UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to ________

Commission File Number: 001-36724

The Joint Corp.

(Exact name of registrant as specified in its charter)

| Delaware | 90-0544160 |

| (State or Other Jurisdiction of | (I.R.S. Employer |

| Incorporation) | Identification No.) |

16767 N. Perimeter Drive, Suite 240, Scottsdale Arizona | 85260 |

| (Address of Principal Executive Offices) | (Zip Code) |

(480) 245-5960

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title Of Each Class | Name Of Each Exchange On Which Registered |

| Common Stock, $0.001 Par Value Per Share | The NASDAQ Capital Market LLC |

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment of this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company ☑ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

As of June 30, 2014, the last business day of the registrant’s most recently completed second fiscal quarter, there was no established public market for the registrant’s common stock. The registrant’s common stock began trading on The NASDAQ Capital Market on November 11, 2014.

There were 9,621,581 shares of the registrant’s common stock issued and outstanding as of March 11, 2015.

Documents Incorporated by Reference

Portions of the registrant's Proxy Statement relating to its 2015 Annual Meeting of Stockholders, to be filed with the Securities and Exchange Commission (“SEC”) pursuant to Regulation 14A within 120 days after the registrant’s fiscal year ended December 31, 2014, are incorporated by reference in Part III of this Form 10-K.

TABLE OF CONTENTS

| | | Page Numbers |

| PART I |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | |

| PART II |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| PART III |

| |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| | |

| | | |

| PART IV |

| | | |

| | |

| | | |

| |

PART I

Overview

As used in this Form 10-K,:

| | · | “we,” “us,” and “our” refer to The Joint Corp. |

| | · | a “clinic” refers to a chiropractic clinic operating under our “Joint” brand, which may be (i) owned by a franchisee, (ii) owned by a professional corporation or limited liability company and managed by a franchisee; (iii) owned directly by us; or (iv) owned by a professional corporation or limited liability company and managed by us. |

| | · | when we identify an “operator” of a clinic, a party that is “operating” a clinic, or a party by whom a clinic is “operated,” we are referring to the party that operates all aspects of the clinic in certain jurisdictions, and to the party that manages all aspects of the clinic other than the practice of chiropractic in certain other jurisdictions. |

We are a rapidly growing franchisor and operator of chiropractic clinics that uses a private pay, non-insurance, cash-based model. We seek to be the leading provider of chiropractic care in the markets we serve and to become the most recognized brand in our industry through the rapid and focused expansion of chiropractic clinics in key markets throughout North America and abroad. Our mission is to improve the quality of life through routine chiropractic care. We strive to accomplish this by making quality care readily available and affordable. We have created a growing network of modern, consumer-friendly chiropractic clinics operated by franchisees and by us that employ only licensed chiropractors. We have priced our services below most competitors’ pricing for similar services and below most insurance co-payment levels (i.e., below the patient co-payment required for an insurance-covered service).

Since acquiring the predecessor to our company in March, 2010, we have grown our enterprise from eight to 246 franchised clinics in operation as of December 31, 2014, with an additional 268 franchise licenses granted across our network. In the year ended December 31, 2014, our franchised clinics registered 2,168,124 patient visits and generated revenues of $46,231,887. We collect a royalty of 7.0% of revenues from directly franchised clinics and 4.0% of revenues from those clinics franchised through regional developers. We also collect a national marketing fee of 1.0% of gross revenues of all franchised clinics. We receive a franchise sales fee of $29,000 for franchises we sell directly and a franchise fee of $14,500 for franchises sold through our network of regional developers.

As of December 31, 2014, all 246 Joint clinics were operated by franchisees. Of these, 53 franchises were awarded directly by us, and 193 franchises were awarded pursuant to our regional developer program. Our future growth strategy will increasingly focus on operating clinics owned by us, while continuing to strategically grow through the sale of additional franchises. We began to implement our growth strategy on December 31, 2014, when we reacquired six franchises from a franchisee.

We completed our initial public offering of 3,000,000 shares of common stock at an initial price to the public of $6.50 per share on November 14, 2014, whereupon we received aggregate net proceeds of approximately $17,065,000 after deducting underwriting discounts, commissions and other offering expenses. Our underwriters exercised their option to purchase 450,000 additional shares of common stock to cover over-allotments on November 18, 2014, pursuant to which we received aggregate net proceeds of approximately $2,710,000 after deducting underwriting discounts, commissions and expenses. Also, in conjunction with the IPO, we issued warrants to the underwriters for the purchase of 90,000 shares of common stock, which can be exercised between November 10, 2015 and November 10, 2018 at an exercise price of $8.125 per share.

For the years ended December 31, 2014 and 2013, we had net income (loss) after taxes of (3,031,220) and $155,635, respectively.

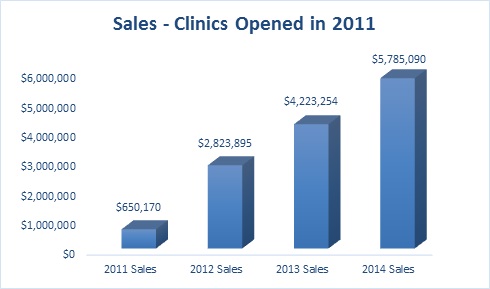

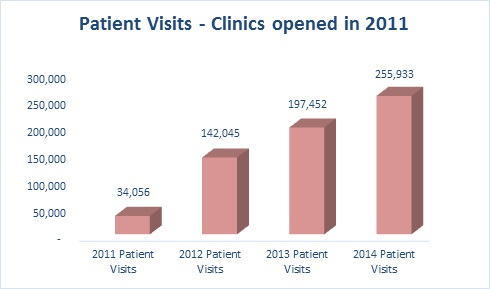

Over the past three years, our franchisees have achieved sustained increases in average monthly revenues and patient visits per clinic, which we believe demonstrates our ability to continue to increase revenues and to grow our brand equity. For the 14 clinics that opened in 2011, we increased sales throughout our system from $650,170 in 2011 to $2,823,895 in 2012, $4,223,254 in 2013 and $5,785,090 in 2014, and increased patient visits from 34,056 in 2011 to 142,045 in 2012, 197,452 in 2013 and 255,933 in 2014.

Note: Patient visits include repeat visits and do not indicate total number of patients.

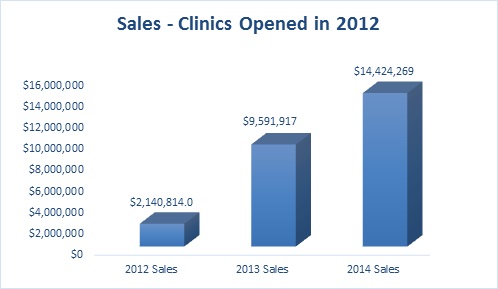

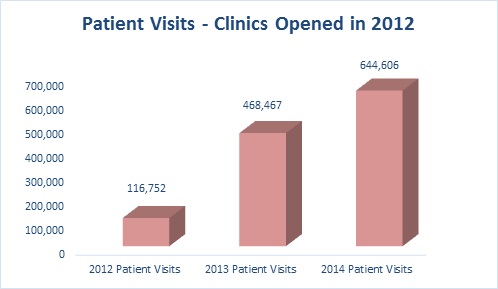

For the 53 clinics that opened in 2012, we increased sales from $2,140,814 in 2012 to $9,591,917 in 2013 and $14,424,269 in 2014, and increased patient visits from 116,752 in 2012 to 468,467 in 2013 and 644,606 in 2014.

