UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C INFORMATION

INFORMATION STATEMENT PURSUANT TO SECTION 14(C) OF THE

SECURITIES EXCHANGE ACT OF 1934

Check the appropriate box:

| ☒ | Preliminary Information Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| ☐ | Definitive Information Statement |

FINDIT, INC.

(Name of Registrant As Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

☐ No fee required

☒ Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11

| (1) | Title of each class of securities to which transaction applies: |

Common Stock, par value $0.001 per share, of Findit, Inc.

Series A Preferred Stock, par value $0.001per share, of Findit, Inc.

| (2) | Aggregate number of securities to which transaction applies: |

(a) 337,793,959 shares of Common Stock

(b) 836,048 shares of Series A Preferred Stock

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

Solely for purposes of calculating this filing fee, the underlying value of the transaction was determined based upon the average closing price for the month of November 2022 ( (i) 337,793,959 shares of Common Stock, multiplied by $0.01495 per share (the average of the close price of such Common Stock for the month of November, as reported on the OTC Market Pinks), totaling $5,050,020; and (ii) 836,048 shares of Series A Preferred Stock, par value $0.001, totaling $836.

In accordance with Section 14(g) of the Securities Exchange Act of 1934, as amended, the filing fee was determined by multiplying 0.0001162 by the sum of the preceding sentence.

(4) Proposed maximum aggregate value of transaction:

$5,050,856

(5) Total fee paid:

$586.91

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

| (3) | Filing party: |

| (4) | Date Filed: |

FINDIT, INC.

5051 Peachtree Corners Circle, #200

Peachtree Corners, GA 30092

NOTICE OF ACTION BY WRITTEN CONSENT AND INFORMATION STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

*, 2023

Dear Stockholder:

This notice of action by written consent and the accompanying information statement (this “Information Statement”) is being furnished by the Board of Directors (the “Board”) of Findit, Inc., a Nevada corporation (“Findit”, the “Company”, “we”, “us” or “our”) to the holders of record at the close of business on January 4, 2023 of the outstanding shares of our common stock, $0.001 par value, Series A preferred stock, $0.001 par value and Series B preferred stock, $0.001 par value (together, the “Voting Securities”), pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The purpose of this Information Statement is to inform the Company’s stockholders that on December 29, 2022, holders of approximately 78.14% of the outstanding Voting Securities acted by written consent (the “Written Consent”) in lieu of a special meeting of stockholders to approve (i) an amendment to the Company’s Articles of Incorporation (the “Charter Amendment”) to increase the number of authorized shares of Common Stock from 500,000,000 to 4,000,000,000 (the “Share Increase”) and change the name of the Company to BioRegenx, Inc., (ii) the Agreement and Plan of Merger dated as of December 29, 2022, by and among the Company and BioRegenx, Inc. (“BioRegenx”), and subject to the satisfaction or waiver of specified conditions, the merger of BioRegenx with and into the Company, with the Company existing as the surviving corporation (the “Merger”), pursuant to which the Common Stock will, upon consummation of the Merger, be converted into the right to receive not more than (x) 337,793,959 shares of Common Stock (subject to the terms and conditions of the Merger Agreement) (such shares of Common Stock, the “Common Stock Consideration”) and (y) 836,048 shares of Series A Preferred Stock (the “Preferred Stock Consideration” and, together with the Common Stock Consideration, the “Merger Consideration”). Concurrently, holder(s) of the Company’s Series A and Series B preferred shares shall retire their Series A and Series B preferred shares back into the treasury. Additionally, the stockholder consent approved, as soon as practicable, the implementation of up to a 1 for 25 reverse split of the Company’s common and preferred stock to improve the Company’s ability to attract institutional investors and analysts as well as to graduate to a senior exchange (OTCQB, NASDAQ).

Simultaneously with the close of the proposed transaction and as a condition precedent to said closing, all of the current assets and liabilities of FDIT, shall be transferred into a wholly owned subsidiary. Both parties agrees that the wholly owned subsidiary may be subsequently spun out upon yet to be determined terms. The parties acknowledge that, subsequent to the spin out, all assets and liabilities currently outstanding in FDIT, including the $150,000 SBA loan, will follow the subsidiary and will not be the responsibility of the merged entity post-closing of this transaction. Also, simultaneously with the close of the proposed transaction and as a condition precedent to said closing, the principals of the Company shall execute an option agreement with the Company relating to its acquisition of all of their shares in Classworx (CHNO), subsequent to the merger. After said closing of the merger with BioRegenx and subsequently upon exercising the option of the acquisition of CHNO, the Company’s board of directors agree to support and cause to be placed on the ballot at each election of the Company’s directors one name chosen by the current principals of CHNO which shall be a nominee to the Company’s board of directors.

Copies of the Merger Agreement and the Amendment to the Articles of Incorporation have been included as Annex A and Annex B, respectively. Approval of the Charter Amendment, the Merger Agreement, the Merger and the Share Issuances are referred to herein collectively as the “Shareholder Approved Actions.” The transactions contemplated by the Merger Agreement, are referred to herein collectively as the “Transactions.”

Under Nevada law and the Company’s Articles of Incorporation and Bylaws, adoption of the Charter Amendment, Merger Agreement and Merger, and the transactions contemplated thereby, by the Company’s stockholders required the affirmative vote or written consent of the holders of a majority of the voting power of all outstanding shares of Common Stock.

Effective December 29, 2022, Firth Family Trust (“Firth”) HVA Family Trust (“HVA Family”) and Wooeb, Inc. (Wooeb”), (together, the “Principal Stockholders”) delivered to the corporate secretary of the Company an irrevocable written consent approving the Shareholder Approved Actions. Effective December 29, 2022, the Principal Stockholders held Voting Securities representing approximately 78.14% of the voting power of all outstanding shares of Common Stock. Accordingly, the adoption of the Shareholder Approved Actions by the Company’s stockholders was affected in accordance with Section 78.390 of the Nevada Revised Statutes as of December 29, 2022. No further approval of the stockholders of the Company under the Nevada Revised Statutes is required to complete the Shareholder Approved Actions. As a result, the Company has not solicited and will not be soliciting your vote for the Shareholder Approved Actions and does not intend to call a meeting of stockholders for purposes of voting on the adoption of either matter.

Pursuant to Rule 14c-2 of the Exchange Act, the actions contemplated by written consent may not be taken until *, 2023, which is twenty (20) calendar days following the date we first mail this Information Statement to our stockholders. The Charter Amendment will not become effective until it is filed with the Secretary of State of the State of Nevada, which will occur only if the other conditions under the Merger Agreement are satisfied.

The Board carefully reviewed and considered the terms and conditions of the Merger Agreement, the Merger and the other transactions contemplated by the Merger Agreement. The Board (i)(a) determined that the Merger and the other transactions contemplated by the Merger Agreement, on the terms and subject to the conditions set forth in the Merger Agreement, are fair to, and in the best interests of, the Company and its stockholders, (b) approved and declared advisable the Merger Agreement, the Merger and the other transactions contemplated by the Merger Agreement, on the terms and subject to the conditions set forth in the Merger Agreement, in the Information Statement, recommended that the holders of Common Stock and Preferred Stock vote in favor of adopting the Merger Agreement and (ii) directed that the Shareholder Approved Actions be submitted to the holders of the Common Stock for their adoption.

This notice of action by written consent and the Information Statement shall constitute notice to you from the Company that the Shareholder Approved Actions have been adopted by the holders of a majority of the voting power of the Common Stock by written consent in lieu of a meeting in accordance with Section 78.390 of the Nevada Revised Statutes.

FINDIT IS NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND FINDIT A PROXY.

PLEASE NOTE THAT THE PRINCIPAL STOCKHOLDERS OF FINDIT HAVE VOTED TO APPROVE AND ADOPT THE SHAREHOLDER APPROVED ACTIONS. THE NUMBER OF VOTES HELD BY THE PRINCIPAL STOCKHOLDERS IS SUFFICIENT TO SATISFY THE STOCKHOLDER VOTE REQUIREMENT UNDER THE NEVADA REVISED STATUTES FOR THESE ACTIONS AND CONSEQUENTLY, NO ADDITIONAL VOTES WILL BE NEEDED TO APPROVE THESE TRANSACTIONS. THE CORPORATE ACTIONS DESCRIBED IN THIS INFORMATION STATEMENT REQUIRED SHAREHOLDER APPROVAL FROM THE HOLDERS OF OUR OUTSTANDING COMMON STOCK BECAUSE OF THE REQUIREMENTS OF NEVADA LAW.

