As filed with the U.S. Securities and Exchange Commission on [date]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23024

Pacer Funds Trust

(Exact name of registrant as specified in charter)

500 Chesterfield Parkway

Malvern, PA 19355

(Address of principal executive offices) (Zip code)

Joe M. Thomson, President

500 Chesterfield Parkway

Malvern, PA 19355

(Name and address of agent for service)

610-644-8100

Registrant's telephone number, including area code

Date of fiscal year end: April 30

Date of reporting period: April 01, 2022 through October 31, 2022

Item 1. Reports to Stockholders.

| (a) |

Pacer Funds

TABLE OF CONTENTS

Page | |

Portfolio Allocation | 1 |

Performance Summary | 19 |

Expense Example | 50 |

Schedules of Investments | 53 |

Statements of Assets & Liabilities | 137 |

Statements of Operations | 144 |

Statements of Changes in Net Assets | 151 |

Financial Highlights | 166 |

Notes to Financial Statements | 195 |

Review of Liquidity Risk Management Program | 223 |

Additional Information | 224 |

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited)

As of October 31, 2022

Pacer Trendpilot® US Large Cap ETF

Industry(a) | Percentage of |

Short-Term Investments | 100.1% |

Liabilities in excess of other assets | -0.1% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer Trendpilot® US Large Cap Index. |

Pacer Trendpilot® US Mid Cap ETF

Industry(a) | Percentage of |

Short-Term Investments | 100.0% |

Liabilities in excess of other assets | -0.0%(b) |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer Trendpilot® US Mid Cap Index. |

(b) | Less than 0.05%. |

Pacer Trendpilot® 100 ETF

Industry(a) | Percentage of |

Automobiles & Components | 2.1% |

Capital Goods | 0.9% |

Commercial & Professional Services | 0.5% |

Consumer Durables & Apparel | 0.2% |

Consumer Services | 1.2% |

Food & Staples Retailing | 1.1% |

Food, Beverage & Tobacco | 2.2% |

Health Care Equipment & Services | 0.8% |

Media & Entertainment | 6.2% |

Pharmaceuticals, Biotechnology | 2.7% |

Retailing | 3.9% |

Semiconductors & Semiconductor | 6.6% |

Software & Services | 9.6% |

Technology Hardware & Equipment | 7.6% |

Telecommunication Services | 0.9% |

Transportation | 0.4% |

Utilities | 0.7% |

Short-Term Investments | 52.4% |

Investments Purchased with Proceeds from Securities Lending | 6.4% |

Liabilities in excess of other assets | -6.4% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer Nasdaq-100 Trendpilot® Index. |

1

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of October 31, 2022

Pacer Trendpilot® European Index ETF

Industry(a) | Percentage of |

Greece | 0.0%(b) |

Netherlands | 0.0%(b) |

United Kingdom | 0.1% |

Short-Term Investments | 99.3% |

Other assets in excess of liabilities | 0.6% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer Trendpilot® European Index. |

(b) | Less than 0.05%. |

Pacer Trendpilot® International ETF

Industry(a) | Percentage of |

Capital Goods | 0.0%(b) |

Diversified Financials | 0.0%(b) |

Insurance | 0.0%(b) |

Real Estate | 0.0%(b) |

Short-Term Investments | 99.8% |

Other assets in excess of liabilities | 0.2% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer Trendpilot® International Index. |

Pacer Trendpilot® US Bond ETF

Industry(a) | Percentage of |

Advertising | 0.6% |

Aerospace/Defense | 2.0% |

Agriculture | 0.3% |

Airlines | 1.7% |

Apparel | 0.2% |

Auto Manufacturers | 3.4% |

Auto Parts & Equipment | 1.0% |

Banks | 2.1% |

Beverages | 0.1% |

Biotechnology | 0.1% |

Building Materials | 1.2% |

Chemicals | 2.1% |

Commercial Services | 3.9% |

Computers | 1.1% |

Cosmetics/Personal Care | 0.2% |

Distribution/Wholesale | 0.2% |

Diversified Financial Services | 3.1% |

Electric | 2.4% |

Electrical Components & Equipment | 0.1% |

Electronics | 0.4% |

Energy-Alternate Sources | 0.2% |

Engineering & Construction | 0.5% |

Entertainment | 2.9% |

2

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of October 31, 2022

Pacer Trendpilot® US Bond ETF (Continued) | |

Industry(a) | Percentage of |

Environmental Control | 0.6% |

Food | 1.8% |

Food Service | 0.4% |

Forest Products & Paper | 0.2% |

Gas | 0.2% |

Healthcare-Products | 0.8% |

Healthcare-Services | 6.4% |

Home Builders | 0.2% |

Home Furnishings | 0.2% |

Housewares | 0.4% |

Insurance | 0.6% |

Internet | 1.8% |

Investment Companies | 0.6% |

Iron/Steel | 0.6% |

Leisure Time | 2.1% |

Lodging | 2.0% |

Machinery-Construction & Mining | 0.2% |

Machinery-Diversified | 0.4% |

Media | 10.2% |

Mining | 1.9% |

Miscellaneous Manufacturing | 0.4% |

Office/Business Equipment | 0.6% |

Oil & Gas | 6.0% |

Oil & Gas Services | 0.5% |

Packaging & Containers | 2.3% |

Pharmaceuticals | 1.6% |

Pipelines | 5.4% |

Real Estate | 4.9% |

Retail | 4.9% |

Semiconductors | 0.6% |

Software | 2.2% |

Telecommunications | 6.8% |

Toys/Games/Hobbies | 0.2% |

Transportation | 0.1% |

Trucking & Leasing | 0.2% |

Investments Purchased with Proceeds from Securities Lending | 3.9% |

Liabilities in excess of other assets | -2.4% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer Trendpilot® US Bond Index. |

3

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of October 31, 2022

Pacer Trendpilot® Fund of Funds ETF

Industry(a) | Percentage of |

Affiliated Exchange Traded Funds | 99.8% |

Short-Term Investments | 0.2% |

Liabilities in excess of other assets | 0.0%* |

Total | 100.0% |

* | Less than 0.05%. |

(a) | The Fund may classify a company in a different category than the Pacer Trendpilot® Fund of Funds Index. |

Pacer Global Cash Cows Dividend ETF

Industry(a) | Percentage of |

Automobiles & Components | 10.4% |

Capital Goods | 8.1% |

Commercial & Professional Services | 0.4% |

Consumer Durables & Apparel | 0.1% |

Consumer Services | 0.1% |

Energy | 8.1% |

Food & Staples Retailing | 2.6% |

Food, Beverage & Tobacco | 12.0% |

Health Care Equipment & Services | 0.3% |

Household & Personal Products | 2.7% |

Materials | 15.8% |

Media & Entertainment | 1.3% |

Pharmaceuticals, Biotechnology | 12.9% |

Real Estate | 0.4% |

Retailing | 1.0% |

Software & Services | 3.2% |

Technology Hardware & Equipmen | 1.3% |

Telecommunication Services | 12.6% |

Transportation | 5.2% |

Utilities | 1.3% |

Short-Term Investments | 0.0%* |

Investments Purchased with Proceeds from Securities Lending | 13.8% |

Liabilities in excess of other assets | -13.6% |

Total | 100.0% |

* | Less than 0.05%. |

(a) | The Fund may classify a company in a different category than the Pacer Global Cash Cows Dividend 100 Index. |

4

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of October 31, 2022

Pacer US Cash Cows 100 ETF

Industry(a) | Percentage of |

Automobiles & Components | 0.3% |

Capital Goods | 1.7% |

Commercial & Professional Services | 0.7% |

Consumer Durables & Apparel | 1.7% |

Consumer Services | 3.7% |

Diversified Financials | 1.8% |

Energy | 29.7% |

Food & Staples Retailing | 0.6% |

Food, Beverage & Tobacco | 2.0% |

Health Care Equipment & Services | 6.8% |

Materials | 16.5% |

Media & Entertainment | 3.0% |

Pharmaceuticals, Biotechnology | 16.5% |

Real Estate | 1.3% |

Retailing | 1.5% |

Semiconductors & Semiconductor | 2.0% |

Software & Services | 1.8% |

Technology Hardware & Equipment | 5.2% |

Telecommunication Services | 0.9% |

Transportation | 0.8% |

Utilities | 1.2% |

Short-Term Investments | 0.1% |

Investments Purchased with Proceeds from Securities Lending | 12.9% |

Liabilities in excess of other assets | -12.7% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer US Cash Cows 100 Index. |

5

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of October 31, 2022

Pacer US Small Cap Cash Cows 100 ETF

Industry(a) | Percentage of |

Automobiles & Components | 2.3% |

Capital Goods | 9.2% |

Commercial & Professional Services | 4.6% |

Consumer Durables & Apparel | 6.6% |

Consumer Services | 5.4% |

Diversified Financials | 1.8% |

Energy | 11.1% |

Food, Beverage & Tobacco | 1.2% |

Health Care Equipment & Services | 5.8% |

Household & Personal Products | 0.3% |

Materials | 8.9% |

Media & Entertainment | 2.9% |

Pharmaceuticals, Biotechnology | 5.4% |

Real Estate | 1.0% |

Retailing | 14.0% |

Semiconductors & Semiconductor | 6.9% |

Software & Services | 3.7% |

Technology Hardware & Equipment | 3.8% |

Transportation | 5.1% |

Short-Term Investments | 0.1% |

Investments Purchased with Proceeds from Securities Lending | 29.9% |

Liabilities in excess of other assets | -30.0% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer US Small Cap Cash Cows 100 Index. |

