UNAUDITED INTERIM CONDENSED NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1) The Company and key events

a) The Company

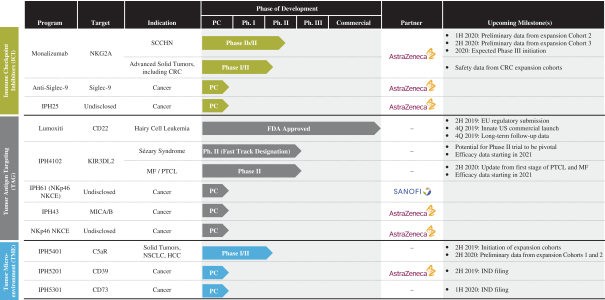

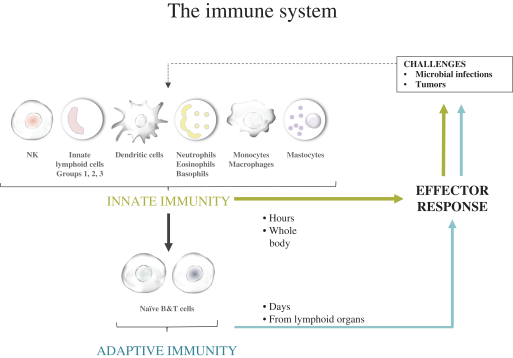

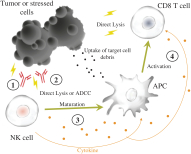

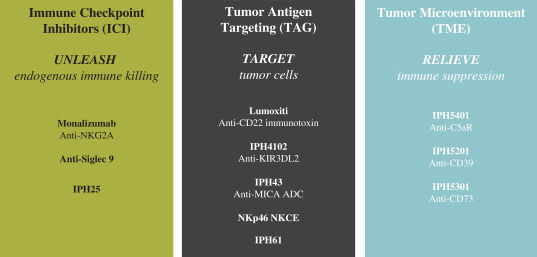

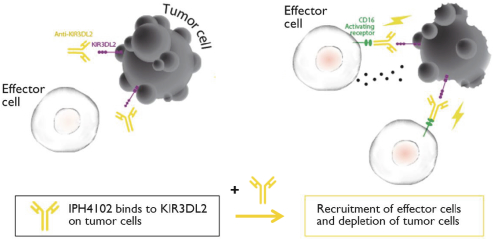

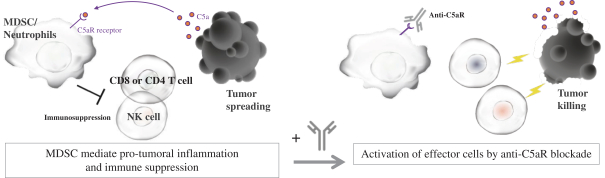

Innate Pharma S.A. (the “Company” and together with its subsidiaries, referred to as the “Group”) is a biotechnology company focused on discovering, developing and commercializingfirst-in-class therapeutic antibodies designed to harness the immune system for the treatment of oncology indications with significant unmet medical need.

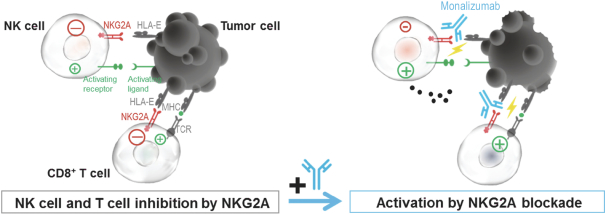

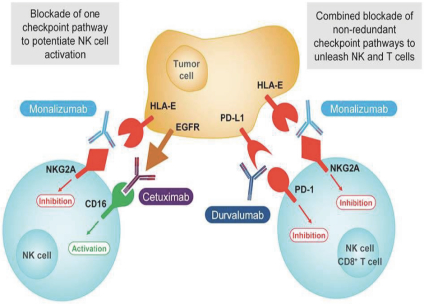

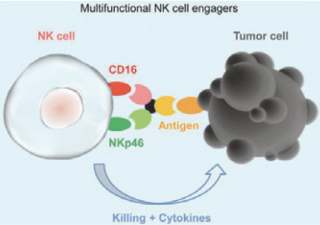

The Company has an extensive experience in research and development in immuno-oncology, having been pioneers in the understanding of natural killer cell, or NK cell, biology, and later expanding its expertise in the tumor microenvironment, tumor antigens and antibody engineering fields. The Company has built, internally and through its business development strategy, a broad and diversified portfolio including an approved product, three clinical product candidates and a robust preclinical pipeline. The Company has entered into collaborations with leaders in the biopharmaceutical industry, such as AstraZeneca and Sanofi.

From its inception, the Company has incurred losses due to its research and development (“R&D”) activity. The six months ended June 30, 2019 generated a €13,240 thousand net income. As of June 30, 2019, the shareholders’ equity amounted to €181,266 thousand. Subject to potential new milestone payments related to its collaboration agreements, the Company anticipates incurring additional losses until such time, if ever, that it can generate significant revenue from its product candidates in development.

The Company’s future operations are highly dependent on a combination of factors, including: (i) the success of its R&D; (ii) regulatory approval and market acceptance of the Company’s future product candidates; (iii) the timely and successful completion of additional financing; and (iv) the development of competitive therapies by other biotechnology and pharmaceutical companies. As a result, the Company is and should continue, in the short tomid-term, to be financed through partnership agreements for the development and commercialization of its drug candidates and through the issuance of new equity instruments.

The Company’s activity is not subject to seasonal fluctuations.

As of June 30, 2019, the Company had two wholly owned subsidiaries: Innate Pharma, Inc., incorporated under the laws of Delaware in 2009, and Innate Pharma France SAS, incorporated under the laws of France in 2018.

b) Key events for thesix-month period ended June 30, 2019

In January 2019 and February 2019, the Company paid $50,000 thousand (€43,800 thousand) to AstraZeneca in relation to the Lumoxiti agreement and $15,000 thousand (€13,100 thousand) to Novo Nordisk A/S in relation to the acquisition of monalizumab rights. Both amounts had been recorded as trade payables – payables related to capital expenditures, as of December 31, 2018.

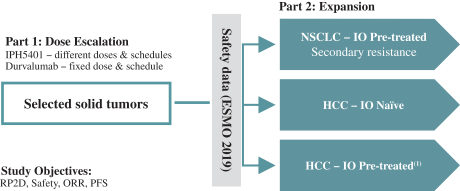

In January 2019, the Company received $100,000 thousand (€87,700 thousand) from AstraZeneca in relation to the monalizumab agreement and $24,000 thousand (€21,100 thousand) from AstraZeneca in relation to the IPH5201 agreement. Both payments had been recorded as trade receivables as of December 31, 2018.

On June 3, 2019, the Company signed an agreement with Orega Biotech amending the license agreement signed on January 4, 2016. Pursuant to this amended agreement, the Company was required to pay Orega Biotech €7,000 thousand in relation to the anti-CD39 program as consideration following the collaboration and option agreement signed on October 22, 2018 with AstraZeneca regarding IPH5201. The payment was made in June

F-69