The Information Statement accompanying this letter provides you with more specific information concerning the Charter Amendment, the Merger Agreement and the other transactions contemplated by the Merger Agreement. We encourage you to carefully read this Information Statement and the copy of the Merger Agreement included as Annex A to the Information Statement.

By order of the Board of Directors

Thomas Powers

Chief Executive Officer

The Merger has not been approved or disapproved by the U.S. Securities and Exchange Commission or any state securities or other regulatory agency. Neither the U.S. Securities and Exchange Commission nor any state securities or other regulatory agency has passed upon the merits or fairness of the Merger or upon the adequacy or accuracy of the information contained in this document or the Information Statement. Any representation to the contrary is a criminal offense.

The Information Statement is dated February 3, 2023 and is first being mailed to our stockholders on or about February ___, 2023.

TABLE OF CONTENTS

| SUMMARY | 9 | |||||

| The Parties | 9 | |||||

| The Merger | 9 | |||||

| Recommendations of the Board; Reasons for the Merger | 10 | |||||

| Approval of the Merger; Record Date, Action by Stockholder Consent | 10 | |||||

| Certain Effects of the Merger | 10 | |||||

| Governance Matters After the Merger | 11 | |||||

| Effects on the Company if the Merger is Not Completed | 11 | |||||

| Conditions to the Merger | 11 | |||||

| Termination | 13 | |||||

| Amendment to the Articles of Incorporation | 14 | |||||

| Material U.S. Federal Income Tax Consequences | 14 | |||||

| Accounting Treatment of the Merger | 14 | |||||

| Risk Factors | 14 | |||||

| Additional Information | 14 | |||||

| Selected Historical Consolidated Financial Data of Findit | 15 | |||||

| Selected Historical Financial Data of BioRegenx | 16 | |||||

| Summary Selected Unaudited Pro Forma Combined Financial Information | 18 | |||||

| QUESTIONS AND ANSWERS ABOUT THE MERGER AND THE CHARTER AMENDMENT | 19 | |||||

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | 21 | |||||

| RISK FACTORS | 22 | |||||

| THE PARTIES | 25 | |||||

| THE MERGER | 25 | |||||

| Overview | 25 | |||||

| Background of the Merger | 26 | |||||

| Reasons for the Merger | 27 | |||||

| Required Approval of the Merger; Record Date; Action by Stockholder Consent | 28 | |||||

| Recommendation of the Board | 28 | |||||

| Certain Effects of the Merger | 28 | |||||

| Governance Matters After the Merger | 29 | |||||

| Effects on the Company if the Merger is Not Completed | 32 | |||||

| Merger Consideration | 32 | |||||

| Interests of the Company’s Directors and Executive Officers in the Merger | 33 | |||||

| Material U.S. Federal Income Tax Consequences of the Merger | 33 | |||||

| Accounting Treatment of the Merger | 35 | |||||

| Dividend Policy | 35 | |||||

| THE MERGER AGREEMENT | 35 | |||||

| The Merger | 36 | |||||

| Closing and Effective Time of the Merger | 36 | |||||

| Consideration to be Received in the Merger | 36 | |||||

| Representations and Warranties | 37 | |||||

| Operating Covenants | 39 | |||||

| Action by Stockholder Consent | 39 | |||||

| Reasonable Best Efforts and Certain Pre-Closing Obligations | 40 | |||||

| Employment Matters | 40 | |||||

| Additional Agreements | 40 | |||||

| Conditions to the Merger | 40 | |||||

| Termination | 41 | |||||

| Effect of Termination | 42 | |||||

| Expenses | 42 | |||||

| Amendment; Extension; Waiver | 42 | |||||

| Governing Law | 42 | |||||

| FINDIT UNAUDITED PRO FORMA COMBINED FINANCIAL STATEMENTS | 43 | |||||

| AMENDMENT TO THE ARTICLES OF INCORPORATION | 46 | ||||

| Description of the Proposed Amendment | 46 | ||||

| Purpose and Reasons for the Share Increase | 46 | ||||

| Effect of the Share Increase | 46 | ||||

| DESCRIPTION OF CAPITAL STOCK | 47 | ||||

| General | 47 | ||||

| Common Stock | 47 | ||||

| Anti-Takeover Provisions | 48 | ||||

| Combination with Interested Stockholders Statute | 48 | ||||

| Acquisition of Controlling Interest Statute | 49 | ||||

| Our Transfer Agent | 50 | ||||

| Listing of Common Stock | 50 | ||||

| NO DISSENTER’S RIGHTS | 50 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 50 | ||||

| INFORMATION ABOUT BIOREGENX | 51 | ||||

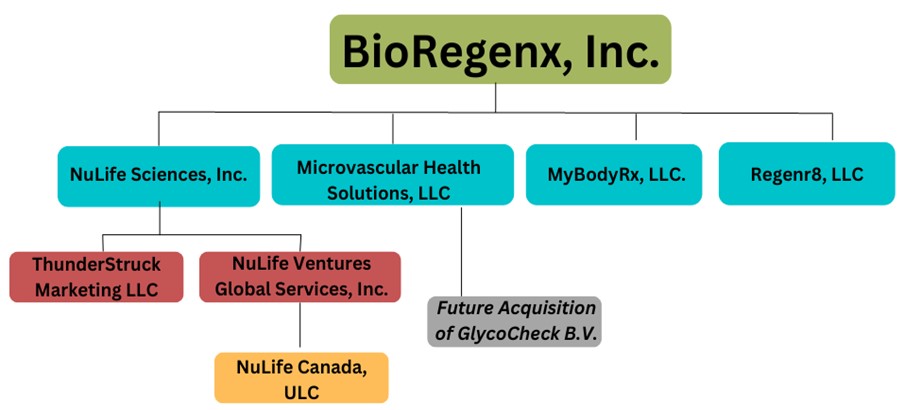

| Operating Subsidiaries | 52 | ||||

| Proposed Acquisition | 54 | ||||

| Market Size | 54 | ||||

| Market Strategy | 55 | ||||

| Revenues | 56 | ||||

| Competition | 56 | ||||

| Competitive Advantages | 56 | ||||

| Facilities | 57 | ||||

| Employees | 57 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS OF BIOREGENX | 58 | ||||

| HOUSEHOLDING | 61 | ||||

| WHERE YOU CAN FIND ADDITIONAL INFORMATION | 61 | ||||

| INFORMATION INCORPORATED BY REFERENCE | 61 | ||||

| INDEX TO FINANCIAL STATEMENTS | 63 | ||||

| ANNEX A: AGREEMENT AND PLAN OF MERGER | 105 | ||||

| ANNEX B: FORM OF AMENDMENT TO THE ARTICLES OF INCORPORATION | 109 | ||||

FINDIT, INC.

5051 Peachtree Corners Circle, #200

Peachtree Corners, GA 30092

INFORMATION STATEMENT

This information statement and notice of action by written consent (collectively, this “Information Statement”) contains information relating to (i) an amendment to the Company’s Articles of Incorporation (the “Charter Amendment”) to increase the number of authorized shares of Common Stock from 500,000,000 to 4,000,000,000 (the “Share Increase”) and change the name of the Company to BioRegenx, Inc., (ii) the Agreement and Plan of Merger effective December 29, 2022 (the “Merger Agreement”), by and among the Company and BioRegenx, Inc. (“BioRegenx”), and subject to the satisfaction or waiver of specified conditions, the merger of BioRegenx with and into the Company, with the Company existing as the surviving corporation (the “Merger”), pursuant to which the Common Stock will, upon consummation of the Merger, be converted into the right to receive not more than (x) 337,793,959 shares of Common Stock (subject to the terms and conditions of the Merger Agreement) (such shares of Common Stock, the “Common Stock Consideration”) and (y) 836,048 shares of Series A Preferred Stock (the “Preferred Stock Consideration” and, together with the Common Stock Consideration, the “Merger Consideration”). Concurrently, holder(s) of the Company’s Series A and Series B preferred shares shall retire their Series A and Series B preferred shares back into the treasury. Additionally, the stockholder consent approved, as soon as practicable, the implementation of up to a 1 for 25 reverse split of the Company’s common and preferred stock to improve the Company’s ability to attract institutional investors and analysts as well as to graduate to a senior exchange (OTCQB, NASDAQ).

