UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

Commission file number 001-36767

Avolon Holdings Limited

(Exact name of Registrant as specified in its charter)

Cayman Islands

(Jurisdiction of incorporation or organization)

The Oval, Building 1

Shelbourne Road

Ballsbridge, Dublin 4

Ireland

(Address of principal executive offices)

Ed Riley, Avolon Holdings Limited, The Oval, Building 1, Ballsbridge, Dublin 4, Ireland

Telephone number: +353 (1) 231 5800, Fax number: +353 (1) 231 5889

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common Shares | | The New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

| | | | |

Common shares, par value $0.000004 per share | | | 81,681,131 | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | x (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

U.S. GAAP x | | International Financial Reporting Standards as issued by the International Accounting Standards Board ¨ | | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

TABLE OF CONTENTS

i

GENERAL INFORMATION

Unless otherwise noted or unless the context provides otherwise, all references in this Annual Report on Form 20-F (“Annual Report”) to:

| | • | | “ACP” refer to Avolon Capital Partners, a joint venture between Avolon and Wells Fargo & Company. |

| | • | | “Aggregate Net Book Value” refer, as of any date, to the sum of the net book value of (i) our flight equipment and (ii) assets held for sale on such date. |

| | • | | “Annualized Lease Rates” refer to annualized lease revenue for flight equipment held at the end of each reporting period divided by the Aggregate Net Book Value of flight equipment held at the end of each reporting period. |

| | • | | “Avolon,” the “Company,” “we,” “our,” and “us” refer to Avolon Holdings and its consolidated subsidiaries for periods after the Share Exchange, giving effect thereto. |

| | • | | “Avolon Holdings” refer to Avolon Holdings Limited, a Cayman Islands exempted company incorporated with limited liability on June 5, 2014, which is tax resident in Ireland. |

| | • | | “Avolon S.à r.l.” refer to Avolon Investments S.à r.l., a private limited liability company incorporated under the laws of Luxembourg and the parent company of the Avolon business immediately prior to the Share Exchange. |

| | • | | “Cinven” refer to the funds affiliated with Cinven Limited that are indirect shareholders in Avolon (or, as the context requires, the special purpose vehicle through which such funds hold their investment in Avolon). |

| | • | | “Committed Portfolio” refer to the 98 aircraft for which we had entered into binding contracts or non-binding letters of intent to acquire through sale-leaseback transactions or direct orders from Boeing and Airbus as of December 31, 2014. Of this number, 17 aircraft were subject to non-binding letters of intent. These letters of intent represent our intention to acquire the aircraft, subject to the execution of definitive documentation which will include customary closing conditions. The remaining aircraft in our Committed Portfolio are subject to binding purchase contracts, which are also subject to customary closing conditions. |

| | • | | “CVC” refer to the funds managed or advised by affiliates of CVC Capital Partners SICAV-FIS S.A. (together with its affiliates, “CVC Capital Partners”) that are indirect shareholders in Avolon (or, as the context requires, the wholly owned special purpose vehicle through which such funds hold their investment in Avolon). |

| | • | | “IPO Options” refer to the 725,000 common shares held by the Trust in respect of nominal price options and restricted share units (“RSUs”) granted to employees, including management, under the 2014 Avolon Equity Incentive Plan (the “Incentive Plan”) upon completion of the IPO, which options have a term up to seven years and are subject to time and performance-based vesting. |

| | • | | “Managed Portfolio” refer to the four aircraft that, as of December 31, 2014, we managed on behalf of other aircraft investors and seven aircraft owned and managed by ACP, with whom we have entered into agreements to contribute personnel and other administrative resources. |

| | • | | “Oak Hill Advisors” refer to the funds affiliated with Oak Hill Advisors, L.P. that are shareholders in Avolon. Oak Hill Advisors, L.P. is an independent investment firm that is not an affiliate of Oak Hill Management, LLC or its related funds. |

| | • | | “Oak Hill Capital Funds” refer to the funds managed by Oak Hill Capital Management, LLC that are shareholders of Avolon. Oak Hill Capital Funds are not affiliates of Oak Hill Advisors, L.P. |

| | • | | “OEM” refer to original equipment manufacturer. |

| | • | | “Owned and Committed Portfolio” refer, collectively to our Owned Portfolio and our Committed Porfolio. |

ii

| | • | | “Owned Portfolio” refer to our owned fleet of 126 aircraft as of December 31, 2014. |

| | • | | “Owned, Managed and Committed Portfolio” refer, collectively, to our Owned Portfolio, our Managed Portfolio and our Committed Portfolio. |

| | • | | “Pre-IPO Options” refer to nominal price options for the purchase of 268,989 common shares granted to certain members of management and employees under the Incentive Plan immediately following the Share Exchange, based on the common shares held by the Trustee immediately following the Share Split, which options have a term up to seven years and were immediately exercisable. |

| | • | | “Reorganization” refers collectively to the Share Split, the Share Exchange and the grant of the Pre-IPO Options. |

| | • | | “Share Exchange” refer to the reorganization transactions that occurred on December 11, 2014 prior to completion of our IPO in which Avolon Holdings issued 78,486,853 of its common shares in exchange for all of the outstanding shares of Avolon S.à r.l., such that Avolon S.à r.l. became a direct, wholly owned subsidiary of Avolon Holdings. |

| | • | | “Share Split” refer to the 246.5528-for-1 subdivision into a lesser par value of the Avolon Holdings outstanding common shares that occurred immediately prior to the Share Exchange. |

| | • | | “Sponsors” refer to Cinven, CVC, Oak Hill Capital Funds and Vigorous, our four largest shareholders. |

| | • | | “Syndicatees” refer to certain beneficial owners of our common shares that acquired such shares directly or indirectly from one or more of our Sponsors or through the assumption of such Sponsors’ equity commitment. |

| | • | | “Trustee” refer to State Street Trustees (Jersey) Limited, as trustee for the beneficiaries under a trust instrument between the trustee and Avolon Aerospace Limited. |

| | • | | “Trust” refer to Avolon Share Trust, a discretionary trust through which common shares of Avolon Holdings may be delivered to employees in satisfaction of outstanding awards under the Incentive Plan. |

| | • | | “Vigorous” refer to Vigorous Investment Pte Ltd, a subsidiary of GIC (Ventures) Pte Ltd (“GIC Ventures”). Vigorous is managed by GIC Special Investments Pte Ltd, a subsidiary of GIC Private Limited (“GIC”). GIC and GIC Ventures are wholly owned by the Government of Singapore. Vigorous is a shareholder of Avolon. |

REORGANIZATION TRANSACTIONS AND INITIAL PUBLIC OFFERING

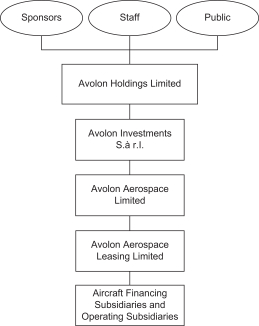

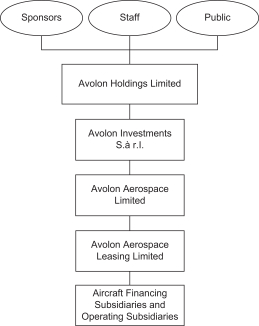

Avolon Holdings Limited is a Cayman Islands exempted company incorporated with limited liability on June 5, 2014 for purposes of effectuating our initial public offering and is tax resident in Ireland. On December 11, 2014, prior to our IPO, we completed the Reorganization pursuant to which Avolon Holdings effected the Share Split and, immediately thereafter, completed the Share Exchange. Avolon Holdings is a holding company with no material assets other than our ownership interests in our operating subsidiaries.

