UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________

FORM 10-K

_______________________________________________

(Mark one)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended: December 31, 2016

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-35653

_______________________________________________

SUNOCO LP

(Exact name of registrant as specified in its charter)

_______________________________________________

| Delaware | 30-0740483 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

8020 Park Lane, Suite 200, Dallas, Texas 75231

(Address of principal executive offices, including zip code)

Registrant's telephone number, including area code: (832) 234-3600

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |||

| Common Units Representing Limited Partner Interests | New York Stock Exchange (NYSE) | |||

Securities registered pursuant to Section 12(g) of the Act: NONE

_______________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted to its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Registration S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See the definitions of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☒ | Accelerated filer | ☐ | |

| Non-accelerated filer ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.): Yes ☐ No ☒

At June 30, 2016, the aggregate market value of common units representing limited partner interests held by non-affiliates of the registrant was approximately $1.5 billion based upon the closing price of its common units on the New York Stock Exchange.

The registrant had 98,538,043 common units representing limited partner interests and 16,410,780 Class C units representing limited partner interests outstanding at February 17, 2017.

Documents Incorporated by Reference: None

SUNOCO LP

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

| Page | ||

| Item 1. | ||

| Item 1A. | ||

| Item 1B. | ||

| Item 2. | ||

| Item 3. | ||

| Item 4. | ||

| Item 5. | ||

| Item 6. | ||

| Item 7. | ||

| Item 7A. | ||

| Item 8. | ||

| Item 9. | ||

| Item 9A. | ||

| Item 9B. | ||

| Item 10. | ||

| Item 11. | ||

| Item 12. | ||

| Item 13. | ||

| Item 14. | ||

| Item 15. | ||

| Item 16. | ||

i

PART I

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This report contains “forward-looking statements.” All statements other than statements of historical fact contained in this report are forward-looking statements, including, without limitation, statements regarding our plans, strategies, prospects and expectations concerning our business, results of operations and financial condition. You can identify many of these statements by looking for words such as “believe”, “expect”, “intend”, “project”, “anticipate”, “estimate”, “continue” or similar words or the negative thereof.

Known material factors that could cause our actual results to differ from those in these forward-looking statements are described below, in Part I, Item 1A (“Risk Factors”) and Part II, Item 7 (“Management’s Discussion and Analysis of Financial Condition and Results of Operations”) of this report.

All forward-looking statements included in this report are based on information available to us on the date of this report. Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements.

| Item 1. | Business |

General

As used in this document, the terms “Partnership”, “SUN”, “we”, “us”, or “our” should be understood to refer to Sunoco LP, known prior to October 27, 2014 as Susser Petroleum Partners LP, and our consolidated subsidiaries as applicable and appropriate.

Overview

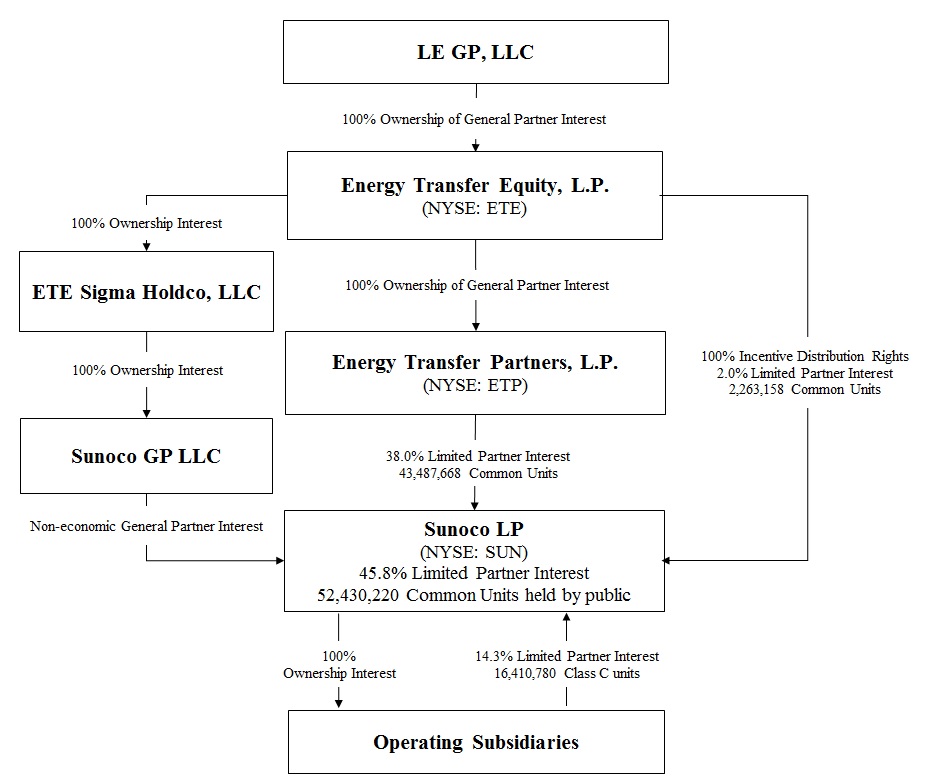

We are a growth-oriented Delaware master limited partnership. We are managed by our general partner, Sunoco GP LLC (our “General Partner”), which is owned by Energy Transfer Equity, L.P., another publicly traded master limited partnership (“ETE”). The following simplified diagram depicts our organizational structure as of December 31, 2016.

1

We are engaged in the retail sale of motor fuels and merchandise through our company-operated convenience stores and retail fuel sites, as well as the wholesale distribution of motor fuels to convenience stores, independent dealers, commercial customers and distributors. Additionally, we are the exclusive wholesale supplier of the iconic Sunoco-branded motor fuel, supplying an extensive distribution network of approximately 5,335 Sunoco-branded company and third-party operated locations.

Effective January 1, 2016, we completed the acquisition from ETP Retail Holdings, LLC ("ETP Retail") of (i) the remaining 68.42% membership interest and 49.9% voting interest in Sunoco, LLC ("Sunoco LLC") and (ii) 100% of the membership interest of Sunoco Retail LLC ("Sunoco Retail"), which immediately prior to the acquisition owned all of the retail assets previously owned by Sunoco, Inc. (R&M), an ethanol plant located in Fulton, NY, 100% of the interests in Sunmarks, LLC and all of the retail assets previously owned by Atlantic Refining and Marketing Corp. This acquisition was accounted for as a transaction between entities under common control. Specifically, the Partnership recognized acquired assets and assumed liabilities at their respective carrying values with no goodwill created. The Partnership’s results of operations include 100% of Sunoco LLC’s and Sunoco Retail’s results of operations beginning September 1, 2014, the date of common control. As a result, the Partnership retrospectively adjusted its financial statements to include the balances and operations of Sunoco LLC and Sunoco Retail from August 31, 2014.

During 2016, we completed other strategic acquisitions of businesses that operate complementary motor fuel distribution and convenience retail stores (see “Acquisitions” below). As a result of these and previously completed acquisitions, we operate approximately 1,345 convenience stores and fuel outlets in more than 20 states, offering merchandise, food service, motor fuel and other services as of December 31, 2016. Our retail stores operate under several brands, including our proprietary convenience store brands Stripes, APlus, and Aloha Island Mart. We distributed approximately 7.8 billion gallons of motor fuel during 2016 through our convenience stores and consignment locations, contracted independent convenience store operators, and other commercial customers.

