Table of Contents

As filed with the Securities and Exchange Commission on October 3, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

National CineMedia, LLC

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 7310 | 20-2632505 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

9110 E. Nichols Ave., Suite 200

Centennial, Colorado 80112-3405

(303) 792-3600

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Ralph E. Hardy, Esq.

Executive Vice President and General Counsel

National CineMedia, Inc.

9110 E. Nichols Ave., Suite 200

Centennial, Colorado 80112-3405

(303) 792-3600

(Name, Address, Including Zip Code and Telephone Number, Including Area Code, of Agent for Service)

COPIES OF ALL COMMUNICATIONS TO:

Jeffrey R. Kesselman, Esq.

Sherman & Howard L.L.C.

633 Seventeenth Street, Suite 3000

Denver, Colorado 80202

(303) 297-2900

Approximate date of commencement of proposed sale of the securities to the public:

As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box ¨

Table of Contents

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, as amended (the “Securities Act”), check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i)(Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d)(Cross-BorderThird-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

| ||||||||

Title of each class of securities to be registered | Amount to be registered | Proposed maximum offering price per unit(1) | Proposed maximum aggregate offering price | Amount of registration fee | ||||

5.750% Senior Notes due 2026 | $250,000,000 | 100% | $250,000,000 | $28,975.00 | ||||

| ||||||||

| ||||||||

| (1) | Estimated pursuant to Rule 457 solely for the purpose of calculating the registration fee. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not complete the exchange offer and issue these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated October 3, 2016

PROSPECTUS

National CineMedia, LLC

Offer to Exchange

all outstanding 5.750% Senior Notes due 2026

($250,000,000 aggregate principal amount)

for

5.750% Senior Notes due 2026

that have been registered under the Securities Act of 1933, as amended

National CineMedia, LLC hereby offers, upon the terms and subject to the conditions set forth in this prospectus and the accompanying letter of transmittal (which together constitute the “exchange offer”), to exchange up to $250,000,000 in aggregate principal amount of our registered 5.750% Senior Notes due 2026, or the exchange notes, the issuance of which has been registered under the Securities Act of 1933, as amended, or the Securities Act, for a like principal amount of our outstanding unregistered 5.750% Senior Notes due 2026, or the original notes. We refer to the original notes and exchange notes collectively as the notes. The terms of the exchange notes are identical to the terms of the original notes in all material respects, except for the elimination of some transfer restrictions, registration rights and additional interest provisions relating to the original notes.

We will exchange any and all original notes that are validly tendered and not validly withdrawn prior to 5:00 p.m., New York City time, on , 2016, unless extended. We do not currently intend to extend the exchange offer.

We have not applied, and do not intend to apply, for listing of the notes on any national securities exchange.

See “Risk Factors” beginning on page 14 of this prospectus for a discussion of certain risks that you should consider before participating in this exchange offer.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. The related letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for original notes where such original notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 180 days after the consummation of the exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2016.

Table of Contents

| Page | ||

| ii | ||

| ii | ||

| iii | ||

| 1 | ||

| 10 | ||

| 14 | ||

| 29 | ||

| 30 | ||

| 31 | ||

| 32 | ||

| 35 | ||

| 45 | ||

| 60 | ||

| 65 | ||

| 79 | ||

| 90 | ||

| 96 | ||

| 99 | ||

| 132 | ||

| 136 | ||

| 138 | ||

| 139 | ||

| �� | 139 | |

| 139 | ||

| F-1 | ||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS, JUNE 30, 2016 | F-2 | |

| F-32 | ||

The information contained in this prospectus speaks only as of the date of this prospectus unless the information specifically indicates that another date applies. No dealer, salesperson or other person has been authorized to give any information or to make any representations other than those contained in this prospectus in connection with the offer contained herein and, if given or made, such information or representations must not be relied upon as having been authorized by us. Neither the delivery of this prospectus nor any sale made hereunder shall under any circumstances create an implication that there has been no change in our affairs or that of our subsidiaries since the date hereof.

i

Table of Contents

Information regarding market share, market position and industry data pertaining to our business contained in this prospectus consists of estimates based on data and reports compiled by industry professional organizations (including Nielsen Media Research, Inc.; the Motion Picture Association of America, or MPAA; and the National Association of Theatre Owners, or NATO) and analysts, and our knowledge of our revenues and markets. Designated Market Area®, or DMA®, is a registered trademark of Nielsen Media Research, Inc. We take responsibility for compiling and extracting, but have not independently verified, market and industry data provided by third parties, or by industry or general publications, and take no further responsibility for such data. Similarly, while we believe our internal estimates are reliable, our estimates have not been verified by any independent sources, and we cannot assure you as to their accuracy

In this prospectus, unless otherwise indicated or the context otherwise requires:

| • | “NCM LLC,” “the Company,” “we,” “us” or “our” refer to National CineMedia, LLC, a Delaware limited liability company, which commenced operations on April 1, 2005; |

| • | “NCM, Inc.,” refers to National CineMedia, Inc., a Delaware corporation, which acquired an interest in, and became a member and the sole manager of NCM LLC, upon completion of its initial public offering, or “IPO,” which closed on February 13, 2007; |

| • | “ESAs” refers to the amended and restated exhibitor services agreements entered into by NCM LLC with each of NCM LLC’s founding members upon completion of the IPO, which were further amended and restated on December 26, 2013 in connection with the sale of the Fathom Events business. |

| • | “AMC” refers to AMC Entertainment Inc. and its subsidiaries, National Cinema Network, Inc., or “NCN,” which contributed assets used in the operations of NCM LLC and formed NCM LLC in March 2005, AMC ShowPlace Theatres, Inc., which joined NCM LLC in June 2010 in connection with AMC’s acquisition of Kerasotes Showplace Theatres, LLC, AMC Starplex, LLC, which joined NCM LLC in December 2015 in connection with AMC’s acquisition of Starplex Cinemas and American Multi-Cinema, Inc., and is party to an ESA with NCM LLC. |

| • | “Cinemark” refers to Cinemark Holdings, Inc. and its subsidiaries, Cinemark Media, Inc., which joined NCM LLC in July 2005, and Cinemark USA, Inc., and is party to an ESA with NCM LLC. |

| • | “Regal” refers to Regal Entertainment Group and its subsidiaries, Regal CineMedia Corporation, or “RCM,” which contributed assets used in the operations of NCM LLC, Regal CineMedia Holdings, LLC, which formed NCM LLC in March 2005, and Regal Cinemas, Inc., and is party to an ESA with NCM LLC. |

| • | “Founding members” refers to AMC, Cinemark and Regal. |

| • | “OIBDA” refers to operating income before depreciation and amortization expense; |

| • | “Adjusted OIBDA” excludes from OIBDA non-cash share based payment costs, merger-related administrative costs and CEO transition costs; |

| • | “Adjusted OIBDA margin” is calculated by dividing Adjusted OIBDA by total revenue; and |

| • | “Adjusted Consolidated EBITDA” has the meaning set forth in “Description of the Exchange Notes – Definitions”. |

See the notes to “Summary historical financial and operating data” included in this prospectus for further information on the definitions, calculations and our use of OIBDA, Adjusted OIBDA, Adjusted OIBDA margin and Adjusted Consolidated EBITDA.

