because hydrogen prices are indexed to natural gas. While an increase in natural gas prices would increase our operating costs (since we consume natural gas as a fuel), such increase would be partially offset by the higher prices we would earn through our hydrogen sales.

C4 Mix/C5+ Streams Sales

We also produce commercial quantities of C4 mix/C5+ streams. We sell the C4 mix stream to specialty chemical consumers or refiners. These customers transport the purchased volumes from our facility by truck with title transferring at our facility. The C5+ stream, which is heavy in aromatics, is transported by our pipeline to a Kinder Morgan terminal, and then sold to a third party.

Our Business Strategy

Our objective is to maximize our quarterly cash distributions to our unitholders by executing the following strategies:

| · | Focus on Operational Excellence, Reliable Production, Safety, and Training. Operational excellence, reliability and safety are our core values. One of the key factors driving our selection of the CATOFIN technology was its reliability. See “Our PDH Technology” below. We also assembled our key management team with an intentional focus on the complement of skills and experience necessary to deliver consistent and efficient operational results. |

| · | Continual Optimization of Our Facility. Our management team and engineering staff are continually working to further optimize and improve the operating performance of our facility. One major focus is to identify cost-efficient methods to increase propylene output beyond current production levels. We have initiatives underway to optimize propylene yield, energy efficiency and general plant operations. |

| · | Pursue Growth Opportunities. We intend to opportunistically pursue expansion and other growth opportunities. In addition, we continue to evaluate and pursue acquisition and organic development opportunities complementary to our operating platform. |

| · | Actively Manage Customer Portfolio. We believe that our current propylene customer portfolio represents an attractive composition of customers that serve diverse end-use markets and that are prominent industry members. We also have well-established relationships with other consumers of propylene developed through active cultivation and regular interaction. During 2013 we completed negotiations with Total, INEOS, BASF and LyondellBasell to extend the terms of their respective contracts with us. We continue to build on our existing relationships with the expectation of continued renewals when contracts expire. We also cultivate additional potential customers to add to our portfolio if existing contracts roll off or our facility’s capacity is expanded. |

| · | Distribute All of the Available Cash We Generate Each Quarter. The board of directors of our General Partner has adopted a policy under which we will distribute all of the available cash we generate each quarter, as described in “Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities—Our Cash Distribution Policy.” |

Our History

We are a Delaware limited partnership that was formed in June 2011.

We purchased a former olefins manufacturing facility from ExxonMobil Corporation (or “ExxonMobil”) in March 2008, and that facility was used as the platform for the construction of our propane dehydrogenation propylene production facility. Initial production at our facility commenced in October 2010. After an approximately year-long start-up and plant optimization phase, our facility demonstrated production rates at our current stated capacity (approximately 20% above our original nameplate capacity) beginning in December 2011.

On May 9, 2012, we completed our IPO. Our common units are traded on the New York Stock Exchange (or “NYSE”) under the symbol “PDH”. Pursuant to a Registration Statement on Form S-1, as amended through the date of its effectiveness, we sold 1,500,000 common units, and Propylene Holdings LLC (or "Propylene Holdings") sold 33,500,000 common units. We received net proceeds of approximately $24.0 million from our sale of the common units, after deducting underwriting discounts.

Our Sponsors

Lindsay Goldberg is a private equity investment firm with approximately $8.3 billion of capital under management that focuses on partnering with entrepreneurial management teams and closely held and family-owned businesses. The firm typically invests in companies in North America and Western Europe in the manufacturing, energy, financial and business services industries. Lindsay Goldberg has an investment structure that permits ownership for up to 20 years and has had a close relationship with our management since 2000.

York Capital is an event-driven global investment firm with approximately $19 billion of capital under management. The firm focuses on a variety of strategies, including private equity investing. Established in 1991, York Capital has offices in New York, Washington DC, London and Hong Kong.

Lindsay Goldberg and York Capital have been instrumental in our management team’s effort to implement the optimal operating and financial platform for the Partnership. Lindsay Goldberg and York Capital indirectly own 67% and 17% interests in our General Partner and 69,690,798 and 17,422,701 common units, respectively.

Our Facility

Our state-of-the-art facility is strategically located in the vicinity of the Houston Ship Channel on a site that was formerly the site of an ExxonMobil ethylene cracker. We believe the former ExxonMobil site is ideally suited for our facility based on its location, infrastructure, utilities, permits, logistics and certain operating units that we were able to utilize in the PDH process. As part of our purchase of the site, we acquired all major environmental and regulatory permits, and we were able to take advantage of these permits through amendments to reflect the specifications of the PDH process. Our facility had an original annual production capacity of 1.2 billion pounds of propylene. However, based on plant optimization and operating improvements our facility currently has an annual production capacity of approximately 1.4 billion pounds. In 2013, we produced 1.1 billion pounds of propylene. Production at our facility was reduced in 2013 as we completed our first triennial plant turnaround in October 2013. During the turnaround, we shut down the facility for 32 days to replace the reactor catalyst and perform other major maintenance activities designed to help ensure the long-term reliability and safety of integrated plant machinery.

Our facility is situated within the largest propylene consumption region in North America. We also have access through third parties to the leading global fractionation and storage hub for propane, our feedstock, located at Mt. Belvieu, Texas, which is approximately 30 miles from our facility.

Our customer contracts provide for potential maximum annual offtake volumes of approximately 1.4 billion pounds of propylene, approximately 96% of our facility's maximum annual production capacity. We believe that our facility has adequate capabilities to provide our customers with their contracted volumes of propylene. In the event that production at our facility is curtailed for any reason (including because of mechanical failure) and we elect not to declare force majeure, we believe that we will be able to satisfy our obligations under our customer contracts through our inventory and spot-market purchases of propylene.