On December 12, 2014, the Company listed 13,636,363 common shares on the New York Stock Exchange at a price of $20.00 per share (the “IPO”). The Company did not receive any of the proceeds from the IPO.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This Annual Report includes forward-looking statements, beliefs or opinions, including statements with respect to our business, financial condition, results of operations and plans. These forward-looking statements involve known and unknown risks and uncertainties, many of which are beyond our control and all of which are based on our management’s current beliefs and expectations about future events. Forward-looking statements are sometimes identified by the use of forward-looking terminology such as “believe,” “expects,” “may,” “will,”

iii

“could,” “should,” “shall,” “risk,” “intends,” “estimates,” “aims,” “plans,” “predicts,” “continues,” “assumes,” “positioned” or “anticipates” or the negative thereof, other variations thereon or comparable terminology or by discussions of strategy, plans, objectives, goals, future events or intentions. These forward-looking statements include all matters that are not historical facts. Forward-looking statements may and often do differ materially from actual results. No assurance can be given that such future results will be achieved. Forward-looking statements appear in a number of places throughout this Annual Report and include statements regarding the intentions, beliefs or current expectations of our management with respect to future events and are subject to risks relating to future events and other risks, uncertainties and assumptions relating to our business concerning, among other things, the results of operations, financial condition, liquidity, prospects, growth, strategies, and our dividend policy and the industry in which we operate, most of which are difficult to predict and many of which are beyond our control. These risks, uncertainties and assumptions include, but are not limited to, the following:

| • | | general economic and financial conditions; |

| • | | the financial condition of our lessees; |

| • | | our ability to obtain additional capital to finance our growth and operations on attractive terms; |

| • | | decline in the value of our aircraft and market rates for leases; |

| • | | the loss of key personnel; |

| • | | lessee defaults and attempts to repossess aircraft; |

| • | | our ability to regularly sell aircraft; |

| • | | our ability to successfully re-lease our existing aircraft and lease new aircraft; |

| • | | our ability to negotiate and enter into profitable leases; |

| • | | periods of aircraft oversupply during which lease rates and aircraft values decline; |

| • | | changes in the appraised value of our aircraft; |

| • | | changes in interest rates; |

| • | | competition from other aircraft lessors; and |

| • | | the limited number of aircraft and engine manufacturers. |

These and other important factors, including those discussed under “Item 3. Key Information—Risk Factors” “Item 4. Information on the Company” and “Item 5. Operating and Financial Review and Prospects” included elsewhere in this Annual Report, may cause our actual events or results to differ materially from any future results, performances or achievements expressed or implied by the forward-looking statements contained in this Annual Report. Such forward-looking statements contained in this Annual Report speak only as of the date of this Annual Report. We expressly disclaim any obligation or undertaking to update these forward-looking statements contained in the Annual Report to reflect any change in our expectations or any change in events, conditions, or circumstances on which such statements are based unless required to do so by applicable law.

iv

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

Selected Financial Data.

The following table presents Avolon Holdings’ (the successor company) and Avolon S.à r.l.’s (the predecessor company) selected consolidated financial data for each of the periods indicated, prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). You should read this information in conjunction with Avolon Holdings’ audited consolidated financial statements and related notes and “Item 5. Operating and Financial Review and Prospects.”

Prior to the consummation of our IPO, Avolon Holdings effected the Share Split and, immediately thereafter, each existing shareholder of Avolon S.à r.l. transferred all of its interests in Avolon S.à r.l. to Avolon Holdings in the Share Exchange, resulting in Avolon S.à r.l. becoming a wholly owned subsidiary of Avolon Holdings. The Share Exchange was accounted for as Avolon Holdings succeeding to the business and activities of Avolon S.à r.l. for financial reporting purposes. The historical financial statements of Avolon Holdings include the historical financial results of Avolon S.à r.l. for all periods presented.

As we had only seven full months of operations in 2010, we believe the results for the period May 21, 2010 (the date of inception) through December 31, 2010 are not meaningful and not representative of the business. The corresponding financial data for the period from the date of inception through December 31, 2010 have been omitted from the table below.

1

The following table sets forth our selected consolidated financial data for the periods and as of the dates indicated. The balance sheet data as of December 31, 2013 and 2014 and the summary consolidated income statement data and cash flow data for each of the years ended December 31, 2011, 2012, 2013 and 2014 are derived from, and qualified by reference to, Avolon Holdings Limited’s audited consolidated financial statements included elsewhere in this Annual Report.

| | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| (in thousands, except share data) | | 2011 | | | 2012 | | | 2013 | | | 2014 | |

Statement of Operations Data: | | | | | | | | | | | | | | | | |

Revenues: | | | | | | | | | | | | | | | | |

Lease revenue | | $ | 133,586 | | | $ | 312,744 | | | $ | 415,006 | | | $ | 537,547 | |

Other revenue and interest income | | | 688 | | | | 13,153 | | | | 34,767 | | | | 68,471 | |

| | | | | | | | | | | | | | | | |

Total revenue | | $ | 134,274 | | | $ | 325,897 | | | $ | 449,773 | | | $ | 606,018 | |

Expenses | | $ | (144,309 | ) | | $ | (266,098 | ) | | $ | (336,723 | ) | | | (508,949 | ) |

| | | | | | | | | | | | | | | | |

Income/(loss) before income tax and interest in earnings/(loss) from unconsolidated equity investees | | | (10,035 | ) | | | 59,799 | | | | 113,050 | | | | 97,069 | |

Earnings/(loss) from unconsolidated equity investees, net of tax | | $ | 1,395 | | | $ | — | | | $ | (46 | ) | | $ | 307 | |

| | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | $ | (8,640 | ) | | $ | 59,799 | | | $ | 113,004 | | | $ | 97,376 | |

Income tax (expense) benefit | | | 5,659 | | | | 1,362 | | | | (204 | ) | | | (6,273 | ) |

| | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (2,981 | ) | | $ | 61,161 | | | $ | 112,800 | | | $ | 91,103 | |

| | | | | | | | | | | | | | | | |

Net income (loss) per share: | | | | | | | | | | | | | | | | |

Basic | | $ | (0.07 | ) | | $ | 0.92 | | | $ | 1.44 | | | $ | 1.16 | |

Diluted | | $ | (0.07 | ) | | $ | 0.92 | | | $ | 1.44 | | | $ | 1.16 | |

Weighted average shares outstanding: | | | | | | | | | | | | | | | | |

Basic | | | 41,199,016 | | | | 66,375,888 | | | | 78,220,312 | | | | 78,390,788 | |

Diluted | | | 41,241,052 | | | | 66,407,415 | | | | 78,241,330 | | | | 78,402,878 | |

| | | | |

Other Financial Data: | | | | | | | | | | | | | | | | |

Adjusted net income (loss)(1) | | $ | 2,863 | | | $ | 73,085 | | | $ | 125,151 | | | $ | 178,994 | |

Balance Sheet Data (at end of period): | | | | | | | | | | | | | | | | |

Flight equipment including assets held for sale (net of accumulated depreciation) | | | | | | $ | 3,575,991 | | | $ | 4,260,412 | | | $ | 5,606,556 | |

Total assets | | | | | | $ | 4,125,063 | | | $ | 5,070,478 | | | $ | 6,326,107 | |

Cash and cash equivalents | | | | | | $ | 53,844 | | | $ | 177,924 | | | $ | 111,392 | |

Restricted cash(2) | | | | | | $ | 182,233 | | | $ | 256,426 | | | $ | 195,095 | |

