UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period to

Commission File No. 001-36629

CAESARS ENTERTAINMENT, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of

incorporation or organization)

46-3657681

(I.R.S. Employer

Identification No.)

100 West Liberty Street, 12th Floor

Reno, Nevada 89501

(Address of principal executive offices)

Telephone: (775) 328-0100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Name of each exchange on which registered |

| Common Stock, $0.00001, par value | | CZR | | NASDAQ Stock Market |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ |

| Smaller reporting company | ☐ | Emerging growth company | ☐ | | |

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that require a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to Section §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the common stock held by non-affiliates of the Registrant was $8.2 billion at June 30, 2024 based upon the closing price for the shares of CZR’s common stock as reported by The Nasdaq Stock Market.

As of February 20, 2025, there were 212,013,306 outstanding shares of the Registrant’s Common Stock, net of treasury shares.

Documents Incorporated by Reference

Portions of the Registrant’s definitive proxy statement to be filed with the Commission pursuant to Regulation 14A in connection with the Registrant’s Annual Meeting of Stockholders (the “Proxy Statement”) are incorporated by reference into Part III of this report. Such Proxy Statement will be filed with the Commission not later than 120 days after the conclusion of the Registrant’s fiscal year ended December 31, 2024.

CAESARS ENTERTAINMENT, INC.

ANNUAL REPORT FOR THE YEAR ENDED DECEMBER 31, 2024

TABLE OF CONTENTS

PART I

In this filing, Caesars Entertainment, Inc., a Delaware corporation, and its subsidiaries may be referred to as the “Company,” “CEI,” “Caesars,” “we,” “us” or “our” or the “Registrant.”

We also refer to (i) our Consolidated Financial Statements as our “Financial Statements,” (ii) our Consolidated Statements of Operations and Consolidated Statements of Comprehensive Income (Loss) as our “Statements of Operations,” (iii) our Consolidated Balance Sheets as our “Balance Sheets,” and (iv) our Consolidated Statements of Cash Flows as our “Statements of Cash Flows,” which are prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). References to numbered “Notes” refer to Notes to our Consolidated Financial Statements included in Item 8.

Item 1. Business

Overview

We are a geographically diversified gaming and hospitality company that was founded in 1973 by the Carano family with the opening of the Eldorado Hotel Casino in Reno, Nevada. Beginning in 2005, we grew through a series of acquisitions, including the acquisition of MTR Gaming Group, Inc. in 2014, Isle of Capri Casinos, Inc. in 2017, Tropicana Entertainment, Inc. in 2018, Caesars Entertainment Corporation in 2020, and William Hill PLC in 2021. Our ticker symbol on the NASDAQ Stock Market is “CZR.”

Our primary source of revenue is generated by our gaming operations, which includes retail and online sports betting and online gaming. Additionally, we utilize our hotels, restaurants, bars, entertainment, racing, retail shops and other services to attract customers to our properties.

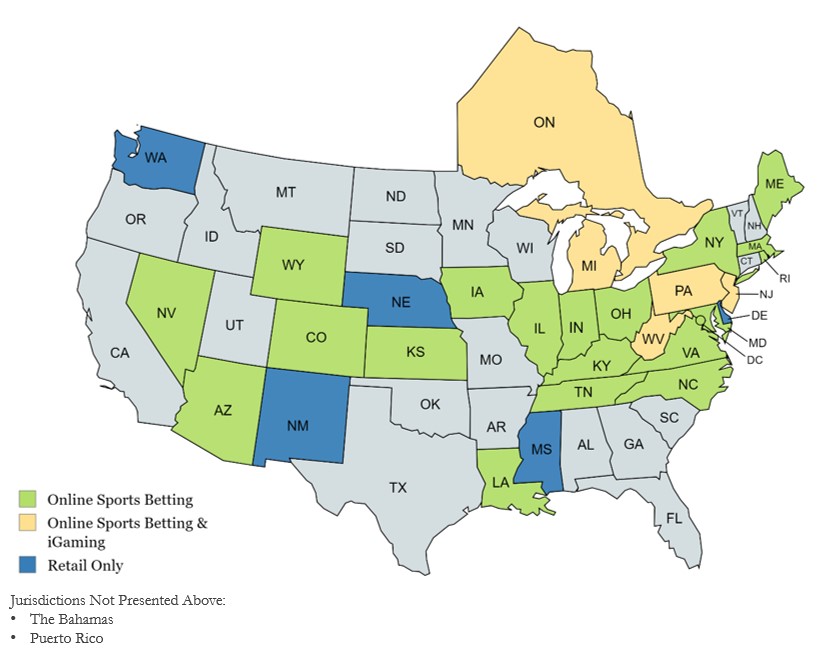

As of December 31, 2024, we own, lease or manage an aggregate of 53 domestic properties in 18 states. We also operate and conduct sports wagering across 32 jurisdictions in North America, 26 of which offer online sports betting, and operate iGaming in five jurisdictions in North America. We currently operate the Caesars Sportsbook app, the Caesars Racebook app, the Caesars Palace Online Casino app and the new Horseshoe Online Casino app which initially launched in October 2024. We expect to continue to grow our operations in the Caesars Digital segment as new jurisdictions legalize retail and online sports betting and iGaming. In addition, we have other properties in North America that are authorized to use the brands and marks of Caesars Entertainment, Inc., as well as other non-gaming properties. We lease certain real property assets from third parties, including GLP Capital, L.P., the operating partnership of Gaming and Leisure Properties, Inc. (“GLPI”) and VICI Properties L.P., a Delaware limited partnership (“VICI”). See Item 2, “Properties,” for more information about our properties. Business Operations

Our consolidated business is composed of complementary businesses that reinforce, cross-promote, and build upon each other: casino, which includes our retail and online sports betting and iGaming, food and beverage, hotel, casino management or branding, entertainment, retail and other business operations.

Casino Operations

Our casino operations generate revenues from approximately 51,400 slot machines, 2,800 table games, including poker, sports betting from our retail and online sportsbooks, iGaming and other games such as keno, all of which comprised approximately 56% of our total net revenues in 2024. Slot revenues generate the majority of our casino revenues.

Retail and Online Sports Betting and iGaming

The Company operates and conducts sports wagering across 32 jurisdictions in North America, 26 of which offer online sports betting, and operates iGaming in five jurisdictions in North America as of December 31, 2024. We offer hundreds of online casino games including slots, table games, live dealer and video poker and we expect to increase our product offerings as iGaming is legalized in additional states. We continue to leverage the World Series of Poker (“WSOP”) brand within the United States with the licensing agreement that we entered into concurrently with the sale of WSOP brand on October 29, 2024.

Our Caesars Sportsbook app operates on our owned and integrated technology platform we have labeled Liberty (“Liberty”). The app offers extensive pre-match and live markets, extensive odds and flexible limits, player props, and same-game parlays. In addition to the Caesars Sportsbook app, we partnered with NYRABets LLC, the official online wagering platform of the New York Racing Association, Inc. and operate the Caesars Racebook app in 22 states. The Caesars Racebook app provides access for pari-mutuel wagering at over 300 racetracks around the world as well as livestreaming of races. Additionally, we launched our Caesars Palace Online Casino app in 2023 and initially launched the new Horseshoe Online Casino app in October 2024. Wagers placed can earn credits towards the Caesars Rewards loyalty program or points which can be redeemed for free wagering credits. No customers under 21 years old are allowed to wager on any of our Caesars Sportsbook, Caesars Racebook and iGaming mobile apps. Growth in the Caesars Digital segment continues to be realized with the strategic expansion into new states as jurisdictions legalize retail and online sports betting, iGaming and online horse race wagering.

