UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 30, 2023

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file numbers:

001-36873 (Summit Materials, Inc.)

333-187556 (Summit Materials, LLC)

SUMMIT MATERIALS, INC.

SUMMIT MATERIALS, LLC

(exact name of registrants as specified in their charters)

Delaware (Summit Materials, Inc.)

Delaware (Summit Materials, LLC)

(State or other jurisdiction of incorporation or organization)

1801 California Street, Suite 3500

Denver, Colorado

(Address of principal executive offices)

47-1984212

26-4138486

(I.R.S. Employer Identification No.)

80202

(Zip Code)

Registrants’ telephone number, including area code: (303) 893-0012

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Class A Common Stock (par value $.01 per share) | SUM | New York Stock Exchange | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | ||||||||||||||||||||||||||||||||

| Summit Materials, Inc. | Yes | ☒ | No | ☐ | Summit Materials, LLC | Yes | ☐ | No | ☒ | |||||||||||||||||||||||

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | ||||||||||||||||||||||||||||||||

| Summit Materials, Inc. | Yes | ☐ | No | ☒ | Summit Materials, LLC | Yes | ☐ | No | ☒ | |||||||||||||||||||||||

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | ||||||||||||||||||||||||||||||||

| Summit Materials, Inc. | Yes | ☒ | No | ☐ | Summit Materials, LLC | Yes | ☒ | No | ☐ | |||||||||||||||||||||||

| Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | ||||||||||||||||||||||||||||||||

| Summit Materials, Inc. | Yes | ☒ | No | ☐ | Summit Materials, LLC | Yes | ☒ | No | ☐ | |||||||||||||||||||||||

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | ||||||||||||||

| Summit Materials, Inc. | ||||||||||||||

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||||||||||

| Emerging growth company | ☐ | |||||||||||||

| Summit Materials, LLC | ||||||||||||||

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||||||||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||||||||||

| Emerging growth company | ☐ | |||||||||||||

| Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. | ||||||||||||||||||||||||||||||||

| Summit Materials, Inc. | Yes | ☒ | No | ☐ | Summit Materials, LLC | Yes | ☒ | No | ☐ | |||||||||||||||||||||||

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ||||||||||||||||||||||||||||||||

| Summit Materials, Inc. | Yes | ☐ | No | ☒ | Summit Materials, LLC | Yes | ☐ | No | ☒ | |||||||||||||||||||||||

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

The aggregate market value of the Summit Materials, Inc. voting stock held by non-affiliates of the Registrants as of July 1, 2023 was approximately $4.5 billion.

As of February 12, 2024 the number of shares of Summit Materials, Inc.’s outstanding Class A and Class B common stock, par value $0.01 per share for each class, was 174,267,964 and 99, respectively.

As of February 12, 2024, 100% of Summit Materials, LLC’s outstanding limited liability company interests were held by Summit Materials Intermediate Holdings, LLC, its sole member and an indirect subsidiary of Summit Materials, Inc.

DOCUMENTS INCORPORATED BY REFERENCE

1

Certain information required by Items 10, 11, 12, 13 and 14 of Part III incorporate information by reference from Summit Materials, Inc.’s definitive proxy statement relating to its 2024 annual meeting of stockholders to be filed with the Securities and Exchange Commission within 120 days after the close of Summit Materials, Inc.’s most recent fiscal year.

2

| PART | ITEM | PAGE | ||||||||||||||||||

3

EXPLANATORY NOTE

This annual report on Form 10-K (this “report”) is a combined annual report being filed separately by two registrants: Summit Materials, Inc. and Summit Materials, LLC. Each registrant hereto is filing on its own behalf all of the information contained in this report that relates to such registrant. Each registrant hereto is not filing any information that does not relate to such registrant, and therefore makes no representation as to any such information. We believe that combining the annual reports on Form 10-K of Summit Materials, Inc. and Summit Materials, LLC into this single report eliminates duplicative and potentially confusing disclosure and provides a more streamlined presentation since a substantial amount of the disclosure applies to both registrants.

Unless stated otherwise or the context requires otherwise, references to “Summit Inc.” mean Summit Materials, Inc., a Delaware corporation, and references to “Summit LLC” mean Summit Materials, LLC, a Delaware limited liability company. The references to Summit Inc. and Summit LLC are used in cases where it is important to distinguish between them. We use the terms “we,” “our,” “Summit Materials” or “the Company” to refer to Summit Inc. and Summit LLC together with their respective subsidiaries, unless otherwise noted or the context otherwise requires.

Summit Inc. was formed on September 23, 2014 to be a holding company. As of December 30, 2023, its sole material asset was a 99.4% economic interest in Summit Materials Holdings L.P. (“Summit Holdings”). Summit Inc. has 100% of the voting rights of Summit Holdings, which is the indirect parent of Summit LLC. Summit LLC is a co-issuer of our outstanding 6 1/2% senior notes due 2027 (“2027 Notes”), our 5 1/4% senior notes due 2029 (“2029 Notes”) and our 7 1/4% senior notes due 2031 (“2031 Notes” collectively with the 2027 Notes, 2029 Notes and 2031 Notes, the “Senior Notes”). Summit Inc.’s only revenue for the year ended December 30, 2023 was that generated by Summit LLC and its consolidated subsidiaries. Summit Inc. controls all of the business and affairs of Summit Holdings and, in turn, Summit LLC.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This report includes “forward-looking statements” within the meaning of the federal securities laws, which involve risks and uncertainties. Forward-looking statements include all statements that do not relate solely to historical or current facts, and you can identify forward-looking statements because they contain words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “intends,” “trends,” “plans,” “estimates,” “projects” or “anticipates” or similar expressions that concern our strategy, plans, expectations or intentions. All statements made relating to our estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results are forward-looking statements. These forward-looking statements are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, it is very difficult to predict the effect of known factors, and, of course, it is impossible to anticipate all factors that could affect our actual results.

Some of the important factors that could cause actual results to differ materially from our expectations are disclosed under “Risk Factors” and elsewhere in this report. All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements.

We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

CERTAIN DEFINITIONS

As used in this report, unless otherwise noted or the context otherwise requires:

•"Argos USA" refers Argos North America Corp., a Delaware corporation;

•“EBITDA” refers to net income (loss) before interest expense, income tax expense (benefit), depreciation, depletion and amortization expense;

•“Finance Corp.” refers to Summit Materials Finance Corp., an indirect wholly-owned subsidiary of Summit LLC and the co-issuer of the Senior Notes;

•“Issuers” refers to Summit LLC and Finance Corp. as co‑issuers of the Senior Notes;

4

•“LP Units” refers to the Class A limited partnership units of Summit Holdings;

•“Mainland” refers to Mainland Construction Materials ULC, which is the surviving entity from the acquisition of Rock Head Holdings Ltd., B.I.M. Holdings Ltd., Carlson Ventures Ltd., Mainland Sand and Gravel Ltd. and Jamieson Quarries Ltd.; and

•“TRA” refers to a tax receivable agreement between Summit Inc. and holders of LP Units.

5

Corporate Structure

The following chart summarizes our organizational structure, equity ownership and our principal indebtedness as of December 30, 2023. This chart is provided for illustrative purposes only and does not show all of our legal entities or all obligations of such entities. We ultimately expect to simplify our overall corporate structure and financial reporting by eliminating our so-called “Up-C” structure after which time all equity holders will holder their equity interests in our business at the Summit Inc. parent entity. See Item 1A. “Risk Factors—Organizational Structure Risks—Risks Related to Our Industry and Our Business—We may not obtain the expected benefits of streamlining our corporate structure, and the costs and detriments may exceed any benefits actually obtained.”

______________________

(1)U.S. Securities and Exchange Commission (“SEC”) registrant.

