UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||||||||||||||

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||||||||

For the fiscal year ended June 30, 2024

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||||||||

For the transition period to

Commission file number: 001-36290

MALIBU BOATS, INC.

(Exact Name of Registrant as specified in its charter)

| Delaware | 5075 Kimberly Way, Loudon, Tennessee 37774 | 46-4024640 | |||||||||||||||||||||

| (State or other jurisdiction of incorporation or organization) | (Address of principal executive offices, including zip code) | (I.R.S. Employer Identification No.) | |||||||||||||||||||||

| (865) 458-5478 | |||||||||||||||||||||||

| (Registrant’s telephone number, including area code) | |||||||||||||||||||||||

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Class A Common Stock, par value $0.01 | MBUU | Nasdaq Global Select Market | ||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ☑ | Accelerated filer | ☐ | |||||||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||||||||||||||||

| Emerging growth company | ☐ | |||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ | ||||||||||||||||||||

| Indicate by a check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. | ☑ | ||||

| If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. | ☐ | ||||

| Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). | ☐ | ||||

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | Yes | ☐ | No | ☑ | ||||||||||

As of December 31, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate value of the registrant’s common stock held by non-affiliates was approximately $1,088.5 million, based on the number of shares of Class A common stock held by non-affiliates as of December 31, 2023 and the closing price of the registrant’s Class A common stock on the Nasdaq Global Select Market on December 31, 2023. Shares held by each executive officer, director and by each person who owns 10% or more of the outstanding Class A common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes. The number of outstanding shares of the registrant’s Class A common stock, par value $0.01 per share, and Class B common stock, par value $0.01, as of August 23, 2024 was 20,012,691 and 12, respectively.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for the 2024 Annual Meeting of Stockholders are incorporated into Part III of this Annual Report on Form 10-K where indicated. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended June 30, 2024.

1

TABLE OF CONTENTS

| Page | ||||||||

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. All statements other than statements of historical facts contained in this Form 10-K are forward-looking statements, including statements regarding demand for our products and expected industry trends, our business strategy and plans, our prospective products or products under development, our vertical integration initiatives, our acquisition strategy and management’s objectives for future operations. In particular, many of the statements under the headings “Item 1A. Risk Factors,” “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Item 1. Business” constitute forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” the negative of these terms, or by other similar expressions that convey uncertainty of future events or outcomes to identify these forward-looking statements. These statements are only predictions, involving known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Such factors include, but are not limited to: our ability to accurately forecast demand for our products; our large fixed-cost base; our ability to execute our manufacturing strategy; increases in the cost of, or unavailability of, raw materials, component parts and transportation costs; disruptions in our suppliers’ operations; our reliance on third-party suppliers for raw materials and components; our reliance on certain suppliers for our engines and outboard motors; climate events in areas where we operate; our ability to meet our manufacturing workforce needs; our dependence on key management employees and our ability to transition to a new Chief Executive Officer; our ability to grow our business through acquisitions and integrate such acquisitions to fully realize their expected benefits; our growth strategy which may require us to secure significant additional capital; our ability to enhance existing products and develop and market new or enhanced products; our ability to protect our intellectual property; compromises or disruptions to our network and information systems; risks inherent in operating in foreign jurisdictions; general economic conditions; the continued strength and positive perception of our brands; the sale of boats previously held in inventory by our former dealer, Tommy's Boats, increased consumer preference for used boats, alternative fuel-powered boats or the supply of new boats by competitors in excess of demand; the seasonality of our business; competition within our industry and with other activities for consumers’ scarce leisure time; changes in currency exchange rates; inflation and rising interest rates; our reliance on our network of independent dealers and increasing competition for dealers; the financial health of our dealers and their continued access to financing; our obligation to repurchase inventory of certain dealers; our exposure to risks associated with litigation, investigation and regulatory proceedings; an impairment in the carrying value of goodwill, trade names and other long-lived assets any failure to comply with laws and regulations including environmental, workplace safety and other regulatory requirements; covenants in our credit agreement governing our revolving credit facility which may limit our operating flexibility; our obligation to make certain payments under a tax receivable agreement; and any failure to maintain effective internal control over financial reporting or disclosure controls or procedures.

We discuss many of these factors, risks and uncertainties in greater detail under the heading “Item 1A. Risk Factors” and elsewhere in this Form 10-K. These factors expressly qualify as forward-looking statements attributable to us or persons acting on our behalf.

You should not rely on forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Actual results may differ materially from those suggested by the forward-looking statements for various reasons, including those discussed under “Item 1A. Risk Factors” in this Form 10-K. Except as required by law, we assume no obligation to update forward-looking statements for any reason after the date of this Form 10-K to conform these statements to actual results or to changes in our expectations.

ii

SUMMARY OF RISK FACTORS

Our business involves significant risks and you are urged to carefully consider the risks discussed under Part I, Item 1A, "Risk Factors" in this Annual Report on Form 10-K prior to making an investment in our common stock. These risks include, but are not limited to, the following:

Risks Related to our Business and Operations

•We have a large fixed-cost base that will affect our profitability when our sales decrease.

•We may not be able to execute our manufacturing strategy successfully, which could cause the profitability of our products to suffer.

•We may not be able to accurately forecast demand for our products, which could impact our ability to manage our inventory and have a material adverse effect on our business and results of operations.

•Our financial results may be adversely affected by our third-party suppliers’ increased costs or inability to adjust for our required production levels due to changing demand or global supply chain disruptions.

•For some of the components used in production, we depend on a small group of suppliers and the loss of any of these suppliers could affect our ability to obtain components timely or at competitive prices, which would decrease our results of operations, financial condition, and cash flows.

•Termination or interruption of informal supply arrangements could have a material adverse effect on our business or results of operations.

•Climatic events, including hurricanes, tornadoes, or other disruptions, may adversely impact our operations and financial condition, disrupt the business of our suppliers, and may not be adequately covered by insurance.

•Our ability to meet our manufacturing workforce’s needs is crucial to our results of operations and future sales and profitability.

•We are dependent on attracting and retaining key management employees and the transition to our new Chief Executive Officer will be critical to our success.

•We have grown our business through acquisitions; however we may not be successful in completing future acquisitions or integrating future acquisitions in a way that fully realizes their expected benefits to our business.

•Our growth strategy may require us to secure significant additional capital, the amount of which will depend upon the size, timing, and structure of future acquisitions or vertical integrations and our working capital and general corporate needs.

•If we are unable to continue to enhance existing products and develop and market new or enhanced products that respond to customer needs and preferences, we may experience a decrease in demand for our products and our business could suffer.

Risks Related to Our Markets and the Recreational Powerboat Industry

•Weak general economic conditions, particularly in the United States, can negatively impact our industry, demand for our products, and our business and results of operations.

•Our continued success is dependent on the positive perception of our brands, which, if impaired, could adversely affect our sales.

•Our sales may be adversely impacted by the sale of boats previously held in inventory by our former dealer, Tommy’s Boats.

•Our sales may be adversely impacted by increased consumer preference for used boats, electric boats, alternative fuel-powered boats, or the supply of new boats by competitors in excess of demand.

•An increase in energy and fuel costs may adversely affect our business, financial condition and results of operations.

iii

•Retail demand for our boats is seasonal and unfavorable weather conditions just before and during spring and summer can have a negative effect on our revenues.

•Our industry is characterized by intense competition, which affects our sales and profits.

•We compete with a variety of other activities for consumers’ scarce leisure time.

