As filed with the Securities and Exchange Commission on June 1, 2020.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_________________________

Great Western Bancorp, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 47-1308512 |

(State or other jurisdiction of

incorporation or organization) | (IRS Employer

Identification Number) |

_________________________

225 S Main Avenue

Sioux Falls, South Dakota 57104

(605-334-2548)

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

_________________________

Donald J. Straka

General Counsel

Great Western Bancorp, Inc.

225 S. Main Ave.

Sioux Falls, SD 57104

(605) 334-2548

(Name and address, including zip code, and telephone number, including area code, of agent for service)

___________________________________

Copy to:

Mark C. Dickinson

Nyemaster Goode, PC

700 Walnut, Suite 1600

Des Moines, IA 50309

(515) 283-3166

___________________________________

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an offering to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If the Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. x

If this Form is a post-effective amendment pursuant to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

___________________________________

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer," “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | |

Large accelerated filer x | Accelerated filer o | Non-accelerated filer o |

Smaller reporting company o | Emerging growth company o | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

___________________________________________________________________________________________________________________________

Calculation of Registration Fee

| | | | | | | | | | | | | | |

Title of each class of securities to be registered (1) | Amount to be registered (2) | Proposed maximum offering price per unit (2) | Proposed maximum aggregate offering price (2) | Amount of registration fee (2) |

| Debt Securities | | | | |

| Common Stock, par value $0.01 per share | | | | |

| Preferred Stock, par value $0.01 per share | | | | |

Depositary Shares (3) | | | | |

| TOTAL: | | | | |

(1) The securities of each class may be offered and sold by the Registrant and/or may be offered and sold, from time to time, by one or more selling securityholders to be identified in the future. The selling securityholders may purchase the securities directly from the Registrant, or from one or more underwriters, dealers or agents.

(2) An indeterminate aggregate initial offering price or number of the securities of each identified class is being registered as may from time to time be offered at indeterminate prices. Separate consideration may or may not be received for securities that are issuable on conversion or exchange of other securities or that are issued in units or represented by depositary shares. In accordance with Rules 456(b) and 457(r), the Registrant is deferring payment of the entire registration fee.

(3) Such indeterminate number of depositary shares to be evidenced by depositary receipts issued pursuant to a deposit agreement. In the event that the Registrant elects to offer to the public whole or fractional interests in shares of the preferred stock registered hereunder, depositary receipts will be distributed to those persons purchasing such interests and such shares will be issued to the depositary under the deposit agreement.

PROSPECTUS

Great Western Bancorp, Inc.

225 S. Main Avenue

Sioux Falls, South Dakota 57104

(605) 334-2548

Debt Securities

Common Stock

Preferred Stock

Depositary Shares

The securities of each class may be offered and sold from time to time by us and/or by one or more selling securityholders to be identified in the future. We will provide the specific terms of these securities in supplements to this prospectus. We and any one or more selling securityholders may offer securities at the same time or in separate transactions. You should read this prospectus and the applicable prospectus supplement carefully before you invest in the securities described in the applicable prospectus supplement. This prospectus may not be used to offer and sell the securities unless accompanied by a prospectus supplement.

This prospectus provides you with a general description of the securities that we and/or any selling securityholders may offer. Each time we or a selling securityholder offer and sell securities, we will provide a prospectus supplement that contains specific information about the terms of those securities. In addition, if any selling securityholder sells securities under this prospectus, the prospectus supplement will contain specific information about such selling securityholder. A prospectus supplement may also add, update, or change information contained in this prospectus. You should read both this prospectus and any applicable prospectus supplement together with the additional information described below under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.” If the information in this prospectus is inconsistent with a prospectus supplement, you should rely on the information in that prospectus supplement. We may also prepare free writing prospectuses that describe particular securities. Any free writing prospectus should also be read in connection with this prospectus and with any prospectus supplement referred to therein. For purposes of this prospectus, any reference to an applicable prospectus supplement may also refer to a free writing prospectus, unless the context otherwise requires.

We and/or any one or more selling securityholders may sell the securities through agents; through underwriters or dealers; directly to one or more purchasers; or through a combination of any of these methods of sale on a continuous or delayed basis. We, our agents, and any underwriters reserve the sole right to accept and to reject in whole or in part any proposed purchase of securities. A prospectus supplement, which we will provide to you each time we and/or one or more selling securityholders offer securities, will provide the names of any underwriters, dealers, or agents involved in the sale of the securities, and any applicable fee, commission, or discount arrangements with them.

Our common stock is listed on the New York Stock Exchange and trades under the ticker symbol “GWB.”

Investing in our securities involves risks. See the “Risk Factors” on page 2 of this prospectus and in any applicable prospectus supplement, and under similar headings in the other documents that are incorporated by reference into this prospectus concerning factors you should consider before investing in our securities.

Neither the Securities and Exchange Commission, the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, the South Dakota Division of Banking, nor any state securities commission or any other bank regulatory agency has approved or disapproved the securities to be issued under this prospectus or determined the adequacy or accuracy of this prospectus or any accompanying prospectus supplement. Any representation to the contrary is a criminal offense.