Note: Patient visits include repeat visits and do not indicate total number of patients.

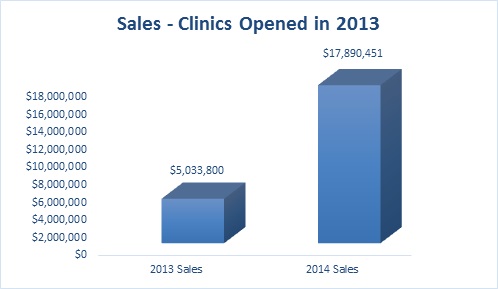

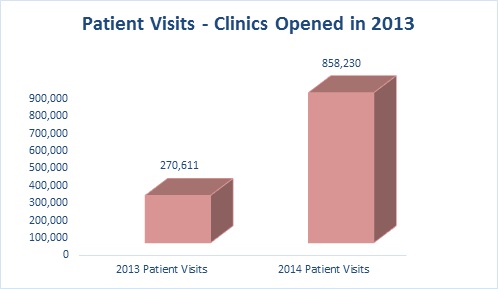

For the 98 clinics that opened in 2013 we increased sales from $5,033,800 in 2013 to $17,890,451 in 2014, and increased patient visits from 270,611 in 2013 to 858,230 in 2014.

Note: Patient visits include repeat visits and do not indicate total number of patients.

As part of our branding strategy, we deliver convenient, appointment-free chiropractic adjustments in an inviting, consumer-oriented environment at prices that are between 56% and 70% lower than the average cost, according to First Research, for comparable procedures offered by traditional chiropractors. In support of our mission to offer affordable and convenient care and value for our patients, our clinics offer a variety of customizable membership and wellness treatment plans which offer additional value pricing even as compared with our single-visit pricing schedules. These flexible plans are designed to attract patients and encourage repeat visits and routine usage.

As of December 31, 2014, we had 246 franchised clinics in operation in 26 states.

Our clinics are located principally in and around retail shopping centers and have been selected to be visible, accessible and convenient. We offer a welcoming, consumer-friendly experience that attempts to redefine the chiropractic doctor/patient relationship. Many of our clinics are open seven days per week, longer hours than most of our competitors, and our patients do not need appointments. We operate a private pay, “cash” business, and we do not accept insurance reimbursement or provide Medicare covered services. We believe that our commitment to affordable pricing, convenient access and ready service delivery model will not only appeal to and attract existing consumers of chiropractic services but will also appeal to the growing market of consumers who seek alternative or non-invasive wellness care.

Services

Our clinics offer a variety of membership and wellness packages. As an added advantage, patients who purchase memberships may receive adjustments at any Joint clinic throughout our system at no additional cost.

Our clinics measure, on average, approximately 1,000 –1,200 square feet and contain a reception area and treatment space generally equipped with three treatment tables. A typical clinic is staffed by one receptionist/wellness coordinator and one or two chiropractic doctors.

Our patients arrive at our clinics without appointments at times convenient to their schedules. Once a patient has joined our system and is returning for treatment, they simply swipe their membership card at a card reader at the reception desk to announce their arrival. Typically, within five to seven minutes (the average throughout our system), the patient is escorted to our open adjustment area, where they are required to remove only their outerwear to receive their adjustment. The adjustment process, administered by a licensed chiropractor, takes approximately 12 – 15 minutes on average for a new patient and 7 minutes on average for a returning patient. Each patient’s records are digitally updated for ready retrieval in our proprietary data storage system by our chiropractors in compliance with all applicable medical records security and privacy regulations.

Our consumer-focused service model targets the non-acute treatment market, which we believe to be the largest segment of the $11 billion chiropractic services market. As our model does not focus on the treatment of severe, acute injury, we do not provide expensive and invasive diagnostic tools such as MRIs and X-rays but instead refer those who present with acute symptoms to alternate healthcare providers, including traditional chiropractors.

Franchisees

As of December 31, 2014, all of our clinics were operated by franchisees. We employ qualification criteria in the selection of franchisees including background checks and validating financial resources, work history and experience. We require franchisees to have a minimum net worth of $250,000. In addition, we make a determination as to the compatibility of franchisee candidates with our approach to chiropractic patient care, based on personal interviews. Once qualified, we require proposed franchisees to attend a three-day training program, and we provide additional field support in advance of a franchised clinic’s opening. We further provide ongoing training though our web portal, quarterly franchisee reviews and scheduled field visits by our operations support personnel. We work hard to ensure that each of our franchise locations meets the same quality and patient service standards in order to preserve the consistency and reliability of our brand and earn the trust of our patients.

We are committed to providing the tools that our franchisees need to succeed before, during and after a clinic opening, including guidance with site selection and development, training, operations and marketing support. As of December 31, 2014, a majority of our franchisees owned one clinic, while approximately 49% of franchisees owned multiple clinics across 26 states. We believe this diversified franchisee base demonstrates not only the appeal and the viability of our concept across numerous types of owners and operators, but also limits concentration risk by providing a distributed base of owners with capacity to grow with our brand. We identify potential franchisees through a variety of methods, including our website, digital search, advertising in chiropractic journals, the use of franchise brokers, referrals from existing franchisees as well as interest from our growing patient base.

While a number of our franchisees are chiropractors, the majority of our franchisees are independent business people. In states that regulate the corporate practice of chiropractic services, our non-chiropractor owned franchisees enter into a management agreement with a professional service organization that is typically a chiropractor-owned professional corporation. Under such management agreements, all aspects of professional chiropractic practice are under the exclusive control of the licensed chiropractor, while all non-chiropractic aspects of the operation of the clinic are managed by the franchisee as manager. Where such arrangements are in place, the chiropractors are employed by the chiropractor-owned and administered, professional corporation and not by the franchisee.

Franchise Disclosure. The United States Federal Trade Commission and many states require a franchisor to provide a franchise disclosure document or “FDD” to all prospective franchisees. In addition, many states require a franchisor to register with a state franchise administrator before offering or selling a franchise in that state. We believe we have complied with all federal regulations regarding disclosure and with all state franchise registration requirements in the states in which we have sold, offered or are offering to sell franchises. Our FDD contains detailed information about our company’s organization and history and explains to prospective franchisees what their rights and responsibilities would be if they became our franchisee. The FDD also includes our financial statements, a copy of our standard franchise agreement and various other documents and agreements that are relevant to a prospective franchisee’s decision to purchase a franchise.

Regional Developers. We have entered into 26 regional developer licenses with 16 regional developers in which we granted to regional developers the right to solicit potential franchisees in a defined territory. The fee for a regional developer license varies from territory to territory and generally depends on the number of franchises anticipated to be awarded within that territory. We reserve the right to approve franchisees and clinic sites identified by our regional developers. We receive 50.0% of our standard franchise fee for franchises awarded under regional developer licenses, and we remit a 3.0% royalty to our regional developers on the gross revenues of franchises opened under regional developer licenses.

Regional developers are typically seasoned entrepreneurs with significant investment capital. Due in part to their prior business experience, regional developers typically have developed networks of potential franchise buyers.

