As confidentially submitted to the Securities and Exchange Commission on February 10, 2022.

This draft registration statement has not been publicly filed with the Securities and Exchange Commission and all

information herein remains strictly confidential.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

MED-X, INC. |

(Exact name of registrant as specified in its charter) |

Nevada | | 2800 | | 46-5473113 |

(State or other jurisdiction of | | (Primary Standard Industrial | | (I.R.S. Employer |

incorporation or organization) | | Classification Code Number | | Identification Number) |

8236 Remmet Avenue

Canoga Park, California 91304

(818) 349-2870

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Matthew Mills

Chief Executive Officer

Med-X, Inc.

8236 Remmet Avenue

Canoga Park, California 91304

(818) 349-2870

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Arthur Marcus, Esq. Sichenzia Ross Ference LLP 1185 Avenue of the Americas New York, New York 10036 Tel: (212) 930-9700 Fax: (212) 930-9725 | David E. Danovitch, Esq.

Angela Gomes, Esq. Sullivan & Worcester LLP 1633 Broadway New York, NY 10019 Tel: (212) 660-3060 Fax: (202) 660 3001 |

(Approximate date of commencement of proposed sale to the public)

As soon as practicable after the effective date of this Registration Statement

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement relating to these securities filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | FEBRUARY 10, 2022 |

Shares

Common Stock

MED-X, INC.

This is a firm commitment initial public offering of shares of our common stock, par value $0.001 per share, based on an assumed public offering price of $ per share, which is the midpoint of the range discussed below. No public market currently exists for our common stock. We are offering all of the shares of common stock offered by this prospectus. We expect the public offering price to be between $ and $ per share.

We intend to apply to list our common stock on the Nasdaq Capital Market (“Nasdaq”) under the symbol “MXRX”. No assurance can be given that our application will be approved.

We are an emerging growth company as that term is used in the Jumpstart Our Business Startups Act of 2012, and, as such, we have elected to take advantage of certain reduced public company reporting requirements for this prospectus and future filings.

We expect to effect a 1-for-8 reverse stock split of our outstanding common stock following the effective time of the registration statement to which this prospectus forms a part but prior to the closing of this offering. The number of shares of common stock offered in this prospectus and all other applicable information has been determined based on an assumed public offering price of $ per share, which is the midpoint of the range discussed above. The actual public offering price of the shares will be determined between the underwriters and us at the time of pricing, considering our historical performance and capital structure, prevailing market conditions, and overall assessment of our business. Therefore, the assumed public offering price per share of common stock used throughout this prospectus may not be indicative of the actual public offering price for the shares of common stock. See “Determination of Offering Price” for additional information.

Unless otherwise noted, the share and per share information in this prospectus reflects, other than in our financial statements and the notes thereto, a proposed reverse stock split of the outstanding common stock of the Company at an assumed 1-for-8 ratio to occur immediately following the effective time of the registration statement of which this prospectus forms a part is declared effective by the Securities and Exchange Commission (the “SEC”) but prior to the closing of the offering.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page ____ of this prospectus, and under similar headings in any amendments or supplements to this prospectus. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| | Per Share | | | Total | |

Initial public offering price | | $ | | | | $ | | |

Underwriting discounts and commissions(1) | | $ | | | | $ | | |

Proceeds to us, before expenses(2) | | $ | | | | $ | | |

___________

(1) | In addition to the underwriting discounts and commissions, we have also agreed to issue EF Hutton, division of Benchmark Investments, LLC, the representative of the underwriters (the “Representative”) warrants to purchase up to 4% of the number of shares of common stock sold in this offering (the “Representative’s Warrants”), to reimburse the Representative for certain expenses, and to provide a non-accountable expense allowance equal to 1% of the gross proceeds of this offering payable to the Representative. See “Underwriting” for a description of the compensation payable to the underwriter. |

| |

(2) | We have granted a 45-day option to the Representative to purchase up to additional shares of common stock based on an assumed public offering price of $ per share, which is the midpoint of the range set forth above (15% of the shares of common stock sold in this offering) at the initial public offering price less underwriting discounts and commissions. The amount of offering proceeds to us presented in this table does not give effect to any exercise of the: (i) over-allotment option (if any) or (ii) Representative’s Warrants. |

The underwriters expect to deliver the securities to purchasers in the offering on or about , 2022.

EF Hutton

division of Benchmark Investments, LLC

The date of this prospectus is , 2022

TABLE OF CONTENTS

We use our registered trademark, Med-X, in this prospectus. This prospectus also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this prospectus appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and tradenames.

You should rely only on the information contained in this prospectus. We have not, and the underwriter has not, authorized anyone to provide you with any information other than that contained in this prospectus or in any applicable prospectus supplement or free writing prospectus prepared by or on behalf of us to which we have referred you. We are offering to sell, and seeking offers to buy, the securities covered hereby only in jurisdictions where offers and sales are permitted. We are not, and the underwriter is not, making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information contained in this prospectus or any prospectus supplement or free writing prospectus is accurate as of any date other than the date on the front cover of those documents. Our business, financial condition, results of operations and prospects may have changed since those dates.

For investors outside the United States: We have not, and the underwriter has not, taken any action that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities covered hereby the distribution of this prospectus outside the United States.

We further note that the representations, warranties and covenants made by us in any agreement that is incorporated by reference or filed as an exhibit to the registration statement of which this prospectus is a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Information contained in, and that can be accessed through our website, https://www.MEDX-RX.com/, shall not be deemed to be part of this prospectus or incorporated herein by reference and should not be relied upon by any prospective investors for the purposes of determining whether to purchase the shares offered hereunder.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus may contain both historical and forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “anticipate”, “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “should,” “will” and “would” or the negatives of these terms or other comparable terminology. To the extent that this prospectus contains forward-looking statements regarding our business, please be advised that our actual financial condition, operating results, and business performance may differ materially from that projected or estimated by us in forward-looking statements. We have attempted to identify, in context, certain of the factors we currently believe may cause actual future experience and results to differ from our current expectations. The differences may be caused by a variety of factors, including but not limited to:

| · | Our ability to continue as a going concern. |

| · | Our limited operating history and ability to earn a profit. |

| · | Our ability to effectively execute our business plan. |

| · | Our potential inability to compete and succeed in highly competitive and evolving industries. |

| · | Our potential inability to manage our research, development, expansion, growth and operating expenses. |

| · | Our potential inability to raise capital and the unavailability of future financing. |

| · | The lack of market acceptance of our Nature-Cide®, Thermal-Aid®, Home Spa™, and other products, including our newly formulated mosquito repellant and eradication solution derived from our current Nature-Cide® All Purpose Concentrate product. |

| · | Our unexpected costs and operating deficits. |

| · | Our inadequate capital and financing. |

| · | Our research and development of cannabis medical compounds, mosquito repellant solutions, and other potential new products may not result in commercial products available for sale by us in the future. |

| · | Our testing of proposed new products, such as our planned mosquito control solution, may indicate that the proposed products are not effective. |

