UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM __________ TO __________ |

Commission File Number 001-39528

PACTIV EVERGREEN INC.

(Exact name of Registrant as specified in its Charter)

Delaware | 88-0927268 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

1900 W. Field Court Lake Forest, IL | 60045 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (847) 482-2000

Securities registered pursuant to Section 12(b) of the Act:

d

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

Common Stock, $0.001 par value |

| PTVE |

| The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☒ | |||

|

|

|

|

|

|

|

Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

|

|

|

|

|

|

|

Emerging growth company |

| ☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☒

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant, based on the closing price of the shares of common stock on the Nasdaq Stock Market on June 30, 2023, was $301,604,107.

The number of shares of Registrant’s Common Stock outstanding as of February 23, 2024 was 178,557,086.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Definitive Proxy Statement relating to the Annual Meeting of Shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. The Registrant’s Definitive Proxy Statement will be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

Pactiv Evergreen Inc.

Table of Contents |

| |

|

|

|

| Page | |

|

|

|

1 | ||

Item 1. | 1 | |

Item 1A. | 9 | |

Item 1B. | 28 | |

Item 1C. | 28 | |

Item 2. | 28 | |

Item 3. | 29 | |

Item 4. | 29 | |

|

|

|

| 30 | |

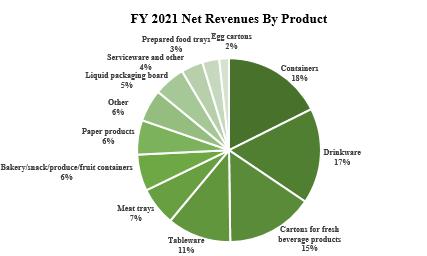

Item 5. | 30 | |

Item 6. | 31 | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 32 |

Item 7A. | 48 | |

Item 8. | 49 | |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 88 |

Item 9A. | 88 | |

Item 9B. | 88 | |

Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | 88 |

|

|

|

| 91 | |

Item 10. | 91 | |

Item 11. | 91 | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 91 |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 91 |

Item 14. | 91 | |

|

|

|

| 92 | |

Item 15. | 92 | |

Item 16. | 95 | |

|

|

|

96 | ||

FORWARD-LOOKING STATEMENTS AND RISK FACTORS SUMMARY

This report contains certain statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue,” the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to risks, uncertainties and assumptions about us, may include projections of our future financial performance, our anticipated growth strategies, anticipated trends in our business and anticipated growth in the markets served by our business. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements, including those factors discussed under the caption entitled “Risk Factors.” You should specifically consider the numerous risks outlined under “Risk Factors.” These risks include, among others, those related to:

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. We undertake no duty to update any of these forward-looking statements after the date of this report to conform our prior statements to actual results or revised expectations.

PART I

Item 1. Business

General

Pactiv Evergreen is a leading manufacturer and distributor of fresh foodservice and food merchandising products and fresh beverage cartons in North America. We produce a broad range of products that protect, package and display fresh food and beverages for consumers who want to eat or drink fresh, prepared or ready-to-eat food and beverages conveniently and with confidence. We supply our products to a broad and diversified mix of companies, including full service restaurants (also referred to as FSRs), quick service restaurants (also referred to as QSRs), foodservice distributors, supermarkets, grocery and healthy eating retailers, other food stores, food and beverage producers and food processors. We operate primarily in North America.

Segment Overview

We manufacture and sell products through the following two reportable segments:

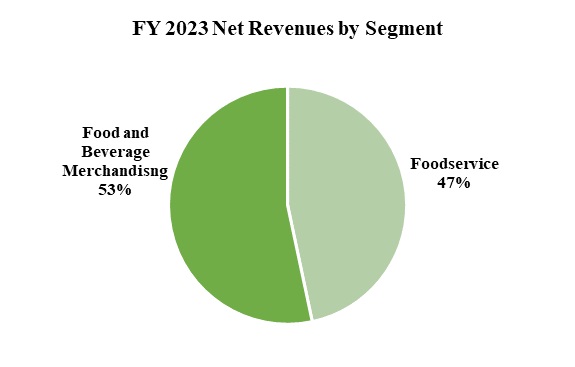

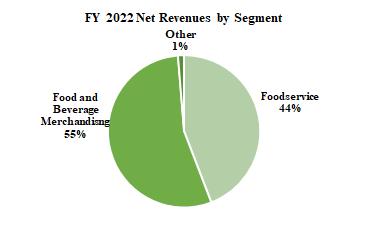

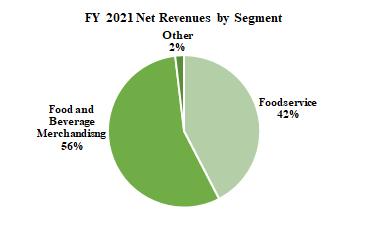

The pie charts below show the breakdown of our net external revenues from continuing operations for fiscal years 2023, 2022 and 2021 by our segments.

(1) Other represents residual businesses that do not represent a reportable segment.