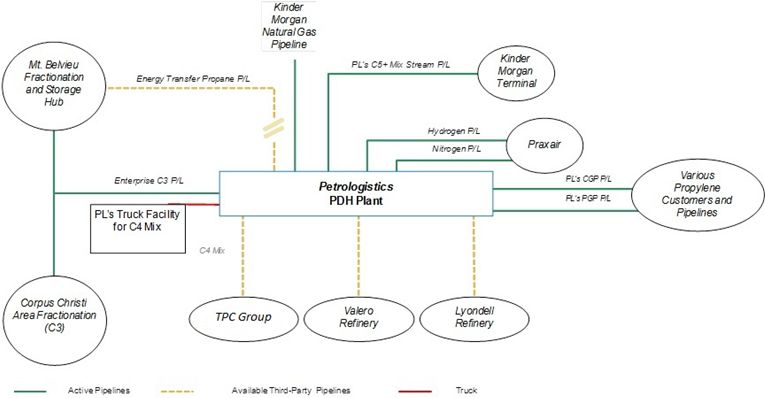

The following is an illustration of the extensive pipeline system either connected to or located within the vicinity of our facility which makes our location well-suited for the business of propylene production, followed by a table indicating pipeline system ownership:

| Pipeline | Ownership | |

| Propane | Enterprise | |

| Propane (currently not connected) | Lone Star (ETP) | |

| PGP | PetroLogistics | |

| CGP | PetroLogistics | |

| C4 Mix Stream (inactive) | PetroLogistics | |

| C5+ Stream | PetroLogistics | |

| Coker Gas (unutilized) | LyondellBasell | |

| FCC Gas (unutilized) | Valero | |

| Hydrogen Delivery | Praxair | |

| Nitrogen Delivery | Praxair | |

| Natural Gas | Kinder Morgan |

Our PDH Technology

Propane dehydrogenation is a straightforward chemical process that produces propylene by removing two atoms of hydrogen (H2) from one molecule of propane (C3 H8 ) to produce one molecule of propylene (C3 H6 ). The technology that is used is the CATOFIN process, which is licensed to us by CB&I Lummus on a non-exclusive and perpetual basis. We selected this technology because of its straightforward design, its record of high reliability and expected low operating costs. Further, our team developed and implemented a variety of energy cost-saving processes which improved upon the typical CATOFIN design, certain of which processes are the subject of a currently pending patent application. Our license with CB&I Lummus requires us to make additional payments if our annual production exceeds the amount set forth in our license. In 2012 we made a one-time payment to CB&I Lummus to cover actual increases in our production in excess of the original design basis and to allow for certain additional production increases. To the extent we further increase our operational capacity at the facility beyond the new designated level, we are responsible for additional one-time payments to CB&I Lummus for each metric ton of additional capacity above the new designated level.

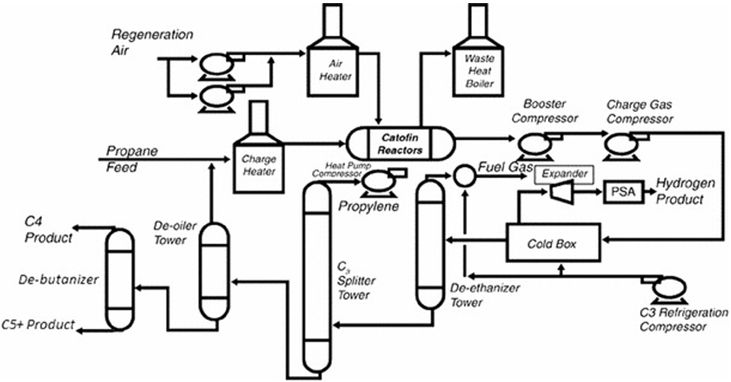

Propane dehydrogenation via the CATOFIN process consists of two general phases: the dehydrogenation phase and the purification phase. In the dehydrogenation phase, the propane feedstock is passed under a vacuum over a chromium–based catalyst contained in fixed bed reactors. Prior to the propane reaching the reactors the catalyst beds are heated to a high temperature with heated compressed air. After the dehydrogenation phase, the resulting propane/propylene mixed effluent is sent to the purification section of our facility where it is separated into polymer grade and chemical grade propylene, C4mix/C5+ streams, hydrogen and also a stream of propane that was not dehydrogenated in each pass over the catalyst beds. The undehydrogenated propane stream is then recycled back to the reactor section. The purification section of our facility utilizes a series of distillation towers, refrigeration units and other apparatus common to many olefins plants. Using our propane dehydrogenation process, approximately 1.2 pounds of propane is required to produce one pound of propylene. This ratio is referred to as the monomer factor.

The CATOFIN propane dehydrogenation process is illustrated below:

Process Flow Diagram

Although our facility relies on the typical CATOFIN process design, we also implemented a number of process innovations that reduce our energy costs. Certain of these process innovations are subject to a pending patent application. For example, the facility produces regeneration air (the hot air utilized to heat the catalyst beds in the reactors) using gas turbines instead of the typical compressor/heater configuration. Also, the hydrogen by-product is captured and purified by a pressure swing absorption unit and then sold to a third party rather than being merely sent to the fuel system in its unpurified form.

During the October 2013 turnaround, in addition to unloading and reloading six million pounds of catalyst, we also upgraded major systems such as the waste heat boiler and the regeneration air heater. We upgraded our emergency shut-off systems for three of our large compressors and reconfigured the air diffusers inside each reactor. We also performed significant maintenance including inspecting and rebuilding reactor valves, cleaning heat exchangers, and repairing expansion joints. Some of the preventative maintenance included upgrades to our electrical distribution system, upgrades to our facility's distributed control system and upgrades to our steam system.

Feedstock Supply

Propane is our sole feedstock. Propane is produced by extraction and separation from natural gas production streams via gas processing facilities and fractionation. It is also produced as a by-product of refineries. Our propane is currently provided to us by Enterprise Products Operating LLC (together with its affiliates, “Enterprise”) under a multi-year contract with market-based pricing consistent with industry practice. Under the propane supply contract, we pay a market price based on the published monthly average price for propane. The initial term of the propane supply contract is for a period of five years (expiring September 30, 2015). Enterprise delivers the propane we purchase to our facility through a connection to Enterprise’s propane pipeline system.

We believe that our supply strategy meets our ongoing feedstock requirements. However, if we choose not to or are unable to renew our Enterprise contract, we believe that, given our location, alternative propane supplies will be available from other suppliers in order to meet our production requirements.

Competition

We consider companies with net long positions in propylene to be our direct competitors, including Enterprise, Chevron Phillips, ExxonMobil Chemical, Shell Chemical, Flint Hills and the Williams Companies. Most of our competitors have significantly greater financial and other resources than us and are engaged on a national or international basis in many segments of the petroleum products business, including refining, transportation and marketing, on a scale substantially larger than ours.