(2)The shares of Class B Common Stock are currently held by pre-initial public offering investors, including certain members of management or their family trusts that directly hold LP Units. A holder of Class B Common Stock is entitled, without regard to the number of shares of Class B Common Stock held by such holder, to a number of votes that is equal to the aggregate number of LP Units held by such holder.

(3)Guarantor under the senior secured credit facilities, but not the Senior Notes.

6

(4)Summit LLC and Finance Corp are the issuers of the Senior Notes and Summit LLC is the borrower under our senior secured credit facilities. Finance Corp. was formed solely for the purpose of serving as co-issuer or guarantor of certain indebtedness, including the Senior Notes. Finance Corp. does not and will not have operations of any kind and does not and will not have revenue or assets other than as may be incidental to its activities as a co-issuer or guarantor of certain indebtedness.

7

PART I

ITEM 1. BUSINESS.

Overview

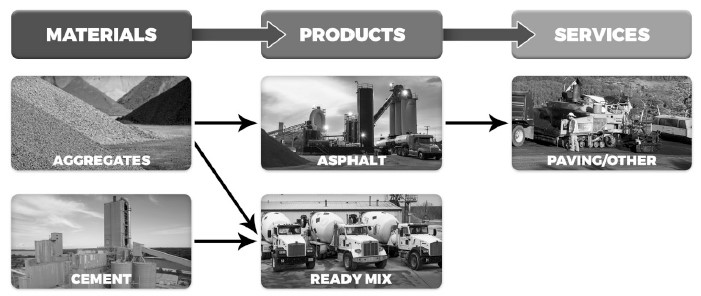

Summit’s vision is to be the most socially responsible, integrated construction materials solution provider, collaborating with stakeholders to deliver differentiated innovations and solve our customers’ challenges. Within our markets, we strive to be a market leader by offering customers a single-source provider for construction materials and related vertically integrated downstream products. Our materials include aggregates, which we supply across the United States, and in British Columbia, Canada, and cement, which we supply to surrounding states along the Mississippi River from Minnesota to Louisiana. In addition to supplying aggregates to customers, we use a portion of our materials internally to produce ready-mix concrete and asphalt paving mix, which may be sold externally or used in our paving and related services businesses. Our vertically integrated business model creates opportunities to increase aggregates volumes, optimize margin at each stage of production and provide customers with efficiency gains, convenience and reliability, which we believe gives us a competitive advantage.

In January 2024, Summit completed a merger with Argos North America Corporation (“Argos USA”), Cementos Argos S.A., Argos SEM LLC and Valle Cement Investments, Inc., pursuant to which Summit acquired all of the outstanding equity interests (the “Transaction”) of Argos USA from the Argos SEM LLC and Valle Cement Investments, Inc. in exchange for $1.2 billion of cash, the issuance of 54,720,000 shares of our Class A common stock and one preferred share in a transaction valued at approximately $3.2 billion. The cash consideration was funded from the net proceeds of an $800 million offering of Senior Notes due 2031 and new term loan borrowings under our current credit facility. The purchase price is subject to customary adjustments, with any upward or downward adjustments made against the cash consideration. The Transaction Agreement, dated as of September 7, 2023 (the “Transaction Agreement”) relating to the Transaction contains customary representations and warranties, covenants and agreements, including entry into a stockholder agreement.

The Argos USA assets include four integrated cement plants, two grinding facilities, 140 ready-mix concrete plants, eight ports and 10 inland terminals across the East and Gulf Coast regions, with a total installed cement grinding capacity of 9.6 million tons per annum and a total import capacity of 5.4 million tons of cement per annum. The import facilities allow the importing of cement from other countries, including a minimum quantity from a cement plant in Cartagena, Colombia, owned by Cementos Argos S.A., as stipulated under a cement supply agreement entered into upon closing the Transaction. The Argos USA assets also include 1.2 billion tons of reserves and resources in four quarries.

For the year ended December 31, 2023, Argos USA sold approximately 6.7 million tons of cement and 5.2 million yards of ready-mix concrete, recognizing approximately $1.7 billion of revenue.

We are a major participant in the U.S. construction materials industry. Including the operations of Argos USA acquired in January 2024, we believe our sales volumes put us in the top 6 of aggregates suppliers, the top 4 of cement producers and we are a major producer of ready‑mix concrete and asphalt paving mix. Summit's aggregates reserves and resources were 5.5 billion tons as of December 30, 2023. In the year ended December 30, 2023, Summit sold 58.4 million tons of aggregates, 2.4 million tons of cement, 4.9 million cubic yards of ready-mix concrete and 3.7 million tons of asphalt paving mix across our nearly 400 sites and plants.

The U.S. private construction market and public infrastructure spending has been a steady contributor to overall construction market growth. We are well positioned to expand our business by capitalizing on growth in the construction market, but economic conditions could challenge our industry growth and, as a result, our growth plans.

Our revenue in 2023 was $2.6 billion with net income attributable to Summit Inc. of $285.9 million. As of December 30, 2023, our total indebtedness outstanding was approximately $2.3 billion.

We anticipate demand to vary by end market. Public infrastructure, which includes spending by federal, state and local governments for roads, highways, bridges, airports and other public infrastructure projects, has been a relatively stable portion of government budgets providing consistent demand to our industry and is projected by the Portland Cement Association (“PCA”) to grow approximately 4% in the U.S. from 2024 to 2028. By fiscal year 2026, The Infrastructure Investment and Jobs Act (the "IIJA") will provide $44.5 billion in formula funding to Texas, Utah, Missouri and Kansas, our top four states by revenue in 2023. Further, the IIJA will provide $66.9 billion in formula funding to Florida, Georgia, Texas and North Carolina, the top four states by revenue for Argos USA the year ended December 31, 2023. We believe states will continue to institute state and local level funding initiatives dedicated towards increased infrastructure spending. Historically, infrastructure spending has varied by geography depending on several factors including population growth, underlying economic conditions,

8

and fiscal health of individual states. Economic conditions in our markets do vary by state, and public infrastructure funding is expected to differ as a result. The public infrastructure market represented approximately 38% of our revenue in 2023.

The private construction market includes residential and nonresidential new construction and the repair and replace market. According to the PCA, the number of total housing starts in the United States, a leading indicator for our residential business, is expected to increase 25% from 2024 to 2028 and residential construction spending will increase 19% from 2024 to 2028. Unlike the expected increases in residential construction, the PCA projects that spending in private nonresidential construction will decline 9% from 2024 to 2028. Residential activity in our key markets will continue to be a driver for volumes in future periods. Growth in private construction spending is influenced by changes in population, employment and general economic activity, among other factors which vary by geography across the United States. The private construction market represented approximately 62% of our revenue in 2023.

We expect continued improvement in pricing, especially in our materials businesses. The United States Geological Survey ("USGS") reports that aggregates pricing has increased in 70 of the last 75 years. Accordingly, we believe that this trend will continue in the future. The PCA estimates that cement consumption will increase approximately 10% in the U.S. from 2024 to 2028, reflecting rising demand in the major end markets. We believe that the increased demand will support higher cement pricing as production capacity in the United States remains tight and the cost of imported cement remains high.

We have supplemented organic growth with acquisitions by strategically targeting attractive, new markets and expanding in existing markets. We consider population trends, employment rates, private and public construction outlook, public funding and various other factors prior to entering a new market. In addition to considering macroeconomic data, we seek to establish, and generally believe that we have, a top three position in our local markets, which we believe supports improving profit margins and sustainable organic growth. This positioning provides local economies of scale and synergies, which benefits our profitability.

Significant opportunities remain for growth through acquisitions. We estimate that approximately 65% of the U.S. construction materials market is privately owned. Our management team maintains contact with hundreds of private companies. These long‑standing relationships have been the primary source for our past acquisitions and will continue to be an important source for future acquisitions. We believe we offer a compelling value proposition for private company sellers, including secure ongoing stewardship of their legacy businesses and brands.