1

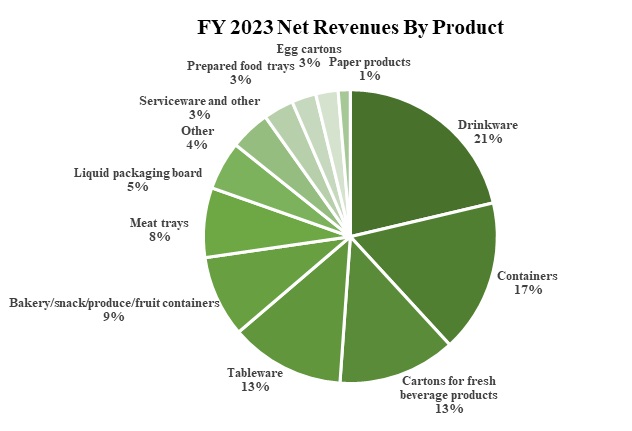

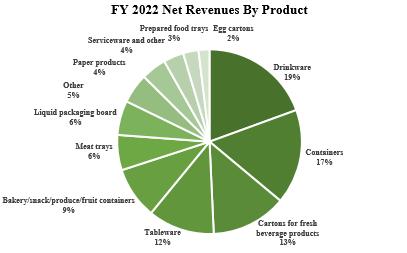

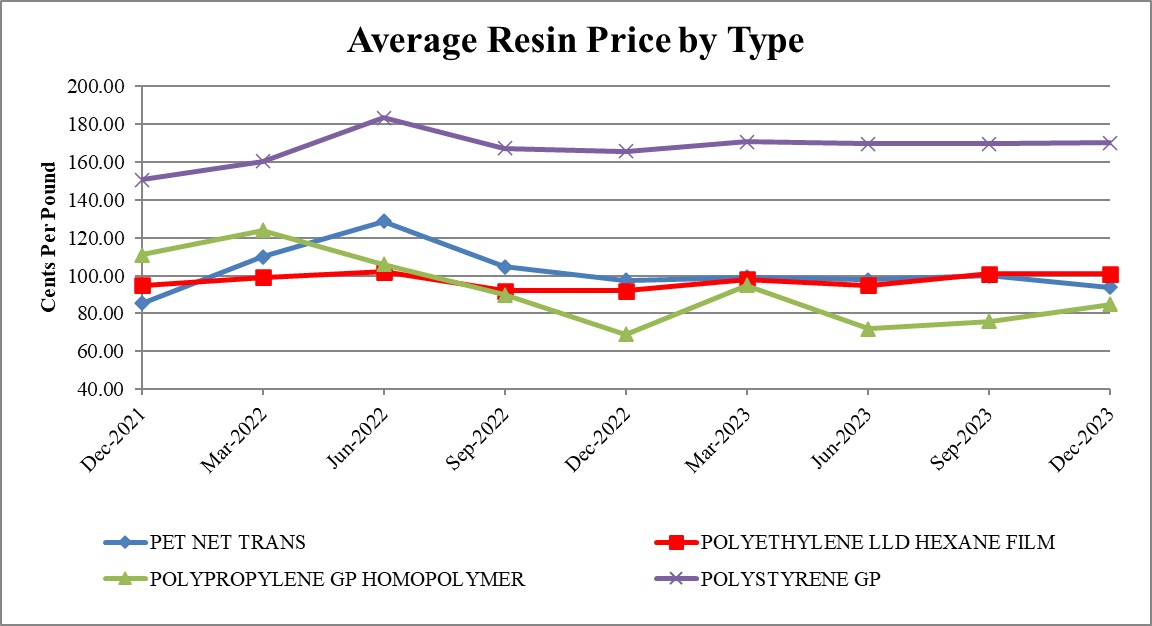

The pie charts below show the breakdown of our net revenues from continuing operations for fiscal years 2023, 2022 and 2021 by our products.

Beverage Merchandising Restructuring

In the second quarter of 2023, we combined our legacy Food Merchandising and Beverage Merchandising segments to create our current Food and Beverage Merchandising segment. At the same time, we also reorganized the management of certain product lines from our Foodservice segment to our Food and Beverage Merchandising segment. All information presented in this report as to prior periods has been recast to reflect the current reportable segment structure and the change in the management of certain product lines.

This change in segments occurred as part of a broader restructuring of our legacy Beverage Merchandising segment, which we refer to as the Beverage Merchandising Restructuring. This restructuring involved, among other things:

For additional information related to the Beverage Merchandising Restructuring, refer to Note 4, Restructuring, Asset Impairment and Other Related Charges, to the consolidated financial statements and to Recent Developments and Significant Items Affecting Comparability – Beverage Merchandising Restructuring within Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations.

2

Strategic Initiatives

Our strategic initiatives are grouped into five key areas: people; profitable growth; social responsibility; operational excellence; and enterprise optimization.

We rigorously track and measure the progress and results of our initiatives. We are focused on long-term planning and goal-setting strategies as well as our near-term operating results. We believe our strategic initiatives help drive our revenue growth and improve our margins.

Where appropriate, we also seek to grow our business with targeted acquisitions that enable us to achieve our strategic goals. For example, in 2021, we acquired Fabri-Kal, a manufacturer of thermoformed plastic packaging products whose products include food containers and drinkware (cold cups and lids) for the institutional foodservice and consumer packaged goods markets. The acquisition included four manufacturing facilities in the United States. For additional details, refer to Note 3, Acquisitions and Dispositions, to the consolidated financial statements.

Over the last several years, we have focused our business on our core, business-to-business North American foodservice and food and beverage merchandising operations. Before and after our IPO in September 2020, we divested certain of our non-core businesses, and may do so in the future. For example, in 2022, we sold our 50% interest in a joint venture with Naturepak Limited, which is a leading provider of fresh liquid carton and packaging systems in the Middle East and North Africa region, and our carton packaging and filling machinery businesses in China, Korea and Taiwan. In addition, we divested our remaining closures businesses during the fourth quarter of 2022 and the first quarter of 2023. In 2023, we also took significant restructuring actions related to our Beverage Merchandising operations. For information on divestitures undertaken before our IPO, please refer to the “Corporate Information” section below. For details on divestitures and distributions of certain operations that impacted our results, refer to Note 3, Acquisitions and Dispositions, and Note 4, Restructuring, Asset Impairment and Other Related Charges, to the consolidated financial statements.

Customers

We supply our products to a broad and diversified mix of companies, including FSRs, QSRs, foodservice distributors, supermarkets, grocery and healthy eating retailers, other food stores, food and beverage producers, food packers and food processors. Our customers range from large blue-chip multinational companies to national and regional companies to small local businesses. We have developed strong and longstanding relationships with our customers, including many leading restaurants and brands. In 2023, one customer in our Foodservice segment accounted for sales representing approximately 10% of our consolidated net revenues. No single customer accounted for more than 10% of our consolidated net revenues in 2022 or 2021. Our ten largest customers accounted for 42% of net revenues in 2023.

Seasonality

Our business does not experience high seasonality due to the complementary nature of the seasonal effects on our segments, though portions of our business are moderately seasonal. Our Foodservice operations and the food merchandising operations of our Food and Beverage Merchandising segment peak during the summer and fall months in North America when the favorable weather and harvest and holiday seasons lead to increased consumption, resulting in greater levels of sales in the second and third quarters. The customers of the beverage merchandising operations of our Food and Beverage Merchandising segment are principally engaged in providing products that are generally less sensitive to seasonal effects, although they do experience some seasonality as a result of increased consumption of milk by school children during the North American academic year, resulting in a greater level of carton product sales in the first and fourth quarters.

Competition

The markets in which we sell our products historically have been, and continue to be, highly competitive. Areas of competition include service, innovation, quality, sustainability and price. While we have long-term relationships with many of our customers, the underlying

3

contracts may be re-bid or renegotiated from time to time, and we may not be successful in renewing on favorable terms or at all, as pricing and other competitive pressures may occasionally result in the loss of a customer relationship.

Distribution and Marketing

We have a large, well-invested manufacturing base and a hub-and-spoke distribution network in the United States and in the international geographies in which we operate. Most of our assets are in the United States, which allows us to provide an extensive offering of U.S.-manufactured products to our customers. We believe our manufacturing footprint and distribution network provide us a competitive advantage in each of our segments. Our Foodservice segment is the only manufacturer among its competitors in the United States with an extensive nationwide hub-and-spoke distribution network, enabling customers to buy across our entire product offering. The food merchandising operation of our Food and Beverage Merchandising segment is a low cost U.S. manufacturer with well-invested facilities within close proximity to our customer base. We have an unrivalled product offering in the North American foodservice and food merchandising markets and a “one-face-to-the-customer” service model. This service model uses one sales representative per account to produce one order with multiple SKUs supported by one customer service representative who is responsible for one shipment with one invoice. We believe that the beverage merchandising operation of our Food and Beverage Merchandising segment is uniquely positioned in the United States as the only producer that manufactures fresh beverage cartons, filling machinery and liquid packaging board, which we believe positions us as a low cost solution with excellent customer service.

We have made manufacturing flexibility a priority in our investment of capital. We are able to offer substrates and product lines to match changing market needs efficiently and at low cost. This enables us to scale production in response to the requirements of our customers and trends in the market, including for example, increasing our use of recycled and recyclable material to produce a greater number of sustainable products. We have strategically invested in flexible manufacturing assets that can be quickly converted to produce alternative products. Our broad manufacturing base includes approximately 1,100 production lines.

