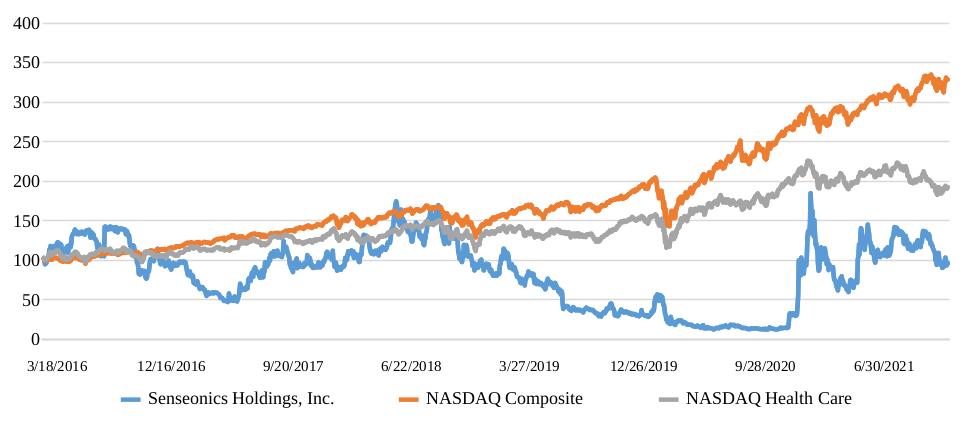

1996. We have never been profitable and our net losses were $302.5 million, $175.2 million, and $115.5 million for the years ended December 31, 2021, 2020 and 2019, respectively. As of December 31, 2021, we had an accumulated deficit of $951.0 million. To date, we have funded our operations principally through the issuance of preferred stock, common stock, convertible note issuance and debt. As of December 31, 2021, we had cash, cash equivalents and marketable securities of $181.8 million.

In November 2021, we entered into an Open Market Sale Agreement, or 2021 Sales Agreement, with Jefferies LLC, or Jefferies, under which we could offer and sell, from time to time, at our sole discretion, shares of our common stock having an aggregate offering price of up to $150.0 million through Jefferies as our sales agent in an “at the market” offering. Jefferies will receive a commission up to 3.0% of the gross proceeds of any common stock sold through Jefferies under the 2021 Sales Agreement. As of the date of this Annual Report on Form 10-K, we have received $8.1 million in net proceeds from the sale of 3,077,493 shares of our common stock under the 2021 Sales Agreement.

In November 2019, we entered into an Open Market Sale Agreement, or 2019 Sales Agreement, with Jefferies, under which we could offer and sell, from time to time at our sole discretion, shares of our common stock having an aggregate offering price of up to $50.0 million through Jefferies as our sales agent in an “at the market” offering. In June 2021, we received $48.4 million in net proceeds from the sale of 12,830,333 shares of our common stock utilizing the full capacity under the 2019 Sales Agreement. For the twelve months ended December 31, 2020, we had received $0.1 million in net proceeds from the sale of 175,289 shares of our common stock under the 2019 Sales Agreement.

On January 21, 2021, we entered into an underwriting agreement, which was subsequently amended and restated on the same day, or the Underwriting Agreement, with H.C. Wainwright & Co., LLC, as representative of the underwriters, the Underwriters, to issue and sell 51,948,052 shares of common stock, in an underwritten public offering pursuant to effective registration statements on Form S-3, including and a related prospectus and prospectus supplement, in each case filed with the Securities and Exchange Commission, the Offering. The price to the public in the Offering was $1.925 per share of common stock. The Underwriters agreed to purchase the shares from the Company pursuant to the Underwriting Agreement at a price of $1.799875 per share and the Company also agreed to reimburse them for customary fees and expenses. The initial closing of the Offering occurred on January 26, 2021. Subsequent to the initial closing, the Underwriters exercised their option to purchase an additional 7,792,207 shares of Common Stock. Total net proceeds from the Offering were $106.1 million after deducting underwriting discounts and commissions and estimated offering expenses.

On January 17, 2021, we entered into a Securities Purchase Agreement (the “Purchase Agreement”) with certain institutional purchasers, the Purchasers, pursuant to which we sold to the Purchasers, in a registered direct offering, the Registered Direct Offering, an aggregate of 40,000,000 shares, the Shares, of common stock, $0.001 par value per share. The Shares were sold at a purchase price of $1.25 per share for aggregate gross proceeds to the us of $50 million, before deducting fees to the placement agent and other estimated offering expenses payables. The Shares were offered and sold by us pursuant to an effective shelf registration statement on Form S-3, which was originally filed with the Securities and Exchange Commission on November 27, 2019. The net proceeds to us from the Registered Direct Offering, after deducting fees and expenses and the estimated offering expenses payable by us, are approximately $46.1 million.

On November 9, 2020, we entered into an equity line agreement, the Equity Line Agreement, with Energy Capital, LLC, or Energy Capital, which provides that, upon the terms and subject to the conditions and limitations set forth therein, Energy Capital is committed to purchase up to an aggregate of $12.0 million of shares of our newly designated series B convertible preferred stock, or the Series B Preferred Stock, at our request from time to time during the 24-month term of the Equity Line Agreement. Under the Equity Line Agreement, beginning January 21, 2021, subject to the satisfaction of certain conditions, including that we have less than $8 million of cash, cash equivalents and other available credit (aside from availability under the Equity Line Agreement), we have the right, in our sole discretion, to present Energy Capital with a purchase notice, or a Regular Purchase Notice, directing Energy Capital (as principal) to purchase shares of Series B Preferred Stock at a price of $1,000 per share (not to exceed $4.0 million worth of shares) once per month, up to an aggregate of $12.0 million of our Series B Preferred Stock at a per share price, or the Purchase Price, equal to $1,000 per share of Series B Preferred Stock, with each share of Series B Preferred Stock initially convertible into common stock, beginning nine months after the date of its issuance, at a conversion price of