Competition in our industry is determined by price considerations, logistics and, to some extent, stability of supply. Our ability to compete effectively depends on our responsiveness to customer needs, our pipeline connectivity to customer facilities and our ability to provide reliable supply at competitive prices. We are the only independent dedicated on-purpose propylene production facility in North America. We believe this is a significant advantage because it enables us to provide customers a more consistent, predictable supply offering than conventional suppliers that produce propylene as a by-product or co-product from other refinery processes, such as ethylene cracking. However, it is possible that in future years competition could come from the construction of additional on-purpose propylene facilities and offer our customers similar capabilities.

See “Item 1A. Risk Factors—Risks Related to our Business—We face competition from other propylene producers.”

Environmental Matters

The petrochemical business is subject to extensive and frequently changing federal, state and local laws and regulations relating to the protection of human health, workplace safety and the environment. These laws, their underlying regulatory requirements and their enforcement impact our business in a number of respects by imposing:

| · | The need to obtain, renew and comply with permits, licenses and authorizations; |

| · | Regulatory controls such as monitoring and recordkeeping requirements; |

| · | Requirements to install enhanced or additional pollution controls; |

| · | Fines and penalties for failing to comply with requirements of applicable laws or permits; and |

| · | Liability for the investigation and remediation of contaminated soil or groundwater at current facilities and off-site waste disposal locations. |

Environmental laws and regulations change regularly and any changes that result in more stringent requirements may cause us to make capital expenditures and could affect our operations and financial position adversely. While we believe that we are in substantial compliance with currently applicable environmental laws and regulations and that continued compliance with existing requirements would not have a material adverse impact on us or our business, there is no assurance that this trend will continue in the future. Failure to comply with environmental laws and regulations may result in the assessment of administrative, civil and criminal fines and penalties and the imposition of injunctive relief.

Our operations are subject to the requirements of the federal Occupational Safety and Health Act (“OSHA”) and comparable state statutes that regulate the protection of the health and safety of workers. In addition, the OSHA hazard communication standard requires that we maintain information about hazardous materials used or produced in our operations and that we provide this information to employees, state and local government authorities and local residents. Failure to comply with OSHA requirements, including general industry standards, recordkeeping requirements and monitoring of occupational exposure to regulated substances could reduce our ability to make distributions to our unitholders if we are subjected to fines or significant compliance costs.

Federal Clean Air Act

The federal Clean Air Act (“CAA”) and its implementing regulations as well as the corresponding state laws and regulations that regulate emissions of pollutants into the air affect our operations both directly and indirectly. We are required to comply with federal and state air permitting regulations or emissions control requirements relating to specific air pollutants. Some or all of the standards promulgated pursuant to the federal CAA, or any future standards which may be promulgated, may require the installation of controls or changes to our operations. If new controls or changes to operations are needed, then the costs could be material.

The federal CAA requires us, in certain situations, to obtain various construction and operating permits and to incur capital expenditures to install certain air pollution control devices at our PDH facility. Some of the applicable programs are the various general and specific source standards under the National Emission Standard for Hazardous Air Pollutants, New Source Performance Standards (“NSPS”), and New Source Review. Some of these programs are implemented by the Texas Commission on Environmental Quality (“TCEQ”) with oversight by the Environmental Protection Agency (“EPA”). We may incur substantial capital expenditures to maintain compliance with these and other air emission regulations. In addition, the EPA has objected to the issuance of air permits on various grounds, creating uncertainty about the authority of TCEQ to issue permits for air emissions, which could have a material adverse effect on our operations in the event that the EPA were to object to a permit issued by TCEQ for our operations.

In addition, the EPA adopted rules to require the development of a Risk Management Plan to prevent the accidental release of hazardous substances that could harm public health or the environment.

The TCEQ has finalized rules in connection with CAA Section 185 fee regulations. The fees are expected to be imposed on businesses starting in 2014. We believe, however, that such fees and our other state and federal air emission obligations under the CAA and similar statutes will not have a material adverse effect on our operations, and the requirements are not expected to be any more burdensome to us than any other similarly situated company.

Climate Change

Responding to certain scientific studies suggesting that emissions of certain gases, commonly referred to as greenhouse gases (“GHG”), which include gases associated with oil and gas production such as carbon dioxide, methane, and nitrous oxide, among others, may be contributing to a warming of the earth’s atmosphere and other adverse environmental effects, the U.S. Congress has proposed numerous legislative measures to restrict or require emissions fees for greenhouse gases. However, to date, there have been no resulting federal regulations promulgated that specifically restrict greenhouse gas emissions, which has resulted in certain states and regional partnerships taking the initiative. Efforts to curb greenhouse gas emissions continue to be led by the EPA greenhouse gas regulations and the efforts of certain states.

Following the U.S. Supreme Court’s 2007 decision in Massachusetts, et al. v. EPA, finding that greenhouse gases fall within the CAA definition of “air pollutant,” the EPA determined that greenhouse gases from certain sources “endanger” public health or welfare. As a result, the EPA has taken the position that the CAA requires an assessment of greenhouse gas emissions within the meaning of certain provisions of the CAA permitting process for certain large new or modified stationary sources under the EPA’s Prevention of Significant Deterioration (“PSD”) and Title V permit programs beginning in 2011. Facilities triggering permit requirements may be required to reduce greenhouse gas emissions consistent with “best available control technology” standards which have yet to be developed. Such changes will also affect state air permitting programs in states that administer the CAA under a delegation of authority. Additionally, in November 2010, the EPA finalized rules expanding its Mandatory Greenhouse Gas Reporting Rule to apply to the oil and natural gas industries.

President Obama recently announced his Climate Action Plan. One of the major components of this plan is to reduce greenhouse gas emissions from the electricity generation sector. On September 20, 2013, the EPA proposed separate standards for coal and natural gas-fired power plants. We expect any final rule that may be promulgated as a result of this proposed rule to be appealed and otherwise subjected to various judicial challenges, the outcome of which cannot be predicted. Although these rules do not apply directly to our operations, should the EPA impose comparable regulations on us, the cost of compliance could be significant.

To the extent that our operations are subject to the EPA’s GHG regulations, we may face increased capital and operating costs associated with new or expanded facilities. Significant expansions of our existing facility or construction of new facilities may be subject to the CAA'S PSD requirements under the EPA’s GHG “Tailoring Rule.” Any further regulation may increase our operational costs.