As of December 31, 2023, our Foodservice segment has 23 manufacturing plants, and our Food and Beverage Merchandising segment has 28 manufacturing plants, including 5 U.S. beverage carton manufacturing plants. Both segments share the use of 34 warehouses and 8 regional mixing centers. Food and Beverage Merchandising also has 2 extrusion plants, 1 filling machinery plant, 1 integrated liquid packaging board mill and 1 chip mill. Each of our manufacturing plants is managed by a manufacturing director, and we use lean operating practices and information systems to measure performance against objective metrics and to optimize manufacturing efficiency and reduce cost.

Raw Materials

The primary raw materials used to manufacture our products are plastic resins, fiber (principally raw wood, wood chips and recycled newsprint) and paperboard (principally cartonboard and cupstock). We also use commodity chemicals, steel and energy, including fuel oil, electricity, natural gas and coal, to manufacture our products. We purchase most of our raw materials based on negotiated rates with suppliers, which are tied to published indices. Typically, we do not enter into long-term purchase contracts that provide for fixed quantities or prices for our principal raw materials. Most of our raw materials and other input costs are purchased on the spot market.

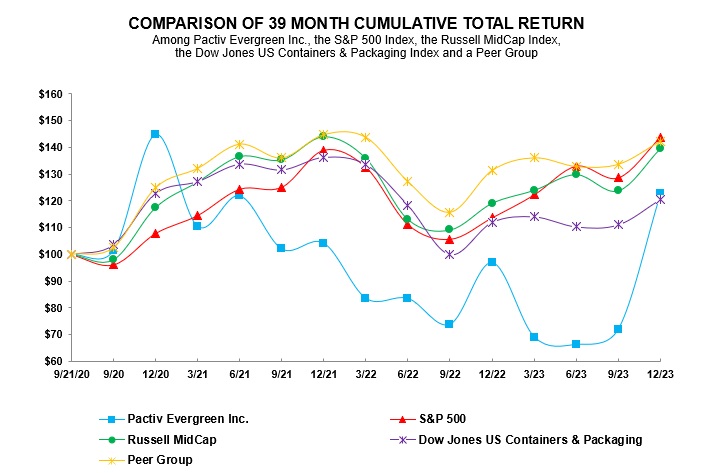

Resin prices have historically fluctuated based on changes in supply and demand and influenced by the prices of crude oil and monomers, which may be impacted by extreme weather conditions and the demand for other end uses. The prices of raw wood and wood chips may fluctuate due to external conditions such as weather, product scarcity, commodity market fluctuations and changes in governmental policies and regulations. Tariffs, trade sanctions and other disruptions in international commerce can also affect the cost of our raw materials.

We mitigate the impact of increased commodity costs principally through higher product pricing, manufacturing and overhead cost control and hedging arrangements. Many of the customer pricing agreements that our segments enter into contain raw material cost pass-through mechanisms that adjust prices to reflect the impact of changes in raw material costs. Generally, the contractual price adjustments do not occur simultaneously with commodity price fluctuations, but rather on a mutually agreed upon schedule, which often causes a lead-lag effect, during which margins are negatively impacted in the short term when raw material costs increase and positively impacted in the short term when raw material costs decrease. The average lag time in implementing raw material cost pass-through mechanisms is approximately three months. From time to time, we may also use hedging techniques to limit the impact of fluctuations in the cost of our principal raw materials, but we do not fully hedge against commodity cost changes, and our hedging strategies may not protect us from increases in specific raw material costs.

At this time, we believe there will continue to be an adequate supply of the raw materials we use and that they will generally remain available from numerous sources.

For additional information on our commodity costs, refer to Financial Outlook – Raw Materials and Energy Prices within Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations.

4

Intellectual Property and Research and Development

We have a proven history of product innovation, including the introduction of new products and the addition of innovative features to existing products. Innovation is a core capability we are proud of and a key focus area going forward as we strive to enhance our product portfolio, drive growth and increase margins.

We have significant intellectual property and proprietary know-how. As of December 31, 2023, we held approximately 300 patents related to product design, utility and material formulations.

Our primary focus areas for product innovation are developing packaging with useful new features, engineering new materials that improve the performance of our products and commercializing new environmentally-friendly packaging. Both consumer preferences and customer requirements continually evolve, and we strive to develop useful new features and products to meet those needs. Through our longstanding customer relationships, we gain valuable insight into our customers’ needs and are able to identify, engineer and develop optimal products for them. Functionality, quality, material savings, brand marketing, sustainability and safety are key drivers in our product development. Examples of our product innovations include reclosable beverage cartons, strawless lids, compostable plates and recycled polyethylene terephthalate “PET” containers.

In our Foodservice segment, our product innovation initiatives are focused on developing new products made from sustainable materials. In our Food and Beverage Merchandising segment, our food product innovation is focused on rapidly growing emerging companies for whom packaging helps deliver their brand, and we have developed a variety of carton designs to help beverage manufacturers differentiate their products and generate stronger brand recognition. Our barrier board technology allows our customers to achieve longer shelf life for their products while protecting against the loss of vitamins and other nutrients.

In 2023, 2022 and 2021, we spent a total of $45 million, $33 million and $22 million, respectively, on research and development efforts. We have dedicated technology and innovation facilities, and we employ personnel focused on product development, material innovation and process improvement. Our material science expertise and state-of-the-art product design and testing capabilities enable us to engineer high-performing materials and create new and innovative products to meet the requirements of our customers and the preferences of consumers as well as to increase food safety. We use our material science expertise to focus on sustainability, performance and material savings. We have industry-leading innovation centers where, among other things, we develop innovative resin blending and compounding formulations and processes and new engineered materials using paper/fiber substrates, which have on-site design, testing, prototyping and production capabilities. These unique material and product design capabilities allow us to partner with our customers to rapidly develop and commercialize new and innovative solutions that further increase the value we provide our customers.

Regulation

Our business is subject to regulations governing products that may contact food in all the countries in which we have operations. Future regulatory and legislative changes can affect the economics of our business activities, lead to changes in operating practices, affect our customers and influence the demand for and the cost of providing products and services to our customers. We have implemented compliance programs and procedures designed to achieve compliance with applicable laws and regulations, and believe these programs and procedures are generally effective. Our production facilities are independently audited for adherence to good manufacturing practices. As of December 31, 2023, 31 of our manufacturing facilities have achieved British Retail Consortium certification for meeting globally-recognized standards related to food safety and quality, and another five manufacturing facilities have received Safe Quality Food certification. Our extrusion plant and three additional manufacturing facilities are certified in accordance with FSSC 22000, another food safety certification scheme. The remaining sites—our paper mill, nine manufacturing and ten warehouse facilities—are certified following food safety and supplier assurance audits conducted by the National Sanitation Foundation.

We are also subject to various federal, state, local and foreign environmental, health and safety laws, regulations and permits. Among other things, these requirements regulate the emission or discharge of materials into the environment, govern the use, storage, treatment, disposal and management of hazardous substances and wastes, protect the health and safety of our employees, regulate the materials used in and the recycling of our products and impose liability, which can be strict, joint and several, for the costs of investigating and remediating, and damages resulting from, present and past releases of hazardous substances related to our current and former sites, as well as at third party sites where we or our predecessors have sent hazardous waste for disposal. Many of our manufacturing facilities require environmental permits, such as those limiting air and water emissions. Compliance with these permits can require capital investment and, in some cases, could limit production.

