UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

COMMISSION FILE NUMBER 001-35811

Health Insurance Innovations, Inc.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 46-1282634 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

15438 North Florida Avenue, Suite 201

Tampa, Florida 33613

(Address of principal executive offices) (zip code)

Registrant’s telephone number, including area code:

(877) 376-5831

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| | |

Title of each class | | Name of each exchange on which registered |

| Class A common stock, par value $0.001 per share | | NASDAQ Global Market |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | x |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes ¨ No x

The aggregate market value of the common stock held by non-affiliates of the registrant, as of March 27, 2013, was approximately $73,313,260 million. Such aggregate market value was computed by reference to the closing price of the common stock as reported on the NASDAQ Global Market on March 27, 2013. For purposes of making this calculation only, the registrant has defined affiliates as including only directors and executive officers and shareholders holding greater than 10% of the common stock of the registrant as of March 27, 2013. The registrant used March 27, 2013 as the measurement date because its common stock was not publicly traded as of the last business day of its most recently completed second fiscal quarter.

As of March 27, 2013, there were 5,295,167 shares of the registrant’s Class A common stock, $0.001 par value per share, outstanding and 8,566,667 shares of the registrant’s Class B common stock, $0.001 par value per share, outstanding.

TABLE OF CONTENTS

INTRODUCTION

In this report, unless the context otherwise requires, “HII,” the “Company,” “we,” “us” and “our” refer to (1) prior to the consummation of the reorganization described under “Item 1. Business—Our History and the Reorganization of Our Corporate Structure,” Health Plan Intermediaries, LLC, and (2) after giving pro forma effect to the reorganization, Health Insurance Innovations, Inc., a Delaware corporation, and its consolidated subsidiaries, including Health Plan Intermediaries Holdings, LLC. References to “Series B Membership Interests” in this report are to Health Plan Intermediaries Holdings, LLC Series B Membership Interests. The term “Predecessor” refers to our Company prior to the acquisition described under “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Basis of Presentation,” and the term “Successor” refers to our Company following such acquisition. Unless otherwise indicated, all references to the year ended December 31, 2012 relate to the year ended December 31, 2012 of the Successor. All references to the nine months ended September 30, 2011 relate to the nine-month period ended September 30, 2011 of the Predecessor. All references to the year ended December 31, 2011 relate to the combined three-month period ended December 31, 2011 of the Successor and the nine-month period ended September 30, 2011 of the Predecessor. The presentation of combined Predecessor and Successor operating results (which is the arithmetic sum of the Predecessor and Successor amounts) is a presentation not incompliance with United States Generally Accepted Accounting Principles (“GAAP”), which is provided as a convenience solely for the purpose of facilitating comparisons of current results with combined results over the same period in the prior year. For more information about the reorganization and our recent initial public offering, including a diagram of our organizational structure, see “Item 1. Business—Our History and the Reorganization of Our Corporate Structure.”

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

We have made statements in “Item 1A. Risk Factors,” “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Item 1. Business” and in other sections of this report that are forward-looking statements. All statements other than statements of historical fact included in this report are forward-looking statements. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “may,” “might,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue,” the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to risks, uncertainties and assumptions about us, may include projections of our future financial performance, our anticipated growth strategies, anticipated trends in our business and other future events or circumstances. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements and other future events or circumstances to differ materially from the results, level of activity, performance or achievements, events or circumstances expressed or implied by the forward-looking statements, including those factors discussed “Item 1A. Risk Factors.” You should specifically consider the numerous risks outlined under “Item 1A. Risk Factors.”

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance, achievements, events or circumstances. We are under no duty to update any of these forward-looking statements after the date of this report to conform our prior statements to actual results or revised expectations.

1

PART I

Overview

Our Company

We are a leading developer and administrator of affordable, web-based individual health insurance plans and ancillary products. Our highly scalable, proprietary, web-based technology platform allows for mass distribution of, and online enrollment in, our large and diverse portfolio of affordable health insurance offerings.

Our technology platform provides customers, who we refer to as members, immediate access to our products through our distribution partners anytime, anyplace. The health insurance products we develop are underwritten by insurance carrier companies, and we assume no underwriting, insurance or reimbursement risk. Members can price and tailor product selections to meet their needs, buy policies and print policy documents and identification cards in real-time. Our sales are executed online and offer instant electronic fulfillment. Our technology platform uses abbreviated online applications, some with health questionnaires, to provide an immediate accept or reject decision on applications for all products that we offer. Once an application is accepted, individuals can use our automated payment system to complete the enrollment process and obtain instant electronic access to their policy fulfillment documents, including the insurance policy, benefits schedule and identification cards. We receive credit card and Automated Clearing House (“ACH”) payments directly from members at the time of sale. Our technology platform provides significant operating leverage as we add members and reduces the costs associated with marketing, selling, underwriting and administering policies.

We are an industry leader in the sale of 12-month short-term medical (“STM”) insurance plans, an alternative to traditional Individual Major Medical (“IMM”) plans, which provide lifetime renewable coverage. STM plans generally offer qualifying individuals comparable benefits for fixed short-term durations of six or 12 months at approximately half the cost of IMM plans. While applications for IMM insurance may take up to 60 days to process, STM plans feature a streamlined underwriting process offering immediate coverage options. We also offer guaranteed-issue hospital indemnity plans for individuals under the age of 65, which pay fixed cash benefits for covered procedures and services, and a variety of ancillary products such as pharmacy benefit cards, dental plans, vision plans and cancer/critical illness plans that are frequently purchased as supplements to STM and hospital indemnity plans. We design and structure insurance products on behalf of insurance carrier companies, market them to individuals through our large network of distributors and manage member relations via our online member portal, which is available 24 hours a day, seven days a week. Our online enrollment process allows us to aggregate and analyze consumer data and purchasing habits to track market trends and drive product innovation. We have established relationships with several highly rated insurance carriers, including Starr Indemnity & Liability Company, Companion Life, United States Fire, ING, Markel and CIGNA, among others. In addition, as of December 31, 2012, the large independent distribution network we access consists of 46 licensed agent call centers and 262 wholesalers, including Marsh, eHealthInsurance and MasterCard, among others, that work with over 8,275 licensed brokers. Our data-driven product design, technology platform and extensive distribution network have enabled us to grow our revenues from $29,878,000 in 2011 to $41,940,000 in 2012.

We focus on the large and under-penetrated segment of the U.S. population who are uninsured or underinsured, which includes individuals who are unable to afford traditional IMM premiums, individuals not covered by employer-sponsored insurance plans, such as those who are self-employed as well as small business owners and their employees, and underserved “gap populations” that require insurance due to changes caused by life events, such as new graduates, divorcees, early retirees, military discharges, the unemployed, part-time and seasonal employees and temporary workers. Our target market consists of approximately 64 million Americans, including approximately 50 million Americans who were uninsured in 2010, according to the U.S. Census Bureau, and approximately 14 million non-elderly Americans who purchased individual health insurance plans in 2010, according to a 2010 Kaiser Family Foundation survey. As of December 31, 2012, we had 23,747 STM members. We expect the number of uninsured and underinsured to significantly increase due to the rising costs and burdensome underwriting requirements of traditional IMM plans and a decline in employer-sponsored health insurance programs.