Operating Segments and Subsidiaries

We operate our business as two segments, which are primarily engaged in wholesale fuel distribution and retail fuel and merchandise sales, respectively. Our primary operations are conducted by the following consolidated subsidiaries:

Wholesale Subsidiaries

| • | Susser Petroleum Operating Company LLC (“SPOC”), a Delaware limited liability company, distributes motor fuel, propane and lubricating oils to Stripes’ retail locations, consignment locations, and third party customers in Texas, New Mexico, Oklahoma, Louisiana, and Kansas. |

| • | Sunoco LLC, a Delaware limited liability company, primarily distributes motor fuel across more than 26 states throughout the East Coast, Midwest, and Southeast regions of the United States. Sunoco LLC also processes transmix and distributes refined product through its terminals in Alabama and the Greater Dallas, TX metroplex. |

| • | Southside Oil, LLC, a Virginia limited liability company, distributes motor fuel primarily in Virginia, Maryland, Tennessee, and Georgia. |

| • | Aloha Petroleum LLC, a Delaware limited liability company, distributes motor fuel and operates terminal facilities on the Hawaiian Islands. |

Retail Subsidiaries

| • | Susser Petroleum Property Company LLC (“PropCo”), a Delaware limited liability company, primarily owns and leases convenience store properties. |

| • | Susser Holdings Corporation ("Susser"), a Delaware corporation, sells motor fuel and merchandise in Texas, New Mexico, and Oklahoma through Stripes-branded convenience stores. |

| • | Sunoco Retail, a Pennsylvania limited liability company, owns and operates convenience stores that sell motor fuel and merchandise primarily in Pennsylvania, New York, and Florida. |

| • | MACS Retail LLC (“MACS Retail”), a Virginia limited liability company, owns and operates convenience stores in Virginia, Maryland, and Tennessee. |

| • | Aloha Petroleum, Ltd. (“Aloha”), a Hawaii corporation, owns and operates convenience stores on the Hawaiian Islands. |

2

Acquisitions

On October 12, 2016, we completed the acquisition of the convenience store, wholesale motor fuel distribution, and commercial fuels distribution business serving East Texas and Louisiana from Denny Oil Company (“Denny”) for approximately $55 million. This acquisition includes six company-owned and operated locations, six company-owned and dealer operated locations, wholesale fuel supply contracts for a network of independent dealer-owned and dealer-operated locations, and a commercial fuels business in the Eastern Texas and Louisiana markets. As part of the acquisition, we acquired 13 fee properties, which included the six company operated locations, six dealer operated locations, a bulk plant and an office facility.

On August 31, 2016, we acquired the fuels business (the "Fuels Business") from Emerge Energy Services LP (NYSE: EMES) ("Emerge") for $171 million, inclusive of working capital and other adjustments. The Fuels Business comprises Dallas-based Direct Fuels LLC and Birmingham-based Allied Energy Company LLC, both wholly owned subsidiaries of Emerge, and engages in the processing of transmix and the distribution of refined fuels. As part of the acquisition, we acquired two transmix processing plants with attached refined product terminals. Combined, the plants can process over 10,000 barrels per day of transmix, and the associated terminals have over 800,000 barrels of storage capacity.

On June 22, 2016, we acquired 14 convenience stores and the wholesale fuel business in the Austin, Houston, and Waco, Texas markets from Kolkhorst Petroleum Inc. for $39 million. The convenience stores acquired include 5 fee properties and 9 leased properties, all of which are company operated. The Kolkhorst acquisition also included supply contracts with dealer-owned and operated sites.

On June 22, 2016, we acquired 18 convenience stores serving the upstate New York market from Valentine Stores, Inc. (“Valentine”) for $78 million. The acquisition included 19 fee properties (of which 18 are company operated convenience stores and one is a standalone Tim Hortons), one leased Tim Hortons property, and three raw tracts of land in fee for future store development.

See Note 3 of the Notes to Consolidated Financial Statements included in Part II, Item 8 for additional information on our acquisitions.

Recent Developments

On January 18, 2017, with the assistance of NRC Realty & Capital Advisors, LLC, we launched a portfolio optimization plan to market and sell 99 real estate assets. Real estate assets included in this process are company-owned locations, undeveloped greenfield sites and other excess real estate. Properties are located in Florida, Louisiana, Massachusetts, Michigan, New Hampshire, New Jersey, New Mexico, New York, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, Texas and Virginia. The properties will be sold through a sealed-bid sale in a ‘buy one, some or all’ format with bids due on March 7, 2017 for the operating sites and on April 4, 2017 for the surplus properties. The Partnership will review all bids before divesting any assets.

On May 2, 2016, we finalized an agreement with the Indiana Toll Road Concession Company to develop and operate 8 travel plazas along the 150-mile toll road. The agreement has a 20-year term with an estimated cost of $31 million. The first series of plaza reconstruction began in the third quarter of 2016, and the total construction period is expected to last two years.

On March 28, 2016, we entered into a Store Development Agreement with Dunkin’ Donuts to be the exclusive developer of Dunkin’ Donuts restaurants in the state of Hawaii for an initial term of eight years. We have committed to building and operating 15 Dunkin’ Donuts restaurants at an estimated cost of $20 million. We anticipate that approximately half the restaurants will be built on existing properties and half will be standalone restaurants developed on properties that will be acquired in the future.

Available Information

Our principal executive offices are located at 8020 Park Lane, Suite 200, Dallas, Texas 75231. Our telephone number is (832) 234-3600. Our internet address is www.sunocolp.com. We make available through our website our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the Securities and Exchange Commission (the "SEC"). Information contained on our website is not part of this report. The SEC maintains an internet site at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Our Relationship with Energy Transfer Equity, L.P. and Energy Transfer Partners, L.P.

ETE is a publicly traded master limited partnership that owns our general partner. ETE also directly and indirectly owns equity interests in Energy Transfer Partners, L.P. ("ETP"), Sunoco Logistics Partners L.P. (“SXL”) and the Partnership, all of which are also publicly traded master limited partnerships engaged in diversified energy-related businesses.

3

ETP is one of the largest publicly traded master limited partnerships in the U.S. in terms of equity market capitalization. ETP, through its wholly owned operating subsidiaries, is engaged primarily in natural gas and natural gas liquids transportation, storage and fractionation services. ETP is also engaged in refined product and crude oil operations including transportation and retail marketing of gasoline and middle distillates through its subsidiaries.

One of our principal strengths is our relationship with ETE and ETP. As of February 17, 2017, ETE owns 100% of the membership interest in our general partner, a 2.0% limited partner interest in us and all of our incentive distribution rights, and ETP owns a 37.8% limited partnership interest in us. Given the significant joint ownership, we believe ETE and ETP will be motivated to promote and support the successful execution of our business strategies. In particular, we believe it will be in the best interest of each of ETP and ETE to facilitate organic growth opportunities and accretive acquisitions from third parties, although neither ETE nor ETP is under any obligation to do so.