Sports Brand Partnerships — Caesars Sportsbook has partnerships with the NFL, NBA, NHL, MLB, and several individual teams. We have continued to create new partnerships among professional sports teams and entered into a 20-year exclusive naming-rights partnership branding the Caesars Superdome in New Orleans in 2021. Our strategy includes developing local and national partnerships that align our sportsbooks, casinos, resorts and brands with sports fans. We have high-profile exclusive sports entertainment partnerships with the NFL, making Caesars the first-ever “Official Casino Sponsor” in the history of the league. This historic partnership combines the NFL’s legendary events with our properties to bring unique experiences to our patrons. This includes exclusive rights to use NFL trademarks to promote our properties and enabling Caesars to host exclusive special events and experiences.

Food and Beverage Operations

Our food and beverage operations generate revenues from our dining venues, bars, nightclubs, and lounges located throughout our casinos and represented approximately 15% of our total net revenues in 2024. Many of our properties include several dining options, ranging from upscale dining experiences to moderately-priced restaurants, some of which offer pickup or in-room delivery options.

Hotel Operations

Hotel operations generate revenues from hotel stays at our properties in our approximately 45,600 guest rooms and suites and represented approximately 18% of our total net revenues in 2024. Our properties operate at various price and service points, allowing us to host a variety of casino guests, who are visiting our properties for gaming and other casino entertainment options, and non-casino guests who are visiting our properties for other purposes, such as vacation travel or conventions.

Management and Branding Arrangements

We earn revenue from fees paid for the management of other hotels and casinos in North America. Managed properties represent Caesars-branded properties where we provide certain staffing and management services under management agreements. In addition, we authorize the use of certain brands and marks of Caesars Entertainment, Inc. from which we earn revenue from fees received based on the arrangements.

Entertainment and Other Non-Gaming Operations

We provide a variety of retail and entertainment offerings at our properties. We operate various entertainment venues across the United States, including the Colosseum at Caesars Palace Las Vegas and PH Live at Planet Hollywood Resort & Casino. These award-winning entertainment venues host or have announced plans to host, prominent headliners such as Garth Brooks, The Killers, Rod Stewart, Jerry Seinfeld, Kelly Clarkson, Shania Twain, Scorpions and Blake Shelton.

On December 12, 2024, we sold the LINQ Promenade, which is an open-air dining, entertainment, and retail development located between The LINQ Hotel & Casino and Flamingo Las Vegas. The retail stores offer guests a wide range of options from high-end brands and accessories to souvenirs and decorative items. We continue to operate the High Roller, a 550-foot observation wheel, and Fly LINQ, the first and only zipline on the Las Vegas Strip located between the LINQ Hotel & Casino and Flamingo Las Vegas.

CAESARS FORUM is a 550,000 square-foot state-of-the-art conference center located at the center of the Las Vegas Strip. CAESARS FORUM can accommodate more than 10,000 participants and features more than 300,000 square feet of flexible meeting space, the two largest pillarless ballrooms in the world, a LEED silver-rated FORUM Plaza, and the first 100,000 square-foot outdoor meeting and event space in Las Vegas.

Market Activities

Trends

Economic Factors Impacting Discretionary Spending — Gaming and other leisure activities we offer represent discretionary expenditures which may be sensitive to economic downturns which impacts the behavior among the components of our customer mix differently.

We continue to monitor the effects of recent inflation and the possible implications on certain customers most affected by lower discretionary income. In addition, our leases with VICI are impacted by inflation as they are subject to annual escalators based on the Consumer Price Index (“CPI”).

We are also continuing to monitor interest rates which have a direct impact on certain of our debt instruments, in addition to an effect on consumer spending. We evaluate projected changes in interest rates when entering into borrowing arrangements and manage our mix of fixed versus variable debt accordingly.

We continue to manage the economic challenges affecting our industry and our Company that arise including labor shortages, higher labor costs, supply chain disruptions, increased costs of goods and services, among other impacts. Further discussion of the effects of these trends are described throughout this Form 10-K. The extent and duration of these trends is uncertain and may intensify.

Online Betting and Gaming — Online betting and gaming is a rapidly developing sector of the e-commerce industry and we believe the digital segment of the global betting and gaming industry will continue to grow in popularity and consumer confidence. The market for online betting platforms is being driven by the increased use of digital processes and growing bettor demand. We anticipate that the United States market will continue to have a strong and steady uptake in active wagers as state-by-state legislation in the United States continues to evolve resulting in new opportunities in the United States sports betting market. The extent and future effects of online betting and gaming on our casino properties is uncertain but we expect that our online betting and gaming offerings will be complementary to our overall brick-and-mortar casino business.

Competition

The casino entertainment business is highly competitive. The industry is composed of a diverse group of competitors that vary considerably in size and geographic diversity, quality of facilities and amenities available, marketing and growth strategies, and financial condition. In most regions, we compete directly with other casino facilities operating in the immediate and surrounding areas. There has been increased competition from openings of newly developed casinos and plans of development in certain regions, including new tribal expansions throughout the United States. In Las Vegas, our largest jurisdiction, there have been openings and proposals for other large scale gaming and non-gaming development projects by various other developers and local casino operators. In response to changing trends, Las Vegas operators have been focused on expanding their non-gaming offerings, including upgrades to hotel rooms, new food and beverage offerings, and new entertainment offerings. Our Las Vegas Strip hotels and casinos also compete, in part, with each other.

In recent years, many casino operators, including us, have been reinvesting in existing facilities, developing or rebranding new casinos or complementary facilities, and acquiring established facilities. These reinvestment and expansion efforts combined with aggressive marketing strategies by us and many of our competitors have resulted in increased competition in many regions. As companies have completed new expansion projects, supply has grown at a faster pace than demand in some areas. The expansion of properties and entertainment venues into new jurisdictions also presents competitive pressures.

Our properties also compete with legalized gaming from casinos located on Native American tribal lands. While the competitive impact on operations in Las Vegas from the continued growth of Native American gaming establishments in California remains uncertain, the proliferation of gaming in California and other areas located in the same regions as our properties could have an adverse effect on our results of operations. In some instances, particularly in the case of Native American casinos, our competitors pay lower taxes or no taxes. In addition, certain states have legalized, and others may legalize, casino gaming in specific areas, including metropolitan areas from which we traditionally attract customers. These factors create additional challenges for us in competing for customers and accessing cash flow or financing to fund improvements for our casino and entertainment products that enable us to remain competitive.

We also compete with other non-gaming resorts and vacation areas, various other entertainment businesses, and other forms of gaming, such as state lotteries, on-track and off-track wagering, video lottery terminals, and card parlors. Our non-gaming offerings also compete with other retail facilities, amusement attractions, food and beverage offerings, and entertainment venues. Internet gaming and sports betting may also create additional competition in certain jurisdictions that our brick-and-mortar properties are located.

We face significant competition in our online sports betting, online horse racing wagering and iGaming businesses in jurisdictions where we currently operate and those jurisdictions in which we wish to expand. We continue to face new forms of competition with the advancement of other mobile sports betting, daily fantasy sports, sweepstakes betting products and other products by operators in similar jurisdictions in which we operate, as well as operators which are unregulated and operate outside of the United States. Although we have experienced recent success in obtaining approval for sports betting and iGaming licenses in new jurisdictions, new state launches may require significant upfront investment and may not be successful.

Resources Material to Business

Rewards Programs

We believe Caesars Rewards enables us to compete more effectively and capture a larger share of our customers’ entertainment spending when they travel among regions or engage in online wagering and gaming versus that of a standalone property, which is core to our cross-market strategy.