We also seek greenfield development opportunities, particularly in our current geographies where there are limited additional acquisition opportunities at reasonable values. While greenfield development opportunities generally take longer to reach positive cash flows, the return on investment can equal or exceed those of business acquisitions.

In March 2021, we launched our Elevate Summit strategy, which at that time included an initiative to divest 10 to 12 business units which did not meet certain criteria. Since that time, we have divested 13 businesses, including two businesses in 2023 that resulted in net proceeds of $65.6 million, and cumulatively the 13 divested businesses generated $567.0 million in net proceeds. We plan to continue our efforts to optimize our portfolio, which could include future divestitures.

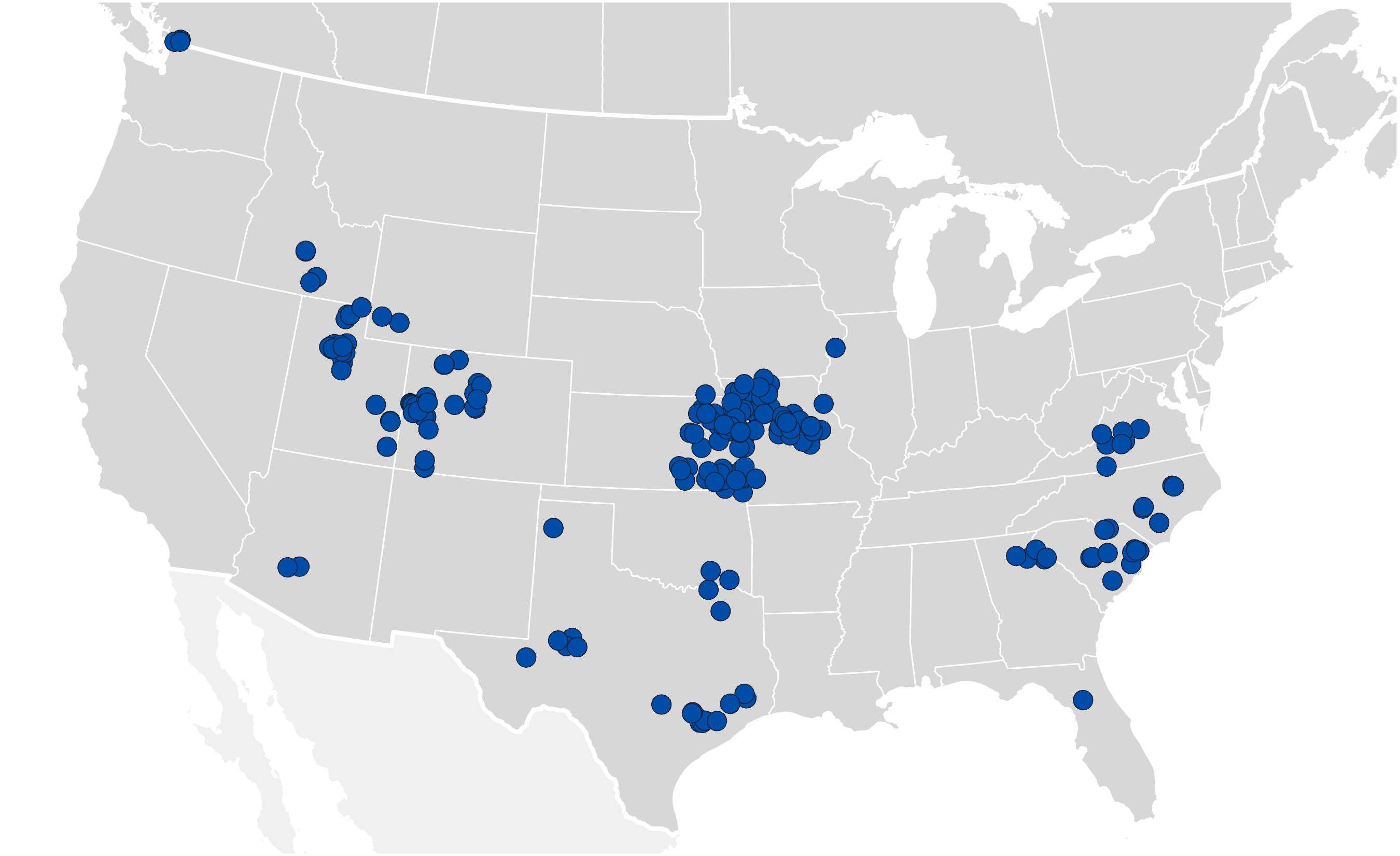

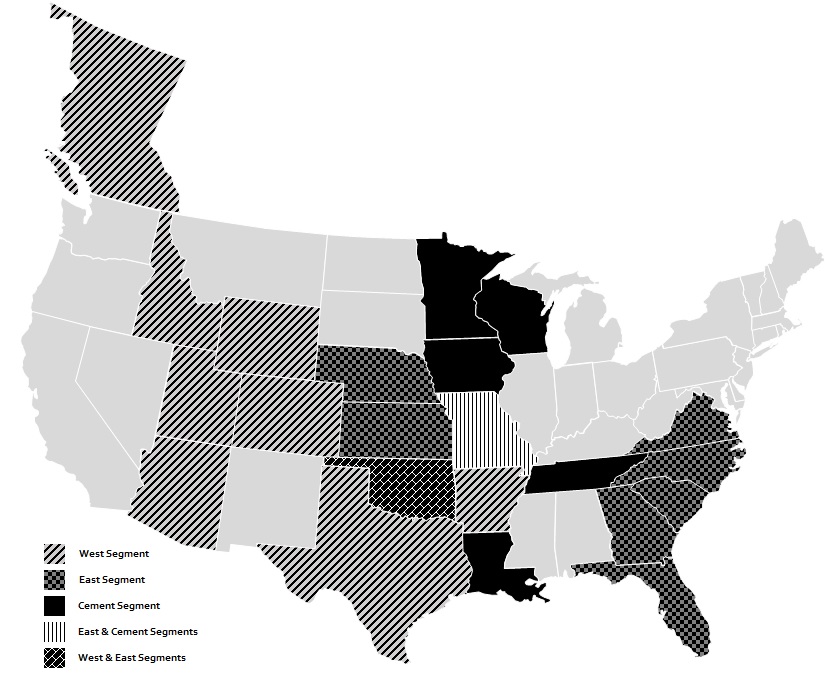

Our Business Segments

As of December 30, 2023, we operate in 21 U.S. states and in British Columbia, Canada and have assets in 21 U.S. states and in British Columbia, Canada through our platforms that make up our operating segments: West, East and Cement. In addition, the Argos USA operations acquired subsequent to year end added operations in 18 states and assets in five states. The platform businesses in the West, East and Cement segments have their own management teams that are responsible for overseeing local operations, implementing commercial and operational best practices, developing growth opportunities and integrating acquired businesses. We seek to enhance value through increased scale, efficiencies and cost savings within local markets.

•West Segment: Our West segment is comprised of our West and South regions, and includes operations in Texas, Utah, Arizona, Colorado, Idaho, Wyoming, Oklahoma, Arkansas and British Columbia, Canada. We supply aggregates, ready‑mix concrete, asphalt paving mix and paving and related services in the West segment. As of December 30, 2023, the West segment controlled approximately 1.7 billion tons of aggregates reserves and resources and $871.5 million of net property, plant and equipment and inventories (“hard assets”). During the year ended December 30, 2023, approximately 61% of our revenue was generated in the West segment.

•East Segment: Our East segment is comprised of our East and Central regions, and serves markets extending across the Midwestern and Eastern United States, most notably in Kansas, Missouri, Virginia, Florida, North Carolina, South Carolina, Georgia and Nebraska where we supply aggregates, ready‑mix concrete, asphalt paving mix and paving and

9

related services. As of December 30, 2023, the East segment controlled approximately 3.3 billion tons of aggregates reserves and resources and $695.1 million of hard assets. During the year ended December 30, 2023, approximately 25% of our revenue was generated in the East segment. The Argos USA operations acquired subsequent to year end serves markets extending across the Southeast United States, notably in Florida, Georgia, South Carolina, North Carolina, Alabama, as well as the Mid-Atlantic United States in Maryland and Virginia.