| · | Our Chairman and Chief Executive Officer, Matthew Mills, owns 10,000 shares of our Series A Preferred Stock, which entitles him to control over 51% of the voting power on all matters submitted to a vote of our shareholders, and together with his common stock ownership, Mr. Mills holds approximately 57% of the total shareholder voting power of the Company. |

| · | Our potential inability to obtain legal permission to grow, supply and sell cannabis. |

| · | Our potential inability to sell our Nature-Cide® Thermal-Aid®, Home Spa™, Malibu Brands, cannabis and other products. |

| · | Heavy development stage expenditures by us, resulting in substantial operating deficits, especially in the early years of operation. |

| · | Our intense competition, including entry of new competitors. |

| · | The decreased demand for our products or increased supply, causing prices for our products to decline. |

| · | Adverse federal, state, and local government regulation and taxation, rendering it difficult for us to monetize our potential products and services. |

| · | Heavy government regulation, taxation and licensing requirements in markets where cannabis is legal. |

| · | The potential lack of new markets for cannabis. |

| · | Contraction of the market for medical cannabis in California, including the closing of medical cannabis dispensaries due to government order. |

| · | Our proprietary rights, trade secrets and other intellectual property may not be adequately protected from legal challenge or third-party infringement. |

| · | Our potential lower sales and revenue than we forecast. |

| · | Our potential defaults on leases or other indebtedness. |

| · | Our potential loss of suppliers and supply. |

| · | Our potential price increases for capital, supplies and materials. |

| · | A potential decline of market prices for our products due to excess supply or for other reasons. |

| · | Our potential failure to obtain customers, loss of customers and failure to obtain new customers. |

| · | Our potential loss of or inability to obtain government licenses and permits. |

| · | Our potential receipt of adverse publicity and news coverage. |

| · | Our potential inability to carry out marketing and sales plans. |

| · | Our potential loss of key executives. |

| · | Our dilution of ownership due to issuance of more securities by the Company. |

| · | The unavailability of banking, trademark registration, and other services to Med-X because cannabis is still illegal under federal law. |

Any of the assumptions underlying forward-looking statements could be inaccurate. You are cautioned not to place undue reliance on any forward-looking statements included in this prospectus. All forward-looking statements are made as of the date of this prospectus and the risk that actual results will differ materially from the expectations expressed in this prospectus will increase with the passage of time. Except as otherwise required by the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements after the date of this prospectus, whether as a result of new information, future events, changed circumstances or any other reason. In light of the significant uncertainties inherent in the forward-looking statements included in this prospectus, the inclusion of such forward-looking statements should not be regarded as a representation by us or any other person that the objectives and plans described in this prospectus will be achieved.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information you should consider in making your investment decision. You should read the following summary together with the more detailed information regarding us and our common stock being sold in the offering, including the risks of investing in our common stock discussed under “Risk Factors,” beginning on page __ and our historical condensed combined financial statements and the related notes appearing elsewhere in this prospectus, before making an investment decision. For convenience, in this prospectus, unless the context suggests otherwise, the terms “we,” “our,” “our company,” “Company” and “us” and “Med-X” refer to Med-X, Inc., a Nevada corporation, and its consolidated subsidiaries as a whole.

Overview

Med-X, Inc. was incorporated in Nevada in February 2014 in order to engage in the business of (a) publishing content about the cannabis industry, primarily online, for industry participants and the general public, (b) growing and selling cannabis on a wholesale basis, initially for the California medical cannabis market, (c) supplying related agricultural products to other commercial cannabis growers, and (d) developing and selling commercial medicinal supplements based on beneficial compounds extracted from cannabis. On April 16, 2018, we completed a merger with Pacific Shore Holdings, Inc. (“PSH” or “Pacific Shore”), our 99% owned subsidiary (the “Merger”). We plan to continue our efforts to acquire other companies that have similar business models to ours - developing natural products, as well as offering pest control services nationally. Our management believes it can create strong value for shareholders by acquiring companies that have growing revenue and assets in an attempt to bolster our revenue and assets. We have no current binding agreements to acquire any other entity.

We are engaged in the business of product development, distribution, and marketing. We ultimately see ourselves as a health and wellness company developing a series of all-natural and environmentally friendly products and offering products and service protocols to other companies and consumers who are also looking to reduce impact of exposer and toxins in their daily routines. We have developed a series of proprietary natural “green” branded products under division names Nature-Cide®, Thermal-Aid®, Home Spa™ and Malibu Brands. Nature-Cide products are all-natural essential oil blends of indoor and outdoor pesticide/insecticide/repellent developed for multiple industries, including professional pest control, turf care, janitorial, hospitality, transportation and agriculture, as well as the cannabis and hemp cultivation and products industries. Thermal-Aid, Thermal-Aid Zoo® and the Thermal-Aid Headache Relief System® are 100% natural heating/cooling pain and physical therapy products for painful ailments affecting adults, children and animals. Nature-Cide and Thermal-Aid are distributed through ecommerce platforms and through national distribution outlets positioned around the United States. Home Spa Shower Sprays are essential oil-based products distributed through various ecommerce platforms. Malibu Brands are all-natural essential oils, including hemp and Cannabidiol (“CBD”) oil products, designed for various ailments and are still in the development stage. The Company does not intend to commence the production and sale of CBD oil products until the Federal Food & Drug Administration (the “FDA”) and the federal government provide more clarity to the current regulatory environment. as it relates to when and if legalization of cannabis is sanctioned by the federal government as well as with hemp. We do not anticipate stocking an inventory of third-party products for sale, rather we expect to fill orders on a real time basis directly from third-party fulfilment sources.

