Goldman Sachs & Co. LLC | | | Citigroup | | | Credit Suisse |

Goldman Sachs & Co. LLC | | | Citigroup | | | Credit Suisse |

| | | Per Note | | | Total Offering(3) | |

Price to the Public(1) | | | $ | | | $ |

Underwriters’ Discounts and Commissions | | | $ | | | $ |

Net Proceeds to the Company(2) | | | $ | | | $ |

| (1) | Price to the public does not include accrued interest, if any, from , 2020. |

| (2) | Before deducting the expenses of the Offering, estimated to be approximately $ , which, together with the Underwriters’ discounts and commissions, will be paid for by us out of the gross proceeds of the Offering. See “Underwriting”. |

| (3) | We have granted to the Underwriters an option (the “Over-Allotment Option”), exercisable for 30 days from the date of this Prospectus Supplement, to purchase up to $120,000,000 aggregate principal amount of additional notes at the offering price listed above, less underwriting discounts and commissions. The Underwriters may exercise this option solely for the purpose of covering the Underwriters’ over-allocation position, if any, made in connection with the initial offering of the notes offered by this Prospectus Supplement and consequent market stabilization purposes. If the Over-Allotment Option is exercised in full, the total “Price to the Public”, “Underwriters’ Discounts and Commissions” and “Net Proceeds to the Company” will be $ , $ and $ , respectively. |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

| (a) | Shopify’s audited consolidated financial statements as at and for the years ended December 31, 2019 and December 31, 2018, together with the related notes thereto, management’s annual report on internal control over financial reporting and the report of our Independent Registered Public Accounting Firm thereon (the “2019 Annual Financial Statements”); |

| (b) | Shopify’s Management’s Discussion and Analysis for the year ended December 31, 2019 (the “2019 Annual MD&A”); |

| (c) | Shopify’s Annual Information Form dated February 12, 2020 (the “Annual Information Form”); |

| (d) | Shopify’s Management Information Circular dated April 16, 2020 in connection with the annual general meeting of the shareholders of Shopify held on May 27, 2020; |

| (e) | Shopify’s unaudited interim condensed consolidated financial statements as at June 30, 2020 and for the three and six months ended June 30, 2020 and 2019, together with the related notes thereto (the “Q2 2020 Financial Statements”); and |

| (f) | Shopify’s Management’s Discussion and Analysis as at and for the three and six months ended June 30, 2020 (the “Q2 2020 MD&A”). |

| | | Year Ended December 31, | | | Six Months Ended June 30, | |||||||

| | | 2019 | | | 2018 | | | 2020 | | | 2019 | |

High | | | 1.3600 | | | 1.3642 | | | 1.4496 | | | 1.3600 |

Low | | | 1.2988 | | | 1.2288 | | | 1.2970 | | | 1.3087 |

Average | | | 1.3269 | | | 1.2957 | | | 1.3651 | | | 1.3336 |

Period end | | | 1.2988 | | | 1.3642 | | | 1.3628 | | | 1.3087 |

| • | during any calendar quarter commencing after the calendar quarter ending on March 31, 2021 (and only during such calendar quarter), if the last reported sale price on the NYSE of our Class A Subordinate Voting Shares for at least 20 trading days (whether or not consecutive) during a period of 30 consecutive trading days ending on, and including, the last trading day of the immediately preceding calendar quarter is greater than or equal to 130% of the conversion price for the notes on each applicable trading day; |

| • | during the ten business day period after any ten consecutive trading day period (the “measurement period”) in which the “trading price” (as defined under “Description of Notes—Conversion Rights—Conversion upon Satisfaction of Trading Price Condition”) per $1,000 principal amount of notes for each trading day of the measurement period was less than 98% of the product of the last reported sale price on the NYSE of our Class A Subordinate Voting Shares and the conversion rate on each such trading day; |

| • | if we call such notes for optional redemption, clean-up redemption or tax redemption, at any time prior to the close of business on the second scheduled trading day immediately preceding the redemption date; or |

| • | upon the occurrence of specified corporate events described under “Description of Notes—Conversion Rights—Conversion upon Specified Corporate Events.” |

| • | senior in right of payment to any of our indebtedness that is expressly subordinated in right of payment to the notes; |

| • | equal in right of payment to any of our unsecured indebtedness that is not so subordinated; |

| • | effectively junior in right of payment to any of our secured indebtedness to the extent of the value of the assets securing such indebtedness; and |

| • | structurally junior to all indebtedness and other liabilities of our current or future subsidiaries (including trade payables). |

| • | significant volatility in the market price and trading volume of comparable companies, including in relation to the overall market volatility connected to uncertainty regarding the COVID-19 pandemic; |

| • | actual or anticipated changes or fluctuations in our operating results or in the expectations of market analysts; |

| • | adverse market reaction to any indebtedness we may incur or securities we may issue in the future; |

| • | short sales, hedging and other derivative transactions in our shares; |

| • | announcements of technological innovations, new products, strategic alliances or significant agreements by us or by our competitors; |

| • | changes in the prices of our solutions or the prices of our competitors’ solutions; |

| • | litigation or regulatory action against us; |

| • | breaches of security or privacy, and the costs associated with any such breaches and remediation; |

| • | investors’ general perception of us and the public’s reaction to our press releases, our other public announcements and our filings with the SEC, and Canadian securities regulators; |

| • | fluctuations in quarterly results; |

| • | publication of research reports or news stories about us, our competitors or our industry, or positive or negative recommendations or withdrawal of research coverage by securities analysts; |

| • | changes in general political, economic, geopolitical, industry, social and market conditions and trends; |

| • | sales of our Class A Subordinate Voting Shares and Class B multiple voting shares by our directors, executive officers and existing shareholders; |

| • | recruitment or departure of key personnel; and |

| • | the other risk factors described in the Annual Information Form and the Q2 2020 MD&A. |

| • | require that any action to be taken by our shareholders be effected at a duly called annual or special meeting and not by written consent; |

| • | establish an advance notice procedure for shareholder proposals to be brought before an annual meeting, including proposed nominations of persons for election to our board of directors; and |

| • | require the approval of a two-thirds majority of the votes cast by shareholders present in person or by proxy in order to amend certain provisions of our restated articles of incorporation, including, in some circumstances, by separate class votes of holders of our Class A Subordinate Voting Shares and Class B multiple voting shares. |

| | | As at June 30, 2020 | |||||||

| | | Actual | | | As Adjusted | | | As Further Adjusted | |

| | | ($ thousands) | |||||||

Cash, cash equivalents and marketable securities | | | $4,000,955 | | | $ | | | $ |

Long-term debt | | | $— | | | $— | | | $— |

Notes(1) | | | — | | | — | | | |

Total long-term debt | | | | | | | |||

Shareholders’ equity | | | | | | | |||

— Class A Subordinate Voting Shares and Class B multiple voting shares | | | $4,859,950 | | | $ | | | $ |

— Additional paid-in-capital | | | 73,578 | | | | | ||

— Accumulated deficit and accumulated other comprehensive income | | | (304,589) | | | | | ||