As of December 31, 2012, we had 23,747 STM plans in force, compared with 18,059 on December 31, 2011, with an average monthly retention rate of 79% from December 31, 2011 to December 31, 2012. We earn our revenues from commissions and fees related to the sale of products to our members. Our ancillary products have created several additional revenue streams and resulted in a significant portion of our business being generated by monthly member renewals. For the year ended December 31, 2012, our premium equivalents, revenues and EBITDA were $75,872,000, $41,940,000 and $4,543,000, respectively, representing a 42.6%, 40.4% and 65.7% increase compared to premium equivalents, revenues and EBITDA of $53,206,000, $29,878,000 and $2,742,000, respectively, for the year ended December 31, 2011. For more detail about the use of premium equivalents as a business metric and a reconciliation of premium equivalents to revenues, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Business Metrics—Premium Equivalents.”

2

Health Insurance Industry and Market Opportunity

We believe ongoing changes in the health insurance industry will expand and reshape our target market. For example, the Patient Protection and Affordable Care Act, or PPACA, and the Health Care and Education Reconciliation Act of 2010, or HCERA, which we refer to, collectively, as “Healthcare Reform”, were signed into law on March 23, 2010. After facing a number of legal challenges, Healthcare Reform was upheld by the U.S. Supreme Court on June 28, 2012. Healthcare Reform includes a mandate requiring individuals to carry health insurance or face tax penalties; a mandate that certain employers with over 50 employees offer their employees group health insurance coverage or face tax penalties; prohibitions against insurance companies that offer traditional IMM insurance plans using pre-existing health conditions as a reason to deny an application for health insurance; and medical loss ratio (“MLR”) requirements that require each health insurance carrier to spend a certain percentage of its IMM premium revenue on reimbursement for clinical services and activities that improve healthcare quality.

According to a 2011 McKinsey survey, the implementation of Healthcare Reform will likely increase the number of Americans in the individual health insurance market from 14 million to more than 100 million starting in 2014. We believe this increase will be primarily driven by two key factors: employers dropping group coverage and an additional 45 million uninsured Americans entering the individual insurance market. The McKinsey survey estimates that approximately 30% of employers would “definitely” or “probably” drop employer-sponsored insurance starting in 2014. The estimated penalty employers will face for not providing their employees coverage is $2,000 per employee for employers with over 50 employees (there is no penalty for employers with less than 50 employees), which is significantly less than the estimated price currently paid for employee coverage ($9,000 to $14,000 per employee). Assuming a 30% drop in employer-sponsored insurance, approximately 50 million Americans would join the individual health insurance market starting in 2014. In addition, because Americans will face penalties if they are uninsured, we expect that a large number of the current uninsured population of 50 million will enter the individual health insurance market. Accordingly, after 2014, we expect that the individual health insurance market will grow more than 600% to over 100 million policyholders, representing annual individual aggregate health insurance premiums in the United States of approximately $361 billion, compared with approximately $50 billion in 2010.

We believe certain dynamics in the health insurance industry present an opportunity to increase our market share in the individual health insurance market. For example, the minimum MLR thresholds require that IMM carriers use 80% of all premiums collected to pay claims. This has significantly reduced distributor commission rates on traditional IMM policies, forcing many distributors to abandon the traditional face-to-face IMM sales model. Starting in 2014, IMM carriers will also be subject to a pre-existing condition mandate, requiring them to accept all customers regardless of their pre-existing conditions. This “must-carry” pre-existing conditions requirement will further increase the costs of IMM coverage. Unlike traditional IMM plans, our STM products are exempt from the minimum MLR thresholds and “must-carry” pre-existing conditions requirements under Healthcare Reform, allowing us to offer attractive distributor commission rates while providing affordable products for individuals. In addition, Healthcare Reform also requires that states establish health insurance exchanges where uninsured individuals can select and purchase health insurance plans. We believe that these exchanges will further the transition from group-based insurance coverage to individual health insurance coverage and that our STM products will be an attractive option in the non-subsidized exchange environment. Moreover, consumers are increasingly accessing the Internet to find affordable health insurance solutions. The current number of Internet users in the United States continues to grow and, according to a report published by Pew Research Center, represented 74% of the population in 2010. In addition, according to the same report, 33% of Internet users in 2010 looked online for information related to health insurance. This represents approximately 75 million Americans who used the Internet to access information related to health insurance in 2010.

We intend to aggressively pursue opportunities to help consumers identify our STM products as the right choice for healthcare coverage, and we believe our technology platform, product focus and industry expertise will allow us to gain an increasing share of this growing market.

Our Solutions

We believe that our products address a significant portion of the issues facing the healthcare system in the United States and improve access to coverage for certain underserved segments of the population.

| | • | | Lack of Access to Health Insurance.Due to the streamlined underwriting process for our STM plans, we are able to provide an instant decision regarding acceptance. Individuals applying for STM coverage only have to answer an abbreviated, online questionnaire regarding the status of their health to screen for risks that cannot be supported by the rate structure and design of the plan before a decision is generated. We also offer hospital indemnity plans under which members are paid fixed dollar amounts by procedure or service according to a defined schedule which includes doctor visits, lab tests, surgeries and hospitalizations. As these plans are not based on an individual’s health status, they guarantee issuance to individuals under the age of 65 and provide a viable coverage alternative for otherwise uninsurable individuals. |

| | • | | Growing Number of Uninsured and Underinsured Americans.We focus on the large and under-penetrated segment of the U.S. population that is uninsured or underinsured. According to the U.S. Census Bureau, 16% of Americans were uninsured in 2011, representing approximately 50 million individuals. In addition, the percentage of non-elderly Americans with employer-sponsored insurance decreased from 68% in 2000 to 59% in 2009, driving more Americans into the individual health insurance market. The number of uninsured and underinsured Americans continues to grow in part due to reductions in employer-provided health benefits. |

| | • | | High Cost of Health Insurance.We offer affordable alternatives to IMM. According to the U.S. Census Bureau, approximately 34 million of the 50 million uninsured Americans in 2011 were members of families with annual incomes of less than $50,000. Based on these figures, we estimate that a sizable portion of the uninsured population chooses not to purchase insurance primarily due to its high cost. According to a 2010 Kaiser Family Foundation survey, traditional IMM premiums increased an average of approximately 20% over a 12-month period, while the cost of our STM plans remained stable. In addition, as a result of Healthcare Reform, IMM premiums are expected to increase significantly in price as a result of guaranteed issue requirements for individuals with pre-existing health conditions. For individuals with pre-existing conditions, we currently offer guaranteed-issue hospital indemnity plans and, only where required by state mandate, STM plans. The implementation of Healthcare Reform will not expand our coverage of such individuals, allowing us to continue to offer attractive distributor commission rates while providing affordable products for members. |