•Changes in currency exchange rates can adversely affect our results.

•Inflation and rising interest rates could adversely affect our financial results.

Risks Related to our Dealers

•We depend on our network of independent dealers, face increasing competition for dealers and have little control over their activities.

•Our success depends, in part, upon the financial health of our dealers and their continued access to financing.

•We may be required to repurchase inventory of certain dealers.

Risks Related to Litigation and our Regulatory, Accounting and Tax Environment

•The nature of our business exposes us to risks associated with litigation, investigation and regulatory proceedings and a significant adverse determination with respect to any material claim against us could adversely affect our operating results or financial condition.

•An impairment in the carrying value of goodwill, trade names, and other long-lived assets could negatively affect our consolidated results of operations and net worth.

•Significant product repair and/or replacement costs due to product warranty claims or product recalls could have a material adverse impact on our results of operations.

•We must comply with environmental laws and regulations as a boat manufacturer that could increase the costs of our products and reduce consumer demand.

•In addition to environmental regulations, we must also comply with product safety, workforce and other laws and regulations that may increase our costs and could result in harm to our reputation if we fail to comply with such regulations.

Risks Related to our Capital Structure

•The only material asset of Malibu Boats, Inc. is our interest in the LLC, and therefore Malibu Boats, Inc. is dependent upon distributions from the LLC for any cash obligations of Malibu Boats, Inc.

•The credit agreement governing our revolving credit facility contains restrictive covenants which may limit our operating flexibility and may impair our ability to access sufficient capital to operate our business.

•Our variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase significantly.

•We will be required to pay the pre-IPO owners (or any permitted assignee) for certain tax benefits pursuant to our tax receivable agreement with them, and the amounts we may pay could be significant.

•In certain cases, payments under the tax receivable agreement to the pre-IPO owners (or any permitted assignees) of LLC Units may be accelerated or significantly exceed the actual benefits we realize in respect of the tax attributes subject to the tax receivable agreement.

iv

PART I.

Item 1. Business

Unless otherwise expressly indicated or the context otherwise requires, in this Annual Report on Form 10-K:

•We use the terms “Malibu Boats,” the “Company,” “we,” “us,” “our” or similar references to refer (1) prior to the consummation of our initial public offering, or "IPO" on February 5, 2014, to Malibu Boats Holdings, LLC, or the LLC, and its consolidated subsidiaries and (2) after our IPO, to Malibu Boats, Inc. and its consolidated subsidiaries;

•We use the term "Boats, LLC" to refer to the LLC's subsidiary Malibu Boats, LLC;

•We refer to the owners of membership interests in the LLC immediately prior to the consummation of the IPO, collectively, as our “pre-IPO owners”;

•We refer to owners of membership interests in the LLC (the "LLC Units"), collectively, as our “LLC members”;

•References to “fiscal year” refer to the fiscal year of Malibu Boats, which ends on June 30 of each year;

•We refer to our Malibu branded boats as "Malibu", our Axis Wake Research branded boats as "Axis", our Pursuit branded boats as "Pursuit", our Maverick, Cobia, Pathfinder and Hewes branded boats as "Maverick Boat Group", and our Cobalt branded boats as "Cobalt";

•We use the term “recreational powerboat industry” to refer to our industry group, which includes performance sport boats, sterndrive and outboard boats;

•We use the term “performance sport boat category” to refer to the industry category, consisting primarily of fiberglass boats equipped with inboard propulsion and ranging from 19 feet to 26 feet in length, which we believe most closely corresponds to (1) the inboard ski/wakeboard category, as defined and tracked by the National Marine Manufacturers Association, or NMMA, and (2) the inboard ski boat category, as defined and tracked by Statistical Surveys, Inc., or SSI;

•We use the terms “sterndrive” and “outboard” to refer to the industry category, consisting primarily of sterndrive and outboard boats ranging from 20 feet to 40 feet, which most closely corresponds to the sterndrive and outboard categories, as defined and tracked by NMMA, and the sterndrive and outboard propulsion categories, as defined and tracked by SSI; in some instances, we provide market information based on specific boat lengths or boat types within the sterndrive or outboard categories to reflect our performance in those specific markets in which we offer products; and

•References to certain market and industry data presented in this Form 10-K are determined as follows: (1) U.S. boat sales and unit volume for the overall powerboat industry and any powerboat category during any calendar year are based on retail boat market data from the NMMA and (2) U.S. market share and unit volume for the overall powerboat industry and any powerboat category during any fiscal year ended June 30 or any calendar year ended December 31 are based on comparable same-state retail boat registration data from SSI, for which data was available for all 50 states as of the date of this Form 10-K.

This Annual Report on Form 10-K includes our trademarks, such as “ Monsoon,” “Surf Gate,” “Wakesetter,” “Surf Band,” and “Swim Step,” which are protected under applicable intellectual property laws and are the property of Malibu Boats, Inc. This Form 10-K also contains trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this Form 10-K may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

Our Company

We are a leading designer, manufacturer and marketer of a diverse range of recreational powerboats, including performance sport boats, sterndrive and outboard boats under eight brands—Malibu, Axis, Pursuit, Maverick, Cobia, Pathfinder, Hewes and Cobalt. As of June 30, 2024, we had the #1 market share position in the United States in the performance sport boat category through our Malibu and Axis brands and the #1 market share position in the United States in the 24’—29’ segment of the sterndrive category through our Cobalt brand, and we are among the leading market share positions in the fiberglass outboard fishing boat market with our Pursuit and Maverick Boat Group brands. Our product portfolio of premium brands are used for a broad range of recreational boating activities including, among others, water sports such as water

1

skiing, wakeboarding and wake surfing, as well as general recreational boating and fishing. Our passion for consistent innovation, which has led to propriety technology such as Surf Gate, has allowed us to expand the market for our products by introducing consumers to new and exciting recreational activities. We design products that appeal to an expanding range of recreational boaters and water sports enthusiasts whose passion for boating and water sports is a key aspect of their lifestyle and provide consumers with a better customer-inspired experience. With performance, quality, value and multi-purpose features, our product portfolio has us well positioned to broaden our addressable market and achieve our goal of increasing our market share in the recreational boating industry.

Our flagship Malibu boats are designed for consumers seeking a premium performance sport boat experience and offer our latest innovations in performance, comfort and convenience. Our Axis boats appeal to consumers who desire a more affordable performance sport boat product but still demand high performance, functional simplicity and the option to upgrade key features. Our Pursuit boats expand our product offerings into the saltwater outboard fishing market and include center console, dual console and offshore models. Our Maverick Boat Group family of boats, including Maverick, Cobia, Pathfinder and Hewes, are highly complementary to Pursuit and its saltwater outboard offerings with a focus in length segments under 30 feet. Our Cobalt boats consist of mid to large-sized luxury cruisers and bowriders that we believe offer the ultimate experience in comfort, performance and quality.

Our boats are constructed of fiberglass, available in a range of sizes, hull designs and propulsion systems (i.e., inboard, sterndrive and outboard). We employ experienced product development and engineering teams that enable us to offer a range of models across each of our brands while consistently introducing innovative features in our product offerings. Our engineering teams closely collaborate with our manufacturing personnel in order to improve product quality and process efficiencies. The results of this collaboration are reflected in our receipt of numerous industry awards.

We sell our boats through a dealer network that we believe is among the strongest in the recreational powerboat industry. As of June 30, 2024, our distribution channel consisted of over 400 dealer locations globally. Our dealer base is an important part of our consumers’ experience, our marketing efforts and our brands. We devote significant time and resources to find, develop and improve the performance of our dealers and believe our dealer network gives us a distinct competitive advantage.