Commercial Agreements with Affiliates

We are party to the following fee-based commercial agreements with various subsidiaries or affiliates of ETP:

| • | Philadelphia Energy Solutions Products Purchase Agreements – two related products purchase agreements, one with Philadelphia Energy Solutions Refining & Marketing (“PES”) and one with PES’s product financier Merrill Lynch Commodities; both purchase agreements contain 12-month terms that automatically renew for consecutive 12-month terms until either party cancels with notice. ETP Retail owns a noncontrolling interest in the parent of PES. |

| • | SXL Transportation and Terminalling Contracts – various agreements with subsidiaries of SXL for pipeline, terminalling and storage services. SXL is a consolidated subsidiary of ETP. We also have agreements with subsidiaries of SXL for the purchase and sale of fuel. |

For more information regarding the commercial agreements, please read “Item 13. Certain Relationships, Related Transactions and Director Independence.”

Our Business and Operations

Wholesale Operations Segment

We are a wholesale distributor of motor fuels and other petroleum products which we supply to our retail segment, to third-party dealers and distributors, to independent operators of consignment locations and other consumers of motor fuel. Also included in the wholesale segment are transmix processing plants and refined products terminals. Transmix is the mixture of various refined products (primarily gasoline and diesel) created in the supply chain (primarily in pipelines and terminals) when various products interface with each other. Transmix processing plants separate this mixture and return it to salable products of gasoline and diesel.

We are the exclusive wholesale supplier of the iconic Sunoco branded motor fuel, supplying an extensive distribution network of approximately 5,335 Sunoco-branded company and third-party operated locations throughout the East Coast, Midwest and Southeast regions of the United States, including approximately 235 company operated Sunoco-branded locations in Texas. We believe we are one of the largest independent motor fuel distributors by gallons in Texas and one of the largest distributors of Chevron, Exxon, and Valero branded motor fuel in the United States. In addition to distributing motor fuels, we also distribute other petroleum products such as propane and lubricating oil, and we receive rental income from real estate that we lease or sublease.

We purchase motor fuel primarily from independent refiners and major oil companies and distribute it across more than 30 states throughout the East Coast, Midwest and Southeast regions of the United States, as well as Hawaii to approximately:

| • | 1,345 company-operated convenience stores and fuel outlets; |

| • | 165 independently operated consignment locations where we sell motor fuel under consignment arrangements to retail customers; |

| • | 5,550 convenience stores and retail fuel outlets operated by independent operators, which we refer to as “dealers” or “distributors,” pursuant to long-term distribution agreements; and |

| • | 2,130 other commercial customers, including unbranded convenience stores, other fuel distributors, school districts and municipalities and other industrial customers. |

4

Dealer Incentives

In addition to motor fuel distribution, we offer dealers the opportunity to participate in merchandise purchasing and promotional programs arranged with vendors. We believe the vendor relationships we have established through our retail operations and our ability to develop programs provide us with an advantage over other distributors when recruiting new dealers into our network, as well as retaining current dealers. Our dealer incentives give our dealers access to discounted rates on products and services that they would likely not be able to obtain on their own.

Sales to Contracted Third Parties

We distribute fuel under long-term contracts to branded distributors, branded and unbranded convenience stores, and branded and unbranded retail fuel outlets operated by third parties. No single third party dealer or distributor is material to our business.

Sunoco-branded supply contracts with distributors generally have both time and volume commitments that establish contract duration. These contracts have an initial term of approximately nine years, with an estimated, volume-weighted term remaining of approximately four years.

Distribution contracts with convenience stores and retail fuel outlets generally commit us to distribute branded (including, but not limited to, Sunoco branded) or unbranded motor fuel to a location or group of locations and arrange for all transportation and logistics. These contracts require, among other things, that dealers maintain the standards established by the applicable fuel brand, if any. The initial term of these contracts range from three to twenty years, with most contracts for ten years.

Our supply contracts and distribution contracts are typically constructed so that we receive either (i) a fee per gallon equal to the posted rack rate, less any applicable commercial discounts, plus transportation costs, taxes and a fixed, volume-based fee, which is usually expressed in cents per gallon, or (ii) receive a variable cent per gallon margin (“dealer tank wagon pricing”).

During 2016, our wholesale business distributed fuel under consignment arrangements at approximately 165 locations. Under these arrangements we generally provide and control motor fuel inventory and price at the site and receive actual retail selling price for each gallon sold, less a commission paid to the independent operators.

We continually seek to expand through the addition of new branded dealers, distributors and consignment locations, new unbranded commercial customers, and through acquisitions of contracts for existing independently operated sites from other distributors. We evaluate potential independent site operators based on their creditworthiness and the quality of their site and operations, including the site’s size and location, projected monthly volumes of motor fuel, monthly merchandise sales, overall financial performance and previous operating experience. We may extend credit to certain dealers based on our credit evaluation process.

Sales to Other Commercial Customers

We distribute unbranded fuel to numerous other customers, including convenience stores, unattended fueling facilities and certain other commercial customers. These customers are primarily commercial, governmental and other parties who buy motor fuel by the load or in bulk and who do not generally enter into exclusive contractual relationships with us, if they enter into a contractual relationship with us at all. Sales to these customers are typically made at a quoted price based upon our cost plus taxes, cost of transportation and a margin determined at time of sale, and may provide for immediate payment or the extension of credit for up to 30 days. We also sell propane, lubricating oil and other petroleum products, such as heating fuels, to our commercial customers on both a spot and contracted basis. In addition, we receive income from the manufacture and wholesale sale of race fuels at our Marcus Hook, Pennsylvania manufacturing facility.

Fuel Supplier Arrangements

We distribute branded motor fuel under the Aloha, Chevron, Citgo, Conoco, Exxon, Mahalo, Mobil, Phillips 66, Shamrock, Shell, Texaco, Sunoco, and Valero brands. We purchase branded motor fuel from major oil companies and refiners under supply agreements. Our largest branded fuel suppliers in terms of volume are Chevron, Exxon, Phillips 66 and Valero. The branded fuel supply agreements generally have an initial term of three to five years. Each supply agreement typically contains provisions relating to payment terms, use of the supplier’s brand names, credit card processing, compliance with other of the supplier’s requirements, insurance coverage and compliance with legal and environmental requirements, among others.

We also distribute unbranded motor fuel, which we purchase on a bulk basis, on a rack basis based upon prices posted by the refiner at a fuel supply terminal, or on a contract basis with the price tied to one or more market indices.

As is typical in the industry, our suppliers generally can terminate the supply contract if we do not comply with any material condition of the contract, including our failure to make payments when due, fraud, criminal misconduct, bankruptcy or insolvency.

5

Bulk Fuel Purchases

We purchase motor fuel in bulk and hold it in inventory or transport it via pipeline. To mitigate inventory risk, we use commodity futures contracts or other derivative instruments which are matched in quantity and timing to the anticipated usage of the inventory. We also blend in various additives including ethanol and biomass-based diesel.

Terminals and Transmix

We operate two transmix processing facilities and eight refined product terminals (six in Hawaii and two associated with our transmix plants). Transmix is the mixture of various refined products (primarily gasoline and diesel) created in the supply chain (primarily in pipelines and terminals) when various products interface with each other. Transmix processing plants separate this mixture and return it to salable products of gasoline and diesel. Our refined product terminals provide storage and distribution services used to supply our own retail stations as well as third-party customers. In addition, we provide services at our terminals to various third-party throughput customers.

Transportation Logistics

We provide transportation logistics for most of our motor fuel deliveries through our own fleet of fuel transportation vehicles as well as third-party and affiliated transportation providers. We arrange for motor fuel to be delivered from the storage terminals to the appropriate sites in our distribution network at prices consistent with those historically charged to third parties for the delivery of fuel. We also deliver motor fuel, propane, and lubricating oils to commercial customers involved in petroleum exploration and production.