Our regional developer licenses grant an exclusive territory to our regional developers, require them to sell a minimum number of franchises within their defined territory and to cause the sold franchises to be opened within a specified time period. Regional developers are obligated also to provide training and support to franchisees. Regional developer licenses typically have a ten year term and are renewable upon payment of a renewal fee. We may terminate regional developer licenses if the regional developer fails to meet its material obligations under the license.

In some, but not all, of our regional developer licenses, we have negotiated repurchase rights wherein we have the option, commencing three years from the effective date of the license, to repurchase the regional developer license pursuant to a negotiated formula.

Franchise Agreements. For each franchised clinic, we enter into a franchise agreement stipulating a standard set of terms and conditions. The initial term of a franchise agreement generally is 10 years, with one 10-year renewal option. The standard initial franchise fee for our clinics is $29,000. This initial fee is paid in full at the time the franchise agreement is signed. A franchise fee allows an owner to open a single clinic at a specific location. Our franchise agreements do not, however, typically create an exclusive territory for our franchisees outside of their specific location. Franchisees that renew their franchises after the initial term must pay us a renewal fee equal to 25.0% of our then-current initial franchise fee.

Under our standard franchise agreements, franchisees are also required to pay an ongoing royalty fee of 7.0% of gross revenues in order to use our registered trademarks and to benefit from corporate franchise support. Our franchisees currently contribute 1.0% of gross revenues to a regional and national advertising fund. We may, under certain circumstances, raise this fee to 2.0% of gross revenues.

Our franchise agreements set forth certain material duties and responsibilities of franchisees, including, but not limited to, the timetable for pre-opening actions such as permitting, the timetable for opening, initial and follow up training responsibilities, advertising standards and spends, restrictions on the use of our trademarks and services marks both during and after the term of the franchise, confidentiality and non-competition provisions, restrictions on transfer of the franchise, and dispute resolution provisions. Our franchise agreements also set forth our material duties and responsibilities, including but not limited to, our right to approve the site selected for each franchise, our right to set and make changes to the operating standards applicable to franchisees, such as plans and specifications for the franchised clinic, choice of equipment, signs, furnishings, software and computer systems, advertising materials, types of products and services offered, operating procedures (with the exception of the practice of chiropractic medicine) conditions and appearance of the franchised clinic, approved vendors and suppliers and insurance requirements. We also retain the right to approve all advertising by a franchisee. Our right to define and/or enforce certain of these standards may be limited by state laws which restrict our ability to control the activities of a licensed chiropractor.

If a franchisee fails to comply with the material provisions of our franchise agreement or our operating policies, or if a franchisee violates other specific provisions of our franchise agreement, including, but not limited to, operating in an unsafe manner, failure to comply with applicable laws, failure to submit financial reports, attempting to transfer the franchise, conviction of a crime, or materially degrading our brand or goodwill, we have the right, after specified notice and in certain cases, specified cure periods, to terminate the franchise and require the franchisee to cease using our brand and our operating systems. Upon termination of a franchise, we are entitled to receive, in addition to any damages to which we are entitled, a termination fee equal to one-half of our then-current franchise fee. We also have the right, but not the obligation, to purchase the assets of the franchise at fair market value. Upon termination of a franchise, the former franchisee will be bound by the confidentiality and non-competition provisions of the franchise agreement. We also have the right to terminate our franchise agreements for a number of additional reasons, including insolvency or bankruptcy, failure to operate franchised clinics according to our standards, understatement of sales, failure to properly insure, failure to pay fees, or material misrepresentations on an application for a franchise.

From time to time, we may enter into amendments to our standard franchise agreements as part of various limited incentive programs targeted to improve clinic growth, accelerate development in certain markets or assist underperforming clinics. These amendments may include lower royalty fees for a limited period.

If a franchisee is not a licensed chiropractor, we provide the franchisee with a standard form of management agreement that, depending on the laws of the state in which the franchisee is located, the franchisee may be required to enter into with a licensed chiropractic professional corporation or professional limited liability company. In such circumstances, the franchisee will provide management and administrative services in support of the professional corporation or limited liability company that will operate the clinic. Under this arrangement, the franchisee is prohibited from providing, supervising, directing or controlling the manner in which the licensed chiropractors who are employed by the professional corporation or limited liability company provide chiropractic services to their patients.

Franchisee Support. From the time the initial franchise agreement is executed, we offer assistance and training in order to ensure that our franchisees begin their Joint franchise ownership in a manner that we believe will foster success.

Site Selection. While franchisees are ultimately responsible for finding their own sites, we offer various levels of guidance and support during this process and specifically reserve the right to approve all sites. Standard specifications involve such factors as: (i) general location/neighborhood; (ii) traffic patterns; (iii) parking; (iv) size; (v) proximity to competing businesses (vi) co-tenants, (vii) traffic counts and patterns; and (vii) other qualitative demographic criteria. Once a franchisee completes a site submission package, which typically occurs at least 150 days prior to the execution of a lease, our real estate personnel will assess the prospective site and, if deemed appropriate, provide written approval to start negotiations for a lease of the site. Throughout this negotiation process, members of our real estate team support the franchisee.

Design and Construction. Once a site is approved, our construction management personnel provide the franchisee with general construction and timeline guidance and a prototypical set of design plans to ensure that the franchised location fits our standards and specifications. Once a lease is signed, we may also help our franchisees in: (i) identifying and selecting qualified contractors; (ii) submitting plans for necessary permits; (iii) reviewing bids; and (iv) if engaged, helping to negotiate prices for design and construction. During the actual construction phase, our construction management personnel also will help the franchisee in ensuring that final punch list instructions are completed.

Training. We have a mandatory training program for new franchisees and their managers, crafted to provide the technical and managerial skills necessary to prepare them for their duties. Our training program consists of 12 hours of classroom training and 14 hours of on-the-job training, covering areas including (i) our operating manual; (ii) computer software; (iii) accounting; (iv) vendor relations; (v) construction specifications; (vi) staffing; (vii) new patients; (viii) an overview of adjusting techniques for non-chiropractors; (ix) communications; (x) patient education; and (xi) marketing and advertising. We equip and support our franchisees with the necessary tools to represent the brand and empower each franchisee to run a successful business. In addition to the initial franchisee training, we offer on-going support materials on-line through our website and help desk, and conduct periodic educational webinars.

System Standards and Operations Support. We have established stringent standards for franchise operations to protect and benefit the Joint brand and our franchisees. These standards are clearly and thoroughly detailed for franchisees through our operations manual, which is given to franchisees in training and amended periodically. Topics covered in our operations manual include, among other things: (i) pre-opening procedures; (ii) construction; (iii) operating guidelines; (iv) detailed daily operating procedures; (v) software; and (vi) marketing guidance. We periodically provide refresher training programs, seminars and regional meetings which we require our franchisees and/or their manager to attend and complete.

Our Industry

Chiropractic care is widely accepted among individuals with a variety of medical conditions, particularly back pain. Between approximately 6.0% and 9.0% of the United States population regularly uses chiropractic. According to the American Chiropractic Association, 80.0% of Americans experience back pain at least once in their lifetime. According to Global Industry Analysts, chiropractic represents one of the most popular and cost effective alternative treatments for musculoskeletal disorders and is being used by more than 50.0% of American patients suffering from persistent back pain. The National Center for Complementary & Alternative Medicine of the National Institutes of Health has stated that spinal manipulation appears to benefit some people with low-back pain and also may be helpful for headaches, neck pain, upper- and lower-extremity joint conditions and whiplash-associated disorders. The Mayo Clinic has recognized chiropractic as safe when performed by trained and licensed chiropractors, and the Cleveland Clinic has stated that chiropractors are established members of the mainstream medical team.