Market and Competitive Position

The recreational powerboat industry, including the performance sport boat, sterndrive and outboard categories, is highly competitive for consumers and dealers. Competition affects our ability to succeed in the markets we currently serve and new markets that we may enter in the future. We compete with several large manufacturers that may have greater financial, marketing and other resources than we do. We compete with large manufacturers who are represented by dealers in the markets in which we now operate and into which we plan to expand. We also compete with a wide variety of small, independent manufacturers. Competition in our industry is based primarily on brand name, price and product performance.

During calendar year 2023, retail sales of new recreational powerboats in the United States totaled $15.8 billion. Of the recreational powerboat categories defined and tracked by the NMMA, we serve three of the top four categories consisting of outboard, sterndrive and performance sport boat representing an addressable market of nearly $12.9 billion in retail sales through our Malibu, Axis, Pursuit, Maverick Boat Group brands and Cobalt brands. The following table illustrates the size of our addressable market in units and retail sales for calendar year 2023:

| Recreational Powerboat Category | Unit Sales | Retail Sales | ||||||||||||

| (Dollars in millions) | ||||||||||||||

| Outboard | 147,564 | $ | 10,427 | |||||||||||

| Performance sport boat | 9,900 | $ | 827 | |||||||||||

| Sterndrive | 6,100 | $ | 1,608 | |||||||||||

| Jet boat | 11,600 | $ | 734 | |||||||||||

| Cruisers | 1,500 | $ | 2,207 | |||||||||||

| Total addressable market | 176,664 | $ | 15,803 | |||||||||||

We maintain a leading market share position in a number of recreational boating categories with our various brands. According to SSI, as of June 30, 2024, we held the number one market share position in the United States for performance sport boats with our Malibu and Axis brands, the number one market share position in the United States for the 24’—29’ segment of the sterndrive boat category through our Cobalt brand, and we are among the leading market share positions in the outboard fiberglass fishing market that our Pursuit and Maverick Boat Group brands serve, in each case based on unit volume. We have grown our U.S. market share in the performance sports boat category from 24.5% in 2010 to 30.5% in 2023 and we have

2

expanded our market share in the 24’-29’ segment of the sterndrive boat category from 14.2% in 2010 to 40.8% in 2023. Our Pursuit brand has gained share within its market since our acquisition of Pursuit and we are positioned to gain a broader share of the overall outboard fiberglass fishing market with our Maverick Boat Group brands.

Our Products and Brands

We design, manufacture and sell recreational powerboats, including performance sport boats, sterndrive and outboard boats across eight brands: Malibu, Axis, Pursuit, Maverick, Cobia, Pathfinder, Hewes, and Cobalt. We believe that we deliver superior performance for general recreational purposes with a significant focus on water sports, including wakeboarding, water skiing and wake surfing as well as general recreational boating and fishing. In addition, we also offer various accessories and aftermarket parts. The following table provides an overview of our product offerings by brand as of June 30, 2024:

| Reportable Segment | Brand | Number of Models | Lengths | Retail Price Range (In thousands) | Description | ||||||||||||

| Malibu | Malibu | 12 | 20'-26' | $80-$300 | Malibu targets consumers seeking a premium boating experience with our latest innovations in performance, comfort and convenience. Across our three product lines, we offer a variety of products to customers from our Response Series tailored for high-performance water ski to highly customizable options in our Wakesetter series to our ultra premium models in the M Series. | ||||||||||||

| Axis | 7 | 20’-25’ | $80-$175 | Axis was formed to target a younger demographic by providing a more affordably priced, high quality, entry-level boat with high performance, functional simplicity and the option to upgrade key features such as Surf Gate. | |||||||||||||

| Saltwater Fishing | Pursuit | 16 | 25'-46' | $130-$1,400 | Pursuit is a premium brand of saltwater outboard fishing boats available in three product lines including our sports center consoles, dual consoles and our offshore series to provide customers with options for ideal fishing as well as casual cruising and luxury entertainment. | ||||||||||||

| Cobia | 11 | 21'-34' | $60-$500 | Cobia models consist of center console and dual console vessels that are designed to promote ease of boating and fishing for all levels of anglers and boaters. | |||||||||||||

| Pathfinder | 8 | 22'-27' | $60-$250 | Pathfinder provides the most versatile inshore fishing boat. The product of bay boats provides for dedicated anglers to fish and do so with comfort, safety and proven technology. | |||||||||||||

| Maverick and Hewes | 6 | 16'-21' | $45-$125 | Maverick and Hewes have been designed to tailor to shallow inshore flats anglers. These boats, with vacuum infused (VARIS) construction and enhanced performance, provide a legacy of dependability, unmatched ride, and exceptional craftsmanship. | |||||||||||||

| Cobalt | Cobalt | 16 | 22’-35’ | $75-$625 | Cobalt is a premium luxury sterndrive and outboard boat manufacturer available in five product lines. Our products tailor sterndrive from entry level to premium with options to expand some models with the patented Surf Gate, as well as our outboard series for increased saltwater use. | ||||||||||||

Innovative Features

In addition to the standard features included on all of our boats, we offer consumers a full selection of innovative optional features designed to enhance performance, functionality and the overall boating experience. We believe our innovative features drive our high average selling prices. Among our most successful and most innovative has been Surf Gate. Introduced in July 2012 and initially patented in September 2013, Surf Gate is available as an optional feature on all Malibu, Axis and certain Cobalt models. Surf Gate has revolutionized the increasingly popular sport of wake surfing. Prior to Surf Gate, boaters needed to empty ballast tanks on one side of the boat and shift passengers around to lean the boat to create a larger, more pronounced surf-quality wake. By employing precisely engineered and electronically controlled panels, Surf Gate alleviates this time-consuming and cumbersome process, allowing boaters to easily surf behind an evenly weighted boat without the need to wait for ballast changes. We have also developed our patented Surf Band technology that allows the rider to remotely control the surf wave, shape, size and side. Some of our other notable innovations include Power Wedge III, G5 and the power actuated G10+ Tower, Electronic Dashboard Controls, Flip Down Swim Step, Tower Mister, Splash and Stow and Cobalt's TruWave Technology. Pursuit also has introduced the industry first Electric Sliding Entertainment Center and sliding second row center

3

console seating. Maverick Boat Group has introduced first of its kind "Hybrid" and "Open" Bay Boat designs in recent years. We won the Boating Industry Magazine's "Top Product" award for the Pursuit S 358 Sport in 2022. Malibu Trailers took the coveted NMMA Innovation Award at the Miami International Boat Show in 2022. The Malibu Wakesetter 23 LSV has won Wakeworld “Readers Choice” Wakeboard and Wakesurf Boat of the Year four years running in 2023, 2022, 2021 and 2020.

We also offer an array of less technological, but nonetheless value-added boat features such as gelcoat upgrades, upholstery upgrades, engine drivetrain enhancements (such as silent exhaust tips, propeller upgrades and closed cooling engine configuration), sound system upgrades, bimini tops, boat covers and trailers which further increase the level of customization afforded to consumers.

Our Dealer Network

We rely on independent dealers to sell our products. We establish performance criteria that our dealers must meet as part of their dealer agreements to ensure our dealer network remains the strongest in the industry. As a member of our network, dealers may qualify for floor plan financing programs, rebates, seasonal discounts and other allowances. We believe our dealer network is the most extensive in the market.