Simultaneously with the close of the proposed transaction and as a condition precedent to said closing, all of the current assets and liabilities of FDIT, shall be transferred into a wholly owned subsidiary. Both parties agrees that the wholly owned subsidiary may be subsequently spun out upon yet to be determined terms. The parties acknowledge that, subsequent to the spin out, all assets and liabilities currently outstanding in FDIT, including the $150,000 SBA loan, will follow the subsidiary and will not be the responsibility of the merged entity post-closing of this transaction. Also, simultaneously with the close of the proposed transaction and as a condition precedent to said closing, the principals of the Company shall execute an option agreement with the Company relating to its acquisition of all of their shares in Classworx (CHNO), subsequent to the merger. After said closing of the merger with BioRegenx and subsequently upon exercising the option of the acquisition of CHNO, the Company’s board of directors agree to support and cause to be placed on the ballot at each election of the Company’s directors one name chosen by the current principals of CHNO which shall be a nominee to the Company’s board of directors.

The Charter Amendment, the Merger Agreement and the transactions contemplated thereby and the Share Issuances are referred to herein collectively as the “Shareholder Approved Actions.” The Merger Agreement, the Subscription Agreement, the Shareholders Agreement, the Charter Amendment, the Certificate of Designations and the Registration Rights Agreement (as further described below) are referred to herein collectively as the “Transaction Documents” and, the transactions contemplated thereby, including the Share Issuances, the “Transactions.” We are furnishing this Information Statement to stockholders of the Company pursuant to applicable provisions of Nevada law and certain securities regulations. The Information Statement is dated February 3, 2023 and is first being mailed to our stockholders on or about February ___, 2023.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

SUMMARY

This summary highlights selected information in this Information Statement and may not contain all of the information about the Transactions that is important to you. We have included page references in parentheses to direct you to more complete descriptions of the topics presented in this summary. You should carefully read this Information Statement in its entirety, including the annexes hereto and the other documents to which we have referred you, for a more complete understanding of the Transactions. You may obtain, without charge, copies of documents incorporated by reference into this Information Statement by following the instructions under the section of this Information Statement entitled “Where You Can Find Additional Information” beginning on page 61.

The Parties

Findit, Inc. owns Findit.com and the Findit App that is available in Android and IOS through the Google Play Store and the Apple App store. Findit.com and the Findit App operate as a Social Media Content Management Platform, that includes its own interactive search engine. Members can utilize Findit search to submit URLs they want Findit to index in Findit search results. Nonmembers can come to Findit and enter search queries, Findit returns matching search results from content posted in Findit along with outside web pages that have been submitted.

BioRegenx, Inc. was created to integrate leading-edge companies into one synergistic platform offering 360-degree solutions for health improvement. BioRegenx provides single-source development, marketing, and education, and offers multiple sales channel deployment. Integrated data is compiled in a secure cloud-based platform and is focused on comprehensive microcirculation, epigenetic, and metabolic profiles. These profiles generate both actionable and comprehensive test result dashboards for the physician. Individual patients have access to personalized mobile apps that are integrated to track improvements and measurable results from their personalized action plan. The result: improved vitality and longevity. This data allows researchers, governments, insurance plans and employers access to real data to improve employee health and reduce the costs.

Please see the section of this Information Statement entitled “The Parties” beginning on page 25.

The Merger

The Company and BioRegenx entered into the Merger Agreement effective December 29, 2022. A copy of the Merger Agreement is included as Annex A to this Information Statement. Under the terms of the Merger Agreement, subject to the satisfaction or waiver of specified conditions, BioRegenx will be merged with and into the Company (the “Merger”) in accordance with the applicable provisions of the Nevada Revised Statutes. As a result of the Merger, the separate existence of BioRegenx shall cease and the Company shall continue its existence under the laws of the State of Nevada as the surviving entity (in such capacity, the Company is sometimes referred to herein as the “surviving corporation”).

At the effective time of the Merger (defined below under “The Merger Agreement—Closing and Effective Time of the Merger”), all of the equity of BioRegenx (the “BioRegenx Equity”) that is issued and outstanding immediately prior to the effective time of the Merger, will be converted into the right to receive not more than (x) 337,793,959 shares of Common Stock (subject to the terms and conditions of the Merger Agreement) (such shares of Common Stock, the “Common Stock Consideration”) and (y) 836,048 shares of Series A Preferred Stock (the “Preferred Stock Consideration” and, together with the Common Stock Consideration, the “Merger Consideration”). Please see the section of this Information Statement entitled “The Merger” beginning on page 25.

The Series A Preferred Stock and the Series B Preferred Stock will be returned to the treasury as more particularly described in the section of this Information Statement entitled “The Merger” beginning on page 25.

Recommendation of the Board; Reasons for the Merger

After careful consideration, the Company’s Board of Directors (the “Board”) approved the Merger Agreement and recommended the approval of the Shareholder Approved Actions by the Company’s stockholders.

The Board believes that the Merger Agreement and the Merger are advisable and in the best interests of the Company and its stockholders. For a discussion of the material factors that the Board considered in determining to approve the Merger Agreement, please see the section of this Information Statement entitled “The Merger—Reasons for the Merger” beginning on page 27.

Approval of the Merger; Record Date; Action by Stockholder Consent

Effective December 29, 2022, Firth Family Trust (“Firth”) HVA Family Trust (“HVA Family”) and Wooeb, Inc. (Wooeb”), (together, the “Principal Stockholders”), delivered to the corporate secretary of the Company an irrevocable written consent approving the Shareholder Approved Actions (the “Written Consent”). As of December 29, 2022, the Principal Stockholders held voting securities representing approximately 78.14% of the voting power of all outstanding shares of Common Stock, Series A and Series B Preferred Stock. Accordingly, the approval of the Shareholder Approved Actions by the Company’s stockholders was affected in accordance with the Nevada Revised Statutes effective December 29, 2022. No further approval of the stockholders of the Company is required to approve the Shareholder Approved Actions. As a result, the Company has not solicited and will not be soliciting your vote for the approval of the Shareholder Approved Actions and does not intend to call a meeting of stockholders for purposes of voting on the approval of the Shareholder Approved Actions. If the Merger Agreement is terminated in accordance with its terms, the Written Consent will be of no further force and effect.

Federal securities laws state that the Shareholder Approved Actions may not be completed until twenty (20) days after the date of mailing of this Information Statement to the Company’s stockholders. Therefore, notwithstanding the execution and delivery of the Written Consent (which was obtained concurrently with the execution of the Merger Agreement), the Shareholder Approved Actions will not occur until that time has elapsed. We currently expect the Merger to be completed before the end of the first quarter of 2023, subject to certain government regulatory reviews and approvals and the satisfaction of the other conditions to closing in the Merger Agreement. However, there can be no assurance that the Merger will be completed on or prior to that time, or at all.

This Information Statement shall constitute notice to you from the Company that the Shareholder Approved Actions have been adopted by the holders of a majority of the voting power of the Common Stock and Preferred Stock by written consent in lieu of a meeting in accordance with the Nevada Revised Statutes.

Please see the section of this Information Statement entitled “The Merger Agreement—Required Approval of the Merger; Record Date; Action by Stockholder Consent” beginning on page 28.

Certain Effects of the Merger

Upon the consummation of the Merger, BioRegenx will be merged with and into the Company, and the Company shall continue its existence under the laws of the State of Nevada as the surviving corporation. At the effective time of the Merger, all of the property, rights, privileges, powers, and franchises of the Company and BioRegenx will vest in the Company, as the surviving corporation, and all debts liabilities, obligations, restrictions, disabilities, and duties of the Company and BioRegenx shall become the debts, liabilities, obligations, restrictions, disabilities, and duties of the Company, as the surviving corporation.