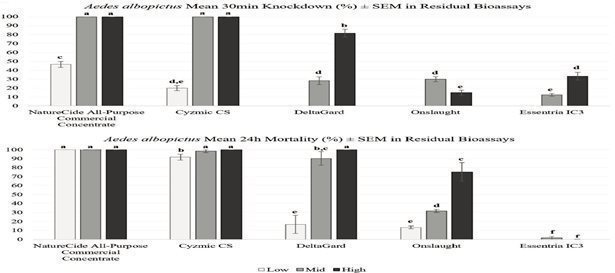

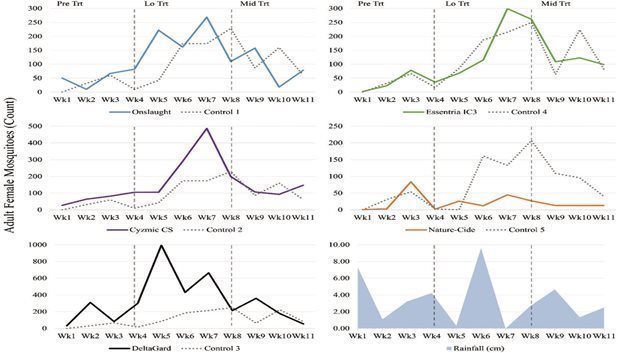

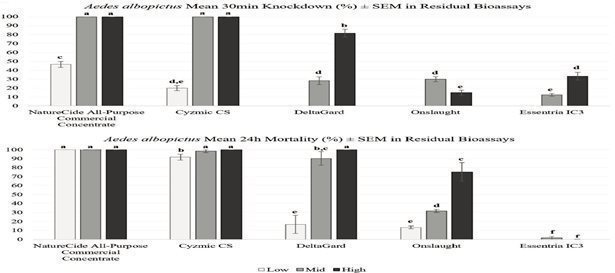

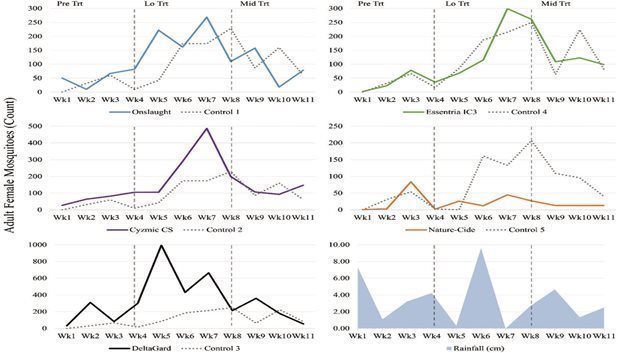

We are currently conducting extensive research, development and testing of a newly formulated solution derived from our Nature-Cide All Purpose Concentrate product, which was studied and judged to be the most effective and environmentally friendly product when compared to the most popular synthetic chemicals for Mosquito Control. The study was conducted in 2017 and led by Rui-De Xue, PhD, Managing Director of the Anastasia Mosquito Control District in Florida. Dr. Xue specializes in the biology and control of mosquitoes, evaluation of insect repellents, insecticide formulations, and population surveillance and control new technology, tools, and methods and has been published 231 times. Dr. Xue’s study was titled, EVALUATION OF PYRETHROID AND BOTANICAL BARRIER INSECTICIDES AGAINST AEDES ALBOPICTUS IN THE LABORATORY AND FIELD and was published in by the Journal of the Florida Mosquito Control Association (Vol. 66, 2019). We believe that the new formulation is specifically designed to eradicate and repel mosquitos in any environment, anywhere in the world, without harmful chemicals and potentially with no environmental impact. Our research is advanced, and our anti-mosquito solution formula is currently undergoing efficacy and toxicity tests to qualify it for export and to launch sales into the international and domestic markets. See “Business – Mosquito Control Study.”

We also operate the MJT Network® through the Company’s online media platform, www.marijuanatimes.org, which publishes media content regarding cannabis and hemp industries to generate revenue from advertisers and traffic optimizing venues. This platform has been publishing cannabis industry news and information since its launch in July 2015. The content is designed to cover a wide variety of topics relating to the cannabis and hemp industries on an ongoing basis, including news and current events, as well as the business, financial, legislative, legal, cultural, medical, scientific and technological aspects of the industry on a national and international scale. Stories, columns, advice and analysis come from a combination of regular consultants, contributors, freelance and staff writers, Company personnel and public news sources. The Company plans to eventually add online ecommerce to its website, offering branded industry products for sale from third party suppliers and from its own product lines, subject in all cases to compliance with applicable federal and state law. The network includes smart phone and tablet applications, and its original content is distributed across several digital platforms including web, Native iOS, Vimeo Video, YouTube, Apple Podcast Audio and Apple News.

We are in the final stages of development of another media platform called the National Investor Network, www.nationalinvestornetwork.com, which was initially built to support the Company’s capital raising efforts. Moving forward once the Company no longer needs private capital, the network will act as a marketing publisher of content to market other companies that are looking to utilize crowdfunding to raise capital for a monthly fee. The National Investor Network is a digital platform that is designed to offer its members highly curated business news content. The member base is currently comprised of approximately 3,800 members, all of which are currently Med-X, Inc. shareholders. Each member controls their own news feed based on the companies or industry categories they chose. The platform is built on a robust database that will allow for the tracking of member behavior giving the system the tools it needs to recommend marketing strategies in proprietary ways. Once positioned for other companies, the platform will give the equity crowdfunding or stock trading space the opportunity to publish their own content in the hopes of driving traffic or raising awareness of their company or crowdfunding initiatives. This acts as a marketing tool for other companies that are looking to be recognized as a company raising capital using the exemptions promulgated under the Jumpstart Our Business Startups Act (the “JOBS Act”), which permits crowdfunding. We also expect to assist in marketing various companies with targeted campaigns inside the National Investor Network platform to certain members as a service. In exchange for these services, we hope to generate monthly marketing revenue from other companies with the hope that more exposure will help them with their equity crowdfunding efforts. This and our media division, the MJT Network, could be profitable if and to the extent that the revenue from advertisers, sponsors, product sales and service fees exceeds the cost of the content (expected to be writers’ and content licensing fees) and products offered for online sale. We are not operating a crowdfunding platform and are only supplying information and exposure for them.

We intend to position Malibu Brands as a homeopathic, botanical, topical, all-natural alternative to traditional everyday pain management methods for consumers of all ages who may suffer from various ailments, including, but not limited to, arthritis, joint pain, headaches and back pain who seek natural pain remedies. We initially launched the Malibu Brands topical product, “Pacific Pain Relief Cream”, which is now available via ecommerce. After the launch of the first product, we began development of other versions of the product that, when completed and provided that federal legality is clarified, could potentially contain full spectrum CBD extracted from industrial hemp and cannabis. Social media marketing, advertising and public relations is continuous and is being used to spread awareness and drive traffic to the product to drive product sales with the goal of continuing to build loyalty and social proof around the product from our core, first early adapters, and take that feedback to pharmacy retailers and government and insurance-based providers that could cover the cost of the Malibu Brands “Pacific Pain Relief Cream” for the consumer patients. We plan to attend distribution and pharmacy tradeshows and educational programs as well as provide support to the public movement to hold pharmaceutical companies accountable and to help curb the opioid epidemic by educating healthcare providers and communities on the availability of alternative everyday pain relief products like the “Pacific Pain Relief Cream.”

Besides supplying Nature-Cide products to pest control, hospitality, janitorial and agricultural industries, Med-X also plans to supply proprietary and non-proprietary products, including Nature-Cide insecticides, pesticides, granular and soil blends to legally operating hemp and cannabis agricultural operators. As these core businesses evolve, and provided it becomes legal to do so, we will seek to develop and monetize techniques for the recognition and extraction of hemp and cannabis compounds for the medical industry. The Company and its subsidiary, Pacific Shore, are currently generating revenue from the Nature-Cide, Thermal-Aid, Malibu-Brands and The MJT Network divisions, however we are not yet profitable.

Our Growth Strategy

We are actively positioning the Nature-Cide and Thermal-Aid brands with major distribution and marketing. We also plan to address the needs required to support the fast-paced emerging cannabis and hemp industries. These potential innovations include new products for consumer health and welfare utilizing hemp oil and other CBD compounds. We plan to utilize 100 plus acres in Northern and Southern California owned by Dr. David Toomey, our Chief Science Officer, for hemp and other cannabis cultivation, operations, and production. If and when the federal government finalizes methods and protocols for hemp CBD extraction production, and if and when we have the capital to do so, the Company plans to obtain the proper government licenses for indoor and outdoor farm property in California to grow, harvest and sell high quality, custom-bred organic hemp for the California medical and CBD compound markets. There can be no assurance that we will obtain such licenses.