North America

As of June 30, 2024, our dealer network consisted of over 300 dealer locations servicing the performance sport boat, sterndrive, and outboard markets strategically located throughout the U.S. and Canada. Approximately 50% of our dealer locations have been with us, or with Pursuit, Maverick Boat Group or Cobalt, prior to our acquisition of them, for over ten years. Our top ten dealers represented 40.4%, 41.1% and 39.9%, of our net sales for fiscal year 2024, 2023 and 2022, respectively. The top ten dealers for each of the Malibu, Saltwater Fishing and Cobalt segments represented approximately 47.8%, 62.4% and 52.2%, respectively, of net sales in fiscal year 2024. The top ten dealers for each segment are not the same across all segments. Sales to our dealers under common control of OneWater Marine, Inc. represented approximately 23.7%, 17.2% and 16.8% of consolidated net sales in fiscal years 2024, 2023 and 2022, respectively, including approximately 9.2%, 38.8% and 19.5% of consolidated sales in fiscal year 2024 for Malibu, Saltwater Fishing and Cobalt, respectively. Sales to our former dealers under common control of Tommy's Boats represented approximately 2.4%, 10.7% and 9.4% of our consolidated net sales in the fiscal years ended June 30, 2024, 2023 and 2022, respectively, including approximately 6.7%, 0.0% and 0.5% of consolidated sales in fiscal year 2024 for Malibu, Saltwater Fishing and Cobalt, respectively. During fiscal year 2024, we informed Tommy's Boats that we would not be renewing any of their agreements that had expired as of June 30, 2023 and we terminated two agreements in Texas that had not expired. Tommy's Boats subsequently filed for bankruptcy protection and is in the process of liquidating its inventory. We have since entered into dealer agreements with dealers in 14 of the 15 markets previously served by Tommy's Boats. As of August 29, 2024, we believe fewer than 280 of our new model year 2023 and 2024 boats were remaining in the inventory of Tommy's Boats. M&T Bank, the lender under the floor financing plan for Tommy's Boats, has a security interest in those boats. During the period from July 1, 2024 to August 29, 2024, we have repurchased 19 new model year 2024 boats totaling $2.5 million subject to our repurchase agreement with M&T Bank. With respect to boats not subject to the repurchase agreement, the bankruptcy trustee has retained Gordon Brothers to sell the remaining inventory as part of liquidation sales that are ongoing. We have been in discussions with the trustee regarding the inventory being liquidated. If the boats previously held by Tommy's Boats are sold at prices significantly below market value or in a manner that creates excess supply in a short period of time, it could have an adverse impact on our brands and create a downward pressure on our selling prices.

We consistently review our distribution network to evaluate the financial health of our dealers, identify opportunities to expand our geographic footprint and improve our coverage of the market. We believe that our diverse product offering and strong market position in each region of the United States helped us capitalize on growth opportunities as our industry recovered from the economic downturn. We have the ability to opportunistically add new dealers and new dealer locations to previously underserved markets and use data and performance metrics to monitor dealer performance. We believe our outstanding dealer network allows us to distribute our products more efficiently than our competitors.

International

We have an extensive international distribution network for our Malibu, Axis, Pursuit, Maverick Boat Group and Cobalt brands. As of June 30, 2024, our dealer network consisted of over 100 dealer locations throughout Europe, Asia, Middle East, South America, South Africa, and Australia/New Zealand.

Dealer Management

Our relationships with our dealers are governed by dealer agreements. Each dealer agreement has a finite term lasting between one and three years. Our dealer agreements also are typically terminable without cause by the dealer with 60 days prior

4

notice and by us for a dealer failing to meet performance criteria. We also may terminate these agreements immediately for cause upon certain events. Pursuant to our dealer agreements, the dealers typically agree to, among other things:

•represent our products at specified boat shows;

•market our products only to retail end users in a specific geographic territory;

•promote and demonstrate our products to consumers;

•meet or exceed mutually agreed performance standards during the term of the agreement in exchange for rebate or discount eligibility that varies according to the level of volume they commit to purchase;

•provide us with regular updates regarding the number and type of our products in their inventory;

•maintain a service department to service our products, and perform all appropriate warranty service and repairs; and

•indemnify us for certain claims.

Our dealer network, including all additions, renewals, non-renewals or terminations, is managed by our sales personnel. Our sales teams operate using a semi-annual dealer review process involving our senior management team. Each individual dealer is reviewed semi-annually with a broad assessment across multiple key elements, including the dealer’s geographic region, market share, customer service ratings, and financial health to identify underperforming dealers for remediation and to manage the transition process when non-renewal or termination is a necessary step.

We have developed a system of financial incentives for our dealers based on customer satisfaction and achievement of best practices. Our brands employ dealer incentive programs that have been refined through decades of experience at each brand and may, from time to time, include the following elements:

•Rebates. Our domestic dealers agree to volume commitments that are used to determine applicable rebates. The structure of the dealer incentive depends on the brand represented. If a dealer meets its volume commitments as well as other terms of the dealer performance program, the dealer is entitled to the specified amounts subject to full compliance with our programs. Failure to meet the commitment volume or other terms of the program may result in partial or complete forfeiture of the dealer’s rebate.

•Free flooring. Our dealers that take delivery of current model year boats in the offseason, typically July through April, are entitled to have us pay the interest to floor the boat until the earlier of (1) the retail sale of the unit or (2) a date near the end of the current model year. This program is an additional incentive to encourage dealers to order in the offseason and helps us balance our seasonal production.

Our dealer incentive programs are structured to promote more evenly distributed ordering throughout the fiscal year, which allows us to achieve better level-loading of our production and thereby generate plant operating efficiencies. In addition, these programs may offer further rewards for dealers who are exclusive to our brands.

Floor Plan Financing

Our North American dealers often purchase boats through floor plan financing programs with third-party floor plan financing providers. During fiscal year 2024, approximately 77% of our North American shipments were made pursuant to floor plan financing programs which our dealers participate in. These programs allow dealers across our brands to establish lines of credit with third-party lenders to purchase inventory. Under these programs, a dealer draws on the floor plan facility upon the purchase of our boats and the lender pays the invoice price of the boats. As is typical in our industry, we have entered into repurchase agreements with certain floor plan financing providers to our dealers. Under the terms of these arrangements, in the event a lender repossesses a boat from a dealer that has defaulted on its floor financing arrangement and is able to deliver the repossessed boat to us, we are obligated to repurchase the boat from the lender. Our obligation to repurchase such repossessed products for the unpaid balance of our original invoice price for the boat is subject to reduction or limitation based on the age and condition of the boat at the time of repurchase, and in certain cases by an aggregate cap on repurchase obligations associated with a particular floor financing program.

Our exposure under repurchase agreements with third-party lenders is mitigated by our ability to reposition inventory with a new dealer in the event that a repurchase event occurs. Historically, the primary cost to us of a repurchase event has been margin loss on the resale of a repurchased unit but we have generally been able to resell repurchased boats at an amount that exceeds our cost. We repurchased 17 units under our repurchase agreements during fiscal year 2024, and those units were subsequently resold during fiscal year 2024 above their cost. Additionally, during the period from July 1, 2024, to August 29,

5

2024, we repurchased 19 units totaling $2.5 million that were subject to our repurchase agreement with M&T Bank, the floor plan financing lender for Tommy's Boats. Pursuant to an order of the bankruptcy court, we agreed to repurchase those boats that were the subject of a repurchase agreement with M&T Bank and that had not otherwise been sold to customers. For fiscal years 2023 and 2022, we did not repurchase any boats under our repurchase agreements.