Please see the section of this Information Statement entitled “The Merger—Certain Effects of the Merger” beginning on page 28.

Governance Matters After the Merger

Following the effective time of the Merger, Ray Firth shall resign as an officer and director and Thomas Powers shall resign as an officer of the Company, the directors of BioRegenx shall be the directors of the Company along with Thomas Powers, and William Resides, Gary Hennerberg, Dan Cortes and Hitesh Juneja shall be the officers of the Company after the effective time of the Merger.

Please see the section of this Information Statement entitled “The Merger—Governance Matters After the Merger” beginning on page 29.

Effects on the Company if the Merger is Not Completed

If the Merger is not completed for any reason, the Company and BioRegenx will remain separate, independent companies and the holder of the BioRegenx Equity will continue to own the BioRegenx Equity.

Please see the section of this Information Statement entitled “The Merger—Effects on the Company if the Merger is Not Completed” beginning on page 32.

Conditions to the Merger

Mutual Conditions

Pursuant to the Merger Agreement each party’s obligation to effect the Merger is subject to the satisfaction or waiver (if permissible under applicable law), on or prior to the closing date of the Merger, which we refer to as the “Closing Date”, of the following conditions:

| · | no governmental authority having jurisdiction over any party shall have issued any order, decree, ruling, injunction or other action that is in effect (whether temporary, preliminary or permanent) restraining, enjoining or otherwise prohibiting the consummation of the Merger and no law shall have been adopted that makes consummation of the Merger illegal or otherwise prohibited; |

| · | this Information Statement shall have been mailed to the Company’s stockholders at least twenty (20) days prior to the Closing Date and the issuance of the Merger Consideration shall be permitted by Regulation 14C of the Exchange Act (including Rule 14c-2 promulgated under the Exchange Act); |

| · | all of the current assets and liabilities of FDIT, shall be transferred into a wholly owned subsidiary. Both parties agrees that the wholly owned subsidiary may be subsequently spun out upon yet to be determined terms, except that the parties agree that no spin out shall occur until the outstanding $150,000 EIDL loan is repaid in full. The parties acknowledge that, subsequent to the spin out, all assets and liabilities currently outstanding in FDIT will follow the subsidiary and will not be the responsibility of the merged entity post-closing of this transaction. |

| · | the Principals of FDIT shall execute an option agreement with FDIT relating to its acquisition of all of their shares in Classworx (CHNO), subsequent to the merger. The option shall be on terms comparable to those agreed to in this Agreement. After said closing of merger with FDIT and subsequently upon exercising the option of the acquisition of ClassWorx, the Board of Directors agree to support and cause to be placed on the ballot at each election of Directors one name chosen by the current principals of Classworx which shall be a nominee to the current Board of Directors of the Company. |

Additional Conditions of the Obligations of Findit

(a) Accuracy of Representations. The representations of Findit in the MergerAgreement or in any Exhibit hereto shall be true and accurate in all material respects at and as of Closing with the same effect as if made at and as of Closing, except as affected by the transactions contemplated hereby.

(b) Performance of Agreements. Findit shall have performed all obligations and agreements and complied with all covenants in this Agreement to be performed and complied with by it at or before Closing.

(c) Retirement of Series A and Series B preferred shares. Findit shall have retired the issued and outstanding Series A and Series B preferred shares, in accordance with the authorization from the Series A and Series B preferred shareholders.

(d) Receipt of Findit Common Stock. Findit shall have delivered to BioRegenx at Closing, certificates (or book entry) representing not more than three hundred thirty seven million, seven hundred ninety three thousand nine hundred fifty nine (337,793,959) common shares and eight hundred thirty six thousand forty eight (836,048) Series A preferred shares issued in the name of the shareholders of BioRegenx.

(e) Officer's Certificate. BioRegenx shall have received a certificate executed by an executive officer of Findit, dated as of Closing, reasonably satisfactory in form and substance to BioRegenx certifying that the conditions stated in the Merger Agreement have been satisfied.

(f) Legal Proceedings. There shall be no Legal Requirement, and no judgment shall have been entered and not vacated by any governmental authority of competent jurisdiction and no litigation shall be pending which restrains, makes illegal or prohibits consummation of the transactions contemplated hereby.

(g) Consents. BioRegenx shall have obtained evidence, in form and substance satisfactory to it, that there has been obtained all consents, approvals and authorizations required by the Merger Agreement.

(h) Resignation of Officers and Directors. Each of the officers and directors of Findit whose written resignation BioRegenx has requested shall have delivered to BioRegenx effective as of the Closing.

(i) Legal Matters Satisfactory to BioRegenx's Counsel. All actions, proceedings, instruments and documents required to carry out the transactions contemplated by this Agreement or incidental thereto and all related legal matters shall be reasonably satisfactory to and approved by BioRegenx's counsel, and such counsel shall have been furnished with such certified copies of actions and proceedings and such other instruments and documents as it shall have reasonably requested. Additionally, the principals of Findit, Inc. shall have executed an option agreement with Findit, Inc. relating to its acquisition of all of their shares in Classworx (CHNO), subsequent to the merger.

Additional Conditions of the Obligations of BioRegenx

(a) Accuracy of Representations. The representations of BioRegenx in the Merger Agreement or in any Exhibit thereto shall be true and accurate (in all material respects) at and as of Closing with the same effect as if they were made at and as of Closing, except as affected by the transactions contemplated hereby.

(b) Performance of Agreements. BioRegenx shall have performed all obligations and agreements and complied with all covenants in the Merger Agreement or in any Transaction Document to which it is a party to be performed and complied with by it at or before Closing.

(a) Delivery of BioRegenx Stock. BioRegenx shall have delivered at Closing, certificate/book entry representing all of its outstanding common shares and Series A preferred shares.

(d) Officer's Certificate. Findit shall have received a certificate executed by an executive officer of BioRegenx, dated as of Closing, reasonably satisfactory in form and substance to Findit, certifying that the conditions stated in the Merger have been satisfied.

(e) Legal Proceedings. There shall be no Legal Requirement, and no judgment shall have been entered and not created by any governmental authority of competent jurisdiction and no litigation shall be pending which,

| (i) | restrains, make illegal or prohibits consummation of the transactions contemplated hereby, or |

| (ii) | could have a material adverse effect upon the operations or financial condition of BioRegenx. |

(f) Consents. Findit shall have received evidence, in form and substance satisfactory to it, that there have been obtained all consents, approvals, and authorizations required by the Merger Agreement.

(g) Legal Matters Satisfactory to Findit and its Representatives. All actions, proceedings, instruments and documents required to carry out the transactions contemplated by this Agreement or incidental thereto and all related legal matters shall be reasonably satisfactory to and approved by Findit's counsel, and such counsel shall have been furnished with such certified copies of actions and proceedings and such other instruments and documents as it shall have reasonably requested.

Please see the section of this Information Statement entitled “The Merger Agreement—Conditions to the Merger” beginning on page 40.

As further discussed under the section titled “Risk Factors,” the Company cannot be certain when, or if, the conditions of the Merger will be satisfied or waived, or that the Merger will be completed.