In June 2013, the Texas Legislature passed a law authorizing the TCEQ to develop rules to authorize major sources of GHG emissions to the extent required by federal law. Texas is currently subject to a Federal Implementation Plan (FIP), which means that major sources of GHG emissions are required to obtain a GHG permit from the EPA. In February 2014, the EPA issued a pre-publication copy of a proposed rule that, if adopted, approves Texas’ revised State Implementation Plan (SIP) and would transfer GHG permitting in Texas from the EPA to the TCEQ. In anticipation of the final approval of the EPA’s rule, the TCEQ has proposed rules regarding a takeover of the GHG permitting program. The TCEQ regulations are expected to be published and take effect later this year.

Clean Water Act (“CWA”)

The federal CWA affects our operations by prohibiting discharges of pollutants into, or impacting, navigable waters except in compliance with permits issued by federal and state governmental agencies. Regular monitoring, reporting requirements and performance standards are preconditions for the issuance and renewal of permits. The federal government has delegated authority to Texas to manage the CWA permit and enforcement process. The CWA and comparable state statutes provide for civil, criminal, and administrative penalties for the unauthorized discharge of pollutants into wetlands or other waters and impose liability on parties responsible for those discharges for the cost of cleaning up any environmental damage or natural resource damages resulting from the release. Our business maintains waste water and storm water discharge permits as required under the National Pollutant Discharge Elimination System program and the Texas Pollutant Discharge Elimination System program. Under the CWA, onshore facilities that could reasonably be expected to cause substantial harm to the environment by discharging pollutants to navigable waters are required to maintain plans for spill prevention, preparedness and response. We have implemented internal programs to oversee our compliance efforts and we believe that we are in substantial compliance with the CWA. In the future, changes to the CWA, state law, or state and federal regulations could require us to make additional capital expenditures or incur additional costs in order to comply with new rules and could have a significant effect on our profitability.

Emergency Planning and Community Right-to-Know Act (“EPCRA”)

The EPCRA requires facilities to report certain chemical inventories to local emergency planning committees and response departments. We believe that we are in substantial compliance with our EPCRA reporting requirements.

Resource Conservation and Recovery Act (“RCRA”)

Our operations are subject to the RCRA requirements for the generation, management, and disposal of hazardous wastes. These requirements entail certain costs. When feasible, materials that would be subject to RCRA are recycled instead of being disposed of. Though we believe that we are in substantial compliance with the existing requirements of RCRA, we cannot assure you that compliance with existing and future RCRA requirements will not entail costs that are significant.

Comprehensive Environmental Response, Compensation, and Liability Act (or “CERCLA”)

CERCLA and comparable state laws impose liability, without regard to fault or the legality of the original conduct, on certain classes of persons who are considered to be responsible for or contributed to the release of a "hazardous substance" into the environment. These persons include the owner or operator of the facility where the release occurred and companies that disposed or arranged for the disposal of the hazardous substances found at the facility. Under CERCLA, these persons may be subject to joint and several liability for the costs of cleaning up the hazardous substances that have been released into the environment, for damages to natural resources, and for the costs of certain health studies. CERCLA also authorizes the EPA, and in some instances third parties, to act in response to threats to the public health or the environment and to seek to recover from the responsible persons the costs they incur. It is possible for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by hazardous substances or other pollutants released into the environment. In the course of our ordinary operations, we may generate substances that fall within CERCLA’s definition of a hazardous substance, and as a result, we may be jointly and severally liable under CERCLA for all or part of the costs required to clean up sites at which those hazardous substances have been released into the environment.

Under CERCLA, we could be required to remove or remediate previously disposed wastes, including wastes disposed of or released by prior owners or operators, to clean up contaminated property, including groundwater contaminated by prior owners or operators.

Safety, Health and Security Matters

Our extensive safety program includes, among other things, (1) employing two full-time safety professionals, (2) implementing policies and procedures to protect employees and visitors at our facility (3) conducting routine safety tests at our facility and (4) ensuring that each employee undergoes the required safety, hazard and task training.

Employees

To carry out our operations, our General Partner currently employs approximately 110 employees. Our employees are not represented by a labor union and are not covered by a collective bargaining agreement. We believe that we have good relations with our General Partner’s employees.

Website Access to Our Periodic SEC Reports

We file and furnish Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and amendments to these reports with the SEC, which are available free of charge through our website (http://www.petrologistics.com) as soon as reasonably practicable after such reports are filed with or furnished to the SEC.

We are subject to certain risks and hazards due to the nature of the business activities we conduct, including the risks discussed below and set forth elsewhere in this annual report. If any of the following risks and uncertainties develops into an actual event, our business, financial condition, cash flows and results of operations could be materially adversely affected. In that case, we might not be able to pay distributions on our common units and the trading price of our common units could decline materially.

Risks Related to Our Business

We may not have sufficient available cash to pay any quarterly distributions on our common units.

We may not have sufficient available cash each quarter to enable us to pay any distributions to our common unitholders. The amount of cash we will be able to distribute on our common units principally depends on the amount of cash we generate from our operations, which is primarily dependent upon the operating margins we generate. Our operating margins, and thus, the cash we generate from operations have been volatile, and we expect that they will continue to fluctuate from quarter to quarter based on, among other things:

| · | the amount of propylene we are able to produce from our facility, which could be adversely affected by, among other things, accidents, equipment failure or severe weather conditions; |

| · | the price at which we are able to sell propylene, which is affected by the supply of and demand for propylene; |

| · | the level of our operating costs, including the cost of propane, our sole feedstock, as well as the price of natural gas, and electricity and other costs; |

| · | our ability to produce propylene products that meet our customers’ specifications; |

| · | non-payment or other non-performance by our customers and suppliers; and |

| · | overall economic and local market conditions. |

In addition, the actual amount of cash we will have available for distribution will depend on other factors, some of which are beyond our control, including:

| · | the level of capital expenditures we make; |

| · | our debt service requirements; |

| · | fluctuations in our working capital needs; |

| · | our ability to borrow funds and access capital markets; |

| · | planned and unplanned maintenance at our facility, which, based on determinations by the board of directors of our General Partner to maintain reserves, may negatively impact our cash flows in the quarters leading up to and including the quarter in which such maintenance occurs; |

| · | restrictions on distributions and on our ability to make working capital borrowings; and |

| · | the amount of cash reserves established by our General Partner. |

Our partnership agreement does not require us to pay a minimum quarterly distribution. The amount of distributions that we pay, if any, and the decision to pay any distribution at all, will be determined by the board of directors of our General Partner. Our quarterly distributions, if any, will be subject to significant fluctuations based on the above factors.