Caesars Rewards members earn Reward Credits for qualifying gaming activities, including sports betting, online gaming and iGaming apps and wagering in the Caesars Sportsbook, Caesars Palace Online Casino, Horseshoe Online Casino, and Caesars Racebook apps. Members also earn Reward Credits for qualifying hotel, dining and retail spending at most Caesars Entertainment destinations in the United States and Canada. Additionally, Reward Credits are earned when members use their Caesars Rewards VISA credit card or make a purchase through a Caesars Rewards partner. Members can redeem their earned Reward Credits for those same experiences.

Caesars Rewards is structured by member tier level (designated as Gold, Platinum, Diamond, Diamond Plus, Diamond Elite or Seven Stars) and member value. This structure allows a member to progressively access the full range of benefits available across our portfolio of destinations as they progress through tier levels. Caesars Rewards is designed to cultivate a gratifying and frictionless relationship with our customers, motivating members to enhance both their frequency of visits and expenditures. Additionally, member data is utilized in conjunction with diverse marketing promotions. This includes campaigns spanning direct mail, email, our websites, mobile devices, social media, and interactive slot machines.

Intellectual Property and Resources

We use a variety of trade names, service marks, trademarks, patents and copyrights in our operations and believe that we have the rights necessary to conduct our continuing operations. The development of intellectual property is part of our overall business strategy. We regard our intellectual property to be an important element of our success. We file applications for and obtain patents, trademarks and copyrights in the United States and foreign countries where we believe filing for such protection is appropriate. While our business as a whole is not substantially dependent on any one patent, trademark, or copyright, we seek to establish and maintain our proprietary rights in our business operations and technology through the use of patents, trademarks, copyrights, and trade secret laws. We also seek to maintain our trade secrets and confidential information by nondisclosure policies and through the use of appropriate confidentiality agreements. Our United States patents have varying expiration dates.

We have not applied for the registration of all of our trademarks, copyrights, proprietary technology, or other intellectual property rights, as the case may be, and may not be successful in obtaining all intellectual property rights for which we have applied. Despite our efforts to protect our proprietary rights, parties may infringe upon our intellectual property and use information that we regard as proprietary, and our rights may be invalidated or unenforceable. The laws of some foreign countries do not protect proprietary rights or intellectual property to as great of an extent as do the laws of the United States. In addition, others may independently develop substantially equivalent intellectual property.

We own or have the right to use proprietary rights to a number of trademarks that we consider, along with the associated name recognition, to be valuable to our business, including Eldorado, Silver Legacy, Isle, Lady Luck, Tropicana, Circus Circus, Caesars, Flamingo, Harrah’s, Horseshoe, Paris, Planet Hollywood, Caesars Rewards, Caesars Sportsbook, and William Hill.

As of December 31, 2024, our Caesars Sportsbook app is powered by our Liberty platform. The Liberty platform resulted in a significant upgrade to our user interface and significant product upgrades including numerous pre-match and live markets, extensive odds and flexible limits, player props, and same-game parlays. Our Liberty platform also integrates customers with the Caesars Rewards loyalty program. In addition, we and NYRABets LLC, the official online wagering platform of the New York Racing Association, Inc., have launched the Caesars Racebook app in 22 jurisdictions. The Caesars Racebook app provides access for pari-mutuel wagering at over 300 racetracks around the world. Wagers placed can earn credits towards the Caesars Rewards loyalty program.

Industry Overview

Seasonality

We believe that business at our regional properties outside of Las Vegas is subject to seasonality, including seasonality based on the weather in the region in which they operate and the travel habits of visitors. Business in our properties can also fluctuate due to specific holidays or other significant events, particularly when a holiday falls in a different quarter than the prior year, the timing of the WSOP tournament (with respect to our Las Vegas properties), city-wide conventions, large sporting events or concerts, or visits by our premium players. We also believe that any seasonality, holiday, or other significant event may affect our various properties or regions differently. We may also experience seasonality with retail and online sports betting which coincides with certain sporting events, as well as seasons of professional sports teams.

Gaming Licenses and Governmental Regulations

The gaming and racing industries are highly regulated, and we must maintain our licenses and pay gaming taxes to continue our operations. We are subject to extensive regulation under laws, rules and supervisory procedures. These laws, rules and regulations generally concern the responsibility, financial stability and characters of the owners, managers, and persons with financial interests in the gaming operations. If additional gaming regulations are adopted in a jurisdiction in which we operate, such regulations could impose restrictions or costs that could have a significant adverse effect on us. From time to time, various proposals have been introduced in legislatures of jurisdictions in which we have operations that, if enacted, could adversely affect the tax, regulatory, operational or other aspects of the gaming industry and us. We do not know whether or when such legislation will be enacted. Gaming companies are currently subject to significant state and local taxes and fees in addition to normal federal and state corporate income taxes, and such taxes and fees are subject to increase at any time. Any material increase in these taxes or fees could adversely affect us.

Some jurisdictions, including those in which we are licensed, empower their regulators to investigate participation by licensees in gaming outside their jurisdiction and require access to periodic reports respecting those gaming activities. Violations of laws in one jurisdiction could result in disciplinary action in other jurisdictions.

Under provisions of gaming laws in jurisdictions in which we have operations, and under our organizational documents, certain of our securities are subject to restriction on ownership which may be imposed by specified governmental authorities. The restrictions may require a holder of our securities to dispose of the securities or, if the holder refuses, or is unable to dispose of the securities, we may be required to repurchase the securities.

A more detailed description of the regulations to which we are subject is contained in Exhibit 99.1 to this Annual Report on Form 10-K, which is incorporated herein by reference.

Internal Revenue Service Regulations, Bank Secrecy Act & Anti-Money Laundering

The Internal Revenue Service requires operators of casinos and online sports betting apps located in the United States to file information returns for U.S. citizens, including names and addresses of winners for certain table games, keno, bingo, slot machine and retail and online sports betting winnings in excess of stipulated amounts. The Internal Revenue Service also requires operators to withhold taxes on some table games, keno, bingo, slot machine and retail and online sports betting winnings of nonresident aliens. We are unable to predict the extent to which these requirements, if extended, might impede or otherwise adversely affect operations of, and/or income from, other games.

Regulations adopted by the Financial Crimes Enforcement Network of the Treasury Department (“FINCEN”) requires the reporting of currency transactions in excess of $10,000 occurring within a gaming day, including identification of the patron by name and social security number. This reporting obligation began in May 1985 and may have resulted in the loss of gaming revenues to jurisdictions outside the United States which are exempt from the ambit of these regulations. In addition to currency transaction reporting requirements, suspicious financial activity is also required to be reported to FINCEN.

Caesars maintains a comprehensive risk-based Bank Secrecy Act (“BSA”) and Anti-Money Laundering (“AML”) program. It includes strong governance and effective internal controls and procedures to comply with applicable BSA requirements, regulatory guidance, and any related laws, and to take measures to prevent its affiliated casinos from being used for money laundering or other criminal activity. Execution of the program is governed with reference to FINCEN’s guidance on the Culture of Compliance. Caesars’ internal AML Policy, Know Your Customer Policy and BSA Identification Policy outline the Caesars AML Program and set the minimum standards for the related procedures and internal controls of the Caesars casino affiliates. Certain employees are required to complete annual trainings related to company policies, including AML.