Termination

The Merger Agreement may be terminated and the Merger may be abandoned at any time prior to the effective time in the following circumstances:

• by mutual written consent of the Company and BioRegenx;

• by either the Company or BioRegenx:

| o | if any governmental authority having jurisdiction over any party shall have issued any order, decree, ruling or injunction or taken any other action permanently restraining, enjoining or otherwise prohibiting the consummation of the Merger and such order, decree, ruling or injunction or other action shall have become final and non-appealable,or if there shall be adopted any law that permanently makes consummation of the Merger illegal or otherwise permanently prohibited; provided that the right to terminate the Merger Agreement will not be available to any party whose failure to fulfill any material covenants or agreement has caused such legal restraint; or |

| o | if the Merger has not been consummated on or before 5:00 p.m. time, March 31, 2023 (such date being the “End Date”); provided that the right to so terminate the Merger Agreement will not be available to a party whose material breach of any provision of the Merger Agreement results in the failure of the Merger to be consummated on or before the End Date; provided, further, that either the Company or BioRegenx shall have the unilateral right to extend the End Date by up to 30 additional days in the event that as of the End Date (prior to such extension) all conditions (other than conditions that by their nature are to be satisfied at the Closing) under certain circumstances have been satisfied or waived and the closing shall not have occurred due solely or in part to the failure of the Company to mail the Information Statement to its stockholders at least 20 days prior to the Closing Date. |

| • | by the Company: |

| o | in the event of certain breaches of the Merger Agreement by BioRegenx; provided that the Company is not then in material breach of any representation, warranty or covenant contained in the Merger Agreement; provided, further, that said breach by BioRegenx cannot be or has not been cured pursuant to the terms of the Merger Agreement. |

• by BioRegenx:

| o | in the event of certain breaches of the Merger Agreement by the Company; provided that BioRegenx is not then in material breach of any representation, warranty or covenant contained in the Merger Agreement provided, further, that said breach by the Company cannot be or has not been cured pursuant to the terms of the Merger Agreement; or |

| o | upon written notice to the Company stating that all conditions to closing of the transactions contemplated by the Merger Agreement shall have been satisfied or waived (other than those conditions that by their nature are to be satisfied at the closing) and that BioRegenx is ready willing and able to consummate the transactions contemplated under the Merger Agreement and, following receipt of such written notice, that the Company fails to consummate the transactions contemplated under the Merger Agreement within five (5)business days. |

Please see the section of this Information Statement entitled “The Merger Agreement—Termination” beginning on page 41.

Amendment to Articles of Incorporation

Prior to the Closing Date of the Merger, the Company will file the Charter Amendment with the Secretary of State of the State of Nevada to increase the number of authorized shares of Common Stock from 500,000,000 to 4,000,000,000 in order to ensure there are enough shares of Common Stock to provide for the Share Issuances.

Please see the section of this Information Statement entitled “Amendment to the Articles of Incorporation” beginning on page 46.

Material U.S. Federal Income Tax Consequences

For U.S. federal income tax purposes, the exchange of property for Common Stock and Series A Preferred Stock, effected pursuant to the Merger are intended to qualify together as an “exchange” described in Section 351 of the Internal Revenue Code of 1986, as amended (the “Code”). If the Exchanges, taken together, qualify as an “exchange” within the meaning of Code Section 351(a), then holders of Common Stock receiving Common Stock and Series A Preferred Stock in the Merger, if any, (“Exchangor(s)”) should not recognize any gain or loss for U.S. federal income tax purposes as a result of the Merger.

For a more detailed discussion, see “The Merger—Material U.S. Federal Income Tax Consequences of the Merger” - page 33.

Tax matters can be complicated and the tax consequences of the Merger to any particular holder of Common Stock and Series A Preferred Stock will depend on such holder’s particular facts and circumstances. Holders of Common Stock and Series A Preferred Stock should consult their own tax advisors to determine the tax consequences of the Merger to them, including the effects of U.S. federal, state, local and foreign tax laws.

Please see the section of this Information Statement entitled “The Merger—Material U.S. Federal Income Tax Consequences of the Merger” beginning on page 33 for a more complete discussion of the material U.S. federal income tax consequences of the Merger.

Accounting Treatment of the Merger

The Company prepares its financial statements in accordance with GAAP and its pro forma financial statements as required by the SEC Article 11 of Regulation S-X. The Merger will be accounted for as an acquisition under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 805, Business Combinations, with BioRegenx being considered the acquirer of the Company for accounting purposes.

Please see the section of this Information Statement entitled “The Merger—Accounting Treatment of the Merger” beginning on page 35.

Risk Factors

An investment in the Company, as the surviving corporation, may include different risks than an investment in the Company on a stand-alone basis. You should carefully review the risks described in the section entitled “Risk Factors” beginning on page 22 together with all of the other information included in this Information Statement.

Additional Information

You can find more information about the Company in the periodic reports and other information we file with the U.S. Securities and Exchange Commission (the “SEC”). The information is available at the website maintained by the SEC at www.sec.gov.

Please see the section of this Information Statement entitled “Where You Can Find Additional Information” beginning on page 61.

Selected Historical Consolidated Financial Data of Findit

The historical financial data presented in the table below sets forth the Company’s selected historical financial information that has been derived from (i) the Company’s financial statements as of and for each of the two years ended December 31, 2021 and 2020, and (ii) the Company’s unaudited condensed financial statements as of and for the nine months ended September 30, 2022 and 2021. The financial results are not necessarily indicative of our future operations or future financial results. The data presented below is only a summary and is not necessarily indicative of our future operations nor does it include the effects of the Merger. You should read this financial information in conjunction with our financial statements, the notes thereto, and the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, all which are incorporated into this Information Statement by reference.

Statement of Operations Data:

| Years Ended December 31, | Nine Months Ended September 30, | |||

| 2021 | 2020 | 2022 | 2021 | |

| Revenues: | ||||

| Findit Services | $197,447 | $363,306 | 33,245 | 185,597 |

| Findit Services – Related Party | - | 35,868 | - | - |

| Sales of Essential Oils | 1,137 | 5,218 | - | 1,137 |

| Total Revenues | 198,584 | 404,392 | ||

| Cost of Goods Sold: | ||||

| Purchases of Materials & Supplies | 554 | 3,229 | - | 554 |

| Cost of Goods Sold – related party | - | 35,868 | - | - |

| Total Cost of Goods Sold | 554 | 39,097 | - | 554 |

| Gross Margin | 198,030 | 365,295 | 33,245 | 186,180 |

| Operating Expenses: | ||||

| Advertising, Marketing & Press Release Expenses | 7,383 | 260,870 | 6,043 | 5,884 |

| Amortization Expense | 4,449 | 5,932 | 4,449 | 4,449 |

| Consulting Services | 6,350 | 21,408 | - | 6,350 |

| Content Writing | 43,100 | 88,649 | 21,750 | 40,300 |

| General and Administrative Expense | 81,115 | 71,488 | 20,884 | 72,654 |

| Professional Fees | 60,231 | 39,738 | 27,613 | 45,651 |

| Programming Fees | 111,270 | 47,483 | 9,150 | 79,470 |

| Web Design and Hosting Expense | 49,250 | 45,375 | 16,129 | 38,408 |

| Total Operating Expenses | 363,148 | 580,943 | (72,773) | (106,986) |

| Loss from Operations | (165,118) | (215,648) | - | 68,245 |

| Other Income: | ||||

| Other Income | 68,245 | - | - | 68,245 |

| Loss on Impairment of Investment | - | (58,088) | - | - |

| Total Other Income | 68,245 | (58,088) | - | 68,245 |

| Loss Before Provision for Income Tax | (96,873) | (273,736) | (72,773) | (38,741) |

| Provision for Income Tax | - | - | - | - |

| Net Loss | (96,873) | (273,736) | (72,773) | (38,741) |

| Other Comprehensive Income (Loss) | ||||

| Unrealized (loss) gain on available-for-sale securities | (165,000) | 189,132 | (39,000) | 475,000 |

| Total Comprehensive Loss | $(261,873) | $(84,604) | (111,773) | 436,259 |

| Loss Per Share, Basic and Diluted | $(0.00) | $(0.00) | $(0.00) | 0.00 |

| Weighted Average Shares Outstanding, | ||||

| Basic and Diluted | 269,745,006 | 267,963,583 | 269,745,006 | 269,745,006 |

Balance Sheet Data:

| December 31, 2021 | December 31, 2020 | September 30, 2022 | September 30, 2021 | |

| Cash and cash equivalents | $ 24,358 | $ 93,875 | $1,541 | 94,725 |

| Accounts Receivable | - | 971 | - | 3,700 |

| Domain Name & Website, net of amortization of $45,577 and $51,399, respectively |

43,404 |

47,854 |

38,955 |

43,404 |

| Investment in Chill N Out Chryotherapy – related party |

60,000 |

225,000 |

21,000 |

700,000 |

| Total assets | $ 127,762 | $ 367,700 | $ 61,496 | $ 841,829 |

| Total debt | $ 197,839 | $ 148,511 | $ 257,503 | $ 227,931 |

| Stockholders’ equity (deficit) |

$ (84,234) |

$ 177,639 |

$ (196,007) |

$ 613,898 |

Cash Flow Data:

| December 31 | Nine Months Ended | Nine Months Ended | ||

| 2021 | 2020 | September 30, 2022 | September 30, 2021 | |

| Cash flows used for operating activities | (119,517) | (94,100) | (60,288) | (49,150) |

| Cash flows used for investing activities | - | - | - | - |

| Cash flows provided by financing activities | 50,000 | 150,000 | 37,471 | 50,000 |

Selected Historical Financial Data of BioRegenx

The selected historical financial data of BioRegenx as of December 31, 2021 and 2020 were derived from the audited historical consolidated financial statements of BioRegenx, Inc. included elsewhere in this Information Statement. The selected historical financial data of BioRegenx, Inc. as of and for the nine months ended September 30, 2022 and 2021 are derived from the unaudited interim financial statements of BioRegenx included elsewhere in this Information Statement.