The securities will not be savings accounts, deposits, or other obligations of our bank or non-bank subsidiaries and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

The date of this prospectus is June 1, 2020.

| | | | | |

| |

| TABLE OF CONTENTS | |

| |

| Page |

| ABOUT THIS PROSPECTUS | |

| RISK FACTORS | |

| THE COMPANY | |

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | |

| GENERAL DESCRIPTION OF SECURITIES | |

| USE OF PROCEEDS | |

| LEGAL MATTERS | |

| EXPERTS | |

| WHERE YOU CAN FIND MORE INFORMATION | |

| INCORPORATION OF CERTAIN INFORMATION BY REFERENCE | |

ABOUT THIS PROSPECTUS

This prospectus is part of a shelf registration statement that we filed with the Securities and Exchange Commission (the “SEC”) as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”) using an automatic shelf registration process. Under this automatic shelf registration process, we and/or one or more selling securityholders may from time to time offer and sell the securities described in this prospectus in one or more offerings, denominated in U.S. dollars or the equivalent in foreign currencies, currency units, or composite currencies.

This prospectus provides you with a general description of the securities we or any selling securityholder may offer. Each time we offer and sell or any selling securityholder offers and sells these securities, we will provide a prospectus supplement and, if applicable, a pricing supplement containing specific information about the terms of those securities. In addition, if any selling securityholder sells securities under this prospectus, the prospectus supplement will contain specific information about such selling securityholder. A prospectus supplement may also add, update, or change information contained in this prospectus and may include a discussion of any risk factors or other special considerations that apply to those securities. You should read both this prospectus and any applicable prospectus supplement together with the additional information described below under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.” If the information in this prospectus is inconsistent with a prospectus supplement, you should rely on the information in that prospectus supplement. We may also prepare free writing prospectuses that describe particular securities. Any free writing prospectus should also be read in connection with this prospectus and with any prospectus supplement referred to therein. For purposes of this prospectus, any reference to an applicable prospectus supplement may also refer to a free writing prospectus, unless the context otherwise requires.

This prospectus omits some information contained in the registration statement in accordance with SEC rules and regulations. You should review the information and exhibits included in the registration statement for further information about us and the securities we or any selling securityholder are offering. Statements in this prospectus concerning any document we filed as an exhibit to the registration statement or that we otherwise filed with the SEC are not intended to be comprehensive and are qualified in their entirety by reference to those filings. You should review the complete document to evaluate these statements.

You should only assume that the information in this prospectus or in any prospectus supplement is accurate as of the date on the front of the document. Our business, financial condition, results of operations and prospects may have changed since that date.

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to “we,” “our,” “us,” “ourselves,” “the Company,” “the company,” and “our company” refer to Great Western Bancorp, Inc., a Delaware corporation, and its consolidated subsidiaries. All references in this prospectus to “Great Western Bank” or “our Bank” refer to Great Western Bank, our wholly-owned South Dakota state chartered bank subsidiary. References to a particular year mean our fiscal year commencing October 1 and ending on September 30 of that year.

We include cross-references in this prospectus and will include cross-references in any accompanying prospectus supplement to captions in these materials where you can find further related discussions. The table of contents in this prospectus and the table of contents included in any accompanying prospectus supplement provide and will provide, respectively, the pages on which these captions are located.

Unless indicated in the applicable prospectus supplement, we have not taken any action that would permit us to publicly offer and sell these securities in any jurisdiction outside of the United States. If you are an investor outside of the United States, you should inform yourself about and comply with any restrictions as to the offering of the securities and the distribution of this prospectus.

RISK FACTORS

Investment in any securities offered pursuant to this prospectus and any applicable prospectus supplement involves risks. You should consider carefully the risks and uncertainties described in any applicable prospectus supplement under “Risk Factors” and elsewhere in our most recently filed Annual Report on Form 10-K for the year ended September 30, 2019, our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020, and in any subsequent filings, which are incorporated by reference in this prospectus, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), before acquiring any of such securities. In addition to those risk factors, there may be additional risks and uncertainties of which management is not aware or that management currently deems immaterial that could impair our business operations. The occurrence of any of these risks might cause you to lose all or part of your investment in the offered securities.