— Total shareholders’ equity | | | 4,628,939 | | | — | | | |

Consolidated capitalization | | | $4,628,939 | | | $ | | | $ |

| (1) | The entire proceeds of the Offering have been included in this figure. As noted in our risk factors, under current applicable accounting principles, a component will be bifurcated to equity to account for the conversion feature in the instrument. The initial liability carrying amount for the notes will be the fair value of a similar debt instrument that does not have a conversion feature, valued using our cost of capital for straight, unconvertible debt. |

| • | be our general unsecured, senior obligations; |

| • | initially be limited to an aggregate principal amount of $800 million (or $920 million if the underwriters’ option to purchase additional notes solely to cover over-allotments is exercised in full); |

| • | bear cash interest at an annual rate of % from September , 2020, payable semiannually on May 1 and November 1 of each year, beginning on May 1, 2021; |

| • | be subject to redemption at our option, in whole or in part, on or after September 15, 2023 if the last reported sale price (as defined under “—Conversion Rights—Conversion upon Satisfaction of Sale Price Condition”) of our Class A subordinate voting shares has been at least 130% of the conversion price then in effect for at least 20 trading days (whether or not consecutive) during any 30 consecutive trading day period (including the last trading day of such period) ending on, and including, the trading day immediately preceding the date on which we provide written notice of redemption at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued and unpaid interest to, but excluding, the redemption date as described under “—Optional Redemption;” |

| • | be subject to redemption at our option, in whole and not in part, at any time if less than $80 million aggregate principal amount of notes remains outstanding at such time, at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued and unpaid interest to, but excluding, the redemption date as described under “—Cleanup Redemption;” |

| • | be redeemable at our option, in whole but not in part, as described under “—Redemption for Changes in Canadian Tax Law;” |

| • | mature on November 1, 2025 unless earlier converted, purchased or redeemed in accordance with their terms; |

| • | be subject to a requirement that we offer to purchase all of the outstanding notes upon a fundamental change, as described under “—Offer to Purchase Upon a Fundamental Change,” occurring prior to the maturity date (and the fundamental change purchase price will be equal to 100% of the principal amount of the notes to be purchased, plus accrued and unpaid interest to, but excluding, the relevant fundamental change purchase date); |

| • | be issued in minimum denominations of $1,000 and multiples of $1,000; and |

| • | be represented by one or more registered notes in global form, but in certain limited circumstances may be represented by notes in definitive form. See “Book-Entry, Settlement and Clearance.” |

| (a) | convert its notes; or |

| (b) | not have its notes redeemed, provided that no additional amounts will be payable on any payment of interest or principal with respect to the notes. |

| • | Canadian taxes imposed on a payment made to a holder of notes with which we do not deal at arm’s length (within the meaning of the Tax Act) at the time of making such payment; |

| • | Canadian taxes that are assessed or imposed on a payment to a holder of notes made in respect of a debt or other obligation to pay an amount to a person with whom we do not deal at arm’s length (within the meaning of the Tax Act) at the time of making such payment; |

| • | Canadian taxes that are assessed or imposed by reason of the holder of the note being a “specified shareholder” as defined in subsection 18(5) of the Tax Act of us or not dealing at arm’s length (within the meaning of the Tax Act) with a “specified shareholder” of us; |

| • | Canadian taxes that would not have been imposed but for the failure of the holder to comply with a timely request from us or the relevant paying agent for any certification, identification, information, documentation or other reporting requirement if compliance is required by law, regulation, administrative practice or an applicable treaty as a precondition to exemption from, or a reduction in the rate of deduction or withholding of, such Canadian taxes (provided that in the case of any imposition or change in any such certification, identification, information, documentation or other reporting requirements which applies generally to holders of notes who are not residents of Canada, at least 60 days prior to the effective date of any such imposition or change, we shall give written notice, in the manner provided in the indenture, to the trustee and the holders of the notes then outstanding of such imposition or change, as the case may be, and provide the trustee and such holders with such forms or documentation, if any, as may be required to comply with such certification, identification, information, documentation or other reporting requirements); |

| • | Canadian taxes imposed by reason of the holder of notes carrying on business in or otherwise being connected with Canada or any province or territory thereof otherwise than by the mere holding of such notes or the receipt of payment, or exercise of any enforcement rights thereunder; or |

| • | any estate, inheritance, gift, sales, excise, transfer, personal property or similar tax, assessment or governmental charge (collectively, the “excluded taxes”). |

| • | for conversions following the regular record date immediately preceding the maturity date; |

| • | if we have specified a fundamental change purchase date that is after a regular record date and on or prior to the business day immediately succeeding the corresponding interest payment date; |

| • | if we have specified a redemption date that is after a regular record date and on or prior to the business day immediately succeeding the corresponding interest payment date; or |

| • | to the extent of any overdue interest, if any overdue interest exists at the time of conversion with respect to such note. |

| • | issue to all or substantially all holders of our Class A subordinate voting shares any rights, options or warrants (other than in connection with a shareholder rights plan prior to separation of such rights from our Class A subordinate voting shares) entitling them, for a period of not more than 45 calendar days after the announcement date of such issuance, to subscribe for or purchase our Class A subordinate voting shares at |

| • | distribute to all or substantially all holders of our Class A subordinate voting shares our assets, securities or rights to purchase our securities (other than in connection with a shareholder rights plan prior to separation of such rights from our Class A subordinate voting shares), which distribution has a per share value, as reasonably determined by us, exceeding 10% of the last reported sale price of our Class A subordinate voting shares on the trading day preceding the date of announcement for such distribution,then, in either case, we must notify the holders of the notes (such notification, a “Certain Distributions Notice”) (x) at least 25 scheduled trading days or (y) if we are then otherwise permitted to elect physical settlement in respect of any conversions and, in the Certain Distributions Notice, we elect physical settlement in respect of any conversions with conversion dates that occur after delivery to the holders of the Certain Distributions Notice until the Certain Distributions Conversion Period End Date (as defined below), at least 5 scheduled trading days prior to, in either case, prior to the ex-dividend date for such issuance or distribution (or, if later in the case of any such separation of rights issued pursuant to a shareholder rights plan as soon as reasonably practicable after we become aware that such separation or triggering event has occurred or will occur). Once we have given such notice, holders may surrender all or any portion of their notes for conversion at any time until the earlier of the close of business on the business day immediately preceding the ex-dividend date for such issuance or distribution and our announcement that such issuance or distribution will not take place, even if the notes are not otherwise convertible at such time (such earlier date and time, the “Certain Distributions Conversion Period End Date”). |

| • | complete and manually sign the conversion notice on the back of the note, or a facsimile of the conversion notice; |

| • | deliver the conversion notice, which is irrevocable, and the note to the conversion agent; |

| • | if required, furnish appropriate endorsements and transfer documents; and |

| • | if required, pay funds equal to interest payable on the next interest payment date. |

| • | if we elect (or are deemed to have elected) physical settlement, we will deliver to the converting holder in respect of each $1,000 principal amount of notes being converted a number of Class A subordinate voting shares equal to the conversion rate; |

| • | if we elect cash settlement, we will pay to the converting holder in respect of each $1,000 principal amount of notes being converted cash in an amount equal to the sum of the daily conversion values for each of the 20 consecutive trading days during the related observation period; and |

| • | if we elect combination settlement, we will pay or deliver, as the case may be, to the converting holder in respect of each $1,000 principal amount of notes being converted a “settlement amount” equal to the sum of the daily settlement amounts for each of the 20 consecutive trading days during the related observation period. |