•Cement Segment: Our Cement segment consists of our Hannibal, Missouri and Davenport, Iowa cement plants and nine distribution terminals along the Mississippi River from Minnesota to Louisiana. Our highly efficient plants, which have converted all production to lower carbon Portland Limestone Cement, are complemented by our integrated distribution system that spans the Mississippi River. We process solid and liquid waste into fuel for the plants, which can reduce the plants’ fuel costs by up to 50%. The Hannibal, Missouri plant is one of very few cement facilities in the United States that can process both hazardous and non-hazardous solid and liquid waste into fuel. As of December 30, 2023, the Cement segment controlled approximately 0.5 billion tons of aggregates reserves and resources, which serve its cement business, and $615.8 million of hard assets. During the year ended December 30, 2023, approximately 15% of our revenue was generated in the Cement segment. The Argos USA operations acquired subsequent to year end includes four cement plants located in Harleyville, South Carolina; Roberta, Alabama; Newberry, Florida; and Martinsburg, West Virginia and two grinding facilities in Atlanta, Georgia and Tampa, Florida.

Our End Markets

Public Infrastructure. Public infrastructure construction includes spending by federal, state and local governments for highways, bridges, airports, schools, public buildings and other public infrastructure projects. Public infrastructure spending has historically been more stable than private sector construction. Historically, public infrastructure spending has been less sensitive to interest rate changes and economic cycles and often is supported by multi-year federal and state legislation and programs. A significant portion of our revenue is derived from public infrastructure projects. As a result, the supply of federal and state funding for public infrastructure highway construction significantly affects our public infrastructure end-use business.

Federal infrastructure funds are allocated to the states, which are required to match a portion of the federal funds they receive. Federal highway spending uses funds predominantly from the Federal Highway Trust Fund, which derives its revenue from taxes on diesel fuel, gasoline and other user fees. The dependability of federal funding allows the state departments of transportation to plan for their long-term highway construction and maintenance needs. The IIJA was signed into law on November 15, 2021. The IIJA legislation provides $1.2 trillion in funding over five years from 2022 through 2026, which includes $347.8 billion for highways, and $91.2 billion for transit.

Residential Construction. Residential construction includes single family homes and multi‑family units such as apartments and condominiums. Demand for residential construction is influenced primarily by employment prospects, new household formation and mortgage interest rates. In recent years, we have observed migration trends towards rural and exurban U.S. markets, notably in our Texas and Utah markets. In 2023, primarily due to higher interest rates and, by extension, affordability challenges, the residential construction market slowed. We expect the demand for residential construction to continue to be influenced by mortgage rates in 2024.

Nonresidential Construction. Nonresidential construction encompasses all privately financed construction other than residential structures. Demand for nonresidential construction is customarily driven primarily by population and economic growth, and activity tends to follow residential activity by 12-24 months. Population growth generally spurs demand for stores, shopping centers and restaurants. Economic growth typically creates demand for projects such as hotels, office buildings, warehouses and factories, although growth rates vary across the U.S. The supply of nonresidential construction projects is also affected by other variables, including interest rates and the availability of credit to finance these projects.

Our Competitive Strengths

Leading market positions. We seek to obtain a top two leadership position in our local market areas. Including the operations of Argos USA acquired in January 2024, we believe we are a top 6 supplier of aggregates, a top 4 producer of cement and a major producer of ready‑mix concrete and asphalt paving mix in the United States by volume. We generally focus on acquiring aggregate-based companies that have leading local market positions, which we seek to enhance by building scale through additional bolt-on acquisitions. The construction materials industry is highly local in nature due to transportation costs from the high weight‑to‑value ratio of the products. Given this dynamic, achieving local market scale provides a competitive advantage that drives growth and profitability for our business. Our ability to prudently acquire, rapidly integrate and improve multiple businesses has enabled, and will continue to enable, our market leadership.

10

Vertically‑integrated business model. We generate revenue across a spectrum of related products and services. In 2023, approximately 17% of the aggregates used in our products and services were internally supplied. When and where it's advantageous, we employ a vertically‑integrated business model operating as a single source provider of materials and paving and related services. This approach creates cost, convenience and reliability advantages for our customers, while at the same time creating significant cross‑marketing opportunities among our interrelated businesses. We believe this creates opportunities to increase aggregates volumes, optimize margin at each stage of the value chain, foster more stable demand for aggregates through a captive demand outlet, create a competitive advantage through the efficiency gains, convenience and reliability provided to customers and enhance our acquisition strategy by providing a greater population of target companies.

Attractive diversity, scale and product portfolio. We operate in dozens of metropolitan statistical areas across 21 U.S. states and in British Columbia, Canada. In the year ended December 30, 2023, 53% of our operating income increase came from the West segment, 21% from East segment and 26% from the Cement segment, excluding corporate charges. As of December 30, 2023, we had 3.9 billion tons of proven and probable mineral reserves and 1.4 billion tons of measured and indicated mineral resources. We estimate that the useful life of our reserves serving our aggregates and cement businesses are approximately 55 years and 170 years, respectively, based on the average production rates in 2023 and 2022. The Argos USA operations acquired subsequent to year end were located in an additional 18 states and added 0.7 billion tons of proven and probable mineral reserves and 0.5 billion tons of measured and indicated mineral resources.

Our dry process cement plants in Hannibal, Missouri and Davenport, Iowa were commissioned in 2008 and 1981, respectively. These low-cost cement plants have efficient manufacturing capabilities and are strategically located on the Mississippi River and complemented by an extensive network of river and rail fed distribution terminals. Our terminal network can accept imported cement to supplement our internal production capacity as demand and market conditions dictate. Due to the location of our Hannibal and Davenport plants on the Mississippi River, in 2023, we shipped approximately 70-80% of our cement by barge, which is more cost‑effective than truck or rail transport.

The Argos USA operations acquired subsequent to year end have four cement plants in Harleyville, South Carolina; Roberta, Alabama; Newberry, Florida; and Martinsburg, West Virginia and two grinding facilities in Atlanta, Georgia and Tampa, Florida. The total clinker capacity at the plants is 5.2 million tons per annum. Each of the plants and grinding facilities is located near multiple transportation access points, and have rail access at each of the cement plants and grinding facilities. The integrated network affords a level of resiliency in dealing with planned and unplanned plant maintenance and shutdowns. Their terminal network can accept imported cement to supplement our internal production capacity as demand and market conditions dictate.

Proven ability to incorporate new acquisitions and grow businesses. Since our inception, we have acquired dozens of businesses, successfully integrating them into three segments through the implementation of operational improvements, industry‑proven information technology systems, comprehensive safety and management programs. A typical acquisition and subsequent integration generally involve implementing common safety and financial back office systems, driving best practices in pricing and productivity. In addition, we seek to leverage scale while maintaining local branding and management decision-making and providing management support, strategic direction and financial capital for investment.

Experienced and proven leadership driving organic growth, acquisition and optimization strategy. Our management team, including corporate and regional managers, corporate development, finance and legal executives and other heavy side industry operators, has extensive experience in the industry. Our management team has successfully enhanced the operations of acquired companies, focusing on scale advantages, cost efficiencies and price optimization to improve profitability and cash flow. Our management team has undertaken an optimization process whereby we are disposing of certain assets and businesses that are not core to our business, helping our management teams narrow their focus to the highest returning components of our business and serve our broader goal of increasing our return on invested capital.