6

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of October 31, 2022

Pacer Developed Markets International Cash Cows 100 ETF

Industry(a) | Percentage of |

Automobiles & Components | 8.7% |

Capital Goods | 11.1% |

Commercial & Professional Services | 0.9% |

Consumer Durables & Apparel | 1.7% |

Energy | 23.0% |

Food & Staples Retailing | 1.3% |

Food, Beverage & Tobacco | 5.1% |

Health Care Equipment & Services | 0.6% |

Materials | 14.0% |

Media & Entertainment | 5.6% |

Pharmaceuticals, Biotechnology | 3.7% |

Retailing | 5.2% |

Semiconductors & Semiconductor | 2.7% |

Software & Services | 0.6% |

Technology Hardware & Equipment | 2.6% |

Telecommunication Services | 2.8% |

Transportation | 8.6% |

Utilities | 1.4% |

Short-Term Investments | 0.1% |

Investments Purchased with Proceeds from Securities Lending | 11.5% |

Liabilities in excess of other assets | -11.2% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer Developed Markets International Cash Cows 100 Index. |

Pacer US Cash Cows Growth ETF

Industry(a) | Percentage of |

Capital Goods | 1.6% |

Commercial & Professional Services | 0.8% |

Consumer Durables & Apparel | 1.0% |

Consumer Services | 2.2% |

Energy | 12.8% |

Health Care Equipment & Services | 1.2% |

Materials | 4.3% |

Media & Entertainment | 7.7% |

Pharmaceuticals, Biotechnology | 13.4% |

Retailing | 18.1% |

Semiconductors & Semiconductor | 20.8% |

Software & Services | 8.1% |

Technology Hardware & Equipment | 5.1% |

Transportation | 1.7% |

Utilities | 1.1% |

Short-Term Investments | 0.1% |

Investments Purchased with Proceeds from Securities Lending | 13.6% |

Liabilities in excess of other assets | -13.6% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer US Cash Cows Growth Index. |

7

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of October 31, 2022

Pacer Emerging Markets Cash Cows 100 ETF

Industry(a) | Percentage of |

Automobiles & Components | 2.9% |

Capital Goods | 6.5% |

Consumer Services | 0.4% |

Energy | 15.3% |

Food & Staples Retailing | 2.0% |

Food, Beverage & Tobacco | 6.3% |

Health Care Equipment & Services | 0.1% |

Household & Personal Products | 0.5% |

Materials | 21.4% |

Media & Entertainment | 0.7% |

Pharmaceuticals, Biotechnology | 1.7% |

Real Estate | 1.0% |

Retailing | 5.2% |

Semiconductors & Semiconductor | 4.6% |

Software & Services | 0.3% |

Technology Hardware & Equipment | 4.9% |

Telecommunication Services | 13.1% |

Transportation | 6.1% |

Utilities | 5.3% |

Short-Term Investments | 1.0% |

Investments Purchased with Proceeds from Securities Lending | 1.8% |

Liabilities in excess of other assets | -1.1% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer Emerging Markets Cash Cows 100 Index. |

Pacer Cash Cows Fund of Funds ETF

Industry(a) | Percentage of |

Affiliated Exchange Traded Funds | 99.9% |

Short-Term Investments | 0.1% |

Liabilities in excess of other assets | 0.0%* |

Total | 100.0% |

* | Less than 0.05%. |

(a) | The Fund may classify a company in a different category than the Pacer Cash Cows Fund of Funds Index. |

Pacer WealthShield ETF

Industry(a) | Percentage of |

Energy | 20.1% |

Health Care Equipment & Servic | 8.5% |

Pharmaceuticals, Biotechnology | 11.7% |

Short-Term Investments | 67.0% |

Investments Purchased with Proceeds from Securities Lending | 0.0% |

Liabilities in excess of other assets | -7.3% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer WealthShield Index. |

8

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of October 31, 2022

Pacer Industrial Real Estate ETF

Industry(a) | Percentage of |

Common Stock | 5.1% |

Real Estate Investment Trusts | 91.7% |

Short-Term Investments | 0.3% |

Investments Purchased with Proceeds from Securities Lending | 14.7% |

Liabilities in excess of other assets | -11.8% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Kelly Industrial Real Estate Index. |

Pacer Data & Infrastructure Real Estate ETF

Industry(a) | Percentage of |

Common Stocks | 33.0% |

Real Estate Investment Trusts | 66.2% |

Short-Term Investments | 0.2% |

Investments Purchased with Proceeds from Securities Lending | 7.6% |

Liabilities in excess of other assets | -7.0% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than theKelly Data Center & Tech Infrastructure Index. |

Pacer CFRA-Stovall Equal Weight Seasonal Rotation ETF

Industry(a) | Percentage of |

Automobiles & Components | 2.1% |

Capital Goods | 16.5% |

Commercial & Professional Services | 3.8% |

Consumer Durables & Apparel | 5.4% |

Consumer Services | 7.8% |

Materials | 24.6% |

Retailing | 9.5% |

Semiconductors & Semiconductor | 6.3% |

Software & Services | 12.2% |

Technology Hardware & Equipment | 6.5% |

Transportation | 4.7% |

Short-Term Investments | 0.1% |

Investments Purchased with Proceeds from Securities Lending | 13.1% |

Liabilities in excess of other assets | -12.6% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer CFRA-Stovall Equal Weight Seasonal Rotation Index. |

9

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of October 31, 2022

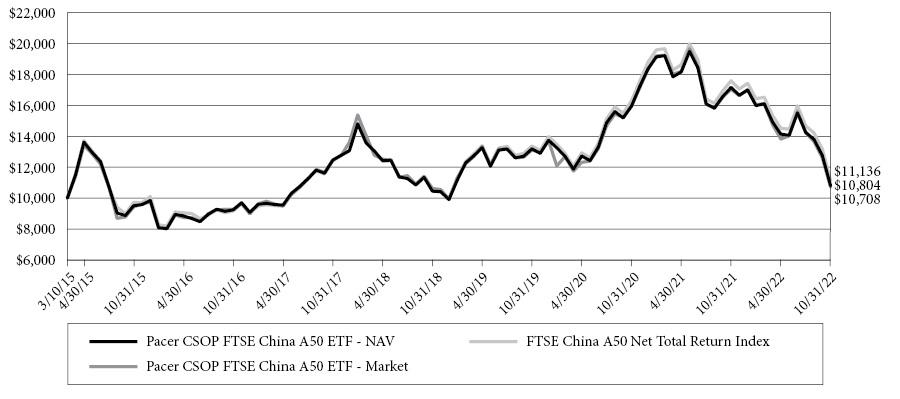

Pacer CSOP FTSE China A50 ETF

Industry(a) | Percentage of |

Automobiles & Components | 5.0% |

Banks | 18.7% |

Capital Goods | 9.6% |

Consumer Durables & Apparel | 1.0% |

Diversified Financials | 3.1% |

Energy | 4.9% |

Food, Beverage & Tobacco | 28.7% |

Health Care Equipment & Services | 3.0% |

Insurance | 3.0% |

Materials | 3.1% |

Pharmaceuticals, Biotechnology | 3.4% |

Real Estate | 1.0% |

Retailing | 2.4% |

Semiconductors & Semiconductor | 2.7% |

Technology Hardware & Equipment | 2.3% |

Transportation | 3.8% |

Utilities | 3.5% |

Short-Term Investments | 0.7% |

Other assets in excess of liabilities | 0.1% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the FTSE China A50 Net Total Return Index. |

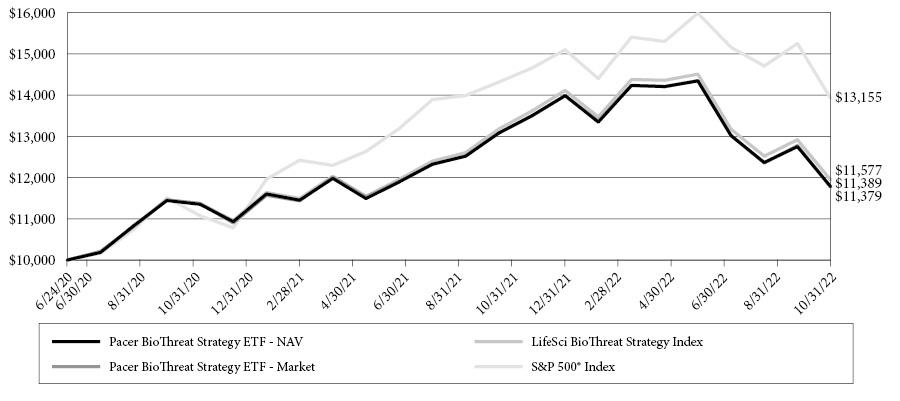

Pacer BioThreat Strategy ETF

Industry(a) | Percentage of |

Capital Goods | 3.5% |

Commercial & Professional Services | 0.7% |

Food & Staples Retailing | 8.2% |

Food, Beverage & Tobacco | 1.6% |

Health Care Equipment & Services | 10.8% |

Household & Personal Products | 3.6% |

Materials | 1.8% |

Media & Entertainment | 5.0% |

Pharmaceuticals, Biotechnology | 43.6% |

Retailing | 14.3% |

Semiconductors & Semiconductor | 3.9% |

Software & Services | 2.2% |

Technology Hardware & Equipment | 0.7% |

Short-Term Investments | 0.1% |

Investments Purchased with Proceeds from Securities Lending | 10.5% |

Liabilities in excess of other assets | -10.5% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the BioShares BioThreat Index. |