Other Laws and Regulations

Our businesses are subject to various federal, state and local laws and regulations in addition to gaming regulations. These laws and regulations include, but are not limited to, restrictions and conditions concerning alcoholic beverages, food service, smoking, environmental matters, employees and employment practices, currency transactions, taxation, zoning and building codes, and marketing and advertising. Such laws and regulations could change or could be interpreted differently in the future, or new laws and regulations could be enacted. Material changes, new laws or regulations, or material differences in interpretations by courts or governmental authorities could adversely affect our operating results.

The sale of alcoholic beverages is subject to licensing, control and regulation by applicable local regulatory agencies. All licenses are revocable and are not transferable. The agencies involved have full power to limit, condition, suspend or revoke any license, and any disciplinary action could, and revocation would, have a material adverse effect upon our operations.

We also deal with significant amounts of cash in our operations and are subject to various reporting and anti-money laundering regulations. Such laws and regulations could change or could be interpreted differently in the future, or new laws and regulations could be enacted. Material changes, new laws or regulations, or material differences in interpretations by courts or governmental authorities could adversely affect our operating results. See Item 1A, “Risk Factors,” for additional discussion. Taxation

Gaming companies are typically subject to significant taxes and fees in addition to normal federal, state and local income taxes, and such taxes and fees are subject to increase at any time. We pay substantial taxes and fees with respect to our operations. From time to time, federal, state, local and provincial legislators and officials have proposed changes in tax laws, or in the administration of such laws, affecting the gaming industry. It is not possible to determine with certainty the likelihood of changes in tax laws or in the administration of such laws.

Environmental Matters

We are subject to various federal, state and local environmental, health and safety laws and regulations, including but not limited to air quality, indoor air quality, water quality, bulk storage of regulated materials, and disposal of waste, including hazardous waste. Such laws and regulations can impose liability on potentially responsible parties (owner/operators of real property) to clean up, or contribute to the cost of cleaning up, sites at which regulated materials were disposed of or released. In addition to investigation and remediation liabilities that could arise under such laws and regulations, we could face personal injury, property damage, fines or other claims by third parties concerning environmental compliance, contamination or exposure to hazardous conditions. Environmental regulatory violations also include monetary penalties assessed by the jurisdictional regulatory agency and civil or criminal penalties for intentional negligence. Occasionally and under certain circumstances, we have investigated and remediated (or contributed to remediation costs) contamination located at or near our facilities. Examples included contamination related to underground storage tanks and groundwater contamination arising from prior uses of land on which certain facilities are located. In addition, we have and continue to contain, manage, and dispose of manure and wastewater generated by concentrated animal feeding operations due to our racetrack operations; manage, abate, or remove indoor air quality concerns such as mold, lead, or asbestos-containing materials; and manage operations within applicable environmental permitting requirements. Although we have incurred and expect to incur costs related to various environmental matters such as investigations, remediation, and management of hazardous materials or conditions known or discovered to exist at our properties, those costs have not had, and are not expected to have, a material adverse effect on our financial condition, results of operations or cash flow. However, such matters in the future could have a material adverse effect on our business.

Climate Change

There has been an increasing focus of international, national, state, regional and local regulatory bodies on greenhouse gas (“GHG”), including carbon emissions, and climate change issues. Future regulation could impose stringent standards to substantially reduce GHG emissions. Legislation to regulate GHG emissions has periodically been introduced in the U.S. Congress. Some Administrations have taken steps to further regulate GHG emissions. Those reductions could be costly and difficult to implement or estimate.

Beyond financial and regulatory effects, the projected severe effects of climate change – such as property damage or supply chain issues stemming from extreme weather events – has already and may continue to directly affect our facilities and operations. We recognize the impacts of climate change and are engaged in long-term initiatives to identify, assess, and manage the risks and opportunities associated with climate change (see “Environmental Stewardship” below).

Reporting and Record-Keeping Requirements

We are required periodically to submit detailed financial and operating reports and furnish any other information about us and our subsidiaries that gaming authorities may require. We are required to maintain a current stock ledger that may be examined by gaming authorities at any time. If any securities are held in trust by an agent or by a nominee, the record holder may be required to disclose the identity of the beneficial owner to gaming authorities. A failure to make such disclosure may be grounds for finding the record holder unsuitable. Gaming authorities may, and in certain jurisdictions do, require certificates for our securities to bear a legend indicating that the securities are subject to specified gaming laws.

Human Capital Management

We aim to provide a workplace that is engaging, empowering, inclusive and respectful for all employees (our “Team Members”), embracing a culture of openness, passion for service and recognition. Our ongoing investment in professional training and development, safety, health and wellbeing, and Team Member recognition linked to guest satisfaction and community engagement are all important drivers of our success in delivering strong business results and creating value. We have approximately 50,000 Team Members throughout our organization, excluding all tribal partnerships.

Labor Relations

Approximately 22,000, or 44% of our Team Members, are covered by collective bargaining agreements with certain of our subsidiaries. The majority of these employees in various job positions are covered by the following agreements:

| | | | | | | | | | | | | | | | | | | | |

| Employee Group | | Approximate Number of Active Employees Represented | | Union | | Expiration Date of Collective Bargaining Agreement (a) |

| Las Vegas Culinary Employees | | 10,300 | | Culinary Workers Union, Local 226 | | September 30, 2028 |

| Atlantic City Food & Beverage and Hotel Employees | | 2,600 | | UNITE HERE, Local 54 | | May 31, 2026 |

| Las Vegas Dealers | | 2,000 | | United Auto Workers | | June 30, 2026 |

| Las Vegas Bartenders | | 1,300 | | Bartenders Union, Local 165 | | September 30, 2028 |

| Las Vegas Teamsters | | 1,200 | | Teamsters, Local 986 | | August 31, 2029 |

____________________

(a)The agreements are generally amendable 60 days prior to expiration date.

Talent acquisition and retention are key priorities. We maintain a wide range of channels for recruiting, including outreach to academic institutions, trade training centers, culinary institutions and nonprofits that help us source a dynamic pool of candidates who represent the communities in which we operate across the United States. We are committed to supporting Team Members throughout their career with Caesars and providing opportunities to achieve their professional goals.

We strive to inspire our Team Members through our mission, vision and values, and our Code of Commitment (described below). To evaluate our Team Member experience and our retention efforts, we monitor several Team Member measures, such as turnover rates and Team Member satisfaction. We send out Team Member experience surveys to help us further understand the drivers of engagement and areas where we can improve. These surveys are completed on a regular basis alongside additional surveys targeted at specific events within a Team Member cycle such as new hire onboarding and exit inquiries.

Our compensation and benefits programs are designed to attract, retain and motivate our Team Members. In addition to competitive salaries and wages, we provide a variety of short-term, long-term and incentive-based compensation programs to reward performance relative to key metrics relevant to our business. We offer comprehensive benefit options including, but not limited to, retirement savings plans, health insurance coverage (including medical, mental health, dental, vision and pharmacy), parental leave, educational assistance, training opportunities, company-paid life insurance and a Team Member assistance program.

We place utmost importance on creating a safe workplace for our Team Members, embedding procedures so that all our Team Members have the awareness, knowledge and tools to make safe working a habit.

We also maintain programs to help our Team Members improve their health and wellbeing. These programs strive to provide metrics to demonstrate improvements in health for participating Team Members and their covered family members. We continue to make enhancements to our offerings and wellbeing programs with a wide range of affordable options, mental health initiatives and onsite primary care clinics.

We remain focused on recruiting and retaining Team Members who represent the communities in which we operate and creating an inclusive environment where all Team Members and guests are welcome. We embrace the unique and dynamic perspectives of our workforce and are committed to providing a workplace where every individual feels valued and empowered to be their best. We are concluding our five-year workforce diversity goals established in 2020, continue to comply with demographic requirements as outlined by various regulators.