Our Business Strategy

Our materials-led business model creates a distinct competitive advantage to support our growth ambitions. We continue to execute on our Elevate Summit Strategy, which has four key themes:

Market Leadership. We expect to create sustainable advantages in suburban and exurban communities that enhance total shareholder value. Our vertical integration of construction materials, products and services is a significant competitive advantage and being materials focused and improving the quality, and sustainability of our earnings will drive share growth in existing markets and enable entry into new markets. A significant portion of materials used to produce our products and provide services to our customers is internally supplied, which enables us to operate as a single source provider of materials, products and paving and related services. This creates cost, convenience and reliability advantages for our customers and enables us to

11

capture additional value throughout the supply chain, while at the same time creating significant cross‑marketing opportunities among our interrelated businesses.

Asset Light Approach. We seek to maximize aggregates pull through in order to improve capital efficiency and reduce volatility. Our growth has been a result of the successful execution of our materials-led acquisition strategy and implementation of best practices to drive organic growth. We believe we have opportunity for further growth through strategic acquisitions in markets adjacent to our existing markets within the states where we currently operate, as well as in additional states as market and competitive conditions permit. We also believe we can enhance our return on investment by partnering with our customers in asset light partnerships by retaining aggregate supply agreements where possible.

Social Responsibility. We strive to build differentiated, heavy materials solutions to enhance returns and maximize social impact. As our customers focus on their own social responsibility goals, we plan to provide innovative solutions to meet those goals. We view social responsibility, which includes human capital, land use, water and addressing carbon emissions impacts, as a strategic imperative essential to serving the needs of our employees, customers, and communities where we operate. We publish an annual sustainability report aligned with the Sustainability Accounting Standards Board Construction Materials Standard. Our sustainability report describes our safety performance as well as water usage, waste production, and carbon emissions impacts. We seek to proactively address those impacts to align our business activities with the interests of our external stakeholders.

Innovation Focus. We seek to make investments to address tomorrow's customer challenges with new products and solutions. We seek to enhance margins through proven profit optimization plans, managed working capital and achieved scale‑driven purchasing synergies and fixed overhead control and reduction. Our management team, supported by our operations, development, risk management, information technology and finance teams, drive the implementation of detailed and thorough profit optimization plans for each acquisition post close. These integration and improvement plans typically include, among other things, implementation of a common pricing strategy, safety and financial systems, systematic commercial strategies, operational benefits, efficiency improvement plans and business-wide cost reduction techniques. In addition, through our portfolio optimization program, we are also evaluating and executing on divestitures of certain assets and businesses that are not core to our business or have underperformed our investment expectations.

Our Industry

The U.S. construction materials industry is composed of four primary sectors: aggregates; cement; ready‑mix concrete; and asphalt paving mix. Each of these materials is widely used in most forms of construction activity. Participants in these sectors typically range from small, privately‑held companies focused on a single material, product or market to publicly traded multinational corporations that offer a wide array of construction materials and services. The industry is shaped in part by the distance materials can be transported efficiently, resulting in primarily local or regional operations. Due to the lack of product differentiation, competition for all of our products is predominantly based on price and, to a lesser extent, quality of products and service. Accordingly, our profitability is generally dependent on the level of demand for our materials and products and our ability to control operating costs.

Transportation infrastructure projects, driven by both federal and state funding programs, represent a significant share of the U.S. construction materials market. Federal funds are allocated to the states, which are required to match a portion of the federal funds they receive. Federal highway spending primarily uses funds from the Federal Highway Trust Fund, which derives its revenue from taxes on diesel fuel, gasoline and other user fees. The dependability of federal funding allows the state departments of transportation to plan for their long-term highway construction and maintenance needs. The IIJA passed in November 2021 provides $1.2 trillion in funding over five years from 2022 through 2026, which includes $347.8 billion for highways, and $91.2 billion for transit.

In addition to federal funding, state, county and local agencies provide highway construction and maintenance funding. Our four largest states by revenue, Texas, Utah, Missouri and Kansas, represented approximately 26%, 14%, 10% and 8%, respectively, of our total revenue in 2023. Further, the four largest states by revenue in 2023 for the Argos USA operations acquired subsequent to year end were Florida, Georgia, Texas and North Carolina.

Our Industry and Operations

We do not believe that increases in our prices of materials or products are likely to affect the decision to undertake a construction project since these costs usually represent a small portion of total construction costs.

We operate our construction materials, products and paving and related services businesses through local management teams, which work closely with our customers to deliver the materials, products and services that meet each customer’s specific

12

needs for a project. We believe that this strong local branding presence gives us a competitive advantage by allowing us to obtain a unique understanding of the evolving needs of our customers.

We have operations in 21 U.S. states and in British Columbia, Canada. The Argos USA operations acquired subsequent to year end were located in an additional 18 states. Our business in each region is vertically‑integrated. We supply aggregates internally for the production of cement, ready‑mix concrete and asphalt paving mix and a significant portion of our asphalt paving mix is used internally by our paving and related services businesses. In the year ended December 30, 2023, approximately 83% of our aggregates production was sold directly to outside customers with the remaining amount being further processed by us and sold as a downstream product. In addition, we operate a municipal waste landfill in our East segment and have construction and demolition debris landfills in our West and East segments.

Approximately 65% of our asphalt paving mix was installed by our paving and related services businesses in the year ended December 30, 2023. We charge a market price and competitive margin at each stage of the production process in order to optimize profitability across our operations. Our production value chain is illustrated as follows:

Aggregates

Aggregates are key material components used in the production of cement, ready‑mix concrete and asphalt paving mixes for the public infrastructure, residential and nonresidential end markets and are also widely used for various applications and products, such as road and building foundations, railroad ballast, erosion control, filtration, roofing granules and in solutions for snow and ice control. Generally extracted from the earth using surface or underground mining methods, aggregates are produced from natural deposits of various materials such as limestone, sand and gravel, granite and trap rock. Aggregates are produced mainly from blasting hard rock from quarries and then crushing and screening it to various sizes to meet our customers’ needs. The production of aggregates also involves the extraction of sand and gravel, which requires less crushing, but still requires screening for different sizes. Aggregate production utilizes capital intensive heavy equipment which includes the use of loaders, large haul trucks, crushers, screens and other heavy equipment at quarries and sand and gravel pits. Once extracted, processed and/or crushed and graded on-site into crushed stone, concrete and masonry sand, specialized sand, pulverized lime or agricultural lime, they are supplied directly to their end use or incorporated for further processing into construction materials and products, such as cement, ready‑mix concrete and asphalt paving mix. The minerals are processed to meet customer specifications or to meet industry standard sizes. Crushed stone is used primarily in ready‑mix concrete, asphalt paving mix, and the construction of road base for highways.

As of December 30, 2023, we mine limestone, gravel, and other natural resources from 128 crushed stone quarries and 109 sand and gravel deposits throughout the United States and in British Columbia, Canada. Our extensive network of quarries, plants and facilities, located throughout the regions in which we operate, enables us to have a nearby operation to meet the needs of customers in each of our markets. As of December 30, 2023, we had approximately 5.5 billion tons of reserves and resources of recoverable stone, and sand and gravel of suitable quality for economic extraction. Our estimate is based on drilling and studies by geologists and engineers, recognizing reasonable economic and operating restraints as to maximum depth of extraction and permit or other restrictions. Reported proven and probable reserves include only quantities that are

13

owned or under lease, and for which all required zoning and permitting have been obtained. Of the 5.5 billion tons of aggregates reserves and resources, 2.4 billion, or 44%, are located on owned land and 3.1 billion are located on leased land.

