AUDIT COMMITTEE FINANCIAL EXPERT

The Registrant’s Board of Directors has determined that each member of the Audit Committee, John Montalbano, Simon Pimstone and Paul Geyer, are “independent” (as defined by Rule 10A-3 of the Exchange Act and Nasdaq Rule 5605(a)(2)) and that each of Mr. Montalbano and Dr. Pimstone are “audit committee financial experts” (as that term is defined in paragraph 8(b) of General Instruction B to Form 40-F). For a description of Mr. Montalbano’s and Dr. Pimstone’s relevant experience in financial matters, see the biographical descriptions for each under “Directors and Executive Officers” in the AIF, which is filed as Exhibit 99.1 to this Annual Report on Form 40-F.

The SEC has indicated that the designation or identification of a person as an audit committee financial expert does not make such person an “expert” for any purpose, impose any duties, obligations or liability on such person that are greater than those imposed on members of the audit committee and the board of directors who do not carry this designation or identification, or affect the duties, obligations or liability of any other member of the audit committee or board of directors.

CODE OF ETHICS

The Board of Directors of the Registrant (the “Board”) has adopted a written code of business conduct and ethics (the “Code”) which emphasizes the importance of matters relating to honest and ethical conduct, full, fair, accurate, timely, and understandable disclosure in reports that the Registrant files with, or submits to, the Securities and Exchange Commission (the “Commission”) and in other public communications, compliance with applicable laws, rules and regulations, the prompt internal reporting of violations of the Code and accountability for adherence to the Code. All individuals representing the Registrant, including the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, are expected to abide by all applicable provisions of the Code and adhere to its principles and values when representing the Registrant to the public or performing services for, or on behalf of, the Registrant. The Board will review the effectiveness of the Code on an ongoing basis to ensure that the Registrant’s business activities are conducted in accordance with the principles and rules set out therein. A copy of the Code can be obtained from the Registrant’s website at www.eupraxiapharma.com/investors.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The information provided under the heading “Audit Committee Information — External Auditor Fees” by Category contained in the AIF, filed as Exhibit 99.1 to this Annual Report on Form 40-F, is incorporated by reference herein.

AUDIT COMMITTEE PRE-APPROVAL POLICIES AND PROCEDURES

The information provided under the heading “Audit Committee Information — Pre-Approval Policies and Procedures” contained in the AIF, filed as Exhibit 99.1 to this Annual Report on Form 40-F, is incorporated by reference herein.

OFF-BALANCE SHEET ARRANGEMENTS

The information provided under the heading “Off-Balance Sheet Arrangements” contained in the MD&A, filed as Exhibit 99.3 to this Annual Report on Form 40-F, is incorporated by reference herein.

CONTRACTUAL OBLIGATIONS

The information provided under the heading “Contractual Obligations” contained in the MD&A, filed as Exhibit 99.3 to this Annual Report on Form 40-F, is incorporated by reference herein.

IDENTIFICATION OF THE AUDIT COMMITTEE

The information provided under the heading “ Audit Committee Information — Audit Committee” contained in the AIF, filed as Exhibit 99.1 to this Annual Report on Form 40-F, is incorporated by reference herein.

DIFFERENCES IN NASDAQ AND CANADIAN CORPORATE GOVERNANCE REQUIREMENTS

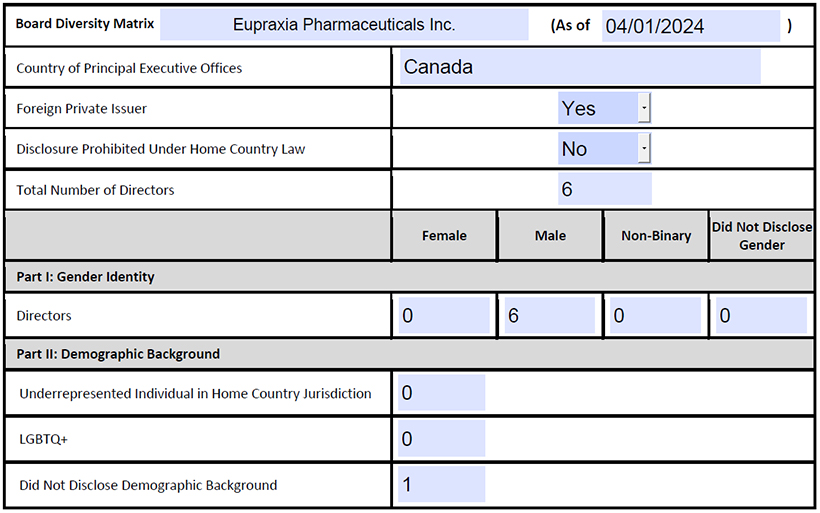

The Registrant is a foreign private issuer and has applied to list its common shares on the Nasdaq Capital Market (“Nasdaq”).

Nasdaq Rule 5615(a)(3) permits a foreign private issuer to follow its home country practice in lieu of the requirements of the Rule 5600 Series, the requirement to disclose third party director and nominee compensation set forth in Rule 5250(b)(3), and the requirement to distribute annual and interim reports set forth in Rule 5250(d), provided, however, that such a Company shall: comply with the Notification of Noncompliance requirement (Rule 5625), the Voting Rights requirement (Rule 5640), the Diverse Board Representation Rule (Rule 5605(f)), the Board Diversity Disclosure Rule (Rule 5606), have an audit committee that satisfies Rule 5605(c)(3), and ensure that such audit committee’s members meet the independence requirement in Rule 5605(c)(2)(A)(ii).