THE COMPANY

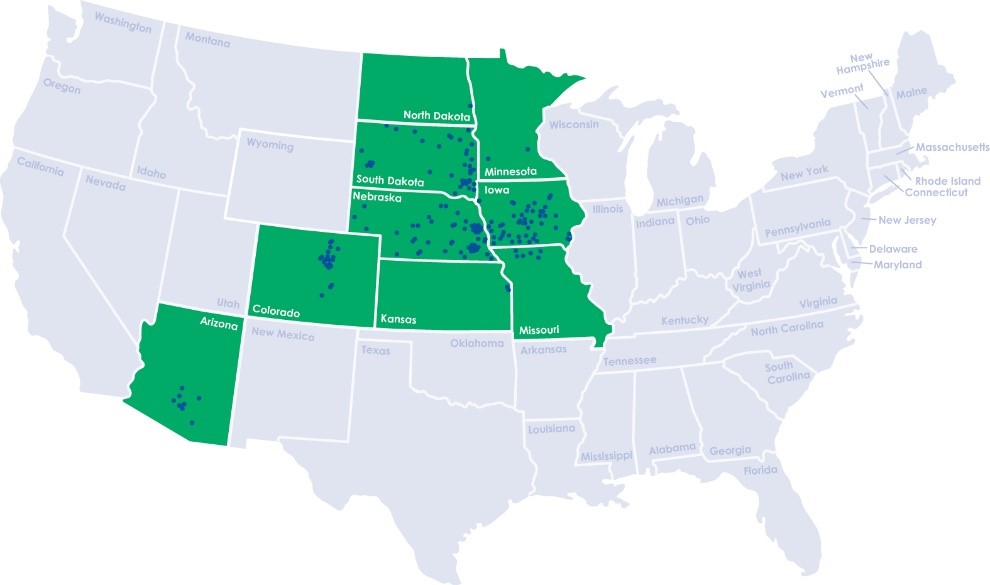

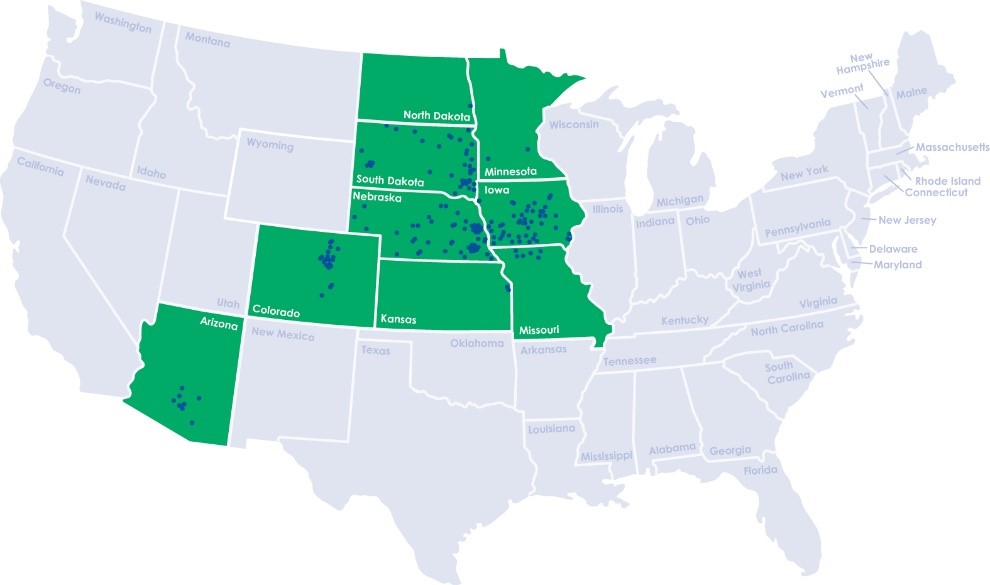

We are a full-service regional bank holding company focused on relationship-based business and agri-business banking headquartered in Sioux Falls, South Dakota. We serve our customers through 175 branches in attractive markets in 9 states: Arizona, Colorado, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota and South Dakota. We were established more than 80 years ago and have achieved strong market positions by developing and maintaining extensive local relationships in the communities we serve.

We have successfully completed nine acquisitions since 2006, including our 2010 FDIC-assisted acquisition of TierOne Bank, which represented approximately $2.54 billion in acquired assets, and our 2016 acquisition of HF Financial, which represented approximately $1.12 billion of acquired assets. At March 31, 2020, we had approximately $12.39 billion in total assets, $9.69 billion in total loans, $10.18 billion in total deposits and $1.15 billion of stockholders’ equity. Our common stock is traded on the New York Stock Exchange under the symbol “GWB.”

We were incorporated under the laws of Delaware in 2014. Our principal executive offices are located at 225 S. Main Avenue, Sioux Falls, South Dakota 57104. Our telephone number at that location is (605) 334-2548 and our website is www.greatwesternbank.com. The information on our website is not a part of this prospectus or any prospectus supplement, and the reference to our website address does not constitute incorporation by reference of any information on that website into this prospectus or any prospectus supplement.

Additional information about us and our subsidiaries is included in documents incorporated by reference in this prospectus. See “Where You Can Find More Information” and “Incorporation of Certain Information by Reference” on pages 6 and 7, respectively, of this prospectus.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements in this prospectus, any accompanying prospectus supplement, and the documents incorporated by reference herein relating to plans, strategies, economic performance and trends, projections of results of specific activities or investments, expectations or beliefs about future events or results, and other statements that are not descriptions of historical facts may be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, and Section 21E of the Exchange Act. These statements are often, but not always, made through the use of words or phrases such as "anticipates," "believes," "can," "could," "may," "predicts," "potential," "should," "will," "estimate," "plans," "projects," "continuing," "ongoing," "expects," "views," "intends" and similar words or phrases. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions, estimates and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements.

Factors that could influence the accuracy of forward-looking statements contained in this prospectus, in any accompanying prospectus supplement and in the documents incorporated by reference herein include, but are not limited to:

•the severity, magnitude and duration of the COVID-19 pandemic and the direct and indirect impact of such pandemic, as well as responses to the pandemic by the government, business and consumers, on our operations and personnel, commercial activity and demand across our business and our customers’ business;

•the disruption of global, national, state and local economies associated with the COVID-19 pandemic, which could affect our liquidity and capital positions, impair the ability of our borrowers to repay outstanding loans, impair collateral values and further increase our allowance for credit losses;

•the impact of the COVID-19 pandemic on our financial results, including possible lost revenue and increased expenses (including the cost of capital), as well as possible goodwill impairment charges;

•current and future economic and market conditions in the United States generally or in our states in particular, including the rate of growth and employment levels;

•our ability to anticipate interest rate changes and manage interest rate risk (including developments and volatility arising from or related to the COVID-19 pandemic);