10

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of October 31, 2022

Pacer Lunt Large Cap Alternator ETF

Industry(a) | Percentage of |

Automobiles & Components | 4.2% |

Banks | 1.7% |

Capital Goods | 2.4% |

Commercial & Professional Services | 0.8% |

Consumer Durables & Apparel | 4.7% |

Consumer Services | 11.6% |

Diversified Financials | 6.5% |

Energy | 1.4% |

Health Care Equipment & Services | 4.4% |

Household & Personal Products | 0.8% |

Insurance | 1.2% |

Materials | 2.3% |

Media & Entertainment | 6.2% |

Pharmaceuticals, Biotechnology | 2.9% |

Retailing | 4.8% |

Semiconductors & Semiconductor | 17.5% |

Software & Services | 17.7% |

Technology Hardware & Equipment | 5.4% |

Transportation | 3.5% |

Short-Term Investments | 0.1% |

Investments Purchased with Proceeds from Securities Lending | 10.6% |

Liabilities in excess of other assets | -10.7% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Lunt Capital U.S. Large Cap Equity Rotation Index. |

11

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of October 31, 2022

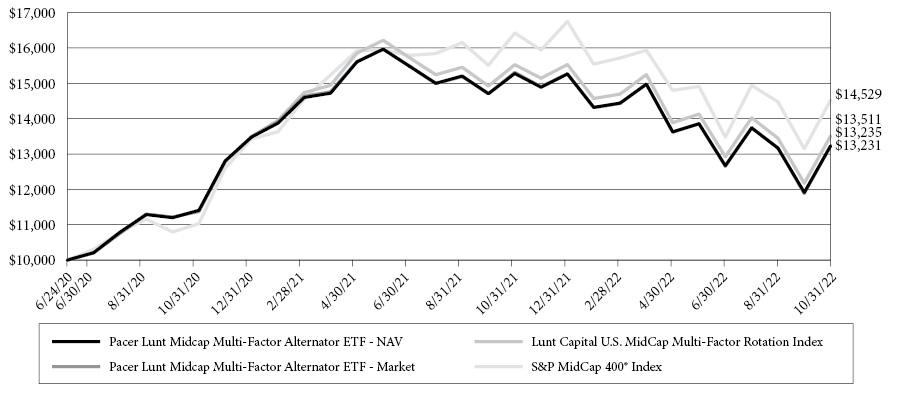

Pacer Lunt Midcap Multi-Factor Alternator ETF

Industry(a) | Percentage of |

Automobiles & Components | 2.7% |

Capital Goods | 10.9% |

Commercial & Professional Services | 2.0% |

Consumer Durables & Apparel | 3.8% |

Consumer Services | 5.5% |

Energy | 7.0% |

Food & Staples Retailing | 0.6% |

Food, Beverage & Tobacco | 1.0% |

Health Care Equipment & Services | 13.5% |

Household & Personal Products | 1.2% |

Insurance | 0.8% |

Materials | 2.8% |

Media & Entertainment | 1.8% |

Pharmaceuticals, Biotechnology | 7.3% |

Real Estate | 2.1% |

Retailing | 10.6% |

Semiconductors & Semiconductor | 8.3% |

Software & Services | 9.8% |

Technology Hardware & Equipment | 3.2% |

Telecommunication Services | 0.8% |

Transportation | 4.2% |

Short-Term Investments | 0.1% |

Investments Purchased with Proceeds from Securities Lending | 22.2% |

Liabilities in excess of other assets | -22.2% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Lunt Capital U.S. MidCap Multi-Factor Rotation Index. |

12

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of October 31, 2022

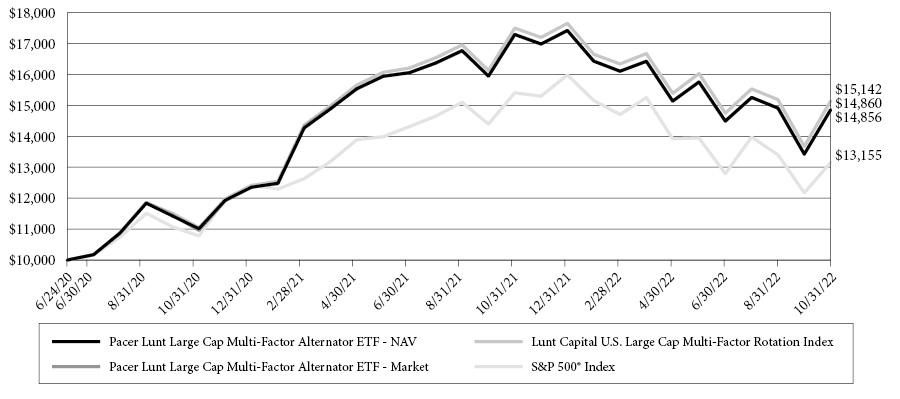

Pacer Lunt Large Cap Multi-Factor Alternator ETF

Industry(a) | Percentage of |

Automobiles & Components | 2.4% |

Banks | 0.8% |

Capital Goods | 4.1% |

Commercial & Professional Services | 1.1% |

Consumer Durables & Apparel | 0.9% |

Consumer Services | 11.4% |

Diversified Financials | 3.6% |

Energy | 1.8% |

Food & Staples Retailing | 0.4% |

Food, Beverage & Tobacco | 5.3% |

Health Care Equipment & Services | 6.0% |

Household & Personal Products | 1.9% |

Insurance | 0.5% |

Materials | 1.3% |

Media & Entertainment | 1.5% |

Pharmaceuticals, Biotechnology | 6.8% |

Real Estate | 5.4% |

Retailing | 12.1% |

Semiconductors & Semiconductor | 6.0% |

Software & Services | 18.1% |

Technology Hardware & Equipment | 5.4% |

Transportation | 0.9% |

Utilities | 1.8% |

Short-Term Investments | 0.5% |

Investments Purchased with Proceeds from Securities Lending | 9.7% |

Liabilities in excess of other assets | -9.7% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Lunt Capital U.S. Large Cap Multi-Factor Rotation Index. |

13

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of October 31, 2022

Pacer US Export Leaders ETF

Industry(a) | Percentage of |

Automobiles & Components | 1.9% |

Capital Goods | 5.3% |

Commercial & Professional Services | 1.1% |

Consumer Durables & Apparel | 0.9% |

Consumer Services | 3.1% |

Diversified Financials | 1.0% |

Energy | 4.9% |

Food, Beverage & Tobacco | 3.1% |

Health Care Equipment & Services | 3.7% |

Household & Personal Products | 2.8% |

Materials | 10.9% |

Media & Entertainment | 4.9% |

Pharmaceuticals, Biotechnology | 12.8% |

Real Estate | 0.9% |

Semiconductors & Semiconductor | 20.0% |

Software & Services | 11.2% |

Technology Hardware & Equipment | 10.4% |

Transportation | 1.0% |

Short-Term Investments | 0.1% |

Investments Purchased with Proceeds from Securities Lending | 15.2% |

Liabilities in excess of other assets | -15.2% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer US Export Leaders Index. |

14

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of October 31, 2022

Pacer Pacific Asset Floating Rate High Income ETF

Industry(a) | Percentage of |

Advertising | 1.6% |

Aerospace/Defense | 2.6% |

Airlines | 2.7% |

Building Materials | 2.0% |

Chemicals | 0.5% |

Coal | 0.0% |

Commercial Services | 1.9% |

Computers | 3.3% |

Cosmetics/Personal Care | 0.6% |

Diversified Financial Services | 2.3% |

Electronics | 0.6% |

Entertainment | 3.0% |

Environmental Control | 3.5% |

Food | 1.3% |

Healthcare-Services | 3.6% |

Insurance | 0.9% |

Internet | 2.0% |

Leisure Time | 2.3% |

Lodging | 2.0% |

Machinery-Diversified | 6.6% |

Media | 2.0% |

Mining | 1.7% |

Packaging & Containers | 2.6% |

Pharmaceuticals | 0.9% |

Pipelines | 2.6% |

Real Estate | 0.6% |

Retail | 6.3% |

Semiconductors | 0.8% |

Software | 2.2% |

Telecommunications | 1.3% |

Transportation | 1.4% |

Asset Backed Securities | 30.2% |

Exchange Traded Funds | 1.6% |

Closed End Funds | 0.0%* |

Short-Term Investments | 8.0% |

Liabilities in excess of other assets | -5.5% |

Total | 100.0% |

15

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of October 31, 2022

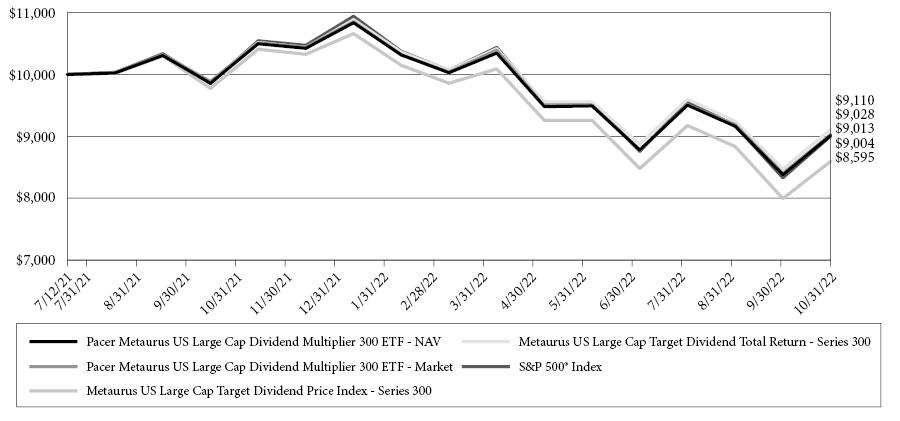

Pacer Metaurus US Large Cap Dividend Multiplier 300 ETF

Industry(a) | Percentage of |

Automobiles & Components | 2.1% |

Banks | 3.6% |

Capital Goods | 5.3% |

Commercial & Professional Services | 0.8% |

Consumer Durables & Apparel | 0.7% |

Consumer Services | 1.8% |

Diversified Financials | 4.8% |

Energy | 5.0% |

Food & Staples Retailing | 1.5% |

Food, Beverage & Tobacco | 3.4% |

Health Care Equipment & Services | 5.9% |

Household & Personal Products | 1.4% |

Insurance | 2.2% |

Materials | 2.3% |

Media & Entertainment | 5.7% |

Pharmaceuticals, Biotechnology | 8.2% |

Real Estate | 2.4% |

Retailing | 5.4% |

Semiconductors & Semiconductor | 4.4% |

Software & Services | 11.7% |

Technology Hardware & Equipment | 8.2% |

Telecommunication Services | 1.1% |

Transportation | 1.5% |

Utilities | 2.7% |

Short-Term Investments | 2.1% |

Other assets in excess of liabilities | 5.8% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Metaurus US Large Cap Dividend Multiplier Total Return - Series 300. |