We also, plan, to the extent it is legal to do so, to cultivate custom-bred hemp and cannabis for the medical market to treat ailments, such as pain, sleep deprivation, appetite disorders, and neurological pathologies or their symptoms. According to the Brookings Institution, which is a non-profit public policy organization based in Washington, D.C. (www.brookings.edu/blog/fixgov/2018/12/14/the-farm-bill-hemp-and-cbd-explainer/), in 2018, the federal government passed the Agriculture Improvement Act of 2018 (the “Farm Bill”, which allows the cultivation of hemp. Once the guidelines have been fully established and approved by the federal government and we have sufficient funding to do so, we plan to cultivate and extract hemp CBD for the medical industry. The Farm Bill ensures that any cannabinoid or the chemical compounds that make up the cannabis plant that come directly from hemp will be legal, if and only if that hemp is produced in a manner consistent with the Farm Bill, associated federal regulations, associated state regulations, and by a licensed cultivator. It explicitly allows the transfer of hemp-derived products across state lines for commercial or other purposes. It also imposes no restrictions on the sale, transport, or possession of hemp-derived products, so long as those items are produced in a manner consistent with the law. Under Section 10113 of the Farm Bill, state departments of agriculture must consult with their state’s governor and chief law enforcement officer to devise a plan to be submitted to the Secretary of United States Department of Agriculture (“USDA”). A state’s plan to license and regulate hemp can only commence once the Secretary of USDA approves that state’s plan. Once the state of California finalizes its hemp regulations, methods and protocols for growing hemp, and provided that the USDA approves it, the Company plans to obtain the proper government licenses to commence farming operations on an indoor and outdoor farm property in California to grow, harvest and sell high quality, proprietary, organic hemp for the U.S. medical and CBD compound markets. Management is planning to produce various hemp CBD products, such as topicals and supplements for pain management, if and when we have capital to do so. Over the past 25 years, 33 states have legalized cannabis for medical use, and over the past several years, ten states have legalized cannabis for adult recreational use. Every one of those programs is illegal under federal law, with no exceptions, and the Farm Bill does nothing to change that situation. That said, many in the cannabis community hope that the reforms to hemp policy under the Farm Bill serve as a first step toward broader cannabis reform. We will not market or sell any of these compounds, supplements or medicines made from these compounds, until it is clearly legal to do so under federal, state and applicable local law. Consequently, such products, even if successfully developed by the Company, are not expected to generate revenue in the short term.

In the future Med-X plans to research, develop and license or otherwise monetize cannabis and hemp compound identification and extraction techniques for the cannabis/hemp medical industry. Management believes that Med-X, if and when the federal government changes its stance and reschedules cannabis from a Schedule 1 to a Schedule 2 or Schedule 3 drug, or de-schedules it altogether, will eventually earn substantial revenue from growing, harvesting and selling custom-bred organic cannabis for the California medical and recreational markets. As applicable cannabis licensing and tax regulations in California are published and licenses become available, we intend to launch our planned cultivation operations in that state. As part of our growth strategy, we may acquire from third parties’ other businesses and products that fit into our business model to generate additional revenue and enhance the value of the Company.

On August 5, 2021 (the “Effective Date”), we entered into a Share Purchase Agreement (the “SPA”) with Gem Global Yield LLC SCS (“GEM” or the “Purchaser”) and Gem Yield Bahamas Limited (“GYBL”). Pursuant to the SPA, we may sell to the Purchaser from time to time up to $100,000,000 (the “Aggregate Limit”) in shares of our common stock. Pursuant to the SPA, the Company may issue a draw down notice pursuant to which the Company may sell the Purchaser an amount of shares that shall not exceed 400% of the average daily trading volume for the 30 days immediately preceding the Draw Down Exercise Date (as defined in the SPA). The per share price shall equal 90% of the average applicable Daily Closing Price (as defined in the SPA) of the Company’s common stock during the applicable draw down pricing period. Following the listing of the Company’s common stock on Nasdaq, the Company may issue a Draw Down Notice (as defined in the SPA) for up to $10,000,000 of the Aggregate Limit (as defined in the SPA). Unless earlier terminated as provided thereunder, the SPA terminates automatically on the earliest of (i) thirty-six (36) consecutive months from the from when we list on Nasdaq; (ii) five (5) years from the Effective Date (as may be extended as provided in the SPA, and (iii) the date the Purchaser shall have purchased the Aggregate Limit.

Pursuant to the SPA, in consideration for these services, we agreed to pay GEM and GYBL the following consideration: a commitment fee equal to two (2) percent of the Aggregate Limit (the "Commitment Fee"), deliverable as described in the SPA. The Commitment Fee may be paid in cash from the proceeds of the Draw Downs (as defined in the SPA) or in freely tradeable shares of common stock of the Company valued at the Daily Closing Price at the time of such payment, at the option of Med-X. Med-X shall pay one percent (1%) of the Commitment Fee on or before the twelve (12) month anniversary of the Public Listing Date (as defined in the SPA), and Med-X shall pay the remaining amount of such Commitment Fee on or before the twenty (20) month anniversary of the date our shares of common stock are listed on Nasdaq. On the Effective Date, we issued GEM a warrant granting GYBL the right to purchase shares of our common stock having an expiration date that is the third anniversary of the date our shares are listed on Nasdaq , granting GYBL the right to purchase, at the exercise price and upon the terms set forth more fully in the SPA, up to the number of shares of common stock that is equal to 4% of the total number of common stock outstanding as of the date our shares of common stock are listed on Nasdaq.

Pursuant to a Registration Rights Agreement, dated August 5, 2021, between us, the Purchaser and GYBL (the “Registration Rights Agreement”), no later than three (3) months following the date on which our shares of common stock are first listed to trade on Nasdaq (the “Filing Deadline”), we are obligated to file a registration statement with the SEC to register the shares of common stock issuable pursuant to the SPA. Pursuant to the Registration Rights Agreement, we are obligated to have the registration statement declared effective by the SEC on the earlier of (A) the 60th calendar day after the earlier of (1) the Filing Deadline and (2) the date on which the registration statement is filed with the SEC and (B) the fifth business day after the date the Company is notified by the SEC that the registration statement will not be reviewed.

Reverse Stock Split

We expect to effect a 1-for-8 reverse stock split of our outstanding common stock following the effective time of the registration statement of which this prospectus forms a part but prior to the closing of this offering. We intend for our board of directors (the “Board”) to effect such reverse stock split in connection with the consummation of this offering and our intended listing of our common stock on Nasdaq, however we cannot guarantee that such reverse stock split will be necessary or will occur in connection with the listing of our common stock on Nasdaq, or that Nasdaq will approve our initial listing application for our common stock upon such reverse stock split.

