Filed Pursuant to Rule 424(b)(5)

Registration No. 333-229323

PROSPECTUS SUPPLEMENT

(To Prospectus dated February 11, 2019)

740,740 Ordinary Shares

Pursuant to this prospectus supplement and the accompanying prospectus, we are offering up to 740,740 ordinary shares, no par value (the “Ordinary Shares”) of Taoping Inc. (the “Company”) at a price of $2.70 per share directly to certain individual investors.

Our Ordinary Shares trade on the NASDAQ Capital Market under the symbol “TAOP.” The last reported sale price of our Ordinary Shares on the NASDAQ Capital Market on January 20, 2021 was $3.08 per share. As of the date of this prospectus supplement, the aggregate market value of our outstanding Ordinary Shares held by non-affiliates is approximately $18.21 million, based on 8,486,956 Ordinary Shares issued and outstanding, of which approximately 5,500,962 Ordinary Shares are held by non-affiliates, and a per share price of $3.31 based on the closing price of our Ordinary Shares on November 25, 2020, which is the highest closing sale price of our Ordinary Shares on The Nasdaq Capital Market within the prior 60 days.

During the 12 calendar months prior to and including the date of this Prospectus Supplement, we have sold $1.2 million of our Ordinary Shares pursuant to General Instruction I.B.5 of Form F-3. Pursuant to General Instruction I.B.5 of Form F-3, in no event will we sell securities registered in a public primary offering with a value exceeding more than one-third of our public float in any 12 calendar month period that ends on, and includes, the date of this prospectus supplement, so long as our public float remains below $75.0 million.

We have not retained an underwriter or placement agent with respect to this offering and therefore are not paying any underwriting discounts or commissions. We estimate the total expenses of this offering will be approximately $0.02 million.

Please read “Risk Factors” beginning on page S-4 of this prospectus supplement and on page 2 of the accompanying prospectus.

Neither the Securities and Exchange Commission nor any states securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is January 19, 2021

TABLE OF CONTENTS

Prospectus

You should rely only on the information contained in this prospectus supplement and the accompanying prospectus. We have not authorized anyone else to provide you with additional or different information. We are offering to sell, and seeking offers to buy Ordinary Shares only in jurisdictions where offers and sales are permitted. You should not assume that the information in this prospectus supplement or the accompanying prospectus is accurate as of any date other than the date on the front of those documents or that any document incorporated by reference is accurate as of any date other than its filing date.

No action is being taken in any jurisdiction outside the United States to permit a public offering of the Ordinary Shares or possession or distribution of this prospectus supplement or the accompanying prospectus in that jurisdiction. Persons who come into possession of this prospectus supplement or the accompanying prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus supplement and the accompanying prospectus applicable to that jurisdiction.

ABOUT THIS PROSPECTUS SUPPLEMENT

On January 22, 2019, we filed with the Securities and Exchange Commission, or the SEC, a registration statement on Form F-3 (File No. 333-229323) utilizing a shelf registration process relating to the securities described in this prospectus supplement. The registration statement was declared effective on February 11, 2019. Under this shelf registration process, we have registered, among others, to sell, from time to time, up to $80,000,000 in the aggregate of Ordinary Shares, debt securities, warrants and units.

This document is in two parts. The first part is the prospectus supplement, which describes the specific terms of this offering and adds, updates and changes information contained in the accompanying prospectus. The second part is the accompanying prospectus, which gives more general information, some of which may not apply to this offering. To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or any document incorporated by reference in this prospectus supplement or the accompanying prospectus, on the other hand, you should rely on the information in this prospectus supplement. However, if any statement in one of these documents is inconsistent with a statement in another document having a later date — for example, a document incorporated by reference in this prospectus supplement or the accompanying prospectus — the statement in the document having the later date modifies or supersedes the earlier statement as our business, financial condition, results of operations and prospects may have changed since the earlier dates.

This prospectus supplement and the accompanying prospectus include important information about us, our Ordinary Shares and other information you should know before investing. You should carefully read this prospectus supplement, the accompanying prospectus, all information incorporated by reference herein and therein, as well as the additional information described under the heading “Where You Can Find More Information.”

This prospectus supplement and the accompanying prospectus and any free writing prospectus may contain and incorporate by reference, market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information, and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included or incorporated by reference in this prospectus supplement and the accompanying prospectus or any applicable free writing prospectus may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in this prospectus supplement and the accompanying prospectus and any applicable free writing prospectus, and under similar headings in other documents that are incorporated by reference into this prospectus supplement. Accordingly, investors should not place undue reliance on this information.

FORWARD-LOOKING INFORMATION

This prospectus supplement contains “forward-looking statements” that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this prospectus supplement, including statements regarding our future results of operations and financial position, strategy and plans, and our expectations for future operations, are forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Our actual results may differ materially or perhaps significantly from those discussed herein, or implied by, these forward-looking statements. Forward-looking statements included or incorporated by reference in this prospectus supplement or our other filings with the SEC, include, but are not necessarily limited to, those relating to:

| | ● | our limited operating history of selling cloud-based products and services; |

| | | |

| | ● | our independent registered auditors’ substantial doubt about our ability to continue as a going concern |

| | | |

| | ● | lack of insurance coverage for our product-related liabilities and other business liability; |

| | | |

| | ● | outbreak of coronavirus; |

| | | |

| | ● | uncertainties related to China’s legal system and economic, political and social events in China; |

| | | |

| | ● | a general economic downturn; and |

| | | |

| | ● | our potential failure to maintain compliance with NASDAQ continued listing requirements. |

The foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or risk factors with which we are faced that may cause our actual results to differ from those anticipated in our forward-looking statements. Please see “Risk Factors” in our reports filed or furnished with the SEC or in this prospectus supplement and the accompanying prospectus for additional risks which could adversely impact our business and financial performance.

Moreover, new risks regularly emerge and it is not possible for our management to predict or articulate all risks we face, nor can we assess the impact of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from those contained in any forward-looking statements. All forward-looking statements included in this prospectus supplement and the accompanying prospectus are based on information available to us on the date of this prospectus supplement or the accompanying prospectus, as applicable. Except to the extent required by applicable laws or rules, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

PROSPECTUS SUMMARY

This summary highlights information about us and the offering contained elsewhere in, or incorporated by reference into, this prospectus supplement and the accompanying prospectus. It is not complete and may not contain all the information that may be important to you. You should carefully read the entire prospectus supplement and the accompanying prospectus, as well as the information incorporated by reference, before making an investment decision, especially the information presented under the heading “Risk Factors” beginning on page S-4 of this prospectus supplement, and our financial statements and the notes to those financial statements, which are incorporated by reference, and the other financial information appearing elsewhere in or incorporated by reference into this prospectus supplement. See “Incorporation of Certain Information by Reference.” In this prospectus supplement, except as otherwise indicated or as the context otherwise requires, “Taoping,” “the Company,” “we,” “our” and “us” refer to Taoping Inc. and its subsidiaries and other consolidated entities.

Unless otherwise indicated, all share amounts and per share amounts in this prospectus supplement have been presented on a retroactive basis to reflect a share combination of our outstanding ordinary shares at a ratio of one for six (1 for 6) which was implemented on July 30, 2020.

About Taoping Inc.