ii

Table of Contents

In addition to historical information, some of the information in this prospectus includes “forward-looking statements.” All statements other than statements of historical facts included in this prospectus, including, without limitation, certain statements under “Business,” Risk factors” and “Management’s discussion and analysis of financial condition and results of operations,” included in this prospectus may constitute forward-looking statements. In some cases, you can identify these “forward-looking statements” by the specific words, including but not limited to “may,” “will,” “should,” “expects,” “forecast,” “project,” “intend,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of those words and other comparable words. These forward-looking statements involve known and unknown risks and uncertainties, assumptions and other factors, including, but not limited to, the following:

Risks related to our business and industry

| • | Significant declines in theatre attendance; |

| • | competition within the overall advertising industry; |

| • | not maintaining our technological advantage; |

| • | national, regional and local economic conditions; |

| • | the loss of any major content partner or advertising customer; |

| • | our plans for developing additional revenue opportunities may not be implemented and may not be achieved; |

| • | failure to effectively manage or continue our growth; |

| • | our inability to retain or replace our senior management; |

| • | changes to relationships with our founding members; |

| • | failures or disruptions in our technology systems; |

| • | infringement of our technology on intellectual property rights owned by others; |

| • | the content we distribute and user information we collect and maintain through our in-theatre, online or mobile services may expose us to liability; |

| • | changes in regulations relating to the Internet or other areas of our online or mobile services; |

| • | our revenue and Adjusted OIBDA fluctuate from quarter to quarter and may be unpredictable; |

| • | changes in market interest rates |

Risks related to our organizational structure

| • | Our substantial debt obligations could impair our financial condition or prevent us from achieving our business goals; |

| • | despite our current levels of debt, we may still incur substantially more debt, including secured debt, which would increase would increase the risks associated with our level of debt; |

| • | our founding members or their affiliates may have interests that differ from those of us or NCM, Inc.’s public stockholders and they may be able to influence our affairs; |

| • | different interests among our founding members or between our founding members and us could prevent us from achieving our business goals; |

iii

Table of Contents

| • | the corporate opportunity provisions in NCM, Inc.’s certificate of incorporation could enable the founding members to benefit from corporate opportunities that might otherwise be available to us; |

| • | the agreements between us and our founding members were made in the context of an affiliated relationship and may contain different terms than comparable agreements with unaffiliated third parties; |

| • | if NCM, Inc. or our founding members are determined to be an investment company, we could be subject to burdensome regulatory requirements and our business activities could be restricted; and |

| • | other factors described under “Risk Factors” or elsewhere in this prospectus, including risks related to the notes, which risks, among other things, may affect our ability to pay or pay timely amounts due under the notes or may affect the market value of the notes. |

This list of factors that may affect future performance, including our ability to make payments on the notes or the market value of the notes, and the accuracy of forward-looking statements are illustrative and not exhaustive. Our actual results, performance or achievements could differ materially from those indicated in these statements as a result of additional factors as more fully discussed in the section titled “Risk Factors,” and elsewhere in this prospectus. Given these uncertainties, readers are cautioned not to place undue reliance on our forward-looking statements.

All subsequent written and oral forward-looking statements attributable to NCM LLC or to persons acting on its behalf are expressly qualified in their entirety by these cautionary statements. NCM LLC disclaims any intention or obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

iv

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus and may not contain all of the information that you should consider in making your investment decision. You should read the entire prospectus, as well as the information to which we refer you, before making an investment decision.

Private Placement of Original Notes

On August 19, 2016, NCM LLC privately placed $250 million of 5.750% Senior Notes due 2026.

Simultaneously with the private placement, NCM LLC entered into a registration rights agreement with the initial purchasers of the original notes. Under the registration rights agreement, NCM LLC must use its commercially reasonable efforts to complete the exchange offer on or before May 16, 2017. If the exchange offer does not meet such deadline, we must pay additional interest to the holders of the original notes until such deadline is met. You may exchange your original notes for exchange notes with substantially the same terms in this exchange offer. You should read the discussion under the headings “—The Offering” and “Description of the Exchange Notes” for further information regarding the exchange notes.

We believe that holders of the original notes may resell the exchange notes without complying with the registration and prospectus delivery provisions of the Securities Act if certain conditions are met. You should read the discussion under the headings “—The Exchange Offer” and “The Exchange Offer” for further information regarding the exchange offer and resales of the exchange notes.

Overview

The Company

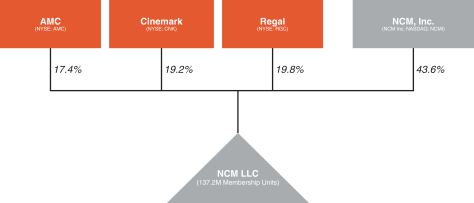

NCM LLC was organized on March 29, 2005 and began operations on April 5, 2005. NCM, Inc. is a holding company that manages its consolidated subsidiaries, including NCM LLC and held 43.6% of the common membership units in NCM LLC as of June 30, 2016. NCM LLC’s founding members, AMC, Cinemark and Regal, the three largest motion picture exhibition companies in the U.S., held the remaining 56.4% of NCM LLC’s common membership units as of June 30, 2016.

We have long-term ESAs with our founding members (approximately 21 years remaining as of June 30, 2016) and multi-year agreements with certain third-party theatre circuits, referred to in this document as “network affiliates,” which expire at various dates through July 22, 2031. The ESAs and network affiliate agreements grant us exclusive rights in their theatres to sell advertising, subject to limited exceptions.

On December 26, 2013, we sold our Fathom Events business to a newly formed limited liability company owned 32% by each of the founding members and 4% by NCM LLC. The Fathom Events business accounted for approximately 7.9% of our revenue for the fiscal year ended December 26, 2013.

Description of Business

Overview

We operate the largest digital in-theatre media network in North America, through which we sell in-theatre and online advertising and promotions. Our advertising and entertainment pre-show called “FirstLook”, lobby entertainment network (“LEN”) and programming are distributed across our digital content network (“DCN”) utilizing our proprietary digital content software (“DCS”).

1

Table of Contents

We currently derive revenue principally from the sale of advertising to national, regional and local businesses within several versions ofFirstLook, which we distribute to theatre screens in our digital network. We also sell advertising programming on our LEN and other forms of advertising and promotions in theatre lobbies and online through ourCinema Accelerator product and on mobile devices through an app calledMovie Night Out®.

We believe that the reach, digital delivery and projection capabilities of our network provides an effective platform for national, regional and local advertisers to reach a large, young and affluent audience on a targeted, engaging and measurable basis. During 2015, over 700 million patrons attended movies shown in theatres in which we currently have exclusive cinema advertising agreements in place. A summary of the screens in our advertising network is set forth in the table below:

Our Network

(As of June 30, 2016)

| Advertising Network | ||||||||||||

| Theatres | Total Screens (1) | % of Total | ||||||||||

Founding Members | 1,272 | 17,028 | 83.4 | % | ||||||||

Network Affiliates | 342 | 3,443 | 16.6 | % | ||||||||

|

|

|

|

|

| |||||||

Total | 1,614 | 20,471 | 100.0 | % | ||||||||

|

|

|

|

|

| |||||||

| (1) | 100% of theFirstLook pre-show is projected on digital projectors (90% digital cinema projectors and 10% LCD projectors), and approximately 99% of the aggregate founding member and network affiliate theatre attendance is generated by theatres connected to our DCN, with the remainder delivered on USB drives. |

Related transaction

We used the net proceeds from the offering of the original notes to finance the redemption of all of our existing 7.875% Senior Notes due 2021, or the 2021 notes. As of June 30, 2016, there was $200.0 million aggregate principal amount of the 2021 notes outstanding. The 2021 notes could be called for redemption at our option at a redemption price of 103.938% of the principal amount thereof plus accrued and unpaid interest thereon, if any, to but not including the redemption date. We issued a notice of redemption to holders of the 2021 notes immediately after the closing of the issuance of the original notes, specifying a redemption date of September 19, 2016. On the date that such notice was delivered, we deposited funds with the trustee for the 2021 notes in an amount that is sufficient for the trustee to pay the full redemption price (including accrued and unpaid interest) to holders of the existing 2021 notes on the redemption date. The redemption of the 2021 notes was completed on such redemption date. We refer to the satisfaction and discharge of the existing 2021 notes as the “2021 notes discharge.”