The reverse stock split will not impact the number of authorized shares of common stock which will remain at 300,000,000 shares. Unless otherwise noted, the share and per share information in this prospectus reflects, other than in our financial statements and the notes thereto, a proposed reverse stock split of the outstanding common stock and treasury stock of the Company at a 1-for-8 ratio to occur immediately following the effective time of the registration statement of which this prospectus forms a part but prior to the closing of this offering.

Implications of Being an Emerging Growth Company and Smaller Reporting Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012(the “JOBS Act”). As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements that are applicable to other companies that are not emerging growth companies. Accordingly, we have included detailed compensation information for only our three most highly compensated executive officers and have not included a compensation discussion and analysis of our executive compensation programs in this prospectus. In addition, for so long as we are an “emerging growth company,” we will not be required to:

| · | engage an auditor to report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002(the “Sarbanes-Oxley Act”); |

| | |

| · | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board (the “PCAOB”) regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| | |

| · | submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay,” “say-on-frequency,” and “say-on-golden parachutes;” or |

| | |

| · | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparison of the chief executive officer’s compensation to median employee compensation. |

In addition, the JOBS Act provides that an “emerging growth company” can use the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”) for complying with new or revised accounting standards.

We will remain an “emerging growth company” until the earliest to occur of:

| · | our reporting of $1.07 billion or more in annual gross revenues; |

| | |

| · | our issuance, in a three-year period, of more than $1 billion in non-convertible debt; |

| | |

| · | the end of the fiscal year in which the market value of our common stock held by non-affiliates exceeds $700 million on the last business day of our second fiscal quarter; and |

| | |

| · | , 2027. |

We are also a “smaller reporting company” (and may continue to qualify as such even after we no longer qualify as an emerging growth company) and accordingly may provide less public disclosure than larger public companies, including the inclusion of only two years of audited financial statements and only two years of management’s discussion and analysis of financial condition and results of operations disclosure. As a result, the information that we provide to our stockholders may be different than what you might receive from other public reporting companies in which you hold equity interests.

THE OFFERING

Issuer | | Med-X, Inc., a Nevada corporation |

| | |

Common stock offered by us | | shares, based upon an assumed public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus. |

| | |

Over-allotment option | | We have granted the Representative a 45-day option to purchase up to additional shares of common stock (15% of the shares of common stock sold in this offering), based upon an assumed public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, from us at a price per share equal to the public offering price per share, less the underwriting discount and commissions payable by us, solely to cover over-allotments, if any. |

| | |

Shares of common stock outstanding prior to the offering (1) | | |

Common stock to be outstanding immediately after this offering(2) | | shares or shares if the Representative exercises in full its option to purchase additional shares of common stock. |

| | |

Use of proceeds | | We currently intend to use the net proceeds received from this offering to enhance our marketing efforts, hire key personnel in sales and management, register our products internationally, conduct research and development and for working capital including any acquisitions that we may undertake. See “Use of Proceeds” on page . |

| | |

Representative’s Warrants | | We have agreed to issue the Representative’s warrants to purchase up to shares of our common stock (4% of the aggregate number of shares sold in the offering), based upon an assumed public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus. The Representative’s Warrants are exercisable at a per share price equal to 120% of the public offering price per share, at any time, and from time to time, in whole or in part, during the four and one-half-year period commencing six months after the effective date of the registration statement of which this prospectus forms a part. |

| | |

Risk factors | | This investment involves a high degree of risk. You should read the description of risks set forth under “Risk Factors” beginning on page of this prospectus for a discussion of factors to consider before deciding to purchase our securities. |

| | |

Lock-up agreements | | We, along with our directors, officers and shareholders, have agreed with the Representative not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock or securities convertible into common stock for a period of 180 days from the closing of this offering. See “Underwriting” beginning on page . |

| | |

Trading symbol | | We intend to apply to list our common stock on Nasdaq under the symbol “MXRX”. We believe that upon completion of this offering, we will meet the standards for listing on Nasdaq, however, we cannot guarantee that we will be successful in listing our common stock on Nasdaq. We will not consummate this offering unless our common stock is approved for listed on Nasdaq. |

Reverse stock split | | We expect to effect a 1-for-8 reverse stock split of our outstanding common stock following the effective time of the registration statement of which this prospectus forms a part but prior to the closing of this offering. |

____________

(1) | Unless we indicate otherwise, the number of shares of our common stock outstanding is based on 16,658,636 shares of common stock outstanding as of September 30, 2021, and gives effect to our planned reverse stock split at a ratio of 1-for-8, but does not include, as of that date (i) shares of common stock to be issued to a consultant at the closing of the offering at the public offering price; (ii) shares to be issued to GEM pursuant to the SPA; and (iii) shares issuable upon the exercise of outstanding options and shares of common stock issuable upon the exercise of outstanding warrants. |

| |

(2) | The number of shares of common stock shown above to be outstanding after this offering gives effect to our planned reverse stock split at a ratio of 1-for-8, but does not include, as of that date: shares of common stock to be issued to a consultant at the closing of the offering at the public offering price. |

Unless otherwise indicated, all information in this prospectus assumes no exercise by the Representative of its option to purchase additional shares of common stock solely to cover over-allotments, if any, or the exercise of any Representative’s Warrants.

RISK FACTORS

Any investment in our securities involves a high degree of risk. You should carefully consider the risks described below as well as other information provided to you in this document, including information in the section of this document entitled “Information Regarding Forward Looking Statements.” If any of the following risks actually occur, the Company’s business, financial condition or results of operations could be materially adversely affected, the value of the Company’s common stock could decline, and you may lose all or part of your investment.

Risks Relating to Our Business

Med-X, Inc. has a limited operating history, which makes it difficult to accurately evaluate our business prospects.

We were formed in February 2014 to engage in the business of (a) publishing content about the cannabis industry, primarily online, for industry participants and the general public, (b) growing and selling cannabis on a wholesale basis, initially for the California medical cannabis market, (c) supplying related agricultural products to other commercial cannabis growers, and (d) developing and selling commercial medicinal supplements based on beneficial compounds extracted from cannabis. To date, we have built a 600 square foot state-of-the-art cultivation center. In 2015 and early 2016, a small, affiliated patient group cultivated small quantities of different strains of cannabis at the facility for personal medical research, with whom we shared data but we generated no revenues from this activity. We have also launched our cannabis news website, and commenced marketing Nature-Cide, but have not yet launched the other components of our business plan. In particular, little revenue is expected from our cannabis compound identification and extraction program until cannabis is sufficiently legalized to engage in such commerce. We have no government permits to legally grow and supply cannabis in California or any other jurisdiction, and have yet to earn significant revenue. We cannot assure at this time that we will be able to commence our planned operations, that we will operate profitably, or that we will have adequate working capital to conduct our business. We believe that our success will depend in large part on government policy, the public’s acceptance of our products and our ability to sell cannabis, Nature-Cide, Thermal-Aid and other branded and non-branded products. We intend to invest heavily in developing and marketing our products, including building and providing content for our websites, researching and developing cannabis compounds for medical uses, promoting and marketing our websites, products and services, and analyzing the market for our planned products. As a result, we will incur operating losses until we earn sufficient revenue from the sale of our products.