The chiropractic industry in the United States is large, growing and highly fragmented. According to a report issued by First Research in March 2014, expenditures for chiropractic services in the U.S. were $11.0 billion in 2013 and are expected to grow at approximately 3.0% annually between 2014 and 2018. In addition, according to Chiropractic Economics, in 2013, approximately 35.0% of total chiropractic expenditures were from out-of-pocket, or cash, payments by patients. The United States Bureau of Labor Statistics expects employment in chiropractic to grow faster than the average for all occupations. Some of the factors the Bureau of Labor Statistics identified as driving this growth are healthcare cost pressures and an aging population requiring more health care and technological advances, all of which are expected to increasingly shift services from inpatient facilities and hospitals to outpatient settings. We believe that the demand for chiropractic services will continue to grow as a result of several additional drivers, such as the increased awareness of the benefits of regular maintenance therapy coupled with an increasing awareness of the availability of our pricing at significant discount relative to the cost of traditional chiropractic adjustments and, in most cases, below the level of insurance co-payment amounts.

Today, most chiropractic services are provided by sole practitioners, generally in medical-office settings. The chiropractic industry differs from the broader healthcare services industry in that it is more heavily consumer-driven, market-responsive and price sensitive, in large measure, a result of many treatment options falling outside the bounds of traditional insurance reimbursable services and fee schedules. According to First Research, expenditures for chiropractic services in the United States in 2013, represented less than 1.0% of all healthcare expenditures,and the top 50 companies delivering chiropractic services in the United States generated less than 10.0% of all industry revenue. In addition, according to Chiropractic Economics, in 2013, 40.0% of all chiropractic expenditures were paid by insurance, with 17.1% of chiropractic costs financed by government programs, including Medicare and Medicaid. We believe these characteristics are evidence of an underserved market with potential consumer demand that is favorable for an efficient, low-cost, consumer-oriented provider.

Most chiropractic practices are set up to accept and to process insurance-based reimbursement. While chiropractors typically accept cash payment in addition to insurance, Medicare and Medicaid, they continue to incur overhead expenses associated with maintaining the capability to process third-party reimbursement. We believe that most chiropractors who operate utilizing this third-party reimbursement model would find it economically difficult to discount the prices they charge for their services to levels comparable with our pricing.

Accordingly, we believe these and certain other trends favor our business model. Among these are:

| | • | individuals are increasingly practicing active lifestyles, people are living longer, and require more medical, maintenance and preventative support; |

| | • | individuals are displaying an increasing openness to alternative, non-pharmacological types of care; |

| | • | utilization of more conveniently situated, local sited urgent-care or “mini-care” alternatives to primary care is increasing; and |

| | • | popularity of health clubs, massage and other non-drug, non-invasive wellness maintenance providers is growing. |

Our Competitive Strengths

We believe the following competitive strengths have contributed to our initial success and will position us for future growth:

Price and convenience. We believe that our strongest competitive advantages are our price and convenience. We offer a much less expensive alternative to traditional providers of chiropractic services by focusing on non-acute care and by not participating in insurance or Medicare reimbursement. We can do this because our clinics are not burdened with the operating expenses required to perform certain diagnostic procedures and the administrative requirements and expense to process reimbursement claims. Our model allows us to pass these savings on to our patients. According to Chiropractic Economics, the average price for a chiropractic adjustment involving spinal manipulation in the United States is between $50 and $75. By comparison, our average price is $22, or between 56% and 70% lower than the average price.

Our service offerings, pricing and growing number of conveniently sited locations encourage consumer trial, repeat visits and sustainable patient relationships. According to a 2013 survey conducted by Chiropractic Economics, the average for repeat patient visits generally in the chiropractic industry is two times per month. We believe our pricing and service offering structure helps us to generate a higher usage. The following table sets forth our average price per adjustment as of December 31, 2014, for patients who pay by single adjustment plans, multiple adjustment packages, and multiple adjustment membership plans. Our price per adjustment averages approximately $22 across all three groups.

| | | The Joint Service Offering |

| | | Single Visit | | Package(s) | | Membership(s) |

| Price per adjustment | | $ | 29 | | | $ | 16 – $20 | | | $ | 13 – $16 | |

We attracted an average of between 540 and 948 new patients per year to our clinics between 2010 and 2014, as compared to the 2013 chiropractic industry average of 364 new patients per year.

We offer our patients the opportunity to visit our clinics without an appointment and receive prompt attention. Additionally, we offer extended hours of operation, including weekends, which is not typical among our competitors.

Retail, consumer-driven approach. To support our consumer focused model, we utilize strong, recognizable brand and retail approaches to stimulate awareness and drive patients to our clinics. We intend to continue to drive awareness of our brand by locating clinics principally at retail centers and convenience points, prominent signage and by deploying consistent, proven and targeted marketing initiatives. We provide our patients with the flexibility to see a chiropractor when they want to because we do not schedule appointments. Most of our clinics offer patient care six or seven days per week at locations people can get to easily and regularly.

By limiting administrative burdens associated with insurance processing, our model helps chiropractors focus on patient service. We believe the time our chiropractors save by not having to attend to administrative duties related to insurance reimbursement allows more time to:

| | • | establish and reinforce chiropractor/patient relationships, and |

| | • | educate patients on the benefits of chiropractic maintenance therapy. |

Our approach has made us an attractive alternative for chiropractic doctors who desire to spend more time treating patients than they typically do in traditional practices, which are burdened with greater overhead, personnel, and administrative expense. We believe that our model will aid us in recruiting chiropractors who desire to focus their practice principally on patient care.

Proven track record of opening franchised clinics and growing revenue at the clinic level. We have grown our franchised clinic revenue base every month since we acquired our predecessor in March 2010. Since January 2012 we have increased monthly sales from $369,296 to $4,793,234 in December 2014. During this period we increased the number of clinics in operation from 33 to 246.

Monthly Sales June 2012 – December 2014

Same store sales growth is a measure commonly used in the retail industry. It is important because it excludes sales growth from new locations, thus illustrating a retailer’s growth from existing units. Our same store sales growth measures the annual sales increase for each clinic that has been open for at least one year. Same store sales growth for our clinics that opened in 2011 (which we refer to as age class 2011) was 99.1% in 2012, 49.6% in 2013, and 36.9% through December 31, 2014.

Strong and proven management team. Our strategic vision and results-oriented culture are directed by our senior management team led by Chief Executive Officer John B. Richards, who previously served as president of Starbucks North America when it expanded from 500 to 3,000 units. Mr. Richards was also Chief Executive Officer of Elizabeth Arden Red Door Salons. Our senior management team is also guided by David Orwasher, who has served as our Chief Operating Officer since January 2014 and who previously served as a vice president of Starbucks, working directly with Mr. Richards during the same significant growth period. John Leonesio, the founder of Massage Envy Spa, who grew that company from inception through the opening of over 300 franchises, serves as non-executive Chairman of our Board of Directors. Mr. Leonesio was our Chief Executive Officer from the commencement of our operations through the opening of 160 clinics across 22 states. Our senior management directs an additional team of dedicated leaders who are focused on executing our business plan and implementing our growth strategy. Messrs. Richards, Orwasher, and Leonesio have had collective responsibility for building, opening or franchising a total of over 7,000 retail units. We believe that our management team’s experience and demonstrated success in building, developing and rapidly scaling operating systems, both company and franchised, will be a key driver of our growth and will position us well for achieving our long-term strategy.