2

Table of Contents

Company structure

The diagram below depicts our organizational structure (ownership percentages as of June 30, 2016):

3

Table of Contents

The Exchange Offer

In connection with the original notes offering, NCM LLC entered into a registration rights agreement, or the registration rights agreement, with the initial purchasers of the original notes, or the initial purchasers. Under that agreement, NCM LLC agreed to deliver to you this prospectus and to consummate the exchange offer. The following is a summary of the principal terms of the exchange offer. A more detailed description is contained in the section of this prospectus entitled “The Exchange Offer”.

| Original Notes | $250,000,000 aggregate principal amount of 5.750% Senior Notes due 2026. | |

Exchange Notes | 5.750% Senior Notes due 2026. The terms of the exchange notes are substantially identical to those terms of the original notes, except that the transfer restrictions, registration rights and provisions for additional interest relating to the original notes do not apply to the exchange notes. | |

Exchange Offer | The Company is offering to exchange up to $250,000,000 aggregate principal amount of its exchange notes that have been registered under the Securities Act, for an equal amount of its original notes.

The Company is also offering to satisfy certain of its obligations under the registration rights agreement that it entered into when it issued the original notes in transactions exempt from registration under the Securities Act. | |

Registration Rights Agreement | We issued the original notes on August 19, 2016. In connection with the issuance of the original notes, we entered into the registration rights agreement with the initial purchasers of the notes which provides, among other things, for this exchange offer. | |

Expiration Date; Withdrawal of Tenders | The exchange offer will expire at 5:00 p.m., New York City time, on , 2016, or such later date and time to which the Company extends it. The Company does not currently intend to extend the expiration date. A tender of original notes pursuant to the exchange offer may be withdrawn at any time prior to the expiration date. Any original notes not accepted for exchange for any reason will be returned without expense to the tendering holder promptly after the expiration or termination of the exchange offer. | |

| Conditions to the Exchange Offer | The exchange offer is subject to customary conditions, some of which the Company may waive. For more information, see “The Exchange Offer—Certain Conditions to the Exchange Offer.” | |

4

Table of Contents

| Procedures for Tendering Original Notes | If you wish to accept the exchange offer, you must complete, sign and date the accompanying letter of transmittal, or a copy of the letter of transmittal, according to the instructions contained in this prospectus and the letter of transmittal. You must also mail or otherwise deliver the letter of transmittal, or the copy, together with the original notes and any other required documents, to the exchange agent at the address set forth on the cover of the letter of transmittal. If you hold original notes through The Depository Trust Company, or DTC, and wish to participate in the exchange offer, you must comply with the Automated Tender Offer Program procedures of DTC, by which you will agree to be bound by the letter of transmittal.

By signing or agreeing to be bound by the letter of transmittal, you will represent to us that, among other things: | |

• any exchange notes that you receive will be acquired in the ordinary course of your business; | ||

• you have no arrangement or understanding with any person or entity, including any of our affiliates, to participate in the distribution of the exchange notes; | ||

• if you are a broker-dealer that will receive exchange notes for your own account in exchange for original notes that were acquired as a result of market-making activities, that you will deliver a prospectus, as required by law, in connection with any resale of the exchange notes; and | ||

• you are not our “affiliate” as defined in Rule 405 under the Securities Act, or, if you are an affiliate, you will comply with any applicable registration and prospectus delivery requirements of the Securities Act. | ||

| Guaranteed Delivery Procedures | If you wish to tender your original notes and your original notes are not immediately available or you cannot deliver your original notes, the letter of transmittal or any other documents required by the letter of transmittal or comply with the applicable procedures under DTC’s Automated Tender Offer Program prior to the expiration date, you must tender your original notes according to the guaranteed delivery procedures set forth in this prospectus under “The Exchange Offer—Guaranteed Delivery Procedures.” | |

| Effect on Holders of Original Notes | As a result of the making of, and upon acceptance for exchange of all validly tendered original notes pursuant to the terms of, the exchange offer, the Company will have fulfilled a covenant contained in the registration rights agreement for the original notes and, accordingly, we will not be obligated to pay additional interest as described in the registration rights agreement. If you are a holder of original notes and do not tender your original notes in the exchange offer, you will continue to hold such original notes and you will be entitled to all the rights and limitations applicable to the original notes in the indenture governing the notes, or the indenture, except for any rights under the registration rights agreement that, by their terms, terminate upon the consummation of the exchange offer. | |

Consequences of Failure to Exchange | All untendered original notes will continue to be subject to the restrictions on transfer provided for in the original notes and in the indenture. In general, the original notes may not be offered or sold unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. | |

5

Table of Contents

| Other than in connection with the exchange offer, the Company does not currently anticipate that it will register the original notes under the Securities Act. | ||

Resale of the Exchange Notes | Based on an interpretation by the staff of the SEC set forth in no-action letters issued to third parties, we believe that the exchange notes issued pursuant to the exchange offer in exchange for original notes may be offered for resale, resold and otherwise transferred by you (unless you are our “affiliate” within the meaning of Rule 405 under the Securities Act) without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that you: | |

• are acquiring the exchange notes in the ordinary course of business; and | ||

• have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person or entity, including any of our affiliates, to participate in, a distribution of the exchange notes. | ||

| In addition, each participating broker-dealer that receives exchange notes for its own account pursuant to the exchange offer in exchange for original notes that were acquired as a result of market-making or other trading activity must also acknowledge that it will deliver a prospectus in connection with any resale of the exchange notes. For more information, see “Plan of Distribution.” Any holder of original notes, including any broker-dealer, who: | ||

• is our affiliate, | ||

• does not acquire the exchange notes in the ordinary course of its business, or | ||

• tenders in the exchange offer with the intention to participate, or for the purpose of participating, in a distribution of exchange notes, | ||

| cannot rely on the position of the staff of the SEC expressed in Exxon Capital Holdings Corporation, Morgan Stanley & Co., Incorporated or similar no-action letters and, in the absence of an exemption, must comply with the registration and prospectus delivery requirements of the Securities Act in connection with the resale of the exchange notes. | ||

| Material U.S. Federal Income TaxConsequences | The exchange of original notes for exchange notes in the exchange offer will not be a taxable event for U.S. federal income tax purposes. For more information, see “Material United States Federal Income Tax Considerations.” | |

Exchange Agent | Wells Fargo Bank, National Association, the trustee under the indenture governing the notes, is serving as exchange agent in connection with the exchange offer. The address and telephone number of the exchange agent are set forth in the section captioned “The Exchange Offer—Exchange Agent.” | |