•our ability to achieve loan and deposit growth;

•the relative strength or weakness of the commercial, agricultural and real estate markets where our borrowers are located, including without limitation related asset and market prices;

•declines in asset prices and the market prices for agricultural products or changes in governmental support programs for the agricultural sector;

•our ability to effectively execute our strategic plan and manage our growth;

•our ability to successfully manage our credit risk and the sufficiency of our allowance for loan and lease loss, including our ability to estimate loan losses and increases to the allowance for loans and

leases as a result of the implementation on October 1, 2020 of the current expected credit losses (CECL) model;

•our ability to develop and effectively use the quantitative models we rely upon in our business;

•possible changes in trade, monetary and fiscal policies of, and other activities undertaken by, governments, agencies, central banks and similar organizations, including the potential negative effects of imposed and proposed tariffs and retaliatory tariffs on products that our customers may import or export, including among others, agricultural products;

•our ability to effectively compete with other financial services companies and the effects of competition in the financial services industry on our business;

•operational risks or risk management failures by us or critical third parties, including without limitation with respect to data processing, information systems, cyber-security, technological changes, vendor problems, business interruption and fraud risks;

•fluctuations in the values of our assets and liabilities and off-balance sheet exposures;

•unanticipated changes in our liquidity position, including but not limited to changes in our access to sources of liquidity and capital to address our liquidity needs (including developments and volatility arising from or related to the COVID-19 pandemic);

•possible impairment of our goodwill and other intangible assets, or any adjustment of the valuation of our deferred tax assets;

•a lowering of our credit rating;

•changes in U.S. monetary policy and changes to the Federal Reserve's balance sheet, including changes in response to the COVID-19 pandemic or otherwise;

•the effects of geopolitical instability, including war, terrorist attacks, and man-made and natural disasters, social instability and changes in governmental policies;

•the effects of adverse weather conditions, particularly on our agricultural borrowers;

•the impact of, and changes in applicable laws, regulations and accounting standards, policies and interpretations, including the impact of the Tax Reform Act and those changes that are in response to the COVID-19 pandemic, including without limitation the Coronavirus Aid, Relief, and Economic Security Act and the rules and regulations that may be promulgated thereunder;

•legal, compliance and reputational risks, including litigation and regulatory risks;

•our inability to receive dividends from our Bank and to service debt, pay dividends to our common stockholders and satisfy obligations as they become due;

•expected cost savings in connection with the consolidation of recent acquisitions may not be fully realized or realized within the expected time frames, and deposit attrition, customer loss and revenue loss following completed acquisitions may be greater than expected;

•our ability to meet our obligations as a public company, including our obligations under Section 404 of the Sarbanes-Oxley Act to maintain an effective system of internal control over financial reporting; and

•other risks and uncertainties inherent to our business, including those discussed under the heading "Item 1A. Risk Factors" in our Annual Report on Form 10-K for the year ended September 30, 2019 and in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2020 and in other documents filed by us from time to time with the SEC.

If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from what we anticipate. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and we do not undertake any obligation to update or review any forward-looking statement to reflect events or circumstances occurring after the date on which the statement is made or to reflect the occurrence of unanticipated events.

GENERAL DESCRIPTION OF SECURITIES

We may use this prospectus to offer securities in one or more offerings. The following description of the various securities that we may offer under this prospectus is not complete and does not contain all of the information you should consider before investing in those securities. A prospectus supplement, which we will provide each time we offer securities, will describe the amounts, prices, and detailed terms of the securities and may describe risks associated with an investment in such securities. We will also include in the prospectus supplement, where applicable, information about material United States federal income tax considerations relating to such securities. Terms used in this prospectus will have the meanings described in this prospectus unless otherwise specified. The securities of each class as described in this prospectus may also be offered and sold, from time to time, by one or more selling securityholders to be identified in the future.

We may sell the securities to or through underwriters, dealers or agents or directly to purchasers. We, as well as any agents acting on our behalf and any underwriters, reserve the sole right to accept or to reject in whole or in part any proposed purchase of our securities. Each prospectus supplement will set forth the names of any underwriters, dealers or agents involved in the sale of our securities described in that prospectus supplement and any applicable fee, commission or discount arrangements with them.

This prospectus may not be used to sell securities unless accompanied by the applicable prospectus supplement.

Debt Securities

We may issue senior debt securities or subordinated debt securities. Senior debt securities will be issued under an indenture, the “senior indenture,” between us and the trustee named in the applicable prospectus supplement, as trustee. Subordinated debt securities will be issued under a separate indenture, the “subordinated indenture,” between us and the trustee named in the applicable prospectus supplement, as trustee. The senior indenture and the subordinated indenture are sometimes collectively referred to in this prospectus as the “indentures.” The indentures will be subject to and governed by the Trust Indenture Act of 1939. When we offer to sell a particular series of debt securities, we will describe the specific terms of the securities in a prospectus supplement. The prospectus supplement will also indicate whether the general terms and provisions described in this prospectus apply to a particular series of debt securities.

Common Stock

We may sell shares of our common stock, $0.01 par value per share. In a prospectus supplement, we will describe the aggregate number of shares offered and the offering price or prices of the shares. We have two classes of common stock, consisting of common stock with voting rights, the “common stock”, and non-voting common stock, the “non-voting common stock”.