16

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of October 31, 2022

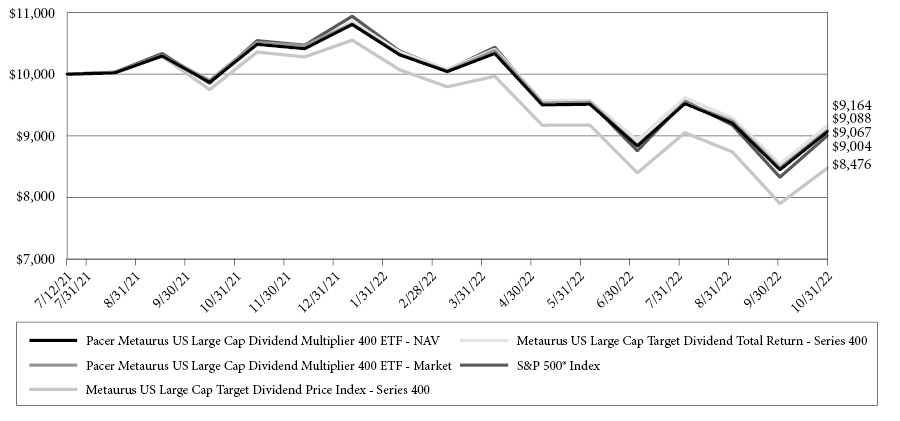

Pacer Metaurus US Large Cap Dividend Multiplier 400 ETF

Industry(a) | Percentage of |

Automobiles & Components | 2.0% |

Banks | 3.4% |

Capital Goods | 5.1% |

Commercial & Professional Serv | 0.8% |

Consumer Durables & Apparel | 0.7% |

Consumer Services | 1.8% |

Diversified Financials | 4.6% |

Energy | 4.7% |

Food & Staples Retailing | 1.4% |

Food, Beverage & Tobacco | 3.3% |

Health Care Equipment & Servic | 5.7% |

Household & Personal Products | 1.4% |

Insurance | 2.1% |

Materials | 2.2% |

Media & Entertainment | 5.4% |

Pharmaceuticals, Biotechnology | 7.8% |

Real Estate | 2.3% |

Retailing | 5.1% |

Semiconductors & Semiconductor | 4.2% |

Software & Services | 11.2% |

Technology Hardware & Equipmen | 7.8% |

Telecommunication Services | 1.0% |

Transportation | 1.5% |

Utilities | 2.6% |

Short-Term Investments | 10.0% |

Other assets in excess of liabilities | 1.9% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Metaurus US Large Cap Dividend Multiplier Total Return - Series 400. |

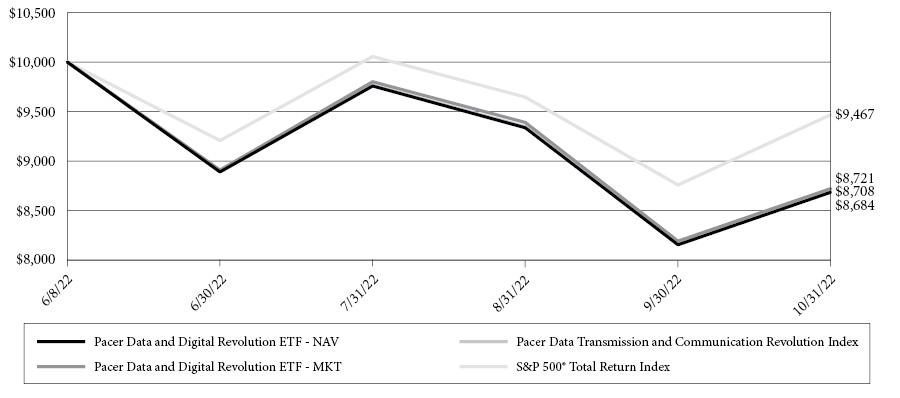

Pacer Data and Digital Revolution ETF

Industry(a) | Percentage of |

Capital Goods | 7.3% |

Semiconductors & Semiconductor | 29.1% |

Software & Services | 35.9% |

Technology Hardware & Equipment | 27.4% |

Short-Term Investments | 0.3% |

Liabilities in excess of other assets | 0.0%* |

Total | 100.0% |

* | Less than 0.05%. |

(a) | The Fund may classify a company in a different category than the Pacer Data Transmission and Communication Revolution Index. |

17

Pacer Funds

PORTFOLIO ALLOCATION (Unaudited) (Continued)

As of October 31, 2022

Pacer Industrials and Logistics ETF

Industry(a) | Percentage of |

Capital Goods | 5.6% |

Commercial & Professional Serv | 0.5% |

Energy | 0.1% |

Pharmaceuticals, Biotechnology | 0.1% |

Retailing | 0.2% |

Software & Services | 15.6% |

Technology Hardware & Equipmen | 1.6% |

Transportation | 73.4% |

Exchange Traded Funds | 2.4% |

Short-Term Investments | 0.3% |

Other assets in excess of liabilities | 0.2% |

Total | 100.0% |

(a) | The Fund may classify a company in a different category than the Pacer Global Supply Chain Infrastructure Index. |

18

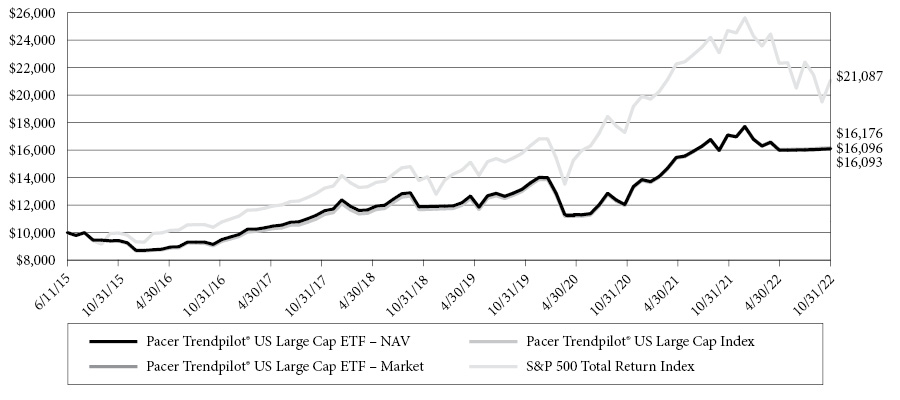

Pacer Trendpilot® US Large Cap ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on June 11, 2015, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Trendpilot® US Large Cap Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure (i) 100% to the S&P 500 Total Return Index, (ii) 50% to the S&P 500 Total Return Index and 50% to 3-Month US Treasury bills, or (iii) 100% to 3-Month US Treasury bills, depending on the relative performance of the S&P 500 Total Return Index and its 200-business day historical simple moving average.

The S&P 500 Total Return Index consists of approximately 500 leading U.S.-listed companies representing approximately 80% of the U.S. equity market capitalization.

Annualized Returns(1)

(For the Periods Ended October 31, 2022)

One Year | Three Year | Five Year | Since Inception(2) | |

Pacer Trendpilot® US Large Cap ETF - NAV | -5.83% | 7.00% | 7.42% | 6.65% |

Pacer Trendpilot® US Large Cap ETF - Market | -5.81% | 6.99% | 7.39% | 6.65% |

Pacer Trendpilot® US Large Cap Index(3) | -5.31% | 7.61% | 8.06% | 7.29% |

S&P 500® Total Return Index (3) | -14.61% | 10.22% | 10.44% | 10.62% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated August 31, 2022, is 0.60%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is June 11, 2015. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

19

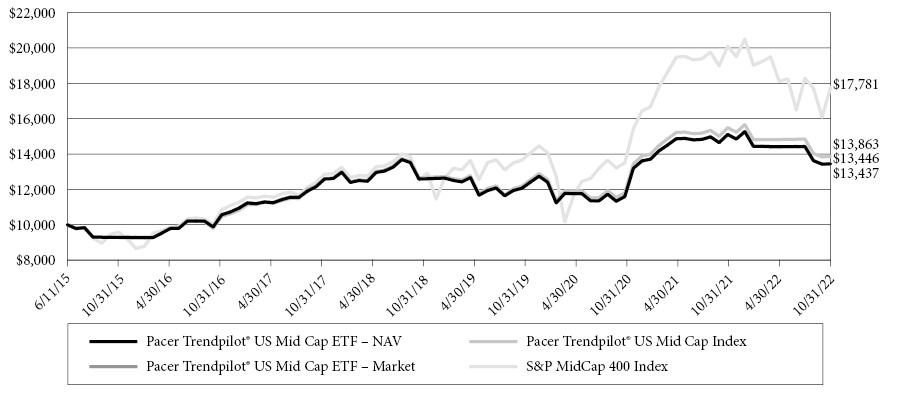

Pacer Trendpilot® US Mid Cap ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on June 11, 2015, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Trendpilot® US Mid Cap Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure (i) 100% to the S&P MidCap 400 Index, (ii) 50% to the S&P MidCap 400 Index and 50% to 3-Month US Treasury bills, or (iii) 100% to 3-Month US Treasury bills, depending on the relative performance of the S&P MidCap 400 Total Return Index and its 200-business day historical simple moving average.