| • | cash equal to the lesser of (i) the maximum cash amount per $1,000 principal amount of notes to be received upon conversion as specified in the notice specifying our chosen settlement method (the “specified dollar amount”), if any, divided by 20 (such quotient the “daily measurement value”) and (ii) the daily conversion value; and |

| • | if the daily conversion value exceeds the daily measurement value, a number of shares equal to (i) the difference between the daily conversion value and the daily measurement value, divided by (ii) the daily VWAP for such trading day. |

| • | subject to the immediately succeeding bullet, if the relevant conversion date occurs prior to August 1, 2025, the 20 consecutive trading day period beginning on, and including, the second trading day immediately succeeding such conversion date; |

| • | if the relevant conversion date occurs during a redemption period with respect to the notes as described under “—Optional Redemption,” “—Cleanup Redemption” or “—Redemption for Changes in Canadian Tax Law,” the 20 consecutive trading days beginning on, and including, the 21st scheduled trading day immediately preceding the relevant redemption date; and |

| • | if the relevant conversion date occurs on or after August 1, 2025, the 20 consecutive trading days beginning on, and including, the 21st scheduled trading day immediately preceding the maturity date. |

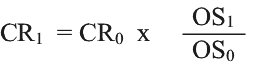

| (1) | If we exclusively issue our Class A subordinate voting shares as a dividend or distribution on our Class A subordinate voting shares, or if we effect a share subdivision or share consolidation, the conversion rate will be adjusted based on the following formula: |

CR0 | | | = | | | the conversion rate in effect immediately prior to the open of business on the ex-dividend date of such dividend or distribution, or immediately prior to the open of business on the effective date of such share subdivision or share consolidation, as applicable; |

CR1 | | | = | | | the conversion rate in effect immediately after the open of business on such ex-dividend date or effective date; |

OS0 | | | = | | | the number of our Class A subordinate voting shares outstanding immediately prior to the open of business on such ex-dividend date or effective date (before giving effect to any such dividend, distribution, share subdivision or share consolidation); and |

OS1 | | | = | | | the number of our Class A subordinate voting shares outstanding immediately after giving effect to such dividend, distribution, share subdivision or share consolidation. |

| (2) | If we issue to all or substantially all holders of our Class A subordinate voting shares any rights, options or warrants entitling them, for a period of not more than 45 calendar days after the announcement date of such issuance, to subscribe for or purchase our Class A subordinate voting shares at a price per share that is less than the average of the last reported sale prices of our Class A subordinate voting shares for the 10 consecutive trading day period ending on, and including, the trading day immediately preceding the date of announcement of such issuance, the conversion rate will be increased based on the following formula: |

CR0 | | | = | | | the conversion rate in effect immediately prior to the open of business on the ex-dividend date for such issuance; |

CR1 | | | = | | | the conversion rate in effect immediately after the open of business on such ex-dividend date; |

OS0 | | | = | | | the number of our Class A subordinate voting shares outstanding immediately prior to the open of business on such ex-dividend date; |

X | | | = | | | the total number of our Class A subordinate voting shares issuable pursuant to such rights, options or warrants; and |

Y | | | = | | | the number of our Class A subordinate voting shares equal to the aggregate price payable to exercise such rights, options or warrants, divided by the average of the last reported sale prices of our Class A subordinate voting shares over the 10 consecutive trading day period ending on, and including, the trading day immediately preceding the date of announcement of the issuance of such rights, options or warrants. |

| (3) | If we distribute shares, evidences of our indebtedness, other assets or property of ours or rights, options or warrants to acquire our shares or other securities, to all or substantially all holders of our Class A subordinate voting shares, excluding: |

| • | dividends, distributions or issuances described in clause (1) or (2) above; |

| • | dividends or distributions paid exclusively in cash as to which an adjustment was effected pursuant to clause (4) below; |

| • | distributions of reference property in exchange for or upon conversion of our Class A subordinate voting shares in a transaction described in “—Recapitalizations, Reclassifications, and Changes of Our Class A Subordinate Voting Shares;” and |

| • | spin-offs as to which the provisions set forth below in this clause (3) shall apply; then the conversion rate will be increased based on the following formula: |

CR0 | | | = | | | the conversion rate in effect immediately prior to the open of business on the ex-dividend date for such distribution; |

CR1 | | | = | | | the conversion rate in effect immediately after the open of business on such ex-dividend date; |

SP0 | | | = | | | the average of the last reported sale prices of our Class A subordinate voting shares over the 10 consecutive trading day period ending on, and including, the trading day immediately preceding the ex-dividend date for such distribution; and |

FMV | | | = | | | the fair market value (as determined by us) of the shares, evidences of indebtedness, assets, property, rights, options or warrants distributed with respect to each outstanding share of our Class A subordinate voting shares on the ex-dividend date for such distribution. |

CR0 | | | = | | | the conversion rate in effect immediately prior to the end of the valuation period (as defined below); |

CR1 | | | = | | | the conversion rate in effect immediately after the end of the valuation period; |

FMV0 | | | = | | | the average of the last reported sale prices of the shares or similar equity interests distributed to holders of our Class A subordinate voting shares applicable to one share of our Class A subordinate voting shares (determined by reference to the definition of last reported sale price set forth under “—Conversion upon Satisfaction of Sale Price Condition” as if references therein to our Class A subordinate voting shares were to such shares or similar equity interests) over the first 10 consecutive trading day period after, and including, the ex-dividend date of the spin-off (the “valuation period”); and |

MP0 | | | = | | | the average of the last reported sale prices of our Class A subordinate voting shares over the valuation period. |

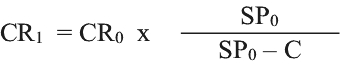

| (4) | If any cash dividend or distribution is made to all or substantially all holders of our Class A subordinate voting shares, the conversion rate will be adjusted based on the following formula: |

CR0 | | | = | | | the conversion rate in effect immediately prior to the open of business on the ex-dividend date for such dividend or distribution; |

CR1 | | | = | | | the conversion rate in effect immediately after the open of business on the ex-dividend date for such dividend or distribution; |

SP0 | | | = | | | the last reported sale price of our Class A subordinate voting shares on the trading day immediately preceding the ex-dividend date for such dividend or distribution; and |

C | | | = | | | the amount in cash per share we distribute to all or substantially all holders of our Class A subordinate voting shares. |

| (5) | If we or any of our subsidiaries make a payment in respect of a tender or exchange offer for our Class A subordinate voting shares that is subject to the then applicable tender offer rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (other than any odd lot tender offer), to the extent that the cash and value of any other consideration included in the payment per Class A subordinate voting share exceeds the average of the last reported sale prices of our Class A subordinate voting shares over the 10 consecutive trading day period commencing on, and including, the trading day next succeeding the last date on which tenders or exchanges may be made pursuant to such tender or exchange offer, the conversion rate will be increased based on the following formula: |

CR0 | | | = | | | the conversion rate in effect immediately prior to the close of business on the 10th trading day immediately following, and including, the trading day next succeeding the date such tender or exchange offer expires; |

CR1 | | | = | | | the conversion rate in effect immediately after the close of business on the 10th trading day immediately following, and including, the trading day next succeeding the date such tender or exchange offer expires; |