Corporate Social Responsibility

Caesars’ Board of Directors (the “Board”) and senior executives view corporate social responsibility (“CSR”) as an integral element in the way we do business, with the belief that being a good corporate citizen helps protect the Company against risk, contributes to improved performance and helps foster positive relationships with all those with whom we connect. The Board and our executive management are committed to being an industry leader in CSR. In 2024, the Board and our leadership continued to engage with our CEO-level external CSR Advisory Board composed of experts representing inclusion, social impact, sustainability, business strategy, academia and investors, and used their guidance to confirm our CSR priorities. These priorities are reflected in our 15th annual CSR report, published in 2024 in accordance with Global Reporting Initiative Standards.

CSR Committee of the Board

Caesars’ Board has a CSR committee that defines the duties and responsibilities of the Board in supporting delivery of our corporate purpose and CSR strategy.

Code of Commitment

Caesars is committed to being a responsible corporate citizen and environmental steward through our CSR strategy, PEOPLE PLANET PLAY. This is reflected in our Code of Commitment which is our public pledge to our guests, Team Members, communities, business partners and all those we reach that we will honor the trust they have placed in us through ethical conduct and integrity. We commit to:

•PEOPLE: Supporting the wellbeing of our Team Members, guests and local communities.

•PLANET: Taking care of the world we all call home.

•PLAY: Creating memorable experiences for our guests and leading responsible gaming practices in the industry.

PEOPLE PLANET PLAY Strategy

Our PEOPLE PLANET PLAY strategy defines how we meet the obligations of our Code of Commitment. PEOPLE PLANET PLAY establishes multi-year targets in key areas of impact, including science-based greenhouse gas emissions-reduction goals aligning with global best practices on climate change action. In 2022, we conducted a comprehensive CSR assessment to evaluate our assumptions. With the help of an external specialist, our assessment gathered input from internal and external stakeholders, reviewed multiple industry and environmental, social and governance (“ESG”) disclosures, standards and frameworks and yielded 21 material topics. Our materiality assessment is available on our website at www.investor.caesars.com within the ESG resource hub on our Corporate Social Responsibility page. We are in the process of reviewing and updating our materiality assessment.

Responsible Gaming

For more than thirty years, Caesars has maintained its Responsible Gaming (“RG”) program. We train tens of thousands of Team Members each year and a cohort of RG Ambassadors throughout our properties to identify guests in need of assistance and provide support. In recent years, Caesars has contributed to the National Center for Responsible Gaming, the National Council on Problem Gaming and other state programs to help advance responsible practices in the gaming industry. Caesars Digital also maintains responsible gaming programs tailored to each state in which it operates, participates in Caesars’ overarching Responsible Gaming program, and offers users in-application RG tools such as time on device restrictions and wagering limits. No customers under 21 years old are allowed to wager on any of our Caesars Sportsbook, Caesars Racebook and iGaming mobile apps.

Code of Ethics and Business Conduct

Caesars also maintains a Code of Ethics and Business Conduct (the “Code”) that includes standards designed to deter wrongdoing and to promote, amongst other standards, honest and ethical conduct and full, fair, accurate, timely and understandable disclosure in reports and documents that the Company files with the Securities and Exchange Commission.

Caesars’ Chief Legal Officer serves as the compliance officer of the Code and Caesars provides periodic training regarding the contents and importance of the Code.

Gaming Compliance Plan

Caesars also maintains an Amended and Restated Gaming Compliance Plan (the “Plan”), which is approved by various gaming regulators. The Plan is designed to implement procedures to enhance the likelihood that no activities of the Company or any affiliate of the Company will impugn the reputation and integrity of Caesars. The Plan also establishes a Compliance Committee that assists the Company in implementing its strict policy that its business be conducted with honesty and integrity, and in accordance with high moral, legal and ethical standards. Caesars’ Senior Vice President & Assistant General Counsel – Regulatory & Compliance serves as the Compliance Officer as defined by the Plan.

Environmental Stewardship

We take a proactive approach to environmental sustainability through our CodeGreen strategy established in 2007, striving to improve our performance across energy and GHG emissions efficiencies, reduction of water consumption and increasing diversion of waste from landfills. Caesars recognizes the impact climate change can play both on our business and the guests we serve. Identifying, assessing, and managing the risks and opportunities therefore plays a vital role in our long-term strategic thinking on climate and water, and how we approach our CSR goals. Our goals are based in science as part of our strategy to reduce our environmental impact.

In 2024, we updated our Scope 1 and 2 GHG emission reduction goals to align with a 1.5-degree Celsius limit to global warming, measured against a 2019 base year. Our goals were established using an absolute contraction approach and align with published guidance from the Intergovernmental Panel on Climate Change. We also reaffirmed our publicly stated goal to become carbon neutral by 2050 with interim absolute GHG emission reduction goal of 46.2% by 2030 measured against a 2019 base year. We have updated our inventory management plan to allow for ongoing management and reporting of Scope 1 and 2 emissions in accordance with industry standards and we have updated and restated our energy and GHG emissions data dating back to 2019. Between 2019 and 2023, Caesars delivered a reduction in absolute Scopes 1 and 2 GHG emissions of 20.7%. In 2024 we also set an absolute reduction target for Scope 3 emissions of 37.5% by 2035 against a 2022 baseline.

To achieve our goals, we have taken initiatives such as pursuing renewable energy sources and low-carbon options, including on site solar developments. For example, we have contracts to purchase energy from solar covered parking canopies completed at two Atlantic City properties, we installed solar covered parking at Harrah’s Pompano Beach and the Harrah’s Atlantic City convention center solar rooftop project is expected to be completed by the end of 2025. We also entered into long-term purchase power agreements for solar energy in Nevada from an on-site rooftop development at our Caesars Forum that is expected to go online by the end of 2025 as well as an off-site, utility-scale project. Our long-term goals include a continued focus on energy efficiency and conservation as well as evaluating additional renewable energy supply opportunities for each of our properties.

We voluntarily participate in the CDP (formerly the Carbon Disclosure Project), an international nonprofit that runs a global disclosure system for investors, companies, and regions to manage their environmental impacts. In 2024, Caesars scored a B for both water security and for climate change.

We are engaged in extensive waste reduction efforts across our facilities, including recycling, food donation, and manure composting. In 2023, we estimated our total waste diversion from landfills at 44%.

Community Investment

Caesars contributes to our local communities to help them develop and prosper, through funding community projects, Team Member volunteering and cash donations from the Caesars Foundation, a private foundation funded from our operating income. In 2024, the Caesars Foundation contributed $3.4 million to communities across the United States. During 2024, our Team Members, including Team Members through our tribal partnerships volunteered over 93,000 hours through the HERO program.

Available Information

We are required to file annual, quarterly and other current reports and information with the Securities and Exchange Commission (“SEC”). Because we submit filings to the SEC electronically, access to this information is available at the SEC’s website (www.sec.gov). This site contains reports and other information regarding issuers that file electronically with the SEC.

We make our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q, our Current Reports on Form 8-K, and all amendments to these reports, available free of charge on our corporate website (www.caesars.com/corporate) as soon as reasonably practicable after such reports are filed with, or furnished to, the SEC. In addition, our Code of Ethics and Business

Conduct and charters of the Audit Committee, Compensation Committee, Corporate Social Responsibility Committee, and the Nominating and Corporate Governance Committee are available on our website. We will provide reasonable quantities of electronic or paper copies of filings free of charge upon request. In addition, we will provide a copy of the above referenced charters to stockholders upon request.

References in this document to our website address do not incorporate by reference the information contained on the website into this Annual Report on Form 10-K.