The S&P Midcap 400 Index measures the performance of mid-capitalization stocks in the United States.

Annualized Returns(1)

(For the Periods Ended October 31, 2022)

One Year | Three Year | Five Year | Since Inception(2) | |

Pacer Trendpilot® US Mid Cap ETF - NAV | -10.98% | 3.69% | 2.05% | 4.09% |

Pacer Trendpilot® US Mid Cap ETF - Market | -11.07% | 3.67% | 1.98% | 4.08% |

Pacer Trendpilot® US Mid Cap Index(3) | -10.51% | 4.42% | 2.65% | 4.73% |

S&P MidCap 400 Index(3) | -11.54% | 9.20% | 7.47% | 8.10% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated August 31, 2022, is 0.60%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is June 11, 2015. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

20

Pacer Trendpilot® 100 ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on June 11, 2015, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

Pacer NASDAQ-100 Trendpilot® Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure (i) 100% to the NASDAQ-100 Index, (ii) 50% to the NASDAQ-100 Index and 50% to 3-Month US Treasury bills, or (iii) 100% to 3-Month US Treasury bills, depending on the relative performance of the NASDAQ-100 Index and its 200-business day historical simple moving average.

The NASDAQ-100 Index includes approximately 100 of the largest non-financial securities listed on The NASDAQ Stock Market based on market capitalization. The NASDAQ-100 Index comprises securities of companies across major industry groups, including computer, biotechnology, healthcare, telecommunications and transportation. However, it does not contain securities of financial companies, including investment companies. The NASDAQ-100 Index was developed by NASDAQ OMX. There is no minimum market capitalization requirement for inclusion in the NASDAQ-100 Index. Inclusion is determined based on the top 100 largest issuers based on market capitalization meeting all other eligibility requirements.

Annualized Returns(1)

(For the Periods Ended October 31, 2022)

One Year | Three Year | Five Year | Since Inception(2) | |

Pacer Trendpilot® 100 ETF - NAV | -13.47% | 10.50% | 11.55% | 10.20% |

Pacer Trendpilot® 100 ETF - Market | -13.63% | 10.43% | 11.50% | 10.18% |

Pacer NASDAQ-100 Trendpilot® Index(3) | -13.05% | 11.07% | 12.13% | 10.84% |

NASDAQ-100 Index(3) | -27.46% | 13.08% | 13.84% | 14.60% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated August 31, 2022, as supplemented October 18, 2022, is 0.65%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is June 11, 2015. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

21

Pacer Trendpilot® European Index ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 14, 2015, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Trendpilot® European Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure (i) 100% to the FTSE Eurozone Index, (ii) 50% to the FTSE Eurozone Index and 50% to 3-Month US Treasury bills, or (iii) 100% to 3-Month US Treasury bills, depending on the relative performance of the FTSE Eurozone Total Return Index and its 200-business day historical simple moving average.

The FTSE Eurozone Index is a rules-based, float-adjusted, market capitalization-weighted index comprised of large- and mid-capitalization stocks providing coverage of the developed markets in the euro zone, including primarily France, Germany, Spain, the Netherlands, and Italy. The FTSE Eurozone Index is a subset of the FTSE Global Equity Index Series, which covers 99% of the investable market capitalization globally.

Annualized Returns(1)

(For the Periods Ended October 31, 2022)

One Year | Three Year | Five Year | Since Inception(2) | |

Pacer Trendpilot® European Index ETF - NAV | -9.78% | -4.69% | -4.55% | -0.46% |

Pacer Trendpilot® European Index ETF - Market | -9.94% | -4.63% | -4.79% | -0.48% |

Pacer Trendpilot® European Index(3) | -9.10% | -3.40% | -3.14% | 0.92% |

FTSE Eurozone Index(3) | -27.32% | -1.64% | -1.06% | 3.72% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated August 31, 2022, is 0.65%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is December 14, 2015. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

22

Pacer Trendpilot® International ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on May 2, 2019, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Trendpilot International Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure (i) 100% to the S&P Developed Ex-U.S. LargeCap Index, (ii) 50% to the S&P Developed Ex-U.S. LargeCap Index and 50% to 3-Month US Treasury bills, or (iii) 100% to 3-Month US Treasury bills, depending on the relative performance of the S&P Developed Ex-U.S. LargeCap Index and its 200-business day historical simple moving average (the “200-day moving average”).

The S&P Developed Ex-US LargeCap Index is a rules-based, float-adjusted, market capitalization-weighted index comprised of large-capitalization stocks providing coverage of the developed markets excluding the United States.

Annualized Returns(1)

(For the Periods Ended October 31, 2022)

One Year | Three Year | Since Inception(2) | |

Pacer Trendpilot International ETF - NAV | -14.80% | -0.34% | 0.74% |

Pacer Trendpilot International ETF - Market | -15.11% | -0.53% | 0.71% |

Pacer Trendpilot International Index | -14.38% | 0.53% | 1.57% |

S&P Developed Ex-US Large Cap Index(3) | -21.97% | 0.45% | 1.57% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated August 31, 2022, is 0.68%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is May 2, 2019. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

23

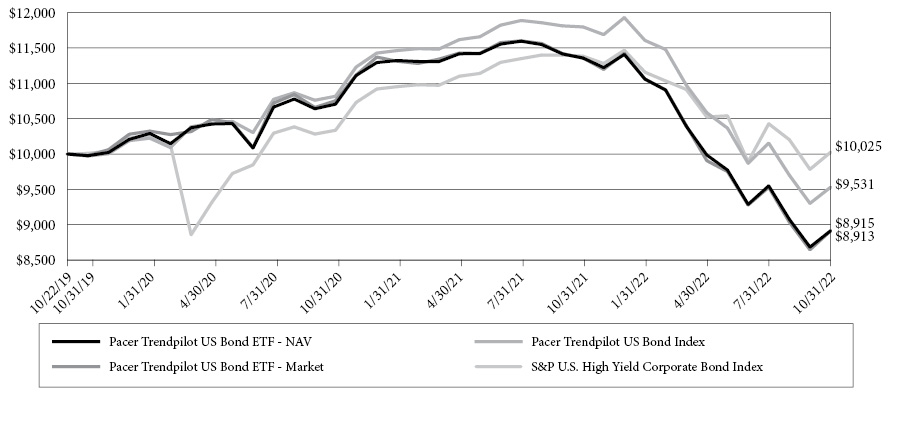

Pacer Trendpilot® US Bond ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on October 22, 2019, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Trendpilot US Bond Index uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure to one of the following positions: (i) 100% to the S&P U.S. High Yield Corporate Bond Index, (ii) 50% to the S&P U.S. High Yield Corporate Bond Index and 50% to the S&P U.S. Treasury Bond 7-10 Year Index or (iii) 100% to S&P U.S. Treasury Bond 7-10 Year Index.

The S&P U.S. High Yield Corporate Bond Index is designed to track the performance of U.S. dollar-denominated, high-yield corporate bonds issued in the U.S. The S&P U.S. Treasury Bond 7-10 Year Index is designed to measure the performance of U.S. Treasury bonds maturing in 7 to 10 years.

Annualized Returns(1)

(For the Periods Ended October 31, 2022)

One Year | Three Year | Since Inception(2) | |

Pacer Trendpilot US Bond ETF - NAV | -21.51% | -3.68% | -3.73% |

Pacer Trendpilot US Bond ETF - Market | -21.53% | -3.69% | -3.73% |

Pacer Trendpilot US Bond Index(3) | -19.21% | -1.50% | -1.58% |

S&P U.S. High Yield Corporate Bond IndexTM(3) | -11.94% | 0.05% | 0.08% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated August 31, 2022, as supplemented July 1, 2022, is 0.60%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is October 22, 2019. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