3

Our Competitive Strengths

We have the following key competitive strengths that we believe collectively provide significant barriers to entry:

| | • | | Value Generated for All Key Constituents. By combining extensive management experience with our technology platform, we have developed a business model that we believe enables us to create a “win-win” proposition for our key constituents. |

| | • | | Our Carriers.We offer carriers access to a large member base with no covered pre-existing conditions. Our technology platform connects our carriers directly to a large independent distribution network. Our platform also provides our carriers access to real-time sales and membership data. We use this information to assist our carriers in designing products that cater to their target populations. We currently utilize several carrier companies, including Starr Indemnity & Liability Company, Companion Life, United States Fire, ING, Markel and CIGNA, among others. Our management team has long-standing relationships with most of the major carrier companies we utilize and has not lost a carrier relationship in over 10 years. |

| | • | | Our Distributors.At a time when commission rates on many health insurance products, including traditional IMM plans, are declining, we provide our distributors with specialized, highly sought-after product offerings and a compensation structure characterized by attractive commission rates and advanced payments. We believe our long-standing relationships with most of the major carriers we utilize, as well as our technology platform, which enables real-time underwriting decisions, immediate sales conversions and access to commission data and selling tools, drive demand for distributors to partner with us. We also offer a turnkey solution that allows us to design products that best meet our distributors’ needs. This solution enables us to assist our distributors in choosing between insurance carriers on a single website and allows them to create customized products for their customers by bundling our STM and hospital indemnity products with our various ancillary products into one package. As of December 31, 2012, we utilized a network of 46 licensed agent call centers and 262 wholesalers that work with over 8,275 licensed brokers nationally. |

| | • | | Our Members.We provide our members with easy access to health insurance coverage at an affordable price. For qualifying individuals, our STM plans offer benefits comparable to traditional IMM plans at approximately half the cost. For example, according to a 2010 Kaiser Family Foundation survey, the average cost for an IMM plan is $3,606 for an individual and $7,102 for a family. However, the average cost for one of our 12-month STM plans is $1,800 for an individual and $3,600 for a family. Our technology platform allows our members to compare and quote prices for a broad spectrum of STM and hospital indemnity products and, after they have made informed purchase decisions, to buy and print policies online. In addition to STM and hospital indemnity plans, we allow our members the opportunity to purchase high quality ancillary products with automatic, monthly renewals at rates that fit our members’ budgets, all at the click of a button. For example, during the year ended December 31, 2012, in addition to the 59,877 STM plans that we sold, we successfully cross-sold 44,064 new ancillary products. |

| | • | | Proprietary, Web-Based Technology Platform. We believe our technology platform represents a distinct competitive advantage as it reduces the need for customer care agents and provides significant operating leverage as we add members and product offerings. Our primary technology platform is named A.R.I.E.S. (“Automated Real-Time Integrated E System”). We believe our business benefits from the increasing trend of Internet use by individuals to research and purchase health insurance. The Internet offers a means of providing individuals access to health insurance products 24 hours a day, seven days a week and, for the carriers and distributors, reduces the cost and time associated with marketing, selling, underwriting and administering these products. We believe our target market is increasingly researching and applying for health insurance products online and shifting away from more traditional buying patterns. We believe our technology platform positions us for strong continued growth due to the following factors: |

| | • | | Plan and Product Design. Our technology platform provides real-time data that enables us, our carriers and our distributors to receive immediate information on our members, and allows us to design products that meet the changing demands of the market. Our platform also allows individuals to supplement our STM and hospital indemnity offerings with ancillary products such as pharmacy benefit cards, dental plans, vision plans and cancer/critical illness plans and makes it possible for us to instantly offer these products, which can be bundled to fit member needs. |

4

| | • | | Sales. Our technology platform combined with our customer service model drives faster sale conversions. The entire underwriting procedure is processed through our technology platform, which uses abbreviated, online health questionnaires and provides an immediate accept or reject decision, allowing for instant electronic fulfillment. Individuals can obtain full access to our technology platform through our distribution partners and can price products, buy policies and print their policy documents and identification cards anytime, anyplace. Our call centers use our technology platform to, among other functions, perform online, real-time electronic quoting, to process electronic applications and to provide instant electronic approval and fulfillment, back-office administrative support and commission reporting. |

| | • | | Distribution.Our technology platform allows for low cost mass distribution of our products and provides significant operating leverage. Our automated payment system allows us to collect credit card and ACH payments electronically and directly from members and to disburse commission payments to our distributors in advance, weekly or monthly. In addition, the system provides distributors with direct access to commission statements, selling tools, reporting tools (for example, information as to cancelations, failed credit card and ACH payments and persistency, renewal and cross-sell rates) and custom links to support their business. |

| | • | | Compliance.In addition to our A.R.I.E.S. platform, we have obtained a license to use a technology platform called HiiVe, which we use to implement a highly automated compliance program that has enhanced quality while minimizing overhead and allowed us to offer higher commissions to our distributors. The compliance program enables us to record each enrollment phone call, retrieve archived calls within seconds and score calls based on script adherence. |

| | • | | Established Long-Standing Insurance Carrier Relationships.Our access to carriers is essential to our business. Our management team has developed close relationships with the senior management teams of many of our insurance carriers, some lasting over 15 years. Our management team has not lost a carrier relationship in over 10 years. We believe that the nature of our relationships with our insurance carriers, combined with our product knowledge and technology platform, allow us to provide value-added products to our members. |

| | • | | Extensive Long-Term Relationships with Licensed Insurance Distributors.We believe our product expertise, our relationships with multiple insurance carriers, our focus on compliance and our technology platform make us a partner of choice for our distributors. We offer an appealing, incentive-based compensation structure that we believe drives demand for distributors to partner with us. We have extensive knowledge of the individual health insurance products that we design and administer, which allows us to assist our distribution partners in placing business. Our management team has built a broad distribution network and continuously adds new distributors. As of December 31, 2012, we utilized a network of 46 licensed agent call centers and 262 wholesalers that work with over 8,275 licensed brokers. Over the last 12 months, we added over 4,675 licensed brokers, 24 independent licensed broker call centers and 73 wholesalers to our national distributor network. |

| | • | | Seasoned Management Team.Our management team has substantial experience and long-standing relationships developed over an average of 25 years in the insurance industry. Our management team draws on its industry experience to identify opportunities to expand our business and collaborate with insurance carriers and distributors to help develop products and respond to market trends. In addition, the majority of our management team has worked together under the leadership of Michael W. Kosloske, our Chairman, President, and Chief Executive Officer, for more than a decade. |

Our Strategy

Our objective is to continue to expand our business and increase our presence in the affordable, web-based health insurance solutions market. Our principal strategies to meet this objective are:

| | • | | Expand and Enhance Distributor Relationships, Distribution Channels and Lead Generation Methods.We believe we will continue to attract new distributors as the insurance marketplace continues to evolve, and we intend to continue to identify large distributor and lead relationships through the following strategies: |

| | • | | Advanced Commission Structure.We will continue to focus on attracting additional distributors through expansion of our advanced commission structure. We believe distributors increasingly demand alternative methods to fund the large and growing costs of lead generation. We estimate that these costs usually range from $2 to $20 per lead and represent a significant startup cost for our distributors. We are in the process of growing our advanced commission structure, whereby we pay distributors commissions on policies sold in advance of when they would ordinarily be due to the distributor. Commissions are advanced for up to six months and are made to distributors with an established track record of selling our products. In return, we reduce subsequent commission fees payable to the distributor by up to 2% of premiums for each month that we advance commissions. We believe this structure will assist our distributors in funding their lead generation costs and will provide us with a competitive advantage in attracting and retaining distributors and will increase sales. |