Our Growth Strategy

Our goal is not only to capture a significant share of the existing market but also to expand the market for chiropractic care. We intend to accomplish this through the rapid and focused geographic expansion of our affordable service offering by the introduction of company-owned clinics and the selected continuation of our franchising program. We propose to employ a variety of growth tactics including:

| | • | the development of company-owned clinics in clustered geographies; |

| | • | the opportunistic acquisition of existing franchises; |

| | • | the continued growth of system and clinic revenue and royalty income; |

| | • | the sale of additional franchises; |

| | • | conversion of existing chiropractic practices to our model; |

| | • | acquiring regional developer licenses; and |

| | • | improving operational margins and leveraging infrastructure. |

Our analysis of data from over 300,000 patients from 173 clinics across 22 states suggests that the United States market alone can support at least 1,600 Joint clinics.

Development of company-owned clinics.

We will focus on the development of company-owned clinics as the principal strategy in our growth plan, and we intend to use a significant portion of the proceeds from our initial public offering to pursue this strategy. We will open or purchase company-owned clinics that meet our criteria for demographics, site attractiveness, proximity to other clinics and additional suitability factors.

We believe we can leverage the experience we have gained in supporting our demonstrated clinic growth and our senior management’s experience in rapidly and effectively growing other well-known high velocity specialty retail concepts to successfully develop and profitably operate company-owned clinics. Since commencing operations as a franchisor of chiropractic clinics, we have gained significant experience in identifying and implementing the business systems and practices that are required to profitably operate our clinics, validate our model and demonstrate proof of concept. We have developed simple, repeatable operating standards which, when applied in a disciplined approach, result in an attractive opportunity for success at the clinic level.

We believe that the direct control over company-owned and/or operated clinics will enable us to apply these operating standards even more effectively than in our franchised clinics. We intend to develop company-owned clinics in geographic clusters where we are able to increase efficiencies through a consolidated real estate penetration strategy, leverage cooperative advertisement and marketing and attain general corporate and administrative operating efficiencies. Our senior management has done this before, and we believe that their experience in this area readily translates to our business model.

We also believe that the development timeline for company-owned clinics can be shorter than the timeline for franchised clinics, which is generally between 9 and 12 months. While there may be material variances among franchisees in customer acquisition and compliance with operating standards, these variances can be reduced at company-owned clinics. In addition, we believe that our revenue from company-owned and operated clinics will exceed revenue that would be generated through royalty income from a franchise-only system.

While we cannot predict the availability for lease of desirable locations for company-owned clinics, nor the availability of suitable chiropractors to staff our clinics, we believe that the application of a centralized process, driven by development, management, human resources and recruiting professionals, will enable us to develop and operate company-owned clinics with greater consistency than if we relied solely on growth through franchising.

Acquiring existing franchises.

We believe that we can accelerate the development of, and revenue generation from, company-owned clinics through the selective acquisition of existing franchised clinics. Our management has developed a template for the acquisition of existing franchised clinics, their conversion to company-owned clinics and their integration into a company-owned clinic system. Before completing our initial public offering, we began to develop a pipeline of franchisees whose franchises may be available for purchase. Following the completion of the IPO, we have entered into several agreements to acquire existing franchises. We may devote a significant portion of the proceeds from our initial public offering to the purchase of such franchised clinics. The acquisition of existing franchises could accelerate the time required to open and stabilize company-owned clinics. From time to time we are approached by franchisees who wish to sell their clinics.

On December 31, 2014, we acquired substantially all the assets and certain liabilities of six franchises including four operating clinics in Los Angeles County for a purchase price of $900,000 which was paid in cash. We intend to operate four of the acquired franchises as company-owned clinics and to relocate two remaining franchises. See Note 11 in the Notes to our Consolidated Financial Statements for discussion of acquisitions subsequent to December 31, 2014.

Increasing revenues from existing franchises.

We have a history of increasing revenues from existing franchises. Our revenues from existing franchises have increased by an average of 27.30% for each of the past 14 calendar quarters through December 31, 2014. We believe that the experience we have gained in developing and refining management systems, operating standards, training materials and marketing and customer acquisition activities has contributed to our system’s revenue growth. Additionally, we believe that increasing awareness of our brand has contributed to revenue growth, particularly in markets where the number and density of our clinics has made cooperative and mass media advertising attractive. We believe that our ability to leverage aggregated and general media digital advertising and search will continue to grow as the number and density of our clinics increases.

Opening clinics in development.

In addition to our 246 opened franchised clinics, we have granted franchises either directly or through our regional developers for an additional 268 clinics that are in various stages of development. We will continue to support our franchisees and regional developers to open these clinics and to achieve sustainable performance as soon as possible.

Selling additional franchises.

We intend to continue to sell franchises. We believe that, to secure leadership in our industry and to maximize our opportunities and presence in identified markets, it is important to gain brand equity and consumer awareness as rapidly as possible, consistent with a disciplined approach to opening clinics. We believe that continued sales of franchises in selected markets complements our plan to open company-owned clinics, particularly in specialized or unique operating environments, and that a growth strategy that includes both franchised and company-owned clinics has advantages over either approach by itself. These advantages include:

| | • | increasing our availability to patients; |

| | • | accelerating our speed to market and our competitive advantages; |

| | • | enhancing our value to present franchisees who may realize benefits from clinic density and cooperative advertising; |

| | • | enhancing our desirability to potential new franchisees; |

| | • | presenting an exit strategy to franchisees, who may view us as a potential acquirer of their franchised clinics at such time as they may choose to sell; and |

| | • | increasing brand awareness. |

Reacquiring regional developer licenses.

We intend to selectively pursue the reacquisition of regional developer licenses. We negotiated repurchase rights in 15 of our 26 regional developer licenses. We have the option, beginning after the third year of regional developer licenses that include this option, to repurchase the license by generally paying $29,000 for each open franchise and $7,250 for each franchise that has not been opened. Before completing our initial public offering, we began to develop a pipeline of existing regional developer licensees whose licenses may be available for purchase. Following the completion of our IPO, we have entered into several agreements to repurchase regional developer licenses. We believe that by repurchasing regional developer licenses we can increase our profitability through capturing the regional developers’ royalty streams from franchises within their regions. In addition, to the extent that we acquire a given regional developer license, we will have fewer limitations on and less cost associated with, opening or acquiring clinics within that region.

On January 1, 2015, we completed the reacquisition and termination of the regional developer license for the Los Angeles County, California region in exchange for cash consideration of $507,500.

Continue to improve margins and leverage infrastructure.

We believe our corporate infrastructure is positioned to support a clinic base greater than our existing footprint. As we continue to grow, we expect to drive greater efficiencies across our operations and development and marketing organizations and further leverage our technology and existing support infrastructure. We believe we will be able control corporate costs over time to enhance margins as general and administrative expenses grow at a slower rate than our clinic base and revenues. We believe we can eventually introduce better and more visible professional marketing and patient acquisition practices that will promote brand recognition and drive revenue increases at a faster pace than marketing costs will increase. At the clinic level, we expect to drive margins and labor efficiencies through continued revenue growth as our clinic base matures and the average number of patient visits increases. In addition, we will consider introducing selected and complementary branded products such as nutraceuticals or dietary supplements and related additional services.