24

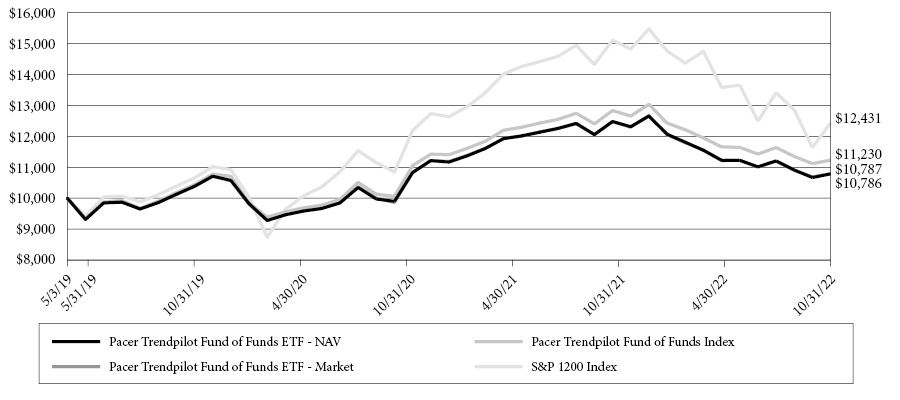

Pacer Trendpilot® Fund of Funds ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on May 3, 2019, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Trendpilot Fund of Funds Index uses an objective, rules-based approach to construct a portfolio that, as of each quarterly rebalance, is composed of the ETFs listed in the following table, each advised by the Adviser (collectively, the “Trendpilot ETFs”). Each of the Trendpilot ETFs is an index-based ETF that seeks to track the total return performance, before fees and expenses, of the underlying index listed in the following table (collectively, the “Trendpilot Indexes”). Each Trendpilot Index other than the Pacer Trendpilot US Bond Index (collectively, the “Trendpilot Equity Indexes”) uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure (i) 100% to the “Underlying Component” specified in the table below, (ii) 50% to the applicable Underlying Component and 50% to 3-Month US Treasury bills, or (iii) 100% to 3-Month US Treasury bills, depending on the relative performance of the Underlying Component and its 200 business day historical simple moving average (the “200-day moving average”). The calculation of the 200-day moving average for each Underlying Component is based on the total return version of such Underlying Component and reflects the reinvestment of dividends paid by the securities in such Underlying Component. The Pacer Trendpilot US Bond Index (the “Trendpilot Bond Index”) uses an objective, rules-based methodology to implement a systematic trend-following strategy that directs exposure to one of the following positions: (i) 100% to the S&P U.S. High Yield Corporate Bond Index, (ii) 50% to the S&P U.S. High Yield Corporate Bond Index and 50% to the S&P U.S. Treasury Bond 7-10 Year Index or (iii) 100% to S&P U.S. Treasury Bond 7-10 Year Index, depending on the value of the S&P U.S. High Yield Corporate Bond Index divided by the value of the S&P U.S. Treasury Bond 7-10 Year Index (the “Risk Ratio”).

Weight | Trendpilot ETF | Trendpilot Index | Equity Component |

20% | Pacer Trendpilot® US Large Cap ETF | Pacer Trendpilot® US Large Cap Index | S&P 500® Index |

20% | Pacer Trendpilot® US Mid Cap ETF | Pacer Trendpilot® US Mid Cap Index | S&P MidCap 400® Index |

20% | Pacer Trendpilot® 100 ETF | Pacer NASDAQ-100 Trendpilot® Index | NASDAQ-100® Index |

20% | Pacer Trendpilot® International ETF | Pacer Trendpilot® International Index | S&P Developed Ex-US Large Cap Index |

20% | Pacer Trendpilot® US Bond ETF | Pacer Trendpilot® US Bond Index | S&P U.S. High Yield Corporate Bond Index |

The S&P 1200 Index captures approximately 70% of global market capitalization.

25

Pacer Trendpilot® Fund of Funds ETF

PERFORMANCE SUMMARY (Continued)

(Unaudited)

Annualized Returns(1)

(For the Periods Ended October 31, 2022)

One Year | Three Year | Since Inception(2) | |

Pacer Trendpilot Fund of Funds ETF - NAV | -13.56% | 2.13% | 2.19% |

Pacer Trendpilot Fund of Funds ETF - Market | -13.53% | 2.15% | 2.19% |

Pacer Trendpilot Fund of Funds Index(3) | -12.49% | 3.33% | 3.37% |

S&P 1200 Index(3) | -17.71% | 6.17% | 6.42% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated August 31, 2022, is 0.77%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is May 3, 2019. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

26

Pacer Global Cash Cows Dividend ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on February 22, 2016, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Global Cash Cows Dividend Index uses an objective, rules-based methodology to provide exposure to global companies with high dividend yield backed by a high free cash flow yield. The initial index universe is derived from the component companies of the FTSE All-World Developed Large Cap Index. The initial universe of companies is screened based on their average projected free cash flows and earnings (if available) over each of the next two fiscal years. Companies with negative average projected free cash flows or earnings are removed from the Index universe. Additionally, financial companies, other than real estate investment trusts, are excluded from the Index universe. The remaining companies are ranked by their free cash flow yield for the trailing twelve month period. The 300 companies with the highest free cash flow yield are then ranked by their dividend yield. The equity securities of the 100 companies with the highest dividend yield are included in the Index.

The FTSE All-World Developed Large-Cap Index is a market-capitalization weighted index representing the performance of large-cap stocks in developed markets.

Annualized Returns(1)

(For the Periods Ended October 31, 2022)

One Year | Three Year | Five Year | Since Inception(2) | |

Pacer Global Cash Cows Dividend ETF - NAV | 0.04% | 2.86% | 3.46% | 6.15% |

Pacer Global Cash Cows Dividend ETF - Market | 0.09% | 2.91% | 3.30% | 6.14% |

Pacer Global Cash Cows Dividend Index(3) | 0.89% | 3.75% | 4.37% | 7.08% |

FTSE All-World Developed Large-Cap Index(3) | -18.40% | 6.58% | 6.94% | 10.26% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated August 31, 2022, is 0.60%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is February 22, 2016. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

27

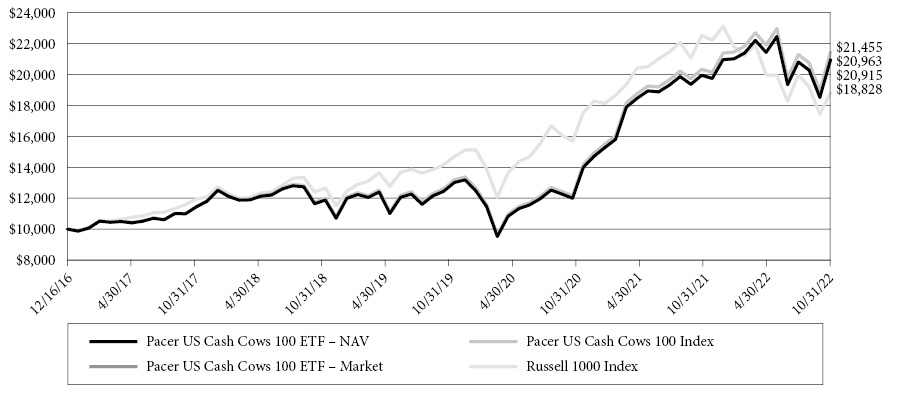

Pacer US Cash Cows 100 ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 16, 2016, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer US Cash Cows 100 Index uses an objective, rules-based methodology to provide exposure to large and mid-capitalization U.S. companies with high free cash flow yields. Companies with high free cash flow yields are commonly referred to as “cash cows.” The initial index universe is derived from the component companies of the Russell 1000® Index. The initial universe of companies is screened based on their average projected free cash flows and earnings (if available) over each of the next two fiscal years. Companies with no forward year estimates available for free cash flows or earnings will remain in the Index universe. Companies with negative average projected free cash flows or earnings are removed from the Index universe. Additionally, financial companies, other than real estate investment trusts, are excluded from the Index universe. The remaining companies are ranked by their free cash flow yield for the trailing twelve month period. The equity securities of the 100 companies with the highest free cash flow yield are included in the Index.

The Russell 1000 Index is a market-capitalization weighted index representing the top 1,000 large-cap stocks in the Russell 3000 Index.

Annualized Returns(1)

(For the Periods Ended October 31, 2022)

One Year | Three Year | Five Year | Since Inception(2) | |

Pacer US Cash Cows 100 ETF - NAV | 5.10% | 18.99% | 13.79% | 13.43% |

Pacer US Cash Cows 100 ETF - Market | 5.09% | 19.02% | 13.71% | 13.38% |

Pacer US Cash Cows 100 Index(3) | 5.52% | 19.40% | 14.27% | 13.88% |

Russell 1000® Index(3) | -16.38% | 9.99% | 10.19% | 11.37% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated August 31, 2022, is 0.49%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is December 16, 2016. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

28

Pacer US Small Cap Cash Cows 100 ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on June 16, 2017, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer US Small Cap Cash Cows Index uses an objective, rules-based methodology to provide exposure to small-capitalization U.S. companies with high free cash flow yields. Companies with high free cash flow yields are commonly referred to as “cash cows.” The initial Index universe is derived from the component companies of the S&P Small Cap 600® Index. The initial universe of companies is screened based on their average projected free cash flows and earnings (if available) over each of the next two fiscal years. Companies for which information on their projected free cash flows or earnings is not available will remain in the Index universe. Companies with negative average projected free cash flows or earnings are removed from the Index universe. Additionally, financial companies, other than real estate investment trusts, are excluded from the Index universe. The remaining companies are ranked by their free cash flow yield for the trailing twelve month period. The equity securities of the 100 companies with the highest free cash flow yield are included in the Index.

The S&P SmallCap 600® Index seeks to measure the small-cap segment of the U.S. equity market.

Annualized Returns(1)

(For the Periods Ended October 31, 2022)

One Year | Three Year | Five Year | Since Inception(2) | |

Pacer US Small Cap Cash Cows 100 ETF - NAV | -10.26% | 15.60% | 10.25% | 9.48% |

Pacer US Small Cap Cash Cows 100 ETF - Market | -10.12% | 15.69% | 10.24% | 9.48% |

Pacer US Small Cap Cash Cows Index(3) | -9.34% | 16.16% | 10.69% | 9.89% |

S&P SmallCap 600® Index(3) | -11.81% | 8.96% | 7.11% | 8.03% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated August 31, 2022, is 0.59%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is June 16, 2017. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

29

Pacer Developed Markets International Cash Cows 100 ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on June 16, 2017, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Developed Markets International Cash Cows 100 Index uses an objective, rules-based methodology to provide exposure to large and mid-capitalization non-U.S. companies in developed markets with high free cash flow yields. Companies with high free cash flow yields are commonly referred to as “cash cows”. The initial index universe is derived from the component companies of the FTSE Developed ex US Index. The initial universe of companies is screened based on their average projected free cash flows and earnings over each of the next two fiscal years (if available). Companies with no forward year estimates available for free cash flows or earnings will remain in the Index universe. Companies with negative average projected free cash flows or earnings are removed from the Index universe. Additionally, financial companies, other than real estate investment trusts, and companies with a market capitalization of less than $3 billion are excluded from the Index universe. The remaining companies are ranked by their average daily trading value (“ADTV”) for the prior three months. The 500 companies with the highest ADTV are then ranked by their free cash flow yield for the trailing twelve month period. The equity securities of the 100 companies with the highest free cash flow yield are included in the Index.