The information set forth below is only a summary and is not necessarily indicative of the results of future operations nor does it include the effects of the Merger. You should read the following selected data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations of BioRegenx” and BioRegenx’s historical financial statements and related notes included elsewhere in this Information Statement.

Statement of Operations Data:

| For the Years Ended December 31, | For the Nine Months Ended September 30, | |||

| 2021 | 2020 | 2022 | 2021 | |

| Revenues: | ||||

| Net sales | $2,990,772 | $7,787,092 | $1,932,512 | $2,281,713 |

| Cost of Sales | 1,072,878 | 2,063,206 | 689,116 | 1,016,702 |

| Gross Profit | 1,917,894 | 5,723, | 1,236,404 | 1,265,011 |

| Operating Expenses: | ||||

| Distributors incentives | 479,816 | 2,218,66 | 166,706 | 216,502 |

| Selling, general and administrative |

3,885,839 |

4,067,567 |

2,530,926 |

2,050,785 |

| Impairment expense | 830,763 | - | - | - |

| Total Operating Expenses | 5,196,418 | 6,286,229 | 2,697,632 | 2,267,287 |

| Loss from Operations | (3,278,524) | (562,343) | (1,461,632) | (1,002,276) |

| Other Income: | ||||

| Interest income | 25,538 | 28,288 | 148 | 20,929 |

| Interest expense and financing costs |

(341,037) |

(127,561) |

(317,842) |

(30,281) |

| Gain (loss) on sale of investments |

390 |

(120,055) |

- |

- |

| Loan forgiveness PPP | 53,387 | - | - | - |

| Total Other Expenses | (261,722) | (219,328) | (317,694) | (9,352) |

| Income (Loss) Before Provision for Income Tax | (3,540,246)) | (781,671) | (1,778,922) | (1,011,238) |

| Provision for Income Tax | - | - | - | - |

| Net Loss | $(3,540,246) | $(781,671) | $(1,776,922) | $(1,011,238) |

| Loss Per Share, Basic and Diluted |

$(0.02) |

$(0.05) |

$(0.05) |

$(0.03) |

| Weighted Average Shares Outstanding, - Basic and Diluted |

35,266,678 |

34,912,500 |

37,876,930 |

35,266,678 |

Balance Sheet Data:

| December 31, 2021 | December 31, 2020 | September 30, 2022 | September 30, 2021 | |

| Cash and cash equivalents | $ 882,112 | $ 592,973 | $ 218,418 | $1,655,681 |

| Accounts Receivable | 985 | - | - | 141,059 |

| Inventories | 653,291 | 850,312 | 390,654 | 688.817 |

| Prepaid expenses and other current assets |

349,281 |

426,798 |

566,173 |

1,751,048 |

| Total assets | $ 1,919,964 | $1,880,718 | $1,194,935 | $4,216,605 |

| Total debt | $ 5,180,176 | $3,885,284 | $ 2,621,177 | $4,947,810 |

| Stockholders’ equity (deficit) | $ (1,419,401) | $(2,004,566) | $ (1,426,242) | $(731,205) |

Cash Flow Data:

| December 31 | Nine Months Ended | Nine Months Ended | ||

| 2021 | 2020 | September 30, 2022 | September 30, 2021 | |

| Cash flows used for operating activities |

(3,726,316) |

(1,840,390) |

(2,374,865) |

(2,241,453) |

| Cash flows used for investing activities |

(23,600) |

- |

- |

(830,762) |

| Cash flows provided by financing activities |

4,039,115 |

122,229 |

1,711,171 |

4,134,923 |

Summary Selected Unaudited Pro Forma Combined Financial Information

The following selected unaudited pro forma combined consolidated statements have been prepared to reflect the effects of the Merger on the financial statements of the Company. The unaudited pro forma combined statements of operations for the nine months ended September 30, 2022 and for the year ended December 31, 2021, are presented as if the Merger had been completed on January 1, 2021. The unaudited pro forma combined balance sheet is presented as if the Merger had been completed on September 30, 2022.

The following selected unaudited pro forma combined consolidated financial information is not necessarily indicative of the results that might have occurred had the Merger taken place on December 31, 2020 for statement of operations purposes or on September 30, 2022 for balance sheet purposes, and is not intended to be a projection of future results. Future results may vary significantly from the results reflected because of various factors, including those discussed in the section entitled “Risk Factors.” The following selected unaudited pro forma combined consolidated financial information should be read in conjunction with the section entitled “Unaudited Pro Forma Combined Financial Statements” and related notes included in this Information Statement.

| Statement of Operations (Unaudited) | Nine Months Ended September 30, 2022 | Year Ended December 31, 2021 | |||

| Revenue | |||||

| Net Sales | $ 1,965,757 | $ 3,189,356 | |||

| Costs of Goods Sold | 696,107 | 1,073,432 | |||

| Gross Profit | 1,269,650 | 2,115,924 | |||

| Costs and Operating Expenses: | |||||

| All selling, general and administrative | 2,790,112 | 4,728,804 | |||

| Impairment expense | - | 830,762 | |||

| Total Costs and Operating Expenses | 2,790,112 | 5,559,566 | |||

| Loss from Operations | (1,520,462) | (3,443,642) | |||

| Other expense and comprehensive losses, net | (356,694) | (358,477) | |||

| Total Comprehensive Loss | $ (1,877,156) | $ (3,802,119) | |||

| Net loss per common share, basic and diluted | $ (0.01) | $ (0.01) | |||

| Weighted average shares outstanding, basic and diluted | 269,745,006 | 269,745,006 | |||

| Balance Sheet (Unaudited) | Nine Months Ended September 30, 2022 | ||||

| Assets | |||||

| Cash and cash equivalents | $ 19,959 | ||||

| Accounts receivable | - | ||||

| Inventories | 390,654 | ||||

| Prepaid and other current assets | 566,173 | ||||

| Other assets | 79,645 | ||||

| Total Assets | $ 1,256,431 | ||||

| Liabilities and stockholders' deficit | |||||

| Total Debt | $ 2,878,680 | ||||

| Total Stockholders' Deficit | (1,622,249) | ||||

| Total Liabilities and Stockholders' Deficit | $ 1,256,431 | ||||

QUESTIONS AND ANSWERS ABOUT THE MERGER AND THE CHARTER AMENDMENT

The following questions and answers are intended to briefly address some commonly asked questions regarding the Merger and Charter Amendment. These questions and answers may not address all questions that may be important to you as a stockholder. You should read the more detailed information contained elsewhere in this Information Statement, the annexes to this Information Statement and the documents referred to or incorporated by reference in this Information Statement.

Q: Why am I receiving this Information Statement?

A: Effective December 29, 2022, the Company entered into the Merger Agreement with BioRegenx, and the Principal Stockholders approved the Shareholder Approved Actions. Prior to the Closing Date, the Company will need to amend its Articles of Incorporation to increase the number of authorized shares of Common Stock in order to provide for the Share Issuances. The filing of the Charter Amendment with the Secretary of State of the State of Nevada is being undertaken solely for the purposes of effecting the Merger Agreement. Applicable provisions of Nevada law and certain securities regulations require us to provide you with information regarding the Shareholder Approved Actions, even though your vote or consent is neither required nor requested to adopt the Charter Amendment or Merger Agreement or to complete the Shareholder Approved Actions.

Q: If the Merger occurs, what happens to my shares of Common Stock in the Company?