Marketing and Sales

We believe that providing a high level of service to our dealers and end consumers is essential to maintaining our reputation. Our sales personnel receive training on the latest Malibu, Axis, Pursuit, Maverick Boat Group and Cobalt products and technologies, as well as training on our competitors’ products and technologies, and attend trade shows to increase their market knowledge. This training is then passed along to our dealers to ensure a consistent marketing message and leverage our marketing expenditures. Malibu, Axis, Pursuit, Maverick Boat Group and Cobalt enjoy strong brand awareness, as evidenced by our substantial market share in their respective categories.

Our marketing strategy focuses on building brand awareness and loyalty in the performance sport boat market with Malibu and Axis brands and the outboard and sterndrive markets with Pursuit, Maverick Boat Group and Cobalt brands. Activating the marketing strategy involves creating custom content to be utilized in outbound marketing campaigns and social media to engage owners and prospects. In addition to retail websites developed for each of those brands and their unique consumers, the brands also manage all other aspects of marketing including traditional print advertising and trade shows.

Product Development and Engineering

We are strategically and financially committed to innovation, as reflected in our dedicated product development and engineering teams located in Tennessee, Kansas, California, and Florida and evidenced by our track record of new product introduction. As of June 30, 2024, our product development and engineering team consisted of approximately 70 professionals. These individuals bring to our product development efforts significant expertise across core disciplines, including boat design, trailer design, computer-aided design, electrical engineering and mechanical engineering. They are responsible for execution of all facets of our new product strategy, including identifying industry trends, designing new and refreshed boat models and new features, engineering these designs for manufacturing and integrating new features into our boats. In addition, our Chief Executive Officer and President have historically been actively involved in the product development process and integration into manufacturing.

Our product development strategy consists of a two-pronged approach. First, we seek to introduce new boat models to target unaddressed or underserved segments of the recreational powerboat industry, while also updating and refreshing our existing boat models regularly. Second, we seek to develop and integrate innovative new or enhanced optional feature offerings into our boats. We intend to release new products and features each model year, which we believe enhances our reputation as a leading innovator in boat manufacturing and provides us with a competitive advantage.

We take a disciplined approach to the management of our product development strategy. We use a formalized phase gate process, overseen by a dedicated project manager, to develop, evaluate and implement new product ideas for both boat models and innovative features. Application of the phase gate process requires management to establish an overall timeline that is sub-divided into milestones, or “gates,” for product development. Setting milestones at certain intervals in the product development process ensures that each phase of development occurs in an organized manner and enables management to become aware of and address any issues in a timely fashion, which facilitates on-time, on-target release of new products with expected return on investment. Extensive testing and coordination with our manufacturing group are important elements of our product development process, which we believe enable us to minimize the risk associated with the release of new products. Our phase gate process also facilitates our introduction of new boat models and features each model year, which we believe provides us with a competitive advantage in the marketplace. Finally, in addition to our process for managing new product introductions in a given fiscal year, we also engage in longer-term product life cycle and product portfolio planning.

Manufacturing

We have eight manufacturing facilities located in four U.S. states and Australia. We produce performance sport boats through our Malibu and Axis brands at our Tennessee and Australia manufacturing facilities; we produce sterndrive and outboard boats through our Cobalt brand at our Kansas and Tennessee manufacturing facilities; and we produce saltwater outboard boats under our Pursuit and Maverick Boat Group brands, as well as tooling parts, in Fort Pierce, Florida. We completed expansion projects at one of our Florida facilities (Maverick Boat Group) in fiscal year 2022 and at our other Florida facility (Pursuit Tooling) in fiscal year 2023. We also purchased a 260,000 square foot manufacturing facility near our Tennessee campus that we completed construction of in fiscal year 2024. For our Malibu and Axis brands, we manufacture towers, tower accessories and stainless steel and aluminum billet at our California facility and engines and trailers at our Tennessee facility.

6

Our boats are built through a continuous flow manufacturing process that encompasses fabrication, assembly, quality management and testing. Each boat is produced on an established cycle depending on model that includes the fabrication of the hull and deck through gelcoat application and fiberglass lamination, grinding and hole cutting, installation of components, rigging, finishing, detailing and on-the-water testing. Production of cruisers occurs on a dedicated line that allows for the increased time needed to add the additional content required for production of larger boats.

We have vertically integrated key components of our manufacturing process, including the manufacturing of our own engines, boat trailers, towers and tower accessories, machined and billet parts, soft grip flooring, and most recently, wiring harnesses. We began including our engines, branded as Malibu Monsoon engines, in our Malibu and Axis boats for model year 2019, and in fiscal year 2024 we began offering Monsoon sterndrive engines to our Cobalt dealers and customers. We believe our engine marinization initiative will reduce our reliance on our previous engine suppliers for our Malibu, Axis and Cobalt brands while reducing the risk that a change in cost or production from any engine supplier for such brands could adversely affect our business. Our trailers are produced in a continuous flow manufacturing process involving cutting and bending of the main frame from raw top grade carbon steel, painting using our state-of-the-art system and installation of components. Our tower-related manufacturing in California uses multiple computer-controlled machines to cut all of the aluminum parts required for tower assembly. We are the only performance sport boat company that manufactures towers in-house. In fiscal year 2022, we acquired a facility to begin manufacturing our own wiring harnesses. In fiscal year 2024, we relocated manufacturing of our own wiring harnesses to our Roane County, Tennessee facility. As a result of this acquisition, we reduced the risk of production delays due to delays in receipt of wiring harnesses from third-party suppliers. Vertical integration of key components of our boats also gives us the ability to increase incremental margin per boat sold by reducing our cost base and improving the efficiency of our manufacturing process. Additionally, it allows us to have greater control over design, consumer customization options, construction quality, and our supply chain. We continually review our manufacturing process to identify opportunities for additional vertical integration investments across our portfolio of premium brands. We procure other components, such as electronic controls, from third-party vendors and install them on the boat.

Suppliers

We purchase a wide variety of raw materials from our supplier base, including resins, fiberglass, hydrocarbon feedstocks and steel, as well as product parts and components, such as engines and electronic controls, through a purchase order process. The most significant component used in manufacturing our boats, based on cost, are engines. Through our vertical integration initiative to marinize our own engines, we entered into an engine supply agreement with General Motors LLC (“General Motors”) in November 2016 for the supply of engine blocks to use in our Malibu and Axis brand boats which began in our model year 2019 and continued through model year 2023. In April 2023, we signed a new supply agreement with General Motors that will continue through model year 2026. We adopted this strategy to more directly control product path (design, innovation, calibration and integration) of our largest dollar procured part, to differentiate our product from our competitors, and to increase our ability to respond to ongoing changes in the marketplace.

Pursuant to our engine supply agreement with General Motors, General Motors will deliver engines to us as we submit purchase orders. No minimum amount of engines is required to be ordered by us. The engine supply agreement will expire at the end of production of model year 2026, unless terminated earlier by either party as permitted under the terms of the agreement, including by General Motors due to market conditions with at least eighteen (18) months’ advanced written notice.

We have a marketing agreement with Yamaha Motor Corporation, U.S.A., or Yamaha, that requires us to equip a significant percentage of our Pursuit, Cobalt and Maverick Boat Group branded boats that are pre-rigged for outboard motors with Yamaha outboard motors in exchange for certain incentives. The agreement expires on June 30, 2027. We also obtain engines and sterndrive assemblies from Volvo for our Cobalt branded boats.