In addition, a number of governmental authorities, both in the United States and abroad, have considered, and are expected to consider, legislation aimed at reducing the amount of plastic waste. For example, in 2022, California enacted the Plastic Pollution Prevention and Packaging Producer Responsibility Act, which, among other things, requires a 25% reduction of plastics in single-use products in the state by 2032 and escalating recycling, reuse or composting rates for single-use packaging, regardless of material, used in the state over time. Additional legislation of this type has included banning certain types of materials or products, mandating certain recycling rates and imposing fees or taxes on packaging material, which could increase our compliance costs and adversely affect our business.

Moreover, as environmental issues, such as climate change, have become more prevalent, governments have responded, and are expected to continue to respond, with increased legislation and regulation, which could negatively affect us. For example, the U.S. Congress has

5

in the past considered legislation to reduce emissions of greenhouse gases. In addition, the Environmental Protection Agency regulates certain greenhouse gas emissions under existing laws such as the Clean Air Act. A number of states and local governments in the United States have also implemented, or announced their intentions to implement, their own programs to reduce greenhouse gases, most notably California. These initiatives may cause us to incur additional direct costs in complying with any new environmental legislation or regulations, such as costs to upgrade or replace equipment, as well as increased indirect costs that could get passed through to us resulting from our suppliers and customers also incurring additional compliance costs.

We have programs across our businesses to ensure we remain in compliance with all applicable laws and regulations. For a more detailed description of the various laws and regulations that affect our business, refer to the “Legal, Regulatory and Compliance Risks” section in Item 1A, Risk Factors.

Environmental, Social and Governance

Aligning purpose and performance creates value for companies, their employees and the community. Our efforts across the Company around Environmental, Social and Governance matters support both our Profitable Growth and Social Responsibility Key Strategic Initiatives.

Environmental

Sustainable Products

We offer products that deliver safe, fresh and convenient food and beverages. Our products help reduce food waste by protecting foods and beverages during transport, extending product shelf life and reducing the threat of contamination. Safety and convenience continue to be important as on-the-go consumption and delivery of foods and beverages drive growth in the industry.

We continue to grow our offering of sustainable products with new, plant-based bio-resin and fiber-based offerings. Today, we provide customers sustainable alternatives across nearly all our products and categories. We offer products made from seven different types of sustainable substrates and nearly all are made in North America. We believe our EarthChoice® brand is the largest brand of sustainable foodservice packaging in North America, with each product meeting at least one of our “Four Rs” of Reduce, Reuse, Recycle or Renew. Our Greenware® and Recycleware® brands complement our sustainable offerings, being made with renewable and recycled content materials, respectively.

Through our state-of-the-art production technology and material science expertise, we can develop new value-add and sustainable solutions. We believe we are well positioned to benefit from changing consumer preferences for more environmentally sustainable products. Our goal is that 100% of the packaging products we sell will be made from recycled, recyclable or renewable materials by 2030, based on associated net revenue. In 2023, we reached approximately 66% of that goal.

In addition, many of our customers have publicly-stated goals to increase the use of sustainable products. A significant portion of our new product and material innovations is geared toward developing sustainable products for our customers, with over 100 new items launched since 2020. As customers look to switch to more sustainable alternatives, we are well-positioned to quickly and effectively support them, thanks to our teams of material scientists and engineers. With a high percentage of our net revenues coming from products that are made from sustainable materials, we are helping our customers achieve their own sustainability goals. As of December 31, 2023, seven of our Pactiv Evergreen facilities have earned International Sustainability and Carbon Certification (“ISCC”) PLUS certifications, which allow us to track and verify certain recycled and/or renewable feedstocks.

In addition to using recyclable and compostable materials, we support efforts to expand opportunities for consumers to recycle or compost our products, notably as one of the founding members of the Carton Council, Paper Recovery Alliance, Plastics Recovery Group, Foam Recycling Coalition and the Paper Cup Alliance. We have demonstrated our commitment to use more recycled plastic by participating in the Association for Plastic Recyclers’ Demand Champions program. We engage with the composting industry through the U.S. Composting Council, and a growing number of our products are certified compostable by the Biodegradable Products Institute and/or the Compost Manufacturing Alliance. We are a longstanding member of the Sustainable Packaging Coalition, an industry working group aligned with our purpose: Packaging A Better Future.

Sustainable Operations

Our dedication to the environment goes beyond just the products we manufacture. Within our operations, we are working to limit our impact by reducing greenhouse gas emissions and energy consumption, optimizing water use and decreasing waste going to landfills. We have committed to the Science Based Targets initiative to establish near- and long-term company-wide greenhouse gas emission reduction goals in line with the Paris Agreement.

Improving energy efficiency is critical to us as energy expenses represent a significant operating cost. We are also looking to use more renewable energy, which further reduces our greenhouse gas emissions. Almost half of our annual energy consumption comes from renewable sources.

Efforts to minimize our water usage take various forms, given the variety of our operations. We primarily use water for process operations, cooling and cleaning. Most of our water use is “non-consumptive use,” which means the water is treated and returned back

6

to the environment after being used in our operations. We use data from the Water Resources Institute to analyze water basin conditions for each of our facilities. This annual process allows us to identify water-related risks and prioritize performance improvement measures. According to our most recent assessment, while 12% of our facilities are located in medium-high to high water risk areas, approximately 99% of our water intake occurs in low or low-medium water risk areas.

Reducing waste in our operations is an ongoing, company-wide pursuit. We reuse a significant majority of plastic and paper scrap to manufacture our own products and implement programs to reduce scrap in production as much as possible. The plastic or paper scrap that cannot be reused in the manufacturing process is recycled by third parties where possible. As of December 31, 2023, all of our U.S. plastics converting facilities had also made the Operations Clean Sweep pledge, a program aiming to keep plastic pellets out of the environment by reducing pellet, flake and powder loss from the plastics manufacturing process. Our applicable facilities in Canada and Mexico also made similar pledges to industry organizations in those countries.

Protecting the sustainability of our forests is a critical initiative, given our broad use of paper through our product offerings. The paper and paperboard purchased from our U.S. paper suppliers are certified to meet internationally-recognized fiber sourcing standards.

Additionally, our North American paper production facilities have chain-of-custody certifications from independent, third-party certifiers. In recent years, we have continually increased the amount of fiber we procure from these certified sources. We met our goal to have 100% of our applicable facilities in North America be chain of custody certified. In 2022, over 98% of our procured virgin fiber met third-party fiber sourcing or controlled wood standards, progressing on our targets to have 100% of our procured virgin fiber meet these standards by 2025. Additionally, we published an updated sustainable forestry policy as well as our Net Zero Deforestation Commitment, which can be found on our investor relations website at https://investors.pactivevergreen.com/esg-documents.

References to our website address do not constitute incorporation by reference of the information contained on the website, and the information contained on the website is not part of this document.

Social and Human Capital Resources

Our most valuable asset is our people, and our human capital management is evolving to meet the changing needs of today’s workforce.

As of December 31, 2023, we employed approximately 15,000 people globally. We believe in supporting and empowering our employees through recognition, health and welfare benefits offerings, development opportunities and fair compensation. Approximately 25% of our employees were represented by labor unions as of December 31, 2023. Our operations are subject to various local, national and multinational laws and regulations relating to our relationships with our employees. We are a party to numerous collective bargaining agreements, and we endeavor to renegotiate these collective bargaining agreements on satisfactory terms when they expire.

