The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

PROSPECTUS

Subject to Completion, dated , 2018

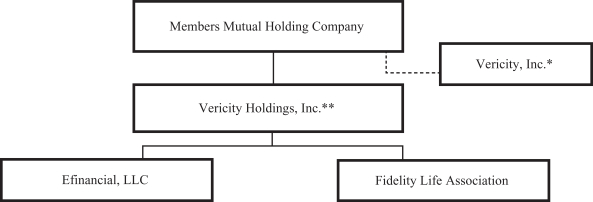

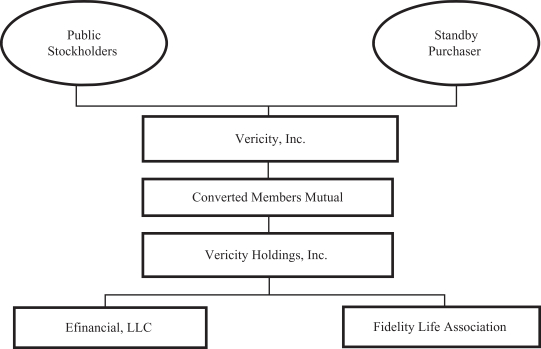

This is the initial public offering of Vericity, Inc. We are offering up to 20,125,000 shares of our common stock for sale at a price of $10.00 per share in connection with the conversion of Members Mutual Holding Company, or Members Mutual, from mutual to stock form of organization. Immediately following the conversion, we will acquire all of the newly issued shares of common stock of converted Members Mutual.

We are offering shares of our common stock in a subscription offering to eligible members of Members Mutual, who were the policyholders of Fidelity Life Association, an Illinois life insurance company and indirect subsidiary of Members Mutual, as of July 31, 2018, and to the directors and officers of Members Mutual.

The subscription offering will end at 5:00 PM, Central Time, on [●]. Our ability to complete this offering is subject to two conditions. First, a minimum of 14,875,000 shares of common stock must be sold to complete this offering. Second, Members Mutual’s plan of conversion and amended and restated articles of incorporation must be approved by the affirmative vote of at least two-thirds of the votes cast at the special meeting of members to be held on [●]. Until such time as these conditions are satisfied, all funds submitted to purchase shares will be held in escrow with [escrow agent]. If the offering is terminated, purchasers will have their funds promptly returned without interest.

In addition, we have entered into an agreement with Apex Holdco L.P., an affiliate of J.C. Flowers IV L.P., a private equity fund managed by J.C. Flowers & Co. LLC, under which Apex Holdco, L.P. has agreed to act as the standby purchaser for this offering. If fewer than 14,875,000 shares are subscribed for in the subscription offering, the standby purchaser has agreed to purchase the number of shares of our common stock equal to the difference between 14,875,000 and the number of shares of common stock subscribed for in the subscription offering, and may purchase additional shares as may be necessary in order to permit the standby purchaser to acquire a majority of the shares sold, provided that no more than 20,125,000 shares may be sold in the offerings. Under the terms of our agreement with the standby purchaser, the standby purchaser will have the right to designate a majority of the nominees to serve on our board of directors. We refer to the offering of shares to the standby purchaser as the standby offering. We refer to the subscription offering and the standby offering as the offerings.

If fewer than 14,875,000 shares are subscribed for in the subscription offering, and if all of the conditions to the standby purchaser’s purchase commitment have been satisfied, the standby purchaser will be obligated to purchase enough shares in the standby offering to assure the sale of the minimum number of shares necessary to complete this offering. In that event, the level of sales to eligible members and directors and officers of Members Mutual will not impact the condition that at least 14,875,000 shares must be sold to complete this offering. Accordingly, the sale of the minimum number of shares necessary to complete this offering does not indicate that sales have been made to investors who have no financial or other interest in the offerings, and the sale of the minimum number of shares should not be viewed as an indication of the merits of this offering.

The minimum number of shares that a person may subscribe to purchase is 25 shares. The maximum number of shares that a person may subscribe to purchase in the subscription offering is the lesser of 743,750 or the individual maximum purchase limitations described in this prospectus. If orders are received for more shares than shares offered, shares will be allocated in the manner and priority described in this prospectus.

Raymond James & Associates, Inc. will act as our marketing agent and will use its best efforts to assist us in selling our common stock in this offering, but Raymond James is not obligated to purchase any shares of common stock that are being offered for sale. Purchasers will not pay any commission to purchase shares of common stock in this offering.

There is currently no public market for our common stock. We intend to apply for the listing of our common stock on the NASDAQ Capital Market under the symbol “VERY.”

We are an “emerging growth company” under applicable Securities and Exchange Commission rules and will be eligible for reduced public company reporting requirements. See “Summary—Implications of Being an Emerging Growth Company and a Smaller Reporting Company.”

Investing in our common stock involves risks. For a discussion of the material risks that you should consider, see “Risk Factors” beginning on page 12 of this prospectus.

OFFERING SUMMARY

Price: $10.00 per share

| | | | | | | | |

| | | Minimum | | | Maximum | |

Number of shares offered | | | 14,875,000 | | | | 20,125,000 | |

Gross offering proceeds | | $ | 148,750,000 | | | $ | 201,250,000 | |

Estimated offering expenses | | $ | 8,381,980 | | | $ | 8,381,980 | |

Commissions(1)(2) | | $ | 3,318,020 | | | $ | 2,012,500 | |

Net proceeds | | $ | 137,050,000 | | | $ | 190,855,520 | |

Net proceeds per share | | $ | 9.21 | | | $ | 9.48 | |

| (1) | Represents commissions to be paid to Raymond James, based on 1.0% of the proceeds from shares sold in the subscription offering, and the amount to be paid to Raymond James and Griffin Financial Group, LLC, based on 3.0% of the proceeds from the shares sold to the standby purchaser. No commission will be paid on the sale of shares sold to directors or officers. Any shares sold to the standby purchaser in the standby offering will be sold in a private placement to close concurrently with the subscription offering at a price equal to the public offering price in this offering. The shares sold to the standby purchaser in the standby offering are not being registered as part of this offering and will be restricted securities. See “The Conversion and Offering—Marketing Arrangements” for a description of the marketing agent compensation. |

| (2) | Assumes (x) at the offering minimum, 2,720,000 shares are sold in the subscription offering to eligible members, 2,001,600 shares are sold to directors and officers of Members Mutual and 10,153,400 shares are sold to the standby purchaser; and (y) at the maximum, that all 20,125,000 shares are sold in the subscription offering to eligible members. We are unable to predict the number of eligible members that may participate in the subscription offering or the extent of their participation. |

None of the Securities and Exchange Commission, the Illinois Department of Insurance or any state securities commission has approved or disapproved of these securities or determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

For assistance, please call the Stock Information Center at [1-8 -[●]].

Raymond James

The date of this Prospectus is [●]