5

| | • | | Call Centers.We believe we can grow our distribution network organically by developing call center managers and incentivizing them via attractive commissions. As part of this strategy, we assist in enhancing the sales model of many of our current call centers in order to increase efficiencies and maximize returns, and we established our Insurance Center for Excellence, LLC (“ICE” or “Insurance Academy”) in June 2012 to expand the number of call centers selling our products. We anticipate that our Insurance Academy operations will closely resemble a “franchise model,” in that we will provide the tools (sales scripts, key metrics, lead programs, compensation programs, technology systems, etc.) for building a profitable and successful call center that focuses on selling our products and leverages our technology. Our goal is to assist in the training of owners and managers, who in return agree to enter into long-term agreements with us, under which they are required to market our products. We anticipate establishing relationships with 10 to 20 new call centers per year through our Insurance Academy initiative. We believe that this will enhance our ability to convert leads from our current distribution channels into sales. |

| | • | | Lead Generation and Innovative Distributor Relationships.We will continue to identify large and innovative distributor and lead relationships that we believe will increase revenue and diversify distribution. For example, in September 2012, we entered into an agreement whereby MasterCard, through its approved pre-paid card member networks, will assist us in targeting and acquiring new relationships or “leads” for marketing our products. Upon notification from MasterCard of a prospective lead, we will negotiate a separate referral fee arrangement with MasterCard at which point such prospective lead will be identified to us. We will then attempt to enter into an agreement with the prospective lead under which it will provide us with a list of its customers who hold MasterCard prepaid cards or it will directly market our products to those customers on our behalf. For example, we have entered into such an agreement with KEEPS America LLC, (“KEEPS”) for our prescription benefits cards. When sending their own pre-paid cards to customers, KEEPS includes our prescription benefits cards in the mailing. If the KEEPS customer uses our card, we pay KEEPS and MasterCard referral fees in connection with the distribution. To further expand our lead generation efforts, we will also continue to explore methods of screening member data for key demographic factors to identify populations for whom our products are well suited. |

| | • | | Increase Sales of Hospital Indemnity and Ancillary Products.We believe we have a significant opportunity to expand our market share in the hospital indemnity market. Our hospital indemnity plans in force have grown with 5,243 plans in force at December 31, 2011 and 8,141 plans in force at December 31, 2012. After the implementation of Healthcare Reform in 2014, we expect hospital indemnity plans to be used increasingly to supplement high deductible plans. In addition, our technology platform enables us to sell ancillary products that carry higher profit margins than our core STM products and that can be issued to a broader population than STM plans. Our members demand a wide range of ancillary products, including pharmacy benefit cards and dental, cancer and critical illness plans. Ancillary product policies in force grew from 6,649 at December 31, 2011 to 26,230 at December 31, 2012. We believe we are well-positioned to take advantage of these additional opportunities at the time of sale. |

| | • | | Enhance Product and Name Recognition. We are focused on increasing our marketing efforts to consumers. We intend to aggressively pursue opportunities to help consumers identify our products as the right choice for health insurance coverage. We are pursuing multiple avenues to increase our brand awareness among distributors, carriers and our target market, such as through our arrangement with MasterCard that introduces our products and name to MasterCard’s large pre-paid card member networks. |

| | • | | Develop and Establish New and Specialized Products to Meet Consumer Needs.We plan to continue to develop and add new products to our existing portfolio of offerings. By leveraging our technology platform member data, feedback gathered by customer service agents and distributors and expertise in plan design, we believe we are well-positioned to design and bundle products that meet customer needs and add a viable source of revenue for us, our distributors and our carriers. For example, in June 2012, we introduced our cancer plan. We sold 1,491 of these policies during the year ended December 31, 2012, and we are currently developing new products, including fully-insured prescription cards. |

| | • | | Supplement Our Growth through Strategic Acquisitions.Part of our continuing business strategy is to acquire or invest in, companies, products or technologies that complement our current products, enhance our market coverage, technical capabilities or production capacity, or offer growth opportunities. |

Our Products

Our differentiated product offering allows us to build leading positions in our target markets for insurance products and related services. The key products we provide include:

| | • | | Short-Term Medical Plans. Our STM plans cover individuals for up to six- and 12-month periods with a wide range of co-pay and deductible options at approximately half the cost of traditional IMM plans. For example, according to a 2010 Kaiser Family Foundation survey, the average cost for an IMM plan is $3,606 for an individual and $7,102 for a family. However, the average cost for one of our 12-month STM plans is $1,800 for an individual and $3,600 for a family. STM plans offer similar benefits for qualifying individuals as IMM plans. For example, both STM plans and IMM plans offer a choice of deductibles, a choice of coinsurance, coverage for emergency room care, surgeries, x-rays, lab work, diagnostics, doctor office co-payments, and preferred provider organization network discounts. However, while IMM plans cover prescription drugs, pre-existing conditions and |

6

| | preventive care, STM plans provide optional coverage for prescription drugs and do not cover pre-existing conditions or preventive care unless such coverage is mandated by the state. STM plans do not cover certain medical events such as pregnancy. Additionally, while IMM plans have guaranteed renewability and can be of a permanent duration, STM plan renewal is not guaranteed and STM plans have a limited duration of up to 12 months. Our STM plans provide up to $2 million of lifetime coverage for each insured individual, allow members to choose any doctor or hospital, offer $50 physician office and urgent care co-pays, cover foreign travel and offer phone access to physician services. As of December 31, 2012, we had 23,747 STM plans in force. For the year ended December 31, 2012, revenues associated with the sale of our STM plans accounted for approximately 63% of our revenues for the period. |

| | • | | Hospital Indemnity Plans. Our hospital indemnity plans provide a daily cash benefit for hospital treatment and doctor office visits as well as accidental injury and death or dismemberment benefits. The claims process for hospital indemnity plans is streamlined: the member simply provides proof of hospitalization and the carrier pays the benefits. These policies are primarily used by customers who do not have adequate health insurance and do not qualify for our STM plans or who wish to supplement existing coverage, typically in conjunction with high deductible plans. As of December 31, 2012, we had 8,141 hospital indemnity plans in force. For the year ended December 31, 2012, revenues associated with the sale of our hospital indemnity plans accounted for approximately 27% of our revenues for the period. |

| | • | | Ancillary Products. We provide numerous low-cost ancillary insurance products, including pharmacy benefit cards, dental plans and cancer/critical illness plans. These are typically monthly policies with automatic renewal. As of December 31, 2012, we had 26,230 ancillary product plans in force. For the year ended December 31, 2012, revenues associated with the sale of our ancillary products accounted for approximately 10% of our revenues for the period. |

Healthcare Laws and Regulations

Our business is subject to extensive, complex and rapidly changing federal and state laws and regulations. Various federal and state agencies have discretion to issue regulations and interpret and enforce healthcare laws. While we believe we comply in all material respects with applicable healthcare laws and regulations, these regulations can vary significantly from jurisdiction to jurisdiction, and interpretation of existing laws and regulations may change. Federal and state legislatures also may enact various legislative proposals that could materially impact certain aspects of our business. The following are summaries of key federal and state laws and regulations that impact our operations:

Healthcare Reform

In March 2010, Healthcare Reform was signed into law. Healthcare Reform contains provisions that have changed and will continue to change the health insurance industry in substantial ways. For example, Healthcare Reform includes a mandate requiring individuals to be insured or face tax penalties; a mandate that employers with over 50 employees offer their employees group health insurance coverage or face tax penalties; prohibitions against insurance companies that offer traditional IMM plans using pre-existing health conditions as a reason to deny an application for health insurance; MLR requirements that require each health insurance carrier to spend a certain percentage of their premium revenue on reimbursement for clinical services and activities that improve healthcare quality; establishment of state and/or federal health insurance exchanges to facilitate access to, and the purchase of, health insurance; subsidies and cost-sharing credits to make health insurance more affordable for those below certain income levels; and expanded eligibility for Medicaid for individuals and families with incomes of up to 133% of the poverty level.