For a description of additional restrictions and factors that may affect our ability to pay distributions, see “Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities—Our Cash Distribution Policy.”

The amount of our quarterly cash distributions, if any, can vary significantly both quarterly and annually and will be directly dependent on the performance of our business. Unlike most publicly traded partnerships, we do not have a minimum quarterly distribution or employ structures intended to consistently maintain or increase distributions over time.

Investors who are looking for an investment that will pay predictable quarterly distributions should not invest in our common units. We expect our business performance will be more cyclical and volatile, and our cash flows will be less stable, than the business performance and cash flows of most publicly traded partnerships. As a result, our quarterly cash distributions will be cyclical and volatile and are expected to vary quarterly and annually. Unlike most publicly traded partnerships, we do not have a minimum quarterly distribution or employ structures intended to consistently maintain or increase distributions over time. The amount of our quarterly cash distributions will be directly dependent on the performance of our business, which will be volatile as a result of a number of factors including fluctuations in propane and propylene prices and the demand for propylene products. Because our quarterly distributions will be subject to significant fluctuations directly related to the cash we generate after payment of our fixed and variable expenses and other cash reserves established by our General Partner, future quarterly distributions paid to our unitholders will vary significantly from quarter to quarter and may be zero. Given the cyclical and volatile nature of our business, our unitholders will have direct exposure to fluctuations in the price of propylene and the cost of propane.

The amount of cash we have available for distribution to unitholders depends primarily on our cash flow and not solely on profitability.

The amount of cash we have available for distribution depends primarily upon our cash flow and not solely on profitability, which may be affected by non-cash items. For example, we may have extraordinary capital expenditures and major maintenance expenses in the future. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation—Liquidity and Capital Resources—Capital Spending.” As a result, we may make cash distributions during periods when we report losses and may not make cash distributions during periods when we report net income.

The board of directors of our General Partner may modify or revoke our cash distribution policy at any time at its discretion. Our partnership agreement does not require us to pay any distributions at all.

The board of directors of our General Partner has adopted a cash distribution policy pursuant to which we will distribute all of the available cash we generate each quarter to unitholders of record on a pro rata basis. However, the board may change such policy at any time at its discretion and could elect not to pay distributions for one or more quarters. See “Our Cash Distribution Policy.”

Our partnership agreement does not require us to pay any distributions at all. Accordingly, investors are cautioned not to place undue reliance on the permanence of such a policy in making an investment decision. Any modification or revocation of our cash distribution policy could substantially reduce or eliminate the amounts of distributions to our unitholders. The amount of distributions we make, if any, and the decision to make any distribution at all will be determined by the board of directors of our General Partner, whose interests may differ from those of our common unitholders. Our General Partner has limited fiduciary and contractual duties, which may permit it to favor its own interests or the interests of Propylene Holdings and its direct and indirect owners to the detriment of our common unitholders.

The propylene business is, and propylene prices are, cyclical and highly volatile and have experienced substantial downturns in the past. Cycles in demand and pricing could potentially expose us to significant fluctuations in our operating and financial results, and expose you to substantial volatility in our quarterly cash distributions and material reductions in the trading price of our common units.

We are exposed to fluctuations in propylene demand and supply in the petrochemical industry. These fluctuations historically have had and could in the future have significant effects on prices and, in turn, significant effects on our financial condition, cash flows and results of operations, which could result in significant volatility in or material adverse effects on the price of our common units or our ability to make quarterly cash distributions on our common units.

Propylene is a commodity, and its price can be cyclical and highly volatile. The price of propylene depends on a number of factors, including the price of crude oil and other commodities, general economic conditions, cyclical trends in end-user markets and supply and demand imbalances.

Demand for propylene is dependent on demand for petrochemicals by the global construction, automotive and housing industries. Propylene supply is affected by available capacity and operating rates, raw material costs, government policies and global trade. A decrease in propylene prices not accompanied by a commensurate decrease in propane prices would have an adverse effect on our cash flow and our ability to make quarterly distributions. If propylene prices fall significantly, we may not generate sufficient revenue to operate profitably or cover our costs, and our ability to make quarterly distributions would be materially adversely affected. Similarly, if our customers nominate at the lower end of their required minimum offtake volumes and we are unable to sell sufficient quantities of our excess supply into the spot market, we may not generate sufficient sales to operate profitably or cover our costs, and our ability to make quarterly distributions will be materially adversely affected.

Our results of operations, financial condition and ability to make cash distributions to our unitholders may be adversely affected by the supply and price levels of propane.

The sole feedstock used in our production is propane. The price of propane is correlated to the price of crude oil and is influenced by the price of natural gas. The prices for crude oil and natural gas are cyclical and volatile, and as a result, the price of propane can be cyclical and volatile. The propane export market may also impact the price of propane. According to the U.S. Energy Information Administration, propane exports increased significantly during 2013.

The cost of propane represents a substantial portion of our cost of sales. If propane costs increase, the market price of propylene may not rise correspondingly or at all. Timing differences between propane prices, which may change daily, and the market price of propylene, which is set monthly, may narrow the propane-to-propylene spread and thus reduce our cash flow, which reduction could be material. Based on our current output, we obtain all of the propane we need from Enterprise through its propane pipeline system, which is connected to the natural gas liquids and refined products storage hub at Mt. Belvieu. The price that we pay Enterprise for propane fluctuates based on market prices. Propane prices could significantly increase in the future. In addition, following the expiration of our current propane supply contract, the price of storage and transportation of propane to our site is subject to change and could adversely impact our financial results.

Significant price volatility or interruptions in supply of other raw materials, such as natural gas, electricity and nitrogen, may result in increased costs that we may be unable to pass on to our customers, which could reduce our profitability.