As of December 31, 2023, the Argos USA operations acquired subsequent to year end include mine limestone from four crushed stone quarries in Harleyville, South Carolina, Newberry, Florida, Roberta, Alabama and Martinsburg, West Virginia. These quarries are located throughout the regions in which Argos USA operates, and provide a nearby operation to meet the needs of customers in each of those markets. As of December 31, 2023, Argos USA had approximately 1.2 billion tons of reserves and resources of recoverable stone of suitable quality for economic extraction. The estimate is based on drilling and studies by geologists and engineers, recognizing reasonable economic and operating restraints as to maximum depth of extraction and permit or other restrictions. Reported proven and probable reserves include only quantities that are owned, and for which all required zoning and permitting have been obtained. All of the Argos USA reserves and resources acquired in January 2024 are located on owned land.

Transportation costs are a major variable in determining the marketing radius for our products. The cost of transporting aggregate products from the plant to the market often equates to or exceeds the sale price of the product at the plant. As a result of the high transportation costs and the large quantities of bulk material that have to be shipped, finished products are typically marketed locally. High transportation costs are responsible for the wide dispersion of production sites. Our transportation costs are also increasing, primarily due to driver shortages and elevated fuel costs. Where possible, construction material producers maintain operations adjacent to highly populated areas to reduce transportation costs and enhance margins. However, more recently, local environmental concerns and a more restrictive permitting and regulatory landscape have been forcing production sites to move further away from the end‑use locations.

Each of our aggregates operations is responsible for the sale and marketing of its aggregates products. For the year ended December 30, 2023, approximately 83% of our aggregates production was sold directly to outside customers and the remaining amount is further processed by us and sold as a downstream product. Even though aggregates are a commodity product, we work to optimize pricing depending on the site location, availability of a particular product, customer type, project type and haul cost. We sell aggregates to internal downstream operations at market prices.

Our competitors in aggregates include large vertically‑integrated companies, which have a combined estimated market share of approximately 30%, in addition to various local suppliers.

We have a strong competitive advantage in aggregates through our well-located reserves and assets in key markets, high quality reserves and our logistic networks. We further share and implement best practices relating to safety, strategy, sales and marketing, production, and environmental and land management. Our local market knowledge enables us to maintain a strong understanding of the needs of our aggregates customers. In addition, our companies have a reputation for responsible environmental stewardship and land restoration, which assists us in obtaining new permits and new reserves.

Cement

Portland cement, an industry term for the common cement in general use around the world, is made from a combination of limestone, shale, clay, silica and iron ore. It is a fundamental building material consumed in several stages throughout the construction cycle of public infrastructure, residential and nonresidential projects. It is a binding agent that, when mixed with sand or aggregates and water, produces either ready‑mix concrete or mortar and is an important component of other essential construction materials. Few construction projects can take place without utilizing cement somewhere in the design, making it a key ingredient used in the construction industry. The majority of all cement shipments are sent to ready‑mix concrete operators. Sales are made on the basis of competitive terms and prices in each market. Nearly two‑thirds of U.S. consumption occurs between May and November, coinciding with end‑market construction activity.

Cement production in the United States is distributed from over 90 production facilities located across a majority of the states and is a capital‑intensive business with variable costs dominated by raw materials and energy required to fuel the kiln. Most U.S. cement producers are owned by large foreign companies operating in multiple international markets. Our largest competitors include large vertically integrated companies. Construction of cement production facilities is highly capital intensive and requires long lead times to complete engineering design, obtain regulatory permits, acquire equipment and construct a plant.

We operate a highly‑efficient, low-cost integrated cement manufacturing and distribution network through our cement plants in Hannibal, Missouri, and Davenport, Iowa and our nine distribution terminals along the Mississippi River from Minnesota to Louisiana. The combined potential capacity at our Hannibal and Davenport cement plants is approximately 2.4 million short tons per annum. We also operate on‑site waste fuel processing facilities at the plants, which can reduce plant

14

fuel costs by up to 50%. Our Hannibal plant is one of very few with hazardous waste fuel facilities permitted and operating out of over 90 cement plants in the United States. Competitive factors include price, reliability of deliveries, location, quality of cement and support services. Aligned with our core strategy of sustainability, we converted 100% of our cement production from general use Portland cement to Portland Limestone Cement (PLC) during 2022. Portland Limestone Cement is accepted in all major specifications, approved in all major markets, can be used in all applications in lieu of Portland cement while reducing cement’s embodied CO2 content by up to 10%. With two cement plants, on‑site raw material supply, a network of cement terminals, and longstanding customer relationships, we are well positioned to serve our customers.

Cement is a product that is costly to transport. Consequently, the radius within which a typical cement plant is competitive with truck transportation is typically limited to 150 miles from any shipping/distribution point. However, access to rail and barge can extend the distribution radius significantly. With both of our plants located on the Mississippi River, we are able to cost effectively distribute cement from both of our plants by truck, rail and barge directly to customers or to our nine storage and distribution terminals along the Mississippi River. Our Hannibal and Davenport plants are located on the Mississippi River and, consequently, we ship approximately 70-80% cement produced at those locations by barge, which is more cost‑effective than truck or rail transport.

The majority of U.S. cement plants are subject to the Portland Cement – Maximum Achievable Control Technology (“PC‑MACT”). Our Hannibal and Davenport cement plants utilize alternative fuels, hazardous and non‑hazardous at Hannibal and non‑hazardous at Davenport, as well as coal, natural gas and petroleum coke and, as a result, are subject to additional standards including the Hazardous Waste Combustor – Maximum Achievable Control Technology (“HWC-MACT”) and Commercial/Industrial Solid Waste Incinerators (“CISWI”) standards, respectively, rather than PC‑MACT standards.

Ready‑mix Concrete

Ready‑mix concrete is one of the most versatile and widely used materials in construction today. Its flexible recipe characteristics allow for an end product that can assume almost any color, shape, texture and strength to meet the many requirements of end users that range from bridges, foundations, skyscrapers, pavements, dams, houses, parking garages, water treatment facilities, airports, tunnels, power plants, hospitals and schools. The versatility of ready‑mix concrete gives engineers significant flexibility when designing these projects.

Cement, coarse aggregate, fine aggregate, water and admixtures are the primary ingredients in ready‑mix concrete. Other materials commonly used in the production of ready‑mix concrete include fly‑ash, a waste by‑product from coal burning power plants, silica fume, a waste by‑product generated from the manufacture of silicon and ferro‑silicon metals, and ground granulated blast furnace slag, a by‑product of the iron and steel manufacturing process. These materials are available directly from the producer or via specialist distributors who intermediate between the ready‑mix concrete producers and the users.

We believe our West and East segments are leaders in the supply of ready‑mix concrete in their respective markets. The West segment has ready‑mix concrete operations in the Texas, Utah, Arizona, Idaho, Oklahoma and Colorado markets. Our East segment supplies ready‑mix concrete in the Kansas and Missouri markets and surrounding areas. The Argos USA operations acquired subsequent to year end included ready-mix operations in an additional four states primarily in the Southeast United States. We operated 70 ready-mix concrete plants and over 850 concrete delivery trucks in the West segment and 22 ready-mix concrete plants and over 150 concrete delivery trucks in the East segment as of December 30, 2023. The Argos USA operations acquired subsequent to year end include 140 ready-mix concrete plants and over 1000 concrete delivery trucks as of December 31, 2023. Our aggregates business serves as the primary source of the raw materials for our concrete production, functioning essentially as a supplier to our ready‑mix concrete operations.

Asphalt Paving Mix

Asphalt paving mix is the most common roadway material used today. It is a versatile and essential building material that has been used to surface 94% of the more than 2.7 million miles of paved roadways in the United States, according to the National Asphalt Pavement Association (“NAPA”).

Typically, asphalt paving mix is placed in three distinct layers to create a flexible pavement structure. These layers consist of a base course, an intermediate or binder course, and a surface or wearing course. These layers vary in thickness.

Asphalt pavement is generally 100% recyclable and reusable and is the most reused and recycled pavement material in the United States. Reclaimed asphalt pavement can be incorporated into new pavement at replacement rates in excess of 30% depending upon the mix and the application of the product. We actively engage in the recycling of previously used asphalt pavement and concrete. This material is crushed and repurposed in the construction cycle. As of December 30, 2023, we

15

operated 25 and 5 asphalt paving mix plants in the West and East segments, respectively. Nearly all of our plants can utilize recycled asphalt pavement.