Healthcare Reform amended various provisions in many federal laws, including the Internal Revenue Code, the Employee Retirement Income Security Act of 1974 and the Public Health Services Act. Healthcare Reform is being implemented by the Department of Health and Human Services, the Department of Labor and the Department of Treasury. These agencies have already issued a number of proposed, interim final and final regulations, as well as general guidance, on key aspects of Healthcare Reform. While many aspects of Healthcare Reform do not become effective until 2014, health insurance carriers have been required to maintain MLRs of 80% in their individual and family health insurance business since the beginning of 2011.

These laws have been the subject of multiple constitutional challenges and the U.S. Supreme Court held hearings in March 2012 inNational Federation of Independent Business v. Sebelius to review the constitutionality of Healthcare Reform. On June 28, 2012, the United States Supreme Court released its decision, upholding Healthcare Reform’s mandate requiring individuals to purchase health insurance. Also, under the U.S. Supreme Court’s ruling, states are able to opt out of expanding Medicaid eligibility to families and individuals with incomes up to 133% of the poverty level. Despite the decision, some uncertainty about whether parts of Healthcare Reform or Healthcare Reform in its entirety will remain in effect is expected to continue with the possibility of future litigation with respect to certain provisions as well as legislative efforts to repeal and defund portions of Healthcare Reform or Healthcare Reform in its entirety. We cannot predict the outcome of any future legislation or litigation related to Healthcare Reform. As described under “Item 1. Business—Health Insurance Industry and Market Opportunity,” we expect Healthcare Reform to result in profound changes to the individual health insurance market and our business.

7

Anti-Kickback Laws

In the United States, there are federal and state anti-kickback laws that generally prohibit the payment or receipt of kickbacks, bribes or other remuneration in exchange for the referral of patients or other health-related business. The United States federal healthcare programs’ Anti-Kickback Statute makes it unlawful for individuals or entities knowingly and willfully to solicit, offer, receive or pay any kickback, bribe or other remuneration, directly or indirectly, in exchange for or to induce the referral of an individual to a person for the furnishing or arranging for the furnishing of any item or service for which payment may be made in whole or in part under a federal healthcare program or the purchase, lease or order, or arranging for or recommending purchasing, leasing, or ordering, any good, facility, service, or item for which payment may be made in whole or in part under a federal healthcare program. Penalties for violations include criminal penalties and civil sanctions such as fines, imprisonment, and possible exclusion from federal healthcare programs.

Federal Civil False Claims Act and State False Claims Laws

The federal civil False Claims Act imposes liability on any person or entity who, among other things, knowingly presents, or causes to be presented, a false or fraudulent claim for payment by a federal healthcare program. The “qui tam” or “whistleblower” provisions of the False Claims Act allow a private individual to bring actions on behalf of the federal government alleging that the defendant has submitted a false claim to the federal government, and to share in any monetary recovery. Our future activities relating to the manner in which we sell and market our services may be subject to scrutiny under these laws.

HIPAA, Privacy and Data Security Regulations

By processing data on behalf of our clients and customers, we are subject to specific compliance obligations under privacy and data security-related laws, including the Health Insurance Portability and Accountability Act (“HIPAA”), the Health Information Technology for Economic and Clinical Health Act (the “HITECH Act”), and related state laws. We are also subject to federal and state security breach notification laws, as well as state laws regulating the processing of protected personal information, including laws governing the collection, use and disclosure of social security numbers and related identifiers.

The regulations that implement HIPAA and the HITECH Act establish uniform standards governing the conduct of certain electronic healthcare transactions and protecting the security and privacy of individually identifiable health information maintained or transmitted by healthcare providers, health plans, and healthcare clearinghouses, all of which are referred to as “covered entities,” and their “business associates” (which is anyone who performs a service on behalf of a covered entity involving the use or disclosure of protected health information and is not a member of the covered entity’s workforce). Our carrier companies’ and our clients’ health plans generally will be covered entities, and as their business associate they may ask us to contractually comply with certain aspects of these standards by entering into requisite business associate agreements.

As part of the payment-related aspects of our business, we may also undertake security-related obligations arising out of the Gramm-Leach-Bliley Act and the Payment Card Industry guidelines applicable to card systems. These requirements generally require safeguards for the protection of personal and other payment related information.

HIPAA Healthcare Fraud Standards

The HIPAA healthcare fraud statute created a class of federal crimes known as the “federal healthcare offenses,” including healthcare fraud and false statements relating to healthcare matters. The HIPAA healthcare fraud statute prohibits, among other things, executing a scheme to defraud any healthcare benefit program while the HIPAA false statements statute prohibits, among other things, concealing a material fact or making a materially false statement in connection with the payment for healthcare benefits, items or services. Entities that are found to have aided or abetted in a violation of the HIPAA federal healthcare offenses are deemed by statute to have committed the offense and are punishable as a principal.

State Privacy Laws

In addition to federal regulations issued under HIPAA, some states have enacted privacy and security statutes or regulations, or State Privacy Laws, that govern the use and disclosure of a person’s medical information or records and, in some cases, are more stringent than those issued under HIPAA. These State Privacy Laws include regulation of health insurance providers and agents, regulation of organizations that perform certain administrative functions such as utilization review or third-party administration, issuance of notices of privacy practices, and reporting and providing access to law enforcement authorities. In those cases, it may be necessary to modify our operations and procedures to comply with these more stringent State Privacy Laws. If we fail to comply with applicable State Privacy Laws, we could be subject to additional sanctions.

Consumer Protection Laws

Federal and state consumer protection laws are being applied increasingly by the United States Federal Trade Commission, or FTC, and states’ attorneys general to regulate the collection, use, storage and disclosure of personal or patient information, through websites or otherwise, and to regulate the presentation of web site content. Courts may also adopt the standards for fair information practices promulgated by the FTC, which concern consumer notice, choice, security and access.

8

State Insurance Laws

Some of the states in which we operate have laws prohibiting unlicensed persons or business entities, including corporations, from making certain direct and indirect payments or fee-splitting arrangements with licensed insurance agents and brokers. Possible sanctions for violation of these restrictions include loss of license and civil penalties. These statutes vary from state to state, are often vague and have seldom been interpreted by the courts or regulatory agencies.

State insurance laws also require us to maintain an insurance agency or broker license in each state in which we transact health insurance business and adhere to sales, documentation and administration practices specific to that state. In addition, each of our employees who solicits, negotiates, sells or transacts health insurance business for us must maintain an individual insurance agent or broker license in one or more states. Because we transact business in the majority of states, compliance with health insurance-related laws, rules and regulations is difficult and imposes significant costs on our business.

State regulations may also require that individuals enroll in group programs or associations in order to access certain insurance products, benefits and services. We have entered into relationships with such associations in order to provide individuals access to our products. For example, we have an agreement with Med-Sense Guaranteed Association (“Med-Sense”), a non-profit association that provides membership benefits to individuals and gives members access to certain of our products. Under the agreement, we primarily market membership in the association and collect certain fees and dues on its behalf. In return, we have sole access to its membership list, and Med-Sense exclusively endorses the insurance products that we offer. Under the agreement, we receive a monthly fee per member. Our agreement with Med-Sense is automatically renewable for one-year terms, unless terminated on 120 days written notice by either party. The agreement is also terminable on 15 days written notice by either party under certain circumstances, such as in the case of a breach of the agreement.