Cautionary Statements Regarding Forward-Looking Information

This Annual Report on Form 10-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding our strategies, objectives and plans for future development or acquisitions of properties or operations, as well as expectations, future operating results, trends and other information that is not historical information. When used in this report, the terms or phrases such as “anticipates,” “believes,” “projects,” “plans,” “intends,” “expects,” “might,” “may,” “estimates,” “could,” “should,” “would,” “will likely continue,” and variations of such words or similar expressions and their negative forms are intended to identify forward-looking statements. These statements are made on the basis of management’s current views and assumptions regarding future events.

Forward-looking statements are based upon certain underlying assumptions, including any assumptions mentioned with the specific statements, as of the date such statements were made. Such assumptions are in turn based upon internal estimates and analyses of market conditions and trends, management plans and strategies, economic conditions and other factors. Such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control, and are subject to change. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend upon future circumstances that may not occur. Actual results and trends may differ materially from any future results, trends, performance or achievements expressed or implied by such statements. Forward-looking statements speak only as of the date they are made, and we assume no duty to update forward-looking statements. Forward-looking statements should not be regarded as a representation by us or any other person that the forward-looking statements will be achieved. Undue reliance should not be placed on any forward-looking statements. Some of the contingencies and uncertainties to which any forward-looking statement contained herein are subject include, but are not limited to, the following:

•our sensitivity to reductions in discretionary consumer spending as a result of downturns in the economy and other factors outside our control;

•projections of future results of operations or financial condition;

•expectations regarding our business and results of operations of our existing casino properties and prospects for future development;

•the impact of economic trends, inflation and public health emergencies on our business and financial condition;

•expectations regarding trends that will affect our market and the gaming industry generally, including expansion of internet betting and gaming, and the impact of those trends on our business and results of operations;

•our ability to comply with the covenants in the agreements governing our outstanding indebtedness and leases;

•our ability to meet our projected debt service obligations, operating expenses, and maintenance capital expenditures;

•expectations regarding availability of capital resources;

•our intention to pursue development opportunities and additional acquisitions and divestitures;

•the ability to identify suitable acquisition opportunities and realize growth and cost synergies from any future acquisitions;

•our ability to complete dispositions and divestitures and effectively reinvest the proceeds thereof;

•the impact of regulation on our business and our ability to receive and maintain necessary approvals for our existing properties, future projects and the operation of our online sportsbook, poker and iGaming applications;

•the effect of disruptions or corruption to our information technology and other systems and infrastructure;

•potential compromises of our information systems or unauthorized access to confidential information and customer data;

•the impact of the Data Incident (as defined below) and any other future cybersecurity breaches on our business, financial conditions and results of operations;

•factors impacting our ability to successfully operate our digital betting and iGaming platform and expand its user base;

•our ability to adapt to the very competitive environments in which we operate, including the online market;

•the impact of win rates and liability management risks on our results of operations;

•our reliance on third parties for strategic relationships and essential services;

•costs associated with investments in our online offerings and technological and strategic initiatives;

•risk relating to fraud, theft and cheating;

•our ability to collect gaming receivables from our credit customers;

•the impact of our substantial indebtedness and significant financial commitments, including our obligations under our lease arrangements;

•restrictions and limitations in agreements governing our debt and leased properties could significantly affect our ability to operate our business and our liquidity;

•financial, operational, regulatory or other potential challenges that may arise as a result of leasing of a number of our properties;

•the impact of governmental regulation on our business and the cost of complying or the impact of failing to comply with such regulations;

•changes in gaming taxes and fees in jurisdictions in which we operate;

•risks relating to pending claims or future claims that may be brought against us;

•changes in interest rates and capital and credit markets;

•the effect of seasonal fluctuations;

•our particular sensitivity to energy and water prices;

•deterioration in our reputation or the reputation of our brands;

•our reliance on information technology, particularly for our digital business;

•our ability to protect our intellectual property rights;

•our reliance on licenses to use the intellectual property of third parties and our ability to renew or extend our existing licenses;

•the effects of war, terrorist activity, acts of violence, natural disasters and other catastrophic events;

•increased scrutiny and changing expectations regarding our environmental, social and governance practices and reporting;

•our reliance on key personnel and the intense competition to attract and retain management and key employees in the gaming industry;

•work stoppages and other labor problems;

•our ability to secure and retain performers and other entertainment offerings on acceptable terms; and

•other factors described in Part II, Item 1A. “Risk Factors” contained herein and our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the SEC.

In light of these and other risks, uncertainties and assumptions, the forward-looking events discussed in this report might not occur. These forward-looking statements speak only as of the date on which this statement is made, even if subsequently made available on our website or otherwise, and we do not intend to update publicly any forward-looking statement to reflect events or circumstances that occur after the date on which the statement is made, except as may be required by law.

You should also be aware that while we, from time to time, communicate with securities analysts, we do not disclose to them any material non-public information, internal forecasts or other confidential business information. Therefore, you should not assume that we agree with any statement or report issued by any analyst, irrespective of the content of the statement or report. To the extent that reports issued by securities analysts contain projections, forecasts or opinions, those reports are not our responsibility and are not endorsed by us.

Item 1A. Risk Factors

Risks Relating to Operating Our Business

We face substantial competition and expect that such competition will continue.

The gaming industry is highly competitive and competition is intense in most of the markets in which we operate. We compete with a variety of gaming operations, including land-based casinos, dockside casinos, riverboat casinos, casinos located on racing tracks, casinos located on Native American reservations and other forms of legalized gaming such as video gaming terminals at bars, restaurants and truck stops and online gambling and sports betting. We also compete, to a lesser extent, with other forms of legalized gaming and entertainment such as bingo, pull tab games, card parlors, sportsbooks, fantasy sports websites, cruise line operations, pari-mutuel or telephonic betting on horse racing and dog racing, state-sponsored lotteries and, in the future, may compete with gaming at other venues. In addition, we compete more generally with other forms of entertainment for the discretionary spending of our customers. In some instances, particularly in the case of Native American casinos, our competitors pay lower taxes or no taxes.

In recent years, many casino and online gaming operators, including us, have reinvested in existing jurisdictions to attract new customers or to gain market share, thereby increasing competition in those jurisdictions. In particular, we and other online betting and gaming operators have undertaken extensive marketing campaigns and made significant investments in customer acquisition through pricing and promotional policies. In addition, in response to changing trends, Las Vegas operators have focused on expanding their non-gaming offerings, including upgrades to hotel rooms, new food and beverage offerings, and new entertainment offerings. The expansion of online betting and gaming in new jurisdictions and the growth of the number of competitors in the online betting and gaming market, the expansion of existing casino entertainment properties, the increase in the number of properties, and the aggressive marketing strategies of many of our competitors have increased competition in many markets in which we operate, and this intense competition is expected to continue. These competitive pressures have and are expected to continue to adversely affect our financial performance.

Our brick-and-mortar operations face increasing competition as a result of the expansion of legalized online gaming and betting, including our own online betting and gaming operations, in a number of the jurisdictions in which we operate. Additionally, we face new competition from sports event trading as derivatives products regulated by the Commodity Futures Trading Commission. This new competition purports to be available nationwide and is currently being offered by a growing number of providers. While we believe that we are well positioned to compete with new entrants to the betting and gaming market through our online betting and gaming offerings, the competitive dynamic is evolving and we cannot assure you that our results of operations will not be adversely impacted by the expansion of legalized online gaming and betting.