Company Overview

We are a leading cloud-based ads display terminal and service provider of digital advertising distribution network and new media resource sharing platform in the Out-of-Home advertising market in China. We provide the integrated end-to-end digital advertising solutions enabling customers to distribute and manage ads on the ads display terminals. Connecting cloud-based ads display terminal owners, advertisers, and consumers, we build up a resource sharing “Smart IoT Terminal - Taoping Net/ App - Taoping E-store” media ecosystem to ultimately achieve the mission “Our technology makes advertising and branding affordable and effective for everyone.”

We were founded in 1993 and are headquartered in Shenzhen, China. Prior to 2014, we generated majority of our revenues through selling our products mostly to public service entities to help improve their operational efficiency and service quality. Since 2014, we have diversified our customer base beyond the public sector into private sectors. Our private sector customers include, among others, advertising agencies, auto dealerships, hotels, shopping malls, educational institutes, and beauty spas. Our new corporate mission is to make publicity accessible and affordable for businesses of every size.

In 2014, we generated revenues from sales of products, software, and other sources including hardware maintenance services, network maintenance services, hardware system upgrade, rental income, and miscellaneous income. Starting in 2015, with the introduction of our cloud-based software as a service (SaaS) offering, also, in May 2017, we completed the business transformation and rolled out Cloud-Application-Terminal and IoT technology based digital ads distribution network and new media resource sharing platform in the Out-of-Home Advertising Market. From 2017, we generated most revenue from selling fully integrated Cloud-Application-Terminal and IoT technology based digital ads display terminals.

In the first 6 months of 2020, various levels of city lock-downs resulted in confining individual’s mobility, ceasing private and public transportations, halting vast majority of business transactions, depleting businesses’ cash flows due to outbreak of the COVID-19 pandemic. As a result of negative impact to overall economy and businesses from the COVID-19 pandemic, the Company was unable to deliver products and services and collect outstanding trade accounts receivable as planned causing significant decline in revenue and increase in allowance for credit losses. The Company incurred a net loss of approximately $7.9 million for the six months ended June 30, 2020. However, because of city lock-downs, internet services and internet user accesses, including but not limited to on-line communications, on-line shopping, on-line entertainments, on-line banking, remote working arrangements, on-line conferences, have significantly increased in the first half of 2020. The Company has increased its capacity to support increasing demands in software development, and other revenues including system upgrades and maintenance accommodating internet on-line transactions. We have also stabilized supply chains for the high-end data storage server to meet market demands.

However, the duration and intensity of disruptions resulting from the pandemic is uncertain. It is unclear as to when the outbreak will be fully contained, and we also cannot predict if the impact will be short-lived or long-lasting. The extent to which COVID-19 impacts our financial results will depend on its future developments.

We report financial and operational information in the following two segments:

(1) Cloud-based Technology (CBT) segment — The CBT segment is our current and future focus of corporate development. It includes our cloud-based products and services offered to customers in the private sector including new media, healthcare, education, and residential community management. In this segment, we generate revenues from the sales of hardware, and the provision of total solutions of interactive advertisement display terminals integrated with proprietary software, out-of-home digital advertising distribution, and advertising time slot programmed trading transactions. We also generate revenue from monthly software subscription and Software-as-a Service (SaaS) fees.

(2) Traditional Information Technology (TIT) segment — The TIT segment includes our project-based technology products and services offered to the public sector, including Digital Public Security Technology (DPST) and Multi-screen Digital Display Systems (MDDS). In this segment, we generate revenues from the sales of software and systems integration services.

Corporate Information

We were incorporated in the British Virgin Islands on June 18, 2012. Our principal executive office is located at 21st Floor, Everbright Bank Building, Zhuzilin, Futian District, Shenzhen, Guangdong Province 518040, People’s Republic of China. Our telephone number is (+86) 755-8831-9888.

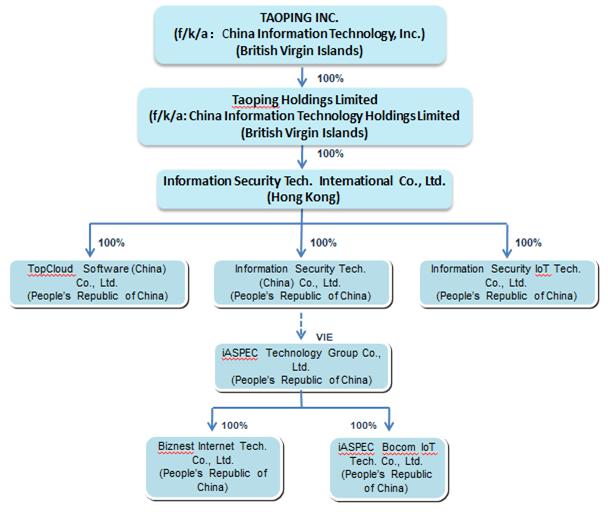

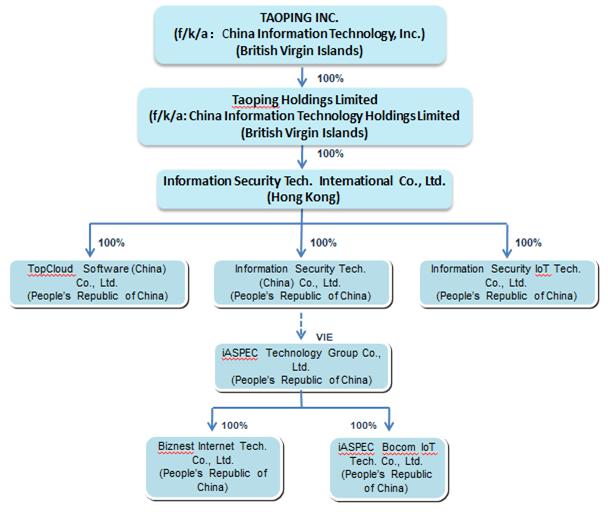

The following chart reflects our organizational structure as of the date of this prospectus supplement.

THE OFFERING

| Ordinary Shares Offered by Us | | 740,740 shares |

| | | |

| Offering Price Per Share | | $2.70 |

| | | |

| Ordinary Shares Outstanding Immediately Before the Offering* | | 8,486,956 shares |

| | | |

| Ordinary Shares to be Outstanding Immediately After the Offering (assumes all Ordinary Shares offered in this offering are sold)* | | 9,227,696 shares |

| | | |

| Market for the Ordinary Shares | | Our Ordinary Shares are traded on the Nasdaq Capital Market under the symbol “TAOP.” |

| | | |

| Use of Proceeds | | We intend to use the net proceeds from this offering for working capital and other general corporate purposes. See “Use of Proceeds” on page S-7 of this prospectus supplement. |

| | | |

| Risk Factors | | Investing in our securities involves a high degree of risk. For a discussion of factors you should consider carefully before deciding to invest in our Ordinary Shares. See “Risk Factors” beginning on page S-4 of this prospectus supplement and on page 2 of the accompanying prospectus and other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus. |

| | | |

| Transfer Agent and Registrar | | Transhare Corporation |

*The number of our Ordinary Shares to be outstanding after this offering is based on 8,486,956 Ordinary Shares outstanding on January 19, 2021.