AC | | | = | | | the aggregate value of all cash and any other consideration (as determined by us) paid or payable for shares purchased in such tender or exchange offer; |

OS0 | | | = | | | the number of our Class A subordinate voting shares outstanding immediately prior to the date such tender or exchange offer expires (prior to giving effect to the purchase of all shares accepted for purchase or exchange in such tender or exchange offer); |

OS1 | | | = | | | the number of our Class A subordinate voting shares outstanding immediately after the date such tender or exchange offer expires (after giving effect to the purchase of all shares accepted for purchase or exchange in such tender or exchange offer); and |

SP1 | | | = | | | the average of the last reported sale prices of our Class A subordinate voting shares over the 10 consecutive trading day period commencing on, and including, the trading day next succeeding the date such tender or exchange offer expires. |

| • | upon the issuance of our Class A subordinate voting shares pursuant to any present or future plan providing for the reinvestment of dividends or interest payable on our securities and the investment of additional optional amounts of our Class A subordinate voting shares under any plan; |

| • | upon the issuance of our Class A subordinate voting shares or options or rights to purchase those shares pursuant to any present or future employee, director or consultant benefit plan or program of or assumed by us or any of our subsidiaries; |

| • | upon the issuance of our Class A subordinate voting shares pursuant to any option, warrant, right or exercisable, exchangeable or convertible security not described in the preceding bullet and outstanding as of the date the notes were first issued; |

| • | upon the repurchase of any of our Class A subordinate voting shares pursuant to an open-market share repurchase program or other buy-back transaction that is not a tender offer or exchange offer of the nature described under clause (5) above; |

| • | upon the issuance of rights to holders of our Class A subordinate voting shares under a shareholder rights plan provided that such rights have not separated from our Class A subordinate voting shares in accordance with the provisions of the applicable shareholder rights plan; |

| • | solely for a change in the par value of our Class A subordinate voting shares (if applicable); or |

| • | for accrued and unpaid interest, if any. |

| • | any recapitalization, reclassification or change of our Class A subordinate voting shares (other than changes resulting from a share subdivision or consolidation); |

| • | any consolidation, merger, amalgamation, arrangement, binding share exchange or combination involving us; |

| • | any sale, lease or other transfer to a third party (other than one or more of our direct or indirect wholly owned subsidiaries) of the consolidated assets of ours and our subsidiaries substantially as an entirety; or |

| • | any statutory share exchange, |

| | | Share Price | |||||||||||||||||||||||||||||||||||||

Effective Date/Redemption Notice Date | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ |

September , 2020 | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||||||||||

November 1, 2021 | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||||||||||

November 1, 2022 | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||||||||||

November 1, 2023 | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||||||||||

November 1, 2024 | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||||||||||

November 1, 2025 | | | | | | | | | | | | | | | | | | | | | | | | | | | |||||||||||||

| • | If the share price is between two share prices in the table or the effective date or redemption notice date, as the case may be, is between two effective dates or redemption notice dates, as applicable, in the table, the number of additional shares by which the conversion rate will be increased will be determined by a straight-line interpolation between the number of additional shares set forth for the higher and lower share prices and the earlier and later effective dates or redemption notice dates, as applicable, based on a 365-day year. |

| • | If the share price is greater than $ per share (subject to adjustment in the same manner as the share prices set forth in the column headings of the table above), no additional shares will be added to the conversion rate. |

| • | If the share price is less than $ per share (subject to adjustment in the same manner as the share prices set forth in the column headings of the table above), no additional shares will be added to the conversion rate. |

| (1) | a “person” or “group” (within the meaning of Section 13(d)(3) of the Exchange Act) (other than (x) us, (y) our wholly owned subsidiaries or (z) any employee benefit plans of ours or our wholly owned subsidiaries) files any schedule, form or report under the Exchange Act disclosing that such person or group has become the direct or indirect “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act) of our common equity representing more than 50% of the voting power of all of our then-outstanding common equity (unless such beneficial ownership arises solely as a result of a revocable proxy delivered in response to a public proxy or consent solicitation made pursuant to the applicable rules and regulations under the Exchange Act and provided that no person or group shall be deemed to be the beneficial owner of any securities tendered pursuant to a tender or exchange offer or takeover bid made by or on behalf of such person or group until such tendered securities are accepted for purchase or exchange under such offer); |

| (2) | the consummation of (A) any recapitalization, reclassification or change of our Class A subordinate voting shares (other than changes resulting from a share subdivision or consolidation) as a result of which our Class A subordinate voting shares would be converted into, or exchanged for, shares, other securities, other property or assets; (B) any consolidation, merger, amalgamation, arrangement, share exchange or combination of us pursuant to which our Class A subordinate voting shares will be converted into cash, securities or other property or assets; or (C) any sale, lease or other transfer in one transaction or a series of transactions of all or substantially all of the consolidated assets of us and our subsidiaries, taken as a whole, to any person other than one of our direct or indirect wholly owned subsidiaries; provided, however, that neither (a) a transaction described in clause (B) in which the holders of all classes of our common equity immediately prior to such transaction own, directly or indirectly, more than 50% of all classes of common equity of the continuing, resulting or surviving company or transferee or the parent thereof immediately after such transaction in substantially the same proportions as such ownership immediately prior to such transaction nor (b) any transaction by us solely for the purpose of changing our jurisdiction of incorporation to a jurisdiction in the United States or Canada that results in a reclassification, conversion or exchange of outstanding Class A subordinate voting shares solely into shares of the resulting or surviving entity shall be a fundamental change pursuant to this clause (2); or |

| (3) | our shareholders approve any plan or proposal for the liquidation or dissolution of us. |

| • | the events causing a fundamental change; |

| • | the date of the fundamental change; |

| • | the last date on which a holder may exercise the purchase right; |

| • | the fundamental change purchase price; |

| • | the fundamental change purchase date; |

| • | the name and address of the paying agent and the conversion agent, if applicable; |

| • | if applicable, the conversion rate and any adjustments to the conversion rate; |

| • | that the notes with respect to which a fundamental change purchase notice has been delivered by a holder may be converted only if the holder validly withdraws the fundamental change purchase notice in accordance with the terms of the indenture; and |

| • | the procedures that holders must follow to require us to purchase their notes in accordance with our offer to purchase such notes. |

| • | if certificated, the certificate numbers of your notes to be delivered for purchase; |

| • | the portion of the principal amount of notes to be purchased, which must be $1,000 or an integral multiple thereof; and |

| • | that the notes are to be purchased by us pursuant to the applicable provisions of the notes and the indenture. |

| • | the principal amount of the withdrawn notes; |

| • | any CUSIP number identifying the notes; |

| • | if certificated notes have been issued, the certificate numbers of the withdrawn notes; and |

| • | the principal amount, if any, which remains subject to the fundamental change purchase notice. |

| • | the notes will cease to be outstanding and interest will cease to accrue (whether or not book-entry transfer of the notes is made or whether or not the notes are delivered to the paying agent); and |

| • | all other rights of the holder will terminate (other than the right to receive the fundamental change purchase price). |

| • | comply with any applicable provisions of Rule 13e-4 and any other tender offer rules under the Exchange Act and any Canadian securities laws and regulations that may then be applicable; |

| • | file a Schedule TO or any other required schedule under the Exchange Act or any applicable Canadian securities laws and regulations; and |