Regulatory Environment

HIPAA

In an effort to further combat healthcare fraud and protect patient confidentially, Congress included several anti-fraud measures in the Health Insurance Portability and Accountability Act of 1996 (HIPAA). HIPAA created a source of funding for fraud control to coordinate federal, state and local healthcare law enforcement programs, conduct investigations, provide guidance to the healthcare industry concerning fraudulent healthcare practices, and establish a national data bank to receive and report final adverse actions. HIPAA also criminalized certain forms of health fraud against all public and private payors. Additionally, HIPAA mandates the adoption of standards regarding the exchange of healthcare information in an effort to ensure the privacy and security of electronic patient information. Sanctions for failing to comply with HIPAA include criminal penalties and civil sanctions. In February 2009, the American Recovery and Reinvestment Act of 2009 (ARRA) was enacted. Title XIII of ARRA, the Health Information Technology for Economic and Clinical Health Act (HITECH), includes substantial Medicare and Medicaid incentives for providers to adopt electronic health records (“EHR”) and grants for the development of health information exchange (“HIE”) systems. Recognizing that HIE and EHR systems will not be implemented unless the public can be assured that the privacy and security of patient information in such systems is protected, HITECH also significantly expands the scope of the privacy and security requirements under HIPAA. Most notable are the new mandatory breach notification requirements and a heightened enforcement scheme that includes increased penalties, and which now apply to business associates as well as to covered entities. In addition to HIPAA, a number of states have adopted laws and/or regulations applicable in the use and disclosure of individually identifiable health information that can be more stringent than comparable provisions under HIPAA and HITECH.

We believe that our operations substantially comply with applicable standards for privacy and security of protected healthcare information. We cannot predict what negative effect, if any, HIPAA/HITECH or any applicable state law or regulation will have on our business.

State regulations on corporate practice of medicine.

With the exception of franchisees that are owned by chiropractors or franchisees that are owned by non-chiropractors in states that do not regulate the corporate practice of chiropractic, our chiropractic services are provided by legal entities organized under state laws as professional corporations, or PCs. Each PC employs or contracts with chiropractors in one or more offices. Each of the PCs is wholly owned by one or more licensed chiropractors, and we do not own any capital stock of any PC. We and our franchisees that are not owned by chiropractors enter into management services agreements with PCs to provide the PCs on an exclusive basis with all non-clinical services of the chiropractic practice. We believe we are in compliance with all applicable laws relating to the corporate practice of medicine or chiropractic.

Regulation relating to franchising

We are subject to the rules and regulations of the Federal Trade Commission and various state laws regulating the offer and sale of franchises. The Federal Trade Commission and various state laws require that we furnish an FDD containing certain information to prospective franchisees, and a number of states require registration of the FDD at least annually with state authorities. Included in the information required to be disclosed in our FDD is our business experience, material litigation, all fees due to us from franchisees, a franchisee’s estimated initial investment, restrictions on sources of products and services we impose on franchisees, development and operating obligations of franchisees, whether we provide financing to franchisees, our training and support obligations and other terms and conditions of our franchise agreement. We are operating under exemptions from registration in several states based on our qualifications for exemption as set forth in those states’ laws. Substantive state laws regulating the franchisor-franchisee relationship presently exist in many states. We believe that our FDD and franchising procedures comply in all material respects with both the Federal Trade Commission guidelines and all applicable state laws regulating franchising in those states in which we have offered franchises. We have not elected to sell franchises in certain states where the time and cost associated with registering our FDD in that state is not, in our judgment, justified by current demand for franchises in that state. As of December 31, 2014, we were registered to sell franchises in 26 states.

Other federal, state and local regulation

We are subject to varied federal regulations affecting the operation of our business. We are subject to the U.S. Fair Labor Standards Act, the U.S. Immigration Reform and Control Act of 1986, the Occupational Safety and Health Act and various other federal and state laws governing such matters as minimum wage requirements, overtime, fringe benefits, workplace safety and other working conditions and citizenship requirements. A significant number of our clinic service personnel are paid at rates related to the applicable minimum wage, and increases in the minimum wage could increase our labor costs. We are continuing to assess the impact of recently-adopted federal health care legislation on our health care benefit costs. Many of our smaller franchisees will qualify for exemption from the mandatory requirement to provide health insurance benefits because of their small number of employees. The imposition of any requirement that we or our franchisees provide health insurance benefits to our or their employees that are more extensive than the health insurance benefits that we currently provide to our employees or that franchisees may or may not provide, or the imposition of additional employer paid employment taxes on income earned by our employees, could have an adverse effect on our results of operations and financial position. Our distributors and suppliers also may be affected by higher minimum wage and benefit standards, which could result in higher costs for goods and services supplied to us.

We are also required to comply with the accessibility standards mandated by the U.S. Americans with Disabilities Act of 1990 and related federal and state statutes, which generally prohibits discrimination in accommodation or employment based on disability. We may in the future have to modify our clinics to provide service to or make reasonable accommodations for disabled persons. While these expenses could be material, our current expectation is that any such actions will not require us to expend substantial funds.

We are subject to extensive and varied state and local government regulation affecting the operation of our business, as are our franchisees, including regulations relating to public and occupational health and safety, sanitation, fire prevention and franchise operation. Each franchised clinic is subject to licensing and regulation by a number of governmental authorities, which include zoning, health, safety, sanitation, environmental, building and fire agencies in the jurisdiction in which the clinic is located. We require our franchisees to operate in accordance with standards and procedures designed to comply with applicable codes and regulations. However, ours or our franchisees’ inability to obtain or retain health or other licenses would adversely affect operations at the impacted clinic or clinics. Although we have not experienced, and do not anticipate, any significant difficulties, delays or failures in obtaining required licenses, permits or approvals, any such problem could delay or prevent the opening of, or adversely impact the viability of, a particular clinic. In addition, in order to develop and construct our clinics, we need to comply with applicable zoning and land use regulations. Federal and state regulations have not had a material effect on our operations to date, but more stringent and varied requirements of local governmental bodies with respect to zoning and land use could delay or even prevent construction and increase development costs of new clinics.

Competition

The chiropractic industry is highly fragmented. According to First Research’s March 2014 report, the top 50 providers of chiropractic services in the United States generate less than ten percent of industry revenue. Our competitors include the approximately 36,000 independent chiropractic offices currently open throughout the United States as well as certain multi-unit operators. We may also face competition from traditional medical practices, outpatient clinics, physical therapists, massage therapists and sellers of devices intended for home use to address back and joint discomfort. Our two largest multi-unit competitors are HealthSource Chiropractic, and ChiroOne, both insurance-based franchised models.

We have identified two competitors who are attempting to duplicate our cash-only, low cost, appointment-free model. Based on publicly available information, these competitors operate five clinics and one clinic respectively as franchises. We anticipate that other direct competitors will join our industry as our visibility, reputation and perceived advantages become more widely known.

We believe the principal areas of competition in our industry include price, convenience, quality and consistency of services provided, comfort and accessibility of clinics and reputation.

Employees

As of March 11, 2015, we had 40 employees on a full-time basis. None of our employees are members of unions or participate in other collective bargaining arrangements.

Facilities

We lease the property for our corporate headquarters and all of the properties on which we own and operate clinics.