The number of our Ordinary Shares outstanding immediately before and immediately after this offering excludes:

| | ● | up to 26,667 Ordinary Shares issuable upon exercise of the warrants issued in October 2019; |

| | ● | up to 53,334 Ordinary Shares issuable upon exercise of the warrants issued in March 2020; |

| | ● | up to 1,000,000 Ordinary Shares issuable upon conversion of the convertible notes issued in March 2020 (the “March 2020 Notes”); |

| | ● | up to 53,333 Ordinary Shares issuable upon exercise of the warrants issued in September 2020; |

| | ● | up to 1,000,000 Ordinary Shares issuable upon conversion of the convertible note issued in September 2020 (the “September 2020 Notes”); and |

| | ● | up to 390,714 Ordinary Shares issuable upon the exercise of outstanding options, which were granted to our officers, employees and consultants in July 2020 under our equity incentive plans. |

RISK FACTORS

Any investment in our securities involves a high degree of risk. You should consider carefully the risks described below as well as the risks described in the section captioned “Risk Factors” in our annual report on Form 20-F for the year ended December 31, 2019, and as updated by any document that we subsequently file with the SEC that is incorporated by reference in this prospectus supplement or the accompanying prospectus, together with other information in this prospectus supplement, the accompanying prospectus and the information and documents incorporated by reference in this prospectus supplement and the accompanying prospectus before you make a decision to invest in our securities. If any of such risks actually occur, our business, operating results, prospects or financial condition could be materially and adversely affected. This could cause the trading price of our Ordinary Shares to decline and you may lose all or part of your investment. The risks described below are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business operations. The risks discussed below also include forward-looking statements and our actual results may differ substantially from those discussed in these forward-looking statements. See “Forward-Looking Information.”

RISKS RELATED TO THIS OFFERING

Our business operations have been and may continue to be materially and adversely affected by the outbreak of the coronavirus (COVID-19).

An outbreak of respiratory illness caused by COVID-19 emerged at the end of 2019 and has spread within the PRC and globally. The coronavirus is considered to be highly contagious and poses a serious public health threat. The World Health Organization labeled the coronavirus a pandemic on March 11, 2020, given its threat beyond a public health emergency of international concern the organization had declared on January 30, 2020.

Any outbreak of health epidemics in the PRC or elsewhere in the world has materially and adversely affected the global economy, our markets and business. For most of the first quarter of 2020, we scaled back operations, as our employees worked remotely or at premises in shifts for limited periods of time in response to nationwide lockdowns and quarantines. We only resumed full operations since late March. The pandemic has also depressed customers’ demand for our products and services, since businesses across China largely suspended or reduced operations in the past few months. In addition, it now takes longer time to collect accounts receivable. As a provider of digital advertising distribution networks, we are sensitive to the overall business environment and vulnerable to any market downturns.

Coronavirus is continuing its spread across the world. The global economy is suffering a noticeable slowdown. Commercial activities throughout the world have been curtailed with decreased consumer spending, business operation disruptions, interrupted supply chain, difficulties in travel, and reduced workforces. The duration and intensity of disruptions resulting from the coronavirus outbreak is uncertain. It is unclear as to when the outbreak will be contained, and we also cannot predict if the impact will be short-lived or long-lasting. The extent to which the coronavirus impacts our financial results will depend on its future developments. If the outbreak of the coronavirus persists, our business operation and financial condition may be materially and adversely affected as a result of slowdown in economic growth, operation disruptions or other factors that we cannot predict.

We will have broad discretion as to the use of the proceeds from this offering, and we may not use the proceeds effectively.

Subject to certain limited exceptions set forth in the offering documents, we have agreed to use the net proceeds from this offering solely for working capital and general corporate purposes; provided, however, that none of such proceeds will be used, directly or indirectly, for (i) the satisfaction of any of our indebtedness, other than payment of trade payables incurred in the ordinary course of business and consistent with prior practices; (ii) the redemption or repurchase of any of our securities; or (iii) the settlement of any outstanding litigation. We have considerable discretion in the application of the net proceeds of this offering. You will not have the opportunity, as part of your investment decision, to assess whether the net proceeds are being used in a manner agreeable to you. You must rely on our judgment regarding the application of the net proceeds of this offering. The net proceeds may be used for corporate purposes that do not improve our profitability or increase the price of our shares. The net proceeds may also be placed in investments that do not produce income or that lose value. The failure to use such funds by us effectively could have a material adverse effect on our business, financial condition, operating results and cash flow.

A large number of shares may be sold in the market following this offering, which may significantly depress the market price of our Ordinary Shares.

The Ordinary Shares sold in the offering will be freely tradable without restriction or further registration under the Securities Act. As a result, a substantial number of our Ordinary Shares may be sold in the public market following this offering. If there are significantly more Ordinary Shares offered for sale than buyers are willing to purchase, then the market price of our Ordinary Shares may decline to a market price at which buyers are willing to purchase the offered Ordinary Shares and sellers remain willing to sell the Ordinary Shares.

If we fail to maintain compliance with the continued listing requirements of NASDAQ, we would face possible delisting, which would result in a limited public market for trading our shares and make obtaining future debt or equity financing more difficult for us.

Our Ordinary Shares are traded and listed on the Nasdaq Capital Market under the symbol of “TAOP.” Our shares may be delisted, if we fail to regain compliance with certain continued listing requirements of the Nasdaq Stock Market, or NASDAQ, in a timely manner.

On June 18, 2019, we received a notification letter from the Listing Qualifications Staff of NASDAQ notifying us that the minimum bid price per share for our Ordinary Shares has been below $1.00 for a period of 30 consecutive business days and we therefore no longer meet the minimum bid price requirements set forth in Nasdaq Listing Rule 5550(a)(2). We regained the compliance with the minimum bid price rule on August 20, 2020 by implementing a 1-for-6 share combination of our outstanding Ordinary Shares effective on July 30, 2020.

If we fail to maintain compliance with the NASDAQ continued listing requirements, our Ordinary Shares may lose their status on Nasdaq Capital Market and they would likely be traded on the over-the-counter market. As a result, selling our Ordinary Shares could be more difficult because smaller quantities of shares would likely be bought and sold, transactions could be delayed, and security analysts’ coverage of us may be reduced. In addition, in the event our Ordinary Shares are delisted, broker dealers would have bear certain regulatory burdens which may discourage broker dealers from effecting transactions in our Ordinary Shares and further limiting the liquidity of our shares. These factors could result in lower prices and larger spreads in the bid and ask prices for our Ordinary Shares. Such delisting from NASDAQ and continued or further declines in our share price could also greatly impair our ability to raise additional necessary capital through equity or debt financing, and could significantly increase the ownership dilution to shareholders caused by our issuing equity in financing or other transactions.

If our Ordinary Shares were delisted from NASDAQ, we may become subject to the trading complications experienced by “Penny Stocks” in the over-the-counter market.

Delisting from NASDAQ may cause our Ordinary Shares to become subject to the SEC’s “penny stock” rules. The SEC generally defines a penny stock as an equity security that has a market price of less than $5.00 per share or an exercise price of less than $5.00 per share, subject to specific exemptions. One such exemption is to be listed on NASDAQ. The market price of our Ordinary Shares is currently below $5.00 per share. Therefore, were we to be delisted from NASDAQ, our Ordinary Shares will become subject to the SEC’s “penny stock” rules. These rules require, among other things, that any broker engaging in a purchase or sale of our securities provide its customers with: (i) a risk disclosure document, (ii) disclosure of market quotations, if any, (iii) disclosure of the compensation of the broker and its salespersons in the transaction, and (iv) monthly account statements showing the market values of our securities held in the customer’s accounts. A broker would be required to provide the bid and offer quotations and compensation information before effecting the transaction. This information must be contained on the customer’s confirmation. Generally, brokers are less willing to effect transactions in penny stocks due to these additional delivery requirements. These requirements may make it more difficult for shareholders to purchase or sell our Ordinary Shares. Because the broker, not us, prepares this information, we would not be able to assure that such information is accurate, complete or current.

