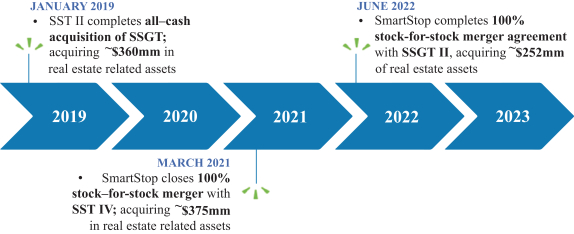

We paid our Transfer Agent a one-time setup fee. In addition, the other fees to be paid to our Transfer Agent are based on a fixed quarterly fee, one-time account setup fees, fees from investor inquiries and monthly open account fees. In addition, we will reimburse our Transfer Agent for all reasonable expenses or other changes incurred by it in connection with the provision of its services to us, and we will pay our Transfer Agent fees for any additional services we may request from time to time, in accordance with its rates then in effect. Upon the request of our Transfer Agent, we may also advance payment for substantial reasonable out-of-pocket expenditures to be incurred by it. In connection with the SST IV merger and SSGT II merger, we paid our Transfer Agent a one-time fee equal to $150,000 and $100,000, respectively.

Self Administration Transaction and Earn-Out

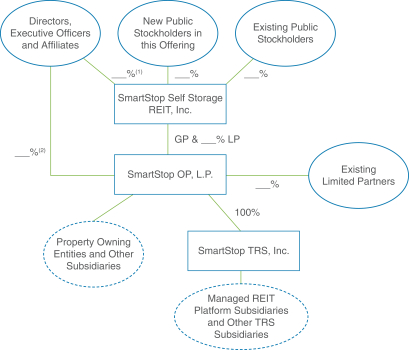

On June 28, 2019, we, along with our operating partnership, entered into the self administration transaction with SAM and SS OP Holdings, pursuant to which, effective as of June 28, 2019, we acquired the self storage advisory, asset management, property management and certain joint venture interests of SAM, along with certain other assets of SAM in exchange for approximately $769,126 in cash, assumption of existing debt in the amount of approximately $15 million, and the issuance to SS OP Holdings of 8,698,956 Class A-1 Units and 3,283,302 Class A-2 Units of our operating partnership.

The Class A-1 Units are entitled to all rights and duties of the Class A limited partnership units in the operating partnership, including cash distributions and the allocation of any profits or losses in the operating partnership. The Class A-2 Units were convertible into Class A-1 Units as earn-out consideration, as described below, in connection with the self administration transaction. The Class A-2 Units were not entitled to cash distributions or the allocation of any profits or losses in the operating partnership until the Class A-2 Units were converted into Class A-1 Units.

The conversion features of the Class A-2 Units were as follows: (A) the first time the aggregate incremental AUM, as amended (as defined in the operating partnership agreement) of the operating partnership equals or exceeds $300,000,000, one-third of the Class A-2 Units would automatically convert into Class A-1 Units, or the First Tier, (B) the first time the incremental AUM equals or exceeds $500,000,000, an additional one-third of the Class A-2 Units would automatically convert into Class A-1 Units, or the Second Tier, and (C) the first time the incremental AUM equals or exceeds $700,000,000, the remaining one-third of the Class A-2 Units would automatically convert into Class A-1 Units, or the Third Tier, and each of the First Tier, the Second Tier and the Third Tier, an Earn-Out Achievement Date. On each Earn-Out Achievement Date, the Class A-2 Units automatically converted into Class A-1 Units based on an earn-out unit exchange ratio, which is equal to $10.66 divided by the then-current value of our Class A common stock, as provided in the operating partnership agreement. On October 19, 2021, the Nominating and Corporate Governance Committee and Board approved resolutions providing that the denominator in the calculation of the earn-out unit exchange ratio would be $10.66 (the value of the Class A common stock at the time of the self administration transaction, pursuant to which the earn-out was established) until October 19, 2022. Thereafter, the denominator in the calculation of the earn-out exchange ratio would be as provided in the operating partnership agreement. All three tiers of earn-out consideration were achieved and the respective Class A-2 Units converted into Class A-1 Units, as follows: on March 24, 2021, 1,094,434 Class A-2 Units were converted into 1,121,795 Class A-1 Units pursuant to the achievement of the First Tier, on March 29, 2022, 1,094,434 Class A-2 Units were converted into 1,094,434 Class A-1 Units pursuant to the achievement of the Second Tier and on August 9, 2022, 1,094,434 Class A-2 Units were converted into 1,094,434 Class A-1 Units pursuant to the achievement of the Third Tier.

The operating partnership agreement also provides for a vote on “Extraordinary Matters” which includes any merger, sale of all or substantially all of the assets, share exchange, conversion, dissolution or charter amendment, in each case where the vote of our stockholders is required under Maryland law. We, as general partner of the operating partnership, agreed that the consent of the operating partnership would be required in connection with any Extraordinary Matter. The consent of the operating partnership will be determined by a vote of the partners of the operating partnership, with our vote as a limited partner being voted in proportion to the votes cast by our stockholders on the Extraordinary Matter.

158