A: Your ownership of shares of Common Stock will not change as a result of the Closing. There will be neither any exchange of nor any new consideration received for your shares of Common Stock. All of the preferences, relative rights and other rights you have in your shares of Common Stock will be unaffected.

Q: When is the Merger expected to close?

A: The closing of the Merger cannot occur until 20 days after the Company mails this Information Statement to its stockholders, assuming all of the other closing conditions specified in the Merger Agreement have been satisfied. We currently expect the Transactions to be completed before the end of the first quarter of 2023, subject to certain government regulatory reviews and approvals and the satisfaction of the other conditions to closing in the Transaction Documents. However, there can be no assurance that the Transactions will be completed on or prior to that time, or at all.

Q: What happens if the Merger does not close?

A: If the Merger does not close for any reason, the holder of the BioRegenx Equity will not receive any payment in connection with the Merger. Instead, the Company and BioRegenx will remain separate, independent companies. In addition, if the closing of the Merger does not occur, the Charter Amendment will not be filed with the Secretary of State of the State of Nevada and will not become effective.

Q: Why did the Board approve the Merger and the Merger Agreement?

A: After careful consideration and evaluation of the Merger, our Board approved and declared advisable the Merger Agreement, the Merger and the other transactions contemplated by the Merger Agreement.

For a discussion of the factors that the Board considered in determining to approve the Merger Agreement, please see the section of this Information Statement entitled “The Merger—Reasons for the Merger.”

Q: What factors did the Board consider in evaluating the Merger Agreement and the Merger?

A: In evaluating the Merger, the Board consulted with Findit’s management, as well as Findit’s legal and financial advisors, and considered a number of factors, weighing both perceived benefits of the Merger as well as potential risks of the Merger. In the course of its deliberations, the Board considered a variety of factors and information that it believes support its determinations and recommendations, including the following (which are not all-inclusive and not necessarily presented in order of relative importance):

| • | The Company’s expectation that the Merger will provide significant EBITDAX accretion as a result of enhanced capital efficiency and operating margins. |

| • | The Company’s expectation that the combination will materially enhance the Company’s financial, operational, and credit metrics. |

| • | The attractiveness of the Merger to the Company in comparison to other acquisition opportunities reasonably available to the Company, including BioRegenx’s desirable asset quality, potential synergies between the companies, accretive cash flow and the immediate actionability of the BioRegenx acquisition opportunity. |

| • | The recommendation of the Merger by the Company’s management team. |

| • | That the Company’s Board believes the restrictions imposed on the Company’s business and operations during the pendency of the Merger are reasonable and not unduly burdensome. |

| • | The likelihood of consummation of the Merger and the Board’s evaluation of the likely time period necessary to close the Merger. |

| • | That the addition of the seven directors to the Company’s Board in connection with the Merger will add further valuable expertise and experience and in-depth familiarity with BioRegenx to the Company’s Board, which will enhance the likelihood of realizing the strategic benefits that the Company expects to derive from the Merger. |

The foregoing factors are some of the principal factors considered by the Board. The Board did not assign relative weights to the factors it considered or determine that any factor was of particular importance. For a discussion of the factors that the Board considered in determining to approve the Merger Agreement, please see the section of this Information Statement entitled “The Merger—Reasons for the Merger.”

Q: Is the approval of stockholders necessary to adopt the Merger Agreement and Charter Amendment? Why am I not being asked to vote on the Merger Agreement and Charter Amendment?

A: Under Nevada law, the approval of the Merger Agreement, the Merger and the Charter Amendments requires approval by the Board and a majority of the outstanding shares of the Common Stock voting as a single class. Per the Nevada Revised Statutes, stockholder approval may be had at a stockholders’ meeting or by written consent in lieu of a stockholders’ meeting. The stockholder approval was obtained effective December 29, 2022, the date on which the Principal Stockholders delivered to the corporate secretary of the Company the Written Consent adopting the Shareholder Approved Actions. As of December 29, 2022, the Principal Stockholders held approximately 78.14% of the voting power of all outstanding shares of Common Stock. Accordingly, the approval of the Shareholder Approved Actions by the Company’s stockholders was effected in accordance with the Nevada Revised Statutes.

No further approval of the stockholders of the Company is required to adopt the Shareholder Approved Actions. As a result, the Company has not solicited and will not be soliciting your vote for the approval of the Shareholder Approved Actions and does not intend to call a meeting of stockholders for purposes of voting on the approval of the Shareholder Approved Actions.

Q: Am I entitled to appraisal rights in connection with the Merger?

A: As no further stockholder approval is required for the Shareholder Approved Actions, dissenter’s appraisal rights or similar rights are inapplicable. Dissenters to the other Shareholder Approved Actions do not have any appraisal rights or similar rights.

Q: What are the U.S. federal income tax consequences?

A: For U.S. federal income tax purposes, the Exchanges are intended to qualify together as an “exchange” described in Section 351 of the Code. If the Exchanges, taken together, qualify as an “exchange” within the meaning of Code Section 351(a), then the Exchangors should not recognize any gain or loss for U.S. federal income tax purposes as a result of the Merger.

For all holders of Common Stock that are not Exchangors, the Merger should not have U.S. federal income tax consequences for such holders.

For a more detailed discussion, see “The Merger—Material U.S. Federal Income Tax Consequences of the Merger.” Tax matters can be complicated and the tax consequences of the Merger to any particular holder of Common Stock will depend on such holder’s particular facts and circumstances. Holders of Common Stock should consult their own tax advisors to determine the tax consequences of the Merger to them, including the effects of U.S. federal, state, local and foreign tax laws.

Q: What is householding and how does it affect me?

A: The SEC permits companies to send a single set of certain disclosure documents to stockholders who share the same address and have the same last name, unless contrary instructions have been received, but only if the applicable company provides advance notice and follows certain procedures. In such cases, each stockholder continues to receive a separate set of disclosure documents. This practice, known as “householding”, is designed to reduce duplicate mailings and save significant printing and postage costs as well as natural resources.

If you received a householded mailing and you would like to have additional copies of this Information Statement mailed to you, or you would like to opt out of this practice for future mailings, please submit your request to the Company by phone at (404) 443-3224 or by mail to Findit, Inc., 5051 Peachtree Corners Circle, 3200, Peachtree Corners, GA 30092. We will promptly send additional copies of this Information Statement upon receipt of such request.

Q: Who can help answer my questions?

A: If you have questions about the Merger after reading this Information Statement, please contact the Company by phone at (404) 443-3224 or by mail to Findit, Inc., 5051 Peachtree Corners Circle, #200, Peachtree Corners, GA 30092.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Any statements in this Information Statement regarding the Charter Amendment, the Merger, the expected timetable for completing the Merger, future financial and operating results, future capital structure and liquidity, benefits and synergies of the Merger, future opportunities for the combined company, general business outlook and any other statements about the future expectations, beliefs, goals, plans or prospects of the Board or management of the Company constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that are not statements of historical fact (including statements containing the words “expects,” “intends,” “anticipates,” “estimates,” “predicts,” “believes,” “should,” “potential,” “may,” “forecast,” “objective,” “plan,” or “targets,” and their variants and other similar expressions) are intended to identify forward-looking statements.

There are a number of factors that could cause actual results or events to differ materially from those indicated by such forward-looking statements, including:

| • | risks and uncertainties relating to the Merger, including the possibility that the Merger does not close when expected or at all because conditions to closing are not satisfied on a timely basis or at all; |

| • | potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the Merger; |

| o | timing of the Merger; |

| o | the possibility that the anticipated benefits of the Merger are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies; |

| o | the possibility that the Merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events; |

| o | diversion of management’s attention from ongoing business operations and opportunities; |

| • | changes in operational and capital plans; |

| • | the potential for production decline rates to be greater than expected; |

| • | delays, |

| • | higher than expected costs and expenses, including the availability and cost of services and material and the surviving corporation’s potential inability to achieve expected cost savings; |

| • | unexpected future capital expenditures; |

| • | economic and competitive conditions; |

| • | debt and equity market conditions, including the availability and costs of financing to fund the surviving corporation’s operations; |

| • | the ability to obtain industry partners to jointly explore certain prospects, and the willingness and ability of those partners to meet capital obligations when requested; |

| • | compliance with environmental and other regulations; |

| • | the success of the surviving corporation’s risk management activities; |

| • | title to properties, including, if any, those to be acquired in the Merger; |

| • | litigation, including litigation concerning the Merger; |

| • | the other factors and financial, operational and legal risks or uncertainties described in the Company’s public filings with the SEC, including its Annual Report on Form 10-K for the year ended December 31, 2022 and subsequent reports on Form 10-Q and 8-K filed with the SEC, all of which are or may in the future be incorporated by reference into this Information Statement. |

The Company disclaims any intention or obligation to update or revise any forward-looking statements as a result of developments occurring after the date of this document except as required by law.