Subject to the rights and preferences granted to holders of any preferred stock then outstanding, and except with respect to voting rights, conversion rights and certain distributions of our capital stock as stock dividends, holders of our common stock and holders of our non-voting common stock rank equally with respect to distributions and have identical rights, preferences, privileges and restrictions. Shares of our non-voting common stock have the right to convert into an equal number of shares of our common stock under certain circumstances.

Holders of our common stock and holders of our non-voting common stock are equally entitled to receive ratably such dividends, if any, as may be declared from time to time by our board of directors out of legally available funds. In the event of a declaration of a stock dividend, shares of common stock shall only be entitled to receive shares of common stock as a dividend and shares of non-voting common stock shall only be entitled to receive shares of non-voting common stock as a dividend.

Each holder of common stock is entitled to one vote for each share of record held on all matters submitted to a vote of stockholders, including the election of directors, subject to the rights and preferences of the holders of any outstanding shares of preferred stock. Holders of common stock are not entitled to cumulative voting in the election of directors. Holders of our non-voting common stock do not have any voting rights and are not entitled to vote on any matter, except as otherwise required by law.

In the event of our liquidation, dissolution or winding up, holders of our common stock and holders of our non-voting common stock are entitled to share ratably in all of our assets remaining after payment of liabilities, including but not limited to the liquidation preference of any then outstanding preferred stock.

Our common stock is listed for trading on the New York Stock Exchange under the trading symbol “GWB.”

Preferred Stock and Depositary Shares

We may sell shares of our preferred stock, $0.01 par value per share, in one or more series. In a prospectus supplement, we will describe the specific designation, the aggregate number of shares offered, the dividend rate or manner of calculating the dividend rate, the dividend periods or manner of calculating the dividend periods, the ranking of the shares of the series with respect to dividends, liquidation and dissolution, the stated value of the shares of the series, the voting rights of the shares of the series, if any, whether and on what terms the shares of the series will be convertible or exchangeable, whether and on what terms we can redeem the shares of the series, whether we will offer depositary shares representing shares of the series and, if so, the fraction or multiple of a share of preferred stock represented by each depositary share, whether we will list the preferred stock or depositary shares on a securities exchange and any other specific terms of the series of preferred stock or depositary shares.

USE OF PROCEEDS

Unless otherwise specified in a prospectus supplement accompanying this prospectus, we currently intend to use the net proceeds from the sale of the securities offered under this prospectus for general corporate purposes. General corporate purposes may include, without limitation, for investments in our Bank as regulatory capital, providing capital to support our growth organically or through strategic acquisitions, financing investments and capital expenditures, redeeming or repurchasing our securities, repaying, reducing or refinancing indebtedness, and any other purposes that we may specify in any prospectus supplement. We may invest the net proceeds temporarily until we use them for their stated purpose. We cannot predict whether the proceeds invested will yield a favorable return.

We will not receive any proceeds from the sale of the securities by selling securityholders.

LEGAL MATTERS

Unless otherwise indicated in the applicable prospectus supplement, the validity of the securities offered hereby is being passed upon for us by Nyemaster Goode, PC, Des Moines, Iowa. Additional legal matters may be passed upon for us or any underwriters, dealers or agents by counsel that we will name in the applicable prospectus supplement. If the securities are being distributed in an underwritten offering, the validity of the securities will be passed upon for the underwriters by counsel identified in the applicable prospectus supplement.

EXPERTS

The consolidated financial statements of Great Western Bancorp, Inc. and its subsidiaries appearing in its Annual Report on Form 10-K for the year ended September 30, 2019, and the effectiveness of its internal control over financial reporting as of September 30, 2019, have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in its reports thereon, included therein, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such reports given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements, and other information with the SEC. The SEC maintains a website that contains annual, quarterly and current reports, proxy statements, and other information about issuers, such as us, who file electronically with the SEC. The address of that website is www.sec.gov.

In addition, we maintain an Internet website, www.greatwesternbank.com. We make available, through our website, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. This reference to our website is for the convenience of investors as required by the SEC and shall not be deemed to incorporate any information on the website into this prospectus or any prospectus supplement. All website addresses in this prospectus or in any prospectus supplement are intended to be inactive textual references only.

We have not authorized anyone to give any information or make any representation about us that is different from, or in addition to, those contained in this prospectus, any prospectus supplement or in any of the materials that we have incorporated into this prospectus. If anyone does give you information of this sort, you should not rely on it. If you are in a jurisdiction where offers to sell, or solicitations of offers to purchase, the securities offered by this document are unlawful, or if you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this document does not extend to you. The information contained in this document speaks only as of the date of this document unless the information specifically indicates that another date applies.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to incorporate by reference the information we file with them, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be a part of this prospectus, and later information that we file with the SEC will automatically update and supersede this information.

We incorporate by reference the following documents listed below, together with any future filings we make with the SEC under Section 13(a), 13(c), 14, or 15(d) of the Exchange Act, until the termination of the offering:

•our Annual Report on Form 10-K for the year ended September 30, 2019, filed on November 27, 2019; •the portions of our Definitive Proxy Statement on Schedule 14A, filed on December 23, 2019, and specifically incorporated by reference in our Annual Report on Form 10-K for the year ended September 30, 2019; •our Quarterly Reports on Form 10-Q for the quarters ended December 31, 2019 and March 31, 2020 filed on February 5, 2020 and April 30, 2020, respectively; •our Current Reports on Form 8-K filed on October 2, 2019, October 24, 2019, October 30, 2019, October 31, 2019, November 26, 2019, December 11, 2019, January 28, 2020, February 5, 2020, February 11, 2020, April 22, 2020, April 27, 2020, April 30, 2020 and May 20, 2020; and •the description of our common stock contained under the heading “Description of Capital Stock” found in our Registration Statement on Form S-1/A (Registration No. 333-198458) filed on October 3, 2014, as updated by Exhibit 4.21 to our Annual Report on Form 10-K for the year ended September 30, 2019, filed on November 27, 2019. Unless otherwise stated in the applicable reports, information furnished under Item 2.02 or Item 7.01 of our Current Reports on Form 8-K is not incorporated by reference.