Fees and Expenses | We will bear all expenses related to consummating the exchange offer and complying with the registration rights agreement. | |

Use of Proceeds | We will not receive any cash proceeds from the issuance of the exchange notes in the exchange offer. | |

6

Table of Contents

The Offering

The terms of the exchange notes and those of the outstanding original notes are substantially identical, except that the exchange notes are registered under the Securities Act, and the transfer restrictions and registration rights, and related special interest provisions, applicable to the original notes will not apply to the exchange notes. The exchange notes represent the same debt as the corresponding series of original notes for which they are being exchanged. Both the original notes and the exchange notes are governed by the same indenture. Certain of the terms and conditions described below are subject to important limitations and exceptions. The “Description of the Exchange Notes” section of this prospectus contains a more detailed description of the terms and conditions of the exchange notes.

| Issuer | National CineMedia, LLC. | |

Notes offered | $250 million in aggregate principal amount of 5.750% Senior Notes due 2026. | |

Maturity date | August 15, 2026. | |

Interest payment dates | Semi-annually in arrears on February 15 and August 15 of each year, commencing February 15, 2017. Interest will accrue from August 19, 2016. | |

Ranking | The exchange notes will be our general unsecured senior obligations and will: | |

• be equal in right of payment with all existing and future senior indebtedness of the issuer, including our existing senior secured credit facility, any future ABL facility, the 2021 notes and our existing 6.00% Senior Secured Notes due 2022 notes, or the 2022 notes, without giving effect to collateral arrangements | ||

• rank senior in right of payment to all of our future subordinated indebtedness; | ||

• be effectively subordinated to all of our existing and future senior secured indebtedness (including our existing senior secured credit facility, any future ABL facility, the 2022 notes and any other secured obligations) to the extent of the value of the collateral securing such other indebtedness; and | ||

• be effectively subordinated to all liabilities of any subsidiaries that we may form or acquire in the future, unless those subsidiaries become guarantors of the notes | ||

| As of June 30, 2016, after giving effect to the issuance of the original notes and the application of the net proceeds as described under “Use of Proceeds,” we would have had outstanding approximately $705.0 million of indebtedness under our existing senior secured credit facility and our 2022 notes, which would have been effectively senior to the notes to the extent of the value of the collateral securing such other indebtedness, and we would have had no other debt outstanding other than the aggregate principal amount of the exchange notes. In addition, as of June 30, 2016 we would have had undrawn availability of $140.0 million under our senior secured credit facility | ||

Guarantees | The exchange notes will not be guaranteed by any subsidiaries that we may form or acquire in the future except in the very limited circumstances set forth under “Description of the Exchange Notes—Certain covenants—Future guarantors.” | |

7

Table of Contents

| Optional redemption | Prior to August 15, 2021, we may redeem all or any portion of the exchange notes, at once or over time, at 100% of the principal amount plus the applicable make-whole premium, plus accrued and unpaid interest, if any, to the redemption date. We may redeem all or any portion of the exchange notes, at once or over time, on or after August 15, 2021 at the redemption prices described in this prospectus, plus accrued and unpaid interest, if any, to the redemption date. In addition, at any time prior to August 15, 2019, we may on any one or more occasions redeem up to 35% of the original aggregate principal amount of notes from the net proceeds of certain equity offerings at the redemption price set forth in this prospectus, plus accrued and unpaid interest, if any, to the redemption date. See “Description of the Exchange Notes—Optional redemption.” | |

| Change of control; asset sales | If we experience a change of control, holders of the exchange notes will have the right to require us to repurchase the notes at a purchase price of 101% of the principal amount plus accrued and unpaid interest, if any, to the purchase date.

The definition of a change of control requiring us to repurchase the exchange notes is very limited. See “Description of the Exchange Notes—Change of control.”

If we sell less than substantially all of our assets, under certain circumstances, we will be required to make an offer to purchase exchange notes at a purchase price of 100% of the principal amount of the notes, plus accrued and unpaid interest, if any, to the repurchase date. See “Description of the Exchange Notes—Certain covenants—Limitation on asset sales.”

We are not permitted to sell all or substantially all of our assets, in a single transaction or through a series of related transactions, except in compliance with the provisions set forth under “Description of the Exchange Notes—Certain covenants—Merger and sale of substantially all assets.” | |

| Certain covenants | The indenture governing the exchange notes contains covenants that, among other things, will restrict our ability and the ability of our restricted subsidiaries, if any, to:

• incur additional debt;

• make distributions or make certain other restricted payments;

• make investments;

• incur liens;

• sell assets or merge with or into other companies; and

• enter into transactions with affiliates.

All of these restrictive covenants are subject to a number of important exceptions and qualifications. In particular, we have the ability to distribute all of our quarterly available cash as a restricted payment if we meet a minimum net senior secured leverage ratio. See “Description of the Exchange Notes—Certain covenants” and “—Merger and sale of substantially all assets.” | |

Trustee, registrar and Paying agent | Wells Fargo Bank, National Association will be the trustee, registrar and paying agent for the exchange notes. | |

8

Table of Contents

Absence of public market for the notes | The exchange notes will be a new issue of securities, and there is currently no trading market for the exchange notes. We do not intend to apply for listing of the exchange notes on any securities exchange or to arrange for quotation on any automated dealer quotation system. We have been informed by the initial purchasers that they presently intend to make a market in the exchange notes as permitted by applicable laws and regulations after the offering is completed. However, the initial purchasers have no obligation to make a market in the exchange notes and they may cease their market-making at any time without notice. As a result, we cannot assure you that an active trading market will develop for the exchange notes. | |

Risk factors | You should consider carefully all the information set forth in this prospectus and, in particular, you should evaluate the specific factors under “Risk Factors” beginning on page 14. | |

9

Table of Contents

Summary historical financial and operating data

The actual results of operations data, other financial data and operating data for the years ended December 31, 2015, January 1, 2015 and December 26, 2013, and the balance sheet data as of December 31, 2015 and January 1, 2015 are derived from the audited financial statements of NCM LLC that are included in this prospectus or the Company’s records. The actual results of operations data, other financial data and operating data for the years ended December 27, 2012 and December 29, 2011, and the balance sheet data as of December 26, 2013, December 27, 2012 and December 29, 2011 are derived from the audited financial statements of NCM LLC that are not included in this prospectus or are derived from the Company’s records. The actual results of operations data, other financial data and operating data for the three and six months ended June 30, 2016 and July 2, 2015 and the balance sheet data as of June 30, 2016 and July 2, 2015 are derived from the unaudited interim financial statements of NCM LLC that are included in this prospectus or the Company’s records. The actual results of operations data, other financial data and operating data for the last twelve months ended June 30, 2016 have been calculated by subtracting the data for the six months ended July 2, 2015 from the data for the year ended December 31, 2015 and adding the result to the data for the six months ended June 30, 2016. The information presented below summarizes certain results of operations data, other financial data and operating data, which you should read in conjunction with the other information that is included with this prospectus, including “Management’s discussion and analysis of financial condition and results of operations” and the financial statements and accompanying notes included herein.

| Twelve months ended June 30, 2016 | Three months ended June 30, 2016 | Three months ended July 2, 2015 | Six months ended June 30, 2016 | Six months ended July 2, 2015 | Year ended December 31, 2015 | Year ended January 1, 2015 | Year ended December 26, 2013 | Year ended December 27, 2012 | Year ended December 29, 2011 | |||||||||||||||||||||||||||||||

| (in millions, except screen data and advertising revenue per attendee data) | ||||||||||||||||||||||||||||||||||||||||