Sales and Marketing

Our sales and marketing initiatives primarily consist of hiring seasoned sales professionals who have worked with or been referred to us by our distributors in order to strengthen our relationships with such distributors, marketing campaigns and attendance at meetings and conferences associated with acquiring new distributors. As we do not distribute insurance products to individuals, we utilize third-party distributors to market our products directly to potential members, and are engaged in their own sales and marketing efforts that include investments in lead acquisition, online marketing and customer referrals. We focus on building brand awareness among our distributors and members, increasing the number of distributors and converting sales leads into buyers. Our marketing initiatives include:

Third-Party Distributors. Our third-party distributor acquisition channel consists of independent licensed agent call centers and individual insurance brokers who market directly to individuals. We have established several initiatives to assist these call centers and distributors in helping individuals select our products, including the provision of sales scripting and monitoring services through the HiiVe technology platform discussed below. We generally compensate our distributors for their individual health insurance sales based on the consumer submitting a health insurance application to us. If a marketing partner is licensed to sell health insurance, we may share a percentage of the commission revenue we earn from the health insurance carrier for each member referred by that distributor.

Marketing Partners. Our marketing partner member acquisition channel consists of a network of affiliate partners, including credit card companies, national banks and database marketing services who make our products available to individuals. We have established a pay-for-performance network that drives individuals to our products. These partners generally fall into one of the following categories:

| | • | | Financial and online services partners in industries such as credit card services, banking, insurance and mortgage and association partners; and |

| | • | | Employers who do not offer health insurance benefits to their employees or to one or more classes of their employees. |

Carrier Relationships

One of our core strengths is our deep integration with some of the leading insurance carriers in the United States, which enables us to offer our STM, hospital indemnity and ancillary products on our technology platform. We currently have relationships with several insurance carriers, including Starr Indemnity & Liability Company, Companion Life, United States Fire, ING, Markel and CIGNA, among others. We have entered into written contracts with each of these carriers pursuant to which we are authorized to sell the carriers’ health plans and products in exchange for the payment of commissions that vary by carrier and by plan. These contracts are typically non-exclusive and terminable on short notice by either party for any reason. In some cases, the amendment or termination of an agreement we have with a health insurance carrier may impact the commissions we are paid on health insurance plans and products that we have already sold through the carrier.

9

For the year ended December 31, 2012, Starr Indemnity & Liability Company accounted for approximately 46% of our premium equivalents. The commission percentage used to calculate our commissions under our agreement with Starr Indemnity & Liability Company is based on net written premium and varies by the state of a member’s domicile. The agreement is terminable on 180 days written notice by either party for any reason and may be terminated on shorter notice under certain circumstances, such as in the case of a breach of the agreement.

For the year ended December 31, 2012, United States Fire accounted for approximately 25% of our premium equivalents. The commission percentage used to calculate our commissions under our agreement with United States Fire is based on gross collected premium. Our agreement with United States Fire is for automatically renewable one-year terms, unless otherwise terminated. The agreement is terminable on 120 days written notice by either party for any reason and may be terminated on shorter notice under certain circumstances, such as in the case of a breach of the agreement.

For the year ended December 31, 2012, Companion Life accounted for approximately 22% of our premium equivalents. The commission percentage used to calculate our commissions under our agreement with Companion Life is based on gross written premium. The agreement is terminable on 180 days written notice by either party for any reason and may be terminated on shorter notice under certain circumstances, such as in the case of a breach of the agreement.

To create an improved experience for our members, we regularly evaluate insurance carriers by comparing their market presence and brand, cost competitiveness, breadth of plans, emphasis on improving the customer experience, and ability to integrate with our data systems. We plan to continue to expand and adjust the number of insurance carriers with which we partner.

Technology

Since we began operations in 2008, we have invested significant financial and human resources in building a unique and scalable proprietary, web-based technology platform. Our technology represents a distinct competitive advantage as it reduces the need for customer care agents, the time associated with billing, underwriting, fulfillment, sale and marketing and provides significant operating leverage as we add members and product offerings. We purchased the intellectual property rights to certain of the software in August 2012.

The key components of our technology platform include:

| | • | | Automated Real-Time Integrated E System. A.R.I.E.S. is the core of our technology platform. This proprietary technology reduces the need for the continual involvement of customer care representatives after a member has enrolled by allowing him or her to change payment information and print identification cards anytime, anyplace. A.R.I.E.S. also offers distributors an unprecedented ability to manage their business by providing direct access to real-time commission statements, commission payment and real-time sales and membership data (including cancelations, failed credit card and ACH payments, persistency, renewal and cross-sell rates). Key elements of A.R.I.E.S. include: |

| | • | | Quote-Buy-Print. Individuals access our technology platform through our distribution partners and can quote products and buy and print their policy documents and identification cards anytime, anyplace. |

| | • | | Automated Underwriting.The entire underwriting process is handled by A.R.I.E.S. through the use of health questionnaires. Because our STM products are largely targeted to healthy individuals who do not have pre-existing conditions, we do not have a traditional underwriting department. Underwriting is an immediate accept or reject decision based on a prospective member’s answers to an abbreviated online health-related questionnaire. |

| | • | | Multiple Value-Added Products.Consumers can purchase multiple plans and specialty products with the click of a button. Consumers are able to supplement our core STM and hospital indemnity offerings with ancillary products such as pharmacy benefit cards, dental plans, vision plans and cancer/critical illness plans. Our technology platform makes it possible for us to instantly offer these bundled products to fit member needs. |

| | • | | Turn-Key Solution.Our technology platform is a turnkey solution, allowing distributors to tailor their offering to meet member needs and can be customized to enhance the experience of an affinity group or employer. |

| | • | | Payment. Our sales are executed online and offer instant electronic fulfillment through our platform, through which we receive credit card ACH payments directly from members at the time of sale. |

| | • | | Member Services. Members have the ability to log-in and change payment information and print new identification cards, all without the need of a customer service representative. |

| | • | | HiiVe. The HiiVe technology system streamlines compliance by providing real-time sales scripting and monitoring for distributors to ensure customers are making informed purchase decisions. The compliance system enables us to record each enrollment phone call, retrieve archived calls within seconds and score calls based on script adherence. In addition, this technology has also allowed us to automate our compliance program, enhancing quality while minimizing overhead and thereby allowing us to offer higher commissions to our distributors. |

10

We rely on BimSym eBusiness Solutions, Inc. (“BimSym”) and other vendors to provide various services relating to our A.R.I.E.S. technology platform, including hosting, support, maintenance and development services, for which we pay both recurring and one-off fees. A.R.I.E.S. was placed in service in March 2011 through an informal relationship with BimSym. On August 1, 2012, we entered into a software assignment agreement with BimSym pursuant to which we acquired certain proprietary rights to the A.R.I.E.S. software for a one-time payment of $45,000. On August 1, 2012, we also entered into a master services agreement with BimSym with respect to the hosting, support, maintenance and development of our A.R.I.E.S. technology platform. This agreement obligates us to make minimum future payments of $312,000 per year for the next five years. Thereafter, this agreement provides for automatic one-year renewals, unless we notify BimSym of our intent not to renew. Additionally, on August 1, 2012, we entered into an exclusivity agreement with BimSym whereby neither BimSym nor any of its affiliates will create, market or sell a software, system or service with the same or similar functionality as that of A.R.I.E.S., under which we are required to make monthly payments of $16,000 for five years. Prior to March 2011, the Company contracted with a third party vendor, Carpe Datum L.L.C., to provide some of the services now provided through A.R.I.E.S. The HiiVe technology system is based on software we license from a third-party. For more information see “Item 1A. Risk Factors—We rely on third-party vendors to develop, host, maintain, service and enhance our technology platform” and “Item 1A. Risk Factors—Our failure to obtain, maintain and enforce the intellectual property rights on which our business depends could have a material adverse effect on our business, financial condition and results of operations.”