You can obtain any of the documents incorporated by reference in this document through us, or from the SEC through the SEC’s web site at www.sec.gov. We will provide, upon written or oral request as described below, each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the information that has been incorporated by reference in this prospectus but not delivered with this prospectus excluding any exhibits to those documents, unless the exhibit is specifically incorporated by reference in those documents. That information is available from us without charge. You can obtain documents incorporated by reference in this prospectus by requesting them in writing or by telephone from us at the following address:

Great Western Bancorp, Inc.

225 S. Main Avenue

Sioux Falls, South Dakota 57104

Attn: Corporate Secretary

(605) 334-2548

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The estimated expenses in connection with the offering described in this Registration Statement are as follows:

| | | | | | | | |

| SEC Registration Statement filing fee | $ | (1) |

| Accountant’s fees and expenses | | (2) |

| Legal fees and expenses | | (2) |

| Trustee and Depositary fees and expenses | | (2) |

| Rating agencies’ fees | | (2) |

| Printing fees and expenses | | (2) |

| Miscellaneous expenses | | (2) |

| TOTAL | | (2) |

(1) The Registrant is registering an indeterminate amount of securities under this Registration Statement and, in accordance with Rules 456(b) and 457(r), the Registrant is deferring payment of the registration fee until the time the securities are sold under this Registration Statement pursuant to a prospectus supplement.

(2) The calculation of these fees and expenses is dependent upon the number of issuances and the amount of securities offered and, accordingly, cannot be estimated at this time. An estimate of the aggregate amount of these expenses will be reflected in the applicable prospectus supplement.

Item 15. Indemnification of Directors and Officers

Section 145 of the Delaware General Corporation Law (the “DGCL”) permits indemnification of the Registrant’s officers and directors under certain conditions and subject to certain limitations. Section 145 of the DGCL also provides that a corporation has the power to purchase and maintain insurance on behalf of its officers and directors against any liability asserted against such person and incurred by him or her in such capacity, or arising out of his or her status as such, whether or not the corporation would have the power to indemnify him or her against such liability under the provisions of Section 145 of the DGCL.

Article VI of the Registrant’s amended and restated bylaws provides generally that the Registrant will indemnify and hold harmless, to the full extent permitted by the DGCL, the Registrant’s directors, officers, employees and agents, as well as other persons who have served as the Registrant’s directors, officers, employees or agents and other persons who serve or have served at the Registrant’s request at another corporation, limited liability company, public limited company, partnership, joint venture, trust, employee benefit plan, fund or other enterprise in connection with any actual or threatened action, suit or proceeding, subject to limited exceptions. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to the Registrant’s directors, officers and controlling persons, the Registrant has been informed that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. Finally, the Registrant’s ability to provide indemnification to it’s directors and officers is limited by federal banking laws and regulations.

As permitted by Section 102(b)(7) of the DGCL, Article XI of the Registrant’s amended and restated certificate of incorporation limits, to the full extent permitted by the DGCL, the personal liability of the Registrant’s directors in actions brought on the Registrant’s behalf or on behalf of the Registrant’s stockholders for monetary damages as a result of a director’s breach of fiduciary duty while acting in a capacity as a director. The Registrant’s amended and restated certificate of incorporation does not eliminate or limit the Registrant’s right or the right of the Registrant’s stockholders to seek injunctive or other equitable relief not involving monetary damages.

The Registrant has purchased directors’ and officers’ liability insurance. The Registrant believes that this insurance is necessary to attract and retain qualified directors and officers.

Item 16. Exhibits

The exhibits filed (unless otherwise noted) as a part of this Registration Statement are as follows:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 1.1 | | Form of Underwriting Agreement * |

| | |

| | Amended and Restated Certificate of Incorporation (incorporated by reference to Exhibit 3.1 to the Annual Report on Form 10-K for the fiscal year ended September 30, 2014 filed on December 12, 2014) |

| | |

| | Amended and Restated Bylaws (incorporated by reference in Exhibit 3.1 to the Registration Statement on Form S-1 (Registration No. 333-198458) filed on August 28, 2014) |

| | |

| | Form of Indenture for Senior Debt Securities |

| | |

| 4.2 | | Form of Note for Senior Debt Securities * |

| | |

| | Form of Indenture for Subordinated Debt Securities |

| | |

| 4.4 | | Form of Note for Subordinated Debt Securities * |

| | |

| | Specimen of Common Stock certificate (incorporated by reference to Exhibit 4.1 to the Registration Statement on Form S-1 (Registration No. 333-198458) filed on August 28, 2014) |