The market price of our Ordinary Shares has been volatile, leading to the possibility that their value may be depressed at a time when you want to sell your holdings.

The market price of our Ordinary Shares has been volatile, and this volatility may continue. From January 2, 2020 through January 20, 2021 the closing price of our Ordinary Shares on the NASDAQ Capital Market has ranged from a high of $8.80 to a low of $1.92. Numerous factors, many of which are beyond our control, may cause the market price of our Ordinary Shares to fluctuate significantly. These factors include, among others:

| | ● | actual or anticipated changes in our earnings, fluctuations in our operating results or our failure to meet the expectations of financial market analysts and investors; |

| | | |

| | ● | changes in financial estimates by us or by any securities analysts who might cover our share; |

| | | |

| | ● | speculation about our business in the press or the investment community; |

| | | |

| | ● | significant developments relating to our relationships with our customers or suppliers; |

| | | |

| | ● | stock market price and volume fluctuations of other publicly traded companies and, in particular, those that are in our industry; |

| | | |

| | ● | customer demand for our services and products; |

| | | |

| | ● | investor perceptions of our industry in general and our company in particular; |

| | | |

| | ● | the operating and share performance of comparable companies; |

| | | |

| | ● | general economic conditions and trends; |

| | | |

| | ● | major catastrophic events; |

| | | |

| | ● | announcements by us or our competitors of new products, significant acquisitions, strategic partnerships or divestitures; |

| | | |

| | ● | changes in accounting standards, policies, guidance, interpretation or principles; |

| | | |

| | ● | loss of external funding sources; |

| | | |

| | ● | sales of our Ordinary Shares, including sales by our directors, officers or significant shareholders; |

| | | |

| | ● | additions or departures of key personnel; and |

| | | |

| | ● | investor perception of litigation, investigation or other legal proceedings involving us or certain of our individual shareholders or their family members. |

Any of these factors may result in large and sudden changes in the volume and price at which our Ordinary Shares will trade. We cannot give any assurance that these factors will not occur in the future again. In addition, the securities market has from time to time experienced significant price and volume fluctuations that are not related to the operating performance of particular companies. These market fluctuations may also have a material adverse effect on the market price of our Ordinary Shares. In the past, following periods of volatility in the market price of their stock, many companies have been the subject of securities class action litigation. If we become involved in similar securities class action litigation in the future, it could result in substantial costs and diversion of our management’s attention and resources and could harm our stock price, business, prospects, financial condition and results of operations.

USE OF PROCEEDS

We estimate that the net proceeds from this offering will be approximately $1.98 million, after deducting the estimated expenses of this registered direct offering.

We intend to use the net proceeds from this offering for working capital and general corporate purposes; provided, however, that none of such proceeds will be used, directly or indirectly, for (i) the satisfaction of any of our indebtedness, other than payment of trade payables incurred in the ordinary course of business and consistent with prior practices; (ii) the redemption or repurchase of any of our securities; or (iii) the settlement of any outstanding litigation.

The amounts and timing of our use of proceeds will vary depending on a number of factors, including the amount of cash generated or used by our operations, and the rate of growth, if any, of our business. As a result, we will retain broad discretion in the allocation of the net proceeds of this offering. In addition, while we have not entered into any agreements, commitments or understandings relating to any significant transaction as of the date of this prospectus supplement, we may use a portion of the net proceeds to pursue acquisitions, joint ventures and other strategic transactions. Depending on future events and others changes in the business climate, we may determine at a later time to use the net proceeds for different purposes.

CAPITALIZATION AND INDEBTEDNESS

The table below sets forth our capitalization and indebtedness as of June 30, 2020:

| | ● | on an actual basis; |

| | | |

| | ● | on a pro forma basis, given the effect of (i) the issuance and sale of 222,222 Ordinary Shares in the registered direct offering in September 2020 at the offering price of $2.70 per share; and the issuance and sale of $1.48 million principal amount of the September 2020 Note and warrant to purchase up to 53,333 Ordinary Shares of the Company resulting in net proceeds of approximately $1.92 million after deducting estimated offering expenses payable by us; (ii) the issuance of 5,000 Ordinary Shares to certain employees in July 2020 as equity awards; (iii) the issuance of 6,250 Ordinary Shares to certain consultant in July 2020 as a result of non-cash exercise of the warrants issued in March 2019; (iv) the issuance of 72,414 Ordinary Shares to certain employees as a result of non-cash exercise of share options granted in 2016 and 2017; (v) the issuance of 42,000 Ordinary Shares to a consultant as compensation for its investor relations service for the second half of 2020; (vi) the issuance of stock options to certain consultants to purchase up 57,366 Ordinary Shares in July, 2020; (vii) the issuance of 11,894 Ordinary Shares to certain consultant in October 2020 as a result of non-cash exercise of the warrants issued in April 2020, (viii) the issuance of 16,220 Ordinary Shares in October 2020 to certain consultant for its service; (ix) the issuance of 8,110 Ordinary Shares to certain employees in October 2020 as equity awards; (x) the issuance of 449,598 Ordinary Shares to certain investors upon conversion of September 2019 Notes, which amount is calculated based on the sum of outstanding principal amount and accrued and unpaid interest as of June 30, 2020, and (xi) the issuance of 309,764 Ordinary Shares to certain investors upon partial conversion of March 2020 Notes, which amount is calculated based on the sum of outstanding principal amount and accrued and unpaid interest as of June 30, 2020. |

| | | |

| | ● | on a pro forma as adjusted basis to give effect to the issuance and sale of 740,740 Ordinary Shares in the registered direct offering pursuant to this prospectus supplement at the offering price of $2.70 per share; resulting in net proceeds of approximately $1.98 million after deducting estimated offering expenses payable by us. |

| | | As of June 30, 2020 | |

| | | Actual** | | | Pro Forma(1) | | | Pro Forma As Adjusted(1) | |

| Total Current Liabilities | | $ | 24,673,246 | | | $ | 24,094,546 | | | $ | 24,094,546 | |

| Short-term bank loans | | | 4,830,062 | | | | 4,830,062 | | | | 4,830,062 | |

| Convertible note payable | | | 2,247,185 | | | | 1,717,151 | | | | 1,717,151 | |

| Stockholders’ equity | | | | | | | | | | | | |

| Ordinary Shares, | | | 127,019,156 | | | | 131,205,685 | | | | 133,185,683 | |

| Additional paid-in capital* | | | 16,746,986 | | | | 15,490,757 | | | | 15,490,757 | |

| Reserve | | | 14,044,269 | | | | 14,044,269 | | | | 14,044,269 | |

| Accumulated deficit | | | (182,194,414 | ) | | | (182,416,812 | ) | | | (182,416,812 | ) |

| Accumulated other comprehensive income | | | 22,907,323 | | | | 22,907,323 | | | | 22,907,323 | |

| Total equity of the Company | | $ | (1,476,680 | ) | | $ | 1,231,222 | | | $ | 3,211,220 | |

| Non-controlling interest | | | 9,088,990 | | | | 9,088,990 | | | | 9,088,990 | |

| Total Equity | | | 7,612,310 | | | | 10,320,212 | | | | 12,300,210 | |

| Total capitalization | | $ | 14,689,557 | | | $ | 16,867,425 | | | $ | 18,847,423 | |

** Based on 7,332,434 Ordinary Shares issued and outstanding as of June 30, 2020

(1) The pro forma information is illustrative only. You should read the above table together with our financial statements and the related notes and the information included in our annual report on Form 20-F, dated June 12, 2020 and our report on Form 6-K, dated September 30, 2020, which is incorporated by reference herein.