| • | otherwise comply in all material respects with all federal and state securities laws in connection with any offer by us to purchase the notes, in each case, so as to permit the rights and obligations under this “—Offer to Purchase upon a Fundamental Change” to be exercised in the time and in the manner specified in the indenture. |

| (1) | default in any payment of interest on any note when due and payable and the default continues for a period of 30 days; |

| (2) | default in the payment of principal of any note when due and payable at its stated maturity, upon optional redemption, cleanup redemption or tax redemption, upon any required purchase, upon declaration of acceleration or otherwise; |

| (3) | our failure to comply with our obligation to convert the notes in accordance with the indenture upon exercise of a holder’s conversion right and the failure continues for a period of five (5) business days; |

| (4) | our failure to give a fundamental change notice as described under “—Offer to Purchase Upon a Fundamental Change” or notice of a specified corporate transaction as described under “—Conversion Rights—Conversion upon Specified Corporate Events,” in each case when due and such failure continues for five (5) business days after the date of such notice; |

| (5) | our failure to comply with our obligations under “Consolidation, Merger and Sale of Assets;” |

| (6) | our failure for 60 days after written notice from the trustee or the holders of at least 25% in principal amount of the notes then outstanding has been received to comply with any of our other agreements contained in the notes or the indenture; |

| (7) | default by us or any of our significant subsidiaries with respect to any hypothec, mortgage, agreement or other instrument under which there may be outstanding, or by which there may be secured or evidenced, any indebtedness for money borrowed in excess of $100 million (or its foreign currency equivalent) in the |

| (8) | certain events of bankruptcy, insolvency, receivership, liquidation or reorganization involving us or our assets or any of our significant subsidiaries or their assets; or |

| (9) | a termination of trading (as defined below) occurs and continues for twenty (20) consecutive days. |

| • | the principal (including the redemption price and the fundamental change purchase price, if applicable) of; |

| • | accrued and unpaid interest, if any, on; and |

| • | the consideration due upon conversion of, |

| (1) | such holder has previously given the trustee written notice that an event of default is continuing; |

| (2) | holders of at least 25% in principal amount of the outstanding notes have requested the trustee to pursue the remedy; |

| (3) | such holders have offered the trustee security or indemnity satisfactory to it against any loss, liability or expense; |

| (4) | the trustee has not complied with such request within 60 days after the receipt of the request and the offer of such security or indemnity; and |

| (5) | the holders of a majority in principal amount of the outstanding notes have not given the trustee a direction that, in the opinion of the trustee, is inconsistent with such request within such 60-day period. |

| (1) | reduce the amount of notes whose holders must consent to an amendment; |

| (2) | reduce the rate of or extend the stated time for payment of interest on any note; |

| (3) | reduce the principal of or extend the stated maturity of any note; |

| (4) | make any change that adversely affects the conversion rights of any note; |

| (5) | reduce the redemption price or the fundamental change purchase price of any note or amend or modify in any manner adverse to the holders the times at which, or the circumstances under which, the notes may or will be redeemed or purchased by us, whether through an amendment or waiver of provisions in the covenants, definitions or otherwise; |

| (6) | make any note payable in money, or at a place of payment, other than that stated in the note; |

| (7) | change the ranking of the notes; |

| (8) | impair the right of any holder to bring suit to enforce any payment of principal and interest on such holder’s notes on or after the due dates therefor; |

| (9) | change the provisions described under “—Additional Amounts” above in a manner adverse to holders of the notes; or |

| (10) | make any change in the amendment provisions that require each holder’s consent or in the waiver provisions. |

| (1) | cure any ambiguity, omission, defect or inconsistency; |

| (2) | provide for the assumption by a successor corporation of our obligations under the indenture; |

| (3) | add guarantees with respect to the notes; |

| (4) | secure the notes; |

| (5) | add to our covenants or events of default for the benefit of the holders or surrender any right or power conferred upon us under the indenture; |

| (6) | make any change that does not materially and adversely affect the rights of any holder under the indenture or the notes; |

| (7) | increase the conversion rate as provided in the indenture; |

| (8) | provide for the acceptance of appointment by a successor trustee or successor co-trustee, remove the co-trustee or facilitate the administration of the trusts under the indenture by more than one trustee and/or one co-trustee; |

| (9) | irrevocably elect a settlement method or a specified dollar amount (or a minimum specified dollar amount), or eliminate our right to elect a settlement method; |

| (10) | make provisions with respect to conversion rights of the holders of the notes as described under “—Conversion Rights—Recapitalizations, Reclassifications and Changes of Our Class A Subordinate Voting Shares” in accordance with the applicable provisions of the indenture; |

| (11) | comply with the requirements of any Canadian securities regulatory authority, the SEC, the NYSE, the TSX or any applicable securities depository or stock exchange or market on which our Class A subordinate voting shares may be principally listed or admitted for trading, provided that no such amendment or supplement materially and adversely affects the rights of any holder of the notes; |

| (12) | comply with any requirement of the SEC in connection with qualification of the indenture under the Trust Indenture Act, as applicable; |

| (13) | comply with the rules of any applicable securities depositary in a manner that does not adversely affect the rights of any holders; or |

| (14) | conform the provisions of the indenture to any provision of the “Description of Notes” in the preliminary Prospectus Supplement, as supplemented by the related pricing term sheet. |

| • | upon deposit of a global note with DTC’s custodian, DTC will credit portions of the principal amount of the global note to the accounts of the DTC participants designated by the underwriters; and |

| • | ownership of beneficial interests in a global note will be shown on, and transfer of ownership of those interests will be effected only through, records maintained by DTC (with respect to interests of DTC participants) and the records of DTC participants (with respect to other owners of beneficial interests in the global note). |

| • | a limited purpose trust company organized under the laws of the State of New York; |

| • | a “banking organization” within the meaning of the New York State Banking Law; |

| • | a member of the Federal Reserve System; |

| • | a “clearing corporation” within the meaning of the Uniform Commercial Code; and |

| • | a “clearing agency” registered under Section 17A of the Exchange Act. |

| • | will not be entitled to have notes represented by the global note registered in their names; |

| • | will not receive or be entitled to receive physical, certificated notes; and |

| ��� | will not be considered the owners or holders of the notes under the indenture for any purpose, including with respect to the giving of any direction, instruction or approval to the trustee under the indenture. |

| • | DTC notifies us at any time that it is unwilling or unable to continue as depositary for the global notes and a successor depositary is not appointed within 90 days; |

| • | DTC ceases to be registered as a clearing agency under the Exchange Act and a successor depositary is not appointed within 90 days; or |

| • | an event of default with respect to the notes has occurred and is continuing and such beneficial owner requests that its notes be issued in physical, certificated form. |

Date | | | Type of Security Issued | | | Number of Securities Issued | | | Issuance/Exercise Price per Security ($) |