Deposits on flight equipment | | | | | | $ | 211,844 | | | $ | 206,781 | | | $ | 199,514 | |

Total debt | | | | | | $ | 2,804,780 | | | $ | 3,536,792 | | | $ | 4,548,448 | |

Total liabilities | | | | | | $ | 2,978,445 | | | $ | 3,776,727 | | | $ | 4,893,110 | |

Temporary equity and shareholders’ equity | | | | | | $ | 1,146,618 | | | $ | 1,293,751 | | | $ | 1,432,997 | |

| | | | |

Cash Flow Data: | | | | | | | | | | | | | | | | |

Net cash flows from: | | | | | | | | | | | | | | | | |

Operating activities | | $ | 65,970 | | | $ | 179,194 | | | $ | 242,834 | | | $ | 284,841 | |

Investing activities | | $ | (1,644,711 | ) | | $ | (1,531,363 | ) | | $ | (799,885 | ) | | $ | (1,466,534 | ) |

Financing activities | | $ | 1,628,365 | | | $ | 1,300,897 | | | $ | 681,131 | | | $ | 1,115,161 | |

| | | | |

Other Operating Data: | | | | | | | | | | | | | | | | |

Aircraft lease portfolio at period end: | | | | | | | | | | | | | | | | |

Owned | | | 53 | | | | 87 | | | | 99 | | | | 126 | |

2

| (1) | Adjusted net income (defined as net income (loss) before non-cash interest expense, which includes the amortization of debt issuance costs and the unrealized gain (loss) on derivatives, and, in each case, the related tax effect and share based compensation) is a measure of both liquidity and operating performance that is not defined by U.S. GAAP and should not be considered as an alternative to net income, income from operations, net cash provided by operating activities, or any other liquidity or performance measure derived in accordance with U.S. GAAP. We believe adjusted net income provides useful information regarding our earnings from ongoing operations, our ability to service our long-term debt and other fixed obligations, and our ability to fund our growth with internally generated funds. We use adjusted net income to assess our core operating performance on a consistent basis from period to period. In addition, adjusted net income helps us identify certain controllable expenses and make decisions designed to help us meet our near-term financial goals. Adjusted net income has limitations as an analytical tool, and you should not consider it in isolation from, or as a substitute for, our operating results or cash flows as reported under U.S. GAAP. Some of these limitations include: |

| | • | | adjusted net income does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments; |

| | • | | adjusted net income does not reflect changes in or cash requirements for our working capital needs; |

| | • | | adjusted net income does not reflect fair value adjustments on our interest rate caps that are included in unrealized (gains) losses on derivatives, as such items are not reflective of our operating performance; |

| | • | | adjusted net income may also exclude certain non-recurring items in the future that are not reflective of our operating performance but that may impact our operating results for the applicable period; and |

| | • | | our calculation of adjusted net income may differ from the adjusted net income or similarly titled measures of other companies in our industry, limiting its usefulness as a comparative measure. |

| (2) | Restricted cash comprises cash held by us but which is ring-fenced or used as security for specific financing arrangements, and to which we do not have unfettered access. |

The following table reconciles cash flows from operating activities and net income, the most directly comparable U.S. GAAP measures of liquidity and performance, to adjusted net income:

Reconciliation of Cash Flows From Operating Activities to Adjusted Net Income (Loss)

| | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| (in thousands) | | 2011 | | | 2012 | | | 2013 | | | 2014 | |

Net cash provided by operating activities | | $ | 65,970 | | | $ | 179,194 | | | $ | 242,834 | | | $ | 284,841 | |

| | | | | | | | | | | | | | | | |

Depreciation | | | (46,615 | ) | | | (110,957 | ) | | | (145,615 | ) | | | (182,437 | ) |

Deferred income tax provision | | | 5,920 | | | | 1,663 | | | | 101 | | | | (5,837 | ) |

Amortization of debt issuance costs | | | (9,444 | ) | | | (9,457 | ) | | | (18,766 | ) | | | (24,277 | ) |

Share based compensation | | | — | | | | — | | | | — | | | | (53,733 | ) |

(Gain) on disposal of flight equipment | | | — | | | | 11,267 | | | | 31,051 | | | | 64,409 | |

(Loss)/earnings from unconsolidated equity investees | | | 1,395 | | | | — | | | | (46 | ) | | | 307 | |

Unrealised gain/(loss) on derivatives | | | (3,959 | ) | | | (2,199 | ) | | | 6,390 | | | | (12,240 | ) |

Changes in operating assets and liabilities: | | | | | | | | | | | | | | | | |

Increase in receivables | | | 1,193 | | | | 3,010 | | | | 957 | | | | 4,217 | |

Increase in other assets | | | 5,961 | | | | 3,245 | | | | 16,114 | | | | 22,396 | |

(Increase) in deferred revenue | | | (6,725 | ) | | | (7,906 | ) | | | (9,993 | ) | | | (7,721 | ) |

(Increase)/decrease in accounts payable, accrued expenses and other liabilities | | | (16,677 | ) | | | (6,699 | ) | | | (10,227 | ) | | | 1,178 | |

| | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (2,981 | ) | | $ | 61,161 | | | $ | 112,800 | | | $ | 91,103 | |

Amortization of debt issuance costs | | | 9,444 | | | | 9,457 | | | | 18,766 | | | | 24,277 | |

Share based compensation | | | — | | | | — | | | | — | | | | 53,733 | |

Unrealized (gain) loss on derivatives | | | 3,959 | | | | 2,199 | | | | (6,390 | ) | | | 12,240 | |

Tax effect | | | (7,559 | ) | | | 268 | | | | (25 | ) | | | (2,359 | ) |

| | | | | | | | | | | | | | | | |

Adjusted net income | | $ | 2,863 | | | $ | 73,085 | | | $ | 125,151 | | | $ | 178,994 | |

3

Risk Factors

Risks Relating to Our Business and Our Industry

Our business is affected by general economic and financial conditions.

Our business and results of operations are significantly affected by general business, financial market and economic conditions. The worsening of economic conditions, particularly if combined with high fuel prices, may have a material adverse effect on our lessees’ ability to meet their financial and other obligations under our operating leases, which, if our lessees default on their obligations to us or seek to renegotiate the terms of their leases, could have a material adverse effect on our financial condition, cash flow and results of operations. General business and economic conditions that could affect us include interest rate fluctuations, inflation, unemployment levels, restructurings and mergers in the airline industry, volatile fuel costs, demand for passenger and cargo air travel, volatility in both debt and equity capital markets, liquidity of the global financial markets, the availability and cost of credit, investor and consumer confidence, global economic growth and the strength of local economies in which we operate.

Our financial condition and results of operations are dependent, in part, on the financial strength of our lessees; lessee defaults, bankruptcies and other credit problems could have a material adverse effect on our financial condition, cash flow and results of operations.