Results of Operations Data | ||||||||||||||||||||||||||||||||||||||||

Advertising Revenue | $ | 439.7 | $ | 115.4 | $ | 121.5 | $ | 191.6 | $ | 198.4 | $ | 446.5 | $ | 394.0 | $ | 426.3 | $ | 409.5 | $ | 386.2 | ||||||||||||||||||||

Total Revenue | 439.7 | 115.4 | 121.5 | 191.6 | 198.4 | 446.5 | 394.0 | 462.8 | 448.8 | 435.4 | ||||||||||||||||||||||||||||||

Operating Income | 161.6 | 46.5 | 55.4 | 52.3 | 31.2 | 140.5 | 159.2 | 202.0 | 191.8 | 193.7 | ||||||||||||||||||||||||||||||

Net Income | 109.5 | 33.2 | 42.4 | 25.7 | 3.7 | 87.5 | 96.3 | 162.9 | 101.0 | 134.5 | ||||||||||||||||||||||||||||||

Other Financial Data | ||||||||||||||||||||||||||||||||||||||||

OIBDA(1) | $ | 195.2 | $ | 55.4 | $ | 63.6 | $ | 69.9 | $ | 47.4 | $ | 172.7 | $ | 191.6 | $ | 228.6 | $ | 212.2 | $ | 212.5 | ||||||||||||||||||||

Adjusted OIBDA(1) | 218.2 | 59.4 | 67.4 | 83.4 | 95.1 | 229.9 | 199.3 | 234.5 | 221.2 | 224.3 | ||||||||||||||||||||||||||||||

Adjusted OIBDA Margin(1) | 49.6 | % | 51.5 | % | 55.5 | % | 43.5 | % | 47.9 | % | 51.5 | % | 50.6 | % | 50.7 | % | 49.3 | % | 51.5 | % | ||||||||||||||||||||

Capital Expenditures | 15.0 | 3.0 | 2.9 | 7.0 | 5.0 | 13.0 | 8.8 | 10.6 | 10.4 | 13.7 | ||||||||||||||||||||||||||||||

Interest on Borrowings | 52.9 | 13.5 | 13.1 | 26.9 | 26.2 | 52.2 | 52.6 | 51.6 | 56.7 | 49.2 | ||||||||||||||||||||||||||||||

Other Non-Operating (Income) Expenses, Net | (0.9 | ) | (0.2 | ) | (0.2 | ) | (0.4 | ) | 1.2 | 0.7 | 9.5 | (13.2 | ) | 33.5 | 9.7 | |||||||||||||||||||||||||

Operating Data | ||||||||||||||||||||||||||||||||||||||||

Founding Member Screens at Period End(2)(6) | 17,028 | 17,028 | 16,471 | 17,028 | 16,471 | 16,981 | 16,497 | 16,562 | 15,528 | 15,265 | ||||||||||||||||||||||||||||||

Total Screens at Period End(3)(6) | 20,471 | 20,471 | 20,150 | 20,471 | 20,150 | 20,361 | 20,109 | 19,878 | 19,359 | 18,670 | ||||||||||||||||||||||||||||||

DCN Screens at Period End(4)(6) | 20,061 | 20,061 | 19,396 | 20,061 | 19,396 | 19,760 | 19,251 | 19,054 | 18,491 | 17,698 | ||||||||||||||||||||||||||||||

Total Theatre Attendance for Period(5)(6) | 686.0 | 172.2 | 191.8 | 344.5 | 353.2 | 694.7 | 688.2 | 699.2 | 690.4 | 636.8 | ||||||||||||||||||||||||||||||

Total Advertising Revenue per Attendee | $ | 0.64 | $ | 0.67 | $ | 0.63 | $ | 0.56 | $ | 0.56 | $ | 0.64 | $ | 0.57 | $ | 0.61 | $ | 0.59 | $ | 0.61 | ||||||||||||||||||||

10

Table of Contents

| As of June 30, 2016 | As of July 2, 2015 | As of December 31, 2015 | As of January 1, 2015 | As of December 26, 2013 | As of December 27, 2012 | As of December 29, 2011 | ||||||||||||||||||||||

Balance Sheet Data (in millions) | ||||||||||||||||||||||||||||

Cash and Cash Equivalents | $ | 6.1 | $ | 5.7 | $ | 3.0 | $ | 10.2 | $ | 13.3 | $ | 10.4 | $ | 9.2 | ||||||||||||||

Receivables, Net | 126.3 | 126.9 | 148.9 | 116.5 | 120.4 | 98.5 | 96.6 | |||||||||||||||||||||

Property and Equipment, Net | 27.6 | 21.9 | 25.1 | 22.4 | 25.6 | 25.7 | 24.6 | |||||||||||||||||||||

Total Assets(7) | 766.1 | 707.8 | 772.0 | 681.1 | 699.2 | 437.4 | 421.4 | |||||||||||||||||||||

Borrowings, gross | 942.0 | 935.0 | 936.0 | 892.0 | 890.0 | 879.0 | 794.0 | |||||||||||||||||||||

Members’ Deficit | (230.7 | ) | (321.9 | ) | (266.5 | ) | (317.4 | ) | (299.2 | ) | (524.2 | ) | (527.5 | ) | ||||||||||||||

Total Liabilities and Members’ Deficit(7) | 766.1 | 707.8 | 772.0 | 681.1 | 699.2 | 437.4 | 421.4 | |||||||||||||||||||||

| As of June 30, 2016(8) | As of July 2, 2015(9) | As of December 31, 2015 | As of January 1, 2015 | As of December 26, 2013 | As of December 27, 2012 | As of December 29, 2011 | ||||||||||||||||||||||

Other Data | ||||||||||||||||||||||||||||

Ratio of secured debt to Adjusted OIBDA | 3.4 | x | 3.4 | x | 3.2 | x | 3.5 | x | 2.9 | x | 3.1 | x | 2.6 | x | ||||||||||||||

Ratio of total debt to Adjusted OIBDA | 4.3 | x | 4.3 | x | 4.1 | x | 4.5 | x | 3.8 | x | 4.0 | x | 3.5 | x | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

| (1) | OIBDA, Adjusted OIBDA and Adjusted OIBDA margin (as such terms are defined in “Glossary” above) are not financial measures calculated in accordance with generally accepted accounting principles in the United States (“GAAP”). OIBDA represents operating income before depreciation and amortization expense. Adjusted OIBDA excludes from OIBDA non-cash share based payment costs, the merger termination fee and related merger costs and Chief Executive Officer transition costs. Adjusted OIBDA margin is calculated by dividing Adjusted OIBDA by total revenue. Our management uses these non-GAAP financial measures to evaluate operating performance, to forecast future results and as a basis for compensation. The Company believes these are important supplemental measures of operating performance because they eliminate items that have less bearing on its operating performance and highlight trends in its core business that may not otherwise be apparent when relying solely on GAAP financial measures. The Company believes the presentation of these measures is relevant and useful for investors because it enables them to view performance in a manner similar to the method used by the Company’s management, helps improve their ability to understand the Company’s operating performance and makes it easier to compare the Company’s results with other companies that may have different depreciation and amortization policies, non-cash share based compensation programs, levels of mergers and acquisitions, CEO turnover, interest rates or debt levels or income tax rates. A limitation of these measures, however, is that they exclude depreciation and amortization, which represent a proxy for the periodic costs of certain capitalized tangible and intangible assets used in generating revenues in the Company’s business. In addition, Adjusted OIBDA has the limitation of not reflecting the effect of the Company’s share based payment costs, costs associated with the terminated merger with Screenvision, or costs associated with the resignation of the Company’s Chief Executive Officer. OIBDA or Adjusted OIBDA should not be regarded as an alternative to operating income, net income or as indicators of operating performance, nor should they be considered in isolation of, or as substitutes for financial measures prepared in accordance with GAAP. The Company believes that operating income is the most directly comparable GAAP financial measure to OIBDA. Because not all companies use identical calculations, these non-GAAP presentations may not be comparable to other similarly titled measures of other companies, or calculations in the Company’s debt agreement. |