The raw materials we consume, such as natural gas, electricity and nitrogen, are generally commodity products that are readily available at market prices. We generally enter into supply agreements with particular suppliers, but disruptions of existing supply arrangements could substantially impact our profitability. If certain of our suppliers are unable to meet their obligations under present supply agreements, we may be forced to pay higher prices to obtain the necessary materials from other sources. In addition, if any of the raw materials that we use become unavailable within the geographic area from which they are now sourced, then we may not be able to obtain suitable or cost effective substitutes. Any interruption in the supply of raw materials will increase our costs or decrease our sales, which will reduce our cash flow.

Our supply agreements typically provide for market-based pricing and provide us no protection against price volatility. If the cost of any of our raw materials rises, the market price of propylene may not rise correspondingly or at all. Timing differences between raw material prices, which may change daily, and the market price of propylene, which is set monthly, may have a negative effect on our cash flow. Any cost increase could have a material adverse effect on our business, results of operations, financial condition and liquidity.

Our operations are dependent on third-party suppliers, including Enterprise, which owns the propane pipeline that provides propane to our facility. The inability of a third-party supplier to perform in accordance with its contractual obligations or an election by any of our suppliers not to renew our supply contracts on comparable terms could have a material adverse effect on our results of operations, financial condition and our ability to make cash distributions to our unitholders.

Our operations depend in large part on the performance of third-party suppliers, including Enterprise for the supply of propane, a subsidiary of Kinder Morgan Energy Partners, L.P. (or “Kinder Morgan”), for the supply of natural gas and Praxair for the supply of nitrogen. Should Enterprise, Kinder Morgan, Praxair or any of our other third-party suppliers fail to perform in accordance with existing contractual arrangements, we could be forced to halt operations at our facility. Alternative sources of supply could be difficult or impossible to obtain. Any shutdown of our operations, even for a limited period, could have a material adverse effect on our results of operations, financial condition and ability to make cash distributions to our unitholders.

When our current supply contracts expire, we may be unable to obtain extensions or replacement contracts on substantially similar terms. If we are unable to find replacement contracts on terms as favorable as our current supply contracts, our business, results of operations, financial condition and our ability to pay cash distributions to our unitholders may be materially adversely affected.

Our facility faces (and the facilities of our suppliers and customers face) operating hazards and interruptions, including planned and unplanned maintenance or downtime. We could face potentially significant costs to the extent these hazards or interruptions cause a material decline in production.

Our operations, located at a single location, are subject to significant operating hazards and interruptions. Any significant curtailing of production at our facility could result in materially lower levels of sales and cash flow for the duration of any shutdown and materially adversely impact our ability to make cash distributions to our unitholders. Operations at our facility could be curtailed or partially or completely shut down, temporarily or permanently, as the result of a number of circumstances, most of which are not within our control. With respect to planned downtime, during the fourth quarter of 2013, we completed our first plant turnaround which required us to bring the plant down for 32 days to replace the reactor catalyst and perform major maintenance on equipment to help ensure the long-term reliability of plant operations. With respect to unplanned downtime, in December of 2012, our facility experienced a mechanical failure in one of our compressors, which required approximately three weeks to repair. We plan to bring the facility down in March of 2014 for approximately eight days in order to replace two heat exchangers and perform additional work. Other scenarios that could result in a shutdown of our facility include:

| · | unplanned maintenance or catastrophic events such as a major accident or fire, damage by severe weather, flooding or other natural disaster; |

| · | planned maintenance for catalyst change-out, repairs, plant enhancement or other purposes; |

| · | labor difficulties that result in work stoppage or slowdown; |

| · | environmental proceedings or other litigation that compel the cessation of all or a portion of the operations at our facility; |

| · | increasingly stringent environmental regulations; |

| · | a disruption in the supply of propane, natural gas or nitrogen to our facility; and |

| · | a governmental limitation on the use of propylene products, either generally or specifically those processed at our facility. |

The magnitude of the effect on us of any shutdown will depend on the length of the shutdown and the extent of the facility operations affected by the shutdown. A major accident, fire, flood or other event could damage our facility or the environment and the surrounding community or result in injuries or loss of life. Planned and unplanned maintenance could reduce our net income, cash flow and ability to make cash distributions during the period of time that any of our units is not operating. Any planned and unplanned future downtime could have a material adverse effect on our ability to make cash distributions to our unitholders.

Many of the factors described above could also affect the facilities of any of our suppliers or customers. Any significant downtime affecting a material supplier or customer could also have a material adverse effect on our operations with a resulting impact on our ability to make cash distributions to our unitholders.

Our facility requires a planned maintenance turnaround approximately every three years, which could have a material impact on our cash flows and ability to make cash distributions in the quarter or quarters in which it occurs. Our turnaround in 2013 lasted 32 days. We assume future turnarounds will be of a similar duration, provided the actual duration will be dependent upon the scope of any additional work we elect to perform.

Based upon the decision(s) made by the board of directors of our General Partner, the cash available for distribution in the quarter(s) preceding such a planned maintenance event may be adversely impacted by the amount of reserves the board of directors of our General Partner establishes to fund the cost of the planned maintenance event. In the period preceding our 2013 turnaround, the board of directors of our General Partner reserved $77.0 million to fund: (i) capital costs associated with the change-out of our reactor catalyst described elsewhere in this annual report, (ii) other capital and maintenance projects completed as part of the turnaround and (iii) all or a portion of the projected lost margin due to the purchase of propylene as inventory for sales to our customers during the turnaround. Additional amounts may be required to be reserved from available cash generated in a quarter subsequent to such a planned maintenance event should the scope of the actual work performed during such period be materially different than that planned.

We are not fully insured against all risks incident to our business, and if an accident or event occurs that is not fully insured it could adversely affect our business.