Our financial condition and results of operations depend, in part, on the financial strength of our lessees, our ability to appropriately assess the credit risk of our lessees and the ability of our lessees to perform under our leases. Many of our lessees have expanded their airline operations through borrowings and long-term leases and may be highly leveraged. These lessees will depend on banks and the capital markets to provide working capital and to refinance existing indebtedness. In 2014, we generated the majority of our revenue from leases to airlines and as a result we are indirectly affected by all the risks facing airlines today. The ability of our lessees to perform their obligations under our leases will depend primarily on our lessees’ financial condition and cash flow, which may be affected by factors outside our control, including:

| • | | passenger air travel demand, air cargo rates and air cargo demand; |

| • | | economic conditions and currency fluctuations in the countries and regions in which the lessee operates; |

| • | | the price and availability of jet fuel; |

| • | | availability of financing and other circumstances affecting airline liquidity, including covenants in financings, collateral posting requirements contained in fuel hedging contracts and the ability of airlines to make or refinance principal payments as they come due; |

| • | | geopolitical and other events, including war, acts of terrorism, outbreaks of epidemic diseases, aircraft accidents and natural disasters; |

| • | | increases in operating costs, including labor costs, insurance costs and other general economic conditions affecting our lessees’ operations; |

| • | | governmental regulation and associated fees affecting the air transportation business; and |

| • | | environmental regulations, including, but not limited to, restrictions on noise or carbon emissions. |

To the extent that our lessees are affected by these risks, we may experience a decrease in demand for our aircraft along with reduced market lease rates, effective lease margins and aircraft values, which could require us to recognize impairments or fair value adjustments on our aircraft. Any of the foregoing could have a material adverse effect on our financial condition, cash flow and results of operations.

4

Most of our existing lessees are not rated investment grade by the principal U.S. rating agencies, may suffer liquidity or funding problems, and, at any point in time, may experience lease payment difficulties or be significantly in arrears in their obligations under our leases. Lessees encountering financial difficulties may seek reductions in their lease rates or other concessions, such as lowered maintenance obligations. Further or future downturns in the aviation industry could exacerbate the weakened financial condition and liquidity problems of some of our lessees and could further increase the risk of delayed, missed or reduced rental payments. We may not correctly assess the credit risk of each lessee or we may charge lease rates that do not correctly reflect these risks. Our lessees may not be able to continue to meet their financial and other obligations under our leases in the future. Delayed, missed or reduced rental payments from a lessee would decrease our revenues, margins and cash flow.

In addition, we may experience lessee defaults, lease restructurings, aircraft repossessions and airline bankruptcies and restructurings in the future. The terms and conditions of possible lease restructurings or reschedulings may result in a significant reduction or deferral of rental payments due over all or part of the remaining lease term, which may adversely affect our financial condition, results of operations and growth prospects. The terms of any revised payment schedules may be unfavorable and such payments may not be made. Our default levels may increase over time if economic conditions deteriorate. If lessees of a significant number of our aircraft default on their leases, our financial condition, cash flow and results of operations could be materially adversely affected.

We will need additional capital to finance our growth and refinance our existing debt, and we may not be able to obtain it on acceptable terms, or at all, which may limit our ability to grow and compete in the commercial aircraft leasing market.

Our ability to acquire additional assets and to refinance our existing debt depends to a significant degree on our ability to access the financing markets. Our access to debt and equity financing will depend on a number of factors including our historical and expected performance, compliance with the terms of our debt agreements, general market conditions, interest rate fluctuations and the relative attractiveness of alternative investments. We are exposed to risk from volatility and disruption in the financing markets in various ways, including difficulty or inability to finance the acquisition of aircraft, increased risk of default by our lessees, exposure to increased bank or counterparty risk and the risk that we will not be able to refinance any of our existing debt financings, as they come due, on favorable terms or at all. In addition, volatility or disruption in the financing markets could adversely affect banks and financial institutions causing lenders to increase the costs of such financing or to be reluctant or unable to provide us with financing on terms acceptable to us. We compete with other lessors and airlines when acquiring aircraft and our ability to grow our portfolio is dependent on our ability to access attractive financing. If we are unable to raise additional funds or obtain capital on terms acceptable to us, we may not be able to satisfy our aircraft acquisition commitments, which as of December 31, 2014 represented an aggregate of $1,560.1 million through December 31, 2015, including $551.3 million represented by letters of intent to purchase 13 aircraft. If we are unable to satisfy our purchase commitments, we may be forced to forfeit our deposits. Further, we would be exposed to potential breach of contract claims by our lessees and manufacturers. These risks may also be increased by the volatility and disruption in the capital and credit markets. Therefore, if we are unable to raise additional funds or obtain capital on acceptable terms, our growth opportunities will be limited and our ability to refinance our existing debt could be materially adversely affected, any of which could have a material adverse effect on our financial condition, cash flow and results of operations.

The value of the aircraft we acquire and the market rates for leases could decline, which would have a negative effect on our financial condition, cash flow and results of operations.

Aircraft values and market rates for leases have from time to time experienced sharp decreases due to a number of factors including, but not limited to, decreases in passenger and air cargo demand, increases in fuel costs, government regulation and increases in interest rates. Operating leases place the risk of realization of residual values on aircraft lessors because only a portion of the aircraft’s value is covered by contractual cash flows under

5

the lease. In addition to factors linked to the aviation industry generally, many other factors may affect the value of our aircraft and market rates for our leases, including:

| • | | the particular maintenance, damage, operating history and documentary records of the aircraft and engine; |

| • | | manufacture and type or model of aircraft or engine, including the number of operators using that type of aircraft; |

| • | | whether the aircraft is subject to a lease, and if so, whether the lease terms are favorable to the lessor; |

| • | | the advent of newer models of such aircraft or aircraft types competing with such aircraft; |

| • | | the regulatory authority under which the aircraft is operated and regulatory actions, including mandatory grounding of the aircraft; |

| • | | any renegotiation of an existing lease on less favorable terms; |

| • | | any tax, customs, regulatory and legal requirements that must be satisfied before the aircraft can be purchased, sold or re-leased; |

| • | | compatibility of aircraft configurations or specifications with other aircraft operated by operators of that aircraft type; |

| • | | decreases in creditworthiness of lessees; and |

| • | | the availability of spare parts. |

Any decrease in the value of our aircraft and market rates for leases, which may result from the above factors or other unanticipated factors, would have a material adverse effect on our financial condition, cash flow and results of operations.

The loss of key personnel would have a material adverse effect on our reputation and relationships with lessees, manufacturers, buyers and financiers of aircraft, which are a critical element to the success of our business.

We believe that our senior management’s reputation and relationships with lessees, manufacturers, buyers and financiers of aircraft are a critical element to the success of our business. We depend on the diligence, skill, experience and network of business contacts of our management team. We believe there are only a limited number of available qualified executives in the aircraft industry, and we therefore have encountered, and will likely continue to encounter, intense competition for qualified employees from other companies in our industry. Our future success will depend, to a significant extent, upon the continued service of our senior management personnel, particularly: Mr. Dómhnal Slattery, our Chief Executive Officer; Mr. John Higgins, our President and Chief Commercial Officer; Mr. Andy Cronin, our Chief Financial Officer; Mr. Tom Ashe, our Chief Operating Officer and Head of Risk and our other senior officers, each of whose services are critical to the success of our business strategies. Any member of our senior management team may terminate his or her employment at any time upon three months’ prior written notice. If we were to lose the services of any of the members of our senior management team, it could have a material adverse effect on our financial condition, cash flow and results of operations.

We may incur costs and suffer other negative consequences resulting from lessee defaults and our attempts to repossess aircraft.

If we are required to repossess an aircraft upon a default by a lessee, we may be required to incur significant costs. Those costs include legal and other expenses of court or other governmental proceedings, including the cost of posting security bonds or letters of credit necessary to effect repossession of the aircraft. These costs may be particularly high if the lessee is contesting the proceedings or is in bankruptcy. In addition, during these

6

proceedings the relevant aircraft would not be generating revenue. We may also incur substantial maintenance, refurbishment or repair costs that a defaulting lessee has failed to pay and that are necessary to put the aircraft in suitable condition for re-lease or sale, or storage costs associated with any aircraft that we repossess and are unable to place immediately with another lessee. It may also be necessary to pay off liens, taxes and other governmental charges on the aircraft to obtain clear possession and to re-lease the aircraft effectively, including, in some cases, liens that the lessee may have incurred in connection with the operation of its other aircraft. We may also incur other costs in connection with the physical repossession of the aircraft. We have not yet repossessed any aircraft.