Our corporate headquarters are located at 16767 North Perimeter Drive, Suite 240, Scottsdale, Arizona 85260. The term of our lease for this location expires on July 31, 2019. The primary functions performed at our corporate headquarters are financial, accounting, treasury, marketing, operations, human resources, information systems support and legal.

We are also obligated under non-cancellable leases for the clinics which we own and operate. Our clinics are on average 1200 square feet. Our clinic leases generally have an initial term of 5 years and include 1 to 2 options to renew for terms of 5 years. Our clinic leases generally require us to pay a proportionate share of real estate taxes, insurance, common area maintenance charges and other operating costs.

As of December 31, 2014, our franchisees operated 246 clinics across 26 states. All of our franchise locations are leased.

Intellectual Property

Trademarks, trade names and service marks

“The Joint… the Chiropractic Place” is our trademark, registered in February 2011, under registration number 3922558. We also registered the words, letters, and stylized form of service mark, “The Joint… the Chiropractic Place” in April 2013 under registration number 4323810.

Risks Related to Our Business

Our long-term success is highly dependent on our ability to open new, primarily company-owned clinics, and is subject to many unpredictable factors.

One of the key means of achieving our growth strategy will be through opening new, primarily company-owned clinics and operating those clinics on a profitable basis. We expect this to be the case for the foreseeable future. We have opened 246 franchised clinics since April 2010, but we have opened only one company-owned clinic, which we then sold to a franchisee. We currently manage 11 company-owned clinics, all of which were recently acquired from existing franchisees. We may not be able to open new company-owned clinics as quickly as planned. In the past, we have experienced delays in opening some franchised clinics, for various reasons, including the landlord’s failure to turn over the premises to our franchisee on a timely basis. Such delays could happen again in future clinic openings. Delays or failures in opening new, primarily company-owned clinics could materially and adversely affect our growth strategy and our business, financial condition and results of operations. As we operate more clinics, our rate of expansion relative to the size of our clinic base will eventually decline.

In addition, one of our biggest challenges is locating and securing an adequate supply of suitable new clinic sites in our target markets. Competition for those sites is intense, and other medical and retail concepts that compete for those sites may have unit economic models that permit them to bid more aggressively for those sites than we can. There is no guarantee that a sufficient number of suitable sites will be available in desirable areas or on terms that are acceptable to us in order to achieve our growth plan. Our ability to open new clinics also depends on other factors, including:

| | • | negotiating leases with acceptable terms; |

| | • | identifying, hiring and training qualified employees in each local market; |

| | • | timely delivery of leased premises to us from our landlords and punctual commencement of our build-out construction activities; |

| | • | managing construction and development costs of new clinics, particularly in competitive markets; |

| | • | obtaining construction materials and labor at acceptable costs, particularly in urban markets; |

| | • | unforeseen engineering or environmental problems with leased premises; |

| | • | generating sufficient funds from operations or obtaining acceptable financing to support our future development; |

| | • | securing required governmental approvals, permits and licenses (including construction permits and operating licenses) in a timely manner and responding effectively to any changes in local, state or federal laws and regulations that adversely affect our costs or ability to open new clinics; and |

| | • | avoiding the impact of inclement weather, natural disasters and other calamities. |

Our progress in opening new, primarily company-owned clinics from quarter to quarter may occur at an uneven rate. If we do not open new clinics in the future according to our current plans, the delay could materially adversely affect our business, financial condition and results of operations.

We intend to develop new, primarily company-owned clinics in our existing markets, expand our footprint into adjacent markets and selectively enter into new markets. However, there are numerous factors involved in identifying and securing an appropriate site, including, but not limited to: identification and availability of suitable locations with the appropriate population demographics, psychographics, traffic patterns, local retail and business attractions and infrastructure that will drive high levels of customer traffic and sales per clinic; consumer acceptance of our chiropractic practice concept; financial conditions affecting developers and potential landlords, such as the effects of macro-economic conditions and the credit market, which could lead to these parties delaying or canceling development projects (or renovations of existing projects), in turn reducing the number of appropriate locations available; developers and potential landlords obtaining licenses or permits for development projects on a timely basis; anticipated commercial, residential and infrastructure development near our new clinics; and availability of acceptable lease arrangements.

We may not be able to successfully develop critical market presence for our brand in new geographical markets, as we may be unable to find and secure attractive locations, build name recognition or attract new customers. If we are unable to fully implement our development plan, our business, financial condition and results of operations could be materially adversely affected. See Note 11 to our consolidated financial statements for subsequent events.

New clinics, once opened, may not be profitable, and the increases in average clinic sales and comparable clinic sales that we have experienced in the past may not be indicative of future results.

Typically, our new clinics continue to increase sales for their first 36 months of operation. Our analysis of clinic growth leads us to believe that revenue growth will continue past 36 months. However, we cannot assure you that this will occur for future clinic openings. In new markets, the length of time before average sales for new clinics stabilize is less predictable and can be longer as a result of our limited knowledge of these markets and consumers’ limited awareness of our brand. New clinics may not be profitable and their sales performance may not follow historical patterns. In addition, our average clinic sales and comparable clinic sales may not increase at the rates achieved over the past several years. Our ability to operate new clinics, especially company-owned clinics, profitably and increase average clinic sales and comparable clinic sales will depend on many factors, some of which are beyond our control, including:

| | • | consumer awareness and understanding of our brand; |

| | • | general economic conditions, which can affect clinic traffic, local rent and labor costs and prices we pay for the supplies we use; |

| | • | changes in consumer preferences and discretionary spending; |

| | • | competition, either from our competitors in the chiropractic industry or our own clinics; |

| | • | temporary and permanent site characteristics of new clinics; |

| | • | changes in government regulation; and |

| | • | other unanticipated increases in costs, any of which could give rise to delays or cost overruns. |

If our new clinics do not perform as planned, our business and future prospects could be harmed. In addition, if we are unable to achieve our expected average clinics sales, our business, financial condition and results of operations could be adversely affected.

Our failure to manage our growth effectively could harm our business and operating results.

Our growth plan includes a significant number of new clinics. Our existing clinic management systems, administrative staff, financial and management controls and information systems may be inadequate to support our planned expansion. Those demands on our infrastructure and resources may also adversely affect our ability to manage our existing clinics. Managing our growth effectively will require us to continue to enhance these systems, procedures and controls and to hire, train and retain managers and team members. We may not respond quickly enough to the changing demands that our expansion will impose on our management, clinic teams and existing infrastructure which could harm our business, financial condition and results of operations.

Our expansion into new markets may be more costly and difficult than we currently anticipate with the resulting risk of slower growth than we expect.

We plan to open clinics in markets where we have little or no operating experience. Clinics we open in new markets may take longer to reach expected sales and profit levels on a consistent basis and may have higher construction, occupancy, marketing or operating costs than clinics we open in existing markets, thereby affecting our overall profitability. New markets may have competitive conditions, consumer tastes and discretionary spending patterns that are more difficult to predict or satisfy than our existing markets. We may need to make greater investments than we originally planned in advertising and promotional activity in new markets to build brand awareness. We may find it more difficult in new markets to hire, motivate and keep qualified employees who share our vision and culture. We may also incur higher costs from entering new markets, particularly with company-owned clinics if, for example, we hire and assign regional managers to manage comparatively fewer clinics than in more developed markets. For these reasons, both our new franchised clinics and our new company-owned clinics may be less successful than our existing franchised clinics or may achieve target rates of patient visits at a slower rate. If we do not successfully execute our plans to enter new markets, our business, financial condition and results of operations could be materially adversely affected.