Our financial situation creates doubt whether we will continue as a going concern.

Since inception, the Company has not generated revenues sufficient to cover operating expenses, has incurred losses and had an accumulated deficit of $12,286,017 as of December 31, 2020 and had an accumulated deficit of $15,474,775 as of September 30, 2021. Further, we expect to incur a net loss for the fiscal year ending December 31, 2021 and thereafter, primarily as a result of increased operating expenses. There can be no assurances that we will be able to achieve a level of revenue adequate to generate sufficient cash flow from operations or obtain funding from this offering or additional financing through private placements, public offerings and/or bank financing necessary to support our working capital requirements. To the extent that funds generated from any private placements, public offerings and/or bank financing are insufficient, we will have to raise additional working capital. No assurance can be given that additional financing will be available, or if available, will be on acceptable terms. These conditions raise substantial doubt about our ability to continue as a going concern. If adequate working capital is not available, we may be forced to discontinue operations, which would cause investors to lose their entire investment. Our auditors have indicated that these conditions raise substantial doubt about our ability to continue as a going concern.

We may not have adequate capital to fund our business.

If our entire original capital is fully expended and additional costs cannot be funded from borrowings or capital from other sources, then our financial condition, results of operations, and business performance would be materially adversely affected. We may not be able to raise needed additional capital or financing due to market conditions or for regulatory or other reasons. We cannot assure that we will have adequate capital to conduct our business.

The COVID-19 pandemic has had and may continue to have a material adverse impact on our operating results, financial condition and business performance.

In December 2019, a strain of Coronavirus known as COVID-19 was reported in China, and in January 2020, the World Health Organization declared it a Public Health Emergency of International Concern. This contagious disease outbreak, which has continued to spread to other countries, and related adverse public health developments, has adversely affect the Company and its customers and suppliers as a result of quarantines, facility closures, and travel and logistics restrictions in connection with the outbreak. The restrictions required us to furlough all but two employees. Our operations were deemed Essential, so these two employees handled our product fulfillment. Also, the Company’s Chief Executive Officer, Chief Operating Officer, Chief Financial Officer, Chief Marketing Officer and Executive Vice President supported business efforts remotely without drawing a salary for one month. After one month, the executive management team agreed as a group to take a significant salary reduction (approximately 48%). Our supply chain that supports our main product lines were impacted as well by COVID-19 which resulted in significant delays in delivery of materials for our product production causing delays in delivery to our customers. Our ability to raise capital was negatively impacted as potential investors, who were affected by COVID-19 themselves, became hesitant to invest or were not in a position to invest due to the state of the country’s economy. This resulted in the Company needing to delay payments to vendors which impacted our credit with some of our vendors. Continued outbreaks of COVID-19 may further have a negative impact on our operations.

We cannot assure that we will develop additional products in the future.

We have developed only a few products lines, Nature-Cide, Thermal-Aid, and Malibu Brands. We have several other products, Energy-X, Burner Balm, and Home Spa Shower Spray, that are in progress and could develop other revenue streams in the future. We therefore do not have a diversified portfolio of proprietary products. While we are currently offering our newly developed mosquito control product based on the formulas in our Nature-Cide All Purpose product line, we cannot assure that we will successfully develop, commercialize or sell a mosquito control product or any other products besides the existing Nature-Cide, Thermal-Aid, and Home Spa Shower Spray, or that we will reach profitably or conduct any other business on a consistent basis. The lack of product diversity could adversely affect our financial condition and operating results and expose investors to a complete loss of their investment in us if our existing products fail to achieve sufficient sales to maintain us or enable us to earn a profit.

Our ability to protect our intellectual property is uncertain.

We have filed several applications with the United States Patent and Trademark Office for service marks and trademarks. While we have been granted several service marks and trademarks, we still have applications pending for other marks. We cannot assure you that we will be successful in obtaining the service marks or trademarks, that these applications will not be challenged, that others will not attempt to infringe upon our marks, or that these marks will afford us any protection or competitive advantages. If we are unable to protect our rights to our trademarks or if such marks infringe on the rights of others, our business could be materially adversely affected. In addition to the Thermal-Aid patents licensed to us by our president, we currently have one patent that was issued in October 2021 by the United States Patent and Trademark Office related to our Nature-Cide infused soil. We cannot assure you that we will be successful in obtaining patents, that these applications will not be challenged, that others will not attempt to infringe upon our patents should they be awarded, or that these patents will afford us any protection or competitive advantages. The existing patents (held by Matthew Mills, our chairman, who has licensed them to us) covering Thermal-Aid may not protect us from legal challenges by competitors or infringement by third parties.

We may not be able to successfully compete against companies with substantially greater resources.

The health and medical therapy, essential oils, and insecticide industries are intensely competitive, and we expect competition to intensify further in the future. We are also subject to intense competition from chemical insecticides, as well as other all-natural insect repellents utilizing cedar wood oil, which have been on the market longer than Nature-Cide and which are manufactured and marketed by competitors with more resources and brand recognition than us. We cannot assure you that Nature-Cide will compete effectively and experience continuing and growing sales. As a supplier of other products, we compete with several larger and better-known companies that specialize in supplying and distributing a vast array of consumer goods to retailers. We cannot assure that we will continue to obtain supply contracts with Walmart.com, Ralphs, or from any other retailers. Barriers to entry are relatively low, and current and new competitors can launch new products that compete in the marketplace. We currently or potentially compete with a number of other companies, including a number of large health and medical therapy, essential oil, and insecticide brand name manufacturers that have greater financial and managerial resources, more experience in developing products, and greater name recognition than we have.

We will not stock inventory for third-party products and will rely on filling orders on a real-time basis.

We do not have the resources or facilities to stock a large amount of inventory. As a result, we do not expect to stock any material amount of inventory for the products we will sell, and we will instead rely on third-party vendors to fill orders on a real-time basis. As a result, we may experience delays in shipping products if our third-party vendors are not able to timely fulfill our orders, which could cause our revenue to suffer.

Disruptions in our relationships with any one of our key distributors could adversely affect our results of operations.

A substantial portion of our sales is derived from our top distributors. During the nine months ended September 30, 2021, our largest distributor accounted for approximately 32% of our sales and our largest three distributors accounted for approximately 83% of our sales during such time. We cannot guarantee that we will be able to generate similar levels of sales from our largest distributors in the future. Should one or more of these distributors substantially reduce their purchases from us, our results of operations could be materially adversely affected. We anticipate this concentration to continue for the foreseeable future.

We may be required to collect sales and other taxes from buyers outside of California.