September 11, 2019 to September 11, 2020 | | | Options to purchase Class A Subordinate Voting Shares(1) | | | 375,294 | | | $348.51 (weighted average exercise price) |

| | | | | | | ||||

September 11, 2019 to September 11, 2020 | | | RSUs and DSUs(2) | | | 562,594 | | | — |

| | | | | | | ||||

September 19, 2019 | | | Class A Subordinate Voting Shares(3) | | | 2,185,000 | | | $317.50 |

| | | | | | | ||||

May 7, 2020 | | | Class A Subordinate Voting Shares(4) | | | 2,127,500 | | | $700.00 |

| | | | | | | ||||

September 11, 2019 to September 11, 2020 | | | Class A Subordinate Voting Shares(5) | | | 514,973 | | | $331.34 |

| | | | | | | ||||

September 11, 2019 to September 11, 2020 | | | Class A Subordinate Voting Shares | | | 3,011,066 (6) | | | $63.05 (weighted average exercise price)(7) |

| | | | | | | ||||

September 11, 2019 to September 11, 2020 | | | Class B multiple voting shares(8) | | | 501,161 | | | $3.38 (weighted average exercise price) |

| (1) | Issued under the Stock Option Plan and the 6RS Stock Option Plan. |

| (2) | Issued under the LTIP. |

| (3) | Issued under a prospectus supplement dated September 16, 2019 to the Company’s short form base shelf prospectus dated August 3, 2018. |

| (4) | Issued under a prospectus supplement dated May 7, 2020 to the Company’s short form base shelf prospectus dated August 3, 2018. |

| (5) | Issued in connection with the acquisition of 6RS. |

| (6) | Includes 929,787 Class A Subordinate Voting Shares issued upon the exercise of options pursuant to the Stock Option Plan and the 6RS Stock Option Plan, 866,736 Class A Subordinate Voting Shares issued as a result of conversions of Class B multiple voting shares and 1,214,543 Class A Subordinate Voting Shares issued upon vesting of RSUs pursuant to the LTIP. |

| (7) | Exercise price relates solely to Class A Subordinate Voting Shares issued upon the exercise of options pursuant to the Stock Option Plan. |

| (8) | Issued upon the exercise of options pursuant to the Legacy Option Plan. |

| | | Pro Forma December 31, 2019 | | | Pro Forma June 30, 2020 | |

Earnings coverage ratio(1)(2) | | | | |

| (1) | After giving effect to the Offering, the Concurrent Equity Offering and the use of proceeds of the Offering and the Concurrent Equity Offering, our borrowing costs amounted to approximately $ million for the twelve month period ended December 31, 2019 and $ for the twelve month period ended June 30, 2020. Our consolidated loss before borrowing costs and income tax expense/recovery was $ million for the twelve month period ended December 31, 2019, which is times our interest borrowing cost requirements for such period, and $ million for the twelve month period ended June 30, 2020, which is times our interest borrowing cost requirements for such period. |

| (2) | The dollar amount of the numerator for the earnings coverage ratio that would be required to achieve an earnings coverage ratio of one to one for the 12-month period ended December 31, 2019 is approximately $ million, and approximately $ million for the 12-month period ended June 30, 2020. |

Month | | | Price per Class A Subordinate Voting Share ($) Monthly High | | | Price per Class A Subordinate Voting Share ($) Monthly Low | | | Class A Subordinate Voting Share Total Volume for Period |

September 2019 | | | 395.71 | | | 286.07 | | | 11,969,454 |

October 2019 | | | 349.22 | | | 291.11 | | | 10,272,543 |

November 2019 | | | 344.00 | | | 282.16 | | | 7,335,599 |

December 2019 | | | 416.60 | | | 311.60 | | | 8,674,206 |

January 2020 | | | 481.56 | | | 396.00 | | | 6,223,246 |

February 2020 | | | 587.00 | | | 425.69 | | | 9,455,684 |

March 2020 | | | 514.00 | | | 305.84 | | | 14,070,606 |

April 2020 | | | 665.34 | | | 335.00 | | | 12,670,827 |

May 2020 | | | 844.00 | | | 595.19 | | | 12,299,741 |

June 2020 | | | 958.50 | | | 702.20 | | | 8,744,057 |

July 2020 | | | 1,104.45 | | | 884.74 | | | 8,795,020 |

August 2020 | | | 1,115.19 | | | 965.00 | | | 4,963,397 |

September 1, 2020 – September 14, 2020 | | | 1,145.00 | | | 897.00 | | | 3,191,170 |

Month | | | Price per Class A Subordinate Voting Share (C$) Monthly High | | | Price per Class A Subordinate Voting Share (C$) Monthly Low | | | Class A Subordinate Voting Shares Total Volume for Period |

September 2019 | | | 524.64 | | | 380.21 | | | 5,948,958 |

October 2019 | | | 462.97 | | | 380.80 | | | 4,301,850 |

November 2019 | | | 457.50 | | | 372.01 | | | 3,700,698 |

December 2019 | | | 544.00 | | | 414.38 | | | 4,979,571 |

January 2020 | | | 639.09 | | | 514.74 | | | 6,238,714 |

February 2020 | | | 786.07 | | | 567.42 | | | 7,120,062 |

March 2020 | | | 688.35 | | | 435.03 | | | 10,910,128 |

April 2020 | | | 945.36 | | | 476.38 | | | 7,005,589 |

May 2020 | | | 1,206.08 | | | 840.01 | | | 5,957,443 |

June 2020 | | | 1,301.77 | | | 943.74 | | | 5,822,963 |

July 2020 | | | 1,472.98 | | | 1,190.00 | | | 4,532,655 |

August 2020 | | | 1,467.00 | | | 1,285.00 | | | 3,744,289 |

September 1, 2020 – September 14, 2020 | | | 1,502.00 | | | 1,178.39 | | | 2,511,023 |

Name | | | Principal amount of notes |

Goldman Sachs & Co. LLC | | | |

Citigroup Global Markets Inc | | | |

Credit Suisse Securities (USA) LLC | | | |

Total: | | | US$800,000,000 |

| | | No Exercise (per US$1,000 principal amount of Notes) | | | Full Exercise (per US$1,000 principal amount of Notes) | | | No Exercise (total) | | | Full Exercise (total) | |

Price to the Public | | | US$ | | | US$ | | | US$ | | | US$ |

Underwriters’ Discounts and Commissions | | | US$ | | | US$ | | | US$ | | | US$ |

Net Proceeds to the Company | | | US$ | | | US$ | | | US$ | | | US$ |

| • | offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or dispose of, directly or indirectly, any Class A Subordinate Voting Shares or Class B multiple voting shares of the Company (collectively, the “subject shares”) or any securities convertible into or exercisable or exchangeable for any subject shares or publicly disclose the intention to do so; or |

| • | enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of the subject shares or such other securities; |

| • | transactions relating to the subject shares or other securities acquired in open market transactions after the completion of the Offering; provided that no filing or public announcement under Section 16(a) of the Exchange Act, under any Canadian securities laws or otherwise is required or voluntarily made during the restricted period in connection with any such subsequent sales of the subject shares or other securities acquired in such open market transactions; |

| • | the exercise of stock options or other similar awards granted pursuant to our equity incentive plans or the vesting or settlement of awards granted pursuant to our equity incentive plans (including the delivery and receipt of subject shares, other awards or any securities convertible into or exercisable or exchangeable for subject shares in connection with such vesting or settlement), provided that the foregoing restrictions shall apply to any locked-party’s subject shares or any security convertible into or exchangeable for such shares issued or received upon such exercise, vesting or settlement; |