We experienced supply chain disruptions during fiscal year 2022 that we believe were driven by numerous factors, including labor shortages, ongoing domestic logistical constraints, and rising prices for our suppliers, in part due to inflationary pressures that continued into fiscal year 2023 and fiscal year 2024. We believe that the systemic supply chain disruptions that we have experienced over the past several years have been largely rectified.

Insurance and Product Warranties

We carry various insurance policies, including policies to cover general products liability, workers’ compensation, director and officer liability, and other casualty and property risks, to protect against certain risks of loss consistent with the exposures associated with the nature and scope of our operations. Our policies are generally based on our safety record as well as market trends in the insurance industry and are subject to certain deductibles, limits and policy terms and conditions.

Our Malibu and Axis brand boats have a limited warranty for a period up to five years. Our Cobalt brand boats have (1) a structural warranty of up to ten years which covers the hull, deck joints, bulkheads, floor, transom, stringers, and motor mount,

7

and (2) a five year bow-to-stern warranty on all components manufactured or purchased (excluding hull and deck structural components), including canvas and upholstery. Gelcoat is covered up to three years for Cobalt and one year for Malibu and Axis. Pursuit brand boats have a (1) limited warranty for a period of up to five years on structural components such as the hull, deck and defects in the gelcoat surface of the hull bottom, and (2) a bow-to-stern warranty of two years (excluding hull and deck structural components). Maverick, Pathfinder and Hewes brand boats have (1) a limited warranty for a period of up to five years on structural components such as the hull, deck and defects in the gelcoat surface of the hull bottom and (2) a bow-to-stern warranty of one year (excluding hull and deck structural components). Cobia brand boats have (1) a limited warranty for a period of up to ten years on structural components such as the hull, deck and defects in the gelcoat surface of the hull bottom and (2) a bow-to-stern warranty of three years (excluding hull and deck structural components). For each boat brand, there are certain materials, components or parts of the boat that are not covered by our warranty and certain components or parts that are separately warranted by the manufacturer or supplier (such as the engine). Our Malibu Monsoon engines that we manufacture for Malibu and Axis models have a limited warranty of up to five years or five-hundred hours.

Strategic Acquisitions

One of our growth strategies is to drive growth in our business through targeted acquisitions that add value while considering our existing brands and product portfolio. We acquired Maverick Boat Group in December 2020, Pursuit in October 2018 and Cobalt in July 2017. The primary objectives of our acquisitions are to expand our presence in new or adjacent categories, to expand into other product lines that may benefit from our operating strengths, and to increase the size of our addressable market. When we identify potential acquisitions, we attempt to target companies with a leading market share, strong cash flows, and an experienced management team and workforce that provide a fit with our existing operations. After completing an acquisition, we focus on integrating the company with our existing business to provide additional value to the combined entity through cost savings and revenue synergies, such as the optimization of manufacturing operations, improved processes around product development, enhancement of our existing dealer distribution network, accelerated innovation, administrative cost savings, shared procurement, vertical integration and cross-selling opportunities.

Intellectual Property

We rely on a combination of patent, trademark and copyright protection, trade secret laws, confidentiality procedures and contractual provisions to protect our rights in our brand, products and proprietary technology. This is an important part of our business and we intend to continue protecting our intellectual property. By law, our patent rights have limited lives and expire periodically. Our boat patent rights relate to boat design, features and components that we feel are important to our competitive position in our business. Some of our well-known patents include our Surf Gate system and Swim Step for our Malibu and Cobalt segments and Power Wedge for our Malibu segment.

Our trademarks, many of which are registered in the U.S. and various countries around the world, generally may endure in perpetuity on a country-by-country basis, provided that we comply with all statutory maintenance requirements, including continued use of each trademark in each such country. Some of our well-known trademarks include: (i) for our Malibu segment, Malibu, Axis, Monsoon, Power Wedge, Surf Band, Surf Gate, and Wakesetter; (ii) for our Saltwater Fishing Segment, Pursuit, Cobia, Maverick, and Redfisher; and (iii) for our Cobalt segment, Cobalt and Splash & Stow.

Seasonality

Our dealers experience seasonality in their business. Retail demand for boats is seasonal, with a significant majority of sales occurring during peak boating season, which coincides with our first and fourth fiscal quarters. In order to minimize the impact of this seasonality on our business, we manage our manufacturing processes and structure dealer incentives to tie our annual volume rebates and discounts program to consistent ordering patterns, encouraging dealers to purchase our products throughout the year. In this regard, we may offer free flooring incentives to dealers from the beginning of our model year through April 30 of each year. Further, in the event that a dealer does not consistently order units throughout the year, such dealer’s rebate is materially reduced. We may offer off-season retail promotions to our dealers in seasonally slow months, during and ahead of boat shows, to encourage retail demand.

Safety and Regulatory Matters

Our operations and products are subject to extensive environmental and health and safety regulation under various federal, commonwealth, state, and local statutes, ordinances, rules and regulations in the United States and Australia where we manufacture our boats, and in other foreign jurisdictions where we sell our products. We believe that we are in material compliance with those requirements. However, we cannot be certain that costs and expenses required for us to comply with such requirements in the future, including for any new or modified regulatory requirements, or to address newly discovered environmental conditions, will not have a material adverse effect on our business, financial condition, operating results, or cash flow. The regulatory programs to which we are subject include the following:

8

Hazardous Materials and Waste

Certain materials used in our manufacturing, including the resins used in production of our boats, are toxic, flammable, corrosive, or reactive and are classified as hazardous materials by the national, state and local governments in those jurisdictions where we manufacture our products. The handling, storage, release, treatment, and recycling or disposal of these substances and wastes from our operations are regulated in the United States by the United States Environmental Protection Agency (“EPA”), and state and local environmental agencies. In the United States, handling, storage, release, treatment, and recycling or disposal of hazardous materials is regulated under Subtitle C of the Resource Conservation and Recovery Act (“RCRA”). The EPA works with state regulatory agencies to implement a compliance monitoring program with the goal of evaluating compliance with companies’ RCRA obligation. Our manufacturing facilities can be subject to on-site compliance evaluation inspections (CEIs) or targeted enforcement actions. The handling, storage, release, treatment and recycling or disposal of these substances and wastes from our operations are regulated in Australia by the Australian Department of Climate Change, Energy, the Environment and Water, the New South Wales Environmental Protection Authority and other state and local authorities. Failure by us to properly handle, store, release, treat, recycle or dispose of our hazardous materials and wastes could result in liability for us, including fines, penalties, or obligations to investigate and remediate any contamination originating from our operations or facilities. We are not aware of any material contamination at our current or former facilities for which we could be liable under environmental laws or regulations, and we currently are not undertaking any remediation or investigation activities in connection with any contamination. Future spills or accidents or the discovery of currently unknown conditions or non-compliance could, however, give rise to investigation and remediation obligations or related liabilities.

Air Quality

In the United States, the federal Clean Air Act (“CAA”) and corresponding state and local laws and rules regulate emissions of air pollutants. Because our manufacturing operations involve molding and coating of fiberglass materials, which involves the emission of certain volatile organic compounds, hazardous air pollutants, and particulate matter, we are required to maintain and comply with a CAA operating permit requirements under Title V of the CAA (“Part 70 Permits”) for our Tennessee, Kansas and Florida facilities and local air permits for our California facilities. Our air permits generally require us to monitor our emissions and periodically certify that our emissions are within specified limits. To date, we have not had material difficulty complying with those limits.