11

Table of Contents

OIBDA and Adjusted OIBDA do not reflect integration payments as integration payments are recorded as a reduction to intangible assets. Integration payments received are added to Adjusted OIBDA to determine our compliance with financial covenants under our senior secured credit facility and included in available cash distributions to our members. During the years ended December 31, 2015, January 1, 2015 and December 26, 2013, the Company recorded integration payments of $2.7 million, $2.2 million and $2.8 million, respectively, and during the three months ended June 30, 2016 and July 2, 2015 and the six months ended June 30, 2016 and July 2, 2015, the Company recorded $0.7 million, $0.8 million, $0.8 million and $1.1 million, respectively, from its founding members. During the twelve months ended June 30, 2016, the Company recorded integration payments of $2.4 million from its founding members.

The following table reconciles operating income to OIBDA and Adjusted OIBDA for the periods presented (dollars in millions):

| Twelve months ended June 30, 2016 | Three months ended June 30, 2016 | Three months ended July 2, 2015 | Six months ended June 30, 2016 | Six months ended July 2, 2015 | Year ended December 31, 2015 | Year ended January 1, 2015 | Year ended December 26, 2013 | Year ended December 27, 2012 | Year ended December 29, 2011 | |||||||||||||||||||||||||||||||

Operating Income | $ | 161.6 | $ | 46.5 | $ | 55.4 | $ | 52.3 | $ | 31.2 | $ | 140.5 | $ | 159.2 | $ | 202.0 | $ | 191.8 | $ | 193.7 | ||||||||||||||||||||

Depreciation and Amortization | 33.6 | 8.9 | 8.2 | 17.6 | 16.2 | 32.2 | 32.4 | 26.6 | 20.4 | 18.8 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

OIBDA | $ | 195.2 | $ | 55.4 | $ | 63.6 | $ | 69.9 | $ | 47.4 | $ | 172.7 | $ | 191.6 | $ | 228.6 | $ | 212.2 | $ | 212.5 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Share-Based Compensation Costs(a) | 19.2 | 3.7 | 2.9 | 10.3 | 5.9 | 14.8 | 7.7 | 5.9 | 9.0 | 11.8 | ||||||||||||||||||||||||||||||

Merger-Related Administrative Costs(b) | — | — | 0.9 | — | 41.8 | 41.8 | — | — | — | — | ||||||||||||||||||||||||||||||

CEO Transition | 3.8 | 0.3 | — | 3.2 | — | 0.6 | — | — | — | — | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Adjusted OIBDA | $ | 218.2 | $ | 59.4 | $ | 67.4 | $ | 83.4 | $ | 95.1 | $ | 229.9 | $ | 199.3 | $ | 234.5 | $ | 221.2 | $ | 224.3 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Total Revenue | $ | 439.7 | $ | 115.4 | $ | 121.5 | $ | 191.6 | $ | 198.4 | $ | 446.5 | $ | 394.0 | $ | 462.8 | $ | 448.8 | $ | 435.4 | ||||||||||||||||||||

Adjusted OIBDA margin | 49.6 | % | 51.5 | % | 55.5 | % | 43.5 | % | 47.9 | % | 51.5 | % | 50.6 | % | 50.7 | % | 49.3 | % | 51.5 | % | ||||||||||||||||||||

| (a) | Share-based payments costs are included in network operations, selling and marketing, administrative expense and administrative fee—managing member in the financial statements. The amount of share-based compensation costs that were non-cash were approximately $2.5 million, $1.7 million, $5.4 million and $3.4 million for the three months ended June 30, 2016 and July 2, 2015 and the six months ended June 30, 2016 and July 2, 2015, respectively, and were $8.0 million, $4.6 million, $3.2 million, $4.3 million and $4.8 million for the years ended December 31, 2015, January 1, 2015, December 26, 2013, December 27, 2012 and December 29, 2011, respectively. The amount of share-based compensation costs that were non-cash were approximately $10.0 million for the twelve months ended June 30, 2016. |

12

Table of Contents

| (b) | Merger termination fee and related merger costs primarily include the merger termination payment and legal, accounting, advisory and other professional fees associated with the terminated merger with Screenvision. |

| (c) | Chief Executive Officer transition costs represent severance, consulting and other costs and are primarily included in administrative fee—managing member in the financial statements. |

| (2) | Represents the total number of screens within NCM LLC’s advertising network operated by NCM LLC’s founding members. |

| (3) | Represents the total screens within NCM LLC’s advertising network. |

| (4) | Represents the total number of screens that are connected to our DCN. |

| (5) | Represents the total attendance within NCM LLC’s advertising network. |

| (6) | Excludes screens and attendance associated with certain Cinemark Rave and AMC Rave theatres for all periods presented. Refer to Note 4 to the audited financial statements for the fiscal year ended December 31, 2015 which are included in this prospectus. |

| (7) | During the first quarter of 2016, the Company adopted Accounting Standards Update 2015-03, Interest—Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs (“ASU 2015-03”) and Accounting Standards Update 2015-15, Interest—Imputation of Interest (“ASU 2015-15”), on a retrospective basis, which provide guidance for simplifying the presentation of debt issuance costs. In connection with the adoption of ASU 2015-03 and ASU 2015-15, the Company reclassified net deferred financing costs related to the Company’s Term Loans, 2022 notes and 2021 notes in the Balance Sheet as a direct deduction from the carrying amount of those borrowings, while net deferred financing costs related to the Company’s Revolving Credit Facility remained an asset in the Balance Sheet. The amounts presented above for total assets and total liabilities and members’ deficit reflect this reclassification as of June 30, 2016 and December 31, 2015. Amounts presented as of July 2, 2015, January 1, 2015, December 26, 2013, December 29, 2012 and December 29, 2011, do not reflect the reclassification. If adjusted, the reclassification for ASU 2015-03 and 2015-15 would reduce both total assets and total liabilities and members’ deficit shown above by $11.7 million, $12.7 million, $14.8 million, $14.6 million, and $9.2 million, as of July 2, 2015, January 1, 2015, December 26, 2013, December 27, 2012 and December 29, 2011, respectively. |

| (8) | Adjusted OIBDA calculations are based on last 12 months ended June 30, 2016. |

| (9) | Adjusted OIBDA calculations are based on last 12 months ended July 2, 2015. |

13

Table of Contents

Before you decide to purchase the notes, you should understand the high degree of risk involved in such investment. You should consider carefully the following risks relating to the notes described below and other information in this prospectus, including our financial statements and related notes included herein. The risks and uncertainties described in this prospectus are not the only ones facing us. Additional risks and uncertainties that we do not presently know about or that we currently believe are not material may also adversely affect our business. If any of the risks and uncertainties described in this prospectus actually occur, our business, financial condition and results of operations could be adversely affected in a material way. This could cause the value of the notes to decline, perhaps significantly, and you may lose part or all of your investment.