Workforce Health and Safety

Safety is a core value and affects everything we do. In 2023, we had a total recordable incidence rate of 1.02 compared to the industry average of 3.0, a total lost time restricted time rate of 0.37 compared to the industry average of 2.1 and a total lost workday rate of 0.64 compared to an industry average of 1.1.

Corporate Culture

Our purpose, mission and values represent the principles we honor, the promises we keep and the foundational beliefs we share. They communicate what our customers and shareholders can expect from us and what we can expect of each other. As we grow our brand, we are also mindful of the need to continue building on this values-based leadership. We continue to prioritize building corporate culture around our purpose of Packaging A Better Future and our values to Celebrate People, Do What’s Right, Win Together, Demand Excellence and Own It, including the creation of a Talent & Culture team. We believe our values-driven and people-centric culture supports diversity, innovative thinking, decisiveness and leadership skills — qualities that are essential in our fast-paced environment. We focus on promoting from within for rewarding careers and long-term growth. We know that we can support our employees in many ways: in 2023, we launched a new parental leave policy for U.S.-based salaried employees and strengthened our leadership development programs. We also launched our inaugural Employee Engagement Survey, seeking to gain insights into how our employees feel about working for Pactiv Evergreen and to identify opportunities for improvement.

In 2021, we launched the Pactiv Evergreen Give Back program, an annual initiative to reward employees and their families for living our values by supporting the communities where we live and work. As a food and beverage packaging company, we believe that we are uniquely equipped to inspire action and support those in need, especially when it comes to food insecurity. In 2023, our Give Back Month of Action supported numerous non-profits through over 100 volunteer events, donating approximately 6,000 hours of volunteer service and collecting nearly 300,000 pounds of non-perishable food items for local pantries. Our Give Back grants also support our employees and the causes important to them. We believe that the success of our Give Back program reflects our employees’ commitment to living our values and making a positive impact in our communities.

Diversity, Inclusion and Talent Development

We focus on attracting and retaining a diverse workforce, and we are committed to being transparent when it comes to diversity. In 2023, we released metrics related to the ethnic background and diversity in leadership of our U.S.-based employees, which represented

7

approximately 86% of our total workforce as of December 31, 2023. Also as of December 31, 2023, approximately 57% of our U.S.-based employees were Black, Indigenous or People of Color, including 23% of those in our senior or mid-level leadership positions. In addition, 30% of our employees were women, including 25% of those in our senior or mid-level leadership positions. In 2023, we were proud to be named a Military Times Best for Vets Employer for a second year in a row, reflecting our commitment to supporting veterans at all phases of recruitment, employment and retention.

Our diversity, equity and inclusion principles are also reflected in our employee training and policies. Diversity, equity and inclusion are embedded into our leadership development courses.

We support the success and growth of our employees through in-depth onboarding training and ongoing development opportunities throughout their careers. In November 2022, we launched two new Leadership Development programs for front line and mid-level leaders. Of more than 900 leaders from across the business, over 800 had completed this course as of the end of 2023. A third program was launched for senior manager and director-level employees with 20 leaders who were nominated by senior executives for this program. We are also testing a standardized hourly operator certification program to support our skilled team members in their career progression.

Governance

The composition of our seven-member Board of Directors includes three women, one of whom is Hispanic. Ms. LeighAnne Baker is our first female Board Chair. Ms. Baker has been an independent member of our Board since our initial public offering, and we are grateful to benefit from her leadership and experience. Our full Board of Directors continues to provide direct oversight over environmental, social and governance, or ESG, issues and corporate sustainability initiatives.

In 2023, we also conducted our ESG materiality assessment, published our first ESG report based on the Global Reporting Institute index and informed by the Sustainability Accounting Standards Board standards and publicly reported to CDP (formerly the Carbon Disclosure Project) on climate, forestry and water security. We received third-party limited assurance on Scope 1 and Scope 2 (location-based) emissions, energy consumed for Scope 1 and 2 (location-based) emissions and energy intensity for Scope 1 and Scope 2 (location-based) emissions.

Policies and ongoing reporting on ESG initiatives and performance can be found on our investor relations website at https://investors.pactivevergreen.com/esg-documents and will be provided, free of charge, to any shareholder who requests a copy.

References to our website address do not constitute incorporation by reference of the information contained on the website, and the information contained on the website is not part of this document.

Corporate Information

We were incorporated on May 30, 2006 as Reynolds Group Holdings Limited under New Zealand’s Companies Act 1993. On September 11, 2020, we converted into a Delaware corporation and changed our name to Pactiv Evergreen Inc. On September 21, 2020, we completed our IPO.

Prior to our IPO, we divested certain of our former business operations and segments as part of our consolidation into our core, business-to-business North American foodservice, food merchandising and beverage merchandising operations. In 2019, we sold our North American and Japanese closures businesses. In February 2020, we distributed all of our ownership of Reynolds Consumer Products Inc., which we refer to as RCP and which produces several consumer-facing brands of cooking products, waste and storage products and tableware, to Packaging Finance Limited, our parent company. In September 2020, we distributed to Packaging Finance Limited all of our ownership of Graham Packaging Company Inc., which we refer to as Graham Packaging or GPC and which designs and manufactures value-added, custom blow mold plastic containers for branded consumer products. For details on divestitures and distributions of certain operations that impacted our results, refer to Note 3, Acquisitions and Dispositions, to the consolidated financial statements.

Available Information

Our Internet address is www.pactivevergreen.com. We make our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports available free of charge on our investor relations website at https://investors.pactivevergreen.com/financial-information/sec-filings as soon as reasonably practicable after we electronically file them with, or furnish them to, the SEC. We may from time to time provide important disclosures to investors by posting them on our investor relations website, as allowed by SEC rules, but no information on our website is incorporated into this Annual Report on Form 10-K or any other filings we make with the SEC. We intend to use our website as a means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor our website, in addition to following our press releases, SEC filings and public conference calls and webcasts.

8

Item 1A. Risk Factors

You should carefully read the following discussion of significant factors, events and uncertainties when evaluating our business and the forward-looking information contained in this Annual Report on Form 10-K, including the Management’s Discussion and Analysis of Financial Condition and Results of Operations section and the consolidated financial statements and related notes. The events and consequences discussed in these risk factors could materially and adversely affect our business, operating results, liquidity and financial condition. While we believe we have identified and discussed below all material risk factors affecting our business, these risk factors do not identify all the risks we face, and there may be additional risks and uncertainties that we do not presently know or that we do not currently believe to be significant that may have a material adverse effect on our business, performance or financial condition in the future.

Risks Relating to Our Business and Industry

Fluctuations in raw material, energy and freight costs impact our business, financial condition and results of operations.

Raw materials, energy and freight are critical inputs to our business, and make up a substantial portion of our cost of sales. We strive to minimize the extent to which the volatility in the prices of these inputs affects our business. However, as described in greater detail below, these efforts are imperfect and we cannot guarantee that we will be able to mitigate the negative impacts on our business of that volatility. For example, during 2021 and 2022, we experienced substantial, broad-based volatility in the prices for these inputs to our business that were greater than we had experienced in the recent past, which meaningfully impacted our results of operations in those years.