The EPA and the California Air Resources Board (“CARB”) have, under the CAA, adopted regulations stipulating that many marine propulsion engines and watercraft meet certain air emission standards. Some of these standards require fitting a catalytic converter to the engine. These regulations also require, among other things, that engine manufacturers provide a warranty that their engines meet EPA and CARB emission standards. The engines used in our products are subject to these regulations. CARB has adopted an evaporative emissions regulation that applies to all spark-ignition marine watercraft with permanently installed fuel tanks sold in California (the Spark-Ignition Marine Watercraft Program). This regulation requires subject boat manufacturers to use specific CARB-certified components for the fuel systems in their boats, or to certify the boat meets a related performance standard. While we believe that our boats meet all applicable emission standards, the USEPA and CARB emissions regulations have increased the cost to manufacture our products.

OSHA

In the United States, the Occupational Safety and Health Administration (“OSHA”) standards address workplace safety generally, and limit the amount of emissions to which an employee may be exposed without the need for respiratory protection or upgraded plant ventilation. Our facilities are regularly inspected by OSHA and by state and local inspection agencies and departments. Our California facilities are also subject to California indoor air quality regulations, overseen by California’s Division of Occupational Safety and Health. We believe that our facilities comply in all material aspects with these regulations. Although capital expenditures related to compliance with environmental and safety laws are expected to increase, we do not currently anticipate any material expenditure will be required to continue to comply with existing OSHA environmental or safety regulations in connection with our existing manufacturing facilities.

At our New South Wales, Australia (“NSW”) facility, employee health and safety is regulated by SafeWork NSW, which also has requirements that limit the amount of certain emissions to which an employee may be exposed without the need for respiratory protection or upgraded plant ventilation. In addition, SafeWork NSW provides licensing and registration for potentially dangerous work, investigates workplace incidents, and enforces work health and safety laws in NSW. Our NSW facilities can be routinely inspected by SafeWork NSW. We believe that our facilities comply in all material aspects with these requirements.

9

Boat Design and Manufacturing Standards

In the United States, the U.S. Coast Guard promulgates regulations related to the minimum construction and safety requirements for recreational boats. In addition, boats manufactured for sale in the European Community must be certified to meet the requirements of the applicable laws and standards, including Directive 2013/53/EU on recreational craft and personal watercraft. These certifications specify standards for the design and construction of powerboats. We believe that all of our boats meet these standards. In addition, safety of recreational boats in the United States is subject to federal regulation under the Boat Safety Act of 1971, which requires boat manufacturers to recall products for replacement of parts or components that have demonstrated defects affecting safety. We have instituted recalls for defective component parts produced by certain of our third-party suppliers, including recalls on third party supplied steering columns during fiscal year 2023 and fuel pumps during fiscal year 2019. None of our recalls have had a material adverse impact on us.

Human Capital Management

Employee Profile

As of June 30, 2024, we had approximately 2,250 employees worldwide.

None of our team members are party to a collective bargaining agreement. We believe in working diligently to establish ourselves as an employer of choice.

Talent Retention and Development

We recognize employees are the heart of our organization and support them by offering a range of competitive pay, recognition and benefit programs. We provide market-competitive pay and benefits to encourage performance that creates sustainable and long-term employment. Additionally, we have numerous initiatives to support employee development, including annual performance evaluations and supervisor training programs, along with training programs for new employees (and those who are internally promoted) to learn new skills in boat production, such as gel coat application and fiberglass repair. We believe in internal promotion where possible and are committed to developing our current team members to become the next generation of leaders throughout the organization. Approximately 89% of our production leaders are internal promotions. We provide tuition assistance programs and take advantage of leadership development where possible. We partner with several colleges and universities to hire students from across the country in our Engineering Internship Program and many come to work for us after attaining their degree.

Employee Well-Being

Safety is a core value of our organization and we are committed to fostering a culture where safety is a number one priority. The success of our business depends, in part, upon the prevention of accidents, the reduction and/or prevention of occupational injuries and illnesses, and compliance with established safety and health policies and requirements. Dependent upon job tasks, some personnel will be required to have OSHA training and/or documentation to satisfy job requirements. Workplace safety is a fundamental organization-wide value, and we are committed to running an efficient program. We remain focused on building a safer workplace for our employees and will continue to work toward an injury-free workplace through the implementation of training and other safety initiatives.

Culture and Values

Our mission statement is a formal summary of our core purpose and focus and clearly communicates who we are. Our mission is to create the ultimate on-the-water lifestyle. Our core values are the guiding principles that dictate how we make decisions and interact with each other daily. We are committed to our core values of Safety, Integrity, People, Quality, Innovation, Customer Focus, and Continuous Improvement. We design products that appeal to an expanding range of recreational boaters, fisherman and water sports enthusiasts whose passion for boating is a key component of their active lifestyle. With our many awards and honors, we cultivate a culture of excellence and premier boat building.

We conducted our first annual engagement survey of all employees in 2023 and again in 2024 as an opportunity to gather feedback from employees on their experience and overall satisfaction to identify areas for organizational improvement. Outside of formal surveys, we encourage employees to continuously share any comments, questions or concerns with our leadership team, which are addressed as needed by our executive team.

Diversity and Inclusion

We are committed to maintaining an employee-first culture. We are dedicated to protecting the well-being of our employees and creating a culture that promotes inclusivity, acceptance, equality and diversity. Our employees bring a blend of

10

diverse backgrounds, and we promote an inclusive workforce and the opportunity for career growth for all employees. We seek to hire the best-qualified individuals and do not discriminate on the basis of race, creed, color, religion, national origin, citizenship status, age, disability, marital status, sexual orientation, gender, gender identity and similar classification. We continually evaluate our internal processes and programs to further build on our diverse, equitable and inclusive culture. We value our team and are committed to treating all employees with dignity and respect.

Community Involvement

We continually strive to make an impact on our local communities and serve them with gratitude. Each year, we partner with community organizations where our facilities are located and support local schools. In Tennessee, we have partnered with Toys for Tots, Angel Tree and local food banks to help families within the community during the holiday season. Our corporate sponsorship with the local Kiwanis Club has allowed us to give back to children with disabilities while also helping students prepare for the upcoming school year. We partner with the local Family Resources center each year to assist local students with cold-weather clothing fund and participate in additional local school initiatives to promote manufacturing trade jobs. In Kansas, we support our community through recreational leagues as well as donations to local foundations, events and school fundraisers, among other initiatives. In Florida, we give back to our local communities through the Treasure Coast Food Bank, Pet Food Drive for the Humane Society, Ready to Work Boot Camp, Everglades Foundation, Recreational Fishing Alliance and Coastal Conservation Association. Additionally, we are proud participants in and sponsors of the annual Making Strides Against Breast Cancer walk. We are proud of our partnerships with these outstanding organizations, and of the funds raised by our employees for children and families in the communities within which we operate.