This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of a number of factors, including the risks described below and elsewhere in this prospectus.

Risks Related to Our Business and Industry

Significant declines in theatre attendance could reduce the attractiveness of cinema advertising and could reduce our revenue

Our business is affected by the level of theatre attendance by our founding members and to a lesser extent our network affiliates, who operate in a highly competitive industry whose attendance is reliant on the presence of motion pictures that attract audiences. From the mid-1990s through 2002, the number of movie screens and the level of theatre attendance in the U.S. increased substantially, as movie theatres began to build larger “megaplex” theatres that offered new amenities such as stadium seating, improved projection quality and superior sound systems, and studios began to increase the number of motion pictures produced and increased the marketing budgets to promote those films. From 1970 through 2015, the box office has fluctuated from year to year but has grown at a compound annual growth rate of 4.8%. Over the last 20 years, theatre attendance has fluctuated from year to year but on average has remained relatively flat at an aggregate annual growth rate of less than 0.5%. If future theatre attendance declines significantly over an extended time period, one or more of our founding members or network affiliates may face financial difficulties and could be forced to sell or close theatres or reduce the number of screens it builds or upgrades. Attendance may also decline if the theatres in our network fail to maintain their theatres and provide amenities that consumers prefer, if they cannot compete with other out-of-home entertainment, including on pricing, or if studios begin to reduce the number of feature films produced and their investments in those films or reduce the investments made to market those films. Our network theatre circuits also may not successfully compete for licenses to exhibit quality films and are not assured a consistent supply of motion pictures since they do not have long-term arrangements with major film distributors. Any of these circumstances could reduce our revenue because our national advertising revenue, and local advertising to a lesser extent, depends on the number of theatre patrons who view our advertising and pre-feature show.

Further, the value of our advertising business could be adversely affected by a decline in theatre attendance or even the perception by media buyers that our network is no longer relevant to their marketing plan due to the decreases in attendance and geographic coverage. Factors that could reduce attendance at our network theatres include the following:

| • | the shortening of the “release window” between the release of major motion pictures in the theatres and release to alternative methods for delivering movies to consumers, such as DVD or HD DVD, cable television, internet downloads, video on demand, satellite and pay-per-view services; |

| • | any reduction in consumer confidence or disposable income in general that reduces the demand for motion pictures or adversely affects the motion picture production industry; and |

| • | the success of first-run motion pictures, which depends upon the production and marketing efforts of the major studios and the attractiveness and value proposition of the movies to consumers compared to other forms of entertainment. |

In addition, the value of our national on-screen advertising and to a lesser extent our local and regional advertising is based on the number of theatre patrons that are in their seats and thus have the opportunity to view theFirstLook pre-show. The number of patrons that are in a theatre seat could be adversely impacted by changes in theatre operating policies and patron amenities, including the number and length of trailers for upcoming films that are played prior to the start of the feature film and the offering of reserved seating. Theatres are also installing new larger, more comfortable seating into theatres that have been viewed favorably by theatre patrons. The installation of these larger seats reduces the number of seats in a theatre auditorium, which could decrease the number of theatre patrons that view ourFirstLook pre-show that may adversely impact our operating results.

14

Table of Contents

The markets for advertising are competitive and we may be unable to compete successfully

The market for advertising is very competitive. Cinema advertising is a small component of video advertising in the U.S. and thus, we must compete with established, larger and better known national and local media platforms such as cable, broadcast and satellite television networks and other video media platforms including those distributed on the internet and mobile networks. In addition to these video advertising platforms, we compete to a lesser extent for advertising directly with several additional media platforms, including radio, various local print media and billboards. We also compete with several other local and national cinema advertising companies. We expect all of these competitors to devote significant effort to maintaining and growing their business at our expense. We also expect existing competitors and new entrants to the advertising business, most notably the online and mobile advertising companies, to constantly revise and improve their business models to meet expectations of advertising clients or competing media platforms, including us. If we cannot respond effectively to changes in the media marketplace in response to new entrants or advances by our existing competitors, our business may be adversely affected.

If we do not maintain our technological advantage, our business could fail to grow and revenue and operating margins could decline

Failure to successfully or cost-effectively implement upgrades to our in-theatre advertising network and proposal and inventory control, audience targeting and other management systems could limit our ability to offer our clients innovative unique, integrated and targeted marketing products, which could limit our future revenue growth. New advertising platforms such as online and mobile networks, and traditional mediums including television networks are beginning to use new digital technology to reach a broader audience with more targeted marketing products, and failure by us to upgrade our technology could hurt our ability to compete with those companies. Under the ESAs, the founding members are required to provide technology that is consistent with that in place at the signing of the ESA. We may request that our founding members upgrade the equipment or software installed in their theatres, but we must negotiate with our founding members as to the terms of such upgrade, including cost sharing terms, if any. For instance, during 2010 we entered into an amendment to the ESA to allow us to connect our digital network to our founding members’ new digital cinema projection systems so that we could display our advertising (including 3-D) on the higher quality digital projection systems. As of June 30, 2016, we had 18,454 screens, or 90% of our network screens, that were connected to digital cinema projection equipment and we expect to continue to convert the remaining screens with LCD digital projectors to these higher quality digital cinema projectors in the future. If we are not able to come to an agreement on a future upgrade request, we may elect to pay for the upgrades requested which could result in our incurring significant capital expenditures, which could adversely affect our results. Over the last several years, we have been upgrading our proposal and inventory control systems, and in 2014 and 2015, we began to develop enhancements to these systems that will allow us to target theatre audiences more effectively. The failure or delay in implementation of such upgrades or problems with the integration with our other systems and software could slow or prevent the growth of our business in the future. In addition, the failure or delay in implementation of such upgrades or problems with the integration of our systems and software could slow or prevent the growth of our business.

Economic uncertainty or deterioration in economic conditions may adversely impact our business, operating results or financial condition

The financial markets have experienced extreme disruption and volatility and certain parts of the world-wide economy remain fragile. A future decline in consumer confidence in the U.S. may lead to decreased demand for our services or delay in payments by our advertising customers. As a result, our results of operations and financial condition could be adversely affected. These challenging economic conditions also may result in:

| • | increased competition for fewer advertising and entertainment programming dollars; |

| • | pricing pressure that may adversely affect revenue and gross margin; |

| • | reduced credit availability and/or access to capital markets; |

| • | difficulty forecasting, budgeting and planning due to limited visibility into the spending plans of current or prospective customers; or |

| • | customer financial difficulty and increased risk of uncollectible accounts. |

15

Table of Contents

Our Adjusted OIBDA is derived from high margin advertising revenue, and the reduction in spending by or loss of a national or group of local advertisers could have a meaningful adverse effect on our business

We generated all of our Adjusted OIBDA from our high margin advertising business. A substantial portion of our advertising revenue relates to contracts with terms of a month or less. Advertisers will not continue to do business with us if they believe our advertising medium is ineffective or overly expensive. In addition, large advertisers generally have set advertising budgets, most of which are focused on traditional media platforms like television and recently online and mobile networks. Reductions in the size of advertisers’ budgets due to local or national economic trends, a shift in spending to new advertising mediums like the internet and mobile platforms or other factors could result in lower spending on cinema advertising. Because of the high incremental margins on our individual advertising contracts, if we are unable to remain competitive and provide value to our advertising clients, they may reduce their advertising purchases or stop placing advertisements with us, which on large contracts even the loss of a small number of clients would negatively affect our Adjusted OIBDA.