Seasonality

Our business of marketing individual STM insurance plans is subject to seasonal fluctuations. A large number of undergraduate and post-graduate students complete their studies during the second fiscal quarter of each year and are no longer eligible for health insurance coverage through the insurance plans of their parents or educational institutions. As a result, we experience a higher volume of new member enrollment from these demographics during the third fiscal quarter when such students purchase our products, producing a seasonal increase in revenue. During the fourth quarter of each fiscal year, many of our call centers and licensed agents are closed or maintain shorter business hours for varying periods of time due to the holiday season. We experience a lower volume of new member enrollment during the fourth quarter compared with other quarters, resulting in a seasonal decrease commission revenue. As our business matures, other seasonality trends may develop and the existing seasonality and consumer behavior that we experience may change.

Competition

The market for selling insurance products is highly competitive and the sale of health insurance over the Internet is rapidly evolving. We compete with individuals and entities that offer and sell health insurance products utilizing traditional distribution channels, as well as the Internet. Our current or potential competitors include:

Traditional local insurance agents. There are tens of thousands of local insurance agents across the United States who sell health insurance products in their communities. We believe that the vast majority of these local agents offer health insurance without significantly utilizing the Internet or technology other than simple desktop applications such as word processing and spreadsheet programs. Some traditional insurance agents, however, utilize general agents that offer online quoting services and other tools to obtain quotes from multiple carriers and prepare electronic benefit proposals to share with their potential customers. These general agents typically offer their services only for the small and mid-sized group markets (not the individual and family markets) and operate in only a limited geographic region. Additionally, some local agents use the Internet to acquire new consumer referrals from companies that have expertise in Internet marketing. These “lead aggregator” companies utilize keyword search, primarily paid keyword search listings on Google, Bing and Yahoo! and other forms of Internet advertising, to drive Internet traffic to the lead aggregator’s website. The lead aggregator then collects and sells consumer information to agents and, to a lesser extent, to carriers, both of whom endeavor to close the referrals through traditional offline sales methods.

Health insurance carriers’ “direct-to-member” sales. Some carriers directly market and sell their plans and products to consumers through call centers and their own websites. Although we offer health insurance plans and products for many of these carriers, they also can compete with us by offering their products directly to consumers. Most of these carriers have superior brand recognition, extensive marketing budgets and significant financial resources to influence consumer preferences for searching and buying health insurance online. The carriers we choose to represent, however, do not have a competitive price advantage over us. Because individual and family plan health insurance prices are regulated in all U.S. jurisdictions, a consumer is entitled to pay the same price for a particular plan, whether the consumer purchased the plan directly from one of our carrier companies or from us.

Online agents. There are a number of agents that operate websites and provide a limited online shopping experience for consumers interested in purchasing health insurance (e.g., online quoting of health insurance product prices). Most of these online agents operate in only one or very few states, and some represent only one or a limited number of health insurance carriers. Some online agents also sell non-health insurance products such as auto insurance, life insurance and home insurance. We are one of the leading sources of STM insurance products.

11

National insurance brokers.Although insurance brokers have traditionally not focused on the affordable STM market, they may enter our markets and could compete with us. These large agencies have existing relationships with many of our carrier companies, are licensed nationwide and have large customer bases and significant financial, technical and marketing resources to compete in our markets. Some of these large agencies and financial services companies, such as eHealthInsurance have partnered with us in order to offer our services to their customer and member bases.

We believe the principal factors that determine our competitive advantage in the online distribution of health insurance include the following:

| | • | | value added healthcare products; |

| | • | | strength of carrier relationships and depth of technology integration with carriers; |

| | • | | proprietary, web-based technology platform; |

| | • | | data-driven product design; |

| | • | | highly automated compliance program; |

| | • | | strength of distribution relationships; and |

| | • | | proven capabilities measured in years of delivering sales and creating and using reliable technology. |

Employees

As of December 31, 2012, we had 79 employees, of which 73 were full-time employees. We have not experienced any work stoppages and consider our employee relations to be good. None of our employees is represented by a labor union.

Intellectual Property

Our success depends, in part, on our ability to protect our intellectual property and proprietary technology, and to operate our business without infringing or violating the intellectual property or proprietary rights of others. We rely on a combination of copyrights, trademarks, domain names, and trade secrets, intellectual property licenses and other contractual rights (including confidentiality and non-disclosure agreements) to establish and protect our intellectual property and proprietary technology. However, these intellectual property rights may not prevent others from creating a competitive online platform or otherwise competing with us.

We may be unable to obtain, maintain and enforce the intellectual property rights on which our business depends, and assertions by third-parties that we violate their intellectual property rights could have a material adverse effect on our business, financial condition and results of operations. For more information see “Item 1A. Risk Factors—Our failure to obtain, maintain and enforce the intellectual property rights on which our business depends could have a material adverse effect on our business, financial condition and results of operations” and “Item 1A. Risk Factors—Assertions by third-parties that we violate their intellectual property rights could have a material adverse effect on our business, financial condition and results of operations.”

Our History and the Reorganization of Our Corporate Structure

Overview

Our business began operations in 2008, and historically, we operated through Health Plan Intermediaries, LLC. In anticipation of our recent initial public offering (the “IPO”), on November 7, 2012, Health Plan Intermediaries, LLC assigned the operating assets of our business through a series of transactions to Health Plan Intermediaries Holdings, LLC, and Health Plan Intermediaries Holdings, LLC assumed the operating liabilities of Health Plan Intermediaries, LLC.

Health Insurance Innovations, Inc. was incorporated as a Delaware corporation on October 26, 2012. Immediately prior to the completion of the IPO, we amended and restated our certificate of incorporation to, among other things, authorize two classes of common stock, Class A common stock and Class B common stock. We also granted the underwriters, which consisted of Credit Suisse, Citigroup, BofA Merrill Lynch and Raymond James, the right to purchase additional shares of Class A common stock to cover over-allotments. Our Class A common stock was issued to investors in the IPO and is held by certain of our employees. As of March 27, 2013, all of our Class B common stock is held by Health Plan Intermediaries, LLC and Health Plan Intermediaries Sub, LLC (a subsidiary of Health Plan Intermediaries, LLC that was formed on October 31, 2012 in connection with the IPO), which are beneficially owned by our Chairman, President, and Chief Executive Officer, Michael Kosloske. Shares of our Class B common stock vote together with shares of our Class A common stock as a single class, except as otherwise required by law. As of March 27, 2013, Mr. Kosloske beneficially owns 62.4% of our outstanding Class A and Class B common stock on a combined basis, which equals his combined economic interest in our Company, and will have effective control over the outcome of votes on all matters requiring approval by our stockholders. As described in more detail below, each Series B Membership Interest of Health Plan Intermediaries Holdings, LLC can be exchanged (together with one share of Class B common stock) for one share of Class A common stock. Health Insurance Innovations, Inc. was formed for purposes of the IPO and prior to the IPO engaged only in activities in contemplation of the IPO. Following the IPO, Health Insurance Innovations, Inc. remains a holding company owning as its principal asset Series A Membership Interests in Health Plan Intermediaries Holdings, LLC.