We may suffer other negative consequences as a result of a lessee default, the related termination of the lease and the repossession of the related aircraft. It is likely that our rights upon a lessee default will vary significantly depending upon the jurisdiction and the applicable law, including the need to obtain a court order for repossession of the aircraft and/or consent for deregistration or export of the aircraft. We anticipate that when a defaulting lessee is in bankruptcy, protective administration, insolvency or similar proceedings, additional limitations may apply. Certain jurisdictions give rights to the trustee in bankruptcy or a similar officer to assume or reject the lease or to assign it to a third party, or entitle the lessee or another third party to retain possession of the aircraft without paying lease rentals or performing all or some of the obligations under the relevant lease.

Additionally, certain of our lessees are owned, in whole or in part, by government-related entities, which could complicate our efforts to repossess our aircraft in that lessee’s domicile. Accordingly, we may be delayed in, or prevented from, enforcing certain of our rights under a lease and in re-leasing the affected aircraft. If we repossess an aircraft, we may not necessarily be able to export or deregister and profitably redeploy the aircraft. For instance, where a lessee or other operator flies only domestic routes in the jurisdiction in which the aircraft is registered, repossession may be more difficult, especially if the jurisdiction permits the lessee or the other operator to resist deregistration. We may also incur significant costs in retrieving or recreating aircraft records required for registration of the aircraft, and in obtaining the Certificate of Airworthiness for an aircraft. If we incur significant costs in connection with repossessing our aircraft, are delayed in repossessing our aircraft or are unable to obtain possession of our aircraft as a result of lessee defaults, it could have a material adverse effect on our financial condition, cash flow and results of operations.

In addition, termination of the leasing of an aircraft as a result of a default by the lessee may have an impact on the debt financing of such aircraft. Any such termination may require a mandatory prepayment of the debt in respect of the aircraft after certain standstill and/or remarketing periods.

Our financial performance is in part dependent on our ability to regularly sell aircraft and we may not be able to do so on favorable terms or at all.

Our financial performance is in part dependent on our ability to regularly sell aircraft profitably. Our ability to sell our aircraft profitably or at all will depend on conditions in the airline industry and general market and competitive conditions at the time we seek to sell. In addition, our ability to sell our aircraft will be affected by the particular maintenance, damage and operating history of the aircraft and its engines. Failure to sell aircraft regularly and profitably could have a material adverse effect on our financial condition, cash flow and results of operations.

Our business model depends on the continual re-leasing of our aircraft when current leases expire and the leasing of new aircraft on order, and we may not be able to do so on favorable terms, if at all.

Our business model depends on the continual re-leasing of our aircraft when our current leases expire in order to generate sufficient revenues to finance our operations and pay our debt service obligations. As of December 31, 2014, we had no leases expiring in 2015, five leases expiring in 2016 and seven leases expiring in 2017. In 2014, we generated revenue of $20.6 million from the leases that are scheduled to expire in 2016 and revenue of $26.2 million from the leases that are scheduled to expire in 2017. The aircraft subject to those leases that we do not sell prior to lease termination will need to be re-leased, or the current leases will need to be extended.

7

Because our leases are operating leases, only a portion of the aircraft’s value is covered by revenues generated from the lease and we may not be able to realize the aircraft’s residual value after expiration of the initial lease. We bear the risk of re-leasing or selling the aircraft in our fleet when our operating leases expire or when aircraft are returned to us prior to the expiration of any lease. Our ability to lease, re-lease or sell our aircraft will depend on conditions in the airline industry and general market and competitive conditions at the time the operating leases are entered into and expire. In addition, our ability to re-lease our aircraft will be affected by the particular maintenance, damage and operating history of the aircraft and its engines. Further, our ability to avoid significant off-lease time is likely to be adversely impacted by, among other things, increases in the cost of fuel, any deterioration in the financial condition of the airline industry, any major airline bankruptcies, any sale of large numbers of repossessed aircraft by financial institutions, the introduction of newer models of aircraft and other factors leading to oversupply (including manufacturer overproduction), and political and economic uncertainties.

We cannot assure you that we will be able to enter into profitable leases for any aircraft acquired, and our failure to do so would have a material adverse effect on our financial condition, cash flow and results of operations.

We cannot assure you that we will be able to enter into profitable leases upon the acquisition of the aircraft we purchase pursuant to our current or future purchase commitments. We rely upon our management team’s judgment and ability to evaluate the ability of lessees and other counterparties to perform their obligations to us and to negotiate transaction documents. However, we cannot assure you that our management team will be able to perform such functions in a manner that will achieve our investment objectives, which would have a material adverse effect on our financial condition, cash flow and results of operations.

From time to time, the aircraft industry has experienced periods of oversupply during which lease rates and aircraft values have declined, and any future oversupply could have a material adverse effect on our financial condition, cash flow and results of operations.

Historically, the aircraft leasing business has experienced periods of aircraft oversupply. The oversupply of a specific type of aircraft is likely to depress the lease rates for and the value of that type of aircraft. The supply and demand for aircraft is affected by various cyclical and non-cyclical factors that are outside of our control, including:

| • | | passenger and air cargo demand; |

| • | | operating costs, including fuel costs; |

| • | | general economic conditions; |

| • | | geopolitical events, including war, prolonged armed conflict and acts of terrorism, as well as aircraft accidents; |

| • | | outbreaks of communicable diseases and natural disasters; |

| • | | governmental regulation; |

| • | | interest and foreign exchange rates; |

| • | | the availability of credit; |

| • | | airline restructurings and bankruptcies; |

| • | | manufacturer production levels and technological innovation; |

| • | | manufacturers merging or exiting the industry or ceasing to produce aircraft types; |

| • | | climate change initiatives, technological change, aircraft noise and emissions regulations, aircraft age limits and other factors leading to reduced demand for, early retirement or obsolescence of aircraft models; |

| • | | reintroduction into service of aircraft previously in storage; and |

8

| • | | airport and air traffic control infrastructure constraints. |

During recent years, the airline industry has committed to a significant number of aircraft deliveries through order placements with manufacturers. In response, aircraft manufacturers have raised their production output. The increase in these production levels could result in an oversupply of aircraft if growth in airline traffic does not meet airline industry expectations. An oversupply of new aircraft could also adversely affect the rental rates for, and market values of, used aircraft.

In addition, many airlines have eliminated certain types of aircraft from their fleets, affecting the prices both of the aircraft types they eliminate and the types they continue to use. This elimination of certain aircraft has resulted in an increase in the availability of such aircraft in the market, a decrease in rental rates for such aircraft and a decrease in market values of such aircraft. We cannot assure you that airlines will continue to acquire the same types of aircraft, or that we will not acquire aircraft that will cease to be used by our potential lessees. Any of these factors may produce sharp and prolonged decreases in aircraft lease rates and values, or may have a negative effect on our ability to lease or re-lease the aircraft in our fleet or in our order book. Any of these factors could have a material adverse effect on our financial condition, cash flow and results of operations.

Changes in the appraised value of our aircraft could have a material adverse effect on our financial condition, cash flow and results of operations.

Aircraft appraisers play a significant role in shaping market perception of aircraft values. Each appraiser’s valuation is based on that appraiser’s professional opinion. Appraisals can be subjective because they are based on various assumptions and conditions with regard to the specific aircraft appraised and the commercial aviation industry generally. In addition, appraisers may use historical data, and subsequent changes or additions to such data may not be adequately captured in the appraised value.