Technology

Technology is an important part of our wholesale operations. We utilize a proprietary web-based system that allows our wholesale customers to access their accounts at any time from a personal computer to obtain prices, place orders, and review invoices, credit card transactions and electronic funds transfer notifications. Substantially all of our customer payments are processed by electronic funds transfer. We use an internet-based system to assist with fuel inventory management and procurement and an integrated wholesale fuel system for financial accounting, procurement, billing and inventory management.

Retail Operations Segment

As of December 31, 2016, our retail segment operated approximately 1,345 convenience stores and retail fuel outlets. Our retail convenience stores operate under several brands, including our proprietary brands Stripes, APlus, and Aloha Island Mart, and offer a broad selection of food, beverages, snacks, grocery and non-food merchandise, motor fuel and other services. We have company operated sites in more than 20 states, with a significant presence in Texas, Pennsylvania, New York, Florida, Virginia and Hawaii.

As of December 31, 2016, we operated approximately 740 Stripes convenience stores in Texas, New Mexico, Oklahoma and Louisiana. Each store offers a customized merchandise mix based on local customer demand and preferences. We have built approximately 255 large-format convenience stores from January 2000 through December 31, 2016. We have implemented our proprietary, in-house Laredo Taco Company restaurant concept in approximately 470 Stripes convenience stores and intend to implement it in all newly constructed Stripes convenience stores. We also own and operate ATM and proprietary money order systems in most Stripes stores and provide other services such as lottery, prepaid telephone cards, wireless services and car washes.

As of December 31, 2016, we operated approximately 445 retail convenience stores and fuel outlets, primarily under our proprietary and iconic Sunoco fuel brand, and principally located in Pennsylvania, New York and Florida, including approximately 400 APlus convenience stores. Sunoco Retail's convenience stores offer a broad selection of food, beverages, snacks, grocery, and non-food merchandise, as well as motor fuel and other services such as ATM's, money orders, lottery, prepaid telephone cards, and wireless services.

As of December 31, 2016, we operated approximately 160 MACS and Aloha convenience stores and fuel outlets in Virginia, Maryland, Tennessee, Georgia, and Hawaii offering merchandise, food service, motor fuel and other services. As of December 31, 2016, MACS operated approximately 110 company-operated retail convenience stores and Aloha operated approximately 50 Aloha, Shell, and Mahalo branded fuel stations.

For further detail of our segment results refer to “Item 8. Financial Statements and Supplementary Data - Notes to Consolidated Financial Statements - Note 19 Segment Reporting” and “Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations”.

6

Merchandise Suppliers

Our retail businesses purchase approximately 46% of total retail merchandise from McLane Company, Inc. We do not maintain additional product inventories other than what is in our stores.

Sale of Regulated Products

In certain areas where our convenience stores are located, state or local laws limit the hours of operation for the sale of alcoholic beverages and restrict the sale of alcoholic beverages and tobacco products to persons younger than a certain age. State and local regulatory agencies have the authority to approve, revoke, suspend or deny applications for and renewals of permits and licenses relating to the sale of alcoholic beverages, as well as to issue fines to convenience stores for the improper sale of alcoholic beverages and tobacco products. Failure to comply with these laws may result in the loss of necessary licenses and the imposition of fines and penalties on us. Such a loss or imposition could have a material adverse effect on our business, liquidity and results of operations.

Real Estate and Lease Arrangements

As of December 31, 2016, our real estate and lease arrangements are as follows:

| Owned | Leased | ||||

| Wholesale dealer and consignment sites | 491 | 221 | |||

| Company-operated convenience stores | 856 | 491 | |||

| Warehouses, offices and other | 91 | 75 | |||

| Total | 1,438 | 787 | |||

Competition

In our wholesale fuel distribution business, we compete primarily with other independent motor fuel distributors. The markets for distribution of wholesale motor fuel and the large and growing convenience store industry are highly competitive and fragmented, which results in narrow margins. We have numerous competitors, some of which may have significantly greater resources and name recognition than we do. Significant competitive factors include the availability of major brands, customer service, price, range of services offered and quality of service, among others. We rely on our ability to provide value-added and reliable service and to control our operating costs in order to maintain our margins and competitive position.

In our retail business, we face strong competition in the market for the sale of retail gasoline and merchandise. Our competitors include service stations of large integrated oil companies, independent gasoline service stations, convenience stores, fast food stores, supermarkets, drugstores, dollar stores, club stores and other similar retail outlets, some of which are well-recognized national or regional retail systems. The number of competitors varies depending on the geographical area. It also varies with gasoline and convenience store offerings. The principal competitive factors affecting our retail marketing operations include gasoline and diesel acquisition costs, site location, product price, selection and quality, site appearance and cleanliness, hours of operation, store safety, customer loyalty and brand recognition. We compete by pricing gasoline competitively, combining our retail gasoline business with convenience stores that provide a wide variety of products, and using advertising and promotional campaigns.

Seasonality

Our business exhibits some seasonality due to our customers’ increased demand for motor fuel during the late spring and summer months as compared to the fall and winter months. Travel, recreation and construction activities typically increase in these months in the geographic areas in which we operate, increasing the demand for motor fuel. Therefore, the volume of motor fuel that we distribute is typically somewhat higher in the second and third quarters of our fiscal year. As a result, our results from operations may vary from period to period.

Working Capital Requirements

We maintain customary levels of fuel and merchandise inventories, and carry corresponding payables balances to suppliers of those inventories, relating to our convenience store operations. In addition, Sunoco LLC purchases a significant amount of unbranded fuel in bulk and stores it for an extended amount of time. We also have rental obligations relating to leased locations. Our working capital needs will typically fluctuate over the medium to long term with the price of crude oil, and over the short term due to the timing of motor fuel tax, sales tax, interest and rent payments.

7

Environmental Matters

Environmental Laws and Regulations

We are subject to various federal, state and local environmental laws and regulations, including those relating to underground storage tanks; the release or discharge of hazardous materials into the air, water and soil; the generation, storage, handling, use, transportation and disposal of regulated materials; the exposure of persons to regulated materials; and the remediation of contaminated soil and groundwater.

Environmental laws and regulations can restrict or impact our business activities in many ways, such as:

| • | requiring remedial action to mitigate releases of hydrocarbons, hazardous substances or wastes caused by our operations or attributable to former operators; |

| • | requiring capital expenditures to comply with environmental control requirements; and |

| • | enjoining the operations of facilities deemed to be in noncompliance with environmental laws and regulations. |

Failure to comply with environmental laws and regulations may trigger a variety of administrative, civil and criminal enforcement measures, including the assessment of monetary penalties, the imposition of remedial requirements and the issuance of orders enjoining or otherwise curtailing future operations. Certain environmental statutes impose strict, joint and several liability for costs required to clean up and restore sites where hydrocarbons, hazardous substances or wastes have been released or disposed of. Moreover, neighboring landowners and other third parties may file claims for personal injury and property damage allegedly caused by the release of hydrocarbons, hazardous substances or other wastes into the environment.

We believe we are in compliance in all material respects with applicable environmental laws and regulations, and we do not believe that compliance with federal, state or local environmental laws and regulations will have a material adverse effect on our financial position, results of operations or cash available for distribution to our unitholders. Any future change in regulatory requirements could cause us to incur significant costs. We incorporate by reference into this section our disclosures included in Note 13 of the Notes to Consolidated Financial Statements included in Part II, Item 8.