The primary raw materials used in our products are plastic resins (principally polystyrene, polypropylene, polyethylene terephthalate, polyvinyl chloride, polyethylene and polylactic acid), fiber (principally raw wood, wood chips and recycled newsprint) and paperboard (principally cartonboard and cupstock). Changes in the prices of raw materials are generally due to movements in commodity market prices, although some raw materials, such as wood, may be affected by local market conditions (including weather) as well as the commodity market. These conditions can be affected by broader macroeconomic trends, such as the macroeconomic disruptions resulting from the Russian invasion of Ukraine in 2022 and the elevated levels of inflation experienced beginning in the second half of 2021. For more information on the impact of macroeconomic trends on our business, please refer to the risk factor under the caption “Our business is subject to risks related to global economic conditions, including inflation and interest rates, consumer demand, global supply chain challenges and other macroeconomic issues that could have an adverse effect on our business and financial performance.”

We typically do not enter into long-term purchase contracts that provide for fixed prices for our principal raw materials. While we enter into hedging agreements from time to time for some of our raw materials and energy sources, such as resin (or components thereof) and natural gas, to minimize the impact of such fluctuations, these hedging agreements do not cover all of our needs, hedging may reduce the positive impact we may otherwise receive when raw material prices decline and hedging arrangements may not always be available at commercially reasonable rates or at all, as is the case with our supply of energy in California, for example.

In addition, over the last several years, there has been a trend toward consolidation among suppliers of many of our principal raw materials, and we expect that this trend may continue. Consolidation among our key suppliers could enhance their ability to increase prices, forcing us to pay more for such raw materials, purchased either directly from these existing suppliers or from costlier alternative suppliers. We may be unable to pass on such cost increases to customers which could result in lower margins or lost sales. Consolidation among our suppliers also increases our vulnerability to catastrophic events impacting particular geographic regions. For more information, please refer to the risk factor “Natural disasters, public health crises and other catastrophic events outside of our control could damage our facilities or the facilities of third parties on which we depend, which could have an adverse effect on our financial condition or results of operations.”

Although many of our customer pricing agreements include raw material cost pass-through mechanisms, which mitigate the impact of changes in raw material costs, not all of them do. For those that do, the contractual price changes do not occur simultaneously with raw material price changes. Due to this contractual delay, as well as differences in timing between purchases of raw materials and sales to customers, there is often a lead-lag effect during which margins are negatively impacted in periods of rising raw material costs and positively impacted in periods of falling raw material costs. Moreover, many of our sales are not covered by such pass-through mechanisms. While we also use price increases, whenever possible, to mitigate the effect of raw material cost increases for customers that are not subject to raw material cost pass-through agreements, we may not be able to pass on cost increases to our customers on a timely basis, if at all, and consequently may not be able to recover the lost margin resulting from cost increases. Additionally, an increase in the selling prices for the products we produce resulting from a pass-through of increased raw material, energy or freight costs could adversely affect sales volumes.

In addition to our dependence on primary raw materials, we are also dependent on different sources of energy and other utilities for our operations, such as coal, fuel oil, electricity and natural gas. For example, our Beverage Merchandising segment is susceptible to price fluctuations in natural gas as it consumes significant amounts of natural gas to convert raw wood and wood chips to liquid packaging board. In addition, if some of our large energy contracts were to be terminated for any reason or not renewed upon expiration, or if market conditions were to substantially change resulting in a significant increase in the price of coal, fuel oil, electricity, natural gas or

9

other utilities, we may not be able to find alternative, comparable suppliers or suppliers capable of providing such energy and utilities on terms satisfactory to us. For instance, climate-related extreme weather conditions, such as hurricanes, flooding, droughts and deep freezes, have the potential to substantially change market conditions and increase prices for our energy and utilities. As a result of any of these events, our business, financial condition and operating results may suffer.

We are also dependent on third parties for the transportation of both our raw materials and other products that we purchase for our operations and the products that we sell to our customers. In certain jurisdictions, we are exposed to import duties and freight costs, the latter of which is influenced by carrier availability and the fluctuating costs of oil and other transportation costs. In recent years, the supply-chain disruptions that began during the coronavirus pandemic substantially increased our freight costs and the lead time associated with shipping our products, although these impacts moderated during 2022. Although some of our customer agreements include pass-through mechanisms for increased freight costs similar to the mechanisms for increases in raw materials costs, not all of our contracts contain these provisions, and those that do are subject to the same “lead-lag” effect described above.

Our business has substantial exposure to freight costs and freight-related disruptions, in particular domestic freight. We seek to reduce our exposure to freight-related disruptions through efforts to, among other things, reduce the need for transfer freight by producing the right product in the right place, increase warehouse automation and efficiency and decrease interdependencies. However, we may not be successful, and if we are not, our business would be negatively affected.

Governmental actions, like tariffs and trade sanctions, also impact the cost of raw materials and other goods and services that our business uses. For example, U.S. tariffs on products imported from certain countries and trade sanctions against certain countries, including on Russia following its invasion of Ukraine, have impacted the cost of certain raw materials, including resin, and other goods and services required to operate our business. Major developments in trade relations, including the imposition of new or strengthened tariffs or sanctions by the United States and other countries, could have a material adverse effect on our business, financial condition and results of operations.

If we fail to maintain satisfactory relationships with our major customers, our results of operations could be adversely affected.

Many of our customers are large and have significant market leverage, which could result in downward pricing pressure that constrains our ability to achieve favorable pricing terms. We sell most of our products under multi-year agreements with customers. Some of these agreements may be terminated at the customer’s convenience on short notice. In other cases, we sell products on a purchase-order basis without any commitment from the customers to purchase any quantity of products in the future.

Our relationships with our customers depend on numerous factors, including, among others, our ability to provide high-quality products at attractive prices, and our ability to meet their requirements in a timely manner. In order to meet customer requirements, we must have adequate inventory supply, which often requires accurately forecasting customer demand and, in many cases, building inventory sufficiently in advance. These forecasts are based on our estimates, and those of our customers, of future demand for our products. Our ability to accurately forecast demand in the future could be affected by many factors, including changes in customer demand for our products, the ability of our customers to provide reliable forecasts of demand, changes in demand for the products of competitors, unanticipated changes in general market or macroeconomic conditions and changes in economic conditions or customer confidence in future economic conditions. For example, as a result of forecasting inaccuracies and a lack of inventory build during the summer of 2023, there was a shortage of school milk cartons in the beginning of the 2023-2024 school year in North America that resulted in unmet market demand and increased costs. Any such failure to accurately forecast our customers’ needs may result in unmet demand, manufacturing delays, increased costs, reputational risk and adverse impacts to customer relationships. If the forecasts used to manage inventory are not accurate, we may experience a shortage of available products, excess inventory levels or reduced manufacturing efficiencies. Further, a deterioration in the strength of our customer relationships could cause our major customers to reduce purchasing volumes or stop purchasing our products, or could cause us to lose customers in the future. Any of these events could adversely affect our business and results of operations.

In addition, over the last several years, there has been a trend toward consolidation among our customers in the food and beverage industry and in the retail and foodservice industries, and we expect that this trend may continue. Consolidation among our customers could increase their ability to apply price pressure, and thereby force us to reduce our selling prices or lose sales, which would impact our results of operations. Following a consolidation, our customers in the food and beverage industry may also close production facilities or switch suppliers, while our customers in the retail industry may close stores, reduce inventory or switch suppliers of consumer products. Any of these actions could adversely impact the sales of our products.

In fiscal year 2023, one of our customers accounted for approximately 10% of our net revenues, and our top ten customers together accounted for approximately 42% of our net revenues. The loss or bankruptcy of any of our significant customers could have a material adverse effect on our business, financial condition and results of operations.