States that already have legalized casino gaming may further expand gaming, and other states that have not yet legalized gaming such as Texas, may do so in the future. We also compete with Native American gaming operations in California and other jurisdictions where Native American tribes operate large-scale gaming facilities or otherwise conduct gaming activities on Native American lands, which we expect will continue to expand. Further expansion of legalized casino gaming in jurisdictions in or near our markets or changes to gaming laws in states in which we have operations and in states near our operations could increase competition and could adversely affect our operations.

Increased competition may require us to make substantial expenditures in marketing, customer development and capital projects to maintain and enhance the competitive positions of our online and brick and mortar operations to increase the attractiveness and add to the appeal of our facilities and product offerings. Because a significant portion of our cash flow is required to pay obligations under our outstanding indebtedness and our lease obligations, there can be no assurance that we will have sufficient funds to undertake, or that we will be able to obtain sufficient financing to fund, such expenditures. If we are unable to make such expenditures, our competitive position could be negatively affected.

Our business is sensitive to reductions in discretionary consumer spending as a result of downturns in the economy and other factors outside our control.

Consumer demand for leisure activities such as casinos, hotels, racetracks, online betting, iGaming and other forms of hospitality or gambling is particularly sensitive to downturns in the economy, inflation and the associated impact on discretionary spending. Changes in discretionary consumer spending or consumer preferences brought about by factors such as perceived or actual general economic conditions, effects of declines in consumer confidence in the economy, the impact of high energy and food costs, rising interest rates, the increased cost of travel, decreased disposable consumer income and wealth, fears of war and future acts of terrorism, or widespread illnesses, epidemics, or similar public health emergencies, can have a material adverse effect on leisure and business travel, discretionary spending and other areas of economic behavior that directly impact the gaming and entertainment industries in general and could further reduce customer demand for the amenities and products that we offer. In addition, increases in gasoline prices, including increases prompted by global political and economic

instabilities, can adversely affect our casino operations because most of our patrons travel to our properties by car or on airlines that may pass on increases in fuel costs to passengers in the form of higher ticket prices.

Win rates (hold rates) for our casino operations depend on a variety of factors, some of which are beyond our control, and participation in the sports betting industry exposes us to trading, liability management and pricing risks. We may experience lower than expected profitability and potentially significant losses as a result of factors beyond our control or a failure to accurately determine odds.

The gaming industry is characterized by an element of chance. Accordingly, we employ theoretical win rates to estimate what a certain type of game, on average, will win or lose in the long run. In addition to the element of chance, win rates (hold percentages) are also affected by the spread of table limits and factors that are beyond our control, such as a player’s skill, experience and behavior, the mix of games played, the financial resources of players, the volume of bets placed, and the amount of time players spend gambling. As a result of the variability in these factors, the actual win rates at our casinos may differ from the theoretical win rates we have estimated and could result in the winnings of our gaming customers exceeding those anticipated. The variability of win rates (hold rates) also has the potential to negatively impact our financial condition, results of operations, and cash flows.

Our fixed-odds betting products involve betting where winnings are paid on the basis of the amounts wagered and the odds quoted. Odds are determined with the objective of providing an average return to the bookmaker over a large number of events. However, there can be significant variation in gross win percentage event-by-event and day-by-day. We have systems and controls that seek to reduce the risk of daily losses occurring on a gross-win basis, but there can be no assurance that these will be effective in reducing our exposure to this risk. As a result we may experience (and we have from time to time experienced) significant losses with respect to individual events or betting outcomes, in particular if large individual bets are placed on an event or betting outcome or series of events or betting outcomes. Any significant losses on a gross-win basis could have a material adverse effect on our business, financial condition and results of operations.

In addition, the odds that we offer in our sportsbook operations may occasionally contain an obvious error. Examples of such errors are inverted lines between teams, or odds that are significantly different from the true odds of the outcome in a way that all reasonable persons would agree is an error. If regulatory restrictions do not permit us to void or re-set odds to correct odds on bets associated with large obvious errors in odds making, we could be subject to covering significant liabilities.

We rely on third parties to provide services that are essential to the operation of our online betting and gaming business, including, player account management, geolocation and identity verification, payment processing and sports data.

We rely on third parties to provide services that are essential to the operation of our online betting and gaming business, including player account management, geolocation and identity verification systems to ensure we comply with laws and regulations, processing deposits and withdrawals made by our online users and providing information regarding schedules, results, performance and outcomes of sporting events to determine when and how bets are settled. Additionally, we rely on third-party sports data providers, such as SportRadar and Genius Sports, among others, to obtain accurate information regarding schedules, results, performance and outcomes of sporting events for our sportsbook product. We rely on this data to determine when and how bets are settled. The software, systems and services provided by our third-party providers may not meet our expectations, contain errors or weaknesses, be compromised or experience outages. A failure of such third-party systems to perform effectively, or any service interruption to those systems, could adversely affect our business by preventing users from accessing our online platform, delaying payment or resulting in errors in settling bets, which could give rise to regulatory issues relating to the operation of our business. By way of example, incorrect or misleading geolocation and identity verification data with respect to current or potential users received from third-party service providers may result in us inadvertently allowing access to our offerings to individuals who are not permitted to access them or otherwise inadvertently denying access to individuals who are permitted to access them, and errors or failures by our payment processors and sports data providers could result in a failure to timely and accurately process payments to and from users or errors in settling bets. Any such errors or failures could result in violations of applicable regulatory requirements and adversely affect our reputation and our ability to attract and retain our online users. Furthermore, negative publicity related to any of our third-party partners could adversely affect our reputation and brand, and could potentially lead to increased regulatory or litigation exposure.

In addition, if any of our third-party services providers terminates its relationship with us, is unable to maintain necessary regulatory approvals, or refuses to renew its agreement with us on commercially reasonable terms, we would have to find alternate service providers. We cannot be certain that we would be able to secure favorable terms from alternative service providers that are critical to the operation of our business or enter into alternative arrangements in a timely manner. Our digital business, results of operations and prospects would be adversely impacted by our inability or delay in securing replacement services that are sufficient to support our online business or are on comparable terms.

The growth of our digital business will depend, in part, on the success of our strategic relationships with third parties.

We rely on relationships with sports leagues and teams, media companies and other third parties in order to attract users to our offerings. For example, in 2019 we entered into an exclusive sports entertainment partnership with the NFL, making us the first ever “Official Casino Sponsor” in the history of the league. These relationships, along with providers of online services, search engines, social media, directories and other websites and e-commerce businesses direct consumers to our offerings. While we believe there are other third parties that could drive users to our online offerings, adding or transitioning to them may disrupt our business and increase our costs, and may require us to modify, limit or discontinue certain offerings. Furthermore, sports leagues, teams and venues may enter into exclusive partnerships with our competitors which could adversely affect our ability to offer certain types of wagers. In the event that any of our existing relationships or our future relationships fail to provide services to us in accordance with the terms of our arrangement, or at all, and we are not able to find suitable alternatives, our ability to cost effectively attract consumers could be impacted and our online betting and gaming business, financial condition, results of operations and prospects could be adversely affected.

The growth of our digital business will require investments in our online offerings, technology and strategic marketing initiatives, which could be costly and negatively impact the economics of our online business.