Hazardous Substances and Releases

Certain environmental laws, including the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (“CERCLA”), impose strict, and under certain circumstances, joint and several, liability on the owner and operator as well as former owners and operators of properties for the costs of investigation, removal or remediation of contamination and also impose liability for any related damages to natural resources without regard to fault. In addition, under CERCLA and similar state laws, as persons who arrange for the transportation, treatment or disposal of hazardous substances, we also may be subject to similar liability at sites where such hazardous substances come to be located. We may also be subject to third-party claims alleging property damage and/or personal injury in connection with releases of or exposure to hazardous substances at, from or in the vicinity of our current properties or off-site waste disposal sites.

We are required to comply with federal and state financial responsibility requirements to demonstrate that we have the ability to pay for remediation or to compensate third parties for damages incurred as a result of a release of regulated materials from our underground storage tank systems. We meet these requirements primarily by maintaining insurance which we purchase from private insurers.

Environmental Reserves

We are currently involved in the investigation and remediation of contamination at motor fuel storage and gasoline store sites where releases of regulated substances have been detected. We accrue for anticipated future costs and the related probable state reimbursement amounts for remediation activities. Accordingly, we have recorded estimated undiscounted liabilities for these sites totaling $40 million as of December 31, 2016. As of December 31, 2016, we have additional reserves of $53 million that represent our estimate for future asset retirement obligations for underground storage tanks.

8

Underground Storage Tanks

We are required to make financial expenditures to comply with regulations governing underground storage tanks adopted by federal, state and local regulatory agencies. Pursuant to the Resource Conservation and Recovery Act of 1976, as amended, the Environmental Protection Agency (“EPA”) has established a comprehensive regulatory program for the detection, prevention, investigation and cleanup of leaking underground storage tanks. State or local agencies are often delegated the responsibility for implementing the federal program or developing and implementing equivalent state or local regulations. We have a comprehensive program in place for performing routine tank testing and other compliance activities which are intended to promptly detect and investigate any potential releases. We believe we are in compliance in all material respects with requirements applicable to our underground storage tanks.

Air Emissions

The Federal Clean Air Act (the “Clean Air Act”) and similar state laws impose requirements on emissions to the air from motor fueling activities in certain areas of the country, including those that do not meet state or national ambient air quality standards. These laws may require the installation of vapor recovery systems to control emissions of volatile organic compounds to the air during the motor fueling process. Under the Clean Air Act and comparable state and local laws, permits are typically required to emit regulated air pollutants into the atmosphere. We believe that we currently hold or have applied for all necessary air permits and that we are in substantive compliance with applicable air laws and regulations. Although we can give no assurances, we are aware of no changes to air quality regulations that will have a material adverse effect on our financial condition, results of operations or cash available for distribution to our unitholders.

Various federal, state and local agencies have the authority to prescribe product quality specifications for the motor fuels that we sell, largely in an effort to reduce air pollution. Failure to comply with these regulations can result in substantial penalties. Although we can give no assurances, we believe we are currently in substantive compliance with these regulations.

Efforts at the federal and state level are currently underway to reduce the levels of greenhouse gas (“GHG”) emissions from various sources in the United States. At the federal level, Congress has considered legislation to reduce GHG emissions in the United States. Such federal legislation may impose a carbon emissions tax or establish a cap-and-trade program or regulation by the EPA. Even in the absence of new federal legislation, GHG emissions have begun to be regulated by the EPA pursuant to the Clean Air Act. For example, in April 2010, the EPA set a new emissions standard for motor vehicles to reduce GHG emissions. New federal or state restrictions on emissions of GHGs that may be imposed in areas of the United States in which we conduct business and that apply to our operations could adversely affect the demand for our products. In addition, in May 2016, the EPA issued final standards that would reduce methane emissions from new and modified oil and natural gas production by up to 45% from 2012 levels by 2025. Moreover, in August 2015, EPA issued final rules outlining the Clean Power Plan or CPP which was developed in accordance with President Obama’s Climate Action Plan announced the previous year. Under the CPP, carbon pollution from power plants must be reduced over 30% below 2005 levels by 2030. The current administration under President Trump has expressed an interest in a change in position on GHG initiatives.

Many studies have discussed the relationship between GHG emissions and climate change. One consequence of climate change noted in many of these reports is the increased severity of extreme weather, such as increased hurricanes and floods. Such events could adversely affect our operations through water damage, powerful winds or increased costs for insurance.

Other Government Regulation

The Petroleum Marketing Practices Act, or “PMPA”, is a federal law that governs the relationship between a refiner and a distributor, as well as between a distributor and branded dealer, pursuant to which the refiner or distributor permits a distributor or dealer to use a trademark in connection with the sale or distribution of motor fuel. Under the PMPA, we may not terminate or fail to renew a branded distributor contract unless certain enumerated preconditions or grounds for termination or nonrenewal are met and we also comply with the prescribed notice requirements. Additionally, we are subject to state petroleum franchise laws as well as laws specific to gasoline retailers and dealers, including state laws that regulate our relationships with third parties to whom we lease sites and supply motor fuels.

Employee Safety

We are subject to the requirements of the Occupational Safety and Health Act, or “OSHA,” and comparable state statutes that regulate the protection of the health and safety of workers. In addition, OSHA’s hazard communication standards require that information be maintained about hazardous materials used or produced in operations and that this information be provided to employees, state and local government authorities and citizens. We believe that we are in substantive compliance with the applicable OSHA requirements.

9

Store Operations

Our stores are subject to regulation by federal agencies and to licensing and regulations by state and local health, sanitation, safety, fire and other departments relating to the development and operation of convenience stores, including regulations relating to zoning and building requirements and the preparation and sale of food. Difficulties in obtaining or failures to obtain the required licenses or approvals could delay or prevent the development or operation of a new store in a particular area.

Our operations are also subject to federal and state laws governing such matters as wage rates, overtime, working conditions and citizenship requirements. At the federal level, there are proposals under consideration from time to time to increase minimum wage rates.

Title to Properties, Permits and Licenses

We believe we have all of the assets needed, including leases, permits and licenses, to operate our business in all material respects. With respect to any consents, permits or authorizations that have not been obtained, we believe that the failure to obtain these consents, permits or authorizations will not have a material adverse effect on our financial position, results of operations or cash available for distribution to our unitholders.

We believe we have satisfactory title to all of our assets. Title to property may be subject to encumbrances, including repurchase rights and use, operating and environmental covenants and restrictions, including restrictions on branded motor fuels that may be sold at such sites. We believe that none of these encumbrances will detract materially from the value of our sites or from our interest in these sites, nor will they interfere materially with the use of these sites in the operation of our business. These encumbrances may, however, impact our ability to sell the site to an entity seeking to use the land for alternative purposes.

Our Employees

We are managed and operated by the board of directors and executive officers of our General Partner, which has sole responsibility for providing us with the employees and other personnel necessary to conduct our operations. All of the employees that conduct our business are employed by our General Partner or its affiliates. As of December 31, 2016, our General Partner’s affiliates had approximately 22,500 employees, 332 of which are represented by labor unions or associations, performing services for our operations, with appropriate costs allocated to us. We believe that we and our General Partner and its affiliates have a satisfactory relationship with employees. Information concerning the executive officers of our General Partner is contained in “Item 10. Directors, Executive Officers and Corporate Governance.”

| Item 1A. | Risk Factors |

Risks Related to Our Business

Cash distributions are not guaranteed, and our financial leverage could increase, depending on our performance and other external factors.