| • | transfers of subject shares or any security convertible into or exercisable or exchangeable for such shares: (i) as a bona fide gift, including as a result of estate or intestate succession, or pursuant to a will or other testamentary document; (ii) if the locked-up party is a natural person, to a member of the immediate family of such locked-up party, any trust or other like entity for the direct or indirect benefit of such locked-up party or the immediate family of such locked-up party or to a corporation, partnership, limited liability |

| • | the sale of subject shares or other securities by officers or directors of the Company or their affiliates pursuant to an automatic share distribution plan established pursuant to Canadian securities laws in effect as of the date of the Underwriting Agreement, provided that the total number of subject shares sold pursuant to such plans shall not exceed 82,488 during the restricted period; |

| • | (A) the establishment or modification of any trading plan that complies with Rule 10b5-1 under the Exchange Act or similar plan under Canadian securities laws for the transfer of subject shares, provided that (i) such plan does not provide for the transfer or modification of such shares during the restricted period and (ii) to the extent a public announcement or filing under the Exchange Act or Canadian securities laws, if any, is required or voluntarily made regarding the establishment of such plan, such announcement or filing shall include a statement to the effect that no transfer or modification of such shares may be made under such plan during the restricted period, and (B) the termination of any trading plan established pursuant to Rule 10b5-1 under the Exchange Act or similar plan under Canadian securities laws for the transfer of subject shares; |

| • | the transfer of subject shares or any security convertible into or exercisable or exchangeable for such shares to us, pursuant to agreements or rights in existence on the date hereof under which we have the option to repurchase such shares or a right of first refusal with respect to transfers of such shares, in each case, in connection with the termination of the locked-up party’s employment or other service relationship with us; provided that any public filing or public announcement under Section 16(a) of the Exchange Act or Canadian securities laws required or voluntarily made during the restricted period shall clearly indicate that such transfer was made solely to the Company pursuant to the circumstances described above; |

| • | the transfer of subject shares or any securities convertible into or exercisable or exchangeable for such shares from a locked-up party to the Company (or the purchase and cancellation of same by us) upon a vesting event of our securities or upon the exercise of options to purchase such shares by a locked-up party, in each case on a “cashless” or “net exercise” basis, or to cover tax withholding obligations of such locked-up party in connection with such vesting or exercise; provided that any public filing or public announcement under Section 16(a) of the Exchange Act or Canadian securities laws required or voluntarily made during the restricted period shall clearly indicate that such transfer was made pursuant to the circumstances described above; |

| • | the transfer of subject shares or any security convertible into or exercisable or exchangeable for such shares pursuant to a bona fide third-party tender offer, merger, amalgamation, consolidation or other similar transaction made to all holders of such shares involving a change of control of the Company, provided that in the event that the tender offer, merger, amalgamation, consolidation or other such transaction is not completed, such shares owned by such locked-up party shall remain subject to the restrictions described in the immediately preceding paragraph; |

| • | the exercise of any right with respect to, or the taking of any other action in preparation for, a registration by the Company of subject shares or any securities convertible into or exercisable or exchangeable for such shares, provided that no transfer of a locked-up party’s shares proposed to be registered pursuant to the exercise of such rights shall occur, and no registration statement shall be filed, during the restricted period; and further provided that no public announcement regarding such exercise or taking of such action shall be required or shall be voluntarily made during the restricted period; |

| • | any transfer of subject shares that occurs by operation of law pursuant to a qualified domestic order in connection with a divorce settlement or other court order; provided that any public filing or public announcement under Section 16(a) of the Exchange Act or Canadian securities laws required or voluntarily made during the restricted period shall clearly indicate that such transfer was made solely to the Company pursuant to the circumstances described above; and |

| • | the conversion of Class B multiple voting shares into Class A Subordinate Voting Shares in accordance with their terms; |

| • | the notes to be sold by the Company in the Offering; |

| • | the issuance of Class A Subordinate Voting Shares upon the conversion of Class B multiple voting shares in accordance with their terms; |

| • | the issuance of the Class A Subordinate Voting Shares in connection with the Concurrent Equity Offering; |

| • | the issuance of Class A Subordinate Voting Shares upon the conversion of the notes; |

| • | the issuance by the Company of subject shares upon the exercise of an option or warrant or the conversion of a security outstanding on the date hereof; |

| • | subject shares issued or options or other securities granted pursuant to our incentive plans disclosed in the documents incorporated by reference into this Prospectus Supplement; |

| • | the filing by the Company of one or more registration statements on Form S-8; |

| • | the establishment of a trading plan pursuant to Rule 10b5-1 under the Exchange Act for the transfer of subject shares, provided that such plan does not provide for the transfer of subject shares during the restricted period and that to the extent a public announcement or filing under the Exchange Act, if any, is required of or voluntarily made by the Company regarding the establishment of such plan, such announcement or filing shall include a statement to the effect that no transfer of subject shares may be made under such plan during the restricted period; or |

| • | the entry into an agreement providing for the issuance by the Company of Class A Subordinate Voting Shares or any security convertible into or exercisable for Class A Subordinate Voting Shares in connection with the acquisition by the Company or any of its subsidiaries of the securities, technology, business, property or other assets of another person or entity or pursuant to an employee benefit plan assumed by the Company in connection with such acquisition, and the issuance of any such securities pursuant to any such agreement, or the entry into an agreement providing for the issuance of Class A Subordinate Voting Shares or any security convertible into or exercisable for Class A Subordinate Voting Shares in connection with joint ventures, commercial relationships, debt financings, charitable contributions or other strategic corporate transactions, and the issuance of any such securities pursuant to any such agreement; provided that in the case of this exception, the aggregate number of Class A Subordinate Voting Shares that the Company may sell or issue or agree to sell or issue pursuant to this exception shall not exceed 10% of the total number of subject shares issued and outstanding immediately following the completion of the Offering and each recipient of Class A Subordinate Voting Shares or securities convertible into or exercisable or exchangeable for Class A Subordinate Voting Shares pursuant to this exception shall execute a lock-up agreement substantially in the form entered into by our other securityholders in connection with the Offering. |

| (a) | a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended, “MiFID II”); |

| (b) | a customer within the meaning of Directive 2016/97/EU (as amended, the “Insurance Distribution Directive”) where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or |

| (c) | not a qualified investor as defined in the Regulation (EU) No 2017/1129, known as the “Prospectus Regulation”. |

| (a) | it has only communicated or caused to be communicated and will only communicate or cause to be communicated an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the Financial Services and Markets Act 2000 (the “FSMA”)) received by it in connection with the issue or sale of the notes in circumstances in which Section 21(1) of the FSMA does not apply to us; and |

| (b) | it has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to the notes in, from or otherwise involving the United Kingdom. |