The online betting and gaming industry is subject to rapid and frequent changes in standards, technologies, products and service offerings, as well as in customer demands and preferences and regulations, which will require us to continually introduce and successfully implement new and innovative technologies, marketing strategies, product offerings and enhancements to remain competitive and effectively stimulate customer demand, acceptance and engagement. The process of developing new online offerings and systems is inherently complex and uncertain, and new offerings may not be well received by users, even if they are well-reviewed and of high quality. Developing new offerings and marketing strategies can also divert our management’s attention from other business issues and opportunities. New online offerings that attain market acceptance and aggressive marketing strategies implemented in the competitive online market environment could impact the mix of our existing business, including our casino business, or the share of our patron’s wallets in a manner that could negatively impact our results of operations. In addition, online betting and gaming operates in a competitive environment that requires significant investment in marketing initiatives, including free play and use of a variety of free and paid marketing channels, including television, radio, social media platforms, such as Facebook, Instagram, X (formerly known as Twitter), and other digital channels. We cannot be sure that our investments in technology, products, service offerings and marketing initiatives will be successful or generate the return on investment that we expect. We have incurred losses in the past in our digital business and cannot be sure that our profitability will continue. If new or existing competitors offer more attractive offerings or engage in marketing initiatives that are better received by customers, we may lose users or users may decrease their spending on our offerings. Further, new customer demands, superior competitive offerings, new industry standards or changes in the regulatory environment could render our offerings unattractive, unmarketable or obsolete and require us to make substantial unanticipated changes to our technology or business model. Failure to adapt to a rapidly changing market or evolving customer demands, and costs required to be incurred to react to dynamic market conditions, could harm our business, financial condition, results of operations and prospects.

We face the risk of fraud, theft, and cheating.

We face the risk that gaming customers may attempt or commit fraud or theft or cheat in order to increase winnings. Such acts of fraud, theft, or cheating could involve the use of counterfeit chips or other tactics, possibly in collusion with our employees. Internal acts of cheating could also be conducted by employees through collusion with dealers, surveillance staff, floor managers, or other casino or gaming area staff. Additionally, we also face the risk that customers may attempt or commit fraud or theft with respect to our non-gaming offerings or against other customers. Such risks include stolen credit or charge cards or cash, falsified checks, theft of retail inventory and purchased goods, and unpaid or counterfeit receipts. Failure to discover such acts or schemes in a timely manner could result in losses in our operations. Negative publicity related to such acts or schemes could have an adverse effect on our reputation, potentially causing a material adverse effect on our business, financial condition, results of operations, and cash flows.

We extend credit to a portion of our customers, and we may not be able to collect gaming receivables from our credit customers.

We conduct our gaming activities on a credit and cash basis. Any such credit we extend is unsecured. High-stakes players typically are extended more credit than customers who tend to wager lower amounts. High-end gaming is more volatile than other forms of gaming, and variances in win-loss results attributable to high-end gaming may have a significant positive or negative impact on cash flow and earnings in a particular period. We extend credit to those customers whose level of play and financial resources warrant, in the opinion of management, an extension of credit. These large receivables could have a significant impact on our results of operations if deemed uncollectible. Gaming debts evidenced by a credit instrument,

including what is commonly referred to as a “marker,” and judgments on gaming debts are enforceable under the current laws of the jurisdictions in which we allow play on a credit basis, and judgments on gaming debts in such jurisdictions are enforceable in all U.S. states under the Full Faith and Credit Clause of the U.S. Constitution; however, other jurisdictions may determine that enforcement of gaming debts is against public policy. Although courts of some foreign nations will enforce gaming debts directly and the assets in the U.S. of foreign debtors may be reached to satisfy a judgment, judgments on gaming debts from U.S. courts are not binding on the courts of many foreign nations.

In addition, the Chinese government has taken steps to prohibit the transfer of cash for the payment of gaming debts. These developments may have the effect of reducing the collectability of gaming debts of players from China. It is unclear whether these and other measures will continue to be in effect or become more restrictive in the future. These and any future foreign currency control policy developments that may be implemented by foreign jurisdictions could significantly impact our business, financial condition and results of operations.

The outbreak of pandemics and other public health matters and related impacts have had, and may once again have, a significant impact on our operations and results of operations.

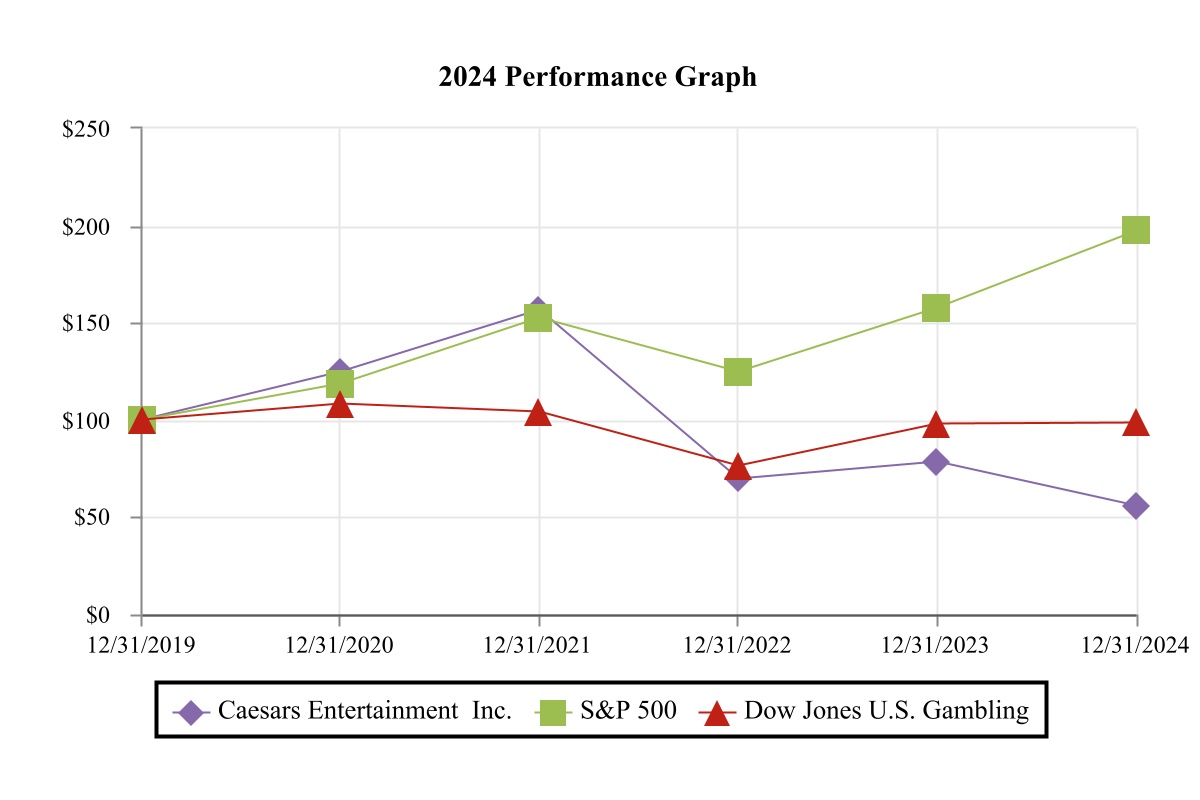

Public health issues and mitigation measures recommended or required by public health officials have had a material adverse effect on our operations. For example, all of our casino properties were temporarily closed for several weeks during 2020 due to orders issued by various government agencies and tribal bodies. Following re-opening of our properties, our operations were affected by social distancing measures, including reduced gaming operations, limitations on number of customers present in our facilities, restrictions on hotel, food and beverage outlets and limits on events that would otherwise attract customers to our properties. As required restrictions were eased, prolonged impacts on the economy, our industry and our business continued, with increased challenges arising from labor shortages, higher labor costs, supply chain challenges, increasing costs of goods and services, inflation and rising interest rates, among other impacts. The extent and duration of the impact of such measures on our business in the future is difficult to predict and could have a material adverse effect on our business, financial condition, results of operations, and cash flows.