Certain of our debt financing arrangements include loan-to-value tests that may require us to set aside a portion of our cash flows or make partial prepayments of debt outstanding under such arrangements in the event that the appraised value of our aircraft decreases. A decrease in the valuation of our aircraft by independent appraisers could also adversely affect our ability to sell or lease our aircraft on terms acceptable to us, or at all, or could decrease amounts available to us under our existing and future debt financing arrangements. In addition, we may be required to incur impairment charges or fair value adjustments to the extent that the appraiser’s valuation of our aircraft is less than the depreciated book value on our balance sheet. The occurrence of any of these events as a result of changes in the appraised value of our aircraft could have a material adverse effect on our financial condition, cash flow and results of operations.

Changes in interest rates may adversely affect our financial condition and results of operations.

We use floating rate debt to finance the acquisition of a portion of our aircraft. As of December 31, 2014, 29.0% of our total outstanding indebtedness was floating rate. We incurred floating rate interest expense (excluding the impact of interest rate derivatives) of $28.5 million in the year ended December 31, 2014. If interest rates increase, we would be obligated to make higher interest payments to our lenders. Our practice has been to protect ourselves against interest rate increases on a portion of our floating rate liabilities by entering into derivative financial instruments, such as interest rate caps and interest rate swaps. We remain exposed, however, to changes in interest rates to the extent that our derivative financial instruments are not correlated to our financial liabilities. In addition, we are exposed to the credit risk that the counterparties to our derivative financial instruments will default in their obligations. If we incur significant fixed rate debt in the future, increased interest rates prevailing in the market at the time of the incurrence or refinancing of such debt will also increase our interest expense.

Decreases in interest rates may also adversely affect our lease revenues generated from leases with lease rates tied to floating interest rates as well as interest revenue on cash deposits. In the year ended December 31, 2014, 15.2% of our lease revenue was attributable to leases with lease rates tied to floating interest rates. In addition,

9

since our fixed rate leases are based, in part, on prevailing interest rates at the time we enter into the lease, if interest rates decrease, new fixed rate leases we enter into may be at lower lease rates and our lease revenue will be adversely affected.

Our ability to obtain debt financing and our cost of debt financing are dependent, in part, upon the internal financial strength ratings assigned to us by our lenders, and a downgrade of these ratings could adversely impact our financial condition, cash flow and results of operations.

Our ability to obtain debt financing, and our cost of debt financing, are dependent, in part, on the financial strength ratings assigned to us by our lenders. Maintaining these ratings depends in part on strong financial results and in part on other factors, including the outlook of our lenders on our sector and on the market generally. In the future we may seek to obtain public corporate credit ratings from ratings agencies as well. A rating downgrade by our lenders or by any rating agencies may result in higher pricing or less favorable terms under debt financings. Rating downgrades may therefore make it more difficult for us to satisfy our funding requirements and may adversely impact our financial condition, cash flows and results of operations.

Competition from other aircraft lessors or purchasers could have a material adverse effect on our financial condition, results of operations and growth prospects.

The aircraft leasing industry is highly competitive. We encounter competition in the acquisition of aircraft from other entities such as airlines, aircraft manufacturers, financial institutions, aircraft brokers, public and private partnerships, investors and funds with more capital to invest in aircraft, and other aircraft leasing companies that we do not currently consider our major competitors.

Competition for a leasing transaction is based principally upon lease rates, delivery dates, lease terms, reputation, management expertise, aircraft condition, specifications and configuration and the availability of the types of aircraft necessary to meet the needs of the customer. Some of our competitors may have greater operating and financial resources and access to lower capital costs than we have and may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of investments. In addition, some competing aircraft lessors may provide inducements to potential lessees that we cannot match. Competition in the purchase and sale of used aircraft is based principally on the availability of used aircraft, price, the terms of the lease to which an aircraft is subject and the creditworthiness of the lessee, if any. We may not always be able to compete successfully with our competitors and other entities, which could have a material adverse effect on our financial condition, results of operations and growth prospects.

There is a limited number of aircraft and engine manufacturers and the failure of any manufacturer to meet its obligations could have a material adverse effect on our financial condition, cash flow and results of operations.

The supply of large commercial jet aircraft is dominated by two airframe manufacturers, Boeing and Airbus, and three engine manufacturers, GE Aircraft Engines, Rolls Royce plc and Pratt & Whitney. As a result, we are dependent on these manufacturers’ success in remaining financially stable, producing products and related components which meet the airlines’ demands and fulfilling their contractual obligations to us. Should the manufacturers fail to respond appropriately to changes in the market environment or fail to fulfill their contractual obligations, we may experience any of the following:

| • | | missed or late delivery of aircraft and engines ordered by us, which could result in an inability to meet our contractual obligations to our customers and/or the loss of pre-delivery payments by our customers to us for new ordered aircraft, resulting in lost or delayed revenues, lower growth rates and strained customer relationships; |

| • | | an inability to acquire aircraft and engines and related components on terms which will allow us to lease those aircraft and engines to customers at a profit, resulting in lower growth rates or a contraction in our aircraft portfolio; |

10

| • | | poor customer support from the manufacturers of aircraft, engines and components; |

| • | | manufacturer reputational damage, resulting in reduced demand for a particular manufacturer’s product, creating downward pressure on demand for those aircraft and engines in our fleet and reduced market lease rates and sale prices for those aircraft and engines; and |

| • | | reduction in our competitiveness due to deep discounting by the manufacturers, which may lead to reduced market lease rates and sale prices and may affect our ability to re-lease or sell some of the aircraft in our portfolio. |

Any of these circumstances could have a material adverse effect on our financial condition, cash flow and results of operations.

There have been recent well-publicized delays by airframe manufacturers in meeting stated delivery schedules for new aircraft programs. Although we may have the right to terminate a purchase agreement in the event of protracted manufacturing delays, subject to certain grace periods, if we experience delivery delays for new aircraft types or aircraft for which we have made future commitments (such as the Airbus A320neo, Airbus A330neo, Boeing 737 MAX and the Boeing 787 Dreamliner), it could delay the receipt of contracted cash flows, and affected lessees could be entitled to terminate their lease arrangements with respect to such aircraft if the delays extend beyond agreed-upon periods of time. Any such termination could negatively affect our financial condition, cash flow and results of operations.

In addition, new aircraft types may not deliver the anticipated performance improvements, or could experience technical problems that result in the grounding of the aircraft, which in either case could adversely affect the values and lease rates of such aircraft.

Changes in fuel costs may adversely affect our lessees’ operating results, which could in turn negatively impact our business. A period of sustained lower fuel costs may reduce the premium that airlines are willing to pay for new fuel-efficient technology aircraft, which could in turn negatively impact our business.

Fuel costs represent a major expense to airlines. Fuel prices can fluctuate widely depending primarily on international market conditions, geopolitical and environmental events and regulation, natural disasters, conflicts, war, regulatory changes and currency exchange rates. As a result, fuel prices are not within the control of our lessees and significant changes in fuel prices could materially and adversely affect their operating results. For instance, ongoing geopolitical disruption in North Africa, the Middle East and Ukraine has generated uncertainty regarding the world’s future fuel supply, which initially led to significant increases in fuel costs. If this unrest continues, fuel costs may rise. Other events can also significantly affect fuel availability and prices, including natural disasters, decisions by the Organization of the Petroleum Exporting Countries regarding its members’ oil output, and changes in global demand for fuel from countries such as China.