Cash distributions to unitholders is principally dependent upon cash generated from operations. The amount of cash generated from operations will fluctuate from quarter to quarter based on a number of factors, some of which are beyond our control, which include, amongst others:

| • | demand for motor fuel in the markets we serve, including seasonal fluctuations in demand for motor fuel; |

| • | competition from other companies that sell motor fuel products or have convenience stores in our market areas; |

| • | regulatory action affecting the supply of or demand for motor fuel, our operations, our existing contracts or our operating costs; |

| • | prevailing economic conditions; and |

| • | volatility of margins for motor fuel. |

In addition, the actual amount of cash we will have available for distribution will depend on other factors such as:

| • | the level and timing of capital expenditures we make; |

| • | the cost of acquisitions, if any; |

| • | our debt service requirements and other liabilities; |

| • | fluctuations in our general working capital needs; |

10

| • | reimbursements made to our general partner and its affiliates for all direct and indirect expenses they incur on our behalf pursuant to the partnership agreement; |

| • | our ability to borrow funds at favorable interest rates and access capital markets; |

| • | restrictions contained in debt agreements to which we are a party; |

| • | the level of costs related to litigation and regulatory compliance matters; and |

| • | the amount of cash reserves established by our general partner in its discretion for the proper conduct of our business. |

If our cash flow from operations is insufficient to satisfy our needs, we cannot be certain that we will be able to obtain bank financing or access the capital markets. Further, incurring additional debt may significantly increase our interest expense and financial leverage and issuing additional limited partner interests may result in significant unitholder dilution and would increase the aggregate amount of cash required to maintain the cash distribution rate which could materially decrease our ability to pay distributions. If additional capital resources are unavailable to us from third parties or from our sponsor, our business, financial condition, results of operations and ability to make distributions could be materially adversely affected.

General economic, financial, and political conditions may materially adversely affect our results of operations and financial conditions.

General economic, financial, and political conditions may have a material adverse effect on our results of operations and financial condition. Declines in consumer confidence and/or consumer spending, changes in unemployment, significant inflationary or deflationary changes or disruptive regulatory or geopolitical events could contribute to increased volatility and diminished expectations for the economy and our markets, including the market for our goods and services, and lead to demand or cost pressures that could negatively and adversely impact our business. These conditions could affect both of our business segments.

Examples of such conditions could include:

| • | a general or prolonged decline in, or shocks to, regional or broader macro-economies; |

| • | regulatory changes that could impact the markets in which we operate, such as immigration or trade reform laws or regulations prohibiting or limiting hydraulic fracturing, which could reduce demand for our goods and services or lead to pricing, currency, or other pressures; and |

| • | deflationary economic pressures, which could hinder our ability to operate profitably in view of the challenges inherent in making corresponding deflationary adjustments to our cost structure. |

The nature of these types of risks, which are often unpredictable, makes them difficult to plan for, or otherwise mitigate, and they are generally uninsurable—which compounds their potential impact on our business.

A significant decrease in demand for motor fuel, including increased consumer preference for alternative motor fuels or improvements in fuel efficiency, in the areas we serve would reduce our ability to make distributions to our unitholders.

Sales of refined motor fuels account for approximately 84% of our total revenues and 55% of our gross profit. A significant decrease in demand for motor fuel in the areas we serve could significantly reduce our revenues and our ability to make or increase distributions to our unitholders. Our revenues are dependent on various trends, such as trends in commercial truck traffic, travel and tourism in our areas of operation, and these trends can change. Regulatory action, including government imposed fuel efficiency standards, may also affect demand for motor fuel. Because certain of our operating costs and expenses are fixed and do not vary with the volumes of motor fuel we distribute, our costs and expenses might not decrease ratably or at all should we experience such a reduction. As a result, we may experience declines in our profit margin if our fuel distribution volumes decrease.

Any technological advancements, regulatory changes or changes in consumer preferences causing a significant shift toward alternative motor fuels could reduce demand for the conventional petroleum based motor fuels we currently sell. Additionally, a shift toward electric, hydrogen, natural gas or other alternative-power vehicles could fundamentally change our customers' shopping habits or lead to new forms of fueling destinations or new competitive pressures.

New technologies have been developed and governmental mandates have been implemented to improve fuel efficiency, which may result in decreased demand for petroleum-based fuel. Any of these outcomes could result in fewer visits to our convenience stores, a reduction in demand from our wholesale customers, decreases in both fuel and merchandise sales revenue, or reduced profit margins, any of which could have a material adverse effect on our business, financial condition, results of operations and cash available for distribution to our unitholders.

11

The industries in which we operate are subject to seasonal trends, which may cause our operating costs to fluctuate, affecting our cash flow.

We experience more demand for our merchandise, food and motor fuel during the late spring and summer months than during the fall and winter. Travel, recreation and construction are typically higher in these months in the geographic areas in which we operate, increasing the demand for the products that we sell and distribute. Additionally, our retail fuel margins have historically been higher in the second and third quarters of the year. Therefore, our revenues and cash flows are typically higher in the second and third quarters of our fiscal year. As a result, our results from operations may vary widely from period to period, affecting our cash flow.

Our financial condition and results of operations are influenced by changes in the prices of motor fuel, which may adversely impact our margins, our customers’ financial condition and the availability of trade credit.

Our operating results are influenced by prices for motor fuel. General economic and political conditions, acts of war or terrorism and instability in oil producing regions, particularly in the Middle East and South America, could significantly impact crude oil supplies and petroleum costs. Significant increases or high volatility in petroleum costs could impact consumer demand for motor fuel and convenience merchandise. Such volatility makes it difficult to predict the impact that future petroleum costs fluctuations may have on our operating results and financial condition. We are subject to dealer tank wagon pricing structures at certain locations further contributing to margin volatility. A significant change in any of these factors could materially impact both wholesale and retail fuel margins, the volume of motor fuel we distribute or sell at retail, and overall customer traffic, each of which in turn could have a material adverse effect on our business, financial condition, results of operations and cash available for distribution to our unitholders.

Significant increases in wholesale motor fuel prices could impact us as some of our customers may have insufficient credit to purchase motor fuel from us at their historical volumes. Higher prices for motor fuel may also reduce our access to trade credit support or cause it to become more expensive.

The dangers inherent in the storage and transportation of motor fuel could cause disruptions in our operations and could expose us to potentially significant losses, costs or liabilities.

We store motor fuel in underground and aboveground storage tanks. We transport the majority of our motor fuel in our own trucks, instead of by third-party carriers. Our operations are subject to significant hazards and risks inherent in transporting and storing motor fuel. These hazards and risks include, but are not limited to, traffic accidents, fires, explosions, spills, discharges, and other releases, any of which could result in distribution difficulties and disruptions, environmental pollution, governmentally-imposed fines or clean-up obligations, personal injury or wrongful death claims, and other damage to our properties and the properties of others. Any such event not covered by our insurance could have a material adverse effect on our business, financial condition, results of operations and cash available for distribution to our unitholders.

Our fuel storage terminals are subject to operational and business risks which, if occur, may adversely affect our financial condition, results of operations, cash flows and ability to make distributions to our unitholders.