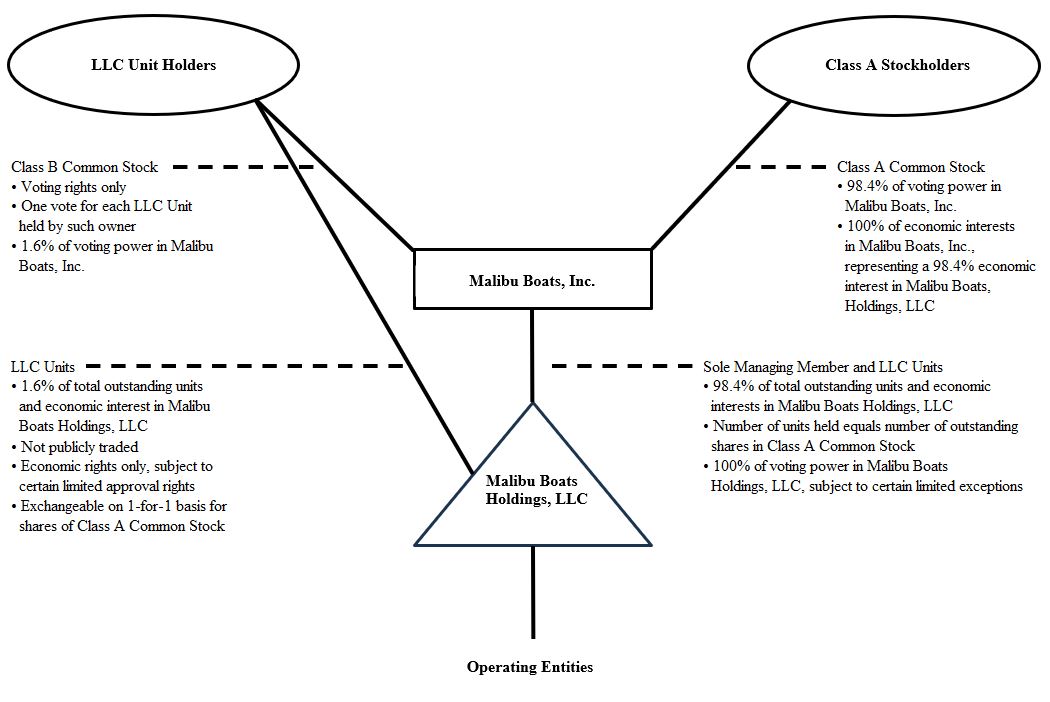

Organizational Structure

Malibu Boats, Inc. was incorporated as a Delaware corporation on November 1, 2013 in anticipation of our IPO to serve as a holding company that owns only an interest in Malibu Boats Holdings, LLC. Immediately after the completion of our IPO and the recapitalization we completed in connection with our IPO, Malibu Boats, Inc. held approximately 49.3% of the economic interest in the LLC, which has since increased to approximately 98.4% of the economic interest in the LLC as of June 30, 2024.

The certificate of incorporation of Malibu Boats, Inc. authorizes two classes of common stock, Class A Common Stock and Class B Common Stock. Holders of our Class A Common Stock and our Class B Common Stock have voting power over Malibu Boats, Inc., the sole managing member of the LLC, at a level that is consistent with their overall equity ownership of our business. In connection with our IPO and the recapitalization we completed in connection with our IPO, Malibu Boats, Inc. issued to each pre-IPO owner, for nominal consideration, one share of Class B Common Stock of Malibu Boats, Inc., each of which provides its owner with no economic rights but entitles the holder to one vote on matters presented to stockholders of Malibu Boats, Inc. for each LLC Unit held by such holder. Pursuant to our certificate of incorporation and bylaws, each share of Class A Common Stock entitles the holder to one vote with respect to each matter presented to our stockholders on which the holders of Class A Common Stock are entitled to vote. Each holder of Class B Common Stock is entitled to the number of votes equal to the total number of LLC units held by such holder multiplied by the exchange rate specified in the exchange agreement with respect to each matter presented to our stockholders on which the holders of Class B Common Stock are entitled to vote. Accordingly, the holders of LLC Units collectively have a number of votes that is equal to the aggregate number of LLC Units that they hold. As the LLC members sell LLC Units to us or subsequently exchange LLC Units for shares of Class A Common Stock of Malibu Boats, Inc. pursuant to the exchange agreement described below, the voting power afforded to them by their shares of Class B Common Stock is automatically and correspondingly reduced. Subject to any rights that may be applicable to any then outstanding preferred stock, our Class A and Class B Common Stock vote as a single class on all matters presented to our stockholders for their vote or approval, except as otherwise provided in our certificate of incorporation or bylaws or required by applicable law. In addition, subject to preferences that may apply to any shares of preferred stock outstanding at the time, the holders of our Class A Common Stock are entitled to share equally, identically and ratably in any dividends or distributions (including in the event of any voluntary or involuntary liquidation, dissolution or winding up of our affairs) that our board of directors may determine to issue from time to time, while holders of our Class B Common Stock do not have any right to receive dividends or other distributions.

As noted above, Malibu Boats, Inc. is a holding company with a controlling equity interest in the LLC. Malibu Boats, Inc., as sole managing member of the LLC, operates and controls all of the business and affairs and consolidates the financial results of the LLC. The limited liability company agreement of the LLC provides that it may be amended, supplemented, waived or modified by the written consent of Malibu Boats, Inc., as managing member of the LLC, in its sole discretion without the approval of any other holder of LLC Units, except that no amendment may materially and adversely affect the rights of a holder of LLC Units, other than on a pro rata basis with other holders of LLC Units, without the consent of such holder (unless more than one holder is so affected, then the consent of a majority of such affected holders is required). Pursuant to the limited liability company agreement of the LLC, Malibu Boats, Inc. has the right to determine when distributions (other than tax distributions) will be made to the members of the LLC and the amount of any such distributions. If Malibu Boats, Inc.

11

authorizes a distribution, such distribution will be made to the members of the LLC (including Malibu Boats, Inc.) pro rata in accordance with the percentages of their respective LLC Units.

The diagram below depicts our current organizational structure, as of June 30, 2024:

Our organizational structure allows the LLC members to retain their equity ownership in the LLC, an entity that is classified as a partnership for U.S. federal income tax purposes, in the form of LLC Units. Holders of Class A Common Stock, by contrast, hold their equity ownership in Malibu Boats, Inc., a Delaware corporation that is a domestic corporation for U.S. federal income tax purposes, in the form of shares of Class A Common Stock. The holders of LLC Units, including Malibu Boats, Inc., will incur U.S. federal, state and local income taxes on their proportionate share of any taxable income of the LLC. Net profits and net losses of the LLC will generally be allocated to the LLC’s members (including Malibu Boats, Inc.) pro rata in accordance with the percentages of their respective limited liability company interests. The limited liability company agreement provides for cash distributions to the holders of LLC Units if Malibu Boats, Inc. determines that the taxable income of the LLC will give rise to taxable income for its members. In accordance with the limited liability company agreement, we intend to cause the LLC to make cash distributions to the holders of LLC Units for purposes of funding their tax obligations in respect of the income of the LLC that is allocated to them. Generally, these tax distributions will be computed based on our estimate of the taxable income of the LLC allocable to such holder of LLC Units multiplied by an assumed tax rate equal to the highest effective marginal combined U.S. federal, state and local income tax rate prescribed for an individual or corporate resident in Los Angeles, California (taking into account the nondeductibility of certain expenses and the character of our income). For purposes of determining the taxable income of the LLC, such determination will be made by generally disregarding any adjustment to the taxable income of any member of the LLC that arises under the tax basis adjustment rules of the Internal Revenue Code of 1986, as amended, or the Code and is attributable to the acquisition by such member of an interest in the LLC in a sale or exchange transaction.

Exchanges and Other Transactions with Holders of LLC Units