Our business is subject to risks related to global conditions, including inflation, consumer demand, global supply chain challenges and other macroeconomic and geopolitical issues that could have an adverse effect on our business and financial performance.

General economic downturns in our key geographic regions and globally can adversely affect our business operations, demand for our products and our financial results. The global economy, including credit and financial markets, has experienced extreme volatility and

10

disruptions, including higher interest rates, relatively high levels of inflation, strained supply chains and expectations of lower economic growth, which have put pressure on our business. Additionally, geopolitical volatility may also contribute to the general economic conditions and regulatory uncertainty in regions in which we operate.

For example, Russia’s invasion of Ukraine in the first quarter of 2022 and the resulting geopolitical responses increased the cost of many of the raw materials that we use and contributed to an aluminum scarcity that negatively affected our business. Similarly, the heightened inflationary environment in recent periods reduced consumer demand, which we believe reduced our volumes and negatively affected our ability to recover the heightened costs resulting from inflationary pressures. When challenging macroeconomic conditions such as these exist, our customers may delay, decrease or cancel purchases from us and may also delay payment or fail to pay us altogether. Suppliers may have difficulty filling our orders and distributors may have difficulty getting our products to customers, which may affect our ability to meet customer demands and result in a loss of business. Weakened global economic conditions may also result in unfavorable changes in our product prices and product mix and lower profit margins. Changes in policy, including as a result of the elections scheduled later this year in the United States and Mexico, the two countries in which we have the largest presence, could disrupt the markets we serve and the policies under which we operate. Any of these factors could have a material adverse effect on our business, the demand for our products, our financial condition and our results of operations.

We depend on a small number of suppliers for our raw materials and any interruption in our supply of raw materials would harm our business and financial performance.

Some of our key raw materials are sourced from a single supplier or a relatively small number of suppliers. For more information, please refer to the risk factor “Fluctuations in raw material, energy and freight costs impact our business, financial condition and results of operations.” As a consequence, we are dependent on these suppliers for an uninterrupted supply of our key raw materials. Such supply could be disrupted for a wide variety of reasons, many of which are beyond our control. We have written contracts with some but not all of our key suppliers, and many of our written contracts can be terminated on short notice or include force majeure clauses that would excuse the supplier’s failure to supply in certain circumstances. An interruption in the supply of raw materials for an extended period of time could have an adverse impact on our business and results of operations.

Labor shortages and increased labor costs have adversely affected our business and operations, and may continue to do so if we are not able to attract additional employees, retain existing employees and reduce the labor intensity of our business.

At times during the past three years, and in particular during the fourth quarter of 2021 and the first quarter of 2022, we experienced labor shortages that decreased production output in many of our plants, negatively impacting our business and operations. We believe that these shortages were attributable to a number of factors, including, among others, substantially increased employee absences due to coronavirus infections, rapid increases in prevailing wages, increased governmental support during the coronavirus pandemic and increased competition from other employers.

These labor shortages also contributed to an increase in our labor cost, which is one of the primary components in the cost of operating our business. Although many of our customer contracts allow us to pass on to our customers increases in certain raw materials, and increases in the broader consumer price index, we generally cannot directly pass on increased labor costs. Price increases tied to the consumer price index often compensate for labor cost increases in a normal wage environment, but this was not the case in some recent periods. As a result, compensating for heightened labor costs sometimes required additional negotiations for further price increases, with which we had mixed success, or increasing prices upon the renewal of a contract.

Although we noticed a marked increase in our ability to attract employees over the course of 2022 and 2023, we continue to experience heightened employee turnover, particularly among our newest employees. Our total rewards programs may not be lucrative enough to attract and retain the best talent, and the fixed shift schedules and manual labor required in many of our facilities could be less attractive than alternative employers’ positions. Increased turnover particularly affects our business, as the equipment required to operate our business is complicated and requires substantial training before an employee is at full productivity. As a result, we have experienced a decrease in employee productivity in certain of our plants, which has contributed to increasing our operating expenses.

To mitigate the impact of labor shortages on our business, we have increased our total reward offerings and provide referral, sign-on and retention bonuses, and have invested in improving the onboarding and training experience for our new hires. These measures are effective but increase our operating costs. We also dedicate a substantial portion of our regular capital expenditures to increasing automation and otherwise reducing the labor intensity of our business. However, these measures may not be successful, in which case our margins would be negatively affected. Additionally, if we increase product prices to cover increased labor costs, the higher prices could adversely affect sales volumes. If we are unable to successfully mitigate the adverse impacts of labor shortages, increased labor costs and employee turnover in our business, our operating expenses, growth and results of operations will continue to be negatively affected.

We may incur significant costs, experience short-term inefficiencies or be unable to realize expected long-term savings from the recently-announced Footprint Optimization, or any other business restructuring or reorganization.

On February 29, 2024, we announced a restructuring plan approved by our Board of Directors to optimize our manufacturing and warehouse footprint. We refer to these activities collectively as the Footprint Optimization. We determined to undertake the Footprint

11

Optimization because we believe that it will improve our operating efficiency. However, the successful completion of the Footprint Optimization, or any other business restructuring or reorganization, is subject to numerous risks and uncertainties. These risks and uncertainties include, but are not limited to, the following:

We cannot assure you that we will be able to realize all, or any, of the expected benefits, or avoid greater than expected inefficiencies or costs, from the Footprint Optimization or any other business restructuring or reorganization that we may undertake. Any such failure would negatively affect our business, financial condition and results of operations.

We may lose the use of all or a portion of any of our key manufacturing facilities due to natural disasters, public health crises and other catastrophic events outside of our control, as well as periodic scheduled outages, which could have an adverse effect on our financial condition or results of operations.

While we manufacture most of our products in a number of diversified facilities, a loss of the use of all or a portion of any of our key manufacturing facilities for any reason, including an accident, labor issues, weather conditions, pandemics, natural disasters, cybersecurity incidents, periodic scheduled outages and other catastrophic events and crises, could adversely affect our financial condition or results of operations. Certain of our products are produced at only one facility, or at a small number of facilities, increasing the risks associated with a loss of use of such facilities. For example, following the closure of our mill in Canton, North Carolina in June 2023, all of the beverage packaging products produced by our Food and Beverage Merchandising segment depend on the liquid paper board produced by our mill in Pine Bluff, Arkansas. Facilities may from time to time be impacted by adverse weather and other natural events, and the prolonged loss of a key manufacturing facility due to such events could have a material adverse effect on our business.

For instance, during February 2021, the Southern portion of the United States was impacted by Winter Storm Uri, which brought record low temperatures, snow and ice and resulted in power failures, hazardous road conditions, damage to property and death and injury to individuals in those states. During most of this weather event, we were unable to fully operate the Pine Bluff mill and some of our other plants and warehouses in Texas and Arkansas. Similarly, in the third quarter of 2021, Tropical Storm Fred caused substantial damage to our former Canton, North Carolina mill, and in the fourth quarter of 2022, during Winter Storm Elliott we were unable to fully operate certain of our facilities. In addition, certain of our equipment requires significant effort to maintain and repair, and prolonged downtime due to planned outages for maintenance, key equipment failure or loss could adversely affect our business.

We face similar risk in the case of certain third parties on which we depend. For example, we source most of our resin supply from the Gulf Coast region of the United States. Any natural disaster or other catastrophic event of the type referred to above, such as a hurricane, that negatively affects this region could disrupt our access to a critical input to our business, and we might not be able to obtain alternative supply on commercially reasonable terms, or at all, which would negatively affect our business and results of operations.

