the JDPD Agreement. In consideration for the assignment and grant of rights under the JDPD Agreement, Ovabrite issued an unsecured promissory note in a principal amount of $0.4 million, or the First Note, to us that represented the total cash paid by us to Novatrans under the JDPD Agreement. Interest on the First Note accrued at an annual rate of 1.46%, and Ovabrite was required to make semi-annual payments on amounts outstanding under the First Note, including any accrued but unpaid interest, until the First Note matured on December 23, 2021.

Additionally, in December 2016, we extended an unsecured line of credit to Ovabrite to be used for working capital under which Ovabrite’s maximum borrowing capacity was $50,000, or the Ovabrite Line of Credit. Interest on the Ovabrite Line of Credit accrued at an annual rate of 1.46%, and Ovabrite was required to make semi-annual payments on amounts outstanding under the line of credit, including any accrued but unpaid interest, until the Ovabrite Line of Credit matured on December 23, 2021. There were no outstanding borrowings under Ovabrite Line of Credit as of March 29, 2020.

In December 2016, we entered into a services agreement with Ovabrite under which we provide certain administrative services to Ovabrite in exchange for a monthly management fee. The management fees incurred by Ovabrite for fiscal years 2017, 2018 and 2019 were $36,000, $36,000 and $6,000, respectively. The management fees incurred by Ovabrite for the fiscal quarter ended March 29, 2020 were $1,500.

In November 2017, Ovabrite modified the First Note and the Ovabrite Line of Credit and issued a 1.45% unsecured convertible promissory note to us in a principal amount of $0.5 million plus previously accrued and unpaid interest of $6,460, or the Ovabrite Convertible Note. In the event of a qualified sale of Ovabrite equity securities to one or more investors resulting in gross proceeds to Ovabrite of at least $1.0 million, all principal and accrued and unpaid interest on the Ovabrite Convertible Note was automatically convertible into a number of shares of Ovabrite’s equity securities issued in such a financing equal to the outstanding principal and accrued but unpaid interest on the Ovabrite Convertible Note, divided by an amount equal to 80% of the lowest price per share of the equity security sold in the financing. In the event of a non-qualified sale of Ovabrite equity securities, or a Nonqualified Financing, all principal and accrued and unpaid interest on the Ovabrite Convertible Note was contingently convertible into a number of shares of Ovabrite’s equity securities issued in such a financing equal to the outstanding principal and accrued but unpaid interest on the Ovabrite Convertible Note, divided by an amount equal to 80% of the lowest price per share of the equity security sold in the financing.

In November 2017, Ovabrite issued 1,065,038 shares of convertible preferred stock, or the Series 2017 Preferred Stock, at $0.14 per share for gross proceeds of $150,000, which constituted a Nonqualified Financing. In January 2018, Ovabrite issued 177,506 shares of Series 2017 Preferred Stock at $0.14 per share for gross proceeds of $25,000. In April 2018, as a result of the Nonqualified Financing event that occurred in November 2017, we elected to exercise our option to convert the outstanding principal balance of the Ovabrite Convertible Note into 4,459,490 shares of Series 2017 Preferred Stock at a conversion price of $0.112672 per share.

As of March 29, 2020, we hold approximately 19% of the capital stock of Ovabrite. Additionally, as of March 29, 2020, Matthew O’Hayer holds approximately 24% of the capital stock of Ovabrite, and certain of our other directors, officers and holders of more than 5% of our capital stock also hold capital stock of Ovabrite.

Matthew O’Hayer and our director Karl Khoury serve as the directors of Ovabrite. Mr. O’Hayer is the chief executive officer of Ovabrite and Jason Dale is the chief financial officer of Ovabrite.

Relationship with Whole Foods

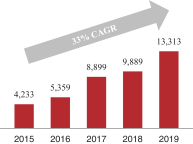

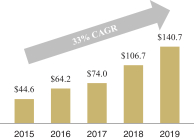

We serve the majority of our natural channel retail customers through food distributors, such as UNFI, which purchases, stores, sells and delivers our products to Whole Foods. As a result, we are not able to precisely attribute our net revenue to Whole Foods. In fiscal years 2017, 2018 and 2019, UNFI accounted for approximately 36%, 36% and 35% of our net revenue, respectively. In the fiscal quarters ended March 31, 2019

131