DESCRIPTION OF ORDINARY SHARES WE ARE OFFERING

In this offering, we are offering 740,740 Ordinary Shares pursuant to this prospectus supplement and the accompanying prospectus. A description of the Ordinary Shares that we are offering pursuant to this Prospect Supplement is set forth under the heading “Description of Share Capital” starting on page 4 of the accompanying prospectus.

PLAN OF DISTRIBUTION

We are selling 740,740 Ordinary Shares in a registered direct offering to certain individual investors in a privately negotiated transaction pursuant to this prospectus supplement and accompanying prospectus at a price of $2.70 per share. The Ordinary Shares were offered directly to the investors without a placement agent, underwriter, broker or dealer.

Transfer Agent and Registrar

The transfer agent and registrar for our Ordinary Shares is Transhare Corporation, 2849 Executive Dr., Suite 200, Clearwater FL 33762 and its telephone number is (303) 662-1112.

Listing

Our Ordinary Shares are traded on the Nasdaq Capital Market under the symbol “TAOP.”

LEGAL MATTERS

The validity of the issuance of the Ordinary Shares offered hereby will be passed upon for us by Maples and Calder, British Virgin Islands counsel.

EXPERTS

The consolidated financial statements of Taoping Inc. as of December 31, 2019 and 2018 and for the years ended December 31, 2019, 2018 and 2017 have been incorporated by reference herein in reliance upon the reports of UHY LLP, independent registered public accounting firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” the information we file with them. This means that we can disclose important information to you by referring you to those documents. Each document incorporated by reference is current only as of the date of such document, and the incorporation by reference of such documents shall not create any implication that there has been no change in our affairs since the date thereof or that the information contained therein is current as of any time subsequent to its date. The information incorporated by reference is considered to be a part of this prospectus supplement and should be read with the same care. When we update the information contained in documents that have been incorporated by reference by making future filings with the SEC, the information incorporated by reference in this prospectus supplement is considered to be automatically updated and superseded. In other words, in the case of a conflict or inconsistency between information contained in this prospectus supplement and information incorporated by reference in this prospectus supplement, you should rely on the information contained in the document that was filed later.

The documents we are incorporating by reference as of their respective dates of filing are:

| | ● | Our Annual Report on Form 20-F for the fiscal year ended December 31, 2019, filed with the SEC on June 12, 2020. |

| | | |

| | ● | Our Reports of Foreign Private Issuer on Form 6-K furnished on July 29, 2020, September 30, 2020, December 30, 2020 and January 21, 2021; and |

| | | |

| | ● | The description of the Company’s Ordinary Shares contained in the Form 8-K12B, filed with the SEC on October 31, 2012, and any further amendment or report filed hereafter for the purpose of updating such description. |

All subsequent annual reports on Form 20-F and all subsequent reports on Form 6-K submitted by us to the SEC, that are identified by us as being incorporated by reference, shall be deemed to be incorporated by reference into this prospectus supplement and deemed to be a part hereof after the date of this prospectus supplement but before the termination of the offering under this prospectus supplement. Unless expressly incorporated by reference, nothing in this prospectus supplement and the accompanying prospectus shall be deemed to incorporate by reference information furnished to, but not filed with, the SEC.

Any statement contained in a document incorporated or deemed to be incorporated by reference into this prospectus supplement will be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained in this prospectus supplement or any other subsequently filed document that is deemed to be incorporated by reference into this prospectus supplement modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement.

Copies of all documents incorporated by reference in this prospectus supplement, including exhibits to these documents, will be provided at no cost to each person, including any beneficial owner, who receives a copy of this prospectus supplement on the written or oral request of that person made to:

Taoping Inc.

21st Floor, Everbright Bank Building, Zhuzilin

Futian District, Shenzhen, Guangdong 518040

People’s Republic of China

Telephone number (+86)755-8370-8333.

You may also obtain information about us by visiting our website at www.taop.com. Information contained in our website is not part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form F-3 (File No. 333-229323) under the Securities Act with respect to the securities offered by this prospectus supplement. This prospectus supplement and the accompanying prospectus, which constitute a part of our registration statement on Form F-3, omit some information contained in the registration statement in accordance with SEC rules and regulations. You should review the information and exhibits in the registration statement for further information on us and the securities we are offering. Statements in this prospectus supplement and the accompanying prospectus concerning any document we filed as an exhibit to the registration statement or that we otherwise filed with the SEC are not intended to be comprehensive and are qualified by reference to these filings. You should review the complete document to evaluate these statements.

We are subject to the reporting requirements of the Exchange Act that are applicable to a foreign private issuer. In accordance with the Exchange Act, we file reports, including annual reports on Form 20-F containing financial statements audited by an independent accounting firm. We also furnish to the SEC, under cover of Reports of Foreign Private Issuer on Form 6-K, material information required to be made public by us or filed by us with and made public by any stock exchange or distributed by us to our shareholders. As a foreign private issuer, we are exempt from the rules under the Exchange Act prescribing the furnishing and content of proxy statements to shareholders, and our officers, directors and principal shareholders are exempt from the “short-swing profits” reporting and liability provisions contained in Section 16 of the Exchange Act and related Exchange Act rules. In addition, we are not required under the Exchange Act to file periodic reports and financial statements as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

The SEC maintains an Internet site that contains reports, information statements and other information regarding issuers, such as us, that file electronically with the SEC (http://www.sec.gov).

Additionally, we make these filings available, free of charge, on our website at www.taop.com as soon as reasonably practicable after we electronically file such materials with, or furnish them to, the SEC. The information on our website, other than these filings, is not, and should not be, considered part of this prospectus supplement and is not incorporated by reference into this document.

PROSPECTUS

TAOPING INC.

$80,000,000

Ordinary Shares

Debt Securities

Warrants

Units

Offered by Taoping Inc.

And

500,000 Ordinary Shares Offered by the Selling Shareholder Named Herein

This prospectus relates to a primary offering by us and a secondary offering by the selling shareholder named in this prospectus (the “Selling Shareholder”).

In the primary offering, we may offer, issue and sell from time to time our ordinary shares, no par value (“Ordinary Shares”), debt securities, warrants, or units up to $80,000,000 or its equivalent in any other currency, currency units, or composite currency or currencies in one or more issuances. We may sell any combination of these securities in one or more offerings.

In addition, the Selling Shareholder may offer and sell from time to time up to 500,000 Ordinary Shares, covered by this prospectus.

This prospectus describes some of the general terms that may apply to these securities and the general manner in which they may be offered. The specific terms of any securities to be offered, and the specific manner in which they may be offered, will be described in a supplement to this prospectus or incorporated into this prospectus by reference. You should read this prospectus and any supplement carefully before you invest. Each prospectus supplement will indicate if the securities offered thereby will be listed or quoted on a securities exchange or quotation system.

The information contained or incorporated in this prospectus or in any prospectus supplement is accurate only as of the date of this prospectus, or such prospectus supplement, as applicable, regardless of the time of delivery of this prospectus or any sale of our securities.