A major accident, fire, flood or other event could damage our facility or the environment and the surrounding community or result in injuries or loss of life. If we experience significant property damage, business interruption, environmental claims or other liabilities, our business could be materially adversely affected to the extent the damages or claims exceed the amount of valid and collectible insurance available to us. We are currently insured under property, business interruption, general liability (including sudden and accidental pollution liability), business automobile, workers compensation and excess liability insurance policies. The property and business interruption insurance policies have a $1.0 billion single occurrence limit with a $1.0 million deductible for physical damage and a 60-day waiting period before losses resulting from business interruptions are recoverable. The policies also contain exclusions and conditions that could have a materially adverse impact on our ability to receive indemnification thereunder, as well as customary sub-limits for particular types of losses. For example, the current property policy contains specific sub-limits of $400.0 million for damage caused by flooding and $100.0 million for damage caused by named windstorms, with deductibles of $1.0 million and $5.0 million per occurrence, respectively. We are fully exposed to all losses in excess of the applicable limits and sub-limits and for losses due to business interruptions of fewer than 60 days. In addition, our insurance portfolio does not cover all of the operating risks that we face. For example, we do not carry contingent business interruption insurance, which would reimburse us for the lost profits and expenses that resulted from an insurable loss suffered by one or more of our customers or suppliers. The occurrence of any operating risk not covered by our insurance could have a material adverse effect on our business, financial condition, results of operations and ability to pay distributions to our unitholders. Our general liability insurance policy, which includes sudden and accidental pollution coverage expires on March 1, 2015, and our property and business interruption insurance policies expire on May 1, 2014. We are currently in negotiations with our underwriters as to the extension of our property and business interruption insurance policies. Market factors, including but not limited to catastrophic perils that impact our industry, significant changes in the investment returns of insurance companies, insurance company solvency trends and industry loss ratios and loss trends, can negatively impact the future cost and availability of insurance. There can be no assurance that we will be able to buy and maintain insurance in the future with adequate limits, reasonable pricing terms and conditions.

We have a limited operating history during which we have experienced both planned and unplanned downtime. As a result, you may have difficulty evaluating our ability to pay quarterly cash distributions to our unitholders or our ability to be successful in implementing our business strategy.

We are dependent on our facility as our sole source of propylene and by-products to generate sales, and we are, therefore, dependent on the continued operation of this facility to generate our sales. As a newly constructed complex processing facility, the operating performance of our facility over the long-term is not yet proven. We have already encountered and will continue to encounter risks and difficulties frequently experienced by companies whose performance is dependent upon newly constructed world-scale processing or manufacturing facilities, such as the risks described in this report.

Our customer contracts provide for potential maximum offtake volumes of approximately 1.4 billion pounds of propylene per year. To the extent that our supply obligations under our customer contracts exceed the volume that we can produce and the volume we have in inventory, we may need to purchase propylene from third parties in the spot market. In periods of extended planned or unplanned downtime, we may be required to purchase significant volumes of propylene in order to satisfy our contractual obligations, which could materially and adversely affect our profitability and our ability to make cash distributions to our unitholders. Further, if we were unable to purchase the volumes of propylene necessary to satisfy our contractual obligations, we may be in default of our customer contracts.

Because of our limited operating history and performance record, it is difficult for you to evaluate our business and results of operations to date and to assess our future prospects. Further, our historical financial statements present a period of limited operations, and therefore do not provide a meaningful basis for you to evaluate our operations or our ability to achieve our business strategy. We may be less successful than a seasoned company in achieving a consistent operating level at our facility capable of generating cash flows from our operations sufficient to regularly pay a quarterly cash distribution or to pay any quarterly cash distribution to our unitholders. We may also be less successful in implementing our business strategy than a seasoned company with a longer operating history. Finally, we may be less equipped to identify and address operating risks and hazards in the conduct of our business than those companies whose major facilities have longer operating histories.

We face competition from other propylene producers.

We consider companies with net long positions in propylene to be our direct competitors, including Enterprise, Chevron Phillips, ExxonMobil Chemical, Shell Chemical, Flint Hills and the Williams Companies. Most of our competitors have significantly greater financial and other resources than us and are engaged on a national or international basis in many segments of the petroleum products and petrochemicals business, including refining, transportation and marketing, on a scale substantially larger than ours. In addition, we may face competition from captive propylene production facilities operated by consumers of propylene, including our customers. Further, it is likely that in future years, competition will come from the construction of additional on-purpose propylene facilities. As a result of these factors, we may be unable to expand our relationships with existing customers or to obtain new customers on a profitable basis, or at all, which would have a material adverse effect on our business, results of operations and financial condition and our ability to pay cash distributions to our unitholders.

We depend on certain third-party pipelines to supply us with feedstock and to distribute propylene to our customers. If these pipelines become unavailable to us, our business could be adversely affected.

Our ability to obtain propane and other inputs necessary for the production of propylene is dependent upon the availability of third-party pipeline systems interconnected to our facility. In addition, we depend in part on third-party pipeline systems to transport propylene to our customers. Because we do not own these pipelines, their continuing operation is not within our control. These pipelines and the pipelines we own may become unavailable for a number of reasons, including testing, maintenance, capacity constraints, accidents, government regulation or other events. If any of such pipelines become partially or completely unavailable, our ability to operate could be restricted and our transportation costs could increase, thereby reducing our profitability. A prolonged or permanent interruption in the availability of third-party or our own pipelines could have a material adverse effect on our business, financial condition, results of operations and ability to pay distributions to our unitholders.

The growth in production of natural gas from shale formations, which is expected to lead to an increased supply of propane, may not continue at projected rates due to the uncertainty associated with the length of their production lives, legislative initiatives restricting such production, or both.

Hydraulic fracturing is a process used by oil and natural gas exploration and production operators in the completion of certain oil and natural gas wells whereby water, sand and chemicals are injected under pressure into subsurface formations to stimulate natural gas production. The proliferation of hydraulic fracturing has led to a marked growth in production of natural gas and the resulting abundance of natural gas has led to a decrease in price. However, production of gas from shale formations is in its nascence, and certain industry reports have indicated that the wells may have shorter economically-viable production lives than previously anticipated. If such reports are accurate, shale gas development and production may be negatively impacted, which may lead to substantial increases in natural gas prices.

Although hydraulic fracturing has been used for decades in connection with conventional or vertical wells, its use has expanded substantially in recent years as the application of hydraulic fracturing on horizontal wells drilled to produce from shale formations has expanded substantially. This expanded use of hydraulic fracturing has recently attracted increased scrutiny from federal and state officials for its potential impact on health and the environment. Adoption of legislation or any implementation of regulations placing restrictions on hydraulic fracturing activities could make it more difficult to perform hydraulic fracturing, resulting in a reduction in the supply of natural gas and an increase in the price of natural gas.