The FTSE Developed ex-US Index is comprised of Large (85%) and Mid (15%) cap stocks providing coverage of Developed markets (24 countries) excluding the US.

Annualized Returns(1)

(For the Periods Ended October 31, 2022)

One Year | Three Year | Five Year | Since Inception(2) | |

Pacer Developed Markets International Cash Cows 100 ETF - NAV | -15.61% | 1.63% | 0.69% | 2.77% |

Pacer Developed Markets International Cash Cows 100 ETF - Market | -16.00% | 1.95% | 0.48% | 2.84% |

Pacer Developed Markets International Cash Cows 100 Index(3) | -15.06% | 2.62% | 1.66% | 3.69% |

FTSE Developed ex-US Index(3) | -22.88% | -0.53% | 0.19% | 1.48% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated August 31, 2022, is 0.65%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is June 16, 2017. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

30

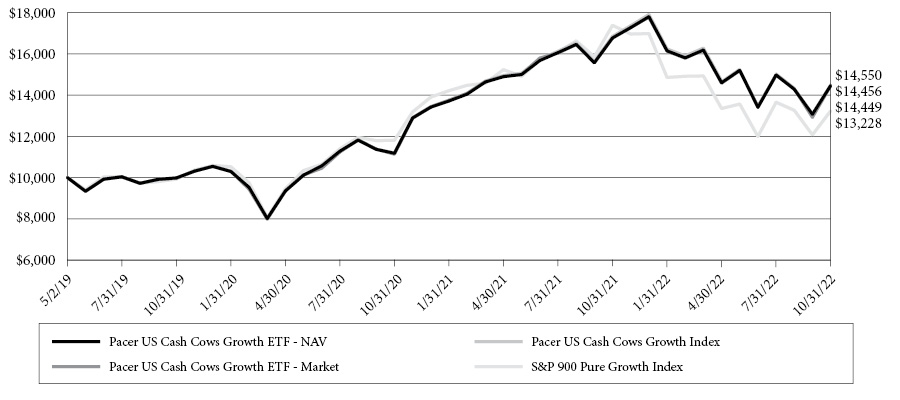

Pacer US Cash Cows Growth ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on May 2, 2019, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer US Cash Cows Growth Index uses an objective, rules-based methodology to provide exposure to mid- and large-capitalization U.S. companies with high free cash flow yields. Companies with high free cash flow yields are commonly referred to as “cash cows”. The initial Index universe is derived from the component companies of the S&P 900® Pure Growth Index. The initial universe of companies is screened based on their average projected free cash flows and earnings (if available) over each of the next two fiscal years. Companies for which information on their projected free cash flows or earnings is not available will remain in the Index universe. Companies with negative average projected free cash flows or earnings are removed from the Index universe. Additionally, financial companies, other than real estate investment trusts, are excluded from the Index universe. The remaining companies are ranked by their free cash flow yield for the trailing twelve month period. The equity securities of the 50 companies with the highest free cash flow yield are included in the Index.

The S&P 900 Pure Growth Index is composed of companies found in the S&P 400 and S&P 500 Indices, including mid- and large-cap stocks based on growth potential with respect to sales, earnings relative to price, and momentum.

Annualized Returns(1)

(For the Periods Ended October 31, 2022)

One Year | Three Year | Since Inception(2) | |

Pacer US Cash Cows Growth ETF - NAV | -13.78% | 13.15% | 11.11% |

Pacer US Cash Cows Growth ETF - Market | -13.86% | 13.17% | 11.09% |

Pacer US Cash Cows Growth Index(3) | -13.63% | 13.40% | 11.31% |

S&P 900 Pure Growth Index(3) | -23.90% | 10.04% | 8.32% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated August 31, 2022, is 0.60%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is May 2, 2019. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

31

Pacer Emerging Markets Cash Cows 100 ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on May 2, 2019, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Emerging Markets Cash Cows 100 Index uses an objective, rules-based methodology to provide exposure to large and mid-capitalization companies in emerging markets with high free cash flow yields. Companies with high free cash flow yields are commonly referred to as “cash cows.” The initial index universe is derived from the component companies of the FTSE Emerging Markets Index. The Fund defines emerging markets countries as those countries included in the FTSE Emerging Markets Index. The initial universe of companies is screened based on their average projected free cash flows and earnings (if available) over each of the next two fiscal years. Companies with no forward year estimates available for free cash flows or earnings will remain in the Index universe. Companies with negative average projected free cash flows or earnings are removed from the Index universe. Additionally, financial companies, other than real estate investment trusts (“REITs”), companies with a market capitalization of less than $2 billion, and companies whose average daily trading value (“ADTV”) for the prior 90 days does not exceed $5 million are excluded from the Index universe. The remaining companies are ranked by their free cash flow yield for the trailing twelve-month period. The equity securities of the 100 companies with the highest free cash flow yield (the “Top 100 Companies”) are included in the Index.

The FTSE Emerging Markets Index is comprised of all the countries that make up the advanced emerging markets and secondary emerging markets within the FTSE Global Equity Index Series.

Annualized Returns(1)

(For the Periods Ended October 31, 2022)

One Year | Three Year | Since Inception(2) | |

Pacer Emerging Markets Cash Cows 100 ETF - NAV | -25.96% | -6.79% | -5.37% |

Pacer Emerging Markets Cash Cows 100 ETF - Market | -25.72% | -6.67% | -5.09% |

Pacer Emerging Markets Cash Cows 100 Index(3) | -24.23% | -4.84% | -3.44% |

FTSE Emerging Markets Index(3) | -28.39% | -3.41% | -3.14% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated August 31, 2022, is 0.70%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is May 2, 2019. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

32

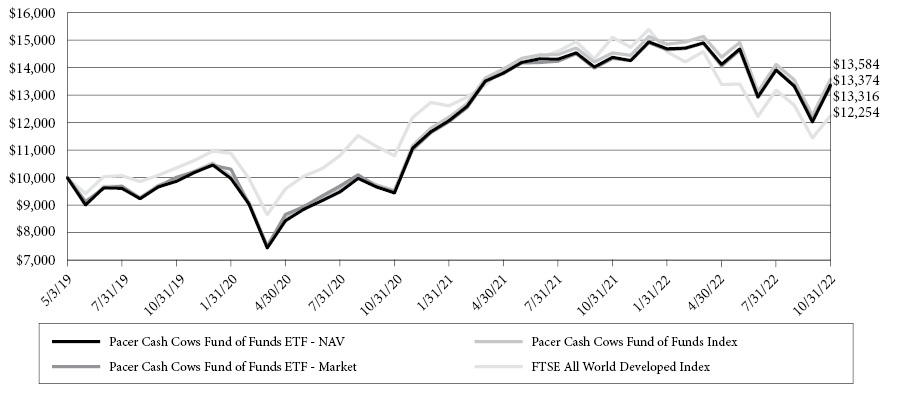

Pacer Cash Cows Fund of Funds ETF

PERFORMANCE SUMMARY

(Unaudited)

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on May 3, 2019, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer Cash Cows Fund of Funds Index uses an objective, rules-based approach to construct a portfolio that, as of each quarterly rebalance, is composed of the ETFs listed in the following table, each advised by the Adviser (collectively, the “Cash Cows ETFs”). Each of the Cash Cows ETFs is an index-based ETF that seeks to track the total return performance, before fees and expenses, of the applicable underlying index listed in the following table (collectively, the “Cash Cows Indexes”). Each Cash Cows Index uses an objective, rules-based methodology to provide exposure to companies with high free cash flow yields (commonly referred to as “cash cows”) selected from the applicable “Equity Universe” as indicated in the following table.

Weight | Cash Cows ETF | Cash Cows Index | Equity Universe |

20% | Pacer US Cash Cows 100 ETF | Pacer US Cash Cows 100 ETF | Russell 1000 Index |

20% | Pacer Global Cash Cows Dividend ETF | Pacer Global Cash Cows Dividend Index | FTSE Developed Large Cap Index |

20% | Pacer US Small Cap Cash Cows 100 ETF | Pacer US Small Cap Cash Cows 100 Index | S&P Small Cap 600® Index |

20% | Pacer US Cash Cows Growth ETF | Pacer US Cash Cows Growth Index | S&P 900® Pure Growth Index |

20% | Pacer Developed Markets International Cash Cows 100 ETF | Pacer Developed Markets International Cash Cows 100 Index | FTSE Developed ex US Index |

The FTSE All World Developed Index is a market-capitalization weighted index representing the performance of large- and mid-cap stocks from the FTSE Global Equity Index Series.