Higher fuel costs may have a material adverse impact on airline profitability, including the profitability of our lessees. Due to the competitive nature of the airline industry, airlines may not be able to pass on increases in fuel prices to their customers by increasing fares. In addition, airlines may not be able to manage this risk by appropriately hedging their exposure to fuel price fluctuations. For these reasons, if fuel prices increase due to adverse supply and demand conditions, future terrorist attacks, acts of war, armed hostilities or natural disasters or for any other reason, our lessees may incur higher costs and generate lower net revenues, which would adversely impact their financial positions. Consequently, these conditions may (i) affect our lessees’ ability to make rental and other lease payments, (ii) result in lease restructurings and aircraft repossessions, (iii) increase our costs of servicing and marketing the aircraft, (iv) impair our ability to re-lease or otherwise dispose of the aircraft on a timely basis and/or at favorable rates and (v) reduce the value receivable for the aircraft upon any disposition. These results could have a material adverse effect on our financial condition, cash flow and results of operations.

A sustained period of lower fuel costs may reduce the premium that airlines are willing to pay for new fuel-efficient technology aircraft and could impact airlines’ desire to lease the Company’s aircraft, which could in turn negatively impact our business.

11

Our level of indebtedness requires significant debt service payments.

As of December 31, 2014, our consolidated indebtedness was $4,548.4 million and represented 71.9% of our total assets as of that date, and our interest expense (including the impact of hedging activities) was $206.6 million for the year ended December 31, 2014. Due to the capital intensive nature of our business and our strategy of expanding our aircraft portfolio, we expect that we will incur additional indebtedness in the future. If market conditions worsen and precipitate further declines in aircraft- and aviation-related markets, our operations may not generate sufficient cash to service our debt which will have a material adverse impact on us. Specifically, our level of indebtedness:

| • | | causes a substantial portion of our cash flows from operations to be dedicated to interest and principal payments and therefore not available to fund our operations, working capital, capital expenditures, expansion, acquisitions or general corporate or other purposes; |

| • | | restricts the ability of some of our subsidiaries and joint ventures to make distributions to us; |

| • | | may place us at a disadvantage compared to competitors that have less debt; |

| • | | may impair our ability to obtain additional financing in the future; |

| • | | may limit our flexibility in planning for, or reacting to, changes in our business and industry; and |

| • | | may make us more vulnerable to downturns in our business, our industry or the economy in general. |

Any of these circumstances could have a material adverse effect on our financial condition, cash flow and results of operations.

Aircraft have finite economic useful lives, depreciate over time and become more expensive to operate as they age, all of which could have a material adverse effect on our financial condition, cash flow and results of operations.

Aircraft are long-lived assets requiring long lead times to develop and manufacture, with particular types and models becoming obsolete or less in demand over time when newer, more advanced aircraft are manufactured. As commercial aircraft age, they will depreciate and will typically generate lower revenues and cash flows. As of December 31, 2014, the age of our Owned Portfolio, weighted by net book value, was 2.5 years. Our existing fleet, as well as the aircraft that we have ordered, have exposure to obsolescence, particularly if unanticipated events occur that shorten the life cycle of such aircraft types. These events include but are not limited to government regulation or changes in our airline customers’ preferences. These events may shorten the life cycle for aircraft types in our fleet and, accordingly, may negatively impact lease rates, trigger impairment charges or increase depreciation expense. We must be able to replace such older aircraft with newer aircraft or our ability to maintain or increase our revenues and cash flow will decline. In addition, if we sell an aircraft for a price that is less than the depreciated book value of the aircraft on our balance sheet, we will recognize a loss on the sale, which could materially adversely affect our results of operations for the period in which we recognize such loss.

In general, the costs of operating an aircraft, including maintenance expenditures, increase with the age of the aircraft. Also, older aircraft typically are less fuel efficient than newer aircraft. Variable expenses like fuel, crew size or aging aircraft corrosion control programs and related airworthiness directives may make the operation of older aircraft less economically feasible and may result in increased lessee defaults and renegotiation of lease terms and also cause us to incur some of these increased maintenance expenses and regulatory costs. These expenses may also impact our ability to re-lease or sell such aircraft upon expiration of the existing lease, which could cause us to incur off-lease time.

Some countries have implemented, and others have considered, regulations restricting or prohibiting the import of aircraft above a certain age. If passed, such regulations may further impact our ability to re-lease or sell any such aircraft on favorable lease terms or at all.

12

Maintenance issues with any aircraft in our fleet could have a material adverse effect on our financial condition, cash flow and results of operations.

Although we may inspect an aircraft and its documented maintenance, usage, lease and other records prior to acquisition, we may not discover all defects during an inspection. Repairs and maintenance costs for existing aircraft are difficult to predict, generally increase as aircraft age and can be adversely affected by prior use. We use a predictive model to determine the amount of supplemental maintenance rent we recognize from lessees who pay us monthly reserves to cover the cost of future maintenance events, and the level of supplemental maintenance rent that we are able to recognize may be reduced if aircraft or engine maintenance costs increase. Even if we are entitled to receive maintenance payments, these payments may not cover the entire cost of maintenance required. Further, variable expenses like fuel, maintenance costs, crew size or aging aircraft corrosion control or modification programs and airworthiness directives could make the operation of older aircraft more costly to our lessees and may result in increased lessee defaults or decreased aircraft values. We may also incur some of these increased maintenance expenses and regulatory costs upon acquisition or re-leasing of our aircraft. Any of these expenses or costs could have a material adverse effect on our financial condition, cash flow and results of operations.

If our lessees fail to discharge aircraft liens, we may be obligated to pay the aircraft liens, which could have a material adverse effect on our financial condition, cash flow and results of operations.

In the normal course of their business, our lessees are likely to incur aircraft liens that secure the payment of airport fees and taxes, customs duties, air navigation charges (including charges imposed by Eurocontrol, the European Organization for the Safety of Air Navigation), landing charges, salvage or other charges. These liens may secure substantial sums that may, in certain jurisdictions or for certain types of liens, particularly liens on entire fleets of aircraft, exceed the value of the particular aircraft to which the liens have attached. Aircraft may also be subject to mechanics’ liens as a result of maintenance performed by third parties on behalf of our lessees. Although we anticipate that the financial obligations relating to these liens will be the responsibility of our lessees, if they fail to fulfill such obligations, the liens may attach to our aircraft and ultimately affect our ability to realize value from the aircraft. In some jurisdictions, aircraft liens may give the holder the right to detain or, in limited cases, sell or cause the forfeiture of the aircraft. Until they are discharged, these liens could impair our ability to repossess, re-lease or sell our aircraft. Our lessees may not comply with the anticipated obligations under their leases to discharge aircraft liens arising during the terms of the leases. If they do not, we may find it necessary to pay the claims secured by such aircraft liens in order to repossess the aircraft. Such payments could have a material adverse effect on our financial condition, cash flow and results of operations.

If we, or our lessees, fail to maintain our aircraft, their value may decline and we may not be able to lease or re-lease our aircraft at favorable rates, if at all, which could have a material adverse effect on our financial condition, cash flow and results of operations.