Our Ordinary Shares are listed on the NASDAQ Capital Market under the symbol “TAOP.” On January 17, 2019, the last reported per share sale price of our Ordinary Share was $1.15. As of January 17, 2019, the aggregate market value of our outstanding Ordinary Shares held by non-affiliates was approximately $27.61 million, which was calculated based on approximately 41,760,163 shares of outstanding ordinary shares, of which approximately 24,011,452 shares were held by non-affiliates. We have not offered and sold any securities pursuant to General Instruction I.B.5 of Form F-3 during the prior 12 calendar month period that ends on, and includes, the date of this prospectus.

We may offer securities through underwriting syndicates managed or co-managed by one or more underwriters, through agents, or directly to purchasers. The prospectus supplement for each offering of securities will describe the plan of distribution for that offering. For general information about the distribution of securities offered, please see “Plan of Distribution” in this prospectus.

Investing in our securities involves risks. You should carefully consider the risk factors beginning on page 2 of this prospectus, in any accompanying prospectus supplement and in any related free writing prospectus, and in the documents incorporated by reference into this prospectus, any accompanying prospectus supplement and any related free writing prospectus before making any decision to invest in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is February 11, 2019

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a “shelf” registration process. Under this shelf registration process, we may sell our securities described in this prospectus in one or more offerings up to a total dollar amount of $80,000,000 (or its equivalent in foreign or composite currencies). In addition, this prospectus relates to the resale, from time to time, by the Selling Shareholder identified in this prospectus under the caption “Selling Shareholder,” of up to 500,000 Ordinary Shares.

This prospectus provides you with a general description of the securities that may be offered. Each time we offer our securities, we will provide you with a supplement to this prospectus that will describe the specific amounts, prices and terms of the securities we offer. The prospectus supplement may also add, update or change information contained in this prospectus. This prospectus, together with applicable prospectus supplements and the documents incorporated by reference in this prospectus and any prospectus supplements, includes all material information relating to this offering. Please read carefully both this prospectus and any prospectus supplement together with additional information described below under “Where You Can Find More Information.”

You should rely only on the information contained in or incorporated by reference in this prospectus and any applicable prospectus supplement. Neither we nor the Selling Shareholder have authorized anyone to provide you with different or additional information. If anyone provides you with different or inconsistent information, you should not rely on it. We nor the Selling Shareholder take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of securities described in this prospectus. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

You should not assume that the information contained in this prospectus and the accompanying prospectus supplement is accurate on any date subsequent to the date set forth on the front of the document or that any information that we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since those dates.

TAOPING INC.

We are a leading provider of cloud-app technologies for Smart City IoT (Internet of Things) platforms, digital advertising delivery, and other internet-based information distribution systems in China. Our Internet ecosystem enables all participants of the new media community to efficiently promote branding, disseminate information, and exchange resources. In addition, we provide a broad portfolio of software, hardware with fully integrated solutions, including Information Technology infrastructure, Internet-enabled display technologies, and IoT platforms to customers in government, education, residential community management, media, transportation, and other private sectors.

We were founded in 1993 and are headquartered in Shenzhen, China. As of September 30, 2018, we had approximately 110 employees.

Prior to 2014, we generated the majority of our revenues through selling our products and services mostly to the public service entities to help them improve their operational efficiency and service quality. Since 2014, we have expanded and diversified our customer base to the private sector as well. Our customers in the private sector include, among others, elevator maintenance companies, residential community management, advertising agencies, auto dealerships, and educational institutes. Our new corporate mission is to make publicity accessible and affordable for businesses of all sizes.

We generated revenues from sales of hardware products, software products, system integration services, and related maintenance and support services. Starting in 2015, with the introduction of our cloud-based software as a service (SaaS) offering, we expect to generate additional recurring monthly revenues from SaaS fees. In 2016 and 2017, a small portion of our revenue was generated from SaaS, which is expected to increase in the coming years with the roll-out of our cloud-based elevator IoT and ad display terminals.

In May 2017, we completed our transformation to a provider of Cloud-App-Terminal (CAT) and IoT technology based digital advertising distribution network and new media resource sharing platform, and offered an end-to-end digital advertising solution enabling customers to efficiently and cost-effectively direct advertisements to specific interactive ad display terminals in the Out-of-Home advertising market across China. In 2017, we became profitable as a result of a successful transition of our business model. During the nine months of 2018, we continued to expand the market and our revenue increased by 34.8% to $16.5 million from $12.2 million and net income attributable to the Company increased 67.4% to $1.9 million from $1.1 million, compared to the same period of last year.

We report financial and operational information in the following two segments:

| | (1) | Cloud-based Technology (CBT) segment — The CBT segment is our current and future focus of corporate development. It includes our cloud-based products and services offered to customers in the private sector including new media, healthcare, education, and residential community management. In this segment, we generate revenues from the sales of hardware, and total solutions of interactive advertisement display terminals integrated with proprietary software, Out-of-Home digital advertising distribution and advertising time slot programmed trading transactions. We also generate revenue from monthly software subscription and Software-as-a Service (SaaS) fees. |

| | | |

| | (2) | Traditional Information Technology (TIT) segment — The TIT segment includes our project-based technology products and services offered to the public sector, including Digital Public Security Technology (DPST) and Multi-screen Digital Display Systems (MDDS). In this segment, we generate revenues from the sales of software and systems integration services. |

RISK FACTORS

An investment in our securities involves a high degree of risk. Some of these risks include:

| | ● | We have a limited operating history of selling our cloud-based products and services and may be unable to achieve or sustain profitability or reasonably predict our future results. |

| | | |

| | ● | Our independent registered auditors have expressed substantial doubt about our ability to continue as a going concern. |

| | | |

| | ● | Our periodic operating results are difficult to predict and could fall below investors’ expectations or estimates by securities research analysts, which may cause the trading price of our ordinary shares to decline. |

| | | |

| | ● | PRC laws and regulations governing our businesses and the validity of certain of our contractual relationships with iASPEC are uncertain. If we are found to be in violation of such PRC laws and regulations, our business may be negatively affected and we may be forced to relinquish our interests in those operations. |

| | | |

| | ● | If we fail to comply with the continued listing requirements of NASDAQ, we would face possible delisting, which would result in a limited public market for trading our shares and make obtaining future debt or equity financing more difficult for us. |

| | | |

| | ● | Because we are incorporated under the laws of the British Virgins Islands, or BVI, it may be more difficult for our shareholders to protect their rights than it would be for a shareholder of a corporation incorporated in another jurisdiction. |

We operate in a highly competitive environment in which there are numerous factors which can influence our business, financial position or results of operations and which can also cause the market value of our ordinary shares to decline. Many of these factors are beyond our control and therefore, are difficult to predict. Prior to making a decision about investing in our securities, you should carefully consider the risk factors noted above, the risk factors discussed in the sections entitled “Risk Factors” contained in our most recent Annual Report on Form 20-F filed with the SEC, and in any applicable prospectus supplement and our other filings with the SEC and incorporated by reference in this prospectus or any applicable prospectus supplement, together with all of the other information contained in this prospectus or any applicable prospectus supplement. If any of the risks or uncertainties described in our SEC filings or any prospectus supplement or any additional risks and uncertainties actually occur, our business, financial condition and results of operations could be materially and adversely affected. In that case, the trading price of our securities could decline and you might lose all or part of your investment.