| | |

| 4.6 | | Form of Specimen Preferred Stock Certificate * |

| | |

| 4.7 | | Form of Deposit Agreement * |

| | |

| 4.8 | | Form of Depositary Receipt (included as part of Exhibit 4.7) * |

| | |

| | Indenture, dated as of December 17, 2003, between Great Western Bancorporation, Inc. and U.S. Bank National Association (incorporated by reference to Exhibit 4.2 to the Registration Statement on Form S-1 filed by Great Western Bancorp, Inc. on August 28, 2014 (File No. 333-198458)) |

| | |

| | Guarantee Agreement, dated as of December 17, 2003, between Great Western Bancorporation, Inc. and U.S. Bank National Association (incorporated by reference to Exhibit 4.15 to Amendment No. 1 to the Registration Statement on Form S-1 filed by Great Western Bancorp, Inc. on September 25, 2014 (Filed No. 333-198458)) |

| | |

| | First Supplemental Indenture dated October 17, 2014, between Great Western Bancorporation, Inc., Great Western Bancorp, Inc. and U.S. Bank National Association (incorporated by reference to Exhibit 4.2 to the Annual Report on Form 10-K for the fiscal year ended September 30, 2014 filed by Great Western Bancorp, Inc. on December 12, 2014) |

| | |

| | Amended and Restated Declaration of Trust of Great Western Statutory Trust IV, dated December 17, 2003 (incorporated by reference to Exhibit 4.4 to the Registration Statement on Form S-1 filed by Great Western Bancorp, Inc. on August 28, 2014 (File No. 333-198458)) |

| | |

| | Indenture dated as of March 10, 2006, between Great Western Bancorporation, Inc. and LaSalle Bank National Association (incorporated by reference to Exhibit 4.5 to the Registration Statement on Form S-1 filed by Great Western Bancorp, Inc. on August 28, 2014 (File No. 333-198458)) |

| | |

| | Guarantee Agreement, dated as of March 10, 2006, between Great Western Bancorporation, Inc. and LaSalle Bank National Association (incorporation by reference to Exhibit 4.16 to Amendment No. 1 to the Registration Statement on Form S-1 filed by Great Western Bancorp, Inc. on September 25, 2014 (File No. 333-198458)) |

| | |

| | First Supplemental Indenture, dated as of October 17, 2014, among Great Western Bancorporation, Inc., Great Western Bancorp, Inc. and U.S. Bank National Association, successor to LaSalle Bank National Association (incorporated by reference to Exhibit 4.5 to the Annual Report on Form 10-K for the fiscal year ended September 30, 2014 filed by Great Western Bancorp, Inc. on December 12, 2014) |

| | |

| | First Supplemental Indenture, among Great Western Bancorporation, Inc., Great Western Bancorp, Inc. and U.S. Bank National Association (incorporated by reference to Exhibit 4.6 to Amendment No. 1 to the Registration Statement on Form S-1 filed by Great Western Bancorp, Inc. on September 25, 2014 (File No. 333-198458)) |

| | |

| | Amended and Restated Declaration of Trust of GWB Capital Trust VI, dated as of March 10, 2006 (incorporated by reference to Exhibit 4.7 to the Registration Statement on Form S-1 filed by Great Western Bancorp, Inc. on August 28, 2014 (File No. 333-198458)) |

| | |

| | | | | | | | |

| Exhibit No. | | Description |

| | Indenture, dated as of June 1, 2005, between Sunstate Bancshares, Inc., and JPMorgan Chase Bank, National Association (incorporated by reference to Exhibit 4.8 to the Registration Statement on Form S-1 filed by Great Western Bancorp, Inc. on August 28, 2014 (File No. 333-198458)) |

| | |

| | Guarantee Agreement, dated as of June 1, 2005, between Sunstate Bancshares, Inc. and JPMorgan Chase Bank, National Association (incorporated by reference to Exhibit 4.17 to Amendment No. 1 to the Registration Statement on form S-1 filed by Great Western Bancorp, Inc. on September 25, 2014 (File No. 333-198458)) |

| | |

| | First Supplemental Indenture, dated as of May 10, 2007, between Great Western Bancorporation, Inc. and The Bank of New York Trust Company, National Association (incorporated by reference to Exhibit 4.9 to the Registration Statement on Form S-1 filed by Great Western Bancorp, Inc. on August 28, 2014 (File No. 333-198458)) |

| | |

| | Second Supplemental Indenture, dated October 17, 2014, between Great Western Bancorporation, Inc., Great Western Bancorp, Inc. and The Bank of New York Trust Company, National Association (incorporated by reference to Exhibit 4.9 to the Annual Report on Form 10-K for the fiscal year ended September 30, 2014 filed by Great Western Bancorp, Inc. on December 12, 2014) |

| | |

| | Amended and Restated Declaration of Trust of Sunstate Bancshares Trust II, dated as of June 1, 2005 (incorporated by reference to Exhibit 4.11 to the Registration Statement on Form S-1 filed by Great Western Bancorp, Inc. on August 28, 2014 (File No. 333-198458)) |

| | |

| | Subordinated Note Purchase Agreement, dated July 31, 2015, between Great Western Bancorp, Inc. and the Note Purchasers identified on Schedule I thereto, and any assignees thereof, including the form of Subordinated Note issued to each of such Purchasers (incorported by reference to Exhibit 4.19 to the Annual Report on Form 10-K for the fiscal year ended September 30, 2015 filed by Great Western Bancorp, Inc. on December 11, 2015) |