We may be exposed to increased maintenance costs for our leased aircraft associated with a lessee’s failure to properly maintain the aircraft or pay supplemental maintenance rent. If an aircraft is not properly maintained, its market value may decline which would result in lower revenues from its lease or sale. Under our leases, our lessees are primarily responsible for maintaining the aircraft and complying with all governmental requirements applicable to the lessee and the aircraft, including operational, maintenance, government agency oversight, registration requirements and airworthiness directives. Although we require many of our lessees to pay us supplemental maintenance rent, failure of a lessee to perform required maintenance during the term of a lease could result in a decrease in value of an aircraft, an inability to re-lease an aircraft at favorable rates, if at all, or a potential grounding of an aircraft. Maintenance failures by a lessee would also likely require us to incur maintenance and modification costs upon the termination of the applicable lease, which could be substantial, to restore the aircraft to an acceptable condition prior to sale or re-leasing and may delay any subsequent sale or re-leasing. If we are unable to re-lease an aircraft when it comes off-lease because we need to make such repairs or conduct such maintenance, we may realize a substantial loss of cash flows without any corresponding cessation in our debt service obligations. We cannot assure you that, in the event a lessee defaults under a lease, any

13

security deposit paid or letter of credit provided by the lessee as security for the performance of its obligations under the lease will be sufficient to cover the lessee’s outstanding or unpaid lease obligations and required maintenance expenses or be sufficient to discharge liens that may have attached to our aircraft. Our lessees’ failure to meet their obligations to pay supplemental maintenance rent or perform required scheduled maintenance or our inability to maintain our aircraft could have a material adverse effect on our financial condition, cash flow and results of operations.

Failure to close our aircraft acquisition commitments could have a material adverse effect on our financial condition, cash flow and results of operations.

As of December 31, 2014, we had entered into purchase commitments to acquire a total of 98 new aircraft for delivery through 2022. If we are unable to maintain our financing sources or find new sources of financing or if the various conditions to our existing commitments are not satisfied, we may be unable to close the purchase of some or all of the aircraft which we have commitments to acquire. If our aircraft acquisition commitments are not closed for these or other reasons, we will be subject to several risks, including the following:

| • | | forfeiting deposits and pre-delivery payments and having to pay and expense certain significant costs relating to these commitments, such as actual damages, and legal, accounting and financial advisory expenses, and not realizing any of the benefits of completing the transactions; |

| • | | defaulting on our lease commitments, which could result in monetary damages and damage to our reputation and relationships with lessees; and |

| • | | failing to capitalize on other aircraft acquisition opportunities that were not pursued due to our management’s focus on these commitments. |

If we determine that the capital we require to satisfy these commitments may not be available to us, either at all or on terms we deem attractive, we may eliminate or reduce any dividend program that may be in place at that time in order to preserve capital to apply to these commitments. These risks could have a material adverse effect on our financial condition, cash flow and results of operations.

The introduction of superior aircraft technology or a new line of aircraft could cause the aircraft that we acquire to become outdated or obsolete or oversupplied and therefore less desirable, which would have a material adverse effect on our financial condition, cash flow and results of operations.

As manufacturers introduce technological innovations and new types of aircraft, some of the aircraft in our fleet could become less desirable to potential lessees. Such technological innovations may increase the rate of obsolescence of existing aircraft faster than currently anticipated by our management, which could negatively affect the value of the aircraft in our fleet. New aircraft manufacturers could emerge to produce aircraft that compete with the aircraft we own. In addition, the imposition of increased regulation regarding stringent noise or emissions restrictions may make some of our aircraft less desirable and accordingly less valuable in the marketplace. The development of new aircraft and engine options could decrease the desirability of certain aircraft in our fleet and/or aircraft that we have ordered. This could, in turn, reduce both future residual values and lease rates for certain types of aircraft in our portfolio. Any of these risks may negatively affect our ability to lease or sell our aircraft on favorable terms, if at all, which would have a material adverse effect on our financial condition, cash flow and results of operations.

Decreases in the demand for or availability of the aircraft types in our portfolio could harm our business and results of operations should any difficulties specific to these particular types of aircraft occur.

As of December 31, 2014, our Owned and Committed Portfolio contained a mix of aircraft types including one Airbus A319ceo aircraft, 56 Airbus A320ceo aircraft, 10 Airbus A321ceo aircraft, 20 Airbus A320neo aircraft, 11 Airbus A330-200/300 aircraft, 15 Airbus A330-900neo, 70 Boeing 737-800 aircraft, 20 Boeing 737 MAX aircraft, 3 Boeing 777-300ER aircraft, 12 Boeing 787-8/9 aircraft and 6 Embraer 190 aircraft. Our business and

14

financial results could be negatively affected if the market demand for any of these models of aircraft (or other types that we acquire in the future) declines or if such aircraft are redesigned or replaced by their manufacturers. Out of production aircraft may have a shorter useful life or lower residual values due to obsolescence. In addition, if any of these aircraft types (or other types that we acquire in the future) should encounter technical or other difficulties, such affected aircraft types may be subject to grounding or diminution in value and we may be unable to lease or sell such affected aircraft types on favorable terms or at all. The inability to lease or sell the affected aircraft types may reduce our revenues and net income to the extent the affected aircraft types comprise a significant percentage of our aircraft portfolio and could have a material adverse effect on our financial condition, cash flow and results of operations.

Airline reorganizations could impair our lessees’ ability to comply with their lease payment obligations to us.

In recent years, several airlines around the world have filed for protection under their local bankruptcy and insolvency laws and, in recent years, certain airlines have gone into liquidation. Any further bankruptcies, liquidations, consolidations or reorganizations may result in aircraft becoming available for lease or purchase at reduced lease values or acquisition prices and reduce the number of potential lessees and operators of particular models of aircraft, either of which would result in inflated supply levels and consequently decreased aircraft values for any such models and lease rates in general. Historically, some airlines involved in reorganizations have undertaken substantial fare discounting to maintain cash flows and encourage continued customer loyalty. Bankruptcies and reorganizations may lead to the grounding or abandonment of significant numbers of aircraft, rejection or other termination of leases and negotiated reductions in aircraft lease rentals, with the effect of depressing aircraft market values. In addition, requests for labor concessions may result in significant labor disputes involving strikes or slowdowns or may otherwise adversely affect labor relations, thereby worsening the financial condition of the airline industry and further reducing aircraft values and lease rates.

To the extent that a significant number of our leases are rejected by an airline customer in a reorganization and we are unable to re-lease such aircraft in a timely manner on commercially reasonable terms, our results of operations, cash flow and financial condition, would be materially adversely affected.

Failure to obtain certain required licenses and approvals could adversely affect our ability to re-lease or sell aircraft, which would have a material adverse effect on our financial condition, cash flow and results of operations.

Lessees are subject to extensive regulation under the laws of the jurisdictions in which they are registered and in which they operate. As a result, certain aspects of our leases require licenses, consents or approvals, including consents from governmental or regulatory authorities for certain payments under our leases and for the import, export, registration or deregistration of the aircraft. Subsequent changes in applicable law or administrative practice may increase such requirements and governmental consent, once given, could be withdrawn. Furthermore, consents needed in connection with the future re-lease or sale of an aircraft may not be forthcoming. Any of these events could adversely affect our ability to re-lease or sell aircraft, which would have a material adverse effect on our financial condition, cash flow and results of operations.

Some of our leases provide the lessees with early termination options.

As of December 31, 2014, 4.8% of leases of aircraft in our Owned Portfolio provide the lessees with early termination options. We also may enter into leases in the future that provide lessees with early termination options. If any lease is terminated early at a time when we cannot re-lease the aircraft at rates at least as favorable to us as the terminated lease or at all, our financial condition, cash flow and results of operations could be adversely affected.

15

Our aircraft and our operations may not be insured at all times as a result of lessees’ failure to maintain the required insurance during the course of a lease, lessees’ coverage limits becoming exhausted or lessees’ insurers excluding coverage for certain risks, which could have a material adverse effect on our financial condition, cash flow and results of operations.

While we do not directly control the operation of any aircraft we acquire, in certain jurisdictions aircraft lessors and/or owners are held strictly liable for losses resulting from the operation of aircraft, and in other jurisdictions aircraft lessors may be deemed liable on other theories of liability.