FORWARD-LOOKING STATEMENTS

This prospectus contains or incorporates forward-looking statements within the meaning of section 27A of the Securities Act and section 21E of the Exchange Act of 1934, as amended, or the Exchange Act. These forward-looking statements are management’s beliefs and assumptions. In addition, other written or oral statements that constitute forward-looking statements are based on current expectations, estimates and projections about the industry and markets in which we operate and statements may be made by or on our behalf. Words such as “should,” “could,” “may,” “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,” variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. There are a number of important factors that could cause our actual results to differ materially from those indicated by such forward-looking statements.

We describe material risks, uncertainties and assumptions that could affect our business, including our financial condition and results of operations, under “Risk Factors” and may update our descriptions of such risks, uncertainties and assumptions in any prospectus supplement. We base our forward-looking statements on our management’s beliefs and assumptions based on information available to our management at the time the statements are made. We caution you that actual outcomes and results may differ materially from what is expressed, implied or forecast by our forward-looking statements. Accordingly, you should be careful about relying on any forward-looking statements. Reference is made in particular to forward-looking statements regarding growth strategies, financial results, product and service development, competitive strengths, intellectual property rights, litigation, mergers and acquisitions, market acceptance or continued acceptance of our products, accounting estimates, financing activities, ongoing contractual obligations and sales efforts. Except as required under the federal securities laws, the rules and regulations of the SEC, stock exchange rules, and other applicable laws, regulations and rules, we do not have any intention or obligation to update publicly any forward-looking statements after the distribution of this prospectus, whether as a result of new information, future events, changes in assumptions, or otherwise.

USE OF PROCEEDS

Except as described in any prospectus supplement and any free writing prospectus in connection with a specific offering, we currently intend to use the net proceeds from the sale of the securities offered by us under this prospectus to fund the growth of our business, primarily working capital, and for general corporate purposes.

We may also use a portion of the net proceeds to acquire or invest in technologies, products and/or businesses that we believe will enhance the value of our Company, although we do not currently have any agreements or understandings with third parties to make any material acquisitions of, or investment in, other businesses. Depending on future events and others changes in the business climate, we may determine at a later time to use the net proceeds for different purposes. As a result, our management will have broad discretion in the allocation of the net proceeds and investors will be relying on the judgment of our management regarding the application of the proceeds of any sale of the securities. Additional information on the use of net proceeds from the sale of securities covered by this prospectus may be set forth in the prospectus supplement relating to the specific offering.

We will not receive any proceeds from any sale of our Ordinary Shares by the Selling Shareholder.

SELLING SHAREHOLDER

This prospectus relates to the possible resale by the Selling Shareholder, Mr. Jianghuai Lin, our President, Chief Executive Officer and Chairman of the Board of Directors, of up to 500,000 of our Ordinary Shares. These shares were acquired by the Selling Shareholder in November 2018 pursuant to a securities purchase agreement that the Selling Shareholder entered into with the Company on September 11, 2018. The Selling Shareholder purchased 500,000 Ordinary Shares from the Company at a price of $1.50 per share.

Pursuant to this prospectus, the Selling Shareholder may from time to time offer and sell any or all of the Ordinary Shares set forth below. When we refer to the “Selling Shareholder” in this prospectus, we mean Mr. Lin and the pledgees, donees, transferees, assignees, successors and others who later come to hold any of the Selling Shareholder’s interest in Ordinary Shares other than through a public sale.

The following table is based on information supplied to us by the Selling Shareholder and sets forth, as of January 17, 2019, information regarding the Selling Shareholders’ beneficial ownership of our Ordinary Shares offered by him. Beneficial ownership is determined in accordance with the rules of the SEC. In computing the number of Ordinary Shares beneficially owned by the Selling Shareholder and the percentage of ownership of the Selling Shareholder, Ordinary Shares and underlying shares of convertible securities, options or warrants held by the Selling Shareholder that are convertible or exercisable, as the case may be, within 60 days of January 17, 2019 are included. The Selling Shareholder’s percentage of ownership in the following table is based upon 41,760,163 Ordinary Shares of the Company outstanding as of January 17, 2019.

| | | Before the Offering | | | | | After the Offering | |

| Name and Address of Beneficial Owner | | Number of Ordinary Shares | | Percentage of Outstanding Ordinary | | | Number of Ordinary Shares Being Offered | | Number of Ordinary Shares | | Percentage of Outstanding Ordinary Shares | |

Jianghuai Lin

c/o Taoping Inc.

21st Floor, Everbright Bank Building

Zhuzilin, Futian District

Shenzhen, Guangdong, 518040

People’s Republic of China | | 17,458,134 | | 41.8 | % | | 500,000 | | 16,958,134 | | 40.6 | % |

The registration of these Ordinary Shares does not mean that the Selling Shareholder will sell or otherwise dispose of all or any of those securities. The Selling Shareholder may sell or otherwise dispose of all, a portion or none of such shares from time to time. We do not know the number of shares, if any, that will be offered for sale or other disposition by the Selling Shareholder under this prospectus. Furthermore, the Selling Shareholder may have sold, transferred or disposed of the shares covered hereby in transactions exempt from the registration requirements of the Securities Act since the date on which we filed this prospectus.

We will not receive any proceeds from the sales by the Selling Shareholder. We have agreed to bear expenses incurred by the Selling Shareholder that relate to the registration of the shares being offered and sold by the Selling Shareholder, including the SEC registration fee and legal, accounting, printing and other expenses of this offering.

DESCRIPTION OF SHARE CAPITAL

The following describes our share capital, summarizes the material provisions of our amended and restated memorandum and articles of association, which is based upon, and is qualified by reference to, our amended and restated memorandum and articles of association. This summary does not purport to be a summary of all of the provisions of our amended and restated memorandum and articles of association. You should read our amended and restated memorandum and articles of association which are filed as exhibits to the registration statement of which this prospectus forms a part, for the provisions that are important to you.

The Company is authorized to issue 100,000,000 Ordinary Shares, with no par value each. The Ordinary Shares may be issued from time to time at the discretion of the Board of Directors without shareholder approval. The Board of Directors of the Company is authorized to issue these shares in different classes and series and, with respect to each class or series, to determine the designations, powers, preferences, privileges and other rights, including dividend rights, conversion rights, terms of redemption and liquidation preferences, any or all of which may be greater than the powers and rights associated with the Ordinary Shares, at such times and on such other terms as they think proper.

As of January 17, 2019, there were 41,760,163 Ordinary Shares outstanding, all of which were fully paid.

Register of Members

Under BVI law, a share in a BVI company is duly issued only when the name of the shareholder is entered in the register of members of a company, and the register of members is by statute regarded as prima facie evidence of the shareholders of a company. A person becomes a shareholder of a BVI company, and is therefore able to benefit from the rights attaching to such shares, only on the date that such person is entered on the register of members.

Rights and Obligations of Shareholders

Dividends. Subject to the BVI Business Companies Act (as amended), or the BVI Act, the directors may, by resolution of directors, authorize a distribution (including a dividend) by us to shareholders at such time and of such an amount as they think fit if they are satisfied, on reasonable grounds, that immediately after the distribution, the value of our assets exceeds our liabilities and we are able to pay our debts as they fall due. Any distribution payable in respect of a share which has remained unclaimed for three years from the date when it became due for payment shall, if the board of the directors so resolves, be forfeited and cease to remain owing by us. The directors may, before authorizing any distribution, set aside out of our profits such sum as they think proper as a reserve fund, and may invest the sum so set apart as a reserve fund upon such securities as they may select. The holder of each ordinary share has the right to an equal share in any distribution paid by us.