New Issue and Secondary Offering | | | August 6, 2020 |

| | | Page | |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

| | | Page | |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

| (a) |

| (b) |

| (c) |

| (d) |

| (e) |

| (f) |

| • | the names of the selling securityholders; |

| • | the number or amount of Securities owned, controlled or directed by each selling securityholder; |

| • | the number or amount of Securities being distributed for the account of each selling securityholder; |

| • | the number or amount of Securities to be owned by the selling securityholders after the distribution and the percentage that number or amount represents of the total number of our outstanding Securities; |

| • | whether the Securities are owned by the selling securityholders both of record and beneficially, of record only, or beneficially only; and |

| • | all other information that is required to be included in the applicable Prospectus Supplement. |

| • | change the rights, privileges, restrictions or conditions attached to the shares of that class; |

| • | increase the rights or privileges of any class of shares having rights or privileges equal or superior to the shares of that class; and |

| • | make any class of shares having rights or privileges inferior to the shares of such class equal or superior to the shares of that class. |

| a) | offers a price per Class A Subordinate Voting Share at least as high as the highest price per share paid or required to be paid pursuant to the take-over bid for the Class B multiple voting shares; |

| b) | provides that the percentage of outstanding Class A Subordinate Voting Shares to be taken up (exclusive of shares owned immediately prior to the offer by the offeror or persons acting jointly or in concert with |

| c) | has no condition attached other than the right not to take up and pay for Class A Subordinate Voting Shares tendered if no shares are purchased pursuant to the offer for Class B multiple voting shares; and |

| d) | is in all other material respects identical to the offer for Class B multiple voting shares. |

| • | the specific designation of the Debt Securities; any limit on the aggregate principal amount of the Debt Securities; the date or dates, if any, on which the Debt Securities will mature and the portion (if less than all of the principal amount) of the Debt Securities to be payable upon declaration of acceleration of maturity; |

| • | the rate or rates (whether fixed or variable) at which the Debt Securities will bear interest, if any, the date or dates from which any such interest will accrue and on which any such interest will be payable and the record dates for any interest payable on the Debt Securities that are in registered form; |

| • | the terms and conditions under which we may be obligated to redeem, repay or purchase the Debt Securities pursuant to any sinking fund or analogous provisions or otherwise; |

| • | the terms and conditions upon which we may redeem the Debt Securities, in whole or in part, at our option; |

| • | the covenants applicable to the Debt Securities; |

| • | the terms and conditions for any conversion or exchange of the Debt Securities for any other securities; |

| • | whether the Debt Securities will be issuable in registered form or bearer form or both, and, if issuable in bearer form, the restrictions as to the offer, sale and delivery of the Debt Securities which are in bearer form and as to exchanges between registered form and bearer form; |

| • | whether the Debt Securities will be issuable in the form of registered global securities (“Global Securities”), and, if so, the identity of the depositary for such registered Global Securities; |

| • | the denominations in which registered Debt Securities will be issuable; |

| • | each office or agency where payments on the Debt Securities will be made and each office or agency where the Debt Securities may be presented for registration of transfer or exchange; |

| • | if other than U.S. dollars, the currency in which the Debt Securities are denominated or the currency in which we will make payments on the Debt Securities; |

| • | material Canadian federal income tax consequences and U.S. federal income tax consequences of owning the Debt Securities; |

| • | any index, formula or other method used to determine the amount of payments of principal of (and premium, if any) or interest, if any, on the Debt Securities; and |

| • | any other terms of the Debt Securities which apply solely to the Debt Securities. |

| • | the number of Warrants offered; |

| • | the price or prices, if any, at which the Warrants will be issued; |

| • | the currency at which the Warrants will be offered and in which the exercise price under the Warrants may be payable; |

| • | upon exercise of the Warrant, the events or conditions under which the amount of Securities may be subject to adjustment; |

| • | the date on which the right to exercise such Warrants shall commence and the date on which such right shall expire; |

| • | if applicable, the identity of the Warrant agent; |

| • | whether the Warrants will be listed on any securities exchange; |

| • | whether the Warrants will be issued with any other Securities and, if so, the amount and terms of these Securities; |

| • | any minimum or maximum subscription amount; |

| • | whether the Warrants are to be issued in registered form, “book-entry only” form, non-certificated inventory system form, bearer form or in the form of temporary or permanent global securities and the basis of exchange, transfer and ownership thereof; |

| • | any material risk factors relating to such Warrants and the Securities to be issued upon exercise of the Warrants; |

| • | any other rights, privileges, restrictions and conditions attaching to the Warrants and the Securities to be issued upon exercise of the Warrants; |

| • | material Canadian federal income tax consequences and U.S. federal income tax consequences of owning the Warrants and the Securities to be issued upon exchange of the Warrants; and |

| • | any other material terms or conditions of the Warrants and the Securities to be issued upon exercise of the Warrants. |

| • | the number of Subscription Receipts offered; |

| • | the price or prices, if any, at which the Subscription Receipts will be issued; |

| • | the manner of determining the offering price(s); |

| • | the currency at which the Subscription Receipts will be offered and whether the price is payable in installments; |

| • | the Securities into which the Subscription Receipts may be exchanged; |

| • | conditions to the exchange of Subscription Receipts into other Securities and the consequences of such conditions not being satisfied; |

| • | the number of Securities that may be issued upon the exchange of each Subscription Receipt and the price per Security or the aggregate principal amount, denominations and terms of the series of Debt Securities that may be issued upon exchange of the Subscription Receipts, and the events or conditions under which the amount of Securities may be subject to adjustment; |

| • | the dates or periods during which the Subscription Receipts may be exchanged; |

| • | the circumstances, if any, which will cause the Subscription Receipts to be deemed to be automatically exchanged; |

| • | provisions applicable to any escrow of the gross or net proceeds from the sale of the Subscription Receipts plus any interest or income earned thereon, and for the release of such proceeds from such escrow; |

| • | if applicable, the identity of the Subscription Receipt agent; |

| • | whether the Subscription Receipts will be listed on any securities exchange; |

| • | whether the Subscription Receipts will be issued with any other Securities and, if so, the amount and terms of these Securities; |

| • | any minimum or maximum subscription amount; |

| • | whether the Subscription Receipts are to be issued in registered form, “book-entry only” form, noncertificated inventory system form, bearer form or in the form of temporary or permanent global securities and the basis of exchange, transfer and ownership thereof; |

| • | any material risk factors relating to such Subscription Receipts and the Securities to be issued upon exchange of the Subscription Receipts; |

| • | material Canadian federal income tax consequences and U.S. federal income tax consequences of owning the Subscription Receipts and the Securities to be issued upon exchange of the Subscription Receipts; |

| • | any other rights, privileges, restrictions and conditions attaching to the Subscription Receipts and the Securities to be issued upon exchange of the Subscription Receipts; and |

| • | any other material terms or conditions of the Subscription Receipts and the Securities to be issued upon exchange of the Subscription Receipts. |

| • | the number of Units offered; |

| • | the price or prices, if any, at which the Units will be issued; |

| • | the manner of determining the offering price(s); |

| • | the currency at which the Units will be offered; |

| • | the Securities comprising the Units; |

| • | whether the Units will be issued with any other Securities and, if so, the amount and terms of these Securities; |

| • | any minimum or maximum subscription amount; |

| • | whether the Units and the Securities comprising the Units are to be issued in registered form, “book-entry only” form, non-certificated inventory system form, bearer form or in the form of temporary or permanent global securities and the basis of exchange, transfer and ownership thereof; |

| • | any material risk factors relating to such Units or the Securities comprising the Units; |

| • | material Canadian federal income tax consequences and U.S. federal income tax consequences of owning the Securities comprising the Units; |

| • | any other rights, privileges, restrictions and conditions attaching to the Units or the Securities comprising the Units; and |

| • | any other material terms or conditions of the Units or the Securities comprising the Units, including whether and under what circumstances the Securities comprising the Units may be held or transferred separately. |