The use of warm mix asphalt (“WMA”) or “green” asphalt is gaining popularity. The immediate benefit to producing WMA is the reduction in energy consumption required by burning fuels to heat traditional hot mix asphalt (“HMA”) to temperatures in excess of 300°F at the production plant. These high production temperatures are needed to allow the asphalt binder to become viscous enough to completely coat the aggregate in the HMA, have good workability during laying and compaction, and durability during traffic exposure. According to the Federal Highway Administration, WMA can reduce the mixing temperature by 50°F to 70°F, resulting in lower emissions, fumes and odors generated at the plant and the paving site.

Approximately 65% of the asphalt paving mix we produce is installed by our own paving crews. The rest is sold on a per ton basis to road contractors, state departments of transportation and local agencies. Asphalt paving mix is used by our paving crews and by our customers primarily for the construction of roads, driveways and parking lots.

As part of our vertical integration strategy, we provide asphalt paving and related services to both the private and public infrastructure sectors as either a prime or sub‑contractor. These services complement our construction materials and products businesses by providing a reliable downstream outlet, in addition to our external distribution channels.

Our asphalt paving and related services businesses bid on both private construction and public infrastructure projects in their respective local markets. We only provide paving and related services operations as a complement to our aggregates operations, which is a major competitive strength. Factors affecting competitiveness in this business segment include price, estimating abilities, knowledge of local markets and conditions, project management, financial strength, reputation for quality and the availability of machinery and equipment.

Contracts with our customers are primarily fixed price or fixed unit price. Under fixed unit price contracts, we provide materials or services at fixed unit prices (for example, dollars per ton of asphalt placed). While the fixed unit price contract shifts the risk of estimating the quantity of units required for a particular project to the customer, any increase in our unit cost over the bid amount, whether due to inflation, inefficiency, errors in our estimates or other factors, is borne by us unless otherwise provided in the contract. Many of our contracts contain adjustment provisions to account for changes in liquid asphalt prices.

Customers

Our business is not dependent on any single customer or a few customers. Therefore, the loss of any single or small number of customers would not have a material adverse effect on any individual respective market in which we operate or on us as a whole. No individual customer accounted for more than 10% of our 2023 revenue.

Seasonality

Use and consumption of our products fluctuate due to seasonality. Nearly all of the products used by us, and by our customers, in the private construction or public infrastructure industries are used outdoors. Our highway operations and production and distribution facilities are also located outdoors. Therefore, seasonal changes and other weather‑related conditions, in particular extended rainy and cold weather in the spring and fall and major weather events, such as hurricanes, tornadoes, tropical storms, heavy snows, flooding and drought, can adversely affect our business and operations through a decline in the use of our products, demand for our services and our ability to provide our products and services. In addition, construction materials production and shipment levels follow activity in the construction industry, which typically occurs in the spring, summer and fall. Warmer and drier weather during the second and third quarters of our fiscal year typically result in higher activity and revenue levels during those quarters. The first quarter of our fiscal year typically has lower levels of activity due to weather conditions. The Argos USA operations acquired subsequent to year end will reduce the combined company's seasonality due to the majority of Argos USA operations being located in warmer markets.

Backlog

Our products are generally delivered upon receipt of orders or requests from customers, or shortly thereafter. Accordingly, the backlog associated with product sales is converted into revenue within a relatively short period of time. Inventory for products is generally maintained in sufficient quantities to meet rapid delivery requirements of customers. Therefore, a period over period increase or decrease of backlog does not necessarily result in a material improvement or a deterioration of our business. Our backlog includes only those products and projects for which we have obtained a purchase

16

order or a signed contract with the customer and does not include products purchased and sold or services awarded and provided within the period.

Subject to applicable contract terms, substantially all contracts in our backlog may be canceled or modified by our customers. Historically, we have not been materially adversely affected by significant contract cancellations or modifications.

Intellectual Property

We do not own or have a license or other rights under any patents that are material to our business.

Corporate Information

Summit Materials, Inc. and Summit Materials, LLC were formed under the laws of the State of Delaware on September 23, 2014 and September 24, 2008, respectively. Our principal executive office is located at 1801 California Street, Suite 3500, Denver, Colorado 80202. Through its predecessor, Summit Inc. commenced operations in 2009 when Summit Holdings was formed. Our telephone number is (303) 893-0012.

Human Capital Resources

As of December 30, 2023, we employed approximately 5,300 employees, of which approximately 5,000 were employed in the United States with the remainder being employed in Canada. Approximately 77% of our employees are hourly workers, with the remainder being salaried. Approximately 9% of our employees are union members, substantially all in our cement division and at our Canadian operations, with whom we believe we enjoy a satisfactory working relationship. Our collective bargaining agreements for employees who are union members generally expire within three years. Because of the seasonal nature of our industry, many of our hourly and certain of our salaried employees are subject to seasonal layoffs. The scope of layoffs varies greatly from season to season as they are predominantly a function of the type of projects in process and the weather during the late fall through early spring. The Argos USA operations acquired subsequent to year end includes approximately 2,400 employees as of December 31, 2023, of which approximately 63% were hourly workers, with the remainder being salaried. Approximately 11% of the Argos USA employees are union members.

Health and Safety: We maintain a safety culture grounded on the premise of striving to eliminate workplace incidents, risks and hazards. We have created and implemented processes to help eliminate safety events by reducing their frequency and severity. We also review and monitor our performance closely. Our goal is to reduce Occupational Safety and Health Administration ("OSHA") recordable incidents each year. During fiscal 2023, our recordable incident rate increased 9% compared to fiscal 2022.

Inclusion and Diversity: We embrace the diversity of our team members, customers, stakeholders and consumers, including their unique backgrounds, experiences, thoughts and talents. Everyone is valued and appreciated for their distinct contributions to the growth and sustainability of our business. We strive to cultivate a culture and vision that supports and enhances our ability to recruit, develop and retain diverse talent at every level. We have a goal to build a highly engaged team by increasing retention year over year. We achieved gender parity at the Board level with over 50% female Board directors.

Talent Development: We prioritize and invest in creating opportunities to help employees grow and build their careers, through various training and development programs. These include on-the-job learning formats as well as executive talent and succession planning paired with an individualized development approach.

Compensation and Benefits: In addition to competitive base compensation, we offer incentive plans for both safety and operational results, stock awards, a 401(k) plan, healthcare and insurance benefits, health savings and flexible spending accounts, paid time off, family leave programs, and employee assistance programs, among other benefits. Our 401(k) plan covers all U.S. employees, and provides for matching contributions to the plan, including 100% of pre‑tax employee contributions, up to 4% of eligible compensation. Employer contributions vest immediately. During 2021, we implemented an Employee Stock Purchase Plan in which the majority of our employees are eligible to participate.

Legal Proceedings

We are party to certain legal actions arising from the ordinary course of business activities. While the ultimate results of claims and litigation cannot be predicted with certainty, management expects that the ultimate resolution of all current pending or threatened claims and litigation will not have a material effect on our consolidated financial condition, results of operations or liquidity.

17

In March 2018, we were notified of an investigation by the Canadian Competition Bureau (the “CCB”) into pricing practices by certain asphalt paving contractors in British Columbia, including Winvan Paving, Ltd. (“Winvan”). The investigation is focused on time periods prior to our April 2017 acquisition of Winvan and we are cooperating with the CCB. Although we currently do not believe this matter will have a material adverse effect on our business, financial condition or results of operations, we are currently not able to predict the ultimate outcome or cost of the investigation.