Voting Rights. Each ordinary share confers on the shareholder the right to one vote at a meeting of the shareholders or on any resolution of shareholders on all matters before our shareholders.

Winding Up. The holder of each ordinary share is entitled to an equal share in the distribution of the surplus assets of us on a winding up.

Redemption. The directors may, on behalf of the Company, purchase, redeem or otherwise acquire any of our own shares for such consideration as the directors consider fit, and either cancel or hold such shares as treasury shares. Shares may be purchased or otherwise acquired in exchange for newly issued shares. The directors shall not, unless permitted pursuant to the BVI Act, purchase, redeem or otherwise acquire any of our own shares unless immediately after such purchase, redemption or other acquisition, the value of our assets exceeds our liabilities and we are able to pay our debts as they fall due.

Changes in Rights of Shareholders

Under our memorandum and articles of association, if at any time the shares which we are authorized to issue are divided into different classes of shares, the rights attaching to any class may only be changed by a consent in writing of the holders of a majority of the issued shares of that class or with the sanction of a resolution passed by the holders of at least a majority of the shares of the class present in person or by proxy at a separate general meeting of the holders of the shares of the class. At such a separate general meeting, the quorum shall be at least one person holding or representing by proxy a majority of the issued shares of the class.

Meetings

Under the BVI Act, there is no requirement for an annual meeting of shareholders. Under our articles of association, we are required to hold an annual meeting of shareholders at the time designated by the Board of Directors. Our annual shareholders’ meetings may be held in such place within or outside the BVI as our Board of Directors considers appropriate.

Our Board of Directors shall call a shareholders’ meeting if requested in writing to do so by shareholders entitled to exercise at least 10% of the voting rights in respect of the matter for which the meeting is being requested.

Our Board of Directors shall give not less than 10 days and not more than 60 days prior written notice of a shareholders’ meeting to those persons whose names on, either (a) the date the notice is given or (b) on a date fixed by the directors as the record date (which must be a date that is not less than 10 days nor more than 60 days prior to the meeting), appear as shareholders in our register and are entitled to vote at the meeting. The inadvertent failure of the directors to give notice of a meeting to a shareholder, or the fact that a shareholder has not received notice, does not invalidate the meeting.

Our articles of association provide that a meeting of shareholders is duly constituted if, at the commencement of the meeting, there are shareholders present in person or by proxy representing not less than a majority of the votes of the shares or class or series of shares entitled to vote on resolutions of shareholders to be considered at the meeting. A shareholder may be represented at a meeting of shareholders by a proxy (who need not be a shareholder) who may speak and vote on behalf of the shareholder. A written instrument giving the proxy such authority must be produced at the place appointed for such purpose. A shareholder shall be deemed to be present at the meeting if he participates by telephone or other electronic means and all shareholders participating in the meeting are able to hear each other.

Holders of our ordinary shares are entitled to one vote for each share held of record on all matters at all meetings of shareholders, except at a meeting where holders of a particular class or series of shares are entitled to vote separately. Our shareholders have no cumulative voting rights. Our shareholders take action by a majority of votes cast, unless otherwise provided by the BVI Act or our memorandum and articles of association.

Limitations on Ownership of Securities

There are no limitations on the right of non-residents or foreign persons to own our securities imposed by BVI law or by our memorandum and articles of association.

Change in Control of Company

Our Board of Directors is authorized to issue our ordinary shares in different classes and series and, with respect to each class or series, to determine the designations, powers, preferences, privileges and other rights, including dividend rights, conversion rights, terms of redemption and liquidation preferences, any or all of which may be greater than the powers and rights associated with the ordinary shares, at such times and on such other terms as they think proper. Such power could be used in a manner that would delay, defer or prevent a change of control of our Company.

Ownership Threshold

There are no provisions governing the ownership threshold above which shareholder ownership must be disclosed imposed by BVI law or by our memorandum and articles of association.

Changes in Capital

Subject to the provisions of our amended and restated memorandum and articles of association, the BVI Act and the rules of NASDAQ, our unissued shares shall be at the disposal of the directors who may, without prejudice to any rights previously conferred on the holders of any existing shares or class or series of shares, offer, allot, grant options over or otherwise dispose of the shares to such persons, at such times and upon such terms and conditions as we may by resolution of directors determine.

Subject to the provisions of the amended and restated memorandum of association relating to changes in the rights of shareholders and the powers of directors in relation to shareholders, we may, by a resolution of members, amend our memorandum of association to increase or decrease the number of ordinary shares authorized to be issued.

DESCRIPTION OF DEBT SECURITIES

The following is a summary of the general terms of the debt securities that we may issue. We will file a prospectus supplement that may contain additional terms when we issue debt securities. The terms presented here, together with the terms in a related prospectus supplement, will be a description of the material terms of the debt securities. You should also read the indenture under which the debt securities are to be issued. We have filed a form of indenture governing different types of debt securities with the SEC as an exhibit to the registration statement of which this prospectus is a part. All capitalized terms have the meanings specified in the indenture.

We may issue, from time to time, debt securities, in one or more series, that will consist of senior debt, senior subordinated debt or subordinated debt. We refer to the subordinated debt securities and the senior subordinated debt securities together as the subordinated securities. The debt securities that we may offer will be issued under an indenture between us and an entity, identified in the applicable prospectus supplement, as trustee. Debt securities, whether senior, senior subordinated or subordinated, may be issued as convertible debt securities or exchangeable debt securities. The following is a summary of the material provisions of the indenture filed as an exhibit to the registration statement of which this prospectus is a part.

As you read this section, please remember that for each series of debt securities, the specific terms of your debt security as described in the applicable prospectus supplement will supplement and, if applicable, may modify or replace the general terms described in the summary below. The statement we make in this section may not apply to your debt security.

General Terms of the Indenture

The indenture does not limit the amount of debt securities that we may issue. It provides that we may issue debt securities up to the principal amount that we may authorize and may be in any currency or currency unit that we may designate. We may, without the consent of the holders of any series, increase the principal amount of securities in that series in the future, on the same terms and conditions and with the same CUSIP numbers as that series. Except for the limitations on consolidation, merger and sale of all or substantially all of our assets contained in the indenture, the terms of the indenture do not contain any covenants or other provisions designed to give holders of any debt securities protection against changes in our operations, financial condition or transactions involving us.

We may issue the debt securities issued under the indenture as “discount securities,” which means they may be sold at a discount below their stated principal amount. These debt securities, as well as other debt securities that are not issued at a discount, may be issued with “original issue discount”, or OID, for U.S. federal income tax purposes because of interest payment and other characteristics. Material U.S. federal income tax considerations applicable to debt securities issued with original issue discount will be described in more detail in any applicable prospectus supplement.

The applicable prospectus supplement for a series of debt securities that we issue will describe, among other things, the following terms of the offered debt securities:

| | ● | the title and authorized denominations of the series of debt securities; |

| | | |

| | ● | any limit on the aggregate principal amount of the series of debt securities; |

| | | |

| | ● | whether such debt securities will be issued in fully registered form without coupons or in a form registered as to principal only with coupons or in bearer form with coupons; |

| | | |

| | ● | whether issued in the form of one or more global securities and whether all or a portion of the principal amount of the debt securities is represented thereby; |

| | | |

| | ● | the price or prices at which the debt securities will be issued; |

| | | |

| | ● | the date or dates on which principal is payable; |