| | |

| | First Supplemental Indenture, dated as of May 13, 2016, among Great Western Bancorp, Inc., HF Financial Corp., and Wilmington Trust Company, as Trustee (relating to the HF Financial Capital Trust III trust preferred securities) (incorporated by reference to Exhibit 4.1 to the Current Report on Form 8-K filed by Great Western Bancorp, Inc. on May 16, 2016) |

| | |

| | First Supplemental Indenture, dated as of May 13, 2016, among Great Western Bancorp, Inc., HF Financial Corp., and Wilmington Trust Company, as Trustee (relating to the HF Financial Capital Trust IV trust preferred securities) (incorporated by reference to Exhibit 4.2 to the Current Report on Form 8-K filed by Great Western Bancorp, Inc. on May 16, 2016) |

| | |

| | First Supplemental Indenture, dated as of May 13, 2016, among Great Western Bancorp, Inc., HF Financial Corp., and Wilmington Trust Company, as Trustee (relating to the HF Financial Capital Trust VI trust preferred securities) (incorporated by reference to Exhibit 4.3 to the Current Report on Form 8-K filed by Great Western Bancorp., Inc. on May 16, 2016) |

| | |

| | First Supplemental Indenture, dated as of May 13, 2016, among Great Western Bancorp, Inc., HF Financial Corp., and Wilmington Trust Company, as Trustee (relating to the HF Financial Capital Trust V trust preferred securities) (incorporated by reference to Exhibit 4.4 to the Current Report on Form 8-K filed by Great Western Bancorp, Inc. on May 16, 2016) |

| | |

| | Opinion of Nyemaster Goode, PC |

| | |

| | Consent of Ernst & Young, LLP |

| | |

| | Consent of Nyemaster Goode, PC (included in Exhibit 5.1) |

| | |

| 24.1 | | Power of Attorney (included on signature page) |

| | |

| 25.1 | | Form T-1 Statement of Eligibility of Trustee to act as Trustee under the Senior Indenture ** |

| | |

| | Form T-1 Statement of Eligibility of Trustee to act as Trustee under the Subordinated Indenture |

| | |

| | |

| * To be filed, if necessary, subsequent to the effectiveness of this Registration Statement by an amendment to this Registration Statement or incorporated herein by reference in connection with an offering of securities to a Current Report on Form 8-K. | | |

| | |

| ** To be filed separately pursuant to Section 305(b)(2) of the Trust Indenture Act of 1939, as amended. | | |

Item 17. Undertakings

(A) The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

Provided, however, that paragraphs (A)(1)(i), (A)(1)(ii) and (A)(1)(iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) each prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5) That, for the purpose of determining liability of the Registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities:

The Registrant undertakes that in a primary offering of securities of the Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the Registrant relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the Registrant or used or referred to by the Registrant;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the Registrant or its securities provided by or on behalf of the Registrant; and

(iv) Any other communication that is an offer in the offering made by the Registrant to the purchaser.

(B) The Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(C) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

(D) The Registrant hereby undertakes that for purposes of determining any liability under the Securities Act of 1933, (A) the information omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the Registrant pursuant to Rule 424(b) (1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement as of the time it was declared effective and (B) each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(E) The Registrant hereby undertakes to file an application for the purpose of determining the eligibility of the trustee to act under Subsection (a) of Section 310 of the Trust Indenture Act (“Act”) in accordance with the rules and regulations prescribed by the Securities and Exchange Commission under Section 305(b)(2) of the Act.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Sioux Falls, State of South Dakota, on June 1, 2020.

| | | | | | | | | | | |

| | | |

| | GREAT WESTERN BANCORP, INC. | |

| | By: | /s/ Peter Chapman |

| | | Peter Chapman |

| | | Executive Vice President and Chief Financial Officer |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Mark Borrecco and Peter Chapman, and each of them, as attorneys-in-fact, for him or her and in his or her name, place and stead, in any and all capacities, so long as such individual remains an executive officer of Great Western Bancorp, Inc., to sign any and all amendments (including post-effective amendments) to this Registration Statement, and to sign any registration statement for the same offering covered by this Registration Statement that is to be effective upon filing pursuant to Rule 462 promulgated under the Securities Act of 1933, as amended, and all post-effective amendments thereto, and to file the same, with all exhibits thereto and all documents in connection therewith, with the SEC, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that such attorneys-in-fact and agents or any of them, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities indicated on the 1st day of June, 2020.

| | | | | | | | | | | |

| Signature: | | Title: | |

| | | |

| /s/ Mark Borrecco | | President and Chief Executive Officer; Director | |

| Mark Borrecco | | (Principal Executive Officer) | |

| | | |

| /s/ Peter Chapman | | Executive Vice President and Chief Financial Officer | |

| Peter Chapman | | (Principal Financial and Accounting Officer) | |

| | | |

| /s/ James Brannen | | Chairperson of the Board | |

| James Brannen | | | |

| | | |

| /s/ Frances Grieb | | Director | |

| Frances Grieb | | | |

| | | |

| /s/ Thomas Henning | | Director | |

| Thomas Henning | | | |

| | | |

| /s/ James Israel | | Director | |

| James Israel | | | |

| | | |

| /s/ Stephen Lacy | | Director | |

| Stephen Lacy | | | |

| | | |

| /s/ Daniel Rykhus | | Director | |

| Daniel Rykhus | | | |

| | | |

| /s/ James Spies | | Director | |

| James Spies | | | |