Our fuel storage terminals are subject to operational and business risks, the most significant of which include the following:

| • | our inability to renew a ground lease for certain of our fuel storage terminals on similar terms or at all; |

| • | our dependence on third parties to supply our fuel storage terminals; |

| • | outages at our fuel storage terminals or interrupted operations due to weather-related or other natural causes; |

| • | the threat that the nation’s terminal infrastructure may be a future target of terrorist organizations; |

| • | the volatility in the prices of the products stored at our fuel storage terminals and the resulting fluctuations in demand for our storage services; |

| • | the effects of a sustained recession or other adverse economic conditions; |

| • | the possibility of federal and/or state regulations that may discourage our customers from storing gasoline, diesel fuel, ethanol and jet fuel at our fuel storage terminals or reduce the demand by consumers for petroleum products; |

12

| • | competition from other fuel storage terminals that are able to supply our customers with comparable storage capacity at lower prices; and |

| • | climate change legislation or regulations that restrict emissions of GHGs could result in increased operating and capital costs and reduced demand for our storage services. |

The occurrence of any of the above situations, amongst others, may affect operations at our fuel storage terminals and may adversely affect our business, financial condition, results of operations, cash flows and ability to make distributions to our unitholders.

Negative events or developments associated with our branded suppliers could have an adverse impact on our revenues.

We believe that the success of our operations is dependent, in part, on the continuing favorable reputation, market value, and name recognition associated with the motor fuel brands sold at our convenience stores and at stores operated by our independent, branded dealers. Erosion of the value of those brands could have an adverse impact on the volumes of motor fuel we distribute, which in turn could have a material adverse effect on our business, financial condition, results of operations and ability to make distributions to our unitholders.

Severe weather could adversely affect our business by damaging our suppliers’ or our customers’ facilities or communications networks.

A substantial portion of our wholesale distribution and retail networks are located in regions susceptible to severe storms, including hurricanes. A severe storm could damage our facilities or communications networks, or those of our suppliers or our customers, as well as interfere with our ability to distribute motor fuel to our customers or our customers’ ability to operate their locations. If warmer temperatures, or other climate changes, lead to changes in extreme weather events, including increased frequency, duration or severity, these weather-related risks could become more pronounced. Any weather-related catastrophe or disruption could have a material adverse effect on our business, financial condition and results of operations, potentially causing losses beyond the limits of the insurance we currently carry.

Our concentration of convenience stores along the U.S.-Mexico border increases our exposure to certain cross-border risks that could adversely affect our business and financial condition by lowering our sales revenues.

Approximately 18% of our convenience stores are located in close proximity to Mexico. These stores rely heavily upon cross-border traffic and commerce to drive sales volumes. Sales volumes at these stores could be impaired by a number of cross-border risks, any one of which could have a material adverse effect on our business, financial condition and results of operations, including the following:

| • | A devaluation of the Mexican peso could negatively affect the exchange rate between the peso and the U.S. dollar, which would result in reduced purchasing power in the U.S. on the part of our customers who are citizens of Mexico; |

| • | The imposition of tighter restrictions by the U.S. government on the ability of citizens of Mexico to cross the border into the United States, or the imposition of tariffs upon Mexican goods entering the United States or other restrictions upon Mexican-borne commerce, could reduce revenues attributable to our convenience stores regularly frequented by citizens of Mexico; |

| • | Future subsidies for motor fuel by the Mexican government could lead to wholesale cost and retail pricing differentials between the U.S. and Mexico that could divert fuel customer traffic to Mexican fuel retailers; and |

| • | The escalation of drug-related violence along the border could deter tourist and other border traffic, which could likely cause a decline in sales revenues at these locations. |

The wholesale motor fuel distribution industry is characterized by intense competition and fragmentation. Failure to effectively compete could result in lower margins.

The market for distribution of wholesale motor fuel is highly competitive and fragmented, which results in narrow margins. We have numerous competitors, some of which may have significantly greater resources and name recognition than us. We rely on our ability to provide value-added, reliable services and to control our operating costs in order to maintain our margins and competitive position. If we fail to maintain the quality of our services, certain of our customers could choose alternative distribution sources and our margins could decrease. While major integrated oil companies have generally continued to divest retail sites and the corresponding wholesale distribution to such sites, such major oil companies could shift from this strategy and decide to distribute their own products in direct competition with us, or large customers could attempt to buy directly from the major oil companies. The occurrence of any of these events could have a material adverse effect on our business, financial condition, results of operations and cash available for distribution to our unitholders.

13

The convenience store industry is highly competitive and impacted by new entrants. Failure to effectively compete could result in lower sales and lower margins.

The geographic areas in which we operate are highly competitive and marked by ease of entry and constant change in the number and type of retailers offering products and services of the type we sell in our stores. We compete with other convenience store chains, independently owned convenience stores, motor fuel stations, supermarkets, drugstores, discount stores, dollar stores, club stores, mass merchants and local restaurants. Over the past two decades, several non-traditional retailers, such as supermarkets, hypermarkets, club stores and mass merchants, have impacted the convenience store industry, particularly in the geographic areas in which we operate, by entering the motor fuel retail business. These non-traditional motor fuel retailers have captured a significant share of the motor fuels market, and we expect their market share will continue to grow.

In some of our markets, our competitors have been in existence longer and have greater financial, marketing, and other resources than we do. As a result, our competitors may be able to better respond to changes in the economy and new opportunities within the industry. To remain competitive, we must constantly analyze consumer preferences and competitors’ offerings and prices to ensure that we offer a selection of convenience products and services at competitive prices to meet consumer demand. We must also maintain and upgrade our customer service levels, facilities and locations to remain competitive and attract customer traffic to our stores. We may not be able to compete successfully against current and future competitors, and competitive pressures faced by us could have a material adverse effect on our business, results of operations and cash available for distribution to our unitholders.

Wholesale cost increases in tobacco products, including excise tax increases on cigarettes, could adversely impact our revenues and profitability.

Significant increases in wholesale cigarette costs and tax increases on cigarettes may have an adverse effect on unit demand for cigarettes. Cigarettes are subject to substantial and increasing excise taxes at both a state and federal level. We cannot predict whether this trend will continue into the future. Increased excise taxes may result in declines in overall sales volume and reduced gross profit percent, due to lower consumption levels and to a shift in consumer purchases from the premium to the non-premium or discount segments or to other lower-priced tobacco products or to the import of cigarettes from countries with lower, or no, excise taxes on such items.

Currently, major cigarette manufacturers offer rebates to retailers. We include these rebates as a component of our gross margin from sales of cigarettes. In the event these rebates are no longer offered, or decreased, our wholesale cigarette costs will increase accordingly. In general, we attempt to pass price increases on to our customers. However, due to competitive pressures in our markets, we may not be able to do so. These factors along with a possible decline in cigarette demand, could materially impact our retail price of cigarettes, cigarette unit volume and revenues, merchandise gross profit and overall customer traffic, which could in turn have a material adverse effect on our business and results of operations.

Failure to comply with state laws regulating the sale of alcohol and cigarettes may result in the loss of necessary licenses and the imposition of fines and penalties on us, which could have a material adverse effect on our business.