RISK FACTORS

An investment in the surviving corporation may include different risks than an investment in the Company on a stand-alone basis. Moreover, by reason of the pending Merger, and the potential change in the business of the surviving corporation as compared to the Company’s business as currently conducted, the nature of the investment by each stockholder of the Company will change. In addition to the other information contained in or incorporated by reference in this Information Statement, including the risk factors contained in the Company’s annual report on Form 10-K for the year ended December 31, 2021, as updated by subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, which are all incorporated by reference in this Information Statement, you should carefully review the risks described below together with all of the other information included in this Information Statement. Additional risks and uncertainties not presently known to the Company or BioRegenx, or that are not currently believed to be important to you, if they materialize, may also adversely affect the Merger and the Company as the surviving corporation. See “Where You Can Find Additional Information” for the location of information incorporated by reference into this Information Statement.

Risks Relating to the Merger

The Company and BioRegenx may fail to complete the Merger if certain required conditions, many of which are outside the companies’ control, are not satisfied.

Completion of the Merger is subject to various customary closing conditions, including, but not limited to, (i) the absence of any order of injunction prohibiting the consummation of the Merger, (ii) no material adverse effect occurring with respect to the Company or BioRegenx, (iii) subject to certain exceptions and materiality and material adverse effect standards, the accuracy of the representations and warranties of the parties to the Merger Agreement and (iv) performance and compliance by the parties to the Merger Agreement in all material respects with the agreements and covenants contained in the Merger Agreement. Despite the companies’ best efforts, they may not be able to satisfy or receive the various closing conditions and obtain the necessary approvals in a timely fashion or at all.

Failure to complete the Merger could negatively impact the Company’s stock price, future business and financial results.

If the Merger is not completed, the Company will be subject to several risks, including the following:

| • | payment for certain costs relating to the Merger, whether or not the Merger is completed, such as legal, accounting and printing fees; |

| • | negative reactions from the financial markets, including declines in the price of the Common Stock due to the fact that current prices may reflect a market assumption that the Merger will be completed; |

| • | diverted attention of Company management to the Merger rather than to the Company’s operations and pursuit of other opportunities that could have been beneficial to it; and |

| • | negative impact on the Company’s future growth plan, including with regard to potential acquisitions, for which the Company is likely to provide a stronger foundation. |

The Company will be subject to various uncertainties and contractual restrictions while the Merger is pending that could adversely affect its business and operations.

Uncertainty about the effect of the Merger on customers, suppliers and vendors may have an adverse effect on the Company’s business, financial condition and results of operations. It is possible that some customers, suppliers and other persons with whom the Company has business relationships may delay or defer certain business decisions, or might decide to seek to terminate, change or renegotiate their relationship with the Company as a result of the Merger, which could negatively affect the Company’s financial results, as well as the market price of the Common Stock, regardless of whether the Merger is completed.

Additionally, under the terms of the Merger Agreement, the Company is subject to certain restrictions on the conduct of its business prior to the consummation of the Merger, which may adversely affect its ability to execute certain aspects of its business strategies. These restrictions may, among other matters, prevent the Company from pursuing otherwise attractive business opportunities, selling assets, incurring indebtedness, engaging in significant capital expenditures in excess of certain limits set forth in the Merger Agreement, entering into other transactions or making other changes to the Company’s business prior to consummation of the Merger or termination of the Merger Agreement. Such limitations could negatively affect the Company’s businesses and operations prior to the completion of the Merger.

The Company may have difficulty attracting, motivating and retaining executives and other employees in light of the Merger.

Uncertainty about the effect of the Merger on the Company’s employees may impair its ability to attract, retain and motivate personnel until the Merger is completed. Employee retention may be particularly challenging during the pendency of the Merger, as employees may feel uncertain about their future roles with the Company. In addition, the Company may have to provide additional compensation in order to retain employees. If employees depart because of issues relating to the uncertainty and difficulty of integration or a desire not to become employees of the Company, the Company’s ability to realize the anticipated benefits of the Merger could be adversely affected.

In connection with the Merger, the Company may be required to take write-downs or write-offs, restructuring and impairment or other charges that could negatively affect the business, assets, liabilities, prospects, outlook, financial condition and results of operations of the Company.

Although the Company has conducted extensive due diligence in connection with the Merger, it cannot assure you that this diligence revealed all material issues that may be present, that it would be possible to uncover all material issues through a customary amount of due diligence, or that factors outside of the Company’s control will not later arise. Even if the Company’s due diligence successfully identifies certain risks, unexpected risks may arise and previously known risks may materialize in a manner not consistent with the Company’s preliminary risk analysis. Further, as a result of the Merger, purchase accounting, and the proposed operation of the Company going forward, the Company may be required to take write-offs or write-downs, restructuring and impairment or other charges. As a result, the Company may be forced to write-down or write-off assets, restructure its operations, or incur impairment or other charges that could negatively affect the business, assets, liabilities, prospects, outlook, financial condition and results of operations of the Company.

The market price of the Common Stock may be volatile, and holders of the Common Stock could lose a significant portion of their investment due to drops in the market price of the Common Stock following completion of the Merger.

The market price of the Common Stock may be volatile, including changes in price caused by factors unrelated to the Company’s operating performance or prospects.

Specific factors that may have a significant effect on the market price for the Common Stock include, among others, the following:

| • | changes in stock market analyst recommendations or earnings estimates regarding the Common Stock, other companies comparable to it or companies in the industries they serve; |

| • | actual or anticipated fluctuations in the Company’s operating results of future prospects; |

| • | reaction to public announcements by the Company; |

| • | strategic actions taken by the Company or its competitors, such as the intended business separations, acquisitions or restructurings; |

| • | failure of the Company to achieve the perceived benefits of the Merger, including financial results and anticipated synergies, as rapidly as or to the extent anticipated by financial or industry analysts; |

| • | adverse conditions in the financial market or general U.S. or international economic conditions, including those resulting from war, incidents of terrorism and responses to such events; and |

| • | sales of Common Stock by the Company, members of its management team or significant stockholders. |

Risks Relating to the Business of the Company upon Completion of the Merger

The Company may fail to realize the anticipated benefits of the Merger and may assume unanticipated liabilities.

The success of the Merger will depend on, among other things, the Company’s ability to combine the Company’s and BioRegenx’s businesses in a manner that realizes the various benefits, growth opportunities and synergies identified by the companies. Achieving the anticipated benefits of the transaction is subject to a number of risks and uncertainties. It is uncertain whether the Company’s and BioRegenx’s existing operations and the acquired properties and assets can be integrated in an efficient and effective manner.

The pro forma financial statements presented for illustrative purposes may not be indicative of the Company’s financial condition or results of operations following the Merger.

The pro forma financial statements contained in this Information Statement are presented for illustrative purposes only and may not be indicative of the Company’s financial condition or results of operations following the Merger for several reasons. The pro forma financial statements have been derived from the Company’s and BioRegenx’s historical financial statements, and certain adjustments and assumptions have been made regarding the Company after giving effect to the Merger. The information upon which these adjustments and assumptions have been made is preliminary, and these kinds of adjustments and assumptions are difficult to make with complete accuracy. Moreover, the pro forma financial statements do not reflect all costs that are expected to be incurred by the Company in connection with the Merger. For example, the impact of any incremental costs incurred in integrating the two companies is not reflected in the pro forma financial statements. As a result, the actual financial condition and results of operations of the Company following the Merger may not be consistent with, or evident from, these pro forma financial statements.