We do not collect sales or other similar taxes with respect to goods sold by us via our website, except for buyers from the State of California. We file quarterly sales tax returns with the State of California. However, other states may seek to impose sales tax collection obligations on out-of-state companies such as us, which engage in or facilitate online commerce, and a number of proposals have been made at the state and local level that would impose additional taxes on the sale of goods and services through the Internet. Such proposals, if adopted, could substantially impair the growth of electronic commerce, and could adversely affect our opportunity to derive financial benefit from such activities. Moreover, a successful assertion by one or more states or any foreign country that we should collect sales or other taxes on the exchange of merchandise on our system could have a material adverse effect on our business, results of operations, and financial condition. Legislation limiting the ability of the states to impose taxes on Internet-based transactions has been proposed in the U.S. Congress. We cannot assure that this legislation will ultimately be enacted into law or that the final version of this legislation will not contain a limited time period in which such tax moratorium will apply. In the event that the tax moratorium is imposed for a limited time period, there can be no assurance that the legislation will be renewed at the end of such period. Failure to enact or renew this legislation could allow various states to impose taxes on Internet-based commerce and the imposition of such taxes could have a material adverse effect on our business, results of operations, and financial condition.

Our business is subject to various government regulations.

We are subject to various federal, state and local laws affecting therapeutic medical and insecticide products. The Federal Trade Commission, the Federal Food and Drug Administration and equivalent state agencies regulate advertising and representations made by businesses in the sale of products, which apply to us. We may be required to obtain permits from various states in order to ship certain of our products to those states. We are also subject to government laws and regulations governing health, safety, working conditions, employee relations, wrongful termination, wages, taxes and other matters applicable to businesses in general.

Cannabis is categorized under federal law as a Schedule 1 drug. Accordingly, the cultivation, production, transport, export, import, distribution, sale, marketing and use of cannabis are prohibited under federal law. Certain activities that comply with state law, such as medical cannabis in states where it has been legalized, are treated by the federal government with a non-enforcement policy under the internal guidelines of the “Cole Memorandum” published by the U.S. Department of Justice. We may be required to obtain permits from various states in order to produce, supply and sell cannabis and certain of our other products in those states. We currently have no government permits to grow or sell cannabis in any jurisdiction. Even if cannabis is generally legalized at the federal and state government levels, commerce in cannabis is still expected to be heavily regulated and taxed, which we believe will have a material effect on our operating results, financial condition and business performance. We expect to be required to apply for licenses in California [to sell cannabis and certain of our other products], even though cannabis is generally legalized in that state, and there is no assurance that those licenses will be granted to us. Furthermore, because cannabis remains illegal under federal law, banking, certain advertising, and trademark registration services, among other services, are generally not available to the cannabis industry.

We are not currently subject to direct federal, state or local regulation, or laws or regulations applicable to access to or commerce on the Internet, other than regulations applicable to businesses generally. Due to the increasing popularity and use of the Internet and other online services, and recent controversial breaches of cyber security, it is possible that a number of laws and regulations may be adopted with respect to the Internet or other online services covering issues such as user privacy, freedom of expression, pricing, content and quality of products and services, taxation, advertising, intellectual property rights and information security. Although sections of the Communications Decency Act of 1996 were held to be unconstitutional by the U.S. Supreme Court, we cannot assure you that similar laws will not be proposed and adopted in the future. In addition, applicability to the Internet of existing laws governing issues, such as property ownership, copyrights and other intellectual property issues, taxation, libel, obscenity and personal privacy is uncertain. The vast majority of such laws was adopted prior to the advent of the Internet and, as a result, do not contemplate or address the unique issues of the Internet and related technologies. In addition, numerous states, including the State of California in which our headquarters are located, have regulations regarding the manner in which “wholesalers/retailers” may conduct business and the liability of “wholesalers/retailers” in conducting such business. We cannot assure that any state will not attempt to impose additional regulations upon us in the future or that such imposition will not have a material adverse effect on our business, results of operations, and financial condition.

Several states have also proposed legislation that would limit the uses of personal user information gathered online or require online services to establish privacy policies. The Federal Trade Commission has also settled a proceeding with one online service regarding the manner in which personal information is collected from users and provided to third parties. Changes to existing laws or the passage of new laws intended to address these issues, including some recently proposed changes, could create uncertainty in the marketplace that could reduce demand for our services or increase the cost of doing business as a result of litigation costs or increased service delivery costs, or could in some other manner have a material adverse effect on our business, results of operations, and financial condition. In addition, because our services are accessible worldwide, and we make sales of goods to users worldwide, other jurisdictions may claim that we are required to qualify to do business as a foreign corporation in a particular state or foreign country. We are qualified to do business in Nevada and California, and our failure to qualify as a foreign corporation in a jurisdiction where it is required to do so could subject us to taxes and penalties for the failure to qualify, resulting in our inability to enforce contracts in such jurisdictions. Any such new legislation or regulation, or the application of laws or regulations from jurisdictions whose laws do not currently apply to our business, could have a material adverse effect on our business, results of operations, and financial condition.

We cannot assure you that we will earn a profit or that our products will be accepted by consumers.

Our business is speculative and dependent upon acceptance of Nature-Cide, Pacific Pain Relief Cream, Home Spa Shower Spray, Thermal-Aid, Energy-X, Burner Balm, and our other branded and non-branded products by retail stores and consumers. Our operating performance is also heavily dependent on whether or not we are able to earn a profit on the sale of our products and the products of other manufacturers from which we supply or distribute consumer goods, if any. We cannot assure you as to whether we will be successful or earn any revenue or profit, or that you will not lose your entire investment.

We may incur uninsured losses.

Although we maintain modest theft, casualty, liability, and property insurance coverage, along with workmen’s compensation and related insurance, we cannot assure you that we will not incur uninsured liabilities and losses as a result of the conduct of our business. In particular, we may incur liability if Nature-Cide, Pacific Pain Relief Cream, Home Spa Shower Spray, Thermal-Aid, Energy-X, Burner Balm, or one of our other products is deemed to have caused a personal injury. Should uninsured losses occur, you could lose your entire investment.

We may acquire businesses, intellectual property or products, or form strategic alliances in the future, and we may not realize the benefits of such acquisitions or alliances.

We may acquire additional businesses, intellectual property or products, form strategic alliances or create joint ventures with third parties that we believe will complement or augment our existing business. If we acquire businesses with promising markets or technologies, we may not be able to realize the benefit of acquiring such businesses if we are unable to successfully integrate them with our existing operations and Company culture. We may encounter numerous difficulties in developing, manufacturing and marketing any new products resulting from a strategic alliance, joint venture or acquisition. Such difficulties may delay or prevent us from realizing the expected benefits or enhancements to our business from such transaction. We cannot assure you that, following any such acquisition, alliance or joint venture, we will achieve the expected synergies.

Like most manufacturers and sellers of consumer goods, and companies that raise capital, we are subject to potential litigation.

As a manufacturer and seller of consumer goods, and a company that raises capital, we are exposed to the risk of litigation for a variety of reasons, including product liability lawsuits, employee lawsuits, commercial contract disputes, defects in supplies and products, government investigations and enforcement actions, shareholder and investor lawsuits and other legal proceedings. We cannot assure you that future litigation in which we may become involved will not have a material adverse effect on our financial condition, operating results, business performance, and business reputation.

We cannot assure you that we will have the resources to repay all of our liabilities in the future.