An increase in the price of natural gas could narrow the propane-to-propylene spread in two ways, each adversely affecting our gross margins. First, a significant increase in natural gas prices could be accompanied by an increase in the price of NGLs such as ethane. An increase in ethane prices could cause ethylene producers to favor the use of naphtha as a feedstock. Because the use of naphtha as a feedstock in the ethylene production process results in significantly more propylene as co-product than ethane, the result would be an increase in propylene production by ethylene plants. The increased supply of propylene would in turn exert downward pressure on the price of propylene, adversely affecting the price we obtain for the propylene we produce, both in the spot market and pursuant to our customer contracts, which are market-based.

Second, an increase in the price of natural gas may be accompanied by an increase in the price of propane, as the majority of propane is derived from natural gas production, thereby further narrowing the propane-to-propylene spread and reducing our gross margins.

We currently derive substantially all of our sales from five customers, and the loss of any of these customers without replacement on comparable terms would affect our results of operations and cash available for distribution to our unitholders.

We have derived, and believe that we will continue to derive, substantially all of our sales from a limited number of customers that purchase all of the propylene we produce. For the year ended December 31, 2013, Dow, Total, INEOS, BASF, and LyondellBasell accounted for 44%, 21%, 18%, 9% and 6% of our total sales, respectively. When our current contracts with these customers expire, our customers may decide not to extend the contracts or may decide to purchase fewer pounds of propylene at lower prices during renegotiations. If at the end of their respective contract terms our customers decide not to renew these contracts, or decide to purchase fewer pounds of propylene or at lower prices, and we are unable to find replacement counterparties on terms as favorable as our current contracts, our business, results of operations, financial condition and our ability to pay cash distributions to our unitholders may be materially adversely affected. During 2013, we amended our contracts with Total, INEOS and BASF to extend the contract terms. Our multi-year propylene supply contracts expire between 2016 and 2018. Also during 2013, we amended our contract with LyondellBasell to extend the term to December 2014.

We are subject to many environmental and safety regulations that may result in unanticipated costs or liabilities, which could reduce our profitability.

We are subject to extensive federal, state and local laws, regulations, rules and ordinances relating to pollution, protection of the environment and human health, and the generation, storage, handling, transportation, treatment, disposal and remediation of hazardous substances and waste materials. Actual or alleged violations of environmental laws or permit requirements could result in restrictions or prohibitions on facility operations, substantial civil or criminal sanctions, as well as, under some environmental laws, the assessment of strict liability and/or joint and several liability.

Continually increasing concerns regarding the safety of chemicals in commerce and their potential impact on the environment constitute a growing trend. Governmental, regulatory and societal demands for continuously increasing levels of product safety and environmental protection could result in continued pressure for more stringent regulatory control with respect to the chemical industry. In addition, these concerns could influence public perceptions, the viability of certain products, our reputation, the cost to comply with regulations and the ability to attract and retain employees. Moreover, changes in environmental regulations could inhibit or interrupt our operations, or require us to modify our facilities or operations. Accordingly, environmental or regulatory matters may cause us to incur significant unanticipated losses, costs or liabilities, which could reduce our profitability.

We could incur significant expenditures in order to comply with existing or future environmental or safety laws. Capital expenditures and costs relating to environmental or safety matters will be subject to evolving regulatory requirements and will depend on the timing of the promulgation and enforcement of specific standards which impose requirements on our operations. Capital expenditures and costs beyond those currently anticipated may therefore be required under existing or future environmental or safety laws.

Furthermore, we may be liable for the costs of investigating and cleaning up environmental contamination on or from our properties or at off-site locations where we disposed of or arranged for the disposal or treatment of hazardous materials or from disposal activities that pre-dated our purchase of the facility. We may, therefore, incur additional costs and expenditures beyond those currently anticipated to address all such known and unknown situations under existing and future environmental laws.

Climate change laws and regulations could have a material adverse effect on our results of operations, financial condition and ability to pay cash distributions to our unitholders.

Federal climate change legislation in the United States appears unlikely in the near-term. As a result, domestic efforts to curb greenhouse gas emissions continue be led by the EPA’s greenhouse gas regulations and the efforts of states. To the extent that our domestic operations are subject to the EPA’s greenhouse gas regulations, we may face increased capital and operating costs associated with new or expanded facilities. Significant expansions of our existing facility or construction of new facilities may be subject to the CAA's PSD requirements under the EPA’s greenhouse gas “Tailoring Rule.”

Under a consent decree with states and environmental groups, the EPA is due to propose NSPS for greenhouse gas emissions from refineries. These standards could significantly increase the costs of constructing or adding capacity to refineries and may ultimately increase the costs or decrease the supply of refined products. Either of these events could have an adverse effect on our business.

It is possible that greenhouse gas emission restrictions may increase over time. Potential consequences of such restrictions include capital costs to modify operations as necessary to meet greenhouse gas emission limits and/or additional energy costs, as well as direct compliance costs. Currently, however, it is not possible to estimate the likely financial impact of potential future regulation on our operations.

Finally, it should be noted that some scientists have concluded that increasing concentrations of greenhouse gases in the earth’s atmosphere may produce climate changes that have significant physical effects, such as increased frequency and severity of storms, droughts, floods and other climatic events. If any of those effects were to occur, they could have an adverse effect on our facilities and operations.

Please read “ Environmental Matters — Climate Change ” above for a more detailed discussion.

We are subject to strict laws and regulations regarding employee and process safety, as well as the prevention of accidental releases, and failure to comply with these laws and regulations could have a material adverse effect on our results of operations, financial condition and ability to pay cash distributions to our unitholders.

Our facility is subject to the requirements of OSHA and comparable state statutes that regulate the protection of the health and safety of workers. OSHA requires that we maintain information about hazardous materials used or produced in our operations and that we provide this information to employees, state and local governmental authorities and local residents. In addition, the Chemical Accident Prevention Provisions adopted by the EPA under the CAA require the development of a Risk Management Plan to prevent the accidental release of hazardous substances that could harm public health or the environment. Failure to comply with these requirements, including general industry standards, record keeping requirements and monitoring and control of potential exposure to regulated substances, could have a material adverse effect on our results of operations, financial condition and ability to pay cash distributions to our unitholders if we are subjected to significant fines or compliance costs.

Instability and volatility in the global capital and credit markets could negatively impact our business, financial condition, results of operations and cash flows.