33

Pacer Cash Cows Fund of Funds ETF

PERFORMANCE SUMMARY (Continued)

(Unaudited)

Annualized Returns(1)

(For the Periods Ended October 31, 2022)

One Year | Three Year | Since Inception(2) | |

Pacer Cash Cows Fund of Funds ETF - NAV | -6.97% | 10.69% | 8.67% |

Pacer Cash Cows Fund of Funds ETF - Market | -7.10% | 9.98% | 8.54% |

Pacer Cash Cows Fund of Funds Index(3) | -6.54% | 10.98% | 9.16% |

FTSE All World Developed Index(3) | -18.85% | 5.78% | 5.98% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated August 31, 2022, is 0.74%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is May 3, 2019. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

34

Pacer WealthShield ETF

PERFORMANCE SUMMARY

(Unaudited)

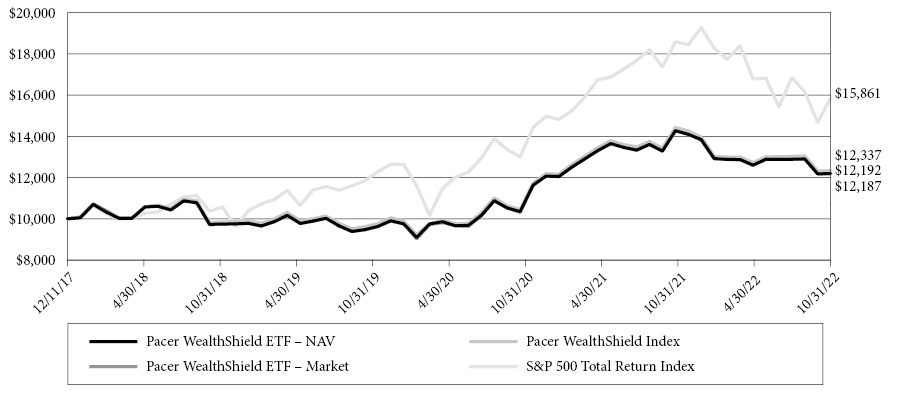

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on December 11, 2017, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Pacer WealthShield Index uses an objective, rules-based methodology to implement a trend-following strategy that directs some or all of the Index’s exposure to (i) U.S. equity securities or (ii) U.S. Treasury securities depending on the strength of the high-yield corporate (“junk”) bond market relative to U.S. Treasury bonds and the momentum of certain U.S. equity sectors or industries and of long-term U.S. Treasury bonds.

The S&P 500 Index consists of approximately 500 leading U.S.-listed companies representing approximately 8% of the U.S. equity market capitalization.

Annualized Returns(1)

(For the Periods Ended October 31, 2022)

One Year | Three Year | Since Inception(2) | |

Pacer WealthShield ETF - NAV | -14.55% | 8.77% | 4.14% |

Pacer WealthShield ETF - Market | -14.61% | 8.79% | 4.13% |

Pacer WealthShield Index(3) | -14.51% | 8.66% | 4.39% |

S&P 500® Index (3) | -14.61% | 10.22% | 9.90% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated August 31, 2022, is 0.60%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is December 11, 2017. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

35

Pacer Industrial Real Estate ETF

PERFORMANCE SUMMARY

(Unaudited)

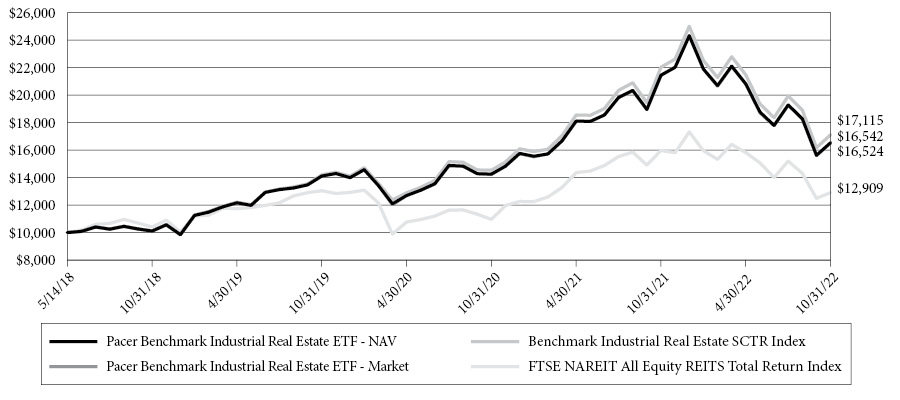

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on May 14, 2018, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Industrial Real Estate Index (formerly known as the Kelly Industrial Real Estate Index) generally composed of the equity securities of developed markets companies that derive at least 85% of their earnings or revenues from real estate operations in the industrial real estate sector (“Industrial Companies”), including companies that derive at least 85% of their earnings or revenues from self-storage real estate operations (“SelfStorage Companies”).

The FTSE Nareit All Equity REITs Index is a free-float adjusted, market capitalization-weighted index of U.S. equity REITs. Constituents of the index include all tax-qualified REITs with more than 50% of total assets in qualifying real estate assets other than mortgages secured by real property.

Annualized Returns(1)

(For the Periods Ended October 31, 2022)

One Year | Three Year | Since Inception(2) | |

Pacer Industrial Real Estate ETF - NAV | -22.88% | 5.44% | 11.93% |

Pacer Industrial Real Estate ETF - Market | -22.91% | 5.38% | 11.90% |

Kelly Industrial Real Estate Index(3) | -22.31% | 6.42% | 12.79% |

FTSE NAREIT All Equity REITS Total Return Index(3) | -19.16% | -0.34% | 5.88% |

(1) | The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than the original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on redemptions of Fund shares. The total annual operating expenses as stated in the fee table to the Fund’s prospectus dated August 31, 2022, supplemented October 14, 2022 is 0.60%. For performance information current to the most recent month-end, please call 1-877-337-0500. |

(2) | Inception date is May 14, 2018. |

(3) | Indexes are unmanaged statistical composites and their returns do not include fees an investor would pay to purchase the securities they represent. Such costs would lower performance. It is not possible to invest directly in an index. |

36

Pacer Data & Infrastructure Real Estate ETF

PERFORMANCE SUMMARY

(Unaudited)

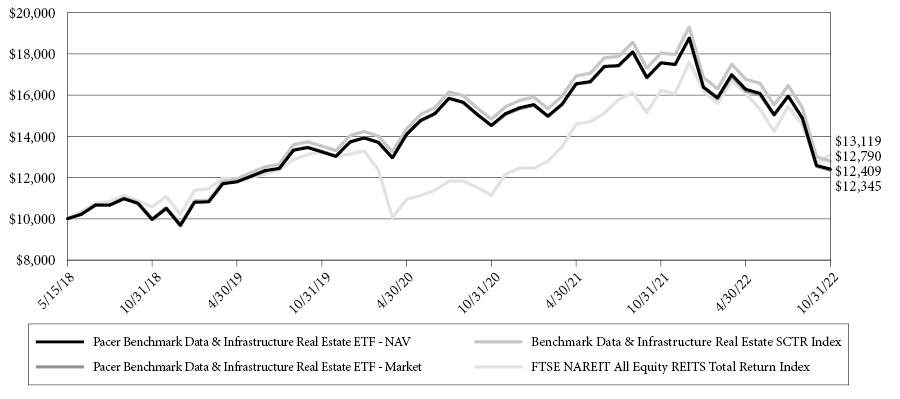

Growth of $10,000

This chart illustrates the performance of a hypothetical $10,000 investment made on May 15, 2018, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The chart assumes reinvestment of capital gains and dividends.

The Data Center & Tech Infrastructure Index (formerly known as the Kelly Data Center & Tech Infrastructure Index) is generally composed of equity securities of developed markets companies that derive at least 85% of their earnings or revenues from real estate operations in the data and infrastructure real estate sectors (“Eligible Companies”). At the time of each reconstitution of the Index, Eligible Companies with a market capitalization of more than $500 million and average daily traded volume of at least 10,000 shares are included in the Index (the “Index Constituents”). A significant portion of the Index is expected to be composed of real estate investment trusts (“REITs”). The real estate companies included in the Index may utilize leverage, and some may be highly leveraged. Additionally, such companies may include significant business operations outside of the United States.

The FTSE Nareit All Equity REITs Index is a free-float adjusted, market capitalization-weighted index of U.S. equity REITs. Constituents of the index include all tax-qualified REITs with more than 50% of total assets in qualifying real estate assets other than mortgages secured by real property.

Annualized Returns(1)

(For the Periods Ended October 31, 2022)

One Year | Three Year | Since Inception(2) | |

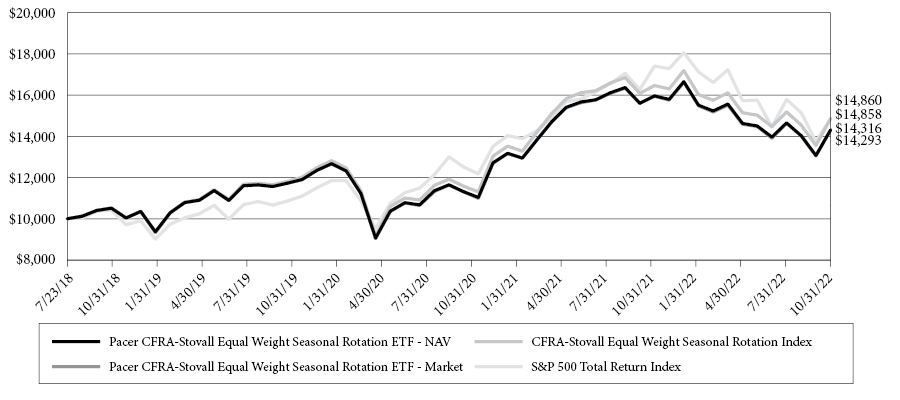

Pacer Data & Infrastructure Real Estate ETF - NAV | -29.34% | -2.15% | 4.95% |