We have liabilities and may in the future have other liabilities to affiliated or unaffiliated lenders. These liabilities represent fixed costs, which are required to be paid regardless of the level of business or profitability experienced by us. For example, as of September 30, 2021, we had $519,427 outstanding under accounts payable, line of credit, accrued employee vacation, equipment financing and other liabilities. We cannot assure you that we will not incur additional indebtedness in the future, that we will have sufficient funds to repay our indebtedness or that we will not default on our debt, jeopardizing our business viability. Furthermore, we may not be able to borrow or raise additional capital in the future to meet our needs or to otherwise provide the capital necessary to conduct our business. We often utilize purchase order financing from third party lenders when we are supplying or distributing consumer goods, which increases our costs and the risks that we may incur a default, which would harm its business reputation and financial condition. We cannot assure you that we will be able to pay all of our liabilities, or that we will not experience a default on our indebtedness.

We may incur cost overruns in the development, manufacture, and distribution of our various products.

We may incur substantial cost overruns in the development, manufacture, and distribution of Nature-Cide, Thermal-Aid, Malibu Brands, and other products. Management is not obligated to contribute capital to us. Unanticipated costs may force us to obtain additional capital or financing from other sources or may cause you to lose your entire investment in us if we are unable to obtain the additional funds necessary to implement our business plan. We cannot assure you that we will be able to obtain sufficient capital to successfully continue to implement our business plan. If a greater investment is required in the business because of cost overruns, the probability of earning a profit or a return of the shareholders’ investment in us is diminished.

If we are unable to pay for material and services timely, we could be subject to liens.

If we fail to pay for materials and services for our business on a timely basis, our assets could be subject to material men’s and workmen’s liens. We may also be subject to bank liens in the event that we default on loans from banks, if any.

Directors and officers have limited liability.

Our Articles of Incorporation provide that we will indemnify and hold harmless our and our subsidiaries’ officers and directors against claims arising from our and their activities, to the maximum extent permitted by applicable Nevada law. If we are called upon to perform under our indemnification obligations, (we have not yet signed individual separate indemnification agreements with each one of our directors and officers), then the portion of our assets expended for such purpose would reduce the amount otherwise available for our business.

If we were to lose the services of our key personnel, we may not be able to execute our business strategy.

Our success is substantially dependent on the performance of our executive officers and key employees. The loss of any of our officers, who are also directors, would have a material adverse impact on us. We will generally be dependent upon Matthew Mills, our Chairman and Chief Executive Officer, for the direction, management and daily supervision of our operations. See “Management.”

If we are unable to hire, retain or motivate qualified personnel, consultants, independent contractors, and advisors, we may not be able to grow effectively.

Our performance will be largely dependent on the talents and efforts of highly skilled individuals. Our future success depends on our continuing ability to identify, hire, develop, motivate and retain highly qualified personnel for all areas of our organization. Competition for such qualified employees is intense. If we do not succeed in attracting excellent personnel or in retaining or motivating them, we may be unable to grow effectively. In addition, our future success will depend in large part on our ability to retain key consultants and advisors. We cannot assure that any skilled individuals will agree to become an employee, consultant, or independent contractor of use. Our inability to retain their services could negatively impact our business and our ability to execute our business strategy.

The cannabis industry is extremely speculative and its legality is uncertain.

The possession, consumption, production and sale of cannabis has historically been, and continues to be, illegal under federal law and in virtually all state and local jurisdictions, other than certain exceptions. As of September 30, 2021, there are 17 states where cannabis is legal for medicinal and recreational use, 19 states where cannabis is legal for medicinal purposes only, 11 states where cannabis use is limited and 3 states that have no cannabis legislation. As indicated in California, Colorado, Washington, Oregon, Alaska, Massachusetts, Maine, Nevada, Illinois, Michigan, Vermont, Arizona, Montana, South Dakota, New Jersey, Virginia, South Dakota and Washington, D.C. where cannabis has been legalized for recreational and medical use. While management believes that legalization trends are favorable and create a compelling business opportunity for early movers, there is no assurance that those trends will continue and be realized, that existing limited markets will continue to be available or that any new markets for cannabis and related products will emerge for the Company. Our business plan is based on the premise that cannabis legalization will expand, that consumer demand for cannabis will continue to exceed supply for the foreseeable future, and that consumer demand for cannabis for medical and recreational uses will grow as it becomes legal to possess and consume it. There is no assurance that this premise will prove to be correct or that we will be profitable in the future. There is no assurance that our cannabis will be of the quality and type that will be accepted by the public or that our breeding of it will be effective. Therefore, you may lose your entire investment in us.

Cannabis remains illegal under federal law, and enforcement of cannabis laws could change.

Even in those states in which the use of cannabis has been legalized, its use remains a violation of federal law pursuant to the Controlled Substances Act (the “CSA”). The CSA classifies cannabis as a Schedule I controlled substance, and as such, medical and adult use of cannabis use is illegal under U.S. federal law. Unless and until Congress amends the CSA with respect to cannabis (and the President approves such amendment), there is a risk that federal authorities may enforce current federal law. Since federal law criminalizing the use of cannabis pre-empts state laws that legalize its use, enforcement of federal law regarding cannabis is a risk that could harm the Company’s business, prospects, revenue, results of operation and financial condition.

Our cannabis business plan is speculative.

Our planned businesses are speculative and subject to numerous risks and uncertainties. The research and development of our new proposed products, including those, if any, resulting from the identification and extraction of cannabis compounds for sale for medicinal use, may not succeed in creating any commercial products or revenue due to functional failure, lack of acceptance or demand from the marketplace, technological inefficiencies, competition or for other reasons. The demand for news and information regarding cannabis is unknown. The further legalization of cannabis in any state jurisdiction, or at the federal level, is not assured. The future demand for cannabis for medical or recreational use is unknown, even if favorable legislation progresses. The burden of government regulation and taxation on cannabis industry participants, including growers, suppliers and consumers, is difficult to quantify. There is no assurance that we will earn revenue or a profit.

As a company that relies upon agricultural operations, we will be exposed to the risks inherent in farming.

Planting, growing, harvesting and selling crops and farming in general, is inherently risky. Adverse weather, natural pests, fungus, agricultural and environmental diseases, falling market prices, excess supply, poor soil, lack of fertilizer and other hazards can destroy crops and inflict severe economic losses on any farm, even with greenhouse facilities. Because we rely on others to provide these agricultural operations, there is no assurance that we will not incur uninsured losses or be subject to hazards beyond our control, or that these activities will be economically successful or sustainable.

There is no assurance that any of our research and development activities will result in any proprietary technology or commercial products.

As discussed, we plan to develop new proprietary products and services for the cannabis or any other industry, including compound identification and extraction and mosquito eradication. Our development efforts for these products may fail to result in any commercial technology, products or services, or any proprietary or patentable technology. The products may not work, competitors may develop and sell superior products performing the same function, or industry participants may not accept or desire those products. We may not be able to protect our proprietary rights, if any, from infringement or theft by third parties. Government regulation may suppress or prevent marketing and sales of those products, even if they can be commercialized. We may have inadequate capital to successfully execute this aspect of our business plan.

Customer complaints regarding our products and services could hurt our business.