State laws regulate the sale of alcohol and cigarettes. A violation of or change in these laws could adversely affect our business, financial condition and results of operations because state and local regulatory agencies have the power to approve, revoke, suspend or deny applications for, and renewals of, permits and licenses relating to the sale of these products and can also seek other remedies. Such a loss or imposition could have a material adverse effect on our business and results of operations.

We currently depend on a limited number of principal suppliers in each of our operating areas for a substantial portion of our merchandise inventory and our products and ingredients for our food service facilities. A disruption in supply or a change in either relationship could have a material adverse effect on our business.

We currently depend on a limited number of principal suppliers in each of our operating areas for a substantial portion of our merchandise inventory and our products and ingredients for our food service facilities. If any of our principal suppliers elect not to renew their contracts with us, we may be unable to replace the volume of merchandise inventory and products and ingredients we currently purchase from them on similar terms or at all in those operating areas. Further, a disruption in supply or a significant change in our relationship with any of these suppliers could have a material adverse effect on our business, financial condition and results of operations and cash available for distribution to our unitholders.

We may be subject to adverse publicity resulting from concerns over food quality, product safety, health or other negative events or developments that could cause consumers to avoid our retail locations.

We may be the subject of complaints or litigation arising from food-related illness or product safety which could have a negative impact on our business. Negative publicity, regardless of whether the allegations are valid, concerning food quality, food safety or other

14

health concerns, food service facilities, employee relations or other matters related to our operations may materially adversely affect demand for our food and other products and could result in a decrease in customer traffic to our retail stores.

It is critical to our reputation that we maintain a consistent level of high quality at our food service facilities and other franchise or fast food offerings. Health concerns, poor food quality or operating issues stemming from one store or a limited number of stores could materially and adversely affect the operating results of some or all of our stores and harm our company-owned brands, continuing favorable reputation, market value and name recognition.

Our growth depends, in part, on our ability to open and profitably operate new retail convenience stores and to successfully integrate acquired sites and businesses in the future.

We may not be able to open all of the currently planned new retail convenience stores, and any new stores we open may be unprofitable. Additionally, acquiring sites and businesses in the future involves risks that could cause our actual growth or operating results to fall short of expectations. If these events were to occur, each could have a material adverse impact on our financial results. There are several factors that could affect our ability to open and profitably operate new stores or to successfully integrate acquired sites and businesses. These factors include:

| • | competition in targeted market areas; |

| • | difficulties during the acquisition process in discovering some of the liabilities of the businesses that we acquire; |

| • | the inability to identify and acquire suitable sites or to negotiate acceptable leases for such sites; |

| • | difficulties associated with the growth of our existing financial controls, information systems, management resources and human resources needed to support our future growth; |

| • | difficulties with hiring, training and retaining skilled personnel, including store managers; |

| • | difficulties in adapting distribution and other operational and management systems to an expanded network of stores; |

| • | the potential inability to obtain adequate financing to fund our expansion; |

| • | limitations on capital expenditures or debt levels contained in our revolving credit facility; |

| • | difficulties in obtaining governmental and other third-party consents, permits and licenses needed to operate additional stores; |

| • | difficulties in obtaining the cost savings and financial improvements we anticipate from future acquired stores; |

| • | the potential diversion of our senior management’s attention from focusing on our core business due to an increased focus on acquisitions; and |

| • | challenges associated with the consummation and integration of any future acquisition. |

If we are unable to make acquisitions on economically acceptable terms from third parties, our future growth and ability to increase distributions to unitholders will be limited.

A portion of our strategy to grow our business and increase distributions to unitholders is dependent on our ability to make acquisitions that result in an increase in cash flow. The acquisition component of our growth strategy is based, in part, on our expectation of ongoing strategic divestitures of retail and wholesale fuel distribution assets by industry participants. If we are unable to make acquisitions from third parties for any reason, including if we are unable to identify attractive acquisition candidates or negotiate acceptable purchase contracts, we are unable to obtain financing for these acquisitions on economically acceptable terms, we are outbid by competitors, or we or the seller are unable to obtain all necessary consents, our future growth and ability to increase distributions to unitholders will be limited. In addition, if we consummate any future acquisitions, our capitalization and results of operations may change significantly, and unitholders will not have the opportunity to evaluate the economic, financial, and other relevant information considered in determining the application of these funds and other resources. Finally, we may complete acquisitions which at the time of completion we believe will be accretive, but which ultimately may not be accretive. If any of these events were to occur, our future growth would be limited.

Any acquisitions are subject to substantial risks that could adversely affect our financial condition and results of operations and reduce our ability to make distributions to unitholders.

Any acquisitions involve potential risks, including, amongst others:

| • | the validity of our assumptions about revenues, capital expenditures and operating costs of the acquired business or assets, as well as assumptions about achieving synergies with our existing business; |

| • | the validity of our assessment of environmental and other liabilities, including legacy liabilities; |

15

| • | the costs associated with additional debt or equity capital, which may result in a significant increase in our interest expense and financial leverage resulting from any additional debt incurred to finance the acquisition, or the issuance of additional common units on which we will make distributions, either of which could offset the expected accretion to our unitholders from such acquisition and could be exacerbated by volatility in the equity or debt capital markets; |

| • | a failure to realize anticipated benefits, such as increased available cash per unit, enhanced competitive position or new customer relationships; |

| • | a decrease in our liquidity by using a significant portion of our available cash or borrowing capacity to finance the acquisition; |

| • | the incurrence of other significant charges, such as impairment of goodwill or other intangible assets, asset devaluation or restructuring charges; and |

| • | the risk that our existing financial controls, information systems, management resources and human resources will need to grow to support future growth and we may not be able to react timely. |

Integration of assets acquired in past acquisitions or future acquisitions with our existing business will be a complex, time-consuming and costly process, particularly given that assets acquired to date significantly increased our size and diversified the geographic areas in which we operate. A failure to successfully integrate the acquired assets with our existing business in a timely manner may have a material adverse effect on our business, financial condition, results of operations or cash available for distribution to our unitholders.

The difficulties of integrating past and future acquisitions with our business include, among other things:

| • | operating a larger combined organization in new geographic areas and new lines of business; |

| • | hiring, training or retaining qualified personnel to manage and operate our growing business and assets; |

| • | integrating management teams and employees into existing operations and establishing effective communication and information exchange with such management teams and employees; |

| • | diversion of management’s attention from our existing business; |

| • | assimilation of acquired assets and operations, including additional regulatory programs; |

| • | loss of customers or key employees; |

| • | maintaining an effective system of internal controls in compliance with the Sarbanes-Oxley Act of 2002 as well as other regulatory compliance and corporate governance matters; and |

| • | integrating new technology systems for financial reporting. |

If any of these risks or other unanticipated liabilities or costs were to materialize, then desired benefits from past acquisitions and future acquisitions resulting in a negative impact to our future results of operations. In addition, acquired assets may perform at levels below the forecasts used to evaluate their acquisition, due to factors beyond our control. If the acquired assets perform at levels below the forecasts, then our future results of operations could be negatively impacted.

Also, our reviews of proposed business or asset acquisitions are inherently imperfect because it is generally not feasible to perform an in-depth review of each such proposal given time constraints imposed by sellers. Even if performed, a detailed review of assets and businesses may not reveal existing or potential problems, and may not provide sufficient familiarity with such business or assets to fully assess their deficiencies and potential. Inspections may not be performed on every asset, and environmental problems, such as groundwater contamination, may not be observable even when an inspection is undertaken.