12

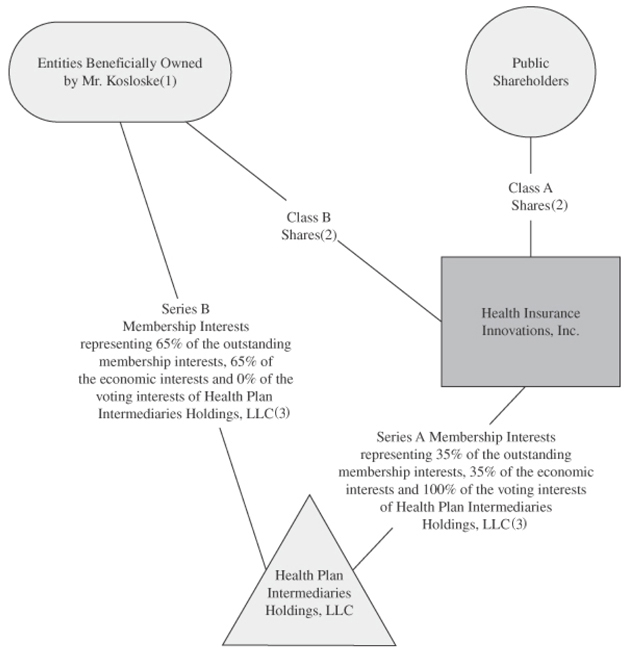

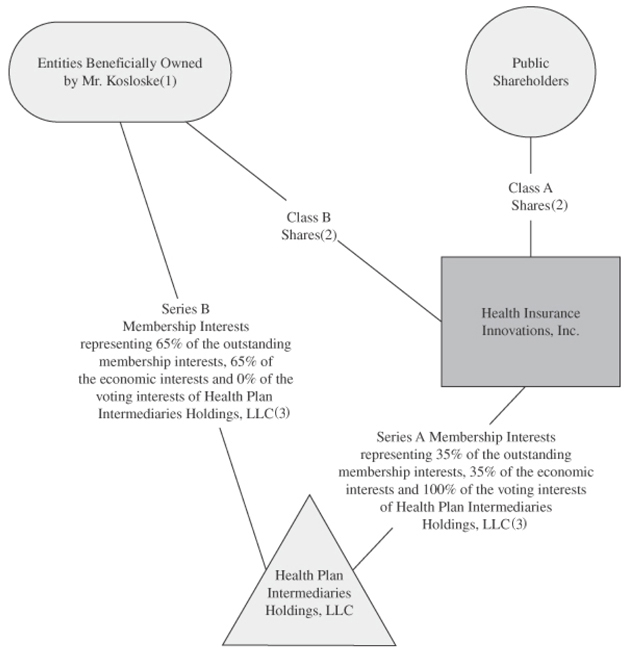

The diagram below shows our organizational structure immediately after completion of the IPO and the reorganization.

| (1) | The members of Health Plan Intermediaries Holdings, LLC, other than us, include Health Plan Intermediaries, LLC and Health Plan Intermediaries Sub, LLC, which are beneficially owned by Mr. Kosloske. |

| (2) | Class A shares represent 100% of the economic rights of the holders of all classes of our common stock to share in our distributions. Class B shares do not entitle their holders to any dividends paid by, or rights upon liquidation of, Health Insurance Innovations, Inc. Each share of our Class A common stock and our Class B common stock entitle its holder to one vote. |

| (3) | As of March 27, 2013, (i) the Series A Membership Interests held by Health Insurance Innovations, Inc. represent 37.6% of the outstanding membership interests, 37.6% of the economic interests and 100% of the voting interests in Health Plan Intermediaries Holdings, LLC and (ii) the Series B Membership Interests held by the entities beneficially owned by Mr. Kosloske represent 62.4% of the outstanding membership interests, 62.4% of the economic interests and 0% of the voting interests in Health Plan Intermediaries Holdings, LLC. |

13

Amended and Restated Limited Liability Company Agreement of Health Plan Intermediaries Holdings, LLC

Following our reorganization and the IPO, we have operated our business through Health Plan Intermediaries Holdings, LLC. The operations of Health Plan Intermediaries Holdings, LLC, and the rights and obligations of its members, are governed by the amended and restated limited liability company agreement of Health Plan Intermediaries Holdings, LLC. The following is a description of the material terms of that amended and restated limited liability company agreement.

Governance

We serve as sole managing member of Health Plan Intermediaries Holdings, LLC. As such, we control its business and affairs and will be responsible for the management of its business. No other members of Health Plan Intermediaries Holdings, LLC, in their capacity as such, we have any authority or right to control the management of Health Plan Intermediaries Holdings, LLC or to bind it in connection with any matter.

Voting and Economic Rights of Members

Health Plan Intermediaries Holdings, LLC has two series of outstanding equity: Series A Membership Interests, which may only be issued to Health Insurance Innovations, Inc., as sole managing member, and Series B Membership Interests. The Series B Membership Interests are held by Health Plan Intermediaries, LLC and Health Plan Intermediaries Sub, LLC (a subsidiary of Health Plan Intermediaries, LLC that was formed on October 31, 2012 in connection with the IPO), entities beneficially owned by Mr. Kosloske. The Series A Membership Interests and Series B Membership Interests entitle their holders to equivalent economic rights meaning an equal share in the profits and losses of, and distributions from, Health Plan Intermediaries Holdings, LLC. Holders of Series B Membership Interests have no voting rights, except for the right to approve certain amendments to the amended and restated limited liability company agreement of Health Plan Intermediaries Holdings, LLC. As of March 27, 2013, (i) the Series A Membership Interests held by Health Insurance Innovations, Inc. represent 37.6% of the outstanding membership interests, 37.6% of the economic interests and 100% of the voting interests in Health Plan Intermediaries Holdings, LLC and (ii) the Series B Membership Interests held by the entities beneficially owned by Mr. Kosloske represent 62.4% of the outstanding membership interests, 62.4% of the economic interests and 0% of the voting interests in Health Plan Intermediaries Holdings, LLC.

Net profits and losses of Health Plan Intermediaries Holdings, LLC generally will be allocated, and distributions made, to its memberspro rata in accordance with the number of Membership Interests (Series A or Series B, as the case may be) they hold. Accordingly, as of March 27, 2013, net profits and net losses of Health Plan Intermediaries Holdings, LLC would be allocated, and distributions would be made, 37.6% to us and 62.4% to the holders of Series B Membership Interests.

Subject to the availability of net cash flow at the Health Plan Intermediaries Holdings, LLC level and to applicable legal and contractual restrictions, we intend to cause Health Plan Intermediaries Holdings, LLC to distribute to us, and to the other holders of Membership Interests, cash payments for the purposes of funding tax obligations in respect of any net taxable income that is allocated to us and the other holders of Membership Interests as members of Health Plan Intermediaries Holdings, LLC, to fund dividends, if any, declared by us and to make any payments due under the tax receivable agreement, as described below. See “Tax Consequences” below. If Health Plan Intermediaries Holdings, LLC makes distributions to its members in any given year, the determination to pay dividends, if any, to our Class A common stockholders will be made by our board of directors. We do not, however, expect to declare or pay any cash or other dividends in the foreseeable future on our Class A common stock, as we intend to reinvest any cash flow generated by operations in our business. Class B common stock will not be entitled to any dividend payments. We may enter into credit agreements or other borrowing arrangements in the future that prohibit or restrict our ability to declare or pay dividends on our Class A common stock.