We will be subject to all of the risks associated with leasing space subject to long-term non-cancelable leases for clinics that we intend to operate.

We do not intend to own any of the real property where our company-owned clinics will operate. We expect the spaces for the company-owned clinics we intend to open in the future will be leased. We anticipate that our leases generally will have an initial term of five or ten years and generally can be extended only in five-year increments (at increased rates). We expect that all of our leases will require a fixed annual rent, although some may require the payment of additional rent if clinic sales exceed a negotiated amount. We expect that our leases will typically be net leases, which require us to pay all of the cost of insurance, taxes, maintenance and utilities, and that these leases will not be cancellable by us. If a future company-owned clinic is not profitable, resulting in its closure, we may nonetheless be committed to perform our obligations under the applicable lease including, among other things, paying the base rent for the balance of the lease term. In addition, we may fail to negotiate renewals as each of our leases expires, either on commercially acceptable terms or at all, which could cause us to pay increased occupancy costs or to close stores in desirable locations. These potential increases in occupancy costs and the cost of closing company-owned clinics could materially adversely affect our business, financial condition or results of operations.

We may not succeed in our plans to reacquire regional developer licenses or to purchase existing franchises, which could delay or prevent revenue increases we require to obtain profitability.

Our growth strategies include the selected re-acquisition of regional developer licenses and the purchase of existing franchised clinics. While we have the right to repurchase the regional developer license in several of our regional developer agreements, we cannot assure you that regional developers will cooperate with us should we choose to exercise such options. Similarly, we cannot assure you that regional developers whose licenses do not include repurchase options, or franchisees, none of whose franchise agreements contain repurchase options, will agree to sell their licenses or franchised clinics to us on terms we consider acceptable, or at all. Our failure to repurchase selected regional developer licenses or to purchase selected existing franchises on attractive terms could materially delay our growth plans, which could have the effect of delaying or preventing the increases in revenues we require to obtain profitability.

Our intended reliance on sources of revenue other than from franchise and regional developer licenses exposes us to risks including the loss of revenue and reduction of working capital.

From the commencement of our operations until the present, we have relied exclusively on the sale of franchises and regional developer licenses as sources of revenue until the franchises we have sold begin to generate royalty revenues. We intend to place less reliance in the future on these sources of revenue as we implement our strategy of developing and operating company-owned clinics. We will not realize revenues from company-owned clinics until the opening of those clinics, and we will be required to use our working capital, including the proceeds from our initial public offering, to operate our business and to develop company-owned clinics. If the opening of our company-owned clinics is delayed or if the cost of developing company-owned clinics exceeds our expectations, we may experience insufficient working capital to fully implement our development plans, and our business, financial condition and results of operations could be adversely affected.

Our potential need to raise additional capital to accomplish our objectives of expanding into new markets and opening company-owned clinics exposes us to risks including limiting our ability to develop or acquire clinics and limiting our financial flexibility.

We intend to use a portion of the proceeds from our initial public offering as consideration for future development and acquisitions of company-owned clinics and related businesses. If we do not have sufficient cash resources, our ability to develop and acquire clinics and related businesses could be limited unless we are able to obtain additional capital through future debt or equity financings. Using cash to finance development and acquisition of clinics and related businesses could limit our financial flexibility by reducing cash available for operating purposes. Using debt financing could result in lenders imposing financial covenants that limit our operations and financial flexibility. Using equity financing may result in dilution of ownership interests of our existing stockholders. We may also use common stock as consideration for the future acquisition of clinics and related businesses. If our common stock does not maintain a sufficient market value or if prospective acquisition candidates are unwilling to accept our common stock as part of the consideration for the sale of their clinics or businesses, we may be required to use more of our cash resources or greater debt financing to complete these acquisitions.

Changes in economic conditions and adverse weather and other unforeseen conditions could materially affect our ability to maintain or increase sales at our clinics or open new clinics.

Our services emphasize maintenance therapy, which is generally not a medical necessity, and should be viewed as discretionary medical expenditures. The United States in general or the specific markets in which we operate may suffer from depressed economic activity, recessionary economic cycles, higher fuel or energy costs, low consumer confidence, high levels of unemployment, reduced home values, increases in home foreclosures, investment losses, personal bankruptcies, reduced access to credit or other economic factors that may affect consumer discretionary spending. Traffic in our clinics could decline if consumers choose to reduce the amount they spend on non-critical medical procedures. Negative economic conditions might cause consumers to make long-term changes to their discretionary spending behavior, including reducing medical discretionary spending on a permanent basis. In addition, given our geographic concentrations in the West, Southwest and mid-Atlantic regions of the United States, economic conditions in those particular areas of the country could have a disproportionate impact on our overall results of operations, and regional occurrences such as local strikes, terrorist attacks, increases in energy prices, adverse weather conditions, tornadoes, earthquakes, hurricanes, floods, droughts, fires or other natural or man-made disasters could materially adversely affect our business, financial condition and results of operations. Adverse weather conditions may also impact customer traffic at our clinics. All of our clinics depend on visibility and walk-in traffic, and the effects of adverse weather may decrease visits to malls in which our clinics are located and negatively impact our revenues. If clinic sales decrease, our profitability could decline as we spread fixed costs across a lower level of sales. Reductions in staff levels, asset impairment charges and potential clinic closures could result from prolonged negative clinic sales, which could materially adversely affect our business, financial condition and results of operations.

Our dependence on the success of our franchisees exposes us to risks including the loss of royalty revenue and harm to our brand.

A substantial portion of our revenues comes from royalties generated by our franchised clinics. We anticipate that franchise royalties will represent a substantial part of our revenues in the future. As of December 31, 2014, we had 122 franchisees operating 246 clinics. Accordingly, we are reliant on the performance of our franchisees in successfully opening and operating their clinics and paying royalties to us on a timely basis. Our franchise system subjects us to a number of risks as described in the next four risk factors, any one of which could impact our ability to collect royalty payments from our franchisees, may harm the goodwill associated with our brand and may materially adversely affect our business and results of operations.

Our franchisees are independent operators over whom we have limited control.

Franchisees are independent operators, and their employees are not our employees. Accordingly, their actions are outside of our control. Although we have developed criteria to evaluate and screen prospective franchisees, we cannot be certain that our franchisees will have the business acumen or financial resources necessary to operate successful franchises in their approved locations, and state franchise laws may limit our ability to terminate or modify these franchise agreements. Moreover, despite our training, support and monitoring, franchisees may not successfully operate stores in a manner consistent with our standards and requirements, or may not hire and adequately train qualified managers and other store personnel. The failure of our franchisees to operate their franchises successfully and the actions taken by their employees could have a material adverse effect on our reputation, our brand and our ability to attract prospective franchisees, and on our business, financial condition and results of operations.

A recent decision by the United States National Labor Relations Board held that McDonald’s Corporation could be held jointly liable for labor and wage violations by its franchisees. If this decision is upheld it could result in us having responsibility for damages, reinstatement, back pay and penalties in connection with labor law violations by our franchisees over whom we have no control, and could have a material and adverse effect on our financial condition and results of operations.

We are subject to the risk that our franchise agreements may be terminated or not renewed.