The loss of any major content partner or advertising customer could significantly reduce our revenue

We derive a significant portion of our revenue from our contracts with our content partners, PSAs and our founding members’ agreements to purchase on-screen advertising for their beverage concessionaires. We currently have marketing relationships with nine content partners, two of which expire in 2016 and seven in 2017. None of these companies individually accounted for over 10% of our total revenue during the year ended December 31, 2015. However, the agreements with the content partners, PSAs and beverage advertising with our founding members in aggregate accounted for approximately 30%, 30%, 34% and 31% of our total revenue during the six months ended June 30, 2016 and the years ended December 31, 2015, January 1, 2015 and December 26, 2013, respectively. Because we derive a significant percentage of our total revenue from a relatively small number of large companies, the loss of one or more of them as a customer could decrease our revenue and adversely affect current and future operating results.

Our plans for developing additional revenue opportunities may not be implemented and may not be achieved

In addition to our strategy to grow our advertising business, we are also considering other potential opportunities for revenue growth, which we describe in “Business—Our Strategy—Expand our Internet/Mobile Platform.” The development of our online and mobile advertising network and mobile apps and the integration of these marketing products with our core on-screen and theatre lobby production is at an early stage and is under increasing competitive pressure from many online and mobile networks, and may not deliver future benefits that we are expecting. Should these networks not continue to grow in importance to advertising clients and agencies, they may not provide a way to help expand our cinema advertising business as it matures and begins to compete with new or improved advertising platforms including online and mobile video services.

Our business and operations have experienced growth, and we may be unable to effectively manage or continue our growth of our network and advertising inventory

We have experienced, and may continue to experience, growth in our headcount and operations, which has placed, and could continue to place, significant demands on our management and operational infrastructure. If we do not effectively manage our growth, the quality of our services could suffer which could negatively affect our brand and our relationships with our current advertising clients. Additionally, we may not be able to continue to expand our network and our advertising inventory which could negatively affect our ability to add new advertising clients. To effectively manage this growth and continue to expand our network and inventory, we will need to continue to improve our systems, including our audience targeting system which we have been upgrading in 2014 and 2015. These enhancements and improvements could require an additional allocation of financial and management resources. If the improvements are not implemented successfully in a timely manner, our ability to manage our limited advertising inventory, create improved audience targeting capabilities for our clients and continue our growth in the future will be impaired and we may have to make significant additional expenditures to address these issues.

We depend upon our senior management and our business may be adversely affected if we cannot retain or replace them

Our success depends upon the retention of our experienced senior management with specialized industry, sales and technical knowledge and/or industry relationships. In August 2015, our President and Chief Executive Officer announced his resignation and, following a defined search process conducted by our Board of Directors, a new Chief Executive Officer was appointed in January 2016. If other critical members of our senior management team leave, we might not be able to find qualified internal or external replacements; accordingly, the loss of critical members of our senior management team could have a material adverse effect on our ability to effectively pursue our business strategy and our relationships with advertisers and content partners. We do not have key-man life insurance covering any of our employees.

16

Table of Contents

Changes in the ESAs with, or lack of support by, our founding members could adversely affect our revenue, growth and profitability

The ESAs with our founding members are critical to our business. The three ESAs each have an initial term of 30 years beginning February 13, 2007 and provide us with a five-year right of first refusal, which begins one year prior to the end of the term of the ESA on February 13, 2037. In connection with the sale of our Fathom Events business on December 26, 2013, the ESAs were modified to remove those provisions addressing the rights and obligations related to digital programming services of the Fathom Events business unit, except for those relating to our exclusive rights to sell advertising in the founding member theatres, including the right to sell Fathom event sponsorships. Our founding members’ theatres represent approximately 83% of the screens and approximately 85% of the attendance in our network as of June 30, 2016. If any one of the ESAs was terminated, not renewed at its expiration or found to be unenforceable, it would have a material adverse effect on our revenue, profitability and financial condition.

The ESAs require the cooperation, investment and support of our founding members, the absence of which could adversely affect us. Pursuant to the ESAs, our founding members must make investments to replace digital network equipment within their theatres and equip newly constructed theatres with digital network equipment. If our founding members do not have adequate financial resources or operational strength, and if they do not replace equipment or equip new theatres to maintain the level of operating functionality that we have today, or if such equipment becomes obsolete, we may have to make additional capital expenditures or our advertising revenue and operating margins may decline.

If the non-competition provisions of the ESAs are deemed unenforceable, our founding members could compete against us and our business could be adversely affected

With certain limited exceptions, each of the ESAs prohibits the applicable founding member from engaging in any of the business activities that we provide in the founding member’s theatres under the amended ESAs, and from owning interests in other entities that compete with us. These provisions are intended to prevent the founding members from harming our business by providing cinema advertising services directly to their theatres or by entering into agreements with third-party cinema advertising providers. However, under state and federal law, a court may determine that a non-competition covenant is unenforceable, in whole or in part, for reasons including, but not limited to, the court’s determination that the covenant:

| • | is not necessary to protect a legitimate business interest of the party seeking enforcement; |

| • | unreasonably restrains the party against whom enforcement is sought; or |

| • | is contrary to the public interest. |

Enforceability of a non-competition covenant is determined by a court based on all of the facts and circumstances of the specific case at the time enforcement is sought. For this reason, it is not possible for us to predict whether, or to what extent, a court would enforce the non-competition provisions contained in the ESAs. If a court were to determine that the non-competition provisions are unenforceable, the founding members could compete directly against us or enter into an agreement with another cinema advertising provider that competes against us. Any inability to enforce the non-competition provisions, in whole or in part, could cause our revenue to decline.

If one of our founding members declared bankruptcy, the ESA with that founding member may be rejected, renegotiated or deemed unenforceable

Each of our founding members currently has a significant amount of indebtedness, which is rated below investment grade. In 2000 and 2001, several major motion picture exhibition companies filed for bankruptcy including United Artists, Edwards Theatres and Regal Cinemas (which are predecessor companies to Regal), and General Cinemas and Loews Cineplex (which are predecessor companies to AMC). The industry-wide construction of larger, more expensive megaplexes featuring stadium seating in the late 1990s that rendered existing, smaller, sloped-floor theatres under long-term leases obsolete and unprofitable, were significant contributing factors to these bankruptcies. If a bankruptcy case were commenced by or against any of our founding members, it is possible that all or part of the ESA with that founding member could be rejected by a trustee in the bankruptcy case pursuant to Section 365 or Section 1123 of the United States Bankruptcy Code, or by the our founding member, and thus not be enforceable. Alternatively, that founding member could seek to renegotiate the ESA in a manner less favorable to us than the existing agreement. Should that founding member seek to sell or otherwise dispose of theatres or remove theatres from our network through bankruptcy or for other business reasons, if the acquirer did not agree to continue to allow us to sell advertising in the acquired theatres the number of theatres in our advertising networks would be reduced which in turn would reduce the number of advertising impressions available to us and thus could reduce our advertising revenue.

17

Table of Contents

The ESAs allow the founding members to engage in activities that might compete with certain elements of our business, which could reduce our revenue and growth potential