We have in the past, and may in the future, pursue acquisitions, divestitures, investments and other similar transactions, which could adversely affect our business.

In pursuing our business strategy, we routinely discuss and evaluate potential acquisitions, divestitures, investments and other similar transactions. We may seek to expand or complement our existing product offerings through the acquisition of or investment in attractive businesses rather than through internal development, such as our acquisition of Fabri-Kal in 2021. Or, conversely, we may seek to further concentrate our focus on our principal products and markets by divesting non-core businesses, as we did with the 2022 divestitures of operations outside of North America.

These transactions require significant management time and resources and have the potential to divert our attention from our ongoing business, and we may not manage them successfully. We may be required to make substantial investments of resources to support these transactions, and we cannot assure you that they will be successful.

The risks we face in pursuing these transactions include, among others:

12

Additionally, as a result of increased scrutiny by antitrust authorities, we may announce an acquisition or divestiture transaction that is challenged by such authorities, is ultimately not completed due to a failure to obtain antitrust or other related regulatory approvals or is subject to litigation by such authorities following its completion. Our failure to address these risks or other issues encountered in connection with our transactions could cause us to fail to realize the anticipated benefits of those transactions, cause us to incur unanticipated costs and liabilities and harm our business generally. Future transactions could also result in dilutive issuances of our equity securities; the incurrence of debt, contingent liabilities or other expenses; or impairments of tangible or intangible assets, any of which could harm our results of operations, and the anticipated benefits of any transaction may not materialize.

We may not be able to achieve some or all of the benefits that we expect to achieve from our capital investment, restructuring and other cost savings programs.

We regularly review our business to identify opportunities to reduce our costs. When we identify such opportunities, we may develop a capital investment, restructuring or other cost savings program to attempt to capture those savings, such as our strategic capital investment program. For example, we direct substantial capital investment toward reducing the labor intensity of our manufacturing processes to control labor costs and reduce our vulnerability to labor shortages. We may not be able to realize some or all of the cost savings we expect to achieve in the future as a result of our capital investment, restructuring and other cost savings programs in the time frame we anticipate. A variety of factors could cause us not to realize some of the expected cost savings, including, among others, delays in the anticipated timing of activities related to our cost savings programs, lack of sustainability in cost savings over time, unexpected costs associated with implementing the programs or operating our business and lack of ability to eliminate duplicative back office overhead and redundant selling, general and administrative functions, obtain procurement related savings, rationalize our distribution and warehousing networks, rationalize manufacturing capacity and shift production to more economical facilities and avoid labor disruptions in connection with any integration, particularly in connection with any headcount reduction.

Our business could be harmed by changes in consumer lifestyle, eating habits, nutritional preferences and health-related, environmental or sustainability concerns of consumers, investors and government and non-governmental organizations.

Consumers use our products to eat and drink food and beverage products. Any reduction in consumer demand for those products as a result of lifestyle, environmental, nutritional or health considerations could have a significant impact on our customers and, as a result, on our financial condition and results of operations. This includes the demand for the products that we make, as well as demand for our customers’ products. For example, certain of our products are used for dairy and fresh juice. Sales of those products have generally declined over recent years, requiring us to find new markets for our products.

Additionally, there is increasing concern about the environmental impact of the manufacturing, shipping and use of single-use food packaging and foodservice products. For instance, in 2023, legislation was introduced in both houses of the U.S. Congress to ban single-use plastic foam products. Further, in 2022, California enacted the Plastic Pollution Prevention and Packaging Producer Responsibility Act, which, among other things, requires a 25% reduction of plastics in single-use products in the state by 2032 and escalating recycling, reuse or composting rates for single-use packaging, regardless of material, used in the state over time. Numerous other U.S. municipalities and states and certain other countries, including Canada, have also proposed or enacted legislation prohibiting or restricting the sale and use of certain foodservice products and requiring them to be replaced with recyclable or compostable alternatives. Several provinces in Canada, as well as states in the United States, have enacted legislation imposing fees or other costs on manufacturers and other suppliers of single-use food packaging and foodservice products to encourage and fund recycling of those products.

Customers’, investors’, governments’ and non-governmental organizations’ concerns about product stewardship and resource sustainability, including product recycling, product packaging and restrictions on the use of potentially harmful materials, have received increased attention in recent years and are likely to play an increasing role in brand management and consumer purchasing decisions. In addition, changes in consumer lifestyle may decrease demand for certain of our products. Our financial position and results of operations might be adversely affected if environmental or sustainability concerns, restrictions on single-use packaging and products or changes in consumer lifestyle reduce demand for, or increase the costs of producing, our products.

13

If we are unable to develop new products or stay abreast of changing technology in our industry, our profits may decline.

We operate in mature markets that are subject to high levels of competition. Our future performance and growth depends on innovation and our ability to successfully develop or license capabilities to introduce new products and product innovations or enter into or expand into adjacent product categories, sales channels or countries. Our ability to quickly innovate in order to adapt our products to meet changing legal requirements and customer demands is essential. The development and introduction of new products require substantial and effective research and development and demand creation expenditures, which we may be unable to recoup if the new products do not gain widespread market acceptance.

In addition, we need effective and integrated systems to gather and use consumer data and information to successfully market our products. New product development and marketing efforts, including efforts to enter markets or develop product categories in which we have limited or no prior experience, have inherent risks, including product development or launch delays. These could result in our not being the first to market and the failure of new products to achieve anticipated levels of market acceptance. If product introductions or new or expanded adjacencies are not successful, costs associated with these efforts may not be fully recouped and our results of operations could be adversely affected. In addition, if sales generated by new products cause a decline in sales of our existing products, our financial condition and results of operations could be materially adversely affected. Even if we are successful in increasing market share within particular product categories, a decline in the markets for such product categories could have a negative impact on our financial results.

Certain aspects of our business are subject to changes in technology, and if we fail to anticipate or respond adequately to such changes, or do not have sufficient capital to invest in these developments, our profits may decline. Our future financial performance will depend in part upon our ability to develop new products and to implement and use technology successfully to improve our business operations. We cannot predict all the effects of future technological changes. The cost of implementing new technologies could be significant, and our ability to potentially finance these technological developments may be adversely affected by our debt servicing requirements or our inability to obtain the financing we require to develop or acquire competing technologies.

We operate in highly competitive markets.

We operate in highly competitive markets. Some of our competitors have significantly higher market shares in select product lines than we do globally or in the geographic markets in which we compete. Other competitors offer a more specialized variety of materials and concepts in select product lines and may serve more geographic regions through various distribution channels. Still others may have lower costs or greater financial and other resources than we do and may be less adversely affected than we are by price declines or by increases in raw material costs or otherwise may be better able to withstand adverse economic or market conditions.

In addition to existing competitors, we also face the threat of competition from new entrants to our markets. To the extent there are new entrants, increasing or even maintaining our market shares or margins may be more difficult. In addition to other suppliers of similar products, our business also faces competition from products made from other substrates. The prices that we can charge for our products are therefore constrained by the availability and cost of substitutes.

In addition, we are subject to the risk that competitors following lower social responsibility standards may enter the market with lower compliance, labor and other costs than ours, and we may not be able to compete with such companies for the most price-conscious customers.