Environmental and Government Regulation

We are subject to federal, state, provincial and local laws and regulations relating to the environment and to health and safety, including noise, discharges to air and water, waste management including the management of hazardous waste used as a fuel substitute in our cement plants, remediation of contaminated sites, mine reclamation, operation and closure of landfills, dust control and zoning, land use and permitting. Our failure to comply with such laws and regulations can result in sanctions such as fines or the cessation of part or all of our operations. From time to time, we may also be required to conduct investigation or remediation activities. There also can be no assurance that our compliance costs or liabilities associated with such laws and regulations or activities will not be significant.

In addition, our operations require numerous governmental approvals and permits. Environmental operating permits are subject to modification, renewal and revocation and can require us to make capital, maintenance and operational expenditures to comply with the applicable requirements. Stricter laws and regulations, or more stringent interpretations of existing laws or regulations, may impose new liabilities on us, reduce operating hours, require additional investment by us in pollution control equipment or impede our opening new, expanding or maintaining existing plants or facilities. We regularly monitor and review our operations, procedures and policies for compliance with environmental laws and regulations, changes in interpretations of existing laws and enforcement policies, new laws that are adopted, and new requirements that we anticipate will be adopted that could affect our operations.

Multiple permits are required for our operations, including those required to operate our cement plants, conduct mining activities at our aggregate quarries, operate our ready-mixed concrete plants and lay asphalt. Applicable permits may include conditional use permits to allow us to operate in certain areas absent zoning approval and operational permits governing, among other matters, air and water emissions, dust, particulate matter and storm water management and control. In addition, we are often required to obtain bonding for future reclamation costs, most commonly specific to restorative grading and seeding of disturbed surface areas.

Like others in our industry, we expend substantial amounts to comply with applicable environmental laws and regulations and permit limitations, which include amounts for pollution control equipment required to monitor and regulate emissions into the environment. The Hannibal and Davenport cement plants are subject to HWC-MACT and CISWI standards, respectively, for which we do not expect any material incremental costs to maintain compliance. Since many environmental requirements are likely to be affected by future legislation or rule making by government agencies, and are therefore not quantifiable, it is not possible to accurately predict the aggregate future costs of compliance and their effect on our future financial condition, results of operations and liquidity.

At most of our quarries, we incur reclamation obligations as part of our mining activities. Reclamation methods and requirements can vary depending on the individual site and state regulations. Generally, we are required to grade the mined properties to a certain slope and seed the property to prevent erosion. We record a mining reclamation liability in our consolidated financial statements to reflect the estimated fair value of the cost to reclaim each property including active and closed sites.

Our operations in Kansas include one municipal waste landfill and three construction and demolition debris landfills, and in Colorado, we have a construction and demolition debris landfill. In Vancouver, British Columbia, we operate a landfill site that accepts environmentally clean soil deposits. Among other environmental, health and safety requirements, we are subject to obligations to appropriately close those landfills at the end of their useful lives and provide for appropriate post‑closure care. Asset retirement obligations relating to these landfills are recorded in our consolidated financial statements.

Health and Safety

Our facilities and operations are subject to a variety of worker health and safety requirements, particularly those administered by the federal Occupational Safety and Health Administration (“OSHA”) and Mine Safety and Health Administration (“MSHA”). Throughout our organization, we strive for a zero‑incident safety culture and full compliance with safety regulations. Failure to comply with these requirements can result in sanctions such as fines and penalties and claims for personal injury and property damage. These requirements may also result in increased operating and capital costs in the future.

18

Worker safety and health matters are overseen by our corporate risk management and safety department as well as operations level safety managers. We provide our operations level safety managers leadership and support, comprehensive training, and other tools designed to accomplish health and safety goals, reduce risk, eliminate hazards, and ultimately make our work places safer.

Where You Can Find More Information

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the internet at the SEC’s website at http://www.sec.gov. Our SEC filings are also available on our website, free of charge, at http://www.summit-materials.com as soon as reasonably practicable after they are filed with or furnished to the SEC.

We maintain an internet site at http://www.summit-materials.com. Our website and the information contained on or connected to that site are not incorporated into this report.

19

ITEM 1A. RISK FACTORS

You should carefully consider the following risk factors as well as the other information set forth in this Annual Report on Form 10-K (this “Annual Report”), including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes thereto. If any of the following risks actually occurs, our business, results of operations, prospects, and financial condition may be materially adversely affected. In such a case, the trading price of our Class A common stock could decline and you may lose all or part of your investment. The risks and uncertainties described below are those that we have identified as material but are not the only risks and uncertainties we face. Our business is also subject to general risks and uncertainties that affect many other companies, including but not limited to overall economic and industry conditions and additional risks not currently known to us or that we presently deem immaterial may arise or become material and may negatively impact our business, reputation, financial condition, results of operations or the trading price of our Class A common stock. Some statements in this Annual Report, including statements in the following risk factors, constitute forward-looking statements. See “Forward-Looking Statements".

Risks Related to Our Industry and Our Business

Industry Risks

Our business depends on activity within the construction industry and the strength of the economies in which we operate.

We sell most of our construction materials and products and provide all of our paving and related services to the construction industry, so our results are significantly affected by the strength of the construction industry. The strength of the construction industry in turn can be substantially affected by macroeconomic and other factors beyond our control, including changes in general economic conditions, political or social trends and unrest, terrorism or war, pandemics or other adverse health developments, and natural, climate-related or man-made disasters and extreme weather conditions. In addition, federal and state budget issues may negatively affect the amount of funding available for infrastructure spending, particularly highway construction, which constitutes a significant portion of our business. Demand for our products, particularly in the residential and nonresidential construction markets, could decline if companies and consumers cannot obtain funding for construction projects, or due to other market factors such as rising interest rates, labor shortages and inflation which have impacted demand more recently and are expected to further impact demand in 2024. A slow pace of economic activity typically results in delays or cancellations of capital projects, which could result in the deferral or reduction of our backlog and anticipated revenues if we are unable to replace those contracts. In addition, in times of a stagnant or declining economy, there is a greater likelihood that we may not be able to collect on certain of our accounts receivable from our customers.

While our business operations cover a wide geographic area, our earnings depend on the strength of the local economies in which we operate because of the high cost to transport our products relative to their price. If economic and construction activity diminishes in one or more areas, particularly in our top revenue‑generating markets of Texas, Florida, Georgia and Utah, our financial condition, results of operations and liquidity could be materially adversely affected.

Our industry is cyclical and requires significant working capital to fund operations.

Our industry is cyclical and requires that we maintain significant working capital to fund our operations. Our ability to generate sufficient cash flow depends on future performance, which will be subject to general economic conditions, industry cycles and financial, business and other factors affecting our operations, many of which are beyond our control. If we are unable to generate sufficient cash to operate our business and service our outstanding debt and other obligations, we may be required, among other things, to further reduce or delay planned capital or operating expenditures, sell assets or take other measures, including the restructuring of all or a portion of our debt, which may only be available, if at all, on unsatisfactory terms.

Weather can materially affect our business and we are subject to seasonality.

The products we sell and the services we provide are used or performed outdoors. Therefore, seasonal changes and other weather‑related conditions can adversely affect our business and operations through a decline in the use and production of our products, demand for our services and our ability to provide our products and services. Adverse weather conditions such as heavy or sustained rainy and cold weather in the spring and fall can reduce demand for our products and reduce sales, render our contracting operations less efficient or restrict our ability to ship our products. For example, unusually low water levels on the Mississippi River in late 2022 negatively impacted the shipping of our products. Major weather events such as hurricanes, tornadoes, tropical storms, flooding, droughts, wildfires and heavy snows have adversely affected and could

20

adversely affect sales in the near term and may be more severe due to climate change. In particular, our operations in the southeastern and Gulf Coast regions of the United States are at risk for hurricane activity, most notably in August, September and October.

Our industry is capital intensive and we have significant fixed and semi‑fixed costs. Therefore, our profitability is sensitive to changes in volume.